Sales Sequence Metrics: The 15 KPIs That Actually Predict Revenue (2026 Benchmarks)

A RevOps manager I know watched her team's reply rate crater from 4.2% to 1.8% over six weeks. The SDRs blamed their copy. The manager rewrote every email in the sequence. Nothing moved. She finally ran a deliverability audit and discovered 31% of their contact list had decayed - bad emails, job changers, defunct domains. The copy was fine. The data was dead.

Two weeks of list cleanup later, reply rates climbed back above 4%.

91% of cold emails generate no reply. But the teams that beat those odds aren't writing better subject lines. They're fixing the invisible stuff first - deliverability, data quality, targeting - while everyone else obsesses over personalization and emoji in subject lines.

Cold email still delivers $36-$42 per dollar spent, but only when your sales sequence metrics infrastructure is sound. Here's the 15 KPIs that actually predict revenue, the benchmarks you should measure against, and the diagnostic framework for fixing what's broken.

What You Need (Quick Version)

Track these 5 metrics daily: inbox placement rate, bounce rate, positive reply rate, meeting conversion rate, and influenced pipeline.

The single most important insight: Deliverability beats copy. Every time. If your emails aren't landing in the inbox, nothing else matters.

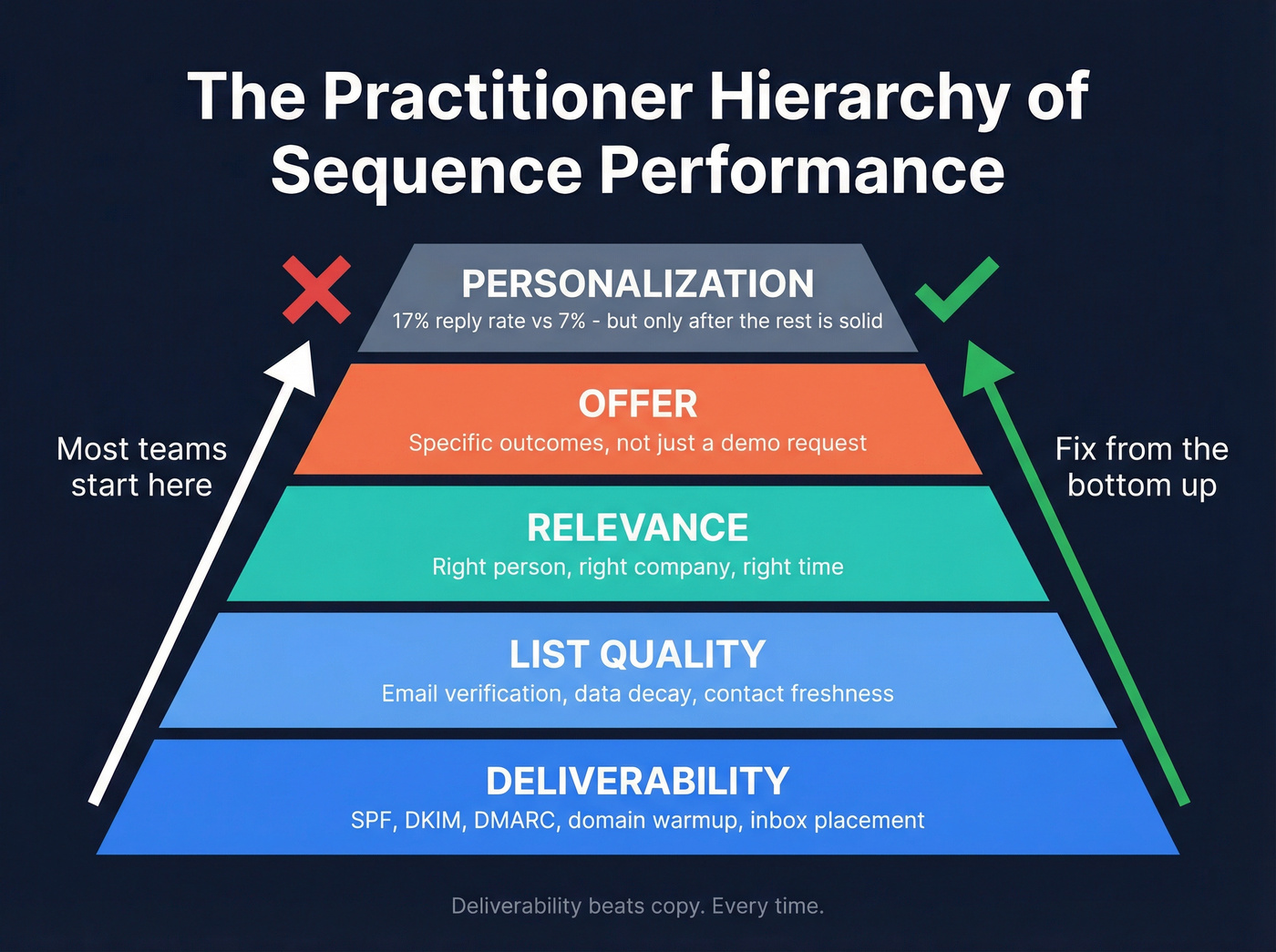

The practitioner hierarchy (what actually moves results, in order):

- Deliverability

- List quality

- Relevance

- Offer

- Personalization

Most teams track too many metrics and none of the right ones. The #1 silent killer? Stale contact data. Email lists decay 23% per year. If you haven't verified your list in the last 30 days, your metrics are lying to you.

The Metrics Hierarchy - What Actually Moves Your Numbers

