The Data-Driven B2B Sales Strategy Guide for 2026

Your team built a $4M pipeline last quarter. Marketing celebrated. The CRO sent a Slack emoji. Then the quarter closed at $280K. The other $3.7M? Stalled in legal review, ghosted after the third call, or stuck in a "committee decision" that never actually happened. 86% of B2B deals stall, and 81% of buyers are unhappy with the outcome of their purchase. That's not a sales problem - it's a b2b sales strategy problem.

Most strategies are built on assumptions that stopped being true two years ago. This guide is the one I wish someone had handed me before I watched three consecutive quarters of "healthy pipeline" produce anemic revenue. It's built on conversion benchmarks from real pipeline data, buyer behavior research from Forrester's 18,000-respondent survey, and the tactical frameworks that actually move deals from "interested" to "signed."

What You Need (Quick Version)

If you're short on time, here are the three things that'll move your number fastest:

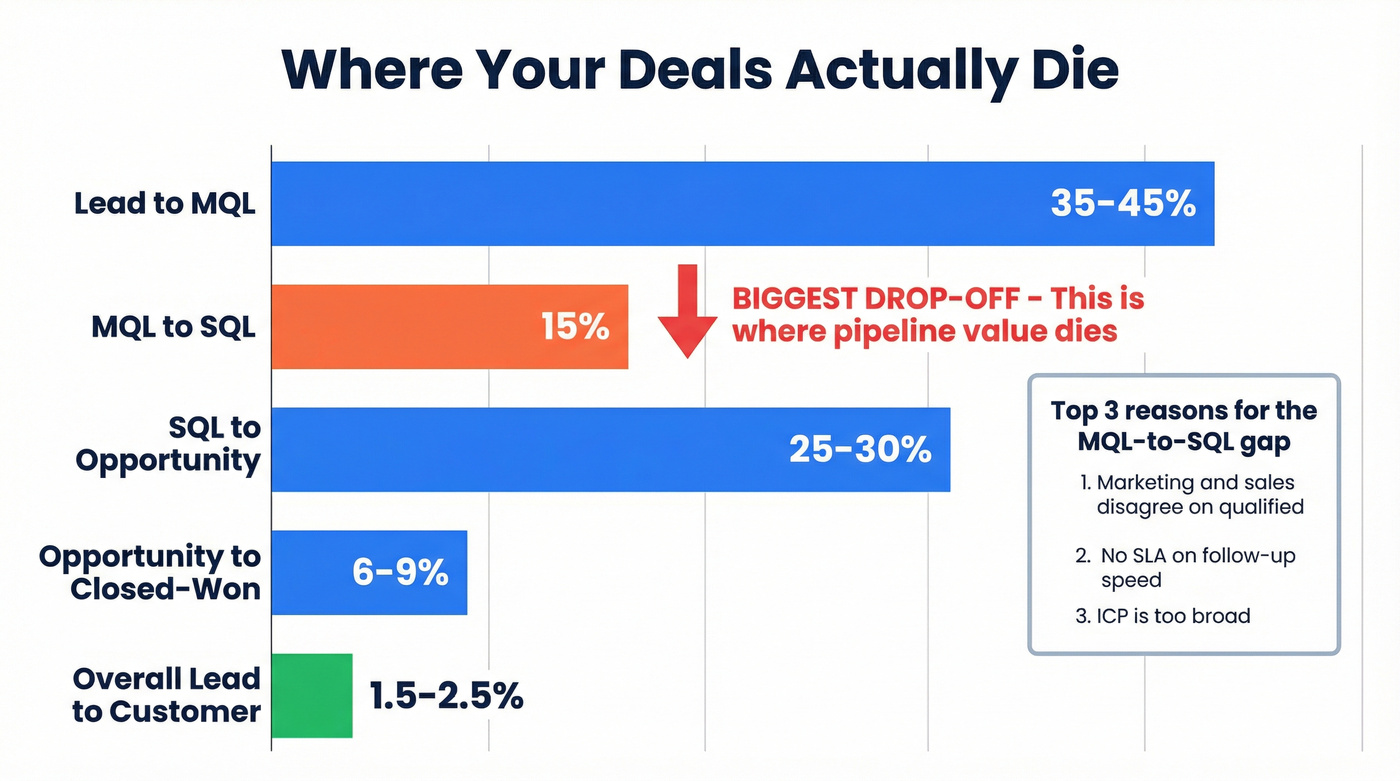

Fix the MQL-to-SQL bottleneck first. Only 15% of MQLs convert to SQLs. That's where pipeline value dies - not at the top of the funnel. Before you spend another dollar on lead gen, audit what's happening between marketing handoff and sales acceptance. (If you want a tighter definition and routing rules, use a formal lead qualification process.)

