AI SDR vs Agency: Which One Actually Books Meetings Worth Taking?

Your CEO just forwarded a LinkedIn post about how AI SDRs are "replacing entire sales teams." Meanwhile, you've been paying an agency $5,000/month for six months. The results? Thirty "booked" meetings, twelve that actually showed up, and a pipeline that still looks anemic. The CFO wants answers. The board wants pipeline. And you're stuck weighing AI SDR vs agency - a robot that sends 3,000 emails a day against a human team that charges $400 per meeting.

Here's the thing: both options work. Both also fail spectacularly. The difference isn't which one is "better" - it's which one matches your deal size, your ICP complexity, and your willingness to manage the machine. I've watched teams blow $50K on agencies with nothing to show for it, and I've seen AI SDRs book six-figure meetings at 6:02 PM on a Saturday. The variable isn't the tool. It's the fit.

Pick wrong and the consequences are real: a burned domain that takes months to recover, a wasted quarter your board won't forget, or a TAM you've poisoned before your product even had a chance.

What You Need (Quick Version)

Before you read 4,000 words, here's the short answer:

Choose an AI SDR if: Your ICP is straightforward (title + industry + company size), you want high-volume outbound or fast inbound follow-up, your budget's under $2,500/mo, and you've got someone internally who can manage the setup and iteration.

Choose an agency if: You're selling complex enterprise deals, entering a new market with no playbook, have zero internal outbound infrastructure, and can commit $4K-$10K/mo for at least 3-6 months.

Skip both if: Your budget's under $3K/mo, or you haven't verified whether your prospect data is even accurate. Build a DIY stack instead - Prospeo for verified emails and mobiles, Instantly or Smartlead for sending, Clay for enrichment. Total: $300-$800/mo. Stack Optimize built from $0 to $1M ARR on exactly this kind of stack, maintaining 94%+ deliverability across all their clients. You'll outperform most AI SDRs and half the agencies at a fraction of the cost.

Hot take: If your average contract value sits below five figures, you almost certainly don't need either an AI SDR platform or an agency. A $500/month DIY stack with clean data will outperform both. The AI SDR and agency markets exist because people overestimate the complexity of sending good emails to the right people.

The rest of this article is the math, the failure stories, and the decision framework behind those recommendations.

