How to Turn Regulatory Changes Into Your Most Predictable Sales Trigger

Your prospect's compliance officer just got an email from legal - the EU AI Act enforcement deadline is 10 months away, and they haven't started their risk management framework. Budget approval that would've taken six months? It's happening in two weeks. The vendor who gets in front of that conversation first wins the deal. The one who shows up three months later gets a polite "we already selected a partner."

Every sales trigger guide mentions regulatory changes in one sentence and spends 2,000 words on funding rounds. That's backwards. A regulatory changes sales trigger is the only type with a public countdown clock, published penalties, and an affected-industry list handed to you on a silver platter. Add the unprecedented divergence between federal rollbacks and aggressive state-level enforcement, and the compliance complexity facing your prospects has never been higher.

This is the dedicated playbook for turning those countdown clocks into pipeline.

What You Need (Quick Version)

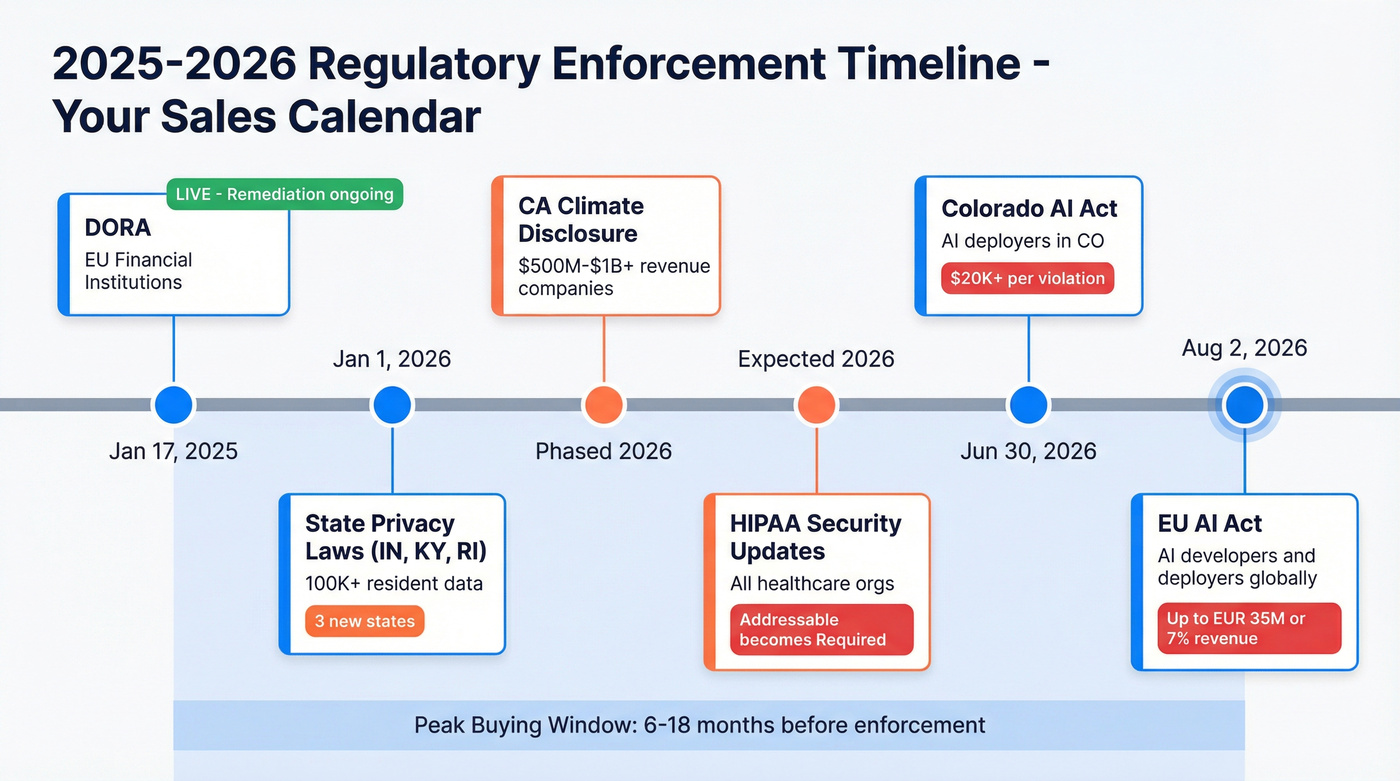

- Which regulations to watch right now: EU AI Act (Aug 2, 2026), DORA (live, remediation ongoing), three new state privacy laws (Jan 1, 2026), Colorado AI Act (Jun 30, 2026), HIPAA security rule updates, California climate disclosure requirements.

- When to act: 6-18 months before enforcement is the peak buying window. Budgets are approved, urgency is rising, RFPs are going out. A secondary spike hits 0-3 months post-enforcement when non-compliant companies panic-buy.

- What you need to execute: A regulatory monitoring stack (free tools + intent data, verified contact data that's actually fresh (stale emails kill your speed advantage), and outreach templates that reference specific regulations - not generic "compliance" messaging.