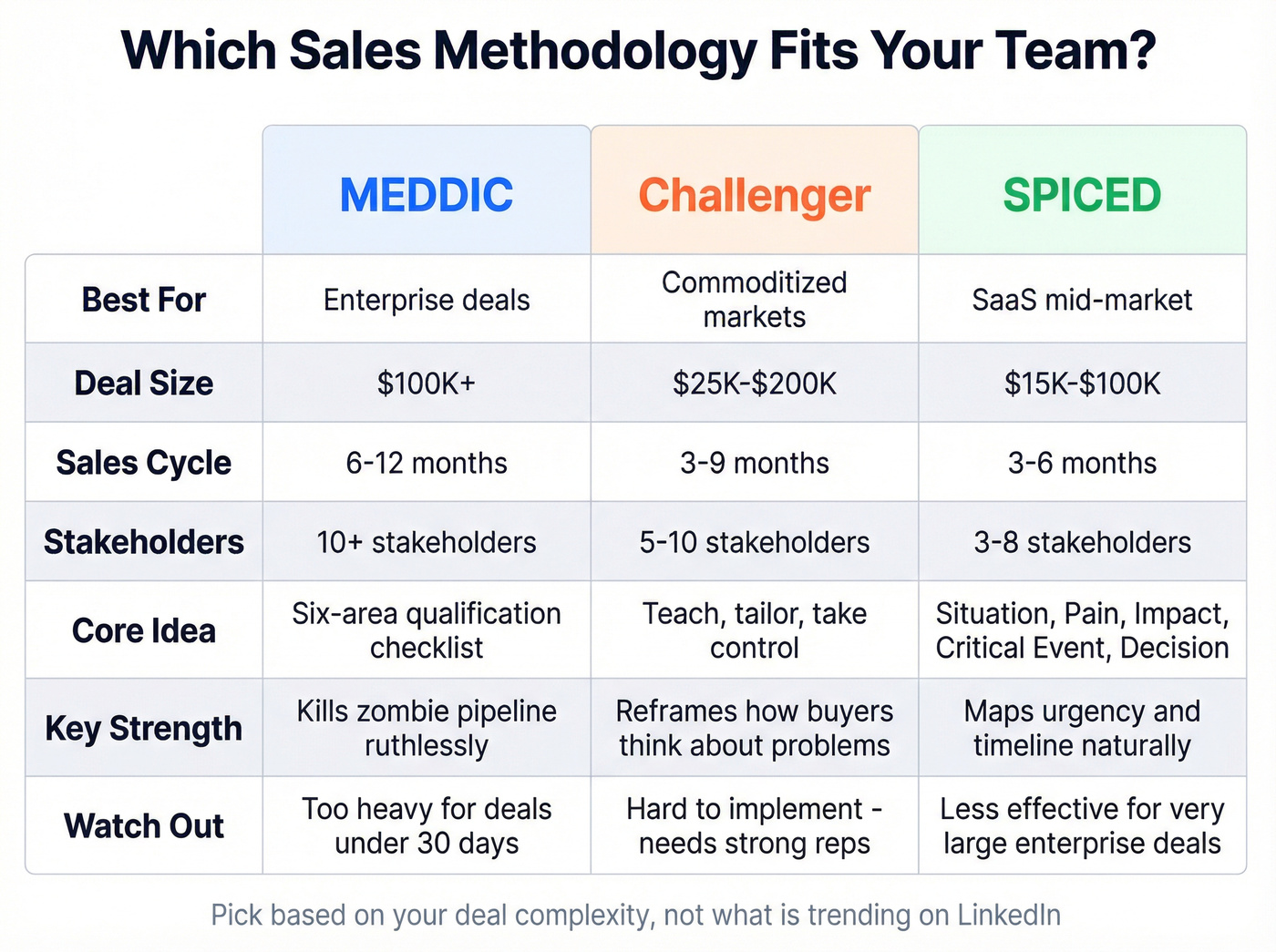

Pick a methodology that matches your deal complexity. MEDDIC for enterprise with 10+ stakeholders. SPICED for SaaS with 3-6 month cycles. Challenger for commoditized markets where you need to teach buyers something new. Stop letting reps wing it.

Prioritize data quality over lead volume. Clean data plus tighter ICP filtering beats volume plays every time. Fewer leads, better conversations, higher close rates.

The 2026 B2B Buyer Has Changed

The buyer you're selling to in 2026 isn't the buyer from 2023. They're using AI to build vendor shortlists before they ever talk to a human. They're running purchases through committees that would make a Senate subcommittee look streamlined. And they're spending less time with you than ever before.

B2B buyers [spend only 17%](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) of their total purchase time with all vendors combined. Not 17% with you - 17% split across every vendor in the running. If three vendors are on the shortlist, you're getting roughly 5-6% of the buyer's attention during the entire purchase process. Buyers are nearly 70% through their purchasing journey before they ever engage a seller directly.

