Uptics Pricing in 2026: What You'll Actually Pay (It's Not $99/mo)

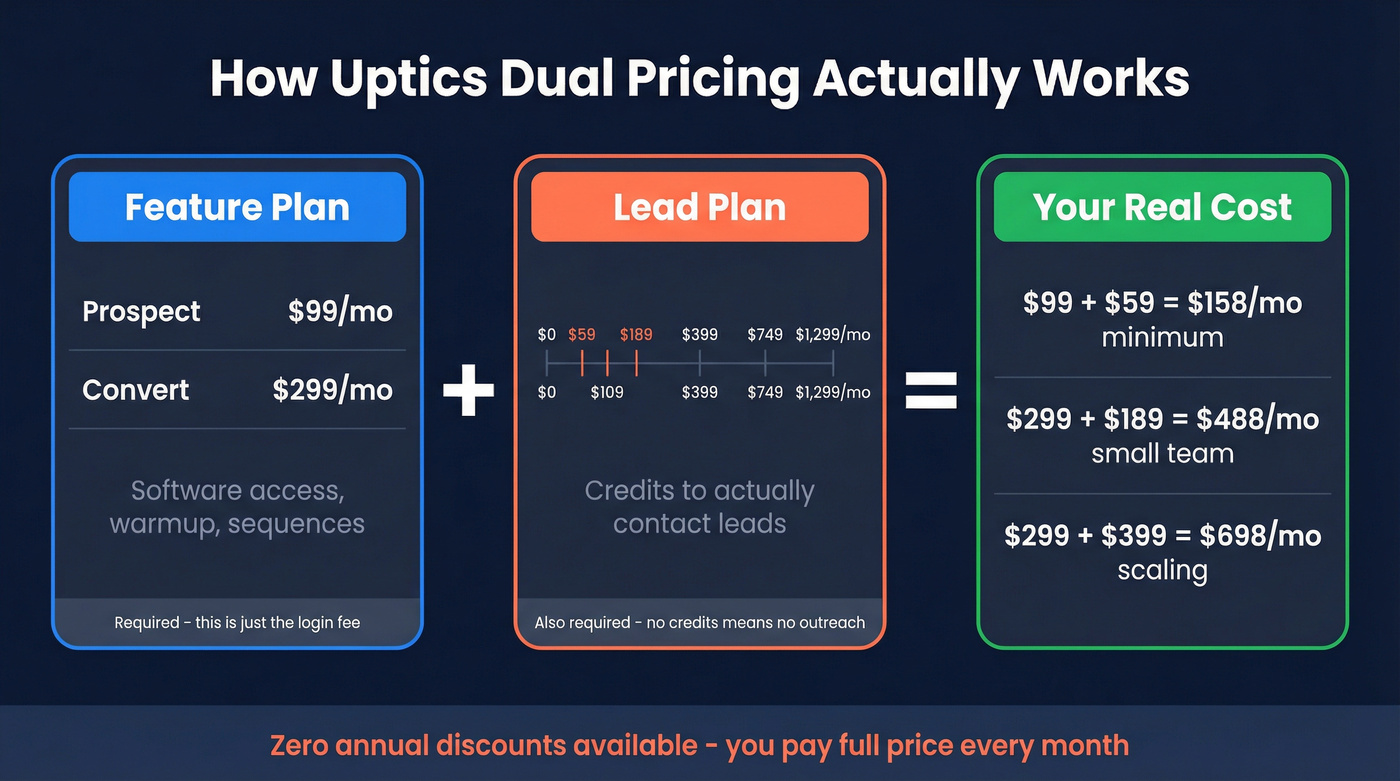

Every pricing page for Uptics quotes $99/mo. That number is technically correct and practically useless. It's the software fee - the right to log in and use the platform. Actually contacting leads? That's a separate bill. Understanding Uptics pricing means understanding this dual-cost structure, especially now that the platform is transitioning to LeadEngine with rates starting around $500/mo.

Here's what you'll really pay, how the dual pricing model works, and whether the all-in-one pitch justifies the cost when Instantly and Smartlead charge a fraction of the price.

