The Best Free Email Finder Tools in 2026 (Ranked by What You Get for $0)

You searched "free" because you don't want a contract, a sales call, or a surprise renewal quote. Fair. The problem is most free email finder tools aren't free in the way you need: credits reset, verification is a second meter, and duplicates quietly burn your allowance.

Give yourself five minutes. Pick one tool, learn the three free-tier traps (verification tax, no rollover, duplicate re-billing), and you'll stay free longer without wrecking deliverability.

Our picks (TL;DR)

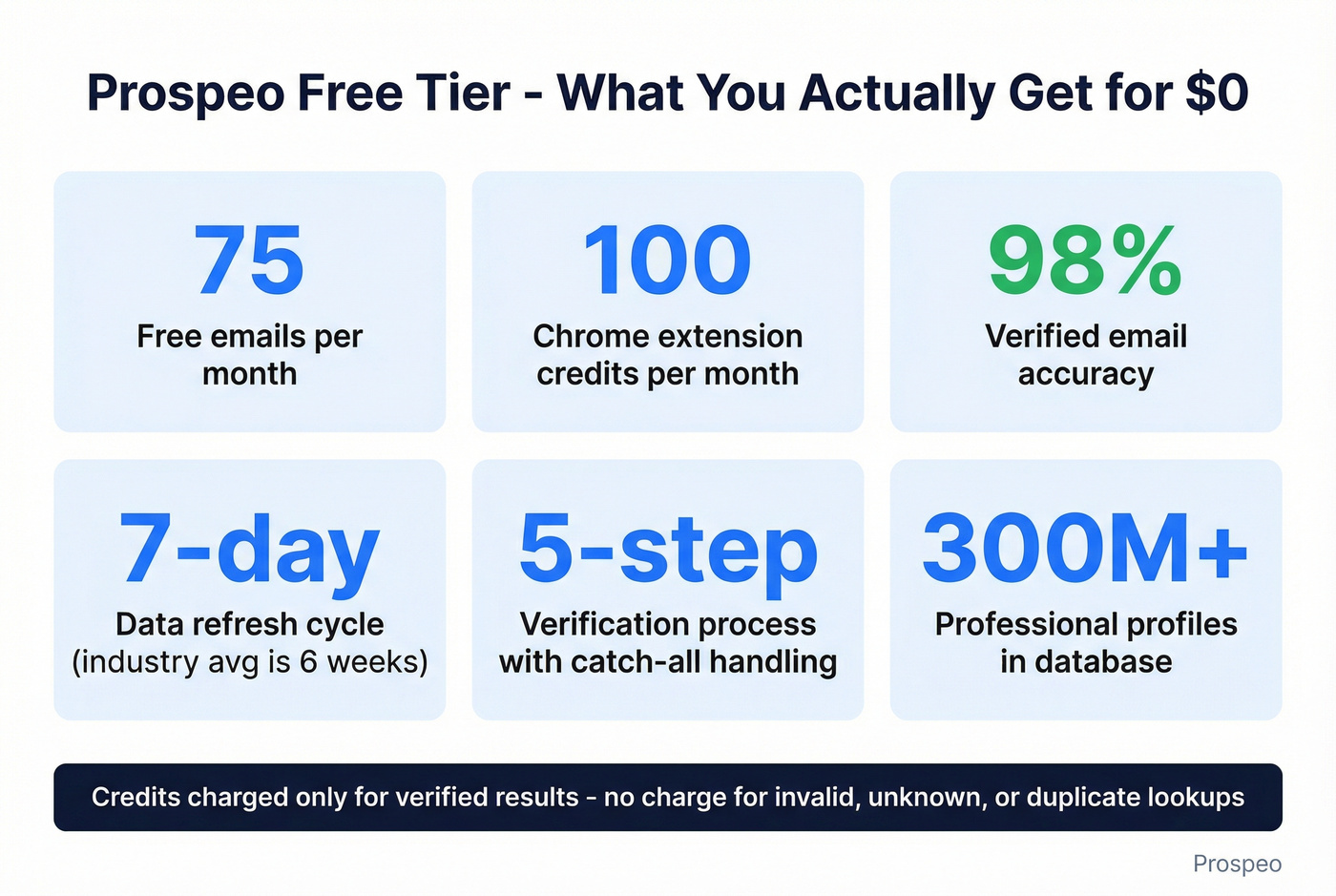

Use Prospeo if you want the cleanest outreach data without platform bloat. The free tier's genuinely usable: 75 emails + 100 extension credits/month, 98% email accuracy, and a 7-day refresh. Skip Prospeo if you refuse to create an account for anything.

