How to Use Social Listening for Sales: The Complete 2026 Playbook

A RevOps practitioner posted on Reddit about sending 217,000 cold emails in 2024. Reply rates dropped from 2.1% to 0.7% over twelve months. That's not a blip - that's a channel dying in real time. Meanwhile, HubSpot's 2025 Sales Trends Report found social media outreach pulls a 42% response rate versus 26% for email and 23% for phone.

That practitioner pivoted to social listening for sales. Within 90 days, reply rates jumped to 12% and meetings went from 8-12 per month to 34. You don't need to abandon email entirely. But if you're not listening to what your buyers say publicly before you reach out, you're leaving the easiest meetings on the table.

Here's what the shift boils down to:

- Monitoring public conversations on forums, review sites, and social platforms lets you spot buying signals and time your outreach to the moment a prospect is actively evaluating solutions.

- The core stack: a listening tool (to detect signals) + an enrichment tool (to get verified contact data) + an outreach tool (to actually reach them). Three layers.

- The time commitment: 15-30 minutes a day. The Reddit practitioner who tripled his meetings spent less time than when he was blasting cold emails.

What Social Listening for Sales Actually Means

This isn't brand monitoring. Brand monitoring tells you when someone mentions your company name. Listening for sales signals tells you when a prospect is thinking about buying something you sell - even if they never mention you at all.

The distinction matters. [Gartner predicted 80% of B2B sales interactions](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) would happen through digital channels by 2025, and the shift has only accelerated since. Your buyers are researching, complaining, asking for recommendations, and comparing vendors in public right now - on Reddit, X, review sites, and industry forums - before they ever fill out a demo form.

Here's the uncomfortable truth: 75% of B2B buyers now prefer a rep-free buying experience. They don't want to talk to you. They want to research on their own terms. Social listening flips that dynamic. Instead of forcing a conversation, you show up where they're already talking, with context they didn't expect you to have.

The social listening market hit $10.32 billion in 2025 and is growing at 14.3% CAGR through 2030. That growth isn't coming from marketing teams tracking brand sentiment. It's coming from sales teams who figured out that public conversations are better intent data than anything you can buy - and most of it costs nothing.

And 80-90% of B2B buyers form their vendor shortlist before making formal contact. If you're waiting for inbound leads, you're competing for the 10-20% who bother to raise their hand.

Why It Works - The Data Behind Social Selling

Sales teams using social selling generate 45% more opportunities than teams relying on traditional outbound. Those opportunities aren't smaller, either - companies with social selling strategies see deals that are 48% larger on average. And 78% of salespeople who use social selling outperform peers who don't.

The quota number should get your VP of Sales's attention: social sellers are 51% more likely to hit quota.

That's the difference between a team consistently at 80% attainment and one consistently over 100%.

Why does it work so well? Because 84% of C-level and VP-level decision-makers use social media as part of their buying process. When you show up in someone's feed with a thoughtful comment before you ever send a cold email, you're not a stranger anymore. You're someone they've already seen adding value. And 84% of B2B buyers say thought leadership content improves their perception of a vendor, so the reps who contribute genuine insight are building pipeline while everyone else burns through email lists.

The ROI data backs this up from the tool side too. Forrester's Total Economic Impact study found Sales Navigator delivers 312% ROI over three years, with payback in under six months - plus 42% larger deal sizes and 59% greater revenue influence for teams using it. A separate Forrester study found 233% ROI for Sprout Social's listening tools. These aren't vanity metrics. They're total economic impact studies from an independent research firm.

My hot take: signal-based social selling is still massively underpriced in terms of attention. Half of sellers who use social media spend less than 10% of their time on it. Most reps treat social as an afterthought - a place to reshare company blog posts. The ones who treat it as an intelligence channel are eating everyone else's lunch. If your average deal is above $5k and you're not doing this, you're subsidizing your competitors who are.

