How to Find Companies That Need Outsourcing in 2026 (Signal-Based Playbook)

If you're trying to figure out how to find companies that need outsourcing, the hard part isn't "finding companies." It's finding the ones that need it now - and will actually take a call.

In 2026, outsourcing lead gen is pattern recognition: spot capacity gaps + budget + urgency, then get to the right stakeholders before everyone else piles in.

Here's the hook: you don't need a bigger list. You need a better weekly feed of triggers.

The problem with most advice (and what this playbook does instead)

Most search results are confused about the buyer.

Half the articles are about finding outsourcing vendors (Upwork-style). You're not trying to hire help - you're trying to find companies that are about to buy help.

The other half says "look for old job posts" and calls it a day. That's how you spam companies with evergreen roles, compliance postings, or ghost jobs that were never meant to be filled.

Look, buyers get hammered. And they're tired of it.

I've lost count of how many operator threads boil down to: "Everyone says they can scale our team. Nobody explains why now." That's the opening. Your outreach wins when you can point to a real trigger and ask a simple question about it.

This playbook does three things most teams skip:

- starts with high-intent signals (not vibes)

- forces a verification step before outreach

- ends with a repeatable weekly pipeline your team can run

Hot take: if your service is under a few thousand per month, skip public RFPs at first. Procurement overhead will eat you alive. Win with job signals + leadership changes, then add RFPs once you've got a process.

What you need (quick version)

Pick three channels and run them weekly:

- RFPs / procurement portals: active buying motion with deadlines

- Job-posting signals: long-open roles, repost loops, hiring spikes in one function

- Headcount + job-change triggers: reorganizations, backfills, new leaders

Define your ICP in one sentence: "We help [industry] teams outsource [function] when [trigger] happens."

Use real outbound math: 1-2% reply rate is normal. Timing beats copy.

Never outreach on one signal. Require two.

Then pull verified contacts so you don't waste sequences on bounces. Prospeo fits naturally at that "contacts" step.

