Multi-Stakeholder Outreach for ABM: The 2026 Playbook

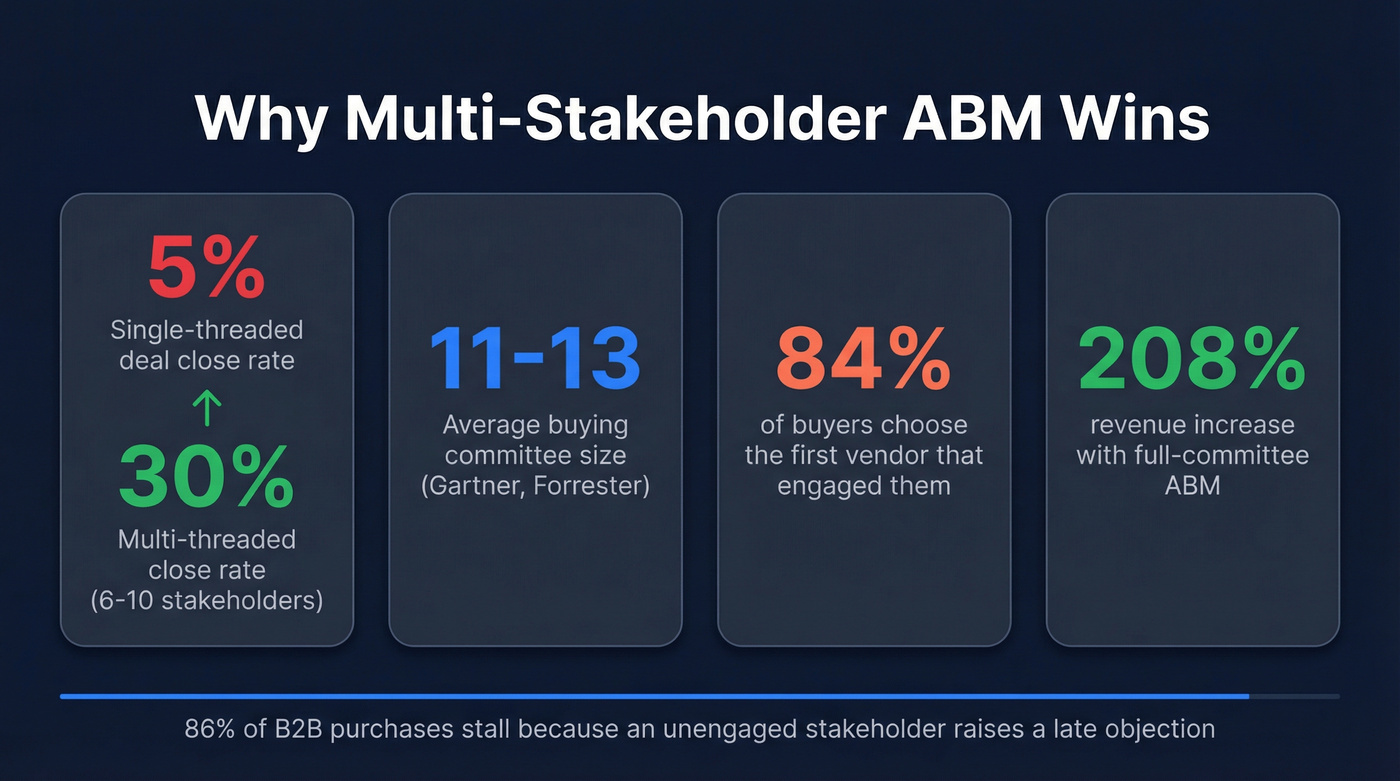

Your AE just lost a $200K deal. Not because the product was wrong or the pricing didn't work - because the champion changed jobs. One contact, one thread, one point of failure. That's single-threaded selling, and it closes at roughly 5%. Multi-threaded deals - where you're engaging 6-10 stakeholders across the buying committee - close at 30%. That's a 6x gap between teams running multi-stakeholder outreach ABM and teams running targeted outbound with an ABM label on it.

The frustrating part? Most teams know multi-threading matters. They just don't have the playbook, the data infrastructure, or the coordination to pull it off. They send one email to the VP, get ghosted, and move on. The rep who mapped the entire committee - the champion, the technical evaluator, the economic buyer, the blocker in procurement - is the one booking the meeting.