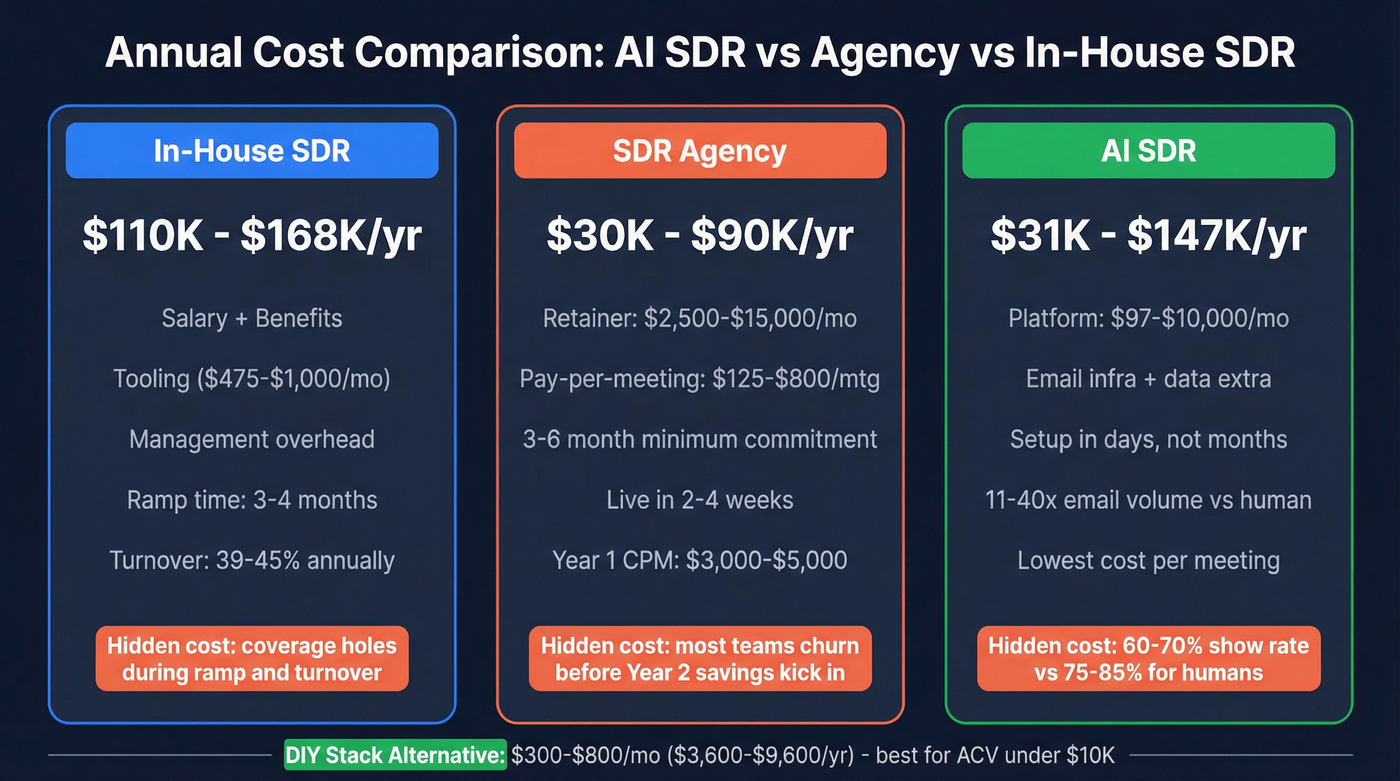

What Each Option Actually Costs in 2026

Cost is the first question everyone asks. It's also where the most misleading numbers live. Here are all three baselines so you're comparing apples to apples.

In-House SDR (The Baseline)

Every comparison needs a baseline, and for most B2B teams, that's hiring a human SDR. Think of this as your total cost of ownership - not just salary, but the full loaded cost of keeping a seat productive.

| Line Item | Low | Typical | High |

|---|---|---|---|

| Cash comp | $6,250/mo | $7,500/mo | $8,750/mo |

| Employer burden | $1,375/mo | $1,625/mo | $1,900/mo |

| Tooling | $475/mo | $750/mo | $1,000/mo |

| Management | $1,250/mo | $1,500/mo | $1,875/mo |

| Monthly total | $9,750 | $12,010 | $14,425 |

Annualized, that's $110K-$168K per productive rep. But "productive" is doing a lot of heavy lifting here. SDRs spend only 18-22% of their day actually talking to prospects. Ramp takes 3-4 months - and during those first months, assume 50-70% productivity at best. Annual turnover runs 39-45%, which means you're restarting the ramp clock roughly every 18 months.

The real cost of an in-house SDR isn't the salary. It's the coverage holes.

SDR Agency Pricing

Agencies run three pricing models, and the one you pick changes your economics dramatically.

| Tier | Retainer | Pay-Per-Meeting | Hybrid (Base + Incentive) | Meetings/Month |

|---|---|---|---|---|

| Entry | $2,500-$4,000/mo | $125-$250/mtg | $1,500/mo + $150/mtg | 8-12 |

| Mid-market | $4,000-$7,500/mo | $250-$450/mtg | $3,000/mo + $250/mtg | 12-20 |

| Enterprise | $7,500-$15,000/mo | $450-$800+/mtg | $5,000/mo + $400/mtg | 20-35+ |

Most agencies require 3-6 month minimum commitments. Some, like SalesHive, offer month-to-month - but you'll pay a premium for that flexibility.

Here's what nobody tells you about agency economics: Year 1 is brutal. Expect $3,000-$5,000 per meeting booked for mid-market B2B. Year 2 drops to ~$2,000. By Year 3, if you've stuck around, you're looking at ~$1,000 per meeting. Belkins' internal data shows their own team went from $2,000 per appointment down to $500 over years of refinement. The catch: most teams don't survive Year 1 long enough to see Year 3 economics. They churn at month 4, convinced agencies don't work - when really, they just didn't give the optimization cycle enough runway.

An outsourced SDR runs roughly $65,000/year all-in - a 48% reduction versus in-house. That's the number that gets agencies in the door.

