Pre call research checklist (with 3, 15, and 30-minute templates)

If your opener's based on stale info, you lose the room in the first 20 seconds. This pre call research checklist isn't about sounding smart. It's about being right, fast, and pointed.

Here's the hot take: on smaller deals, "deep research" is usually procrastination. Timebox it, get one real angle, and start the conversation.

Most reps don't need more tabs. They need a repeatable output.

What you need in a pre call research checklist (60-second + timeboxes)

By the time you're talking to a buyer, you're late. Demand Gen Report's summary of the 6sense 2024 Buyer Experience Report shows buyers are ~70% through their journey and 81% already have a preferred vendor ; first contact is initiated by buyers 80% of the time, requirements are set 85% of the time, the buying group averages 11 people, and the cycle runs 11.3 months. Your advantage is diagnosis speed.

60-second checklist (do this every time):

- Confirm the basics: company, role, region, segment, and whether this is inbound/outbound.

- Confirm contactability: correct title + a working email/number (Prospeo: 98% email accuracy, 7-day refresh).

- Find one "why now" trigger: funding, hiring, product launch, leadership change, security event, new partnership, M&A.

- Pick one wedge problem: the most likely pain tied to their role (not your product).

- Check technographics (quick): 1-2 tools that hint at maturity/constraints.

- Set a call outcome: what "good" looks like (next meeting, intro to EB, security review, pilot).

- Write 3 questions: one business, one technical/process, one decision/paper-process.

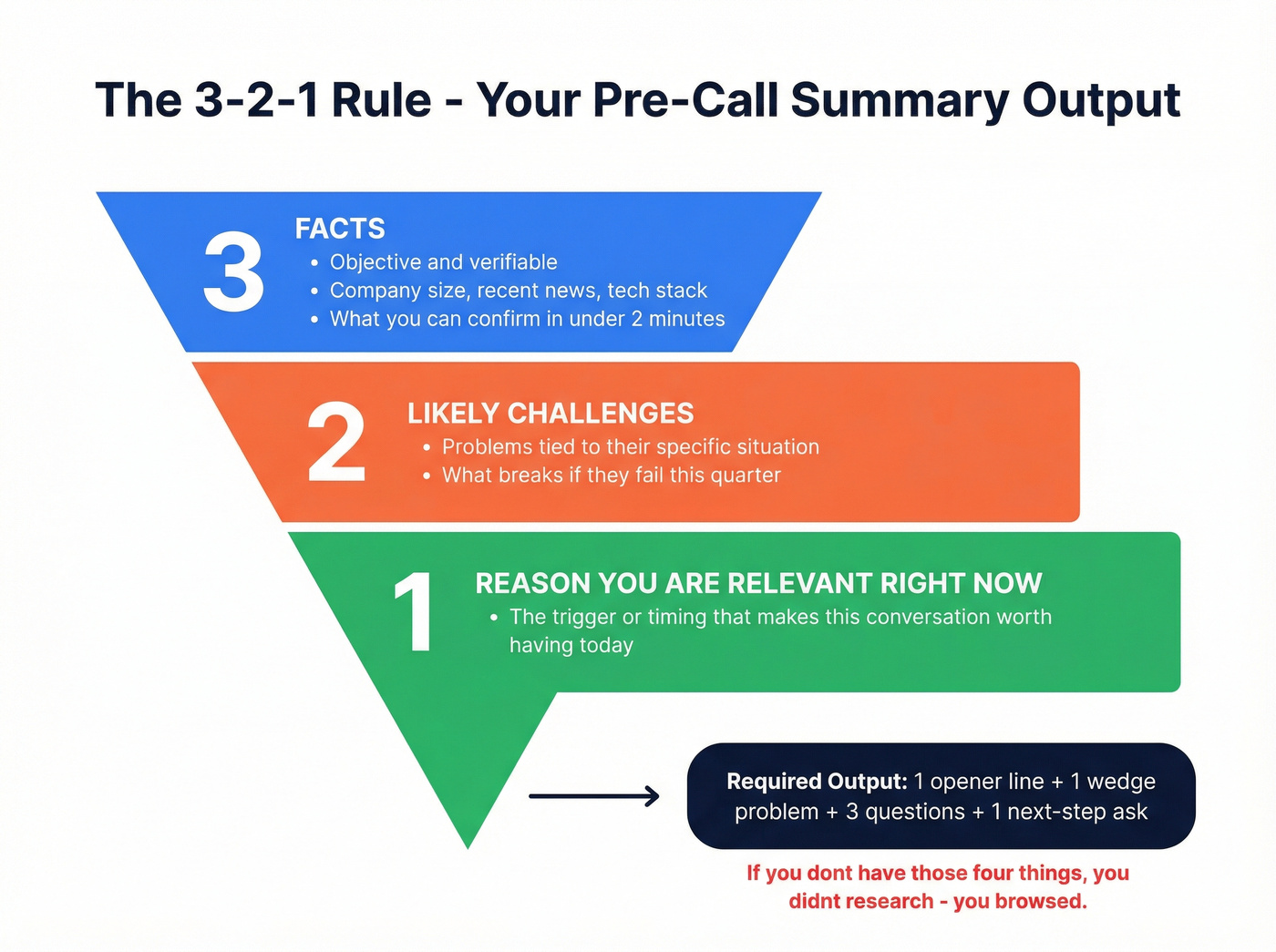

Your required output (non-negotiable): 1 opener line + 1 wedge problem + 3 questions + 1 next-step ask.

