Sales Sequence Best Practices: The 2026 Playbook for Reps Who Want Replies

You built a 12-step sequence over the weekend. Personalized subject lines, clever CTAs, a breakup email you were genuinely proud of. You launched Monday morning, checked stats by Friday, and saw... nothing. Three opens. Zero replies. One bounce notification that made your stomach drop.

So you did what most reps do. You rewrote the subject line. Swapped the CTA. Asked your manager for feedback. Maybe you even bought a course on cold email copywriting. And the next campaign? Same result. Because the problem was never your words - it was everything underneath them.

91% of cold emails get zero response. Only 24% of reps exceed their yearly quota. And 60% of deals aren't lost to competitors - they're lost to indecision, which means your sequence never created enough urgency or relevance to force a choice. The gap between "I have a sequence" and "I have a sequence that works" is enormous, and it's almost never about the copy. It's about the architecture, the data, the channel mix, and the dozens of small decisions that compound into either pipeline or silence.

This is the playbook for closing that gap.

What You Need (Quick Version)

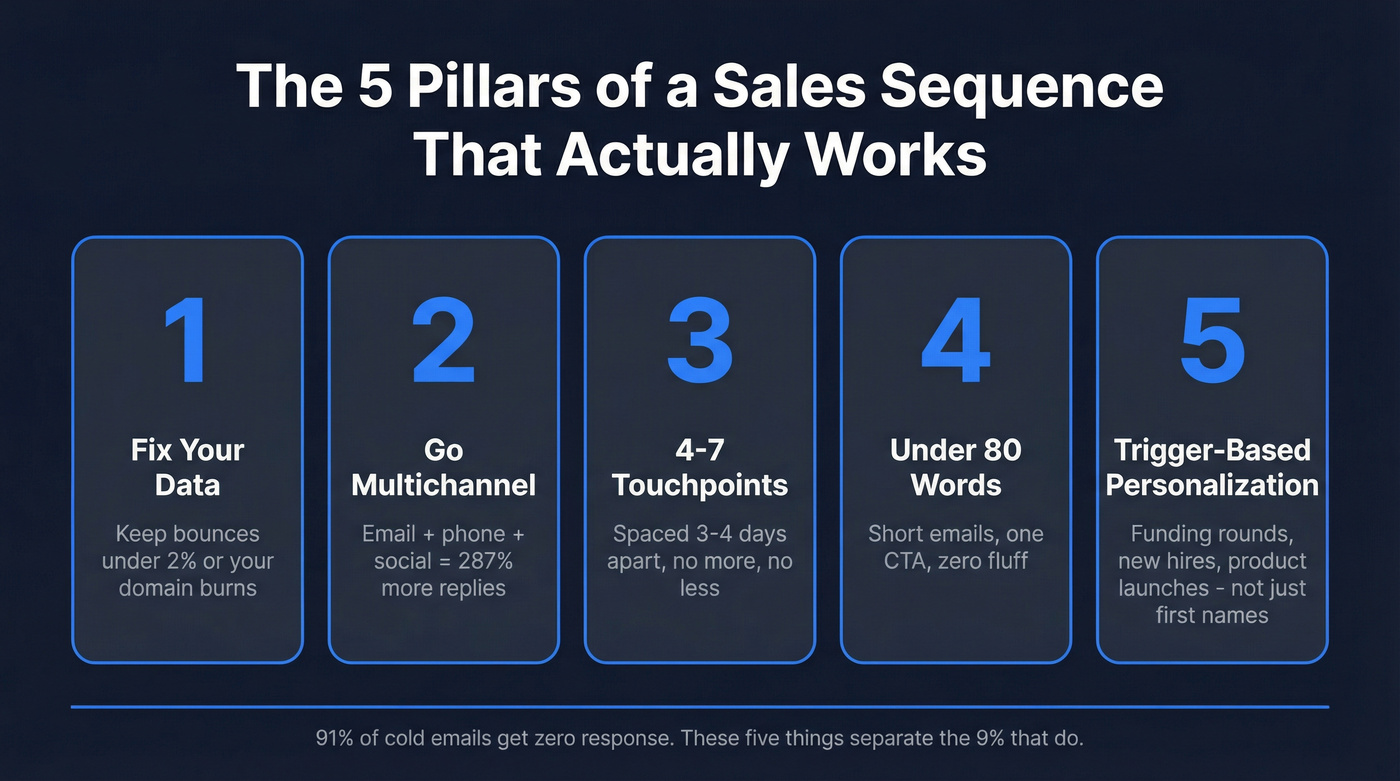

If you read nothing else, nail these five things:

- Fix your data first. If your bounce rate is above 2%, nothing else matters. Your domain reputation tanks, your emails land in spam, and your copy never gets seen. Start with a verified data source - Prospeo delivers 98% email accuracy on a 7-day refresh cycle.

- Go multichannel. Email + phone + social increases response rates by 287% compared to single-channel outreach. Email-only sequences are dead.

- 4-7 touchpoints, spaced 3-4 days apart. Under 4 gives up too early. Beyond 7 shows diminishing returns and risks higher spam complaints.

- Under 80 words per email, one CTA. The best-performing cold emails are short, focused, and ask for one thing.

- Personalize with triggers, not just first names. Funding rounds, new hires, product launches - these are the signals that make prospects actually read your email. "{First_name}, quick question" isn't personalization. It's a mail merge.

Now let's break each of these down with the data behind them.

Fix Your Foundation Before You Write a Single Email

Here's the thing: most sequence failures aren't copywriting failures. They're infrastructure failures. You can write the best cold email ever crafted, and it won't matter if it bounces, lands in spam, or hits someone who left the company six months ago.