The Buying Committee Explosion

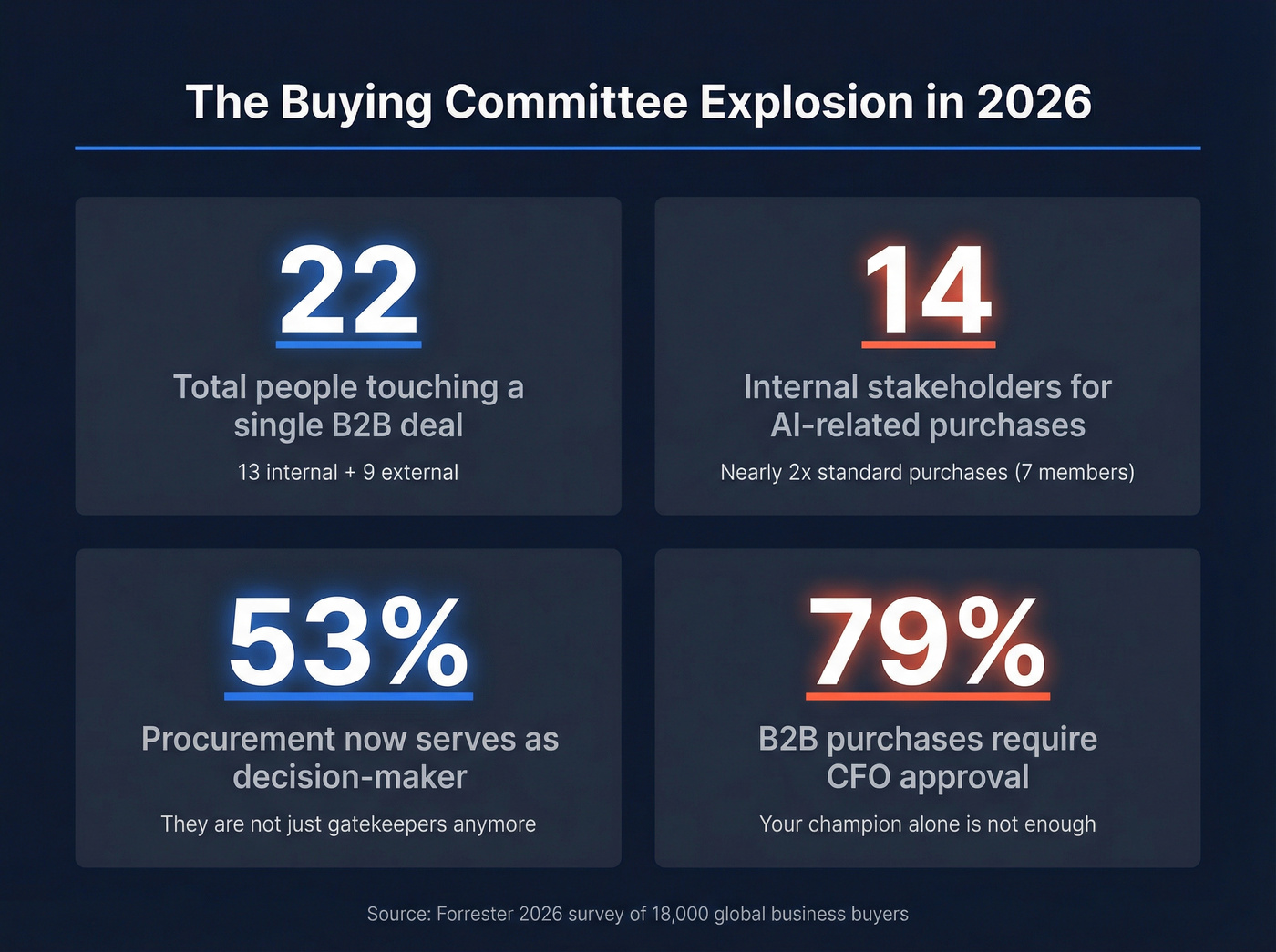

Forrester's 2026 survey of nearly 18,000 global business buyers found the average B2B purchase now involves 13 internal stakeholders and 9 external participants - 22 people touching a single deal. For purchases involving genAI features, internal buying groups nearly double, jumping from 7 members for standard purchases to 14 for AI-related ones.

Procurement professionals now serve as decision-makers more than half the time (53%), and 79% of B2B purchases require CFO approval. Your champion isn't enough anymore. If you're single-threaded into one contact, you're building on sand.

Any business to business sales strategy that ignores this committee reality is setting itself up for stalled deals. (If you need a deeper model of how committees actually behave, see B2B decision making.)

The Looping Journey (Why Your Linear Funnel Is Wrong)

