Inbound vs outbound sales in 2026: what works, what's changed, and how to run both

Inbound vs outbound sales isn't a philosophical debate anymore - it's an operating decision. Outbound isn't dead. It's just less forgiving: one sloppy list, one spammy follow-up pattern, and mailbox providers will throttle you before you even learn what's broken.

Inbound isn't free. It's just delayed. You pay upfront in content, conversion, and routing ops, then earn it back over time if you don't fumble speed-to-lead.

And yes, you can absolutely run both. Most teams should.

What you need (quick version)

Use this as your "don't overthink it" checklist.

Pick your primary motion

- ☐ Inbound-first if buyers already search for you (category demand exists) and you can respond fast.

- ☐ Outbound-first if you're creating demand (new category, tight ICP, enterprise targets) and you can run deliverability-compliant outreach.

- ☐ Hybrid if you want predictable pipeline (most teams do).

Mini decision rules

- If you can't hit a 5-minute speed-to-lead SLA, inbound will underperform even with great traffic.

- If you can't keep spam complaints under control, outbound will collapse regardless of copy.

- If your ICP isn't crisp (industry + role + trigger), outbound becomes expensive hope marketing.

- If your product needs education, inbound content + webinars do the heavy lifting, and outbound just accelerates the right accounts.

Benchmarks to anchor expectations

- Buyers want less seller involvement: 61% of B2B buyers prefer a rep-free buying experience. Self-serve and clean inbound flows aren't optional anymore.

- Outbound takes work: the baseline is 4.81 touches per response. If your sequences assume "email 1 = meetings," your forecast is fantasy.

Micro-scenario (copy this) If you're a Series A with low brand search and a narrow ICP, run outbound-first for 90 days - but only after you fix deliverability and verify your list. Pair it with two inbound assets (a pricing explainer page and one "switching from X" comparison) so outbound clicks don't land on a content void.

One practical truth Outbound only works with verified data and deliverability compliance. Bad emails don't just bounce - they create complaints, unsubscribes, and domain reputation damage.

Inbound vs outbound sales (the only difference that matters)