If you don't have those four, you didn't "research." You browsed.

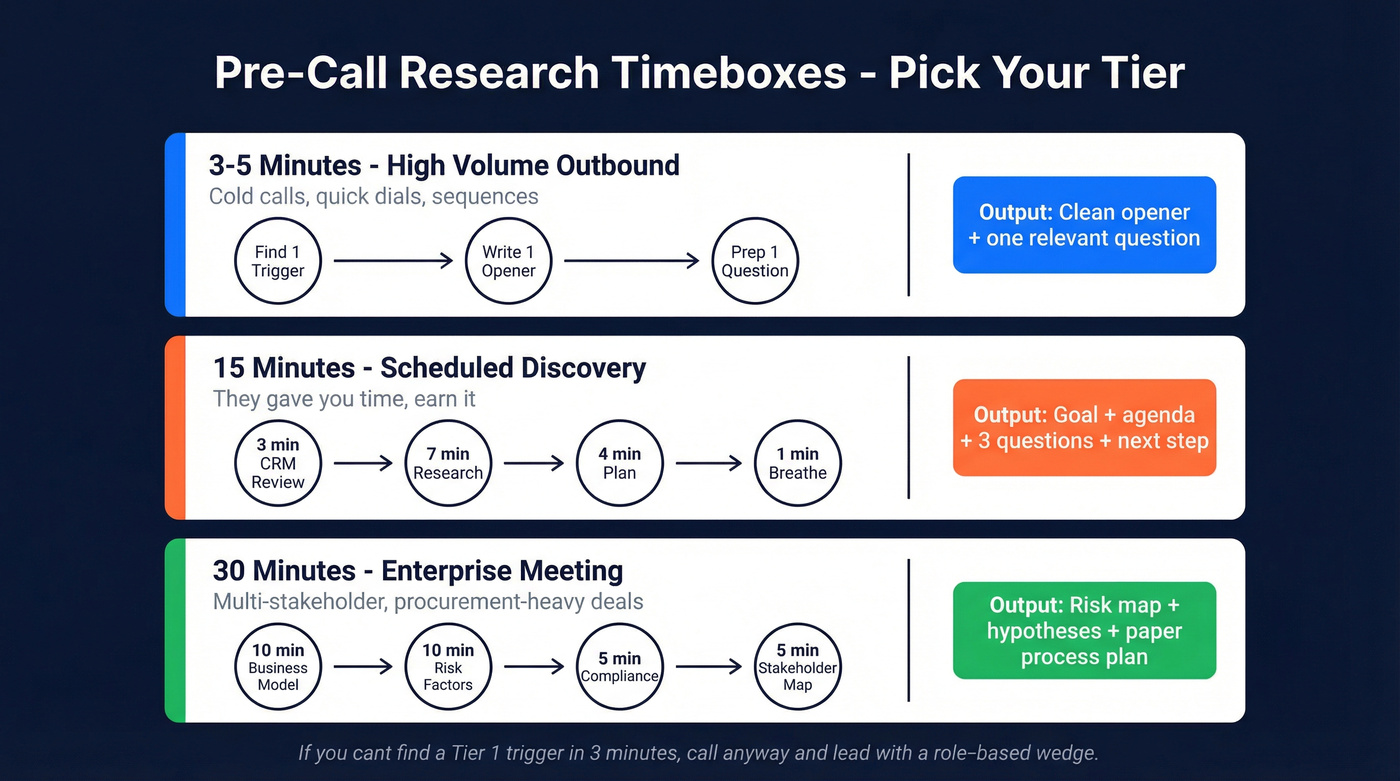

Timeboxes (pick based on call type):

- 3-5 min: cold outbound, quick dials, high-volume sequences

- 15 min: scheduled discovery (they gave you time, earn it)

- 30 min: enterprise/regulatory, multi-threading, procurement-heavy deals

If you can't find a Tier 1 trigger in 3 minutes, call anyway and lead with a role-based wedge. Waiting for the perfect angle is how pipelines die quietly.

One-page pre-call worksheet (copy/paste)

This worksheet forces "interesting facts" into a call plan and keeps you out of rabbit holes. If you're training new reps on how to research prospects before cold calling, this one-pager's the fastest way to standardize outputs without turning prep into a research project.

