Business 2 Business Examples (B2B): 50+ Real-World Scenarios for 2026

B2B gets weirdly abstract fast. People argue about "is this company B2B?" like it's a personality trait.

If you're searching for business 2 business examples, stop asking for logos and start asking for transactions.

I've sat in enough go-to-market meetings to tell you the only definition that survives contact with reality: if money moves from one business entity to another business entity (with approvals, a PO, and an invoice), it's B2B.

What you need (quick version)

B2B = a business selling products or services to another business, with procurement steps (approvals, purchase orders, invoicing) and ongoing commercial terms (contract pricing, net terms, SLAs). If you're stuck on what counts as a B2B example, don't start with brands. Start with who signs, who gets invoiced, and how payment clears.

Quick classification checklist

- Buyer is a business, not a consumer (even if a consumer touches the experience).

- Purchase is tied to business use (resale, operations, production, compliance).

- There's a requisition/approval step (formal or informal).

- Payment runs through invoice / net terms / ACH, not just a card swipe.

- The "unit" is seats, usage, volume, replenishment, or milestones, not one-off items.

Remember these 5 categories (covers most real B2B):

- Manufacturers (components -> OEMs)

- Distributors (bulk + replenishment)

- Service providers (contract + SLA)

- SaaS & infrastructure (seat-based + annual terms)

- Marketplaces & intermediaries (platform as the buying motion)

Why these five cover almost everything: they map to the five repeatable ways businesses buy - capex equipment, replenished supplies, contracted labor, licensed software, and platform-led purchasing. The rest is hybrids: channel-heavy models (manufacturer -> distributor -> contractor), regulated buying (healthcare/government-style controls), and B2B2C plays where a business pays but a consumer uses the product.

Real talk: if you can't explain who pays, who signs, and how payment clears, you don't have a model. You have a vibe.

What is B2B (business-to-business)? B2B vs B2C in one minute

B2B (business-to-business) is when one company sells to another company. That includes physical goods (steel coils, lab supplies), services (accounting, logistics), and software (CRM, cloud infrastructure). The defining feature isn't the product. It's the buying context: the purchase exists to drive a business outcome, and the paperwork exists to control risk and spend.

B2C (business-to-consumer) is when a company sells to an individual for personal use. The buyer and user are usually the same person, and the transaction's built for speed: browse, click, pay, done.

B2B vs B2C: the differences that actually matter

- Stakeholders: B2B purchases involve multiple people (user, manager, finance, security, procurement). B2C has one decision-maker.

- Pricing: B2B uses negotiated pricing, volume tiers, and contract terms. B2C uses fixed price.

- Payment terms: B2B runs on net terms, invoicing, and vendor onboarding. B2C runs on immediate payment (card, wallet, BNPL).

- Risk & compliance: B2B buyers demand security reviews, legal terms, and continuity. B2C buyers demand trust and convenience.

B2B vs B2C vs B2G vs B2B2C (and the models people confuse)

