How to Market to CEOs: What Actually Works (and What Wastes Your Budget)

A B2B firm spent $80,000 over six months on LinkedIn Ads targeting CFOs, treasurers, and CEOs at companies with $100M-$1B in revenue. The result? Zero pipeline. Leadership still believed in the channel despite the evidence staring them in the face. That story - shared in a recent Reddit thread - isn't an outlier. It's the norm for teams trying to figure out how to market to CEOs with standard B2B playbooks.

This guide is built on actual benchmarks: data from 40,000+ analyzed deals, 20 million+ outreach attempts, and campaign case studies with real dollar figures attached.

The Priority Stack (If You're Short on Time)

- Build a referral engine first. It's the #1 access method for C-suite meetings, and it's not close. Every other channel performs better when a warm introduction opens the door. (If you need copy/paste asks, use a referral engine.)

- Send creative direct mail to your top 25-50 accounts. 79% of executives rank direct mail as their best-performing marketing channel. Almost nobody in B2B does it well.

- Publish original-data thought leadership on LinkedIn. 54% of C-suite executives spend 1+ hour per week consuming thought leadership - but 71% say most of it is useless. The bar is low if you bring real data.

Every strategy below requires accurate CEO contact data. We'll cover that too.

What CEOs Actually Care About in 2026

If your messaging doesn't connect to what's keeping a CEO up at night, it doesn't matter how clever your campaign is.