Clean Your Data (Or Watch Your Domain Burn)

17% of cold emails get blocked or land in spam. That's before anyone even decides whether your message is relevant. And the #1 driver of spam placement? Bounce rates.

Keep bounces under 2%. That's not a suggestion - it's a survival threshold. Teams with clean deliverability see 15-25% more replies without changing a single word of copy.

The proof is in the numbers. Meritt was running a 35% bounce rate before they switched to verified data. They got it under 4%, connect rates tripled to 20-25%, and their pipeline jumped from $100K to $300K per week. Snyk had 50 AEs prospecting 4-6 hours a week with bounce rates of 35-40%. After cleaning their data, bounces dropped under 5%, AE-sourced pipeline jumped 180%, and they were generating 200+ new opportunities per month.

Every best practice in this playbook falls apart if your emails bounce. Prospeo's 7-day data refresh and 98% email accuracy keep your bounce rate under 2% - the survival threshold for sender reputation. Meritt cut bounces from 35% to under 4% and tripled their pipeline.

Stop optimizing copy on top of broken data. Fix the foundation first.

Define Your ICP (Stop Spraying and Praying)

Emails sent to large, untargeted lists receive 67% fewer replies. That stat alone should kill the "blast 10,000 contacts and see what sticks" approach.

The best-performing teams micro-segment ruthlessly. We're talking 30-150 very similar prospects per campaign - same industry, same role, same pain point, same company stage. When every prospect in a campaign looks alike, your messaging can be specific enough to feel personal without requiring 10 minutes of research per email.

Watch out for what B2B GTM strategists call the "Big TAM fallacy" - the belief that a larger addressable market means more pipeline. It doesn't. It means more wasted sends. "Logo lust" is the enterprise version: chasing Fortune 500 logos instead of companies that actually match your ICP. Both are spray-and-pray traps dressed up as strategy.

If you're selling project management software, "VP of Engineering at Series B SaaS companies with 50-200 employees who just raised funding" is an ICP. "Tech leaders" is not.

Warm Your Domain

New domains and cold inboxes need a ramp-up period. Skip this step and you'll torch your sender reputation before your first real campaign.

The warmup schedule: start at 5-10 sends per day. After a week, increase to 30. Then 80. Then 150+. The full ramp takes 4-6 weeks. Yes, it's slow. No, you can't skip it.

During warmup, send to engaged contacts - people who'll open and reply. Most sequence platforms (Instantly, Smartlead) have built-in warmup tools. Use them.

2026 Benchmark Data - Know Your Numbers

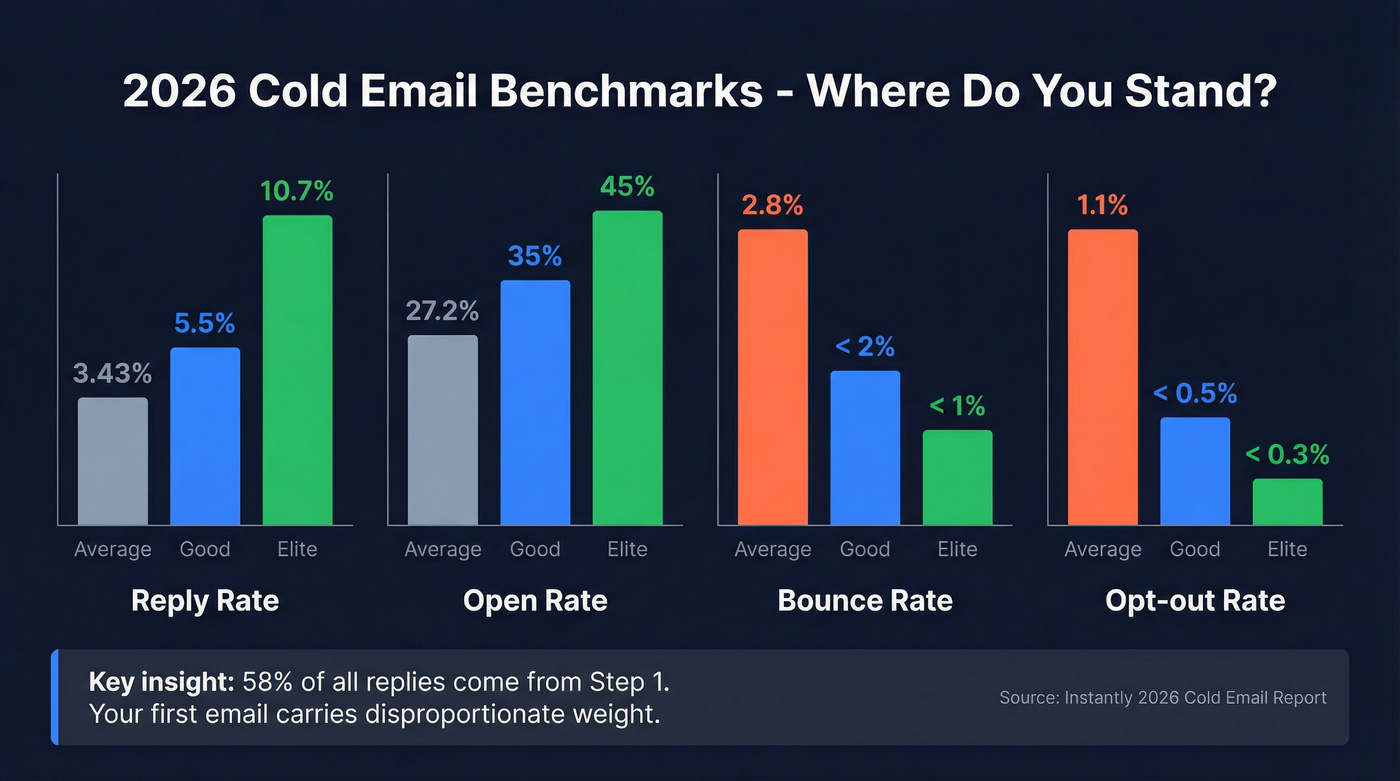

Before you optimize anything, you need to know what "good" looks like. These benchmarks come from Instantly's 2026 cold email report (billions of emails analyzed) and Outreach's platform data across thousands of workspaces.

