AI for Bootstrapped SaaS Sales in 2026: The Operator Playbook

Bootstrapped SaaS sales used to be "do a little outbound, post on social, pray." In 2026, that's not enough, because your competitors are using ai for bootstrapped saas sales to run tighter loops: cleaner data, faster follow-up, and consistent volume.

At scale, the only numbers that really matter are bounce rate and spam complaints. Everything else is downstream.

Why AI is now table stakes for bootstrapped sales (and what AI isn't)

AI's table stakes because it's the cheapest labor you'll ever hire, and it doesn't get tired of tagging replies, enriching leads, or writing first drafts of outreach. SaaS Capital's private SaaS survey (around ~1,000 exec responses, mostly CEOs/CFOs/operators) found 69% of companies already use AI in day-to-day operations, and 76% use it in product. That's not "early adopter" territory anymore. It's the default.

Here's the contrarian part: AI doesn't fix bad fundamentals. It amplifies them.

If your list is junk, AI helps you spam faster. If your offer's weak, AI helps you get ignored at scale. If your follow-up is slow, AI helps you generate "insights" while hot leads go cold.

Here's the thing: most founders don't have a tooling problem. They've got a latency problem.

Hot take: if your deal size is small (say, low five figures or less), you don't need an "all-in-one" enterprise sales suite. You need deliverability + verified data + ruthless follow-up. Everything else is a distraction tax.

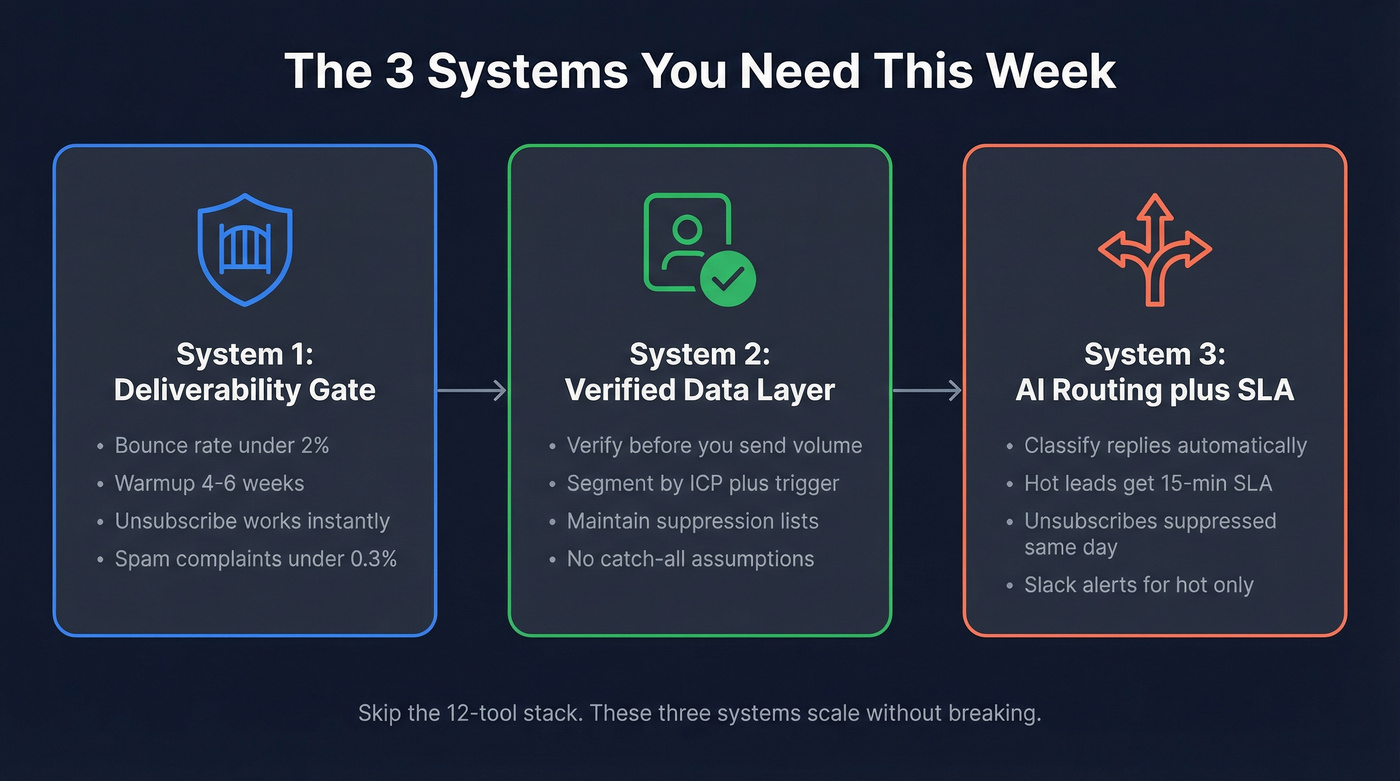

What you need (quick version): the 3 systems to implement this week

You don't need 12 tools. You need three systems that don't break when you scale.

