Outbound AI in 2026: What Works, What Doesn't, and How to Build a System That Books Meetings

You just pulled the quarterly outbound report. 10,000 emails sent. Three meetings booked. Your CEO's asking why you're paying for an AI SDR that produces worse results than the intern did last summer.

This is the state of outbound AI for most teams right now - and the gap between teams doing it right and teams burning money has never been wider.

50-70% of teams that deploy AI SDRs churn within three months. That's not a typo. It's the dominant pattern across the industry. The problem isn't that AI for outbound sales doesn't work. It's that most teams deploy it wrong: bad data in, garbage out, burned domains, and a Slack channel full of "why are our emails going to spam?"

Quick note - if you Googled "Outbound AI" looking for the healthcare company Outbound.ai (the Seattle-based startup doing revenue cycle management for hospitals), that's a different thing entirely. This guide is about using AI for B2B sales outbound: cold email, voice agents, AI SDRs, and the data infrastructure underneath all of it.

What You Need (Quick Version)

Three paths depending on where you are:

Solo founders / small teams (under $150/mo):

- Apollo ($49/mo) for data + basic outreach

- Prospeo for email and mobile verification before anything hits a sequence

- Instantly ($37/mo) for cold email sending

- Total: under $150/month. You're live in a week.

Mid-market teams going hybrid ($500-2,000/mo):

- Clay (~$149/mo) for signal-based list building and enrichment

- Verification on every contact before it touches your sending infrastructure

- AiSDR or Agent Frank for AI-assisted outreach

- Humans handle every reply that shows intent

Enterprise / voice-heavy ($2,000+/mo):

- Retell AI for outbound voice dialing at scale

- Verified direct dials - you need 125M+ mobile coverage with a 30% pickup rate, not the 10-15% industry average

- Qualified (Piper) for inbound AI routing

Every path runs through the same bottleneck: data quality. The AI tools are only as good as the contacts you feed them.

What "Outbound AI" Actually Means in 2026

The term gets thrown around loosely, so let's break it into what actually exists.

AI SDRs are autonomous agents that research prospects, write personalized messages, and send multi-channel sequences without human involvement. Think AiSDR, Agent Frank, 11x. They exist on a spectrum: assistive copilots that draft messages for human approval, semi-autonomous agents where humans approve before sending, and fully autonomous agents that run end-to-end without oversight. Most teams should start semi-autonomous and earn their way to full autonomy.

AI voice agents make outbound calls at scale - 15,000 dials per day, 20 concurrent conversations. Retell AI, Synthflow, Vapi, Bland AI, and PolyAI are the main players. They're not closers. They're connectors. Their job is booking appointments and transferring warm leads to humans.

Cold email AI handles the sending infrastructure: sequencing, warmup, inbox rotation, reply classification. Instantly, Smartlead, Lemlist. The AI layer here is mostly about deliverability optimization and response handling.

Data and enrichment AI powers everything upstream: finding the right contacts, verifying emails, enriching records with intent signals, and keeping your CRM clean.

The numbers tell the story. 93% of CROs are embedding AI into prospect research and account prioritization. But only 22% of sales teams have gone fully autonomous. 45% use a hybrid approach - AI for the grunt work, humans for the conversations. And 23% haven't adopted AI at all yet.

That hybrid number - 45% - is the one that matters.

