Lead Generation Phone Numbers: The 2026 Playbook (Sourcing, Verification, Compliance)

$15,000/year for a database - and you still can't get a working phone number for the VP of Sales at a Series B company. Meanwhile, the calls that do go through show up as "Spam Likely."

Here's the fix: treat lead generation phone numbers like an ops system, not a one-time purchase. Build a weekly workflow for sourcing, validating (line type + status + portability), scrubbing DNC/opt-outs, and keeping caller ID reputation clean enough to actually connect.

Look, "more data" isn't the answer. Better process is.

What lead generation phone numbers actually are (and aren't)

Lead generation phone numbers are numbers you can use to start a sales conversation: direct dials for decision-makers, main lines that route to the right team, and sometimes verified mobiles that get answered.

They aren't permission to call. They aren't guaranteed to connect. And they aren't "safe" just because a vendor sold them to you.

Here's the vocabulary that matters:

Mobile vs landline vs VoIP

- Mobile: best for direct outreach, and the most sensitive for compliance and spam labeling.

- Landline: often a switchboard or office line. Lower pickup, but useful for routing and validation.

- VoIP: can be a real direct dial or a forwarding/disposable number. It's also where "Spam Likely" problems blow up when your dialing patterns are sloppy.

Direct dial vs main line

- Direct dial: reaches a person (or their voicemail) without the operator maze.

- Main line: reaches the company. Useful as a fallback and for confirming you've got the right org.

B2B vs B2C implications

- B2B calling still collides with consumer protections when you hit personal mobiles, home offices, or sole proprietors. Treat mobiles like they're regulated, because they are.

- B2C is where DNC/TCPA risk is highest and list buying punishes you fast if your suppression process is weak.

Hot take: most teams don't have a "phone number problem." They have a phone number lifecycle problem.

What you need (quick version): the 7-step system that works in 2026

If you skip steps, you pay twice: once for data, then again in wasted rep time and spam labeling.

- Source numbers from a method that matches your motion (net-new discovery vs enriching known accounts).

- Enrich missing phones onto the list you already trust (CRM/CSV first).

- Validate beyond "looks like a phone number": line type + carrier + portability (LRN) + active status.

- DNC scrub and maintain suppression lists like it's production infrastructure.

- Dialer setup: pacing rules, voicemail strategy, and call disposition hygiene.

- Caller-ID reputation: register numbers, push for strong attestation, and stop the patterns that trigger "Spam Likely."

- Refresh weekly: re-enrich, re-validate, re-suppress, and QA sample.

Direct recommendation: if your team already has inbound leads, event scans, or target accounts, start with enrichment. Don't buy a giant database first.

In our experience, the teams that win on phones are boring about it: they run the same checklist every week, they don't let reps freestyle imports, and they treat suppression like a production system, not a spreadsheet someone updates "when they get a minute."

Prospeo fits cleanly here as a self-serve way to enrich mobiles (10 credits per mobile number, only when found) and refresh every 7 days, which is exactly what you want for weekly list maintenance.