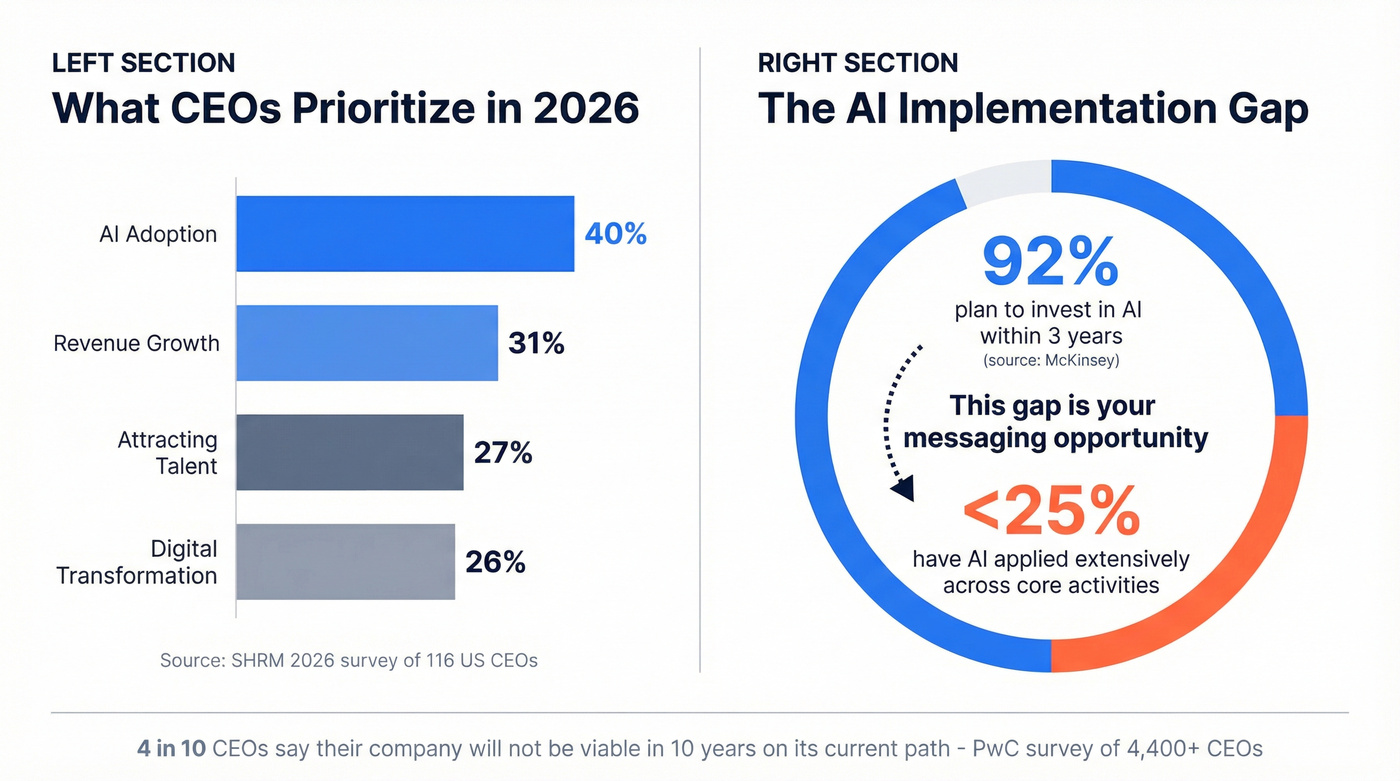

SHRM surveyed 116 US CEOs for their 2026 priorities. AI dominates the conversation, but it's not the only thing on the table.

| Priority | % of CEOs |

|---|---|

| AI adoption | 40% |

| Revenue growth | 31% |

| Attracting talent | 27% |

| Digital transformation | 26% |

Source: SHRM 2026 survey of 116 US CEOs

PwC's survey of 4,400+ CEOs across 95 countries paints an even starker picture: nearly 4 in 10 said their company won't be viable in 10 years on its current path. That's existential anxiety, not incremental optimization. The CEOs who successfully reinvent their businesses see a 71% performance premium in combined profit margin and revenue growth. Your messaging should speak to transformation, not tweaks.

Here's the thing: 89% of CEOs expect AI to redefine how their organizations create and capture value. 92% of companies plan to invest in AI within the next three years. But fewer than 25% say AI is applied extensively across core activities.

That gap - between knowing AI matters and actually deploying it - is where smart marketers position their messaging.

If you're selling anything that touches AI implementation, revenue acceleration, or talent strategy, you've got a natural entry point. If you're selling something else, your job is to connect your solution to one of these three priorities. CEOs don't care about your product category. They care about outcomes that map to their agenda.

Every channel in this guide - referrals, direct mail, thought leadership - requires one thing: verified CEO contact data. Prospeo gives you 300M+ profiles with 30+ filters including job title, company revenue, headcount growth, and buyer intent across 15,000 topics. 98% email accuracy. 125M+ verified mobile numbers. $0.01 per email.

Stop guessing which CEOs to target. Start reaching the right ones today.

