The Best AI Sales Systems in 2026: A Practitioner's Guide to What Actually Works

Your VP of Sales just told you to "figure out AI." You've got a budget that could be $500/month or $100,000/year, a Salesforce instance full of stale data, and 47 vendors in your inbox promising to 10x your pipeline. Sound familiar?

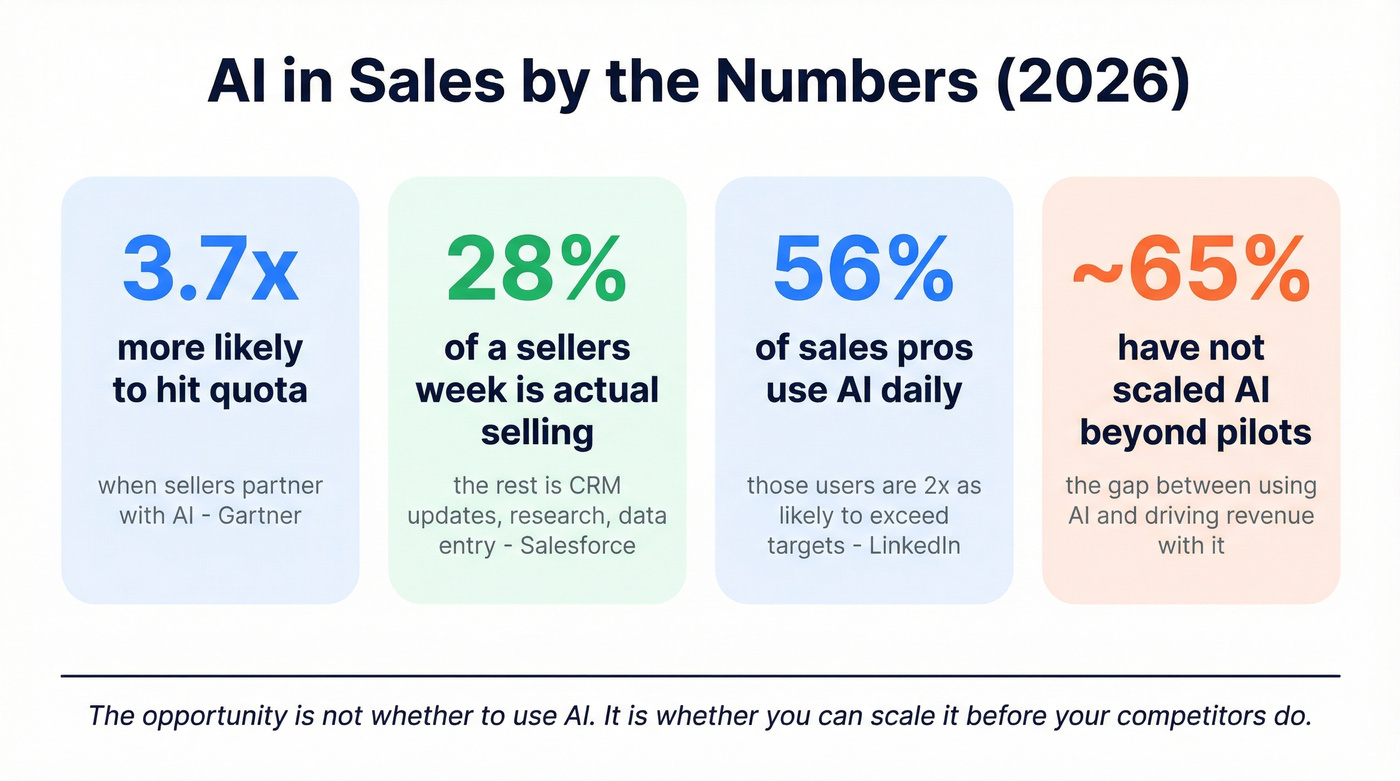

Here's the reality: 87% of sales orgs already use AI in some form, but nearly two-thirds haven't scaled beyond pilot projects. That gap - between "we use AI" and "AI is driving revenue" - is where most of that budget gets wasted. Gartner found that sellers who effectively partner with AI sales systems are 3.7x more likely to meet quota, and LinkedIn's data backs it up: [56% of sales professionals](https://news.linkedin.com/2025/the-roi-of-ai - new-research-on-how-ai-is-transforming-b2b-sales) now use AI daily, with those users 2x as likely to exceed targets.

The average seller spends just 28% of their week actually selling. The rest disappears into CRM updates, prospect research, data entry, and chasing contacts who changed jobs three months ago. AI-powered sales platforms exist to claw that time back - but only if you pick the right ones and implement them in the right order.

