The 10 Best B2B Email Lookup Tools in 2026 (With Real Pricing & Accuracy Data)

You send 500 cold emails. 87 bounce. Your domain reputation tanks, your sequences stall, and your SDRs spend the next two weeks cleaning lists instead of booking meetings.

That's not a hypothetical - it's what happens when you trust the wrong b2b email lookup tool. And here's the uncomfortable math: 33% of B2B contact data goes stale every year. Sales reps spend roughly 20% of their time just researching contact information instead of selling. The tool you pick to find those emails isn't a nice-to-have. It's the foundation your entire outbound motion sits on.

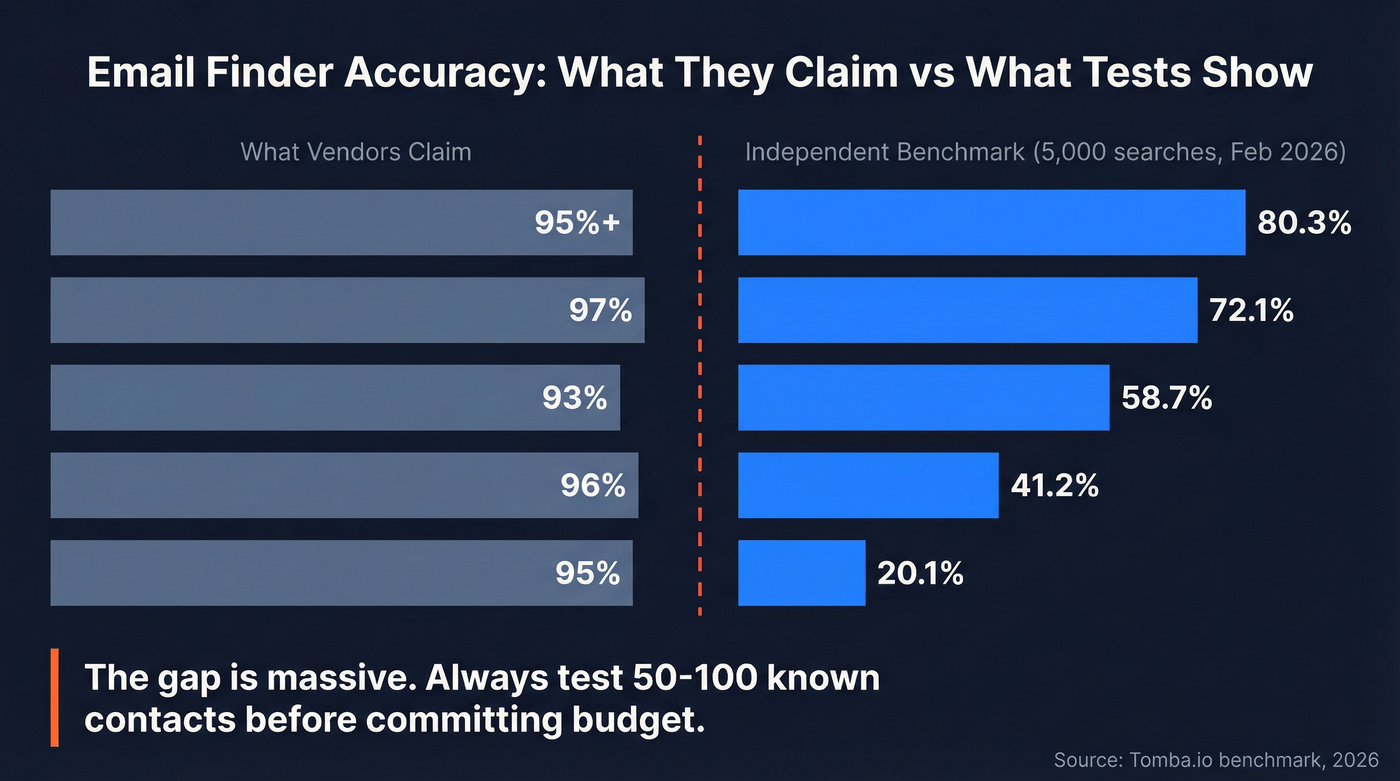

Every tool claims 95%+ accuracy. Almost none deliver it.