Why Standard Marketing Fails With Executive Buyers

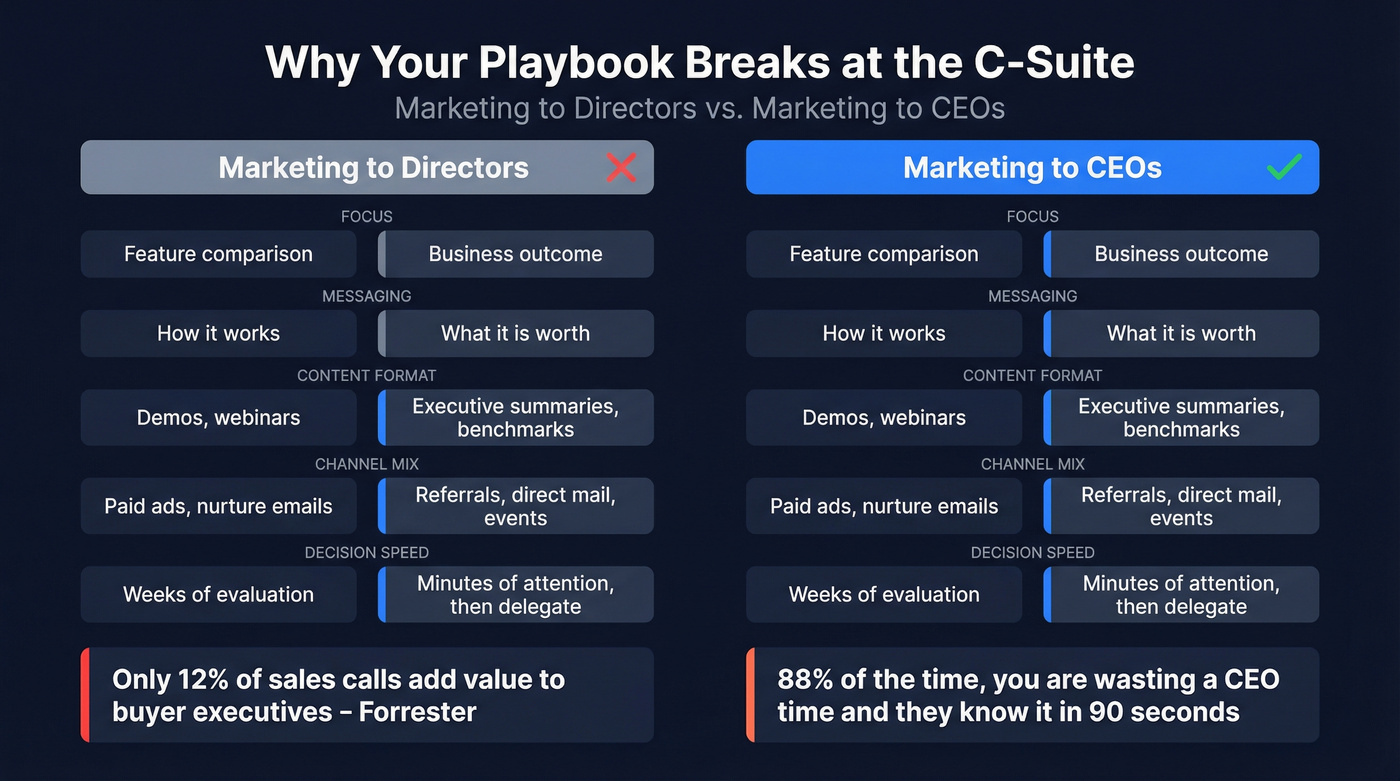

Most B2B marketing is built for directors and VPs. It assumes the buyer has time to explore, compare, and evaluate. CEOs don't operate that way.

| Dimension | Marketing to Directors | Marketing to CEOs |

|---|---|---|

| Focus | Feature comparison | Business outcome |

| Messaging | "How it works" | "What it's worth" |

| Content format | Demos, webinars | Executive summaries, benchmarks |

| Channel mix | Paid ads, nurture emails | Referrals, direct mail, events |

| Decision speed | Weeks of evaluation | Minutes of attention, then delegate |

Gong's analysis of nearly 40,000 deals found something counterintuitive: discovery questions - the foundation of most sales methodologies - actually decreased success rates with executive buyers. The higher you go, the less patience buyers have for being interrogated. They want insights, not an interview.

Forrester's data is equally brutal. Only 12% of sales calls add value to buyer executives. That means 88% of the time, you're wasting a CEO's time - and they know it within the first 90 seconds.

Here's why each standard channel underperforms at the C-suite level:

LinkedIn Ads target job titles, not buying intent. CPMs for C-suite audiences run $30-60+, and you're competing with every other vendor who discovered the "CEO" targeting filter. That $80K failure isn't surprising - it's predictable.

Generic cold email gets buried. CEOs at mid-to-large companies receive 150-200+ emails per day. Your "quick question" subject line is competing with board updates, investor notes, and their COO's Slack summary. Average B2B cold email reply rates sit at 5.1% across all titles. For CEOs, expect lower. (If you're building sequences, start with a proven cold email cadence.)

Thought leadership should work, but 71% of decision-makers say most of it fails to deliver meaningful insight. The problem isn't the format. It's that most thought leadership is thinly veiled product marketing dressed up with a few stats. CEOs can smell it instantly.

The reason standard B2B marketing fails on CEOs isn't that they're unreachable. It's that most marketers use channels and messages designed for people three levels below them.

Five Channels That Actually Reach CEOs

Referrals - The #1 Access Method

SBI Growth calls referrals "by far the most effective way to get a C-Suite appointment." I've seen this play out repeatedly - the competitor closing deals you can't isn't running better ads. They've got a CEO who knows your prospect's CEO.

The mechanics are simple but require discipline:

- Be generous first. Make introductions for others before you ask for them. CEOs track reciprocity.

- Be proactive. After every successful engagement, ask: "Who else in your network is dealing with [specific problem]?"

- Make it easy. Draft the intro email for your referrer. Give them a two-sentence blurb they can forward.

- Thank publicly. A CEO who refers you and gets acknowledged becomes a repeat referral source.

The uncomfortable truth is that referral engines take months to build. You can't shortcut relationship capital. But every other channel in this list performs better when a warm introduction precedes it.