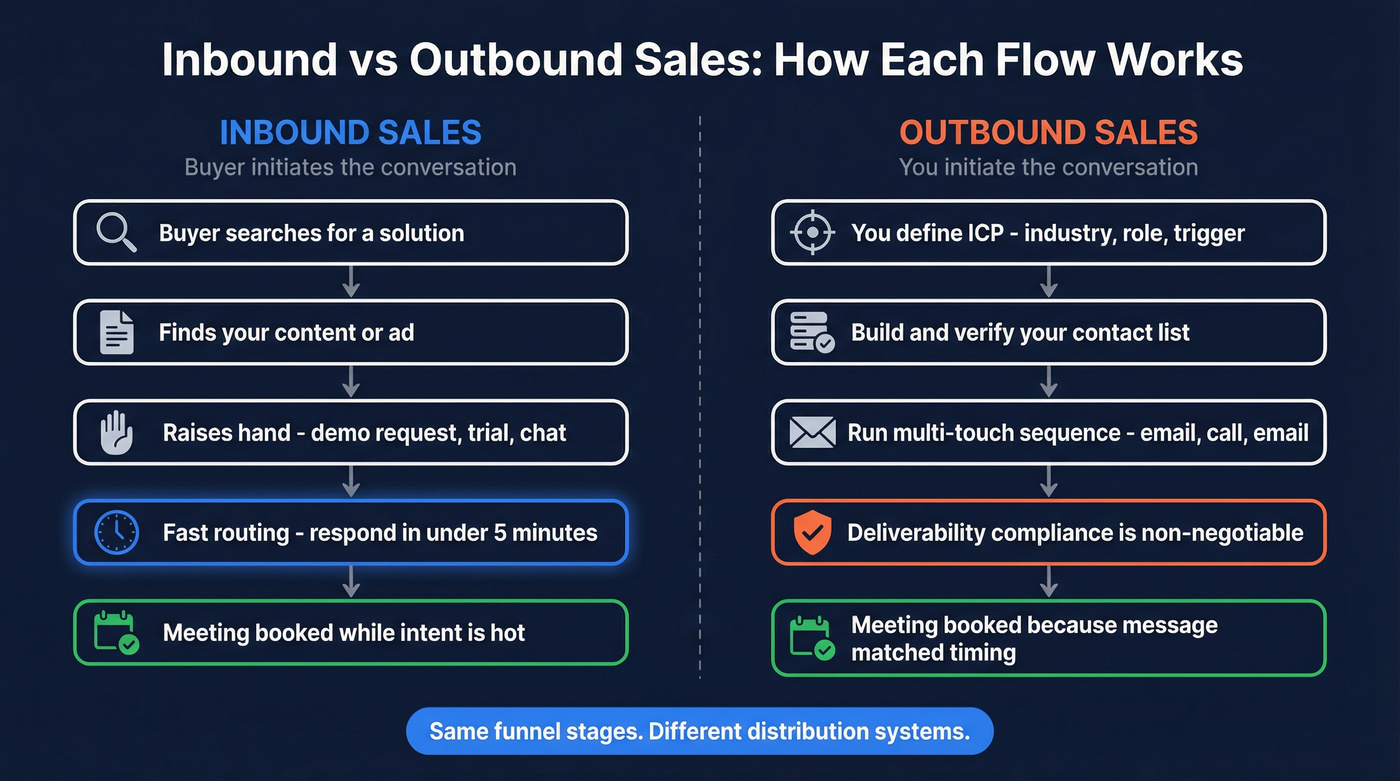

The only difference that matters is who initiates the conversation--which is also the simplest answer to "what is inbound and outbound sales?"

Inbound sales starts when the buyer raises their hand. They find you, consume something, and take an action: demo request, pricing page, webinar signup, inbound chat, trial signup.

Common inbound channels:

- SEO + content (problem-aware searches)

- Webinars + virtual events

- Paid search that captures existing intent

Outbound sales starts when you initiate. You pick the account, pick the persona, and create the first touch.

Common outbound channels:

- Cold email sequences

- Cold calls (plus voicemail)

- Social touches and DMs

- Direct mail for high-value accounts

One clarity win: the funnel stages are the same (awareness -> consideration -> decision). The difference is how awareness happens. Inbound creates awareness through content and intent capture; outbound creates awareness through targeted interruption plus relevance.

Here's the thing: inbound and outbound aren't "strategies." They're distribution systems.

Inbound distributes your message through platforms and content. Outbound distributes it through reps, lists, and sequences.

Concrete examples (so the framing is useful)

- Inbound example: buyer hits your pricing page -> clicks "Request demo" -> instant scheduling (no double step) -> AE calls within 5 minutes -> meeting booked while intent is still hot.

- Outbound example: you build an ICP list -> verify and enrich contacts -> run a 3-touch sequence (email/call/email) tied to a real trigger -> book a meeting because the message matches the buyer's current situation.

In 2026, the winner isn't inbound or outbound. It's the team that can turn signals into conversations without wasting the buyer's time.

Inbound vs outbound sales: side-by-side comparison (with CAC ranges)

