SDR Cadence Best Practices: The Data-Backed Guide for 2026

Booking an outbound meeting used to take 200-400 touchpoints per sourced opportunity. Now it's 1,000-1,400. The SDR cadence best practices that worked two years ago - blast emails, generic sequences, hope-based follow-ups - aren't cutting it anymore. And the teams adapting aren't just sending more touches. They're sending better touches, through the right channels, backed by data that actually connects.

Here's the thing: 80% of B2B sales require at least 5 follow-ups, but 44% of reps quit after one attempt. The gap between persistence and quitting is where pipeline lives or dies.

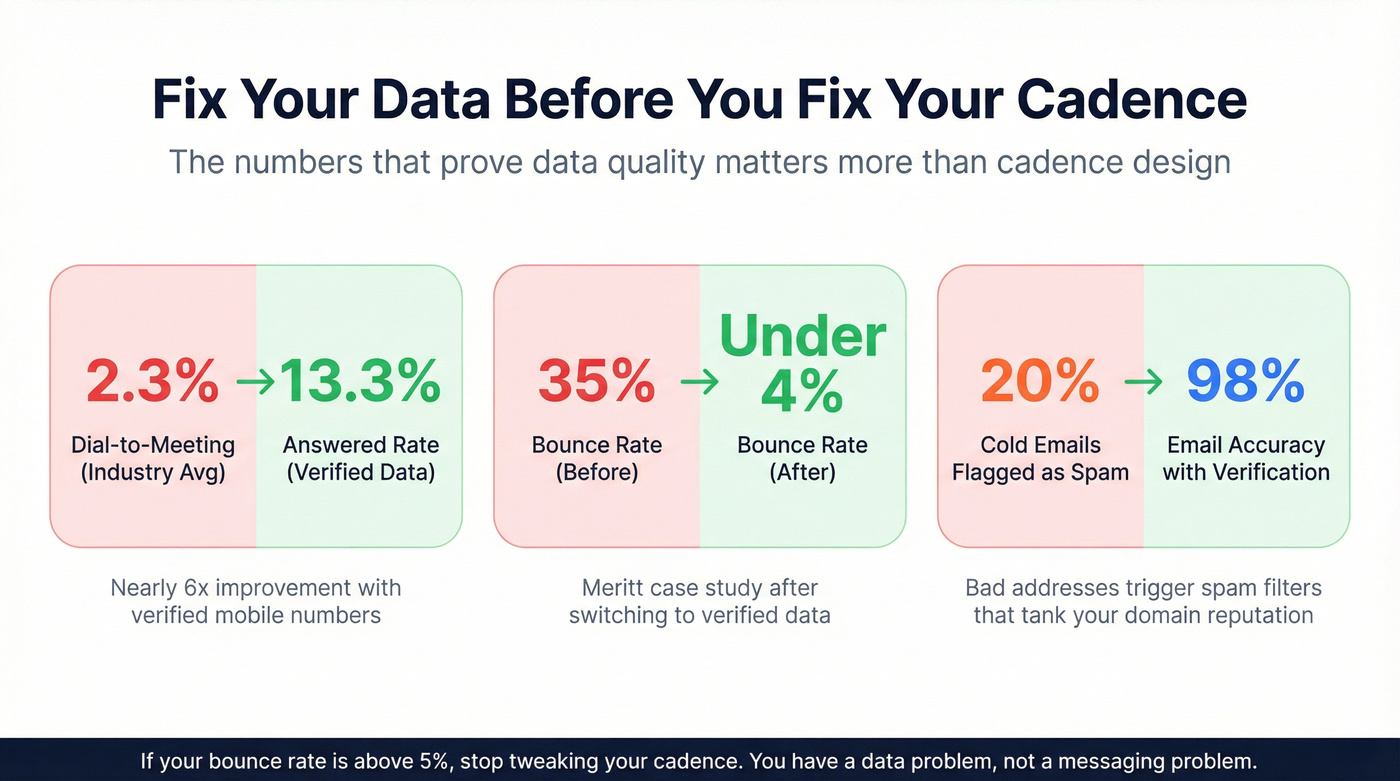

Your cadence probably isn't broken. Your data probably is. The difference between a 2.3% dial-to-meeting rate and a 13.3% answered rate comes down to whether the phone number you're dialing is real.