Direct Mail - The Channel Nobody's Using

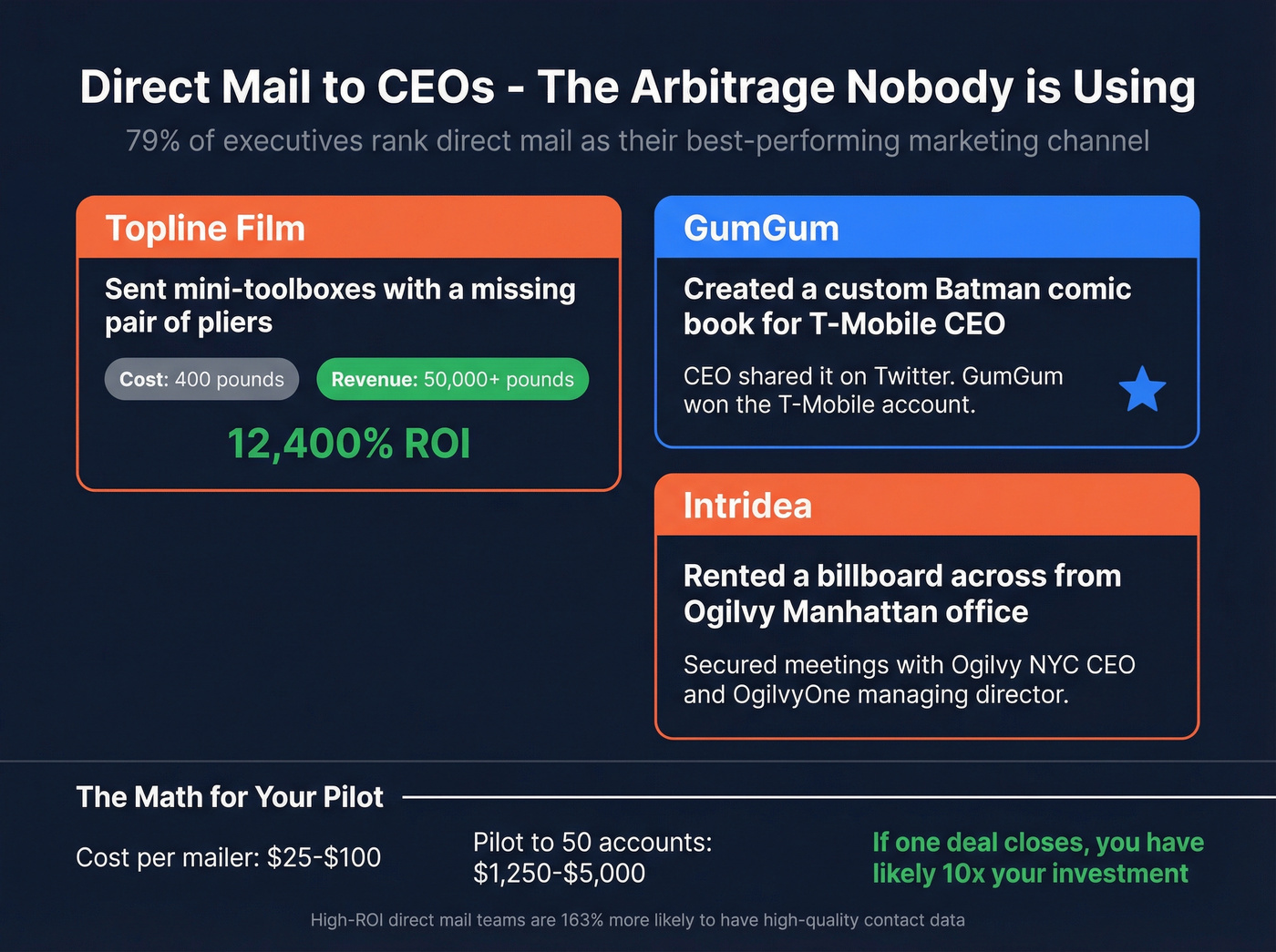

79% of executives rank direct mail as their best-performing marketing channel. And yet almost no B2B SaaS company has a direct mail program.

That's a massive arbitrage opportunity.

The case studies are absurd. Topline Film sent mini-toolboxes with a missing pair of pliers and the message "Something missing from your marketing toolkit?" Cost: £400. Revenue generated: £50,000+. That's a 12,400% ROI.

