HG Insights vs ZoomInfo (2026): Which One Fits Your GTM Workflow?

Most teams shopping for HG Insights and ZoomInfo aren't actually choosing between two "data tools." They're choosing what problem they want to solve first: market decisions (TAM, technographics, whitespace) or rep execution (contacts, dials, enrichment, workflows).

Here's the thing: if your average deal is small and you're mostly SDR-led outbound, you probably don't need "market intelligence software" yet. You need clean contacts, verified emails, and a tight outbound system that doesn't torch your domain reputation.

I've watched teams burn an entire quarter because they bought the "wrong kind" of data platform for their motion, then tried to force it into a workflow it wasn't built for.

The 30-second verdict (and who should skip both)

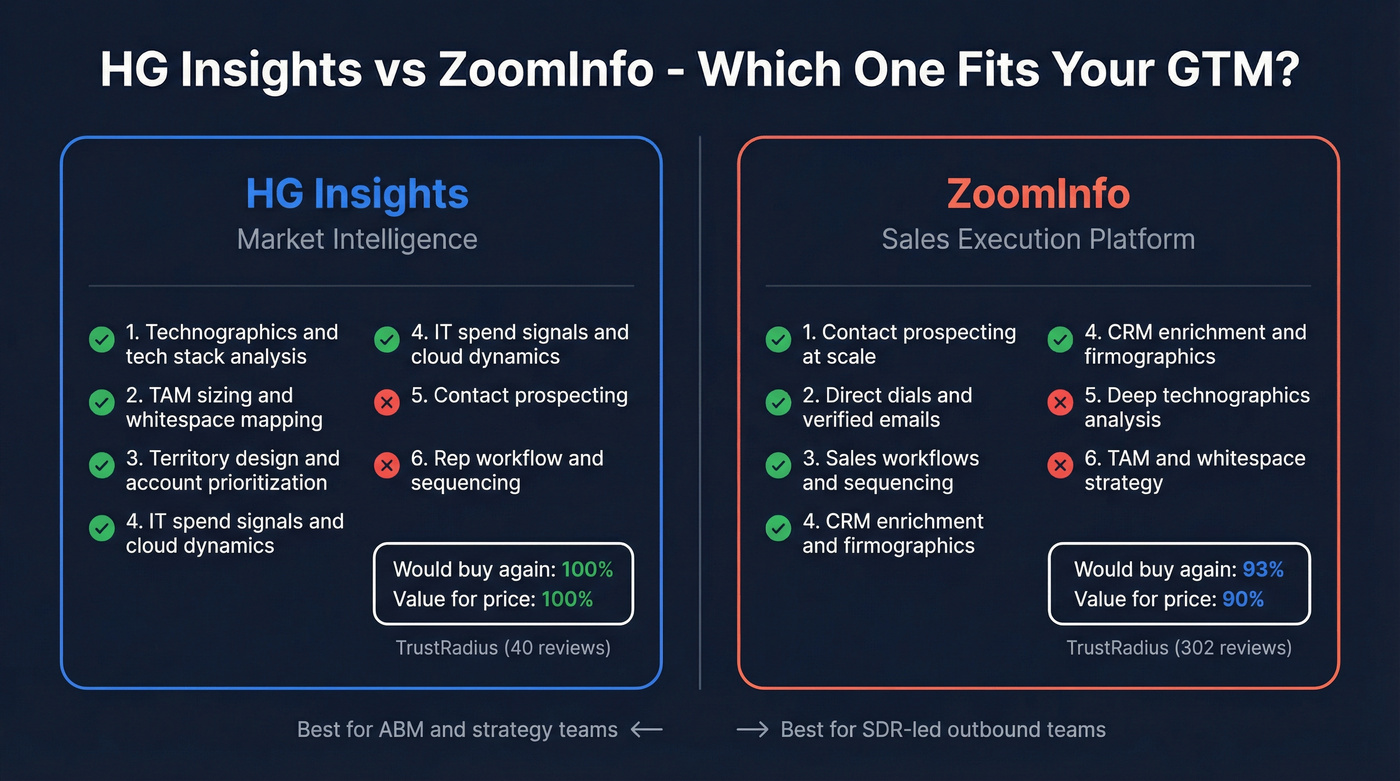

Pick HG Insights if technographics, TAM sizing, whitespace, and market intelligence drive ABM/territory strategy - and you're fine activating those accounts through a separate contact/workflow stack.