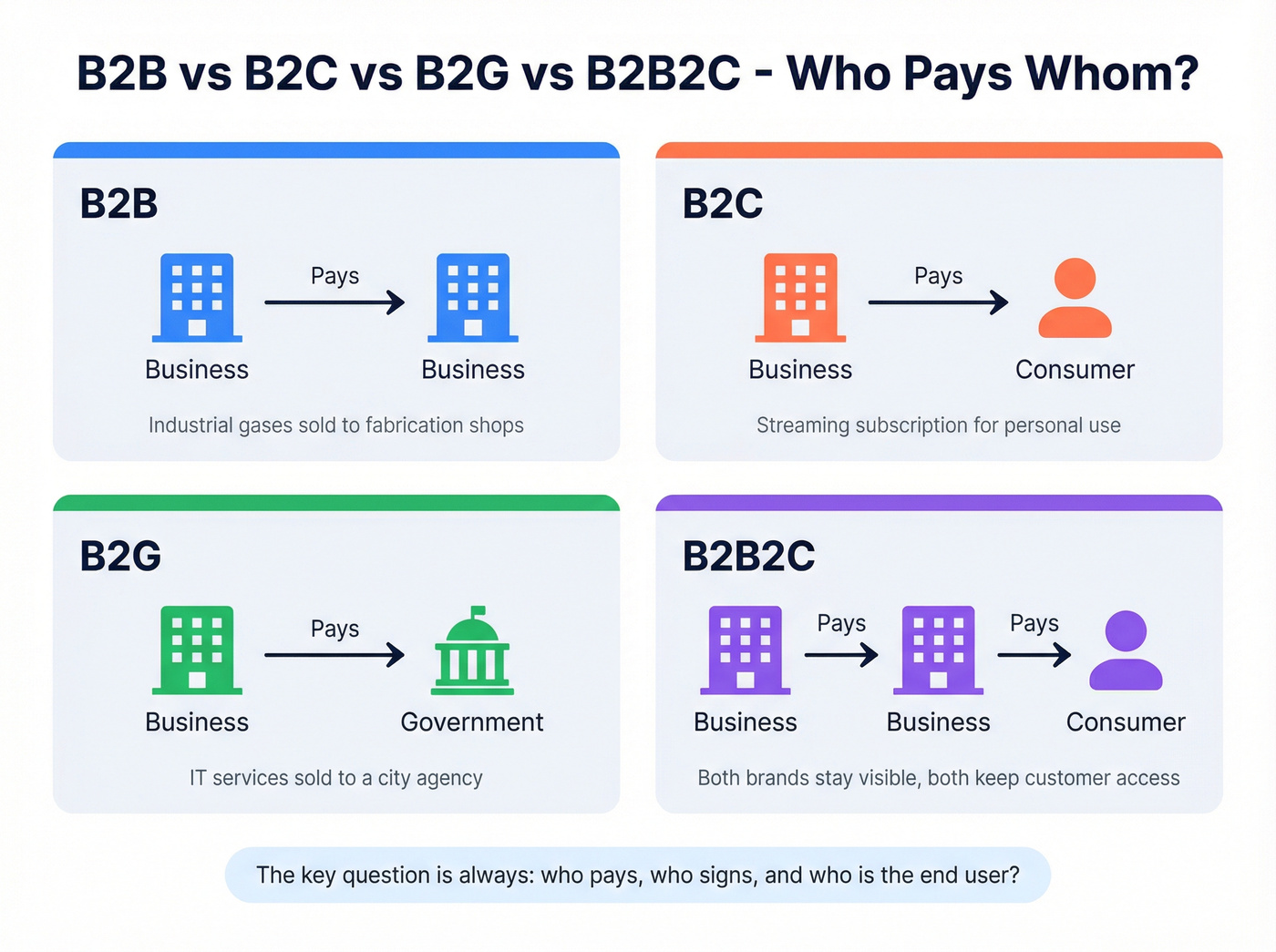

A clean way to end the "is this B2B?" debate is to classify by who pays whom and who the end customer is.

| Model | Buyer | End user | Example |

|---|---|---|---|

| B2B | Business | Business | Industrial gases to fabrication shops |

| B2C | Consumer | Consumer | Streaming subscription |

| B2G | Government | Public agency | IT services to a city |

| B2B2C | Business | Consumer | Restaurant booking platform where restaurants pay and diners use it |

Confusion-busters (the stuff people mix up):

- B2G isn't "big B2B." Government buying adds procurement rules, contract vehicles, and compliance requirements that change timelines and paperwork.

- B2B2C isn't resale. In B2B2C, both brands stay visible and both keep customer access. In resale, the upstream supplier disappears.

- "Ecommerce" doesn't mean B2C. A password-protected portal with contract pricing and PO checkout is still ecommerce - it's just B2B ecommerce.

Adjacent models you'll hear (and what they mean)

- D2C: brand sells direct to consumers (no retailer)

- C2C: consumers sell to consumers (marketplaces)

- B2E: business sells to employees (benefits, internal purchasing)

- C2B: consumers sell value to businesses (creators, freelancers)

