SaaS Go-to-Market Strategy Template (2026 Copy/Paste)

You can have the "right" positioning and still miss your number because nobody can execute it consistently. I've watched teams spend weeks polishing a GTM doc... then ship nothing but a new tagline.

Most saas go to market strategy template downloads are either gated, vague, or both. This one is built for the messy reality: multiple channels, partial attribution, and a sales team that needs clarity more than theory. You'll walk away with a one-page strategy, a tracker schema, and benchmark targets you can defend in a meeting.

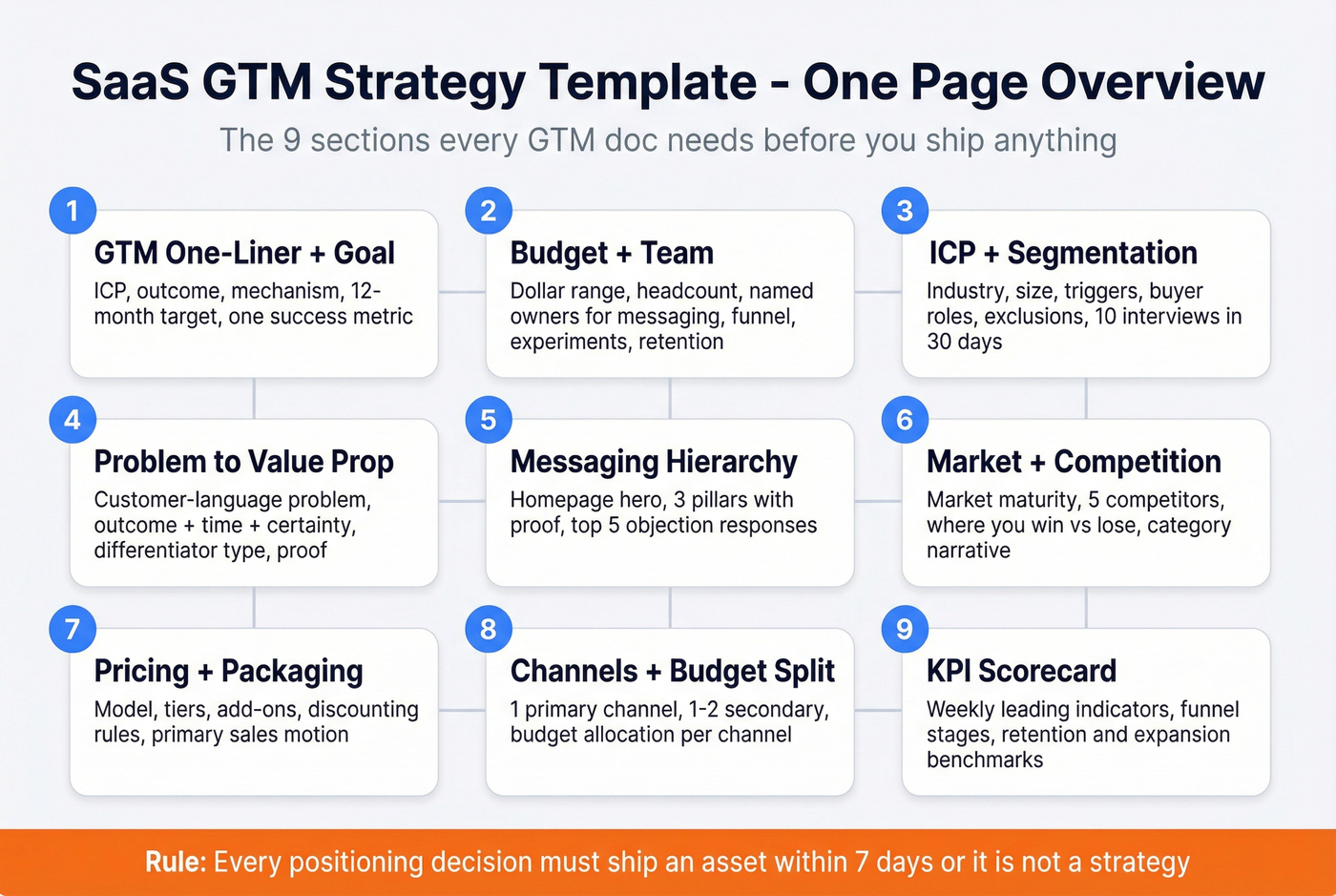

What you need (quick version)

Skip the 40-slide deck. Start with three formats that work together:

- A one-page GTM doc (strategy): ICP, problem, value prop, pricing/packaging, motion, channels, funnel definitions, and a 12-month goal - tight enough to execute.

- An execution tracker (operations): a Notion/Sheet database with owners, due dates, budgets, and links to assets/experiments so work doesn't disappear after the kickoff.

- A KPI scorecard (measurement): weekly leading indicators (traffic -> lead -> MQL -> SQL -> opp -> close) plus retention/expansion, with benchmarks so targets start sane.

Two rules keep this from turning into doc theater:

- Pick your motion first (PLG vs sales-led vs hybrid). Pricing, channels, and hiring follow.

- Every positioning decision must ship an asset (homepage hero, deck spine, outbound angle, onboarding checklist) within 7 days.

Later, if you run outbound, add a verified data layer (Prospeo) so deliverability and attribution don't get corrupted.

GTM strategy vs marketing strategy (and why templates fail)

A GTM strategy isn't "your marketing plan." Mixing them is why templates rot.

- GTM strategy is a finite system: who you sell to, what you sell, how you sell it, and how you measure it - so revenue can repeat the motion. It's the operating system for acquisition, sales execution, and retention.

- Marketing strategy is always-on: brand, content, campaigns, and channels that create demand over time.

Templates fail for two predictable reasons:

- They stop at words. Teams agree on messaging, then nothing changes on the website, in the deck, or in the product onboarding.

- They dodge decisions. "Hybrid," "multi-channel," and "mid-market" become placeholders for "we didn't choose."

If your GTM doc doesn't force tradeoffs (motion, ICP, channel focus, stage definitions), it's not a strategy - it's a shared Google Doc.