Pick ZoomInfo if reps need high-volume prospecting, direct dials, enrichment, and workflows in one place - and you want the biggest "all-in-one" footprint.

TrustRadius snapshot (review sentiment, not lab testing):

- Would buy again: HG Insights 100% (40) vs ZoomInfo 93% (302)

- Value for price: HG Insights 100% (27) vs ZoomInfo 90% (219)

If you're primarily outbound SDR-led, ZoomInfo's the default. If you're ABM-led, HG's the default.

What each platform is actually for (technographics vs contact database)

HG Insights and ZoomInfo overlap just enough to confuse buyers, but they solve different jobs.

HG Insights = market intelligence for account decisions. You use it to answer: "Which accounts should we pursue, how big is the opportunity, and what's the evidence (tech stack, spend signals, whitespace)?" Their packaging maps to that:

- Platform: the analysis and workflow layer - build segments, scoring, and account prioritization GTM teams can use.

- Fabric: the underlying datasets (firmographics, technographics, IT spend, buying center, competitive, and buyer intent datasets) that power targeting and territory design.

- Intent-Driven Leads: turns intent + fit into delivered leads so teams can act without building everything from scratch.

- Customer Voice: review sourcing + syndication widget for SEO/social proof.

ZoomInfo = activation for reps and RevOps. You use it to answer: "Who do I contact, how do I reach them, and how do I push that into my workflows today?" It's built around prospecting, enrichment, and sales execution.

One gap matters either way: neither tool guarantees deliverability. If outbound's your motion, you still need an email verification layer before sequences.

Decision tree: pick HG if / pick ZoomInfo if

Use this as a pre-demo filter. If you can't answer these, you're not ready to buy either tool.