- G2C / G2G: government to citizen / government to government

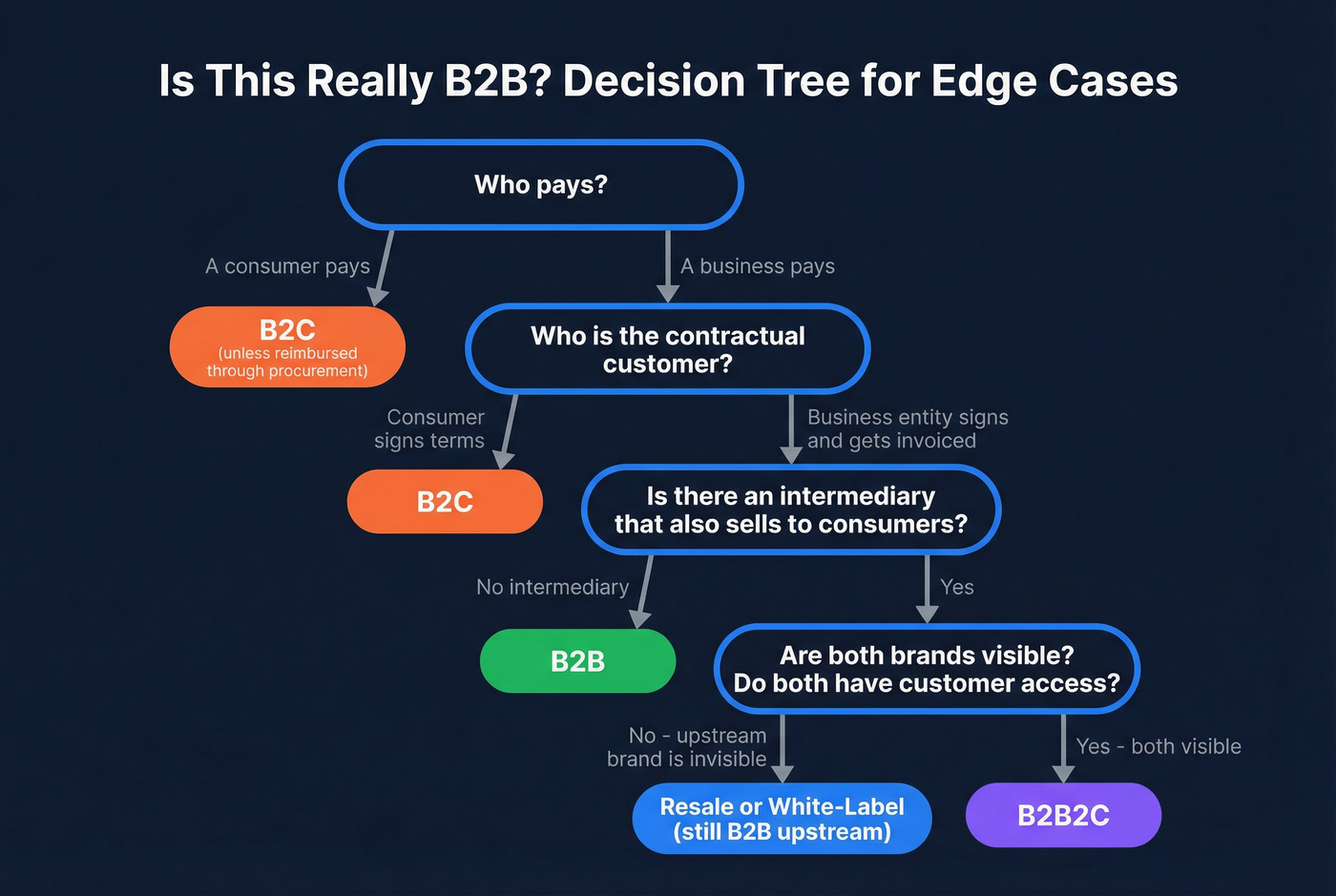

"Is this really B2B?" A simple decision tree for edge cases

Edge cases happen when consumers touch the experience but businesses fund the transaction - or when a platform sits in the middle.

Decision tree (use this in meetings):

- Who pays?

- A business pays -> go to (2)

- A consumer pays -> B2C (unless reimbursed through procurement)

- Who's the contractual customer?

- Business entity signs terms / gets invoiced -> go to (3)

- Consumer signs terms / pays directly -> B2C

- Is there an intermediary that also sells to consumers?

- No -> B2B

- Yes -> go to (4)

- Are both brands visible and do both have customer access?

- Yes -> B2B2C

- No (upstream brand invisible) -> resale/white-label (still B2B upstream)

Edge examples

- Instacart: B2B2C. Retailers and Instacart are both visible, and both touch the customer relationship.

- OpenTable: B2B2C. Restaurants pay, diners use it, and both brands are visible in the experience.

- White-label counterexample: A manufacturer produces "StoreBrand" vitamins for a retailer. The manufacturer is invisible to the consumer. That's classic B2B supply + resale, not B2B2C.