We've spent months testing these tools, interviewing customers, and analyzing thousands of practitioner reviews. This isn't a listicle of every tool with an AI label. These recommendations come from what's working right now.

Our Picks (TL;DR)

If you're short on time, here's where to start:

Best for data accuracy: Prospeo - 300M+ profiles, 98% email accuracy, 7-day data refresh. Free tier includes 75 verified emails/month, plus 100 Chrome extension credits/month. Paid plans run about ~$0.01/email. Your entire stack is only as good as the data feeding it.

Best all-in-one: Apollo.io - database + sequencer + dialer + AI SDR features, all from $49/user/month. The obvious starting point for 80% of teams.

Best for enrichment workflows: Clay - 150+ data providers, waterfall enrichment, credit-based pricing from $149/month. Steep learning curve, unmatched flexibility.

Best for conversation intelligence: Gong - 81% forecast accuracy, analyzes 33B interaction signals weekly. $160+/user/month, custom. Worth it above 20 reps.

The Five Types of AI Sales Systems You Need to Know

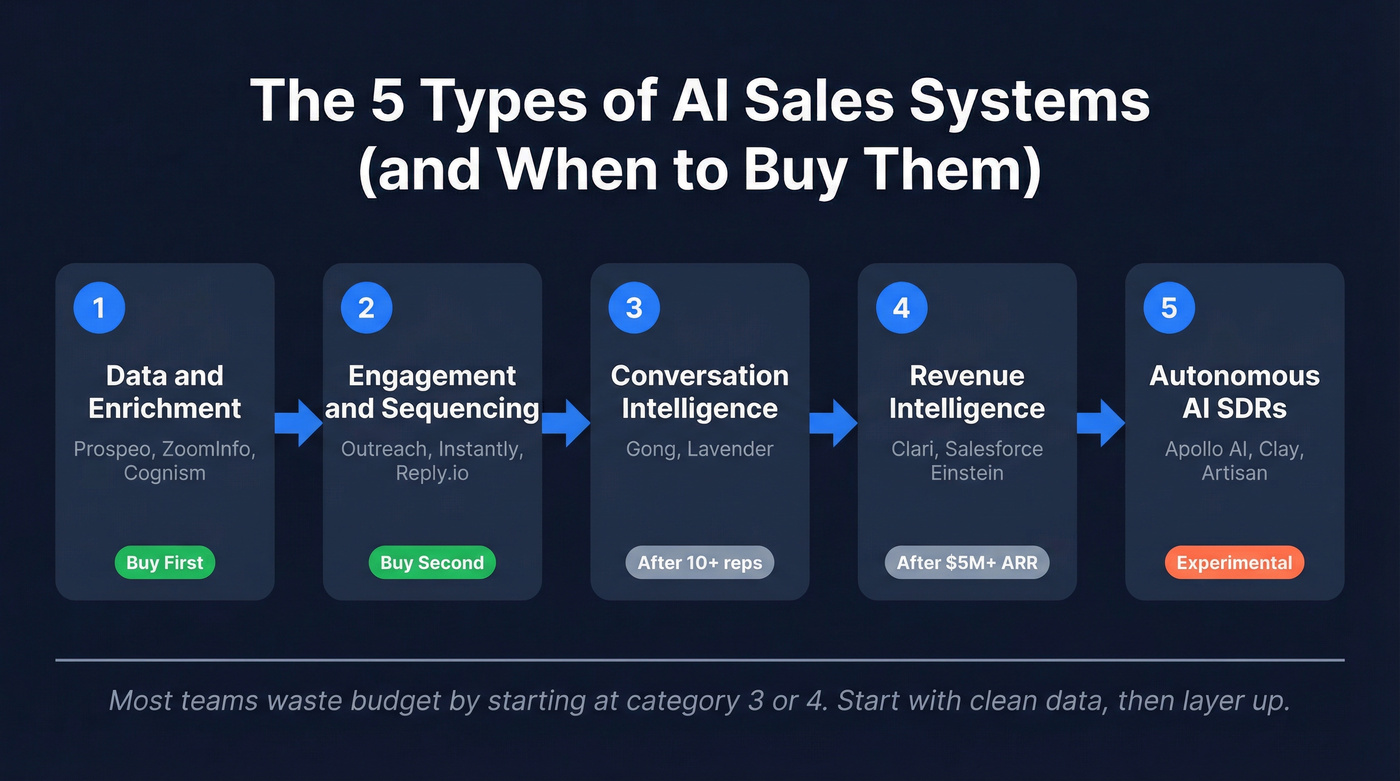

Before you buy anything, understand what you're buying. Not every "AI sales tool" does the same thing, and most teams make the mistake of buying from the wrong category first.

