How to Find Email Addresses: The Complete Guide for 2026

You send 200 cold emails on Monday. By Tuesday, 47 have bounced. Your domain reputation tanks. Your sequences stall. And the "98% accurate" email finder you're paying for suddenly feels like a lie.

Here's the thing: the gap between marketed accuracy and real-world accuracy is the single biggest problem you'll face when trying to find email addresses. Independent benchmarks consistently show tools delivering 20-80% accuracy - not the 90-99% plastered across every pricing page. That difference is the difference between a pipeline that works and a domain that's blacklisted.

Below: the free methods that actually work, the paid tools worth paying for, the accuracy data nobody wants you to see, and the mistakes that'll torch your sender reputation before you book a single meeting.

What You Need (Quick Version)

Finding fewer than 100 emails per month? The free methods below - search operators, email permutation, the newsletter trick - work fine. You don't need a paid tool yet.

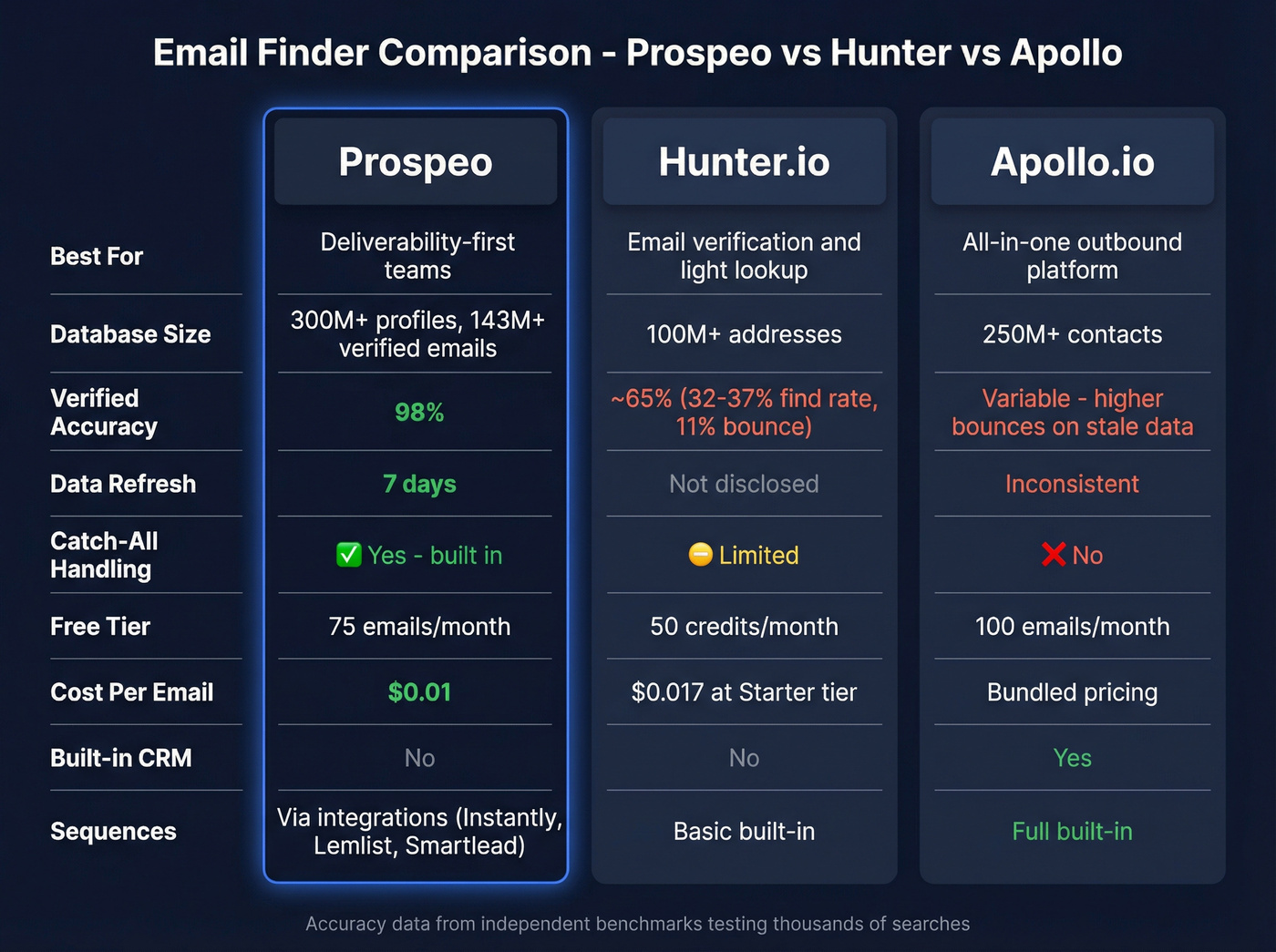

Want an all-in-one platform with CRM, sequences, and data? Apollo.io has a 250M+ contact database, a built-in CRM, and email sequencing. Free tier includes 100 emails per month.