What Uptics Actually Costs (30-Second Version)

Uptics runs on a dual pricing model. You pay for a Feature Plan ($99-$299/mo) to access the software, then a separate Lead Plan ($59-$1,299/mo) to actually contact anyone. The minimum realistic budget is ~$158/mo, and that only gets you 2,500 lead credits.

There are no annual billing discounts. Monthly only.

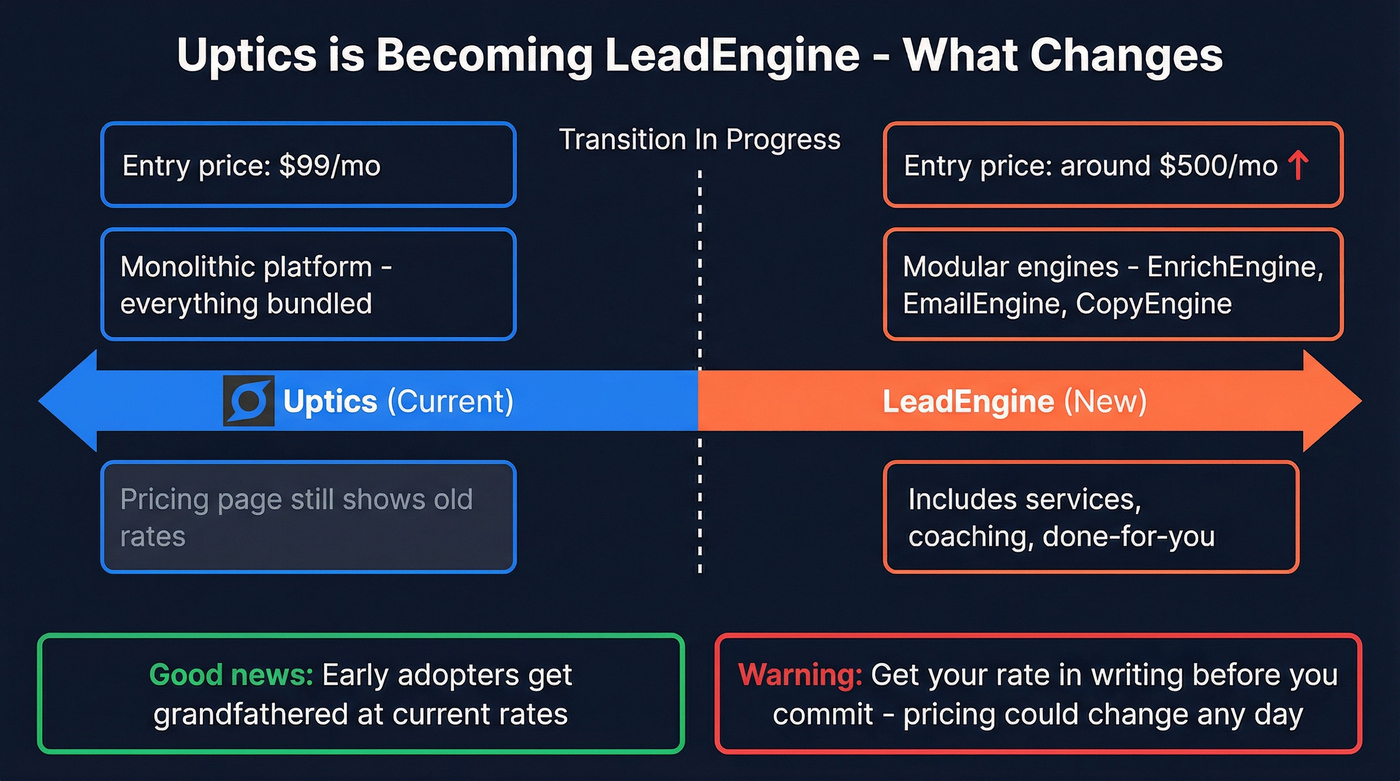

The platform is actively transitioning to LeadEngine, with new pricing starting around $500/mo. Existing customers get grandfathered, but new sign-ups need to confirm which pricing structure they're actually getting.