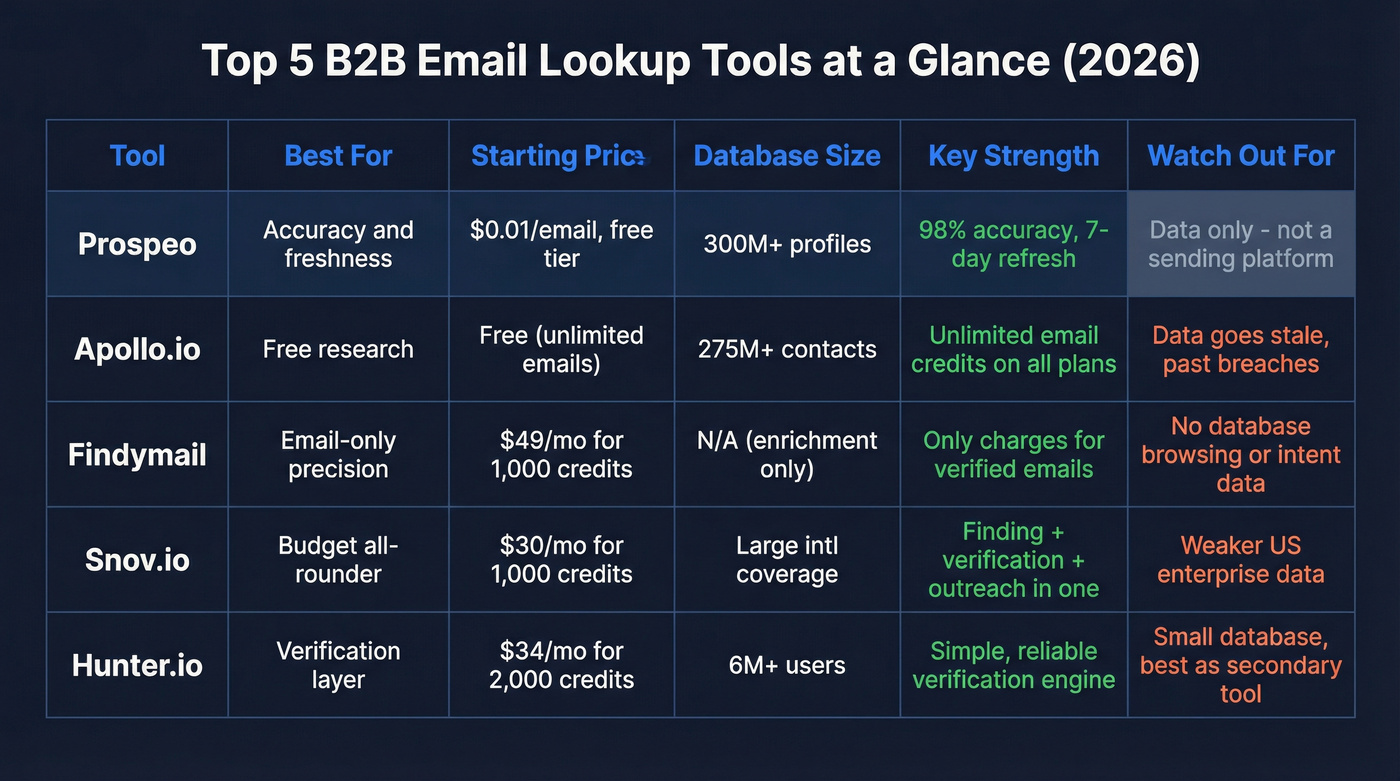

Our Picks (TL;DR)

| Use Case | Tool | Why |

|---|---|---|

| Email accuracy & freshness | Prospeo | 98% accuracy, 7-day refresh, free tier |

| Free database for research | Apollo.io | Unlimited email credits, 275M+ contacts |

| Email-only accuracy | Findymail | Only charges for verified emails |

| Budget all-rounder | Snov.io | $30/mo for 1,000 credits + automation |

| Verification layer | Hunter.io | 6M+ users, solid verification engine |

Now let's get into why these numbers matter - and why most accuracy claims are garbage.

The Truth About B2B Email Search Accuracy Claims

Every email lookup tool on the market advertises accuracy somewhere between 90% and 98%. The actual numbers tell a different story.

