Outreach vs Yesware: Which Sales Engagement Platform Actually Deserves Your Budget in 2026?

You started on Yesware's free plan. Email tracking, a few campaigns, done. Then your team grew to eight reps, you needed real sequencing, and suddenly Yesware's limitations were everywhere - 10 campaign recipients a month, no conversation intelligence, a UI that looks like it hasn't been touched since 2021. So you searched "outreach vs yesware," expecting a clean answer.

Here's the problem: these two tools aren't really competing anymore. Outreach has evolved into a full-blown revenue intelligence platform with AI agents, conversation analytics, and deal management at $100/user/month. Yesware got acquired by Vendasta in 2022 and has been eerily quiet since - every signal points to maintenance mode.

The real question isn't which of these two platforms to pick. It's whether either tool fits your team size, budget, and workflow - or whether you should skip both entirely. And honestly, this debate matters far less than the quality of the data feeding whichever tool you choose.

The 30-Second Verdict

| Tool | Verdict |

|---|---|

| Outreach | Best for enterprise teams (20+ reps) on Salesforce with $15K+/year budgets who need multi-channel sequencing, conversation intelligence, and deal management. |

| Yesware | Acceptable for solo reps or 2-5 person teams needing basic email tracking inside Gmail/Outlook - if you're comfortable with a product that's likely in maintenance mode. |

| Skip both if... | You're 5-20 reps who need prospecting AND sequencing without enterprise pricing. Apollo.io is the obvious choice. |

If your budget is under $5K/year and you just need email tracking, Yesware's free or Pro tier works. If you're running a 50-person SDR floor, Outreach earns its price tag. Everyone in between? Keep reading.

Outreach - What It Actually Costs and Does

Outreach Pricing Breakdown

Outreach doesn't publish pricing, so here's the math they don't want you to see.