At the top, use the 3-2-1 rule as your summary output:

- 3 facts (objective, verifiable)

- 2 challenges (likely problems tied to their situation)

- 1 reason you're relevant right now

Copy/paste this into your notes tool or CRM:

TOP SUMMARY (3-2-1)

- 3 facts: 1) 2) 3)

- 2 likely challenges: 1) 2)

1 reason we're relevant now:

Company snapshot (5 bullets max)

- What they do (one sentence):

- Who they sell to / who buys:

- Size (revenue/headcount band):

- Geo footprint:

- Current priorities (from site/news/jobs):

Contact/persona + stakes (what they're measured on)

- Role + scope (team size, region, function):

- What "good" looks like for them this quarter:

- What breaks if they fail:

- Likely internal partners (IT, RevOps, Security, Finance, Legal):

Why now triggers (ranked)

Rank 1-3 based on recency + impact: 1) 2) 3)

Technographics (signals + confidence score)

- Tool signal #1:

- Tool signal #2:

- What it implies:

- Confidence: High / Med / Low (why):

Hypotheses -> questions (3 max)

Hypothesis 1:

- Question:

Hypothesis 2:

- Question:

Hypothesis 3:

- Question:

MEDDPICC notes (enterprise-ready, optional)

- Metrics:

- Economic Buyer:

- Decision Criteria:

- Decision Process:

- Paper Process:

- Identify Pain:

- Champion:

- Competition:

Next step + calendar ask + close plan

- Best next step (demo, technical deep dive, pilot, security review):

- Who needs to be there:

- Calendar ask (two options):

- Close plan (what you'll send + by when):

Example output (condensed):

TOP SUMMARY (3-2-1)

- 3 facts: (1) Hiring SDRs + RevOps (2) New VP Sales joined ~60 days ago (3) Job posts mention Salesforce + Outreach

- 2 likely challenges: (1) Ramp pressure + pipeline coverage (2) Routing/reporting friction

- 1 reason now: new leadership + hiring means process is changing anyway

Company snapshot:

- Mid-market SaaS; US + UK

- Priorities: pipeline creation, conversion, reporting

Persona + stakes:

- VP Sales measured on pipeline + win rate

- Partners: RevOps + Enablement (Security if PII's involved)

Why now triggers:

- New VP Sales

- SDR hiring spike

- New product launch

Technographics:

- Salesforce + Outreach in recent job posts

- Confidence: Medium

Hypotheses -> questions:

- "Where do leads get stuck today - handoff, routing, or follow-up?"

- "What's the one metric you need to improve this quarter?"

- "Who else needs to sign off - RevOps, Finance, Security, Legal?"

Next step:

- 30-min working session with VP Sales + RevOps to map workflow + success metrics

The 3-5 minute checklist (high-volume outbound) - "5x5" guardrails

A practical guardrail popularized by Klenty is to cap research at 3-5 minutes per prospect. It works because it prevents rabbit holes and forces a usable call plan: one angle, one question, one next step. In other words, it's prospect research before cold calling that's designed for volume without sacrificing relevance.

Use the 5x5: 5 minutes to find 5 facts.

- Headcount growth: scaling or shrinking?

- Tool stack: one signal tool (CRM, marketing automation, data warehouse, ticketing)

- Job ads: 1-2 roles that hint at priorities (RevOps, Security, Data, SDR hiring)

- Background: one relevant detail about the person (tenure, prior company, function)

- Mission: one sentence from the site you can mirror back

Here's the thing: if you can't ask a better question after 5 minutes, stop researching and start calling.

Use this if:

- You're doing cold calls, quick dials, or high-volume sequences.

- You need a clean opener + one relevant question, not a thesis.

Skip this (and move to 15 minutes) if:

- They booked time on your calendar.

- There's a technical evaluation coming.

- You're walking into a multi-stakeholder deal.

Position #1: For cold calls, technographics are optional; a single trigger beats a stack guess every time.

