Customer Profiling for B2B Sales: The 2026 Playbook

Your VP of Sales just pulled up the pipeline review. Half the deals are stalled. A quarter will never close. The reps swear the leads looked good on paper - right industry, right size, even the right titles. But the accounts don't have budget, don't have urgency, and don't have the pain your product solves.

That's what happens when customer profiling for B2B sales is a checkbox instead of a system. Almost unanimously, companies have ICPs that are far too broad. A company with 101 employees and one with 699 are at completely different stages of maturity - you can't target both with the same message, the same sequence, or the same rep.

The fix isn't more leads. It's better profiling. As one RevOps practitioner put it: "B2B marketing success is less about campaigns and more about the underlying systems - data quality, enrichment logic, scoring rules, routing, timing signals." That's what this guide builds: a 10-role buying committee framework, an Anti-ICP template, and an intent signal scoring model that most ICP guides skip entirely.

What You Need (Quick Version)

If you're short on time, here's the framework in 60 seconds:

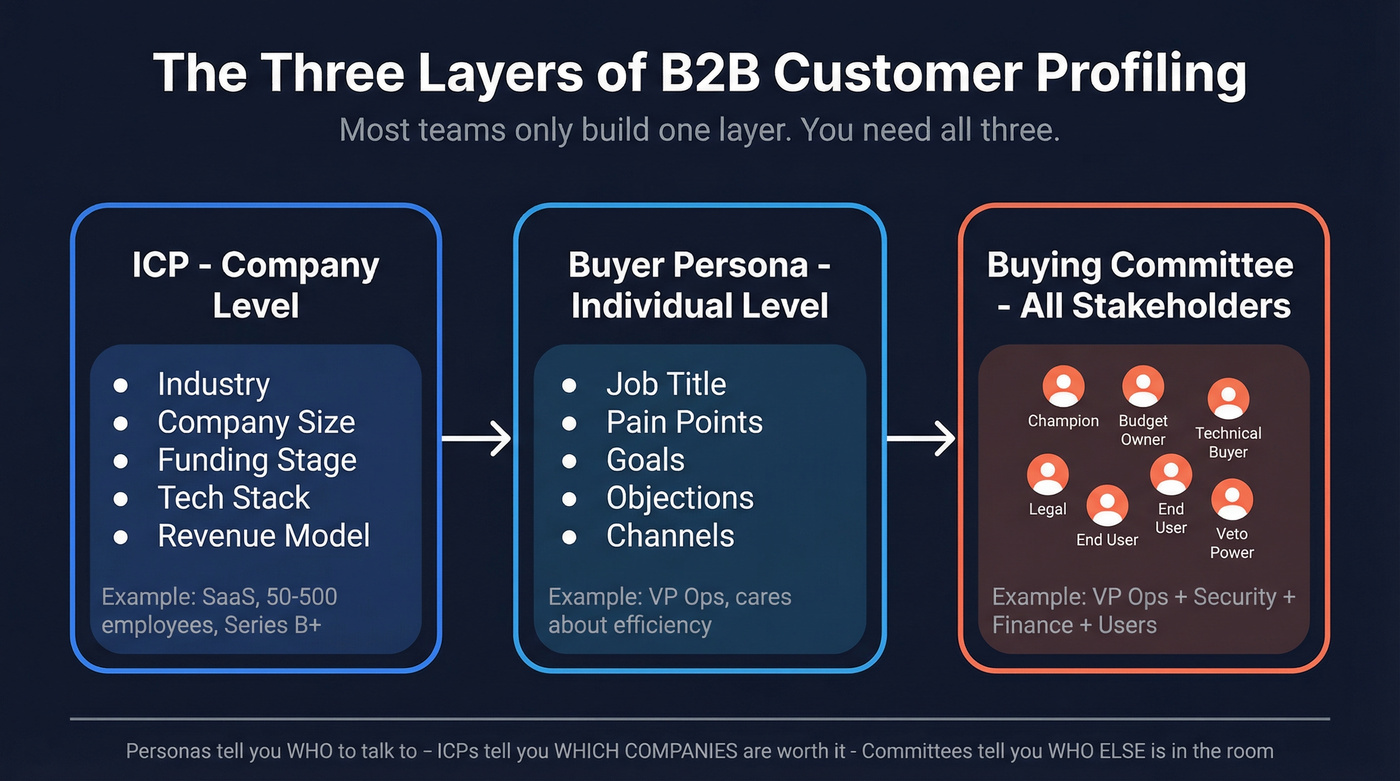

- Customer profiling is three layers: ICP (company-level) + buyer personas (individual-level) + buying committee map. Most teams only do one. You need all three.

- Start with your 10 best existing customers, not aspirations. Your ICP isn't a wish list.

- Define your Anti-ICP alongside your ICP. Knowing who NOT to sell to saves more pipeline than knowing who to sell to.

- A profile in a Google Doc is a wish list. Operationalize it with enrichment tools and intent signals so it actually filters leads in your CRM.

