Salesforce vs ZoomInfo: Different Tools, Wrong Comparison - Here's What Actually Matters in 2026

Your ZoomInfo renewal just landed. It's 20% higher than last year. Your CFO is asking why you're paying $25,000 for a data tool when you already spend $175/user/month on Salesforce - which now has its own AI that supposedly does prospecting, enrichment, and outreach. You're searching "Salesforce vs ZoomInfo" not because you think they're the same thing, but because you're wondering if you still need both.

Here's the short answer: Salesforce is a CRM. ZoomInfo is a data provider. They aren't competitors - most teams use them together. The real question is whether ZoomInfo's $15K+ annual price tag is justified to feed your Salesforce instance, or whether a lighter, more accurate alternative does the job for a fraction of the cost.

30-Second Verdict

If you need full-stack sales intelligence with intent data and the budget allows: ZoomInfo Advanced or Elite. You're paying for the ecosystem, not just contacts. (If you’re evaluating data vendors broadly, start with this roundup of B2B data providers.)

If you want the best free-to-paid ramp for prospecting data: Apollo.io - generous free tier, $49-119/user/month, 275M+ contacts. (See a deeper breakdown of Apollo.io accuracy before you commit.)

Skip both if: You're under 2 users and just need basic CRM. Salesforce Free Suite, 2 users max handles that without any data provider.

What Each Tool Actually Does

The confusion exists because both touch sales workflows - but they solve fundamentally different problems. G2 categorizes them in entirely different software categories, which tells you everything.

Salesforce Sales Cloud (Now Agentforce Sales)

Salesforce recently rebranded Sales Cloud to Agentforce Sales, part of a broader push to make AI the foundation of every product rather than an add-on. At its core, it's still your system of record. Deals live here. Pipelines get managed here. Forecasts get built here. (If you’re tightening process, use this B2B sales pipeline management guide as a baseline.)

With 150,000+ customers worldwide and 5,000+ apps on AppExchange, Salesforce is the gravitational center of most B2B tech stacks. Pricing runs from $0 (Free Suite, 2 users max) to $550/user/month for the full Agentforce 1 Sales package. The mid-market sweet spot is Enterprise at $175/user/month.

Salesforce doesn't natively tell you who to sell to. It manages the people you've already found.

ZoomInfo Sales

ZoomInfo is the opposite. It's a B2B intelligence platform that tells you who to call, what they care about, and when they're in-market. The database covers 321M+ contacts across 100M+ companies, with 174M emails and 70M phone numbers. It serves 35,000+ customers and holds a 4.5/5 on G2 across nearly 9,000 reviews.

Pricing starts at $14,995/year for Professional. Real-world contracts run much higher - Vendr data shows mid-market companies paying $24,800-$44,200/year. (For a dedicated cost/credit breakdown, see our ZoomInfo pricing analysis.)

ZoomInfo doesn't manage your pipeline. It fills it.

