Emailchaser pricing (2026): what you'll actually pay

Emailchaser looks cheap until you do the boring math.

The sticker price is $37/month or $97/month. Your real cost is plan + verification credits + the inbox setup (mailboxes, domains, warmup). "Unlimited emails" just means they aren't charging per send.

Emailchaser lists two plans: Basic at $37/month and Professional at $97/month, and both come with a 7-day free trial. After the trial, spend mostly depends on how many inboxes you connect and how many contacts you verify.

What you actually pay for:

- Subscription: $37 or $97 per month (not per seat)

- Verification credits: $0.0017 per credit (the variable cost)

- Email accounts (inboxes): 3 on Basic, unlimited on Pro (with safe daily caps)

- Optional stack costs: domains, mailboxes, warmup, and sometimes a separate data source

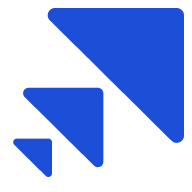

Emailchaser pricing plans compared (Basic vs Professional)

Emailchaser keeps it simple: two tiers with the same core workflow. The practical difference is the inbox limit.

| Feature / limit | Basic ($37/mo) | Professional ($97/mo) |

|---|---|---|

| Email accounts | 3 | Unlimited |

| Seats | Unlimited | Unlimited |

| Active leads | Unlimited | Unlimited |

| Emails | Unlimited | Unlimited |

| Workspaces | Yes | Yes |

| Lead Finder | Yes | Yes |

| Master Inbox | Yes | Yes |

| Sales CRM | Yes | Yes |

A few notes that matter once you're running campaigns daily:

- The CRM is reply-centric. Replies from campaigns show up in Emailchaser's Sales CRM, and leads get added to the CRM when they respond. It's built for conversations and follow-up, not heavy record-keeping.

- Unlimited seats is a real pricing win. Agencies and small teams get punished by per-seat tools, and Emailchaser doesn't play that game.

We've tested enough outreach stacks to say this plainly: inbox limits are the only "feature" that decides whether a plan works.

Who should pick Basic (and who shouldn't)

Basic is great when you're running one brand, one offer, and you can live inside three inboxes. It's a clean setup for a founder, a solo SDR, or a tiny team validating messaging.

Professional is the default for real outbound ops:

- Multi-client agencies (separate workspaces + lots of inboxes)

- Multi-domain setups (you rotate domains to protect deliverability)

- Any team that needs more than three inboxes to hit volume targets without torching reputation

- Anyone scaling, because the 3-inbox cap becomes the bottleneck long before the $97 fee does

Here's the thing: if you're planning to add inboxes within the next 30 days, start on Professional. The $60 difference is nothing compared to the time you'll waste redesigning your setup around a hard inbox ceiling, then migrating campaigns mid-flight while deliverability's already wobbling.

The "unlimited emails" reality: safe sending limits + inbox math

Emailchaser recommends 40 cold emails/day per inbox, and it enforces that by limiting campaigns to 40/day per email address. Good. Most deliverability blow-ups start with someone "testing" 150-300/day from a new mailbox and then acting surprised when replies die.

Quick sanity checklist:

- Plan around 40 cold emails/day per inbox

- Use ~22 business days/month for forecasting

- Scale by adding inboxes, not by cranking one inbox

- Remember ESP hard caps exist even if you never want to touch them:

Inboxes needed (blueprint math)

Formula (use this once and stop guessing): inboxes = monthly sends ÷ (40 × 22) -> round up

| Monthly send goal | Inboxes @ 40/day |

|---|---|

| 2,000/mo | 2 |

| 10,000/mo | 9 |

| 50,000/mo | 42 |

Two blunt truths:

- "Unlimited email accounts" doesn't mean "free to scale." It means Emailchaser won't charge you for connecting more inboxes. You still pay for the inboxes (and the work to keep them healthy).

- On Basic, 3 inboxes caps you at about 2,640 cold emails/month (3 × 40 × 22). That's the real limit, no matter what "unlimited emails" says.

