How to Build Account Based Marketing Personas That Actually Navigate Buying Committees

Fourteen people on the buying committee. Four departments with competing priorities. And your marketing team just sent the same case study to all of them. That's not account based marketing - that's spray and pray with a target account list.

Gartner's research found that 74% of B2B buyer teams demonstrate unhealthy conflict during the decision process, and here's the kicker: content tailored for individual relevance actually creates a 59% negative impact on buying group consensus. You read that right. The more you optimize for one person, the harder you make it for the group to agree. Content designed for buying group relevance, on the other hand, creates a +20% positive impact on consensus.

The problem isn't that teams don't build account based marketing personas. It's that they build the wrong kind - B2C-style demographic profiles that describe individuals in isolation, then wonder why deals stall when the CFO and the end user can't align on priorities. ABM buyer personas need to model how buying groups make decisions together, not just how individuals think alone. Most teams have never been taught the difference.

What You Need (Quick Version)

If you're short on time, here's the framework in six bullets:

- Design for buying groups (5-16 people), not individuals. Buying groups that reach consensus are 2.5x more likely to close high-quality deals.

- Start with three personas: User, Supervisor, and Executive. These cover 90% of buying committee dynamics without creating a persona graveyard.

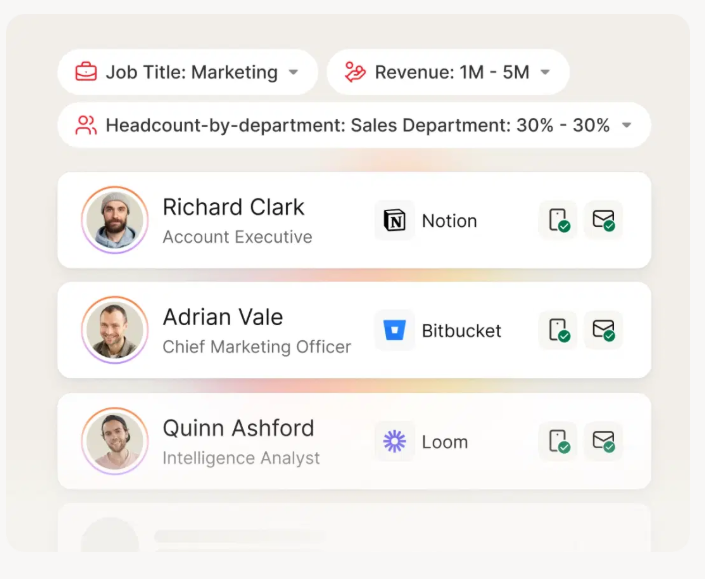

- Research using closed-won CRM data and enrichment tools. Use B2B database filters covering job function, seniority, and buyer intent to find real contacts matching each persona - so your personas connect to actual people, not fictional composites.

- Map content to each persona by buying stage. Awareness, consideration, and decision content should differ by role, not just by funnel position.

- Layer in political dynamics. Who's the champion? Who's the blocker? Who has budget authority but zero technical context?

- Update at least twice a year. Stale personas produce stale campaigns.

The rest of this guide shows you exactly how to build, validate, and operationalize each piece.

What ABM Personas Are (and What They're Not)

ABM personas get confused with two things: traditional buyer personas and buying group roles. They overlap with both but match neither exactly. Getting this distinction wrong is the root cause of most ABM content failures.