Personalization is the most overrated lever in outbound sales.

A practitioner running 100K+ emails per month on Instantly put it bluntly: "Personalization only moves the needle when something else in the equation is off." The hierarchy that actually determines your sequence performance looks like a pyramid, and most teams are obsessing over the top while ignoring the base.

Level 1: Deliverability. If your emails hit spam, nothing else matters. SPF, DKIM, DMARC, domain warmup, inbox placement - this is the foundation.

Level 2: List quality. Email lists decay 23% per year. Nearly a quarter of your "verified" contacts from last January are bouncing, forwarding, or dead. Bad data doesn't just hurt bounce rates - it destroys your sender reputation, which drags deliverability down with it. Prospeo's 7-day data refresh cycle and 98% email accuracy keep your list clean while competitors' data rots on a 6-week refresh schedule.

Level 3: Relevance. 71% of ignored cold emails lack relevance to the recipient. Are you reaching the right person at the right company at the right time? Measuring prospect engagement at this level means looking beyond opens and clicks to whether your message actually resonates with the right audience.

Level 4: Offer. What's in it for them? A demo isn't an offer. A specific outcome is. (If you need ideas, start with proven lead generation offers.)

Level 5: Personalization. Yes, it helps. Personalized emails pull 17% reply rates vs. 7% without. But only after the first four levels are solid.

Fix from the bottom up. Always.

31% list decay killed that RevOps manager's reply rates - not her copy. Prospeo refreshes every record on a 7-day cycle (industry average: 6 weeks) with 98% email accuracy and 5-step verification. Stop debugging your sequences when the real problem is stale data.

Fix Level 1 and Level 2 of the hierarchy in one platform.