GumGum discovered T-Mobile's CEO was a Batman fan. They created a custom comic book - "T-Man and Gums" - and sent it directly to him. He shared it on Twitter. GumGum won the T-Mobile account.

Intridea rented a billboard across from Ogilvy's Manhattan office that read "Ogle this, Ogilvy" with a personalized landing page URL. They secured a meeting with Ogilvy NYC's CEO and OgilvyOne's managing director.

The cost math works too. High-quality dimensional mailers run $25-$100 per piece. A pilot campaign to 50 accounts costs $1,250-$5,000. If one deal closes, you've likely 10x'd your investment. But here's the catch: the creative gets the attention, and the data determines whether it arrives. High-ROI direct mail teams are 163% more likely to have high-quality contact data than low performers. Before shipping $50 packages, verify mailing addresses and enrich contact records so your expensive mailer actually reaches the right desk. (If your CRM is messy, fix your data quality process first.)

LinkedIn - Organic, Not Ads

Use this if: You're willing to invest 30-60 minutes daily in genuine engagement with CEO content. 98% of Fortune 500 CEOs use LinkedIn, and an analysis of 8,000+ CEO posts found that authenticity - less polished, more real - drives the most engagement.

Skip this if: You're planning to run LinkedIn Ads targeting C-suite titles. We've already covered the $80K failure.