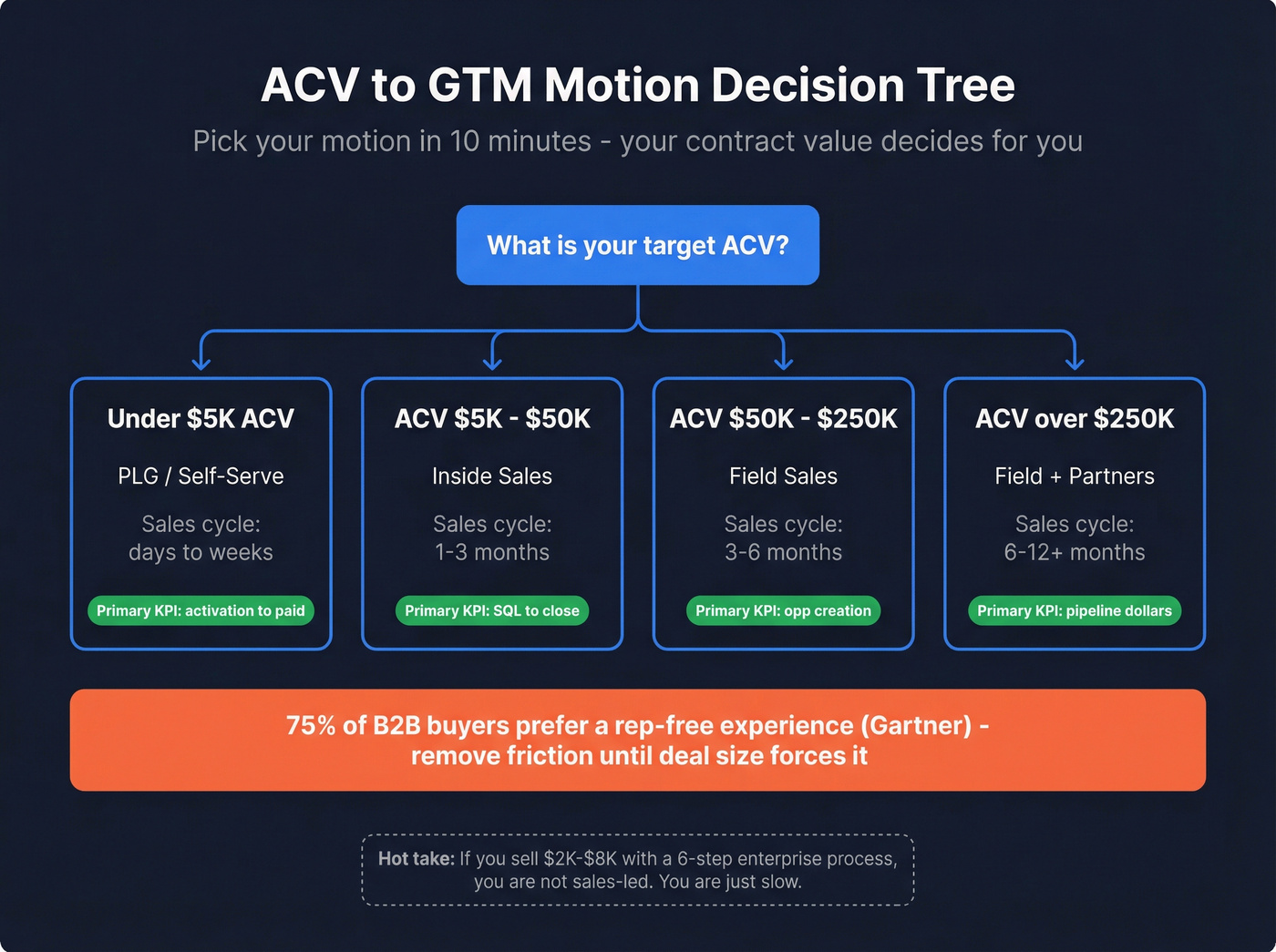

Choose your GTM motion in 10 minutes (ACV -> motion)

Here's the thing: most GTM debates are really pricing debates in disguise. Your average contract value (ACV) forces your hand on motion, sales cycle, and how much human time you can afford per deal.

This ACV banding comes from Tom Tunguz's GTM writing, and it's the fastest sanity check I know: https://tomtunguz.com/

The 10-minute decision tree

Step 1: What's your target ACV band (not your current average)?

- If you're early, pick the ACV you're designing for in the next 12 months.

Step 2: Map ACV to motion

- <$5K ACV -> PLG / self-serve (sales cycle: days-weeks) Product does the selling. Sales is optional or focused on expansion.

- $5K-$50K ACV -> inside sales (sales cycle: 1-3 months) Inbound + outbound, demos, light procurement.

- $50K-$250K ACV -> field sales (sales cycle: 3-6 months) Multi-threading, security, pilots, ROI cases.

- >$250K ACV -> field + partners (sales cycle: 6-12+ months) Partners, services, exec alignment, formal procurement.

Step 3: Check your "rep-free preference" reality

- Gartner research: 75% of B2B buyers prefer a rep-free sales experience. That doesn't mean "no sales." It means: remove friction until the deal size forces it.

Step 4: Pick one primary motion

- Hybrid is real, but "hybrid" as a starting point usually means "we didn't decide."

ACV -> motion mini table

| Target ACV | Default motion | Sales cycle | Primary KPI |

|---|---|---|---|

| <$5K | PLG / self-serve | days-weeks | activation -> paid |

| $5K-$50K | inside sales | 1-3 mo | SQL -> close |

| $50K-$250K | field sales | 3-6 mo | opp creation |

| >$250K | field + partners | 6-12+ mo | pipeline $ |

My hot take (that saves teams months)

If you're trying to sell a $2K-$8K product with a 6-step enterprise sales process, you're not "sales-led." You're just slow.

And if you're trying to sell a $120K product with a pure self-serve funnel and no sales assist, you're not "PLG." You're leaving money on the table and letting churn do the talking.

SaaS go to market strategy template (copy/paste, 2026-ready)

Copy everything below into a doc. Fill the brackets. Don't overthink it. Clarity beats cleverness.

If you want a concrete schema to mirror, SaaS Operations' GTM template generator uses a strong field set (ICP, problem, UVP, competitors, market maturity, budget, team size, pricing model, sales motion, goal, success metric, differentiator): https://saasoperations.com/tools/gtm-strategy-template/.