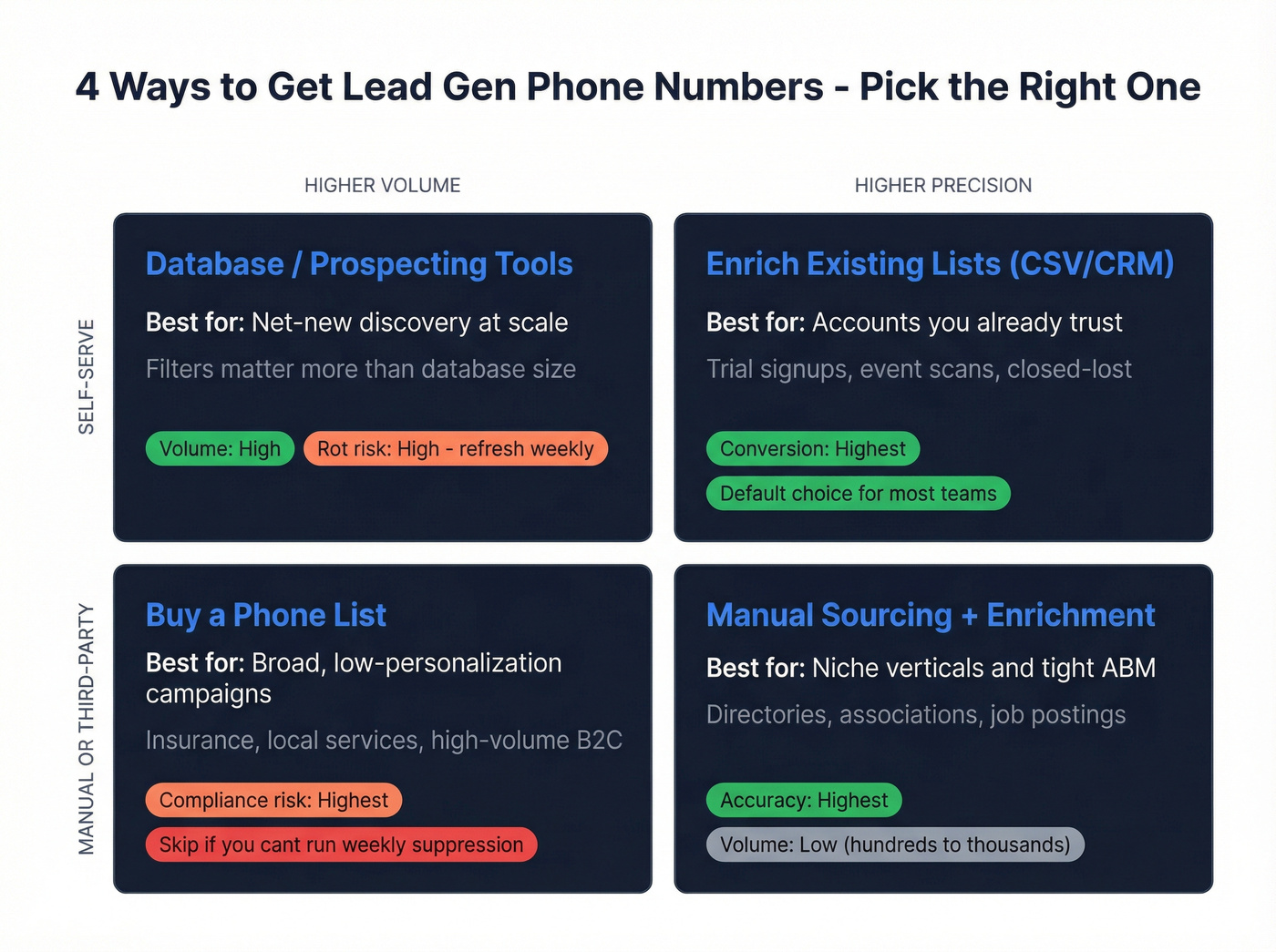

How to get lead generation phone numbers (4 practical methods)

You've got four real options. Pick based on whether you need net-new discovery or better coverage on a known list.

1) Database/prospecting tools (net-new discovery; filters matter)

Use this when you're building lists from scratch: "VP Sales at 200-1,000 employee SaaS companies in Texas using Salesforce" and you need it today.

What makes this work isn't database size. It's the filters and your ability to slice your ICP without creating junk, so your "company phone list" doesn't turn into a pile of stale switchboards.

Filters that actually move results:

- SIC/NAICS: blunt, consistent, great for regulated industries.

- Geo targeting: useful for territory alignment. Stop assuming area code = location; portability breaks that.

- Company signals: headcount growth, hiring, funding, tech stack. These beat job title alone.

Two pitfalls that hit almost everyone:

- Overpaying for "coverage" you can't use. Teams buy a big database, then discover only a fraction survives validation + suppression.

- Direct dials rot fast. If you aren't refreshing weekly, you're calling ghosts.