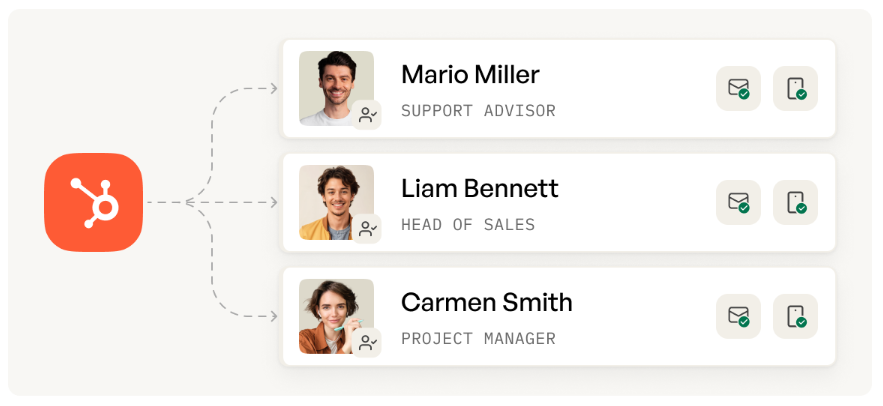

- Minimum viable stack: CRM (HubSpot free tier) + data enrichment platform + orchestration layer (Clay if you need multi-source enrichment). You can start today with those three.

What Customer Profiling Actually Means in B2B

Most teams use "ICP," "buyer persona," and "customer profile" interchangeably. They're not the same thing, and conflating them is how you end up targeting the right people at the wrong companies.

HubSpot shared a case study that nails this. A B2B SaaS client had perfected their buyer personas - detailed role descriptions, pain points, objections, the works. But they had no ICP. They were targeting the right people at the wrong companies: startups that couldn't afford their product and enterprises that didn't have the problem it solved. The distinction is clean: personas tell you who you're speaking to; ICPs tell you which companies are worth speaking to in the first place. The highest ROI comes when you combine both - target the right organizations with ICPs, then win over the right people with buyer personas.

Take Zapier's ICP as an example: "Fast-growing companies with 50-500 employees that use 5+ disconnected software tools, have dedicated operations teams, and lose 10+ hours weekly to manual data entry between systems." That's specific. That's filterable. That's useful.

A complete customer profile wraps all three layers together:

| Layer | What It Defines | Example |

|---|---|---|

| ICP | Company-level fit | SaaS, 50-500 employees, Series B+ |

| Buyer Persona | Individual decision-maker | VP Ops, cares about efficiency |

| Buying Committee | All stakeholders involved | VP Ops + Security + Finance + End Users |

When you build all three, you stop wasting sequences on accounts that look good in a spreadsheet but die in the pipeline.

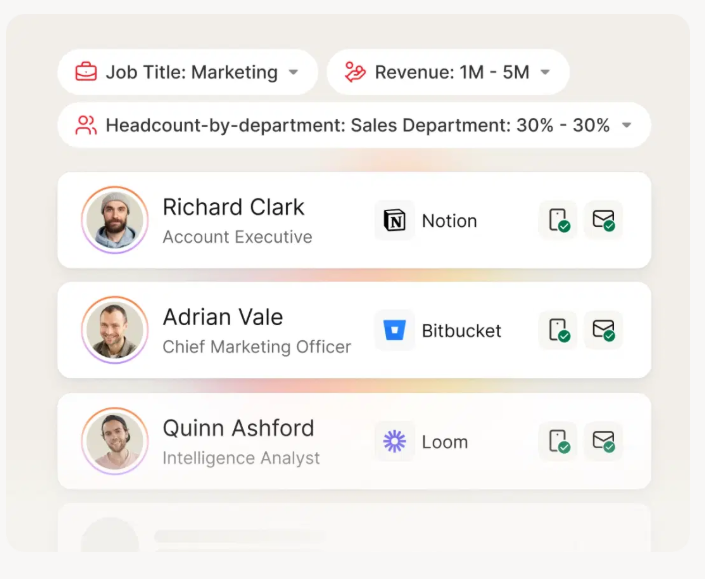

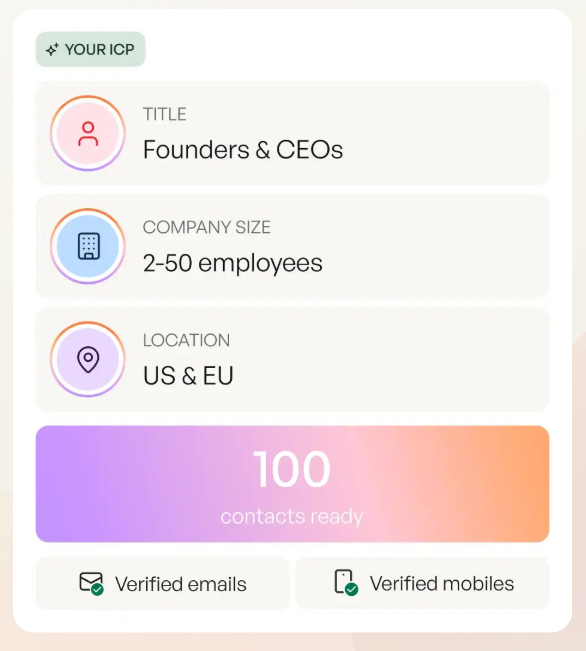

You just built a three-layer customer profile. Now operationalize it. Prospeo gives you 30+ filters - buyer intent, technographics, headcount growth, funding, job changes - so your ICP isn't a Google Doc, it's a live pipeline. 98% email accuracy. 7-day data refresh. $0.01 per lead.