Use Skrapp if you care about credit fairness more than maximum coverage. You get 100 credits/month + rollover, and you're charged only for Valid/Catch-all results. Skip Skrapp if you need the highest match rate in tough segments.

Use Hunter if you want the fastest "name + domain -> email" workflow and the most polished UX. Free is 50 credits/month. Skip Hunter if you hate verification taxes and no-rollover credits.

Use GetProspect if you want a steady drip of 50 valid emails/month + 100 verifications, plus rollover. Skip GetProspect if you're planning to multi-account your way to more free credits. Enforcement's real.

Use Mailmeteor if you want no-signup lookups for a couple business emails right now. Skip Mailmeteor if you need bulk. No-signup tools clamp down fast once you hammer them.

Free email finder comparison table (limits, credits, API)

Most people compare only "free credits per month." That's the easiest number to market, and it's the least predictive of whether you'll get usable emails.

What actually changes outcomes when you're evaluating tools in this category:

- Credit definition (attempt vs valid result)

- Rollover (use-it-or-lose-it is how "free" becomes paid)

- Duplicate policy (rebilling duplicates is a hidden tax)

- Bulk/API (if you can't CSV/API, you pay in manual labor)

- Verification economics (separate verification meters push bounces up)

Table 1 - Free limits + credit rules (2026)

| Tool | "Free" type | Free monthly limit | Rollover | Credit definition |

|---|---|---|---|---|

| Skrapp | Freemium | 100 | Yes | 1 credit = find one professional email or verify one email |

| Hunter | Freemium | 50 | No | 1 search credit per successful find; verification costs 0.5 credit/email |

| GetProspect | Freemium | 50 valid + 100 ver | Yes | Valid emails use "valid email" credits; verification uses separate verification credits |

| Anymail Finder | Trial-first | 100 (3 days) | Unused credits roll over up to 2x plan credits | Valid found |

| Mailmeteor | No-signup | Small/one-off | N/A | Lookup attempts |

| EXPERTE Verif | No-signup | 25/batch | N/A | Verifications |

Table 2 - Ops fit (what matters after "free")

| Tool | Charged only on success? | Duplicate policy | Bulk/CSV | API | Best for |

|---|---|---|---|---|---|

| Prospeo | Yes (verified only) | Auto de-dupe | Yes | Yes | Clean outreach |

| Skrapp | Yes (Valid/C-A) | No re-bill | Yes | Limited | Cost control |

| Hunter | Find: yes; Verify: 0.5 | - | Yes | Yes | Quick lookups |

| GetProspect | Yes (valid-only) | - | Yes | Yes | Free drip lists |

| Anymail Finder | Yes (valid-only) | Duplicate searches within 1 month are free | Yes | Yes | Pay-only-valid |

| Mailmeteor | N/A | N/A | No | No | One-off checks |

| EXPERTE Verif | N/A | N/A | Yes (small) | No | Sanity check |

The stuff that bites you later (winners, not "it depends"):

- Best credit fairness: Skrapp (rollover + no charge for Invalid/Unknown + no duplicate re-billing).

- Best "fastest to usable email": Hunter (workflow speed + provenance UI), if you accept the verification meter.

- Best free drip for patient list-building: GetProspect (valid-only framing + rollover + separate verification pool).

- Best "trial that behaves like pay-only-valid": Anymail Finder (great model, but it's trial-first).

- Best no-signup utility: Mailmeteor (quick checks, not list-building).

Trial mechanics detail that matters: Anymail Finder's trial includes a $1 authorization that gets refunded, then it converts unless you cancel. That's not evil. It's just the part people miss.

Privacy reality check (free tools and "we don't store queries")

Privacy's a real differentiator in this category, and it's not complicated:

- No-signup tools lean on "queries aren't stored" because they can't offer dedupe, audit trails, or team history.

- Account-based tools store searches/results to power deduping, rollover accounting, and "don't charge twice" policies.

What to look for in a privacy policy:

- Data retention windows (30/90/180 days)

- Whether searches are tied to your account

- Whether exports are logged

- Opt-out and deletion controls

You just read about verification taxes, duplicate re-billing, and no-rollover traps. Prospeo's free tier sidesteps all three: 75 emails + 100 extension credits/month, auto-deduplication, and you only pay for verified results. 98% email accuracy on a 7-day refresh cycle.

Stop burning free credits on bad data. Get emails that land.

What "free" actually means (so you don't get tricked)

Use this checklist before you invest time building a workflow, especially if you're comparing options and trying to avoid "free until you actually use it" pricing.