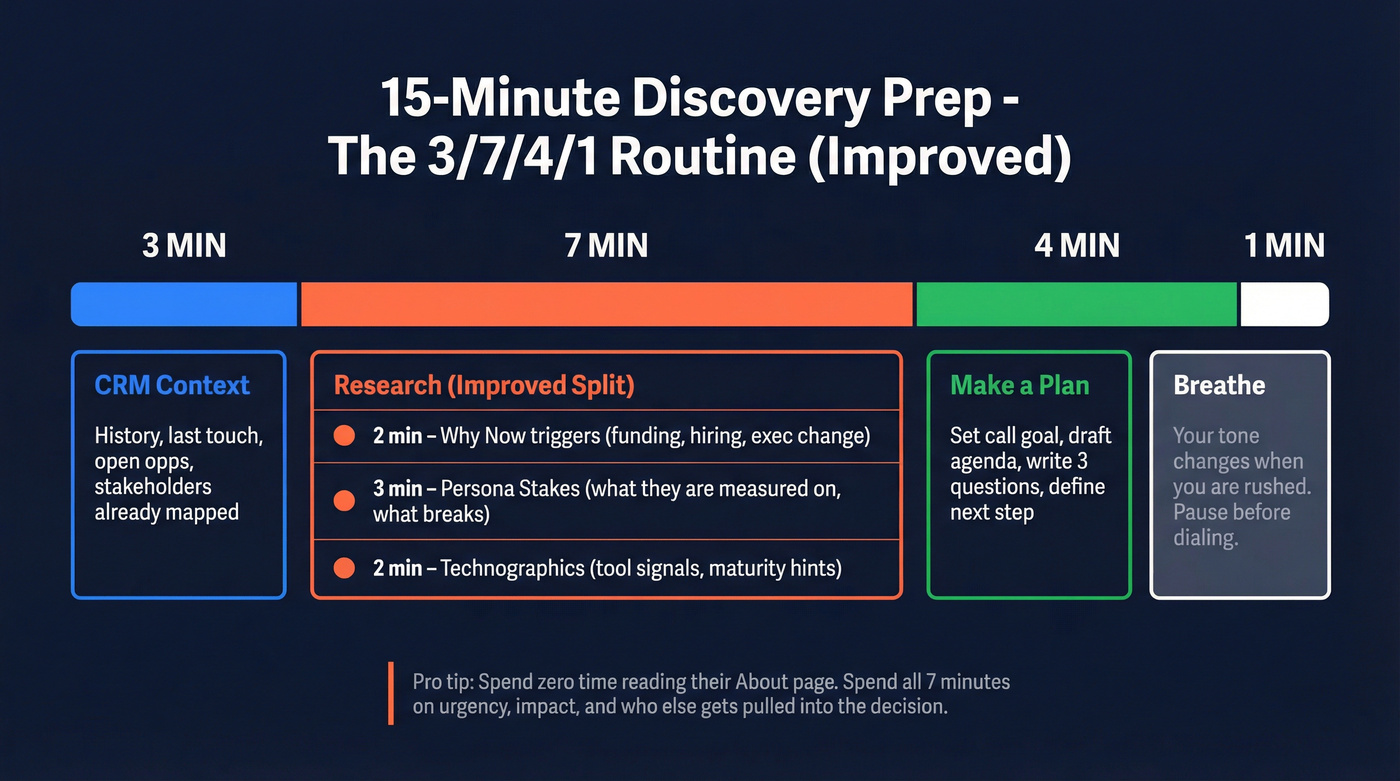

The 15-minute checklist (scheduled discovery) - the 3/7/4/1 routine (improved)

Salesforce's 3/7/4/1 breakdown is still the cleanest "don't overthink it" routine:

- 3 minutes: review CRM context (history, last touch, open opps, stakeholders)

- 7 minutes: research contact + company (site, news, role priorities, triggers)

- 4 minutes: make a plan (goal, agenda, 3 questions, next step)

- 1 minute: breathe - your tone changes when you're rushed

Speed-to-lead benchmarks are brutal. Benchmarks commonly cited from Lead Response Management research (21x) and Harvard Business Review research (60x) show leads convert far more when you respond fast, so don't spend 45 minutes "prepping" and then show up late. If you want to operationalize it, track speed-to-lead metrics as an SLA, not a vibe.

My tweak: in the 7-minute research slice, spend 2 minutes on "why now," 3 minutes on persona stakes, and 2 minutes on technographics. That mix produces better questions than reading their About page, and it keeps you focused on what actually changes the call: urgency, impact, and who else is going to get pulled into the decision.

Step one of every pre-call checklist: confirm contactability. Stale emails and dead numbers kill calls before they start. Prospeo gives you 98% accurate emails and 125M+ verified mobiles on a 7-day refresh cycle - so your 3-minute research actually connects.

Stop prepping calls for contacts that bounce.

The 30-minute checklist (enterprise meeting) - risk factors + regulated readiness

Enterprise prep isn't "more of the same." It's about de-risking the deal early, especially security, compliance, and procurement. If you're running true enterprise sales, treat prep as risk removal - not trivia collection.

30-minute checklist:

- 10 minutes: company + business model + segment (what makes them money, where margins live)

- 10 minutes: risk factors -> hypotheses (public companies: 10-K)

- 5 minutes: regulated readiness (security/compliance fit)

- 5 minutes: stakeholder map + next step plan

Aircover's method is gold: pull the company's 10-K and go straight to Part 1A: Risk Factors. Then map:

- Risk factor (theme) ->

- Hypothesis (how it shows up operationally) ->

- Questions (what you need to confirm)

Mini-case mapping (example):

- Risk factor: "Demand forecasting errors can lead to inventory write-downs."

- Hypothesis: forecasting + planning data is fragmented across teams/tools.

- Questions: "Where does forecast data live today?" "What's the cost of being wrong?" "Who owns the forecast call?"

Regulated readiness items to have ready (even if you don't lead with them):

- SOC2 Type 2 status and security posture

- GDPR and CCPA considerations

- Data residency expectations

- On-prem vs cloud constraints

- Procurement + legal review timelines

Position #2: Enterprise: ask Paper Process in meeting #1 or accept a longer cycle. I've watched deals die because a rep waited until week 6 to learn how security review actually works, and by then the champion's already tired, procurement's already annoyed, and your "quick pilot" has turned into a quarter-long slog.