The Buying Signals Framework - What to Listen For

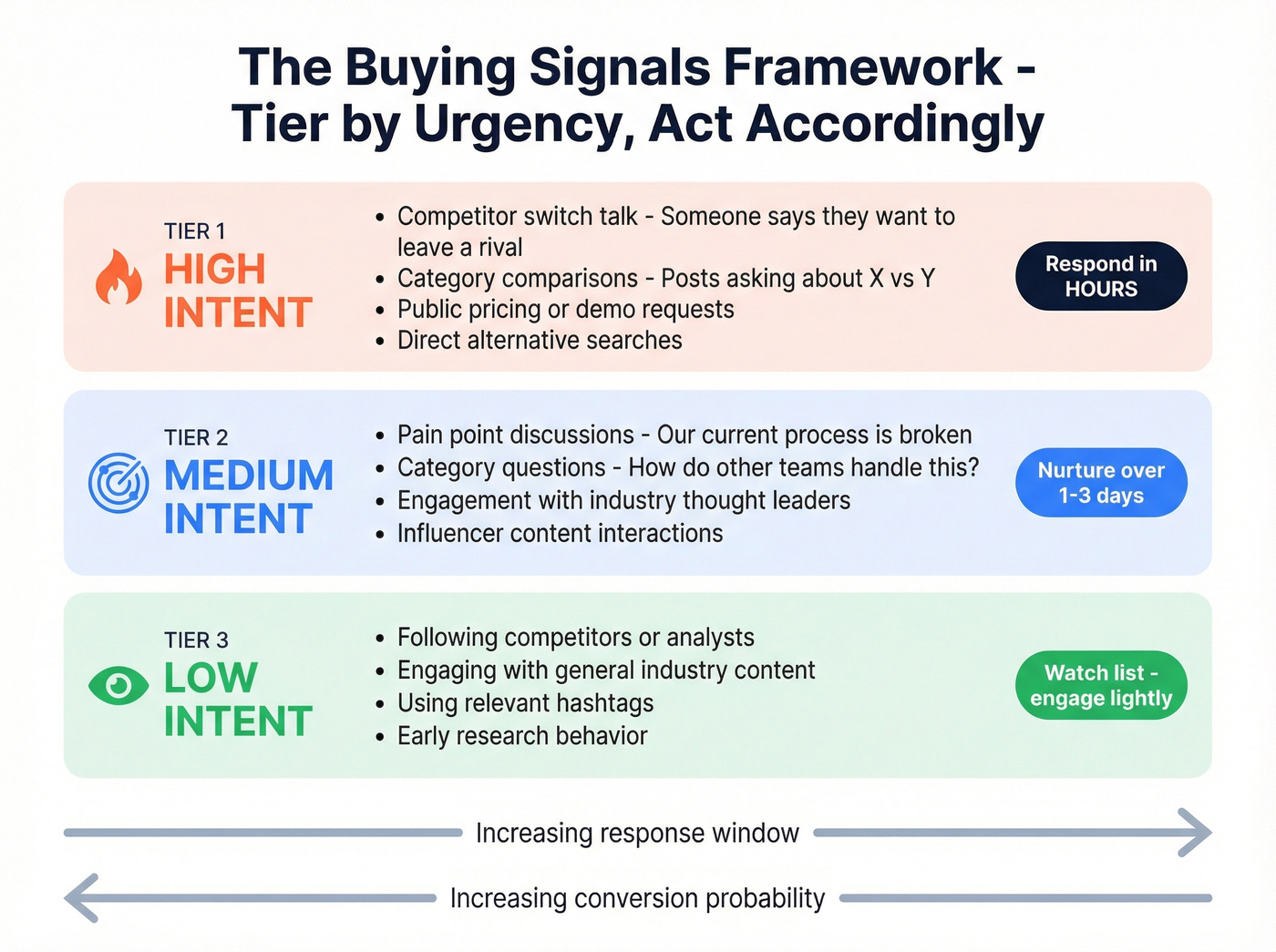

Knowing that monitoring social conversations works is step one. Knowing what to listen for is where most teams stall out. Not every social mention is a buying signal. You need a framework for separating noise from intent.

I've found the most useful approach is tiering signals by urgency. A prospect asking "What's the best alternative to [your competitor]?" needs a response within hours. A prospect sharing an article about industry trends needs a different touch entirely.

High-Intent Signals (Respond Within Hours)

These are prospects actively evaluating solutions. They're in-market right now:

- Direct competitor mentions: "We're looking to switch from [Competitor]" or "Anyone have experience migrating off [Competitor]?"

- Product/category searches: "What's the best [your category] tool for mid-market teams?" or "Looking for pricing on [category]"

- Comparison language: Phrases involving direct comparisons ("X vs Y," "alternative to X") are the strongest buying signals in B2B social conversations

- Demo/pricing requests in public: Prospects asking about pricing or implementation timelines in forums or comment threads

When you spot these, you have hours - not days. The NLP Cloud team built their entire competitive positioning by monitoring phrases like "alternative to OpenAI" and "model hallucination" across Reddit, X, and developer forums. They didn't wait for inbound. They went where the conversations were happening.

Concrete example: If you sell project management software, your five starter alerts would be: "Asana alternative," "Monday.com frustrated," "best project management tool 2026," "switching from Jira," and "project management for remote teams." Those five phrases will surface 80% of the high-intent conversations happening in your category right now.