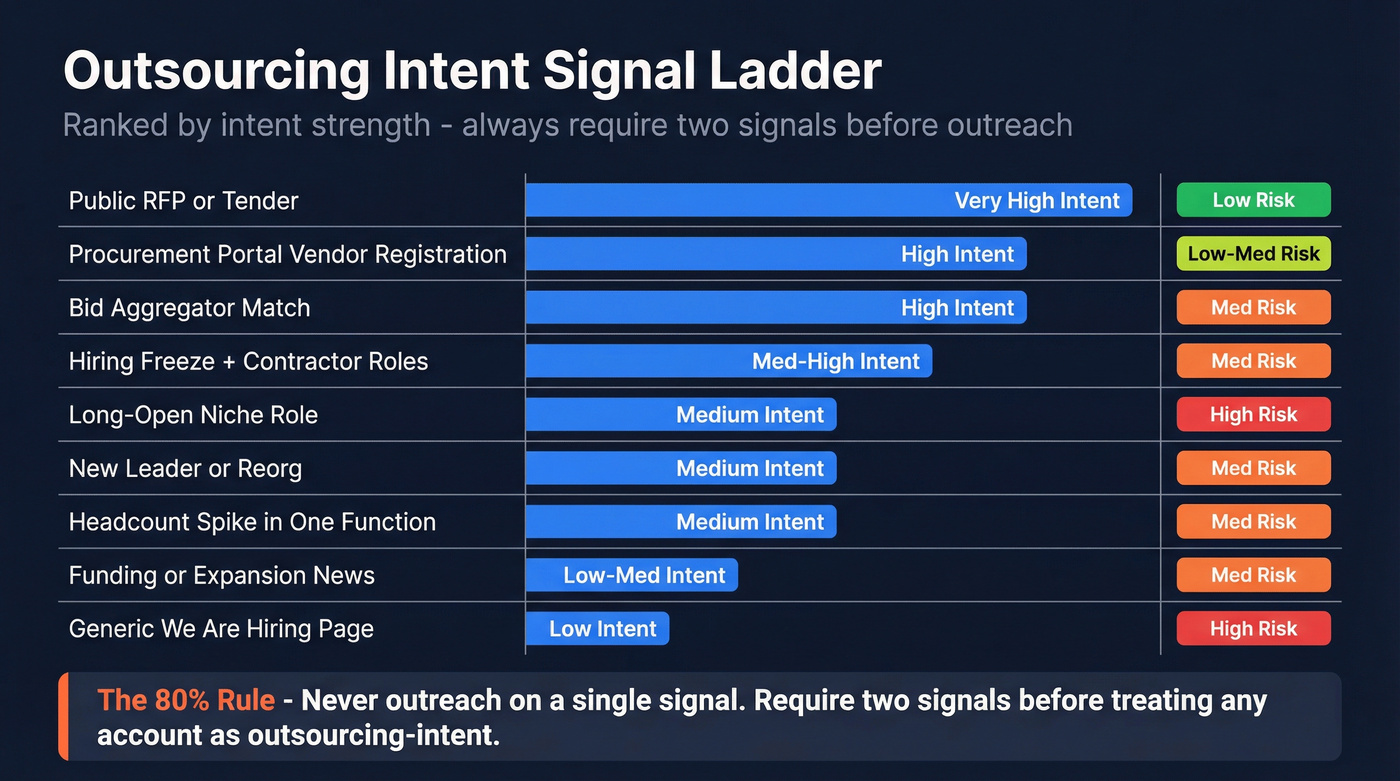

The Outsourcing Intent Signal Ladder (ranked + how to verify)

Signals aren't equal. A public RFP is a buying motion. A 120-day job post can be nothing.

Greenhouse's "2024 State of Job Hunting" report (published July 2025) found 18-22% of jobs posted on its platform were "ghost jobs" in a given quarter. That's why you rank signals and verify.

| Signal (ranked) | Intent strength | False-positive risk | How to confirm fast |

|---|---|---|---|

| Public RFP / tender | Very high | Low | Scope + dates + owner |

| Procurement portal vendor registration | High | Low-med | Category + budget hints |

| Bid aggregator match | High | Med | Cross-check the portal listing |

| Hiring freeze + contractor roles | Med-high | Med | Role mix shift |

| Long-open niche role | Medium | High | Reposts + team size |

| New leader / reorg | Medium | Med | Mandate + hires |

| Headcount spike in one function | Medium | Med | Growth + gaps |

| Funding / expansion news | Low-med | Med | Hiring + ops strain |

| Generic "we're hiring" page | Low | High | Needs other signals |

Rule that fixes 80% of targeting mistakes: require two signals before you treat an account as "outsourcing-intent."

Example: (1) role open 90+ days and (2) repost loop, or (1) new VP/Director and (2) contractor hiring in the same function.

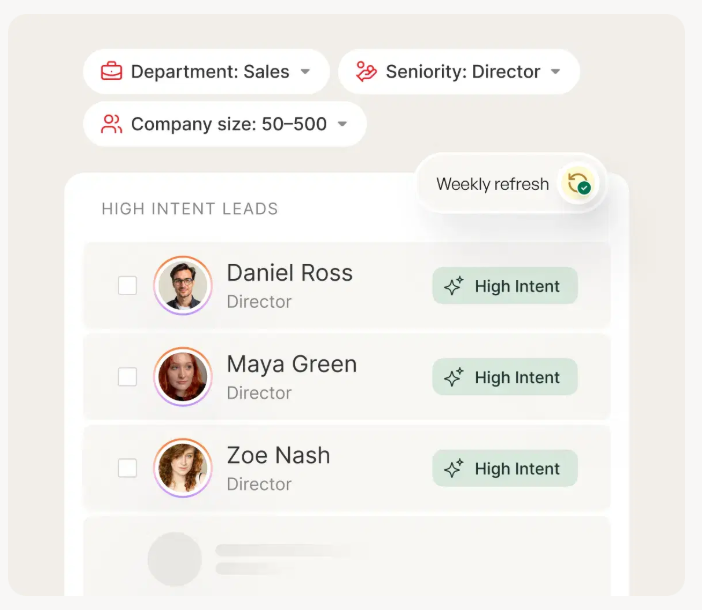

You found the outsourcing signal - a 90-day open role, a new VP, a contractor hiring spike. Now you need the right stakeholder's verified email before every other agency floods their inbox. Prospeo gives you 98% accurate emails with 30+ filters to pinpoint decision-makers at outsourcing-ready companies, refreshed every 7 days so you're never working stale data.

Signals decay fast. Reach the buyer while the pain is fresh.

How to find companies that need outsourcing with RFPs, procurement portals, and bid aggregators

Public procurement is the closest thing you'll get to "they're buying outsourcing right now."

If you're selling enterprise staff augmentation, this channel can carry your whole pipeline. If you're selling a small monthly retainer, be picky and qualify hard.