How to Find Email Addresses for Free (No Tools Required)

You don't need to pay for software to locate a handful of contacts. These methods are manual, but they work - especially when you're targeting fewer than 100 people per month.

Google Search Operators

The fastest free method. Use targeted search strings to surface contact details indexed on public web pages.

Try these exact queries:

"John Smith" "@acmecorp.com"- searches for the name alongside the company domainsite:acmecorp.com "email" "contact" "John Smith"- limits results to the company's own site"John Smith" "acmecorp.com" filetype:pdf- catches addresses buried in PDFs, presentations, and whitepapers

Pro tip: DuckDuckGo handles the @ symbol better than Google for email searches. If Google strips it out, switch search engines.

Email Permutation (Guess and Verify)

Most companies follow a standard email format. Once you crack the pattern for one employee, you've got the formula for everyone.

Common patterns to test:

firstname.lastname@company.com(most common)firstinitiallastname@company.comfirstname@company.comlastname@company.comfirstname_lastname@company.com

Generate 4-5 variations, then verify each one using a free tool like MailTester or a basic SMTP check. Never send to an unverified guess - that's how you burn domains.

The Newsletter Trick

Subscribe to the target company's newsletter using a throwaway email. The welcome email often reveals the company's email format - the "from" address, the reply-to, or even a team member's direct address in the signature.

This works surprisingly well for mid-market companies that haven't locked down their email infrastructure. You'll see patterns like marketing@company.com or sarah.jones@company.com in the headers.

Company Website Patterns

Don't overlook the obvious. Check these pages on the target company's website:

- About / Team / Leadership - often lists executives with direct emails

- Press / Newsroom - press contacts are almost always published

- Investor Relations - SEC filings and annual reports frequently contain executive emails. This is also how to find investor emails when you're fundraising - public filings, pitch event speaker lists, and fund websites often publish partner contact details directly.

- Job postings - sometimes include the hiring manager's contact info

When Free Methods Stop Working

Free methods hit a wall around 100 contacts per month. The manual effort becomes unsustainable, accuracy is inconsistent, and you've got no verification layer to protect your domain.

That's when paid tools start earning their keep.

This article shows why most email finders deliver 20-60% accuracy at scale. Prospeo's proprietary infrastructure - no third-party email providers - hits 98% verified accuracy with catch-all handling, spam-trap removal, and a 7-day data refresh cycle. You pay $0.01 per email, only for valid addresses.

Stop babysitting bad data. Get 500 emails you can actually trust.

The Accuracy Problem - What Email Finders Actually Deliver

Every email finder claims 90-98% accuracy on their marketing page. The independent data tells a very different story.