The Economics: Human SDR vs. AI SDR

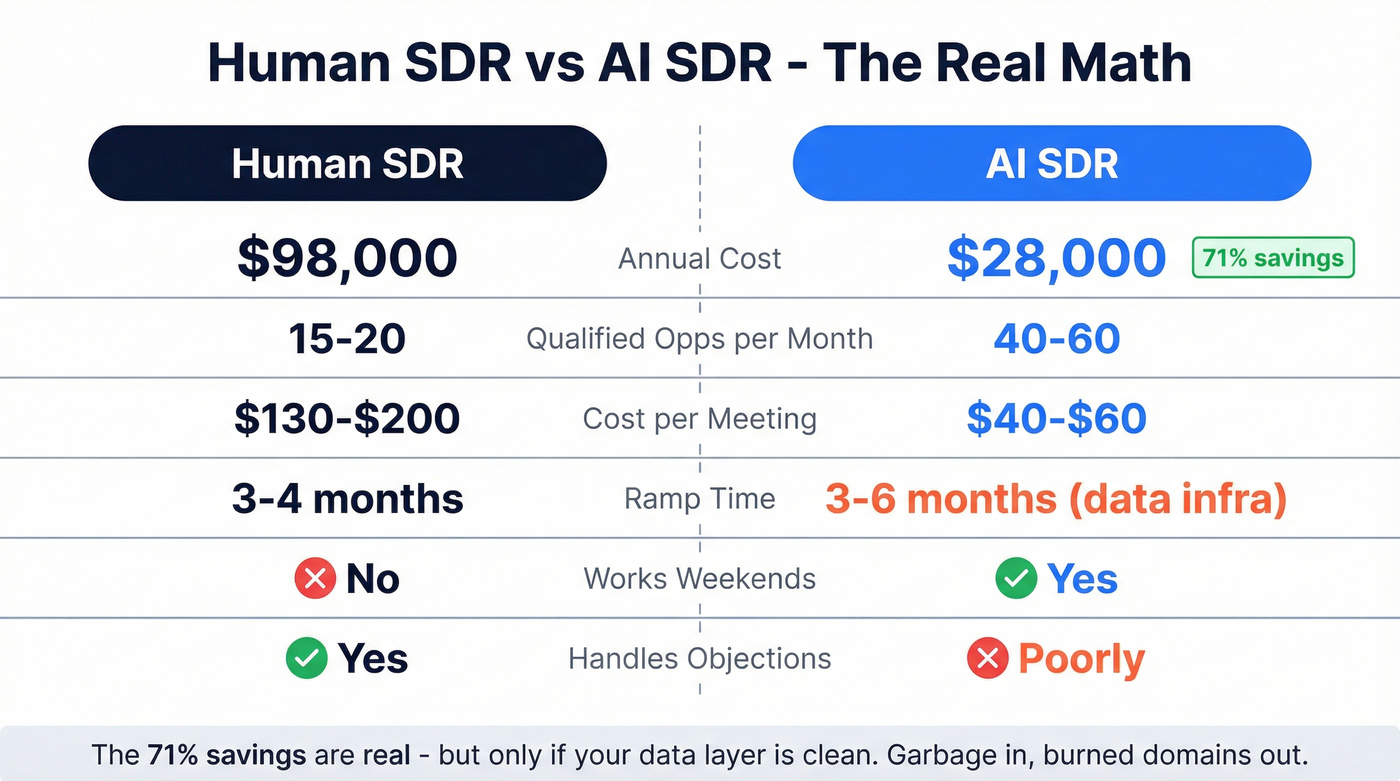

Here's the math driving every VP of Sales to at least evaluate AI for outbound:

| Metric | Human SDR | AI SDR |

|---|---|---|

| Annual cost | ~$98,000 | ~$28,000 |

| Qualified opps/month | 15-20 | 40-60 |

| Cost per meeting | $130-$200 | $40-$60 |

| Ramp time | 3-4 months | 3-6 months* |

| Works weekends | No | Yes |

| Handles objections | Yes | Poorly |

*The tool itself deploys in days. The 3-6 months is data infrastructure: building verified lists, tuning ICP filters, and iterating on messaging. Building from scratch without clean data pushes this to 6-9 months.

The 71% cost savings look incredible on a spreadsheet. And they're real - if the system works. Teams using AI-driven lead scoring see 51% higher lead-to-deal conversion rates, and predictive lead targeting delivers a 47% boost in conversions. One UK SaaS company shrank their sales cycle from 45 to 28 days after deploying AI across their entire outbound workflow.

SaaStr deployed 3 AI SDRs and 2 AI BDRs, and their inbound AI agent generated over $1M in closed revenue in 90 days. Their outbound AI sent 19,326 messages with a 6.7% response rate - more than double the industry average.

Here's the thing, though: SaaStr also reported that their sponsor AI SDR took 47 iterations to stop being too aggressive on pricing. Their support agent was retrained three times on VIP escalation. The agents work weekends and never quit, sure. But they require daily management - not weekly check-ins, daily.

100% of teams using AI in their outbound workflow saved at least 1 hour per week, with 38% saving 4-7 hours weekly. The time savings are real. The question is whether you invest that saved time into managing the AI or into higher-leverage activities.

This article makes one thing clear: AI outbound fails when the data layer fails. Prospeo's 7-day refresh cycle, 98% email accuracy, and 125M+ verified mobiles with a 30% pickup rate give your AI SDR the foundation it needs to actually book meetings - not burn domains.

Stop feeding garbage data into your AI outbound system.

Why Most AI Outbound Deployments Fail

The 50-70% churn rate within three months isn't a bug in the tools. It's a pattern in how teams deploy them.

I've watched this play out repeatedly. A team signs up for an AI SDR, loads 5,000 contacts from a stale database, writes a generic prompt, and hits send. Two weeks later, their domain reputation is cratered, their bounce rate is 25%, and the "AI-generated" emails read like they were written by a chatbot having a stroke.