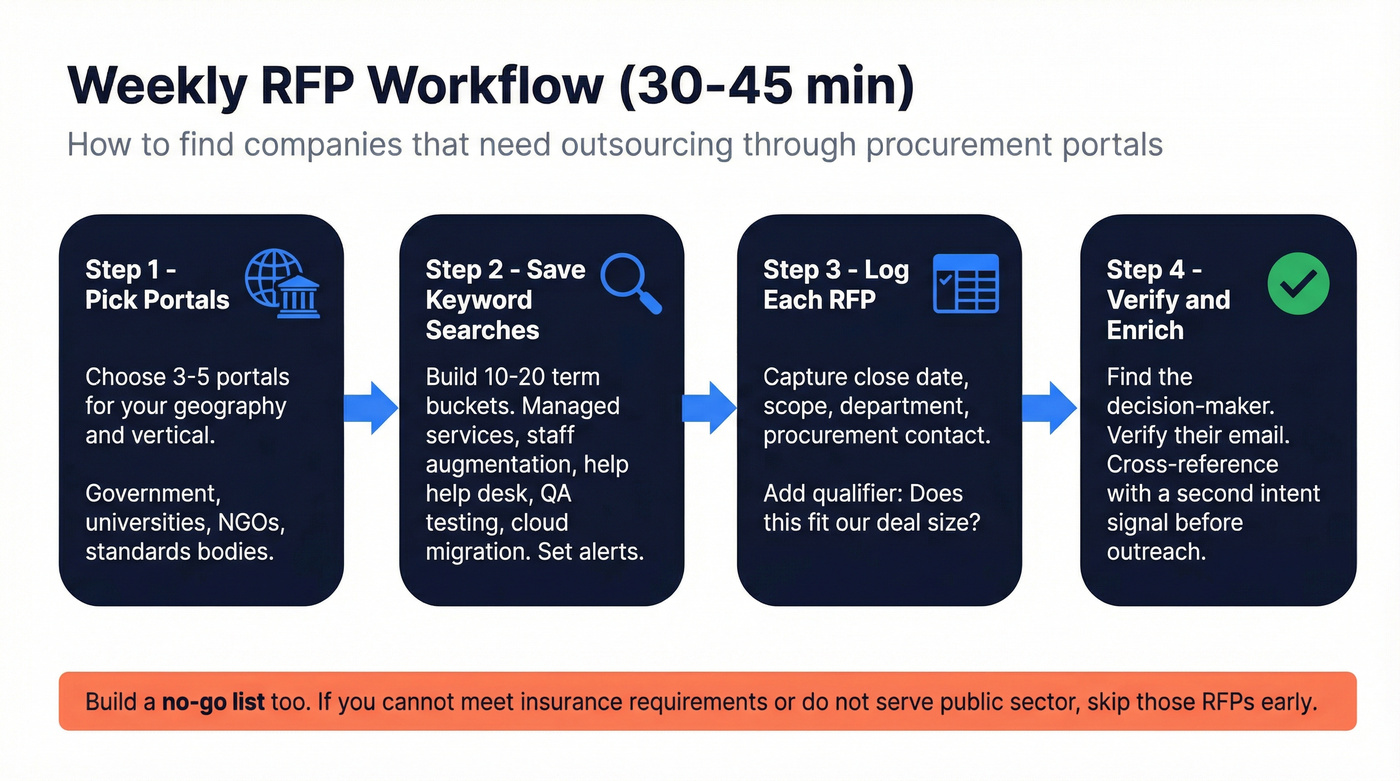

Workflow (30-45 minutes per week)

- Pick 3-5 portals relevant to your geography/vertical (government, universities, NGOs, standards bodies).

- Create keyword buckets (10-20 terms) and save searches/alerts:

- "managed services," "staff augmentation," "software development," "help desk," "call center," "data entry," "cybersecurity," "QA testing," "cloud migration"

- Log each RFP as an account with: close date, scope, department, and procurement contact.

- Add one qualifier field: "Is this a fit for our deal size?" (this stops you from chasing $500k tenders when you sell $3k/month support).

One more thing that saves time: build a "no-go" list. If you don't do public sector, don't pretend you do. If you can't meet insurance requirements, skip it. You'll thank yourself later.

Match your keywords to your outsourcing type (steal this)

- BPO / call center outsourcing: "contact center," "customer support," "back office," "claims processing"

- MSP / IT outsourcing: "managed services," "service desk," "NOC," "endpoint management"

- Dev / product outsourcing (nearshore/offshore): "software development," "application modernization," "QA," "DevOps"

- Staff augmentation: "staff augmentation," "contract resources," "temporary personnel," "surge support"

Concrete examples you can copy

ICANN RFPs: ICANN publishes open RFPs with timelines. One example window is 13 Feb 2026-13 Mar 2026, with a structured process and deadlines on the RFP listing page.

CanadaBuys: CanadaBuys' tender opportunities page supports filters (notice type like RFP/RFI, status, location, published/closing dates) and notifications. Narrow by category and set alerts so you're not browsing manually.

BidNet Direct: BidNet Direct reports 25k daily open bids, 90k agencies, 280k suppliers, and $3T in government spend. It's a firehose, so tight keyword buckets and dedupe matter.

