Cloze vs HubSpot: A Real Estate CRM vs a Horizontal Platform - Here's How to Choose

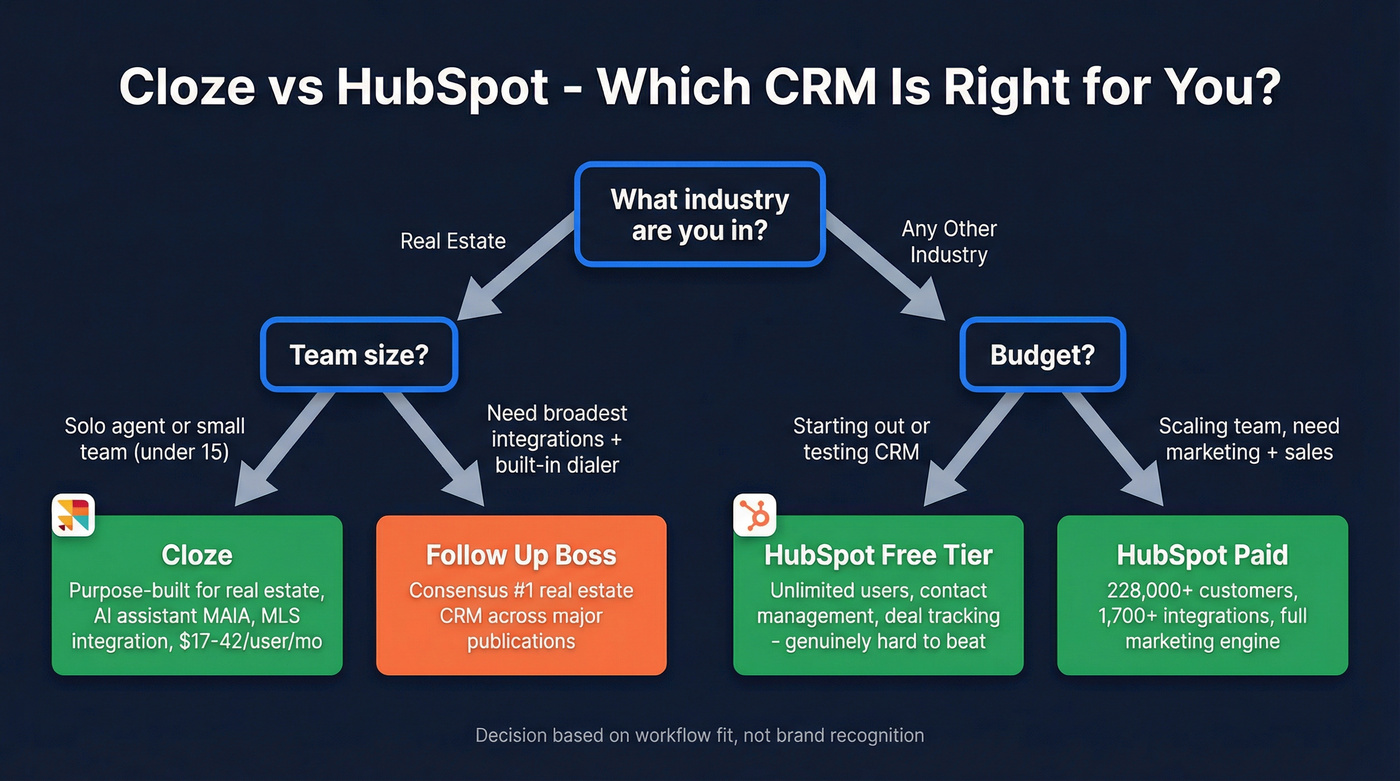

Your brokerage just rolled out Cloze as a CRM option. You've never heard of it. You pull up G2 and see 38 reviews - then you look at HubSpot's 13,000+. Your gut says go with the name you know. But the Cloze vs HubSpot decision isn't about brand recognition. It's about whether you sell houses or software.