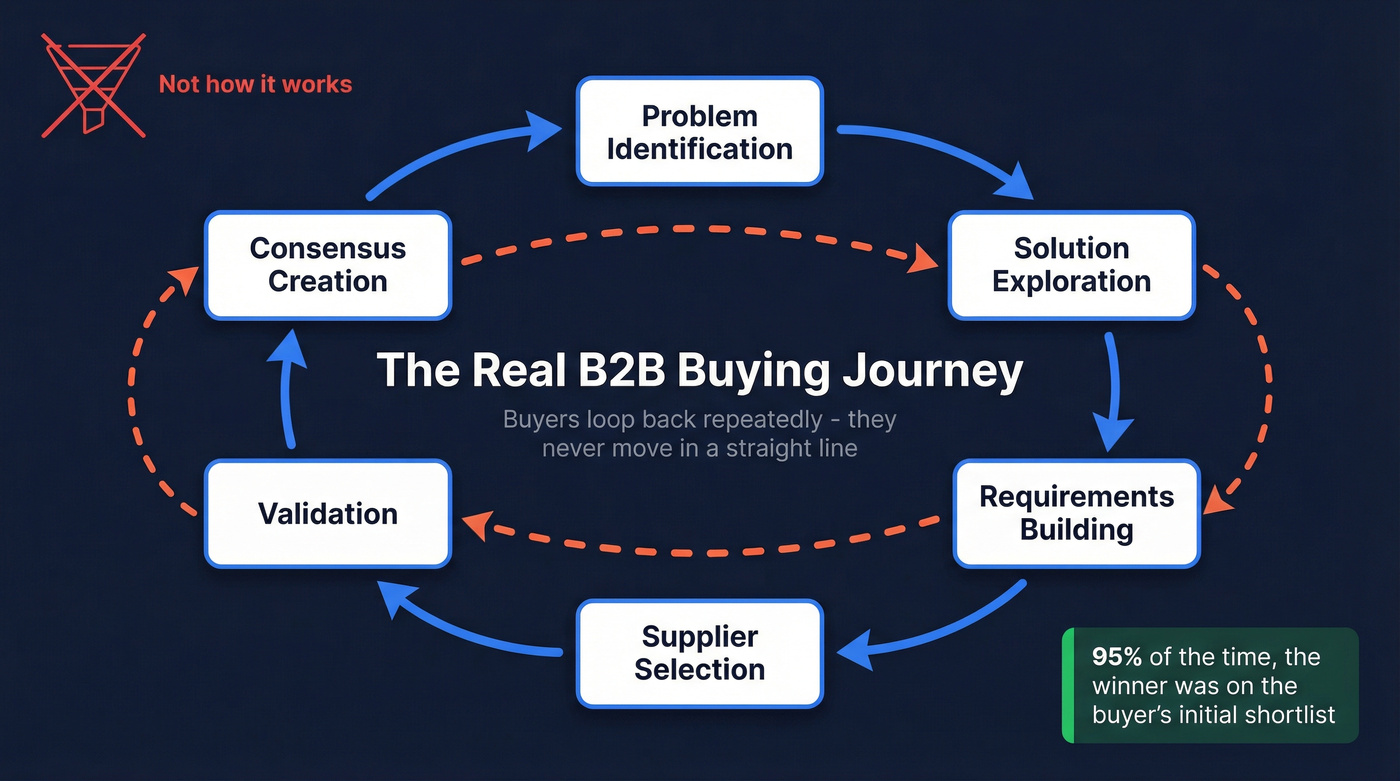

Gartner's research demolished the linear funnel model. Buyers don't move neatly from awareness to consideration to decision. They loop across six buying jobs - problem identification, solution exploration, requirements building, supplier selection, validation, and consensus creation - revisiting each one multiple times.

A prospect who seemed "ready to buy" last week might loop back to solution exploration after a new stakeholder raises a concern. That's not a stalled deal. It's a normal buying process. Your strategy needs to account for re-engagement at every stage, not just forward momentum.

And here's the stat that should keep you up at night: 95% of the time, the winning vendor is on the buyer's initial shortlist. If you're not in the consideration set from day one, your odds are catastrophic. Brand awareness and thought leadership aren't vanity plays - they're how you get on the list before the buying process even starts.

The Hybrid Selling Imperative

75% of B2B buyers say they prefer a rep-free buying experience. But here's the twist: self-service digital purchases are far more likely to result in purchase regret. Buyers who engage with supplier-provided digital tools in partnership with a sales rep are 1.8x more likely to complete a high-quality deal.

The takeaway isn't "go fully digital" or "double down on reps." It's hybrid. Give buyers self-service tools for research and validation, but make reps available for the moments that matter - consensus building, technical validation, commercial negotiation. More than 60% of buyers now purchase some form of trial before committing, and just over a third of those trial users plan to convert to fully paid with the same provider.

| Buyer Behavior Shift | 2023 | 2026 |

|---|---|---|

| AI usage in buying process | Emerging | 94% of buyers |

| Internal stakeholders | 6-8 | 13 |

| External participants | 3-5 | 9 |

| Prefer rep-free experience | ~50% | 75% |

| Trial before buying | ~40% | 60%+ |

Only 15% of MQLs convert to SQLs - and bad contact data is the silent killer. Prospeo's 300M+ profiles with 98% email accuracy and 125M+ verified mobile numbers mean your reps reach real decision-makers, not dead ends. At $0.01/email with a 7-day data refresh, you stop feeding stale leads into a pipeline that was already leaking.

Fewer bounces, more conversations, higher close rates. Start free today.

B2B Conversion Benchmarks That Actually Matter

Most "benchmark" articles give you a single conversion rate and call it a day. A 2.9% median conversion rate means nothing without context - what industry, what channel, what stage of the pipeline. Here's the data that actually helps you diagnose where your funnel is broken.

Conversion Rates by Industry

Not all B2B verticals convert the same way. Legal services leads at 7.4%, largely because buyers have urgent, specific needs. B2B e-commerce sits at the bottom at 1.8%, where high competition and low switching costs compress margins.

| Industry | Conversion Rate |

|---|---|

| Legal Services | 7.4% |

| Professional Services | 4.0-6.0% |

| Manufacturing | 3.0-5.0% |

| Healthcare | 3.0-4.0% |

| B2B SaaS | 1.1-7.0% |

| B2B E-commerce | 1.8% |

| Median (all B2B) | 2.9% |

The SaaS range is enormous - 1.1% to 7.0% - because it spans everything from self-serve freemium products to enterprise platforms with six-month sales cycles. If you're benchmarking your enterprise SaaS conversion rate against a PLG company, you're comparing apples to aircraft carriers.

Conversion Rates by Channel

Where your leads come from matters as much as how many you generate. Referral traffic converts at 2.9%, one of the highest of any channel. Organic search follows at 2.6-2.7%. Paid search ranges wildly from 1.5% to 3.2% depending on how tight your targeting is.

| Channel | Conversion Rate |

|---|---|

| Referral | 2.9% |

| Organic Search | 2.6-2.7% |

| 2.4% | |

| Social Media | 1.8-2.2% |

| Paid Search | 1.5-3.2% |

Where Deals Die: The Stage-by-Stage Breakdown

Here's where the real diagnostic value lives.

The biggest drop-off in any B2B pipeline is MQL-to-SQL - only 15% of marketing-qualified leads survive the handoff to sales.

| Pipeline Stage | Conversion Rate |

|---|---|

| Lead to MQL | 35-45% |

| MQL to SQL | 15% |

| SQL to Opportunity | 25-30% |

| Opp to Closed-Won | 6-9% |

| Overall Lead to Customer | 1.5-2.5% |

That MQL-to-SQL gap is where most pipeline value evaporates. It usually means one of three things: marketing's definition of "qualified" doesn't match sales' definition, there's no SLA on follow-up speed (contacting leads within 24 hours increases conversion by 5x), or the ICP is too broad and marketing is sending over leads that were never going to buy.