AI SDR Pricing

The AI SDR market has stratified fast. Here's what you'll actually pay:

| Tool | Monthly Cost | Annual Range |

|---|---|---|

| SalesTools.io | From $97/mo | ~$1,200 |

| LeadLoft | $400/mo | ~$4,800 |

| Agent Frank (Salesforge) | $499/mo | ~$6,000 |

| AiSDR | $900-$2,500/mo | ~$11K-$30K |

| Reply.io (Jason AI) | $2,500-$5,000/mo | ~$30K-$60K |

| Artisan (Ava) | ~$2,000-$5,000/mo | ~$24K-$60K |

| 11x (Alice) | $5,000-$10,000/mo | ~$60K-$120K |

| Agentforce (Salesforce) | Custom (enterprise) | ~$50K-$150K+ |

The full annual cost range - including platform, setup, email infrastructure, data, and optimization - runs $31,000-$147,000. Compare that to $110,000-$168,000 for a human SDR. On paper, even the expensive AI SDRs look like a deal.

On paper.

Stack Optimize built $0 to $1M ARR on clean data and a DIY sending stack. Prospeo gives you 98% verified emails, 125M+ direct dials, and 30+ filters to nail your ICP - for $0.01/lead. That's the foundation that outperforms most AI SDRs and half the agencies in this article.

Stop paying $400/meeting when the data layer costs a penny per lead.