What You Need (Quick Version)

If you're short on time, here's the playbook in three bullets:

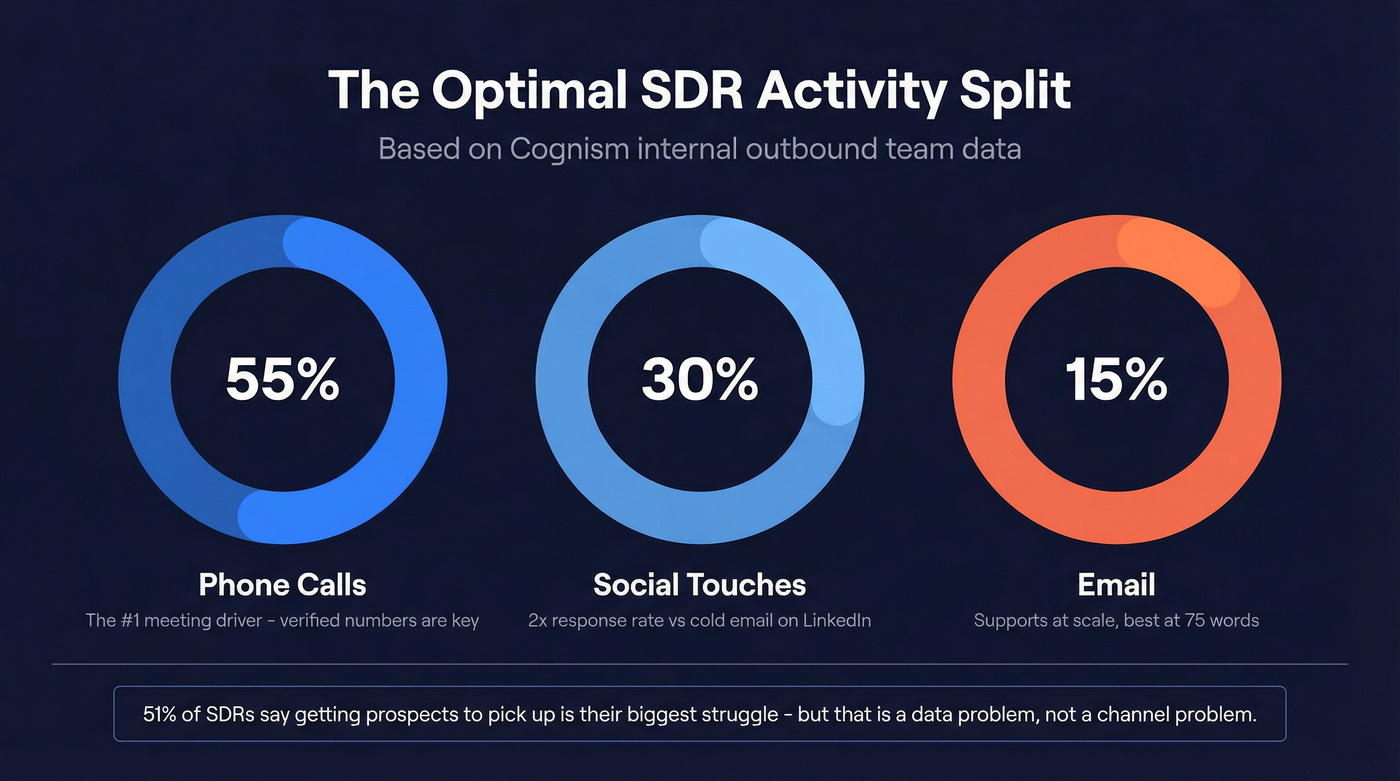

Lead with phone (55% of activity), support with email and social. Phone drives the most meetings. Email supports at scale. Social warms the relationship. The 55/30/15 split from Cognism's internal data is the best benchmark available.