Here's a scenario I've seen too many times: a team exports 20,000 "direct dials," loads them into a power dialer, and then spends two weeks arguing about rep performance while the real issue is that 30-40% of the list is dead, mis-typed (VoIP labeled as mobile), or suppressed somewhere else but not in the dialer.

If your average deal size is small and your reps aren't using intent/workflows, you don't need an enterprise suite. You need accurate phones, fast refresh, and a dialer that won't torch your caller ID.

2) Enrich your existing list (CSV/CRM) (best default for most teams)

This is the default because it starts with accounts you already believe in: trial signups, webinar attendees, target accounts, closed-lost, partner lists, event scans, inbound hand-raisers.

Enrichment beats net-new discovery when you care about conversion more than volume, and it's the most reliable way to find phone numbers for decision-makers from records you already trust.

A workflow that keeps your CRM sane:

- Export a CSV with company domain + full name + title (and company name if you've got it).

- Enrich phones in bulk.

- Validate line type + status + portability.

- Push only "usable" records into your dialer/sequencer.

Two practitioner complaints you should plan for:

- Garbage in, garbage out. Bad domains and merged companies create "confidently wrong" enrichment.

- Duplicates multiply. If you enrich into Salesforce/HubSpot without rules, you create contact chaos in a week.

One sentence that saves a lot of pain: don't enrich straight into your CRM without a dedupe rule.

3) Buy a phone list (strict caveats)

Buying lists is the fastest way to get volume and the fastest way to inherit compliance risk, especially if you're buying a phone list for sales and expecting it to behave like a clean CRM list.

Use this if:

- You run broad, low-personalization campaigns (local services, insurance, high-volume B2C).

- You already run suppression weekly and process opt-outs fast.

Skip this if:

- You sell a considered B2B product and need direct dials to specific roles.

- You can't operationalize suppression lists within days.

Real talk: if you can't run suppression weekly, don't buy lists. You'll pay for it in complaints, spam labeling, and wasted dials.

4) Manual sourcing + enrichment (high intent, low volume)

This is underrated for niche verticals and tight ABM lists.

Use this when:

- Your ICP is small (hundreds to a few thousand accounts).

- You want the right department more than a random direct dial.

- You're doing targeted outreach and you're prepared to validate and suppress aggressively.

Workflow:

- Pull targets from directories, association lists, job postings, and company sites.

- Capture domain + location + department contact info.

- Enrich to find direct dials/mobiles.

- Validate and suppress like any other list.

Skip the "reps do it by hand" version. Systematize it or it turns into busywork.

Your reps don't need more phone numbers. They need numbers that actually pick up. Prospeo delivers 125M+ verified mobiles with a 30% pickup rate - refreshed every 7 days, not every 6 weeks. Pay 10 credits per mobile, only when found.

Stop paying for dead dials. Get phones that connect.