Walnut's framework breaks AI in sales into three types - predictive, generative, and conversational. That's useful conceptually, but in practice, the market has organized into five functional categories:

| Category | What It Does | Key Tools | When to Buy |

|---|---|---|---|

| Engagement & Sequencing | Automates outreach across channels | Outreach, Instantly, Reply.io | Second |

| Conversation Intelligence | Records, analyzes, coaches calls | Gong, Lavender | After 10+ reps |

| Revenue Intelligence | Forecasts pipeline, flags risk | Clari, Salesforce Einstein | After $5M+ ARR |

| Autonomous AI SDRs | Prospects and books meetings independently | Apollo AI, Clay, Artisan | Experimental |

Gartner predicts 40% of enterprise applications will integrate task-specific AI agents by 2026, up from under 5% in 2025. That's a massive shift. Anthropic's research on multi-agent architectures shows parallel processing systems outperform single agents by 90% on complex research tasks, which explains why tools like Clay - orchestrating 150+ data providers - are outperforming monolithic platforms on enrichment quality.

The platform consolidation trend is real. Organizations are moving from 8-12 point solutions to 4-6 integrated platforms. But "integrated" doesn't mean "one tool does everything." It means fewer tools that talk to each other well.

One thing to assess before you swipe the corporate card: your team's AI maturity. Involve IT and data security early. If your CRM data is a mess, no AI tool will save you.

Most teams should start with Category 1 (data) and Category 2 (engagement), then layer on intelligence and autonomous features as they scale. Buying Gong before you have clean contact data and working sequences is putting the cart before the horse.

Every AI sales system on this list depends on one thing: clean data. Prospeo's 7-day refresh cycle and 98% email accuracy mean your sequencers, AI SDRs, and enrichment workflows actually connect with real buyers - not bounced addresses that tank your domain.

Fix the foundation layer first. Start free at $0.01/email.

The Best AI-Powered Sales Tools for 2026

Data & Enrichment

This is the foundation layer. Every tool downstream - your sequencer, your conversation intelligence, your forecasting - depends on the quality of data flowing into it. Get this wrong and nothing else matters.

Prospeo

Use this if: Data quality is your bottleneck (it probably is). You need verified emails and direct dials that actually connect. You want self-serve pricing without a 45-minute demo call.

The database covers 300M+ professional profiles with 143M+ verified emails and 125M+ verified mobile numbers that deliver a 30% pickup rate across all regions. The 98% email accuracy comes from a proprietary 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering - built on proprietary email-finding infrastructure, not third-party providers.

The 7-day data refresh cycle is the real differentiator. The industry average is 6 weeks. That means competitors are serving you contacts that are already going stale by the time you download them. A weekly refresh means your sequencer isn't burning through emails that bounce.

The proof is in the numbers: Meritt went from a 35% bounce rate to under 4% after switching, and their pipeline tripled from $100K to $300K per week. That's not a marginal improvement - that's a different business.

Pricing is refreshingly transparent: free tier with 75 verified emails/month plus 100 Chrome extension credits/month, paid plans at roughly $0.01/email. No annual contracts, no "talk to sales" gates. For context, ZoomInfo charges roughly $1/lead - about a 100x cost difference.

Pair with: Outreach or Instantly for the engagement layer, Clay for enrichment workflows.

ZoomInfo

ZoomInfo is the enterprise default for a reason: 500M+ contacts, 100M+ companies, 35,000+ customers, and an ecosystem of integrations that's hard to match. If you're a 500-person sales org running outbound, ABM, and intent from one platform, ZoomInfo still makes sense.

But the gap has shrunk. Dramatically. A 10-seat ZoomInfo contract with intent data and mobile numbers runs $15,000-40,000/year. That's real money - especially when smaller platforms now cover 80% of the same use cases at a fraction of the cost. The #1 complaint about ZoomInfo on Reddit? Paying for modules you don't use.

Where ZoomInfo still wins: US database depth, workflow breadth, enterprise compliance requirements. Where it's losing ground: pricing transparency, data freshness, and SMB/mid-market value.

G2 rating: 4.5/5. Pricing: $15,000-40,000/year depending on seats and modules.

Cognism

If you're selling into EMEA, Cognism answers the question ZoomInfo can't solve well. Diamond Data phone-verified mobiles, GDPR-compliant by design, and coverage in European markets that US-first databases consistently miss.

Cognism's sweet spot is teams running outbound into the UK, DACH, and Nordics who need direct dials that actually connect. Where ZoomInfo still wins: US database depth and workflow breadth.

G2 rating: 4.5/5. Custom pricing, typically $1,000-3,000/month for small teams.

Sales Engagement & Sequencing

Once you've got clean data, you need to actually reach people. This category has gotten crowded, but the leaders are clear. Multichannel sequences - email, phone, social - consistently outperform single-channel approaches.