Emailchaser's sending behavior is also worth calling out because it makes "unlimited inboxes" usable: rotation includes randomized 5-10 minute delays and a gradual build-up pattern, which helps avoid the robotic timing that gets campaigns flagged.

You're budgeting for Emailchaser credits, inbox costs, warmup tools, and a separate data source - and you still need to verify everything. Prospeo bundles 300M+ profiles, 98% verified emails, and 125M+ direct dials into one platform at ~$0.01/email. No verification credits. No stacking tools.

Stop paying four tools to do what one platform handles out of the box.

Verification credits explained (the real cost driver)

The subscription is predictable. The variable part is verification credits at $0.0017 per credit - that's $1.70 per 1,000 credits.

Emailchaser charges credits in two places:

- When you launch campaigns (verification happens as leads move into sending)

- When you run Lead Finder extractions (Lead Finder returns double-verified emails and consumes credits)

Emailchaser also publishes a benchmark: Lead Finder shows a 91% find rate in a 100-contact vendor-run test. Treat that as directional, but it explains why credits climb fast when you extract aggressively: pull 10,000 contacts and you'll verify a lot of them.

Planning assumption: assume 1 credit per verified email unless the in-app flow shows otherwise.

How to avoid paying for verification twice

The fastest way to waste money is re-verifying the same people across tools and workflows.

Do this instead:

- Dedupe before you verify (email + domain + company + name; not just email)

- Verify once, then treat that list as "campaign-ready" and reuse it across sequences

- Export your verified list and keep a single source of truth (sheet, warehouse, or a CRM field) so you don't accidentally re-run the same contacts next month

Real talk: most teams don't have a "tool cost" problem. They've got a process leak.

Monthly cost examples: 3 real-world scenarios

Below is the clean math using Emailchaser's published $0.0017 per verification credit.

But first, the line item that blindsides people.