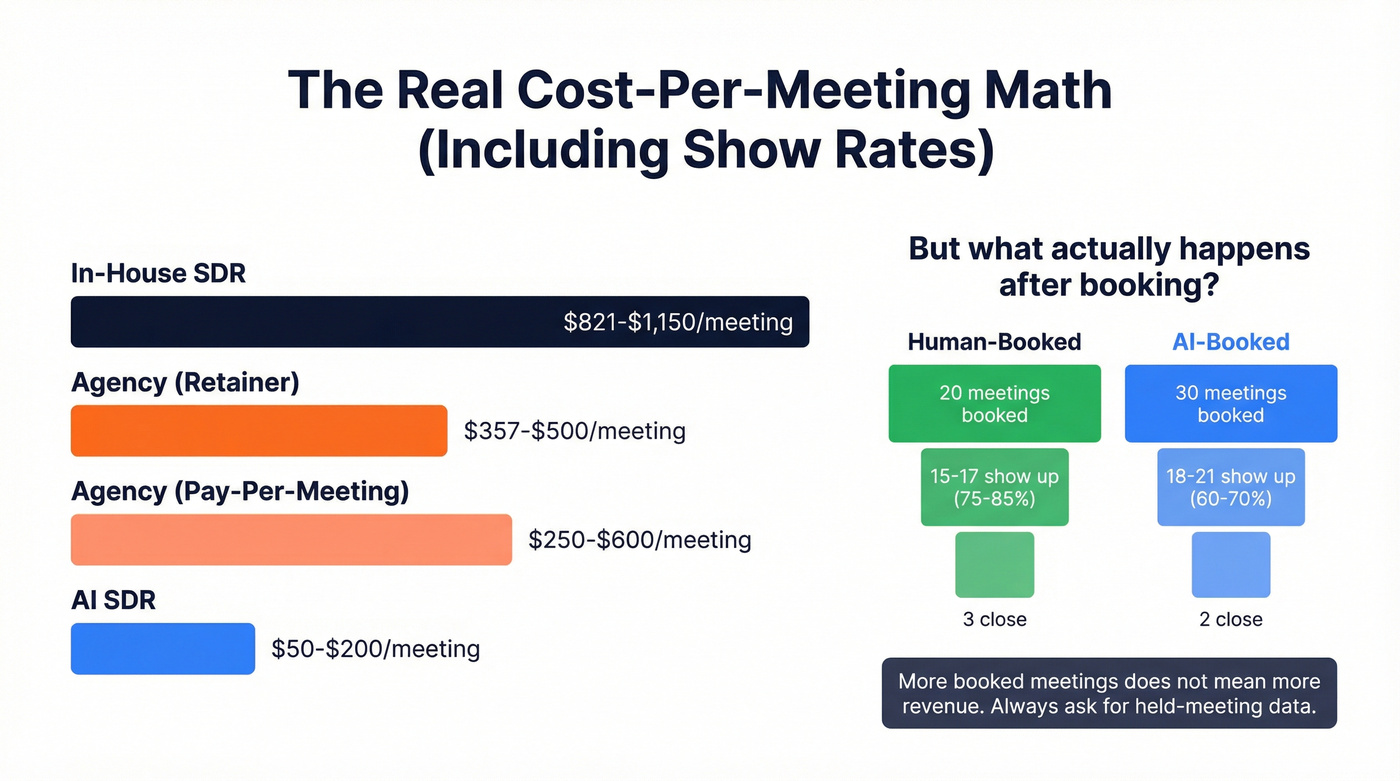

The Cost-Per-Meeting Math Nobody Shows You

Raw monthly cost is meaningless without output. Here's what each approach actually costs per meeting:

| Approach | Cost/Meeting | Meetings/Mo | Show Rate |

|---|---|---|---|

| In-house SDR | $821-$1,150 | 12-15 | 75-85% |

| Agency (retainer) | $357-$500 | 12-20 | 75-85% |

| Agency (PPM) | $250-$600 | 5-20+ | 75-85% |

| AI SDR | $50-$200 | 25-30 | 60-70% |

AI SDRs crush on volume and cost-per-meeting. But look at that show rate column. AI-booked meetings show at 60-70%. Human-booked meetings show at 75-85%. That's not a rounding error - it's the difference between 20 meetings and 14 that actually happen.

And here's the distinction that separates experienced buyers from first-timers: booked meetings, held meetings, and closed deals are three completely different numbers. An AI SDR that books 30 meetings where 18 show and 2 close isn't better than an agency that books 15 meetings where 12 show and 3 close. The math only works if you follow it all the way to revenue.

Most AI SDR vendors report booked meetings. Most agencies report booked meetings. Neither wants you looking at held meetings or closed revenue, because that's where the story gets complicated. When you're evaluating either option, demand held-meeting data. If they can't provide it, that tells you everything.