System 1: Deliverability gate (do this / skip this)

Do this

- Treat deliverability like a release checklist, not vibes.

- Build to provider rules: Yahoo's spam complaint threshold is <0.3%.

- Set hard internal gates before you scale volume:

- Bounce rate <2% (see bounce rate fixes)

- Warmup 4-6 weeks, starting 5-10/day per inbox (follow a real warmup playbook)

- Unsubscribe works instantly, and opt-outs are honored fast

Skip this

- Scaling to 500-1,000/day because a benchmark screenshot said "10% replies."

- "Spray and pray" lists that haven't been verified.

- AI personalization that pulls creepy/non-public details (it spikes complaints) (common AI cold email personalization mistakes).

System 2: Verified data layer (do this / skip this)

Do this

- Use verified contacts before volume. One bad list can burn a domain in a week. (Use an email verification list SOP.)

- Segment by ICP + trigger (job change, headcount growth, intent topic), not just title (get tighter on your Ideal Customer).

- Keep a suppression list (unsubscribes, bounces, "do not contact").

Skip this

- Buying a giant database and assuming it's clean.

- Counting "catch-all" emails as deliverable without verification (use a real verify an email address workflow).

System 3: AI routing + SLA (SLA rules table)

Your routing system should feel boring. Boring's good. Boring means deals don't slip.

| Incoming signal | AI classification | Owner action | SLA | Alert? |

|---|---|---|---|---|

| "Interested / send times" | Hot | Reply + book | 15 min | Slack: yes |

| "Maybe / Q3" | Not now | Set follow-up date | 24 hrs | Slack: no |

| "Not a fit" | Objection | One-line close-the-loop | 24 hrs | Slack: no |

| "Stop / remove me" | Unsubscribe | Confirm removal + suppress | Same day | Slack: no |

| "Wrong person" | Wrong person | Find correct contact + continue thread | 24 hrs | Slack: no |

Channel mix that actually works for bootstrappers (2026 reality)

Most founders over-index on cold email and under-index on "cheap trust." The best bootstrapped motion is a channel mix where outbound creates conversations and everything else increases conversion.

- Cold email at real volume: 200-1,000/day only after your deliverability gate is green (see how to scale outbound sales without burning domains).

- Reddit + niche communities: comment like a human, not a marketer. Two helpful comments a day beats one "thought leadership" post a week.

- Content cadence: one "operator" post weekly (a teardown, a template, a benchmark). Consistency wins; virality's optional.

- Partnerships: one integration partner or agency partner can outproduce 10,000 cold sends if your offer's clean.

- Customer network mapping: ask new customers "who else should see this?" and actually follow up. Referrals aren't luck; they're a process.

Reality check benchmarks (so you don't get discouraged)

Plan for 3-5% replies and 1-3% meetings on cold outbound when you're doing it right. If you're below that, it's usually list quality, deliverability, or offer, not "you need better prompts."

