Buying Center Definition: The 2026 Guide for Sales and Marketing Teams

A RevOps lead I know lost a $120K deal last quarter. Not because the product was wrong. Not because the pricing was off. The deal died because her AE spent four months building a relationship with a single director - who turned out to have zero budget authority and couldn't sell the solution internally. The committee she never mapped killed the deal in a meeting she didn't know was happening.

That story isn't unusual. It's the default outcome when sellers single-thread into complex organizations. Gartner's data says B2B buyers [spend only 17%](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) of their total buying time with potential suppliers. If you're one of three vendors being evaluated, you're getting roughly 5-6% of the committee's attention. Waste that sliver on the wrong person, and you're done.

The buying center definition - and a working understanding of who's actually in it - is the concept that explains why this keeps happening and how to fix it.

What the Buying Center Definition Actually Means

A buying center is the group of individuals within an organization who participate in a B2B purchase decision. It's not a department. It's not a standing committee. It's an informal, fluid collection of people whose roles, influence, and involvement shift depending on the purchase.

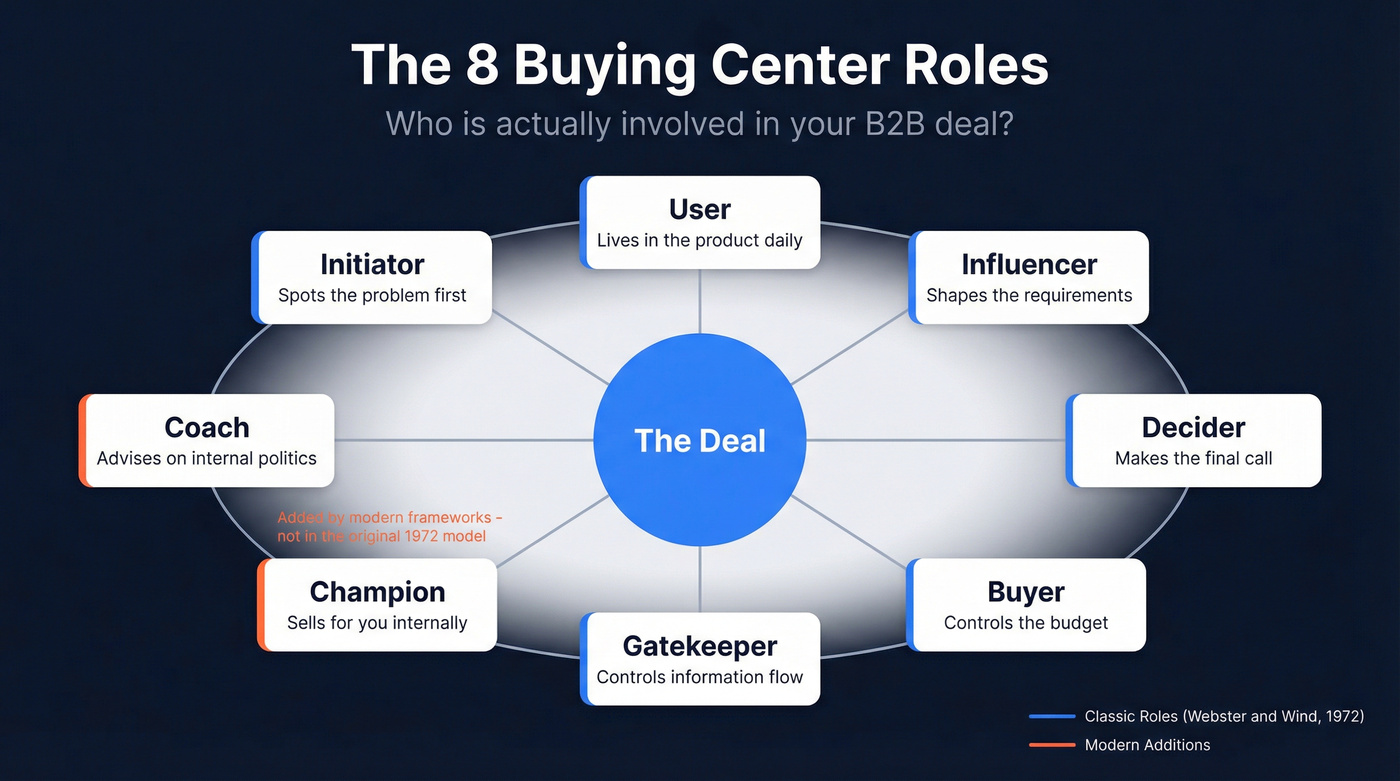

The term comes from Frederick Webster and Yoram Wind, who formalized the concept in 1972. Their original model identified five roles: Users, Influencers, Buyers, Deciders, and Gatekeepers. A decade later, Thomas Bonoma added a sixth - the Initiator - the person who first recognizes the need and kicks off the organizational buying behavior.