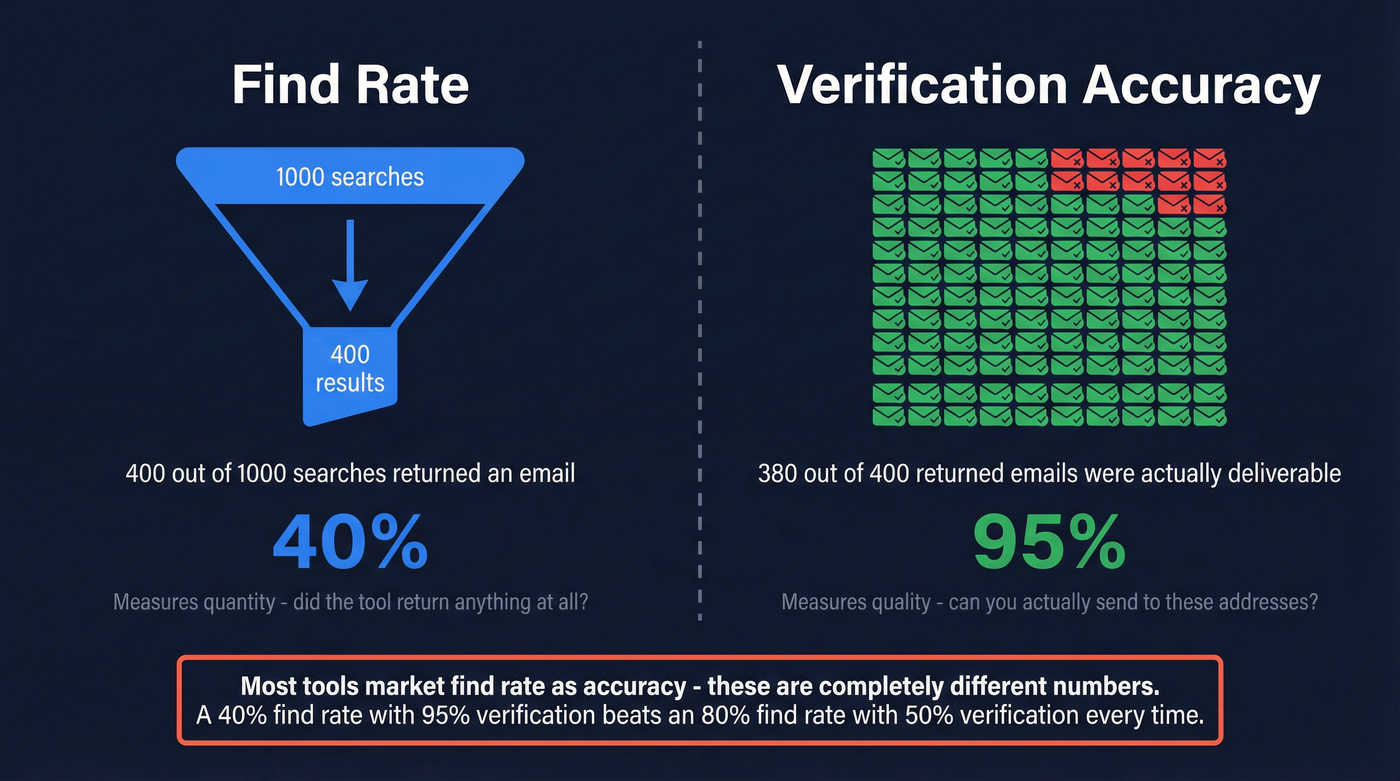

Before going further, you need to understand two metrics that the industry deliberately conflates:

- Find rate: How often a tool returns any email for a given search. This is what most benchmarks measure.

- Verification accuracy: Of the emails a tool does return, what percentage are actually deliverable.

These are completely different numbers. A tool with a 40% find rate but 95% verification accuracy is far more useful than one with an 80% find rate and 50% verification accuracy. The first tool finds fewer contacts but almost never burns your domain. The second tool fills your CRM with garbage. Most marketing pages blur this distinction on purpose.