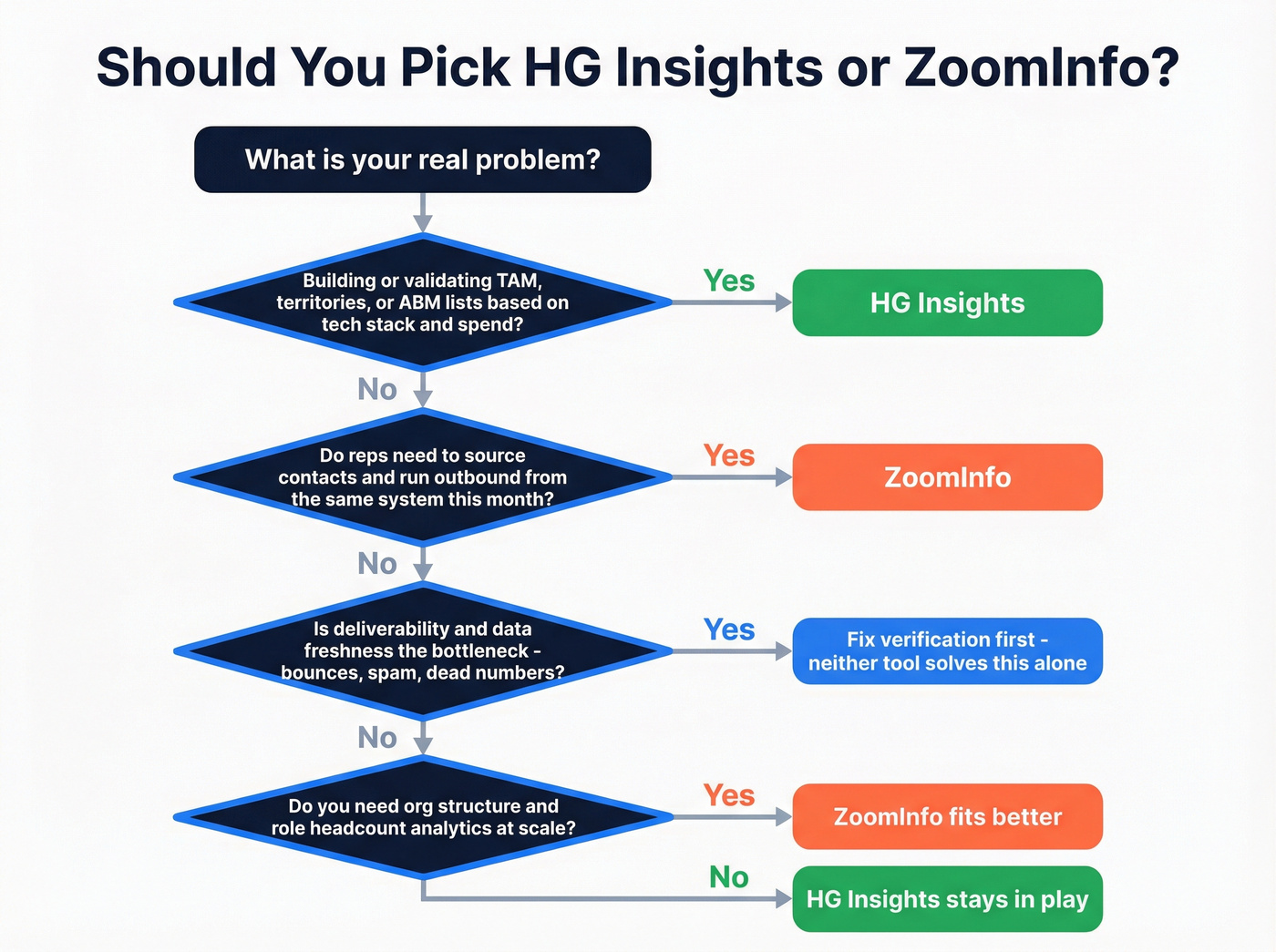

Start here: what's the real problem?

Q1: Are you trying to build or validate TAM, territories, or ABM account lists based on tech stack and spend signals?

Yes: HG Insights.

No: go to Q2.

Q2: Do reps need to source contacts and run outbound from the same system this month?

Yes: ZoomInfo.

No: go to Q3.

Q3: Is deliverability and data freshness the bottleneck (bounces, spam placement, dead numbers)?

No: go to Q4.

Q4: Do you need "count people in role at scale" (org structure / role headcount analytics) as a core requirement?

Yes: ZoomInfo fits better.

No: HG stays in play.

Two churn triggers buyers underestimate

- ZoomInfo churn trigger #1: renewal friction. A common practitioner complaint is aggressive sales outreach and renewal pressure; if your internal champion gets burned, adoption drops fast.

- ZoomInfo churn trigger #2: enrichment disappointment. Teams buy it expecting set-and-forget enrichment, then discover staleness and gaps once they pressure-test specific regions and segments.

Real talk: neither tool fixes a broken workflow.

If your CRM's a duplicate factory and your sequences aren't segmented, you'll blame the vendor when the real problem is governance.