You'll hear the same concept called different things. "Decision-Making Unit" (DMU) is the preferred term in European marketing circles, particularly when discussing the DACH decision making process, where consensus-driven governance often expands the group further. "Buying committee" is what most sales practitioners say. "Buying group" shows up in Forrester and Gartner research. They all describe the same thing: the network of participants involved in a B2B purchase decision.

The academic lineage matters because it shows the concept has been refined over decades and it's still evolving: Robinson, Faris, and Wind (1967) introduced the "buygrid" framework for classifying organizational buying situations, Webster and Wind (1972) defined the buying center roles within those situations, Bonoma (1982) added the Initiator, and Bunn (1993) expanded the classification of buying situations beyond the original three buy classes.

Quick Summary

- One-sentence definition: A buying center is the informal group of people within an organization who influence or make a B2B purchase decision.

- The 6 classic roles: Initiator, User, Influencer, Decider, Buyer, Gatekeeper

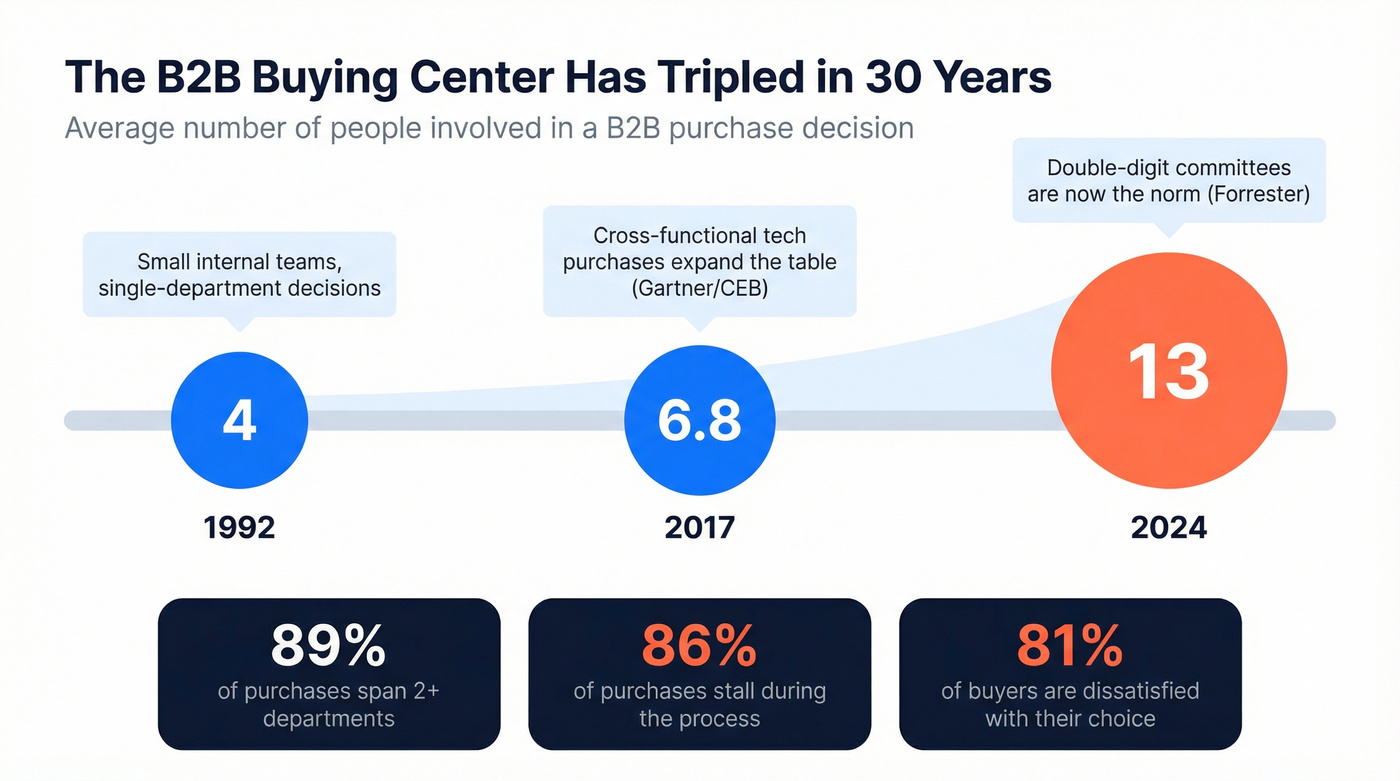

- The modern reality: 13 people are now involved in the average B2B buying decision

- 89% of purchases involve two or more departments

- The takeaway: Map the full committee or lose the deal. Single-threading is the #1 reason complex deals stall.

The 6 Classic Buying Center Roles (and 2 Modern Additions)

| Role | What They Do | Real-World Example |

|---|---|---|

| Initiator | Identifies the need | Marketing mgr flags lead gen gaps |

| User | Uses the product daily | SDRs running outbound sequences |

| Influencer | Shapes requirements | Sales ops defining integrations |

| Decider | Makes the final call | VP of Sales signs off on vendor |

| Buyer | Controls the budget | Finance lead negotiating terms |

| Gatekeeper | Controls info flow | IT security approving vendors |

| Champion | Advocates internally | AE pushing for your solution |

| Coach | Advises on politics | Former colleague sharing intel |

One person can fill multiple roles simultaneously. The VP of Sales might be both the Decider and the Initiator. An SDR team lead might be a User and an an Influencer. In a 50-person startup, the buying center might be the CEO, a department head, and someone from finance - three people covering all eight roles. In a Fortune 500, the same purchase could involve 15-20 people across five departments, with formal procurement gates at every stage.

The Buyer-User tension is one of the most underappreciated dynamics in B2B sales. The people using a product daily want speed and simplicity. The people signing the checks want dashboards, compliance features, and roadmap commitments. I've seen product teams get pulled in completely opposite directions - buyers keep requesting a heavy reporting module that most users would never touch. Understanding this tension is half the battle when you're selling into a purchase committee.