How the Dual Pricing Model Actually Works

Here's the thing most articles miss: Uptics doesn't have one price. It has two prices that stack on top of each other. You pick a Feature Plan for software access, then a Lead Plan for credits to contact prospects. Both are required to actually run outreach.

Feature Plans - Prospect vs. Convert

| Feature | Prospect ($99/mo) | Convert ($299/mo) |

|---|---|---|

| Contacts | 25,000 | 100,000 |

| Email warmup | Unlimited | Unlimited |

| IntelliSpin | ✓ | ✓ |

| Catch-all scoring | ✓ | ✓ |

| Smart rotating IPs | ✓ | ✓ |

| AI A/B testing | ✓ | ✓ |

| Webhooks & Zapier | ✓ | ✓ |

| Power dialer | ✗ | ✓ |

| SMS automation | ✗ | ✓ |

| ChatGPT-4 personalization | ✗ | ✓ |

| Website scraper | ✗ | ✓ |

| ESP routing | ✗ | ✓ |

| Team inboxes | ✗ | ✓ |

| Unlimited deal pipelines | ✗ | ✓ |

The jump from $99 to $299 is steep, but it's where the multi-channel features live - dialer, SMS, AI personalization, and the CRM pipeline tools. If you're only sending cold email, the Prospect tier covers it.

Uptics has no per-inbox email send limits, unlike Instantly and Smartlead which cap sends per account. That's a genuine advantage for high-volume senders. On the flip side, Uptics has no built-in lead database - you're sourcing contacts elsewhere and importing them, while Apollo and Instantly bundle lead discovery into their platforms.