Quick classifier table (printable)

| Signal | Usually B2B | Usually B2C | Edge case note |

|---|---|---|---|

| PO + invoice + 3-way match | Winner | Loser | If AP's matching documents, it's B2B. |

| Net terms (Net 30/60/90) | Winner | Loser | Consumers don't run net terms; reimbursements don't change the model. |

| Security/legal review (MSA/DPA) | Winner | Loser | Even "simple" SaaS becomes B2B the moment security blocks go-live. |

| Contract pricing behind login | Winner | Loser | B2B ecommerce looks like B2C UX with B2B controls underneath. |

| End user is consumer, payer is business | B2B2C | - | Both brands visible + both have access = B2B2C. Otherwise it's resale. |

Look, this matters because your go-to-market changes. B2B2C means partner mechanics and shared data. B2B means procurement mechanics and risk reduction.

Every B2B deal starts with reaching the right person - the one who signs the PO and approves the invoice. Prospeo gives you 300M+ professional profiles with 98% email accuracy and 125M+ verified mobile numbers, so you can skip the gatekeepers in any B2B model.

Stop studying B2B examples. Start closing B2B deals.

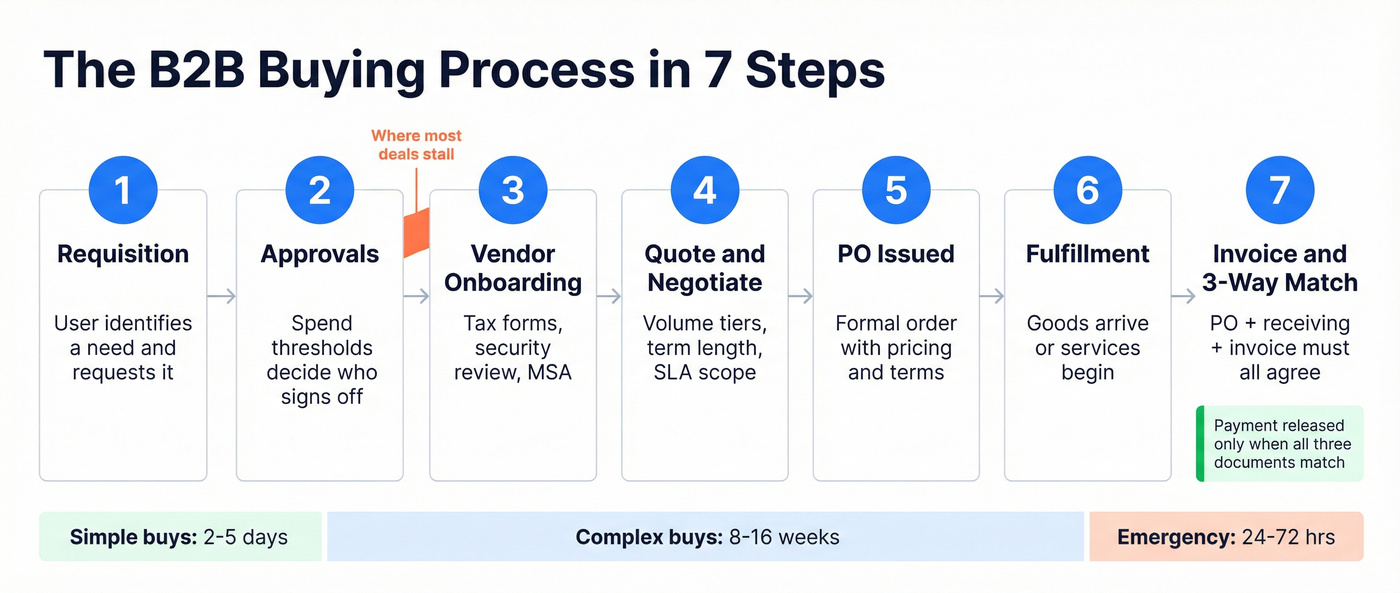

How the B2B buying process works (PO -> invoice -> 3-way match)

Most "examples" lists skip the part that makes B2B... B2B: the buying workflow. The product can be boring. The process is the plot - and it's also the easiest way to explain what a B2B transaction is in plain English.

Step 1: Someone creates a requisition (or a "request")

A user realizes they need something: safety gloves, a new CRM seat, a freight lane, a penetration test.

In mature orgs, this is a formal requisition in a procurement tool. In smaller orgs, it's a Slack message that turns into "send me a quote."

Step 2: Approvals happen (thresholds drive behavior)

Spend thresholds decide who gets pulled in:

- Under $500: department manager approves

- $500-$5k: manager + finance review

- $5k-$25k: director-level approval

- $25k+: exec sign-off + competitive bidding

This is why B2B sellers obsess over deal size bands. Cross a threshold and you didn't just increase price - you added stakeholders, timelines, and usually a legal review that wasn't on your calendar yesterday.