Champion and Coach - The Roles Your Textbook Missed

The Baylor Keller Center framework expands the buying center to eight roles by adding two that every experienced seller already knows exist:

Champion: Your internal advocate. This is the person inside the buying organization who actively sells your solution in rooms you'll never enter. They're not just a friendly contact - they're putting their reputation on the line by pushing for your product. Champions typically emerge from the User or Influencer role, but what makes them a Champion is their willingness to fight for you internally.

Coach: Someone who advises you on internal politics, personalities, and process. The Coach might not even be part of the buying center - they could be a former colleague, a friendly contact in an adjacent department, or someone who's been through a similar purchase before. They tell you who really decides, who's likely to block, and what language resonates with the CFO.

If you don't have at least a Champion in a complex deal, you don't have a deal. You have a conversation. The Champion is the person who keeps your solution alive when you're not in the room - which, given that 17% stat, is most of the time.

You can't multithread a deal if you can't find the committee. Prospeo gives you 30+ filters to identify every stakeholder in a buying center - by role, department, seniority, and company - with 98% verified emails and 125M+ direct dials.

Stop single-threading. Reach every decision-maker in one search.

How Buying Centers Have Grown - From 4 People to 13

The buying center hasn't just evolved conceptually. It's physically expanded.

In 1992, the average B2B purchase involved roughly 4 people. By 2017, Gartner/CEB put that number at 6.8. Forrester's research landed at 13.

That's a tripling in three decades.

If you're still wondering how many people in a B2B buying group you should expect to encounter, the answer depends heavily on deal size and organizational complexity - but double digits is now the norm for enterprise purchases.

Three forces are driving the expansion: increasing deal complexity, cross-functional technology purchases, and organizational risk aversion. When a SaaS platform touches sales, marketing, IT, finance, and legal, all of those departments want a seat at the table.

89% of B2B purchases now involve two or more departments. For large deals, 75% involve four or more. And here's the painful part: 86% of B2B purchases stall during the buying process. Even when buying centers do reach a decision, 81% of buyers express dissatisfaction with their chosen provider - suggesting the process itself is broken, not just slow.