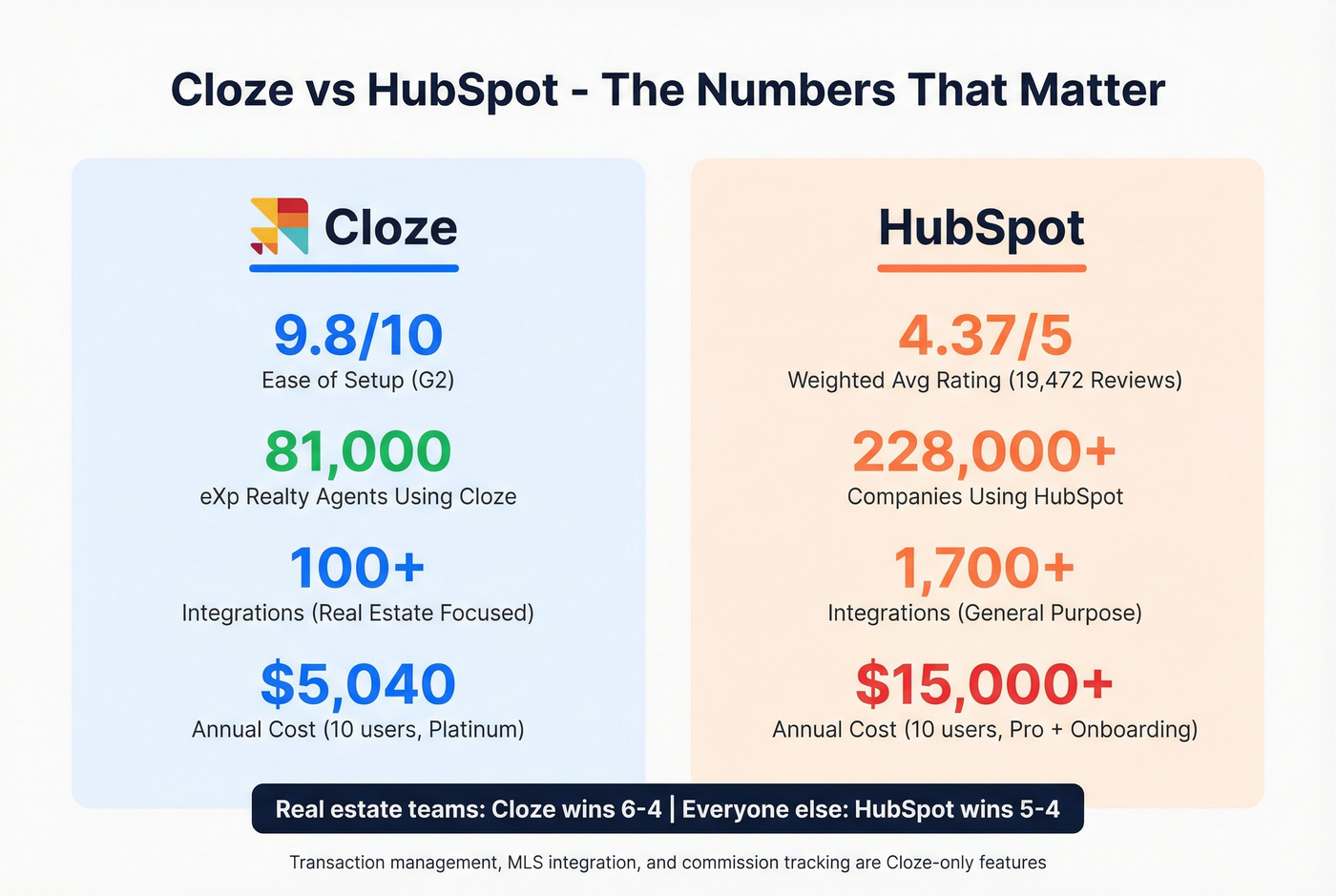

Cloze isn't the generic relationship manager it was in 2012. It's pivoted hard into real estate, landed eXp Realty's 81,000 agents, and shipped an AI assistant that speaks MLS, not marketing funnels. HubSpot, meanwhile, is the everything platform - 228,000+ customers, 1,700+ integrations, and a free tier that's genuinely hard to beat. Comparing them is like comparing a fishing boat to a cargo ship. Both float. Both move. They're built for completely different water.

Here's how to pick the right one without wasting a quarter on the wrong CRM.

30-Second Verdict

- If you're a real estate agent or brokerage: Cloze wins. Purpose-built for your workflow, an AI assistant (MAIA) that understands listings and transactions, and adopted by eXp Realty's 81,000 agents.

If you're in any other industry: HubSpot wins, and it's not close. Horizontal platform, 1,700+ integrations, free tier to start, and a marketing engine Cloze can't touch outside of property.