The 15 KPIs That Matter for Sequence Performance

Email Metrics

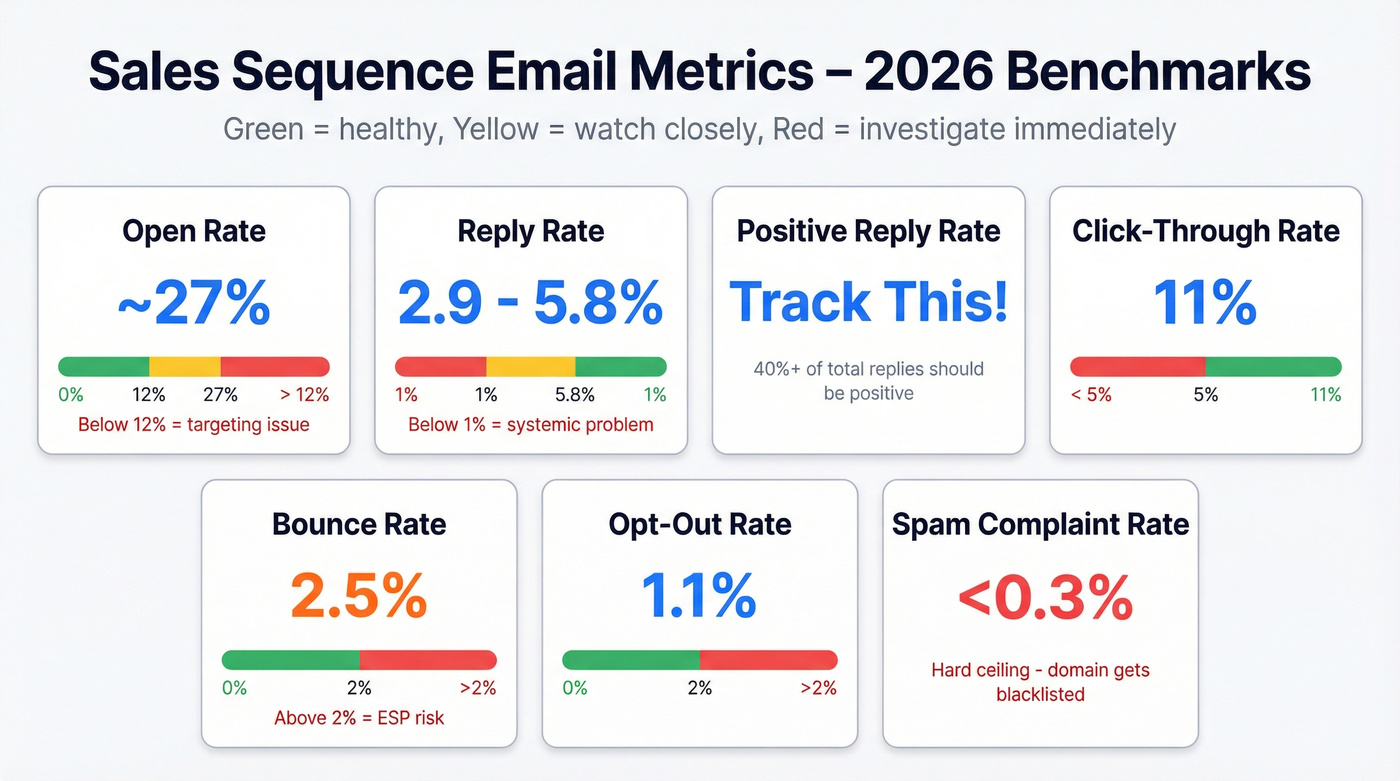

These seven metrics form the core of any sequence dashboard. Context matters, though - a 27% open rate means something very different for cold outbound than for warm inbound follow-up.

| Metric | Benchmark | Threshold to Investigate |

|---|---|---|

| Open rate | ~27% | Below 12% = targeting issue |

| Reply rate | 2.9-5.8% | Below 1% = systemic problem |

| Positive reply rate | Varies by hook | Below 40% of replies |

| CTR | 11% | Below 5% |

| Bounce rate | 2.5% | Above 2% = ESP risk |

| Opt-out rate | 1.1% | Above 2% |

| Spam complaint rate | <0.3% | At 0.3% = critical |

Open rate (~27%). Revenue.io benchmarks this at 27%, which aligns with Outreach's 27.2% across their customer base. The caveat: Apple Mail Privacy Protection pre-loads tracking pixels, inflating open rates for any prospect using Apple Mail. Disabling open-rate tracking pixels actually increased reply rates by 3% in one large-scale test. Use open rate as a directional signal, not gospel.

If you're below 12%, don't touch your subject lines yet. That's a targeting or deliverability problem.

Reply rate (2.9-5.8%). This is where the range tells a story. Outreach reports 2.9% across all customers. Instantly's 2026 benchmark across billions of emails: 3.43%. Belkins' 16.5M-email study: 5.8% - though that's a 15% decline from 6.8% the year prior. The trend line on reply rates is moving against outbound teams.

The top 10% of senders hit 10.7%+. The gap between 2.9% and 5.8% isn't noise - it's the difference between spray-and-pray volume and targeted, well-timed sequences. Your benchmark should come from your own historical data segmented by ICP, not from generic averages.

Positive reply rate. The metric most teams don't track and absolutely should. Reply rate counts every response - including "unsubscribe me," auto-replies, and "wrong person." Positive reply rate measures only replies expressing genuine interest.

Timeline-based hooks generate a 10.01% reply rate with 65% positive, while problem hooks get 4.39% with only 46% positive. That gap between total replies and positive replies reveals whether your messaging attracts interest or just provokes reactions.

Click-through rate (11%). This only matters if your sequence includes links - and many cold email practitioners argue you shouldn't include links in early touches because they trigger spam filters. If you're tracking CTR, it's most useful in later sequence steps or for warm sequences.