Enterprise buying committees now average 11-13 people. If you're only talking to two of them, you're not doing ABM. You're doing hopeful outbound.

What You Need to Run Committee-Wide ABM (Quick Version)

If any one of these is missing, you have a targeted outbound program, not ABM.

- A stakeholder map with 6-10 contacts per account - using the 9-archetype model (Economic Buyer, Champion, Blocker, etc.)

- Tiered account selection - 1:1, 1:few, 1:many, with investment matched to deal potential

- Role-specific sequences across 3+ channels - email, phone, ads, direct mail, social

- Verified contact data for every committee member - this is where most campaigns silently fail (see what “verified” should mean in practice in our email verifier websites breakdown)

- Account-level attribution - not contact-level MQLs that make your dashboard look good while pipeline stalls

Miss one, and the whole system breaks. Miss #4, and you won't even know it's broken until your domain reputation is toast.

Why Engaging the Full Buying Committee Is the Highest-Leverage ABM Tactic

The data on this isn't subtle.

Buying committees have ballooned. Gartner puts the average at 11+ decision-makers. Forrester says roughly 13. And 86% of B2B purchases stall during the buying process - usually because a stakeholder you never engaged raised an objection nobody anticipated.

Here's the stat that should change how you allocate resources: 84% of buyers go with the first vendor that engaged them. Not the best vendor. The first one. If your competitor is running surround-sound buying group outreach across the committee while you're waiting for your champion to "loop in the right people," you've already lost. Companies using ABM see a 208% increase in revenue - but only when they're actually engaging the full committee, not just one friendly contact.

Multi-channel behavior amplifies the gap. B2B customers now use about 10 channels to interact with suppliers, up from 5 in 2016. Campaigns using 3+ channels generate 287% higher purchase rates than single-channel efforts, and 95% of buyers engage with at least three different channels before purchasing.

And yet the disconnect between engagement and pipeline remains the #1 frustration. One practitioner on r/b2bmarketing put it bluntly: "Decent success with clicked ads, forms, demos. Sadly, the actual deals fall flat. Our demo-to-op rate is crap, and we're flooding Salesforce with dead leads." That's what happens when marketing generates activity and sales doesn't have a coordinated committee strategy to convert it.

Coordinated stakeholder outreach bridges that gap. It's not a marketing tactic or a sales tactic. It's the only way to match how enterprise buyers actually buy.

Mapping Your Buying Committee

Before you write a single email, you need to know who's in the room - and who's lurking outside it with veto power. The 9-archetype model covers the full committee (if you want a deeper framework, use account based marketing personas to operationalize roles and messaging):

| Role | What They Care About | Preferred Content | Best Channel |

|---|---|---|---|

| Economic Buyer | ROI, cost justification | Business cases, TCO | Email, exec briefing |

| Technical Evaluator | Integration, security | Technical docs, demos | Email, product demo |

| Champion | Internal credibility | Case studies, proof | All channels |

| End User | Daily workflow impact | Product walkthroughs | Email, webinar |

| Influencer | Industry trends | Thought leadership | Social, events |

| Blocker | Risk, compliance | Risk assessments | Direct outreach |

| Decision Maker | Strategic alignment | Executive summaries | Phone, exec events |

| Gatekeeper | Relevance filtering | Concise value props | Email, phone |

| Signer | Contract terms, legal | Agreements, SLAs | Email, legal review |

Not every account has all nine. But most enterprise deals involve at least five or six of these archetypes, and the ones you miss are usually the ones that kill the deal.

Snowflake's ABM team gets this right. CIOs receive strategic thought leadership about data strategy. Data engineers get technical deep-dives. Same product, completely different messaging - because the committee member's role determines what resonates.

Use intent data to prioritize who to engage first. Not all committee members are equally active at any given moment. Layer intent signals - topic-level research activity, hiring triggers, technology evaluations - to identify which stakeholders are actively exploring solutions. Cognism found that combining real-time intent with hiring triggers lifted CTR by 63%. Start with the stakeholders showing buying signals, then expand outward to the rest of the committee (more on operationalizing signals in intent signals).

Multi-threaded ABM requires verified contact data for every committee member - not just the champion. Prospeo gives you 300M+ profiles with 30+ filters to map 6-10 stakeholders per account, layer Bombora intent data across 15,000 topics, and deliver 98% accurate emails so your sequences actually land.

Stop single-threading deals because your data only covers one contact.