If you're looking for a go to market plan for SaaS that works for both PLG and sales-led motions, this is designed to be "one-page clear" and "ops-ready," not a deck you never open again.

GTM one-liner + goal

Company / product: [Name] Category: [e.g., "B2B workflow automation for finance teams"] GTM one-liner:

- [We help ICP achieve outcome by mechanism, unlike alternative.] Example: "We help mid-market finance teams close the month in 3 days using automated reconciliations, without the brittle spreadsheet chaos."

12-month primary GTM goal (pick one):

- Reach $X ARR / $X MRR

- Reach X paying customers in segment [A]

- Prove repeatable channel [SEO / outbound / partners / PLG]

- Expand into new segment [vertical / geo / company size]

- Reduce churn / improve NRR to unlock scale

Success metric (one number): [e.g., "$150K new ARR/month by Q4"] Secondary guardrails (3 max):

- [CAC payback <= X months]

- [Gross margin >= X%]

- [Churn <= X] or [NRR >= X]

GTM owner: [Name] Weekly operating cadence: [e.g., "Monday funnel review, Thursday experiment review"]

GTM budget + team (required)

This is the part most templates skip, and it's why plans die in week 3.

GTM budget (first 12 months, pick a range):

- $0-$25K

- $25K-$100K

- $100K-$250K

- $250K-$500K

- $500K-$1M

- $1M-$2M

- $2M+

GTM team size (number + roles):

- Headcount: [#]

- Roles: [Founder/CEO], [PMM], [Demand Gen], SDR, [AE], [RevOps], [CS], [Design/Content], [Agency/Contractors]

Non-negotiable owners (name them):

- Messaging owner: [ ]

- Funnel definitions + CRM hygiene owner: [ ]

- Experiment cadence owner: [ ]

- Retention/expansion owner: [ ]

ICP & segmentation

ICP definition (be specific):

- Industry / vertical: [ ]

- Company size: [employees range]

- Revenue range: [$]

- Geo: [ ]

- Tech environment: [must-have tools / stack]

- Trigger events: [funding, hiring, compliance change, tool migration]

- Buyer roles: [economic buyer], [champion], [users], [IT/security]

- "Not ICP" exclusions: [ ] Example: "Not ICP: agencies, companies <20 employees, or teams without a dedicated ops owner."

Segmentation (choose 2-4 segments max):

Segment A: [Vertical + size + use case]

Segment B: [Vertical + size + use case]

Segment C: [Optional]

Jobs-to-be-done (per segment):

- Segment A job: [ ]

- Current workaround: [ ]

- Switching cost: [ ]

- "Must-have" requirement: [ ]

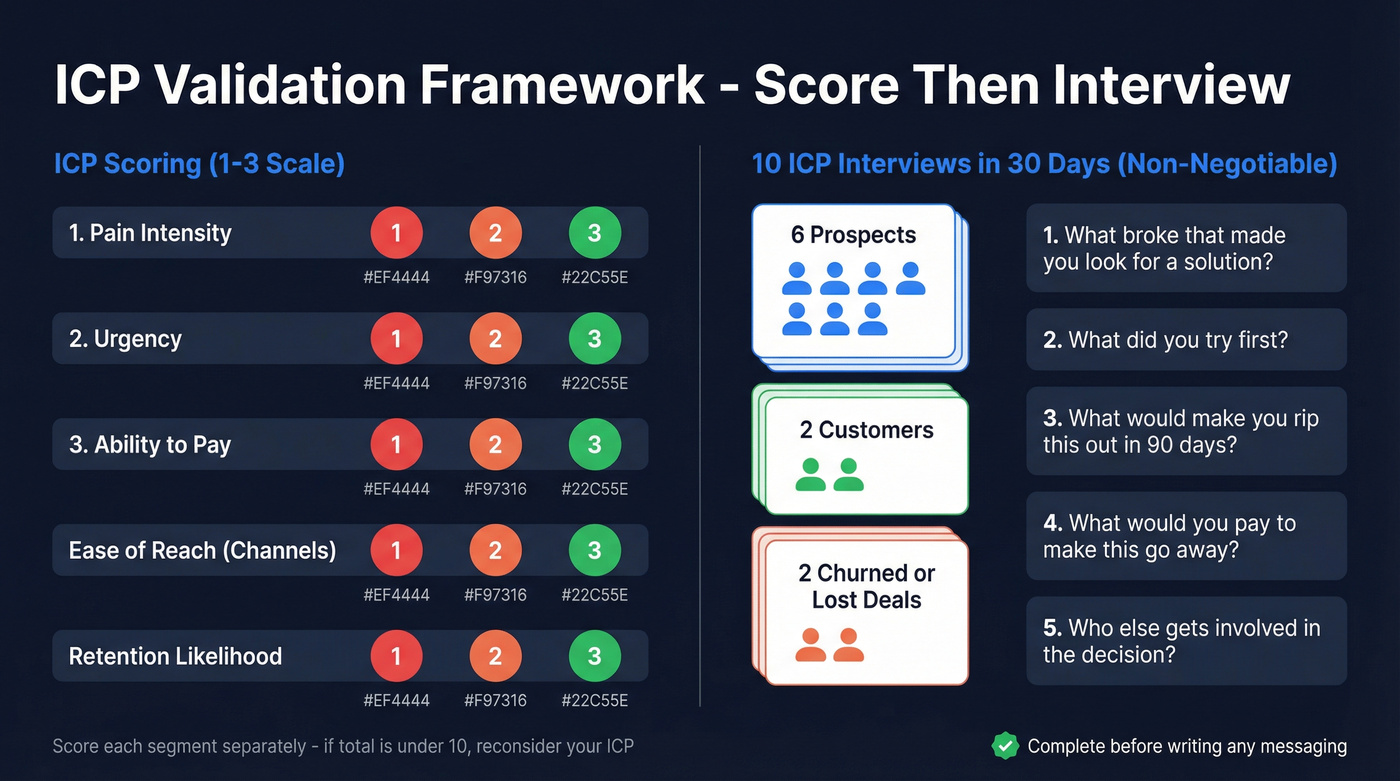

10 ICP interviews (non-negotiable):

- Requirement: Do 10 interviews in the next 30 days.

- Mix: 6 prospects, 2 customers, 2 churned/lost deals.

- Script prompts:

- "What broke that made you look for a solution?"