Outreach

I watched a team at a mid-market SaaS company implement Outreach's AI coaching features last year. The result: their AI assistant (Kaia) shaved 11 days off average sales cycles and delivered a 10-point lift in win rate on deals over $50K. That's not incremental - that's the difference between hitting and missing the quarter.

Outreach has evolved from a sequencer into a full AI-driven sales platform. LivePerson cut prospect research time from 20 minutes to 2 minutes using Outreach's AI agents - a 10x efficiency gain with a 35% lift in engagement rates. The Research Agent, Revenue Agent, Deal Agent, and Personalization Agent work together to handle the grunt work that eats 70% of a rep's day.

Key tradeoff: At ~$150/user/month, Outreach is an enterprise tool with enterprise pricing. A 10-person team is looking at $18,000-36,000/year. That's justified if your average deal size is six figures. For teams closing deals in the low five figures, it's overkill.

Skip this if: You're a 3-person team doing high-volume cold email. Instantly at $37/month will get you further per dollar.

G2 rating: 4.3/5. Pricing: ~$150/user/month, custom.

Instantly

The cold email weapon for teams who care about math, not features.

Instantly costs $37/month with unlimited sending accounts and built-in warmup. Outreach costs $150/user/month. If you're a 5-person team sending 5,000+ cold emails per week, the unit economics aren't even close.

The catch: Instantly is a sending engine, not a data platform. You bring your own verified contacts. Pair it with a strong data layer and you've got a high-volume outbound stack for under $200/month that outperforms setups costing 10x more.

G2 rating: 4.8/5. Pricing: from $37/month.

Reply.io

Solid multichannel sequencer with AI SDR capabilities baked in. $69-99/user/month gets you email, calls, and social touches in one workflow. Not as polished as Outreach, not as cheap as Instantly - a good middle ground for teams that want multichannel without enterprise pricing. The AI-powered sales inbox uses machine learning to categorize and prioritize responses, so reps focus on the hottest replies first.

Salesloft

The Outreach alternative. Comparable feature set, comparable pricing (~$125-150/user/month). The choice often comes down to which one your team already knows. Outreach's AI features have a slight edge in 2026, but Salesloft's Rhythm workflow engine is genuinely good.

Conversation Intelligence & Coaching

Gong

Gong processes 33 billion interaction signals weekly across 4,000+ companies. Their forecast accuracy sits at 81% - which means Gong's AI predicts your quarter more accurately than your VP of Sales does. That's either exciting or terrifying depending on your role.

No one else has Gong's depth of conversation data. The platform doesn't just record calls - it identifies patterns across your entire revenue team. Which talk tracks correlate with closed deals? Where do reps lose momentum? Which competitors keep coming up? Gong answers these questions with data, not gut feel.

Key tradeoff: Gong is expensive. At $160+/user/month, a 20-person team is looking at $40,000-100,000/year. I've seen this tool transform organizations with 20+ reps running complex sales cycles. I've also seen 5-person teams buy it and use it as a glorified call recorder. Know which one you are before signing.

G2 rating: 4.8/5. Pricing: $160+/user/month, custom.

Lavender

AI email coaching at $29/user/month. Scores your emails before you send them, suggests improvements, and tracks what's working across your team. Think of it as Grammarly for sales emails, but with conversion data behind the suggestions. 4.8/5 on G2 for a reason.

Revenue Intelligence & Forecasting

Salesforce Einstein

If you're already on Salesforce Enterprise+, Einstein is included. That's the pitch and the limitation. Einstein's predictive lead scoring and opportunity insights are genuinely useful - but only if your Salesforce data is clean. And let's be honest: most Salesforce instances are a graveyard of duplicate contacts and outdated stages.

Best for Salesforce-native teams who've invested in data hygiene. Skip if you're on HubSpot or a lightweight CRM.

G2 rating: 4.4/5. Pricing: included with Enterprise+ licenses.

HubSpot Sales Hub (Breeze)

HubSpot's Breeze AI agents are the most interesting development in the SMB CRM space. Starting at $20/user/month with 200,000+ customers, HubSpot is making AI accessible to teams that can't afford Gong or Outreach. Breeze agents handle prospecting, content creation, and customer service - and they resolve 50% of support tickets without human intervention.

Best for HubSpot-native SMBs. The AI features are good, not great - but the price-to-value ratio is unbeatable if you're already in the ecosystem.

G2 rating: 4.4/5. Pricing: from $20/user/month.

Clari

Revenue intelligence and forecasting for enterprise teams. Clari aggregates signals across email, calendar, CRM, and conversation data to predict pipeline outcomes. If your board asks "are we going to hit the number?" every month, Clari gives you a data-backed answer instead of a spreadsheet and a prayer.