Pricing signal: portals are usually free; aggregators often land in the $1k-$5k/year range depending on coverage.

Hard call: If you sell staff augmentation into enterprise, RFPs beat job posts. Enterprise buyers formalize vendor selection; job posts just tell you they're busy.

How to find outsourcing-ready companies using job postings (works in 2026, but you must verify)

Job posts are still a top "budget + need" signal in 2026.

They're also full of traps.

Use them as discovery, then verify.

The Indeed "aged postings" URL workflow (still works in 2026)

You can force Indeed to show older postings using URL parameters:

fromage=120&toage=90&sr=directhire

How to use it:

- Search your function keyword (DevOps, Customer Support, Data Engineer).

- Add:

fromage=120(max age)toage=90(min age)sr=directhire(filters out staffing/recruiting firms so you see direct employers)

- Capture: company, role, location (remote vs on-site), repost behavior.

Treat this as a lead generator, not proof.

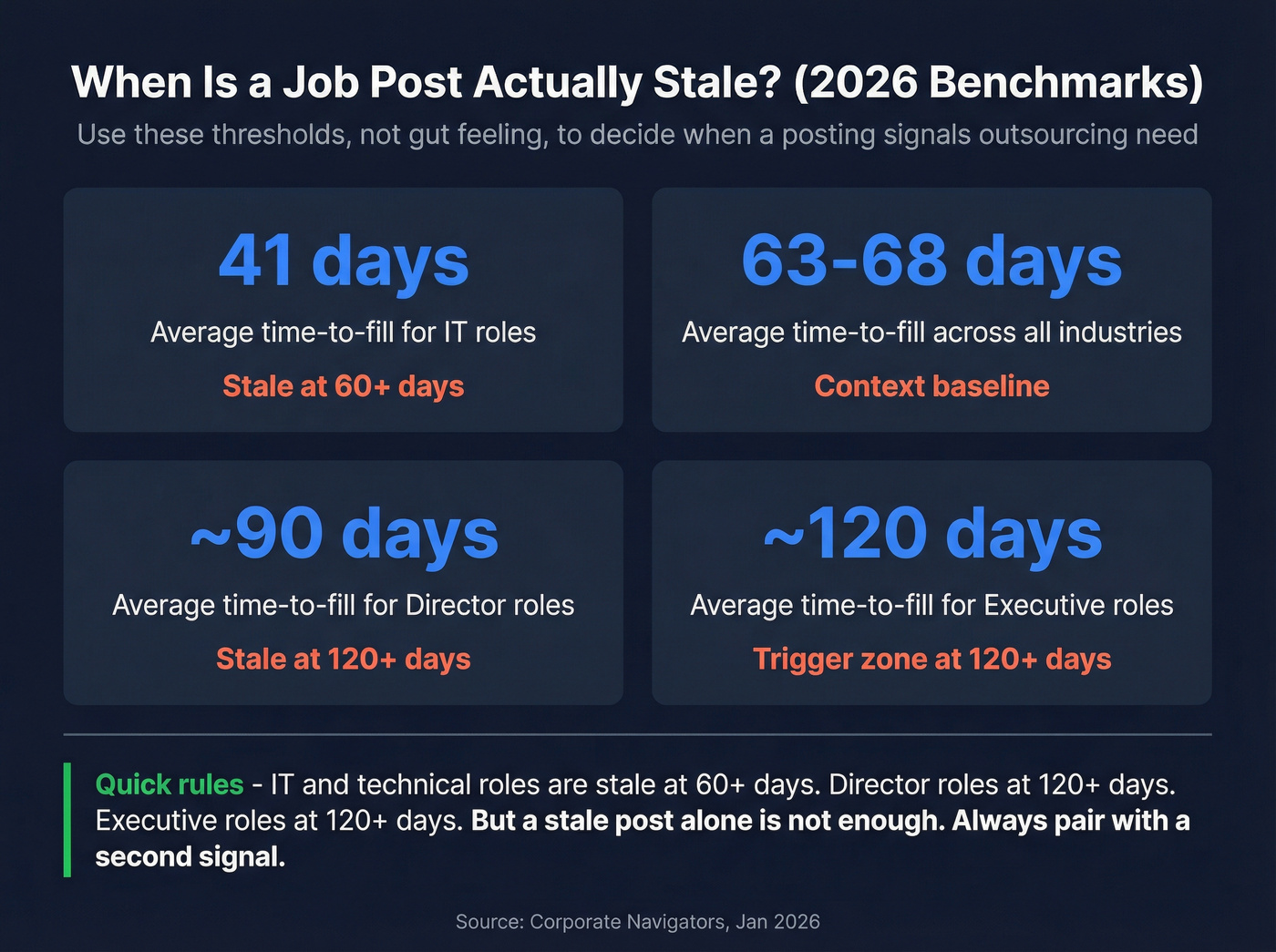

What "stale" means in 2026 (use benchmarks, not vibes)