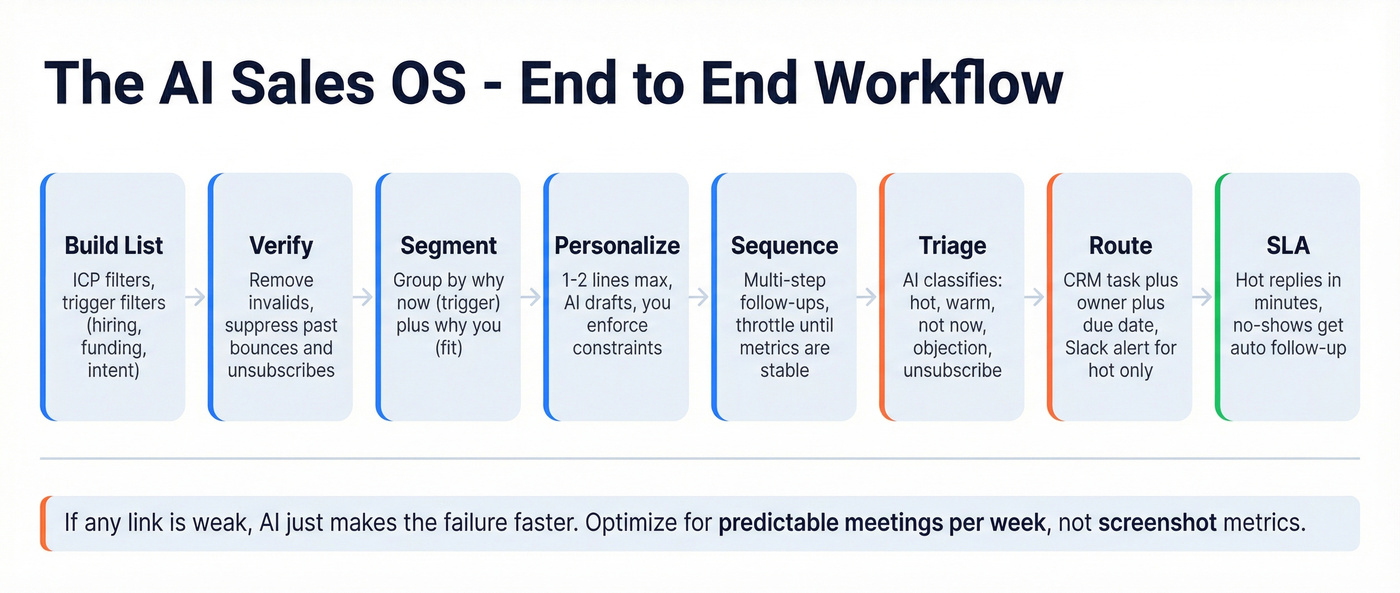

The AI Sales OS for bootstrapped SaaS (the full workflow)

Think in an end-to-end chain. If any link is weak, AI just makes the failure faster.

List -> Verify -> Segment -> Personalize -> Sequence -> Triage -> CRM tasks -> Follow-up SLA

Here's a simple text "diagram" you can copy into Notion:

1) Build list

- ICP filters (industry, size, tech, region)

- Trigger filters (hiring, funding, intent topics, job changes)

2) Verify

- Remove invalids and risky catch-alls

- Suppress past unsubscribes/bounces

3) Segment

- Segment by "why now" (trigger) + "why you" (fit)

- Keep segments small enough to learn fast

4) Personalize (lightly)

- 1-2 lines max, based on trigger + role pain

- AI writes drafts; you enforce constraints

5) Sequence

- Multi-step follow-ups (most replies come after email 1)

- Throttle volume until metrics stay stable

6) Triage

- AI classifies replies: hot / warm / not now / objection / unsubscribe

- AI extracts next action and suggested response

7) Route

- Create CRM task + owner + due date (keep your CRM data clean so routing doesn’t rot)

- Alert in Slack for "Hot" only (don't spam your own team)

8) SLA

- Hot replies get a response in minutes, not "later today"

- No-shows and "not now" get scheduled follow-ups automatically

Benchmarks are misleading without volume context. I've watched teams celebrate a 12% reply rate on 80 emails, then panic when it drops to 2% at 20,000 sends/month. That's normal, and it's why you should optimize for predictable meetings per week without burning domains, not screenshot metrics that don't survive scale.