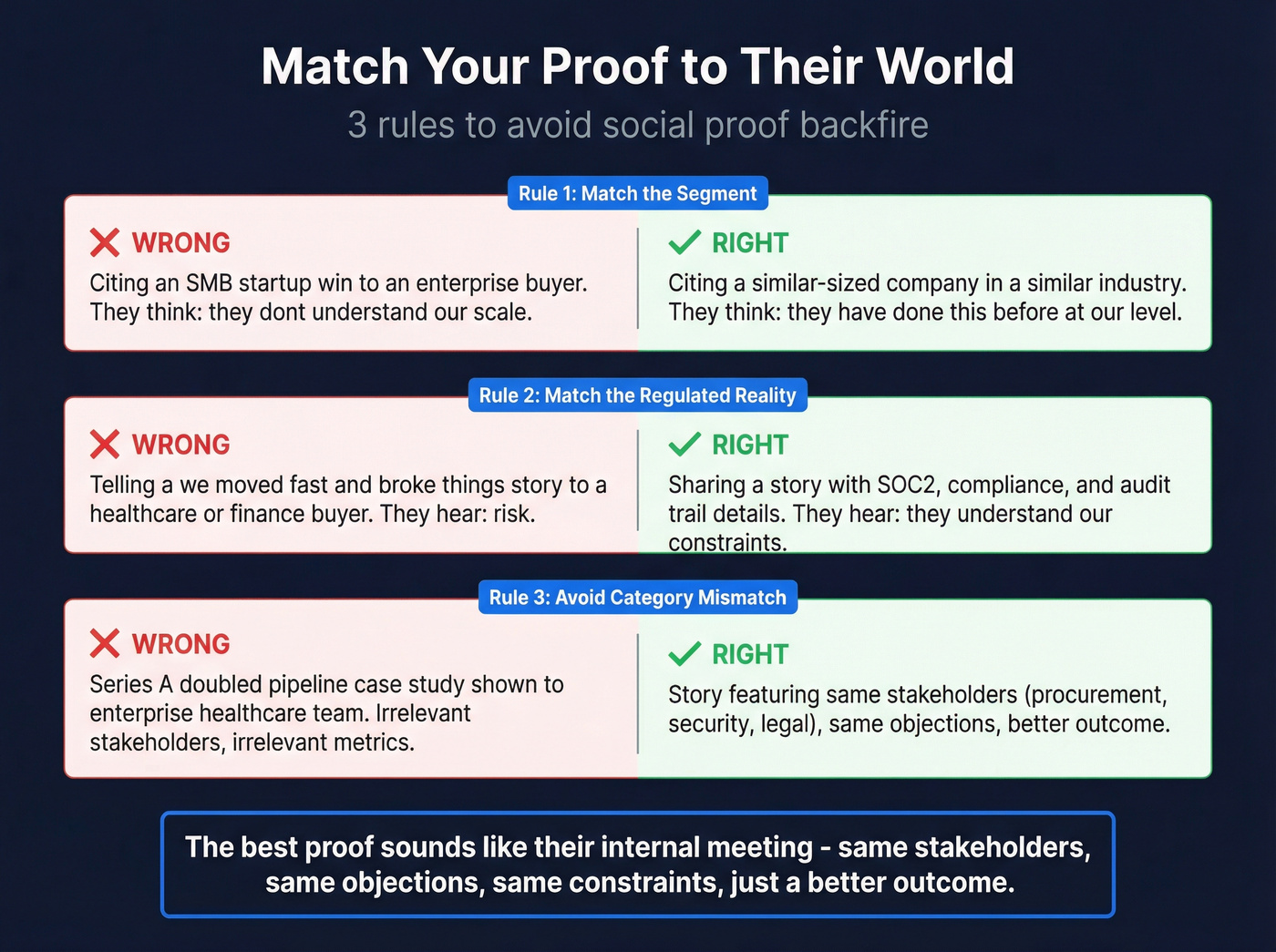

Pick the right proof: match customer stories to their segment

Social proof can help. It can also backfire.

When your examples don't match their world, buyers assume you don't understand their constraints.

Use these three rules:

- Match the segment: SMB wins don't reassure enterprise buyers. Enterprise wins can intimidate SMBs. Pick the story that mirrors their scale and complexity.

- Match the regulated reality: if they're in healthcare, finance, or public sector, your proof needs security/compliance credibility. A "we moved fast" startup story doesn't answer risk questions.

- Avoid category mismatch: don't cite a Series A "we doubled pipeline" win to an enterprise healthcare team that cares about audit trails, procurement, and data residency.

The best proof sounds like their internal meeting: same stakeholders, same objections, same constraints, just a better outcome.

