Sales Prospecting Training That Actually Moves Pipeline (2026 Guide)

Most prospecting training fails for one simple reason: it doesn't change what reps do at 9:00 a.m. tomorrow.

If your "training" doesn't show up as cleaner lists, tighter messages, and a repeatable cadence in the CRM within a couple weeks, it won't show up as pipeline this quarter either.

We've tested this the hard way across teams that had smart reps, good products, and plenty of activity. The difference was never motivation. It was the operating system.

What you need (quick version)

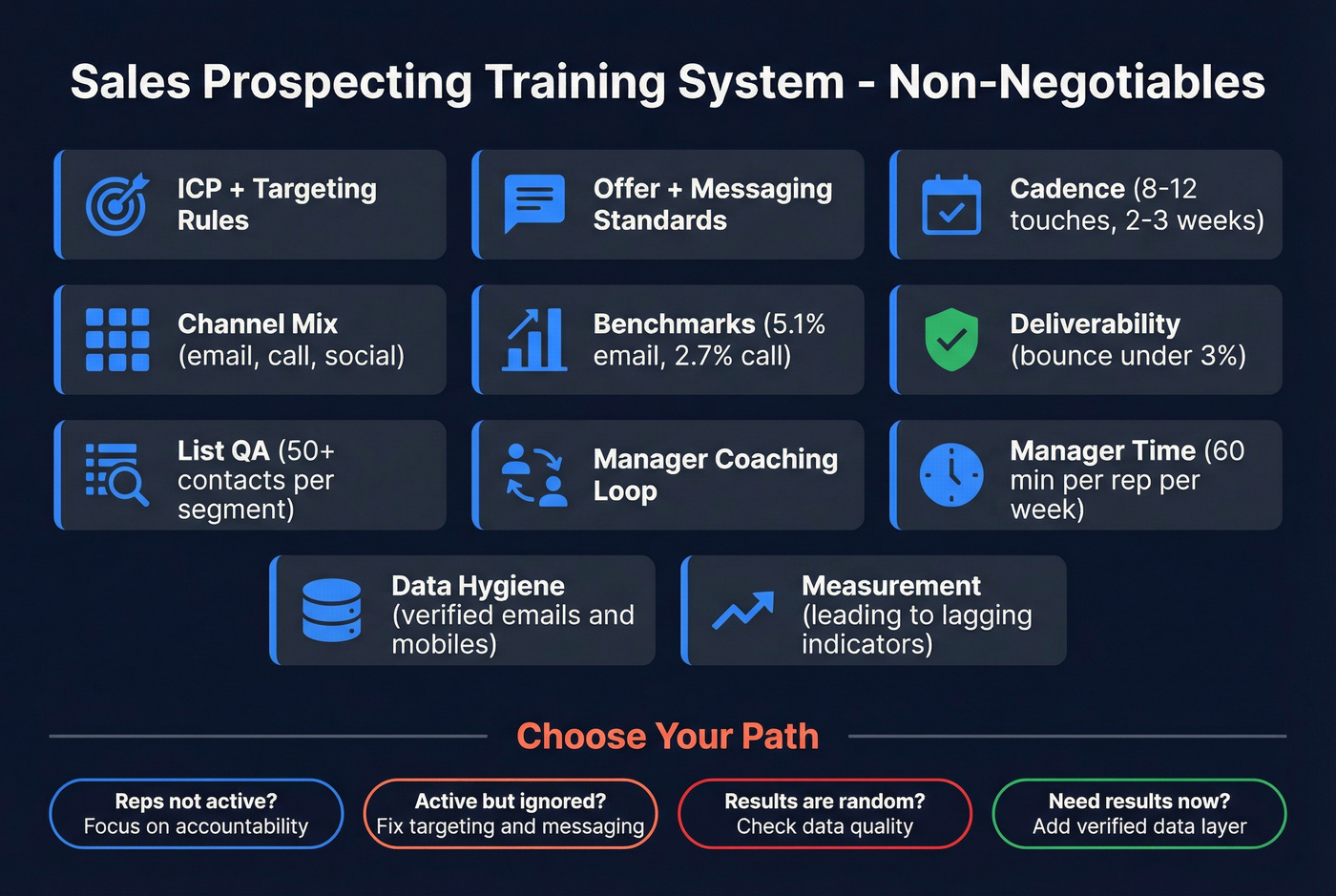

This is the minimum viable prospecting training system. If you can't check these boxes, don't buy another course - you'll just get better at doing the wrong things.

Training system checklist (non-negotiables)

- ICP + targeting rules: who you're allowed to prospect, and who you're not.