What Makes Regulatory Changes the Highest-Value Sales Trigger

Funding rounds are random. Leadership changes are unpredictable. A company's Series B might close next week or next year - you have no idea. But the EU AI Act enforcement date? August 2, 2026. It's on the calendar. You can build pipeline around it right now.

That's what makes compliance-driven triggers fundamentally different from every other sales trigger event. They're the only trigger with all three ingredients for predictable pipeline: a known deadline, quantifiable penalties for inaction, and a published list of who's affected.

Craig Elias, who wrote the book on trigger event selling (Shift!), describes three buyer modes: Status Quo, Window of Dissatisfaction, and Searching for Alternatives. The window between a buyer realizing they have a problem and actively searching for solutions is roughly 5 days - and the first vendor to reach a motivated decision-maker wins the sale 5X more often than competitors who show up later. Forrester's research puts it differently: reaching decision-makers before the competition increases your odds by up to 74%. Either way, first in wins.

With regulatory triggers, you know exactly when that Window of Dissatisfaction opens. It's when the compliance team does the gap analysis and realizes they're not ready. For the EU AI Act, that window is opening right now across thousands of companies. For DORA, it opened in late 2024 and the remediation buying is still happening.

84% of sales reps missed quota last year. Regulatory triggers let you beat those odds - not through luck, but through a calendar.

The math: Non-compliance costs $15 million on average. Compliance costs $5.5 million. That $10 million gap is why compliance buyers move fast - and why the first seller in wins 5X more often.

Six Regulations Creating Trigger Event Opportunities in 2026

Bookmark this section. Each of these regulations is creating active buying cycles right now, with enforcement dates that give you a concrete timeline for outreach.

| Regulation | Enforcement | Who's Affected | Penalties | What They Buy |

|---|---|---|---|---|

| EU AI Act | Aug 2, 2026 | AI developers/deployers in EU | Up to EUR 35M or 7% rev | Risk mgmt + documentation |

| DORA | Jan 17, 2025 (live) | EU financial institutions | 1% daily worldwide turnover | ICT risk + resilience testing |

| State Privacy Laws | Jan 1, 2026 (3 new) | Cos w/ 100K+ resident data | Varies by state | Data mapping + consent tools |

| CO/CA AI Acts | Jun 30, 2026 / Active | AI deployers in CO/CA | $20K+ per violation (CO) | Impact assessments + audits |

| HIPAA Updates | Proposed (expected 2026) | Healthcare orgs | $100K-$2M per category | Mandatory security controls |

| CA Climate Disclosure | Phased 2026+ | Cos $500M-$1B+ rev | TBD | Scope 1/2/3 reporting |

EU AI Act - The Biggest AI Compliance Wave in History

The EU AI Act is the first comprehensive legal framework on AI anywhere in the world. Full enforcement hits August 2, 2026, and it touches every company that develops or deploys AI systems in EU markets - tens of thousands of organizations globally.