Failure mode #1: The blast-and-pray approach. Teams send thousands of generic emails because the AI makes volume cheap. But as one practitioner on Reddit put it: "People have a 6th sense for detecting AI-written content and they absolutely detest it." The "[Name], picture this..." opener is the new "I hope this email finds you well." Prospects delete it on sight.

Failure mode #2: The over-research trap. The opposite extreme - 2 hours per prospect, using AI to write hyper-personalized novels. It doesn't scale, and the ROI per email doesn't justify the effort. You end up with 50 beautiful emails and no pipeline.

Failure mode #3: The warm-leads-only cop-out. Restricting your AI SDR to inbound leads that already showed intent. That's fine, but it's not outbound. You're just automating what a human could do in 10 minutes.

The real failure is upstream. It's data.

Before you launch any AI outbound system, you need 40-60 hours of data preparation. That means building your ICP list, verifying every email address, confirming direct dials, deduplicating against your CRM, and segmenting by signal strength. Skip this step and you're feeding garbage into a machine that will distribute that garbage at scale - and burn your domain in the process.

The teams that succeed with AI-powered outbound prospecting spend more time on data prep than on prompt engineering. The AI is the easy part. The data is the hard part.

The Data Layer: Why Everything Else Fails Without Clean Contacts

Every AI outbound tool - every single one - has the same dependency: the contacts you feed it need to be real, current, and reachable.

Bounce rates above 5% crater your sender reputation. Once Gmail or Outlook flags your domain, you're not landing in spam - you're not landing at all. Recovering a burned domain takes weeks, sometimes months.

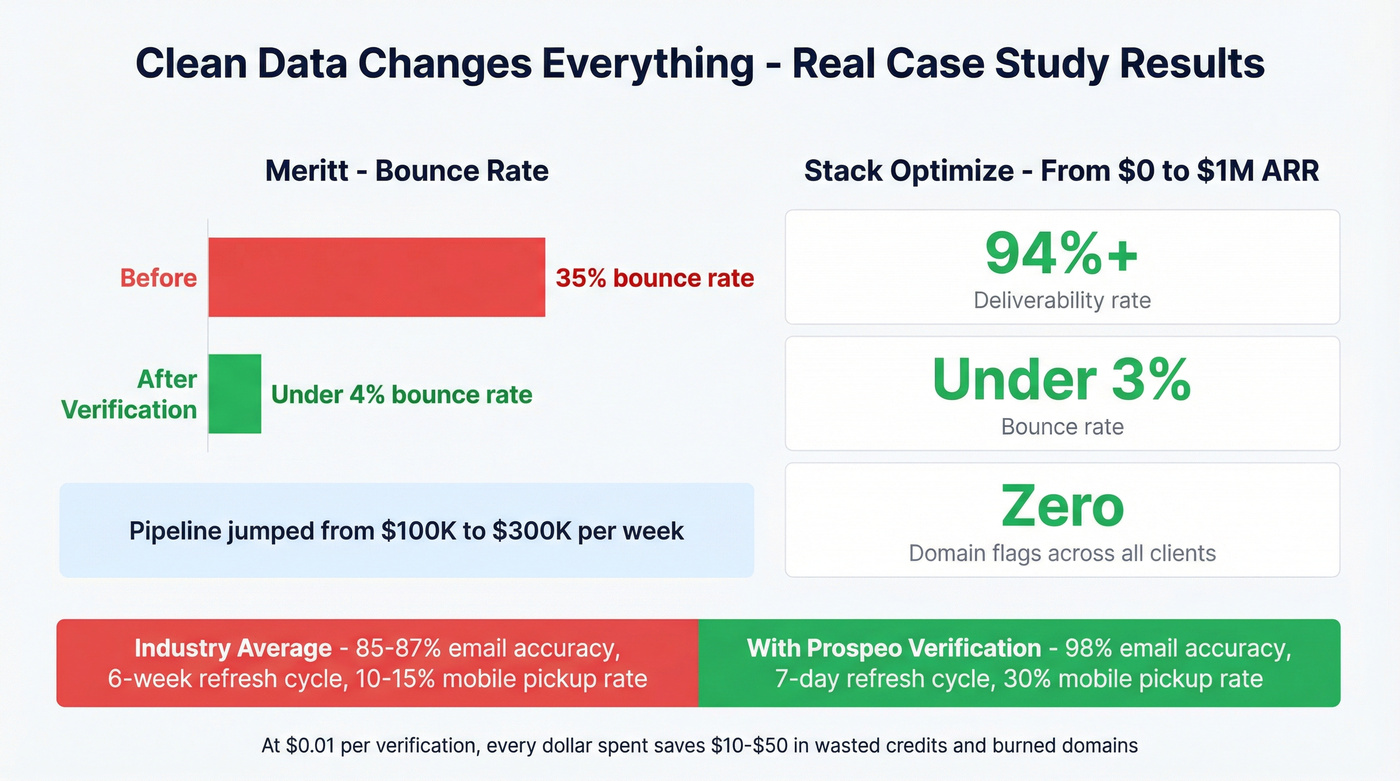

The case studies tell the story. Meritt was running a 35% bounce rate before switching their data layer. After running every contact through verification, bounces dropped under 4% and their pipeline tripled from $100K to $300K per week. Stack Optimize built from $0 to $1M ARR maintaining 94%+ deliverability, under 3% bounce rates, and zero domain flags across all their clients - all on verified data with a 7-day refresh cycle.