| Salesforce | ZoomInfo | |

|---|---|---|

| Category | CRM | B2B Data Platform |

| Core function | Manage deals & pipeline | Find & enrich contacts |

| Database | Your data | 321M+ contacts |

| G2 rating | 4.4/5 (25,418 reviews) | 4.5/5 (8,997 reviews) |

| Starting price | $0-$550/user/mo | $14,995/yr |

| Best for | Pipeline management | Prospect discovery |

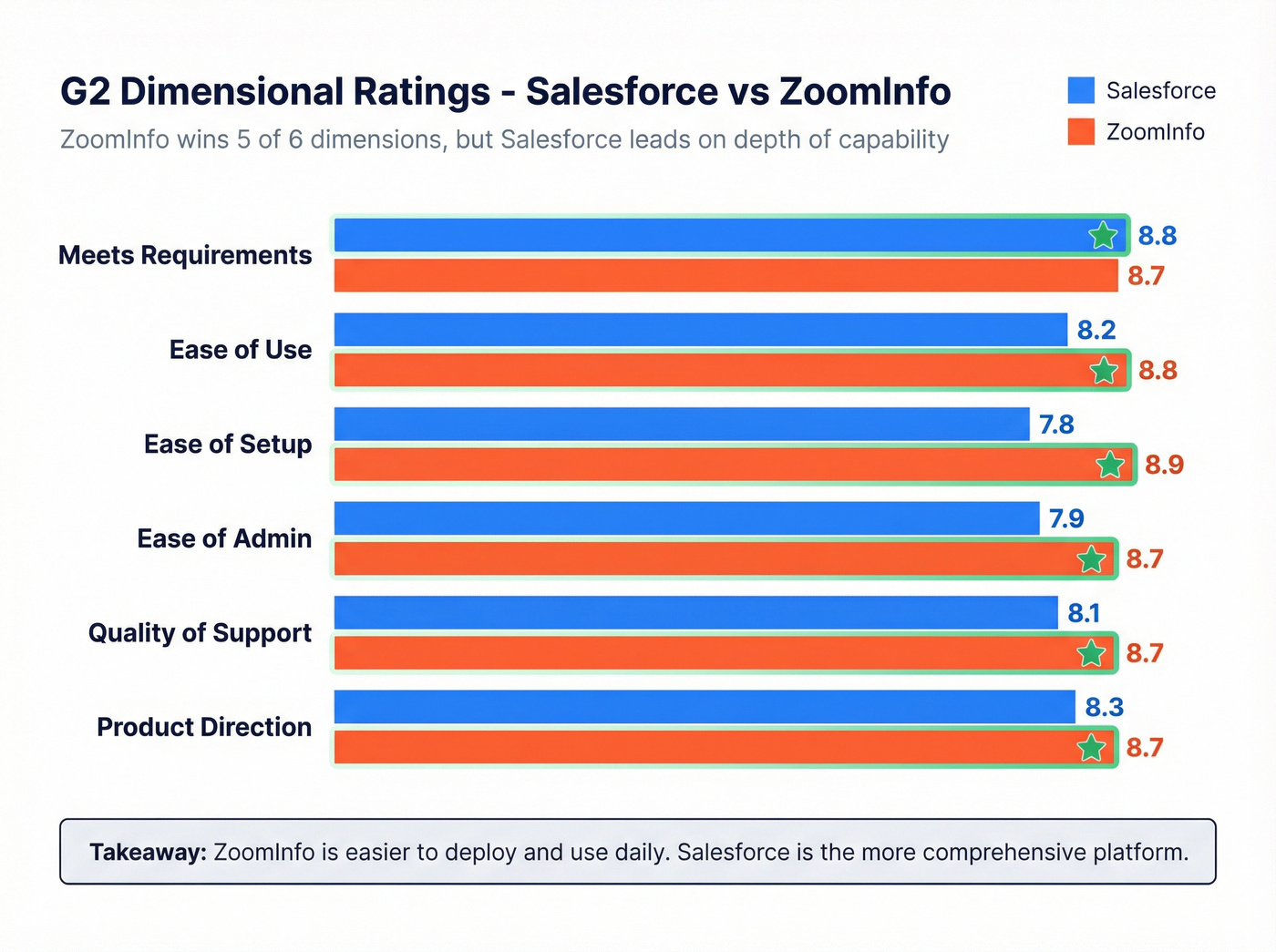

G2 Dimensional Ratings: The Nuance Behind the Stars

The headline G2 scores are close, but the dimensional breakdown tells a sharper story:

| Dimension | Salesforce | ZoomInfo |

|---|---|---|

| Meets Requirements | 8.8 | 8.7 |

| Ease of Use | 8.2 | 8.8 |

| Ease of Setup | 7.8 | 8.9 |

| Ease of Admin | 7.9 | 8.7 |

| Quality of Support | 8.1 | 8.7 |

| Product Direction | 8.3 | 8.7 |

ZoomInfo beats Salesforce on every dimension except "Meets Requirements." Translation: ZoomInfo is easier to deploy and use day-to-day, but Salesforce is the more comprehensive platform. This tracks - Salesforce's learning curve is legendary (1,783 G2 mentions), while ZoomInfo's pain points center on data quality, not UX.

ZoomInfo charges $15K+/year to fill your Salesforce pipeline - and G2 reviewers still flag data accuracy as the #1 complaint. Prospeo delivers 98% verified emails on a 7-day refresh cycle for ~$0.01/lead. Native Salesforce integration, zero annual contracts.

Feed your Salesforce instance cleaner data at 90% less cost.

How ZoomInfo and Salesforce Work Together (And Where It Breaks)

Integration Mechanics

The ZoomInfo-Salesforce integration is straightforward on paper. You connect accounts in ZoomInfo's integration settings, select which objects to sync (Contacts, Accounts, Leads), set auto-sync frequency, and map ZoomInfo fields to Salesforce fields. Reps can one-click export ZoomInfo records directly into Salesforce, see ZoomInfo data on contact and account records, and run bulk exports. Updates sync in real time.

The majority of ZoomInfo's 35,000+ customers integrate with Salesforce as their primary CRM. On the surface, it works well.

Where the Integration Fails

Here's the thing: the integration is only as good as your governance. And most teams don't have governance.