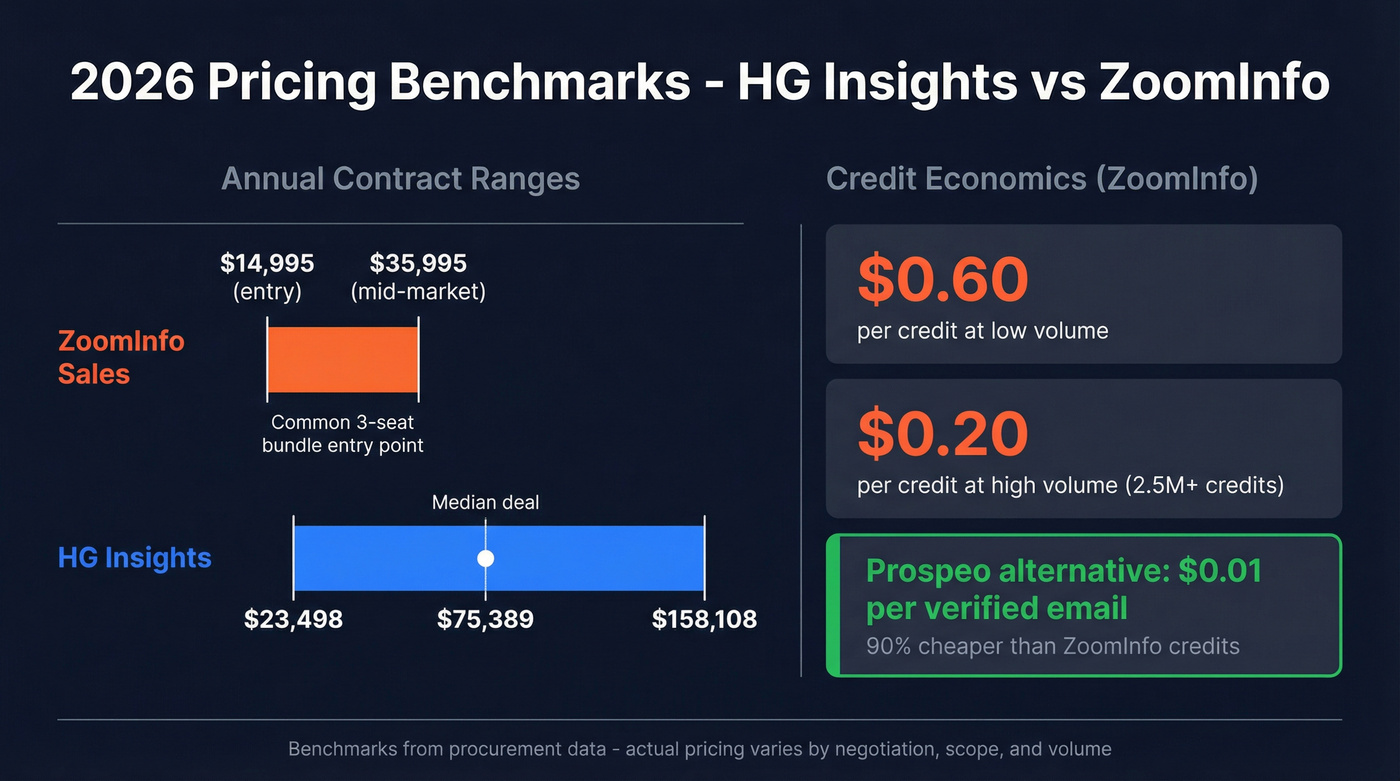

ZoomInfo's credit economics quietly bleed your budget at $0.20-$0.60 per credit. Prospeo delivers 98% verified emails at $0.01 each - 90% cheaper - with a 7-day data refresh cycle that makes ZoomInfo's 6-week staleness look reckless for outbound.

Stop overpaying for data that bounces. Start with 100 free credits today.

hg insights vs zoominfo: workflow matrix (day-to-day)

The practical difference is what you can do without building a bunch of glue.

| Workflow area | Winner | What you actually do | Outcome |

|---|---|---|---|

| Technographics targeting | HG Insights | Filter accounts by installed tech, stack maturity, and spend signals | Targeting |

| TAM + whitespace | HG Insights | Size market, map whitespace by segment/region, prioritize territories | Strategy |

| Contact prospecting | ZoomInfo | Build people lists, pull emails/phones, export to sequences | Outreach |

| Sales workflows | ZoomInfo | Run rep workflows inside one platform (lists -> tasks -> outreach) | Execution |

| Enrichment at scale | ZoomInfo | Append fields to CRM/MAP; standardize firmographics | Ops speed |

| Intent for ABM | Tie (different emphasis) | Monitor in-market signals; route to ABM plays | Timing |

| Reporting | Tie (different KPIs) | HG: market/coverage views; ZoomInfo: activity/output views | Visibility |

| Deliverability & refresh | Neither | Verify before sequencing; don't trust any export blindly | Risk control |

How teams actually use this in the real world

If you run ABM or territory design: HG becomes the "account truth layer." The clean pattern is: define ICP + segments, build a prioritized account universe, push segments to CRM/MAP, then measure coverage and whitespace quarterly.