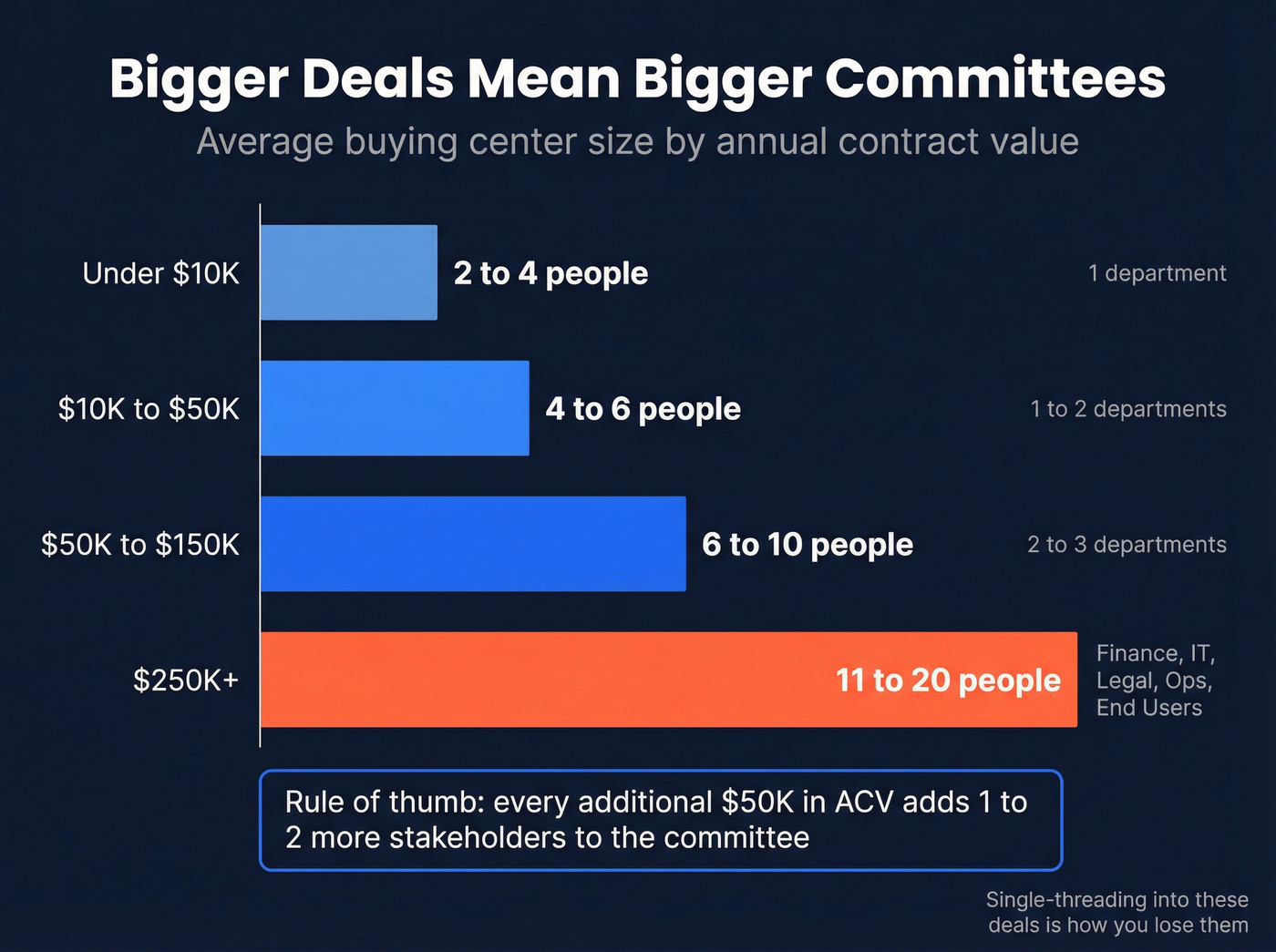

B2B Buying Group Size by Deal Size

The average buying committee size varies dramatically based on contract value. Small deals under $10K might involve 2-4 people. Mid-market deals in the $50K-$150K range typically pull in 6-10 members across two or three departments. Enterprise buying decisions above $250K regularly involve 11-20 stakeholders spanning finance, IT, legal, operations, and the end-user team.

The correlation is nearly linear - every additional $50K in ACV tends to add another 1-2 stakeholders to the committee.