- Offer + messaging standards: 2-3 "reasons to talk" per persona, with proof.

- Cadence: baseline 8-12 touches over 2-3 weeks (enterprise often needs 15-20).

- Channel mix: email + call + social + light personalization, not "spray and pray."

- Benchmarks: cold email response baseline 5.1% (typical 1-5%), cold calling success 2.7%.

- Deliverability minimums: keep bounce rate under 3% (hard stop if you're above 5%). If you can't land emails, training won't matter.

- List QA: audit a weekly sample (at least 50 contacts per segment) for wrong titles, missing mobiles, duplicates, and "not a fit" accounts.

- Manager coaching loop: weekly call reviews + weekly pipeline review + weekly activity quality audit.

- Minimum manager time: budget 60 minutes per rep per week for QA + coaching. If managers can't do that, the program will fail.

- Data hygiene: verified emails/mobiles, bounce control, and a refresh rhythm (bad data kills morale fast).

- Measurement: leading indicators (activity quality) tied to lagging indicators (meetings, pipeline).

Choose your path (based on your real constraint)

- If reps aren't doing the work: pick a program heavy on accountability + coaching.

- If reps are doing activity but getting ignored: fix targeting + offer + messaging first.

- If activity looks fine but results are random: your bottleneck is usually data quality + deliverability.

- If you need execution tomorrow: add a data layer like Prospeo so reps start with verified contacts and can apply the training immediately.

What sales prospecting training should change in 30 days

Prospecting training isn't "make reps more confident." It's "make pipeline more predictable."

In 30 days, you should see behavior change that shows up in the CRM without squinting. The point's to move from random acts of outreach to a repeatable machine.

Sales teams spend 60% of their time on non-selling tasks, per Salesforce. If your training adds more admin, more templates, more "enablement steps," it'll get ignored.

What should change fast:

- Calendar reality: protected prospecting blocks actually happen (and don't get eaten by internal meetings).

- Output quality: fewer "Hi {FirstName}" emails, more role-relevant offers with proof.

- List discipline: fewer junk accounts, more tight ICP coverage and multi-threading.

- Conversation control: reps ask better questions, set clearer next steps, and stop "checking in."

Coaching matters more than the course. 75% of reps say they're more likely to hit targets with a coach or mentor (Salesforce). If you buy training but don't change manager behavior, you bought entertainment.

My favorite tell that training's working: reps bring better problems to 1:1s. Not "nobody replies," but "CFOs respond to X angle, VPs respond to Y - let's tighten the offer."

Why prospecting training fails (and how to avoid it)