As of Jan 2026, benchmarks from Corporate Navigators:

- Average time-to-fill across industries: 63-68 days

- Director roles: ~90 days

- Executive roles: ~120 days

- IT roles: ~41 days

Rules that keep you honest:

- IT/technical roles: 60+ days = stale, 90+ = very stale

- Director+ roles: 120+ days is where you lean in

- Exec roles: 120+ days is the real trigger

Why job posts create false positives (ghost jobs are real)

Greenhouse's "2024 State of Job Hunting" (published July 2025) doesn't just give the 18-22% ghost-job rate. It explains the mess behind it: candidates widely suspect they've hit ghost jobs, recruiters are carrying heavier workloads (up 26%), and mass-applying is common (around 38%). Translation: postings stay up longer, get reposted more, and signal less.

So don't message because it's old. Message because it's old and something else is happening.

Here's a scenario I've seen play out: a SaaS company keeps a "Senior Support Engineer" role open for 4 months, reposts it twice, and looks like a perfect outsourcing target. We reached out, got a polite "not hiring right now," and later learned it was an evergreen posting used to collect resumes. The meeting we did book that week came from a different account where the support role was stale and a new Head of Support had started two weeks earlier and was triaging backlog.

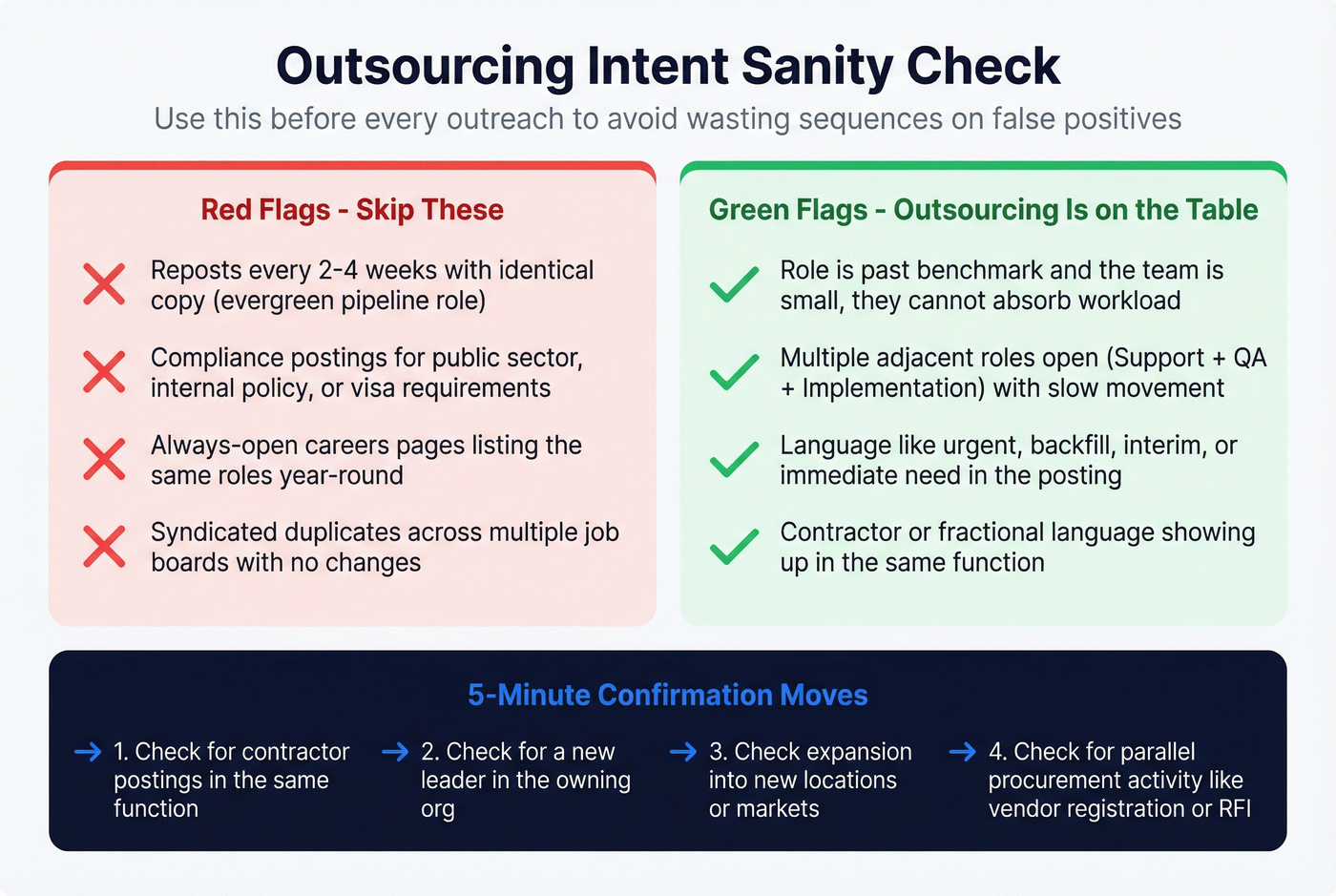

Sanity-check checklist (use before outreach)