- "What did you try first?"

- "What would make you rip this out in 90 days?"

- "What would you pay to make this go away?"

- "Who else gets involved in the decision?"

ICP scoring (simple 1-3 scale):

- Pain intensity: [1-3]

- Urgency: [1-3]

- Ability to pay: [1-3]

- Ease of reach (channels): [1-3]

- Retention likelihood: [1-3]

Problem -> value prop -> proof

Problem statement (customer language):

- [When X happens, it causes Y pain, and teams lose Z.] Example: "When approvals live in email threads, finance loses auditability and month-end slips by a week."

Value proposition (outcome + time + certainty):

- [We deliver outcome in time frame, with mechanism.] Example: "Close month-end 30-50% faster with automated controls."

Differentiator type (pick 1-2):

- Price

- Features

- Ease of use

- Integrations

- Support

- Niche / vertical focus

- Innovation

Proof (what you can actually show):

- Customer results: [metric]

- Time-to-value: [minutes/hours/days]

- Security/compliance: [SOC2, ISO, etc.]

- Social proof: [logos, reviews, case studies] Example: "Time-to-value: first workflow live in 45 minutes."

Positioning guardrails (so you don't drift):

- We are not: [category you're not in]

- We win when: [scenario]

- We lose when: [scenario]

- One sentence you'll repeat everywhere: [ ]

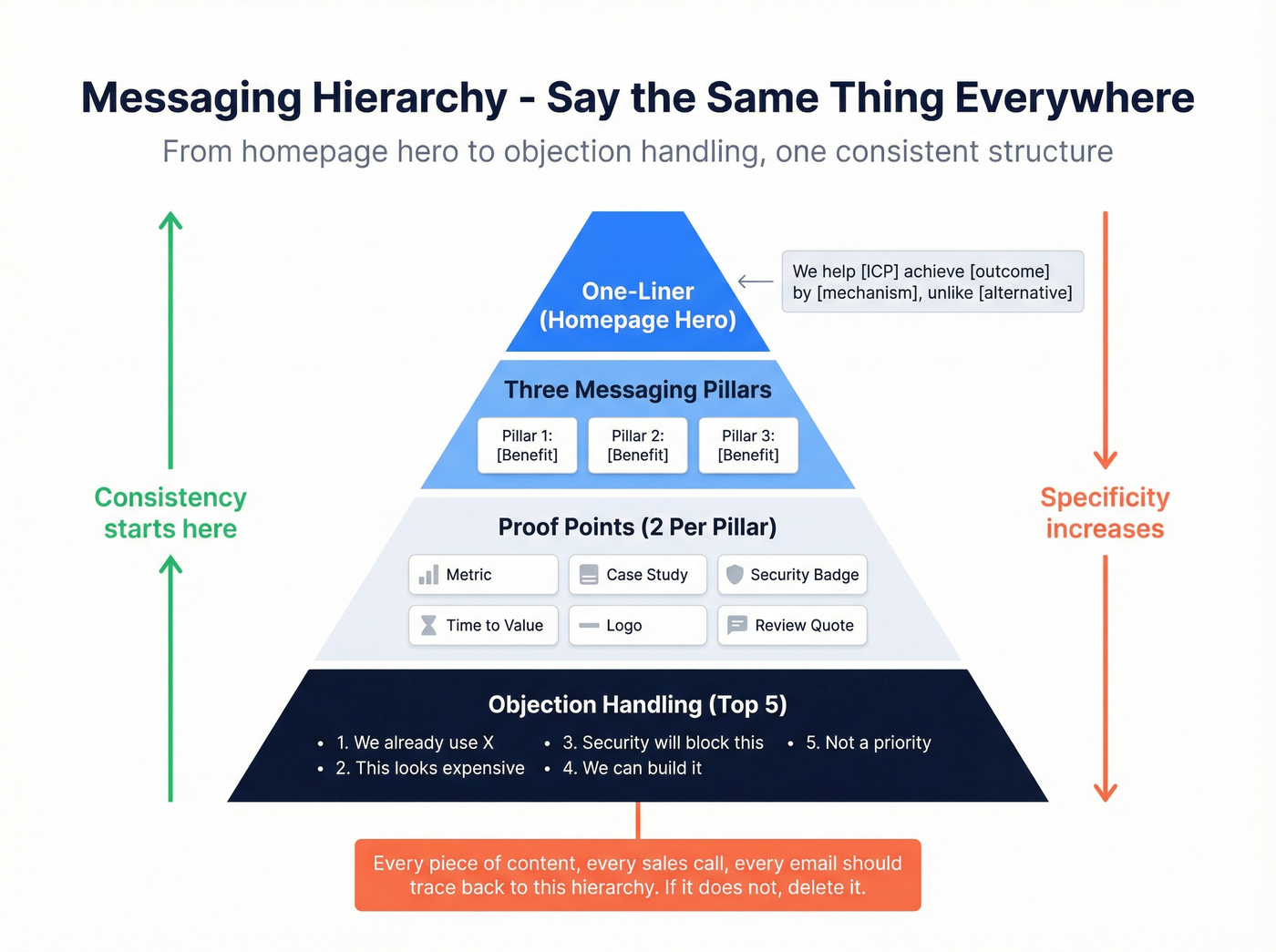

Messaging hierarchy (so everyone says the same thing)

This is the fastest way to stop random-walk outbound and Frankenstein decks.

One-liner (homepage hero): [ ] 3 messaging pillars (benefit-led):

- Pillar 1: [ ]

- Pillar 2: [ ]

- Pillar 3: [ ]

Proof points (2 per pillar):

- Pillar 1 proof: [metric], [logo/case study]

- Pillar 2 proof: [metric], [security/compliance]

- Pillar 3 proof: [time-to-value], [review quote]

Objection handling (top 5):

- "We already use X" -> [response]

- "This looks expensive" -> [response]

- "Security will block this" -> [response]

- "We can build it" -> [response]

- "Not a priority" -> [response]

Market & competition

Market maturity (pick one):

- New / emerging

- Growing

- Mature

- Declining / consolidating

Competitive set (name 5):

- Direct competitors: [A, B, C]

- Indirect / "do nothing" competitor: [spreadsheets, internal build, agency]

- Next-adjacent tools you get compared to: [ ]

Competitive notes (per competitor):

- Who they're best for: [ ]

- Where they win: [ ]

- Where you win: [ ]

- Landmine you must address in sales: [ ]

Category narrative (your POV):

- "The old way is broken because..."