I've seen this pattern play out repeatedly - a team connects ZoomInfo to Salesforce, bulk imports 10,000 contacts, and within a week their CRM is a mess. Duplicates everywhere. Fields overwritten. Industry codes that make no sense. One Salesforce admin on Reddit described ZoomInfo's SIC and NAICS codes as "wildly off" - an automotive manufacturer tagged as Metals because metal is used in their manufacturing process. That's not an edge case. When you merge ZoomInfo exports with existing HubSpot or NetSuite data inside Salesforce, dirty data compounds fast. (If you want an ops-safe playbook, start with how to keep CRM data clean.)

The numbers back this up. Across G2, roughly 982 negative mentions about ZoomInfo reference data accuracy or freshness. The top five cons are all variations of the same complaint: inaccurate data, outdated data, outdated contacts, data inaccuracy, outdated information. Same problem, five different hats. (Related: B2B contact data decay is why this keeps happening even after “cleanup.”)

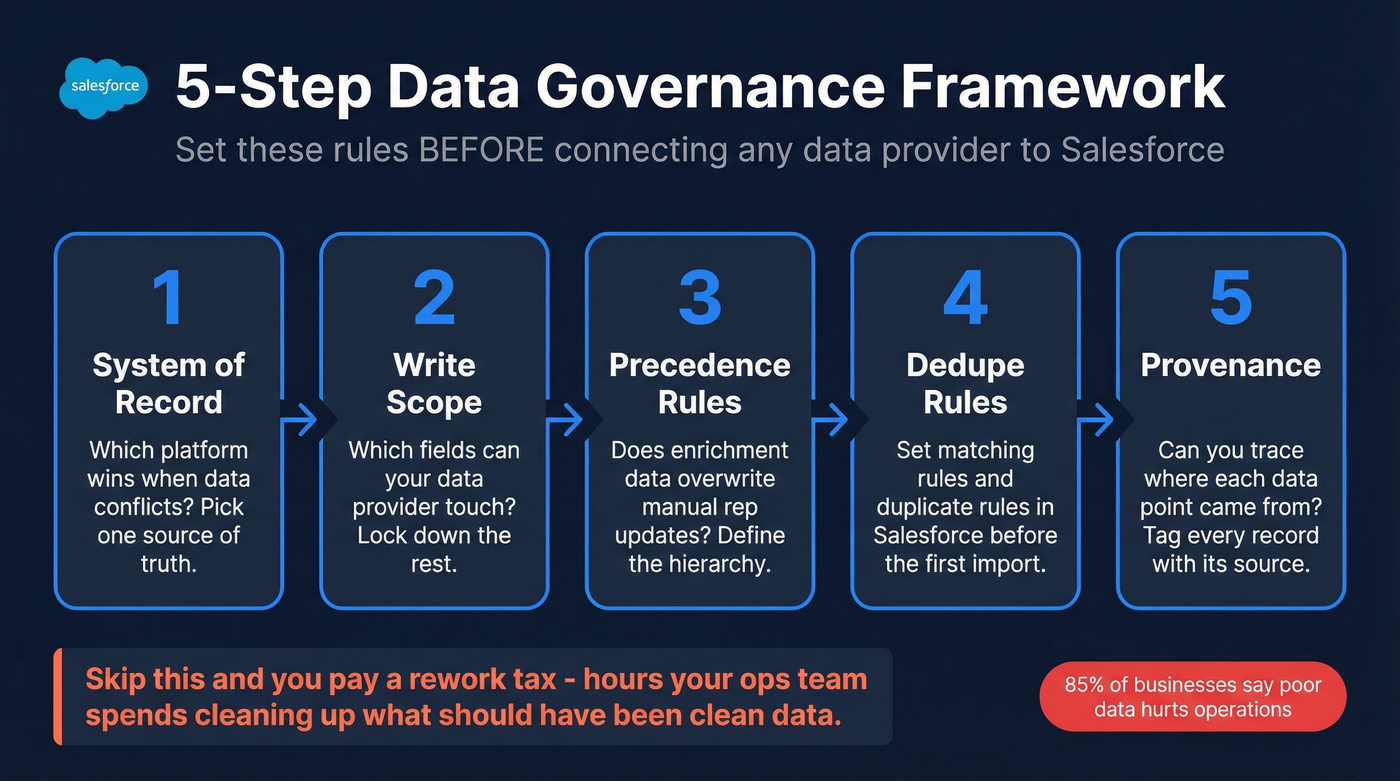

85% of businesses say poor-quality customer data harms operational efficiency. Before you connect any data provider to Salesforce, you need a five-step governance framework:

- System of record - which platform wins when data conflicts?

- Write scope - which fields can ZoomInfo touch?

- Precedence rules - does ZoomInfo overwrite manual rep updates?

- Dedupe rules - matching rules + duplicate rules in Salesforce

- Provenance - can you trace where each data point originated?