This is why the old playbook of "find the decision-maker and close them" doesn't work anymore. There isn't one decision-maker. There's a committee of 13 people across multiple departments, each with different priorities, different timelines, and different definitions of success. When committees do reach consensus, they're 2.5x more likely to call the outcome a high-quality decision. The problem is getting there.

How Buying Centers Actually Work in 2026

The Digital-First Buying Committee

Buyers define their purchase requirements 83% of the time before ever talking to a sales rep. By the time you get the discovery call, the committee has already researched your product, your competitors, and probably your pricing.

94% of buyers now use LLMs during their buying process - for vendor comparisons, requirements docs, ROI modeling, and shortlist creation. The research phase has been compressed and democratized. A junior analyst can now produce a competitive matrix that used to take a consultant a week. And 62% of buyers needed sellers to clarify AI capabilities, one area where human interaction still adds clear value.

Then there's the dark funnel. Anonymous research, peer communities, Slack groups, Reddit threads, and social lurking all shape preferences before anyone fills out a form. 61% of B2B buyers prefer to buy without a sales rep entirely. 73% actively avoid vendors that blast irrelevant outreach. The buying center is making decisions in channels you can't see and can't track.

Millennials, Gen Z, and the Generational Shift

The demographic makeup of buying committees has shifted. Millennials and Gen Z now make up the majority of B2B buying group members, and their expectations are fundamentally different - they default to self-serve research, trust peer reviews over vendor claims, and expect consumer-grade digital experiences throughout the procurement process. Sellers who rely on phone-first outreach and PDF brochures are increasingly misaligned with how these committees actually operate.

The Consensus Problem - 74% of Teams Experience Unhealthy Conflict

Gartner found that 74% of buying teams experience "unhealthy conflict" during the decision process. That's not healthy debate about vendor capabilities. That's political infighting, misaligned priorities, and stakeholders who fundamentally disagree on what the organization needs.

This is where deals go to die.

Not because your product is wrong, but because the buying center can't agree internally. The VP of Sales wants pipeline velocity. The CFO wants cost reduction. IT wants security compliance. The users want something that doesn't add three clicks to their workflow. When these priorities collide without a framework for resolution, the default outcome is "do nothing." The finance stakeholder dynamic is especially fraught - CFOs often enter late in the process with cost objections that blindside sellers who never engaged them early.

From Buying Centers to Buying Networks

Here's a hot take: the term "buying center" is starting to feel too neat for what's actually happening. Modern buying committees include roles that don't map neatly to the classic six - economic owners, mobilizers, and compliance gatekeepers who operate across traditional departmental lines. Gartner describes modern buying as a set of "jobs" - problem identification, solution exploration, requirements building, and supplier selection - that people bounce between non-linearly.

Formal buying committees are giving way to fluid "buying networks." Internal stakeholders, external peers, AI agents, and digital communities all shape decisions before sellers get involved. A prospect's former colleague at another company who had a bad experience with your competitor? That's part of the buying network. The Slack community where your prospect's IT lead asks for vendor recommendations? That's part of it too.

The average sales cycle dropped from 11.3 months to 10.1 months between 2024 and 2025, driven largely by economic pressures and buyers engaging sellers earlier in the process. Buyers average 16 interactions per person with the winning vendor, but those interactions are increasingly digital and asynchronous.

If you're selling deals under $15K, you probably don't need to map all 13 stakeholders. But the moment you're selling six-figure deals, ignoring the buying network is how you lose to the competitor who mapped it.

Buying Centers Across Industries and Verticals

Buying Committee in Manufacturing

In manufacturing, the buying committee tends to be more hierarchical and process-driven than in tech. Procurement departments hold significant power, and purchases often require sign-off from plant managers, operations leads, and supply chain directors alongside finance. Capital expenditure approvals can add weeks or months to the cycle, and committees frequently require in-person demonstrations or site visits before advancing a deal. Skip this section if you're purely in SaaS - the dynamics below on software purchases are more relevant.

Education Buying Center Dynamics

The education buying center introduces unique complexity. Purchasing decisions in K-12 and higher education often involve administrators, department heads, IT coordinators, and sometimes board-level approval. Budget cycles are rigid and tied to academic calendars, meaning timing matters as much as stakeholder mapping. Sellers who don't understand the education buying center's procurement cadence often miss entire fiscal windows.