Building Your Multi-Stakeholder ABM Playbook

This is where strategy becomes execution. Three components: account selection, sequence orchestration, and persistence.

Tiered Account Selection

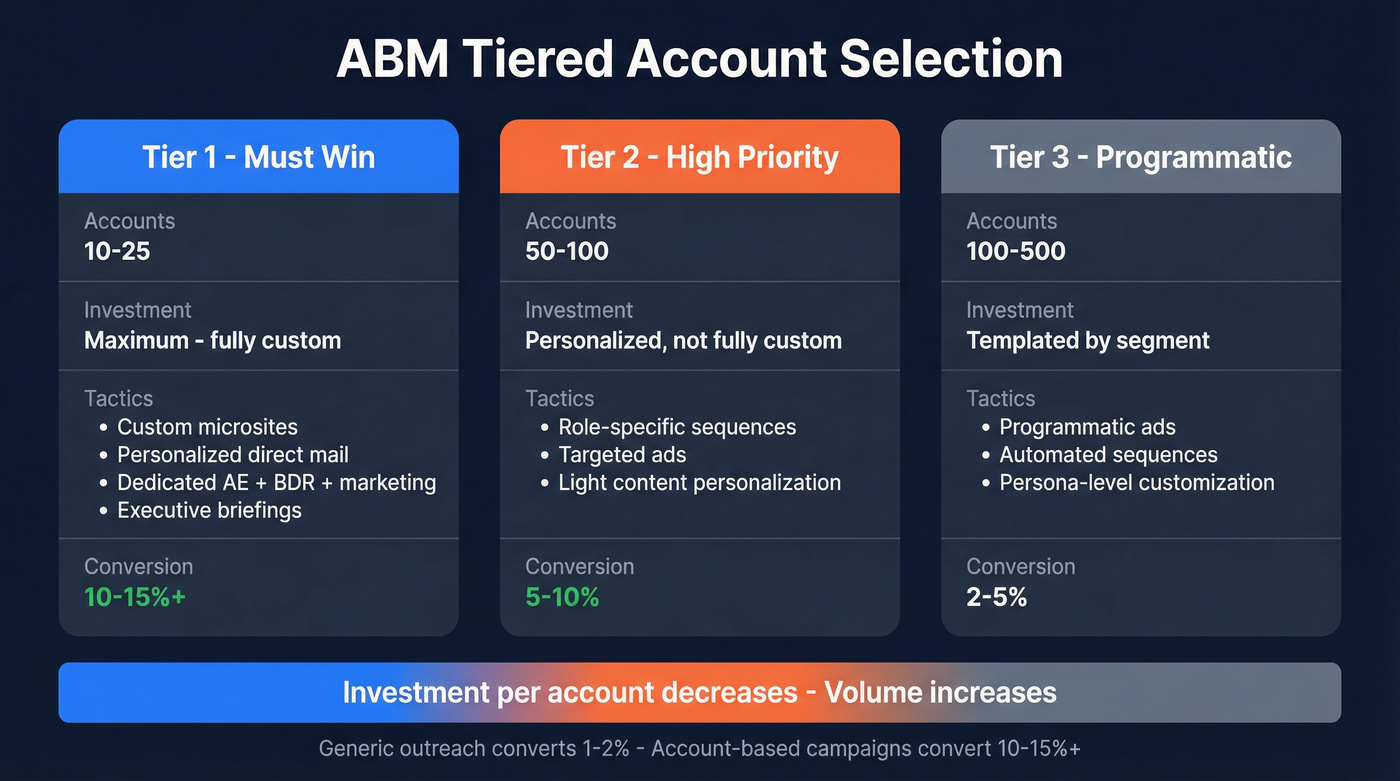

Not every account deserves the same investment. Trying to run 1:1 ABM across 500 accounts is how you burn out your team and produce mediocre results everywhere.

Tier 1 (10-25 accounts): Maximum investment. Custom microsites, personalized direct mail, dedicated AE + BDR + marketing alignment. These are your must-win accounts.

Tier 2 (50-100 accounts): Personalized but not fully custom. Role-specific sequences, targeted ads, light content personalization. This is where most mid-market teams should focus their energy.

Tier 3 (100-500 accounts): Templated personalization at the industry or segment level. Programmatic ads, automated sequences with persona-level customization.