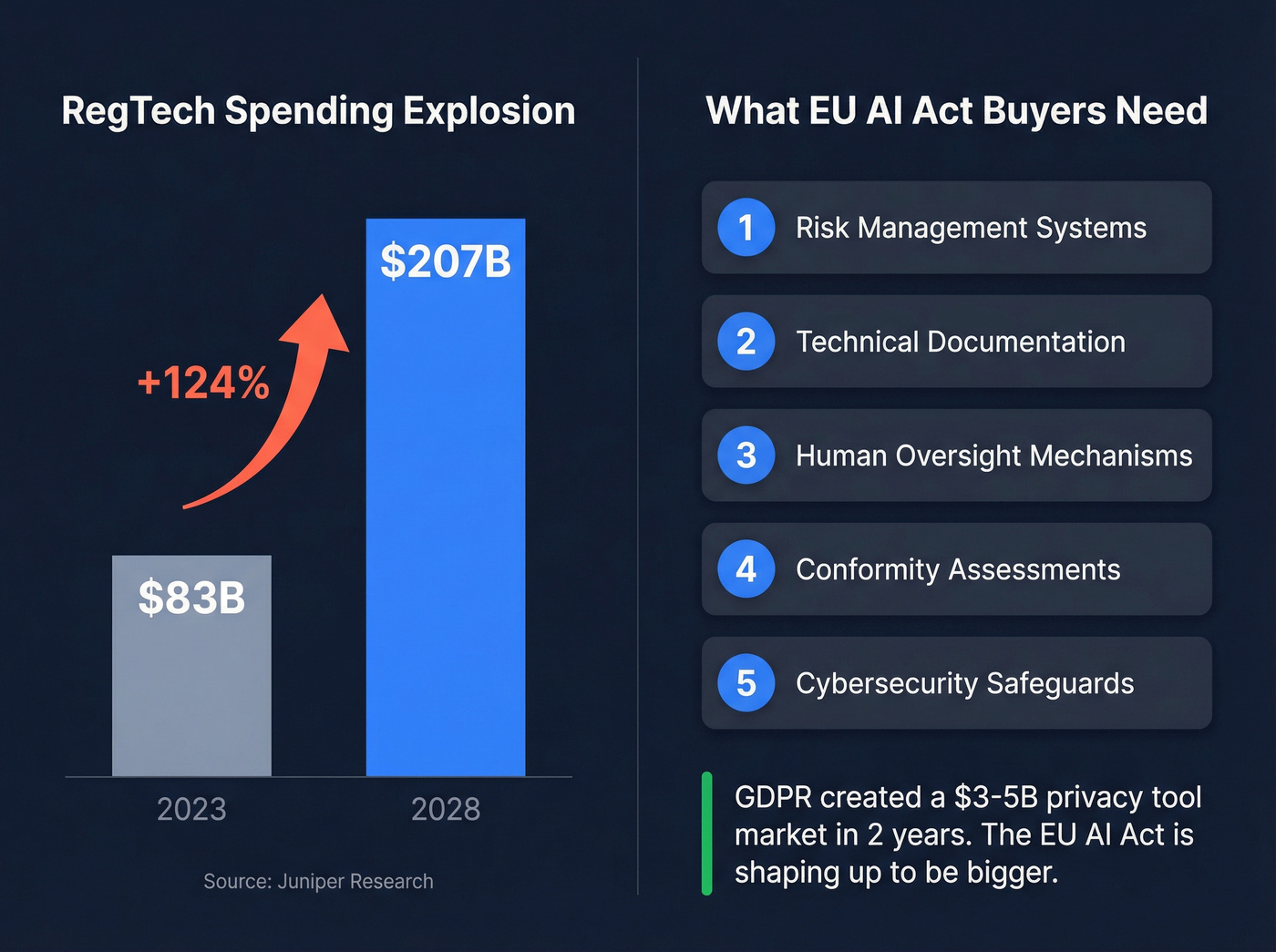

High-risk categories include healthcare, employment, critical infrastructure, and law enforcement. If your product touches any of these, your prospects need risk management systems, technical documentation, human oversight mechanisms, conformity assessments, and cybersecurity safeguards. That's not a single vendor purchase - it's an entire compliance stack.

RegTech spending is projected to grow 124% by 2028 from $83 billion in 2023, and the EU AI Act is the single biggest driver of that growth. GDPR created an estimated $3-5 billion market for privacy compliance tools within two years of enforcement. The EU AI Act is shaping up to be bigger. If you sell anything adjacent to AI governance, risk management, or documentation, this is your GDPR moment.

DORA - The Financial Services Compliance Sprint

DORA went live January 17, 2025, but don't assume the selling window is closed. Remediation is still ongoing across the EU financial sector. 78% of EU financial institutions experienced a third-party breach last year, and the four pillars of DORA - ICT risk management, resilience testing, incident reporting, and third-party vendor oversight - require deep operational changes that most institutions haven't finished.

A critical deadline most teams missed: financial entities had to submit a comprehensive register of contractual arrangements with ICT service providers to national authorities by April 30, 2025. Many scrambled. Smart technology providers proactively prepared DORA-compliant contract templates as a differentiator, and they're still winning deals because of it. Penalties run up to 1% of worldwide daily turnover, and authorities can force suspension of non-compliant vendor relationships.

If you sell to financial services, DORA outreach should be in your sequences today.