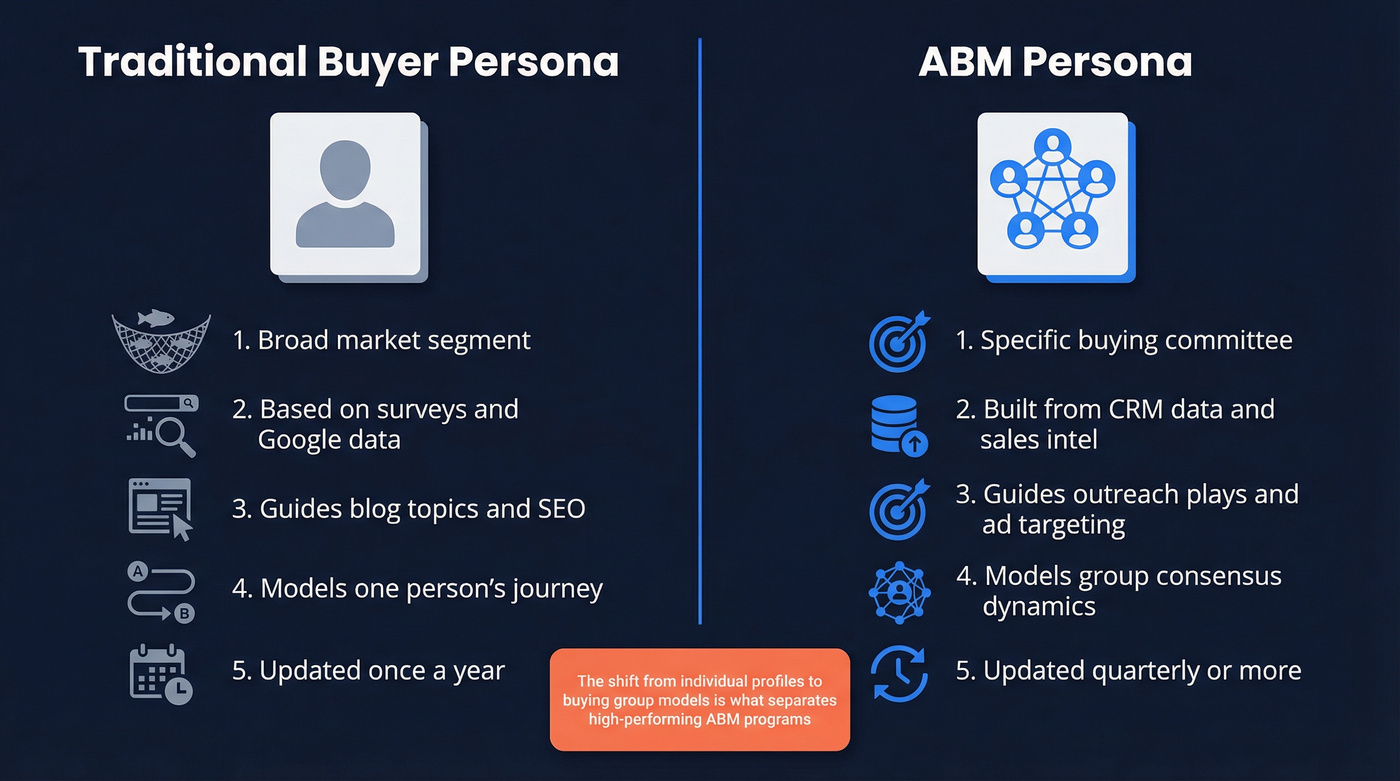

ABM Personas vs. Traditional Buyer Personas

Traditional buyer personas were designed for inbound marketing. They're broad by nature - meant to represent large audience segments so you can plan blog topics, keyword strategies, and lead magnets. They answer the question: "Who might find us through search or social?"

ABM personas flip that entirely. They're specific to buying committees within named accounts. They answer: "Who's in the room when this deal gets decided, and what does each person need to hear?"

The structural differences matter:

| Dimension | Traditional Buyer Persona | ABM Persona |

|---|---|---|

| Scope | Broad market segment | Specific buying committee |

| Research inputs | Forms, Google, interviews | CRM data, sales input, enrichment |

| Guides | Content calendar, SEO | Ad targeting, outreach plays |

| Relationship model | Individual journey | Group consensus dynamics |

| Update frequency | Annually | Quarterly or more |

Companies that exceeded revenue and lead goals were 71% more likely to have documented buyer personas, and 56% of businesses reported generating higher quality leads after implementing them. But the type of persona matters enormously. A beautifully designed inbound persona won't help your AE navigate a seven-person buying committee at a target account. The shift from generic profiles B2B marketing teams typically create to target account personas built for specific committees is what separates high-performing ABM programs from the rest. (If you want examples of what "good" looks like, see these buyer personas.)

Personas and Buying Group Roles Aren't the Same Thing

Here's the thing: a persona captures who someone is and what matters to them. A buying group role defines what part they play in a specific purchase decision.

The same person can occupy different roles across different deals. A VP of Marketing might champion your ABM platform but act as a passive influencer when the team evaluates a new CRM. The persona stays constant - their motivations, fears, communication preferences, and career incentives don't change deal to deal. But their role in the buying group shifts based on the purchase.

You need both layers: personas that describe the human, and role mappings that describe their function in each buying scenario. Build the personas first. Map the roles second.