Skip both if: You need a real estate CRM with the broadest integration ecosystem and a built-in dialer - Follow Up Boss is the consensus #1 across every major publication.

Cloze in 2026 - Not the Generic CRM You Think It Is

Cloze started life in 2012 as a general-purpose relationship manager. Around 2015, it pivoted to real estate - and that pivot has paid off in ways most people outside the industry haven't noticed.

Here's a stat that explains why Cloze exists: 88% of the people an agent interacts with never make it into their CRM. Cloze's auto-capture - pulling contacts from your actual phone calls, texts, and emails without manual logging - attacks that problem directly. NAR data shows the typical REALTOR earns 41% of business through referrals and repeat clients. If those contacts aren't in your CRM, you're leaving nearly half your revenue to memory and sticky notes.

The headline enterprise move: eXp Realty, the largest independent brokerage with roughly 81,000 agents, selected Cloze for its CRM of Choice program in mid-2025. Agents across the U.S., Canada, and Puerto Rico can use Cloze at no additional cost. That's not a pilot. That's a platform bet.

Then came MAIA, Cloze's AI virtual assistant, launched in fall 2025. Cloze also took home the 2025 Inman AI Award for Best AI-Powered Platform.

The enterprise results back it up:

- Windermere: 74-215% increase in agent engagement with clients after switching to Cloze

- Baird & Warner: Some agents saw sales increases of 50%, 70%, and even 100%

- T3 Sixty Best-in-Class winner three consecutive years

- 2025 Inman AI Award for Best AI-Powered Platform

Despite these enterprise wins, Cloze doesn't appear in ZDNET's or HousingWire's top real estate CRM lists - a recognition gap that'll likely narrow as MAIA matures and the eXp rollout generates more visibility.

Cloze's secret weapon isn't any single feature. It's that the entire product speaks real estate. Transaction management, MLS integration, commission tracking, showing scheduling. None of these exist in HubSpot without custom work.

Neither Cloze nor HubSpot solve your biggest CRM problem: bad contact data. 88% of contacts never make it into a CRM - and the ones that do often have outdated emails. Prospeo's 300M+ profiles with 98% email accuracy and 7-day refresh cycles mean your pipeline stays current, whether you're running HubSpot or Cloze.

Stop feeding stale data into a shiny CRM. Fix the source.

HubSpot in 2026 - The Everything Platform (With Everything Pricing)

HubSpot is the CRM that 228,000+ companies run on. It's earned a weighted average of 4.37/5 across 19,472 aggregate reviews. Business.com gave it a 9.5/10 editor rating. It's the default recommendation for a reason.

The free tier is legitimately useful - unlimited users, contact management, deal tracking, basic reporting. For a solo founder or a small team testing CRM waters, it's hard to argue with free.

Then there's Breeze AI, HubSpot's AI suite launched in 2025. Copilot summarizes records and drafts emails. Agents (still in beta) handle prospecting and content. Intelligence, powered by the Clearbit acquisition, enriches records with firmographic data. Ambitious and improving fast.

Here's the thing, though.

HubSpot's pricing has a cliff that catches teams off guard. Sales Hub Starter runs $20/seat/month. Professional jumps to $100/seat/month - a 5x increase. That's the wall where "free CRM" becomes a $12,000+/year commitment for a 10-person team, and that's before you add Marketing Hub Professional at $890/month.

One solo freelancer reviewing HubSpot called it "completely overwhelming." The #1 complaint across reviews? "So many dashboards, you won't know what to do with yourself." HubSpot's TrustRadius support rating sits at a rough 5.9/10 from 24 ratings - paired with what reviewers describe as "customer-support horror stories." HubSpot also carries a D- rating with the BBB. That doesn't mean the product is bad - 97% of TrustRadius reviewers say they'd buy it again. But when things go wrong, getting help is a known pain point.

One Reddit user in residential real estate said they "still like HubSpot the best" even after trying real estate-specific tools - proof that if you're willing to customize, HubSpot's core platform is genuinely strong.

Pricing Breakdown - What Your Team Actually Pays

Nucleus Research found companies investing in CRM see an average return of $3.10 per dollar spent. But that return evaporates if you overspend on the wrong platform.