The conversion gap is real: generic outreach converts 1-2% of contacts, while account-based campaigns regularly achieve 10-15%+ on well-selected target lists. Personalized landing pages alone produce 50% higher form submissions and 60% longer time on site - and that's before you factor in committee-wide coordination.

The Pedowitz Group's maturity matrix frames the progression clearly. At the lowest level, teams run single-threaded outreach with firmographic lists and generic persona copy. At the highest, they orchestrate committee-wide plays with ICP + intent + relationship signals, role-specific objection briefs, and buying-group scoring. Most teams think they're at level three. They're at level one (to tighten tiering and rollups, use an account segmentation model).

Customs4Trade's ABM pilot illustrates what happens when you move up the maturity curve: 10 discovery calls in 90 days, 29 accounts moved to active focus, and impressions jumped from 600-800 to 50,000+. Small team, disciplined approach, no massive budget.

Orchestrating the Surround-Sound Sequence

Here's where most teams fall apart. They know they need to reach multiple stakeholders, but they blast everyone on the same day with the same message. That's not orchestration. That's a spam raid.

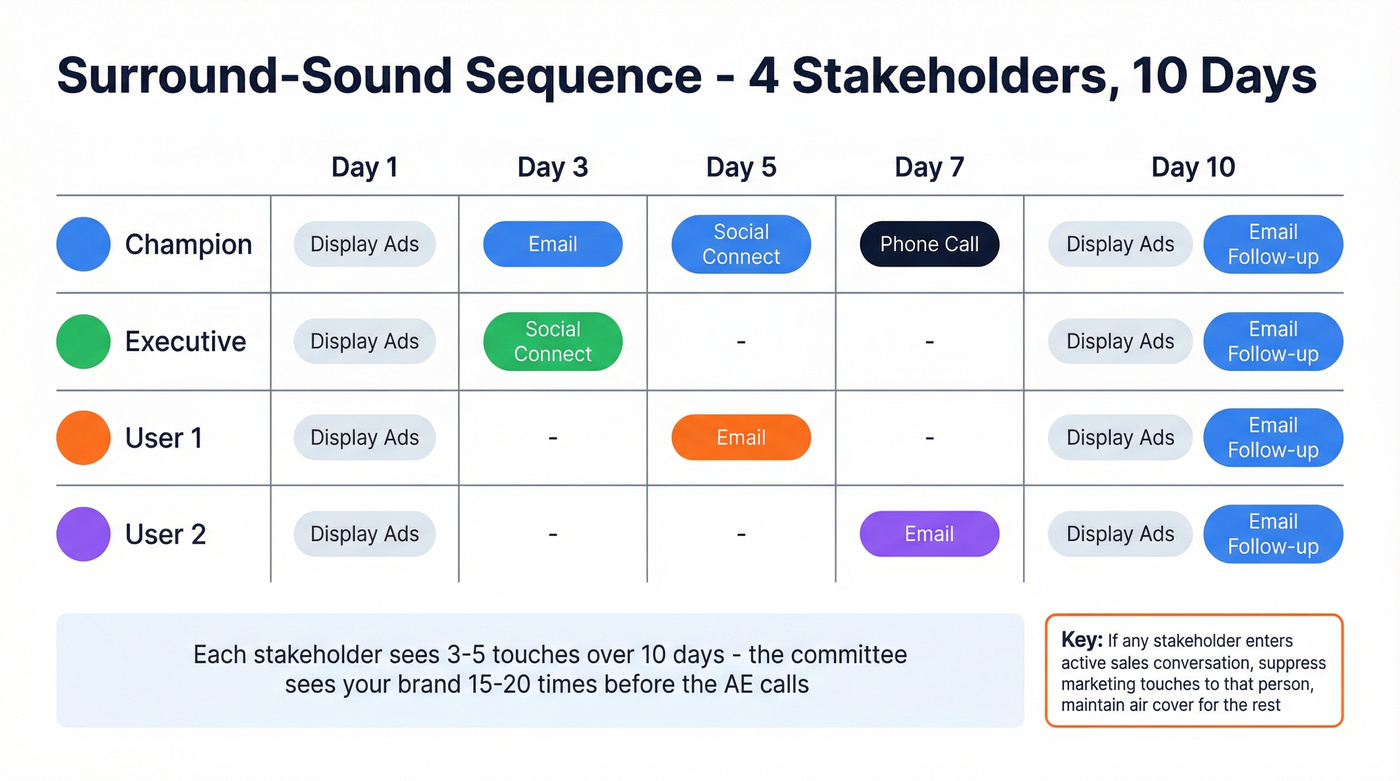

The goal of multi-threading ABM buying groups is to create a coordinated sequence of touches that feels organic to each individual while building collective momentum across the account (for the sales-side mechanics, pair this with ABM multi-threading in sales).