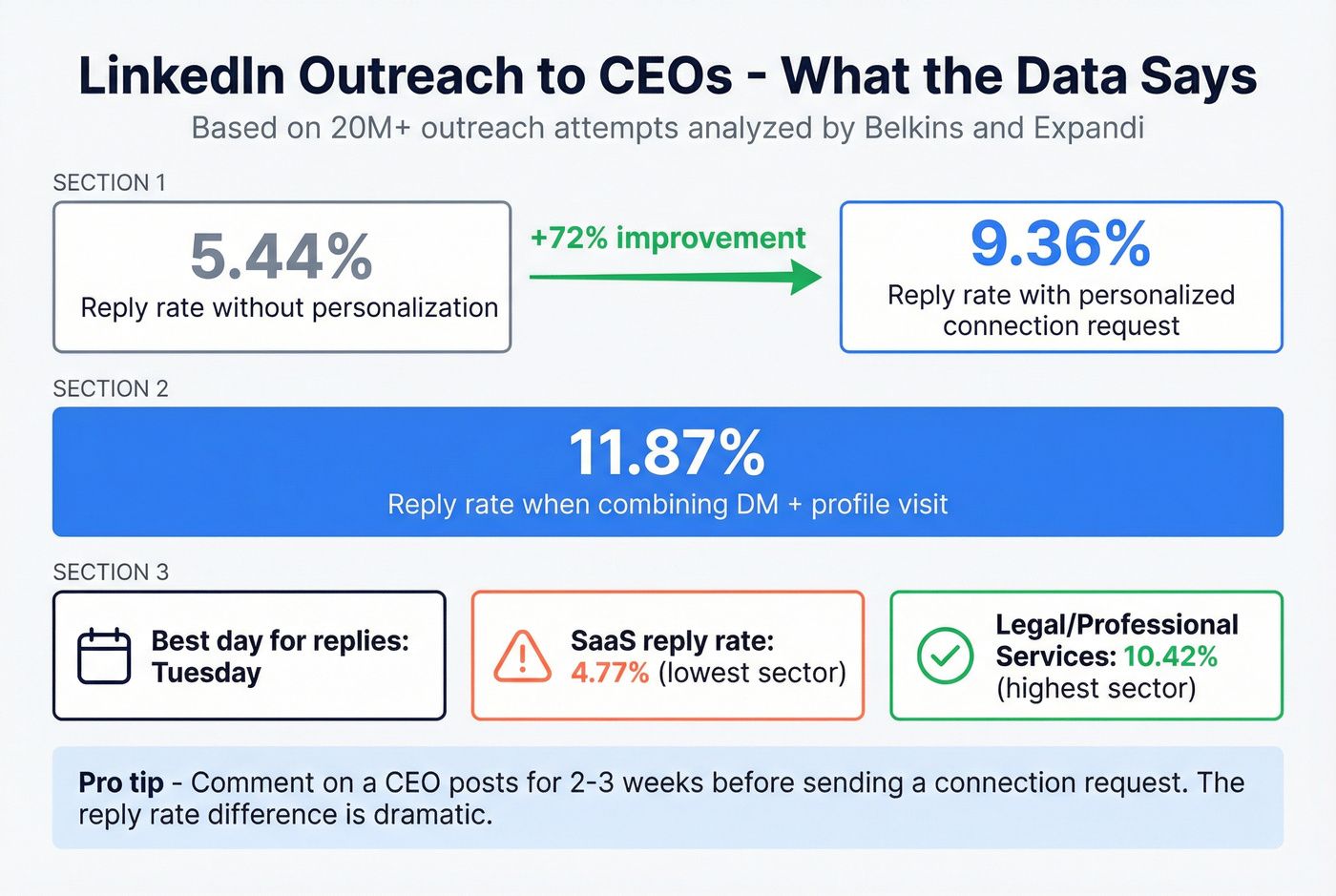

Belkins and Expandi analyzed 20 million+ LinkedIn outreach attempts and found:

- Personalized connection requests: 9.36% reply rate vs. 5.44% without a message

- Campaigns combining a DM + profile visit: 11.87% reply rate

- Best day for replies: Tuesday (email peaks on Wednesday - different platform dynamics)

- Software/SaaS industry reply rates: 4.77% (lowest across sectors - legal/professional services leads at 10.42%)

The key insight: comment on a CEO's content before you ever send a connection request. CEOs at smaller companies (under 200 employees) often write their own posts. Engage genuinely for 2-3 weeks. Then reach out. The reply rate difference between a cold connection request and one from someone who's been engaging with their content is dramatic. (For a repeatable system, use a comment-first social selling workflow.)

LinkedIn organic is a long game. But it's free, and it compounds.

Cold Email - With the Right Benchmarks

Average B2B cold email reply rate: 5.1%. Average open rate: 27.7%. Best day: Wednesday. Optimal send windows: 7-11 AM (primary) and 4:00-5:30 PM (secondary) in the recipient's local time zone. Weekend response rates drop below 1%.

For CEOs, the difference between a 1% and a 4% reply rate comes down to relevance and brevity. Here's a PAS framework adapted for CEO priorities:

Subject: [Company]'s AI implementation gap

[First name], PwC's latest survey found that 40% of CEOs say their company won't survive a decade on its current path - and most cite AI readiness as the gap.

We helped [similar company] close that gap in 90 days, moving from pilot to production across three business units. Revenue impact: $2.4M in the first year.

Worth a 15-minute call to see if the approach fits [Company]?

And a Value-First template:

Subject: Noticed something about [Company]'s [specific initiative]

[First name], I saw [Company] just [specific trigger - hiring, expansion, product launch]. Based on what we've seen with similar companies at that stage, there's usually a [specific challenge] that shows up within 60 days.

I put together a quick breakdown of how [comparable company] handled it. No pitch - just thought it'd be useful. Want me to send it over?

Replace every bracketed placeholder with account-specific details. Generic templates sent as-is will get ignored. (If you want more openers, pull from these email opener examples.)

Executive Events and Roundtables

In-person events rank as the #1 ABM channel, with 72% of practitioners citing them as a top performer. The format that works best for CEO access isn't a conference booth - it's an intimate dinner or roundtable for 10-15 executives.

Cost range: $5,000-$25,000 for a well-produced executive dinner. That sounds steep until you calculate the cost per C-suite meeting - typically $500-$3,000 through other channels.

Cognism ran a cupcake campaign to invite executives to events and hit an 80% response rate (their target was 20%). Dreamdata's team found that podcast invitations and speaker invitations open doors that cold outreach can't - because you're offering the CEO a platform, not asking for their time.

The trick is positioning yourself as the convener, not the seller. Host a dinner on "AI implementation challenges for [industry] CEOs." Invite 12 executives. Bring one customer who can share results. Don't pitch. Let the conversation do the work. (To operationalize it, use an ABM campaign planning template.)