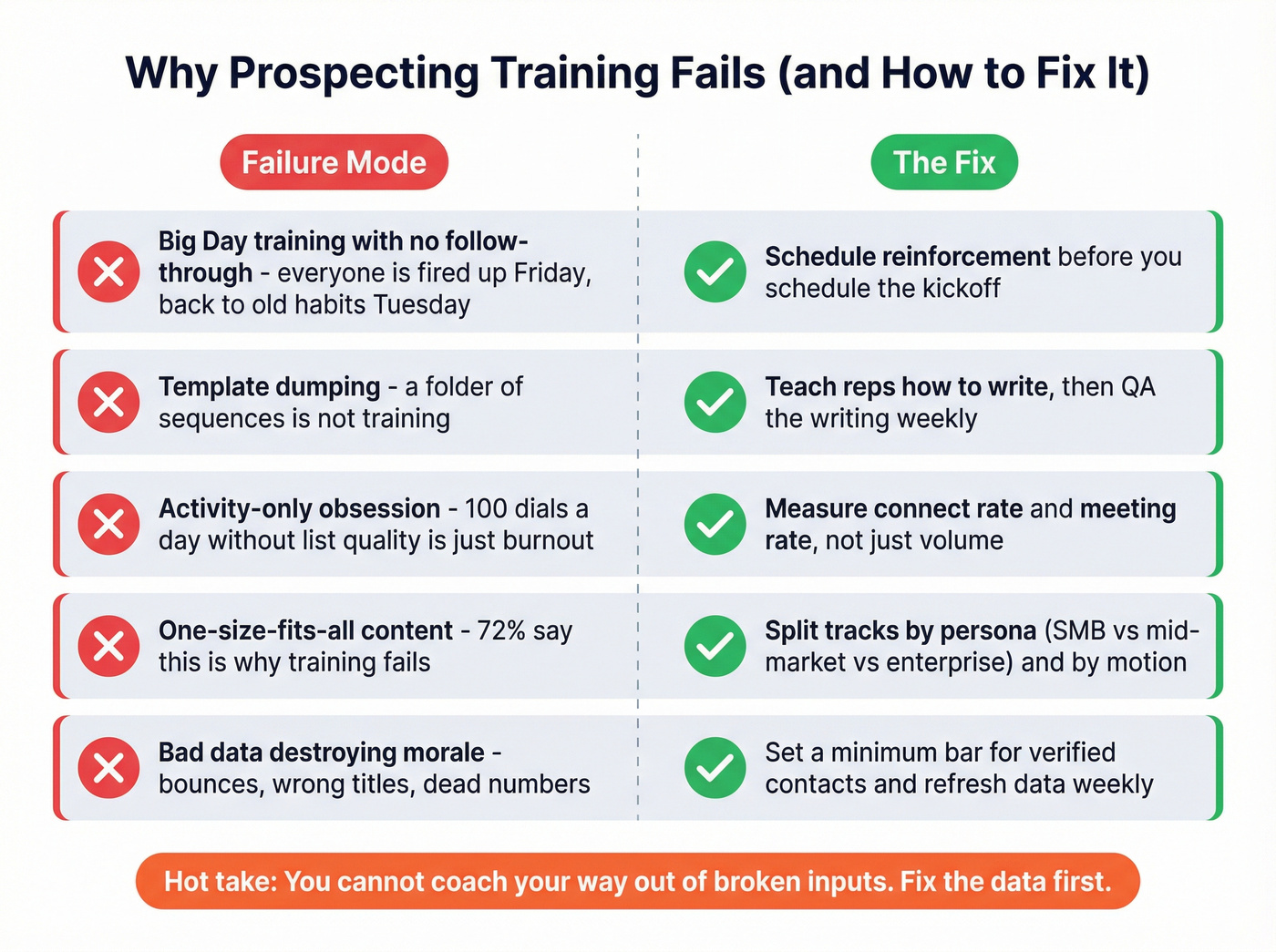

Run this as a pre-mortem. Most teams don't fail because the content's wrong. They fail because the rollout's wrong.

Do this if you want training to stick

- Tailor by segment + role: 72% say training fails because it's one-size-fits-all, and 62% cite outdated training as a barrier (Sales Collective).

- Fix: split tracks by persona (SMB vs mid-market vs enterprise) and by motion (inbound follow-up vs outbound).

- Tie it to a cadence + a number: "Do better outreach" isn't a standard.

- Fix: commit to 8-12 touches over 2-3 weeks, and measure response + meeting rate by persona.

- Make managers the product: reps copy what managers inspect.

- Fix: weekly coaching rhythm with call reviews and message reviews, not just pipeline inspection.

- Reinforce with spaced repetition: one workshop doesn't change habits.

- Fix: weekly sustainment sessions, role plays, and QA.

Redesign it if you see these failure modes

- "Big day" training with no follow-through: everyone's fired up on Friday, back to old habits by Tuesday.

- Fix: schedule reinforcement before you schedule the kickoff.

- Template dumping: a folder of sequences isn't training.

- Fix: teach reps how to write, then QA the writing.

- Activity-only obsession: "100 dials/day" without list quality is just burnout with spreadsheets.

- Fix: measure connect rate and meeting rate, not just volume.

- Bad data destroys morale + outcomes: bounces, wrong titles, dead numbers - reps stop trusting the system.

- Fix: set a minimum bar for verified contacts and refresh your data weekly so reps aren't calling ghosts.

Hot take: if your average deal is small, you don't need a fancy "enterprise methodology" to prospect. You need a tight ICP, a clear offer, clean data, and managers who actually coach.

I've watched teams waste months "training" while their sequences quietly bounced 15-25% and their call blocks were full of wrong numbers. You can't coach your way out of broken inputs, and you definitely can't "mindset" your way out of a list that's half garbage.

This article says keep bounce rates under 3% or training won't matter. Prospeo's 5-step email verification delivers 98% accuracy with a 7-day refresh cycle - so reps apply new skills to contacts that actually exist. At $0.01/email, clean data costs less than one wasted coaching hour.

Stop training reps to prospect into dead inboxes and wrong numbers.

What good prospecting training covers (module checklist)

Most prospecting programs teach tactics. The good ones teach decisions: who to target, what to say, and how to run the week.

RAIN Group's curriculum outline is a solid reference point because it covers both strategy and execution (and their research stats are useful anchors). Their research center numbers are blunt:

- 82% of buyers accept meetings with sellers who proactively reach out.

- 71% want to talk to sellers early in the sales process.