A Tomba.io independent benchmark tested 5,000 searches across eight tools in February 2026. The highest accuracy measured was 80.3%. The lowest? 20.1%. That's a massive gap from the "95%+" plastered on every landing page.

On the other end, a Saleshandy vendor-run test of 100 contacts per tool showed results between 90% and 98%. The catch: Saleshandy ranked their own tool #1. Funny how that works.

The gap between these benchmarks isn't random. It comes down to what happens after the initial lookup. Most tools stop at pattern matching - they guess firstname.lastname@company.com and call it a day. The good ones run multi-step verification: checking MX records, handling catch-all domains, filtering spam traps, removing honeypots, and confirming deliverability in real time.

The takeaway: never trust a vendor's self-reported accuracy number. Test 50-100 known contacts against any tool before committing budget. If the bounce rate comes back above 5%, move on.

You just read that independent benchmarks show most email finders top out at 80% accuracy. Prospeo's 5-step verification and 7-day refresh cycle deliver 98% - and Snyk's 50-rep team proved it by dropping from 40% bounce rates to under 5%. At $0.01 per email, bad data costs more than good data.

Test 75 emails free and see your actual bounce rate drop.

What Actually Matters When Choosing an Email Finder

Forget feature lists. Here are the six things that actually determine whether a tool is worth paying for:

Bounce rate in production. Industry benchmark is under 2%. Top performers hit under 1% hard bounces. Ask for this number during trials - if a vendor won't share it, that tells you everything.

Cost per verified email. This is the real metric, not cost per credit. A tool charging $0.02/credit that requires two credits per lookup (one to find, one to verify) costs $0.04/verified email. A tool charging $0.05/credit that includes verification costs $0.05. Do the math.

Data freshness. If the tool refreshes data every 6 weeks (industry average), you're working with contacts that are already aging by the time you export them. Weekly refresh cycles cut bounce rates dramatically.

Credit expiration policies. Some tools expire unused credits monthly. Others roll them over. One slow month shouldn't mean you lose $200 in credits.

Catch-all domain handling. About 30% of business domains are catch-all, meaning they accept any email address. Tools that can't handle these will either skip them entirely (losing coverage) or mark them as "valid" (inflating your bounce rate).

Time cost of bad data. A tool that saves 2 hours per week of manual list cleaning is worth $200/month in SDR time before you count the pipeline impact. Factor labor costs into every pricing comparison.