Stop profiling customers you can't actually reach.

How to Build Customer Profiling for B2B Sales (Step by Step)

Define Your ICP Using the Situational Framework

Most ICP guides tell you to list firmographics and call it a day. That's how you end up with "B2B SaaS companies, 50-1000 employees, North America" - a description so broad it's useless.

Lincoln Murphy's situational framework is better. It forces you to define your ICP through three inputs: time frame (what does "ideal" mean in the next 3-6 months?), goal (are you optimizing for revenue, new logos, or customer advocates?), and current capabilities (what can your product and team actually deliver today?). This matters because your ICP isn't static. The ideal customer for a pre-PMF startup burning runway is different from the ideal customer for a Series C company optimizing for net retention. Murphy's insight is that FOMO is the #1 reason companies resist narrowing their ICP. "When you don't focus, and try to be everything to everyone, you end up making a connection with no one."

You don't need 20 data points to start. Begin with five: industry, company size, pain point, tech stack indicator, and buying trigger. That's your minimum viable ICP. You can refine from there, but those five will filter out 60-70% of bad-fit accounts immediately.

And be specific. A company with 101 employees and one with 699 has massive differences. Don't use ranges so wide they're meaningless.

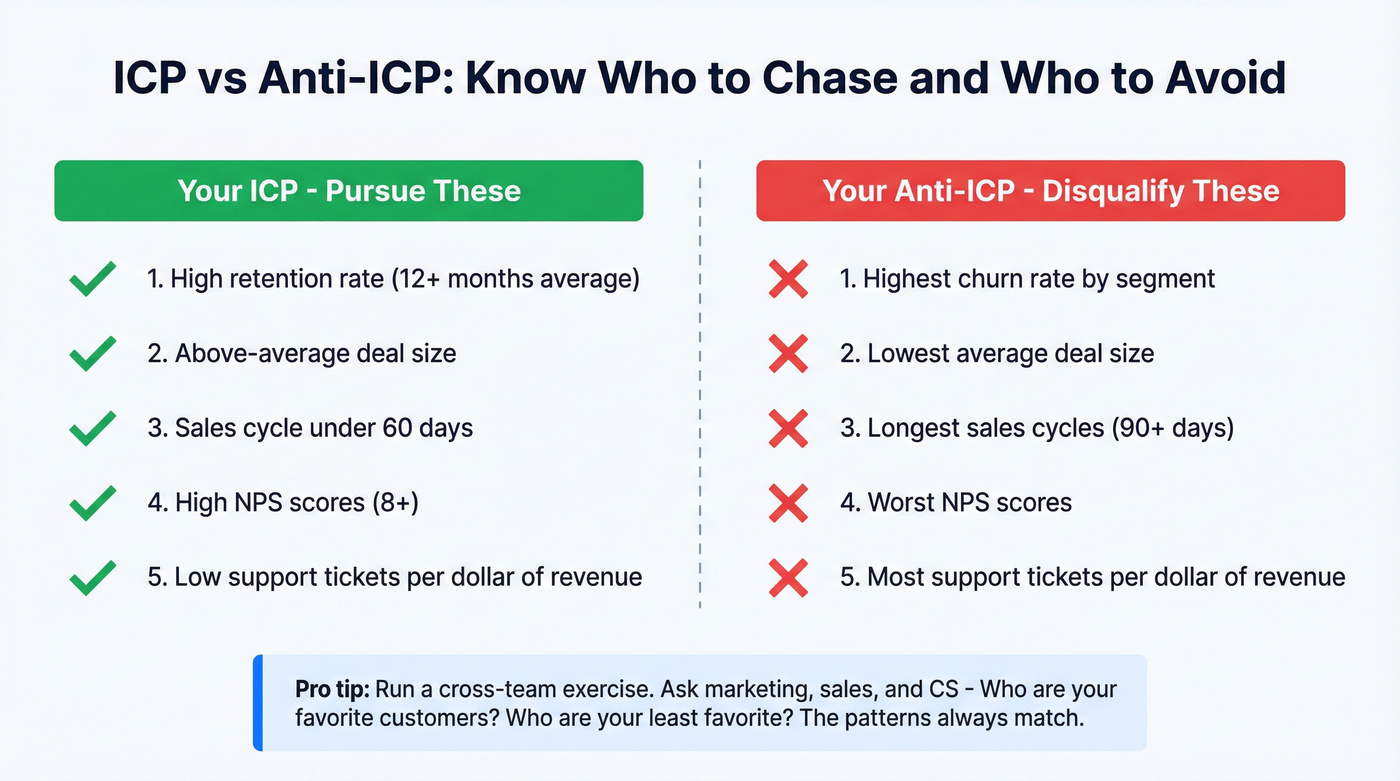

Define Your Anti-ICP

This is the step everyone skips, and it's arguably more valuable than the ICP itself.