Channel Benchmarks at a Glance

| Channel | Response Rate | Cost Range | Best For |

|---|---|---|---|

| Referrals | Highest (varies) | $0 (time investment) | Any company size |

| Direct Mail | Up to 80% (creative) | $25-$100/piece | Top 25-50 accounts |

| LinkedIn Organic | 9-12% reply | Free (time) | Mid-market CEOs |

| Cold Email | 1-5% reply | ~$0.01/email | Scale outreach |

| Executive Events | 72% cite as #1 | $5K-$25K | Enterprise accounts |

Content That CEOs Actually Read

54% of C-suite executives spend at least an hour per week consuming thought leadership. 75% trust thought-leadership content more than traditional marketing materials. But 71% say most of it fails to deliver meaningful insight.

That gap is your opportunity - if you get the format right.

| CEOs Ignore | CEOs Bookmark |

|---|---|

| Generic blog posts | Original research with data |

| Product pitches | Industry benchmarks |

| AI-generated fluff | Specific data with methodology |

| "5 tips" listicles | Long-form reports with analysis |

| Gated eBooks (no preview) | Newsletters with curated insights |

If you're selling deals under $15K, you probably don't need a full ABM program or enterprise-grade thought leadership. A tight referral engine and well-crafted cold emails will outperform a $50K content program every time. Save the quarterly benchmarking reports for when you're selling six-figure deals.

Format Preferences by C-Suite Role

Not all executives consume content the same way:

- CEOs prefer executive summaries, strategic frameworks, and peer benchmarking reports. Keep it under 2 pages or over 20 - nothing in between.

- CFOs respond to ROI calculators, financial models, and total-cost-of-ownership analyses. Lead with numbers.

- CTOs engage with technical architecture diagrams, benchmark reports, and implementation case studies. Depth matters more than polish.

The content that works across all three shares one trait: original data that can't be found anywhere else. We've seen teams transform their CEO engagement by publishing one quarterly benchmarking report with original data from their customer base. No product mentions. Just useful data. The sales team uses it as a door-opener, and CEOs actually read it because it helps them benchmark against peers.

Over 70% of executives consume thought leadership specifically to stay updated on industry trends and stimulate thinking. Give them something worth thinking about.

ABM - The Framework That Ties It All Together

Every channel above works better inside an account-based marketing framework. ABM isn't a tactic - it's the coordination layer that ties referrals, direct mail, LinkedIn, email, and events into a single campaign against specific accounts.

71% of B2B practitioners now use an ABM strategy. Companies with mature ABM programs see 208% higher revenue compared to traditional marketing. The average successful ABM program uses 4.7 channels per campaign - which is why single-channel approaches to CEOs consistently underperform.

The biggest ABM challenges: proving ROI (47%), sales-marketing alignment (43%), and scaling (40%). Plan for these from day one.

The buying committee at most enterprise deals includes 6-10 people. Even when you're targeting the CEO, you need to engage the CFO, VP of Operations, and whoever else influences the decision. A tiered approach works:

- One-to-many: Brand-level plays across your total addressable market

- One-to-few: Trigger-based campaigns for accounts showing intent signals (this is where intent signals matter)

- One-to-one: Fully customized campaigns for your top 10-25 accounts (this is where direct mail and executive events live)

The case studies speak for themselves.

LiveRamp targeted 15 Fortune 500 accounts with a 5-touch strategy (display ads, gated content, email, SDR calls, direct mail). Result: $50M+ in annual revenue, 33% conversion rate in 4 weeks, 25x customer lifetime value over two years.

IBM's "Every Second Counts" campaign targeted C-suite executives at financial institutions with personalized content showing how milliseconds of latency cost millions. The campaign combined direct mail, executive dinners, and custom microsites - and generated a measurable pipeline lift because it spoke directly to a CEO-level business outcome, not a technical feature.

Auth0 piloted an ABM program and built $3M in pipeline in just 6 weeks.

DocuSign ran dynamic content targeting 450 enterprise accounts and saw a 300% increase in page views and 22% increase in sales.

The pattern across all of these: multi-channel, personalized, and sustained over weeks or months. No single touchpoint closes a CEO. It's the accumulated weight of relevant interactions across channels that builds enough trust and familiarity to earn a meeting.

Look, ABM isn't cheap. But the alternative - spraying generic campaigns at C-suite titles and hoping something sticks - is more expensive in the long run because it doesn't work. (If you're lean, start with ABM without expensive tools.)

The Data Quality Foundation

Every strategy in this article fails if you're working with bad data.