| Dimension | Inbound | Outbound |

|---|---|---|

| Intent | High at hand-raise | You create a reason to engage |

| Speed | Slow build, fast close | Fast start, slower close |

| Cost structure | Fixed upfront | Variable per touch |

| Scalability | Compounds over time | Scales with people + data |

| Control | Lower (platform rules) | Higher (targeting control) |

| Measurement | Cleaner first-touch | Needs attribution rules |

| Failure modes | Routing + friction | Deliverability + fatigue |

| Deliverability | Not a gating factor | Gating factor (critical) |

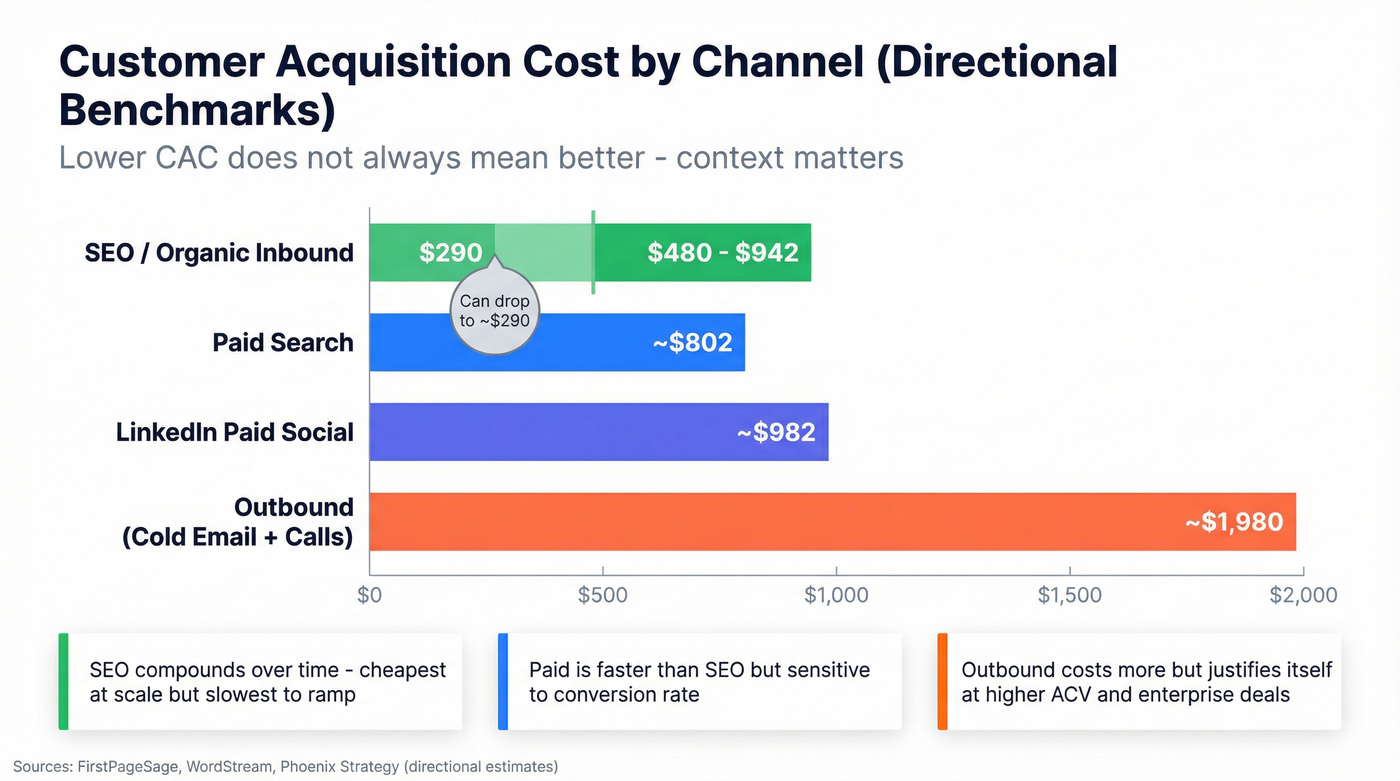

| Directional CAC | SEO: $480-$942 (sometimes ~$290) | Outbound: ~$1,980 |

| Paid CAC (context) | Paid search: ~$802 | LinkedIn paid social: ~$982 |

A few interpretations that matter in real life:

- Inbound is a conversion problem. You're optimizing forms, routing, qualification, and speed-to-lead. Traffic without ops is expensive noise.

- Outbound is a compliance + relevance problem. Great copy can't outrun poor list hygiene and mailbox enforcement.

- Where attribution breaks: inbound looks amazing on first-touch (because the hand-raise is obvious). Outbound looks amazing on "sourced meetings" (because reps can point to the sequence). If you don't define sourced vs influenced, you'll argue forever.

- Where each motion lies to you:

- Inbound lies with traffic vanity ("we're up 30% MoM") while meetings stay flat because routing is slow or forms are leaky.

- Outbound lies with activity vanity ("we sent 50k emails") while deliverability quietly collapses and replies turn into unsubscribes.

- Hot take: if your ACV is on the lower end and your product's easy to try, you'll get more mileage from ruthless inbound speed-to-lead and lifecycle email than from building a giant outbound SDR team. Outbound still helps - but it shouldn't be your entire identity.

If you want a basic definitions refresher, Salesforce's inbound vs outbound explainer is fine. The rest of this article is the operational reality that decides outcomes in 2026.

This article proves it: outbound collapses without clean data. Spam complaints spike by email 4, and one bad list tanks your domain. Prospeo's 98% email accuracy and 7-day refresh cycle keep your sequences out of spam folders - at $0.01/email.

Stop bleeding deliverability. Build outbound lists that actually convert.

Benchmarks to set expectations (so you can plan capacity)

Most teams don't have a strategy problem. They have a math problem.

They plan pipeline like "we'll send more emails" or "we'll publish more content," then act surprised when meetings don't appear. Use these benchmarks to set capacity, headcount, and volume assumptions.