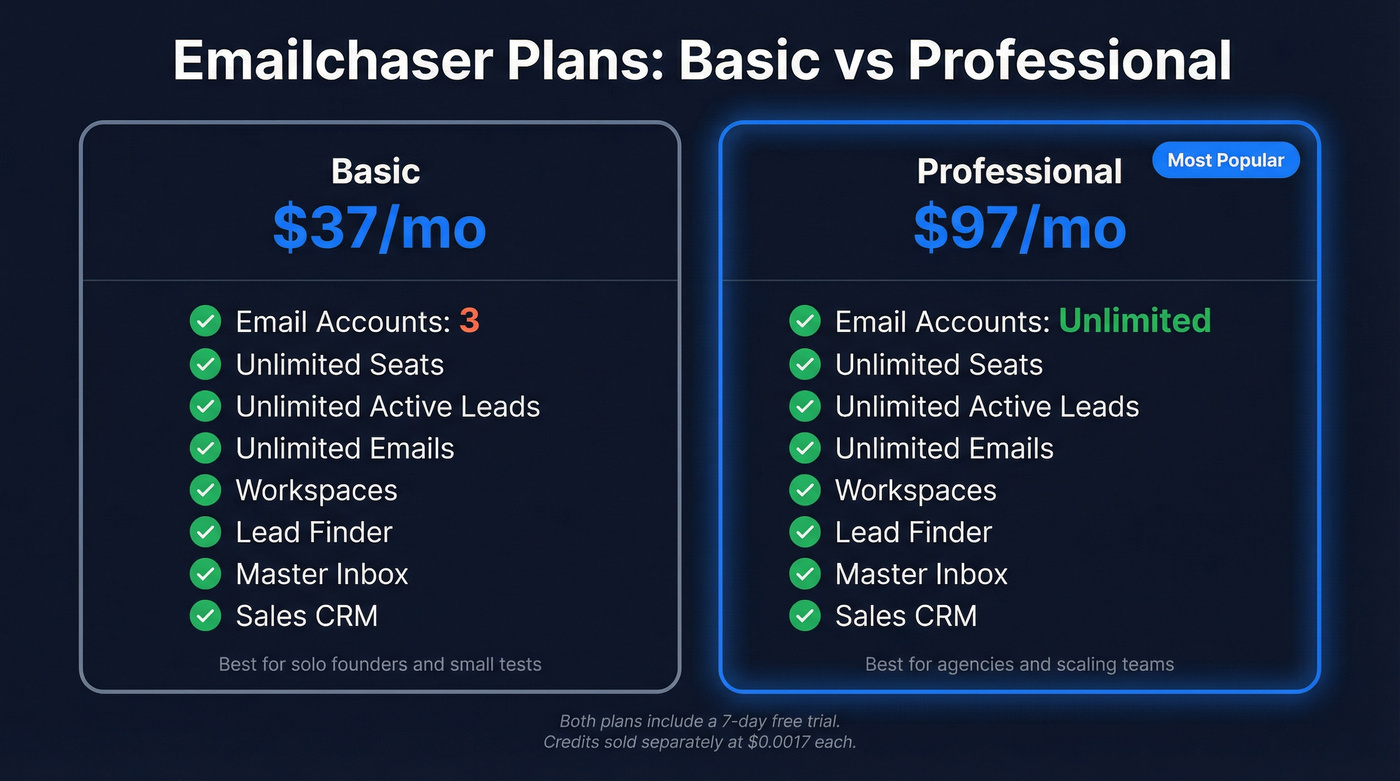

Inbox infrastructure cost ranges (the part nobody budgets)

Typical ranges for the outbound stack:

- Mailboxes: $4-$8 per inbox/month (common reseller pricing for Google/Microsoft mailboxes)

- Warmup: $10-$30 per inbox/month (if you use a warmup tool)

- Domains: $10-$15/year each (call it ~$1/month per domain when amortized)

Concrete example: 9 inboxes (the 10k/month send tier) often means $36-$72/month in mailboxes before warmup. Add warmup and you're quickly at $126-$342/month just to keep the sending infrastructure stable - separate from Emailchaser.

I've seen teams obsess over a $60 plan upgrade while running 20 inboxes with no warmup, one domain, and a list they scraped three months ago. That isn't "saving money." It's paying later, in bounces, spam placement, and a pipeline that quietly flatlines.

One Reddit user pegged inbox cost at $1,250/month for 250 inboxes at $5/inbox. That's not a universal benchmark, but it's a perfect reminder that at scale, inboxes - not software - become the bill.

Scenario A: Solo founder testing outbound (1,000 verifications/month)

| Item | Basic plan | Pro plan |

|---|---|---|

| Plan fee | $37 | $97 |

| Verification (1,000 × $0.0017) | $1.70 | $1.70 |

| Total (tool + credits) | $38.70 | $98.70 |

Verdict: Basic wins if three inboxes covers your volume.

Scenario B: Small team doing steady outbound (10,000 verifications/month)

| Item | Basic plan | Pro plan |

|---|---|---|

| Plan fee | $37 | $97 |

| Verification (10,000 × $0.0017) | $17.00 | $17.00 |

| Total (tool + credits) | $54.00 | $114.00 |

Verdict: this is where Basic starts lying to you. The plan is cheaper, but 3 inboxes can't support steady volume safely. Professional is the operational choice.

Scenario C: Agency / high-volume outbound (50,000 verifications/month)

| Item | Basic plan | Pro plan |

|---|---|---|

| Plan fee | $37 | $97 |

| Verification (50,000 × $0.0017) | $85.00 | $85.00 |

| Total (tool + credits) | $122.00 | $182.00 |

Verdict: at this level, the $60 plan difference is irrelevant. Your inbox count and infrastructure discipline decide whether you scale or crash.

Send goals -> inbox count (40/day, ~22 business days)

| Monthly send goal | Inboxes needed |

|---|---|

| 2,000/mo | 2 |

| 10,000/mo | 9 |

| 50,000/mo | 42 |

If you want one forecasting rule that doesn't break: the platform fee is stable, credits scale with list-building, and inboxes set your ceiling.

Why pricing info online conflicts (trial length, free plan, rotation)

Most conflicting posts about Emailchaser pricing are just stale. Third-party comparison pages drift fast, and pricing pages change faster than blog posts do.