- "The new way is..."

- "We're the best choice because..."

Offer: pricing model + packaging

This is where most templates get fluffy. Don't.

Pricing model (choose primary + optional secondary):

- Freemium

- Free trial (14-30 days)

- Tiered (Good/Better/Best)

- Per seat/user

- Usage-based

- Flat rate

- Custom/enterprise

Target price point (monthly): [$] Example: "$399-$899/mo for core; enterprise starts $24K/yr."

Packaging (what's in each tier):

- Tier 1 name: [ ]

- For: [segment]

- Includes: [3-6 bullets]

- Limits: [users/usage]

- Tier 2 name: [ ]

- Tier 3 name: [ ]

Add-ons (optional, 1-5 max):

- [Add-on] -> priced by [seat/usage/flat] because [value driver]

Discounting rules (write them down now):

- Annual discount: [e.g., 10-15%]

- Multi-year: [e.g., 5-10%]

- Approval required above: [e.g., 20%]

- "Never discount" items: [implementation, add-on X]

Sales motion (pick one primary):

- Self-serve (PLG)

- Sales-assisted

- Field sales

- Hybrid

- Channel/partner-led

Distribution channels + budget split

Pick fewer channels than you want. You can't "try everything" and learn anything.

Primary channel (1): [ ] Secondary channels (1-2): [ ] Channels you're explicitly not doing this quarter: [ ]

Channel budget split (rough, must total 100%):

- Content/SEO: [%]

- Paid (search/social): [%]

- Outbound (tools + data + sequencing): [%]

- Partners/events/webinars: [%]

- Lifecycle (email, in-app, nurture): [%]

- Brand/PR/other: [%]

Channel hypotheses (per channel):

- Target segment: [A/B/C]

- Hook: [message angle]

- Offer: [trial/demo/lead magnet]

- Conversion event: [signup/demo request]

- Sales assist: [yes/no]

- Success metric: [SQLs/week, trials/week, opps/month]

Channel-specific notes:

- SEO: [topics, pages, intent level]

- PPC: [keywords, landing pages, CPL target]

- Social: [who posts, cadence, POV]

- Webinars: [partner vs solo, topic, CTA]

- Outbound: [ICP list source, sequences, deliverability rules]

- Partners: [who, why they care, referral economics]

Funnel + handoffs

Define your funnel once. Then stop re-litigating it.

Funnel stages (definitions):

- Visitor: [unique website visitor]

- Lead: [form fill / signup / captured email]

- MQL: [meets criteria: role + company + intent]

- SQL: [sales accepted + discovery scheduled]

- Opportunity: [qualified deal with next step + $ value]

- Closed-won: [paid]

Lifecycle stage entry/exit criteria (micro-table)

| Stage | Enters when... | Exits when... |

|---|---|---|

| Lead | Email captured + consent + deduped | Enriched + routed (or disqualified) |

| MQL | Meets ICP + intent threshold | Accepted by SDR/AE or recycled |

| SQL | Meeting booked + agenda confirmed | Discovery completed + next step set |

| Opportunity | MEDDICC-lite (or your method) met + $ value | Closed-won/lost or pushed to nurture |

| Closed-won | Contract executed + payment started | Onboarding kickoff scheduled |

Routing rules:

- Segment A -> [AE/SDR/CSM]

- Segment B -> [ ]

- Inbound demo requests -> [speed-to-lead SLA]

- Trial signups -> [product-led nurture vs SDR follow-up]

SLAs (write them down):

- Inbound response time: [e.g., <5 minutes during business hours]

- SDR to AE handoff: [e.g., within 24 hours]

- Lead enrichment: [e.g., within 2 hours of capture]

Attribution model (keep it simple):

- Primary source: [first touch / last touch / self-reported]

- Secondary: [multi-touch in analytics]

- Rule: "If it's not tagged, it didn't happen."

PLG add-on (only if you're PLG or hybrid)

If you're PLG and you don't define these, you'll argue about "lead quality" forever.

Activation event (the moment value becomes real):

- [e.g., "First workflow published" / "First dashboard shared" / "First integration connected"]

TTV target (time-to-value):

- [e.g., "<15 minutes to first value"]

- Instrumentation: [event name], [property], [where tracked]

PQL definition (product-qualified lead):

- PQL = [role + firmographic fit] + [usage threshold] + [intent signal]

- Example: "Admin user at ICP account + invited 3 teammates + hit usage X in 7 days."

PQL routing rule:

- When PQL triggers -> [auto-enrich] -> [SDR/AE task within X hours] -> [sequence/nurture]

Retention & expansion

Growth hides churn until it doesn't.

Retention targets (fill placeholders):

- Gross churn target: [ ]

- Net revenue retention (NRR) target: [ ]

- Logo retention target: [ ]

- Expansion target: [% of accounts expanding per quarter]

Expansion motions (pick 1-2):

- Seat expansion

- Usage expansion

- Add-on expansion

- Cross-sell product line

- Annual uplift / repackage

Customer success operating system:

- Onboarding success milestone: [time-to-value definition]

- Health score inputs: [usage, tickets, champion]

- QBR cadence: [segment-based]

- Renewal process start: [90/120 days before renewal]

Risks & assumptions

This is the section founders skip, then investors ask about.

Top assumptions (3-5):

- [We can acquire customers via channel X at CAC payback <= Y]

- [Segment A has pain intensity >= B]

- [Trial converts at >= C%]

- [Sales cycle stays within D days]

Top risks (3-5):

- [Competitor bundles us out]

- [Security review blocks mid-market]

- [Churn in segment B due to low usage]

- [Channel X saturates]

Mitigations (one line each):

- Risk -> mitigation -> owner -> date

Two mini examples (so you can see "filled in")

Example A: PLG (self-serve analytics tool)

- ICP: Product teams at B2B SaaS, 50-500 employees, modern data stack

- One-liner: "Ship self-serve product analytics in a day - without waiting on data engineering."