Overall Email Benchmarks

| Metric | Average | Good | Elite |

|---|---|---|---|

| Reply rate | 3.43% | 5.5%+ | 10.7%+ |

| Open rate | 27.2% | 35%+ | 45%+ |

| Bounce rate | 2.8% | <2% | <1% |

| Opt-out rate | 1.1% | <0.5% | <0.3% |

Benchmarks by Sequence Type

| Sequence Type | Reply Rate | Meeting Rate |

|---|---|---|

| Cold outbound | 8-15% | 1-3% |

| Warm inbound | 20-30% | 8-12% |

| Customer expansion | 25-40% | 15-20% |

| Win-back/nurture | 10-18% | 2-5% |

Cold prospecting sequences should target at least a 12% prospect reply rate. If you're below 8%, you've got a targeting or data problem - not a copy problem. And qualified opportunities should close at a 20-30% rate. If your close rate is lower, the issue is likely qualification criteria, not sequence design.

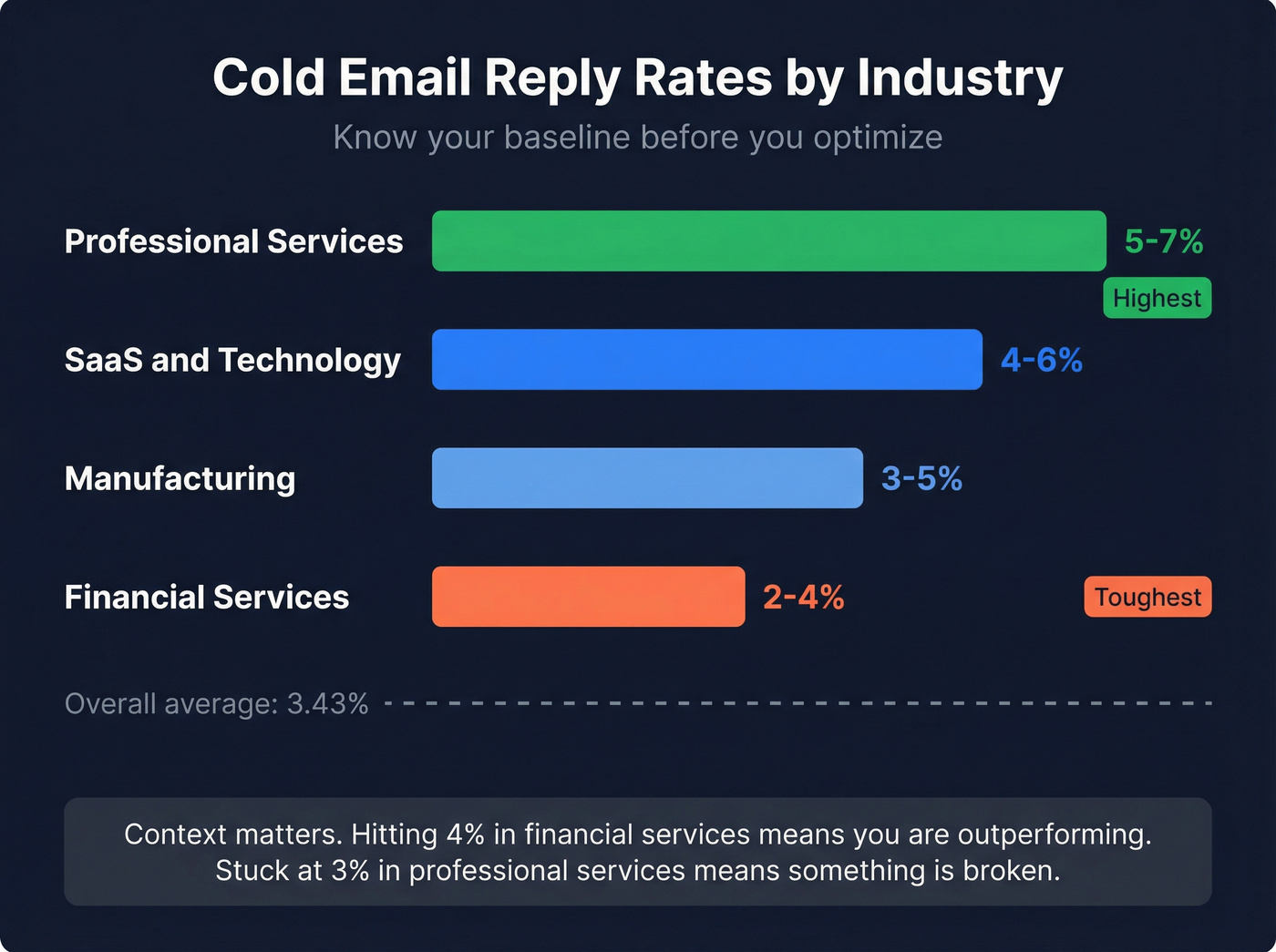

Reply Rates by Industry

Not every vertical performs the same:

| Industry | Estimated Reply Rate |

|---|---|

| SaaS / Technology | 4-6% |

| Professional Services | 5-7% |

| Manufacturing | 3-5% |

| Financial Services | 2-4% |

If you're in financial services and hitting 4%, you're outperforming. If you're in professional services and stuck at 3%, something is broken. Context matters.