Salesforce's native tools - Data Import Wizard, Data Loader, and Matching/Duplicate Rules - handle most of this, but you have to configure them before the first import.

Skip this, and you're paying a "rework tax" - the hours your ops team spends cleaning up what should've been clean data in the first place. (More on building scorecards in our data quality guide.)

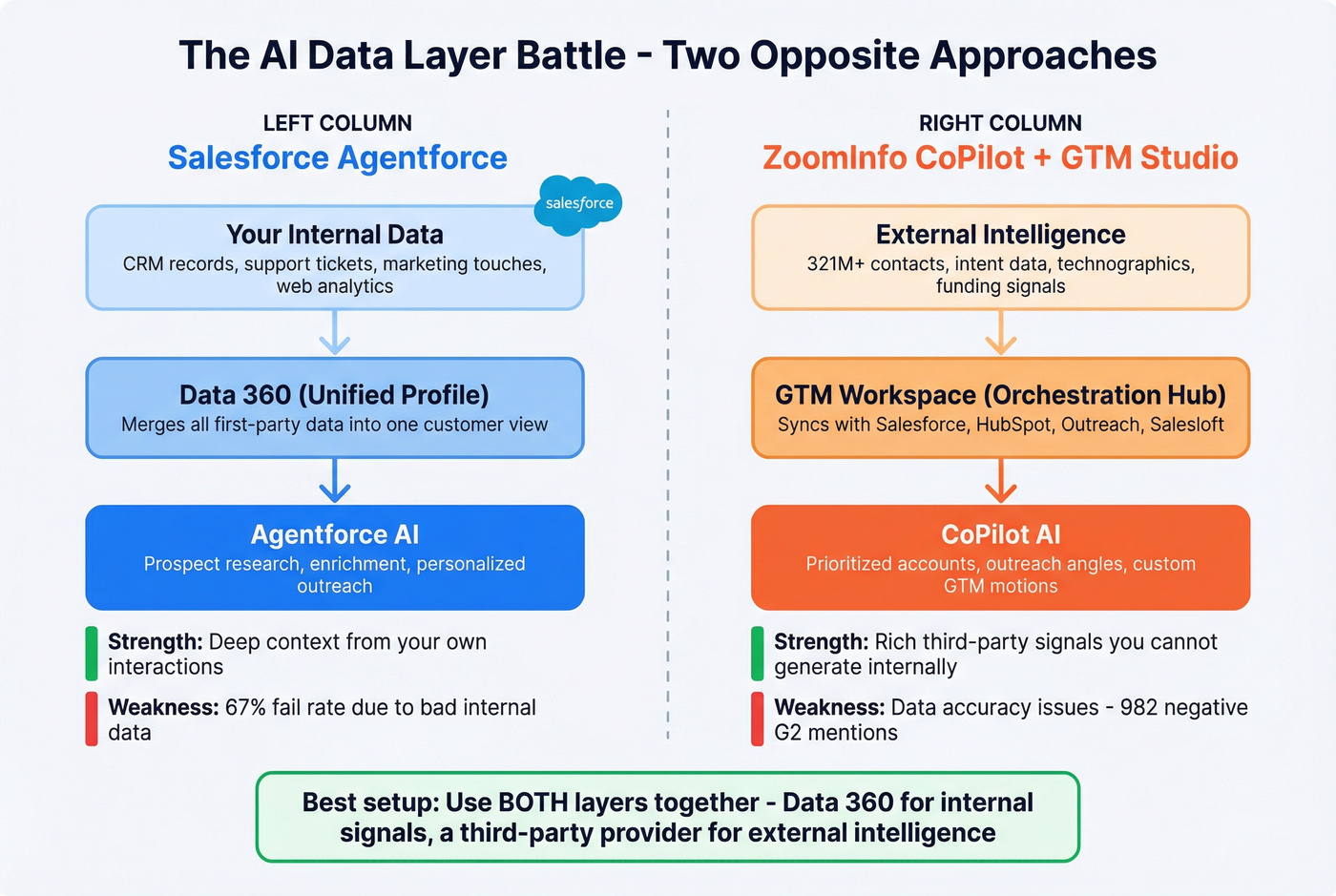

The 2026 Plot Twist: Salesforce Is Coming for ZoomInfo's Territory

This is where the comparison gets genuinely interesting.

Salesforce isn't content being just a CRM anymore. Agentforce is a direct play into ZoomInfo's core value proposition: telling reps who to sell to and what to say.

What Agentforce Actually Does Now

Agentforce autonomously researches prospects, enriches contact records, and generates personalized outreach - all inside Salesforce. It pulls data from your CRM, call recordings, the web, and third-party sources to build always-current account intelligence.