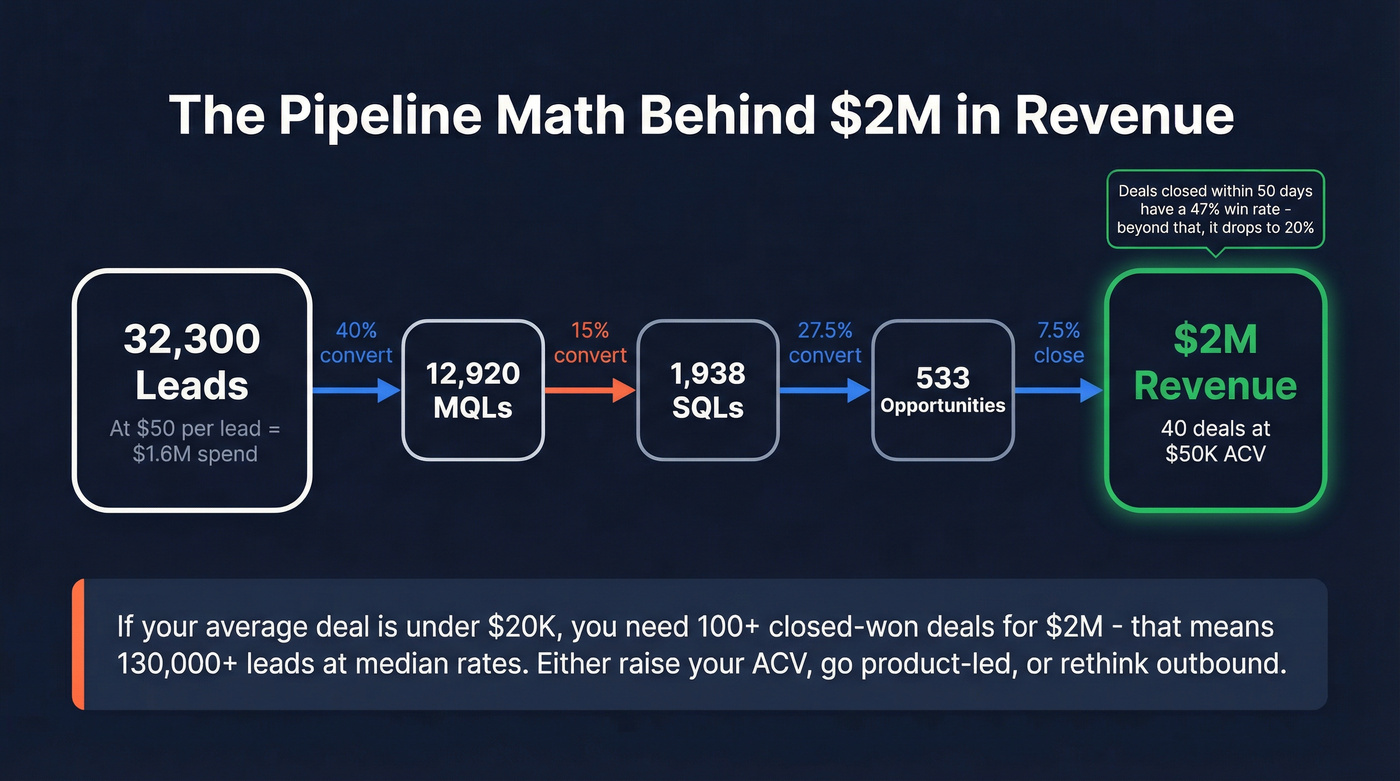

Pipeline Math: Working Backward from Your Revenue Target

Let's say you need $2M in new revenue this quarter. Your average deal size is $50K, so you need 40 closed-won deals. Working backward:

- 40 closed-won deals / 7.5% opp-to-close rate = 533 opportunities

- 533 opportunities / 27.5% SQL-to-opp rate = 1,938 SQLs

- 1,938 SQLs / 15% MQL-to-SQL rate = 12,920 MQLs

- 12,920 MQLs / 40% lead-to-MQL rate = 32,300 leads

That's 32,300 leads to produce $2M in revenue. If your average cost per lead is $50, you're spending $1.6M to generate $2M. The math only works if you improve conversion rates at each stage - which is exactly why strategy matters more than volume.

One more critical data point: deals closed within 50 days have a 47% win rate. Beyond that threshold, win rates drop to 20%. Velocity isn't a nice-to-have. It's the difference between a 47% and 20% close rate.

If your average deal is under $20K, you probably can't afford the pipeline math above. At that deal size, you need 100+ closed-won deals for $2M - which means 130,000+ leads at median conversion rates. Either raise your ACV, go product-led, or accept that outbound alone won't get you there.

Building a B2B Sales Strategy Framework That Fits

Organizations implementing structured sales methodologies report 15-28% improvement in win rates. But "structured" doesn't mean "pick whatever's trending on LinkedIn." The right framework depends on your deal complexity, market dynamics, and team size.

MEDDIC: The Enterprise Standard

Developed at PTC, MEDDIC is a six-area qualification checklist: Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion. It's built for complex enterprise deals with multiple decision-makers and long sales cycles.

MEDDIC forces reps to answer hard questions early: Who's the economic buyer? What metrics will they use to justify the purchase? What's the actual decision process? If a rep can't fill in the MEDDIC framework, the deal isn't qualified - period. It's ruthlessly effective at killing zombie pipeline, which is why it remains the gold standard for enterprise sales teams running $100K+ deals with 10+ stakeholders.

Skip it if your average deal closes in under 30 days. The overhead isn't worth it for transactional sales.