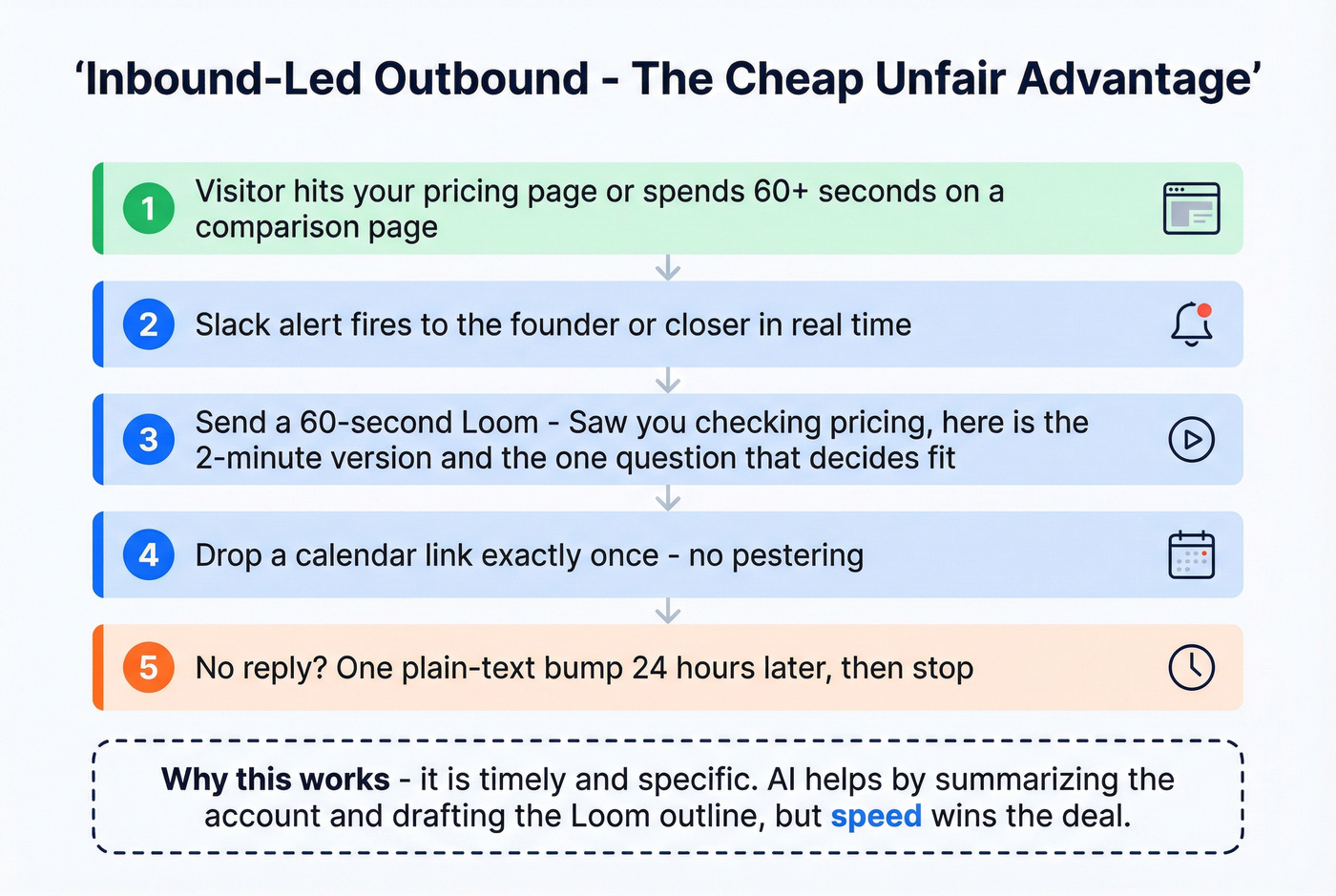

Inbound-led outbound (cheap, unfair advantage)

Bootstrapped teams love outbound because it's controllable. The smarter play is inbound-led outbound: use inbound signals to make outbound feel inevitable.

A simple flow:

- Someone visits your pricing page (or spends 60+ seconds on a comparison page).

- Slack alert to the founder (or whoever can close).

- Send a 60-second Loom: "Saw you checking pricing - here's the 2-minute version and the one question that decides fit."

- Drop a calendar link only once.

- If no reply, follow up with one plain-text bump 24 hours later.

This works because it's timely and specific. AI helps by summarizing the account, pulling likely objections, and drafting the Loom outline, but speed wins the deal.

Your playbook says verified data before volume. Prospeo delivers 98% email accuracy with a 7-day refresh cycle - so your bootstrapped outbound hits real inboxes, not spam traps. 30+ filters for intent, job changes, and headcount growth mean every send has a 'why now.'

Stop burning domains on bad data. Start sending to verified buyers.

Deliverability & compliance non-negotiables (2026-ready)

If you're bootstrapped, deliverability's existential. One domain getting flagged can wipe out a month of pipeline.

Provider requirements you don't get to debate

Yahoo (bulk sender rules that matter in practice)

- Authentication: SPF + DKIM

- DMARC: p=none minimum (and DMARC must pass)

- One-click unsubscribe: List-Unsubscribe with one-click support

- Honor unsubscribes within 2 days

- Spam complaint rate <0.3%

Barracuda's summary of the Google/Yahoo bulk-sender guidance

- Bulk sender threshold: >5,000/day

- Spam rate target: <0.1%

- Never hit 0.3%+ (that's the danger zone)

This is why "just send more" is bad advice. Volume multiplies mistakes.