Step 3: Vendor onboarding (the hidden time sink)

Before the PO, many companies require vendor setup: tax forms, insurance certs, security questionnaires, bank details, and an MSA.

I've watched deals die here because the seller treated onboarding like admin work instead of a sales stage. Hot take: if you sell into procurement, optimize onboarding and risk reviews before you optimize your pitch deck.

Step 4: Quote -> negotiation -> contract pricing

B2B pricing runs on:

- volume tiers

- term length (annual beats monthly in procurement)

- scope (SLA, support, regions)

- risk (liability caps, data processing terms)

Even with list price, the real price is what survives procurement.

Step 5: Purchase order (PO) gets issued

A PO is the buyer's formal order: items, quantities, pricing, delivery instructions, and payment terms. For many suppliers, "no PO, no work" isn't negotiable because it's how the buyer controls spend and how the supplier protects themselves from "we never approved that" later.

Step 6: Fulfillment + receiving

Goods arrive. Services start. Software gets provisioned.

For physical goods, receiving documentation matters (packing slip, receiving report). For services, it's acceptance criteria, milestones, or sign-off.

Step 7: Invoice + three-way match (plain English)

Three-way match means accounts payable checks that:

- the PO (what was ordered),

- the receiving record (what was received), and

- the invoice (what you're billing) all agree before payment's released.

If any of those don't match, payment stalls. That's not finance being annoying. It's how companies prevent overbilling and fraud.

Timelines (what to expect)

A common benchmark looks like this:

- Simple purchases: 2-5 business days (repeat vendor, low risk, below approval thresholds)

- Complex/strategic buys: 8-16 weeks (security + legal + procurement + competitive bake-off)

- Emergency buys: 24-72 hours (with retroactive paperwork)

Mini scenario (real-world feel) A plant manager needs replacement bearings to avoid downtime. Under normal conditions, they run approvals and issue a PO. But downtime costs more than the parts, so procurement fast-tracks the order, then cleans up the PO/invoice trail after the fact.

That's B2B: the "why" is operational risk, and the "how" is controlled spend.

What teams get wrong (the arguments I hear inside companies)

These are the debates that waste weeks - and they're all solvable if you stick to the transaction.

- "It's self-serve, so it's B2C." No. If the buyer needs invoicing, net terms, or vendor onboarding, it's B2B with a clean UI.

- "The end user is a consumer, so it's B2C." Wrong question. Ask who pays and who signs. That's how you separate B2B2C from resale.

- "We don't need procurement enablement; sales will handle it." Procurement doesn't care about your deck. They care about risk, paperwork, and price protection.

- "Let's push annual contracts later." Annual terms are the default in B2B because budgeting and approvals run annually.

- "We'll fix billing after we close the deal." Billing is part of closing. If AP can't match your invoice to a PO, you didn't really close.

- "We should chase every industry." B2B wins come from one repeatable buying motion, then expansion - not from a thousand tiny exceptions.

B2B is digital now (and why "examples" include marketplaces)

If your mental model of B2B is still "a rep with a catalog," you're behind. Digital buying is the default, and the winners design for procurement controls without making the experience miserable.

Digital Commerce 360 puts US B2B digital sales at about $2.1T, up 17% from the prior year. Here's the contrast that matters: U.S. manufacturers and distribution companies sit at about $14.87T in total sales and that topline is flat, while digital keeps climbing. Translation: the market isn't magically exploding; the channel is shifting as buyers demand speed, auditability, and repeatability.

Grand View Research projects the global B2B ecommerce market at $57,578.97B (about $57.6T) by 2030. The useful part isn't the giant number. It's what grows fastest: intermediary-oriented (marketplace-led) ecommerce posts the highest growth rate in their segmentation, and Asia-Pacific is the fastest-growing region in the same outlook, driven by manufacturing density and cross-border supply chains.

My opinion: the rep-led motion is now the premium path, not the default path. Reorders, standard SKUs, and mid-ticket SaaS move through portals and platforms because procurement wants clean controls and clean reporting.

Business 2 business examples: 50+ real transactions by category

These are written as transactions, not logo bingo. Use them as templates when you're classifying your own business model - or when you need to explain B2B to someone who only thinks in consumer brands.

Manufacturers & component suppliers

Pattern: "parts -> OEM" (and why it matters) Primary sales are the finished product sold downstream (OEM -> end customer). Secondary sales are the components that make that product possible (supplier -> OEM). Tertiary sales are the ecosystem around it (maintenance, spares, calibration, compliance). If you sell components, you win by locking specs, qualifying as an approved supplier, and owning replenishment.