Medium-Intent Signals (Nurture and Engage)

These prospects are problem-aware but not yet solution-shopping:

- Pain point discussions: "Our current [process] is broken" or "We're spending too much time on [task your product solves]"

- Category questions: "How do other teams handle [problem]?" or "What's the best approach to [challenge]?"

- Industry conversation participation: Prospects engaging with thought leadership content in your space

- Influencer engagement: When a decision-maker likes, shares, or comments on content from industry thought leaders in your category

The right move here isn't a pitch. It's adding value to the conversation - answering a question, sharing a relevant resource, or offering a perspective. You're building recognition so that when they do start evaluating, you're already on the shortlist.

Low-Intent Signals (Build Awareness)

Early indicators that an account might become relevant: repeated engagement with industry content, following competitors or analysts, or using relevant hashtags. These don't warrant direct outreach. Add the account to a watch list and engage lightly over time.

Micro-Signals Most Teams Miss

Beyond social signals, experienced practitioners track structural changes that indicate buying readiness:

- Pricing page copy changes on a prospect's website (signals repositioning, which often triggers tool evaluation)

- Tech stack shifts visible through job postings or tools like Wappalyzer

- New department-specific roles (a VP of RevOps hire almost always means a tool audit is coming)

- Homepage messaging tweaks that signal a strategic pivot

One B2B marketing practitioner put it well: "These micro-signals tell you SO much more about what your audience actually cares about versus what they say they care about." The best workflows combine public conversation monitoring with these structural signals and layer in intent data to confirm buying readiness. A prospect complaining about their current tool on Reddit and showing research activity on your category through intent signals is a much stronger lead than either data point alone.

| Signal Type | Intent Level | Response Window | Action |

|---|---|---|---|

| Competitor switch talk | High | Hours | Direct outreach |

| Category comparison | High | Hours | Engage + offer |

| Pain point discussion | Medium | 1-3 days | Add value first |

| Industry engagement | Medium | 1 week | Comment + connect |

| Hashtag/content activity | Low | Ongoing | Watch list + nurture |

| Micro-signals (tech/hiring) | Varies | 1-2 weeks | Research + sequence |

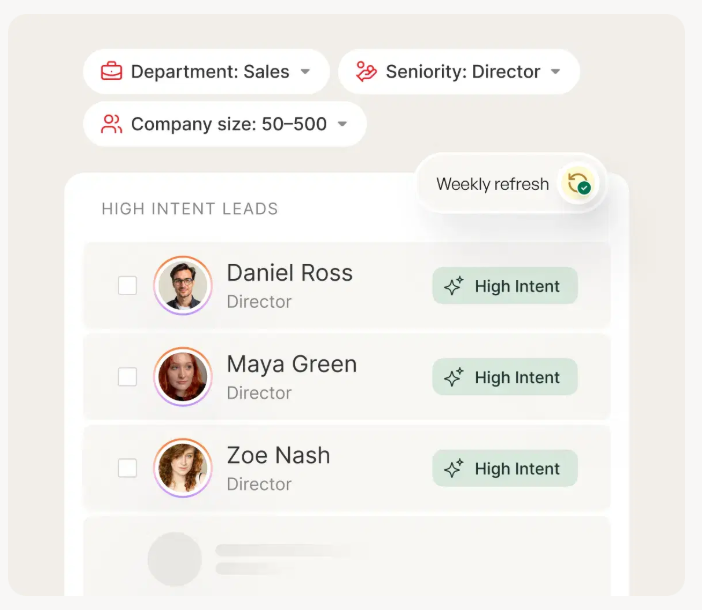

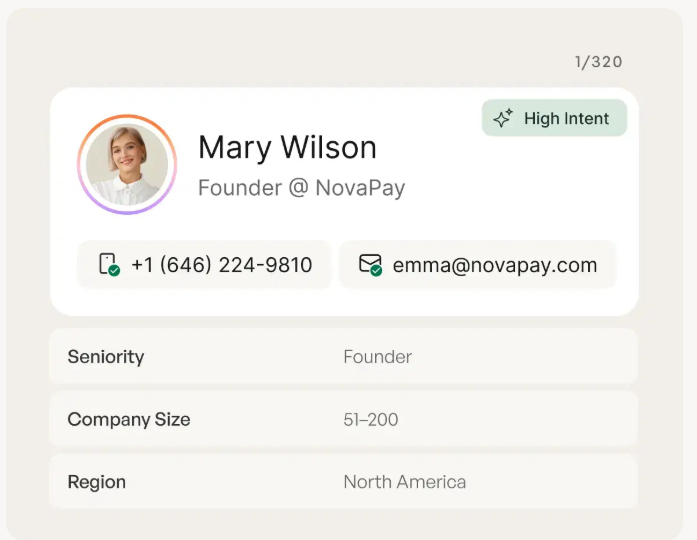

Social listening finds the signal. Prospeo closes the gap. When you spot a prospect asking for competitor alternatives on Reddit or X, you need their verified email fast - not a bounced address that tanks your domain. Prospeo delivers 98% accurate emails from 300M+ profiles, refreshed every 7 days.