What the Benchmarks Show

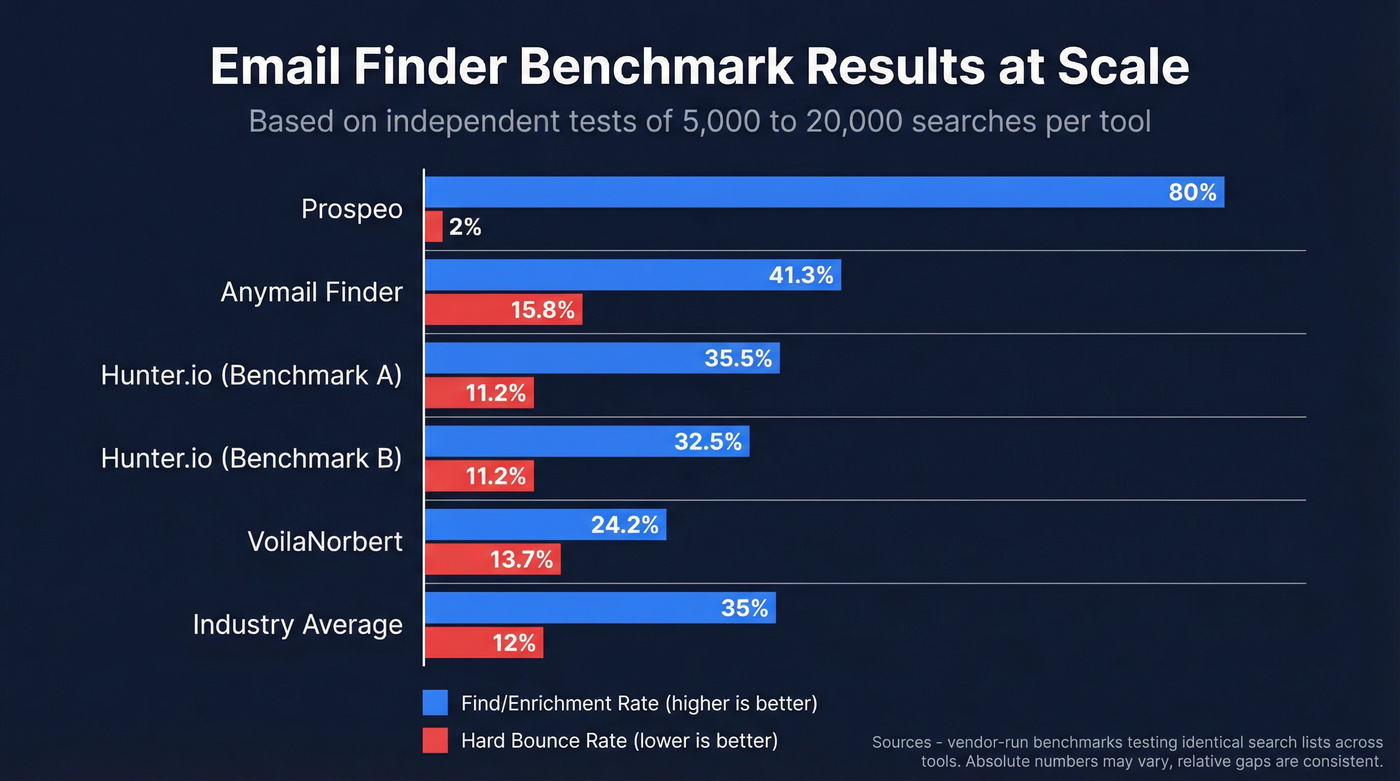

Multiple vendor-run benchmarks have tested email finders at scale. I say "vendor-run" because both major public benchmarks were conducted by companies that - surprise - ranked themselves first. Take the absolute numbers with skepticism, but the relative performance gaps are instructive.

One benchmark tested 5,000 identical searches across 9 tools. The top performer hit 80.3% find rate. Most tools landed between 20-60%. Hunter.io - one of the most popular tools in the space - found only 887 valid emails out of 2,500 domain searches, a 35.5% find rate.

A separate benchmark ran 20,000 tests across 15 tools. Hunter scored 32.5% effective enrichment with an 11.2% hard bounce rate. VoilaNorbert hit 24.2% effective enrichment with a 13.7% hard bounce rate. Even Anymail Finder, which scored 41.3% enrichment, carried a 15.8% hard bounce rate.

A third comparison tested 10 tools on a curated 100-contact list and reported accuracy between 90-98% across the board. The discrepancy isn't a mystery - smaller, hand-picked test sets produce flattering numbers. Scale the test to thousands of real-world searches, and accuracy craters.

Why Most Tools Return the Same Results

Here's the uncomfortable truth one benchmark surfaced: 98% of enrichment solutions are built from the same underlying data sources. Most tools query the same third-party providers and slap different UIs on top. That's why accuracy numbers cluster together in independent tests - and why tools with proprietary infrastructure tend to outperform on verification quality.

One more wrinkle: 15-28% of B2B domains are catch-all domains. These accept mail sent to any address, which means standard verification can't confirm whether a specific mailbox actually exists. If your email finder doesn't handle catch-all domains intelligently, you're flying blind on a significant chunk of enterprise prospects.

Hot take: Most teams don't have an email finding problem - they have an email verification problem. A tool that returns fewer results but verifies them rigorously will outperform a tool that floods your CRM with unverified addresses every single time. I'd rather have 500 emails I can trust than 2,000 I have to babysit.

How to Test Tools Yourself (50-Contact Protocol)