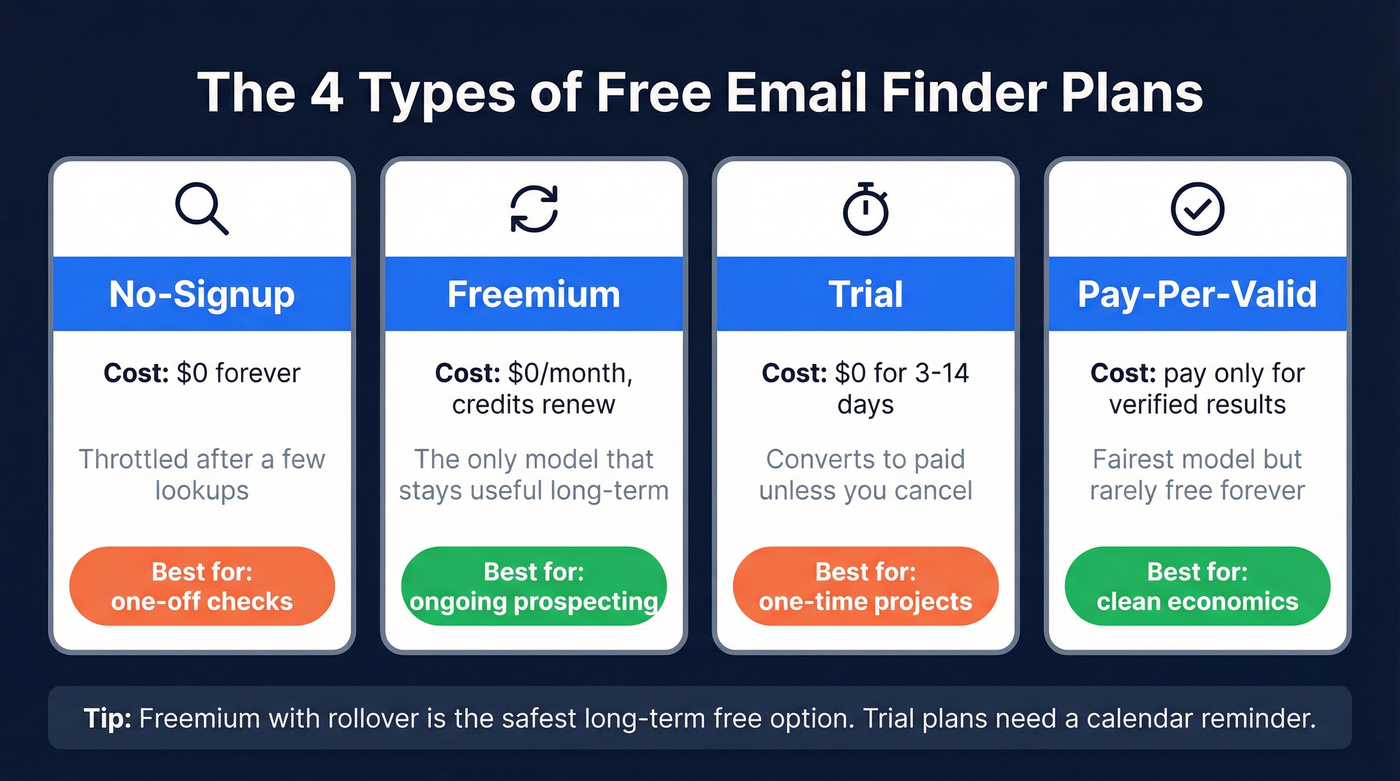

The 4 "free" types (and what they really cost)

- No-signup tools: perfect for one-off lookups; they throttle hard when you push volume.

- Freemium: monthly credits that keep renewing; the only model that stays useful long-term.

- Trial: generous for a few days, then converts; set a reminder before you test.

- Pay-per-valid: the fairest paid model; rarely "free forever," but the economics are clean.