Bounce rate (2.5%). Google, Yahoo, and Microsoft all enforce a 2% bounce ceiling for bulk senders. The industry average sits at 2.5%, which means the typical sender is already flirting with danger. Above 2%, ESPs start throttling your domain. Above 6%, you're actively damaging your sender reputation. Cold campaigns average a brutal 7.5% bounce rate - most teams simply aren't verifying their lists.

Opt-out rate (1.1%). Anything above 2% signals your targeting is off or your sales cadence is too aggressive. Opt-outs climb from 0.1% on the first email to 2% by the fourth.

Spam complaint rate (<0.3%). This is the hard ceiling. Google, Yahoo, and Microsoft all enforce 0.3% as the maximum. Hit it, and your domain gets throttled or blacklisted. There's no recovering quickly from a sender reputation hit. Monitor this obsessively. (If you need the exact limits and how to stay under them, see spam complaint thresholds.)

Call Metrics

Phone isn't dead - but the numbers are humbling.

| Metric | Benchmark |

|---|---|

| Dials-to-conversation | 9% |

| Dials-to-meeting | 3.6% |

| Dial-to-opportunity | 1.6% |

| Voicemail return rate | 6% |

Dials-to-conversation (9%). That means 91 out of 100 dials go to voicemail or no answer. Cold calling success rate averages 2.3% overall, but connect rates rise above 60% with three or more attempts. The first call is the worst. Persistence pays - literally. (More calling KPIs here: answer rate benchmarks.)

Dials-to-meeting (3.6%). Of the conversations you do have, roughly 40% convert to a meeting. That's actually strong. The problem isn't conversion - it's getting someone on the phone in the first place.

Dial-to-opportunity (1.6%). For every 100 dials, you're generating 1-2 opportunities. At scale, that math works. A 5-person SDR team making 50 dials each per day generates 4-5 new opportunities daily.

Voicemail return rate (6%). Low, but not zero. Voicemails serve a dual purpose: they build familiarity, and they occasionally generate callbacks. Don't skip them.