The 10 Best B2B Email Lookup Tools in 2026

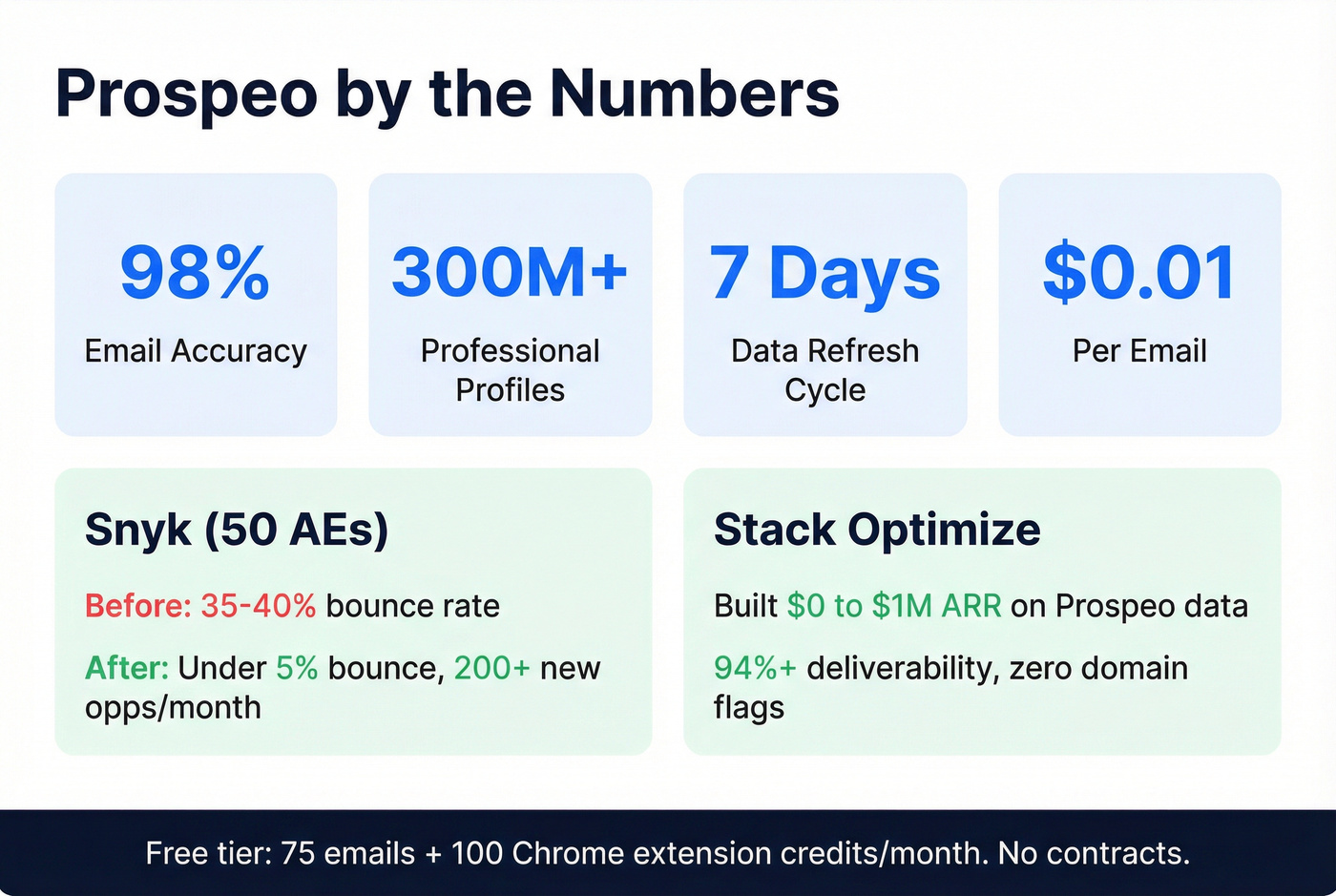

Prospeo - Best for Email Accuracy and Data Freshness

Use this if: You've been burned by bad data and need the lowest possible bounce rate. You want self-serve pricing without a sales call.

Skip this if: You need a full-stack sales engagement platform with a built-in dialer and sequence builder - Prospeo is a data platform, not a sending platform. Pair it with Instantly or Lemlist for that.

Prospeo's database covers 300M+ professional profiles with 143M+ verified emails and 125M+ verified mobile numbers. The 98% email accuracy comes from proprietary infrastructure - they don't rely on third-party email providers, which is a genuine differentiator. The 7-day data refresh cycle is the fastest in this category, and it shows in production bounce rates.

The proof point that sold us: Snyk's sales team of 50 AEs was running 35-40% bounce rates before switching. After the switch, they dropped under 5% and generated 200+ new opportunities per month. Stack Optimize built from $0 to $1M ARR using Prospeo data, maintaining 94%+ deliverability with zero domain flags across all clients. Those aren't marginal improvements - those are teams that actually book meetings.

Pricing is straightforward: ~$0.01 per email, 10 credits per mobile number. Free tier gives you 75 emails and 100 Chrome extension credits monthly. No contracts, no annual commitment. Intent data powered by Bombora (15,000 topics) and 30+ search filters - including technographics, job changes, headcount growth, and funding signals - make this more than just an email finder. CRM and CSV enrichment returns 50+ data points per contact at a 92% API match rate.

Apollo.io - Best Free Database for Initial Research

Apollo's 275M+ contact database with unlimited email credits across all plans makes it the obvious starting point for teams that need volume. The free tier alone gives you unlimited email views (with a 10-export limit), which is enough to validate whether their data covers your ideal customer.

Pros:

- Unlimited email credits on every plan, including free

- Built-in sequencer and dialer - true all-in-one

- $49/user/mo (annual) for the Basic plan is competitive

Cons:

- The top Reddit complaint: Apollo is a "jack of all trades, master of none." Data feels stale on older contacts, and bounce rates spike on lists that haven't been re-verified.

- Two data breaches (2018 and 2021) compromised 130M+ records. If your prospects Google your tools, this comes up.