What makes the difference is verification infrastructure. A 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering delivers 98% email accuracy when the industry average hovers around 85-87%. And data that refreshes every 7 days versus the 6-week cycle most providers run means you're not sending to contacts who changed jobs last month.

The mobile side matters just as much for voice-heavy teams. A database covering 125M+ verified mobile numbers with a 30% pickup rate versus the industry average of 10-15% is the difference between a productive campaign and an expensive dial-tone marathon.

At $0.01 per email verification, the economics are almost absurd. You're spending pennies to prevent thousands of dollars in domain damage. And native integrations with Instantly, Smartlead, Lemlist, and Clay mean verification slots directly into whatever sending infrastructure you're already running.

Look - I'm biased toward clean data. But the math doesn't lie: every dollar you spend on verification saves you $10-$50 in wasted sending credits, burned domains, and lost pipeline.

Outbound AI Tools Compared

AI SDR Platforms

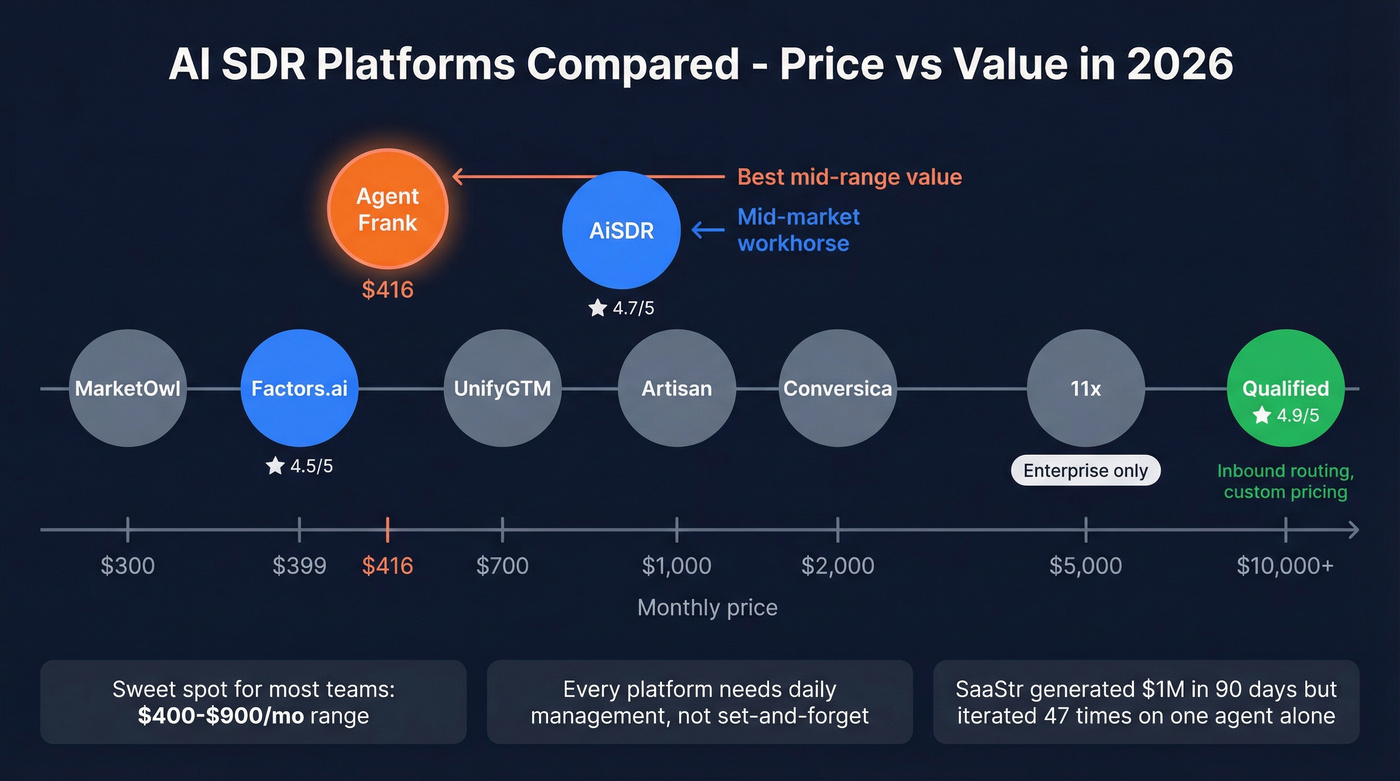

The AI SDR market is crowded and confusing. Here's what the pricing landscape actually looks like:

| Platform | Starting price | G2 rating | Best for |

|---|---|---|---|

| MarketOwl | ~$300/mo | N/A | Budget entry |

| Factors.ai | $399/mo | 4.5/5 | Account intelligence |

| Agent Frank | $416/mo | N/A | Mid-range value |

| UnifyGTM | $700/mo | N/A | Multi-channel |

| AiSDR | $900/mo | 4.7/5 | High automation |

| Artisan | ~$1,000/mo | N/A | Full-stack AI |

| Conversica | ~$1,500/mo | N/A | Enterprise conv. |

| 11x | $5K-$10K/mo | 4.5/5 | Enterprise scale |

| Qualified | Custom (enterprise) | 4.9/5 | Inbound AI routing |

For context, SaaStr's AI SDR deployment generated over $1M in closed revenue in 90 days - but that was with daily iteration, not set-and-forget. Every platform in this table requires the same commitment.

AiSDR is the mid-market workhorse. At $900/month, it's not cheap, but it handles the full sequence - research, personalization, multi-channel outreach - with minimal babysitting compared to cheaper alternatives. The 4.7 G2 rating from ~60 reviews is one of the strongest signals in the category.

Agent Frank by Salesforge hits a sweet spot at $416/month. If you're a team of 5-15 reps and want AI handling initial outreach while humans manage replies, this is where I'd start. In my view, the price-to-capability ratio is the best in the mid-range.

Factors.ai at $399/month takes a different approach - it's stronger on account intelligence and visitor identification than on outreach execution. Worth evaluating if your bottleneck is knowing who to contact rather than automating the contact itself.

11x is the enterprise play. At $5K-$10K/month, you're paying for deep multi-channel personalization and the kind of AI autonomy that actually works at scale. Skip this if you're under 50 employees - the ROI math doesn't work until you're running serious volume.

Qualified deserves a special mention even though it's primarily inbound. Their Piper AI SDR routes and qualifies inbound leads with a speed that humans can't match. The 4.9 G2 rating from ~1,200 reviews is the highest in the category by a wide margin.

MarketOwl at $300/month is the budget entry point. I haven't tested it deeply enough to recommend it confidently, but it's on my radar for teams that need to start somewhere without committing $900+/month.

AI Voice Agent Platforms

Voice agents are the fastest-growing segment of AI-powered outbound, and the economics are compelling: call centers charge $0.50/minute. AI voice agents run $0.05-$0.11/minute.

| Platform | Cost/minute | Latency | Best for |

|---|---|---|---|

| Vapi | ~$0.05 + fees | Varies | Developers (BYO) |

| Retell AI | $0.07-$0.08 | 600ms | Outbound dialing |

| Synthflow | $0.08 | <500ms | No-code pilots |

| Bland AI | ~$0.09 + sub | <500ms | Enterprise custom |

Retell AI is the outbound dialing standard right now. 600ms response latency, designed for regulated industries, and the ability to handle 20 concurrent conversations simultaneously. One practitioner reported doubling live transfers while saving clients 80% of call center costs with 20x output. That's not a marginal improvement - that's a category shift.

Two separate metrics matter for voice campaigns: phone number quality (pickup rate on verified dials) and AI dialing optimization (connection-to-conversation rate). Verified mobile databases deliver 30% pickup rates versus 10-15% on traditional lists. AI-enhanced dialing pushes connection rates from 8-15% to 20-25% by optimizing call timing and retry logic. Stack both and you're running a fundamentally different operation than your competitors.

Synthflow is the no-code option. At $0.08/minute with built-in telephony and templates, it's the fastest way to pilot a voice agent campaign without writing code. Good for testing the channel before committing to a more complex setup.

Vapi is developer-first at ~$0.05/minute plus provider fees. If you have engineering resources and want full control, it's the cheapest per-minute option. But you're bringing your own telephony, which adds complexity.

Bland AI targets enterprise with fully customizable call flows at ~$0.09/minute plus subscription fees.

The global call center AI market is projected to hit $4.1B by 2027. But here's the critical best practice: keep AI calls under 2 minutes with concise scripts. The objective is either transfer to a human specialist or book an appointment. Nothing more. AI voice agents that try to close deals on the phone fail spectacularly.