Red flags (don't treat as outsourcing intent):

- Reposts every 2-4 weeks with identical copy (evergreen pipeline role)

- Compliance postings (public sector, internal policy, visa requirements)

- Always-open careers pages listing the same roles year-round

- Syndicated duplicates

Green flags (outsourcing is on the table):

- Role is past benchmark and the team is small (they can't absorb workload)

- Multiple adjacent roles open (Support + QA + Implementation) with slow movement

- Language like "urgent," "backfill," "interim," "immediate need"

- Contractor/fractional language showing up in the same function

5-minute confirmation moves:

- Check for contractor postings in the same function

- Check for a new leader in the owning org (new VP/Director = mandate + budget)

- Check expansion into new locations/markets (ops strain)

- Check for parallel procurement activity (vendor registration, RFI/RFP)

I've run outreach programs where "aged job posts" produced meetings - then we realized the wins came from the second signal (new leader + backfill). The age filter just surfaced the accounts.

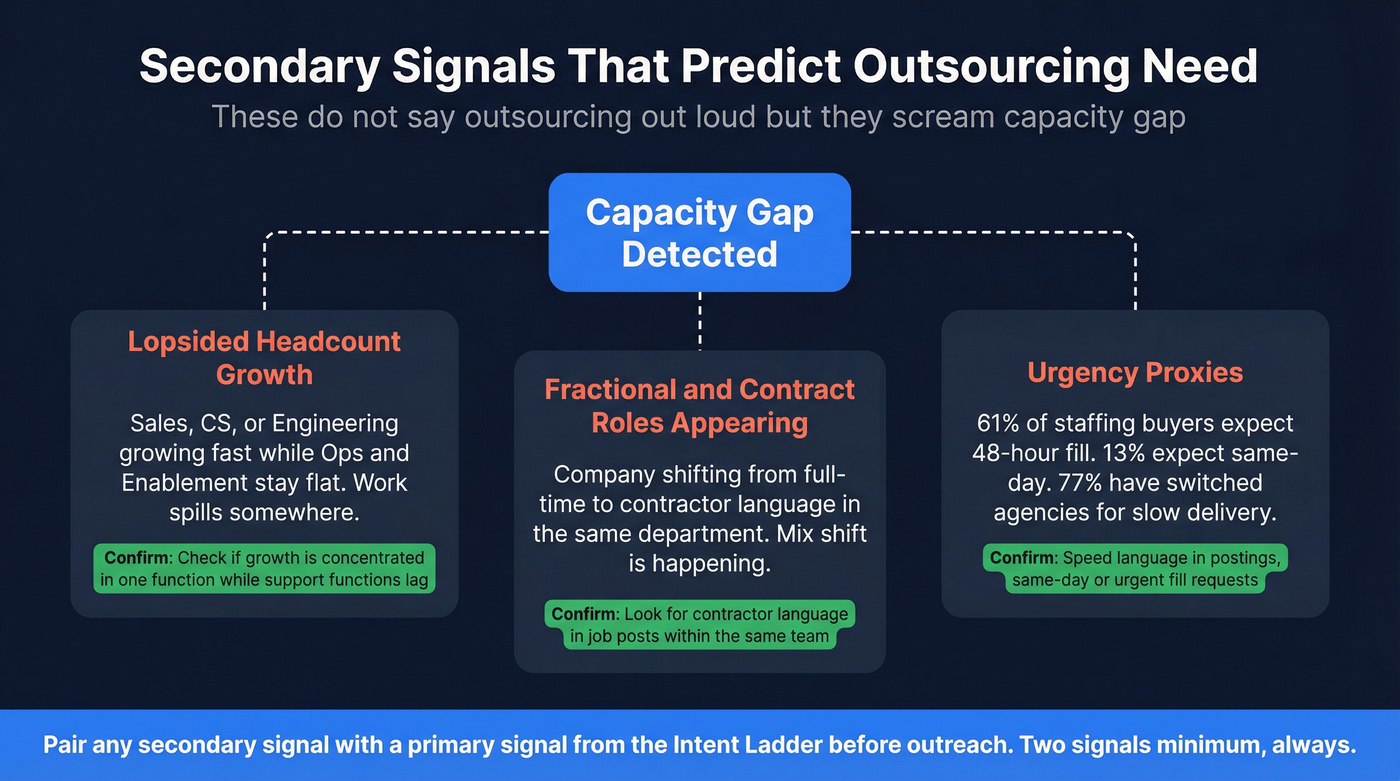

Secondary signals that predict outsourcing (without guessing)

These signals don't say "outsourcing" out loud. They still predict it because they scream capacity gap.