| Plan | Price | Notes |

|---|---|---|

| Standard | $100/user/mo | Annual contract required |

| Professional | ~$130-150/user/mo | Adds AI deal scoring (estimated) |

| Enterprise | Custom | Talk to sales |

| Unlimited | Custom | Talk to sales |

| Implementation | $1,000-$8,000 | One-time onboarding fee |

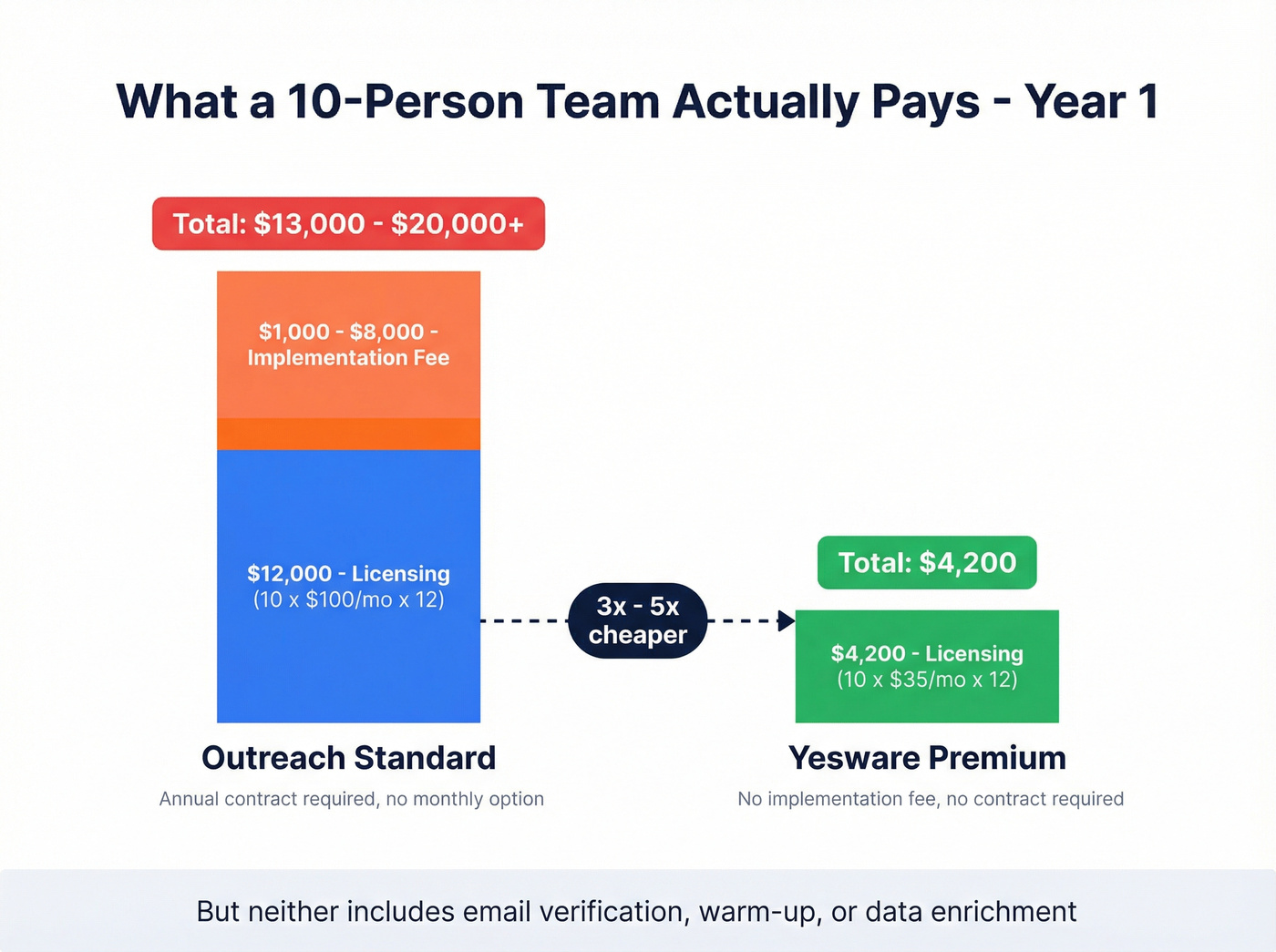

For a 10-person team on Standard, you're looking at $12,000/year in licensing alone. Add the implementation fee and you're at $13,000-$20,000+ in year one. Professional bumps that to $15,600-$18,000 before implementation.

The annual contract is non-negotiable. No monthly option. And the implementation fee stings - some teams report paying $8,000 just to get properly onboarded. That's real money before a single sequence fires.

Outreach AI Features - Promise vs Reality

Outreach shipped a wave of AI features in late 2025: Smart Account Assist scanning up to 80 recorded conversations and 500+ emails, personalized AI voicemails, content insights showing which message parts were AI-generated vs human-written, personalized homepages for prospectors vs deal closers, and a full suite of AI agents covering deals, research, calls, and prospecting.

The beta feedback tells a different story. One Reddit user who went through the beta put it bluntly: "Still early but so far it doesn't feel like the juice is worth the squeeze." The AI content generation "would still not catch nuances" - when a deal was closed-lost on price, the AI generated something tone-deaf like "I know you had pricing problems." That user built their own AI emailer using OpenAI that "performed better."

The prospecting agent got better marks - it's "pretty good" at identifying ICPs in your CRM and surfacing new contacts. But the email generation still feels like a ChatGPT wrapper with extra steps and a much higher price tag.

Who Outreach Is Actually For

Use Outreach if:

- You have 20+ reps running multi-channel sequences at scale

- You're on Salesforce (or one of the 4 other supported CRMs)

- You need conversation intelligence and deal management in one platform

- You have dedicated sales ops to manage months of onboarding

- Your budget clears $15K/year comfortably

Skip Outreach if:

- You're under 10 reps - you'll pay enterprise prices for features you won't touch

- You need CRM flexibility beyond the 5 supported integrations

- You don't have a sales ops person to own implementation

- You need responsive support - Outreach's is notoriously slow

- You want to start this week, not this quarter

The scale numbers are real: 390,000 weekly active users, $765 billion in pipeline created, 43.9 million deals moved through the platform. Outreach is the market leader for a reason. But market leader doesn't mean right for everyone - and the late-2024 reports of Outreach laying off their entire enterprise sales team (~70 people) suggest even they're recalibrating.