Cold Email Platforms

Cold email is the most mature segment of AI-assisted outbound. The tools are commoditized on features - the differentiation is deliverability infrastructure.

| Platform | Starting price | Key differentiator |

|---|---|---|

| Lemlist | Free plan available | Multi-channel |

| Instantly | $37/mo | 4.2M+ warmup network |

| Smartlead | $39/mo | Agency features |

| Reply.io | $59/mo | AI classification |

Instantly is the default recommendation for most teams. At $37/month with unlimited email accounts on all Outreach plans and a private deliverability network of 4.2M+ accounts for warmup, the infrastructure advantage is real. Their AI Reply Agent classifies responses as interested, out-of-office, objection, or unqualified - saving 15-20 hours per week per account manager.

Smartlead at $39/month is the agency play. If you're managing outbound for multiple clients, the campaign separation and inbox rotation features are built for that workflow.

Lemlist offers a free plan and leans into multi-channel (email + social). Good for teams that want to test before committing budget.

Under the radar: ReachInbox and ManyReach are gaining traction among power users for their inbox rotation and deliverability features at lower price points. Worth evaluating if you're scaling past 5 sending domains.

One thing every cold email platform has in common: they're all useless if your contact data is bad. Reply rates of 1-5% are achievable - but only with verified contacts hitting real inboxes. And with Apple Mail Privacy Protection, open rates are meaningless anyway. Focus on replies and meetings booked.

AI Personalization at Scale: The 3x Response Rate Workflow

Generic personalization is dead. "Saw you're hiring" stopped working two years ago. Here's what's replacing it - and sellers using AI personalization are 3.7x more likely to exceed quota.

The workflow that's producing 3x response rate improvements:

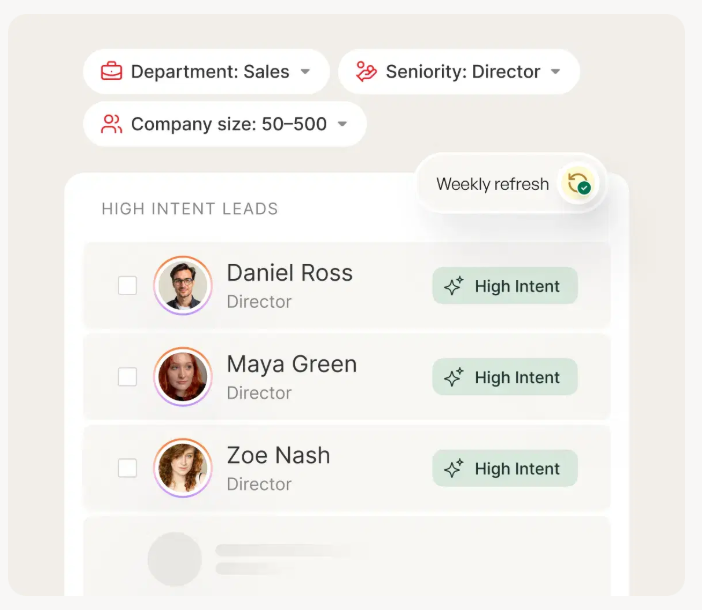

Step 1: Signal monitoring. Track job changes, funding rounds, tech stack changes, and hiring patterns. These are buying signals - not just personalization fodder. Intent signals tracking 15,000+ topics, layered with job change and headcount growth filters, feeds directly into this workflow.

Step 2: Scrape and enrich. Pull recent content from prospect profiles. Run it through GPT-4o mini (or stronger models like GPT-5 or Gemini 2.5 Pro if quality isn't there) to generate a custom message variable based on what the prospect actually cares about. Bounti.ai is an interesting alternative here - it generates personalized landing pages per prospect rather than personalized emails, which is useful for high-value targets.

Step 3: Template with variables. Export to CSV with a {{custom_message}} field. Import into your cold email platform. The template stays consistent; the personalization is unique per contact.

Before (generic):

"Hi Sarah, saw you're hiring SDRs. We help teams scale outbound. Want to chat?"

After (signal-based):

"Hi Sarah - noticed you just opened a Dublin office and posted 3 EMEA AE roles last week. When [similar company] expanded into EMEA, they hit 40% of quota in Q1 because their data provider didn't cover European mobiles. Happy to show you how we solved that."

The difference isn't subtle. Amplemarket found that 87% of recipients who received targeted, contextual outreach built on this kind of signal intelligence started a conversation.

As Sian Taylor from Klaviyo put it: "With AI, anyone can send 10,000 emails for pennies. Human connection is almost the premium currency left in B2B." The irony is that AI is the tool that makes human-feeling connection scalable.

The Hybrid Model: What Actually Works

Only 13% of sales leaders believe AI matches humans at cold calling.

That number should tell you everything about where we are.