Challenger: For Commoditized Markets

The Challenger model - teach, tailor, take control - works best when you're selling into markets where buyers think all solutions are the same. Used by Salesforce and Oracle, it's built around the idea that the best reps don't just respond to buyer needs; they reshape how buyers think about their problems.

The "commercial insight" is the core weapon: a data-backed perspective that challenges the buyer's assumptions and reframes the problem in a way that uniquely favors your solution. If your reps are showing up to discovery calls and just asking questions, Challenger says you're already losing.

Real talk: Challenger is hard to implement. It requires reps who can hold their ground with senior executives and marketing teams that can produce genuinely provocative insights. Most teams that "adopt" Challenger end up doing a watered-down version that's just aggressive selling with a fancy name.

SPICED: The SaaS Playbook

SPICED - Situation, Pain, Impact, Critical Event, Decision - is purpose-built for SaaS and consultative selling with mid-length cycles (3-6 months). It's less rigid than MEDDIC and more customer-centric than Challenger.

Where MEDDIC focuses on qualification, SPICED focuses on understanding the buyer's world. What's their current situation? What pain are they experiencing? What's the business impact? Is there a critical event driving urgency? What does their decision process look like? Use SPICED if you're selling $20K-$100K SaaS deals where the buyer needs to feel understood, not just qualified.

SPIN: The Consultative Classic

SPIN Selling - Situation, Problem, Implication, Need-payoff - is the OG consultative framework, used by IBM and Microsoft for decades. It's a question-based methodology that guides buyers from surface-level problems to deep implications, then positions your solution as the logical answer. Best for complex, high-value sales where the buyer doesn't fully understand the scope of their problem.

Which Framework Is Right for You?

| Factor | MEDDIC | Challenger | SPICED | SPIN |

|---|---|---|---|---|

| Deal size | $100K+ | Any | $20K-$100K | $50K+ |

| Cycle length | 6-18 months | 1-12 months | 3-6 months | 3-12 months |

| Best for | Enterprise qual | Commoditized mkts | SaaS/consultative | Complex/high-value |

| Structure level | Very high | Medium | Flexible | Medium |

| Team size | 10+ reps | 5+ (needs coaching) | 5-20 reps | Any |

Implementation tip: Don't try to adopt a methodology by sending reps a PDF. Build question banks for each stage, run role-play sessions weekly for the first quarter, and inspect deals through the methodology's lens in every pipeline review. The methodology only works if it becomes the language your team uses to talk about deals.

Winning B2B Sales Strategies and Tactics for 2026

These are the patterns we see separating teams that hit quota from teams that "almost" hit quota. Each one combines strategic thinking with specific, executable tactics.

1. ICP Precision Over Volume

The #1 complaint from practitioners on Reddit right now? Cold email reply rates are down, paid ads are expensive and inconsistent. The consistent answer from teams that are still winning: clean data plus tighter ICP filtering. Fewer leads, better conversations.

Top performers generate 50% more qualified leads - not more leads total. Cold email reply rates run 1-3% for untargeted outreach versus 5-8% for ICP-targeted campaigns. That's a 3-5x improvement just from being more selective about who you contact.

Stop treating your TAM as your target list. Define your ICP with surgical precision - industry, company size, tech stack, growth signals, funding stage - and only pursue accounts that match. This is one of the most effective sales strategies for B2B because it improves every downstream metric simultaneously. (If you need an ICP definition you can actually operationalize, start with ideal customer.)

2. Multi-Threading Across Buying Committees

With 13 internal stakeholders and 9 external participants per deal, single-threading is a death sentence.

Do this: Build relationships with 3-5 contacts per account across different functions and seniority levels. Map the buying committee early: who's the economic buyer, who's the technical evaluator, who's the end user, and who's the blocker? Create tailored messaging for each persona.

Not that: Rely on your champion to "socialize internally." They won't. Or they'll do it badly. Or they'll leave.

I've seen teams lose seven-figure deals because their champion left the company mid-cycle and nobody else at the account knew who they were. Multi-threading isn't optional anymore - it's insurance. (For a step-by-step system, use this ABM multi-threading playbook.)

3. Sales-Marketing Alignment

Only 8% of companies have strong alignment between sales and marketing. That's staggering when you consider the payoff: 208% higher marketing revenue, 38% higher win rates, and 36% higher customer retention. The misalignment tax is real - roughly $1 trillion annually in lost productivity and wasted spend globally. 60-70% of B2B content goes unused by sales. 65% of reps say they can't find content to send to prospects. 50% of marketing leads get ignored by reps. 79% of marketing leads never convert due to lack of nurturing.

The good news: alignment isn't a culture problem. It's a process problem. Three specific fixes:

- Shared ICP definition. Sales and marketing must agree on exactly who they're targeting. Not "mid-market tech companies" - specific firmographic, technographic, and behavioral criteria.

- SLA on lead follow-up. Marketing delivers X qualified leads per month. Sales contacts them within Y hours. Both sides are accountable. (Use speed to lead metrics to set the SLA with real benchmarks.)

- Joint pipeline reviews. Weekly, 30 minutes, both teams in the room. Review what's converting, what's stalling, and why.

4. AI-Augmented Prospecting

89% of revenue organizations now use AI in some capacity, and 92% of sales teams plan to increase their AI investment this year. The productivity gains are real: up to 40% lift in sales productivity, 25% reduction in sales cycles, and up to 90% reduction in prospect research time. LivePerson cut research time from 20 minutes to 2 minutes per prospect - a 10x efficiency gain - with a 35% lift in engagement rates.

45% of high-performing sales teams have adopted hybrid human-AI SDR models. The pattern is consistent: AI handles research, list building, initial personalization, and follow-up sequencing. Humans handle the conversations that require judgment, empathy, and creative problem-solving.