- Motion: PLG primary, sales-assist for expansion

- Activation event: first dashboard shared

- TTV target: <10 minutes

- PQL: ICP account + 2 dashboards + 5 teammates invited in 7 days

- Primary channel: SEO (BOFU comparisons + use cases)

- KPI focus: activation -> paid, then NRR via seat expansion

Example B: Sales-led (security/compliance platform)

- ICP: Regulated mid-market, 500-5,000 employees, security review required

- One-liner: "Pass audits faster with automated evidence collection and controls."

- Motion: inside sales -> field for larger deals

- Primary channel: outbound + partner referrals

- Funnel definition: SQL = discovery scheduled with security owner + timeline confirmed

- KPI focus: opp creation and win rate; retention via annual uplift + add-ons

You just built your GTM strategy. Now your outbound channel needs data that won't wreck your domain. Prospeo gives you 300M+ profiles with 98% email accuracy, 125M+ verified mobiles, and a 7-day refresh cycle - so your ICP targeting actually converts instead of bouncing.

Bad data kills GTM execution faster than bad positioning ever will.

Turn the doc into assets (so positioning doesn't die)

Positioning dies in the doc. That's the most common failure mode, and it's painfully predictable: everyone agrees on messaging in a workshop, then the website stays the same, sales decks drift, and outbound becomes a random walk.

Make this a rule: every GTM doc update must ship at least one asset within 7 days.

Template-to-assets checklist (minimum required)

Homepage hero (above the fold)

- One-liner + primary outcome + proof point Example: "Close month-end 30% faster. Live in 45 minutes. Trusted by X teams."

Sales deck spine (10-slide structure)

- Problem -> why now -> impact -> solution -> proof -> ROI -> implementation -> pricing/packaging -> security -> next steps

Outbound angle library (3 angles)

- Angle 1: trigger-based (funding/hiring/tool change)

- Angle 2: pain-based (cost of status quo)

- Angle 3: competitor displacement (why switch)

Onboarding checklist

- Day 0 setup, Day 7 first value, Day 30 habit formed

- Define time-to-value in one sentence

One-page battlecard

- Who we're for, why we win, landmines, proof, talk tracks

If you're running a sales-assisted motion, this asset conversion is the difference between "marketing made a doc" and "revenue has a system."

Pricing & packaging worksheet (by ACV band)

Real talk: pricing has to be wildly easy to understand. If a buyer needs a call to decode your tiers, you've added friction before you've added value.

Money on the Table's packaging guidance is the cleanest rule set I've seen: as contract size grows, you can support more options and configuration. At low ACV, options just confuse people.

Pricing/packaging defaults by ACV band

| ACV band | Plans | Add-ons | Price display | Use / skip notes |

|---|---|---|---|---|

| <$5K | 1-2 | 0-1 | show all | Use trial/freemium |

| $5K-$50K | 2-3 | 1-2 | show all | Add annual option |

| $50K-$250K | 3-4 | 2-5 | hide top | Add catalog add-ons |

| >$250K | 3-4 | catalog | no list | Bespoke + partners |

Money on the Table's rule of thumb: above ~EUR333K/year contracts, pricing becomes bespoke.

Prompts you can paste into your doc

For <$5K (PLG/self-serve):

- What's the one metric that scales with value? [seats / usage / projects]

- Can a buyer understand pricing in 10 seconds? [yes/no]

- Do we need freemium, or is a 14-30 day trial enough?

For $5K-$50K (inside sales):

- What's the default plan you want most customers on?

- What's the upgrade trigger that naturally appears at month 2-4?

- What's the add-on that maps to a clear buyer persona?

For $50K-$250K (field):

- Which features are truly enterprise-only (security, controls, scale)?

- Which add-ons are value-based vs cost-based?

- Should the top tier price be hidden to avoid anchoring?

For >$250K (field + partners):

- What's the partner motion (referral vs resale vs services)?

- What's bespoke (pricing) vs standardized (packaging)?

- What's your procurement story (MSA, DPAs, security pack)?

Rule: If you can't explain what someone's paying for, who should pay for it, and how it scales - in one sentence - your packaging isn't done.

Channel plan + funnel benchmarks (numbers-first defaults)

Most channel plans are vibes. "We'll do SEO, paid, social, outbound, and partners" isn't a plan - it's a wish list.

Start with baseline conversion benchmarks, set a 4-6 week kill window for experiments, and force every channel to earn more budget.

These benchmarks come from 50+ B2B SaaS companies (mostly $10M-$100M revenue) tracked over roughly a decade: https://firstpagesage.com/seo-blog/b2b-saas-funnel-conversion-benchmarks-fc/.

Funnel conversion benchmarks by channel (defaults)

| Stage | SEO | PPC | Webinar | ||

|---|---|---|---|---|---|

| Visitor->Lead | 2.1% | 0.7% | 2.2% | 1.3% | 0.9% |

| Lead->MQL | 30% | 22% | 18% | 27% | 20% |

| MQL->SQL | 51% | 26% | 30% | 46% | 39% |

| SQL->Opp | 42% | 38% | 40% | 44% | 41% |

| Opp->Close | 36% | 35% | 39% | 32% | 40% |

(Lead->MQL and SQL->Opp are included here as practical defaults so you can run the math end-to-end. Your definitions will shift them. Keep stage definitions consistent.)

How to use this table without lying to yourself

1) Pick one primary constraint per quarter.

Examples: "We need more SQLs" or "We need higher Opp->Close." Don't try to fix three stages at once.

2) Back into volume targets. If you need 20 closed-won/month and your Opp->Close is 35%, you need ~57 opps/month. Then work backward to SQLs, MQLs, leads, visitors.

3) Set a 4-6 week kill window for experiments. If a channel experiment can't show signal in 4-6 weeks (or a clear leading indicator), pause it. I've seen teams burn entire quarters "testing" channels with no decision criteria, then act surprised when the pipeline graph looks like a flatline.

4) Instrument before you scale. UTMs, form routing, CRM fields, lifecycle stages. If you can't measure it, you'll end up debating it.

Hot take: if your deal size is on the smaller side and you're spreading budget across five channels, you're not diversifying. You're starving every channel of learning.

Execution tracker + KPI scorecard (the ops layer)

A KPI scorecard should do two things: (1) tell you if the motion's healthy, and (2) tell you where to look when it's not.