Cloze Pricing

| Plan | Annual Billing | Monthly Billing |

|---|---|---|

| Pro (individual) | $17/mo flat | $19.99/mo |

| Business Silver | $21/user/mo | $24.99/user/mo |

| Business Gold | $29/user/mo | $34.99/user/mo |

| Business Platinum | $42/user/mo | $49.99/user/mo |

Concierge add-on (priority support, dedicated CSM, training): $20/user/month with a $500/month minimum. All plans include a 14-day free trial, no credit card required.

HubSpot Sales Hub Pricing

| Plan | Per Seat/Month | Notes |

|---|---|---|

| Free CRM | $0 | Unlimited users, limited features |

| Starter | $20/seat | Core features |

| Professional | $100/seat | + $3,000 onboarding |

| Enterprise | $150/seat | + custom implementation |

Marketing Hub Professional adds $890/month.

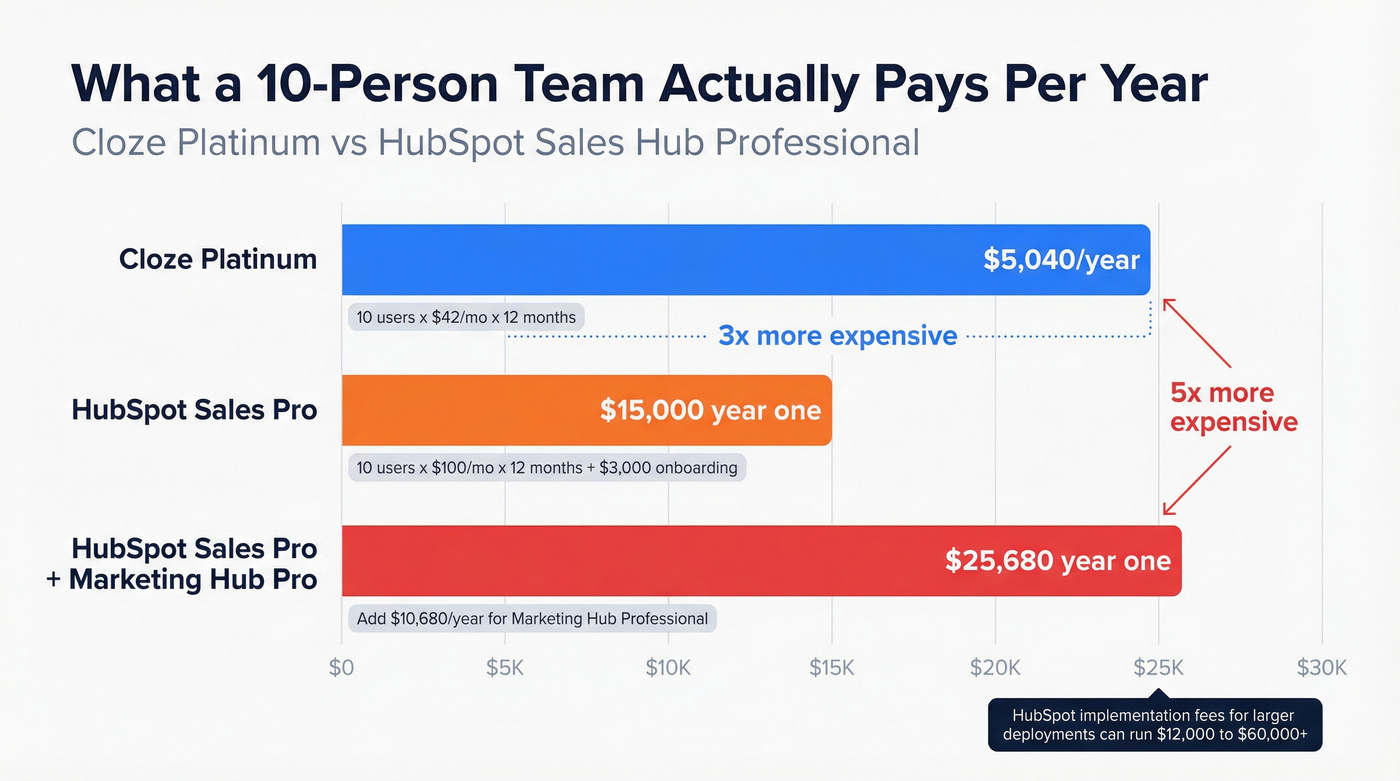

The 10-Person Team Math

Cloze Platinum (10 users, annual): 10 x $42 x 12 = $5,040/year

HubSpot Sales Hub Professional (10 users): 10 x $100 x 12 = $12,000 + $3,000 onboarding = $15,000 year one

That's a 3x difference. And if you need Marketing Hub Professional on top? Add another $10,680/year. Implementation fees for larger HubSpot deployments run $12,000-$60,000+.