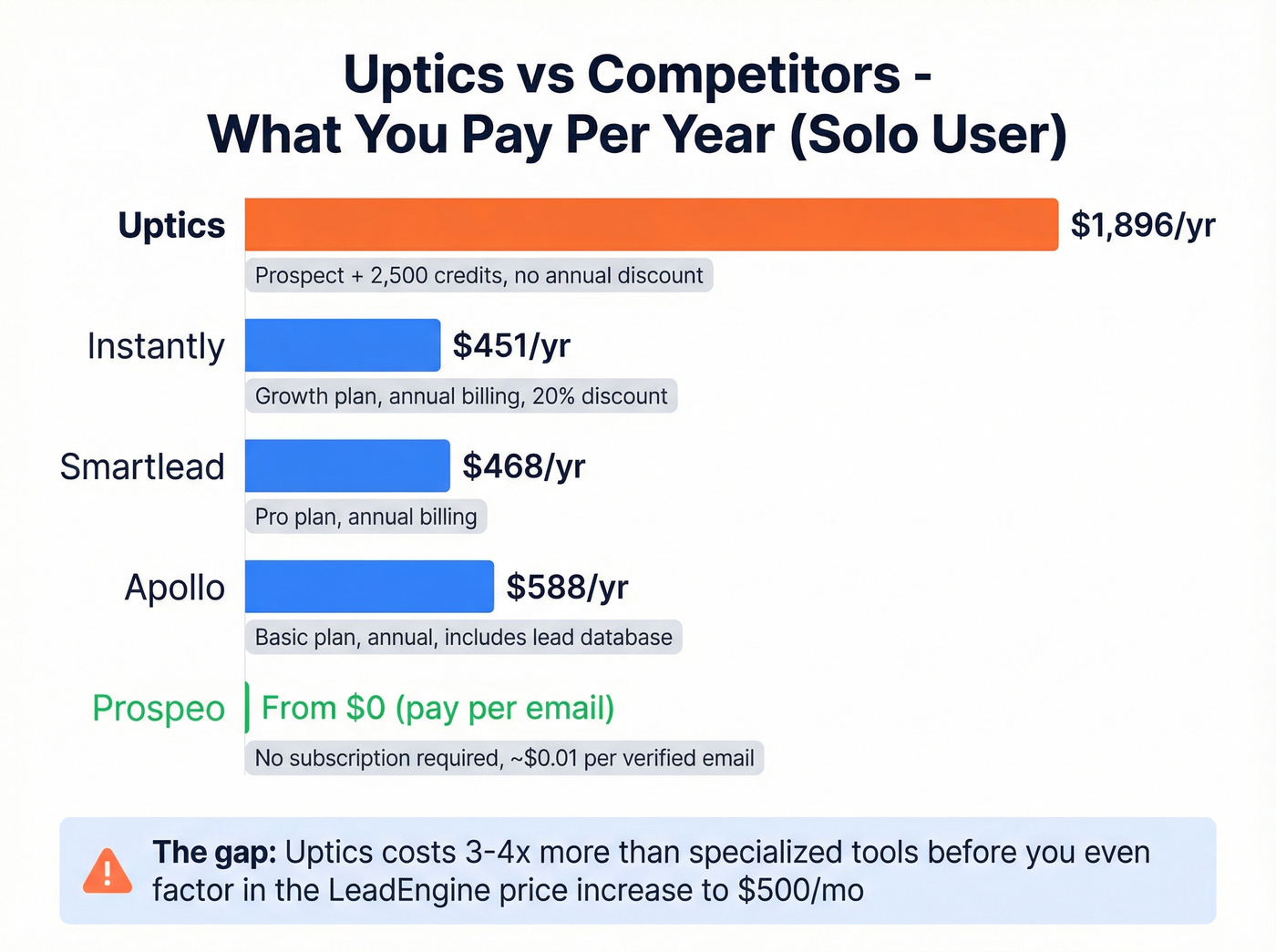

No annual discounts exist. Unlike Instantly (20% off annual), Smartlead (~17% off), and Woodpecker (~33% off), you're paying full monthly rate every single month. To put that in dollars: over 12 months at the Prospect tier, you'll pay $1,188. Instantly's comparable Growth plan at annual billing runs $451 for the same period. That's a $737 gap before you even add lead credits.

Also worth flagging: HubSpot and Salesforce integrations are listed as "coming soon" on the Convert plan rather than currently available. If CRM syncing is critical to your workflow, verify the status before you commit. (If you need a workflow blueprint, see CRM syncing.)

Both plans include a 14-day risk-free trial. No long-term contracts. You can send up to 450 emails/day per inbox, though Uptics recommends capping cold outreach at 50/day per inbox for deliverability (more on sending limits).

Lead Plans - The Credit System

This is the part that catches people off guard.

| Credits/Month | Price |

|---|---|

| 1,000 | Free |

| 2,500 | $59/mo |

| 5,000 | $109/mo |

| 10,000 | $189/mo |

| 25,000 | $399/mo |

| 50,000 | $749/mo |

| 100,000 | $1,299/mo |

Credits are consumed when a lead is contacted, but each lead only costs one credit per billing period regardless of how many follow-ups you send. That's actually a fair mechanic. Unused credits roll over as long as your plan stays active.

Two catches: the free 1,000 credits don't roll over, and AI catch-all scoring burns 1 credit per check. Email validation is included in the credit cost, which is a nice touch - you're not paying a separate verification fee on top (see email verification basics).

Uptics charges $158/mo minimum before you contact a single lead - and that's before the LeadEngine transition pushes it to $500/mo. Prospeo gives you verified emails at $0.01 each with 98% accuracy, 30+ search filters, and a built-in database of 300M+ profiles. No dual pricing. No credit stacking.

Stop paying two bills to send one cold email.