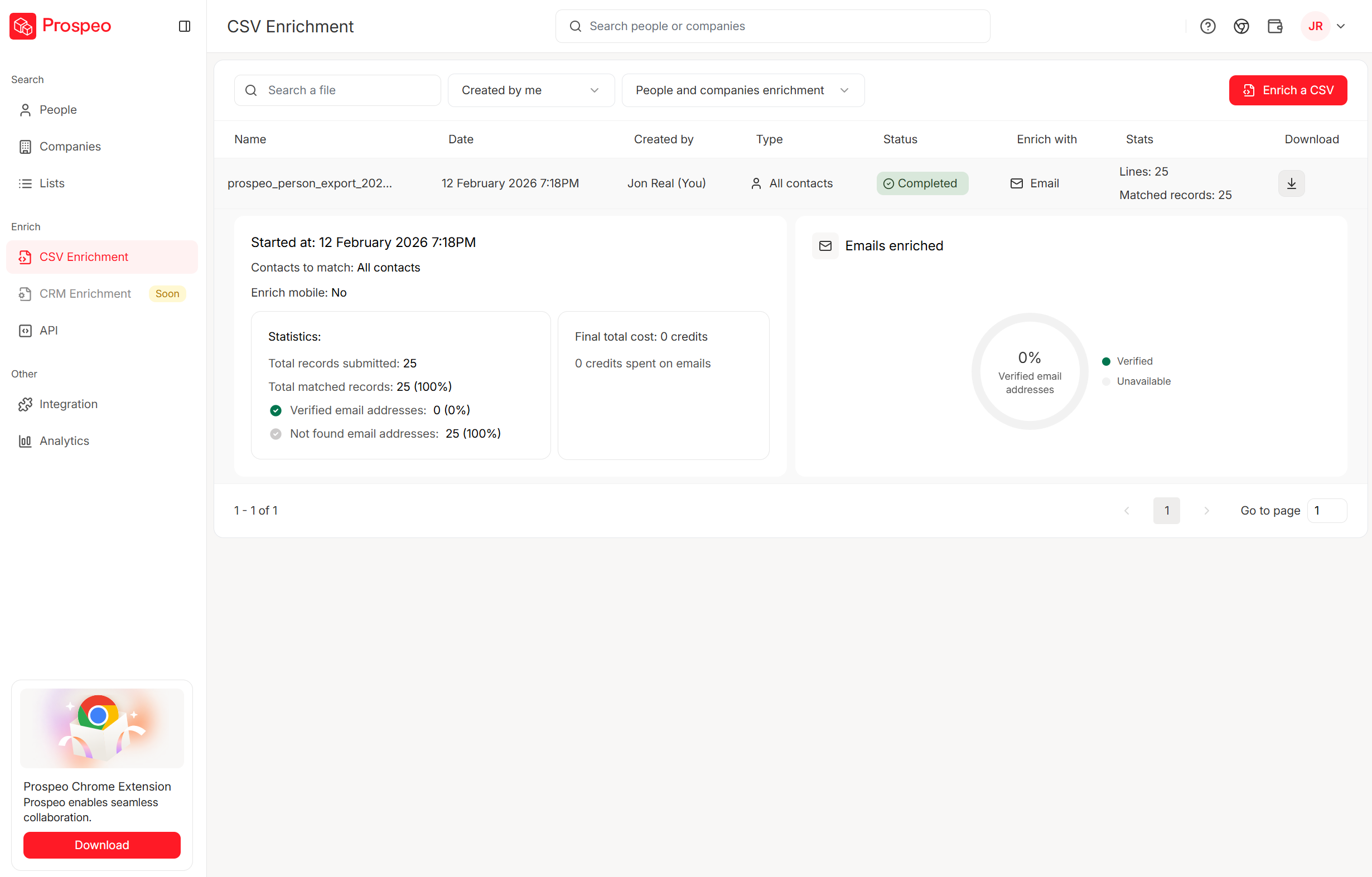

Neither Outreach nor Yesware solves your biggest problem: bad contact data. Prospeo feeds your sequences with 98% verified emails from 300M+ profiles - refreshed every 7 days, not every 6 weeks. At $0.01/email, one month costs less than Outreach's implementation fee.

Fix your data before you fix your sequencing tool.

Yesware - Affordable, But for How Long?

Yesware Pricing Breakdown

Yesware's pricing is refreshingly transparent.

| Plan | Monthly | Annual | Key Feature |

|---|---|---|---|

| Free | $0 | $0 | Basic tracking (emails <24hrs old), 10 recipients/mo |

| Pro | $19/seat/mo | $15/seat/mo | Unlimited tracking, 20 recipients/mo |

| Premium | $45/seat/mo | $35/seat/mo | Unlimited campaigns, teams |

| Enterprise | $85/seat/mo | $65/seat/mo | Full Salesforce bi-directional sync, SSO |

A 10-person team on Premium annual runs $4,200/year. That's roughly a quarter of what Outreach Standard costs - with zero implementation fees and no multi-month onboarding.