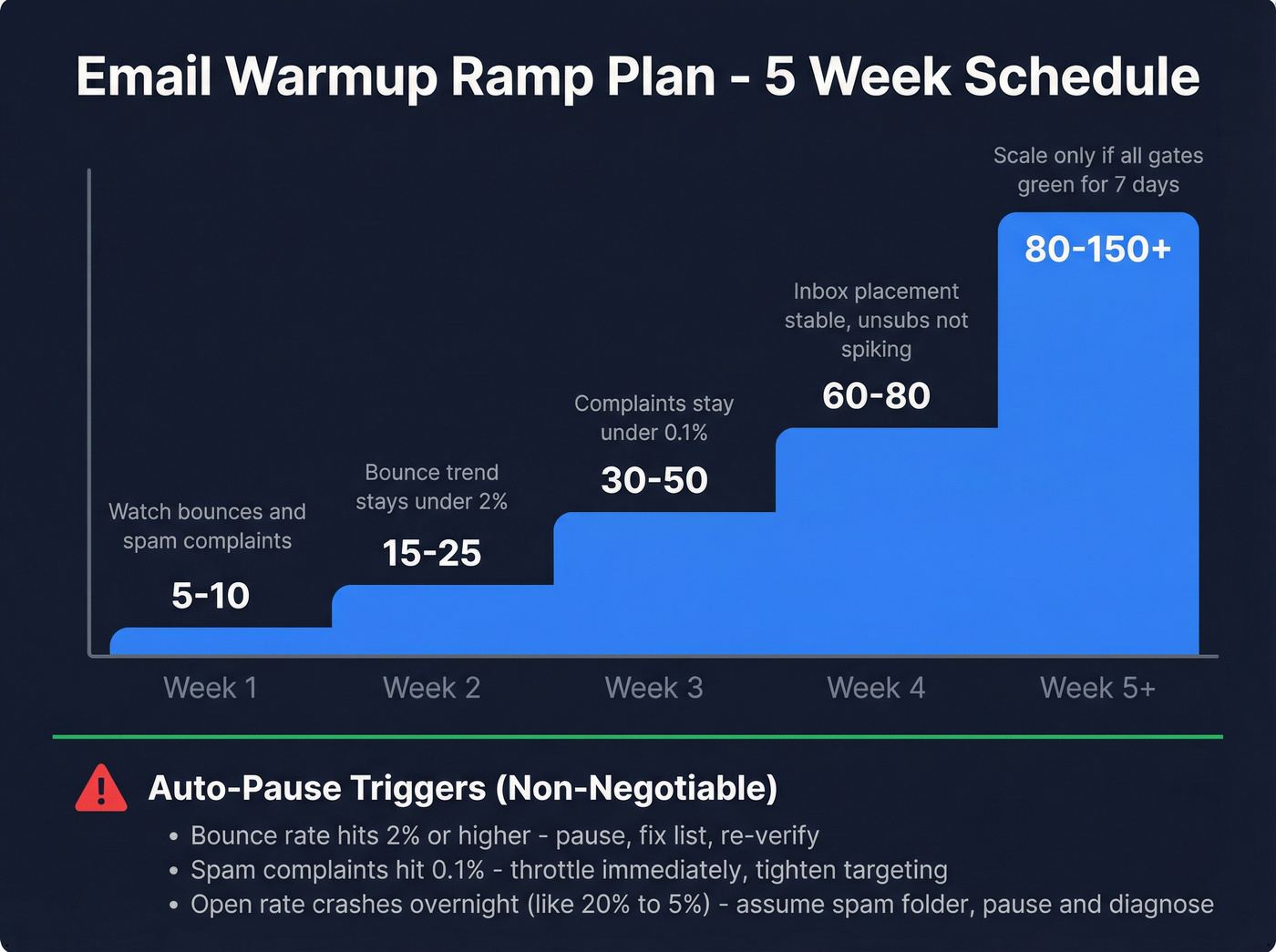

Week-by-week warmup + ramp plan (with pause rules)

This is the ramp I'd run for a bootstrapped team that wants to scale without nuking domains. It's conservative on purpose.

| Week | Sends per inbox per day | What you're watching |

|---|---|---|

| 1 | 5-10 | bounces, spam complaints, basic reply signals |

| 2 | 15-25 | bounce trend stays under 2% |

| 3 | 30-50 | complaints stay under 0.1% target |

| 4 | 60-80 | inbox placement stays stable; unsubscribes aren't spiking |

| 5+ | 80-150+ | scale only if all gates are green for 7 days |

Auto-pause triggers (non-negotiable)

- Bounce rate >=2% on any meaningful batch -> pause, fix list, re-verify.

- Spam complaints >=0.1% -> throttle immediately, tighten targeting, simplify copy.

- Sudden open-rate collapse (e.g., 20% -> 5% overnight) -> assume spam-folder placement; pause and diagnose.

Failure modes (and the fast fix)

Deliverability failures look mysterious until you treat them like incidents.

Symptom: open rate falls off a cliff Likely cause: spam-folder placement from complaints or sudden volume jump. Fix: cut volume 50-80%, remove risky segments, shorten copy, and stop "clever" personalization.

Symptom: bounce spikes out of nowhere Likely cause: unverified list source, catch-all assumptions, or a bad export merge. Fix: re-verify the entire batch, enforce suppression, and stop sending until bounce is back under 2%.

Symptom: replies are fine but meetings drop Likely cause: slow follow-up or weak CTA. Fix: tighten SLA (15 minutes for hot), and ask one question that qualifies instead of pitching features.

Your internal "gate to scale" checklist (print this)

Authentication & alignment

- SPF passes for your sending domain (use this SPF DKIM & DMARC setup guide)

- DKIM passes and aligns

- DMARC exists and passes (start with p=none, then tighten later)

- PTR/rDNS and TLS are configured (your infra provider usually handles this)

List hygiene

- Bounce rate <2% (hard stop if you exceed it)

- No role accounts (info@, sales@) unless you're intentionally targeting them

- Suppression list's enforced everywhere (CRM + sequencer + sheets)

Warmup & ramp

- Warmup 4-6 weeks

- Start 5-10/day per inbox

- Increase slowly; don't double overnight

Complaint prevention

- Don't use deceptive subject lines

- Don't over-personalize with creepy data

- Keep copy short and relevant

- Make unsubscribe obvious (yes, even for cold)

Compliance basics (the founder version)

You're not trying to become a lawyer. You're trying to avoid obvious risk.

- GDPR penalties can be up to EUR20M.

- CAN-SPAM civil penalties can be up to $50,120 per violation in enforcement actions (rare, but real).

- CCPA penalties can be up to $7,500 per violation.

If you add SMS/WhatsApp follow-ups, TCPA exposure can be $500-$1,500 per incident. Actual exposure depends on enforcement and pattern of behavior. Don't play chicken with it.

The easiest compliance win is operational: make opt-out instant, honor it fast, and don't message people who asked you to stop.