But here's the emerging wrinkle: buyer-side AI agents are now screening vendors before human engagement. 94% of buyers use AI during their buying process, and over half ask AI for vendor shortlists before they ever open Google. Your content, your reviews, and your digital presence need to be optimized for AI consumption, not just human consumption. (If you’re building workflows around this, start with outbound AI.)

5. Omnichannel Execution: A B2B Sales Strategy Example in Action

McKinsey's research across 3,800+ B2B decision-makers found that companies using all five winning tactics - advanced sales tech, hybrid teams, hyperpersonalization, marketplace strategies, and e-commerce excellence - are 2x as likely to see greater than 10% market share growth.

Here's what this looks like in practice. A Series B cybersecurity company was struggling with a single-channel outbound motion - cold email only, 2% reply rates, pipeline stalling at $400K/quarter. They shifted to a hybrid model: AI-powered research to identify in-market accounts, multi-channel sequences (email + phone + social), and a self-serve product trial for technical evaluators. Within six months, MQL-to-SQL conversion jumped 38% and pipeline doubled.

The "rule of thirds" holds: buyers want an evenly divided mix of traditional, remote, and self-service channels. B2B e-commerce was rated the most effective sales channel by 35% of respondents - ahead of in-person at 26%. And roughly 70% of decision-makers are prepared to spend up to $500K on a single e-commerce transaction.

If you're still running a single-channel sales motion, you're leaving market share on the table.

6. Data Quality as Competitive Advantage

Here's a scenario I've watched play out at least a dozen times: an SDR team sends 10,000 emails. 35% bounce. The sender domain's reputation tanks. Deliverability craters across the entire organization. The VP of Sales blames messaging. The SDR manager blames volume.

Nobody looks at the data.

It was a data problem the entire time. The contacts were wrong ICP, the emails were stale, and the phone numbers were disconnected. No amount of A/B testing your subject lines fixes bad data.

Data quality isn't the sexy strategy. It's the one that works. (To operationalize this, implement a real data quality scorecard and refresh workflow.)

7. Referral and Community-Led Growth

Here's a quick implementation checklist - because most teams agree referrals matter and then do nothing about it:

- Identify your top 20 happiest customers (NPS 9-10, or anyone who's given you a case study or testimonial).

- Make the ask easy. Provide templates, talking points, and intro email drafts they can forward in 30 seconds.

- Create aligned incentives. Account credits, exclusive access, or co-marketing - whatever matches how your customers think.

- Set a target. Five qualified introductions per month is worth more than 5,000 cold emails.

- Track it like a channel. Referral pipeline, referral conversion rate, referral revenue. If you don't measure it, it stays accidental.

The numbers justify the effort: referrals convert around 26%, while cold email reply rates sit at 1-3% for untargeted outreach. 73% of B2B executives say peer recommendations and word-of-mouth are the #1 influence on purchasing decisions. 42% say case studies are the most influential content format.

Only 9% trust vendor websites.

That trust deficit is real. Buyers don't believe marketing claims anymore. They want proof from people like them - peers who've implemented the solution and can speak to results.

AI in B2B Sales - Beyond the Buzzword

Daily AI usage among desk workers rose 233% in six months. 86% of sales teams see positive ROI within the first year of AI adoption. But most teams are still using AI for the wrong things - generating generic emails that sound like every other AI-generated email in the buyer's inbox.

What AI Actually Does at Each Pipeline Stage

Prospecting: AI cuts research time by up to 90% and improves engagement rates by 35%. The best use case isn't writing emails - it's identifying which accounts to target and what to say based on intent signals, job changes, and technographic data.

Pipeline management: Conversation intelligence tools like Gong close deals 11 days faster with a 10 percentage point improvement in win rates on deals over $50K. They're not replacing reps - they're giving managers visibility into what's actually happening on calls.

Pricing and forecasting: Businesses using AI for pricing optimization see an average profit margin lift of 12%. Predictive AI improves conversion rates by 20-30% by identifying which deals are most likely to close and where to focus rep time.

The Buyer-Side AI Trend You're Not Ready For

Customer interactions automated by AI agents are projected to grow from 3.3 billion in 2025 to 34 billion by 2027. 29% of buyers now start research with an AI tool more often than a search engine. Over half ask AI for vendor shortlists before Googling.

Your buyers' AI agents are evaluating you before any human does. Your website content, your G2 reviews, your case studies, your pricing transparency - all of it feeds into AI-generated recommendations. If your digital presence is thin, you won't make the AI-curated shortlist. And remember: 95% of winners were on the buyer's initial shortlist.

The Human-AI Hybrid Model

Look, only about a third of B2B organizations have implemented agentic AI at scale. That means there's still an early mover window. But the winning model isn't "replace reps with AI" - it's "make every rep operate like they have a team of analysts behind them."

The 45% of high-performing teams using hybrid human-AI SDR models aren't replacing humans. They're eliminating the 66-72% of time reps currently spend not selling - the research, the data entry, the CRM updates, the list building. AI handles the grunt work. Humans handle the judgment calls. (If you're formalizing agent workflows, see AI sales agent.)

Common Mistakes That Kill Your B2B Pipeline

These are the patterns I see killing pipeline at otherwise competent organizations. Even teams with solid go-to-market plans fall into these traps when execution drifts.

Confusing Tactics with Strategy

Running LinkedIn ads, sending cold emails, and posting content are tactics. A strategy defines who you sell to, why they buy, and how you reach them - then selects tactics that execute against that strategy. I've seen teams run 15 different "campaigns" simultaneously with no strategic spine connecting them. They're busy. They're not effective.