Custom enterprise pricing, typically $30,000-80,000/year. G2 rating: 4.6/5.

Autonomous AI SDRs (The Honest Truth)

Here's the thing: fully autonomous AI SDRs aren't ready for complex B2B sales in 2026. Hybrid models - AI handling research, personalization, and initial outreach while humans manage replies and relationships - outperform pure autonomy every time. 45% of high-performing teams use this hybrid approach.

Apollo.io

Apollo is the Swiss Army knife of sales tools, and it's quietly become one of the best AI SDR platforms without anyone noticing. The database covers 265M+ contacts across 35M companies. The free tier is genuinely useful. And the paid plans at $49/user/month include native sequencing, a dialer, and AI SDR features that a Reddit user accurately described as "low-key an AI SDR... better than half the stuff on the market."

Apollo's AI Research Agent helps reps book 46% more meetings by automating prospect research and personalization. The platform saw 500% year-over-year growth in AI usage with 50K+ weekly active AI users. That kind of adoption velocity tells you something - people are actually using these features, not just buying them.

Use this if: You want one tool that handles prospecting, sequencing, and basic AI SDR functionality. It's the best starting point for 80% of teams.

Skip this if: You need enterprise-grade conversation intelligence or deep enrichment workflows. Apollo is broad, not deep. Pair it with Gong for call coaching or Clay for complex enrichment.

G2 rating: 4.7/5. Pricing: free tier available, paid from $49/user/month.