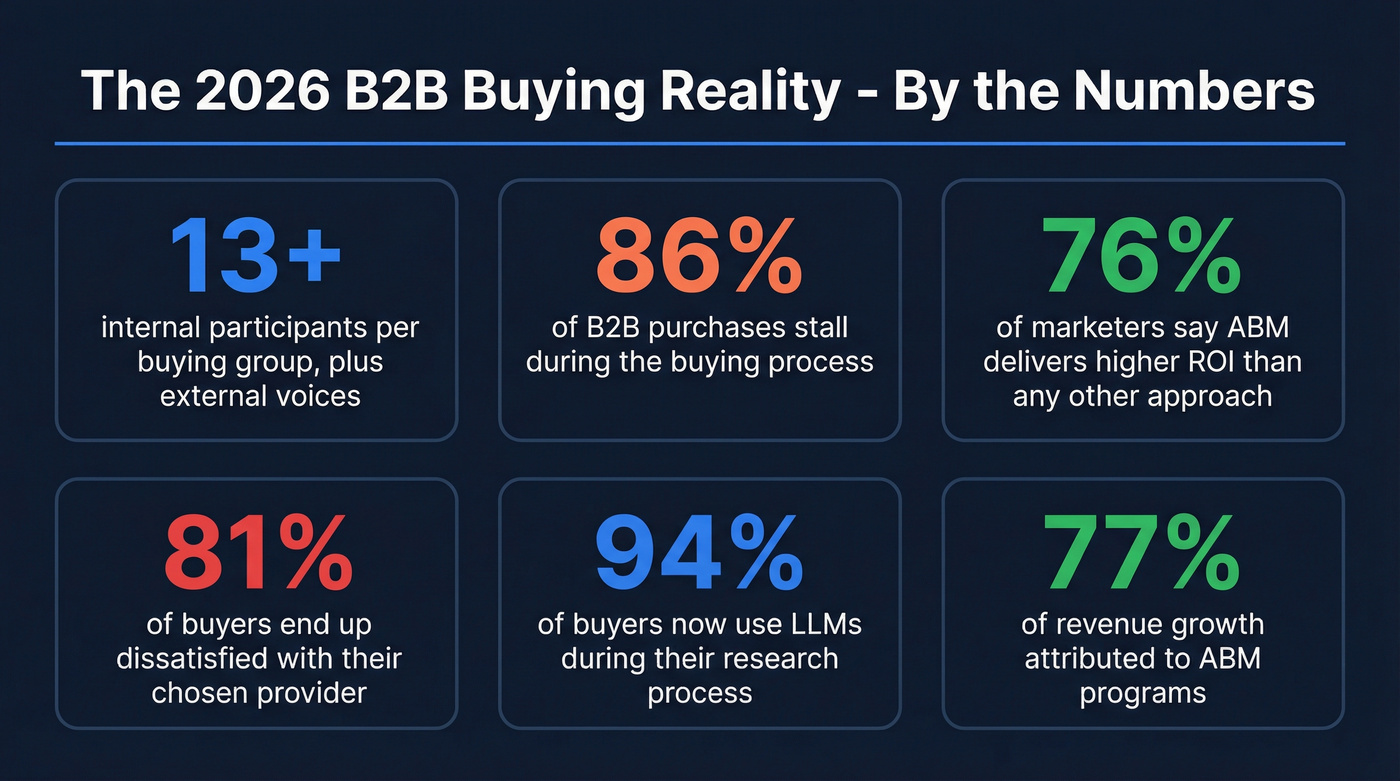

The 2026 B2B Buying Reality

The buying environment your personas need to navigate has changed dramatically, and most persona frameworks haven't caught up.

Forrester's research shows the average buying group now includes 13 internal participants plus external voices: partners, peers, analysts, and increasingly, AI agents. Formal buying committees are giving way to fluid networks of influence - internal stakeholders, external peers, and digital communities all shaping the decision. The average sales cycle dropped from 11.3 months to 10.1 months recently, with 49% of buyers saying economic conditions shortened their timelines. Faster cycles with more stakeholders means your B2B marketing personas need to work harder, sooner. (If you need a deeper model of how committees actually decide, see B2B decision making.)

The numbers paint a brutal picture.