Send a $50 direct mail piece to the wrong address? Wasted. Email a CEO who left the company six months ago? Bounced - and your domain reputation takes the hit. Call a number that's been reassigned? You've annoyed a stranger and burned a touchpoint.

B2B contact data decays fast. People change jobs, companies restructure, phone numbers rotate. (Build a refresh cadence around B2B contact data decay.)

Prospeo's B2B database covers 300M+ professional profiles with 98% email accuracy - verified through a proprietary 5-step process that includes catch-all handling, spam-trap removal, and honeypot filtering. Data refreshes every 7 days, compared to the 6-week industry average. For CEO targeting specifically, 30+ search filters let you narrow by job title, company size, revenue, headcount growth, technographics, and buyer intent across 15,000 topics. Find CEOs at Series B fintech companies actively researching AI implementation - that's the specificity these strategies require.

The free tier gives you 75 verified emails per month, enough to test your messaging on a small CEO list before scaling. Paid plans start at ~$39/mo with no contracts.

That $80K LinkedIn Ads failure? It happened because the team targeted job titles instead of buying signals. Prospeo layers Bombora intent data across 15,000 topics with firmographic filters - so you find CEOs actively researching AI adoption, revenue growth, or digital transformation. Data refreshed every 7 days, not 6 weeks.

Find CEOs who are in-market right now, not just CEOs who exist.

Six Mistakes That Sabotage CEO Marketing Campaigns

Even with the right channels and data, these errors will kill your campaigns:

1. Interrogating instead of informing. Gong's analysis of ~40,000 deals is unambiguous: discovery questions decrease success with executive buyers. Don't ask "What keeps you up at night?" Tell them what should keep them up at night - then show how you fix it.

2. Bypassing the buying committee. Going straight to the top without engaging the VP or director who manages the relevant function creates enemies. Those mid-level leaders will actively block your deal. Multi-thread the account. (Use an ABM multi-threading plan.)

3. Going solo to C-suite meetings. CEOs ask unpredictable questions spanning finance, operations, and technology. If you can't answer a technical question about implementation timelines, you've lost credibility. Bring a specialist.

4. Failing to attach a dollar sign. The most likely question from any CEO: "Tell me how this will make me money." Every claim needs a revenue or margin impact number attached. Features and workflows don't close executive buyers.

5. Treating every executive buyer the same. A CEO at a 50-person startup operates differently than one at a Fortune 500. Forrester's finding that only 12% of sales calls add value exists because 88% of sellers haven't done the homework to understand who they're talking to, what that person cares about, and what a relevant insight looks like for their specific situation.

6. Giving up after one touch. ABM campaigns average 4.7 channels. A single cold email isn't a strategy - it's a lottery ticket. Coordinate multi-touch campaigns over weeks.

FAQ

How long does it take to get a meeting with a CEO?

Expect 4-8 weeks through coordinated ABM campaigns averaging 4.7 channels. Referrals compress the timeline to days - a warm introduction from a peer CEO is the fastest path. Direct mail follow-up sequences typically need 3-6 touches before a meeting materializes.

What's the best channel for reaching CEOs at mid-market companies?

Direct mail paired with LinkedIn organic outreach. Gatekeeping is lighter at companies under 200 employees, and CEOs there often manage their own inbox. Referrals still outperform everything else when available - prioritize building that engine alongside outbound.

Do CEOs actually read cold emails?

Yes, but they decide within seconds whether to read or delete. Send on Wednesday between 7-11 AM in their time zone for peak open rates (27.7% average). Lead with a specific, relevant insight - not a generic "quick question" - and keep the email under 100 words.

How much should I budget for a CEO-targeted ABM campaign?

Start with $1,000-$5,000 for a direct mail pilot targeting 25-50 accounts. Executive dinners run $5,000-$25,000. Cost per C-suite meeting typically falls between $500-$3,000 depending on channel. Start small, measure pipeline impact, then scale what converts.

What's a reliable way to find verified CEO email addresses?

Use a B2B data platform with frequent refresh cycles - stale data is the top reason CEO outreach fails. Prospeo refreshes records every 7 days (vs. the 6-week industry average) and delivers 98% email accuracy. The free tier includes 75 verified emails per month, enough to pilot a targeted CEO list before committing budget.