Social Metrics

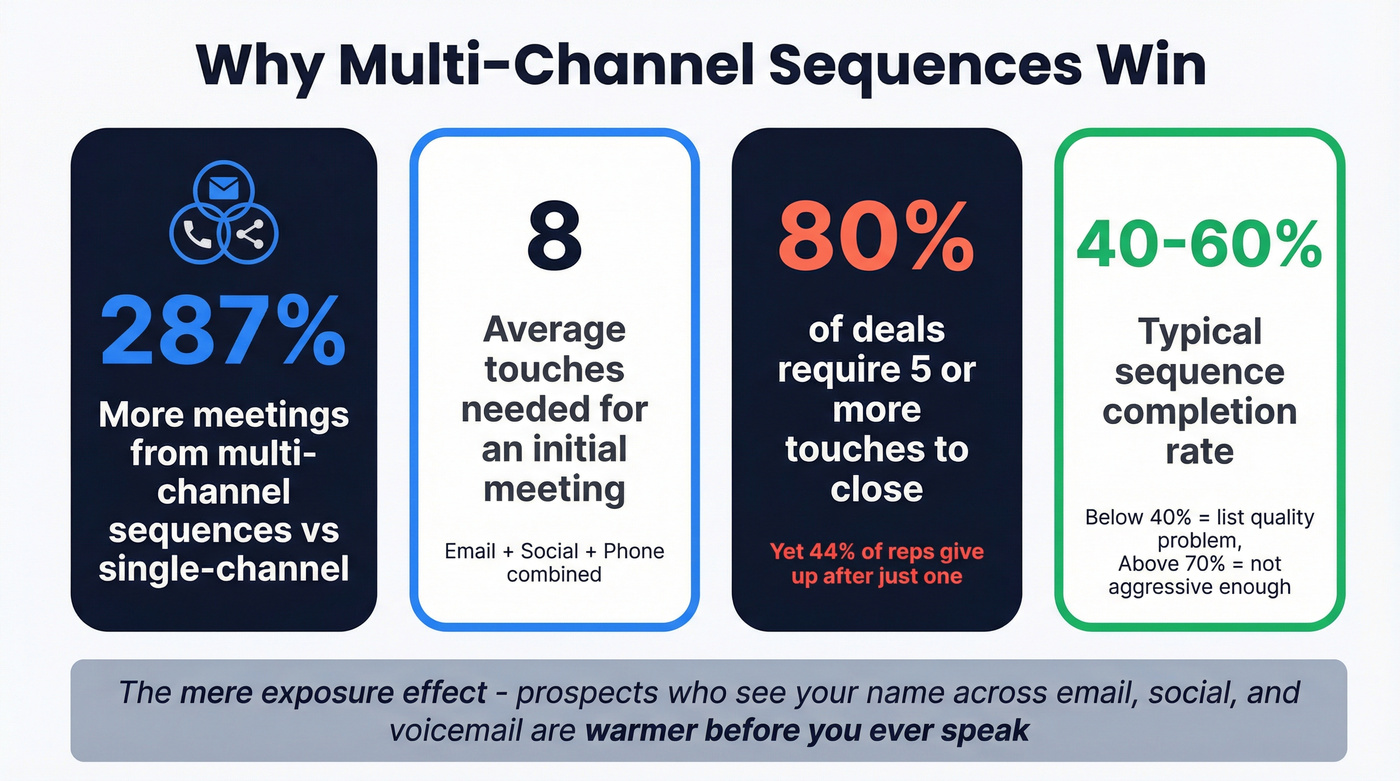

If you're running multi-channel sequences (and you should be), you need social benchmarks too.

| Metric | Benchmark |

|---|---|

| Connection request acceptance | ~25-35% (personalized) |

| InMail reply rate | ~10-25% (targeted) |

| Video message response rate | 2-3x text-only email |

Personalized connection requests significantly outperform generic ones. Video messages in sequences pull 2-3x higher response rates than text-only emails - worth testing as a mid-sequence touchpoint when a prospect hasn't responded to your first two emails. (More data: social selling statistics.)

Sequence-Level and Multi-Channel Metrics

Individual channel metrics tell you how each step performs. Sequence-level metrics tell you whether the whole machine is working.

Sequence completion rate (~40-60%). No platform publishes this number, so here's the math: with 2-7% bounces, 1-2% opt-outs, and 3-6% replies, roughly 40-60% of prospects reach your final step. If your completion rate is below 40%, your list quality is the problem. If it's above 70%, your sequence probably isn't aggressive enough.

Meeting rate by sequence type. The metric that connects activity to pipeline. Outreach segments this by sequence type: cold outbound targets 1-3%, warm inbound 8-12%, customer expansion 15-20%. If your meeting rate is strong but pipeline is weak, you're booking meetings with the wrong people.

When to extend your sequence: if your last step still pulls a reply rate above 3%, your sequence isn't long enough - add another step. If it's below 1%, you've already hit diminishing returns.

Influenced pipeline. The total pipeline value touched by your sequences - even if the sequence wasn't the last touch before a meeting. This is the metric that justifies your headcount to the CFO. If a prospect receives email Monday, a social touch Wednesday, a call Friday, then replies to email Saturday - what worked? All of it. Attribution is messy. Influenced pipeline embraces that messiness.

Multi-channel meeting lift. Multi-channel sequences (email + social + phone) generate 287% more meetings than single-channel approaches. An average of 8 touches are needed for an initial meeting. Psychologists call it the mere exposure effect - prospects who've seen your name across email, social, and voicemail are warmer before you ever speak. 80% of deals require 5+ touches, yet 44% of reps give up after just one. (If you're building this system, start with multi-channel sales automation.)

Benchmark Tables - Segmented by What Actually Matters

Generic benchmarks are dangerous. A 5% reply rate means you're crushing it in cold outbound to enterprise CFOs - and underperforming badly in warm inbound follow-up. Here's the segmented data that actually helps.

Benchmarks by Sequence Type

| Sequence Type | Reply Rate | Meeting Rate |

|---|---|---|

| Cold outbound | 8-15% | 1-3% |

| Warm inbound | 20-30% | 8-12% |

| Customer expansion | 25-40% | 15-20% |

| Win-back/nurture | 10-18% | 2-5% |

These ranges represent well-optimized sequences by type - not platform-wide averages. The 8-15% cold outbound range reflects teams with strong deliverability and targeting, not the median sender (who sits closer to 3-5%). The win-back range (10-18%) is higher than most teams expect, which means your churned customer list is probably underworked.