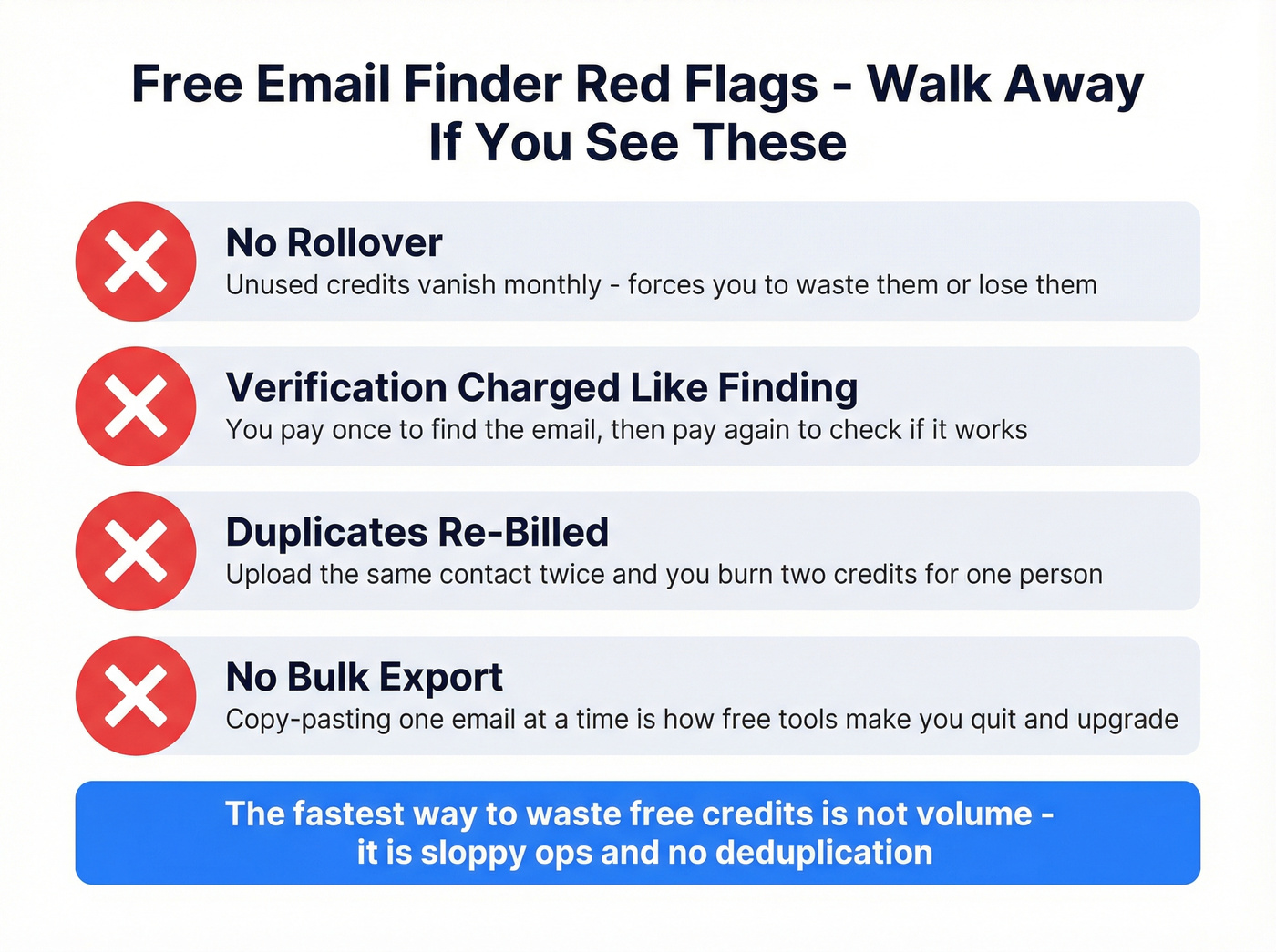

Red flags I treat as deal-breakers

Look, if any of these show up, I move on.

- No rollover (forces waste).

- Verification charged like finding (you pay twice for safety).

- Duplicates re-billed (you pay for your own process noise).

- No bulk export (you'll copy/paste your way into quitting).

In our experience, the fastest way to waste "free credits" isn't volume. It's sloppy ops: re-checking the same people, re-uploading the same CSV with slightly different formatting, and paying again because the tool doesn't dedupe well.