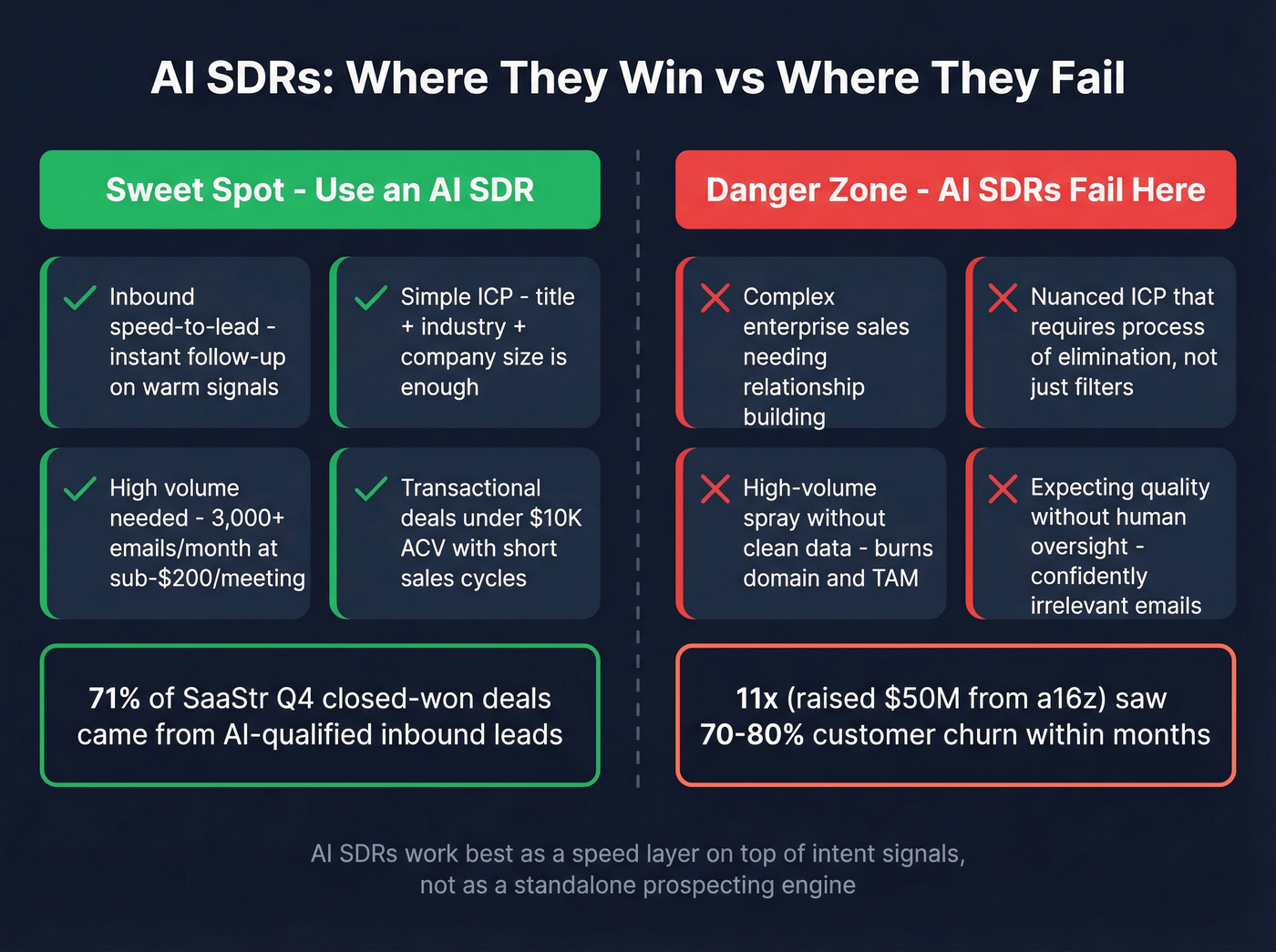

Where AI SDRs Actually Work (and Where They Fail)

When AI SDRs Deliver

The best AI SDR use case isn't cold outbound. It's speed-to-lead on warm signals.

SaaStr deployed 20+ AI agents and published the operational data. Their AI SDRs send 3,221 emails/month versus 75-285 for human SDRs - that's 11-40x the volume. Response rates ran 5.5-12% depending on campaign warmth. Their AI inbound agent processed 45,188 sessions, qualified 1,025 prospects, booked 91 meetings, and closed $1,010,000 in revenue in the first 90 days. 71% of Q4 closed-won sponsorship deals came from AI-qualified inbound leads.

Here's a stat that surprised me: G2 data shows buyers actually trust AI chatbots more than human salespeople for initial interactions - 17.2% versus 9.3%. The "people want to talk to humans" argument is weaker than most sales leaders assume, at least at the top of the funnel.

The Saturday night anecdote is real. An AI SDR booked a six-figure sponsor meeting at 6:02 PM on a Saturday. No human SDR is working that shift.

AI SDRs deliver when:

- You're handling inbound or warm leads that need instant follow-up

- Your ICP is simple enough to define with filters (title + industry + company size)

- You need high-volume outbound and have the infrastructure to manage it

- Speed matters more than nuance - think sub-$10K deals with transactional sales cycles

The pattern is clear: AI SDRs work best as a speed layer on top of existing intent signals, not as a standalone prospecting engine.

When AI SDRs Fail

Here's where it gets ugly.

The term I keep seeing on Reddit is "confidently irrelevant." AI SDRs write hyper-personalized intros - referencing your job title, your company's latest post, your tech stack - then pivot to a completely unrelated pitch. One example that made the rounds: "Really impressed by how your PM team is scaling [Feature] - I bet you'd love our travel reimbursement software!" More volume, less signal. Still spam, just with creepier intros.

The 11x cautionary tale. 11x raised $50M from Andreessen Horowitz and became the poster child for AI SDR hype. The reality? Users on Reddit called it "incredibly underwhelming" with "pretty much zero results." Human reps consistently outperformed on meeting quality and show rates. The tool churned an estimated 70-80% of customers within months. They falsely claimed companies like ZoomInfo and Airtable as customers, per TechCrunch reporting.

Artisan's CEO admitted publicly: "We had extremely bad hallucinations when we first launched."