Turn every buying signal into a booked meeting - starting at $0.01 per email.

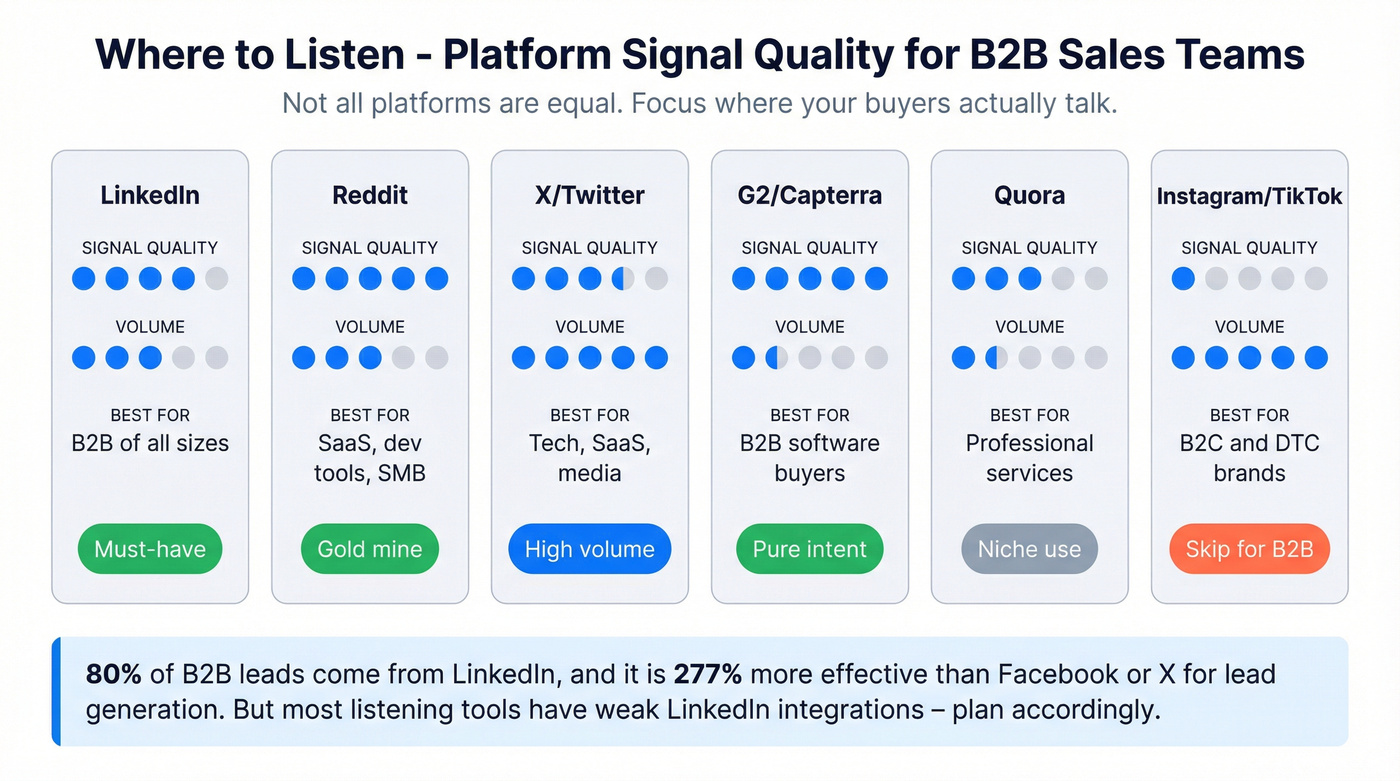

Where to Listen - Platform-by-Platform Breakdown

The biggest mistake I see is sales teams setting up monitoring on six platforms when their buyers only hang out on two.

| Platform | Best For | Signal Quality | Volume |

|---|---|---|---|

| B2B (all sizes) | High | Medium | |

| X / Twitter | Tech, SaaS, media | Medium-high | High |

| SaaS, dev tools, SMB | Very high | Medium | |

| G2 / Capterra | B2B software | Very high | Low |

| Quora | Professional services | Medium | Low |

| Instagram / TikTok | B2C, DTC brands | Low (for B2B) | Very high |

For B2B sales teams, LinkedIn is the center of gravity - 80% of B2B leads come from LinkedIn, and it's 277% more effective than Facebook or X for lead generation. But here's the frustrating reality: most social listening tools treat LinkedIn as an afterthought.