Benchmark table (the numbers you can plan around)

| Motion | Metric | Benchmark | Dataset / context | What it means |

|---|---|---|---|---|

| Inbound | Demo form disqualified | 14.1% | ~4M form submissions (benchmark report) | Spam + bad-fit is baseline |

| Inbound | Qualified -> booked | 66.7% | Same dataset | Routing + UX decide outcomes |

| Inbound | Live call option | 69.2% | Same dataset | Small lift, big at volume |

| Inbound | Remove double scheduling | ~50% lift | Same dataset | Friction kills meetings |

| Outbound email | Avg reply rate | 5.8% | 16.5M cold emails (Jan-Dec 2024) | Replies are scarce |

| Outbound email | Spam complaints | 0.5% -> 1.6% by email 4 | Same dataset | Follow-ups add risk |

| Outbound email | Unsub spike | 2% at round 4 | Same dataset | Sequence caps matter |

| Outbound effort | Touches/response | 4.81 | Survey of 500 revenue pros (published 2026) | Plan multi-touch |

| Cold calling | Conv -> meeting | 4.82% | Cold calling dataset; conversation->meeting | Calls still work |

| Cold calling | Conversations by call 3 | 93% | Same dataset | Diminishing returns after 3 |

| Cold email | Emails/meeting | 344 | Sales engagement benchmark | Volume reality check |

| Performance gap | Top vs avg | 8.1x meetings | Same benchmark | Skill dominates |

Sources:

- Chili Piper form conversion benchmark report: https://www.chilipiper.com/post/form-conversion-rate-benchmark-report

- Belkins cold email response rates: https://belkins.io/blog/cold-email-response-rates

- Outreach prospecting benchmarks (survey of 500 revenue pros, published 2026): https://outreach.io/resources/blog/prospecting-2025