Real talk: HubSpot's free tier is the best loss leader in SaaS. But most real estate teams don't need what HubSpot sells at the Professional tier. If your average commission sits below five figures and your team is under 15 people, you almost certainly don't need a horizontal enterprise CRM. Cloze or Follow Up Boss will serve you better at a fraction of the cost.

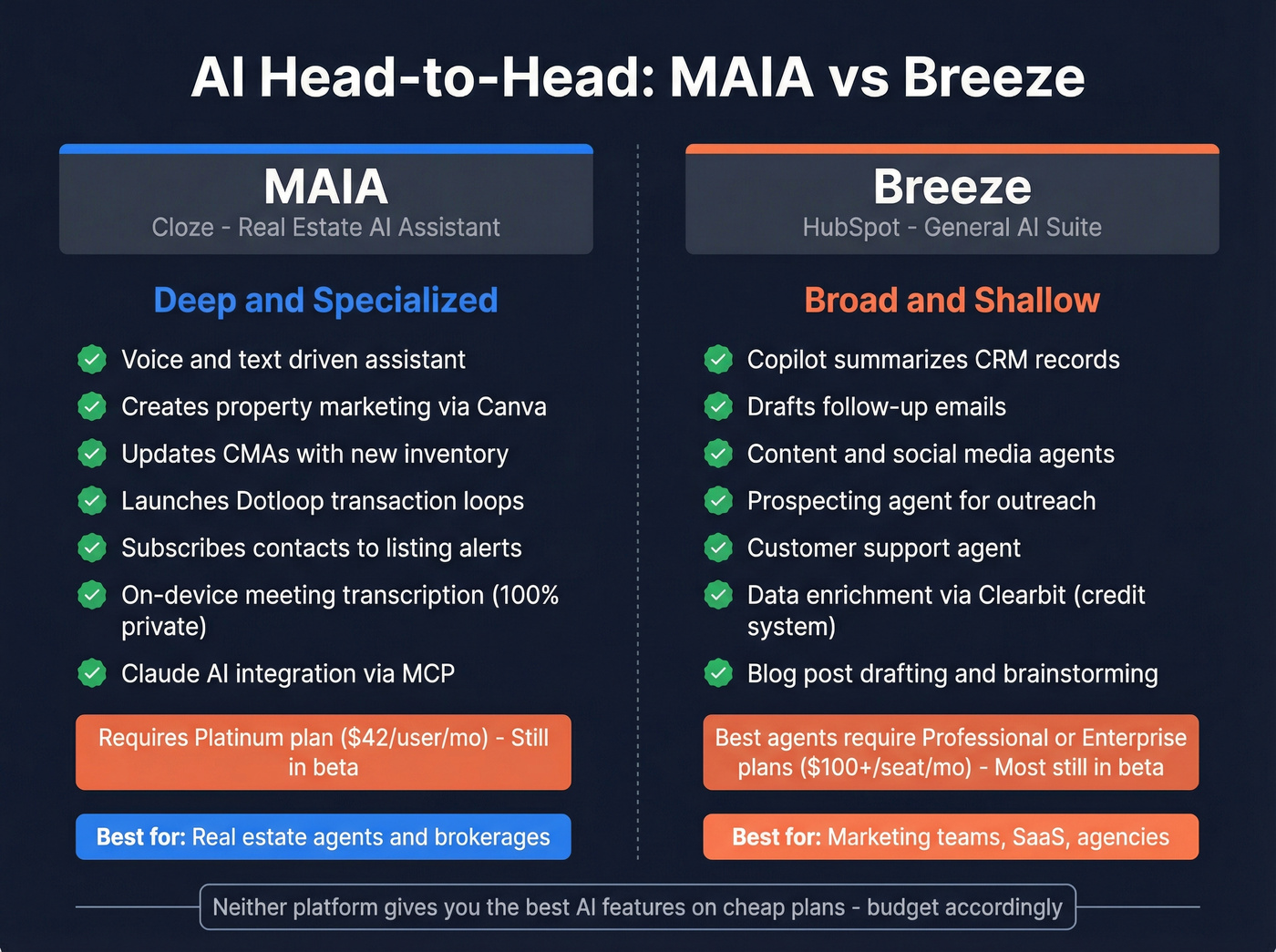

AI Features Compared - MAIA vs Breeze

Both platforms shipped AI features in 2025. The approaches couldn't be more different.