A few things jump out from the data. Open rates are no longer a reliable metric - between Apple Mail Privacy Protection and various inbox pre-fetching behaviors, open tracking is increasingly fiction. Track replies and meetings booked. Those are the numbers that matter.

And here's the one most teams miss: 58% of all replies come from Step 1. Your first email carries disproportionate weight. If that first touch doesn't land, the rest of your sequence is fighting uphill.

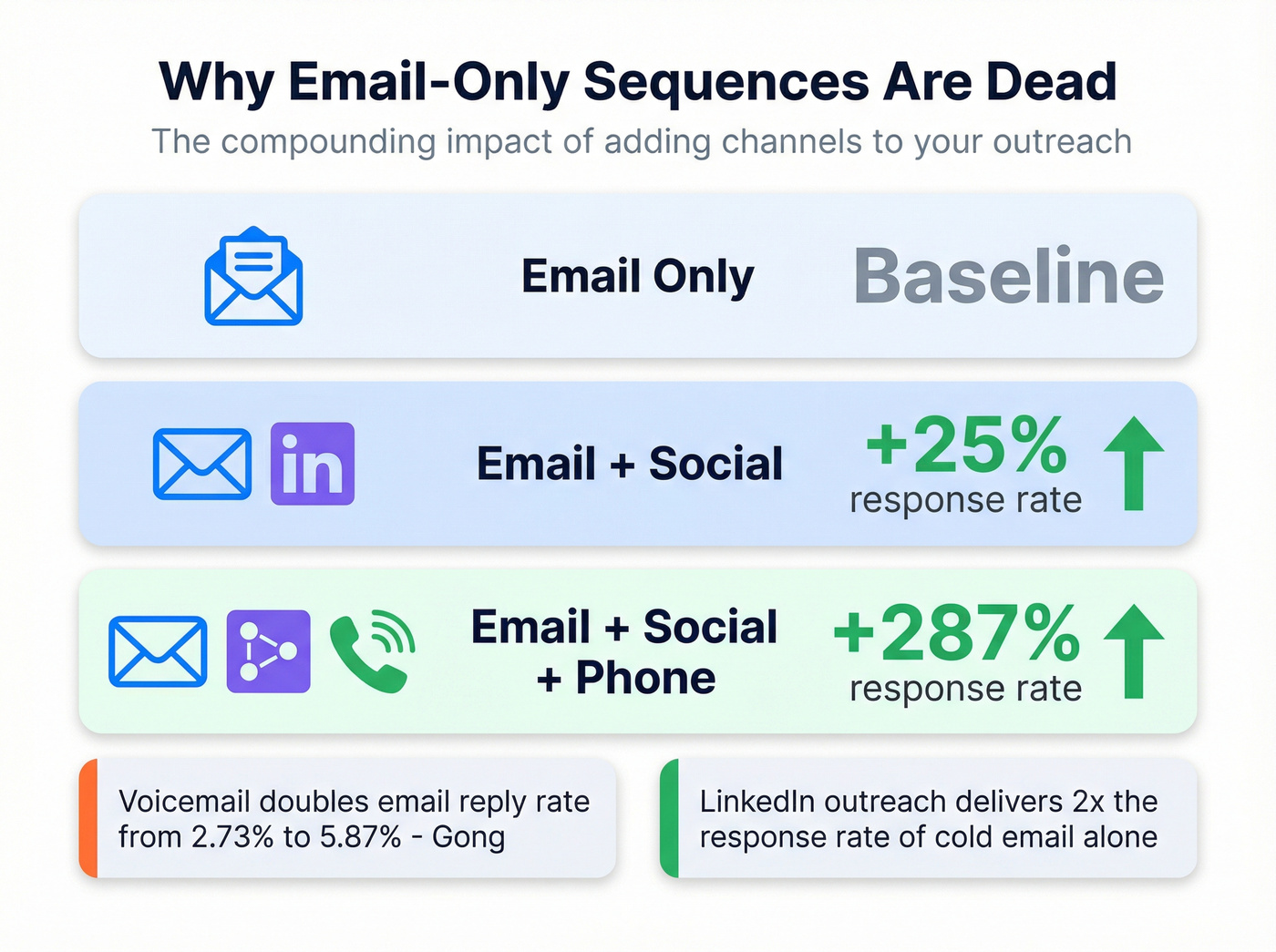

Why Email-Only Sequences Are Dead in 2026

The Data Behind Multichannel

Email engagement rates dropped nearly 5x between 2021 and 2023, and the trend has only continued. What used to get 8% engagement now gets 1-2%. The inbox is a warzone.

LinkedIn outreach delivers double the response rate compared to cold email alone. Adding social touchpoints to email improves results by 25%. Adding phone calls on top of that improves results by another 20%. And the headline stat: multichannel outreach increases response rates by 287% compared to single-channel.

Leaving a voicemail doubles reply rates on your initial outreach email - from 2.73% to 5.87%, per a Gong study. That's not a marginal improvement. That's the difference between a dead sequence and a pipeline-generating one.

You need verified direct dials for those phone steps, not switchboard numbers that route to a receptionist who'll never transfer you.

For enterprise accounts, direct mail and gifting are worth considering too. Physical mail increases response rates by 3-5x for high-value targets. Typical costs run $20-$75 per gift for mid-tier prospects and $100+ for executive-level targets. It's not scalable for every prospect, but for your top accounts, it's a high-leverage channel.