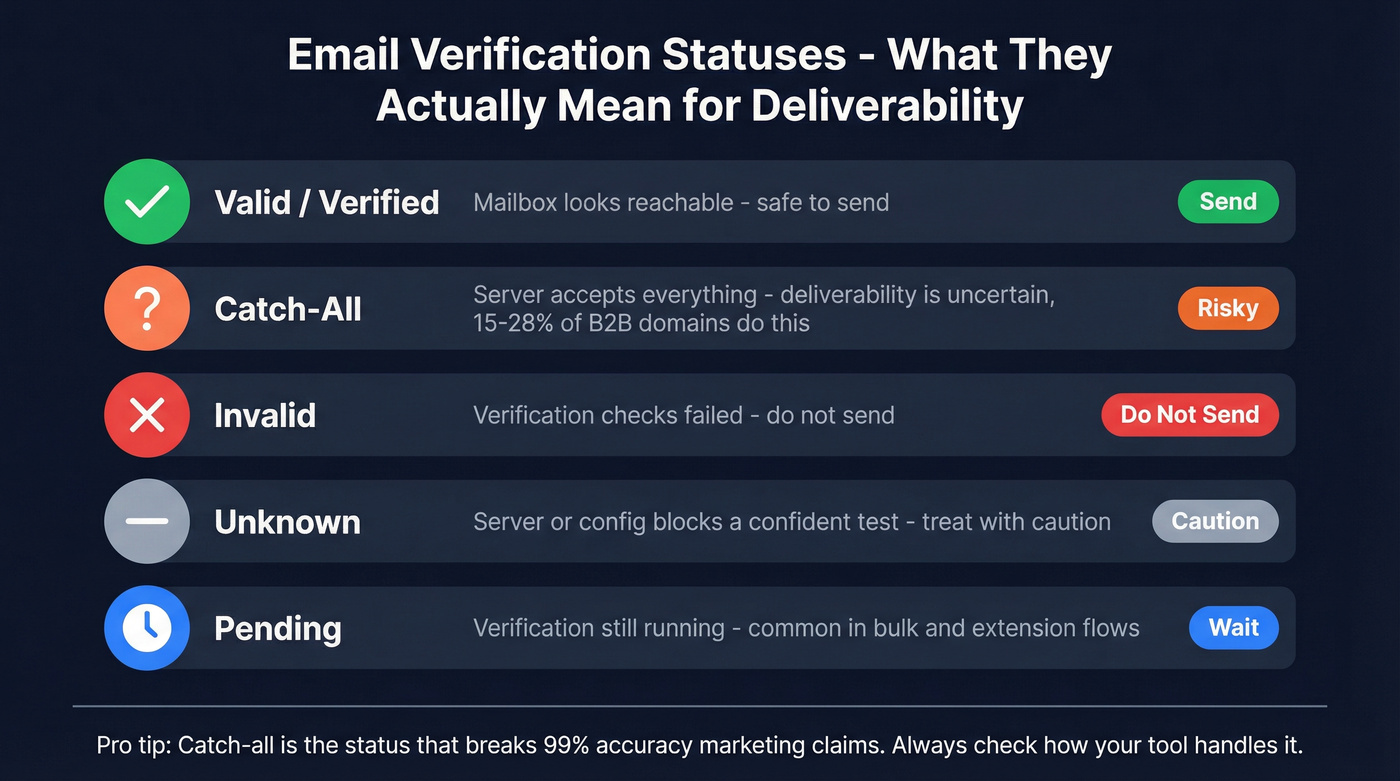

What "verified" means (and why catch-all breaks "99% accuracy" marketing)

"Accuracy" is two different problems vendors love to blend:

- Coverage (match rate): can the tool find an email?

- Verification accuracy: if it returns an email, is it safe to send?

Catch-all domains are the reason "verified" isn't a guarantee. Dropcontact's benchmark puts ~15%-28% of B2B domains in catch-all mode, which means the mail server accepts any recipient during checks and forces you to treat verification like risk management, not a yes/no stamp.

Mini glossary (statuses you'll actually see)

- Valid/Verified: mailbox looks reachable.

- Catch-all: server accepts all recipients; deliverability's uncertain.

- Invalid: checks fail.

- Unknown: server/config blocks a confident test.

- Pending: verification takes time in bulk/extension flows.

Verification isn't magic. The good tools run a stack of checks like syntax, MX/domain, SMTP signals, plus filters for role-based addresses, disposable domains, free mailbox providers, and obvious gibberish.

Best free email finder tools in 2026 (ranked)

Two benchmarks help set expectations:

- Tomba's vendor-authored Feb 2026 benchmark ran 5,000 identical searches across nine tools and showed big coverage spread: Tomba ~80.3%, Anymail Finder ~77.5%, GetProspect ~61.9%, Skrapp ~42.8%, Hunter ~37.6%. Use it as directional, not as a final verdict: https://blog.tomba.io/best-email-finder-in-2026/

- Clay's data tests (their internal tool comparisons) land on the same reality in practice: coverage and quality move in opposite directions more often than people want to admit.

Here's my rule from running these tools weekly: optimize for deliverability first, then add coverage with a waterfall. A list of 500 "found" emails that bounces at 8% is worse than 250 verified emails that bounces under 3%, even if the first list looks better in a dashboard.