Salesforce claims 33% faster meeting prep and a 10% increase in win rates - vendor benchmarks, not independent data. But the capability is real: Agentforce ranks prospects using intent signals from enrichment data, surfaces company overviews and competitive insights with a single click, and drafts brand-aligned outreach at scale. It operates in two modes - Suggestive (recommends actions for human approval) and Autonomous (executes independently). It's available in Slack, ChatGPT, and mobile. (If you’re building guardrails, see AI SDR Co Pilot Mode for practical workflows.)

The Data 360 layer matters here. Data 360 (formerly Data Cloud) unifies all your first-party data - CRM records, marketing interactions, support tickets, web analytics - into a single customer profile. Agentforce sits on top of Data 360, which means its AI draws from every touchpoint your company has ever had with a prospect. ZoomInfo provides third-party intelligence - who's hiring, who's buying what technology. The strongest setups use both: Data 360 for internal signal unification, a third-party data layer for external intelligence.

No SERP competitor is talking about this distinction, but it's the architectural reality.

ZoomInfo's AI Counter-Move

ZoomInfo isn't standing still. CoPilot surfaces prioritized account feeds based on technographic fit, recent funding rounds, and job changes - and suggests outreach angles based on recent company news so reps aren't sending generic openers. GTM Studio lets you build custom go-to-market motions that orchestrate data, signals, and engagement across your stack. The broader GTM Workspace syncs natively with Salesforce, HubSpot, Microsoft Dynamics, Outreach, and Salesloft, making it a genuine orchestration hub rather than just a database.

The key distinction: ZoomInfo's AI is data-first. It starts with external intelligence and pushes that into your CRM. Salesforce's AI is CRM-first. It starts with your internal data and tries to make it smarter.

Both approaches have merit. The question is which data layer you trust more.

The Catch: 67% of Agentforce Implementations Fail

Here's the stat that reframes everything: 67% of Agentforce implementations fail because the underlying CRM data quality is insufficient.

Read that again.

Salesforce built an AI that can autonomously prospect, enrich, and qualify - and two-thirds of the time, it doesn't work because the data feeding it is garbage. This is the fundamental tension. Salesforce's AI is only as good as what's inside Salesforce. And what's inside Salesforce is whatever your reps entered manually, whatever your marketing automation synced over, and whatever your last data provider dumped in.

You still need a third-party data layer. The question is whether that layer needs to be ZoomInfo's full $15K+ stack - or something leaner and more accurate. (If you’re comparing options, start with these lead enrichment tools.)