Cargo's surround-sound timing model for 4 stakeholders at one account:

- Day 1: Display ads to all stakeholders

- Day 3: Email to Champion + social connect to Executive

- Day 5: Email to User 1 + social connect to Champion

- Day 7: Phone call to Champion + Email to User 2

- Day 10: Display ads + email follow-up to all

The 8-week phased approach layers intensity over time. Weeks 1-2 are air cover - display ads, social engagement, light touches. By Weeks 7-8, you're in intensive mode: heavy dial, direct mail, meeting booking. The committee has seen your brand 15-20 times before the AE picks up the phone.

One critical concept: surround-sound suppression. If one stakeholder enters an active sales conversation, automatically reduce marketing touches to that person while maintaining air cover to the rest of the committee. You don't want your SDR's carefully crafted outreach undermined by a retargeting ad that feels tone-deaf.

Outreach's platform data shows average email open rates of 27.2% and reply rates of 2.9% across all customers. Multi-channel approaches see 2x higher response rates. Those numbers jump significantly when you're running coordinated committee outreach instead of isolated cold sequences (tighten the execution layer with sales sequence best practices).

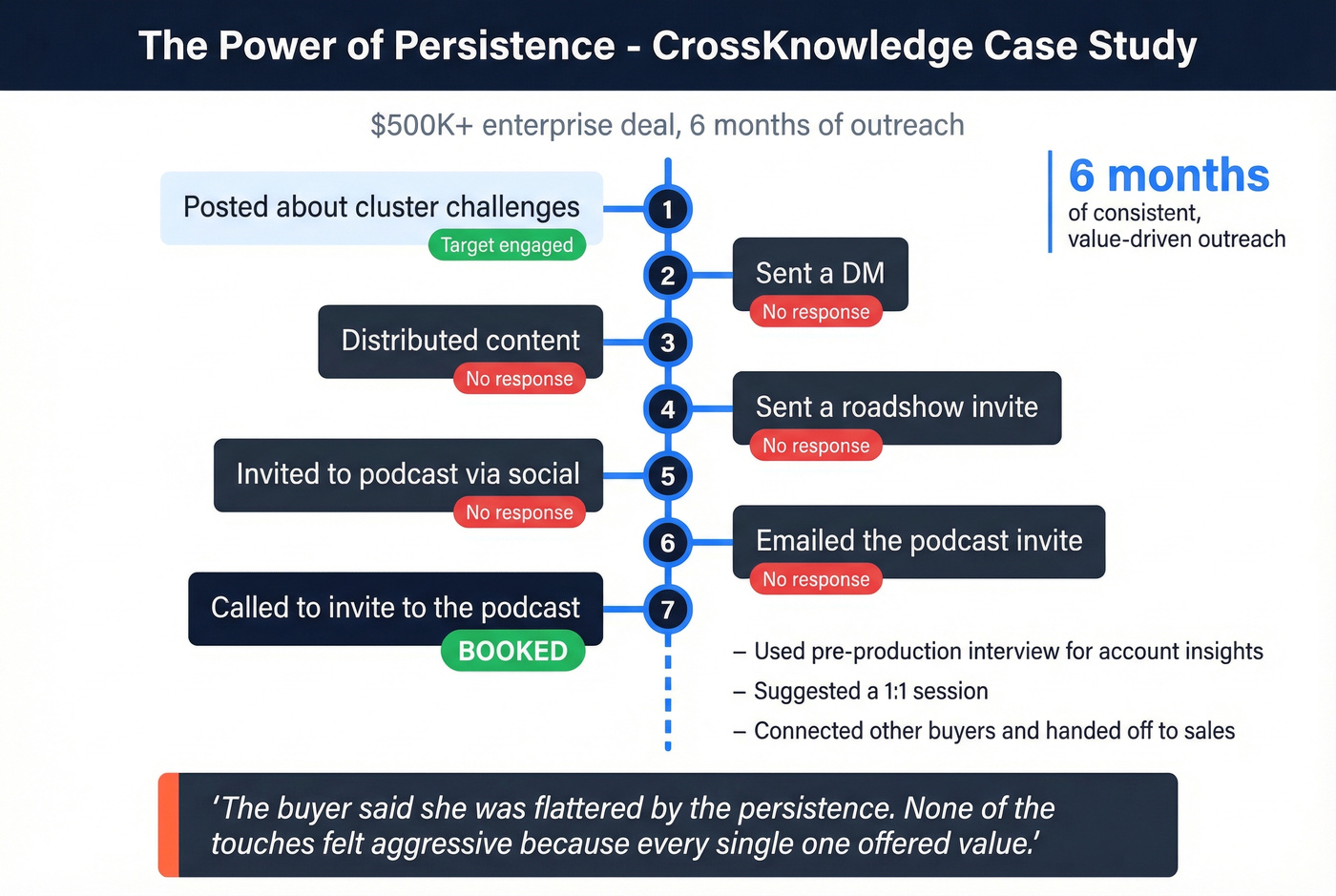

The Power of Persistence - CrossKnowledge Case Study

CrossKnowledge sells digital corporate learning to Global 1000 enterprises. Deal sizes exceed $500K. Contracts run 3+ years. Budgets are set far in advance - sometimes for three years at a time.

Their sales rep Magali targeted one account over six months:

- Posted about cluster challenges - target engaged

- Sent a DM - no response

- Distributed content - no response

- Sent a roadshow invite - no response

- Invited to a podcast via social - no response

- Emailed the podcast invite - no response

- Called to invite to the podcast - booked

From there, she used the pre-production interview to gather account insights, suggested a 1:1 session, distributed the interview content, connected other buyers, and handed off to sales.

The buyer later told Magali she was "flattered by the persistence." None of the touchpoints felt aggressive because every single one delivered value.

FullFunnel's own ABM pilot found podcast outreach generated a 76% response rate - 46% of targets agreed to be interviewed. Podcasts work because they offer something to the prospect (exposure, thought leadership positioning) rather than asking for something (see a repeatable workflow in podcast email outreach).