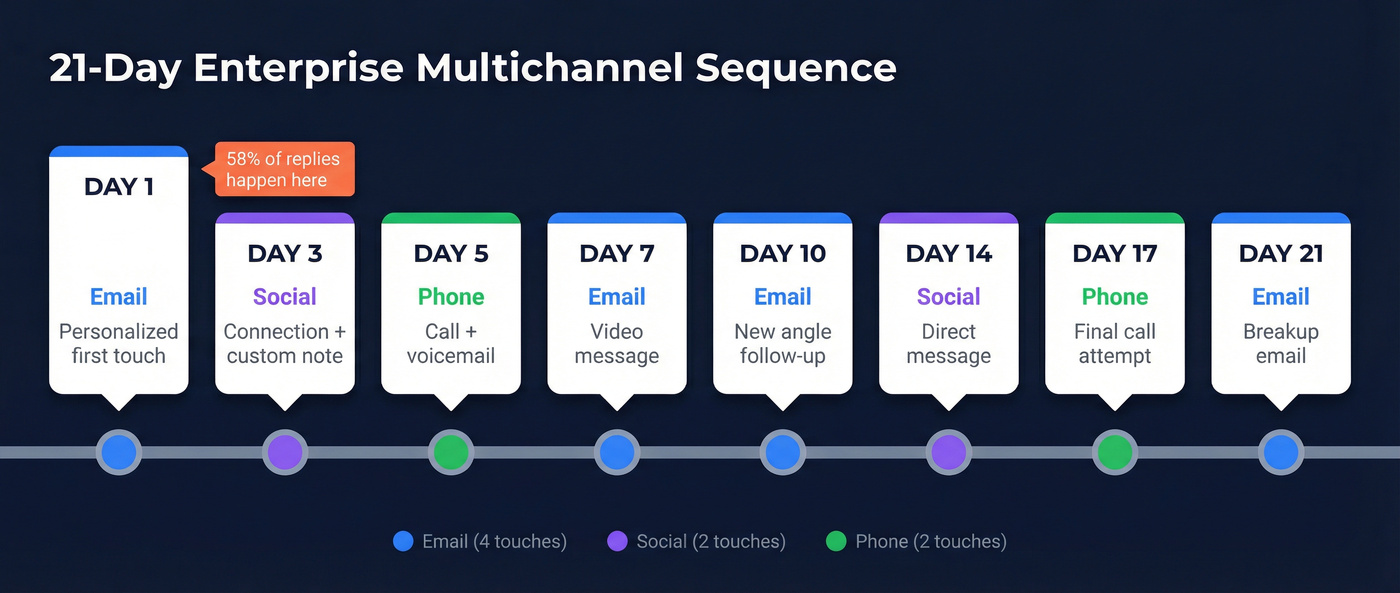

The 21-Day Multichannel Template (Enterprise)

This framework is adapted from Outreach's sequence methodology and stress-tested across multiple campaign types. Adjust timing based on your audience, but the channel progression is the key.

| Day | Channel | Action | Why It Works |

|---|---|---|---|

| 1 | Personalized first touch | Highest reply probability (58% of replies) | |

| 3 | Social | Connection + custom note | References email, builds familiarity |

| 5 | Phone | Call + voicemail | Voicemail doubles email reply rates |

| 7 | Video message | Pattern interrupt; stands out in inbox | |

| 10 | Follow-up with new angle | Adds value, doesn't repeat | |

| 14 | Social | Direct message | Builds on connection from Day 3 |

| 17 | Phone | Final call attempt | Last high-touch effort |

| 21 | Breakup email | Low-pressure close; recovers 5-10% |

One rule worth memorizing: if your reply rate on the last step is still above 3%, the sequence isn't long enough. Add another step.

The 14-Day SMB Sprint

SMB deals move fast. The CEO makes the purchasing decision 96% of the time, so you often don't need heavy multi-threading - you need speed and clarity.

| Day | Channel | Action |

|---|---|---|

| 1 | Short, pain-focused first touch | |

| 3 | Social | Connect + brief note referencing email |

| 5 | One-line follow-up ("Any thoughts on this?") | |

| 9 | New angle with social proof or case study | |

| 14 | Breakup email |

Five touchpoints, two weeks, done. This outperforms a sprawling 18-step cadence for SMB every time because it respects the buyer's decision speed.

The 7-Day Inbound Follow-Up

Inbound leads are warm - they raised their hand. The goal isn't to convince them you exist; it's to convert interest into a conversation before it goes cold.

| Day | Channel | Action |

|---|---|---|

| 0 | Immediate response (within 1 hour) | |

| 1 | Phone | Call to discuss their request |

| 3 | Follow-up with relevant resource | |

| 7 | Soft close or reschedule offer |

Speed is everything here. Teams that respond within 1 hour are 7x more likely to qualify the lead. If your inbound follow-up takes 24 hours, you've already lost to the competitor who replied in 20 minutes.

The Multichannel Execution Problem

The biggest bottleneck with multichannel? Reps skip the phone steps. Manual tasks create what Outreach calls "Sequence Purgatory" - prospects stuck in limbo because a rep didn't make the call. If you're going to run multichannel, you need to actually execute every step. Otherwise, strip the phone steps and accept the lower response rates.

58% of replies come from Step 1. That first email needs to hit a real inbox, at the right person, with a trigger-based reason to care. Prospeo gives you 30+ filters - buyer intent, job changes, funding, headcount growth - so every contact in your sequence matches your micro-segment.