1) Headcount growth that's lopsided

Fast growth creates process debt. If Sales/CS/Engineering is growing and Ops/Enablement isn't, work spills somewhere.

Confirm it by checking whether growth is concentrated in one function while adjacent support functions lag behind.

2) Fractional and contract roles showing up

HireQuest's 2026 labor outlook points to more fractional and contract work. Treat that as macro context, then look for the local proof inside the company: contractor language in the same department, or a mix shift from full-time to contract.

3) Urgency proxies (staffing-like needs)

Industrial staffing buyers demand speed: 61% expect a 48-hour fill, 13% expect same-day, and 77% have switched agencies due to performance gaps.

Confirm it with language like "start immediately," "rapid ramp," "coverage needed," plus evidence of churn (repeat postings, new vendor onboarding).

Opinion: secondary signals are where most teams win, because competitors chase the obvious (RFPs and job boards) and ignore the operational tells.

Systemize it: build a weekly "outsourcing-intent" pipeline (alerts → dedupe → CRM)

Manual browsing doesn't scale. Alerts + dedupe + clean CRM handoff does.

TheirStack monitors job postings automatically. It tracks job listings across 312k sources, 195 countries, and 166M active listings.

Weekly architecture (simple, works)

- Define 3-6 saved searches (role keywords + geo + industry if possible).

- Turn on webhook alerts (not email).

- Route the webhook to:

- Slack channel

- Zapier / Make / n8n

- CRM (create account + tag "outsourcing-intent")

- Enable trigger once per company.

- Dedupe by company domain before creating anything in CRM.

- Require a field: Signal type (RFP, stale role, hiring spike, job change).

Data flow:

TheirStack search → Webhook → (Slack + Automation) → Dedupe → CRM account + task

Pricing signal:

- TheirStack's free plan includes 50 company credits + 200 API credits/month (with limits).

- Paid plans typically land around $49-$199+/mo depending on volume.

I've seen teams "implement intent signals" and still fail because they skipped dedupe. One week later, Salesforce is full of duplicates and nobody trusts the system.

Dedupe isn't busywork. It's adoption.

Turn signals into stakeholders + verified contact data (so you can actually reach them)

A company signal isn't a lead. You still need the humans who can say yes.

Stakeholder map (who to contact first)

- Economic buyer: owns budget (VP Ops, VP Engineering, Head of Customer Support, COO)

- Functional owner: feels the pain (Engineering Manager, Support Manager, IT Director)

- Procurement/finance: controls process (Procurement Manager, Vendor Management, Finance BP)

Who to contact first:

- RFP/procurement-led: procurement + functional owner

- Job-posting-led: functional owner first, then budget owner

Stakeholder discovery (practicals)

Free search tools cap out fast. Sales Navigator is usually $80-$150/user/month, and it earns its keep when you're building lists weekly.

Use it like an operator:

- Start from your account list.

- Layer Spotlights (job change, posted recently, engaged signals).

- Prioritize people who changed roles in the last 90 days; they're still fixing problems and they're more open to outside help.

A commonly repeated benchmark in Sales Navigator write-ups is that Spotlight prospects drive higher InMail reply rates (one figure you'll see a lot is 64% higher). Even if you ignore the exact number, the direction is right: change creates urgency.

Prospeo for verified contacts (the part that keeps your deliverability intact)

Once you've got your weekly company list and stakeholder titles, you need verified emails and mobiles fast so you don't burn deliverability on bounces.

Prospeo ("The B2B data platform built for accuracy") is built for this execution step: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy, with records refreshed every 7 days. That freshness matters because signals decay quickly, org charts change constantly, and stale data turns good targeting into wasted sends.

Use Prospeo to pull the economic buyer + functional owner + procurement contacts for each account, then export or enrich into your CRM so your reps aren't copy-pasting and guessing.

Outreach reality check (and how to not sound like everyone else)

Outreach works in 2026, but it's less forgiving than it was last year. One scaled operator baseline matches what we've seen in the field: 100 mailboxes, 10k leads/month, 30k emails/month, and 1-2% reply rate.