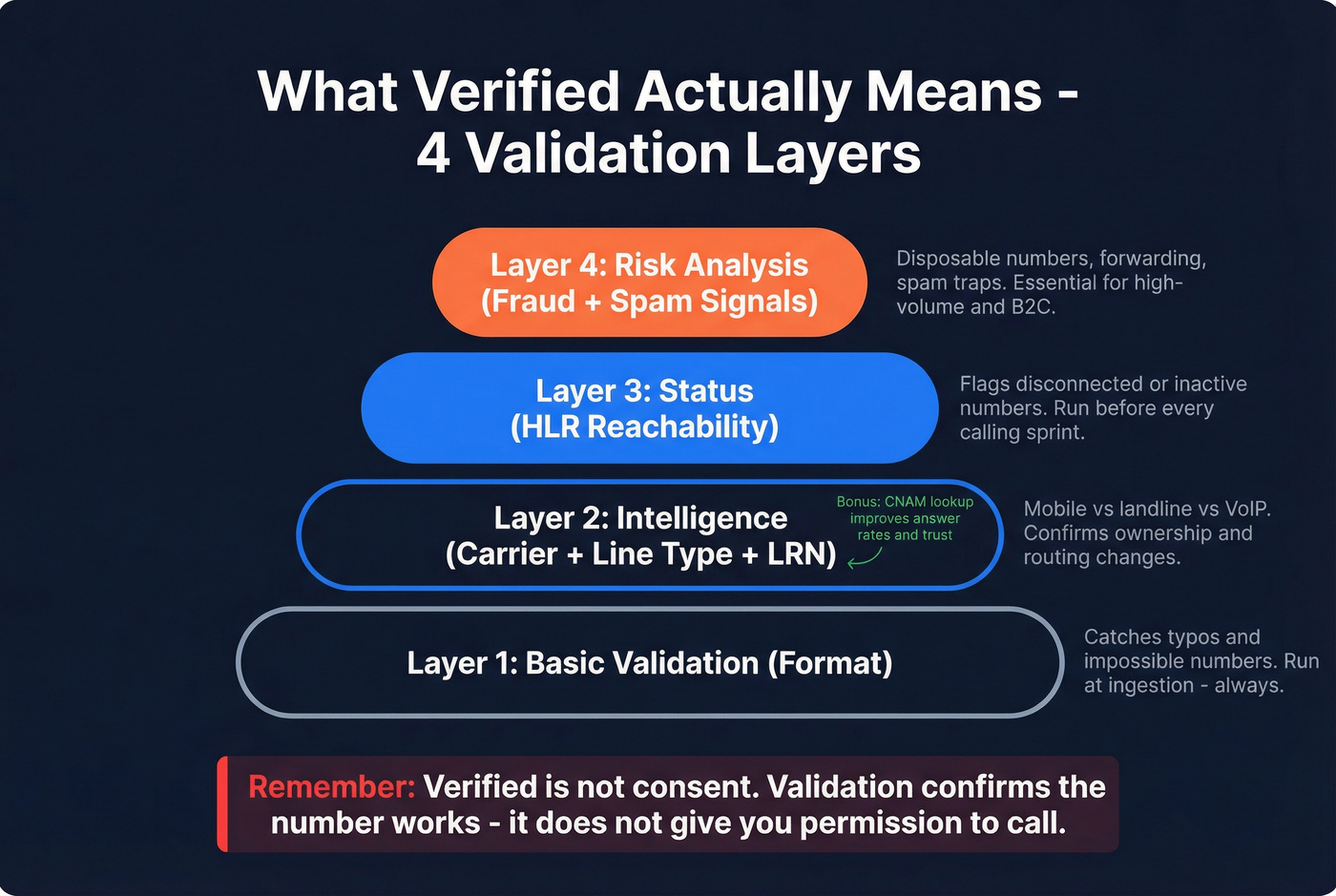

What "verified" should mean for lead generation phone numbers (validation layers that matter)

"Verified" is the most abused word in lead gen. A number can pass a format check and still be disconnected, reassigned, or the wrong line type.

Use this framing because it maps to real-world outcomes:

1) Basic validation (format)

What it does: catches typos and impossible numbers. When to run: always, at ingestion.

2) Intelligence (carrier + line type + portability/LRN)

What it does: tells you what the number is right now.

- Line type: mobile vs landline vs VoIP (this drives your dialing/SMS rules).

- Carrier lookup: confirms ownership changes.

- portability (LRN): shows routing changes and helps avoid "local presence" mistakes.

When to run: before you load a dialer, and again on any list older than a week.

3) Status (HLR lookup reachability)

What it does: reduces dead dials by flagging disconnected/inactive numbers. When to run: right before a calling sprint, especially on older lists.

4) Risk analysis (fraud/spam signals)

What it does: flags high-risk patterns (disposable/forwarding behavior, spam-trap-like signals, high complaint likelihood). When to run: when you do high-volume outreach, SMS, or B2C.

Add one more check that teams forget: CNAM (caller name display). CNAM doesn't validate the number, but it affects answer rates and trust.