The State Privacy Law Patchwork

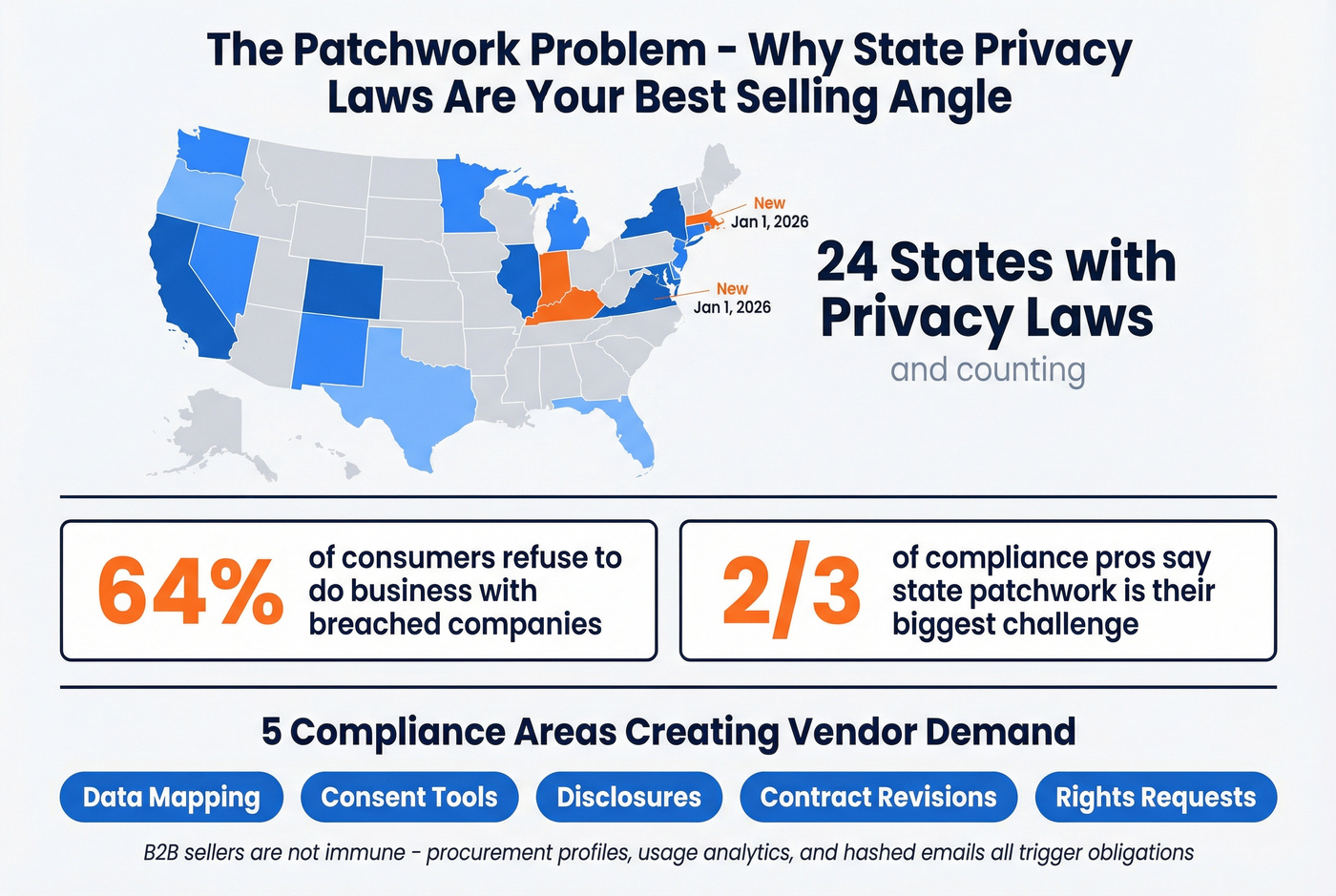

Indiana, Kentucky, and Rhode Island privacy laws went effective January 1, 2026, bringing the total to two dozen U.S. jurisdictions with comprehensive privacy legislation. Rhode Island's law has a particularly broad definition of "sale" that encompasses analytics and advertising data sharing.

Here's what most sales teams miss: B2B sellers aren't immune. Procurement officer profiles, usage analytics, and hashed email lists all trigger compliance obligations. The five compliance areas creating vendor demand are data inventory and mapping, consent and opt-out mechanisms, customer-facing disclosures, vendor contract revisions, and rights request workflows.

Nearly two-thirds of U.S. regulatory compliance professionals say the patchwork of state laws is their biggest challenge. And 64% of consumers now refuse to do business with companies that have suffered data breaches - so the stakes extend well beyond fines. That complexity is your selling angle.

AI Regulation at the State Level

Colorado's AI Act takes effect June 30, 2026, demanding risk management programs, impact assessments, and algorithmic discrimination prevention. California requires pre-use notices and opt-out mechanisms under its automated decision-making technology regulations, while AB 2013 mandates generative AI developers publicly disclose training dataset information.

The enforcement teeth are real. 42 state attorneys general sent a joint warning letter to AI companies. Massachusetts extracted a $2.5 million settlement from a student loan company over AI-driven lending discrimination.

And here's the line that should be in every outreach email: "We bought it from a vendor" is not a defense. Regulators are going after deployers, not just developers.

Cyber insurance carriers are introducing AI Security Riders that condition coverage on documented AI security practices. So even companies that aren't worried about regulators need to worry about their insurance.