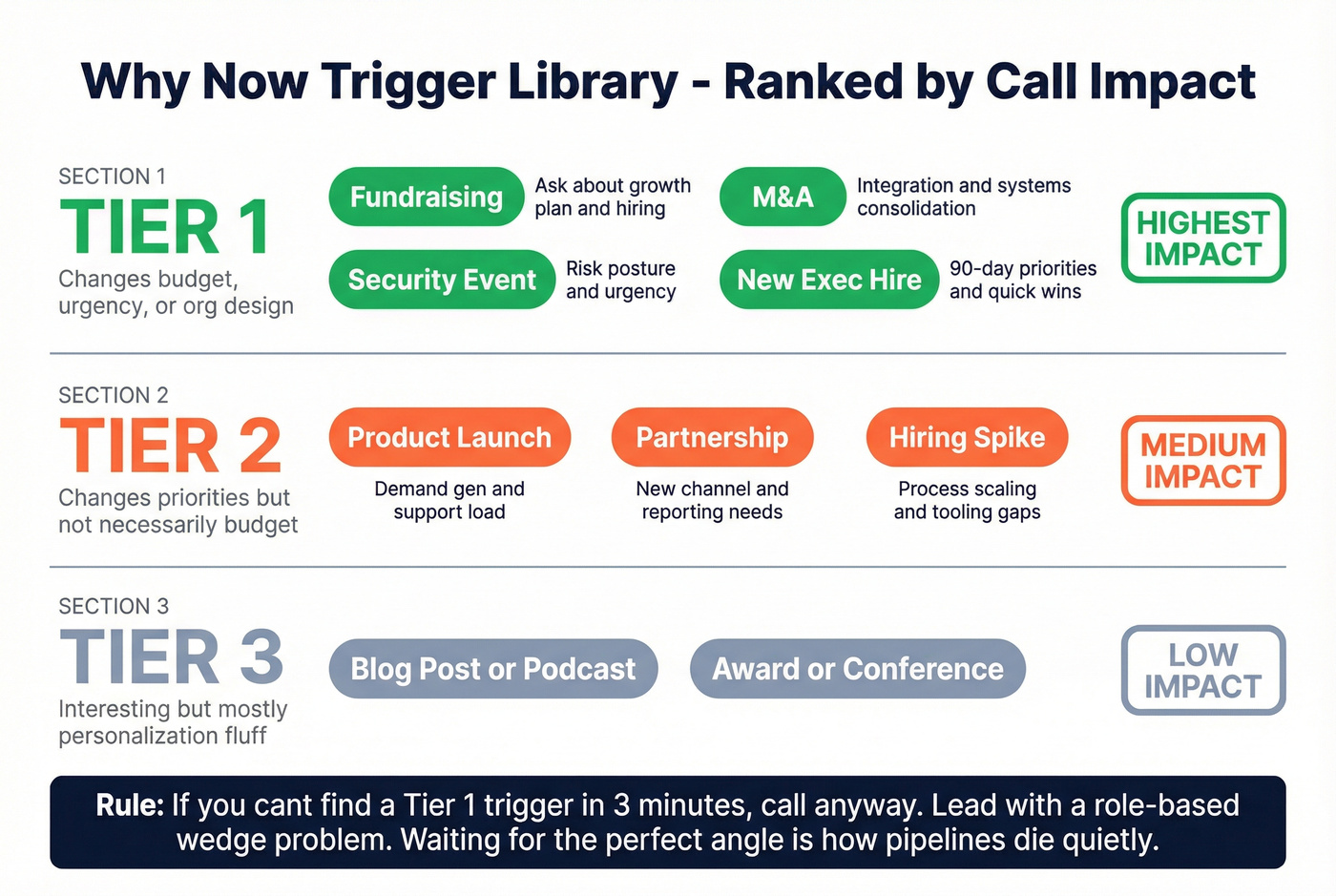

"Why now" trigger library (ranked) + prioritization rules

Triggers are only useful if they change your call angle. Otherwise they're just personalization glitter.

Prioritization rules:

- Tier 1 triggers: change budget, urgency, or org design (highest call impact)

- Tier 2 triggers: change priorities but not necessarily budget

- Tier 3 triggers: interesting, but mostly fluff

| Trigger | What it changes on the call |

|---|---|

| Fundraising | "What's the growth plan?" + hiring |

| M&A | Integration + systems consolidation |

| Partnership | New channel + reporting needs |

| Product launch | Demand gen + support load |

| New exec hire | 90-day priorities + quick wins |

| Security event | Risk posture + urgency |

| Hiring spike | Process scaling + tooling gaps |

| Re-org | Ownership + decision process |

| New region | Compliance + localization |

| Big customer win | Capacity + onboarding strain |

If you only have time for one trigger, pick the one that changes decision process (new exec, M&A, security event). Those reshape the buying group and the paper process - i.e., how B2B decision making actually works.

Technographics without guessing: 3-source method + confidence scoring

Technographics are a signal, not truth. The fastest way to embarrass yourself is to talk like you're certain when you're not.