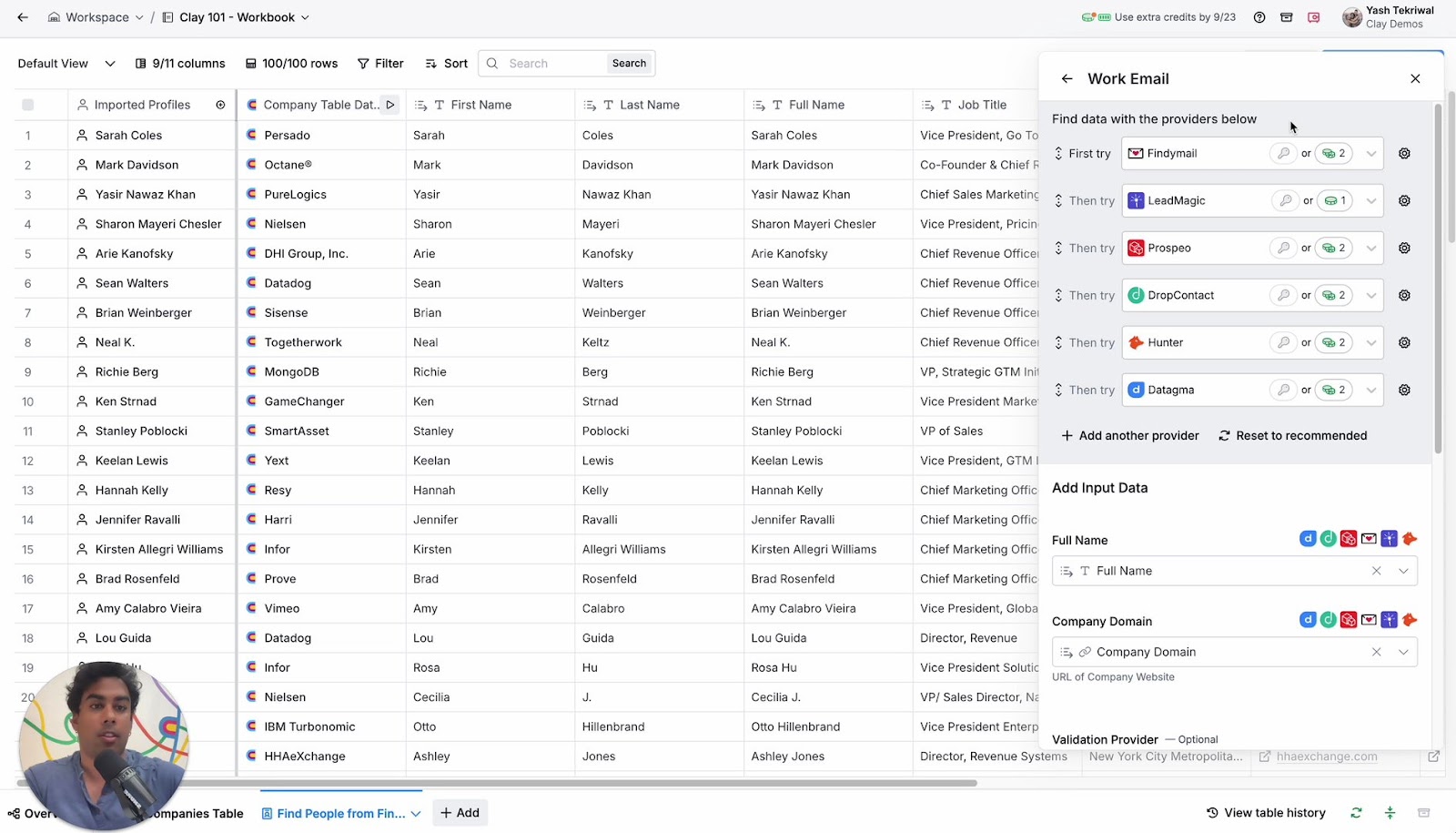

Clay

Clay isn't a traditional sales tool - it's a workflow orchestration platform that happens to be incredible for sales. The waterfall enrichment approach queries 150+ data providers sequentially until it finds accurate information, which means match rates that blow single-source tools out of the water.

The learning curve is steep. We've seen GTM ops teams build extraordinary automated workflows - lead scoring, enrichment cascades, personalized outreach at scale - and we've also seen teams buy it, stare at the interface for two weeks, and cancel. If you don't have someone on your team who thinks in workflows and APIs, Clay will frustrate you.

Use this if: You have a GTM ops person (or are one) who wants to build custom AI-powered workflows.

Skip this if: You want plug-and-play. Apollo is a better fit for teams that want to prospect in 10 minutes, not 10 hours of setup.

G2 rating: 4.6/5. Pricing: credit-based, from $149/month. Expect $150-500/month depending on volume.

Artisan (Ava)

Autonomous AI SDR with 300M+ B2B contacts, priced at $2,000-10,000/month with annual lock-in. One practitioner on r/gtmengineering put it bluntly: "most of the 'AI SDR' features worked very poorly." The technology will improve. It's not there today.

11x.ai (Alice)

Autonomous prospecting starting at $500+/month. Earlier stage than Artisan with less user feedback available. If you're evaluating autonomous SDRs, test 11x alongside Apollo's built-in AI features and compare actual meeting conversion rates before committing.

Master Comparison Table

G2 ratings reflect the latest available data. Pricing shows publicly available tiers - enterprise contracts will vary. Use the "Best For" column to find your match: if two tools share a category, the one listed first is our top pick for most teams.

| Tool | Category | G2 | Starting Price | Best For |

|---|---|---|---|---|

| Prospeo | Data & Enrichment | 4.5+/5 | Free; ~$0.01/email | Data accuracy, verification, self-serve |

| Apollo.io | All-in-One / AI SDR | 4.7/5 | Free; $49/user/mo | SMB all-in-one |

| Clay | Enrichment / Workflows | 4.6/5 | $149/mo | GTM ops, enrichment |

| Gong | Conversation Intel | 4.8/5 | $160+/user/mo | Call coaching, forecasting |

| Outreach | Engagement | 4.3/5 | ~$150/user/mo | Enterprise sequences |

| ZoomInfo | Data & Enrichment | 4.5/5 | ~$15K-40K/yr | Enterprise data |

| Cognism | Data & Enrichment | 4.5/5 | ~$1K-3K/mo | EMEA, phone-verified |

| Instantly | Cold Email | 4.8/5 | $37/mo | High-volume outbound |

| HubSpot Breeze | CRM + AI | 4.4/5 | $20/user/mo | HubSpot-native SMBs |

| SF Einstein | CRM + AI | 4.4/5 | Incl. w/ Enterprise+ | Salesforce-native |

| LinkedIn Sales Nav | Social Selling | 4.3/5 | $90/user/mo | Warm outreach, networking |

| Artisan (Ava) | Autonomous SDR | N/A | ~$2K-10K/mo | Not recommended yet |

| 11x.ai (Alice) | Autonomous SDR | N/A | $500+/mo | Early adopters only |

| Reply.io | Engagement | 4.5/5 | $69-99/user/mo | Multichannel mid-market |

| Salesloft | Engagement | 4.5/5 | ~$125-150/user/mo | Outreach alternative |

| Clari | Revenue Intel | 4.6/5 | ~$30K-80K/yr | Enterprise forecasting |

| Lavender | Email Coaching | 4.8/5 | $29/user/mo | Email optimization |

How to Build Your Sales AI Tech Stack by Budget

The biggest mistake teams make isn't picking the wrong tool - it's buying tools in the wrong order. Data first, engagement second, intelligence third. Here's what that looks like at three budget levels.