If you run SDR-led outbound: ZoomInfo becomes the "rep engine." The clean pattern is: build lists by persona + trigger, push to sequencing tools, track connect rate and reply rate, then tighten filters until reps stop wasting dials.

Where teams screw this up: they buy HG and expect reps to prospect in it, or they buy ZoomInfo and expect it to solve TAM. That mismatch is where quarters go to die.

Pricing & TCO: what you'll actually pay in 2026

Pricing's where buyers get whiplash because both can look reasonable in a demo and brutal in procurement.

Pricing benchmarks (what you'll budget)

| Vendor | Typical entry | Typical mid | Notes |

|---|---|---|---|

| ZoomInfo Sales (benchmarks) | $14,995/yr | $29,995-$35,995 | Common benchmark ranges; entry often anchors around a 3-seat bundle |

| HG Insights | $23,498-$158,108 | $75,389 median | Benchmark spread + median across deals |

ZoomInfo has two naming systems floating around.

- Official packaging (ZoomInfo site): Sales tiers Professional / Copilot Advanced / Copilot Enterprise. Marketing tiers Demand / ABM Lite / ABM Enterprise.

- Procurement benchmarks: "Professional+ / Advanced+ / Elite+" show up as common bundle labels and don't always map 1:1 to the website names.

ZoomInfo Marketing tiers (the details buyers ask for)

On ZoomInfo's pricing page, Marketing tiers are framed around included credits and intent topics:

- Demand: 75K included credits + 25 intent topics

- ABM Lite: 100 intent topics

- ABM Enterprise: 150K included credits + unlimited intent topics

Is there a free plan?

Yes. ZoomInfo Lite is the free entry point: 10-25 monthly credits plus WebSights Lite (10 reveals/day). It's fine for poking around, not for running a real outbound motion.

The part that quietly drives your total cost: credits

ZoomInfo's credit economics are the hidden tax. Benchmarks peg credits at roughly $0.60/credit at low volume down to $0.20/credit at very high volume (2.5M+ credits). That's why two companies can "both have ZoomInfo" and one pays double.

HG's cost drivers are easier to reason about: modules + data scope + services. It's less "credits per export" and more "how much intelligence coverage are you licensing?"

Two TCO scenarios (so you can model the jump)

These aren't quotes. It's the math that explains why contracts balloon once usage gets real.

Scenario A: Small team (3 seats) + moderate usage You anchor around the common $14,995/yr benchmark bundle, then your cost jumps as soon as you add seats, credits, and the add-ons that suddenly become "required" after week two (global coverage, intent expansions, workflow modules). If reps export aggressively, credits become the bill.

Scenario B: Mid-market team (10 seats) + Global Data + higher credits Seat count alone can add about $2,500/user/year at list price for additional users (before discounting), and add-ons like Global Data ($9,995) plus higher credit consumption push you into a different contract class. The trap is multi-team usage (Sales + RevOps + Marketing) multiplying seats and credits at the same time.

Negotiation notes that actually move the number

- ZoomInfo: expect 30-65% discounts off list if you negotiate like you're willing to walk. Biggest savings comes from cutting modules your reps won't use weekly.

- HG Insights: benchmark spreads are real; you control cost by narrowing scope (regions, segments, datasets) and being explicit about how you'll activate.

Data quality reality (contact freshness vs technographics accuracy)

This is where the debate stops being a feature checklist and becomes a measurement problem. Review scores reflect user sentiment, not controlled accuracy testing.