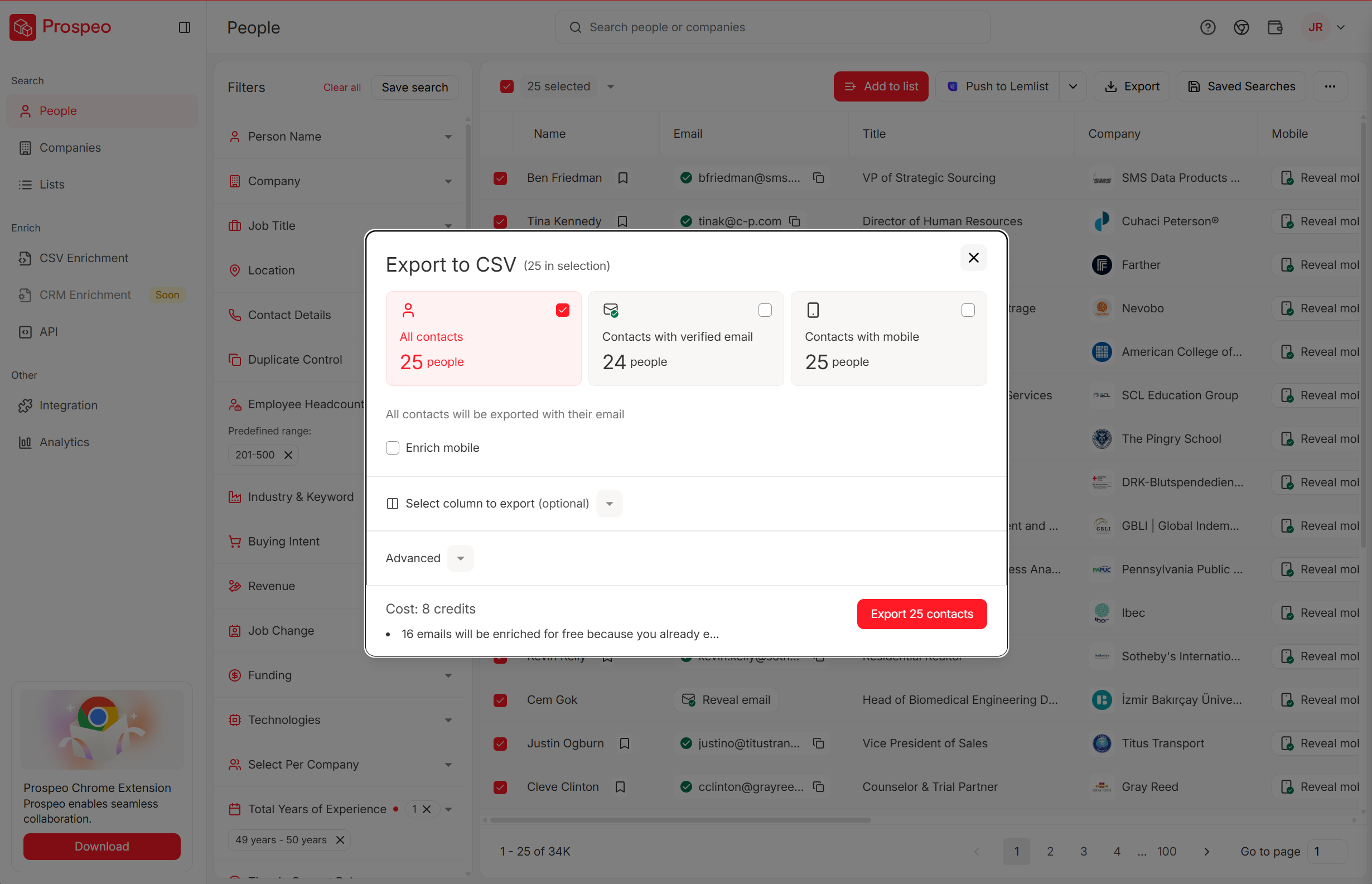

Prospeo - best overall free-first email finder for clean outreach

Best for: teams that care about accuracy, freshness, and self-serve workflows (no contracts, no sales gate). What's free: 75 emails + 100 Chrome extension credits/month. What's annoying: you'll want to connect it to your workflow fast, because manual exporting gets old. When to upgrade: when you're pulling weekly lists, enriching a CRM, or adding mobile numbers for higher connect rates.

Prospeo is "The B2B data platform built for accuracy", and it shows up where it counts: 98% verified email accuracy, a 7-day data refresh cycle (vs a 6-week industry average), and a credit model that doesn't punish you for being careful.

Prospeo includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, and it's used by 15,000+ companies and 40,000+ Chrome extension users. That scale matters, but the refresh cadence matters more. If you're targeting fast-moving roles (ops, growth, rev, security), stale data isn't a minor inconvenience; it's the difference between a clean week of replies and a week of bounce notifications and "no longer at this company" auto-responders.