Hot take: If your average contract value sits below $15K, you probably don't need ZoomInfo-level data or Gong-level conversation intelligence. Apollo + Instantly + clean data will outperform a $100K enterprise stack for most SMB sales motions. Save the big spend for when your deal complexity demands it.

The Startup Stack (~$500/month)

Apollo.io ($49/user/month) + Reply.io ($69-99/user/month) = under $500/month for a 2-3 person team.

Apollo handles your database, basic sequencing, and AI SDR features. Reply.io adds multichannel outreach with phone and social touches. This stack gets a scrappy team running outbound in a day. The limitation: Apollo's email accuracy isn't best-in-class, so expect some bounces. Once you're sending enough volume for that to matter, upgrade to the Growth Stack.

The Growth Stack (~$1,500/month)

Prospeo (data foundation, ~$100-200/month) + Apollo.io ($49/user/month for CRM and sequencing) + Clay ($149/month for enrichment workflows) + Instantly ($37/month for high-volume sending) = ~$1,500/month.

This is the stack we recommend for most scaling teams. A 98% email accuracy foundation means your Instantly sequences don't burn domains. Clay handles enrichment cascades and personalization at scale. Apollo serves as your CRM and secondary prospecting tool. Instantly does the high-volume sending with unlimited accounts and warmup.

The key insight: separating your data layer from your sending layer from your enrichment layer gives you best-in-class at each step instead of one tool's mediocre version of everything.

The Enterprise Stack ($100,000+/year)

ZoomInfo ($15,000-40,000/year) + Outreach (~$150/user/month) + Gong ($40,000-100,000/year) + a verification layer (~$2,000-5,000/year).

Even at the enterprise level, data verification matters. ZoomInfo's database is deep but running exports through a verification step before loading them into Outreach sequences eliminates the 10-15% bounce rate that tanks deliverability. At enterprise volume, that's thousands of saved contacts per month.

The consolidation trend is real - teams are moving from 8-12 tools to 4-6. But "fewer tools" doesn't mean "one tool." It means fewer, better-integrated tools that each do their job exceptionally well.

The Economics of AI Sales Systems

Let's talk money. Not vendor pricing - actual ROI math.

Early AI deployments that get the implementation right see win rates jump 30%+, per Bain & Company. Here's what the math looks like in practice.

A fully loaded human SDR costs roughly $98,000/year when you add salary ($60K), benefits ($18K), training ($5K), tools ($3K), and management overhead ($12K). That SDR produces 15-20 qualified opportunities per month on a good month.

An AI-augmented system - not a fully autonomous one, but a hybrid stack - runs about $28,000/year in platform costs, setup, data, and monitoring. It produces 40-60 qualified opportunities per month once ramped.

| Metric | Human SDR | AI-Augmented System |

|---|---|---|

| Annual cost | ~$98,000 | ~$28,000 |

| Monthly opps | 15-20 | 40-60 |

| Cost per meeting | $385-514 | ~$50 |

| Ramp time | 3-6 months | 1-3 months |

That's a 71% cost reduction with 2-3x the output. Even if you discount those numbers by half, the economics are compelling.

But the hidden costs are real. Expect 40-60 hours of data preparation before launch. Ongoing daily management and quality control. And a realistic ramp timeline of 3-6 months with clean data, or 6-9 months if you're building from scratch.

Month 1 typically yields 5-10 qualified opportunities. Month 2 ramps to 20-30. By Month 3, you're hitting 40-60 - but only if your data is clean and your processes are dialed.

The caveat that matters: AI-booked meetings don't always convert to pipeline at the same rate as human-booked ones. Complex enterprise deals still need humans in the room. AI is best for the initial outbound prospecting and meeting-booking phase - not for closing six-figure contracts.

Why Most AI Sales Systems Fail (And How to Fix It)

79% of sales teams use automation tools. Only 30% achieve expected ROI.

That gap isn't a technology problem - it's a data and process problem. 26% of AI transformations fail outright. Here are the three failure patterns we see repeatedly.

Failure Pattern #1: Bad Data

This is the big one. Email lists decay roughly 20% annually. 65% of sales professionals can't completely trust their organization's data. If you're feeding your sequencer contacts from a database that refreshes every 6 weeks - the industry average - you're sending emails to people who've already changed jobs, bouncing off invalid addresses, and training your AI on garbage signals.

The difference between a weekly data refresh and a monthly-plus refresh cycle is the difference between a 4% bounce rate and a 20% bounce rate. Bounce rate isn't just a vanity metric. It directly impacts domain reputation, which impacts deliverability, which impacts whether your AI-generated emails even reach the inbox.

Failure Pattern #2: Overpromise, Underdeliver

Carnegie Mellon research found that AI agents fail 70% of multi-step office tasks. Salesforce's own study showed advanced AI agents succeed on only 30-35% of multi-turn CRM tasks. Yet vendors sell you "autonomous AI SDRs" that promise to replace your entire outbound team.