The fix: Before launching any new tactic, answer three questions: Who specifically is this targeting? What stage of the buying journey are they in? How does this connect to our pipeline goals?

Chasing Vanity Metrics

Pageviews, impressions, and "engagement" feel good in a dashboard. They're meaningless without pipeline attribution.

The fix: Track pipeline contribution by channel and campaign. If you can't draw a line from a marketing activity to an SQL, question whether it's worth continuing.

Ignoring Retention

Everyone chases new clients. Meanwhile, existing customers - who already trust you, already have budget allocated, and already know your product - get neglected. Acquiring a new customer costs 5-7x more than retaining an existing one.

The fix: Dedicate at least 20% of your sales capacity to expansion and renewal. Your best new revenue source is your current customer base.

Casting Nets Too Wide

When your ICP is "any company with 50+ employees that uses software," you're not targeting - you're hoping.

The fix: Narrow your ICP until it feels uncomfortably specific. Then test. You can always expand later. You can't un-waste the months you spent chasing bad-fit accounts.

Not Following Up

79% of marketing leads never convert due to lack of nurturing. Reps send one email, get no response, and move on. Meanwhile, the buyer was in a "looping" buying journey and would've engaged two weeks later.

The fix: Build follow-up sequences that run 8-12 touches over 30-45 days. Vary the channel - email, phone, social. Most responses come after touch 4-7, not touch 1. (Use a proven follow up email sequence strategy to standardize this.)

Reps Spending Time on Everything Except Selling

Sales reps spend only 28-34% of their time actually selling. The rest goes to CRM updates, internal meetings, prospecting research, and administrative tasks. That's a structural problem, not a motivation problem.

The fix: Audit where rep time goes. Automate or eliminate everything that isn't customer-facing. AI tools, better CRM workflows, and dedicated sales ops support can reclaim 10-15 hours per rep per week.

The 2026 B2B Sales Tool Stack

Your strategy is only as good as the tools executing it. Here's the stack that covers the core categories, with approximate pricing so you can actually budget.

| Category | Tool | Starting Price | Best For |

|---|---|---|---|

| Data & Prospecting | Prospeo | Free / ~$0.01/email | Verified emails, mobiles, intent data |

| Data & Prospecting | ZoomInfo | ~$15-40K/year | Enterprise org charts + technographics |

| Data & Prospecting | Apollo | Free / ~$49-99/user/mo | All-in-one outbound for startups |

| Data & Prospecting | Cognism | ~$1-3K/mo | European mobiles, GDPR compliance |

| CRM | Salesforce | $25-165+/user/mo | Enterprise CRM, full ecosystem |

| CRM | HubSpot | Free / $20-150/user/mo | SMB-to-mid-market, strong marketing |

| Engagement | Outreach | ~$100-130/user/mo | Multi-channel sequences at scale |

| Engagement | Salesloft | ~$100-130/user/mo | Revenue workflow automation |

| Intelligence | Gong | ~$100-150/user/mo | Conversation intel, deal analytics |

| Intent | Bombora | ~$25K+/year | Standalone intent data |

ZoomInfo remains the default for large enterprise teams that need org charts, technographics, and intent bundled into one platform - but a 10-seat contract with intent data and mobile numbers can run $30-60K/year. That's real money for a Series A company. Apollo is the obvious starting point for SMB teams that want prospecting, sequencing, and a database in one tool, though email accuracy doesn't match dedicated verification platforms. For teams that prioritize accuracy over feature bloat, Prospeo delivers 98% verified email accuracy at around 90% lower cost than ZoomInfo.

22 stakeholders per deal means you need direct dials and verified emails for the entire buying committee - not just your champion. Prospeo gives you 30+ filters including buyer intent, job changes, and department headcount to multi-thread into every account. Teams using Prospeo book 26% more meetings than ZoomInfo users.

Stop being single-threaded. Reach the whole committee.

FAQ

What's the average B2B sales cycle length?

SMB deals typically close in 2-6 months, mid-market in 3-9 months, and enterprise deals in 6-18 months. Deals closed within 50 days have a 47% win rate; beyond that, win rates drop to 20%. Compress cycles by multi-threading across buying committees and removing friction from evaluation.

What's a good B2B conversion rate?

The median B2B conversion rate across all industries is 2.9%, with a typical range of 2.0-5.0%. Legal services leads at 7.4%, while B2B e-commerce sits at 1.8%. Top performers achieve 40-50% higher rates by focusing on ICP precision and optimizing each pipeline stage.

How many decision-makers are involved in a B2B purchase?

The average B2B purchase now involves 13 internal stakeholders and 9 external participants - 22 people total. For AI-related purchases, internal groups nearly double from 7 to 14. Multi-threading into 3-5 contacts per account is essential for any deal above five figures.

What's the biggest mistake in B2B sales strategy?

Confusing tactics with strategy. Running ads, sending cold emails, and posting content are tactics. A strategy defines who you sell to, why they buy, and how you reach them - then selects tactics that execute against that framework.

How do I improve B2B email outreach without burning my domain?

Start with data quality - if your bounce rate exceeds 5%, fix your contact data before touching your messaging. Then narrow your ICP, personalize on intent signals, and build 8-12 touch sequences across multiple channels. Most responses come after touch 4-7, so patience and persistence matter as much as the first email.

That $4M pipeline doesn't have to close at $280K. Fix the data, pick the methodology, and stop treating every lead like a good lead. The math is on your side when your b2b sales strategy is built on real benchmarks instead of wishful thinking.