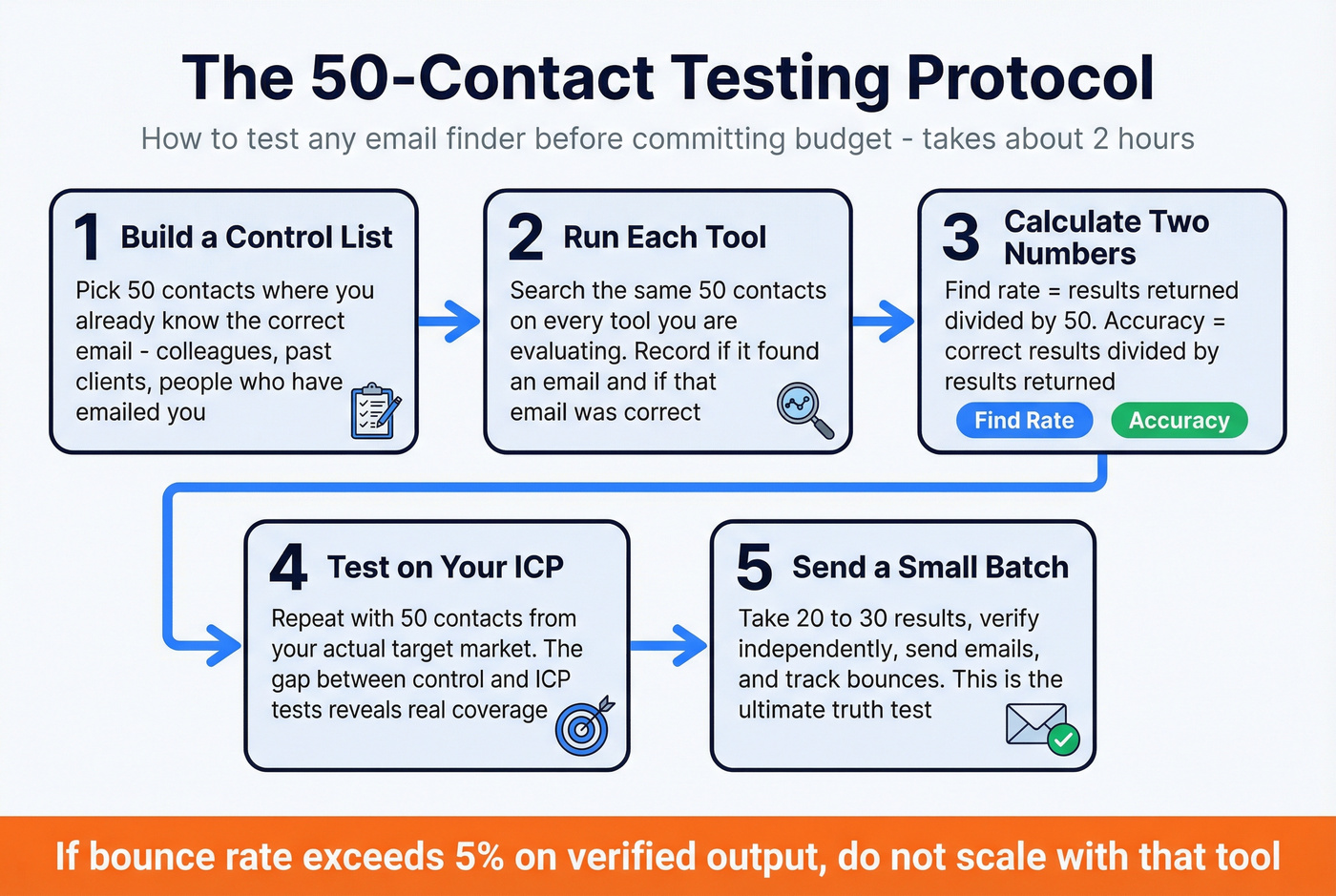

Don't trust any tool's self-reported accuracy. Here's how we test every new email finder before committing budget:

- Build a control list. Pick 50 contacts where you already know the correct email address - colleagues, past clients, people who've emailed you.

- Run each tool against the same 50 contacts. Record: Did it find an email? Was the email correct?

- Calculate two numbers: Find rate (results returned / 50) and accuracy (correct results / results returned).

- Test on your actual ICP. Repeat with 50 contacts from your target market. The gap between the control test and the ICP test reveals how well the tool covers your specific segment.

- Send a small batch. Take the tool's output, verify it independently, and send 20-30 emails. Track bounces.

This takes about 2 hours and will save you thousands in wasted spend and domain damage.

Best Tools to Find Email Addresses in 2026

Prospeo

Best for: Teams that prioritize deliverability over database size.

Prospeo runs on proprietary email-finding infrastructure - it doesn't rely on the same third-party providers that power most of the market. That's a meaningful difference when 98% of tools are pulling from the same data well.

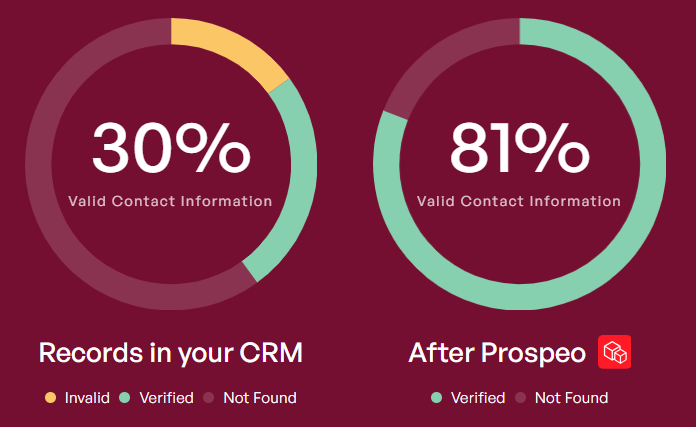

The 5-step verification process includes catch-all handling, spam-trap removal, and honeypot filtering. The result: 98% email verification accuracy with a 7-day data refresh cycle (the industry average is 6 weeks). For context, Meritt went from a 35% bounce rate to under 4% after switching, tripling their pipeline from $100K to $300K per week.