I've seen a revenue leader's team spend $5-10K chasing a company that was never going to be a fit. The account looked right on paper - right industry, right size. But the buying process was a nightmare, the champion had no authority, and the deal died after three months of back-and-forth. As one B2B practitioner put it: "They're probably going to churn and burn your name in market."

Your Anti-ICP is a deliberate list of accounts that churn quickly, drive up CAC, and frustrate your team. Here's how to build it:

Run a cross-team exercise. Have marketing, sales, and CS each answer two questions: "Who are your favorite customers?" and "Who are your least favorite?" Patterns always emerge. The accounts CS dreads supporting are the same ones sales struggled to close.

Then look at the data. Your Anti-ICP signals:

- Highest churn rate by segment

- Lowest average deal size

- Longest sales cycles

- Worst NPS scores

- Most support tickets per dollar of revenue

Document these signals and build them into your CRM as disqualification criteria. A rep who can disqualify a bad-fit account in 5 minutes instead of 5 weeks is worth their weight in gold.

Interview Your Best Customers

Firmographics tell you what your best customers look like. Interviews tell you why they bought, how they decided, and what almost stopped them. You need both.

Leah Tharin's interview framework is the best we've used. She recommends targeting customers who've been with you 12+ months and spend above average - higher spend is a proxy for getting the most value from your product. Minimum 10 interviews. After 10, patterns emerge. After 20, you'll have high confidence.

Her structure covers six categories:

- Learning patterns - how they stay informed, what they read

- Industry context - broad challenges and common objections

- Role within organization - economic buyer vs. champion vs. influencer

- Goals and why they matter - personal and organizational

- Challenges and past attempts - what they tried before you

- Decision-making process - buying triggers, timeline, who was involved

Tharin uses a dating analogy that sticks: "Imagine going on a first date and asking 'So, do you work in tech or finance? Is your company Series A or post-IPO?'" Firmographics are necessary but not sufficient. You need to understand motivations, not just demographics.

Include a version of Sean Ellis's product-market fit question - "How would you feel if you could no longer use our product?" The answers reveal which customers are genuinely dependent on you versus which ones are just along for the ride.

Map the Buying Committee

This is where B2B profiling diverges completely from B2C. You're not selling to a person. You're selling to a committee.

Forrester's research puts the average B2B purchase at 13 stakeholders, with 89% of buying decisions crossing multiple departments. Gartner's number is slightly lower - 6-10 decision makers - but each one enters with 4-5 pieces of independent research. Buyers spend only 17% of their purchasing time meeting with vendors. The other 83% is internal consensus-building you can't see.

That's why 86% of B2B purchases stall at some point.

It's not your pitch. It's the stakeholder you didn't know existed. And even when deals close, 81% of buyers end up disappointed with their chosen vendor - often because the seller only engaged one stakeholder and missed the rest of the committee's priorities.

Here's the 10-role framework that covers most enterprise deals:

| Role | Function | Example Title |

|---|---|---|

| Project Sponsor | Owns the initiative | VP of Operations |

| Champion/Advocate | Internal seller | Sr. Manager |

| Executive Sponsor | Budget authority | C-suite |

| Financial Approver | ROI gatekeeper | Finance Director |

| Technical Buyer | Evaluates integration | IT Lead |

| Operations/Process Owner | Owns the workflow | Ops Manager |

| Business User | Daily user | Team Lead |

| Legal Reviewer | Compliance/contracts | Legal Counsel |

| Influencer | Shapes opinion | Industry advisor |

| Final Authority/Veto | Can kill the deal | CEO/Board |

Not every deal has all 10. But if you're selling six-figure contracts, you're dealing with 5-7 of these roles. And 41% of B2B buyers already have a preferred vendor before formal evaluation begins - so if you're not multi-threading early, you're already behind.

You can't multi-thread a deal if you only have one person's email. Use an email finder to pull verified contact data for each stakeholder before your first call, not after.