Build sequences that land. Start with 75 free verified contacts.

Structure and Architecture That Drive Results

How Many Touchpoints (and How Far Apart)

The sweet spot is 4-7 touchpoints. This isn't arbitrary - it's where the data converges across every major benchmark study.

80% of deals require 5+ touches to close. Yet 44% of reps give up after just one attempt. That's not persistence - that's quitting before the game starts.

Spacing matters too. 3-4 days between touchpoints gives prospects enough breathing room to respond without forgetting you exist. Tighter spacing feels aggressive. Wider spacing loses momentum.

And remember: 58% of replies come from Step 1. Your first email does the heavy lifting. But the other 42% come from follow-ups - proving that persistence pays, even when it doesn't feel like it.

Enterprise vs SMB - Two Different Playbooks

The biggest mistake I see teams make is running the same sequence for a 200-person startup and a Fortune 500 account. These are fundamentally different sales motions.

| Dimension | Enterprise | SMB |

|---|---|---|

| Sales cycle | 6-18 months | 30-90 days |

| Decision-makers | 6-13 stakeholders | 1-4 (CEO decides 96%) |

| Approach | High-touch, consultative | Digital-first, speed wins |

| Personalization | 5-10 min per email | 30 seconds per email |

| Channel mix | Multi-threaded, calls heavy | Email-led, social support |

| Key message | ROI + risk reduction | Speed + immediate value |

Enterprise sequences need multi-threading across the buying committee. The average B2B deal involves 13 stakeholders. You can't win an enterprise deal by emailing one person. You need parallel sequences hitting the economic buyer, the technical evaluator, the champion, and the blocker - each with messaging tailored to their role.

SMB is the opposite. Speed and simplicity win. Use the 14-day SMB sprint template above and resist the urge to over-engineer it.

Designing by Persona

Not all prospects within the same company should get the same sequence. The economic buyer wants brief emails and executive briefings - they're evaluating ROI and strategic fit. The technical evaluator wants detailed documentation and demo videos - they're evaluating feasibility and integration.

Build a persona matrix: buyer personas on one axis, high-touch vs. low-touch on the other. Each cell gets its own sequence. It sounds like a lot of work upfront, but it compounds. Once you've built the matrix, you're not reinventing the wheel for every campaign.

One practice that separates good teams from great ones: a Content Committee. This is a cross-functional team including your top-performing reps, meeting monthly to review sequence performance. The agenda is simple - pull reply rates by sequence, identify the top and bottom performers, run one A/B test per sequence, and flag any messaging that feels stale. Minor tweaks monthly. Full overhaul every six months. The sequences that worked in Q1 won't work in Q3.

Writing Emails That Get Replies

Subject Lines That Convert

47% of people open an email based solely on the subject line. That makes it the single highest-leverage element in your entire sequence.

Personalized subject lines are 26% more likely to be opened. The sweet spot is 6-9 words. And the psychological triggers that consistently work: curiosity gap, urgency, familiarity, social proof, pain-to-solution, and specificity.

Here's what's actually working in 2026:

| Category | Examples |

|---|---|

| Cold outreach | "Quick question about {Company}'s {goal}" |

| Cold outreach | "{First name}, idea to cut {pain} 25%" |

| Cold outreach | "How {peer company} hit {metric} in 30 days" |

| Cold outreach | "7-minute idea for {Company}" |

| Follow-up | "Still helpful for {Company}?" |

| Follow-up | "New angle on {pain} we missed" |

| Follow-up | "Should I close the loop?" |

| Meeting request | "10 minutes on {metric} next week?" |

| Breakup | "Should I close your file?" |

The curiosity gap is the most reliable trigger. "Quick question about {Company}'s hiring plans" works because the prospect can't help wondering what the question is. Specificity amplifies everything - "cut churn 25%" beats "improve retention" every time.

Real talk: most subject lines fail because they're generic. "Reaching out" and "Introduction" are the subject line equivalent of a blank stare. If your subject line could apply to any company in any industry, it's not specific enough.

Body Copy - Under 80 Words, One CTA

The best-performing cold emails are under 80 words with a single call to action. That's not a guideline - it's what the data says, consistently, across billions of emails.

81% of emails are opened on mobile devices. On a phone screen, 80 words is about three short paragraphs. Anything longer gets the scroll-and-archive treatment.

Step 2 emails that feel like replies outperform formal follow-ups by roughly 30%. Instead of "Hi {First name}, I wanted to follow up on my previous email..." try "Hey - any thoughts on this?" Short. Casual. Feels like a real reply, not a marketing automation.

The top-performing CTA: "Would you have a couple minutes to chat about this over the next few days?" It works because it's low-commitment and specific. Compare that to "Would you be open to a 30-minute demo?" - one feels like a conversation, the other feels like a time commitment.

Follow-ups that add new value crush "just checking in" emails. Every follow-up should introduce a new angle, a new data point, a new reason to respond. If you can't think of something new to say, your sequence is too long.

The Breakup Email

The breakup email is the most underrated step in any sequence. It recovers 5-10% of otherwise-lost opportunities because the low-pressure approach removes friction.

The template that works:

Subject: Should I close your file?

Body: "Hey {First name} - I've reached out a few times and haven't heard back. Totally understand. Usually means one of three things: (1) You're swamped and this fell off the radar, (2) Timing isn't right, (3) Not interested. Any of those is completely fine. Just let me know and I'll either follow up later or close the loop."

The psychology is simple: giving someone explicit permission to say "no" paradoxically makes them more likely to say "yes" - or at least "not now, try me in Q3."