86% of B2B purchases stall during the buying process. 81% of buyers end up dissatisfied with the provider they ultimately choose. Buyers still average 16 interactions per person with the winning vendor. And 94% of buyers now use LLMs during their research - meaning your personas need to account for how AI-assisted research changes information gathering and evaluation.

Despite this complexity, ABM remains the highest-ROI marketing approach available. 76% of marketers report higher ROI with ABM than any other form of marketing (a stat that's held steady since ABMLA first measured it in 2020). Businesses attribute 77% of their revenue growth to ABM programs. And 58% of marketers see deal size increase when ABM is executed well.

The gap between ABM's potential and its execution comes down to one thing: most teams don't understand the buying group well enough to influence it. That's what personas are supposed to solve.

Hot take: If your average deal size is under $15k, you probably don't need account-level persona research at all. Run programmatic ABM with three solid personas and spend your time on content, not committee mapping. The ROI on deep persona work only kicks in when deal sizes justify the investment.

Your ABM personas are only useful if they connect to real people. Prospeo's 300M+ profiles with 30+ filters - including buyer intent, job function, seniority, and department headcount - let you find every member of a buying committee and reach them with 98% verified emails.

Stop building personas you can't actually prospect into.

The Buying Group Archetypes Your ABM Personas Must Cover

Every buying committee contains predictable archetypes. The titles change by company, but the behavioral patterns are remarkably consistent. Your personas need to map to these archetypes - or you'll miss the people who actually decide.

The 8 Buying Group Archetypes

I've seen teams try to simplify this to three or four roles. That works for persona creation (more on that in the next section), but for understanding the committee, you need the full picture. Here are the eight archetypes that show up across B2B purchases, along with how to spot them by their content engagement patterns:

| Archetype | What They Do | Content They Consume | How to Spot Them |

|---|---|---|---|

| Champion | Advocates internally | Use cases, ROI calcs, deep dives | Repeat visits, shares content |

| Decision Maker | Final authority | Exec summaries, analyst reports | Late-stage engagement |

| Executive Sponsor | Provides air cover | Leadership briefs, impact summaries | Light but strategic touches |

| Budget Controller | Controls the money | Pricing pages, ROI tools, comparisons | Spikes on cost content |

| Influencer | Shapes requirements | Blogs, comparison guides, reviews | Early-stage, broad browsing |

| End User | Uses it daily | Demos, tutorials, feature pages | Product-focused engagement |

| Blocker | Raises objections | Security docs, checklists, ROI tools | Sporadic, skeptical pattern |

| Legal/Compliance | Manages risk | Security docs, compliance content | Brief, focused, late-stage |

Typical tech purchases involve 14 to 23 stakeholders with overlapping and evolving roles. A single person might be a champion in Q1 and a blocker by Q3 if implementation concerns surface. Engaging just three buying group members boosts conversion rates by over 50% - which means identifying even a few of these archetypes early can transform your win rate. (For execution, pair this with an ABM multi-threading plan.)

Two additional archetypes worth noting: the Initiator (the person who first identifies the problem and starts the search) and the Gatekeeper (who controls access to decision makers and budget). The Initiator is often your first touchpoint - they're consuming industry reports and case studies to validate their instinct that something needs to change. Miss them, and you might never get into the conversation.

The Three Layers: Official Committee, Shadow Committee, and Political Layer

This is where most ABM programs fall apart. They map the official committee - the people on the calendar invite for the vendor evaluation - and stop there.

Real buying groups operate on three layers:

The Official Committee is who you see. They attend demos, ask questions, and fill out scorecards. Your AE knows their names.

The Shadow Committee is who you don't see. These are the people the official committee consults privately - a trusted peer in another department, a former colleague who's used your competitor, the IT architect who'll have to integrate your tool. They influence the decision without ever joining a call.

The Political Layer is the organizational dynamics that shape the outcome. Who's trying to get promoted? Who's protecting their budget? Who has a relationship with a competitor's executive? These aren't roles - they're motivations that override rational evaluation.

Your personas need to account for all three layers. The official committee is table stakes. The shadow committee is where deals are actually won or lost. And the political layer explains why "the best product" sometimes loses.

How to Build Account Based Marketing Personas - The Practical Framework

Enough theory. Here's how to actually build personas that your sales team will use and your campaigns will benefit from.

Start With Three Personas: User, Supervisor, Executive

Look, you could build twelve personas. You could map every archetype to a detailed profile with a stock photo and a clever name. And then nobody would use any of them.