Don't overcomplicate it. Pick 10-15 metrics max, split into Acquisition, Activation/Sales, and Retention/Expansion.

How to set targets (fast, and not delusional)

- Start with benchmarks (below).

- Adjust for your segment (SMB vs mid-market vs enterprise).

- Set good as the goal and average as the floor.

- Review weekly, change quarterly. If targets move every week, nobody trusts them.

CAC payback benchmarks (by industry + segment)

These CAC payback benchmarks are segmented by industry and customer size: https://firstpagesage.com/reports/saas-cac-payback-benchmarks/.

| Industry | Segment | Avg payback | Good payback |

|---|---|---|---|

| Fintech | SMB | 12 mo | 7 mo |

| Fintech | Mid-market | 18 mo | 12 mo |

| Fintech | Enterprise | 23 mo | 18 mo |

| Project Mgmt | SMB | 14 mo | 9 mo |

| Project Mgmt | Mid-market | 18 mo | 14 mo |

| Project Mgmt | Enterprise | 22 mo | 18 mo |

Operator interpretation:

- If you're SMB and payback's drifting past ~12-15 months, you're either overspending on acquisition or underpricing/under-retaining.

- If you're enterprise and payback's 24+ months, that can be fine - if NRR's strong and churn's low.

Inbound demo request handling (form -> meeting)

Chili Piper analyzed ~4 million form submissions:

- 14.1% of form submissions are disqualified (spam, personal emails, mismatch)

- 66.7% of qualified submissions book a meeting

- 69.2% book when there's a live call option

Benchmark report: https://www.chilipiper.com/post/form-conversion-rate-benchmark-report.

Targets to paste:

- Disqualified rate: [target <= 14%]

- Qualified -> booked meeting: [target >= 67%]

- With live call option: [target >= 69%]

Retention & expansion thresholds (the "don't ignore this" set)

These thresholds are operator guidance from GTM Strategist. Use them as guardrails, not scripture.

| Metric | SMB target | Mid-market target |

|---|---|---|

| Gross churn | 2-3% monthly max | 8-12% annually max |

| NRR floor | 100-105% | 110-120% |

| Trial->paid (self-serve) | 20-25% | n/a |

| Trial->paid (sales-assisted) | 30-40% | 30-40% |

| Pipeline coverage | 2.5-3.5x | 3-5x+ |

Notes that matter in practice:

- If SMB churn's above 2-3% monthly, you don't have a scaling problem. You've got a retention problem.

- Pipeline coverage goes up with deal size and sales cycle. Higher-ACV motions can run 5-8x coverage and still be normal.

Sales cycle + win rate sanity checks

If you're far outside these ranges, assume something's broken and investigate before scaling spend:

- Lead-to-customer conversion: 2-5%

- Typical win rate: 20-30%

- Median sales cycle: ~84 days (with "optimal" often 46-75 days)

I've seen teams blame "lead quality" for a 12% win rate while running a vague ICP, a mushy qualification bar, and a deck that tries to be everything to everyone. Fix the story and the process before you buy more leads.

Execution tracker schema (Notion/Sheet) + minimum viable GTM project plan

A GTM doc without a tracker is a strategy hobby.

Smartsheet's GTM template structure is a good operational baseline: https://www.smartsheet.com/content/go-to-market-strategy-templates. Notion is also a legit option: https://www.notion.com/templates/go-to-market-gtm-launch-plan.

Minimum viable tracker schema (copy/paste columns)

| Column | Type | Example |

|---|---|---|

| Initiative | text | "Outbound: CFO segment" |

| Phase | select | Product Mktg |

| Channel | select | |

| Segment | select | Mid-mkt SaaS |

| Owner | person | "A. Patel" |

| Status | select | In progress |

| Priority | select | P1 |

| KPI target | text | "10 SQL/wk" |

| KPI actual | text | "6 SQL/wk" |

| Budget | number | "$2,000" |

| Start date | date | 2026-03-01 |

| Due date | date | 2026-03-29 |

| Asset link | URL | deck doc |

| Experiment link | URL | test brief |

| Notes | text | blockers |

Views to create:

- Kanban by Status

- Calendar by Due date

- Table filtered to P1

- Gantt (if your tool supports it)

Example rows (so it's not abstract)

| Initiative | Phase | Channel | Owner | KPI target | Due date |

|---|---|---|---|---|---|

| Homepage hero rewrite | Product Mktg | Website | PMM | +20% demo CVR | 2026-03-15 |

| Demo form routing SLA | Sales Tools | Inbound | RevOps | 67% booked | 2026-03-08 |

| SEO: 5 BOFU pages | Planning | SEO | Content | 30 MQL/mo | 2026-04-01 |

| Webinar w/ partner | Social | Webinar | Marketing | 15 SQL | 2026-03-29 |

How to finalize your GTM plan in 60 minutes (no fluff)

If you timebox this, you'll actually ship it.

0-10 min: Lock motion + target ACV (Founder + Sales lead)

- Pick the ACV band you're designing for.

- Pick one primary motion. Write it at the top of the doc.

10-25 min: Choose ICP + one "not ICP" (Founder + PMM)

- Fill the ICP fields.

- Write one exclusion that will annoy someone internally (that's how you know it's real).

25-40 min: Define funnel stages + SLAs (RevOps + Sales lead)

- Fill the stage definitions and the entry/exit criteria table.

- Set speed-to-lead and handoff SLAs. Put owners next to each SLA.

40-50 min: Pick one primary channel + one secondary (Marketing lead)

- Write the channel hypothesis for each.

- Add a kill window (4-6 weeks) and the success metric.

50-60 min: Convert strategy into two assets (PMM + Design/Content)

- Asset #1: homepage hero or landing page headline + proof.

- Asset #2: deck spine or outbound angle library.

- Put both into the tracker with due dates inside 7 days.

If you can't do this in an hour, you're not being thorough. You're avoiding decisions.

GTM doc table of contents (Zendesk-style) + why CX belongs in GTM

If you want a clean structure that reads well to execs, use this GTM doc outline:

| Section | What to include |

|---|---|

| Timeline | launch date, phases, dependencies |

| Pain points | top 3 pains by segment + evidence |

| SWOT | strengths/weaknesses/opportunities/threats |

| Customer journey map | awareness -> evaluation -> onboarding -> renewal |

| Promotion plan | channels, offers, owners, budget |

| Status log | weekly updates, decisions, changes |

Customer experience belongs in GTM because it directly drives retention and expansion. Zendesk's 2026 CX trends report is blunt: 85% of CX leaders believe customers will drop brands over an unsatisfactory experience. If your GTM plan ignores onboarding and support readiness, you're building a leaky bucket on purpose.