Total Cost of Ownership - What You'll Really Pay

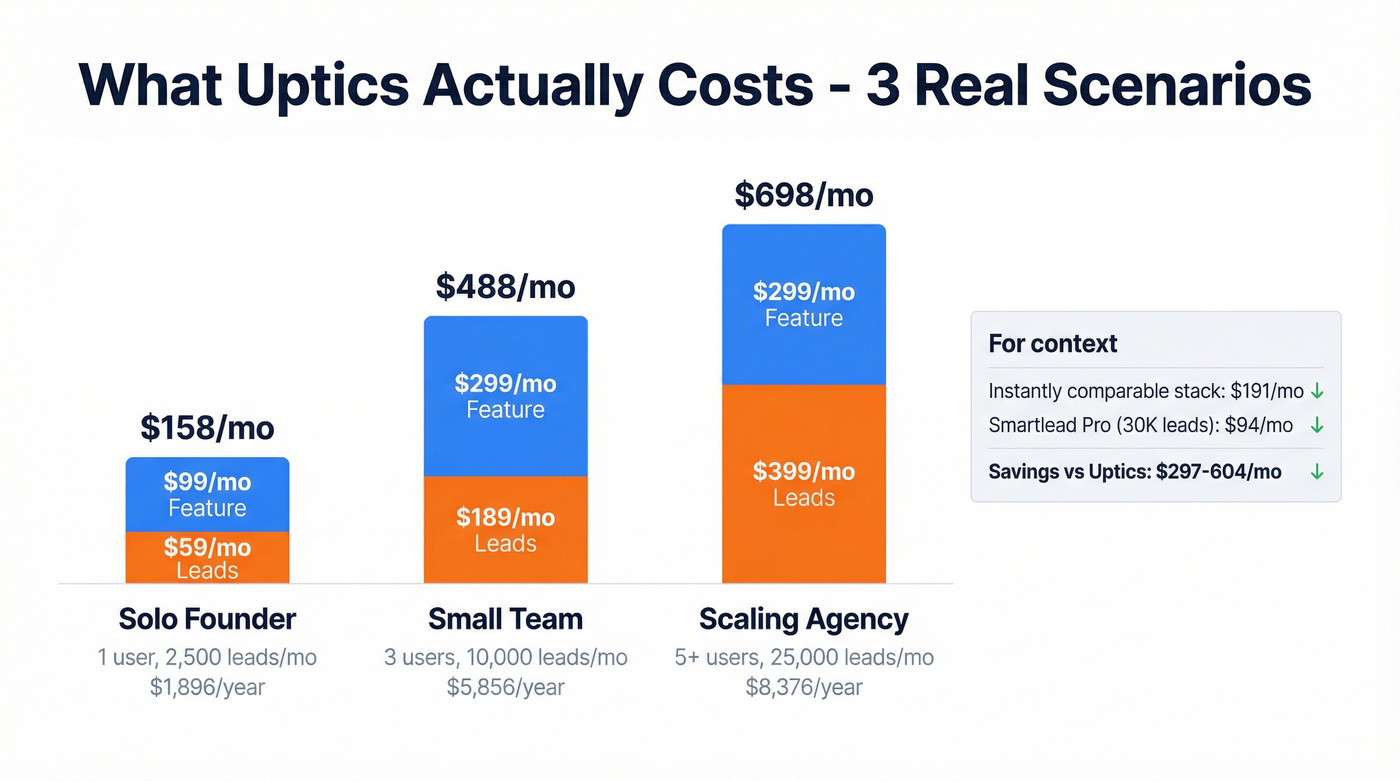

The dual model means you need to do math that the pricing page doesn't do for you. Here are three realistic scenarios.

Solo Founder (1 User, 2,500 Leads/Month)

| Line Item | Cost |

|---|---|

| Prospect Plan | $99/mo |

| 2,500 lead credits | $59/mo |

| Total | $158/mo ($1,896/yr) |

This is the true floor for anyone doing real outreach. The free 1,000 credits won't last a week if you're actively prospecting.

Small Team (3 Users, 10,000 Leads/Month)

At this level, you need the Convert plan for team inboxes and the power dialer. The math: $299/mo (Convert) + $189/mo (10K credits) = $488/mo, or $5,856/year. No annual discount softens that number.

For comparison, an Instantly full stack - Outreach Hypergrowth ($97) + SuperSearch Growth ($47) + CRM Growth ($47) - runs $191/mo for a comparable feature set. That's $297/mo extra you're paying for Uptics's bundled dialer and SMS. Whether that's worth it depends entirely on whether your team actually picks up the phone (and whether you have a real outbound calling strategy).

Scaling Agency (5+ Users, 25,000 Leads/Month)

Here's where I'd push back hardest. Convert ($299) + 25K credits ($399) = $698/mo ($8,376/yr) with zero annual discount. Smartlead Pro handles 30,000 active leads at $94/mo. Yes, Smartlead doesn't include a CRM or dialer - but $604/mo buys a lot of standalone CRM and dialer software.