- Per-seat pricing scales fast. Five reps on the Professional plan runs $395/mo.

Compared to ZoomInfo: Apollo gives you 80% of the database at 10% of the cost. Where ZoomInfo wins: data accuracy, intent data depth, and enterprise integrations. Where Apollo wins: price, ease of setup, and built-in sequencing for teams under 20 reps.

Here's the thing: Apollo is a great research tool and a mediocre data source. Export from Apollo, verify elsewhere, send through a dedicated platform. That's the workflow that actually works.

Hunter.io - Best as a Verification Layer

Hunter has 6M+ users for a reason: it's simple, it works, and the verification engine is solid. The domain search feature is genuinely useful for mapping out an organization's email patterns - essentially functioning as a company email directory for any business you target. But Hunter works best as a scalpel, not a Swiss Army knife.

The pricing math gets tricky. Starter runs $34/mo (annual) for 2,000 credits - except verification costs 0.5 credits each. So if you're finding and verifying, your effective cost per verified email is roughly $0.025-0.034, not the $0.017 the headline suggests. Growth plan at $104/mo (annual) for 10,000 credits is where Hunter starts making sense for teams.

The Reddit consensus is right: "database is pretty small, works better as a verification layer than a primary source." If you already have a primary data source and need a reliable verification engine, Hunter is excellent. If you need a primary prospecting database, look elsewhere.

Findymail - Best Email-Only Accuracy

Clay placed Findymail first in their internal waterfall enrichment benchmark - notable because Clay aggregates dozens of data providers and has no obvious reason to favor one over another. When the platform that tests all the providers says one tool wins, pay attention.

$49/mo gets you 1,000 credits. $99/mo for 5,000 (most popular). Bounce rates consistently come in below 5%. Credits roll over, capped at 2x your monthly limit. And here's the billing model that matters: Findymail only charges for verified emails found. If they can't verify it, you don't pay.

The tradeoff is scope. Findymail is an email finder, full stop. No database browsing, no intent data, no company filters. You bring the prospect list; Findymail finds and verifies the emails. Phone lookups cost 10 credits each (vs. 1 credit per email), making it 10x more expensive for phone data than dedicated providers. For teams already using Sales Navigator or another prospecting tool, the narrow focus is a feature. For teams that need a full database, it's a dealbreaker.

Snov.io - Best Budget All-Rounder

Who it's for: Small teams and agencies that need email finding, verification, and outreach automation in one tool under $50/mo. If you're running campaigns across multiple geographies, Snov.io covers more international ground than you'd expect at this price.

Who should skip it: Teams needing deep US enterprise data or phone numbers at scale.

Snov.io's Starter plan at $30/mo (annual) gives you 1,000 credits that work across domain search, prospect finding, and email verification. Most tools charge separately for each function. Built-in email automation with warmup means you can go from finding a prospect to sending a sequence without leaving the platform.

Pro plans ($75-$300/mo annual) unlock unlimited team seats and sender accounts, making Snov.io one of the few tools where per-seat pricing doesn't kill you as you scale. If you're comparing Snov.io to ZoomInfo, you already know which one fits your budget - they serve completely different buyers. Snov.io is a $30-300/mo self-serve tool for SMBs and agencies. ZoomInfo is a $15-40K/year enterprise platform.

Every tool on this list claims high accuracy. Only one refreshes every 7 days instead of 6 weeks, runs proprietary verification instead of relying on third-party providers, and helped Stack Optimize maintain 94%+ deliverability across every client with zero domain flags.

Run your own benchmark - 100 free credits, no sales call required.

GetProspect - Best "Pay Only for Valid Emails" Model

GetProspect's billing model is its killer feature: you only get charged for contacts with valid emails. Not-found emails don't cost credits. That's a meaningful difference when you're prospecting in industries with high job turnover or smaller companies where email patterns are inconsistent.

Starter runs $34/mo (annual) for 1,000 valid emails with unlimited users on all plans - a rarity in this space. Credits roll over month to month. The "unlimited users" angle makes GetProspect particularly attractive for agencies managing multiple client accounts without paying per-seat fees.

The database isn't as deep as Apollo or the top-tier tools, but the billing model means you're never paying for garbage data.