The database covers 300M+ professional profiles with 143M+ verified emails. Search filters include buyer intent, technographics, job changes, and headcount growth - 30+ options total. The Chrome extension (40,000+ users) works on any website for one-click prospecting.

Pricing is straightforward: ~$0.01 per verified email, free tier with 75 emails per month, no contracts. Self-serve onboarding means you're finding emails in minutes, not waiting for a sales call.

Pair it with Instantly, Lemlist, or Smartlead for sequences - Prospeo has native integrations with all three.

Hunter.io

Hunter is the most recognized name in email finding, trusted by 6M+ users. The Chrome extension is genuinely excellent - fast, clean, and works well on professional profiles. Domain search is the standout feature: plug in a company domain and get a list of associated addresses with confidence scores.

But here's the reality check. In large-scale benchmarks, Hunter found valid emails for just 32-37% of searches, with an 11.2% hard bounce rate. Reddit sentiment echoes this - one practitioner put it bluntly: "works better as a verification layer than a primary source."

Hunter's strength is verification, not discovery. If you already have addresses and need to clean them, Hunter's solid. As a primary finder at scale, the numbers don't hold up.

Pricing: Free tier with 50 credits/month. Starter runs $34/mo (annual) for 2,000 credits. Growth is $104/mo for 10,000 credits. Verification costs 0.5 credits per email.

Apollo.io

Apollo is the Swiss Army knife nobody asked for but everyone ends up using. A 250M+ contact database, built-in CRM, email sequences, and targeting by title, industry, and tech stack - all in one platform. For solo founders and early-stage teams building outbound from scratch, it's the fastest way to go from zero to sending.

The tradeoff is data freshness. I've tested Apollo lists against verified data and consistently see higher bounce rates on contacts that haven't been recently updated. Reddit users flag the same pattern: "data feels bad sometimes, lots of bounces on older contacts." Apollo's 91% accuracy claim looks good on paper, but real-world performance drops noticeably for contacts outside their most active segments.

The free tier is generous - 100 emails per month with basic CRM features. Paid plans run ~$49-99/mo per user. If your average deal size is modest and you need one tool to do everything, Apollo is hard to beat. If data accuracy is your top priority, it's not the answer.

Snov.io

| Price | From $39/mo with email finding, verification, and drip campaigns bundled |

| Best for | International leads and teams that need a little bit of everything on a budget |

| Biggest weakness | Large-scale benchmarks showed a 20.1% find rate - near-total failure on company name searches (19 valid emails out of 2,500) |

| Verdict | Budget option for light-volume international prospecting. Don't rely on it as your primary source for high-volume campaigns. |

ContactOut

Skip this if you're running high-volume outbound. ContactOut caps you at 6,000 emails per year on the $79/mo Sales plan - that's 500/month, which gets tight fast. The Recruiter plan jumps to $199/mo for 12,000 emails/year and 600 phone numbers.

Use this if you're a recruiter or individual prospector. The free tier gives you 100 contacts/month, and the Chrome extension works on professional profiles and GitHub - great for technical recruiting. The 30M company database includes direct dials on higher tiers.

RocketReach

The most overpriced email finder on the market. Essentials starts at $80/user/month for email only. Pro is $150/user/month. Ultimate hits $833/user/month.

One Reddit user paid ~$50/mo for over a year and reported "low reply rates" - an expert friend told them "RocketReach may not be the most payworthy tool in market." At $80-833/user/month, RocketReach needs to deliver exceptional data quality to justify the price. The user complaints suggest it doesn't.

My recommendation: Unless you're locked into an enterprise contract that bundles RocketReach, there's no reason to pay these prices in 2026.

VoilaNorbert

Pricing runs $39-499/mo depending on volume. The standout feature: VoilaNorbert only charges for successful finds, so you're not burning credits on dead ends. Separate verification is available at $0.003/email. Solid for teams that want predictable costs, but benchmarks showed a 36% find rate - mid-pack at best.