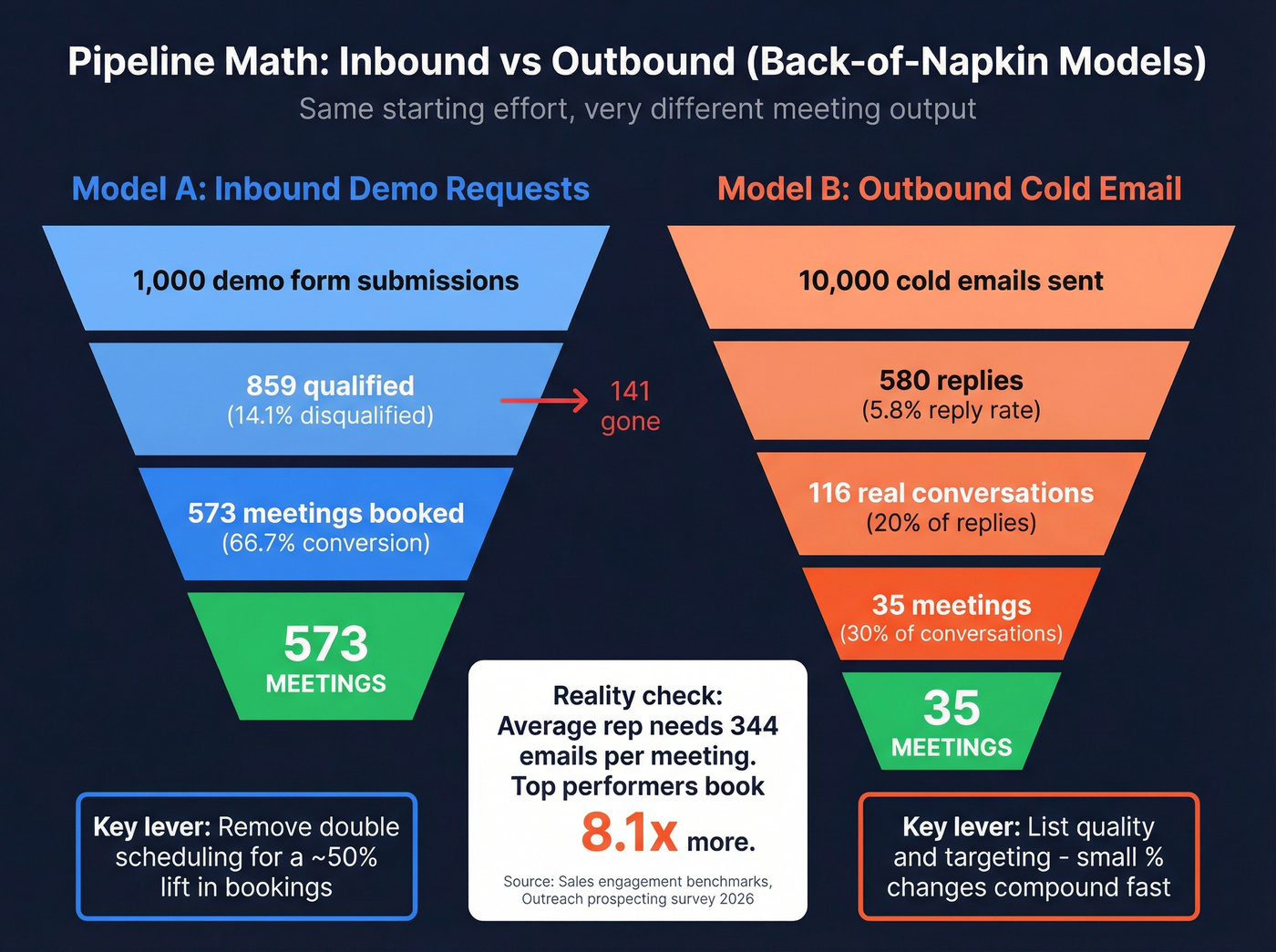

Planning math (steal these back-of-napkin models)

Model A: inbound hand-raisers -> meetings (demo request flow) Start with 1,000 demo form submissions/month.

- Disqualified: 14.1% -> 141 gone

- Qualified: 859

- Qualified -> booked: 66.7% -> 573 meetings

Inbound feels reliable when it's working because conversion at the hand-raiser stage is strong.

Operational punchline: removing "double scheduling" (fill form, then separately book) creates a ~50% lift. If your flow still forces two steps, you're donating meetings to competitors.

Model B: outbound email -> replies -> meetings Assume you send 10,000 cold emails/month.

- Reply rate: 5.8% -> 580 replies

- Plan for 10-25% of replies becoming real conversations in most B2B motions. If you're below 10%, your targeting or offer is broken.

- If 20% become real conversations: 116 conversations

- If 30% of those become meetings: 35 meetings

That's why outbound teams obsess over targeting and list quality. Small percentage changes compound.

Model C: cold email meetings using the 344 emails/meeting reality check

The benchmark is blunt: 344 emails per meeting for the average rep.

So:

- 10,000 emails / 344 ~= 29 meetings

- 50,000 emails / 344 ~= 145 meetings

And the uncomfortable part: top performers book 8.1x more meetings than average. Most "outbound doesn't work" complaints are actually "we never standardized research, targeting, and list hygiene."

Model D: cold calling meetings using the 4.82% benchmark If your team gets 1,000 real conversations/month:

- 1,000 x 4.82% = 48 meetings

But you don't get conversations by "dialing more" forever. 93% of conversations happen by call 3 (98.6% by call 5). After 3 calls, you're mostly paying for diminishing returns.

CAC ranges (directional) and what they change in planning

Channel economics matter because they decide how patient you can be.

Directional CAC benchmarks (Phoenix Strategy):

- Outbound CAC: ~$1,980

- SEO CAC: $480-$942 (sometimes ~$290)

- Paid search CAC: ~$802

- LinkedIn paid social CAC: ~$982

How to use this without fooling yourself:

- Outbound often costs more per customer but can justify it when ACV is higher, deals are expansion-heavy, or you need account control (enterprise, regulated, narrow ICP).

- Inbound/SEO gets cheaper at scale because content compounds - but it ramps slower and requires real resourcing (more on that below).

- Paid sits in the middle: faster than SEO, usually cleaner than outbound, and brutally sensitive to conversion rate.

Inbound sales, explained (what it is, where it breaks, how to fix it)

Inbound sales is the system for converting hand-raisers into qualified meetings and opportunities. It's not waiting for leads. It's operating a response machine.

The part nobody budgets for: inbound resourcing

Inbound looks "cheap" until you staff it.

Content Marketing Institute data makes this obvious:

- 76% of B2B orgs have a dedicated content team

- 54% run with 2-5 people

- only 29% rate their content strategy as very effective

My opinion: most inbound programs fail because they're staffed like a side project and measured like a growth engine. If you want inbound to carry pipeline, you need owners for content, conversion, and routing - not one person doing "content and demand gen" between meetings.