- Intel -> laptop OEMs: chips sold under supply agreements with volume commitments, QA requirements, and delivery schedules.

- Boeing -> airlines: aircraft sale plus multi-year maintenance, parts, training, and service-level commitments.

- Industrial pumps -> chemical plants: engineered-to-order equipment bought via RFQ, then commissioned under a service contract.

- Bearings -> manufacturing plants: replenishment buying tied to maintenance schedules, with net terms and approved-vendor rules.

- Packaging film -> food manufacturers: recurring volume orders with spec sheets, compliance docs, and contract pricing.

- Injection-molded parts -> appliance brands: supply with qualification audits and long-run pricing agreements.

- Printed circuit boards -> electronics assemblers: RFQs, lead times, and quality audits drive supplier selection and PO cadence.

- Steel coils -> automotive stamping plants: contract pricing indexed to commodities, shipped on schedules with receiving controls.

- Industrial adhesives -> furniture manufacturers: spec-driven buying with change-control; switching triggers requalification work.

- IoT sensors -> logistics equipment OEMs: components bundled into a larger product, sold under supply and warranty terms.

- Commercial refrigeration units -> grocery chains: capex purchase plus install, warranty, and maintenance agreements.

- Lab reagents -> biotech companies: recurring orders with lot tracking, documentation, and controlled shipping terms.

- HVAC systems -> servicing companies: manufacturer sells through contractors with partner pricing, rebates, and warranty rules.

- POS hardware -> retailers: hardware plus warranty, replacements, and rollout scheduling across locations.

Wholesalers & distributors

- Grainger -> facilities teams: contract catalogs, approvals, and replenishment with invoicing and consolidated reporting.

- MSC Industrial Direct -> machine shops: cutting tools and consumables bought on reorder cycles with account pricing.

- Fastenal -> manufacturing sites: onsite/vending programs that automate replenishment and keep spend inside approved channels.

- Building materials distributor -> contractors: jobsite delivery, project quotes, returns policies, and trade credit.

- Electrical supply house -> electricians: project-based quoting plus replenishment for common SKUs under net terms.

- Plumbing distributor -> commercial plumbers: contractor pricing, job tracking, and staged deliveries aligned to build schedules.

- Medical supplies distributor -> hospitals: contract pricing, compliance requirements, and tight fulfillment SLAs.

- Dental supplies -> dental practices: recurring consumables with account-based pricing and reorder lists.

- Foodservice distributor -> restaurants: bulk purchasing, scheduled routes, and credit lines with invoice reconciliation.

- Janitorial distributor -> office buildings: standardized SKUs across locations with approvals and replenishment triggers.

- Industrial gases distributor -> fabrication shops: cylinder exchange programs, safety compliance, and recurring billing.

- Auto parts distributor -> repair shops: same-day delivery, returns, and trade credit tied to shop accounts.

- Pharma wholesaler -> pharmacies: regulated supply chain with strict tracking, chargebacks, and payment terms.

- IT hardware distributor -> MSPs: partner margins, deal registration, and distributor financing for larger rollouts.

Service providers

- Accounting firm -> mid-market company: monthly retainer with deliverables, invoice cadence, and renewal terms.

- Marketing agency -> SaaS company: service contract with scope, reporting cadence, and performance expectations.

- Recruiting agency -> enterprise HR: vendor onboarding plus contingent fees or retained search under approved vendor lists.

- 3PL -> ecommerce brand: warehousing + pick/pack/ship under a service agreement and rate card.

- Freight forwarder -> importer: cross-border logistics, customs brokerage, and compliance paperwork billed on invoices.

- Managed IT services (MSP) -> law firm: per-user pricing, security stack, and response-time SLAs.

- Penetration testing firm -> fintech: scoped engagement with security requirements, legal terms, and acceptance criteria.

- Facilities maintenance -> retail chain: multi-location contract with dispatch workflows, KPIs, and performance SLAs.

- Commercial cleaning -> hospitals: compliance-heavy service with documentation, audits, and strict staffing requirements.

- Training provider -> call center: seat-based training with renewals, reporting, and manager approvals.

- Legal firm -> startup: outside counsel on retainer or project fees with vendor onboarding and billing controls.

- PR firm -> enterprise: annual contract tied to campaigns, approvals, and brand governance.

SaaS & infrastructure

- Salesforce -> sales orgs: seat-based licensing, annual terms, admin controls, and security review gates.