The most effective framework we've tested uses three personas per buying scenario:

P1 - The User. The day-to-day functional person who'll actually use your product. Your marketing goal is to make them an advocate - or at minimum, prevent them from becoming a blocker. They're your gateway to P2. They're also your best audience for message testing, because they'll tell you immediately if your positioning resonates or sounds like marketing fluff.

P2 - The Supervisor. The manager or group leader of P1. Usually the primary decision-maker. They care about ROI, team productivity, and not making a decision that blows up in their face. The content that works here: ROI calculators, RFP templates, buyer's guides. P2 needs to "sell" the decision to P3 - so give them the slides, data points, and case studies to do it.

P3 - The Executive. The executive sponsor. Least technical knowledge, highest authority. They care about strategic alignment, risk mitigation, and whether this purchase makes them look smart. They need a practical foundation - not a feature tour.

The recommended cadence: start with P1 to optimize messaging, then target P2 as the key decision-maker, then equip P2 to sell P3. This mirrors how decisions actually flow in most organizations. This three-tier approach also forms the backbone of effective account based sales personas, giving your SDRs and AEs a clear framework for tailoring outreach by seniority level. (For a practical outreach layer on top, use multi-stakeholder outreach ABM.)

Research Method: Storytelling Interviews, Not Surveys

Most buyer persona templates are designed for simpler B2C decisions. They ask about demographics, hobbies, and "a day in the life." That's useless for modeling a multi-buyer, 10-month B2B sales cycle.

Adele Revella's framework (from her book Buyer Personas) uses qualitative one-on-one interviews focused on storytelling, not scripted questions. The technique: get interviewees to share stories from how the challenge first surfaced through to choosing a vendor. Don't ask "what features matter to you?" Ask "tell me about the moment you realized you needed to solve this problem."

Stories surface subconscious motivations that direct questions can't reach.

One practitioner using this method discovered that a key persona wasn't primarily motivated by efficiency gains - they were fighting for C-suite recognition. That insight armed the ABM team with a completely different content strategy: instead of ROI calculators, they created content about how this persona's peers had used the tool to gain visibility with leadership.

"Just asking sales" isn't enough either. Salespeople miss every interaction that happens before they get involved - and 83% of buyers conduct independent research before contacting sales. The 82.4% of organizations that exceeded revenue goals conducted qualitative interviews with buyers, nearly 3x more common than underperformers. This is the research depth that separates a useful buyer persona B2B marketing teams can act on from a decorative slide deck.

Why Vertical Targeting Fails (and Use-Case Clusters Work)

One of the most expensive ABM mistakes is organizing your personas by industry vertical.

A B2B learning platform targeting "enterprise organizations" ran ABM for a full year with poor results. The problem? Three distinct ICP clusters existed within their target market - companies focused on acquisition onboarding, internal leadership development, and change management. Each cluster had different buyers, different pain points, and different evaluation criteria. One set of personas couldn't serve all three.

Another team targeting "banks" learned the same lesson the hard way: retail banks need onboarding solutions, investment banks need advisor retention tools, and commercial banks need fraud prevention. Same industry, completely different buying groups. They generated 178 MQLs, created 2 opportunities, and closed zero deals.

A cluster is a set of ICP accounts sharing the same use case and challenges, regardless of industry or tier. Here's how to build them:

- Audit your closed-won deals for the actual use case each customer bought for

- Group accounts by use case, not by industry or company size

- Identify the primary buyer persona within each cluster

- Map the typical buying committee for that use case

- Build cluster-specific messaging that speaks to the shared pain point

- Test and refine - merge clusters that behave identically, split ones that don't

This is harder to set up but dramatically more effective. Each cluster gets its own primary buyer persona and specific messaging. (If you need to tighten your upstream definition work, start with your ideal customer.)

How Persona Depth Changes by ABM Tier

Not every account deserves the same persona investment. Match your depth to your tier:

Tier 1 (Strategic, 1:1): Your top 10-20 accounts. Full persona research with interviews, political mapping, and account-specific customization. Dedicated resources per account.

Tier 2 (Scale, 1:Few): 50-100 accounts. Semi-personalized personas segmented by use-case cluster. You're using the three-persona framework but customizing messaging by cluster, not by individual account.