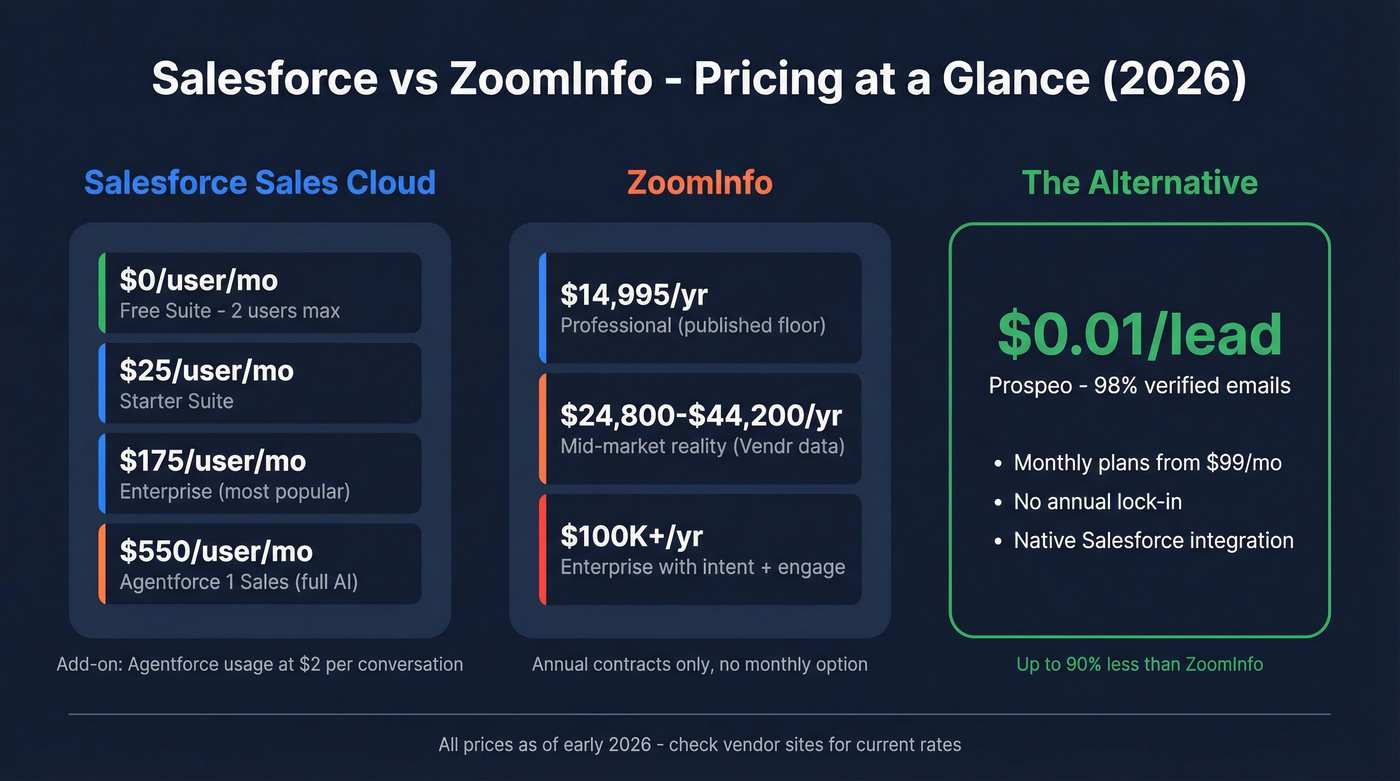

Salesforce vs ZoomInfo: Full Pricing Breakdown for 2026

Salesforce Pricing

Salesforce's pricing looks simple until you add AI. The base tiers are well-published:

| Tier | Monthly/User | Key Features |

|---|---|---|

| Free Suite | $0 (2 users max) | Leads, contacts, deals |

| Starter Suite | $25 | Sales flows, AI email sync |

| Pro Suite | $100 | Automation, forecasting |

| Enterprise | $175 | Pipeline mgmt, Agentforce |

| Unlimited | $350 | Predictive AI, engagement |

| Agentforce 1 Sales | $550 | Full AI + unified data |

The real cost of AI: Enterprise ($175) plus Einstein capabilities (~$50 add-on) gets you to $225/user/month minimum. If you want the full Agentforce autonomous stack, you're looking at $500-650/user/month. That's $6,000-$7,800/user/year before you've bought a single contact record.

ZoomInfo Pricing

ZoomInfo's published tiers:

| Tier | Annual Cost | Credits | Add'l Users |

|---|---|---|---|

| Professional | $14,995/yr | 5,000 bulk | $1,500/user |

| Advanced | $24,995/yr | 10,000 bulk + 1K/mo | $2,500/user |

| Elite | $39,995/yr | 10,000 bulk + 1K/mo | $2,500/user |

Published pricing and real-world pricing are different animals. Vendr procurement data tells the real story: a 200-person company pays $24,800-$44,200/year. A 1,000+ employee company? Anywhere from $50,200 to $161,900/year depending on headcount and add-ons.

Then there are the add-ons nobody tells you about upfront. Intent data runs $9,000-$40,000 depending on tier and topic count. Enrich is $15,000 including 25K credits. Engage is $15,000 and only available on Elite. Worldwide Data adds $9,995.

ZoomInfo also offers ZoomInfo Lite - a separate product with a free plan and paid tiers from $130-$750/month. It's stripped-down, without the Salesforce integration or intent data that makes the enterprise product valuable. Worth knowing about, but it's a different product entirely.

All enterprise contracts are annual. Auto-renewal with a 60-day cancellation notice. Miss that window and you're locked in for another year.

What You're Actually Paying (Scenario Math)

5-person team:

- Salesforce Enterprise: 5 x $175 x 12 = $10,500/year

- ZoomInfo Professional: $14,995/year

- Combined: ~$25,500/year - and that's before any ZoomInfo add-ons

20-person team:

- Salesforce Enterprise: 20 x $175 x 12 = $42,000/year

- ZoomInfo Advanced + 15 additional users: $24,995 + (15 x $2,500) = $62,495/year

- Combined: ~$104,500/year

Now contrast that with a lighter stack. Salesforce Enterprise ($10,500 for 5 users) plus a verified enrichment tool at ~$0.01/lead - even 50,000 enriched contacts would run roughly $500. That's $11,000/year vs. $25,500. The math isn't subtle.

ZoomInfo's cost per credit on Professional works out to about $3.00 per contact ($14,995 / 5,000 credits). The best self-serve alternatives run ~$0.01/lead. That's a 300x difference in unit economics.

Hot take: If your average deal size sits below $10K, you almost certainly don't need ZoomInfo-level data spend. The ROI math just doesn't work when your data budget rivals your contract value. A lighter enrichment layer paired with Agentforce will outperform a bloated ZoomInfo contract that your reps only use for basic email lookups.