What "good" looks like in that world:

- 15-20% positive reply rate (positive = real conversation, not "remove me") is a strong program.

- At that scale, one sale every ~3 months is a realistic outcome if your offer and targeting are average. Better targeting is how you beat average.

The triggers that consistently outperform generic personalization:

- Backfill (someone left; they need coverage now)

- Job change (new leader cleaning up messes)

- New hires in adjacent roles (workload expanding faster than capacity)

Don't "solve" this by building bigger lists. That's how you torch deliverability and morale.

Build a weekly signal feed of 50-200 companies and anchor every message to the trigger.

Do / don't (the stuff that moves reply rates)

Do

- Lead with the trigger in line one.

- Ask a binary question.

- Offer a low-friction next step (two times, or "who owns this?").

Don't

- Pitch your whole company in paragraph one.

- Attach a case study PDF nobody asked for.

- Fake personalization ("noticed you're scaling") without evidence.

Two short templates tied to real triggers

Template 1: stale role (90+ days)

Subject: Quick question on the [Role] hire

Hi [Name] - I saw you've had a [Role] open past the normal fill window. Teams usually cover that gap with a short-term partner while they keep hiring. Are you trying to fill it fully in-house, or open to outsourcing part of the workload for the next 60-90 days?

Template 2: RFP / procurement trigger

Subject: Re: [RFP name] timeline

Hi [Name] - I saw the [RFP name] window runs through [date]. We support teams with [service] in a procurement-friendly way (clear scope, SLAs, ramp plan). Who's the functional owner for this project so I can confirm fit before we submit?

I've watched teams double reply rates by deleting fluff and anchoring every message to a verifiable trigger. Not prettier writing. Better relevance.

Tooling & cost snapshot (so you can run this without guessing)

You don't need a giant stack. You need one monitoring layer, one stakeholder layer, and one contact-data layer.

| Tool | What it's for | Pricing signal | Best for |

|---|---|---|---|

| TheirStack | Job alerts + webhooks | Free; paid ~$49-$199+/mo | Weekly signals |

| Sales Navigator | Stakeholders | ~$80-$150/user/mo | Org mapping |

| BidNet Direct | Bid aggregation | Paid sub (~$1k-$5k/yr) | RFP scale |

| Prospeo | Verified contacts | Free tier available; ~$0.01/email | Verified emails + mobiles |

Skip this if you're a solo founder doing five cold emails a day: you don't need webhooks and automations yet. Pick one signal (stale roles + job changes), build a tight list of 50 accounts, and get your first 10 conversations the manual way.

Your two-signal qualification is worthless if emails bounce. At 1-2% reply rates, every wasted send kills your pipeline math. Prospeo's 5-step verification and proprietary email infrastructure keep bounce rates under 2% - Stack Optimize built a $1M agency on that deliverability. At $0.01 per email, you can enrich every qualified account weekly without flinching.

Stop burning sequences on dead addresses. Verify before you send.

FAQ

What's the fastest way to find companies that need outsourcing right now?

Public RFPs plus job-posting alerts is the fastest combo because it shows both active buying timelines and real capacity gaps. Aim for 50-200 companies per week, then require a second confirmation signal (reposts, job changes, contractor hiring) before outreach.

Are old job postings a reliable sign a company will outsource?

Old postings are a solid lead source, but they're not proof because 18-22% of jobs on Greenhouse in a given quarter were "ghost jobs" (Greenhouse "2024 State of Job Hunting," published July 2025). Treat age as a filter, then validate with repost patterns, adjacent hiring, contractor language, or a new leader/backfill trigger.

What counts as a "long-open" role in 2026?

A practical benchmark is 60+ days for many IT roles and 120+ days for Director+ and executive roles. Corporate Navigators (Jan 2026) cites 63-68 days average time-to-fill overall, ~90 days for Director roles, ~120 days for executive roles, and ~41 days for many IT roles.

How do I get verified decision-maker emails from my target company list?

Use an enrichment tool that verifies emails and mobiles, then pull the economic buyer + functional owner + procurement contacts for each account. Prospeo is built for this step with 98% email accuracy and a 7-day refresh cycle, so you waste fewer sequences on bounces and stale org charts.

Summary: a repeatable way to find buyers (not "interested companies")

If you want a reliable answer to how to find companies that need outsourcing, stop guessing and run a weekly signal system: start with RFPs and monitored job postings, require two signals before you treat an account as real intent, then move fast with verified stakeholder contact data.

Do that consistently and you'll have a predictable 50-200 account pipeline every week.

Key references: ICANN RFP listings, TheirStack documentation (monitoring + plan limits), Greenhouse "2024 State of Job Hunting" report (published July 2025), and the Indeed aged-posting URL parameter pattern.