- 58% of sales meetings aren't valuable for buyers.

That last stat's the warning label: buyers will take meetings... and still think you wasted their time. So training has to cover value, not just volume.

Module checklist (copy this into your enablement doc)

- ICP + disqualification rules

- What "good fit" means in observable terms (tech stack, headcount band, trigger events, job roles).

- Account research that doesn't waste time

- A repeatable research standard reps can do between meetings.

- Offer design ("reason to talk")

- One offer per persona that's specific, credible, and easy to say yes to.

- Messaging fundamentals

- Subject lines, first lines, relevance, proof, CTA discipline.

- Cold email execution

- Personalization rules (what's worth doing vs what's theater). This is where most courses over-index on templates and under-index on QA.

- Phone + voicemail

- Opener, pattern interrupt, objection handling, and voicemail that supports email.

- Multi-channel sequencing

- How email, call, and social touches reinforce each other instead of duplicating.

- Referral + internal champion paths

- How to ask for the right introduction without sounding desperate.

- Numbers + iteration

- How to read response rates, connect rates, meeting conversion, and where to adjust.

- Manager coaching + QA

- Scorecards for emails, calls, and discovery handoffs.

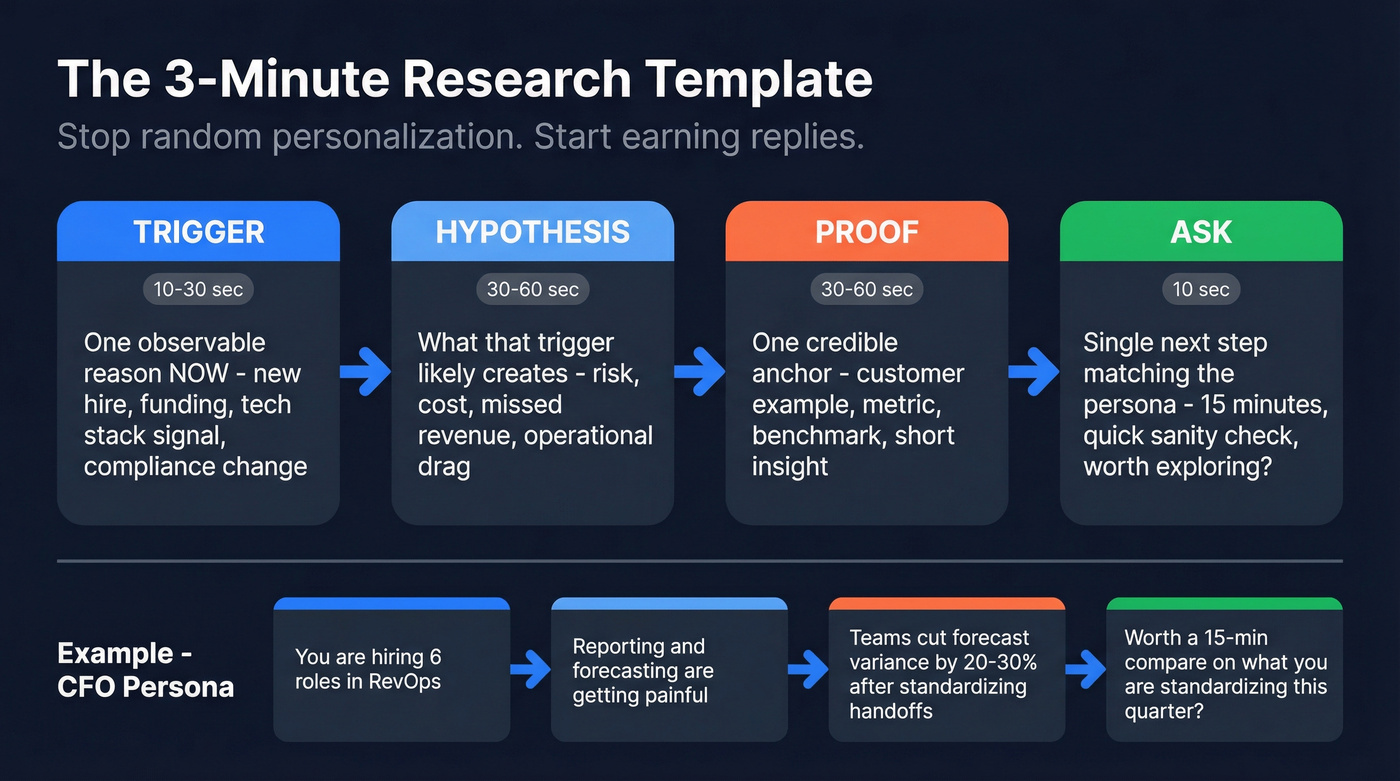

The 3-minute research template (Trigger -> Hypothesis -> Proof -> Ask)

This is the fastest way I've found to stop "random personalization" and start sending messages that earn replies.