The 45% of teams using a hybrid approach aren't hedging - they're optimizing. Here's the split that works:

AI handles:

- 24/7 lead response (speed-to-lead is everything)

- Data enrichment and list building

- Personalization at volume

- CRM hygiene and admin

- Low-intent lead nurturing

- Initial outreach sequences

Humans handle:

- Complex conversations with multiple stakeholders

- Trust-building in high-value deals

- Objection handling that requires empathy

- High-intent leads where the deal is real

- Anything that requires reading between the lines

One VP quoted in a Cognism survey nailed it: "We use AI SDR for 50% of incoming leads. High-intent leads go to humans, low-intent funneled through AI."

Here's my hot take: if your average deal size is under $10K, you probably don't need a $900/month AI SDR at all. Apollo + Instantly + verified data gets you 80% of the way there for under $150/month. The AI SDR platforms justify their cost when you're running enough volume that the time savings compound - typically 500+ outbound touches per week across multiple reps. Below that threshold, you're paying for automation you don't need yet.

The teams booking 20+ qualified meetings monthly follow the hybrid pattern. AI does the research, enrichment, and initial touches. Humans step in the moment a prospect shows genuine interest. The handoff point matters more than either side of it.

AI SDRs that try to handle the full cycle - from first touch to booked meeting to qualification - fail because prospects can tell. The moment a conversation requires nuance, the AI stumbles. But AI handling the first 80% of the work and handing off a warm, contextualized lead to a human? That's where the 40-60 qualified opportunities per month come from.

Email Deliverability Infrastructure

Your outbound AI system is only as good as your sending infrastructure. Get this wrong and nothing else matters.

| Type | Cost | Volume/inbox | Best for |

|---|---|---|---|

| Google Workspace | $2.50-3.50/box | 15-25/day | Default choice |

| Azure inboxes | Lower | 5-10/day | Budget (risky) |

| Shared SMTP | $3-15/inbox | Varies | Scale + redundancy |

| Dedicated SMTP | Custom | 50K+/month | High volume only |

Google Workspace + shared SMTP is the default combo. Buy GW mailboxes through resellers at $2.50-3.50 each, run 3-5 mailboxes per domain, and never push past 20-25 sends per day per inbox. Add shared SMTP (Mailforge, Mailscale) for redundancy and risk distribution.

The rules that matter:

- 14-day warmup minimum. Add +1 email per day. Never turn warmup off, even after you're sending live campaigns. (If you need the full SOP, see warmup.)

- Never exceed 20-25 sends/day per inbox. Need more volume? Add domains. Don't increase per-inbox volume.

- Minimum 2-3 domain registrars and 2-3 ESPs. If one registrar flags you, you don't lose everything.

- Separate sending domain. Never send cold email from your primary domain. Ever.

A warning on Azure inboxes: they're cheaper, but at least two companies running Azure-based infrastructure have gone dark. One policy update from Microsoft and your entire operation disappears. The cost savings aren't worth the platform risk.

Bounce rates above 5% destroy sender reputation. Run every list through verification before loading it into your sending tool. Stack Optimize maintains 94%+ deliverability and under 3% bounce rates across all clients using this exact workflow.

Stop tracking open rates. Apple Mail Privacy Protection makes them meaningless. Use placement tests and reply rates instead.

Compliance: The Legal Landscape You Can't Ignore

The FCC's February 2024 ruling set the foundation for today's compliance landscape: AI-generated voice calls are classified as "robocalls" under TCPA. No exceptions. Not even for "conversational" AI that generates dynamic responses.

This means prior express written consent is required before making AI-generated calls to mobile or residential lines. Any team deploying AI for outbound needs to treat compliance as a prerequisite, not an afterthought.

The penalties are real. The FCC fined one company $225 million for illegal robocalls. A $6 million fine was proposed for AI-generated calls during the New Hampshire primary. These aren't theoretical risks.

Key compliance rules for 2026:

The FCC One-to-One Consent Rule took effect January 27, 2026. Each business must obtain separate, explicit consent - the old loophole of shared consent across multiple businesses is dead.

State-level regulations are piling on:

- Texas SB 140 (September 2025): text messages are now "telephone solicitations" with treble damages

- Virginia SB 1339 (January 2026): must honor opt-out requests for 10 years, $500/violation statutory damages

- Florida: requires written consent for AI-initiated telemarketing calls, no bundled consent

Your compliance checklist:

- AI disclosure required at the beginning of every call, before any sales pitch

- A2P 10DLC registration required for all business text messaging - carriers block unregistered traffic

- Two-party consent for recording in: CA, CT, FL, IL, MD, MA, MT, NH, PA, WA

- Carriers now use AI to match live messages against registered samples in real-time

- Prior express written consent for every AI voice call - no exceptions

Most AI voice agent platforms don't handle compliance for you. They provide the dialing infrastructure, but consent management, disclosure scripts, and state-by-state compliance are your responsibility. Budget for legal review before launching any voice campaign.