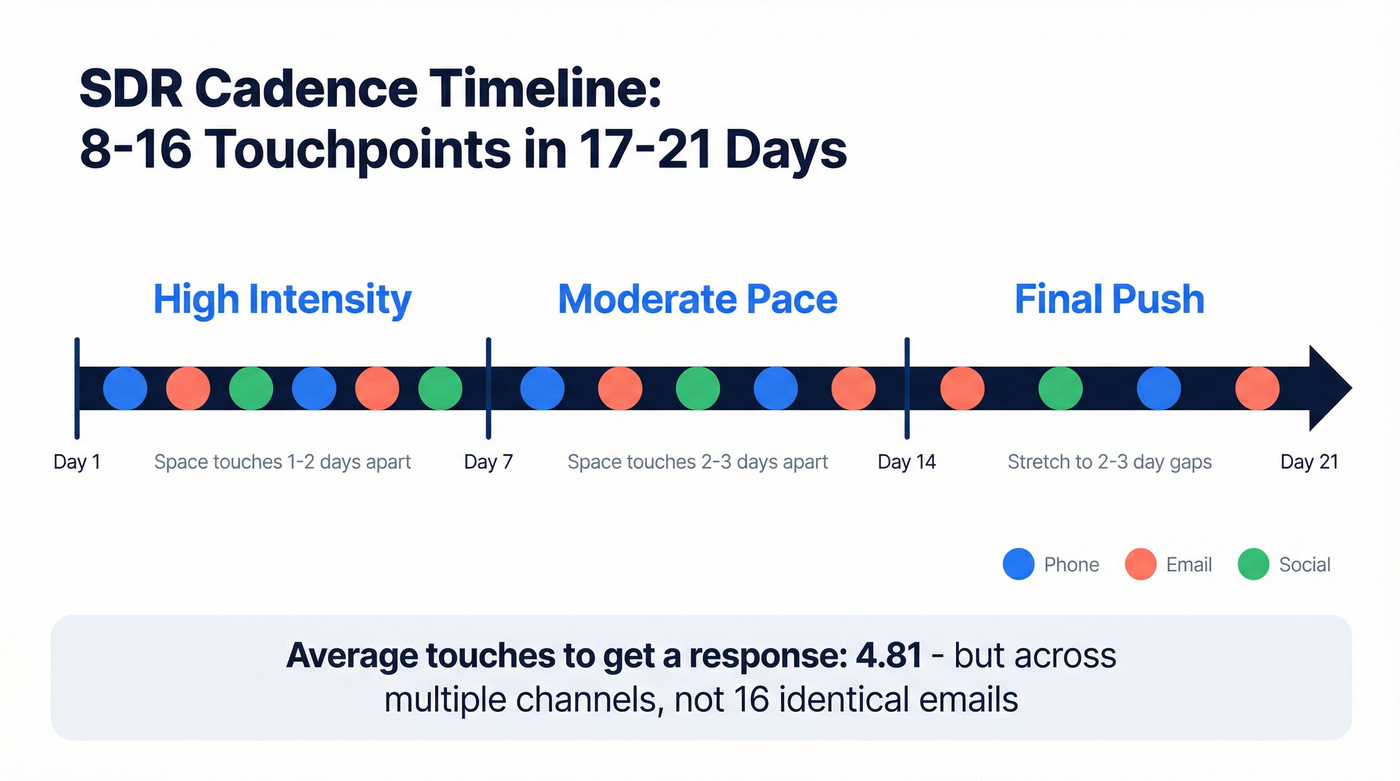

Segment cadences by buyer temperature. 5-12 touches for warm inbound, 8-16 for cold outbound, spread across 17-21 days. One-size-fits-all cadences waste effort on warm leads and under-serve cold ones.

Fix your data before you fix your cadence. SDRs using verified contact data see a 13.3% cold-call answered rate vs. the 2.3% industry average. That's not a cadence problem - it's a data problem. Bad numbers and bounced emails will tank even a perfectly designed sequence.