I've seen agencies buy all-in-one platforms for the promise of consolidation, then only use the email sequencer. That's the most expensive way to send cold email (see cold email outreach tools if you’re stack-building).

The LeadEngine Transition - What's Changing

This is the elephant in the room. Founder Patrick Spielmann announced that Uptics is transitioning to LeadEngine - a new brand with fundamentally different pricing.

Key transition details:

- New pricing starts around $500/mo - a significant jump from the current $99 entry point.

- Modular "Engine" products replace the monolithic platform: EnrichEngine, EmailEngine, CopyEngine.

- EnrichEngine is already live: $21.75/mo (annual) or $29/mo (monthly) for enrichment credits, with metered billing for third-party enrichments and AI writing. It's being positioned as a Clay replacement, which signals the strategic direction (compare approaches in lead enrichment tools).

- Early adopters are grandfathered at current rates.

- The Uptics pricing page still shows the $99/$299 Feature Plans - the transition is in progress but not fully reflected on the main site.

The strategic shift makes sense. Most customers want implementation services, coaching, and done-for-you outreach - not just software. LeadEngine is built around that reality.

But if you're evaluating the platform today, you need to ask directly: are you getting the $99 pricing or the $500 pricing? We've checked the current pricing page and it still shows the old structure, but that could change any day. Get your rate in writing before you commit.

Cold to Gold Managed Services

For teams that want done-for-you outreach, Uptics offers three Cold to Gold tiers. All are paid quarterly with no long-term contracts.

| Tier | Price | Includes |

|---|---|---|

| Coach | $3,000/mo | Software, email course, weekly strategy calls |

| Copilot | $5,000/mo | Software, 50 DFY email accounts, bi-weekly 1-on-1, DFY sequences & lists |

| Concierge | $7,500/mo | Everything + 20hr/wk cold caller, script writing, call coaching |

Coach is essentially a training program with software bundled in. Copilot is where the real done-for-you work starts - they build your sequences, source your lists, and manage your inboxes. Concierge adds a dedicated cold caller, which almost no SaaS company offers.

At $9,000-$22,500/quarter, these aren't impulse buys. But for agencies or teams without in-house outbound expertise, the Copilot tier replaces hiring an SDR at a comparable cost - and you get the software included.

What Users Say About Uptics

Uptics carries a 4.4/5 on G2 (60 reviews) and a 3.6/5 on Trustpilot (36 reviews). The G2 profile has been inactive for over a year, which tracks with the LeadEngine transition.

What users like:

- The all-in-one value proposition. Multiple reviewers call out not needing separate tools for warmup, CRM, and sequences.

- Email warmup and deliverability features get consistent praise. IntelliSpin (AI spintax) is a standout (related: automated email warmup).

- Long-term users report strong support: "I've been using Uptics for about two years now and the support and results have been great."

- The continuous improvement cadence - training classes and feature updates get mentioned positively.

What users complain about:

- Billing issues. Multiple Trustpilot reviews report being charged after cancellation or after free trials with no ability to log in.

- Sequences breaking - follow-up emails not threading properly, sequences doubling or disappearing.

- Lack of responsive customer support, with some users reporting hidden features they'd already paid for.

- Confusing onboarding. The platform does a lot, and figuring out where to start isn't intuitive.

For context on scale: Instantly has over 4,000 reviews at 4.8/5. Apollo has over 9,000 at 4.7/5. Uptics has 60. That's not a quality judgment, but it tells you about market adoption and community size. If you hit a problem, you're far less likely to find a community post with the answer.

How Uptics Compares to Competitors on Price

The real question isn't whether the cost is high in isolation - it's whether the all-in-one bundle justifies the premium over specialized tools.

Real talk: most teams don't need an all-in-one outbound platform. They think they do because the pitch sounds efficient. But the teams we've watched succeed at cold outreach almost always use 2-3 best-in-class tools rather than one mediocre-at-everything suite. Uptics is better than most all-in-ones, but the math still favors a stack approach for 80% of use cases (see a practical B2B sales stack blueprint).