Tier 3 (Programmatic, 1:Many): 100-200+ accounts. Light personalization using your core personas with scalable tactics. The personas guide targeting and content selection, but you're not doing custom research per account. This is also where persona-based advertising becomes essential - using your persona profiles to build audience segments for LinkedIn, display, and programmatic ad campaigns that reach the right roles at scale. (If you're running lean, see ABM without expensive tools.)

The tiers aren't static. A Tier 3 account showing high engagement signals should get promoted to Tier 2 treatment. A Tier 1 account that goes dark might drop.

What a Complete ABM Persona Looks Like

Here's a filled-out persona example that goes beyond demographics. This is what a usable ABM persona actually contains - including the "proof artifacts" each persona needs to see before they'll move forward.

Persona: "Data-Driven Dana" P2 - The Supervisor

Role: Director of Revenue Operations, B2B SaaS (200-1,000 employees)

Psychographic Profile: Values efficiency and measurability above all. Skeptical of vendor claims - wants to see the data before committing. Career-motivated: wants to be seen as the person who modernized the GTM stack. Reads industry newsletters, follows RevOps influencers, and benchmarks her team's metrics against peers.

Behavioral Patterns: Consumes an average of 13 pieces of content during the buying journey. Starts with peer recommendations and community discussions. Downloads comparison guides and ROI calculators before engaging sales. Shares content internally via Slack - if your content isn't shareable, it doesn't reach her committee.

Emotional Drivers: Fear of making a bad technology bet that wastes budget and credibility. Ambition to build a best-in-class RevOps function. Frustration with tools that promise automation but require constant manual intervention.

Purchase Criteria: Integration with existing CRM (non-negotiable). Transparent pricing without annual lock-in. Data accuracy above 95%. Time-to-value under 30 days.

Proof Artifacts She Needs:

- A one-page financial model showing cost-per-lead impact (for her CFO conversation)

- A side-by-side feature comparison she can paste into Slack

- A customer reference in her industry segment she can call directly

- An implementation timeline with specific milestones, not vague "onboarding support"

Content Preferences by Stage:

- Awareness: Benchmark reports, "state of RevOps" content, peer case studies

- Consideration: Feature comparisons, integration documentation, ROI calculators

- Decision: Free trial, implementation timeline, customer references in her industry

Internal Selling Challenges: Needs to convince her VP (P3) that the switch is worth the migration risk. Needs to show the end users (P1) that the new tool won't add to their workload. Needs to prove to finance that the ROI justifies the spend within two quarters.

Political Context: Currently championing the decision. Has budget authority for tools under $30k/year. Needs executive sponsor sign-off above that threshold. Her biggest internal blocker: the IT security team, who'll want a full vendor assessment.

B2B buyers who see personal value in a product are 3x as likely to purchase. That's why the emotional and political dimensions matter as much as the functional ones. A persona without career motivations, proof artifacts, and internal selling challenges is a demographic profile pretending to be strategy.

Mapping Content to Personas by Buying Stage

Once your personas exist, you need to map specific content to each one at each stage of the buying journey. This is where most ABM programs break down - they build great personas and then send the same webinar invite to everyone.

83% of buyers conduct independent research before ever talking to sales. Your content is doing the selling for the first two-thirds of the cycle. It needs to be persona-specific.

| Stage | User (P1) | Supervisor (P2) | Executive (P3) |

|---|---|---|---|

| Awareness | How-to guides, infographics | Benchmark reports, trend analysis | Industry leadership briefs |

| Consideration | Product demos, tutorials | Comparison guides, ROI calcs | Peer case studies, analyst reports |

| Decision | Onboarding guides, feature docs | Implementation plans, pricing | Exec summary, risk assessment |

Each cell represents a different content asset - or at minimum, a different angle on the same asset. A case study for P1 highlights ease of use and daily workflow improvements. The same case study reframed for P2 emphasizes ROI metrics and team productivity gains. For P3, it's a one-page executive summary showing strategic alignment and competitive advantage.

The champion (often P2) needs content they can forward internally. If your case study is a 3,000-word PDF, create a one-slide summary version. If your ROI calculator requires a login, you've just killed the internal sharing loop. Remember: buying group-relevant content creates a +20% positive impact on consensus. Individual-optimized content creates a -59% impact. Design every asset to help the group agree, not just to impress one person. (To systematize this, use an ABM campaign planning template.)