SDR Cadence Benchmarks for 2026

Before you redesign anything, you need to know what "good" looks like. These benchmarks come from datasets large enough to trust - Sopro's 151 million outreach data points, Outreach's survey of 500 revenue professionals, and Cognism's internal SDR performance data.

| Metric | Benchmark | Source |

|---|---|---|

| Cold email response rate | 5.1% avg | Sopro (151M data pts) |

| SDR email reply rate | 8.98% | Cognism internal |

| Avg touches to response | 4.81 | Outreach (500 respondents) |

| Cold-call answered rate (verified data) | 13.3% | Cognism |

| Dial-to-meeting avg | 2.3% | SalesHive |

| LinkedIn response vs. cold email | 2x higher | Sopro |

| Multi-channel lift (3+ channels) | +14.6% sales | Valley |

A few things jump out. The gap between 2.3% dial-to-meeting and 13.3% answered rate tells you everything about data quality - SDRs with verified numbers perform nearly at the level of AEs calling warm leads (14.4%). That's staggering.

The 4.81 average touches to response means most deals don't happen on the first try, but they also don't require 20 emails. The magic is in the channel mix and timing, not brute force.

And that 14.6% sales increase from multi-channel campaigns? It confirms what every experienced SDR already knows: email-only cadences are leaving money on the table.

This article shows the gap: 2.3% dial-to-meeting with bad numbers vs. 13.3% answered rate with verified data. Prospeo's 125M+ verified mobile numbers deliver a 30% pickup rate - turning phone from your most frustrating channel into your highest-converting one. At $0.01/email, fixing your data costs less than one wasted SDR hour.

Stop optimizing cadences built on bad data. Fix the foundation first.

The 8 Practices That Separate Top-Performing SDR Cadences

1. Lead with the Phone, Support with Email and Social

The optimal activity split across Cognism's outbound teams is 55% phone, 30% social, 15% email. That ratio surprises people who've built their entire motion around email sequences.

Phone is consistently the #1 meeting driver. Not email. Not social. Phone. The challenge? 51% of SDRs say getting prospects to pick up is their biggest struggle. That's a data quality problem masquerading as a channel problem.

LinkedIn outreach delivers double the response rate of cold email, which is why social earns that 30% allocation. It's not filler - it's the channel that warms prospects before you call. If you're dialing numbers that go straight to a switchboard or a disconnected line, of course your phone channel underperforms. Fix the numbers first. Then watch phone become your highest-converting channel.

2. Use 8-16 Touchpoints Across 17-21 Days

Morgan J Ingram recommends a 17-21 day sales cadence to give prospects enough time to respond. Florin Tatulea, Director of Sales at Barley, recommends 8-12 touchpoints within that window. Jack Neicho, AE at Salesloft, found the sweet spot at 16+ touchpoints.

There's a contrarian view worth addressing. One experienced SDR on Reddit put it bluntly: "I just can't see someone finally giving in after the 6th email or 4th voicemail." Fair point. If your touches are all the same channel with the same message, more isn't better - it's annoying.

The data reconciles this nicely: 4.81 touches to get a response on average, but that's across multiple channels. The 8-16 range works because it includes calls, emails, social touches, and videos - not 16 identical emails. Variety is what makes volume work.

3. Segment Cadences by Buyer Temperature

Not every prospect deserves the same cadence. Valley's touchpoint ranges break it down:

- Inactive prospects: 1-3 touches (re-activation attempt)

- Warm inbound leads: 5-12 touches over 7-10 days

- Cold outbound prospects: 20-50 touches over the full lifecycle

A clarification on that 20-50 range: Valley's number accounts for the full lifecycle including long-term nurture sequences. The 8-16 touchpoints recommended above cover the initial cadence before a prospect enters nurture. Don't confuse the two - your first-pass cadence shouldn't be 50 touches deep.

For inbound, speed-to-lead is everything. Responding within 5 minutes makes you 21x more likely to qualify a lead. One SDR on Reddit described getting access to leads the second they sign up instead of waiting 24 hours - and immediately outperformed teammates who just dropped leads into a sequence.

Cold outbound needs more patience and more channels. Don't apply your inbound cadence to cold prospects. They need warming up.

4. Personalize the First Line, Not the Whole Email

The optimal email length is 75 words. Not 75 sentences - 75 words.

Personalization doubles reply rates compared to generic outreach, and 81% of decision-makers engage when outreach is tailored to their company or context. But here's where teams waste time: they try to personalize every paragraph. You don't need to. 68% of teams use both email templates and call scripts - the key is personalizing the first line while keeping the body templated. Reference something specific: a recent funding round, a job posting, a tech stack signal. Then deliver your value prop in a tight, templated body. 54% of teams already use AI for personalized outbound emails, and the best ones use it for that first-line research, not for writing entire bespoke messages.