One practitioner who tested five tools for LinkedIn monitoring put it bluntly: "Most social listening tools are built for Twitter and Reddit and then slap on a LinkedIn integration that doesn't actually track individual posts or keywords." Mention only tracks company pages, not individual posts. Hootsuite's LinkedIn listening capabilities are basically nonexistent. Brandwatch's LinkedIn coverage is weak despite costing $800+/month.

This matters because the average B2B buying decision involves 5-11 stakeholders, each independently gathering information. In B2B, who says something is more important than what is said. A VP of Engineering complaining about their current tool carries ten times the weight of a junior dev doing the same.

If you're selling B2C or DTC, the equation flips. Instagram and TikTok become your primary listening channels - track trending hashtags, competitor mentions, and influencer conversations. Reddit is surprisingly strong for both B2B and B2C signal detection.

Real talk: if you're selling B2B, you need a LinkedIn-specific monitoring solution alongside your broader listening tool. Don't assume one tool covers everything.

From Signal to Meeting - The Full-Stack Workflow

Detecting a signal is useless if you can't turn it into a conversation. Here's the five-step workflow that connects listening to pipeline.

Step 1 - Detect the Signal

Set up keyword alerts in your listening tool using the buying signal language from the framework above. Focus on:

- Your competitor names + words like "alternative," "switch," "migrate," "frustrated"

- Your product category + words like "best," "recommend," "pricing," "compare"

- Pain points your product solves, phrased the way buyers actually talk

The Reddit practitioner who went from 8 to 34 meetings per month used OutX for real-time LinkedIn keyword monitoring and Sales Navigator for broader signal detection. He spent 15-30 minutes each morning reviewing alerts - less time than he'd spent managing cold email campaigns.

Step 2 - Research the Account

When a signal fires, don't immediately reach out. Spend 3-5 minutes understanding the context:

- What's the company's size, stage, and tech stack?

- Who's the likely decision-maker for what you sell?

- Is this a single frustrated user or a pattern across the organization?

- What's the specific pain they're expressing?

This research is what separates social selling from slightly-warmer spam. You're building context that makes your outreach feel like a conversation, not a template.