ZoomInfo: massive scale, uneven freshness

ZoomInfo's G2 listing includes vendor-stated scale numbers: 70M direct dials, 174M verified emails, 500M professional profiles, and over one billion buying signals each month. That scale is exactly why it's the default for rep-led prospecting.

The trade-off's predictable: broad coverage means staleness shows up, especially in fast-changing orgs and smaller companies. If you buy it, plan for governance (field mapping, dedupe rules, and verification before sequencing), because "we'll just enrich Salesforce" is how you end up with three versions of the same account and routing that breaks at the worst possible time.

HG Insights: technographics depth built for strategy

HG positions itself around technographics accuracy and breadth: 13.2M+ companies, 236 countries, 20K+ products, and 90% technographics accuracy. It's the right dataset for "what's installed" and "how mature is the stack."

One proof point that matters for cloud-heavy ICPs: HG Cloud Dynamics monitors 10M+ cloud companies, which is exactly the kind of coverage you want when your targeting depends on cloud adoption signals.

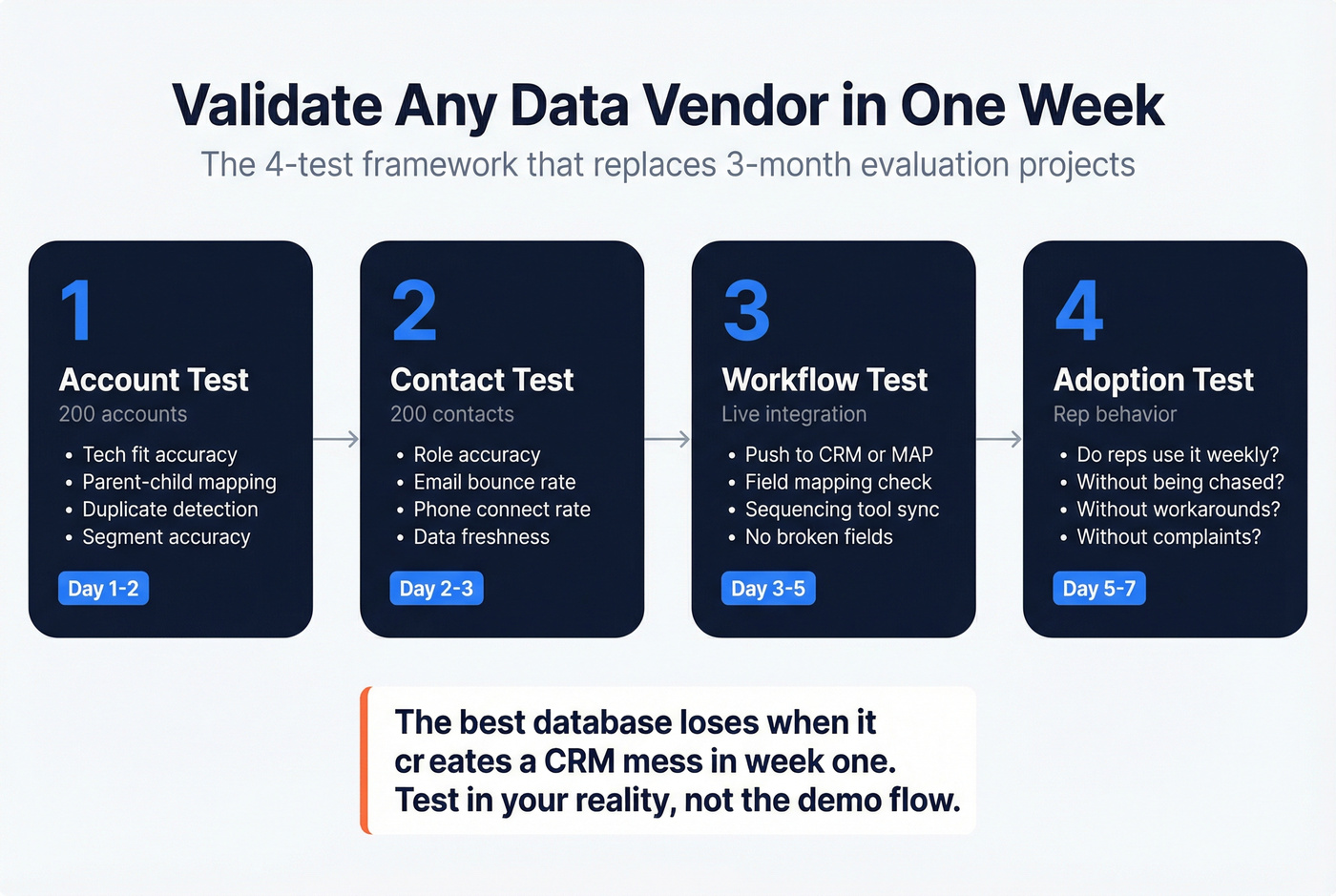

How to validate either tool in one week (no drama)

We've tested this approach with teams that didn't have time for a three-month "evaluation project," and it works because it forces the vendor into your reality instead of a demo flow.

- Account test (200 accounts): tech fit, parent/child mapping, duplicates, segment accuracy.

- Contact test (200 contacts): role accuracy, bounce rate, phone connect rate.

- Workflow test: push into CRM/MAP/sequencing without breaking fields.

- Adoption test: do reps use it weekly without being chased?

The "best database" loses when it creates a Salesforce mess in week one. Clean activation beats theoretical coverage.

Implementation, integrations, and activation into your stack

ZoomInfo implementation's straightforward: turn it on for reps, then layer enrichment and workflows. The risk isn't setup - it's governance. If RevOps doesn't lock down field writes and dedupe rules, you'll pollute your CRM fast.

HG Insights implementation is a GTM data project. On G2, the average time to implement is 2 months, because you're mapping signals, building segments, and wiring destinations before it becomes useful.