Reply Rate by Hook Type

This data from Digital Bloom's research is some of the most actionable we've come across. The hook - your email's opening angle - determines not just whether someone replies, but whether that reply is positive.

| Hook Type | Reply Rate | Positive Reply % | Meeting Rate |

|---|---|---|---|

| Timeline | 10.01% | 65% | 2.34% |

| Numbers | 8.57% | 62% | 1.86% |

| Social proof | 6.53% | 53% | 1.25% |

| Problem | 4.39% | 46% | 0.69% |

Timeline hooks ("We're working with three companies in your space ahead of Q3 planning") outperform problem hooks ("Are you struggling with X?") by 2.3x on reply rate and 3.4x on meeting rate. The problem hook is the default for most SDR teams. It shouldn't be.

Prospect Engagement Rates by ICP Title and Industry

| ICP Title | Reply Rate |

|---|---|

| CEO / Founder | 7.63% |

| CTO / VP Tech | 7.16% |

| CFO | 6.82% |

| Head of Sales | 5.86% |

| Industry | Reply Rate |

|---|---|

| Consulting | 7.88% |

| Healthcare | 6.88% |

| SaaS | 6.42% |

| Financial Services | 6.22% |

CEOs reply more than Heads of Sales. Consulting firms reply more than SaaS companies. If you're benchmarking your SaaS-focused sequence against generic averages that include consulting outreach, you're setting yourself up for disappointment.

Follow-Up Diminishing Returns

Belkins' 16.5M-email study tells a clear story about when to stop.

| Follow-Up # | Reply Impact | Spam Complaints | Unsubscribes |

|---|---|---|---|

| 1st email | 8.4% reply rate | 0.5% | 0.1% |

| 1st follow-up | +49% vs. prior | 0.7% | 0.3% |

| 2nd follow-up | -20% vs. prior | 1.0% | 0.8% |

| 4th follow-up | -55% vs. earlier | 1.6% | 2.0% |

The first follow-up is gold - a 49% reply boost over the initial email. But by the fourth follow-up, reply rates have cratered 55% while spam complaints have tripled. 58% of all replies come from the first email alone. Most teams are over-sequencing. Three to four total emails is the sweet spot.

Deliverability - The Metric Nobody Tracks That Kills Everything Else

17% of cold emails hit spam due to poor domain reputation. That's before anyone even sees your brilliant subject line or your carefully personalized first sentence.

Here's the thing: deliverability is the invisible metric that determines whether every other number in your dashboard means anything.

The hard ceilings. Google, Yahoo, and Microsoft all enforce these thresholds for bulk senders:

- Spam complaints: under 0.3% (hit this and you're throttled)

- Bounce rate: under 2% (above this, ESPs flag your domain)

- Inbox placement: target 80%+ (below this, your sequence is performing in a vacuum)

The non-negotiable checklist:

- SPF record configured

- DKIM signing enabled

- DMARC policy published

- Custom tracking domain (avoid shared domains)

- One-click unsubscribe header (required by Google and Yahoo for bulk senders)

Domain warmup schedule. Don't blast 500 emails from a fresh domain. You'll get blacklisted in a day. Plan for 6-7 weeks of warmup:

- Weeks 1-2: 5-10 emails/day

- Weeks 3-4: 15-20 emails/day

- Weeks 5-6: 30-40 emails/day

- Week 7+: max 50 emails/day from a single inbox

Pro tip: Consider disabling open-rate tracking pixels in cold sequences. Removing them increased reply rates by 3% in one large-scale test. The pixels trigger spam filters - and the open rate data they provide is unreliable anyway thanks to Apple Mail Privacy Protection.

Bounce rates by industry (so you know what "normal" looks like):

| Industry | Avg Bounce Rate |

|---|---|

| Agencies | 3.15% |

| Legal | 2.39% |

| Finance | 1.79% |

The #1 deliverability lever isn't your email infrastructure. It's your data. Lists decay 23% per year. If you built your prospect list six months ago, roughly 12% of those contacts have changed jobs, switched emails, or left the company entirely. Every bounced email chips away at your sender reputation.

Prospeo's 5-step verification process - including catch-all domain handling, spam-trap removal, and honeypot filtering - delivers 98% email accuracy. The 7-day data refresh cycle means your list doesn't decay between campaigns. Meritt dropped their bounce rate from 35% to under 4% after switching, and Stack Optimize maintains 94%+ deliverability with zero domain flags across all their clients. (For a step-by-step SOP, use an email verification list.)

Cold campaigns average 7.5% bounce rates. The ESP ceiling is 2%. Prospeo's proprietary verification catches bad emails, spam traps, and honeypots before they torch your sender reputation - at $0.01 per verified email.

Keep your bounce rate under 2% without manual list scrubbing.