MAIA (Cloze)

As Inman put it, "artificial intelligence was a thing at Cloze before it was a thing anywhere in real estate." MAIA is a voice- and text-driven AI assistant built exclusively for real estate workflows. It doesn't just draft emails - it operates across the real estate tech stack:

- Creates property-specific marketing materials through Canva integration

- Updates existing CMAs with new inventory via Cloud CMA

- Launches Dotloop loops for transaction management

- Subscribes contacts to listing alerts through Zenlist

- Transcribes meetings on-device (audio never leaves the phone - 100% private)

- Connects to Claude AI via MCP integration

The catch: MAIA requires the Platinum plan ($42/user/month). It's in beta, so expect rough edges. But the depth of real estate integration is something no horizontal CRM can match right now.

Breeze (HubSpot)

Breeze has three components:

- Copilot: Summarizes CRM records, drafts follow-up emails, brainstorms ideas. Available across the platform.

- Agents: Content, Social Media, Prospecting, and Customer agents. Most are still in beta. Require Professional or Enterprise plans.

- Intelligence: Data enrichment powered by Clearbit. Company size, industry, job titles, buyer intent. Operates on a credit system - it's a premium add-on.

Breeze is broader but shallower. It can draft a blog post, manage social media, and enrich a contact record. It can't launch a transaction, update a CMA, or create a property flyer.

The Verdict on AI

If you're in real estate, MAIA is the more useful assistant today. If you're not, Breeze is the obvious choice - MAIA literally doesn't apply to you.

I've watched teams get excited about AI features and then never use them because they're locked behind expensive tiers. Both platforms gate their best AI behind higher plans. Budget accordingly.