If you need examples, start with proven email opener examples and adapt them to your ICP.

5. Ask for Interest, Not a Meeting

Florin Tatulea's advice here is dead simple: your first email shouldn't ask for a 30-minute meeting. It should ask for interest.

"We help [similar company] cut their bounce rate by 30% - is that something your team is dealing with?" beats "Do you have 15 minutes next Tuesday?" every time. The first reduces friction. The second creates it.

Save the meeting ask for touch 3 or 4, after you've established some relevance. The first touch is about opening a door, not walking through it.

6. Time Your Touches Strategically

Emails land better on Tuesday and Wednesday mornings. Calls perform best just before lunch or late afternoon. Monday has the highest open rate among weekdays.

Here's a detail most cadence guides miss: 81% of emails are now opened on mobile. That means your subject line (6-10 words for highest open rates) and your first sentence matter more than anything below the fold. If your email doesn't hook in the preview pane, it's dead.

Space your touches 1-2 days apart in the first week, then stretch to 2-3 days in weeks two and three. Front-loading too aggressively burns the prospect; spacing too widely loses momentum. The rhythm of your cadence matters as much as the content - this is one of the most overlooked sales sequence best practices.

Emerging channels worth testing: David Bentham at Cognism recommends experimenting with WhatsApp and Slack Connect for prospects who are active on those platforms. These won't replace phone or email in 2026, but they're low-competition channels where a well-timed message stands out. If your ICP skews toward tech or startup buyers, add one WhatsApp or Slack touch to your cadence and measure the response.

7. Build a Cadence Committee

Florin Tatulea's rule: "Have 4 to 6 cadences max. As teams get bigger, they should be centrally controlled by management."

This is the organizational practice most teams skip. Without a cadence committee - even if it's just two people - you end up with 15 reps running 15 different cadences with no way to compare results. Hold a monthly review covering reply rates by cadence, channel performance, and any sequences with under 2% response rates that need to be killed or rebuilt. Elric Legloire, SDR Manager at Agorapulse, puts it simply: "You need to A/B test constantly to improve your results."

You can't test what you can't control.

8. Fix Your Data Before You Fix Your Cadence

Real talk: if your bounce rate is above 5%, stop tweaking your cadence. You don't have a messaging problem. You have a data problem.

Almost 20% of cold emails get flagged as spam despite legitimate intent. That number skyrockets when you're sending to unverified addresses that bounce, triggering spam filters that tank your entire domain reputation. The 13.3% cold-call answered rate that Cognism's SDRs achieved happened because they were dialing verified mobile numbers - not switchboards, not landlines, not disconnected lines.

When Meritt switched to verified data, their bounce rate dropped from 35% to under 4%, and their connect rate tripled. That's not a cadence change - it's a data change.

Before you launch any sequence, run your list through verification. Tools like Prospeo let you upload a CSV, get results in minutes, and push clean data to your sequencer. With 98% email accuracy and a 7-day data refresh cycle, you're not just verifying once - you're working with contacts that stay current. If you want the SOP, use an email verification list workflow.

Hot take: If your average deal size is under $10k and your team has fewer than 5 reps, you don't need a more sophisticated cadence. You need cleaner data and a phone. I've watched teams spend months perfecting 20-step multi-channel sequences when their real problem was a 30% bounce rate and phone numbers that rang into the void. Fix the inputs before you optimize the process.