One critical data point from Belkins' analysis of 16.5 million emails: the sweet spot is 1 initial email + 1 follow-up for the highest reply rates. Each additional follow-up shows diminishing returns, and 4+ emails triples your spam complaint rate. More isn't always better. If you're running a 12-step email-only sequence, you're probably hurting yourself after step 4 or 5.

Personalization That Actually Scales

Most "personalization" is mail merge with extra steps. Swapping in a first name and company name isn't personalization - it's the bare minimum, and prospects see right through it.

Real personalization doubles response rates. 71% of buyers expect personalized interactions, and 76% get frustrated when they don't get them. McKinsey links advanced personalization to revenue lifts of up to 40%.

But here's the tension: you can't spend 10 minutes researching every prospect when you're running 500 contacts through a sequence. The answer is tiered personalization.

Enterprise (5-10 minutes per email): Research their specific initiatives. Reference their latest earnings call, a recent product launch, or a post from the prospect. Mention a competitor they're losing to. This is where deals are won - one deeply personalized email to a CRO beats 50 generic ones.

Mid-market (2-3 minutes per email): Company news + role-specific pain. "Saw {Company} just raised a Series B - congrats. Usually that means the sales team is about to double and data quality becomes a nightmare. That's what we solve."

SMB (30 seconds per email): AI-generated first line + one custom sentence. At this volume, trigger-based sending is your best friend. Funding announcements, new hires, role changes, product launches - these signals let you personalize at scale without manual research.

The distinction that matters: tactical personalization (one-off custom messages) vs. systemic personalization (a compounding system that improves over time). The best teams build systems. They create templates organized by trigger type, persona, and industry - then customize the variables, not the structure.

Here's my hot take: if your average deal size is under $10K, you probably don't need deep personalization at all. A clean, direct email that nails the pain point will outperform a mediocre "I saw your LinkedIn post about..." opener every time. Personalization without insight is worse than none at all - a first line that says "I noticed you're in the SaaS space" signals you did the minimum. Either go deep or go clean and direct.

AI, Automation, and What to Keep Manual

What AI Actually Does Well in 2026

80%+ of B2B teams using AI report measurable revenue growth, compared to roughly 66% of manual-only teams. 75% of B2B sales organizations now augment their playbooks with AI-based automation. This isn't experimental anymore - it's standard practice.

The practical use cases that actually move the needle:

- Personalized first lines based on company research and prospect activity - this is where AI saves the most time at scale

- Send-time optimization based on engagement patterns - Wednesday is best on average, but AI can find your audience's specific sweet spot

- Reply handling and classification - sorting positive replies from objections from auto-replies

- Prospect research - firmographics, technographics, hiring trends, social signals, intent data, all synthesized in seconds

- Conditional follow-up logic - changing the next step based on opens, replies, or profile views

AI-driven prospecting saves 4-7 hours per rep per week on research and list building. Teams responding to buying signals within 1 hour are 7x more likely to qualify the lead. AI intent detection compresses sales cycles by 20-30%.

The results speak for themselves. Unity improved their win rate by 29.9% after implementing AI-guided selling. Grammarly saw an 80% increase in conversion rates from AI-powered lead scoring.

I've seen teams cut outreach prep from 2 hours to 20 minutes per rep per day using AI for research and first-line generation. That's not a marginal improvement - that's giving every rep an extra 90 minutes of selling time daily.

What NOT to Automate

"Automating chaos scales chaos." That line from Woodpecker's team is the best summary I've heard. If your process is broken - bad targeting, wrong ICP, no clear value prop - automation just helps you fail faster.

Automate: List building, CRM updates, send scheduling, data enrichment, meeting booking, lead scoring, reply classification.

Keep manual: First-touch personalization for enterprise accounts, phone calls, negotiation, objection handling, relationship-building, strategic deal guidance, coaching conversations.

The biggest automation trap: automating outreach before fixing your foundation. If your data is bad, your ICP is vague, and your messaging is generic, automation just sends more bad emails faster. Fix the inputs first. Then scale.

How to A/B Test Your Sequences

Testing is where good sequences become great ones. But most teams either don't test at all or test wrong.

Test priority order (highest impact first):

- Subject lines - 47% of opens depend on this alone

- CTAs - question-based vs. statement-based (this is often the bigger lever than body copy)

- Email body copy - short vs. shorter, different angles

- Sender names - formal ("John Smith, VP Sales") vs. casual ("John from Acme")

- Send times - morning vs. afternoon, specific days

Rules that matter:

- Test one variable at a time. Changing the subject line AND the body AND the CTA makes results uninterpretable.

- Minimum 200 prospects per variant over 2+ weeks. Sales sequences are lower volume than marketing email - you need more time to reach significance.

- Run tests for a full business cycle - at least two weeks. Weekday bias is real.

- Track replies and meetings booked, not opens. Opens are unreliable.

- Cap sends at 30 per day per inbox during tests to protect sender reputation.

- If reply rate on the last step is still above 3%, add another step.

Agile teams A/B test monthly. Full sequence overhauls happen every six months. The sequences that crushed it in January will be stale by July - buyer expectations shift, inbox competition changes, and what felt fresh becomes familiar.

One pattern we see repeatedly: teams test subject lines obsessively but never test their CTA. "Would you have a couple minutes to chat?" vs. "Can I send you a 2-minute video?" can swing reply rates by 20%+. Test your CTAs before you test your third subject line variant.

Common Sequence Mistakes (and the Data Behind Each)

These are the anti-patterns that kill sequences. Every single one is avoidable.

1. Giving up after one touch. 80% of deals require 5+ touches. 44% of reps give up after just one. If you're not following up, you're leaving the majority of your pipeline on the table.