The data layer: build verified lists without burning domains

Most bootstrapped outbound fails for a boring reason: the list's bad. Not "a little messy" - bad enough to cause bounces, complaints, and silent spam-folder placement.

And when that happens, founders do the wrong diagnosis. They rewrite copy. They buy another sequencer. They add more inboxes. Meanwhile the real issue is upstream: you're feeding garbage into the system.

The verified-first workflow (what actually works)

Step 1: Start with a narrow ICP Pick one wedge you can win. If you're early, "everyone" is a trap.

Good filters:

- Industry + employee range

- Tech stack (if relevant)

- Geography/time zone

- A trigger that creates urgency (hiring, headcount growth, job change, intent)

Step 2: Pull contacts + verify before you send In our experience, this is where bootstrapped outbound either becomes a machine or turns into a domain-rehab project.

If you want to see what "verified-first" looks like in practice, their Email Finder is a clean starting point: https://prospeo.io/email-finder

Step 3: Segment and suppress

- Segment by trigger + persona

- Suppress: unsubscribes, bounces, competitors, existing customers, "do not contact"

Step 4: Export into your sequencer Push verified contacts into Smartlead/Instantly and keep the source-of-truth list somewhere you can audit (HubSpot or even Google Sheets early on).

Mini decision table: what to use for list building (bootstrapped reality)

| Need | Best move | Why it matters |

|---|---|---|

| Verified emails | Prospeo | Protects domains |

| Enrichment ops | Clay | Flexible workflows |

| Send at scale | Smartlead / Instantly | Predictable sequences |

| "Free" lists | Sheets scraping | Usually burns you |

The cost of bad data (why this is non-negotiable)

A bounce isn't just a bounce. It's a reputation signal.

- Bounce spikes -> inbox providers throttle you.

- Complaints spike -> you hit the 0.3% line and get punished.

- Unsubscribes ignored -> you create angry recipients (and more complaints).

I've run bake-offs where the "cheapest" list source ended up being the most expensive because it caused a deliverability collapse and forced a full domain reset. That's weeks of lost pipeline you don't get back.

A quick note on "intent" for bootstrapped teams

Intent data's only useful if you can act on it fast. The best use is simple: "they're researching X" -> you send a relevant message today, not next week. (If you want to operationalize this, start with intent signals.)

If your follow-up SLA is slow, intent becomes an expensive dashboard.

Benchmarks + funnel math for ai for bootstrapped saas sales

Benchmarks are useful as guardrails, not goals. The fastest way to get demotivated is comparing your 20,000-send reality to someone's 50-contact "hyper-personalized" experiment.

Directional outbound benchmarks (cold email)

| Metric | Typical range | What it means |

|---|---|---|

| Open rate | 15-25% | Deliverability + subject |

| Reply rate | 3-5% | Offer + targeting |

| Meetings | 1-3% | Fit + follow-up |

Volume changes everything. At 100K+/month, a ~1.6% reply rate can still be a working machine if your meeting conversion and close rate are solid. That's why "low reply rate" isn't automatically bad. It's only bad if the funnel doesn't produce revenue.

Copy constraint that wins: timeline hooks + 3-7-7 follow-ups

Most cold email fails because it's vague. The fix is a tight hook and a disciplined follow-up cadence.

Two hooks that work (copy/paste)

- Timeline hook: "Quick one - are you evaluating a solution for {{problem}} in the next 30-60 days, or is this a later-in-the-year project?"

- Problem hook: "I'm reaching out because teams like {{peer}} keep running into {{pain}} once they hit {{trigger}}. Is that on your radar?"

3-7-7 cadence (simple, effective)

- Day 0: Email 1 (hook + one question)

- Day 3: Email 2 (new angle: proof or short teardown)

- Day 10: Email 3 (direct bump + opt-out)

- Day 17: Email 4 (breakup / referral ask)

This cadence works because it's spaced enough to avoid annoyance but tight enough to catch active buyers while they're still active.

Funnel math walkthrough (internally consistent)

Let's say you send 10,000 emails/month.

Assumptions:

- Reply rate: 4% -> 400 replies

- Positive reply rate: 25% -> 100 positive replies

- Positive -> meeting booked: 50% -> 50 meetings

- Close rate from meetings: 15% -> 7-8 new customers

That's the model to optimize. If you want more customers, you can pull four levers:

- Better list quality (more replies)

- Better offer (more positives)

- Faster follow-up (more meetings)

- Better sales process (higher close rate)

Copy this: AI workflows that save founder time (triage + routing + SLA)

AI automation creates busywork unless it routes to a next action. Your goal's simple: no hot reply sits in an inbox unnoticed.

The lean architecture (works for founders)

Gmail -> label -> AI triage -> HubSpot task -> Slack alert -> Sheets log

This is straight out of an n8n template that's actually usable in the real world:

- Trigger: new Gmail email with a specific label

- AI extracts: intent, urgency, sentiment, next action, summary, priority flags

- Actions: create HubSpot task, notify Slack, log to Google Sheets

If you're bootstrapped, HubSpot's the sweet spot for a lean CRM. Salesforce is great later, but it's overhead early.