Decision Making Process in DACH Markets

Selling into Germany, Austria, and Switzerland requires adapting to a consensus-heavy decision making process. Buying centers in this region tend to be larger, more methodical, and more risk-averse. Committees expect thorough documentation, data privacy compliance, and often require multiple rounds of internal review before a vendor is shortlisted. We've seen teams underestimate DACH cycles by 2-3 months because they applied US-style timelines to a fundamentally different buying culture.

Buying Centers in SaaS and Software Purchases

If you're selling SaaS, the dynamics above hit differently. 83% of all B2B software purchasing decisions are made by teams, not individuals. The average SaaS buying committee runs 5-8 people, and the average evaluation-to-purchase cycle is 4.6 months.

63% of companies now have a formal process for buying and renewing SaaS that includes finance, operations, business users, and IT. Five years ago, a lot of SaaS was bought on a credit card by a department head. The formalization means more stakeholders, more process, and more opportunities for deals to stall.

Finance is increasingly embedded in SaaS procurement - 44% of organizations say their finance team is part of the SaaS buying process most of the time. That's a stakeholder many sellers forget to account for until the contract redline phase. By that point, the CFO's objections can kill months of work.

Integration is the top technical concern. 39% of buyers identified integration with existing software as the most important factor when choosing a provider. Your Sales Ops Manager or IT lead - the Influencer in buying center terms - often has effective veto power. If your product doesn't integrate with their stack, the Decider's enthusiasm doesn't matter.

Only 30% of organizations say IT has an effective SaaS purchasing or renewal process. That gap creates chaos - and opportunity. Sellers who help the buying center navigate their own internal process (providing security questionnaires proactively, offering ROI templates for the CFO, giving technical docs to IT) win more often than sellers who just pitch features.

How to Map and Navigate a Buying Center

I've watched teams book 15 meetings in a quarter and see 12 of them stall. The pattern is almost always the same: every deal was single-threaded. One contact. One relationship. One point of failure.

Top-performing sales orgs multi-thread 80%+ of their deals. Average orgs? Fewer than 40%.

Here's the four-step process that actually works.

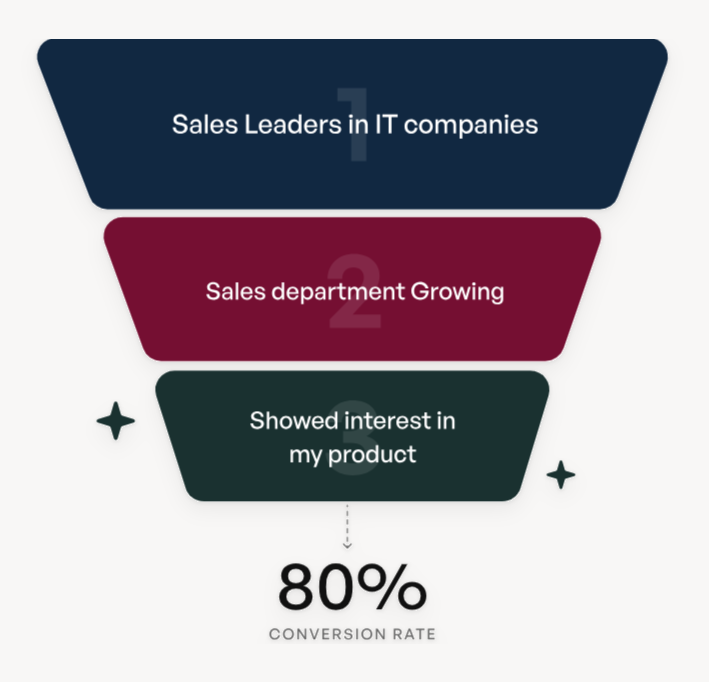

Step One - Identify Every Stakeholder

Before your first real conversation, you should know who fills each role in the buying center. Don't rely on your one contact to reveal the full committee - they often don't know themselves, or they're reluctant to bring in colleagues who might complicate the deal.