Pricing Comparison Table

| Tool | Starting Price | What's Included | Annual Discount | Rating |

|---|---|---|---|---|

| Uptics | $99 + $59/mo | CRM, email, warmup, dialer | None | 4.4/5 (60) |

| Prospeo | Free (~$0.01/email) | Email/mobile finder, enrichment | N/A (no contract) | N/A |

| Instantly | $47/mo | Cold email, warmup, unlimited accounts | ~20% off | 4.8/5 (4,002) |

| Smartlead | $39/mo | Cold email, warmup, unlimited accounts | ~17% off | 4.6/5 (213) |

| Woodpecker | $24/mo (annual) | Cold email, warmup, catch-all verify | ~33% off | N/A |

| Apollo.io | $59/user/mo ($49 annual) | Database, email, dialer, CRM | ~17% off | 4.7/5 (9,111) |

Real-World Cost - 3-Person Team, 10K Leads/Month

This is where the math gets uncomfortable for Uptics.

| Tool | Monthly Cost | What You Get |

|---|---|---|

| Uptics | $488/mo | CRM + email + dialer + SMS |

| Instantly (full stack) | ~$191/mo | Outreach + lead finder + CRM |

| Smartlead Pro | $94/mo | Email only (no CRM/dialer) |

| Apollo Professional | ~$237/mo (annual) | Database + email + dialer |

| Woodpecker Growth | $126/mo (annual) | Email + catch-all verify |

Uptics costs 2-5x more than pure cold email tools. The justification is the bundled CRM, power dialer, and SMS automation. If you're actually using all three channels, the consolidation has real value - you're replacing Smartlead + a CRM + a dialer. If you're only sending cold email, you're overpaying by a wide margin.

Who Should (and Shouldn't) Use Uptics

Uptics makes sense if:

- You genuinely need CRM + power dialer + email + SMS in one tool and don't want to manage four separate subscriptions

- You'll actually use the multi-channel features - dialer, SMS automation, deal pipelines

- You want managed services (Cold to Gold) and prefer a vendor that handles implementation

- You're already grandfathered at current pricing before the LeadEngine transition

Skip Uptics if:

- You only need cold email at scale - Instantly ($47/mo) and Smartlead ($39/mo) do it cheaper and better for pure email

- You need a large built-in lead database - Apollo's 275M+ contacts dwarf what Uptics offers natively

- Annual billing discounts matter to your budgeting - Uptics doesn't offer them, period

- The LeadEngine transition pricing (~$500/mo) is outside your budget and you're a new customer

- You want a large user community for troubleshooting - 60 reviews vs. Instantly's 4,000+ tells the story

Uptics makes you source leads elsewhere and import them - then charges you credits to contact them. Prospeo includes a 300M+ lead database, 143M+ verified emails, and intent data across 15,000 topics. Data refreshes every 7 days, not 6 weeks. One platform, one price.

Get the leads and the data in one place for a fraction of the cost.

FAQ

Does Uptics offer a free plan?

No. Uptics includes 1,000 free lead credits, but you still need a paid Feature Plan ($99/mo minimum) to access the software. The 14-day risk-free trial lets you test both Prospect and Convert tiers before committing, but there's no permanently free tier.

Does Uptics offer annual billing discounts?

No - Uptics only offers monthly billing with no annual discount. Instantly saves you 20% annually, Smartlead ~17%, and Woodpecker ~33%. Over 12 months at the Prospect tier, you'll pay $1,188 vs. $451 for Instantly's comparable annual plan.

Do unused Uptics credits roll over?

Yes, unused lead credits roll over to the next billing period as long as your plan stays active. If you cancel, remaining credits are forfeited. The free 1,000-credit tier doesn't include rollover - use them or lose them each month.

Is Uptics becoming LeadEngine? What happens to pricing?

Uptics is transitioning to LeadEngine with new pricing starting around $500/mo. Existing customers are grandfathered at current rates. New sign-ups should confirm directly which pricing structure applies before committing.

What's a cheaper alternative to Uptics for cold email?

Instantly ($47/mo) and Smartlead ($39/mo) handle cold email at a fraction of the cost. Pair either with Prospeo (free tier, 75 emails/month) for verified contact data upstream, and you'll spend under $90/mo total - versus $158/mo minimum with Uptics.