UpLead - Best for Data Accuracy Guarantee

UpLead's 95% accuracy guarantee with credit refunds for bounced emails is unique. If an email bounces, you get the credit back. That's putting money where your mouth is. The tool holds a 4.7/5 rating on G2 from 800+ reviews.

The catch: pricing. Essentials at $74/mo (annual) gets you only 170 credits - that's $0.44 per contact. For an active SDR prospecting 50+ contacts daily, you'd blow through the monthly allotment in three days. Plus plan at $149/mo adds technographics (16,000+ technologies tracked), which is genuinely useful for tech-stack-based targeting.

UpLead makes sense for teams with small, high-value target lists where accuracy per contact matters more than volume. If you're doing ABM with 500 target accounts, $0.44/contact is fine. If you're running volume outbound, look elsewhere.

RocketReach - Best for Database Size

RocketReach's 700M+ profiles make it one of the largest databases in the category. Essentials starts at $33/mo (annual) for 100 exports - but export credits don't roll over, which is frustrating for teams with variable prospecting volume.

The database breadth is real, but breadth without freshness creates a false sense of coverage. Based on user reports, RocketReach works best as a secondary source in a waterfall setup rather than a primary finder. Pro plan at $75/mo (annual) for 500 exports with phone numbers is where the value starts.

Skrapp.io - Budget-Friendly with Fair Credit Policy

Skrapp.io offers 1,000 credits at $30/mo (annual) with a fair credit policy: no charge for invalid or unknown emails, and credits roll over. They claim a 92% email search success rate and 97%+ verification accuracy. For teams that need a simple, affordable email finder without bells and whistles, it's a solid no-frills option.

Lusha - Quick Lookups (With Caveats)

Real talk: Lusha's pricing is hard to justify for anything beyond one-off lookups.

The Pro plan gives you just 250 credits - roughly one week's worth for an active SDR. Credits expire monthly, and accuracy runs around 60-70%. At ~$71/mo per user for 80 credits on the base paid plan, the cost-per-contact math gets ugly fast.

A Note on Cognism

Cognism doesn't appear in the main list because its $15,000-$25,000/year pricing puts it in a different category entirely. But for teams selling into the EU or UK, it's the clear pick. GDPR-native compliance, DNC screening built in, and stronger European data coverage than any tool above. If you're in a regulated industry targeting European buyers, the compliance infrastructure justifies the premium. For everyone else, the tools above cover you at a fraction of the cost.

B2B Email Lookup Pricing - What You'll Actually Pay

Here's what the entry-level plans actually cost, side by side:

| Tool | Free Tier | Entry Paid (Annual) | Credits/Mo |

|---|---|---|---|

| Apollo.io | 10 exports/mo | $49/user/mo | Unlimited emails |

| Hunter.io | 50 credits/mo | $34/mo | 2,000 credits |

| Findymail | 10 credits (one-time) | $49/mo | 1,000 credits |

| Snov.io | 50 credits/mo | $30/mo | 1,000 credits |

| GetProspect | 50 valid emails/mo | $34/mo | 1,000 valid emails |

| UpLead | 5 credits (trial) | $74/mo | 170 credits |

| RocketReach | 5 lookups/mo | $33/mo | 100 exports |

| Skrapp.io | 100 credits/mo | $30/mo | 1,000 credits |

| Lusha | Limited lookups | ~$71/user/mo | 80 credits |

The headline price doesn't tell the full story. Here's the metric that actually matters - cost per verified email:

| Tool | Cost/Verified Email | Notes |

|---|---|---|

| Prospeo | ~$0.01 | Includes verification |

| Snov.io | ~$0.03 | Credits shared across features |

| Skrapp.io | ~$0.03 | Fair credit policy helps |

| GetProspect | ~$0.034 | Only valid emails charged |

| Hunter.io | ~$0.025 | +0.5 credits for verification |

| Findymail | ~$0.049 | Only verified emails charged |

| Apollo.io | ~$0.05 | Per export, not per email view |

| RocketReach | ~$0.33 | 100 exports at $33/mo |

| UpLead | ~$0.44 | 170 credits at $74/mo |

| Lusha | ~$0.89 | 80 credits at $71/mo |

For enterprise context: ZoomInfo starts at ~$15,000/year for the Professional plan (which doesn't even include phone numbers or intent data). Cognism runs $15,000-$25,000/year with stronger EU/UK coverage. Both require annual commitments.