Results across the CrossKnowledge ABM pilot: 130 target accounts, 35 engaged (26% engagement rate), marketing contribution to qualified pipeline jumped from 35% to 60%.

Email Templates by Stakeholder Role

ABM emails raise reply rates from the typical 2-10% cold email range to 10-34% when they're warm and targeted. The key is crafting messages that speak to each buying group member's actual concerns - not yours. Here are four templates mapped to committee roles.

Value-Forward Intro (for Champions):

Subject: [Company]'s [specific challenge] - how [peer company] solved it

Hi [Name], I noticed [Company] is [specific observation from research]. [Peer company] faced the same challenge and [specific result]. I put together a quick breakdown of their approach - would it be useful to share?

Peer Insight (for VPs/Directors):

Subject: What [their peer title]s are changing in 2026

Hi [Name], we just published research on how [3-4 peer companies] are rethinking [relevant area]. The biggest shift: [one-sentence insight]. Happy to send the full report - no strings.

Direct Problem-Solver (for Technical Buyers):

Subject: [Specific technical pain point] - 3 approaches that work

Hi [Name], your team is likely evaluating [category]. The three integration approaches we see working: [bullet 1], [bullet 2], [bullet 3]. Want me to send the technical comparison doc?

Low-Barrier Invitation (for C-Suite):

Subject: Let's talk about [their area of expertise]

Hi [Name], I'm putting together a roundtable with [2-3 peer titles] on [topic]. Your perspective on [specific angle] would add a lot. 30 minutes, no pitch. Interested?

Best practices across all four: keep it under 100 words, make one clear ask, ground claims in data or named peers. The low-barrier invitation works for hard-to-reach executives because it flatters and provides value through exposure - not a product pitch.

The Data Quality Problem Nobody Talks About

Here's the thing nobody wants to admit: committee-wide outreach amplifies every data quality problem you have. When you're emailing one person at a company, a bounce is annoying. When you're emailing eight people at the same company and three bounce, you've just triggered the exact security defenses designed to stop phishing attacks.

Corporate firewalls apply advanced filtering based on sender reputation, domain reputation, IP reputation, and historical engagement. When you aggressively target multiple decision-makers simultaneously with unverified data, your personalized outreach looks like a spam raid. The result isn't just a bounce - it's a domain-wide block that silences your entire sales team's outreach to that organization.