Best-fit scenarios for inbound

Use inbound when:

- You're PLG or SMB-friendly and buyers can self-educate.

- Your category has obvious search demand ("SOC 2 automation," "expense management," "warehouse WMS").

- Your differentiation's easy to understand quickly (clear before/after value).

- Your sales team can respond fast and consistently.

Inbound shines when the buyer already has a problem and is actively looking. You're catching demand, not creating it.

Inbound failure modes (the boring stuff that kills pipeline)

Inbound breaks in operational ways:

- Spam and personal emails pollute your funnel. A 14.1% disqualified rate on demo forms is normal.

- Routing delays kill conversion. If a buyer raises their hand and waits hours, you train them to go rep-free (which 61% already prefer).

- Calendar friction destroys meetings. Double scheduling is a self-inflicted wound.

- No-shows and misqualification spike when forms don't enforce basic fit rules (geo, company size, use case) and when confirmation flows are weak.

I've watched teams spend six figures on demand gen and then lose the pipeline in the last 20 feet because the meeting booking experience was clunky.

It drives me nuts because it's so fixable.

The "live call" nuance (precision matters)

Offering a live call option moves qualified-to-booked from 66.7% to 69.2%. That's a ~3.75% relative lift--small on paper, huge at volume. If you book 500 meetings/month, that lift's the difference between "we hit plan" and "we missed by a quarter."

Inbound ops checklist (make it behave like a pipeline source)

- Routing rules

- ☐ Route by segment (SMB/MM/ENT), geo, and product line.

- ☐ Define "fast lane" routing for high-intent pages (pricing/demo).

- Qualification rules

- ☐ Auto-disqualify obvious spam patterns and personal domains.

- ☐ Require one or two fields that actually matter (company size, use case).

- Speed-to-lead SLA

- ☐ Operating target: call within 5 minutes for demo requests and high-intent chats.

- ☐ If you can't staff that, use instant scheduling or a live call option.

- Meeting handoff

- ☐ Confirm meeting + agenda in the first 2 minutes of the call.

- ☐ Push context into CRM so AEs don't ask the buyer to repeat everything.

Outbound sales in 2026 (what changed: deliverability + buyer behavior)

Outbound in 2026 is constrained by two forces: mailbox enforcement and buyer intolerance for irrelevant outreach. Gartner's benchmark makes the second part painfully clear: 73% of B2B buyers actively avoid suppliers who send irrelevant outreach.

The old playbook - spray, lightly personalize, follow up six times - still produces replies. It also burns domains, annoys buyers, and makes results wildly inconsistent.

Skip outbound until you can verify contacts and keep your complaint rate under control. Otherwise you're paying to damage your own ability to reach anyone later.

Deliverability compliance checklist (non-negotiables)

If you're sending cold email at any meaningful volume, these are table stakes:

- Volume threshold: Gmail treats you as a bulk sender at 5,000+ messages/day to Gmail recipients.

- Spam rate guidance: keep reported spam rate below 0.10% and avoid ever hitting 0.30% or higher.

- Authentication: SPF, DKIM, and DMARC (at least a baseline policy).

- One-click unsubscribe: required (List-Unsubscribe headers).

- Unsubscribe timing: honor unsubscribes within 2 days (provider requirement).

- Microsoft enforcement: Outlook/Hotmail consumer domains began rejecting non-compliant bulk mail starting May 5, 2026.

Real talk: deliverability isn't a marketing problem. It's a revenue constraint. If your domain reputation dips, your outbound motion becomes a rounding error, and you'll waste weeks arguing about copy while your emails quietly land in spam.

AI in outbound: useful for relevance, useless for deliverability

A lot of teams tried to "AI their way out" of outbound performance. That's backwards.

Outreach data shows:

- 54% use AI for personalized outbound emails

- 45% use AI for account research

That's fine - AI helps you write faster and research faster. But AI doesn't fix bounces, spam complaints, or wrong-person emails. Data quality and compliance do. In our experience, the best use of AI is tightening relevance, then shortening sequences so every touch earns its spot.

A good outbound example (short, compliant, and actually relevant)

Subject: Quick question about {{trigger}}

Hi {{Name}}--noticed {{company}} is hiring {{role}} and expanding {{team}}. Teams in that spot usually run into {{pain}} within 60-90 days.