Use a 3-source method:

- Website detection (good for public-facing tools; misses internal stack)

- Job postings (best internal signal when multiple recent roles mention the same tools)

- Confidence scoring (so you don't overstate)

Confidence bands (simple rubric):

- High (80%+): multiple recent job posts + website detection agree

- Medium (70-80%): one strong signal (recent job post) or multiple weaker signals

- Low (50-70%): old job posts, indirect mentions, or only one detection tool hit

Don't say this / say this instead:

- Don't: "I saw you use HubSpot, so..."

- Say: "I noticed HubSpot mentioned in a recent role - are you still on it, or has that changed?"

Look, the goal isn't to be right about tools. It's to ask smarter questions faster.

Tools to speed up research (and avoid bad data)

You don't need a giant stack for pre-call research. You need two things: (1) fast trigger/tech signals and (2) verified contact data so you don't waste your best messaging on the wrong person.

Prospeo (Tier 1) - data verification + enrichment that protects credibility

I've seen teams do everything "right" on messaging and still faceplant because the contact data was wrong. The opener was fine. The offer was fine. The follow-up never landed.

Prospeo is "The B2B data platform built for accuracy," and it's the one tool I'd keep closest to the rep workflow because it removes the #1 research bottleneck: "Is this contact info even right?" If you're comparing options, start with an email lookup workflow and then add verification.

You get 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, all refreshed every 7 days (the industry average is 6 weeks). When you enrich a list or CRM, 83% of leads come back with contact data, and the API hits a 92% match rate, which is exactly what RevOps wants to hear when they're trying to stop reps from building their own shadow spreadsheets.

What this changes in practice: you stop wasting your best opener on the wrong person. You pull the right contact, confirm the role, and go into the call knowing your follow-up will land. The Chrome extension's especially handy for fast lists, and the platform plugs into common workflows (Salesforce, HubSpot, Clay, Zapier, Make, and more).

Pricing signal: free tier includes 75 emails + 100 extension credits/month. Paid usage is transparent: ~$0.01 per verified email and 10 credits per mobile (with a 30% pickup rate on verified mobiles). If you’re building a repeatable ops workflow, pair it with a documented email verification list SOP.

Links: Chrome Extension, Email Finder, Data Enrichment, Pricing.

Wappalyzer (Tier 2) - quick tech lookup for 3-5 minute prep

Wappalyzer is the fastest "what's on their website" check. Open the company site, click the extension, and you get a categorized list of detected technologies.

Pricing signal: free tier includes 50 free monthly lookups; paid plans typically start around $20/month and scale up with lookup volume and features.

BuiltWith (Tier 2) - deeper technographics when you need coverage

BuiltWith is the heavier-duty option when you want broader coverage and historical context. Their coverage is big: 111,532+ technologies across 673M websites.

Pricing signal: subscription pricing that scales with usage (lookups, exports, API, seats). In practice, expect ~$300-$1,500+/month for teams that need consistent exports and reporting, with higher tiers for API-heavy workflows.

Google News (Tier 3) - fastest trigger scan

Google News is still the quickest way to catch "why now" without overthinking it. Search the company name + trigger terms (fundraising, partnership, announcement, acquisition), then set alerts for your top accounts.

Pricing signal: $0.

Your CRM (Tier 3) - the only place that knows what already happened

Your CRM is where you find the landmines: last meeting notes, closed-lost reasons, stakeholders who ghosted, and internal politics. If you skip this, you'll ask questions they already answered three months ago. Keeping it usable is a discipline - use a lightweight data quality scorecard so the "history" is actually trustworthy.

Pricing signal: effectively $50-$250/user/month for most SMB/mid-market CRMs (and far more at enterprise tiers), which is exactly why you should use it like it matters.

Quick comparison

| Tool | Best for | Time to value | Cost note |

|---|---|---|---|

| Prospeo | Email/mobile verify + enrichment | Minutes | Free; ~$0.01/email; 10 credits/mobile |

| Wappalyzer | Website tech scan | <1 min | Free tier; paid typically starts around $20/mo |

| BuiltWith | Tech coverage + history + exports | 2-5 min | ~$300-$1,500+/mo typical |

| Google News | Trigger scan + alerts | 2-3 min | Free |

| Your CRM | Account history + stakeholders | 3 min | ~$50-$250/user/mo typical |

Turn research into a call plan: hypotheses -> questions + MEDDPICC "paper process"

Research that doesn't change your questions is trivia.

Use this workflow:

- Write 1-3 hypotheses (what you think is true)

- Convert each into one clean question

- Map answers to MEDDPICC so you're building deal clarity, not just rapport

Use MEDDPICC as an internal compass, not a script you read at buyers. Paper Process and Competition are the two fields that prevent late-stage surprises (procurement delays and the "we're comparing you to X" ambush).

Copy/paste question bank (hypothesis -> question):

- Hypothesis: They're scaling fast and process is breaking

- "What's the first thing that breaks when volume spikes - people, process, or systems?"