Using Personas to Power Persona-Based Ad Campaigns

One of the highest-leverage applications of well-built ABM personas is persona-based advertising across LinkedIn, programmatic display, and connected TV. Instead of targeting accounts with a single generic message, you create distinct ad creatives and landing pages for each persona within the buying committee.

In our experience, the execution looks like this: your P1 (User) sees ads highlighting ease of use and workflow integration. Your P2 (Supervisor) sees ads featuring ROI data and peer case studies. Your P3 (Executive) sees ads focused on strategic outcomes and competitive positioning. Each persona-driven ad campaign maps to a dedicated landing page with content tailored to that role's priorities.

The targeting mechanics vary by platform. LinkedIn lets you layer job function, seniority, and company list targeting to reach specific personas within your target accounts. Programmatic platforms like Demandbase and 6sense use IP-based account matching combined with role-level signals. The key is that your persona research directly informs your audience segmentation - the same three personas driving your sales outreach should drive your ad targeting.

ABM Persona Mistakes That Kill Your Pipeline

I've watched teams invest months in persona development and end up with documents nobody uses. Here are the seven mistakes that cause that:

1. Building "fairytale personas." This is the #1 complaint from practitioners on Reddit - and it's earned. Personas built by marketers who never talk to customers or sales teams are fiction. They describe an idealized buyer who doesn't exist. If your persona includes hobbies and a stock photo but no purchase criteria or internal politics, start over.

2. Using B2C templates for B2B. Demographics, age ranges, and "a day in the life" narratives are designed for consumer marketing. A persona B2B marketing teams can actually use needs firmographics, buying committee dynamics, and organizational politics. A persona's Netflix preferences won't help your AE navigate a seven-person evaluation committee.

3. Not involving sales from day one. If sales didn't help build the personas, sales won't use the personas. Period. Involve your AEs and SDRs in the research, the framework, and even the naming.

4. Creating too many personas. Five is a practical maximum per buying scenario. Most teams need three. Every persona beyond five dilutes your focus and increases the odds that none of them get operationalized. I've seen teams build eight personas and use zero of them.

5. Building personas and never updating them. Job titles change. Buying group structures shift. Market conditions evolve. At minimum, revisit your personas twice a year. Teams that treat personas as living documents outperform those that laminate them and pin them to a wall.

6. Developing personas and never using them. More common than you'd think. The persona project gets completed, the deck gets presented, and then nothing changes about how campaigns are built or how sales approaches accounts. Personas must connect to specific outreach plays, content assets, and targeting criteria - or they're expensive decoration.

7. Optimizing for individual persuasion instead of group consensus. This is the Gartner finding that should reshape how every ABM team thinks about personas. Content focused on individual-level relevance creates a 59% negative impact on buying group consensus. When you optimize for one person, you make it harder for the group to agree. Your personas need to model how the group decides together, not just how individuals think alone.

ABM Persona Tools and Tech Stack

Enterprise ABM platforms are overkill for most teams. A $60,000/year Demandbase contract makes sense when you're running programmatic ABM across 500+ accounts with dedicated headcount. For everyone else, you can build an effective persona-driven ABM program with a fraction of that spend.

Data Enrichment and Verification

Your personas are useless if you can't find real contacts who match them.

Apollo covers 275M+ contacts and works as a budget-friendly all-in-one. Free tier is generous; paid plans start at $49/mo. Email accuracy runs lower than dedicated verification tools, and phone data is thinner outside North America. (If you're comparing options, start with these B2B email lookup tools.)

Clay is the power tool for automated enrichment workflows, waterfalling across 100+ data providers. Free tier available, paid from ~$149/mo. Best for RevOps teams building custom enrichment sequences.

ZoomInfo remains the enterprise default with 500M+ contacts. Mid-market contracts run $15,000-$40,000+/year. If you need massive US database depth and don't mind the price, it's still the benchmark.

LinkedIn Sales Navigator deserves a mention for account-level research: $99/mo and up. Strong for identifying buying committee members by title and department within target accounts, though it won't give you verified emails or phone numbers.

ABM Platforms

Skip this category entirely if you're a team of three trying to get ABM off the ground. These are for organizations with dedicated ABM headcount and 50+ strategic accounts.

Demandbase One: Full-stack ABM - account identification, intent data, advertising, orchestration. $30,000-$100,000+/year. G2: 4.3/5.

6sense Revenue AI: Predictive buying stage signals tell you when accounts are in-market. $30,000-$100,000+/year. G2: 4.3/5. The predictive models are genuinely useful - but only with enough volume to train them.