Hot take: If your average deal size is under $10K, you almost certainly don't need ZoomInfo-level data. A $30-50/mo tool with proper verification will get you 90% of the results at 2% of the cost. The enterprise platforms justify themselves when a single closed deal covers the annual subscription - not before.

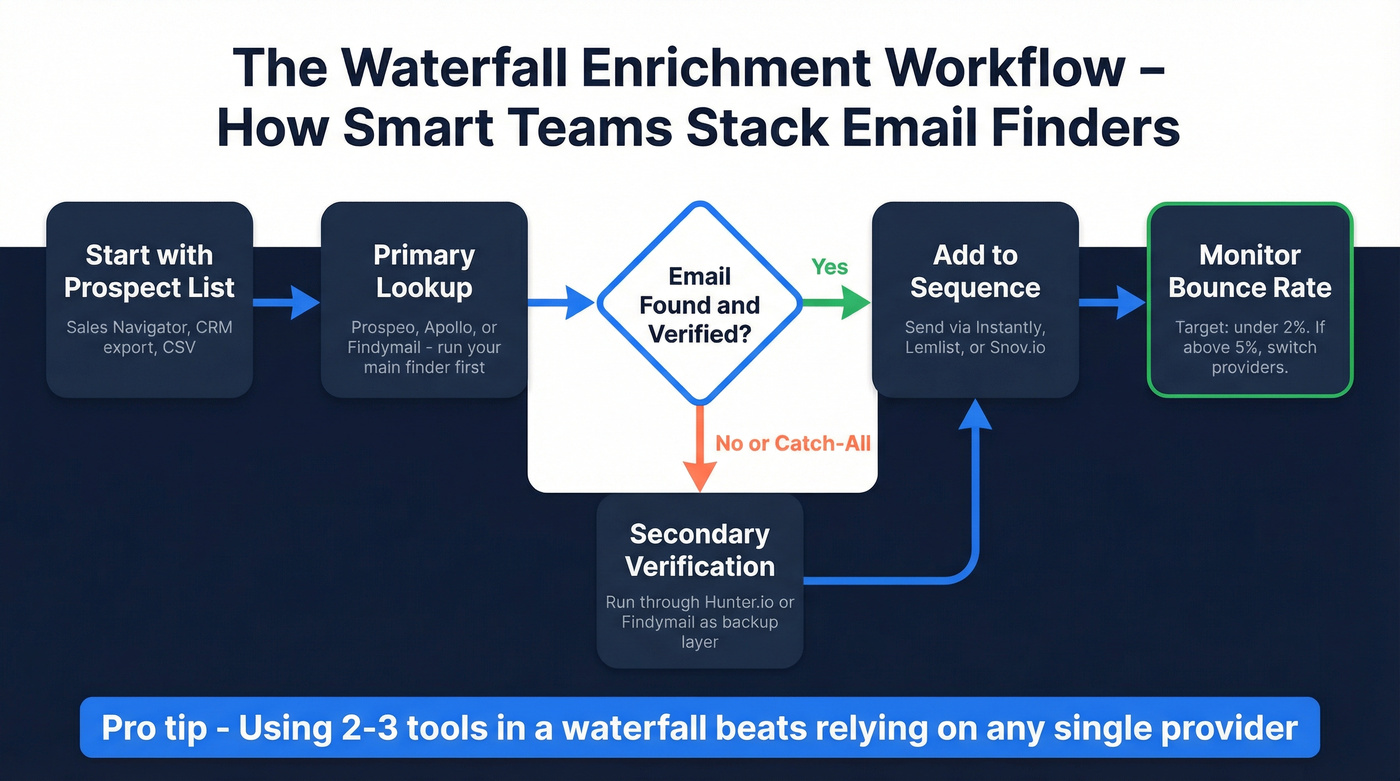

Why No Single Tool Is Enough (Waterfall Enrichment)

Single-source match rates top out around 50-60%. That means roughly half your target list comes back empty from any individual provider.