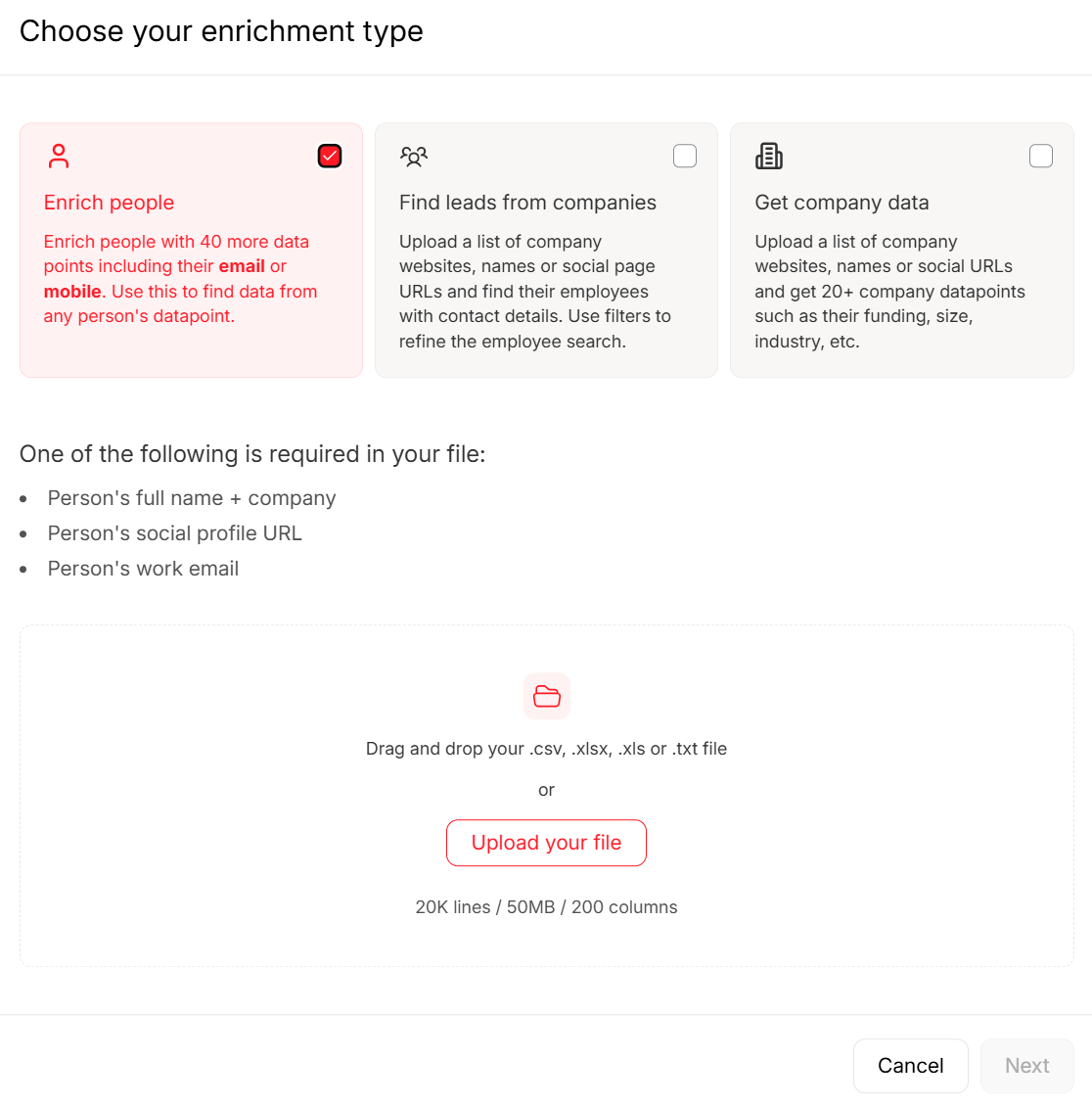

Step 3 - Enrich and Verify the Contact

Step 4 - Personalize Your Outreach

Reference the specific signal you detected. Not vaguely - specifically:

- "Saw your question in [subreddit] about migrating off [Competitor]. We helped [similar company] make that switch in 3 weeks - happy to share what worked."

- "Noticed you're hiring a Head of RevOps - that usually means a tool audit is coming. Here's a framework we put together for evaluating [category]."

Two sentences that prove you actually read what they wrote. That's enough to stand out from every templated cold email in their inbox.

Step 5 - Engage (Not Pitch)

The Hootsuite team tested this approach by monitoring complaints about a competitor's long wait times. They built a "No-Wait Guarantee" campaign around those signals, resulting in 35% more traffic and a 10% lift in new customer sign-ups.

The key insight: they led with the solution to the pain, not with a product pitch. Your first touch should add value. Share a resource. Answer a question. Offer a perspective. The meeting request comes in the second or third interaction, after you've established that you actually understand their problem.

Best Social Listening Tools for Sales Teams in 2026

The tool market is fragmented. Before you buy anything, check CRM integration - if it doesn't connect to Salesforce, HubSpot, or whatever your team runs, you'll spend more time on manual data entry than on actual selling.

| Tool | Starting Price | Best For | G2 Rating | LinkedIn Coverage |

|---|---|---|---|---|

| Brand24 | ~$149-199/mo | Budget monitoring | 4.6/5 (322) | Basic |

| Mention | $599/mo | Mid-market teams | 4.3/5 (442) | Pages only |

| Sprout Social | $199-399/seat + add-on | Enterprise analytics | 4.4/5 (6,097) | Limited |

| OutX.ai | $49/mo | LinkedIn signals | - | Strong |

| Sales Navigator | $80-140/seat/mo | B2B baseline | - | Native |

| Brandwatch | $800-15,000+/mo | Enterprise research | - | Weak |

Listening Tools

Brand24 is the budget pick, and it's genuinely good for the price. At $149-199/mo, you get real-time monitoring across social, news, blogs, forums, and review sites. Sentiment analysis, influencer identification, and GPT-powered recommendations are all included. The interface is clean enough that an SDR can set it up in 20 minutes without bothering ops.

Where Brand24 wins over enterprise tools: you don't need a two-week onboarding or a dedicated admin. Where it falls short: LinkedIn coverage is basic, and sentiment analysis occasionally needs manual correction. For a team spending under $200/mo on listening, it's the obvious starting point.

Skip Mention if LinkedIn is your primary channel. At $599/mo you get unlimited users (10+), Boolean search alerts, 50,000 mentions, and a dedicated account manager. G2 reviewers consistently call it the "best value for money" in the category. But LinkedIn tracking is limited to company pages only - you can't monitor individual posts or keyword mentions. For teams that care more about Reddit, X, forums, and review sites, Mention covers those well. For everyone else, pair it with OutX.