Build Your Profile Template

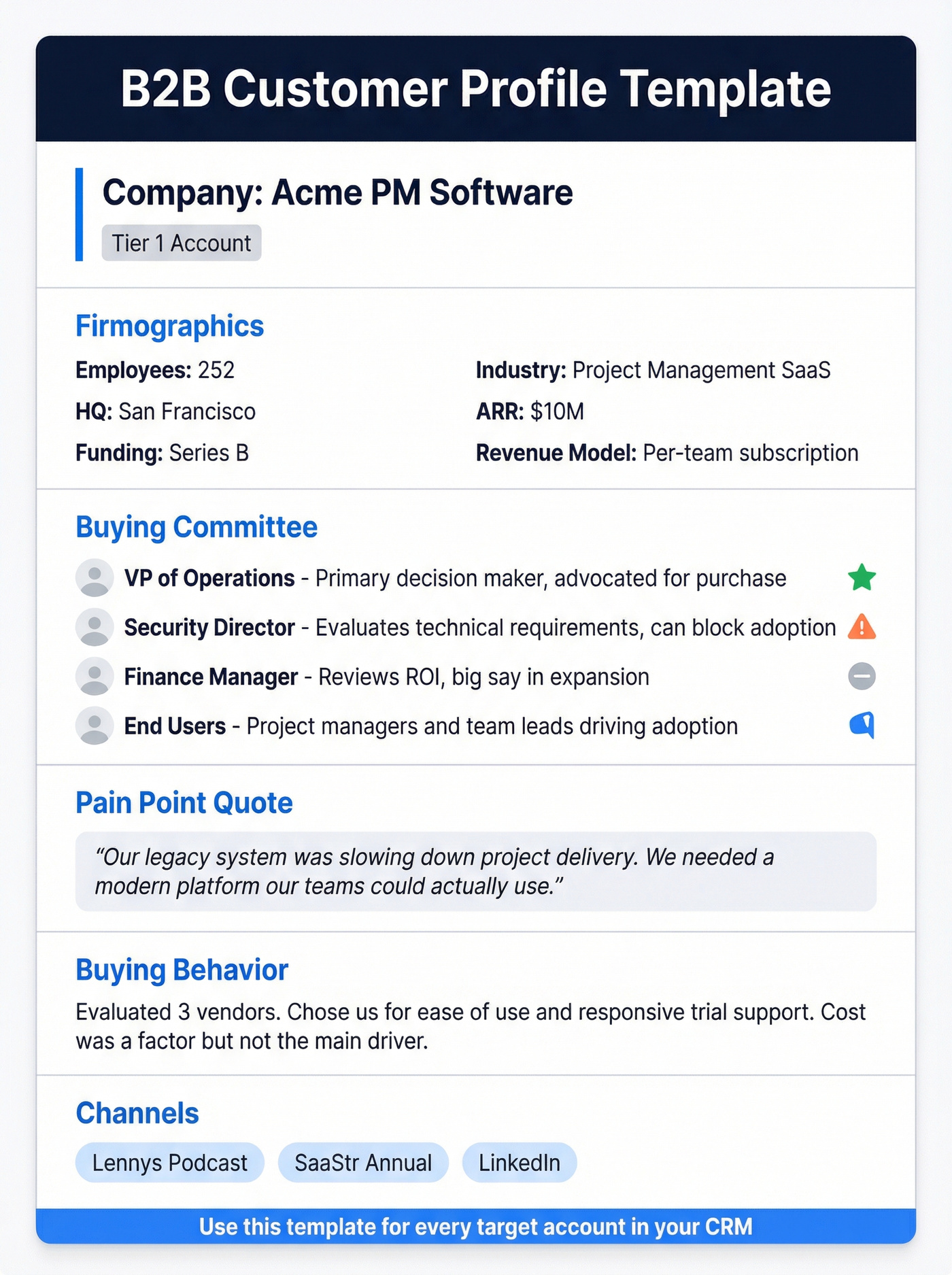

Here's what a filled-out B2B customer profile looks like in practice. I'm leading with the example because templates make more sense when you see the output first. Adapted from Pylon's framework:

Company Profile: Acme PM Software

Firmographics

- Company size: 252 employees

- Industry: Project management software

- Location: San Francisco

- ARR: $10M

- Funding: Series B

- Revenue model: Subscription-based per-team pricing

Buying Committee

- VP of Operations (primary decision maker, advocated for initial purchase)

- Security Director (evaluates technical requirements, can block adoption)

- Finance Manager (reviews ROI, big say in expansion decisions)

- End-user adoption drivers: project managers and team leads

Pain Point Quote "Our legacy system was slowing down project delivery. We needed a modern platform our teams could actually use."

Buying Behavior "We evaluated three vendors. We chose you because your software was easy to use and you had responsive customer support during the trial. Cost was a factor, but not the main driver."

Channels: Listens to Lenny's Podcast, attends SaaStr Annual, active in RevOps Co-op Slack

Renewal Criteria: "We'll renew if the integration improves and adoption reaches 60%."

Expansion Criteria: "We're looking to add three teams if we see the tool is saving us time."

Every field serves a purpose. Firmographics filter accounts in or out. The buying committee drives multi-threading. Pain points and buying behavior inform the pitch. Channels tell you where to show up before the deal even starts.

For template tools: Miro works best for cross-functional workshops. Notion is ideal if your team already uses it as a knowledge hub - the database format lets you link ICPs to case studies and account plans. Smartsheet has a solid ICP scorecard template if you want a structured scoring approach.

Here's the thing: a template should be a living tool integrated into your team's daily workflow. If it lives in a shared drive, it'll be ignored.