Day-by-Day Cadence Examples

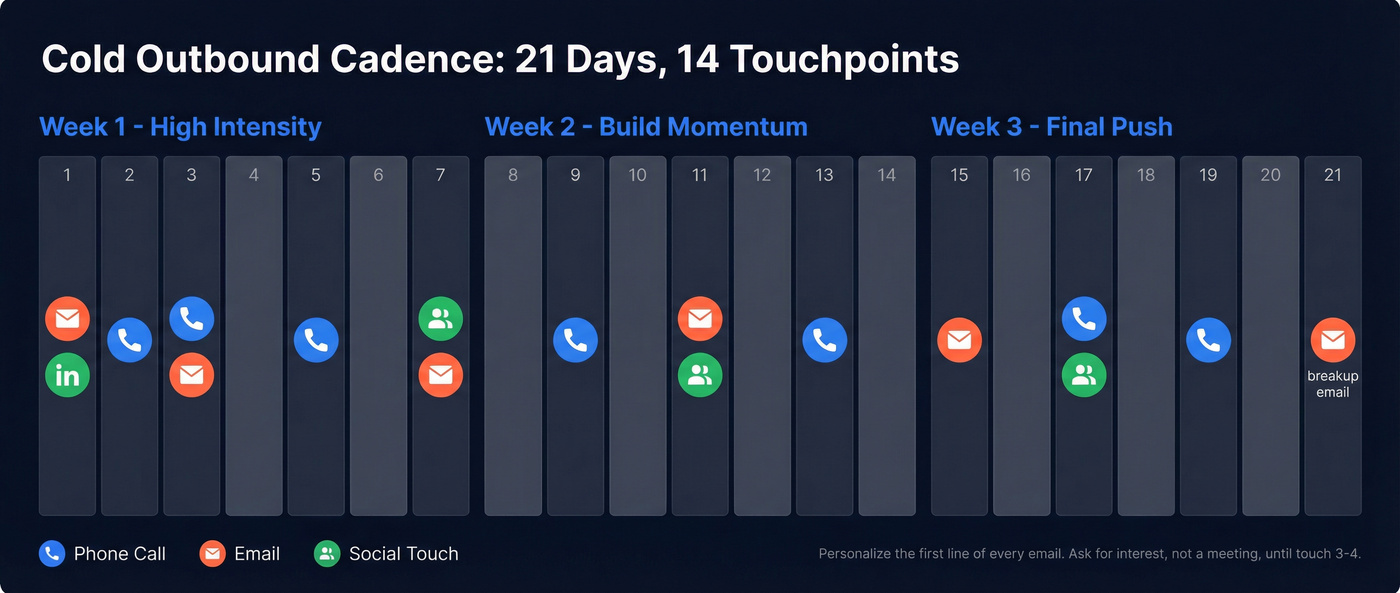

Cold Outbound Cadence (21 Days, 14 Touchpoints)

This is the workhorse cadence for net-new prospecting into accounts with no prior relationship. It follows a structure similar to Morgan J Ingram's "Spider-Man Cadence" - layering channels progressively so each touch builds on the last.

| Day | Channel | Action |

|---|---|---|

| 1 | Social | Blank connection request (no note) |

| 2 | Ask for interest, not a meeting | |

| 3 | Phone + Email | Call + voicemail + follow-up email |

| 5 | Phone | Call (no voicemail) |

| 7 | Phone | Call (no voicemail) |

| 7-10 | Video | Send video if engagement signals detected |

| 10 | Persona-based, highly personalized | |

| 12 | Social | Engage with their content |

| 14 | Phone | Call attempt |

| 16 | New angle / case study | |

| 18 | Phone | Call attempt |

| 19 | Social | Direct message |

| 21 | Breakup email |

Note: 14 touchpoints across 13 calendar entries - Day 3 includes a triple touch (call + voicemail + email).

Morgan J Ingram's blank connection request on Day 1 is counterintuitive but works - no note means a higher acceptance rate. You're not pitching yet. You're getting in the door.

The Day 3 triple touch (call + voicemail + email) is the highest-impact single day in the cadence. The voicemail creates name recognition; the email provides context. Together they're more than the sum of their parts.

One regional note: this cadence is calibrated for US markets. In EMEA and APAC, dial back to 8-10 touches. Triple touchpoints on Day 1 can feel intrusive in DACH markets. Cold calling is more popular in the US than almost anywhere else.

Warm Inbound Cadence (10 Days, 7 Touchpoints)

Speed kills here - in a good way. The entire philosophy is different from cold outbound.

| Day | Channel | Action |

|---|---|---|

| 0 | Phone | Call within 5 minutes of sign-up |

| 0 | Immediate follow-up if no answer | |

| 1 | Phone | Second call attempt |

| 2 | Value-add (resource or insight) | |

| 4 | Phone | Third call attempt |

| 7 | Re-engagement with new angle | |

| 10 | Soft breakup |

The Day 0 phone call is non-negotiable. The 21x qualification boost from a 5-minute response time makes this the single most important touch in any inbound cadence. Every hour you wait, conversion drops dramatically. If you want to operationalize this, build SLAs around speed to lead metrics.