Sprout Social: the best analytics, the worst pricing model. Sprout has the deepest analytics and the largest review base (6,097 G2 reviews, 4.4/5). AI-powered insights, Smart Categories, and ML-powered filters make it the most sophisticated listening platform on this list.

But social listening is a separate add-on, not included in any base plan. Base plans run $199-399/seat/mo. The listening add-on requires a sales call, and total cost lands around $400-800+/seat/month. If you've got the budget and need deep analytics, Sprout is excellent. If you're an SDR team of five, the math doesn't work.

Enrichment and Outreach Tools

OutX.ai fills the gap every other listening tool leaves open on LinkedIn. At $49/mo, it monitors LinkedIn keywords in real time and handles auto-engagement. The Reddit practitioner who went from 8 to 34 meetings per month used OutX as his primary signal detection layer - it saves SDRs roughly an hour per day compared to manual monitoring. If LinkedIn is where your buyers live, this is the tool that actually works there.

Sales Navigator is the B2B baseline. At $80-140/seat/mo, it's not traditional social listening, but it's essential for LinkedIn signal detection - saved searches, lead alerts, and account activity tracking. The 312% ROI and under-six-month payback make it one of the highest-ROI tools in any sales stack. Skip this if you're selling B2C.

Enterprise Options (Probably Not for You)

Brandwatch runs $800-15,000+/mo with annual contracts and a two-week onboarding process. Enterprise-grade research infrastructure - overkill for sales teams doing prospecting. LinkedIn coverage is weak despite the price tag.

Talkwalker starts around $800/mo and is now part of Hootsuite. Enterprise-only, annual contracts. Solid for brand research, not built for sales workflows.

Awario starts at $30/mo for basic monitoring - a budget option if Brand24 is too rich.

Keyhole starts at $79/mo for hashtag and keyword tracking. Decent for campaign monitoring, not deep enough for sales signal detection.

Hootsuite starts at $99/mo for its base social management plan. Use it for scheduling posts, not for sales intelligence.

Seven Mistakes That Kill Your Social Listening Pipeline

1. Broadcasting instead of engaging. Resharing your company's blog posts isn't social selling. It's a billboard. The 92% of buyers who engage with thought leaders aren't looking for corporate content - they're looking for people who add genuine perspective to conversations.

2. Pitching before building trust. The fastest way to get blocked is to respond to someone's Reddit question with "Hey, we solve that! Book a demo." Your first interaction should add value. The pitch comes later - if it comes at all. Sometimes the meeting books itself.

3. Using the wrong platforms for your audience. If you're selling enterprise SaaS and spending your listening time on Instagram, you're wasting every minute. Match your monitoring to where your buyers actually talk. For most B2B teams, that's LinkedIn, Reddit, and G2 - not X or TikTok.

4. Ignoring LinkedIn in favor of Twitter-only tools. Teams buy a listening tool, set up keyword alerts, and wonder why they're only catching signals from developers on X. If your tool can't monitor LinkedIn properly, you've got a blind spot the size of your entire TAM.

5. Skipping data verification. You find a perfect buying signal. You pull an email from some free tool. You send your beautifully personalized outreach. It bounces. Now your domain reputation takes a hit, and your next 50 emails land in spam. Verification isn't optional - it's infrastructure. (If bounces are a recurring issue, see 550 Recipient Rejected and tighten your verification workflow.)

6. Forgetting compliance. Social listening doesn't exempt you from outreach regulations. If you're reaching out to EU-based prospects you found through social monitoring, GDPR still applies. CAN-SPAM governs every commercial email to US recipients. Verified data from a compliant provider isn't just about deliverability - it's legal protection.

7. Checking once a week instead of daily. Buying signals decay fast. A prospect asking for recommendations on Monday has already gotten five DMs by Wednesday. The 15-minute daily check beats the 2-hour weekly deep dive every time.

Bonus: Not tracking results. If you can't tell me how many meetings came from social signals last month versus cold outbound, you're flying blind. Track signal source, response rate, and meetings booked by channel. You don't need a dashboard - you need the discipline to log it.

Case Study - From 217K Cold Emails to 34 Meetings a Month

The numbers from this Reddit practitioner's story show exactly what the shift from volume-based outbound to signal-based outreach looks like in practice.

Before (2024): 217,000 cold emails sent. Reply rate started at 2.1% and dropped to 0.7% by year-end. Meetings booked: 8-12 per month. Roughly 18,000 emails per meeting.

After (90 days of social listening): Reply rate jumped to 12%. Meetings booked: 34 per month. Same person, same product, same market. The only thing that changed was the approach.