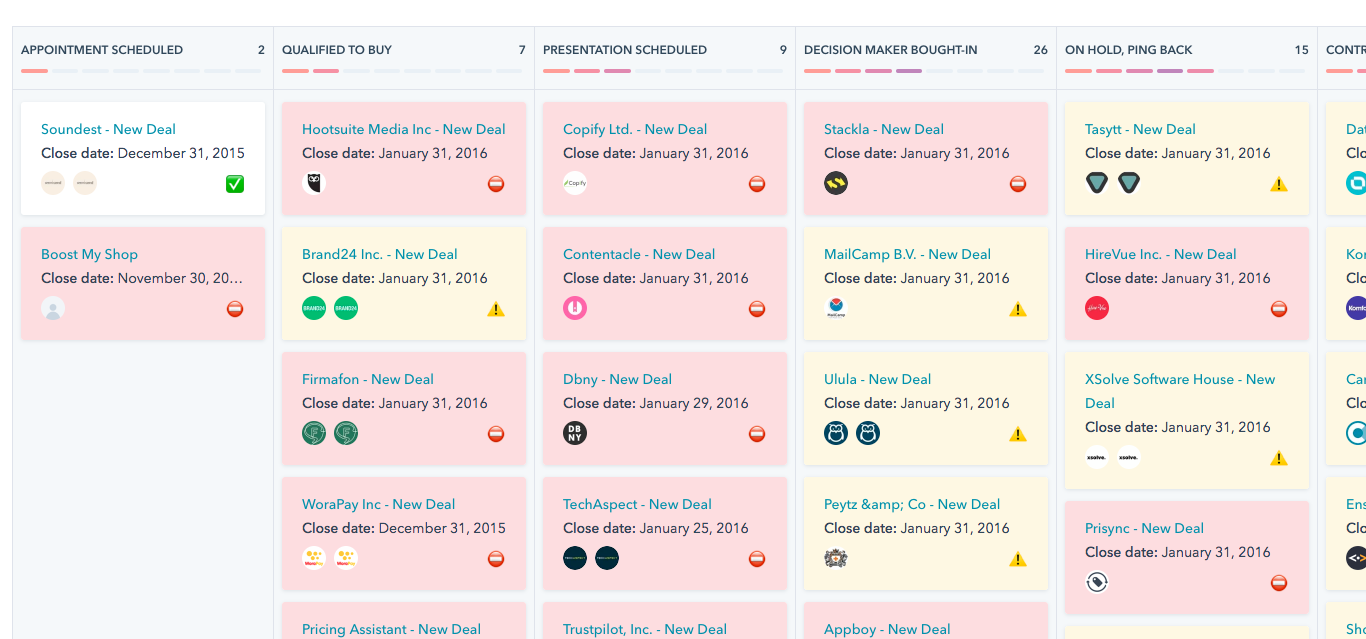

Feature Comparison - Side by Side

| Feature | Cloze | HubSpot | Winner |

|---|---|---|---|

| Contact Management | Auto-capture (calls, texts, email) | Manual + import | Cloze |

| Automation | Drip campaigns, showing reminders, anniversary follow-ups | Multi-step sequences, lead scoring, deal rotation | HubSpot |

| AI Assistant | MAIA (Platinum+) | Breeze (varies by tier) | Cloze (real estate) / HubSpot (all other) |

| Integrations | 100+ (real estate-focused) | 1,700+ general | HubSpot |

| Mobile App | Full functionality | Full functionality | Tie |

| Reporting | Agent/team analytics | Custom dashboards | HubSpot |

| Transaction Mgmt | Built-in | Not available | Cloze |

| MLS Integration | Native | Not available | Cloze |

| Commission Tracking | Built-in | Not available | Cloze |

| Ease of Setup (G2) | 9.8/10 | 8.3/10 | Cloze |

| Free Tier | 14-day trial only | Unlimited users | HubSpot |

Scorecard: Cloze wins 5 rows, HubSpot wins 4, one tie, one split by industry. For real estate teams, Cloze takes it 6-4. For everyone else, HubSpot wins 5-4 with the tie.

The three rows that matter most for real estate agents - transaction management, MLS integration, and commission tracking - are all Cloze-only. HubSpot would need custom objects, third-party integrations, and significant setup time to approximate these features. Most agents won't bother.

For everyone else, HubSpot's 1,700+ integrations and free tier make it the pragmatic choice. Cloze's 100+ integrations are deep but narrow - they're almost entirely real estate tools like SkySlope, Dotloop, Zenlist, and HomeSpotter.

What Real Users Say - Ratings, Praise, and Warnings

Consolidated Ratings

| Platform | G2 | Capterra | TrustRadius |

|---|---|---|---|

| Cloze | 3.8/5 (38 reviews) | 4.4/5 (16 reviews) | 9.9/10 (5 ratings) |

| HubSpot | 4.4/5 (13,496 reviews) | 4.5/5 (4,436 reviews) | 8.4/10 (1,701 ratings) |

The volume disparity is massive. Cloze's TrustRadius score of 9.9/10 comes from five people - treat it as directional, not definitive. HubSpot's 4.4/5 on G2 comes from 13,496 reviews - that's statistically meaningful.

Capterra also flags Cloze for missing features in Data Security, Sales Pipeline Management, and Activity Dashboard - areas where HubSpot is strong out of the box.

On Reddit, brokerages are now offering Cloze as one of three CRM choices alongside Follow Up Boss and kvCORE - a sign that Cloze has earned its seat at the table even without the publication rankings.

The Contact Merging Bug (Cloze's Biggest Risk)

This is the one that should give you pause.

Cloze's "smart features" automatically merge contacts it thinks are duplicates - and it doesn't always get it right. One G2 reviewer (Kris W.) wrote: "Will merge contacts together without your permission... we have asked Cloze to turn off those features on our account and they refused."

A TrustRadius reviewer described how after five years of use, their "database of contacts was so messed up with contacts merged together that don't belong together" they had to start over completely. There's also a data portability concern: Reddit users have reported difficulty bulk-exporting timeline data from Cloze. If you ever need to migrate, plan for friction.

Cloze's Product Direction score on G2 is 6.4/10. That's low. It suggests users aren't confident the team is fixing the right problems. For a CRM - where your contact database is everything - an uncontrollable auto-merge feature is a serious risk. If this is your biggest fear, read our guide on keep CRM data clean before you migrate.