Skrapp.io

Free tier with 100 emails/month. Professional plan starts at $30/mo (annual) for 1,000 credits. Claims a 92% search success rate and 97%+ verification accuracy. Strong for professional profile prospecting via Chrome extension. G2 rating sits at 4.4/5 across 296 reviews.

A quiet workhorse that doesn't get enough attention.

GetProspect

Free tier with 50 emails/month, paid plans from $34-49/mo. Independent benchmarks placed GetProspect at 61.9% find rate - middle of the pack, which honestly makes it one of the more reliable options tested. Decent for small teams that need a straightforward lookup tool without complexity.

Mailmeteor

Gmail-native tool that's better for sending than finding. The email finder is free to use with no sign-up required, and the broader mail merge product has paid tiers starting around $10/mo. The database is limited compared to dedicated finders. If you're already in Gmail and need to send personalized campaigns, it's useful. For email discovery, look elsewhere.

You just read why 98% of enrichment tools query the same underlying sources - and why accuracy craters at scale. Prospeo is built on proprietary email-finding infrastructure with 5-step verification. 143M+ verified emails. 92% API match rate. Teams book 35% more meetings than Apollo users.

Run the 50-contact test yourself. Your first 100 credits are free.

Pricing Comparison: The True Cost Per Verified Email

The sticker price of an email finder is meaningless without factoring in accuracy. A tool that costs $0.03/credit but only delivers valid results 35% of the time is far more expensive than one charging $0.01/credit with 98% verification accuracy.

| Tool | Free Tier | Starter (Annual) | Credits/mo | Cost/Credit |

|---|---|---|---|---|

| Hunter.io | 50/mo | $34/mo | 2,000 | ~$0.017 |

| Apollo.io | 100/mo | ~$49/mo/user | Varies | ~$0.03-0.05 |

| Snov.io | Yes | $39/mo | 1,000 | ~$0.039 |

| ContactOut | 100/mo | $79/mo | 500 | ~$0.16 |

| RocketReach | No | $80/user/mo | 125 | ~$0.64 |

| VoilaNorbert | 50 credits | $39/mo | 1,000 | ~$0.039 |

| Skrapp.io | 100/mo | $30/mo | 1,000 | ~$0.03 |

| GetProspect | 50/mo | $34/mo | 1,000 | ~$0.034 |

| Mailmeteor | Free finder | ~$10/mo | N/A | N/A |

Important distinction: Prospeo only charges for verified results - you pay ~$0.01 per email that passes their 5-step verification. Most other tools charge per search or per credit regardless of whether the result is valid. That means the effective cost gap is even wider than the table suggests once you factor in each tool's find rate and bounce rate.

For reference, enterprise tools like ZoomInfo ($15-40K/year) and Cognism ($15-25K/year) require sales calls and annual contracts. They're playing a different game - if you're reading this article, you probably don't need them yet.

Why Verification Matters More Than Finding

Finding an email address and verifying it are two completely different steps. Most people treat them as one.

That's how domains get burned.

Industry benchmarks are clear: keep total bounces below 2%. Hard bounces above 1% will damage your sender reputation. Above 5%, most providers will throttle or suspend your account entirely.

"It takes three months to warm up a domain and three seconds to burn it with a bad list."

The problem is compounded by catch-all domains. These domains accept mail sent to any address - anything@company.com will get accepted by the server, whether or not the mailbox exists. Standard verification tools can't distinguish real addresses from fake ones on catch-all domains. And 15-28% of B2B domains are catch-all, meaning a significant chunk of your enterprise prospect list is essentially unverifiable by basic tools.

The Verification Cost Gap Most Teams Miss

Here's a number that surprised me: dedicated verification tools like DeBounce charge roughly $1.50 per 1,000 emails. Hunter's verification runs $24.50 per 1,000. That's a 16x price difference for the same basic function. If you're verifying at scale, the tool you choose for verification matters almost as much as the tool you choose for finding.

Never send to an unverified list. Even if your email finder claims 95% accuracy, run every address through a dedicated verification step before it touches your sequences. The cost of verification ($0.001-0.003/email) is trivial compared to the cost of rebuilding a burned domain.

Mistakes That Will Burn Your Domain Reputation

I've seen teams make every one of these mistakes. Some recover. Some have to buy new domains and start over. One agency we worked with lost three sending domains in a single quarter because they skipped verification on a 40,000-contact import.

1. Sending to unverified lists. The cardinal sin. Even "verified" emails from your finder tool should be re-verified before sending. Data decays fast - people change jobs, companies rebrand, mailboxes get deactivated. One bad send can spike your bounce rate above the 2% threshold and trigger ISP throttling.