Step Two - Build Your Buyer's Matrix

Once you have names, build a buyer's matrix - the working document that keeps your deal strategy honest and maps each stakeholder to their role, priorities, and level of influence.

| Role | Name(s) | Wants / Key Priorities |

|---|---|---|

| Decider | VP of Sales | Pipeline growth, rep productivity |

| User | SDR Team Lead | Ease of use, data accuracy |

| Influencer | Sales Ops Manager | CRM integration, API reliability |

| Buyer | Director of Finance | ROI, contract flexibility |

| Gatekeeper | IT Security Lead | GDPR compliance, data handling |

| Champion | Account Executive | Faster prospecting, fewer bounces |

Fill this in for every deal above a certain threshold. The Baylor framework recommends confirming five pieces of information: members and roles, step-by-step process, timing, key attributes, and budget considerations. Understanding each member's personal wants - not just business needs - is critical. Personal risks and relationship values often matter more than feature comparisons.

Step Three - Multi-Thread from Day One

Multi-threading isn't something you do when a deal stalls. It's something you do from the first meeting. The goal is to have at least 2-3 active relationships in every deal before you send a proposal.

The consultative framing matters. Instead of asking "Can you introduce me to your CFO?", try: "I want to make sure our proposal addresses the financial priorities that matter to your CFO. Could I get their input on our business case?" That's not a power play - it's positioning yourself as someone who wants to get the deal right.

Tailor your messaging per role. Users care about ease of use. Influencers want technical details. Buyers want ROI. Deciders want the big picture. Gatekeepers want you to respect their role and their process. Sending the same deck to everyone is lazy and it shows.

Step Four - Arm Your Champion with Internal Selling Tools

Your Champion is selling for you in meetings you'll never attend. Give them ammunition.

Build an internal "cheat sheet" - a one-page summary that explains your solution in language that resonates with each stakeholder. Include the ROI case for Finance, the integration story for IT, the user experience narrative for the team leads.

I've run this playbook enough times to know: the deals where you provide internal selling tools close 30-40% faster than deals where you leave your Champion to figure it out on their own. They're already putting their reputation on the line. The least you can do is make it easy for them.

After the deal closes, follow up with every stakeholder - not just your Champion. The buying center becomes your renewal committee. The relationships you built during the sale are the ones that protect you at contract renewal.

Tools for Mapping Buying Centers in 2026

Three categories of tools matter here:

| Category | What It Does | Top Pick |

|---|---|---|

| B2B data platform | Find contacts by role, department, seniority | Prospeo - 300M+ profiles, 30+ filters, intent data, starts free |

| Intent data platform | Identify in-market accounts | Bombora, 6sense, Demandbase |

| CRM enrichment | Fill gaps in existing pipeline | Enrichment APIs returning 50+ data points per contact |

The advantage of using a platform with built-in intent data is that you don't need separate tools - the intent signal and the contact data live in the same workflow. Layer intent topics on top of department and seniority filters, and you're identifying not just who's in the buying center, but which accounts are actively researching solutions like yours right now.

13 people in the average buying center means 13 contacts you need accurate data for. Prospeo's 7-day data refresh ensures you're never reaching out to someone who changed roles six weeks ago - because stale data kills deals just like single-threading does.

Fresh data on every stakeholder, refreshed weekly, at $0.01 per email.

FAQ

What's the buying center definition vs. buying committee?

They're the same concept with different names. "Buying center" is the academic term coined by Webster and Wind in 1972, while "buying committee" is what most sales practitioners say. "Decision-Making Unit" (DMU) is common in European marketing. All describe the group of people involved in a B2B purchase decision - the terminology just depends on who's talking.

How many people are typically in a buying center?

The average B2B buying group now includes 13 people across multiple departments. For SaaS purchases specifically, expect 5-8 stakeholders. Enterprise deals above $250K regularly involve 11-20 people spanning four or more departments - roughly triple the committee size from the early 1990s.

What are the main roles in a buying center?

The classic model identifies six roles: Initiator, User, Influencer, Decider, Buyer, and Gatekeeper. Modern frameworks add the Champion (your internal advocate) and the Coach (someone who advises on internal politics). One person can fill multiple roles simultaneously - a VP of Sales might be both Decider and Initiator.

Why do deals stall in buying centers?

74% of buying teams experience "unhealthy conflict" during the decision process - political infighting, misaligned priorities, and stakeholders who disagree on what the organization needs. Deals stall most often when sellers single-thread (engage only one contact) or when late-stage stakeholders like the CFO raise objections no one anticipated.

How do you identify buying center members before a sales call?

Use a B2B data platform to search by company, department, and seniority, then layer in buyer intent data to confirm the account is actively in-market. This lets you map the full committee before your first conversation instead of relying on a single contact to reveal who else is involved.