Yesware's feature page now lists "Prospector," "Contacts," and "Data Enrichment" as product capabilities. Whether these are fully built products or placeholders is unclear - there's no meaningful documentation or user feedback on any of them. I'd treat them as aspirational until proven otherwise.

The Elephant in the Room - Yesware's Future After Vendasta

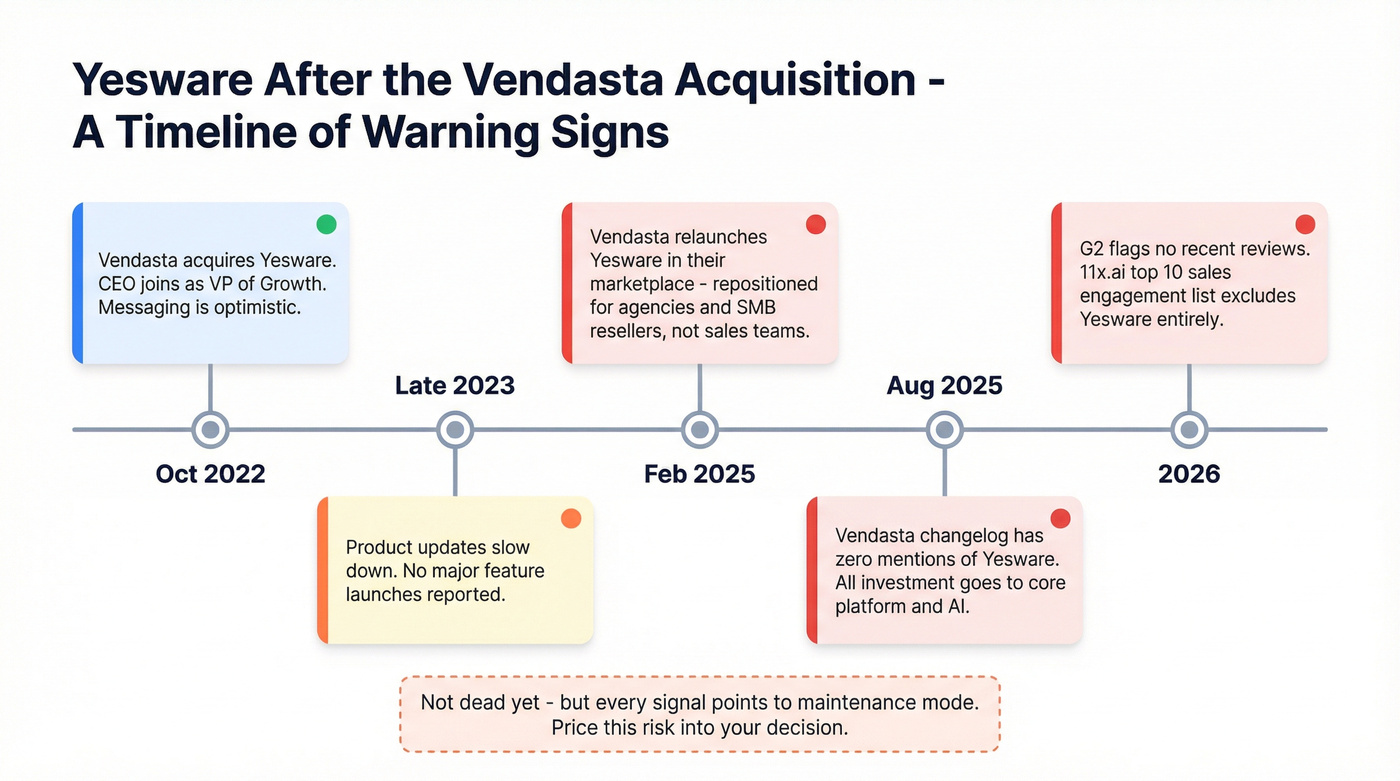

Vendasta acquired Yesware in October 2022. At the time, the messaging was optimistic - Yesware's CEO joined Vendasta as VP of Growth, and Vendasta's CEO said they "loved Yesware so much that we acquired it."

Fast forward to 2026, and the picture looks different.

In February 2025, Vendasta relaunched Yesware in their marketplace - not as a standalone product, but as a tool for agencies and resellers to sell to their SMB clients. Yesware went from "the sales engagement tool for reps" to "a product agencies can white-label for home services companies and law firms."