Healthcare Cybersecurity Mandates

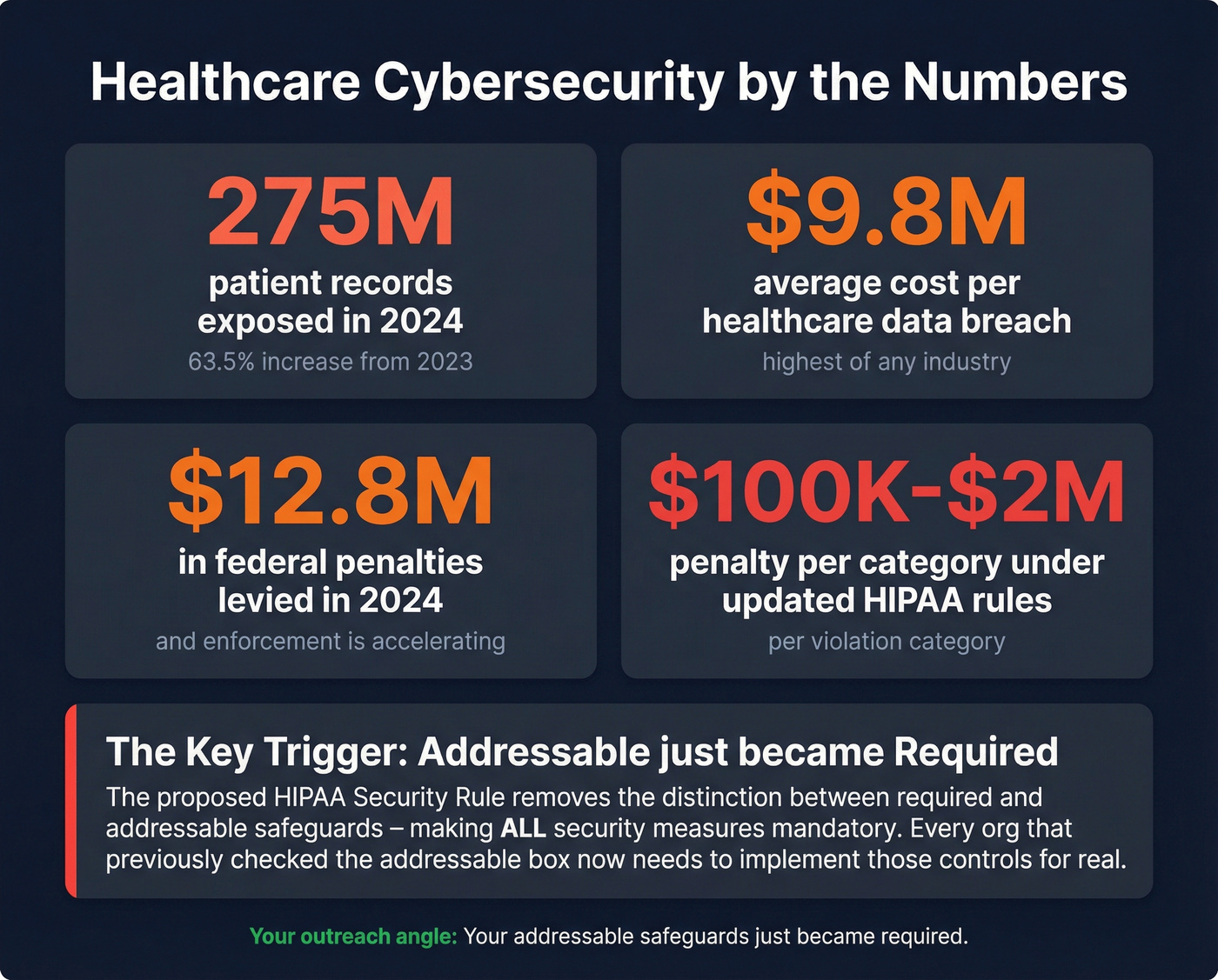

275 million patient records were exposed in 2024 - a 63.5% increase from 2023. Healthcare data breaches cost $9.8 million per incident. Federal regulators levied $12.8 million in penalties in 2024 alone.

The proposed HIPAA Security Rule updates remove the distinction between "required" and "addressable" safeguards, making ALL security measures effectively mandatory. That single word change - from "addressable" to "required" - is a massive trigger for compliance spending. Every healthcare organization that previously checked the "addressable" box and moved on now needs to implement those controls for real. FDA medical device cybersecurity mandates add another layer: premarket software bill of materials is now required.

If you sell cybersecurity, compliance automation, or managed security services to healthcare, your outreach angle writes itself: "Your 'addressable' safeguards just became required."

Climate and ESG Disclosure - The Patchwork Trigger

The SEC killed federal climate disclosure rules, but that didn't make the compliance obligation disappear. California's laws cover 3,000+ companies (including private companies with $500M+ revenue). The EU's Corporate Sustainability Reporting Directive covers another 3,000 companies, including non-EU entities with significant EU revenues.

As Harvard Business School's Ethan Rouen put it: "Major companies are going to wind up in the business of disclosure." About half of corporations that would've been covered by the SEC rules still must comply with rules from other jurisdictions. The patchwork IS the trigger - companies now need to navigate California, EU, and potentially other state-level requirements simultaneously, and that compliance complexity creates vendor demand for reporting tools, emissions tracking, supply chain transparency platforms, and advisory services.