Copy/paste workflow blueprint (n8n)

Trigger

- Gmail: "New email in labeled mailbox"

- Label:

inbound-leads(you apply this via filter rules)

AI node (LLM)

- Input: email subject + body + sender address

- Output JSON fields:

intent= {hot, warm, not_now, objection, unsubscribe, wrong_person}urgency= {high, medium, low}next_action= short imperativepriority_score= 1-100suggested_reply= 3-5 sentences maxneeds_follow_up= true/false

HubSpot

- Create task:

- Title:

Reply: {{intent}} / {{company}} - Due: now + 15 minutes if hot, else + 1 day

- Notes: summary + suggested reply

- Title:

Slack

- Only alert if:

intent = hotORurgency = high

- Message includes:

- Sender + company

- Summary

- Next action

- Link to HubSpot task

Google Sheets

- Append row:

- timestamp, sender, domain, intent, urgency, priority_score, owner, status

The 3-minute SLA pattern (steal this)

Buldrr's workflow pattern is simple and brutal:

- Wait 3 minutes

- If lead is "Hot" and "Followed Up?" is empty -> send a reminder

That's the whole advantage. Most bootstrapped teams don't lose deals to competitors with better products. They lose to competitors who respond first. (If you want the benchmark context, see average lead response time.)

Prompt blocks (use these as-is)

Classification prompt

You're a sales ops assistant. Classify this inbound email into: hot, warm, not_now, objection, unsubscribe, wrong_person. Extract urgency (high/medium/low) and a single next action. Output strict JSON only.

Suggested reply prompt

Write a concise reply (max 90 words). Goal: book a call if hot/warm, confirm timing if not_now, address one objection if objection, confirm removal if unsubscribe. No fluff. One question max.

Skip "AI SDR" black boxes early. Build triage/routing with n8n-style blocks so you can audit the logic, change the rules, and swap models without ripping out your process.

Copy/paste: a 4-email sequence + objection snippets

Email 1 (Day 0 - timeline hook)

Subject: {{company}} + {{problem}}

{{firstName}} - quick one. Are you trying to improve {{metric/outcome}} in the next 30-60 days, or is this a later project?

If it's near-term, I can share the exact playbook we've used to get {{result}} without adding headcount. Worth a 10-min chat?

Email 2 (Day 3 - proof + relevance)

Subject: Re: {{company}}

Following up with one concrete example: we helped a {{peer type}} team reduce {{pain}} by {{result}} by fixing {{lever}} first (not "more outreach").

Is {{pain}} a priority this quarter?

Email 3 (Day 10 - teardown offer)

Subject: 2-minute teardown?

If you want, I'll do a quick teardown of your current {{process}} and send back 3 fixes (no deck).

Should I look at {{thing}} or {{thing}}?

Email 4 (Day 17 - breakup / referral)

Subject: close the loop

I haven't heard back, so I'll close this out.

If there's an owner for {{problem}} at {{company}}, who should I talk to?

Objection replies (keep them short)

- "We already have a tool for this." "Makes sense. I'm not trying to replace it - usually the win is tightening {{process}} so the tool actually performs. Want me to share the 3 checks we use to spot leaks?"

- "No budget." "Understood. If I could show a path to {{result}} without adding headcount, would it be worth revisiting next month?"

- "Not a priority." "Got it - when it becomes a priority, what typically triggers it? (New hire, pipeline dip, new target?) I'll follow up around that."

AI for bootstrapped SaaS sales: budget-based stacks (pick tools by outcome, not hype)

Bootstrapped teams don't lose because they lack tools. They lose because they buy the wrong layer first.

Order of operations:

- Deliverability guardrails

- Verified data

- Sequencing

- Enrichment/personalization ops

- Automation + routing

Sequencers (monthly pricing you can actually plan around)

| Tool | Entry | Mid | Scale |

|---|---|---|---|

| Smartlead | $39 | $94 | $174-$379 |

| Instantly | $37 | $97 | ~$358 |

Smartlead's add-ons matter if you're serious about scaling:

- SmartDelivery: $49/mo (Growth) or $174/mo (Pro)

- SmartServers: $39/server/mo

Recommended for: founders who want controlled scaling and deliverability tooling.

Skip this if: you're still figuring out ICP. Don't pay for 150K sends/month when you don't know who you're targeting.

Enrichment/personalization ops (Clay)

Clay is the enrichment workbench. It's powerful, but the credit system is a tax if you don't design workflows carefully.

| Plan (billed yearly) | Price | Good for |

|---|---|---|

| Free | $0 | Learning + small tests |

| Starter | $134/mo | Light enrichment |

| Explorer | $314/mo | Webhooks + scale |

| Pro | $720/mo | CRM integrations |

Credit gating reality: if you enrich everything, you'll burn credits fast. If you enrich only the leads that hit your ICP + trigger filters, Clay becomes a force multiplier.