Here's what's more telling: Vendasta's August 2025 changelog contains zero mentions of Yesware. All development investment is going to their core platform, AI workforce features, and CRM. Yesware doesn't appear.

G2's comparison page AI summary flags that Yesware "has not received any recent reviews, raising questions about its current user satisfaction." And when 11x.ai published their top 10 sales engagement platforms for 2026, Yesware didn't make the list.

I'm not ready to say Yesware is dead. But every signal points to maintenance mode - and that's a risk you should price into your decision.

Yesware's Biggest Problems (From 1,298 Reviews)

An analysis of 1,298 reviews across G2, Capterra, and Trustpilot surfaces six recurring complaints:

Unresponsive support. "No support. Product is faulty and not working. I am paying for features that are not working and waiting for a response." Tickets go unanswered for weeks.

Unreliable features. Campaigns randomly stop functioning. Tracking becomes inaccurate. Notifications "keep on not alerting at the right time."

CRM lock-in. Integration is essentially Salesforce-only. No native Pipedrive, HubSpot, or Zapier support.

Performance issues. "When I had a lot of emails to send, Yesware slowed down my inbox." The browser extension becomes a bottleneck at volume.

Outdated UI. Multiple reviewers call the interface "ridiculously not well designed and outdated."

Inaccurate tracking data. Open and link tracking inconsistencies undermine the core value proposition.