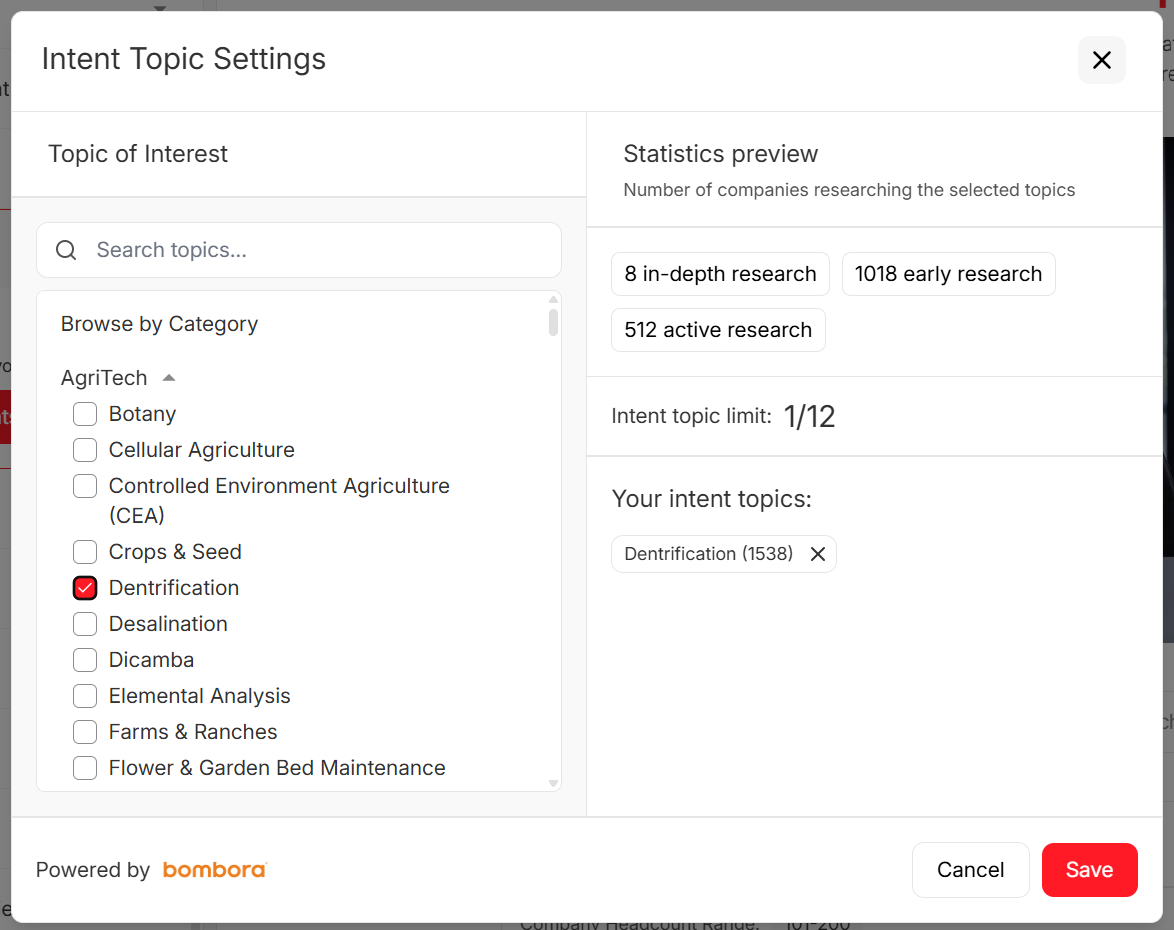

Regulatory triggers only work if you reach compliance buyers first. Prospeo's intent data tracks 15,000 topics - including AI governance, DORA, and data privacy - so you know which companies are actively researching compliance solutions right now. Pair that with 98% verified emails refreshed every 7 days, and you hit the Window of Dissatisfaction before your competitors even spot the signal.

The first vendor in wins 5X more often. Make sure it's you.

How to Time Your Outreach Around Regulatory Deadlines

Not all regulatory triggers are created equal. Act too early and your prospect is in Status Quo mode - they know the regulation exists but haven't internalized the urgency. Act too late and they're already in vendor selection with your competitor.

Phase 1: Announcement to Final Rule (12-24 Months Out)

Early movers and consultants dominate here. Budget hasn't been allocated yet. This is the best window for advisory and consulting sales - companies are trying to understand what the regulation means for them. Product sales are harder because procurement hasn't been triggered. Build relationships now; close later.

Phase 2: Final Rule to Enforcement (6-18 Months Out)

This is where most deals close.

Budgets are approved, urgency is rising, RFPs are going out. The compliance team has done their gap analysis and knows what they need. For the EU AI Act, we're squarely in this window right now. For DORA, this window opened in mid-2024 and the buying is still happening.

Phase 3: Post-Enforcement (0-6 Months After)

Remediation and panic buying. Companies that missed the deadline scramble. This is a secondary spike - often at premium pricing because the buyer has zero leverage. DORA is in this phase now, and vendors are closing deals at higher margins than they did pre-enforcement.

Apply Elias's 5-day Window of Dissatisfaction to each phase: once a compliance officer gets the internal memo that they're not ready, you have roughly 5 days before they start Googling solutions and your competitors show up. With regulatory triggers, the enforcement date removes the ambiguity - the countdown clock tells you exactly when to start.

Here's what this looks like in practice. We've seen cybersecurity vendors track the DORA enforcement timeline, build target lists of EU financial institutions 8 months before the deadline, and close a dozen deals in Q3 2024 - all from companies that hadn't started third-party vendor oversight. By the time competitors noticed the opportunity, those deals were signed. That's the power of a regulatory countdown clock.

Industry Playbooks - Regulatory Triggers by Vertical

Different regulations hit different verticals, and the buyer persona changes with each.

| Vertical | Key Regulations | Buyer Persona | Primary Pain Point |

|---|---|---|---|

| Healthcare | HIPAA updates, FDA cyber | CISO, Compliance Dir. | All safeguards now mandatory |

| Financial Svcs | DORA, PSD2, AML/KYC | CTO, Head of Risk | Third-party oversight gaps |

| SaaS / AI | EU AI Act, CO/CA AI laws | VP Eng, Head of Legal | Two deadlines in two months |

| Mfg / Energy | CA climate, EU CSRD | VP Sustainability, CFO | Scope 3 supply chain reporting |

Healthcare: 275 Million Records Exposed - and Counting

Those numbers are why the CISO or Compliance Director at every healthcare organization is already under pressure - and the HIPAA update eliminating "addressable" safeguards just turned that pressure into a purchasing mandate.