Don't over-touch warm leads. They already raised their hand. Your job is to connect, not to convince.

Re-engagement Cadence (15 Days, 6 Touchpoints)

For prospects who went dark after initial engagement - they opened emails, clicked a link, but never responded.

| Day | Channel | Action |

|---|---|---|

| 1 | Acknowledge prior contact, new trigger | |

| 3 | Social | Engage with their content |

| 6 | Phone | Call with specific reference point |

| 9 | Share relevant case study | |

| 12 | Social | Direct message, lighter tone |

| 15 | Breakup email |

The tone here matters more than the structure. Don't pretend you've never talked to them. Open with "I reached out a few weeks ago about X - wanted to share something new." Lighter frequency, different angles, and a genuine breakup at the end. If they're not interested after 6 touches with prior engagement, they're not interested.

Five Cadence Mistakes That Kill Your Pipeline

1. Generic mass emails with no clear CTA. "Just checking in" isn't a CTA. Every email needs a specific ask - even if it's just "Is this relevant to you right now?" Without a clear next step, you're sending noise.

2. Overloading early-stage touches without context. Hitting a cold prospect with three emails in two days before they know who you are is a fast track to the spam folder. Earn attention before you demand it.

3. Using too many channels too soon. Day 1 email + call + social + video + SMS isn't multi-channel - it's harassment. Introduce channels gradually. Social on Day 1, email on Day 2, phone on Day 3. Let each channel build on the last.

4. Failing to follow up after engagement signals. This one drives me crazy. A prospect opens your email three times, clicks the case study link, and... nothing. No call. No follow-up. Your sequencing tool is tracking these signals. Use them. A video message after a link click converts at dramatically higher rates than a cold touch.

5. Inconsistent logging and reporting. If reps aren't logging calls and outcomes consistently, you can't optimize anything. You're flying blind. We've seen teams run cadences for months without realizing their Day 7 call had a 0% connect rate because nobody was logging dispositions.

AI in SDR Cadences: What to Automate, What to Keep Human

54% of teams already use AI for personalized outbound emails. 45% use it for account research. And 22% have fully replaced SDRs with AI agents.

Here's my position: the 45% using a hybrid AI+human approach have it right. Full replacement is premature for most B2B sales cycles where relationships matter.

| Automate | Keep Human |

|---|---|

| Account research & ICP scoring | Live phone conversations |

| First-draft email personalization | Objection handling |

| Engagement signal monitoring | Relationship-building moments |

| Data enrichment, verification & list cleaning | Strategic account planning |

| Meeting scheduling | Complex discovery calls |

AI is exceptional at the research layer - pulling technographic data, identifying trigger events, drafting a personalized first line based on a prospect's recent activity. It's terrible at the human moments that actually close deals: reading tone on a call, navigating a tricky objection, building genuine rapport.

The winning formula in 2026: let AI handle the 80% of prep work that used to eat SDR mornings, then let humans handle the 20% that actually books meetings. Don't automate the handshake.

How to A/B Test Your Cadences

Most teams say they A/B test. Most teams don't. Here's how to actually do it:

Step 1: Change one variable at a time. Subject line OR CTA OR timing OR channel order. Never two at once. You won't know what moved the needle.

Step 2: Split 50/50. Randomize your list. Don't put "better" leads in the test group. That's not a test - it's confirmation bias.

Step 3: Allow 3-7 days for reply data. Email opens happen in hours. Replies take days. For outbound cadences, you need at least a week before the data means anything.

What to test first (in order of impact):

- Subject lines (6-10 words vs. longer; personalized vs. curiosity-driven)

- CTA type (soft ask vs. hard meeting request)

- Channel order (phone-first vs. email-first on Day 1)

- Timing (morning vs. afternoon sends)

Elric Legloire's advice: "Test multiple things at once and do it often." He means run parallel tests across different cadences - not multiple variables in the same cadence. Teams that A/B test subject lines consistently see 10-20% improvements in open rates over time. That compounds fast across thousands of prospects. For a tighter experimentation system, follow an A/B testing lead generation campaigns framework.