His stack: OutX for LinkedIn keyword and competitor tracking, Sales Navigator for account-level signals, Clay for data enrichment, Apollo for contact verification, Instantly for the reduced cold email volume he still ran, Notion for tracking, and ChatGPT for personalization at scale.

The workflow was simple. Each morning, he'd review signals from OutX - prospects mentioning competitors, asking category questions, or discussing pain points his product solved. He'd research the account, enrich the contact, and send a personalized message referencing the specific conversation he'd seen.

His key quote: "I'd rather have 50 warm convos than 500 cold bounces."

The tradeoff is real: this doesn't scale to 1,000+ touches per day like cold email. But 34 meetings from warm outreach are worth more than 34 meetings from cold outreach - the conversion rate downstream is higher because the prospect already feels understood.

The social listening playbook only works if you can actually reach the people behind the signals. Prospeo's Chrome extension lets you grab verified emails and direct dials from any profile or company page in one click - so you respond in hours, not days. 40,000+ users already do.

Stop losing high-intent prospects to slow enrichment workflows.

How to Start Social Listening for Sales in 15 Minutes

You don't need a $15,000 enterprise tool to get started.

- Pick one platform. If you sell B2B, start with LinkedIn. If your buyers are developers or SMB founders, add Reddit.

- Set up 5 keyword alerts using buying signal language: your top competitor's name + "alternative," your product category + "best" or "recommend," and 2-3 pain point phrases your buyers actually use.

- Spend 15 minutes tomorrow morning reviewing signals. Not an hour. Not "when you get to it." Block 15 minutes before your first meeting.

- Respond to one signal today. Not with a pitch. With value. Answer a question. Share a perspective. Start a conversation.

- Track it. Use a simple tracker:

| Date | Signal Source | Platform | Prospect | Action Taken | Outcome |

|---|---|---|---|---|---|

| 6/2 | "Asana alternative" | Jane Smith, Acme | Answered thread + DM | Meeting booked | |

| 6/3 | VP RevOps hired | Bob Lee, Initech | Sent framework PDF | Replied, follow-up Thurs |

Six columns. You'll thank yourself in 30 days when you can show your manager the pipeline impact.

The budget stack ($200/month): Brand24 ($149/mo) for monitoring + Prospeo's free tier (75 verified emails/month) + manual LinkedIn monitoring. Total: under $200.

The mid-tier stack ($700/month): Mention ($599/mo) + OutX ($49/mo) for LinkedIn coverage + Prospeo paid tier (~$0.01/email). Full multi-platform listening with LinkedIn covered.

The enterprise stack: Sprout Social + Sales Navigator + enrichment API for scale. Budget varies, but expect $600-1,000+/seat/month all-in.

Upgrade when the pipeline justifies it. The teams that started small and proved ROI first are the ones that got the budget.

Here's a stat that should motivate you: half of sellers who use social media spend less than 10% of their time on it. The bar is low. Fifteen minutes a day puts you ahead of half the sales professionals who claim to do social selling. (If you want more benchmarks, pull the latest social selling statistics.)

FAQ

Is social listening the same as social selling?

No. Social listening is the intelligence-gathering layer - monitoring public conversations to detect buying signals and understand what prospects care about. Social selling is the broader strategy of using social platforms to build relationships and close deals. Listening feeds selling; you can't do social selling well without listening first.

How much time does social listening for sales take per day?

Expect 15-30 minutes daily once your keyword alerts are configured. The Reddit practitioner who went from 8 to 34 meetings per month spent less total time than when he was managing 217K cold emails. Alerts do the heavy lifting - you just review and act.

What's the cheapest way to start monitoring social buying signals?

Google Alerts (free) + LinkedIn Sales Navigator ($80/mo) + Prospeo's free tier (75 verified emails/month) gets you running for under $100/month. That covers basic signal detection, LinkedIn monitoring, and verified contact data. Upgrade to Brand24 ($149/mo) when you outgrow manual monitoring.

Do social listening tools work well for LinkedIn?

Most don't. Brandwatch, Mention, and Hootsuite are built for X/Twitter and Reddit first - LinkedIn coverage is either limited to company pages or nonexistent. For LinkedIn-specific monitoring, OutX.ai ($49/mo) and Sales Navigator are the strongest options in 2026.

What ROI can I expect from signal-based social outreach?

Independent Forrester studies show 233% ROI for Sprout Social's listening tools and 312% ROI for Sales Navigator over three years. Individual practitioners report reply rates jumping from under 1% to 12% after switching from cold outreach to signal-based outreach. The ROI compounds because warmer conversations convert at higher rates downstream.