2. Sending to unverified lists. 17% of cold emails land in spam. Bounce rates above 2% tank your domain reputation, and recovery takes weeks. This is the most expensive mistake because it compounds - every bad send makes your next good send less likely to land.

3. Running email-only sequences. You're leaving 287% of potential responses on the table. Multichannel isn't optional in 2026.

4. Generic mass emails. Untargeted lists get 67% fewer replies. If your email could be sent to anyone, it resonates with no one.

5. Ignoring mobile formatting. 81% of emails are opened on mobile. If your email looks like a wall of text on a phone screen, it's getting archived.

6. No A/B testing. 47% of opens depend on the subject line alone. If you're not testing subject lines, you're flying blind on the single highest-leverage element of your sequence. (Use an A/B test plan that keeps variables clean.)

7. Automating before fixing process. Scaling chaos just creates more chaos. Fix your ICP, clean your data, and validate your messaging manually before you automate anything.

8. Ignoring intent data. Prospects who are actively researching solutions convert at dramatically higher rates. Sending the same sequence to someone actively evaluating competitors and someone who's never heard of your category wastes both their time and yours.

9. Ignoring compliance. GDPR fines run up to 4% of global revenue or EUR 20M - whichever is higher. CAN-SPAM penalties can exceed $50,000 per email. Include an unsubscribe mechanism, honor opt-outs immediately, and make sure your data provider is GDPR compliant. This isn't just legal risk - it's deliverability risk. ISPs penalize senders with high complaint rates regardless of jurisdiction.

Metrics That Matter - What to Track and Where to Benchmark

Open rates are dead as a reliable metric. Stop building dashboards around them.

Here's what actually tells you whether your sequences are working:

| Metric | What It Tells You | Target |

|---|---|---|

| Lead reply rate | Message-market fit | 5.5%+ (cold outbound) |

| Meeting conversion | Sequence effectiveness | 1-3% cold, 8-12% warm |

| Close rate (qualified) | Qualification quality | 20-30% |

| Influenced pipeline | Revenue impact | 3x-4x quota coverage |

| Asset engagement | Content relevance | Trending up quarter/quarter |

| Time-to-first-response | Speed-to-lead | Under 1 hour |

Your pipeline-to-quota ratio should be 3x-4x. If you're running at 2x, you don't have enough pipeline to absorb the 60% of deals that die to indecision. That stat deserves repeating because it reframes everything: your biggest competitor isn't the other vendor. It's your prospect's status quo.

Companies with defined sales processes see up to 28% higher revenue growth. That means documenting your sequences, tracking these metrics consistently, and reviewing performance monthly. The teams that treat sequences as "set and forget" are the ones stuck at 2% reply rates wondering what went wrong.

One metric most teams overlook: time-to-first-response. Teams that respond to inbound signals within 1 hour are 7x more likely to qualify the lead. If your sequence generates a reply and it sits in a rep's inbox for 6 hours, you've wasted all the work that got you there. (If you want to operationalize this, track speed-to-lead as a first-class KPI.)

Recommended Tools for 2026

You don't need 10 tools. You need the right stack for your stage and motion.

| Category | Tool | Price | Best For |

|---|---|---|---|

| Data quality | Prospeo | Free-~$39+/mo | Verified emails + mobiles |

| Data quality | Clay | $149+/mo | Enrichment workflows |

| Sequences (SMB) | Instantly | $37-$358/mo | High-volume cold email |

| Sequences (SMB) | Apollo.io | Free-$59/user/mo | Database + sequencing combo |

| Sequences (Enterprise) | Outreach | ~$100-150/user/mo | Multichannel orchestration |

| Sequences (Enterprise) | Salesloft | ~$75-125/user/mo | Enterprise cadences + coaching |

| AI-native | Reply.io Jason AI | From $500/mo | Autonomous SDR workflows |

Look, if you're building your first real sequence: start with clean data, pick a multichannel tool (Apollo or Instantly for SMB, Outreach for enterprise), and run the templates from this guide. You can get fancy later. The foundation matters more than the features. If you need help choosing, start with a short list of cold email outreach tools and work backwards from your motion.

FAQ

How many emails should be in a sales sequence?

4-7 touchpoints is the sweet spot based on 2026 benchmark data. Under 4 means you're giving up before most deals even get started - 80% require 5+ touches. Beyond 7 shows diminishing returns, and 4+ emails triples spam complaint rates. For multichannel sequences, the total count can go higher because you're spreading across email, phone, and social.

What's a good reply rate for a cold email sequence?

The average cold email reply rate is 3.43%. Anything above 5.5% puts you in the top quartile, and elite performers hit 10%+. If you're below 2%, don't tweak your copy - fix your data and targeting first.

Should I use multichannel sequences or email only?

Multichannel, without question. Email + phone + social increases response rates by 287% versus email alone. Email engagement dropped nearly 5x between 2021 and 2023 and has continued declining. Email-only sequences aren't competitive in 2026.

How do I keep my emails out of spam?

Keep bounce rates under 2%, warm your domain gradually (5-10 sends/day ramping to 150+ over 4-6 weeks), use verified email data, and cap sends at 30 per day per inbox. Monitor spam complaint rates and keep them under 0.01%. One bad send to an unverified list can damage your domain reputation for weeks.

What's the best day to send cold emails?

Wednesday consistently shows the highest reply rates across multiple 2026 studies. Monday works well for launching new sequences when prospects are planning their week. Friday triggers an auto-reply surge - useful for identifying out-of-office contacts but poor for actual engagement. Skip weekends entirely.