SDR Cadence Tools Worth Considering

The tools matter less than the data and the process - but the right stack eliminates friction. Here's what's worth your time:

| Tool | Best For | Starting Price | G2 Rating |

|---|---|---|---|

| Prospeo | Data quality layer | Free (75 emails/mo) | - |

| Apollo.io | All-in-one outbound + data | Free; $49/user/mo Pro | ~4.8/5 |

| Outreach | Enterprise outbound | ~$100-130/user/mo | 4.3/5 |

| Salesloft | Mid-market SDR scaling | ~$75-125/user/mo | ~4.5/5 |

| HubSpot Sales Hub | CRM-connected warm outreach | $90/user/mo (annual) | - |

| Saleshandy | Simple cold email cadences | $25/mo | - |

Best All-in-One: Apollo.io

Apollo is the obvious starting point for SMB and mid-market teams that want prospecting data and sequencing in one platform. The free tier is genuinely useful - you can build lists, run sequences, and make calls without paying a dime. The $49/mo Pro plan unlocks the database depth most teams need. Where Apollo falls short: phone number accuracy and email deliverability at scale. It's a great 80% solution, but you'll want a verification layer on top (especially if you're seeing B2B contact data decay).

Skip These If You're Under 20 Reps: Outreach & Salesloft

Outreach is the enterprise standard for structured multi-channel cadences - advanced analytics, AI-powered insights, and deep Salesforce integration. Salesloft sits just below in complexity but punches above its weight on call coaching and rep analytics. Both run $75-130/user/month depending on your contract.

The frustrating part: neither publishes transparent pricing. Expect a multi-week sales cycle just to get a quote. If you have fewer than 20 reps, the ROI math rarely works - start with Apollo and upgrade when you outgrow it.

Best Budget Option: Saleshandy

| Pros | Cons |

|---|---|

| $25/mo - cheapest option by far | No built-in phone dialer |

| Simple UI, fast setup | Limited analytics |

| Solid for cold email sequences | No multi-channel orchestration |

| Unlimited email accounts on paid plans | You'll outgrow it quickly |

Saleshandy is the no-frills option for solo founders and early-stage SDRs who just need cold email cadences running. Good for getting started. Not good for scaling past 2-3 reps.

Budget reality check: A full SDR tech stack (sequencing + data + analytics) typically costs $150-300/user/month at enterprise level. Self-serve alternatives like Apollo + Prospeo can get you to 80% of the capability for under $100/user/month total.

SDRs waste 4-6 hours per week dialing disconnected numbers and sending emails that bounce. Prospeo refreshes all 300M+ profiles every 7 days - not every 6 weeks like competitors. That means your 8-16 touchpoint cadence actually reaches real people at real companies.

Every touch in your cadence should land. Start with data that connects.

FAQ

How many touchpoints should an SDR cadence include?

Cold outbound cadences perform best with 8-16 touchpoints spread across 17-21 days, while warm inbound needs only 5-12 touches over 7-10 days. The right number depends on buyer temperature and channel mix. More channels means fewer touches per channel feel intrusive.

What's the best channel mix for an SDR cadence?

Phone 55%, social 30%, email 15% - based on Cognism's internal outbound data. Phone drives the most meetings by a wide margin. Email creates air cover at scale. Social warms the relationship before you call. Teams that go email-only leave significant pipeline on the table.

How do I improve my cadence reply rate?

Start with data quality - verify emails and phone numbers before launching any sequence. SDRs using verified data see 5-6x higher answered rates on calls. Keep bounce rates under 5%, personalize first lines, and A/B test subject lines consistently. The cadence you already have probably works fine; the data feeding it probably doesn't.

Should I use AI in my sales cadence?

Yes, selectively. Use AI for account research, engagement signal monitoring, and email first drafts - it handles the prep work that used to eat SDR mornings. Keep humans on live calls and relationship-building moments. The hybrid approach outperforms both full-human and full-AI models across most B2B sales cycles.