- Microsoft 365 -> companies: per-user subscriptions with centralized billing and tenant governance.

- SAP -> manufacturers: multi-year ERP contracts, implementation partners, and change-management milestones.

- Oracle -> enterprises: negotiated enterprise agreements with procurement-led renewals and audit clauses.

- IBM -> regulated industries: software + services bundles with compliance requirements and contractual SLAs.

- Cisco -> IT departments: hardware plus support contracts with renewal cycles and approved reseller channels.

- HubSpot -> SMB/mid-market: tiered bundles, seats, onboarding services, and renewal negotiation.

- AWS -> startups and enterprises: usage-based cloud spend with committed-use discounts and consolidated billing.

- Cloud security platform -> IT/security: vendor risk review, SOC 2 expectations, and annual renewal motion.

- HRIS (payroll/benefits) -> employers: per-employee pricing, implementation, and data processing terms.

- Data warehouse -> analytics teams: consumption pricing with governance, budgets, and procurement thresholds.

- Customer support platform -> support orgs: seats + add-ons, procurement review, and renewal negotiation.

Transaction pattern to recognize: "seat-based + annual terms" signals B2B. Don't overthink it.

Marketplaces & intermediaries

- Amazon Business -> procurement teams: business accounts, approvals, invoicing, and consolidated purchasing controls.

- Alibaba -> importers/wholesalers: supplier discovery + RFQ + trade terms with cross-border documentation.

- Industry-specific marketplace -> contractors: discovery + quote comparison + payment rails with compliance checks.

- Payment processor -> SaaS platforms: platform sells payments to businesses with revenue share and risk controls.

- Staffing marketplace -> operations teams: flexible labor with compliance, timesheets, and invoicing.

- Travel management platform -> enterprises: negotiated rates, policy controls, approvals, and reporting.

Three modern B2B patterns you'll see everywhere (marketplaces, cross-border, ACH)

Mordor Intelligence's benchmarks are a clean snapshot of what B2B ecommerce looks like in practice.

Pattern: Marketplace-first buying (65.12% share)

Marketplace purchasing holds 65.12% of B2B ecommerce share in the latest reported split.

What it changes: pricing transparency goes up; differentiation shifts to fulfillment, compliance, and availability.

Pattern: Cross-border is normal (44.32% of volume)

Cross-border transactions represent 44.32% of volume in the same split.

What it changes: compliance and payment risk become part of the buying decision, not an afterthought.

Pattern: ACH/bank transfer is still the workhorse (40.68% share)

Bank transfers/ACH account for 40.68% of payment share.

What it changes: "checkout" is a PO + invoice flow, not a card form.

Pattern: Asia-Pacific dominates revenue (69.23%)

Asia-Pacific accounts for 69.23% of B2B ecommerce revenue in the same benchmark set.

What it changes: if you sell cross-border, you design for APAC supplier discovery, documentation, and payment rails from day one, not as a "someday" expansion project.

Advanced B2B ecommerce example: PunchOut catalogs (cXML/OCI) in plain English

PunchOut is the most "real" B2B ecommerce mechanic because it's built around procurement control.

PunchOut flow (what happens)

- A buyer starts inside a procurement suite (SAP Ariba, Coupa, Oracle Procurement Cloud).

- They click a supplier tile, which launches the supplier's site with authentication and contract pricing.

- They shop on the supplier site (catalog, availability, negotiated items).

- Instead of checking out, they return the cart back into the procurement system.

- The requisition runs approvals.

- A PO is issued.

- Supplier fulfills. Invoice gets matched and paid.

If you've ever wondered why some B2B supplier sites feel "weird," it's because the real checkout isn't on the site. It's back in procurement.

Standards you'll hear

- cXML: a common protocol for ecommerce <-> procurement data exchange. TradeCentric notes cXML was developed by Ariba in 1999.

- OCI: SAP's alternative integration standard (common in SAP-heavy environments).

Why companies bother

- It reduces manual work and errors.

- It enforces contract pricing.

- It cuts transaction costs: Order.co cites $75 for electronic-catalog validated orders vs $109 for standard transactions.

- It reduces maverick spend, which Order.co estimates costs 5%-16% of negotiated savings when buyers go off-contract.

Glossary (quick)

- Procurement suite: the system that controls buying (approvals, budgets, vendors).

- Catalog: the supplier's items and pricing available to that buyer.

- Maverick spend: purchases outside negotiated suppliers/contracts.