If you're open to it, I'll share a 2-minute teardown of how peers handle {{use case}}--no deck. Worth a quick call Tue or Wed?

PS: If I missed the mark, use the unsubscribe link below and I won't follow up.

The new outbound rule: fewer, higher-quality touches

Outbound performance is now a game of small numbers:

- Average reply rates hover around 5.8% across large datasets.

- It takes 4.81 touches per response on average.

- Spam complaints climb as sequences drag on (email 4 is where things get ugly).

So the planning implication's simple: cap sequences and make each touch earn its right to exist.

Data quality as deliverability protection (the B2B data layer that matters)

This is where a data platform stops being "nice to have" and becomes infrastructure.

I've seen teams torch a perfectly good domain because they scaled outreach on half-verified contacts, then tried to fix it with warmer inboxes and "better prompts." That doesn't work. You fix it by keeping bad data out of the sequencer in the first place, and by making verification part of the workflow instead of a one-time cleanup.

If you're running outbound at scale, that "data layer" isn't optional. It's your seatbelt.

Decision matrix: when inbound wins, when outbound wins, when hybrid is mandatory

Most teams end up hybrid because reality forces it. 43% run a hybrid model combining inbound + outbound within the same function, and 37% run dedicated inbound and outbound teams.

Here's a decision matrix that matches how revenue actually behaves.

| Situation | Inbound wins | Outbound wins | Hybrid mandatory |

|---|---|---|---|

| ACV | Lower-mid | Mid-enterprise | Mixed segments |

| ICP clarity | Medium is fine | Must be crisp | Getting crisp |

| Time urgency | Medium | High | High + steady |

| Market maturity | High | Low/creating | Medium |

| CAC tolerance | Lower over time | Higher acceptable | Balanced |

Scenarios (what I'd do)

You sell a clear category with existing demand (mature market). Go inbound-first. Put your best ops person on routing + speed-to-lead. Use outbound to target competitor installs and "why switch" angles.

You sell something new or misunderstood (category creation). Go outbound-first, but content-assisted. Outbound creates the first conversations; inbound content prevents those conversations from dying in confusion.

You're scaling and can't afford pipeline volatility. Hybrid is mandatory. Inbound gives you compounding efficiency; outbound gives you control and coverage.

If you're trying to pick one motion forever, you're solving the wrong problem.

The real question is: which motion is your base load and which is your accelerator?

Inbound and outbound sales in practice: the hybrid operating system

Hybrid isn't "do inbound and outbound." It's one operating system where inbound signals trigger outbound actions, and outbound learnings feed inbound content.

The teams that win treat it like a single factory: one set of definitions, one SLA, one dashboard, and clear rules for when a rep's allowed to sequence someone.

Mini-case: the hybrid flow that actually prints meetings

A buyer from a target account visits your pricing page twice and starts a demo form - but abandons at the calendar step. That's not "inbound failed." That's a high-intent signal with friction.

Here's the play:

- Route the lead instantly and try to book via inbound (fast lane).

- If no meeting's booked within 2 hours, trigger a short outbound sequence to the same persona and one adjacent stakeholder.

- When they reply, attribute it cleanly: inbound influenced (signal), outbound sourced (meeting), and fix the friction that caused the abandon.

This is why hybrid wins: it turns "almost" into pipeline, and it forces your team to improve the system instead of blaming the channel.

Routing + SLA rules (speed-to-lead without chaos)

- Define lead types

- Hand-raiser (demo/pricing/contact)

- Engaged (webinar attendee, high-intent page views)

- Cold target (ICP match, no engagement)

- SLA targets

- Hand-raiser: call within 5 minutes

- Engaged: same day (within 2 hours is the goal)

- Cold target: sequence within 24-48 hours

- Routing rules

- Hand-raisers route to the fastest available qualified rep, not "account owner" if that adds hours.

- If no rep's available, offer instant scheduling or a live call option.

Trigger-based outbound (what fires a sequence and what doesn't)

Good triggers (sequence-worthy):

- Demo request that didn't book

- Pricing page visits (especially repeat visits)

- Webinar attendance + role match

- Intent topics that match your category (paired with ICP fit)

Bad triggers (don't do it):

- "Visited the blog once"

- "Downloaded a generic ebook"

- "Any intent signal regardless of role"

Hybrid works when outbound is selective. Longer sequences aren't free follow-ups - they're reputation debt.