One operational truth: reassigned numbers are where wrong-party calls come from, and while status plus carrier/LRN checks won't eliminate that risk, they cut it down enough to save reps from calling the same wrong person three times in a month.

The line to tattoo on your process: Verified isn't consent.

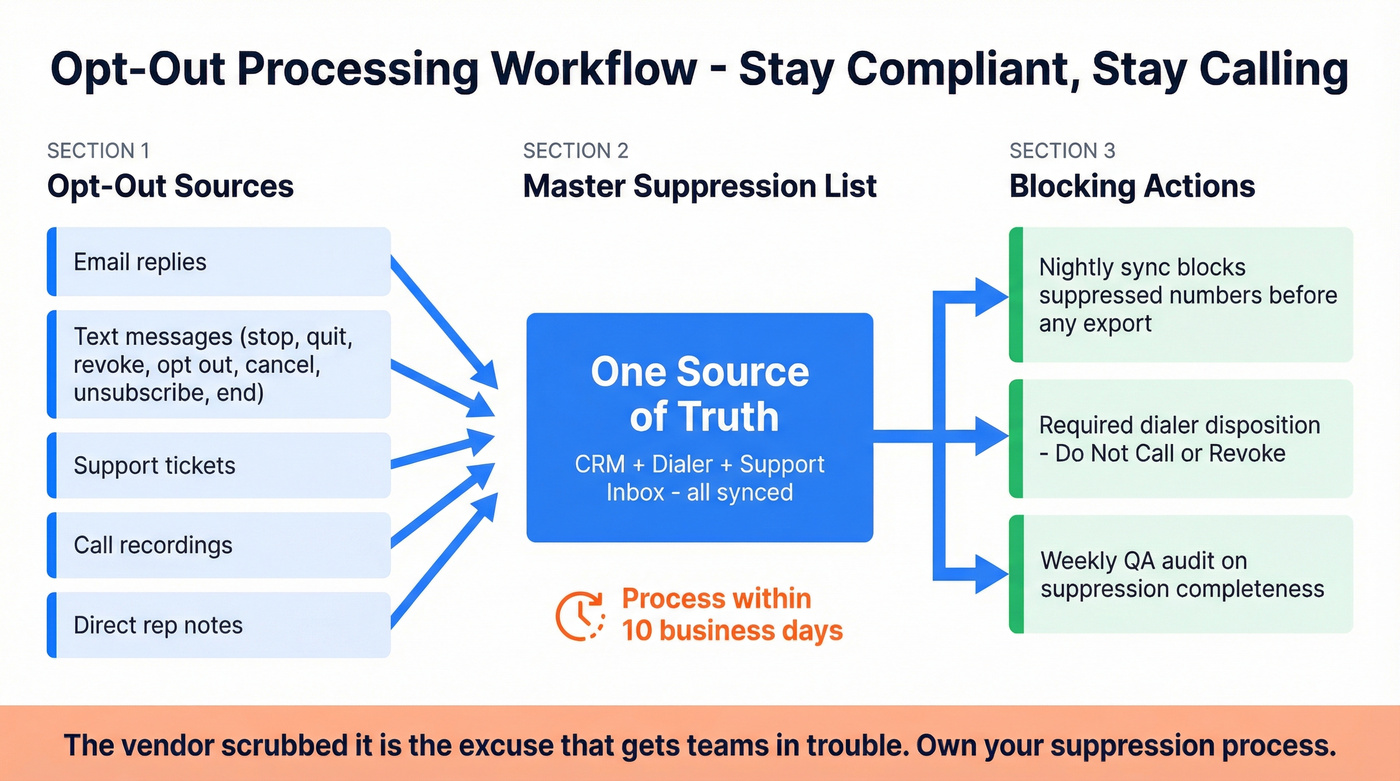

Compliance for lead generation phone numbers (TSR/DNC + TCPA opt-outs)

Not legal advice. Just the operational reality: compliance is a system, not a checkbox.