The solution is waterfall enrichment - querying multiple data sources sequentially until you find a verified result. Waterfall approaches consistently hit 80%+ match rates. Guideflow saw a 37% pipeline increase after switching from single-source to waterfall, going from under 50% phone coverage to 85%+ match rates.

Tools like Clay, FullEnrich, and Instantly now offer built-in waterfall functionality. Clay queries dozens of providers in sequence. Instantly's SuperSearch pulls from 5+ sources.

But here's the key insight: you don't need 10 data providers. You need one excellent primary source and one or two backups. More providers means more duplicates, more data conflicts, and more CRM cleanup. Start with your highest-accuracy, lowest-cost provider as the first step, then cascade to secondary sources for the remaining contacts. That's the architecture that works.

GDPR and Compliance - What You Need to Know

GDPR considers names, direct email addresses, and job titles as personal data - even in B2B contexts. There's no blanket exemption for business contacts.

The legal basis most B2B teams rely on is "legitimate interest." This works if your message is relevant to the person's professional role, you include a clear opt-out mechanism, and you've documented a legitimate interest assessment. That third point is where most teams fall short. You need a written record explaining why contacting this person serves a legitimate business purpose. It doesn't need to be a legal brief - a documented process is enough.

Apollo's two data breaches (2018 and 2021) are a cautionary tale. If your data provider gets breached, your prospects' information is exposed - and your company's name is attached to the outreach that used it. When evaluating any tool, ask about their security posture and breach history.

For teams selling into the EU or UK specifically, Cognism is the compliance-focused option with GDPR/CCPA compliance and DNC screening built in. It's expensive, but for regulated industries targeting European buyers, the compliance infrastructure justifies the premium.

Our Final Recommendation by Use Case

| Priority | Pick | Why |

|---|---|---|

| Accuracy above all | Prospeo | 98% emails, 7-day refresh, ~$0.01/email |

| Free tier for testing | Apollo.io | Unlimited email credits, huge database |

| Email-only precision | Findymail | Only pay for verified emails found |

| Budget + automation | Snov.io | $30/mo with built-in sequences |

| EU/UK compliance | Cognism | GDPR-native, DNC screening |

| Enterprise all-in-one | ZoomInfo | $15K+/yr, deepest US database |

Here's my contrarian take: you don't need 10 tools. You don't even need five. You need one good primary email finder and - if you're running serious volume - a waterfall backup for the contacts your primary source misses.

I've seen teams waste months evaluating every tool on this list, running elaborate bake-offs, building comparison spreadsheets with 47 columns. Meanwhile, their reps sit idle waiting for "the perfect data stack."

Pick one. Test it against 100 known contacts. If bounce rates come back under 3%, you've found your b2b email lookup tool. If they don't, try the next one. The best tool is the one that's actually feeding your pipeline today - not the one you're still evaluating next quarter.

FAQ

How accurate are B2B email lookup tools really?

Independent benchmarks show real-world accuracy between 20-81%, despite vendor claims of 90-98%. Always test any tool against 50-100 known contacts before committing to a paid plan. The gap between marketing claims and production performance is the single biggest risk in this category.

What's the difference between email finding and email verification?

Email finding discovers a person's work address from their name and company domain. Verification checks whether that address is actually deliverable - via SMTP confirmation, not just pattern matching. Some tools bundle both; others charge separate credits for each step. Always confirm whether "verified" means SMTP-confirmed or just format-guessed.

How many credits do I actually need per month?

An active SDR prospecting 50-100 new contacts per day needs 1,000-2,000 credits monthly. Factor in verification credits if charged separately - Hunter costs 0.5 credits per verification on top of the search credit. For a 5-person team, budget 5,000-10,000 credits monthly minimum.

Which tool has the best free tier for finding business emails?

Apollo offers the most generous free plan with unlimited email credits and 10 exports monthly. Prospeo's free tier includes 75 verified emails plus 100 Chrome extension credits - better for teams that need confirmed deliverability over raw volume. Start free to validate data quality against your ICP before committing budget.

Can I use these tools to find company emails for leads at scale?

Yes - most platforms let you upload a target company list and return verified contacts in bulk. The key is choosing a provider with real-time verification so you're not paying for stale addresses. For high-volume lead generation, pair a primary lookup tool with waterfall enrichment to maximize coverage across your entire target account list.