The Diagnostic Framework - What to Fix When Metrics Drop

When a metric drops, resist the urge to rewrite your emails. Diagnose first, fix second. Work through this decision tree from infrastructure up.

Low Open Rate

Step 1: Check deliverability. Run an inbox placement test. Are you landing in spam? Check SPF/DKIM/DMARC configuration. If inbox placement is below 80%, stop everything else and fix this first. (Deep dive: email deliverability.)

Step 2: Check targeting. If open rate is below 12%, it's a targeting problem, not a subject line problem. Are you reaching the right titles at the right companies?

Step 3: Then check subject lines. Subject lines under 40 characters with quantified claims achieve 37% higher open rates. "3 companies in [industry] cut churn 40%" beats "Quick question about your retention strategy." (More examples: cold email subject lines.)

Low Reply Rate

Step 1: Check relevance. 71% of ignored cold emails lack relevance to the recipient. Is your message about their problem, or about your product?

Step 2: Check your offer. "Want to hop on a 15-minute call?" isn't compelling. "Here's how [similar company] cut their CAC by 30% - want the playbook?" is.

Step 3: Then check personalization. Only after relevance and offer are dialed in.

High Bounce Rate

Step 1: Check data freshness. When was this list built? If it's more than 90 days old, re-verify before sending another email.

Step 2: Check list source. Some data providers have higher decay rates than others. Catch-all domains are particularly tricky - they accept everything during verification but bounce in practice.

Step 3: Check for role-based and generic addresses. info@, sales@, team@ - these inflate bounce rates and rarely convert anyway. Strip them out.

Watch for "Sequence Purgatory"

Manual steps like phone calls create bottlenecks when reps can't keep up with task volume. If your sequence includes manual steps and your reps are consistently behind on tasks, prospects are sitting in limbo - too far into the sequence to restart, but not receiving touches on schedule. Either automate more steps or reduce the number of prospects entering the sequence at once.

The Sequence Failure Checklist

When the whole outbound sequence is underperforming, five common causes explain most failures:

- Generic messaging (not tailored to persona or pain)

- Bad timing (wrong day, wrong cadence, wrong buying cycle)

- Lack of personalization (after relevance is confirmed)

- No touchpoint variety (email-only when multi-channel works 287% better)

- No real value offered (every touch should earn the next one)

Skip the elaborate root-cause analysis if you haven't checked these five first. In our experience, one of them is always the culprit.

The Optimization Playbook

Sequence Length and Timing

Most teams are over-sequencing. Here's what the data says.

The optimal follow-up cadence is 3-7-7: send your first email on Day 0, first follow-up on Day 3, second on Day 10, third on Day 17. This captures 93% of total replies by Day 10. After that, you're chasing the last 7% while tripling your spam complaint rate.

The sweet spot for total touchpoints across channels is 8-12, based on analysis of 14,000 sequences yielding 35-45% response rates. But that includes calls, social touches, and emails combined - not 12 emails.

Activity benchmarks for planning: Target 100-1,000 accounts per rep, 2-5 contacts per account, 200-500 emails per rep per day, aiming for 10-20 meetings per month per rep. If your reps are spending more than 72% of their time on non-selling activities (the industry average), your sequence tooling is the bottleneck, not your reps.

Best days and times (from a 16.5M-email dataset):

- Thursday: 6.87% reply rate (best)

- Monday: 5.29% (worst)

- Evenings 8-11 PM: 6.52% reply rate (peak)

I know "send emails at 9 PM" sounds counterintuitive. But these emails land at the top of the inbox when prospects check their phone before bed or first thing in the morning. The data is consistent across multiple studies.

Email Body and CTA Optimization

Quick hits that move the needle:

- Under 80 words outperforms longer emails

- 6-8 sentences is the sweet spot - 42.67% open rate, 6.9% reply rate

- Single CTA beats multiple asks. Every time.

- Interest-based CTAs ("Want the playbook?") hit 30% success vs. open-ended ("Thoughts?") at 13%

- 4-8 word CTAs perform best

- Follow-ups framed as replies beat formal reminders by ~30%

- Never write "Just bumping this" - it drops meeting rates 14%

Testing, Segmentation, and Improving Your Sales Cadence Conversion Rate

A/B testing priority order (ranked by impact):

- Subject lines (highest impact - 200+ sends per variant minimum)

- First line of email body

- Number of touchpoints

- Channel sequence order

- Timing between touches

- Send time

- CTA phrasing

The single biggest testing insight: segment your cohorts to 50 contacts or fewer. This increases reply rates by 2.76x. Why? Smaller cohorts force you to write more relevant, targeted messaging. You can't be lazy with 50 people the way you can with 5,000. (Framework: A/B testing lead generation campaigns.)