To keep routing accurate and sequences clean, use an enrichment/verification layer that plugs into your workflows. Prospeo's Integrations page is the quickest way to see the native connectors: https://prospeo.io/integrations.

Lightweight stack map (vendor-neutral, but realistic)

You don't need a bloated stack. You need the right categories covered.

Inbound stack

- Forms + routing (and spam filtering)

- Scheduling (avoid double steps)

- Chat / conversational routing

- CRM + lead status hygiene

Outbound stack

- Data + verification (this is where most teams lose)

- Sequencer (email + tasks)

- Dialer (if you call at volume)

- Deliverability monitoring (bounces, complaints, domain health)

Measurement stack

- Attribution rules (sourced + influenced)

- BI/dashboarding (one weekly view)

Inbound vs outbound sales measurement: attribution rules that stop the fight

Inbound vs outbound arguments usually aren't about performance. They're about credit.

Attribution benchmarks show 57% of teams use both sourced and influenced, and <25% rate their measurement as fair. That's normal - multi-touch is messy.

Here's the line that ends the debate in exec meetings: If you're arguing first-touch vs last-touch, you're negotiating credit.

A practical attribution framework that ends the fight

Use two numbers side-by-side:

- Sourced pipeline (who created the opportunity)

- Influenced pipeline (who meaningfully contributed)

Rules that work:

- If an inbound form fill created the opp: inbound sourced.

- If an outbound sequence created the first meeting that became an opp: outbound sourced.

- If outbound touched the account before inbound conversion: outbound influenced (and vice versa).

- If the buyer self-served for weeks and only then replied to outbound: inbound influenced, outbound sourced.

My recommendation: pick rules you can enforce in CRM, then stop relitigating them every quarter. Consistency beats philosophical purity.

Example reporting view (what I want to see)

For each channel (inbound, outbound, partners, paid):

- Sourced pipeline $

- Influenced pipeline $

- Win rate %

- Sales cycle (median days)

- CAC (directional) and payback trend

FAQ

Is inbound sales better than outbound sales?

Inbound is better when demand already exists and you can respond in under 5 minutes; outbound is better when you need control over target accounts and timing. For most B2B teams in 2026, a hybrid model wins because inbound compounds over time while outbound fills coverage gaps and creates focus.

What is the difference between inbound and outbound sales?

The difference is who initiates: inbound starts with a buyer hand-raise (demo request, trial, chat), while outbound starts with your team reaching out first (email, calls, social). The funnel stages are similar, but inbound captures existing intent and outbound creates a reason to engage.

How many touches does outbound usually take to get a response?

Outbound takes 4.81 touches per response on average, so plan sequences as multi-touch across email and calls instead of expecting a single message to book meetings. As a practical cap, keep most sequences to 3-5 touches to avoid the unsubscribe and spam-complaint spikes that show up later.

What are the minimum deliverability requirements for cold email in 2026?

At minimum: SPF, DKIM, and DMARC; one-click unsubscribe (List-Unsubscribe); and honor unsubscribes within 2 days. Keep spam complaints under 0.10% and never hit 0.30%+. Gmail's bulk-sender threshold is 5,000/day, and Outlook/Hotmail began rejecting non-compliant bulk mail on May 5, 2026.

What tool helps keep outbound lists accurate to protect deliverability?

Prospeo is a top choice for list accuracy because it delivers 98% email accuracy on a 7-day refresh, plus catch-all handling and spam-trap/honeypot removal. The free tier includes 75 emails + 100 Chrome extension credits/month, and you can start with Email Finder or Data Enrichment to keep bad data out of your sequencer.

Running hybrid inbound + outbound? Your outbound side needs verified contacts matched to real triggers. Prospeo gives you 30+ ICP filters - buyer intent, job changes, technographics, headcount growth - across 300M+ profiles so every sequence hits the right person at the right time.

Turn ICP signals into booked meetings without the bounce-rate tax.

Summary: choosing inbound vs outbound sales (and why hybrid usually wins)

Inbound vs outbound sales comes down to one thing: who starts the conversation. Inbound is your compounding engine when you have demand and tight speed-to-lead; outbound is your control lever when you need to pick accounts, timing, and triggers - assuming your data and deliverability are clean. In 2026, the most consistent pipeline comes from a hybrid system that turns intent signals into fast follow-up and uses verified data to keep outreach compliant.