Cold email requires CAN-SPAM compliance (unsubscribe link, physical address, no deceptive subject lines) and GDPR compliance for EU prospects. The penalties are smaller but the domain reputation damage from non-compliance is permanent.

Implementation Playbook: Start Here

Solo Founder Track

You don't need a $900/month AI SDR. Here's what actually works at the founder stage:

Step 1: Define your ICP. Not "SaaS companies with 50-200 employees." More like "Series A B2B SaaS companies in North America that just hired their first VP of Sales and are using HubSpot." Specificity is the entire game.

Step 2: Build and verify your list. Search by your ICP filters, then verify every contact. Use a Chrome extension for one-off prospecting or an enrichment API for batch processing at a 92% match rate. Load only verified contacts into your sending tool.

Step 3: Set up sending infrastructure. Buy 2-3 domains (variations of your brand). Set up Google Workspace mailboxes at $2.50-3.50 each. Configure SPF, DKIM, DMARC. Start warmup - 14 days minimum.

Step 4: Write 3-5 email variants. First email: 3-5 sentences max. Lead with a signal or pain point, not your product. No "I hope this finds you well." No "[Name], picture this..."

Step 5: Send 25-100 per batch. Not 5,000. Start small, measure reply rates, iterate. Keep under 50 emails per day per inbox.

Expected results: 800-1,200 personalized touches per month, 8-12% reply rate, 15-30 qualified meetings per month, 5-10 hours per week of your time. Starting cost: as low as ~$20/month for tools.

Growing Team Track

Week 1-2: Audit your current data. How old is it? What's the bounce rate? Run a sample through verification and see how many contacts are actually reachable. Clay (~$149/mo) is the go-to for enrichment workflows; pair it with a verification layer.

Week 3-4: Deploy the hybrid model. Agent Frank ($416/mo) or AiSDR ($900/mo) handles research, enrichment, and initial sequences. Humans handle every reply within 10 minutes - responding within 10 minutes increases conversion 4x versus waiting an hour. This is where most teams see the real value of outbound AI: the agents generate volume while reps focus on closing.

Month 2: Add a voice channel if your deal size justifies it. Start with Retell AI on a small segment - 500 verified direct dials, 2-minute scripts, appointment booking only.

Month 3: Evaluate and scale. Which channel produces the best cost-per-meeting? Double down there. Kill what isn't working.

The teams that fail skip straight to Month 3 volume without doing the Week 1 data audit. Don't be that team.

Those 40-60 hours of data prep before launching AI outbound? Prospeo cuts that to a fraction. 30+ ICP filters, real-time verification, and bounce rates under 4% - so your AI SDR starts producing pipeline instead of spam complaints.

Verified contacts at $0.01 each. Your AI handles the rest.

FAQ

Is outbound AI legal?

Yes, but heavily regulated for voice. The FCC classifies AI-generated calls as robocalls under TCPA, requiring prior express written consent for every call. Email outreach must comply with CAN-SPAM (US) and GDPR (EU). State laws like Texas SB 140 and Virginia SB 1339 add treble damages and 10-year opt-out windows. Budget for legal review before any voice campaign.

How much does an AI SDR cost?

Budget AI SDRs start at $300-$416/month (MarketOwl, Agent Frank). Mid-range platforms like AiSDR run $900/month. Enterprise solutions like 11x cost $5,000-$10,000/month. A full solo founder stack - Apollo, Instantly, and Prospeo for verification - runs under $150/month. Mid-market hybrid setups land at $1,500-$3,000/month all-in.

Can AI fully replace human SDRs?

Not yet. Only 13% of sales leaders believe AI matches humans at cold calling. The hybrid model works best: AI handles research, enrichment, initial outreach, and CRM admin while humans manage complex conversations and closing. Teams booking 20+ qualified meetings monthly use this AI-plus-human split consistently.

What's the biggest reason AI outbound fails?

Bad data. Teams feeding stale addresses or wrong numbers into AI tools burn domain reputation and waste credits before generating a single meeting. The 50-70% churn rate among AI SDR users traces directly to skipped data preparation. Verify every contact before loading it - bounce rates above 5% trigger spam filters that take weeks to recover from.

What data accuracy do I need for outbound AI to work?

Aim for 98%+ email accuracy with verification that includes catch-all handling, spam-trap removal, and honeypot filtering. Bounce rates above 5% damage sender reputation and tank deliverability. Data should refresh weekly; stale contacts are the top source of bounces and the fastest way to crater a campaign before it starts.