The catch-all domain problem makes this worse. Many enterprise domains use catch-all configurations - addresses accept emails but never reach real inboxes. You think you've reached the CIO. You haven't. You've created false confidence while your domain reputation quietly degrades (if you need the deliverability mechanics, start with what is domain reputation).

Poor data quality costs organizations roughly $12.9M per year. One in six marketing emails never reaches the inbox globally. For ABM teams running multi-threaded campaigns, those numbers aren't abstract - they're the difference between pipeline and silence (a deeper benchmark view: B2B contact data decay).

We've seen this play out firsthand. Snyk's 50 AEs were prospecting 4-6 hours per week with bounce rates running 35-40%. After implementing Prospeo's verification, bounce rates dropped to under 5% and AE-sourced pipeline jumped 180% - over 200 new opportunities per month. The 5-step verification process with proprietary infrastructure catches what other tools miss: catch-all domains get flagged instead of passed through, spam traps and honeypots are removed, and every record refreshes on a 7-day cycle (the industry average is six weeks).

At 98% email accuracy, you're not gambling with your domain reputation every time you launch a committee-wide sequence. For multi-stakeholder ABM specifically, the email finder at ~$0.01 per email means verifying all 8-10 contacts per account costs less than a dollar. Skip verification when the downside is losing access to an entire target account? There's no math that justifies it.

86% of deals stall because a stakeholder you never engaged killed it. Prospeo's 7-day data refresh means every committee member's email and direct dial is current - not 6 weeks stale. At $0.01 per email, mapping a full 11-person buying committee costs you $0.11.

Engage the whole committee before your competitor does.

Five Mistakes That Kill Multi-Stakeholder ABM Campaigns

1. Setting "generate leads" as your ABM goal. A single webinar signup doesn't mean an account is interested in buying. The right ABM goals are stage-based: % of target accounts moving from interested to considering to selecting to closed won. If your dashboard measures MQLs, you're measuring the wrong thing.

2. Using contact-level attribution. HubSpot's attribution breaks when click-tracking parameters or cookies are lost - redirects, ad blockers, Safari ITP all destroy the trail. Account-level attribution based on deals opened from accounts targeted with ABM campaigns (requiring 10+ ad impressions) is the only model that reflects reality. Emilia Korczynska at Userpilot has been vocal about this: contact-level attribution systematically undercounts ABM's impact.

3. BDR outreach misaligned with campaign content. Your ads are talking about data security. Your BDR is emailing about cost savings. The committee member who clicked the ad gets a completely disconnected experience. Coordinated messaging isn't optional - it's the whole point.

4. Over-segmenting into tiny audiences. Splitting campaigns into micro-segments of 15-20 accounts means you'll never get enough data to optimize. You need statistical significance. Tier 2 campaigns of 50-100 accounts are the minimum for learning what works.

5. Personalizing only on persona level, not company level. "Hey VP of Sales" isn't personalization. "Hey [Name], I noticed [Company] just opened a London office and is hiring 12 SDRs - here's how [peer company] handled EMEA expansion" is personalization. The company-level context is what makes coordinated outreach feel intentional rather than coincidental.

ABM Tech Stack - What You Actually Need

Look, stop buying ABM platforms before you fix your data. I've watched teams spend $50K on Demandbase or 6sense and then wonder why pipeline didn't move - because 30% of their committee contacts were bouncing. The stack matters, but the foundation is verified contact data for every stakeholder you're trying to reach.

If your average deal size is under $25K, you don't need an ABM platform at all (this is the same logic behind ABM without expensive tools).

You can run effective committee-wide outreach with a CRM, a sequencing tool, and a verified contact database. Everything else is a nice-to-have once the playbook is proven. The teams I see wasting the most money are the ones buying orchestration software before they've confirmed they can actually reach the buying committee.