Here's the clean view.

| Topic | Common outdated claim | What Emailchaser shows now |

|---|---|---|

| Trial length | 14-day trial | 7-day trial |

| Free plan | "Free tier exists" | No free plan shown |

| Pricing basis | "Per user/month" | Unlimited seats |

| Inbox rotation | "Manual rotation" | Automatic rotation + throttling |

Rotation is the one that matters operationally. Emailchaser's rotation isn't just an on/off toggle - it uses randomized 5-10 minute delays and gradual build-up so volume increases over time. That's why "unlimited inboxes" can work without turning your sending pattern into a spam signal.

One more cleanup: the "Chaser" listing on G2 isn't Emailchaser. It's an accounts receivable tool with the same name.

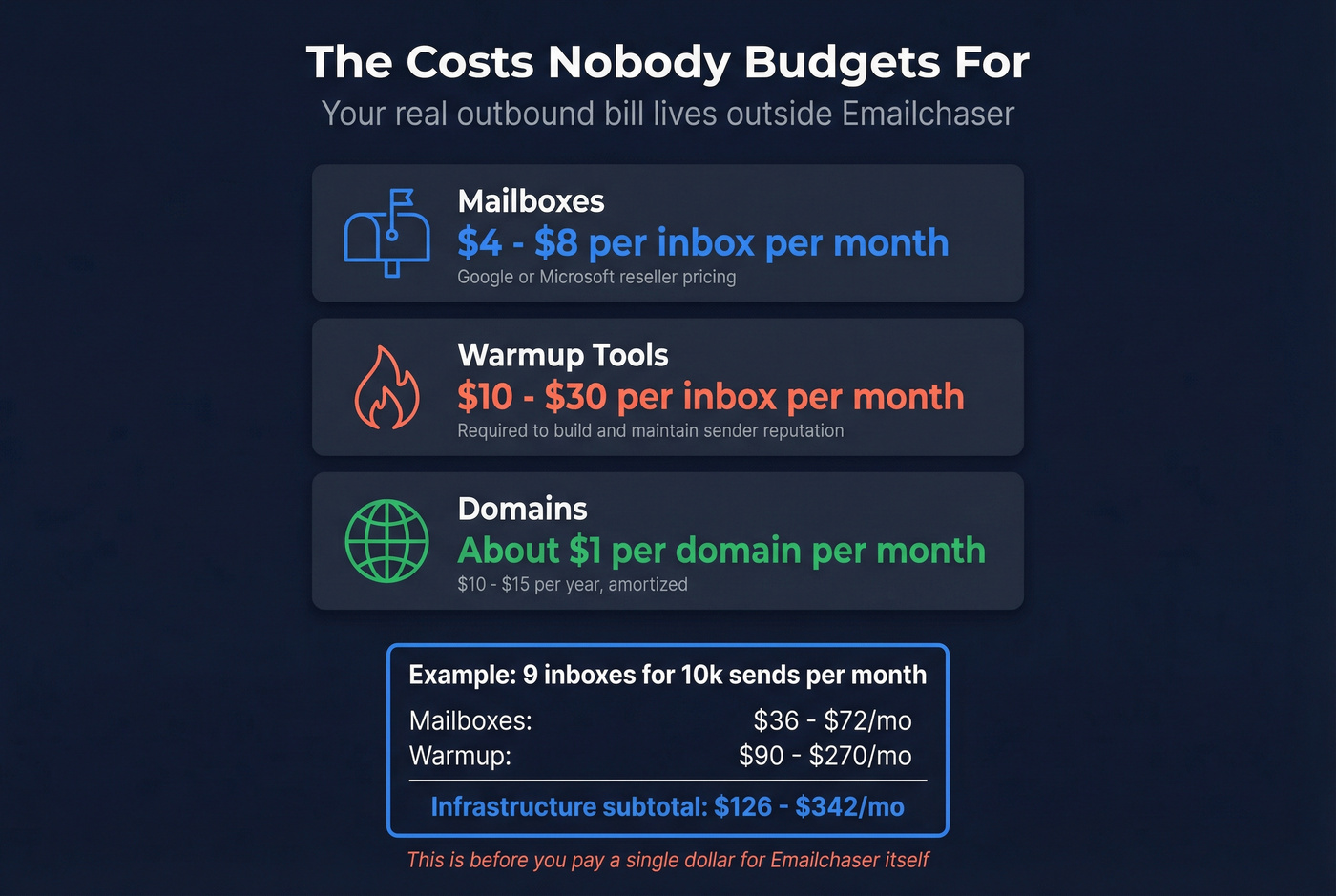

Emailchaser vs Instantly vs Smartlead (pricing predictability)