What Users Actually Say

ZoomInfo: Great UX, Inconsistent Data

The #1 complaint about ZoomInfo isn't pricing - it's data quality. Across G2's 8,997 reviews, approximately 982 negative mentions reference inaccurate or outdated data. The top five cons are literally all variations of the same issue. (If you’re pressure-testing the claims, see: is ZoomInfo accurate.)

On Reddit, the complaints get more specific. One user reported an 80% email bounce rate: "I have stupidly signed a long contract with ZoomInfo which has resulted in thousands wasted due to ridiculously poor quality data." Another described paying "$15K+ annually for features most people don't even need."

The contract terms make it worse. To prove breach, you must demonstrate that 5% of ZoomInfo's entire database is poor quality - not just your specific contacts. Good luck with that. There's an active class action lawsuit, which tells you something about how widespread the frustration is.

Look - ZoomInfo's database is massive, and when the data is fresh, it's genuinely useful. The 421 positive G2 mentions about contact information quality aren't fake. ZoomInfo's ease of use (397 positive mentions) and CRM integration capabilities (328 mentions) are real strengths. The frustration isn't with the product's UX. It's with the data underneath. The gap between "best contacts in the database" and "average contact you actually pull" is wider than the marketing suggests.

Salesforce: Powerful but Punishing to Learn

Salesforce's biggest weakness isn't data - it's complexity.

G2 reviewers mention learning curve 1,783 times. That's not a minor gripe; it's the defining characteristic of the product. TechRadar's assessment captures it well: "powerful and versatile CRM... ideal for medium to large enterprises." The flip side is that implementation timelines consistently run longer than expected, support wait times frustrate standard-tier users, and cost escalation with AI features catches teams off guard.

The Agentforce rebrand has added another layer of confusion. Teams that bought Salesforce for CRM are now being upsold on AI capabilities that cost $500+/user/month - and 67% of those implementations fail anyway. We've seen mid-market teams cut their data spend by 80% without losing pipeline velocity simply by switching from ZoomInfo to a lighter enrichment layer and investing the savings into better Salesforce configuration.

Do You Actually Need ZoomInfo for Salesforce?

This is the question that matters. It depends on three things: your team size, your budget, and what you actually need from a data provider.

Yes - You Need ZoomInfo If...

ZoomInfo makes sense if you're an enterprise team (500+ employees) running complex ABM with technographic targeting and intent signals. If you need the full GTM platform - Engage for sequencing, Chorus for conversation intelligence, intent data for prioritization - and you have $25K+/year in budget for data alone, ZoomInfo's ecosystem is hard to replicate with point solutions. (If you’re building ABM motion design, use this ABM campaign planning template.)

Where ZoomInfo still wins over everything else: US database depth, direct dial coverage for director+ roles, and the sheer breadth of buying signals. If your ICP is mid-market to enterprise US companies and you're running multi-threaded ABM plays, ZoomInfo earns its price tag.

Skip the Professional tier, though. The 5,000 annual credit limit is restrictive for any team doing real volume. Advanced or Elite is where the value lives.

Agentforce + a Data Layer Is Probably Enough

If you're a mid-market team already on Salesforce Enterprise or Unlimited, you've got Agentforce baked in. It can prospect, enrich, and qualify autonomously. The 67% failure stat exists because most teams feed Agentforce dirty CRM data - not because the AI itself is broken.

The fix isn't a $25K ZoomInfo contract. It's a clean, accurate third-party data layer that keeps your CRM fresh.

Prospeo plugs directly into Salesforce and delivers 98% email accuracy at ~$0.01/lead. The 7-day data refresh cycle means your CRM doesn't decay between quarterly "data cleansing" projects - it stays current automatically. Pair that verified data with Agentforce's AI, and you get the prospecting intelligence without the $15K+ ZoomInfo contract.

No - A Self-Serve Alternative Is Better

If you're an SMB, agency, or solo consultant, ZoomInfo's pricing structure is designed to exclude you. The $14,995 annual minimum with no monthly option is a non-starter for teams under 50 reps.

One Reddit user nailed it: "ZoomInfo pricing is absolutely insane for solo consultants and small teams, like we're talking $15k+ annually for features most people don't even need."

For these teams, self-serve tools with free tiers and no contracts let you validate the workflow before spending anything. Scale up when the pipeline justifies it.

Lighter Alternatives for Salesforce Enrichment

Apollo.io - Best Free-to-Paid Ramp

Apollo's database covers 275M+ contacts with a generous free tier that includes 10,000 email credits/month. Paid plans run $49-119/user/month - a 5-seat team pays roughly $4,740/year vs. ZoomInfo's ~$18,000.

The tradeoff: user-reported email accuracy runs 65-80%, which is meaningfully lower than verified-first platforms. Apollo is strongest as a prospecting starting point for budget-conscious teams who verify emails through a separate tool before sequencing.