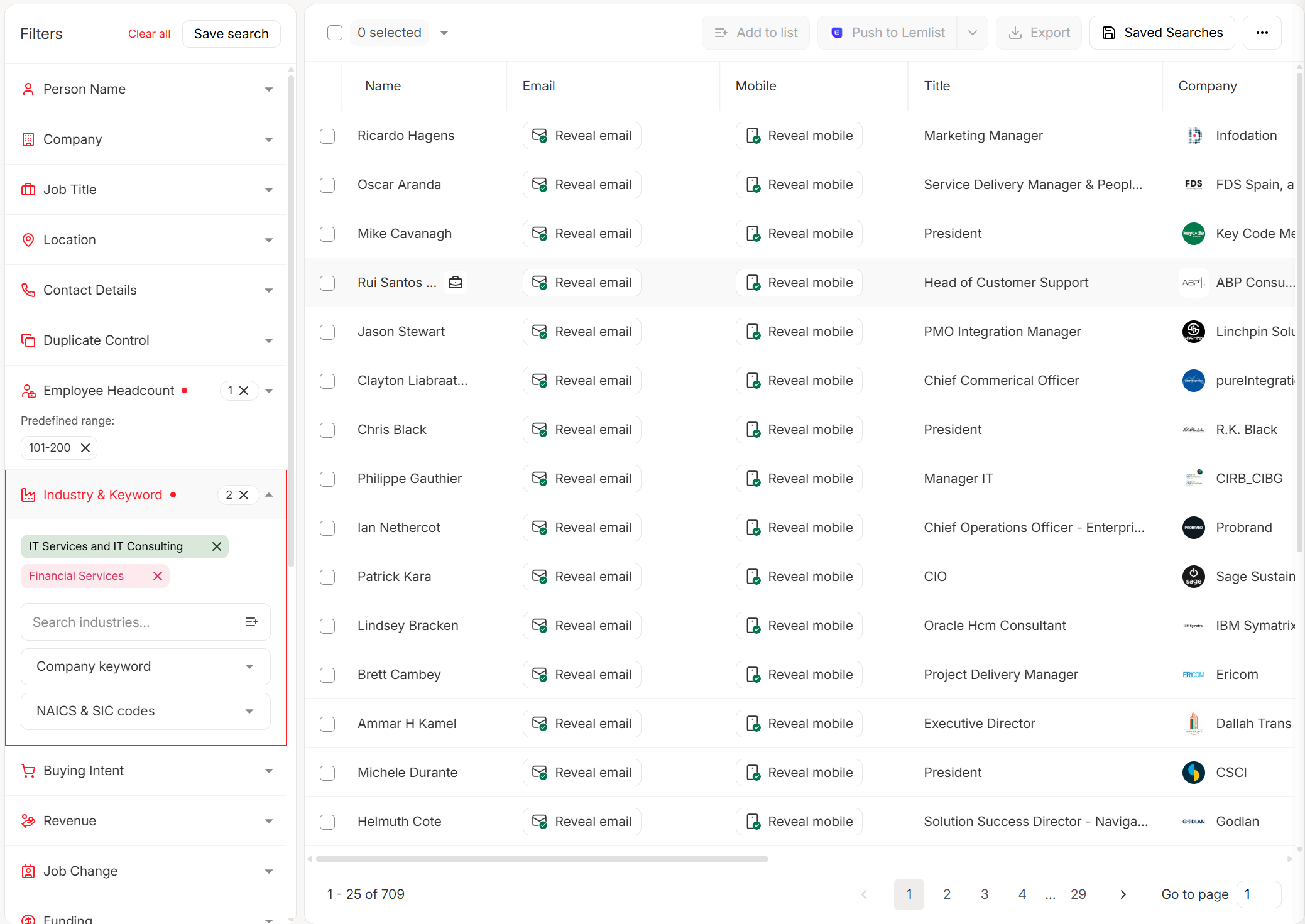

Enrich Your Profiles with Real Data

You've defined your ICP, built your Anti-ICP, interviewed customers, mapped the buying committee, and created a template. Now you need to fill it with real, verified data at scale.

The concept you need is waterfall enrichment - checking multiple data sources sequentially until you get a match. OpenAI used this approach with Clay to increase their contact coverage from 40% to 80%+. No single data provider covers every contact. Stacking them is how you close the gaps.

But there's a problem most teams underestimate: data decay. Most enrichment tools refresh data every 6 weeks. By the time you use the contacts, they're already degrading. People change jobs, companies get acquired, phone numbers rotate. A 6-week-old email list will bounce at 15-20%. A list refreshed weekly bounces under 4%. The difference is your domain reputation.

Here's the workflow that works:

- Define your ICP criteria from the steps above

- Apply those criteria as filters in your enrichment platform - industry, headcount, funding stage, tech stack, revenue range

- Pull verified contacts for each buying committee role

- Sync to your CRM with automatic deduplication

Prospeo handles this workflow end-to-end: 30+ search filters that map directly to ICP criteria (buyer intent, technographics, job changes, headcount growth, funding, revenue), 98% email accuracy, and a 7-day data refresh cycle. It also includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, plus CRM enrichment that returns 50+ data points per contact with an 83% enrichment match rate.

Layer Intent Signals on Your Profiles

OpenWorks rebuilt their targeting around buyer intent and saw 117% revenue growth from paid media with a 42% drop in cost per customer. That result didn't come from better ads. It came from knowing when to reach out, not just who to reach.