Head-to-Head Feature Comparison: Outreach vs Yesware

| Feature | Outreach | Yesware | Edge |

|---|---|---|---|

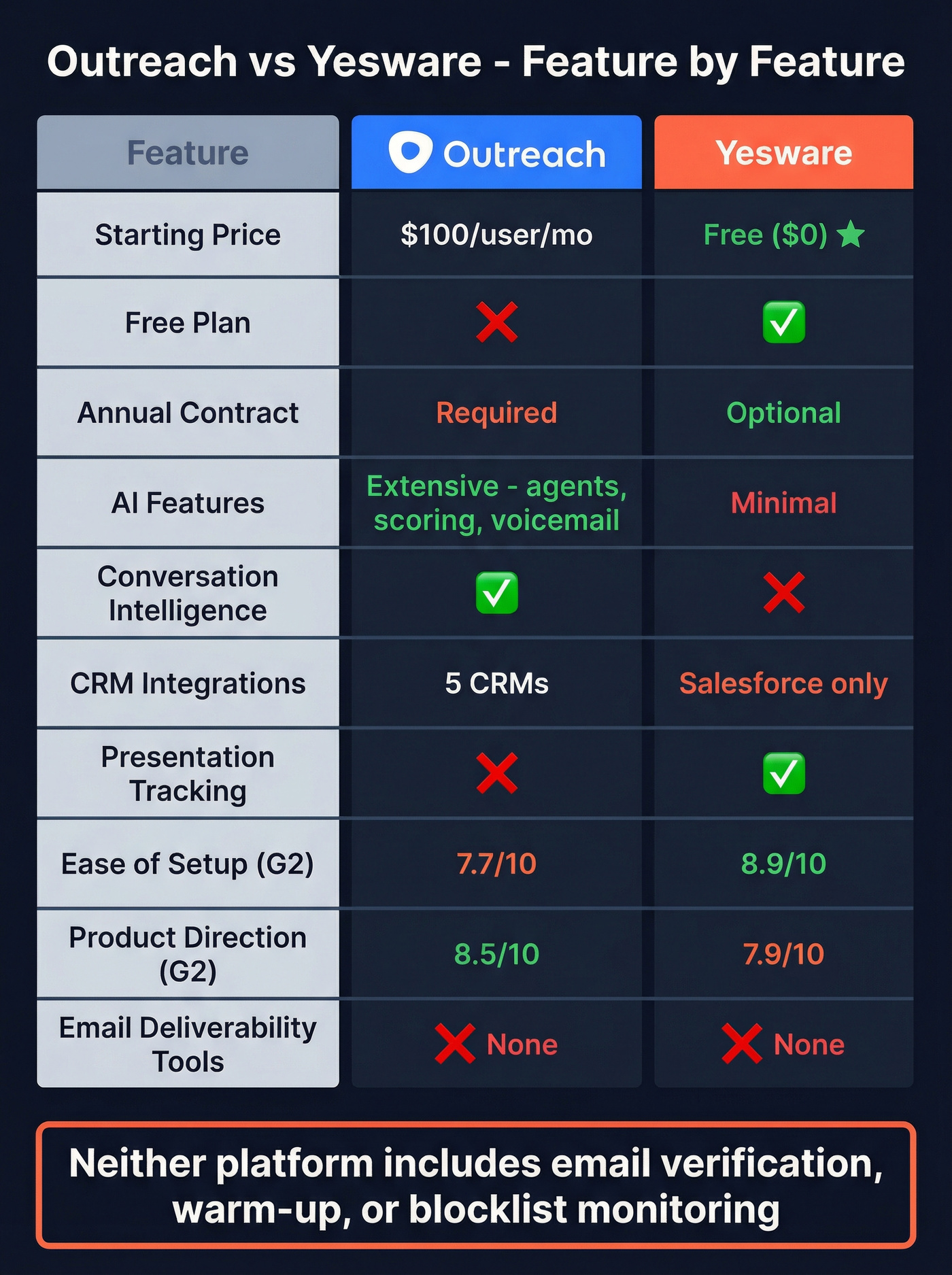

| Starting price | $100/user/mo | Free ($0) | Yesware |

| Free plan | No | Yes (limited) | Yesware |

| Annual contract | Required | Optional | Yesware |

| Email tracking | Yes | Yes | Tie |

| Multi-channel | Email, phone, social | Email, phone, social | Tie |

| AI features | Extensive (agents, scoring) | Minimal | Outreach |

| Conversation intel | Yes (built-in) | No | Outreach |

| CRM integrations | 5 CRMs (incl. Salesforce, Dynamics) | Salesforce only | Outreach |

| Presentation tracking | No | Yes | Yesware |

| Deliverability tools | None built-in | None built-in | Neither |

| Ease of setup (G2) | 7.7 | 8.9 | Yesware |

| Product direction (G2) | 8.5 | 7.9 | Outreach |

| Total G2 reviews | 3,528 | 820 | Outreach (more data) |

Outreach wins on depth - more AI, more CRM options, stronger analytics, better product direction scores. Yesware wins on accessibility - easier setup, transparent pricing, a free tier, and no contract lock-in. Yesware also has presentation and PDF tracking that Outreach lacks, which is genuinely useful for teams sending proposals.

But look at that deliverability row. Neither tool has built-in email warm-up, blocklist monitoring, or email verification. Both assume the data you're loading is clean.

That's a dangerous assumption.

Here's the thing: The difference between these two platforms matters less than the quality of the contact data feeding either one. A $100/user/month sequencer sending to bad emails will underperform a $15/seat/month tool with verified contacts every single time. We've watched teams agonize over the outreach vs yesware decision for weeks, then load 30,000 unverified emails into whichever tool they picked and wonder why their domain ended up on a blocklist. If your average deal size is below $10K, you probably don't need Outreach-level tooling - you need clean data and a simple sequencer.