"Most real" B2B examples (mini case callouts)

These are the examples we use when someone thinks B2B is just "selling software to companies." They show the mechanics: approvals, replenishment, governance, and the boring paperwork that decides who wins.

Fastenal: B2B distribution embedded into operations

Fastenal isn't "a distributor with a website." It's distribution designed to disappear into the customer's workflow. With 61% of Q1 sales coming through digital channels, the buying motion looks like this: a plant standardizes SKUs, sets contract pricing, and pushes ordering into controlled paths (vending, onsite programs, and digital reordering). The user grabs what they need; procurement still gets audit trails, budget controls, and invoice consolidation.

What makes it B2B is the control loop: approved items, replenishment triggers, and purchasing that maps cleanly to cost centers.

If you sell physical goods, build for replenishment and approvals first.

Apple supply chain governance: B2B as compliance + audits at scale

Apple's supplier responsibility program is B2B in its most grown-up form: governance as a system. Apple reports 893 assessments of supplier facilities, with more than 22% unannounced. They trained 2.5M+ supplier employees and review 1.4M+ employees' working hours weekly.

That's not "nice corporate responsibility content." It's contract enforcement, and it's a reminder that in brand-sensitive or regulated supply chains your compliance artifacts aren't paperwork. They're part of the product, and buyers will treat them that way.

PunchOut supplier scenario: contract pricing meets approvals

A distributor sells MRO supplies to a multi-site manufacturer. The manufacturer launches the distributor's PunchOut catalog from their procurement suite, shops pre-approved SKUs at negotiated pricing, returns the cart, and routes it for approvals before the PO's issued. After delivery, AP runs three-way match and pays on net terms.

Here's the thing: if you're selling into enterprise procurement, integration isn't a "nice to have." It's the deal.

From examples to action: how B2B companies find and reach buyers

Corporate Visions' numbers explain why examples matter: buyers define purchase requirements 83% of the time before talking to sales, 86% of purchases stall, and 94% use LLMs during buying. By the time you show up, the buyer already has a shortlist and a mental model.

So the practical move is simple:

- Pick one category above (say, "medical supplies -> hospitals").

- Define the buying committee (user, budget owner, procurement/finance, security if relevant) - and document it like a real buying committee.

- Build a contact list by role + company type + signals (growth, tech stack, intent) using firmographic data.

- Verify contact data before outreach, or you'll burn deliverability - use a proper email verification workflow.

Skip this if you're only doing inbound and never plan to run outbound. If you are running outbound, though, bad data will make you hate your life.

Key takeaways (save this)

- Classify the transaction, not the logo. If there's a PO, invoice, and three-way match, it's B2B.

- Use the five buckets. Manufacturers, distributors, service providers, SaaS/infrastructure, and marketplaces cover almost every real B2B deal.

- Stop debating B2B2C. If both brands are visible and both have customer access, it's B2B2C. Otherwise it's resale.

- Optimize for procurement reality. Vendor onboarding, risk reviews, and clean billing win deals more reliably than clever positioning.

FAQ: business-to-business examples

Is Amazon a B2B company or B2C?

Amazon's both: Amazon (retail) is B2C, while Amazon Business is B2B because it supports business accounts, approvals, invoicing, and procurement-style purchasing. The same parent company can run multiple models; classify the transaction, not the logo.

Is a marketing agency B2B?

A marketing agency is B2B when it sells services under a contract (scope of work, retainer, reporting) to another company. Even if the agency's work targets consumers, the buyer and payer are still a business, and the relationship runs on invoices and renewal terms.

What's a simple B2B example of the procurement process (PO + invoice)?

A facilities team buys $3,000 of supplies: the manager requests items, finance reviews, procurement issues a PO, the supplier ships, then AP pays the invoice after a three-way match (PO, receiving record, invoice). That's the classic B2B control loop.

What's the difference between B2B2C and resale/white label?

B2B2C means both brands are visible to the consumer and both have customer access (shared experience and data). Resale/white label means the upstream supplier is invisible to the end customer; the reseller owns the customer relationship and branding.

How do I find decision-makers at B2B companies like these?

Map the buying committee (user + budget owner + procurement/finance) and pull contacts by role and company filters, then verify emails before outreach. Prospeo helps by delivering verified emails with 98% accuracy on a 7-day refresh cycle.

Whether you're selling to manufacturers, SaaS buyers, or distributors, the buying process you just read about has one constant: a real person triggers that requisition. Prospeo finds their verified email for ~$0.01 - with 30+ filters to target by intent, tech stack, and company growth.

Turn every B2B category on this list into a pipeline.