Outbound + data quality module (so your GTM metrics are real)

Outbound is the fastest way to test positioning against a real ICP - if your data isn't garbage.

Baseline expectations:

- Cold outbound positive reply rate: 1-5%

- Meeting show rate: 60-80%

If you're seeing 0.3% positive replies, don't rewrite messaging first. Check deliverability and list quality. Bad emails create bounces, bounces hurt domain reputation, and then even good leads won't see your messages.

The "metrics aren't real without data hygiene" workflow

1) Build your ICP list from your template fields

- Segment, industry, headcount, geo, tech environment, triggers.

2) Verify before you send

- Don't trust emails because a database had them. Verify them.

3) Enrich + standardize fields

- You need consistent company names, domains, job titles, and segments for attribution.

4) Refresh on a real cadence

- Weekly refresh is ideal for active segments. Prospeo refreshes data every 7 days, which matches that cadence.

Prospeo mini-callout (execution layer)

Prospeo is "The B2B data platform built for accuracy". If your GTM plan includes outbound, it's one of the cleanest ways to keep your list quality high: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobiles, 30+ filters, and intent across 15,000 topics, all refreshed every 7 days with 98% verified email accuracy.

Explore: https://prospeo.io/b2b-leads-database • Verify: https://prospeo.io/email-finder • Enrich: https://prospeo.io/b2b-data-enrichment

Map your template fields into outbound (procedural checklist)

- Create saved searches by Segment A/B (industry, headcount, geo, role/seniority, technographics, triggers).

- Export lists with standardized fields: company name, domain, role, seniority, segment, source.

- Verify emails before sequencing; route bounces into a fix-data queue (not a rewrite-copy queue).

- Enrich your CRM so attribution and routing rules stay consistent across inbound + outbound.

Free tier includes 75 emails + 100 extension credits/month; paid is credit-based (about $0.01/email).

Your ACV picked your motion. Your ICP is defined. Now you need to reach those buyers. Prospeo's 30+ search filters - intent data, technographics, funding, headcount growth - map directly to the trigger events and segments in your GTM doc. At $0.01 per email, your CAC payback guardrail stays intact.

Turn your ICP definition into a live prospect list in under 5 minutes.

Investor-ready GTM addendum (data room checklist)

If you're in an accelerator, raising Seed/A, or prepping for serious diligence, this addendum matters more than your pitch deck narrative. Investors want to see that growth is a system, not a one-off channel spike, and the easiest way to prove it is to show repeatability: clear ICP, clear motion, clear economics, and proof you can diagnose constraints.

Keep it tight (board-friendly), but specific (diligence-friendly). Include screenshots and exports where possible. Investors trust artifacts more than adjectives.

Use this as your data room checklist:

- Market sizing: TAM / SAM / SOM with assumptions and a why-now narrative

- ICP + segmentation: ICP definition, segment sizing, and your not-ICP exclusions

- Customer evidence: 10 interview notes (sanitized) + top 5 verbatims that shaped messaging

- Competitive analysis: direct/indirect set, landmines, and your battlecard talk tracks

- Pricing + packaging: pricing page screenshots, tier logic, add-ons, and discount policy (who can approve what)

- Distribution performance: channel mix, what's working, what you cut, and why

- Unit economics: CAC, LTV, gross margin, CAC payback by segment (not blended)

- Pipeline snapshot: by stage and by segment, with conversion rates and cycle length

- Retention: cohort retention chart, churn reasons, NRR by segment, expansion drivers

- Sales process: qualification rubric, discovery checklist, and top 3 objection responses

- Loss analysis: top 10 lost reasons + what you changed because of them

- Operating cadence: weekly scorecard, experiment log, and the next 6 weeks of planned bets

- Assumptions + tests: what must be true, how you'll test it, and the kill criteria

If you can't answer "what's the one constraint in the funnel right now?" you're not investor-ready. You're just optimistic.

FAQ

What should a SaaS go-to-market strategy include in 2026?

A SaaS GTM strategy in 2026 should include: 1 ICP, 1 primary motion, pricing/packaging, 1-2 priority channels, funnel stage definitions with SLAs, and retention/expansion targets - plus an execution tracker with owners and due dates. If it doesn't ship assets within 7 days and run on weekly KPIs, it won't execute.

How do I choose PLG vs sales-led vs hybrid for my SaaS?

Choose based on target ACV and sales cycle: <$5K usually fits PLG (days-weeks), $5K-$50K fits inside sales (1-3 months), $50K-$250K fits field sales (3-6 months), and >$250K often needs field + partners (6-12+ months). Start with one primary motion, then add the second after you've proven repeatability.

What are good benchmark targets for CAC payback and funnel conversion?

For many SMB SaaS motions, a good CAC payback is roughly 7-12 months, while enterprise motions often operate around 18-23 months when retention's strong. As a starting funnel baseline, Visitor->Lead is ~2.1% for SEO and ~0.7% for PPC, and Opp->Close commonly lands around 32-40%.

How do I turn a GTM strategy into an execution plan (owners + timeline)?

Create a tracker with initiatives, phase, channel, segment, owner, KPI target/actual, budget, and due date, then run a weekly review with a 4-6 week kill window for experiments. If an initiative can't show signal inside that window (or a clear leading indicator), pause it and reallocate budget.

What tool helps verify and refresh outbound contact data for GTM execution?

Prospeo is a strong option for outbound data hygiene because it delivers 98% verified email accuracy and refreshes records every 7 days, which keeps deliverability and attribution from getting polluted. The free tier includes 75 emails plus 100 extension credits per month, and paid pricing is credit-based at about $0.01 per email.

Summary

If you want a saas go to market strategy template that actually survives contact with reality, keep it simple: pick a motion, lock an ICP, define funnel stages and SLAs, choose one primary channel, and run everything through a tracker and weekly scorecard.

Ship assets within 7 days.

Then keep your outbound data clean so your GTM metrics stay trustworthy.