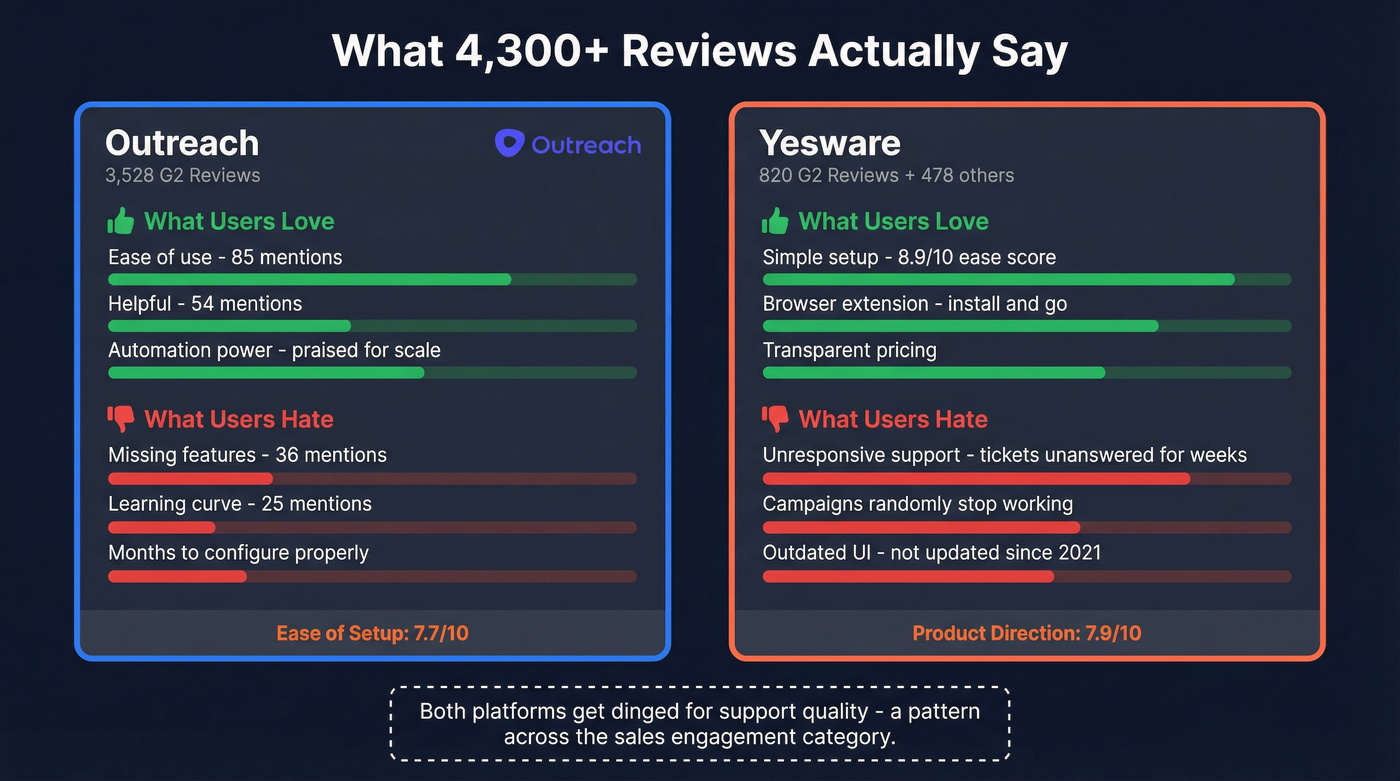

What Real Users Say

Outreach users praise the platform's automation power and analytics depth. "Ease of use" appears in 85 positive G2 mentions, and "helpful" shows up 54 times. But the complaints are equally consistent: "missing features" (36 mentions) and "learning curve" (25 mentions) top the list. The G2 ease-of-setup score of 7.7 confirms what everyone suspects - Outreach is powerful but takes months to configure properly.

Yesware users love the simplicity. An ease-of-setup score of 8.9 is exceptional - install a browser extension and you're running. But the product direction score of 7.9 reflects the stagnation concern. The most damning signal isn't any single review - it's the absence of recent reviews entirely. When users stop reviewing a product, they've usually stopped using it.

I've seen this pattern before with acquired products. The acquirer keeps the lights on, ships a marketplace integration, but the core product slowly atrophies. Yesware's trajectory looks uncomfortably similar.

The Problem Neither Tool Solves - Your Data

Here's a quote from an Outreach beta user that should be pinned to every sales ops Slack channel: "Generations are only as good as your data. For most teams this is brutal bc CRMs are pretty messy."

Neither Outreach nor Yesware includes built-in email verification, warm-up tools, or blocklist monitoring. Both platforms assume you're loading clean, verified contact data. Both will happily send sequences to invalid emails that bounce, damage your domain reputation, and land your entire sending infrastructure in spam.

This is the upstream problem nobody talks about in sequencer comparisons. You can debate which sales engagement tool to use all day, but if 15-20% of your emails bounce, it doesn't matter which platform sent them. Your domain is cooked.

Before you spend $100/user/month on a sequencer, make sure the emails you're loading into it actually work. If you want a deeper SOP, start with an email verification workflow and a simple list scrubbing step.

Spending $12K+/year on Outreach or settling for Yesware's maintenance-mode features? Your sequences still bounce without verified data. Prospeo delivers 143M+ verified emails and 125M+ direct dials that integrate natively with both platforms.

Stop paying enterprise prices for emails that bounce.

The Verdict - Which One Should You Pick?