- Hypothesis: They're paying a tax on slow response times

- "What's your current response-time target, and where do leads get stuck?"

- Hypothesis: Data quality is hurting outbound and attribution

- "Where does bad data show up most - bounces, wrong titles, duplicates, or missing contact methods?"

- Hypothesis: Security/procurement will be the real timeline driver

- "What does security review look like, and when does it typically start?"

MEDDPICC mapping (keep it lightweight):

- Metrics: "What number has to move for this to be a win?"

- Economic Buyer: "Who owns the budget and signs?"

- Decision Criteria: "What must be true to choose a vendor?"

- Decision Process: "What are the steps from here to yes?"

- Paper Process: legal/procurement/security steps (the silent killer)

- Identify Pain: "What's the cost of doing nothing?"

- Champion: "Who's driving this internally?"

- Competition: "What are you comparing us against - including doing nothing?"

Paper Process prompts to use early:

- "How do you manage your paper process - are legal or procurement involved?"

- "If we need to adjust pricing or terms, how much lead time do you need for reviews?"

- "If your business grows or downsizes, what'll the contract adjustment process look like?"

If you want a deeper enterprise-ready approach to pre-call research, Aircover's breakdown is a solid reference: Aircover's pre-call research method.

After the call (2 minutes): lock in the win while it's fresh

Most reps lose deals in the gap between "good call" and "no follow-up."

Do this immediately after you hang up:

- Update the worksheet with 3 confirmed facts (not assumptions)

- Log 3 learnings in the CRM (pain, timeline, stakeholders)

- Send a next-step email with: recap -> decision/process steps -> calendar link -> one clear ask (use a tight follow up format so it’s consistent across reps)

Two minutes here saves two weeks later.

What not to do (so you don't sound creepy or waste time)

Pre-call research should make you sound prepared, not like you've been lurking.

Do:

- Follow the 5-minute research rule for cold calls: role, company basics, one trigger.

- Keep a 40/60 talk-to-listen ratio (you talk less than 40%).

- Use research to ask better questions, not to deliver a monologue.

- Verify role/contact data before you reference it. Wrong title = instant credibility loss.

Don't:

- Don't open with personal details (marathon, kids, vacation). It's rarely worth it.

- Don't recite their About page. They know what they do.

- Don't pretend technographics are certain, match your wording to your confidence.

- Don't research for 30 minutes for a 90-second cold call. That's procrastination dressed up as professionalism.

Field note (from call audits): the most common failure isn't "not enough personalization." It's walking in without a point of view. If you can't articulate the wedge problem in one sentence, you'll default to feature questions and the buyer will steer the call.

Position #3: If you can't write a 3-2-1 summary, don't take the call yet - reschedule or downgrade the meeting.

AI in pre-call research (the 2026 reality)

AI's already in the workflow. Outreach's 2026 sales engagement research (500 respondents) found 45% use AI for account research and 54% use it for personalized outbound, with an average of 4.81 touches per prospect. If you’re building this into your motion, borrow patterns from AI in sales cadences rather than bolting on random prompts.

My rule: let AI draft, but make a human verify. Use it to summarize the company, pull likely triggers, and propose questions, then you confirm the one trigger you'll actually lead with and rewrite the opener in your voice. Done right, it's the fastest way to get consistent discovery call prep without turning every account into a 30-minute project.

Next steps (do this for the next 10 calls)

Pick the right timebox (3/15/30), paste the one-page worksheet into your CRM notes, and force the same four outputs every time: opener, wedge problem, three questions, next-step ask.

Consistency beats brilliance.

And a simple pre call research checklist beats "I'll just wing it" every single time.

FAQ

How long should pre-call research take for outbound vs discovery vs enterprise?

Outbound should be 3-5 minutes, scheduled discovery 15 minutes, and enterprise meetings 30 minutes. Timebox the work, pull one trigger, form 1-3 hypotheses, and walk in with a clear next step.

What are the most important things to learn before a discovery call?

Learn the persona's stakes, one credible "why now" trigger, the likely problem tied to that trigger, and what a good next step looks like. If you can't write a 3-2-1 summary (3 facts, 2 challenges, 1 reason now), you're not ready.

How do you research a company's tech stack without guessing?

Use three sources: website detection tools, job postings, and a confidence score. If multiple recent job posts mention the same tool and a detector also sees it, treat it as high confidence (80%+). Otherwise, ask conditionally and let them confirm.

What tool helps verify emails and mobile numbers before outreach?

Prospeo is the fastest way to verify contact data before you reach out, with 98% email accuracy, 125M+ verified mobile numbers, and a 7-day refresh. The free tier includes 75 emails + 100 extension credits/month, which is enough to validate real outreach lists before you scale.

Your 5x5 research needs triggers, technographics, and hiring signals fast. Prospeo's 30+ filters - including buyer intent, job changes, headcount growth, and tech stack - give you five usable facts in under a minute, not five.

Turn your pre-call research from browsing into a real call plan.