The healthcare vertical is drowning in overlapping compliance frameworks - HIPAA, state privacy laws, FDA mandates, and emerging AI governance requirements. The outreach angle that works: reference the specific HIPAA update. Every healthcare compliance officer knows exactly what "addressable to required" means, and it signals you understand their world. Skip the generic "compliance is important" framing. It'll get you deleted.

Financial Services: The Third-Party Problem

DORA created four distinct buying needs: ICT risk management frameworks, digital operational resilience testing, incident reporting systems, and third-party vendor oversight tools. The buyer is typically the CTO or Head of Risk, and they're under pressure from regulators who can force suspension of non-compliant vendor relationships.

Lead with the third-party angle - 78% of EU financial institutions experienced a third-party breach last year, and DORA makes that their problem, not just the vendor's. Smaller fintech startups struggle disproportionately here: they face the same compliance requirements as major banks but with a fraction of the budget and headcount. That creates a distinct opportunity for compliance solution vendors targeting the SMB fintech segment.

SaaS and AI Companies: Two Major Deadlines, Two Months Apart

How do you prepare for the Colorado AI Act (June 30, 2026) and the EU AI Act (August 2, 2026) simultaneously? That's the question every AI company should be asking. Each requires conformity assessments, bias audits, risk management documentation, and human oversight mechanisms.

The VP of Engineering and Head of Legal are your targets. The double deadline creates a natural urgency angle that doesn't require any embellishment - just state the dates and let the calendar do the selling.

Manufacturing and Energy: Your Suppliers' Emissions Are Your Disclosure

California's climate disclosure laws and the EU CSRD are forcing Scope 1, 2, and 3 emissions reporting - and Scope 3 means your prospect's entire supply chain. The VP of Sustainability or CFO is your buyer, and the pain point is that their suppliers' emissions are now their disclosure obligation.

This is a complex, multi-year compliance project, which means larger deal sizes and longer relationships.

Your Regulatory Monitoring Stack

You can't act on regulatory triggers you don't know about. Compliance professionals dedicate 38% of their work time to manual tasks, and compliance costs drop 30-50% with automation. The right stack pays for itself. Here's how to build one at every budget level.

Free / Budget Tier

Google Alerts is the obvious starting point - it's a starting point, not a strategy. It misses government database updates, regulatory filings, and enforcement actions. Fine for a baseline. Insufficient as your only tool.

Visualping is the upgrade that actually works. The free tier monitors government regulatory pages for changes and sends AI-powered summaries via email. Set it on the Federal Register, SEC EDGAR, and EU Official Journal pages relevant to your vertical. Paid plans (~$10-$50/mo) increase monitoring frequency and page count.

Government RSS feeds from SEC EDGAR, the Federal Register, and the EU Official Journal are free and underutilized. Subscribe to the specific dockets and categories that matter to your ICP.

Mid-Market ($100-$500/month)

Drata runs continuous compliance automation with AI features and 100+ integrations - solid for teams that need to track their own compliance posture alongside regulatory changes. Expect ~$200-$500/mo for mid-market plans.

Hyperproof covers continuous compliance with real-time alerts across SOC 2, ISO 27001, HIPAA, and NIST frameworks. Similar price range.

Owler tracks company news, funding events, and regulatory filings across your target accounts for ~$35-$50/mo - useful as a lightweight complement to deeper compliance tools.

The practitioner hack that actually works: set up Google Alerts -> Zapier -> ChatGPT to summarize and score regulatory changes -> Slack notification. Total cost: ~$50/mo for Zapier and ChatGPT API credits. One user described automating this so they could "contact prospects right when a crucial event happens."

In our experience, teams combining regulatory monitoring with intent data close 2-3X faster than those relying on monitoring alone. Knowing what's changing is half the equation - knowing who's actively researching it is the other half.

Enterprise ($5K+/month)

Finreg-E provides financial regulatory intelligence with digital rulebooks and real-time tracking. Purpose-built for financial services compliance teams. Expect $5K-$15K/mo depending on scope.

Ascent offers regulatory lifecycle management with global horizon scanning. Cloud-based, focused on financial services. Similar enterprise pricing.

OneTrust covers 55+ frameworks with automated risk scoring. It's the 800-pound gorilla of enterprise GRC - expect $50K-$200K/year.

Real talk: if your average deal size is under $25K, you don't need enterprise regulatory intelligence tools. The free tier + Zapier automation + one intent data source will get you 80% of the value at 5% of the cost. Save the enterprise budget for when you're closing six-figure compliance deals.

If Google Alerts is your only regulatory monitoring tool, you're bringing a knife to a gunfight. At minimum, add Visualping for page-level monitoring and one intent data source for buyer signals.