Credit rule (the part free users actually feel): Prospeo charges credits only when it returns a verified/valid email. It also runs a 5-step verification process with catch-all handling, spam-trap removal, and honeypot filtering, so you aren't "finding" addresses that quietly torch your domain reputation.

A scenario we've seen a dozen times: a founder pulls 200 contacts from a tool that optimizes for coverage, blasts them from a new domain, and gets hit with a bounce spike plus a couple spam complaints. Two weeks later they're asking why deliverability fell off a cliff. The fix isn't a new subject line. It's better data and a slower ramp.

If you want to see how it works, start with the Email Finder page: https://prospeo.io/email-finder

Skrapp - best free plan for credit fairness and cost control

Best for: staying on-budget and avoiding wasted credits from invalid results and duplicates. What's free: 100 credits/month with rollover. What's annoying: coverage isn't top of the market, so you'll miss some hard-to-find contacts. When to upgrade: when you need higher volume and want predictable credit accounting.

Skrapp's free plan is built around fairness: you're charged only for results marked Valid or Catch-all, not for Invalid or Unknown. It also avoids duplicate re-billing by tracking searches across your account history.

Skrapp says its data's refreshed daily and positions itself around quality, with claims like 92% average email search success rate and 97%+ verification accuracy.

Pricing signal: credit-based plans start around $30/month for ~1,000 credits and scale up from there.

Hunter - best for quick lookups and provenance you can trust

Best for: fast domain searches, quick one-off lookups, and teams that want provenance (where the email came from). What's free: 50 credits/month, plus free-plan inclusions that matter: 1 connected email account, 500 recipients per sequence, and unlimited team members. What's annoying: verification is a second meter (0.5 credit per verification) and monthly credits don't roll over. When to upgrade: when you're doing consistent prospecting and want higher search + verification pools.

Hunter's the default email finder for a reason: it's fast, polished, and it shows where it found an email and when (provenance + discovery date). That directly answers the question people should ask more often: "Is this stale?"

Pricing signal: paid plans are published and straightforward (monthly tiers like $49 / $149 / $299, with lower annual equivalents). Hunter also sells large credit bundles; one example from their widget is $6,500 for 1,000 search credits + 200,000 verification credits, which makes the "search vs verify" split impossible to ignore.

G2 snapshot: 4.4/5 across 629 reviews.

GetProspect - best "steady free drip" for valid emails + separate verifications

Best for: patient list-building with valid-only credits and rollover. What's free: 50 valid emails/month + 100 verification credits, with rollover. What's annoying: strict enforcement of one free account per person. When to upgrade: when you need predictable monthly volume and larger verification pools.

GetProspect's "valid emails" framing is exactly what free users need: you don't burn your allowance on "not found." The separate verification pool also keeps your workflow honest.

Pricing signal: paid starts around $49/month (Starter), with Growth tiers around $99 / $199 / $399 depending on volume. Extra verification bundles are also available (for example, 10,000 verifications for $29), and verification bundles don't expire, which is genuinely useful if you work in bursts.

Anymail Finder - best pay-only-valid model, but it's trial-first

Best for: teams that want pay-only-valid economics. What's free: 100 credits for 3 days (trial). What's annoying: trial mechanics require attention: $1 authorization (refunded) and conversion risk if you forget to cancel; refund rules are strict. When to upgrade: when you've validated it on your ICP and want pay-only-valid at scale.

Anymail Finder's model is how this category should work: you pay for valid emails found, and "not found" results are free.

The catch is the trial-first setup. If you test it, set a calendar reminder the same minute you sign up.

More operational detail (because this is where people get burned): verification costs 0.2 credits, unused credits can accumulate up to 2x your plan credits, and their refund policy includes conditions tied to bounce thresholds and timing/usage (including being charged within 72 hours and having used under 10% or 1,000 credits, whichever's lower). Translation: test carefully, track bounces, and don't treat the trial like a free-for-all.

Pricing signal: paid plans commonly start around $9/month (annual billing) and scale up toward $200/month for higher volume.

Mailmeteor - best no-signup option for one-off business lookups

Best for: grabbing 1-5 business emails without creating an account. What's free: the finder is $0 and no-signup. What's annoying: throttling kicks in when you try to use it like a bulk tool. When to upgrade: if you're doing outreach weekly, move to an account-based finder with CSV/API.

Mailmeteor's Email Finder is convenient for quick checks. It says it finds verified email addresses with 97%+ accuracy using pattern matching + real-time validation, and it says search queries aren't stored or shared.

EXPERTE Email Verification - best free verifier to sanity-check a small list

Best for: a second opinion on a tiny list before you send. What's free: up to 25 addresses simultaneously. What's annoying: it's not a finder; it won't build lists for you. When to upgrade: when you need bulk verification inside a workflow.