TSR + National DNC: the basics you can't ignore

- The National Do Not Call Registry is enforced by the FTC, FCC, and states. If you call consumers, you need a process.

- TSR DNC provisions cover most interstate campaigns selling goods/services by phone.

- Existing Business Relationship (EBR) windows to operationalize:

- 18 months after a consumer's last purchase/delivery/payment

- 3 months after an inquiry or application Unless they ask you not to call again.

- Penalties are real: the FTC cites fines up to $53,088 for certain TSR/DNC violations.

One strong opinion: "the vendor scrubbed it" is the excuse that gets teams in trouble.

Primary reference: FTC TSR/DNC Q&A https://www.ftc.gov/business-guidance/resources/qa-telemarketers-sellers-about-dnc-provisions-tsr-0

TCPA revocation: the rule that changes your day-to-day ops

Opt-outs count through any reasonable method that clearly expresses "stop contacting me."

Operational requirements to implement:

- Accept opt-outs from email replies, texts, support tickets, call recordings, and direct rep notes.

- Honor common keywords: stop, quit, revoke, opt out, cancel, unsubscribe, end.

- Process revocations within 10 business days.

Do this in your CRM/dialer today:

- One master suppression list (CRM + dialer + support inbox)

- A required disposition for "Do not call / revoke"

- A nightly job (or weekly minimum) that blocks suppressed numbers before any export/import

A clear explainer: Nixon Peabody's TCPA revocation guidance https://www.nixonpeabody.com/insights/alerts/2025/04/11/fcc-partially-delays-new-tcpa-consent-revocation-rules

Stop getting "Spam Likely": caller ID reputation & dialing setup

A lot of "bad phone data" is actually bad calling infrastructure. Fix reputation before you buy more data.

Do this (the boring stuff that works)

- Register your numbers with caller-ID analytics providers: Hiya, First Orion, TNS.

- Get A-level STIR/SHAKEN attestation by fixing your carrier setup so the carrier can authenticate you as the originating customer. If you can't get A-attestation, your setup's the problem, so fix it.

- Warm up new numbers: start low volume, increase gradually, keep call outcomes healthy.

- Separate numbers by purpose: sales vs support vs collections. Mixed use tanks trust.

- Track abandonment rate and dead air. High abandonment is a spam-label magnet.

Practitioner reality from the field: VoIP numbers get flagged faster when they're unregistered, unwarmed, and blasted at volume. Treat VoIP as a higher-scrutiny lane: registration + pacing + clean dispositions matter more.

Avoid that (the patterns that trigger flags)

- High volume + short duration calls

- Sequential dialing patterns

- Frequent number rotation

- Dead air

- "Local presence" that doesn't match your story

If you're getting Spam Likely, stop rotating numbers.

"Spam Likely" troubleshooting decision tree (fast diagnosis)

- If new numbers get flagged in the first week: you skipped warm-up and registration -> register (Hiya/First Orion/TNS), cut volume, ramp slowly.

- If only one carrier/region flags you: your carrier routing/attestation is weak -> fix STIR/SHAKEN and originating identity with your carrier/dialer.

- If flags spike after you increase power-dialing: your pacing/abandonment is too aggressive -> lower dial rate, tighten answer detection, reduce drops.

- If flags correlate with short calls/voicemail-only: your list quality or rep behavior is broken -> validate status, enforce dispositions, retrain openers.

- If you "fixed it" by rotating numbers and it got worse: you trained the algorithms to distrust you -> stop rotating, stabilize, rebuild reputation.

Reference checklist: https://www.3treetech.com/insights/navigating-the-spam-likely-labyrinth

Tool shortlist + pricing reality (so you can run the workflow)

This isn't a beauty contest. It's a shortlist that maps to the workflow: enrich, validate, buy lists (carefully), and refresh on a weekly cadence.