Pierre Herubel's 2026 B2B marketing playbook frames the underlying math: 95% of your potential buyers aren't ready to buy today. If you're blasting the same sequence to every ICP-fit account, you're annoying 95% of them. Intent signals let you prioritize the 5% who are actively researching.

Signal types to track:

- Content engagement: whitepaper downloads, webinar attendance, blog visits

- Website visits: especially pricing pages and comparison pages

- Job postings: hiring for roles your product supports

- Funding rounds: new capital = new budget

- Tech installs/removals: switching off a competitor's tool

Not every signal carries the same weight. A pricing page visit is worth more than a blog view. A funding round plus a job posting for your buyer persona is a strong compound signal. Build a weighted scoring model: assign points by signal type and recency, then route high-scoring accounts to reps.

Real talk: most teams skip intent because it feels complex. Start simple. Track three signals. Score them 1-3. Route anything above 5 to a rep. You can get sophisticated later.

What a Complete B2B Customer Profile Looks Like

Here's everything from the previous steps synthesized into a single, screenshot-worthy profile. Save this. Adapt it. Make it yours.

COMPLETE B2B CUSTOMER PROFILE

ICP Fit (Company Layer)

- Industry: Project management SaaS

- Headcount: 200-500 employees

- Revenue: $5-15M ARR

- Funding: Series B-C

- Location: US West Coast (primary), UK (secondary)

- Tech stack: Uses Salesforce + Slack + at least one legacy PM tool

- Buying trigger: Hired VP of Operations in last 90 days

Anti-ICP Flags ⚠️

- Under 50 employees (churn rate 3x average)

- No dedicated operations team (no champion)

- Currently in M&A process (deals stall 100% of the time)

Buyer Personas (Individual Layer)

- Primary: VP of Operations - cares about team velocity, reports to COO

- Secondary: Security Director - cares about compliance, can veto

- Financial: Finance Manager - cares about ROI payback period

- End users: Project managers - care about daily usability

Buying Committee Map

- Champion: VP of Operations (drives evaluation)

- Blocker: Security Director (integration concerns)

- Budget holder: CFO (final sign-off above $50K)

- Influencers: Team leads who'll use the product daily

Intent Signals (Timing Layer)

- Researching "project management migration" (Bombora topic, score: 85)

- Visited competitor comparison page 3x in 14 days

- Posted job for "Operations Analyst" (headcount growth signal)

Channels: Attends SaaStr, active in RevOps Co-op Slack, reads First Round Review

Pain Point: "Our legacy system was slowing down project delivery."

Buying Behavior: Evaluated 3 vendors. Chose based on usability and support responsiveness. Cost was secondary.

Renewal Criteria: Integration improvement + 60% adoption

Expansion Criteria: Add 3 teams if time savings demonstrated

ICP fit filters accounts in or out. Anti-ICP flags protect reps from wasting time. Buyer personas shape messaging. The buying committee map drives multi-threading. Intent signals determine timing.

Increasing Sales with Customer Profiling: Score and Prioritize Your Accounts

A customer profile without a scoring model is like a map without a route. You know the terrain, but you don't know where to go first.

The shift is from "who are they" to "what are they doing." Your scoring model needs both dimensions:

Explicit fit (who they are):

- Firmographic match to ICP: industry, size, revenue, funding

- Technographic match: uses tools in your integration ecosystem

- Buying committee accessibility: can you reach 3+ stakeholders?

Implicit behavior (what they're doing):

- Website visits (especially pricing/comparison pages)

- Content downloads and webinar attendance

- Email engagement (opens, clicks, replies)

- Intent topic surges

Here's a simple scoring model to start:

| Signal | Points | Category |

|---|---|---|

| ICP firmographic match | +30 | Explicit |

| Tech stack match | +15 | Explicit |

| 3+ committee contacts found | +10 | Explicit |

| Pricing page visit | +20 | Implicit |

| Intent topic surge | +15 | Implicit |

| Job posting for buyer role | +10 | Implicit |

| Anti-ICP flag present | -40 | Disqualify |

Accounts scoring 50+ get routed to reps immediately. Accounts at 25-49 go into nurture sequences. Anything below 25 stays in marketing's domain. Anything with an Anti-ICP flag gets disqualified regardless of score.

I've watched teams waste months building elaborate scoring models before they have enough data to calibrate them. Start with this simple version. Refine quarterly based on win/loss data.

Seven Mistakes That Kill Your Customer Profiling

Building your ICP from aspirations, not data. Your ICP isn't a wish list. Start with your 10 best existing customers - the ones who renewed, expanded, and refer others. Aspiration-based ICPs target accounts you want but can't actually serve. Fix: Pull your top 10 accounts by NRR, list their shared attributes, and build your ICP from that overlap.

Believing you don't have enough data to start. You do. Even 5 closed-won deals contain patterns. Deanonymize your website traffic. Pull CRM reports. You don't need a data science team - you need a spreadsheet and 2 hours. Fix: Export your last 20 closed-won deals, highlight the 5 most common firmographic and behavioral attributes, and use those as your starting ICP.