How to Write Regulatory Trigger Outreach That Gets Replies

Generic "compliance" outreach gets ignored. Regulation-specific outreach with deadline urgency gets meetings. The benchmarks tell the story:

| Metric | Baseline | Top Quartile |

|---|---|---|

| Open Rate | 20-30% | 50%+ |

| Response Rate | 3-6% | 15%+ |

| Meeting Rate | 0.5-2% | 4%+ |

The template structure that hits top-quartile numbers follows four rules: reference the specific regulation and deadline (not "upcoming regulatory changes"), state the specific pain it creates for their company or industry, show a result from a similar company, and include a single low-friction CTA.

Example: DORA Outreach to a Fintech CTO

Subject: Your ICT vendors + DORA - quick question

Hi [Name],

DORA's been live since January, but most fintechs I talk to are still working through the third-party vendor oversight requirements. The April 30 register submission deadline caught a lot of teams off guard.

We helped [similar company] build their ICT vendor compliance framework in 6 weeks - including the contractual provisions for service locations, incident reporting, and business continuity that DORA mandates.

Worth a 15-minute call to see if we can help with the remaining gaps?

Example: EU AI Act Outreach to a VP of Engineering

Subject: Aug 2, 2026 - your AI conformity assessment timeline

Hi [Name],

The EU AI Act full enforcement date is 10 months out. For companies deploying AI in [high-risk category], that means conformity assessments, technical documentation, and human oversight mechanisms need to be in place - not in progress.

We worked with [similar company] to complete their risk management framework and CE marking process in 4 months. Most teams I talk to haven't started.

Can I share what the assessment process looks like for [their specific use case]?

The Multi-Touch Cadence

Budget 90 minutes daily: 30 minutes on research, 45 on outreach, 15 on follow-ups. Here's the cadence:

- Day 1: Email (regulation-specific, personalized - like the templates above)

- Day 3: Social touch (comment on their content or share a relevant regulatory update)

- Day 7: Follow-up email (new angle - cost data or enforcement example)

- Day 14: Phone call (direct dial)

- Day 21: Breakup email

If you want a tighter process for timing, QA, and follow-ups, build this into your SDR cadence and track outcomes with sales sequence metrics.

The Data Quality Problem That Kills Trigger-Based Selling

You identified the trigger. You built the target list. You wrote the perfect outreach email referencing the EU AI Act deadline.

It bounced.

The contact left the company three months ago. Your 5-day window just closed. Three competitors already had the meeting.

This is where most trigger-based selling strategies fail - not at the signal detection stage, but at the contact data stage. If your data provider refreshes every 6 weeks (the industry average), a contact who changed roles last month won't show up correctly until next month. By then, the Window of Dissatisfaction has closed.

Prospeo refreshes its 300M+ professional profiles every 7 days. That's the difference between reaching a compliance director who started last month and emailing someone who left in Q3. Snyk's 50-person AE team dropped their bounce rate from 35-40% to under 5% and generated 200+ new opportunities per month after switching. When you're racing a regulatory deadline, data freshness isn't a feature - it's the entire foundation.

Look, the monitoring stack gets you the signal. The outreach templates get you the message. But if the contact data is wrong, none of it matters. The 5-day window doesn't care about your excuses.

If you're troubleshooting bounces and list decay, start with B2B contact data decay and a strict email verification workflow. If you're seeing hard rejects, this guide on 550 Recipient Rejected will save you hours.

Stale contact data kills your speed advantage on regulatory triggers. By the time a bounced email gets corrected, your prospect already selected a partner. Prospeo refreshes 300M+ profiles every 7 days - not the 6-week industry average - so the compliance officer you're targeting actually receives your outreach. At $0.01 per verified email, speed doesn't have to cost enterprise budgets.

Stop losing compliance deals to bounced emails and outdated job titles.

FAQ

What is a regulatory change sales trigger?

A regulatory change sales trigger is a new law or compliance requirement that forces companies to purchase products or services before an enforcement deadline. Unlike funding rounds or leadership changes, regulations come with public deadlines, published penalties, and affected-industry lists - making them the most predictable trigger event in B2B sales.

How far in advance should you act on a regulatory trigger?

The peak buying window is 6-18 months before enforcement, when budgets are approved and RFPs are actively circulating. A secondary spike occurs 0-3 months post-enforcement when non-compliant companies panic-buy at premium pricing. Reach decision-makers within 5 days of their internal gap analysis - that's Elias's Window of Dissatisfaction.

Which industries face the most regulatory triggers in 2026?

Financial services faces DORA remediation and PSD2 compliance. Healthcare is dealing with HIPAA security rule updates and FDA cyber mandates. AI companies must prepare for both the EU AI Act (Aug 2) and Colorado AI Act (Jun 30). Companies with $500M+ revenue face California climate disclosure requirements. Any company processing consumer data across two dozen U.S. states faces privacy compliance obligations.

How do you monitor regulatory changes for sales purposes?

How do you find accurate contact data for compliance decision-makers?

Use a data provider with weekly refresh cycles rather than the 6-week industry average, and verify emails before sending. Compliance roles turn over frequently as companies staff up for new regulations. A 7-day refresh cycle and 98% email accuracy ensure you reach the current compliance director - not someone who left last quarter while your competitors booked the meeting.