Quick comparison table (<=5 columns)

| Tool | Best for | Pricing model | Cost signal | Refresh |

|---|---|---|---|---|

| Prospeo | Enrich + refresh (B2B) | Credit-based, self-serve | 10 credits per mobile (only when found) | 7-day refresh |

| LeadLoft | Simple phone finding | Monthly plans | $99/mo-$400/mo; 5 credits/phone | Ongoing |

| ListKit | Cheap-ish at scale enrichment | Annual plans + credits | $83/mo-$508/mo billed yearly; 5 credits/mobile | Ongoing |

| TelephoneLists.biz | Bulk consumer/business lists | Monthly/bulk | $99/mo-$999/mo (volume tiers) | Quarterly updates |

| DataToLeads | Commodity bulk lists | Per record | $0.001-$0.01/record | Varies |

| FindThatLead | Lightweight enrichment | Tiered monthly | ~$55-$399/mo; phones often capped/add-on | Monthly-ish |

Compliance caveats by tool (plain English):

- Any list broker (TelephoneLists.biz, DataToLeads): you own DNC scrubbing, opt-outs, and complaint monitoring.

- Any enrichment tool: "found" doesn't equal "consent." You still suppress and honor revocations.

- Any dialer: your pacing/abandonment and number registration determine whether your numbers get answered.

Prospeo (Tier 1)

Prospeo is the B2B data platform built for accuracy, and it's the pick when you care about freshness and self-serve enrichment instead of annual contracts.

It's built for repeatable ops: 300M+ professional profiles, 143M+ verified emails (98% accuracy), and 125M+ verified mobile numbers, all refreshed on a 7-day cycle. That refresh cadence matters more than most teams think because phone data decays quietly; if you're only updating every month or two, you're basically choosing to pay reps to dial stale numbers.

For phone workflows, the mechanic's simple: 10 credits per mobile number, only when found. And if you're running enrichment at scale, the API match rate is 92% and CRM/CSV enrichment returns 50+ data points per contact, which makes it easier to keep your dialer list clean without turning your CRM into a duplicate factory.

Links that matter:

- Mobile Finder: https://prospeo.io/lead-mobile-finder

- Pricing: https://prospeo.io/pricing

- Data enrichment (CRM/CSV + API): https://prospeo.io/b2b-data-enrichment

LeadLoft (Tier 1)

LeadLoft is refreshingly straightforward. If you want a simple phone-finder motion without a giant suite, it's a strong choice.

Pricing is clear: $99/mo for Unlimited (1 user) and $400/mo for Scale AI (1 user). Additional users run $99/mo (Unlimited) or $149/mo (Scale AI). The phone mechanic is explicit: 5 data credits per phone found. It also offers a 7-day 100% money-back guarantee plus a free trial.

Skip it if you need heavy governance, complex routing, or multi-source waterfall orchestration.

ListKit (Tier 1)

ListKit's model is fairer than most credit systems because credits are only redeemed for successfully enriched data points. That single detail changes your cost math.

Pricing (billed yearly) is transparent: $83/mo Professional (24,000 credits), $253/mo Scale (120,000 credits), $508/mo Ultimate (600,000 credits), plus a free tier. A mobile phone number costs 5 credits.

Common gripe from practitioners: phone credits feel pricey if you don't control credit burn. If reps enrich everything that moves, you'll feel it.

TelephoneLists.biz (Tier 2)

TelephoneLists.biz is a classic list broker: lots of volume, predictable pricing, and you do the compliance work.

Monthly portal pricing runs $99/mo (3,000 leads), $149/mo (10,000 leads), $399/mo (50,000 leads) up to $999/mo (500,000). They update data quarterly and cite around 80-90% accuracy as an expectation for list buying.

The key caveat is explicit: no DNC guarantee. Scrub before you dial.

DataToLeads (Tier 2)

DataToLeads is priced like a commodity list shop. Their pages show $0.001 per lead in some places and $0.01 per record in others, and their B2B leads page also says pricing starts at $0.01 per record.

This is for teams with a QA process. If you can't sample, validate, and suppress aggressively, cheap lists get expensive fast.