Contact Data - the foundation. Nothing else works if emails bounce and phone numbers are dead.

| Tool | Best For | Starting Price | Key Differentiator |

|---|---|---|---|

| Prospeo | Email/mobile accuracy | Free, ~$39/mo paid | 98% accuracy, $0.01/email, intent data |

| Apollo | SMB all-in-one | Free, $49/mo | 275M+ contacts, sequences |

| ZoomInfo | US enterprise depth | ~$15-40K/yr | Broadest US database |

| Cognism | EMEA compliance | ~$15-30K/yr | Diamond-verified mobiles |

ABM Platforms - add these after your data layer is solid and your playbook is generating pipeline.

| Tool | Best For | Starting Price | Key Differentiator |

|---|---|---|---|

| Demandbase | Enterprise orchestration | ~$40-80K/yr | B2B-purposed DSP |

| 6sense | Predictive analytics | ~$35-100K/yr | 1T+ daily intent signals |

| RollWorks | Mid-market ads | ~$15-30K/yr | Quick setup, ad-first |

Sales Engagement & CRM - the execution layer for sequencing and tracking.

| Tool | Best For | Starting Price | Key Differentiator |

|---|---|---|---|

| Outreach | Sequence orchestration | ~$100-130/user/mo | Multi-channel sequences |

| Salesloft | Enterprise workflows | ~$100-150/user/mo | Cadence + analytics |

| HubSpot | Native ABM tools | $800/mo | All-in-one marketing |

Cognism's own ABM case study is worth studying: their 1:1 microsite approach generated $300K+ pipeline in 8 weeks, with microsites averaging 5.6 minutes dwell time, 70+ website visits, and 150+ demo views. That's what happens when you combine verified data with deeply personalized content for each committee member.

Measuring Multi-Stakeholder ABM

Stop measuring ABM like demand gen. Contact-level metrics will mislead you every time.

Here's what actually matters:

- Account Engagement Score - aggregate engagement across all stakeholders, weighted by seniority and recency

- Penetration Rate - % of target contacts engaged per account. If you've mapped 10 stakeholders and only reached 3, you're at 30% penetration. That's not enough.

- Pipeline Velocity - how fast accounts move through stages. ABM programs typically show 20-30% faster sales cycles than traditional approaches

- Seniority Mix - what % of your touches are reaching C-suite and VP-level contacts vs. individual contributors? If you're only engaging managers, you haven't reached the economic buyer

The Pedowitz Group documented a 37-stakeholder buying group where orchestrated executive briefs, IT security proof, and aligned SDR + partner outreach produced 34% faster time-to-meeting and 22% higher stage-to-stage conversion. Eve Chen's results tell a similar story: close rate doubled within six months, deal velocity improved by 30%.

And from the FullFunnel team on Reddit: $51M pipeline generated, 84% conversion from engagement to pipeline, 28 new enterprise logos. Their takeaway? "ABM works best when marketing and sales execution are actually integrated. Marketing engagement alone didn't move deals. Coordinated follow-up and account strategy did."

That last sentence should be tattooed on every ABM team's wall.

Multi-stakeholder outreach ABM isn't a channel or a campaign type - it's the operating model that matches how enterprise deals actually close.

FAQ

How many stakeholders should you target per account?

Target 6-10 stakeholders for mid-market accounts and 11-15+ for enterprise deals. Gartner and Forrester consistently report buying committees of 11-13 people on average. Each stakeholder needs verified contact data - a committee map with bounced emails is just a wish list.

What's the difference between multi-threading and multi-stakeholder ABM?

Multi-threading is a sales tactic where your AE contacts multiple people within an active deal to reduce single-point-of-failure risk. Multi-stakeholder ABM is a coordinated marketing + sales motion across the entire buying committee, starting before a deal exists. The two work best in tandem: ABM warms the account, multi-threading ensures sales maintains multiple relationships once a deal opens.

How do you engage buying group members who aren't responding?

Vary the channel and the value offer - if email fails, try direct mail, social engagement, or a podcast invitation. The CrossKnowledge case study shows persistence across seven different touchpoints eventually broke through because each touch delivered standalone value. Tailor content to the stakeholder's role: a technical evaluator who ignores your ROI email will often respond to a security whitepaper.

How do you avoid triggering spam filters when emailing multiple people at the same company?

Stagger sends across stakeholders (never email 5+ people at the same company on the same day), verify every address before sending, and throttle volume per domain. Catch-all verification is critical - you need a process that flags addresses which accept everything but deliver nothing, preventing the false confidence that tanks domain reputation.

How long does a multi-stakeholder ABM campaign take to show results?

Mid-market teams can see pipeline in 8-12 weeks - Cognism generated $300K+ pipeline in 8 weeks with their signal-led approach. Enterprise ABM requires 417+ touchpoints across 18 months for complex deals. Set expectations by deal size: contracts above $500K typically need 6+ months of coordinated engagement.