These tools charge in three different "philosophies," and that's what you're choosing.

- Emailchaser: flat subscription + verification credits

- Instantly: subscription tiers with explicit caps + modular add-ons

- Smartlead: subscription tiers with explicit caps + verification included per tier

Pricing snapshot (monthly)

| Tool | Best entry price | Best mid-tier price | Winner (predictability) |

|---|---|---|---|

| Emailchaser | $37 | $97 | Smartlead (verification bundled) |

| Instantly | $37 (Growth) | $97 (Hypergrowth) | Emailchaser (simpler base bill) |

| Smartlead | $39 (Base) | $94 (Pro) | Smartlead (clear allowances) |

And here's the detail people care about:

Instantly (Outreach)

- Growth $37/mo: 1,000 active leads; 5,000 emails/month

- Hypergrowth $97/mo: 25,000 active leads; 100,000 emails/month

- Light Speed $358/mo: 500,000 emails/month

- Add-ons: SuperSearch has a $47/mo tier; CRM has a $47/mo tier

Instantly's modularity is powerful. It's also how you end up with three separate line items and a finance team asking what happened.

Smartlead

- Base $39/mo: 6,000 sends/month, 2,000 contacts, 2,000 verified emails

- Pro $94/mo: 90,000 sends/month, 30,000 contacts, 30,000 verified emails

- Smart $174/mo: 150,000 sends/month, unlimited contacts, 50,000 verified emails

- Prime $379/mo: 500,000 sends/month, unlimited contacts, 170,000 verified emails

On Smart/Prime, Smartlead includes verification up to the tier allowance, which makes forecasting simple.

My take (and I'm not neutral): if you're selling a lower-ticket offer and you're still learning outbound, you don't need a "platform strategy." Pick the tool that keeps you shipping campaigns without surprise bills. For most teams, that's Emailchaser (simple base + credits) or Smartlead (bundled verification), not a sprawling modular stack.

When data quality - not sequencing features - is your cost driver, separating "data" from "sending" usually wins. Tools like Prospeo fit that model: it's a B2B data platform built for accuracy, with 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy on a 7-day refresh cycle, so you can build clean lists and then push them into your sender of choice.

Final recommendation: who it's for (and who should skip)

Emailchaser pricing is straightforward on purpose. It fits buyers who want an all-in-one cold email workflow without per-seat taxes.

It's a strong fit if:

- You're an agency managing multiple clients: unlimited seats + workspaces protects margin

- You scale outbound with multiple inboxes and want the platform enforcing 40/day safety limits

- You prefer "flat plan + usage credits" over tier plans with a dozen caps

Skip it if:

- You want your monthly bill to be one number with zero variable components

- You're planning serious volume but haven't budgeted for mailboxes + warmup + domains (that's where the real spend lives)

One more "skip this if": if you're the type to ignore deliverability basics, don't buy more software. Fix your list hygiene, warmup, and domain rotation first, or you'll just pay to send more mail into spam.

Summary: Emailchaser is cheap on the subscription line, but the true cost is governed by inbox count and verification volume. Basic only makes sense if you'll stay at 3 inboxes or fewer for the next quarter; Professional is the practical default once you're scaling.

Emailchaser's Lead Finder claims a 91% find rate in a vendor-run test of 100 contacts. Prospeo's enrichment API hits a 92% match rate across millions of lookups - returning 50+ data points per contact with emails refreshed every 7 days, not whenever you burn credits re-verifying stale lists.

Get fresher data without paying to verify the same contacts twice.