That's the CEO. Saying this out loud.

The most damning quote came from a founder who built an AI SDR, tested it, and then killed his own product. His verdict: "the most under-delivered promise in MarTech." His diagnosis: AI SDRs can't build sharp prospect lists (that requires process of elimination, not just filters), they generate generic messaging at volume which guarantees burned leads and destroyed deliverability, and they're stuck at the top of the funnel with no ability to handle the messy middle of a sales conversation.

The structural problem is this: AI SDRs optimize for superficial signals - opens, replies, booked meetings. They don't optimize for held meetings, pipeline quality, or revenue. And when you're spraying 2,500 emails a day with mediocre targeting, you're not just wasting money. You're burning through your TAM and damaging your domain reputation. That cost doesn't show up on any dashboard.

Where Agencies Actually Work (and Where They Fail)

When Agencies Deliver

Agencies earn their fee in three scenarios: complex enterprise sales where relationship-building matters, new market entry where you don't have a playbook, and situations where you have zero internal outbound infrastructure and need pipeline yesterday.

The speed advantage is real. An outsourced team goes live in 2-4 weeks with tested playbooks. An in-house hire takes 3-4 months to ramp. If your board is asking for pipeline next quarter, not next year, agencies are the fastest path.

The agency market has matured. Belkins is the most recognized name in the space. CIENCE runs large-scale multichannel campaigns. SalesHive offers month-to-month contracts - rare in an industry that loves lock-ins. memoryBlue (which acquired Operatix) focuses on enterprise tech and global expansion. Martal Group specializes in IT, SaaS, and cybersecurity with an intent-data-driven approach. The right agency, given 12-18 months, can compress what would take an in-house team 3 years to optimize. That's the core value proposition - agencies bring playbooks and human judgment that AI still can't replicate for complex deals.

When Agencies Fail

Now for the horror stories.

The $50K lesson. One Reddit user documented spending $50K on three SDRs through an agency. The results: 15,000+ cold emails, a 1.2% response rate (mostly "unsubscribe"), 8 meetings booked, 2 deals closed. Cost per deal: $25,000. They switched to content marketing and got better results for essentially nothing.

The outright scam. Another buyer paid $1,000 per campaign to an agency that claimed to use ZoomInfo premium data. After a month: zero reports, zero transparency, zero results. "Basically got scammed" was the exact phrasing.

Then there's the dirty secret that even AI SDR vendors have surfaced: agencies are increasingly using AI tools behind the scenes while charging you for "manual, personalized outreach." You're paying $5,000/month for a human touch that doesn't exist.

The structural problems with agencies are predictable:

Black-box operations. Many agencies won't share their targeting criteria, email copy, or raw campaign data. You're trusting a vendor with your brand's reputation and getting a monthly slide deck in return.

Misaligned incentives. Agencies optimize for booked meetings - that's their metric. Held meetings and closed revenue are your metrics. These aren't the same thing, and the gap between them is where agency relationships die.

No residual value. When the contract ends, your outbound engine disappears with it. You don't own the playbook, the data, or the infrastructure. You're renting pipeline, not building it.

We've seen teams spend $20K-$30K before they can even tell whether an agency is good or bad. That's an expensive way to learn.

The Problem Nobody Talks About: Your Data Is Garbage

Here's the upstream problem that makes both AI SDRs and agencies fail: the data feeding them is wrong.

B2B contact data decays 2-3% per month. People change jobs, companies get acquired, phone numbers rotate. In a year, a quarter of your database is stale. Gmail and Yahoo enforce tighter deliverability rules - SPF, DKIM, DMARC authentication, spam complaints under 0.3%. Send to a list with 15% invalid emails and your domain reputation tanks. It doesn't matter whether a human or a robot wrote the email.

An AI SDR sending 2,500 emails a day with 85% accuracy is generating 375 bounces daily. That's not a pipeline strategy. That's a deliverability death spiral.

An agency using "ZoomInfo premium data" that's 6 weeks stale is burning your brand on contacts who left the company two months ago.

You're automating garbage.

Whether you choose an AI SDR or an agency, the first question isn't "which one books more meetings?" It's "is the data feeding this thing actually accurate?" Get that wrong, and nothing downstream matters.