Relying solely on firmographics. Industry and company size are table stakes. Without technographics, buying triggers, and pain point data, you're targeting shells, not opportunities. Practitioners call these "fairytale personas" - profiles built by marketers who never talk to customers or sales teams. They collect dust. Fix: Add at least one technographic filter and one behavioral trigger to every ICP definition.

Being too narrow. The opposite mistake. If your ICP only matches 200 companies globally, you've over-filtered. Your TAM needs to support your revenue goals. Fix: Test your ICP against your last 50 closed-won deals. If fewer than 30% match, widen one criterion at a time until you hit 50%+.

Not involving other departments. Sales, marketing, CS, and product all see different facets of the customer. An ICP built by marketing alone misses the signals CS sees in churn patterns and the objections sales hears on calls. Fix: Run the cross-team exercise from the Anti-ICP section. Two questions, four teams, one hour.

Failing to update. Markets shift. Your product evolves. Competitors emerge. An ICP from 18 months ago is wrong. Fix: Set a quarterly calendar reminder. Pull win/loss data, compare against ICP criteria, and adjust the three attributes that drifted most.

Developing a profile and never using it. This is the most common failure mode. The profile gets built in a workshop, documented in a slide deck, and never touches the CRM. If your reps can't see ICP fit scores on a lead record, the profile doesn't exist. Fix: Build ICP scoring into your CRM as a lead property. If reps don't see it on every record, it doesn't count.

The Customer Profiling Tech Stack

Skip ZoomInfo if your average deal is in the low five figures. I've watched companies sign $30K contracts for a database when they needed an enrichment tool and a CRM. ZoomInfo is still the most feature-rich all-in-one B2B data platform, but most teams don't need all-in-one.

Here's what actually matters, organized by function:

| Category | Tool | Starting Price | Best For |

|---|---|---|---|

| CRM | HubSpot | Free | Foundation layer |

| Enrichment | Prospeo | Free (75 emails/mo) | Verified emails + ICP filters |

| Enrichment | Apollo.io | Free-$149/mo | All-in-one prospecting |

| Enrichment | ZoomInfo | ~$15K+/yr | Enterprise with budget |

| Enrichment | Cognism | ~$1K+/mo | EU data + verified mobiles |

| Enrichment | Lusha | $37.45/mo | Quick lookups |

| Orchestration | Clay | Free-$149+/mo | Multi-source waterfall |

| Intent Data | Bombora | ~$2K+/mo | Topic-level intent |

| Intent Data | 6sense | ~$25K+/yr | Enterprise ABM |

| Visitor ID | Dealfront | ~$500+/mo | European visitor tracking |

The workflow we recommend for most teams: CRM (HubSpot) -> Visitor ID (Dealfront or similar) -> Signal Detection (intent data) -> Enrichment -> Outbound (Smartlead or Instantly). Each layer feeds the next.

Where does Clay fit? If you need to stack multiple data providers in a waterfall (your primary enrichment tool + Clearbit + another source), Clay orchestrates that. Clay's Clearbit integration auto-updates every 24 hours, making it a strong pairing with weekly-refresh data sources for maximum freshness.

Your Anti-ICP saves pipeline. Your enrichment stack fills it. Prospeo enriches CRM contacts with 50+ data points at a 92% match rate - so every account in your pipeline maps to real firmographics, intent signals, and verified contact data. No stale records. No guesswork.

Enrich your CRM and disqualify bad-fit accounts in seconds.

FAQ

How often should I update my customer profile?

Quarterly is the right default for most teams, because win/loss patterns shift and contact data decays fast. Review ICP filters, Anti-ICP rules, and scoring weights every 90 days, and make at least 3 concrete changes based on the last quarter's closed-won vs. closed-lost deals.

What's the difference between an ICP and a buyer persona?

An ICP defines which companies are worth pursuing (industry, size, tech stack, triggers), while a buyer persona defines the individual you're persuading (goals, objections, success metrics). In B2B, you typically need 1 ICP plus 3-5 personas to cover the real buying committee.

How many customer interviews do I need to build a reliable profile?

Do 10 interviews to get usable patterns, and 20 to get high confidence. Prioritize customers who've been live for 12+ months and are above-average in expansion or retention - they're the cleanest signal of "this is a real fit," not a lucky close.

What tools do I need to start customer profiling?

You can start with 3 tools: a CRM (HubSpot free is fine), an enrichment platform, and a place to store the template (Notion or a spreadsheet). If you want weekly-fresh verified data, tools like Prospeo add 30+ filters, 98% email accuracy, and CRM enrichment that returns 50+ data points per contact.

How do I get my sales team to actually use the customer profile?

Put it directly in the workflow: show an ICP fit score on every lead/account record and route anything above a threshold (like 50+) to reps within 5 minutes. Also add hard disqualifiers from your Anti-ICP so reps can kill bad-fit accounts fast instead of "being hopeful" for 6 weeks.

Turn Profiling Into a System, Not a Slide Deck

The best teams treat customer profiling for B2B sales like infrastructure: clear ICP criteria, an explicit Anti-ICP, a mapped buying committee, verified enrichment, and a simple scoring model that routes the right accounts at the right time. Do that, and pipeline stops being a mystery - it becomes a set of inputs you can actually control.