A practical 6-week implementation playbook (what "2 months" really means)

Week 1: Define the decision you're powering Territory design? ABM account selection? Whitespace expansion? Lock ICP, segments, and what counts as a qualified account.

Week 2: Data mapping + identity resolution Parent/child rules, account matching, CRM field mapping. Decide where truth lives (CRM vs warehouse vs HG).

Week 3: Build segments + scoring Technographics + firmographics + intent rules. Create Tier 1/2/3 account lists sales will actually accept.

Week 4: Activate destinations Push to CRM/MAP, route to owners, create views/dashboards. Set governance: who can change scoring, who can export, what gets written.

Week 5: Pilot with one region/team Measure coverage, meeting rate, rep usage, list quality feedback. Fix the top 10 reasons reps reject accounts.

Week 6: Rollout + quarterly operating rhythm Quarterly refresh of territories/whitespace. Monthly feedback loop with Sales + ABM + RevOps.

Integration reality (what connects where)

Per HG's integrations documentation, HG can:

- Pull signals from: Salesforce, HubSpot, Marketo, Eloqua

- Connect to warehouses: S3, BigQuery, Snowflake

- Use product/event tooling: Amplitude, Segment, Mixpanel

- Push to: Salesforce (Lead/Contact/Account), HubSpot (Contact), Marketo (Contact), Eloqua (Contact), Intercom, and Segment (Identify)

- Embed insights: iframes and a Chrome extension for in-workflow insights

- Trigger workflow actions into: Outreach, Salesloft, and Gong Engage

HG wins when RevOps owns the model and ABM owns the account list. When Sales owns it alone, it turns into "interesting insights" that never become pipeline.

For a neutral side-by-side feature scan, use the G2 compare page: https://www.g2.com/compare/hg-insights-vs-zoominfo-sales

Common buying mistakes (that cost a quarter)

- Buying ZoomInfo to "solve TAM." It's not built for territory design. You'll end up with activity metrics and still argue about account priority.

- Buying HG and expecting reps to prospect inside it. HG's a decision layer; reps still need a contact/workflow motion.

- Ignoring credit math until procurement. If you don't model seats + credits + add-ons up front, you'll sign a contract you can't operationalize.