Skip Apollo if your primary need is phone numbers or EMEA coverage - it's a US-first platform with phone data that's inconsistent outside North America.

Cognism - The EMEA and Phone Data Play

| Pros | Cons |

|---|---|

| Diamond Verified phone data (human-verified mobiles) | Pricing starts ~$15K/year - ZoomInfo territory |

| Strong GDPR compliance, built for EU selling | US database depth doesn't match ZoomInfo |

| High connect rates on mobile numbers | Limited intent data compared to ZoomInfo |

Best for teams selling into the UK and Europe where GDPR compliance isn't optional. If your ICP is primarily North American, Cognism's premium doesn't make sense.

Clay - For RevOps Teams Who Want Control

Clay isn't a database - it's an enrichment orchestration layer. It connects to 75+ data sources and runs waterfall enrichment, checking multiple providers in sequence until it finds a match. Pricing runs on credits, typically $150-500/mo. (If you’re considering this approach, compare tools in waterfall alternatives.)

Use Clay when: You want to build custom enrichment workflows, chain multiple data sources, and have a RevOps team that thinks in automations. Skip Clay when: You just need clean emails in Salesforce - it's overkill for simple enrichment.

Lusha - Quick Lookups

Lusha is a credits-based tool starting at ~$29/month, focused on quick contact lookups from professional profiles. The database is smaller than ZoomInfo or Apollo, and credits expire monthly. Best for individual reps who need a handful of verified contacts per day, not teams running bulk enrichment. (If you’re budgeting it, see Lusha pricing.)

LinkedIn Sales Navigator - The Prospecting Companion

At $65/month, Sales Navigator is the most common tool paired with Salesforce for account research and lead discovery. It doesn't provide emails or phone numbers directly, but its advanced search filters and InMail capabilities make it a strong top-of-funnel research layer. Many teams use it alongside a data provider rather than as a replacement.

| Tool | Database Size | Email Accuracy | Starting Price | Best For |

|---|---|---|---|---|

| Prospeo | 300M+ profiles | 98% | ~$0.01/lead, free tier | Verified enrichment |

| Apollo.io | 275M+ contacts | 65-80% | $49/user/mo | Free-to-paid ramp |

| Cognism | 400M+ profiles | ~85% | ~$15K/yr | EMEA / phone data |

| Clay | 75+ sources | Varies by source | ~$150/mo | Custom workflows |

| Lusha | Not public | ~60-65% | ~$29/mo | Quick lookups |

| Sales Navigator | LinkedIn network | N/A (no emails) | $65/mo | Account research |

| ZoomInfo | 321M+ contacts | 75-85% | $14,995/yr | Enterprise GTM |

Dirty ZoomInfo imports wreck your Salesforce instance. Prospeo's 5-step verification with catch-all handling and spam-trap removal means fewer duplicates, fewer bounces, and no rework tax. 143M+ verified emails, refreshed every 7 days - not every 6 weeks.

Stop paying a rework tax on stale data. Start with 100 free credits.

FAQ

Does ZoomInfo integrate with Salesforce?

Yes - one-click export, field mapping, and configurable auto-sync are all supported natively. But without governance rules for deduplication, field precedence, and provenance tracking, ZoomInfo imports routinely create duplicate records and overwrite clean data. Set up matching rules and write-scope permissions before you connect anything.

How much does ZoomInfo cost in 2026?

ZoomInfo starts at $14,995/year for Professional with 5,000 credits. Real-world contracts show mid-market companies paying $24,800-$44,200/year. Annual contracts only, with auto-renewal and a 60-day cancellation notice. Add-ons like intent data ($9K-$40K) and Enrich ($15K) push total spend significantly higher.

Can Salesforce Agentforce replace ZoomInfo?

Partially. Agentforce now prospects, enriches, and qualifies leads autonomously, overlapping with ZoomInfo's core value. But 67% of implementations fail due to poor CRM data quality. Most teams still need a third-party data source to make Agentforce effective; that source just doesn't have to cost $15K+/year.

What's the best ZoomInfo alternative for Salesforce enrichment?

For verified contact data at scale, Prospeo delivers 98% email accuracy with native Salesforce integration at ~$0.01/lead - 90% cheaper than ZoomInfo. Apollo.io is the best free-to-paid option for budget-conscious teams. Cognism leads for EMEA coverage and verified phone numbers.

Is ZoomInfo worth it for small teams?

Usually not. ZoomInfo's $15K+ annual minimum and annual-only contracts are built for enterprise procurement cycles. Teams under 20 reps get better value from self-serve tools with free tiers and monthly billing that let you scale spend alongside pipeline growth.