Automation backbone (n8n vs Make/Zapier)

- n8n: typically $0-$50/mo if self-hosted, or ~$20-$100+/mo hosted depending on usage. Best when you want control and real logic.

- Make/Zapier: typically ~$20-$150+/mo for lighter workflows. Best when you want speed and don't care about edge cases.

Vendor-risk note (Clearbit)

Clearbit is the classic "looks perfect until procurement shows up" tool for bootstrapped teams.

- Pricing: typically $10k-$60k/year for smaller teams, and it can reach $100k+/year depending on volume/modules.

- Concrete risk example: Clearbit's Logo API was discontinued Dec 1, 2026.

That's not a knock on Clearbit. It's a reminder that vendor roadmaps change, and bootstrapped stacks should minimize lock-in.

Three stacks I'd actually run (with rough monthly totals)

Stack A: "Just ship pipeline" (solo founder) - ~$80-$220/mo

- Verified list building: ~$40-$120/mo (assumes ~4k-10k verified emails/month at ~$0.01/email plus occasional mobile credits)

- Instantly Growth: $37/mo

- Google Sheets + Gmail: $0

Stack B: "Operator mode" (1-3 people) - ~$250-$800/mo

- Verified data + some mobiles: ~$120-$400/mo (same assumption, higher volume + a few direct dials)

- Smartlead Pro: $94/mo

- Clay Starter: $134/mo (billed yearly)

- n8n hosted: ~$20-$100/mo

Stack C: "Scale outbound safely" (3-8 people) - ~$800-$2,500/mo

- Verified data + intent + mobiles: ~$400-$1,200/mo

- Smartlead Smart/Prime: $174-$379/mo + add-ons as needed

- Clay Explorer/Pro: $314-$720/mo (billed yearly)

- n8n + Slack + HubSpot: varies, but predictable

Real talk: I've seen teams waste months "optimizing AI prompts" while their real bottleneck was that nobody owned follow-up SLAs. Spend money where it reduces risk: verified data and routing.

1-week implementation sprint (day-by-day)

If you want momentum, run this as a sprint. You'll have a working system in 7 days, no heroics.

- Day 1: Define ICP wedge + offer Output: 1 ICP paragraph, 3 triggers, 1 primary CTA question.

- Day 2: Set deliverability gates Output: SPF/DKIM/DMARC checked, suppression list created, unsubscribe tested.

- Day 3: Build + verify first list Output: 500-1,000 verified contacts in 1-2 tight segments.

- Day 4: Write the 4-email sequence + objections Output: sequence loaded, one variable to test (hook or CTA).

- Day 5: Launch low volume Output: 5-10/day per inbox, monitoring bounce/complaints.

- Day 6: Build triage + routing automation Output: hot replies -> tasks + Slack alerts, not-now -> follow-up dates.

- Day 7: Review + tighten Output: kill the worst segment, keep the best, and plan Week 2 ramp.

FAQ

What spam complaint rate should I target for cold email in 2026?

Target <0.1% spam complaints as your operating goal, and treat 0.3% as the hard danger line because Yahoo enforces that threshold for senders. If you're creeping up, throttle volume, tighten targeting, and simplify copy before you burn your domain reputation.

What reply rate is "good" for bootstrapped SaaS outbound at real volume?

A "good" reply rate is 3-5% on normal volumes, with 1-3% turning into meetings. At 100K+/month, even ~1.6% replies can work if meeting conversion and close rate are healthy. Judge success by meetings and revenue, not screenshot-worthy replies.

Do I need DMARC and one-click unsubscribe if I'm sending cold email?

Yes - DMARC (p=none minimum) and one-click unsubscribe are table stakes for bulk sending to major inbox providers, and Yahoo requires honoring unsubscribes within 2 days. Even at low volume, setting this up early prevents painful deliverability resets later.

What's a good free tool for verified B2B leads without contracts?

Prospeo's free tier includes 75 emails plus 100 Chrome extension credits per month with real-time verification, which is enough to run a 7-day micro-pilot without signing anything. Pair it with Instantly or Smartlead and keep bounce rate under 2% before you scale.

What's the simplest AI workflow to avoid missing hot replies?

Label inbound emails in Gmail, then use an automation where AI extracts intent/urgency/next action and creates a HubSpot task plus a Slack alert for "Hot" replies. Add a 3-minute check: if it's hot and nobody followed up, trigger a reminder.

The article's clear: bounce rate under 2% or don't scale. Prospeo's 5-step verification with catch-all handling and spam-trap removal keeps you under that gate - at $0.01/email. Teams using Prospeo see bounce rates drop from 35%+ to under 4%.

Build the deliverability-first stack your bootstrapped motion demands.

Summary: ai for bootstrapped saas sales is a system, not a prompt

The point of ai for bootstrapped saas sales isn't "better copy." It's a boring, reliable operating system: deliverability gates so you don't get flagged, verified data so you don't bounce, and routing + SLAs so hot replies get handled in minutes.

Nail those three layers first. Then scale channels and volume without lighting your domains on fire.