AI SDRs fail when they blast bad data. Agencies fail when they burn your domain. Both problems start with the same root cause: unverified emails. Prospeo's 7-day refresh cycle and 5-step verification keep bounce rates under 4% - the exact threshold that protects your sender reputation.

Fix the data layer first. Everything else is noise.

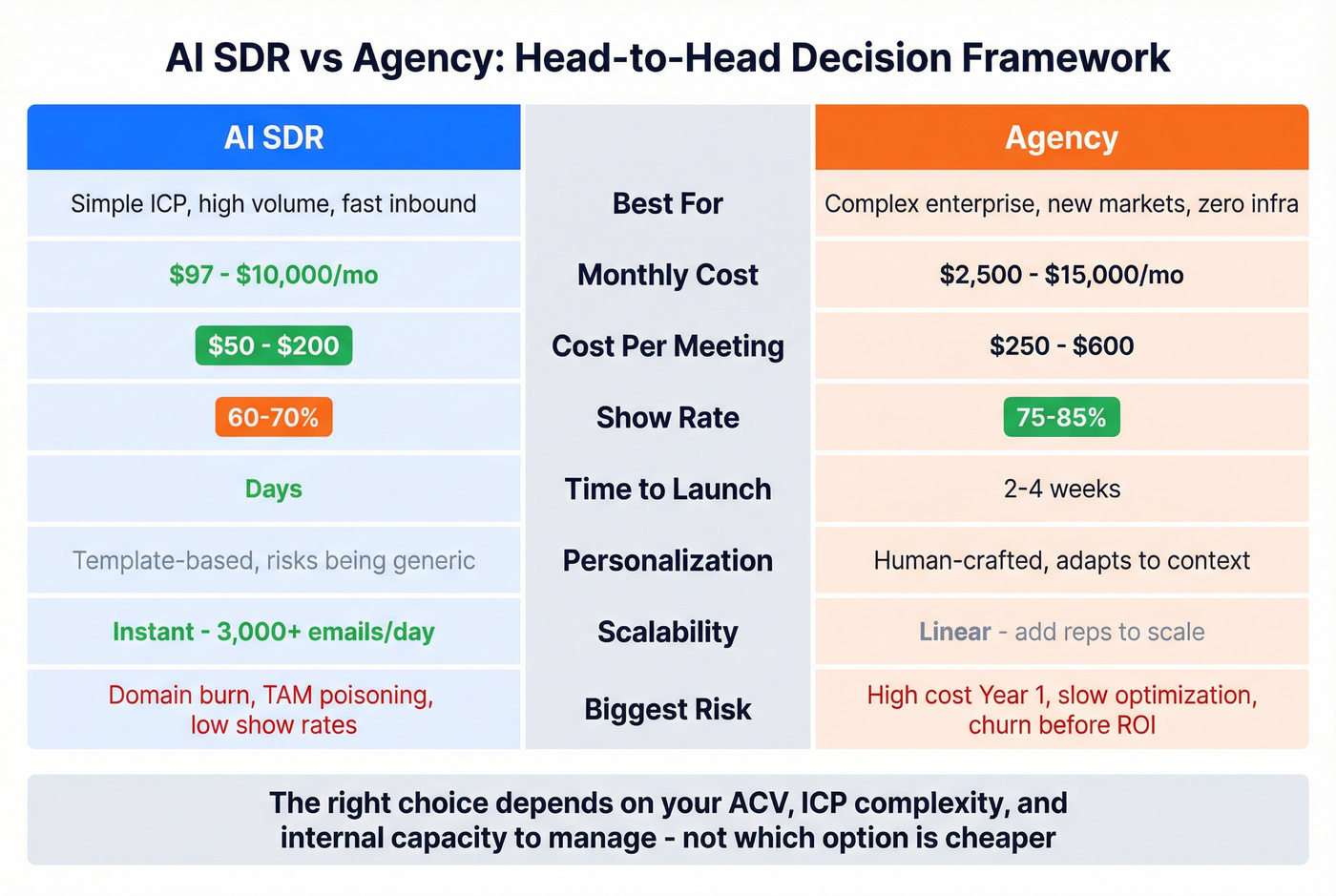

How to Actually Decide: The AI SDR vs Agency Framework

Stop thinking about this as a binary choice. Think about five variables.