HubSpot's Support Problem

HubSpot's TrustRadius support rating is 5.9/10. "So many dashboards, you won't know what to do with yourself" is a common refrain. The frustrating part? 97% of TrustRadius reviewers say they'd buy HubSpot again. So the product works - you just can't get help when it doesn't.

The learning curve is real too. HubSpot is powerful, but that power comes with complexity that solo agents and small teams simply don't need.

Who Should Choose Which - And When to Skip Both

Choose Cloze If...

- You're a real estate agent or brokerage - this is non-negotiable

- You want auto-capture from your actual phone calls, texts, and emails without manual logging

- You need transaction management, MLS integration, and commission tracking in one platform

- Your team can commit to the Platinum plan ($42/user/month) to unlock MAIA

- You value simplicity over customization - Cloze's G2 ease-of-setup score is 9.8/10

- You've looked at Salesforce and thought "too expensive, too much noise"

Choose HubSpot If...

- You're not in real estate - full stop

- You need marketing and sales alignment in one platform (email marketing, landing pages, workflows, reporting)

- You want to start free and grow into paid features

- Your team has 5+ people and can justify Professional pricing ($100/seat/month)

- You need 1,700+ integrations with your existing tech stack

Budget for Professional from day one. We've seen teams start on HubSpot's free tier, fall in love with the interface, then hit the $100/seat wall six months later when they need sequences or custom reporting. The free-to-paid jump is the steepest in SaaS.

Skip Both - Alternatives Worth Considering

Follow Up Boss - The consensus #1 real estate CRM across ZDNET, HousingWire, and Reddit. It has 250+ integrations, a built-in dialer ($39/month upgrade), and the broadest ecosystem in the space. Pricing: $58/month for Grow, $416/month for Pro (10 users), $833/month for Platform (30 users). If Cloze's auto-merge bug scares you and HubSpot feels like overkill, this is the safe bet. Skip it if you need AI-powered marketing automation.

If you're evaluating other platforms too, start with our roundup on CRM software for small businesses to sanity-check pricing and feature tiers.

Wise Agent - Budget option for solo agents at $41.58/month. Basic but functional. Won't wow you, won't break you.

Lone Wolf Relationships - Starting at $33.25/month, it's the budget AI email marketing play for real estate. HousingWire ranks it #2 for AI-powered outreach on a tight budget.

If your main pain is list quality (not the CRM UI), use an email verifier website before you import contacts and start sending.

Spending $15,000/year on HubSpot Professional? Prospeo enriches your CRM contacts with 50+ data points at 90% less than ZoomInfo - verified emails, direct dials, intent signals. Works natively with HubSpot and Salesforce. No contracts, no sales calls.

Enrich every CRM record for $0.01 per email. Start in minutes.

FAQ

Is Cloze only for real estate agents?

Cloze started as a general-purpose CRM in 2012 but pivoted to real estate around 2015. Today it's almost exclusively a real estate platform - its AI (MAIA), integrations (SkySlope, Dotloop, Zenlist), and enterprise clients (eXp Realty, Windermere) are all real estate-focused.

Can HubSpot work for real estate?

Yes, but it requires significant customization. HubSpot lacks transaction management, MLS integration, and commission tracking natively. ZDNET ranks it "best for marketing" in real estate - not as a primary agent CRM. You'd need third-party tools and custom objects to replicate what Cloze offers out of the box.

Which CRM is cheaper for a 10-person team?

Cloze Platinum costs $5,040/year for 10 users on annual billing. HubSpot Sales Hub Professional costs $15,000 in year one ($12,000 seats + $3,000 onboarding). HubSpot's free tier costs $0 but lacks sequences, AI meeting notes, and custom reporting.

What's the best real estate CRM in 2026?

Follow Up Boss is the consensus #1 across ZDNET, HousingWire, and Reddit. Cloze is the strongest AI-powered option, especially for brokerages wanting auto-capture and MAIA. For clean contact data flowing into any of these CRMs, Prospeo handles email verification at 98% accuracy with a free tier - 75 credits/month, no contracts.

Does Cloze have a free plan?

No. Cloze offers a 14-day free trial with no credit card required, but there's no permanent free tier. Plans start at $17/month. HubSpot's free CRM is available indefinitely with unlimited users, though features are significantly limited compared to paid plans.