EXPERTE is a clean companion tool: syntax checks, MX records, SMTP-style checks, and catch-all detection. It's also a good reminder that catch-all "unknown" outcomes are often the mail server's design, not the verifier's failure.

Pricing signal: free for small batches; paid verification tools in this category typically land in the $10-$50/month range for light usage, scaling with volume.

How to stay free longer (and reduce bounces): the 2-tool workflow

Hot take: for smaller deal sizes, you don't need an all-in-one platform to find emails. You need a finder that returns safe emails, plus a simple second-pass check for the risky bucket.

That's it.

Here's the workflow we've tested when we want to stretch free tiers and keep bounce rates under control. It's boring, and it works whether you're doing a handful of prospects or building a repeatable weekly process.

The executable micro-waterfall (copy this)

Batch size: 100 leads at a time (not 5,000).

CSV columns: first_name, last_name, company, domain, title, company_website (keep it simple).

- Run the batch through your primary finder.

- Stop condition: export Verified/Valid only into your sequencer/CRM.

- Quarantine condition: put Catch-all + Unknown into a separate sheet.

- Second pass: verify the quarantine sheet with a second verifier (small batches are fine).

- Send policy:

- Verified/Valid -> normal sequences

- Catch-all (that passes second verification) -> separate low-volume sequence

- Anything else -> don't send

Messy reality detail: the biggest free-tier leak is duplicate lookups. If you re-upload the same CSV with slightly different domains or spacing, some tools charge again. That's why duplicate policy matters more than people think.

If you're building a repeatable process, it's worth tightening your data quality rules and following an email verification list SOP.

Compliance and deliverability checklist (practical, not legal advice)

You can pick the "best" tool and still get crushed by deliverability if you ignore basics.

Do

- Use accurate header info and a real sending identity.

- Include a physical mailing address in outbound.

- Make unsubscribing easy (one click's best).

- Honor opt-outs within 10 business days (CAN-SPAM operational requirement).

- Suppress role-based and disposable addresses where possible (info@, support@, etc.).

- Warm up new domains and ramp volume gradually.

Don't

- Email obvious spam traps, disposable domains, or scraped junk lists.

- Treat catch-all as verified. It isn't.

- Blast the same message to everyone. Complaints tank reputation fast.

- Keep emailing people who opted out.

Decision recap (pick in 20 seconds)

- If you want the best free email finder for cold outreach (accuracy + freshness + verified outputs), pick Prospeo.

- If you want the fairest free credits and hate paying for invalid results or duplicates, pick Skrapp.

- If you want the fastest workflow and you care about seeing where/when an email was found, pick Hunter, and accept that verification's a separate meter.

- If you want a slow, steady free drip with rollover and valid-only credits, pick GetProspect.

- If you want no-signup and you're doing a couple lookups, pick Mailmeteor.

Bottom line: a free email finder is only "free" if the credit rules match your workflow: verified-only charging, sane duplicate handling, and a path to CSV/API when you stop messing around. If you want more options, compare this list to our broader roundup of email lookup tools and B2B email lookup platforms.

FAQ

What's the difference between an email finder and an email verifier?

An email finder generates likely work emails from a name + company/domain, while an email verifier checks deliverability signals (syntax, MX, SMTP behavior, and catch-all risk) to reduce bounces. For cold outreach, aim for under 3% bounces by sending only Verified/Valid and quarantining catch-all/unknown.

Why do tools return "catch-all" or "unknown," and is it safe to email those addresses?

Catch-all means the domain accepts all recipients during checks, and unknown means the server blocked a confident test, so neither's a green light. Treat them as a separate segment: re-verify, then send low volume (10-20/day per domain) with fast suppression if you see bounces or complaints.

Are free tools actually free, or just trials?

Freemium plans renew monthly credits and can stay usable long-term, while trials give a short burst (often 3-7 days) and then convert unless you cancel. If you want "free that lasts," pick a freemium plan with clear credit definitions and avoid duplicate re-billing. Those two rules matter more than headline credits.

What's a good free alternative to Hunter?

For deliverability-first prospecting, Prospeo's a strong free alternative because you get 75 verified emails + 100 extension credits/month and credits are used only when an email's verified/valid. If you mainly want rollover and predictable credit math, Skrapp's free plan (100 credits/month + rollover) is the most forgiving.

Most free email finders charge you twice - once to find, once to verify. Prospeo charges only for verified results, removes duplicates automatically, and refreshes every 7 days so you're never emailing stale contacts. That's why teams see bounce rates under 4%.

Zero verification tax. Zero duplicate re-bills. 98% accuracy at $0.