FindThatLead (Tier 3)

FindThatLead shows up in a lot of shopping journeys as an email-first enrichment tool with paid tiers around $55-$399 per month.

For phone numbers, treat it like this: phones are often capped, limited, or sold as an add-on, and the practical cost ends up closer to "bundle value" than "phone-first economics." If your core requirement is direct dials at scale, pick a phone-first tool instead of forcing this into the job.

Already have a CRM full of contacts missing direct dials? Enrich your existing list with Prospeo's 92% match rate and get 50+ data points back per record - including verified mobiles. No contracts, no sales calls, $0.01/email and 10 credits per mobile.

Enrich your CRM with phones that actually ring.

Operational SOP: cost-per-usable-number math + weekly maintenance (plus quick FAQs)

If you want this to work in production, you need an SOP. Not vibes.

The metric that matters: cost per usable mobile direct dial

Use this formula and stop arguing about sticker price:

Cost per usable mobile direct dial =

(credits spent + validation + DNC scrub + dialing infra)

/

(working mobiles after QA)

A concrete example (so it's real)

You enrich 1,000 contacts from your CRM.

- Enrichment returns 520 mobiles (52% coverage).

- You validate status/line type and drop 70 (disconnected/VoIP you don't want) -> 450 left.

- You DNC/suppression scrub and drop 50 -> 400 usable mobiles.

Costs:

- Enrichment: 520 mobiles x $0.20 each effective (example credit economics) = $104

- Validation: 1,000 lookups x $0.01 = $10

- DNC scrubbing: $15

- Dialing infra allocation for the sprint: $25

Total cost = $154 Cost per usable mobile direct dial = $154 / 400 = $0.385

That's the number you manage. Not "we pay $X per month."

Weekly maintenance checklist (the part teams skip)

- Refresh last week's "no phone found" list and re-check high-value contacts.

- Suppression: merge opt-outs from dialer, CRM, and support inbox into one master list. Apply it before every export.

- QA sample: spot-check 50 numbers: line type, wrong-person rate, and connect outcomes.

- Waterfall logic: route "no result" contacts to a second provider before giving up.

- Disposition hygiene: require reps to tag wrong numbers, do-not-call requests, and "left company." Feed it back into enrichment rules.

Teams cut wasted dials fast when they enforce suppression + QA weekly. This is the unsexy work that prints pipeline.

Quick FAQs

Verified number vs permission to call? Verified means the number is real and characterized (carrier/line type/status). Permission is separate. You still suppress DNC/opt-outs and honor revocations.

How fast do opt-outs need to be processed? Within 10 business days. Build one suppression brain across CRM + dialer + support channels.

What validation checks matter most for calling? Line type + portability (LRN) + status. Add risk scoring when you run volume or SMS.

Compliance watchlist for 2026 (what to monitor without panicking)

Regulators keep tightening enforcement tools around robocalls and high-volume patterns. Don't wait for a headline to clean up your program.

What to monitor in 2026:

- New FCC rulemakings focused on robocall mitigation and enforcement mechanics

- Carrier-level tightening around attestation and analytics-driven labeling

- State-level enforcement trends (often faster than federal)

Practical stance: if your program already runs weekly suppression, fast opt-out processing, number registration, and sane pacing, you're positioned well for whatever gets finalized next.

Next steps this week (do these five things)

- Pick one sourcing lane (enrich CRM/CSV first unless you truly need net-new).

- Run the validation stack: line type + LRN/portability + status before loading the dialer.

- Scrub DNC and merge opt-outs into one master suppression list.

- Register numbers (Hiya/First Orion/TNS), fix attestation, and set pacing to keep abandonment low.

- Put a recurring calendar block for weekly refresh + QA sampling so your list doesn't rot.

Summary: make lead generation phone numbers a weekly system

The teams that win in 2026 don't "find a list" and hope. They treat lead generation phone numbers as a lifecycle: enrich from trusted sources, validate line type/status/portability, scrub DNC and revocations fast, protect caller ID reputation, and refresh weekly so direct dials don't decay between sprints.