One Reddit practitioner nailed it: AI "falls short of answering if you ask something slightly more advanced." The current state of AI in sales is excellent for research, personalization, and initial outreach automation. It's mediocre at handling objections, navigating complex buying committees, and adapting to unexpected responses.

Failure Pattern #3: Integration Complexity

51% of sales leaders with AI say disconnected systems slow their AI initiatives. You buy Gong for conversation intelligence, but it doesn't talk to your enrichment tool. You buy Clay for workflows, but the data doesn't flow cleanly into your CRM. Every broken integration is a manual workaround, and manual workarounds are where AI ROI goes to die.

The fix: buy tools that integrate natively. Look for platforms that push directly to Salesforce, HubSpot, and your sending tools - plus Zapier or Make for custom workflows. That's not a feature list - it's the difference between a stack that works and a stack that creates more work.

Sellers spend 72% of their week not selling. Stale data makes it worse - every bounce, every wrong number, every dead-end is time your AI stack can't claw back. Prospeo delivers 300M+ profiles with 125M+ verified mobiles at a 30% pickup rate.

Stop feeding bad data into good AI tools. Start with 75 free verified emails.

How to Implement AI-Driven Sales Processes Without Wasting 6 Months

Sales reps spend just 28% of their time actually selling. Companies can automate roughly 33% of sales tasks. Teams using automated sales software save 2+ hours per rep per day. The math is obvious - the execution is where teams stumble.

Here's the five-step approach that actually works:

Step 1: Fix Your Processes Before You Buy Tools

If your sales process is broken, AI will automate the broken process faster. Map your current workflow end-to-end. Identify where reps spend time on non-selling activities. Fix the process gaps first, then automate.

Step 2: Start With One Pain Point

Don't try to implement an entire AI sales stack in Q1. Pick the highest-impact bottleneck - usually data quality or manual prospecting - and solve that first. One tool, one problem, one quarter.

Step 3: Clean Your Data

74% of sales professionals prioritize data cleansing, and 79% of high performers make it a top priority versus only 54% of underperformers. Upload your existing contacts to a verification tool, purge the invalids, and enrich what's left before you turn on any automation.

Step 4: Measure Before You Scale

Run your new tool for 30 days. Track bounce rates, reply rates, meetings booked, and pipeline generated. Compare to your baseline. If the numbers improve, expand. If they don't, diagnose whether it's a data problem, a messaging problem, or a tool problem.

Step 5: Expand Deliberately

Once your foundation layer is working, add the next category. Data, then engagement, then intelligence, then forecasting. Each layer compounds the one before it.

Rushing to buy Gong before your outbound sequences are producing consistent meetings is a waste of $50K+. The teams that get this right save 2+ hours per rep per day and see 33% efficiency gains within the first quarter. The teams that don't are the two-thirds still stuck in pilot mode.

FAQ

What is an AI sales system?

An AI sales system is an integrated set of tools using predictive, generative, and conversational AI to automate prospecting, engagement, coaching, and forecasting across the sales cycle. It's not one tool - it's a stack of 3-5 specialized platforms that work together to reduce manual work and increase pipeline output.

How much does a complete AI sales stack cost?

A complete stack ranges from ~$500/month for startups (Apollo + Reply.io) to $100,000+/year for enterprise teams (ZoomInfo + Outreach + Gong). Most mid-market teams spend $1,500-3,000/month covering data, engagement, and basic intelligence. Prospeo's free tier (75 verified emails/month) lets you test the data layer at zero cost before committing.

Do AI SDRs actually work in 2026?

Hybrid models - AI handling research and initial outreach, humans managing replies - consistently outperform fully autonomous SDRs. 45% of high-performing teams use this approach. Pure autonomous tools like Artisan are improving but aren't reliable for complex B2B deals yet. Apollo's built-in AI SDR features are the most practical option for most teams today.

What's the biggest reason AI sales tools fail?

Bad data. Email lists decay 20% annually, and 65% of sales pros can't trust their CRM data. If contacts bounce or enrichment data is stale, every downstream tool - sequencers, coaching platforms, forecasting engines - produces garbage outputs. Weekly data refresh cycles and 98%+ email accuracy solve this at the source.

How long until I see ROI from an AI sales system?

Expect 3-6 months with clean data and clear processes, or 6-9 months if building from scratch. Month 1 typically yields 5-10 qualified opportunities as you calibrate messaging and targeting. By Month 3, well-implemented systems produce 40-60 qualified opportunities monthly. Starting with verified data is the single biggest accelerator - bad data adds 2-3 months to every timeline.