One more data point that should change your behavior: reaching 1-2 contacts per company yields a 7.8% reply rate. Reaching 10+ contacts at the same company drops to 3.8%. Don't carpet-bomb org charts. Be surgical.

Test one variable at a time. Run 200+ sends per variant minimum. Document everything. And resist the temptation to test send time before you've tested subject lines and first lines - the impact hierarchy matters.

Beyond Vanity Metrics - What Actually Predicts Revenue

Open rates and reply rates are activity metrics. They tell you the machine is running. They don't tell you the machine is producing revenue.

Leading vs. Lagging Indicators

Leading indicators are the metrics you can influence today: inbox placement rate, email engagement, bounce rate, activity volume, and sequence completion rate. A composite sequence engagement score - combining open rate, reply rate, and click-through rate weighted by quality - gives you a single number to track daily health. When inbox placement drops from 90% to 70%, your pipeline will shrink two weeks later. Guaranteed.

Lagging indicators are the outcomes: meetings booked, pipeline generated, opportunities created, revenue closed. By the time these move, the damage (or the win) already happened upstream. Track both, but act on leading indicators.

The Revenue Metrics

The metrics that actually predict revenue live downstream: a 20% conversion rate from meeting to opportunity is the benchmark, with a 35-55% quote win rate for well-qualified pipeline. Maintain a 3:1 pipeline-to-quota ratio, and you've got a healthy funnel. (If you want templates/examples, see revenue dashboards.)

Real talk: if your deal size is under $15K, you probably don't need a 15-metric dashboard. Track inbox placement, positive reply rate, and meetings booked. That's it. The elaborate dashboards are for teams running complex, multi-segment outbound motions with $50K+ deals. Everyone else is over-engineering their reporting and under-investing in the actual selling.

I've seen teams build 40-metric dashboards and miss the one number that mattered: are we generating enough qualified pipeline to hit quota? Start there. Work backward. Every metric you track should connect to that question. If it doesn't, delete it.

The best sequence operators we've worked with track five things daily (inbox placement, bounce rate, positive reply rate, meeting conversion, influenced pipeline), review segmented benchmarks weekly, and overhaul their sequences every six months with minor tweaks monthly. That's it. Simplicity wins.

FAQ

What's a good reply rate for a cold email sequence?

Average cold email reply rate is 3-5%, but the top 10% of senders hit 10.7%+. Cold outbound to enterprise targets: 8-15% is strong for well-optimized sequences. Warm inbound follow-up: 20-30%. Always benchmark against your specific ICP and industry - a 6% reply rate to CFOs in financial services is excellent, while the same rate for warm inbound signals a problem.

How many follow-ups should a sales sequence include?

Three to four total emails is optimal based on a study of 16.5 million cold emails. The first follow-up boosts replies by 49%, but by the fourth, reply rates drop 55% and spam complaints triple. Use the 3-7-7 cadence (Day 0, Day 3, Day 10, Day 17) to capture 93% of replies by Day 10.

Why are my sequence open rates dropping?

Three likely causes in diagnostic order: deliverability issues (check SPF/DKIM/DMARC and run an inbox placement test), stale data inflating bounces and damaging sender reputation (lists decay 23% per year - tools like Prospeo with 7-day refresh cycles prevent this), or Apple Mail Privacy Protection artificially inflating your previous numbers, making current rates look worse by comparison.

What's the difference between reply rate and positive reply rate?

Reply rate counts every response including "unsubscribe me," auto-replies, and "wrong person." Positive reply rate measures only replies expressing genuine interest. Timeline-based hooks get 10% reply rate with 65% positive; problem hooks get 4.4% with only 46% positive. The gap reveals whether your messaging attracts real buyers or just provokes reactions.

How do I measure prospect engagement across a multi-channel sequence?

Combine email reply rates, social connection acceptance, call connect rates, and content clicks into a composite engagement score weighted by intent signal strength. A positive email reply carries more weight than an open; a booked meeting carries more than a social accept. Multi-channel sequences generate 287% more meetings than single-channel, so tracking cross-channel engagement isn't optional anymore.