Pick Outreach if:

- You have 20+ reps and a dedicated sales ops team

- You're on Salesforce and need conversation intelligence baked in

- Your budget clears $15K+/year (realistically $20K+ in year one)

- You want a platform actively shipping AI features - even if they're still maturing

- You need multi-channel sequencing at enterprise scale

Pick Yesware if:

- You're solo or running a team of 2-5 reps

- You just need email tracking and basic campaigns inside Gmail or Outlook

- You're already on Salesforce and want the bi-directional sync

- You're comfortable with the product viability risk - and have a migration plan if Yesware goes dark

- Your budget is under $5K/year

Pick neither if:

- You're a team of 5-20 reps who need prospecting AND sequencing

- You don't want to pay enterprise prices or bet on a potentially abandoned product

- You need built-in deliverability tools

The total cost gap is stark. A 10-person team pays $13,000-$20,000+ for Outreach in year one vs $4,200 for Yesware on Premium annual. But cost alone doesn't tell the story - Outreach gives you conversation intelligence, AI agents, and deal management that Yesware simply doesn't offer.

Here's the contrarian take: this comparison is outdated because these tools serve fundamentally different audiences now. Outreach is a revenue intelligence platform. Yesware is a lightweight email tracker that may or may not have a development team behind it. Comparing them is like comparing Salesforce to a spreadsheet - technically they both track deals, but that's where the similarity ends. Whichever side of the outreach vs yesware debate you land on, the upstream data quality problem remains the same.

Alternatives Worth Considering

Apollo.io - The In-Between Option

Apollo is the obvious choice for teams of 5-20 who need prospecting and sequencing in one platform without enterprise pricing. The database covers 275M+ contacts, the sequencer handles multi-channel outreach, and there's a genuinely useful free tier. Paid plans run ~$49-99/user/month. With 9,400+ G2 reviews at 4.7/5, it's the highest-rated tool in the category. If you're reading this article because neither Outreach nor Yesware feels right, Apollo is probably your answer.

If you're evaluating stacks beyond Apollo, it helps to sanity-check the broader category of cold email outreach tools and the current sales engagement platform alternatives.

Salesloft - "I Want Outreach But Less Painful"

That's the actual pitch, and users back it up. Salesloft runs ~$140-180/user/month and competes directly with Outreach at the enterprise level. Users who've switched from Outreach consistently cite a cleaner UI, faster onboarding, and higher rep adoption. It ranked #4 on 11x.ai's 2026 sales engagement list. If Outreach's implementation complexity scares you but you still need enterprise-grade sequencing, Salesloft is the alternative to demo.

Instantly.ai and Mixmax - Specialists, Not Platforms

Skip these if you need a full platform. Pick them if you have a specific gap. Instantly.ai (~$30/month) is purpose-built for cold email deliverability - warm-up, inbox rotation, and send optimization. It fills the exact gap neither Outreach nor Yesware addresses. Mixmax (~$29/user/month) is the lightweight Gmail-native option for teams that want email tracking and basic sequences without leaving their inbox. Both are specialist tools, not platforms - and that's their strength.

If deliverability is your bottleneck, pair any sequencer with an email deliverability playbook and a warm up an email address routine.

FAQ

Is outreach vs yesware still a relevant comparison in 2026?

Barely. These tools have diverged so far that comparing them is misleading - Outreach is an enterprise revenue intelligence platform while Yesware is a lightweight email tracker whose development has stalled. The decision usually comes down to budget: under $5K/year means Yesware, over $15K/year means Outreach, and teams in between should look at Apollo.io instead.

Is Yesware still being actively developed?

Signs point to maintenance mode. Vendasta acquired Yesware in October 2022 and relaunched it as a marketplace product for agencies in February 2025. Vendasta's August 2025 changelog contains zero Yesware mentions, G2 flags no recent user reviews, and 11x.ai's 2026 top-10 list omits it entirely. The product works, but active development appears minimal.

Why doesn't Outreach publish pricing?

Outreach uses an enterprise sales model designed to maximize deal size per account. Standard starts at $100/user/month with a mandatory annual contract, and implementation fees run $1,000-$8,000 on top. Professional and Enterprise tiers require a sales conversation - you can't get a ballpark without booking a demo.

Can I use Outreach or Yesware without Salesforce?

Outreach integrates with 5 CRMs total, giving you limited options beyond Salesforce. Yesware's value proposition largely collapses without Salesforce - no native Pipedrive, HubSpot, or Zapier integration exists. If you're not on Salesforce, consider Apollo.io or Instantly.ai, which offer broader CRM compatibility.

Do either of these tools verify email addresses before sending?

Neither includes built-in email verification, warm-up, or blocklist monitoring - both assume your data is clean. Use a dedicated verification tool like Prospeo (98% accuracy, ~$0.01/email, free tier with 75 credits) before loading contacts into any sequencer. A 15% bounce rate will damage your domain reputation regardless of which platform you're sending from.