- Letting anyone write anything into CRM. Enrichment without governance creates duplicates, bad routing, and broken reporting.

- Measuring the wrong success metric. HG success = coverage + whitespace conversion. ZoomInfo success = connect rate + meetings + pipeline per rep.

Security, privacy, and procurement checklist (SOC 2 / ISO 27001)

Security rarely differentiates these two, but procurement still needs clean answers.

Procurement checklist

- SOC 2:

- ZoomInfo has SOC 2 attestation.

- HG Insights has SOC 2 Type II certification.

- ISO posture: ZoomInfo states its ISMS is aligned to ISO 27001.

- Encryption: ZoomInfo uses AES-256 at rest and TLS 1.2 minimum in transit.

- DPAs + privacy: confirm DPA availability, subprocessors, opt-out handling.

- Access controls: SSO/SAML, role-based permissions, audit logs.

- Data retention: how long exports and enrichment logs persist.

The bigger risk is operational: uncontrolled exports, messy CRM writes, and no governance around who can push what into production fields.

Skip both (or pair either): add an accuracy layer before outbound

Look, if you're doing outbound at any real volume, you don't win by owning the biggest database. You win by putting verified, fresh contact data into sequences so your deliverability stays healthy and your reps aren't dialing ghosts.

Prospeo is The B2B data platform built for accuracy: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy on a 7-day refresh cycle (industry average: 6 weeks). It's also self-serve (no contracts), GDPR compliant, and built to verify and enrich exports before they hit your sequencer.

A scenario we see all the time: a team exports 5,000 contacts from their "main database," loads them into a sequencer, and then spends the next two weeks dealing with bounces, blocked domains, and reps complaining that "the phones are dead." That's not a sourcing problem. It's a verification and freshness problem.

Use Prospeo when:

- You need verified emails to protect deliverability

- You need verified mobiles to lift connect rate (30% pickup rate)

- You need fresh data before sequences go live (7-day refresh)

Learn more: https://prospeo.io/b2b-data-enrichment

This article flags deliverability as the gap neither HG Insights nor ZoomInfo solves. Prospeo's 5-step verification with catch-all handling and spam-trap removal keeps bounce rates under 4% - the same results Snyk saw across 50 AEs.

Verify before you sequence. Prospeo handles both in one platform.

FAQ

Is HG Insights a replacement for ZoomInfo?

No. HG Insights is for technographics, TAM sizing, and whitespace strategy, while ZoomInfo is for contact prospecting, direct dials, enrichment, and rep workflows. Most teams that "replace" one with the other end up rebuilding the missing half with extra tools (and losing a quarter to the transition).

Does ZoomInfo include intent data, and what do "intent topics" mean?

Yes. ZoomInfo packages intent across Sales and Marketing, and "intent topics" are the research categories you can monitor and route into plays. On the Marketing side, Demand includes 25 topics, ABM Lite includes 100 topics, and ABM Enterprise includes unlimited topics (with higher included credits in some tiers).

Why does ZoomInfo pricing vary so much between companies?

ZoomInfo contracts bundle seats + credits + add-ons, then discount heavily, so two companies can both "pay ~$20k" while one has 3 seats and the other has 10 seats plus Global Data and a larger credit pool. Model the renewal with your expected export volume, not your current usage.

How long does HG Insights take to implement in practice?

Plan for about 2 months for a real rollout: identity resolution, segmentation, scoring, destination wiring, and a pilot before you scale. If you keep it to one ICP and one region, you can shorten the timeline, but territory/TAM work needs governance to stick.

Summary: choosing between HG and ZoomInfo (and what most teams miss)

In hg insights vs zoominfo, the split is account strategy vs rep activation: HG is strongest for technographics-led targeting, TAM, and whitespace; ZoomInfo is strongest for contact sourcing, enrichment, and day-to-day outbound workflows.

Don't skip the unsexy part: verification and freshness. Deliverability problems erase the gains from either platform.