2. Relying on historical data. An email verified six months ago might as well be unverified. Best practice: verify within a month of use. Ideally, within a week.

3. Ignoring catch-all domains. If you exclude all catch-all addresses from your sends, you're missing 15-28% of enterprise prospects. That's a lot of pipeline left on the table. Instead, segment catch-all addresses into a separate sending pool with lower volume and tighter monitoring.

4. Skipping domain warmup. New domains need a gradual volume ramp. Sending 500 cold emails on day one from a fresh domain is a guaranteed trip to the spam folder. Start with 20-30 per day and increase over 2-3 weeks. (If you need a complete ramp plan, use this domain warmup guide.)

5. Using a single tool instead of a waterfall approach. No single email finder covers every contact. Waterfall enrichment - running your list through 2-3 tools sequentially - delivers about 30% more valid results than any single tool alone. Tools like Instantly's Lead Finder (450M+ database) are built specifically for waterfall workflows. Use one primary finder, verify everything independently, and add a backup for gaps. If you're building this workflow, start with a waterfall approach comparison.

6. Skipping personalization. This isn't a data problem, but it amplifies data problems. Generic emails get marked as spam at higher rates. If your email looks like a template, recipients are more likely to hit "report spam" than "unsubscribe" - and spam reports hurt your domain far more than unsubscribes.

7. Not monitoring domain reputation. Use MXToolbox or Google Postmaster Tools to check your domain's health regularly. By the time you notice deliverability dropping in your sequencer, the damage is already done. Catch it early. (More on what to watch in domain reputation.)

Is It Legal to Find Email Addresses and Cold Email Someone?

Short answer: yes, in most jurisdictions - with conditions. The conditions vary dramatically by country, and the penalties for getting it wrong are severe.

| Jurisdiction | Key Rule | Penalty |

|---|---|---|

| US (CAN-SPAM) | Opt-out required, physical address, no deceptive headers | Up to $50,120/email |

| EU (GDPR) | Legitimate interest or consent, opt-out mandatory | EUR 20M or 4% global revenue |

| Canada (CASL) | Express or implied consent required | Up to $10M |

| Australia | Explicit consent required | Up to $1.1M AUD |

| UK (PECR) | Follows GDPR, more B2B flexibility with opt-out | Aligned with GDPR |

In the US under CAN-SPAM, you can email someone without prior permission as long as you include a clear opt-out mechanism, a valid physical address, and don't use misleading subject lines. Process opt-out requests within 10 business days.

In the EU under GDPR, you need either explicit consent or a "legitimate interest" justification. For B2B cold outreach, legitimate interest can work - but you need to document your reasoning and provide an easy opt-out.

In Canada under CASL, you need express or implied consent before sending. Implied consent covers things like existing business relationships, but the bar is higher than CAN-SPAM.

Regardless of jurisdiction, set up SPF, DKIM, and DMARC authentication on your sending domain. These aren't optional - they're the baseline for deliverability and compliance. (If you need a setup walkthrough, use this SPF, DKIM, and DMARC guide.) And 53% of users mark emails as spam because they can't find the unsubscribe link, so make it obvious.

FAQ

What's the most accurate email finder in 2026?

Prospeo delivers 98% verification accuracy using a proprietary 5-step process with a 7-day data refresh cycle - the highest independently verifiable rate among self-serve tools. Independent benchmarks show most competitors landing between 20-80% find rates. Always test against your own target list using the 50-contact protocol before committing budget.

Can I find email addresses for free?

Yes. Google search operators, email permutation, the newsletter trick, and company website patterns work well for under 100 contacts per month. Most paid tools also offer free tiers - Prospeo gives you 75 verified emails/month, Hunter 50/month, Apollo 100/month, and ContactOut 100/month.

How many bounced emails is too many?

Keep total bounces below 2% of your send volume. Hard bounces above 1% will damage your sender reputation with ISPs. Above 5%, most providers will throttle or suspend your account. Re-verify your list before every campaign, especially if the data is more than 30 days old.

Is it legal to email someone without their permission?

In the US under CAN-SPAM, yes - if you include an opt-out mechanism and a physical address. In the EU under GDPR, you need legitimate interest justification and must provide easy opt-out. In Canada under CASL, you need express or implied consent. Penalties range from $50,120/email (US) to EUR 20M (EU).

Should I use one email finder or multiple tools?

Waterfall enrichment using 2-3 tools delivers about 30% more valid results than any single tool. Use one primary finder for discovery and verification, then add a backup tool for gaps. The extra cost of a second tool is almost always worth the incremental coverage.