Terminus: ABM advertising and orchestration, now part of DemandScience. $25,000-$75,000/year. G2: 4.4/5.

Persona Creation and Planning Tools

HubSpot Make My Persona: Free, guided questionnaire that generates a shareable persona document. Basic - won't handle buying group dynamics - but it'll get you a baseline in 20 minutes.

Juma (Team-GPT): AI-powered persona generation. Describe your persona, answer follow-ups, choose your AI model, and get a full draft. Free tier plus paid plans. Use AI to accelerate research, not replace it.

UXPressia: Design-focused persona tool with collaboration features. Paid plans from ~$16/mo.

Smartsheet: Offers free ABM strategy, campaign, and planning templates that pair well with the persona frameworks above. Good for teams that want structured project management around their ABM program.

Intent Data

Bombora: The standard for B2B intent data. Company Surge data shows which accounts are actively researching relevant topics. Persona-level intent - knowing which roles within an account show intent - is where Bombora adds the most value. $20,000-$50,000+/year depending on volume. (To operationalize signals, see intent signals.)

6sense: Combines intent with predictive analytics. If you're already on 6sense for orchestration, intent is built in. No standalone access.

| Tool | Category | Starting Price | Best For |

|---|---|---|---|

| Prospeo | Enrichment + verification | Free; ~$0.01/email | Verified persona contacts |

| Apollo | Prospecting + enrichment | Free; from $49/mo | Budget all-in-one |

| Clay | Enrichment workflows | Free; from ~$149/mo | Multi-source automation |

| ZoomInfo | Enterprise enrichment | ~$15K-$40K+/yr | Large teams, US depth |

| LinkedIn Sales Nav | Account research | From $99/mo | Committee identification |

| Demandbase | ABM platform | ~$30K-$100K+/yr | Enterprise orchestration |

| 6sense | ABM + intent | ~$30K-$100K+/yr | Predictive buying signals |

| HubSpot Make My Persona | Persona generator | Free | Quick baseline personas |

| Juma (Team-GPT) | AI persona generator | Free + paid | AI-powered persona drafts |

| Smartsheet | ABM templates | Free templates | Campaign planning |

Buying groups shift fast - 7-day data refresh means your committee maps never go stale. Enrich your CRM contacts with 50+ data points at 92% match rate so every persona has real names, verified emails, and direct dials behind it.

Turn persona frameworks into pipeline for $0.01 per contact.

FAQ

How many account based marketing personas do I need?

Most teams need 3-5 personas per buying scenario. The simplest effective framework uses three: User, Supervisor, and Executive. These cover the core dynamics of nearly every B2B buying committee. Creating more than five usually means they'll sit unused - focus on depth over breadth.

What's the difference between an ABM persona and a traditional buyer persona?

Traditional buyer personas target broad audiences for inbound marketing - they're generalized by design. ABM personas are specific to buying committees within target accounts. They map roles, political dynamics, and group decision-making patterns, not just individual demographics. The research inputs differ too: ABM programs rely on CRM data and sales input, not form captures and keyword research.

Can AI build ABM personas?

AI generates solid first drafts using tools like Juma or ChatGPT, cutting research time by 60-70%. But the best personas are validated through qualitative interviews with customers and sales teams. AI misses organizational politics, emotional motivations, and the shadow committee dynamics that determine whether deals close. Use AI to accelerate, not replace.

How do I get sales to actually use the personas I build?

Involve sales from day one - in the research, the framework, and the naming. Map each persona to specific outreach plays, talk tracks, and content assets. If sales helped build it, they'll use it. If marketing built it in isolation and presented it in a deck, it'll gather dust.

What's a good free tool for building ABM personas from scratch?

HubSpot's Make My Persona tool generates a basic persona document in 20 minutes - solid for a starting framework. For populating those personas with real contacts, Prospeo's free tier includes 75 email credits and 100 Chrome extension credits monthly, enough to validate your personas against actual prospects in target accounts before committing budget.

The buying committee isn't getting smaller, the sales cycle isn't getting simpler, and AI is making every buyer more informed before they ever talk to your team. The teams that win in 2026 won't be the ones with the most account based marketing personas - they'll be the ones whose three personas actually map to how real committees make real decisions. Build for the group, not the individual. And then make sure every persona connects to a real person you can actually reach.