Budget

- Under $1K/mo: DIY stack. Use a verified data provider for prospect emails and mobiles, Instantly or Smartlead for sending, Clay for enrichment. One practitioner documented running 1,000 emails/day on a DIY infrastructure for $1,175/month - and outperforming agencies charging 5x that.

- $1K-$3K/mo: AI SDR (budget tier). SalesTools.io, LeadLoft, or Agent Frank. You'll need internal ops capacity to manage it.

- $3K-$7K/mo: Agency (entry/mid-market) or premium AI SDR. This is the decision zone where the rest of the variables matter most.

- $7K+/mo: Agency (mid-market/enterprise) or hybrid approach. At this budget, you can run both.

Deal Size

Under five figures? AI SDRs. The economics of paying a human $400 per meeting to book a $7K deal don't work.

For $50K+ deals with 6-month sales cycles, you need humans in the loop - and the human vs AI BDR debate tilts decisively toward humans at this deal size.

Sales Cycle Complexity

Transactional sales (clear problem, known solution, short cycle) → AI SDR. Consultative sales (multiple stakeholders, custom solutions, long cycle) → agency or in-house. Most AI SDR tools on the market today handle outreach, not deals. They're top-of-funnel machines. If your sales process requires qualification, multi-threading, or custom demos before a deal moves forward, you need a human somewhere in the loop.

Team Size & Market Maturity

Solo founders and teams under 5: DIY stack or AI SDR. Teams of 10+: agency or hybrid.

Established ICP with proven messaging → AI SDR. New market, unproven messaging → agency.

The Hybrid Play

This is where the data points. One analysis showed a hybrid model (AI for volume + initial qualification, humans for conversations and complex deals) delivering 428% ROI versus 92% for pure human approaches. A UK SaaS company cut their sales cycle from 45 to 28 days using a hybrid setup. Payback periods: 2-4 months for SMB, 4-6 months for enterprise.

The practical version: use an AI SDR for inbound follow-up and high-volume top-of-funnel outreach. Use humans (in-house or agency) for the meetings that actually matter. Let the AI do what it's good at - speed and volume. Let humans do what they're good at - judgment and relationships.

36% of B2B companies decreased SDR/BDR headcount last year, per Emergence Capital data across 400+ companies. Only 19% increased headcount. The market is moving toward augmentation, not replacement. Some teams are even asking whether a CRM can replace SDR hiring entirely - and while platforms like HubSpot and Salesforce are adding AI-powered outreach features, they still can't replicate the strategic thinking a good BDR brings to complex deals.

FAQ

Can an AI SDR fully replace a human SDR?

No. AI SDRs handle volume (500-2,500 emails/day, sub-60-second inbound response) but show rates drop to 60-70% versus 75-85% for humans, and they can't navigate complex objections. Best results come from hybrid setups where AI qualifies and humans close. The performance gap narrows for simple, transactional deals but widens as deal complexity increases.

How long before an SDR agency delivers results?

Expect first meetings within 2-4 weeks, but realistic cost-per-meeting in Year 1 is $3,000-$5,000 for mid-market B2B. Agencies need 12-18 months to optimize down to ~$1,000 per meeting. Ask for month-to-month contracts to limit risk during that evaluation window.

What's the biggest risk with AI SDRs?

Brand damage from "confidently irrelevant" outreach that burns your TAM and destroys domain reputation. 11x churned 70-80% of customers within months despite $50M in funding. The risk isn't wasted budget - it's permanently poisoning your market before your product gets a fair shot.

How do I know if my SDR agency is using AI tools behind the scenes?

Ask for their tech stack and personalization process, then request real-time campaign data access - not monthly reports. If they can't explain how each email is crafted or won't share targeting criteria, they're running automation while charging for manual work.

What's the most cost-effective way to start outbound in 2026?

A DIY stack: a verified data provider like Prospeo for prospect emails (98% accuracy, ~$0.01/email), Instantly or Smartlead for sending, Clay for enrichment. Total: $300-$800/month - less than one month of most AI SDR tools, and you own the infrastructure from day one.