- Trigger (10-30 seconds): one observable reason now (new hire, headcount growth, new product line, funding, compliance change, tech stack signal).

- Hypothesis (30-60 seconds): what that trigger likely creates (risk, cost, missed revenue, operational drag).

- Proof (30-60 seconds): one credible anchor (customer example, metric, benchmark, short insight).

- Ask (10 seconds): a single next step that matches the persona (15 minutes, quick sanity check, "worth exploring?").

Example (CFO persona):

- Trigger: "You're hiring 6 roles in RevOps."

- Hypothesis: "That usually means reporting and forecasting are getting painful."

- Proof: "We see teams cut forecast variance by 20-30% after standardizing handoffs."

- Ask: "Worth a 15-minute compare on what you're standardizing this quarter?"

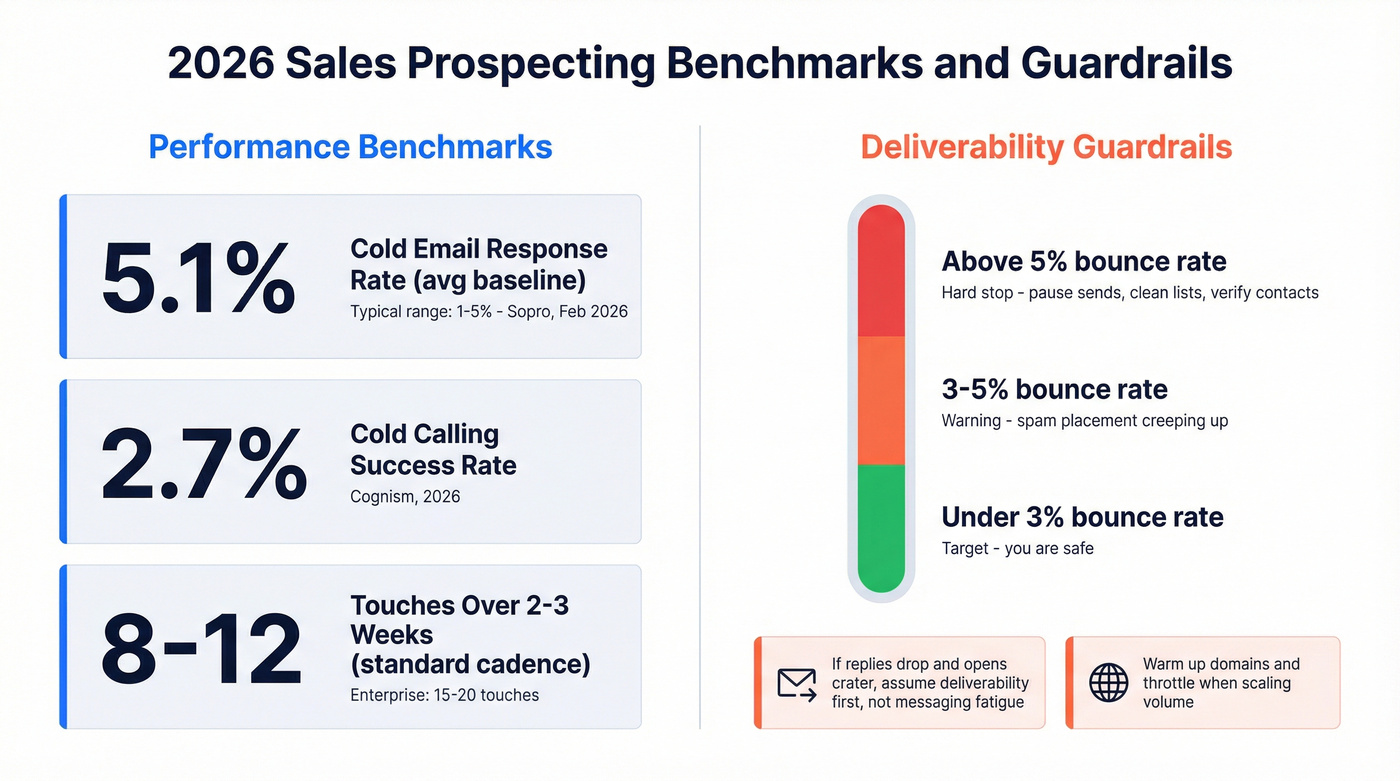

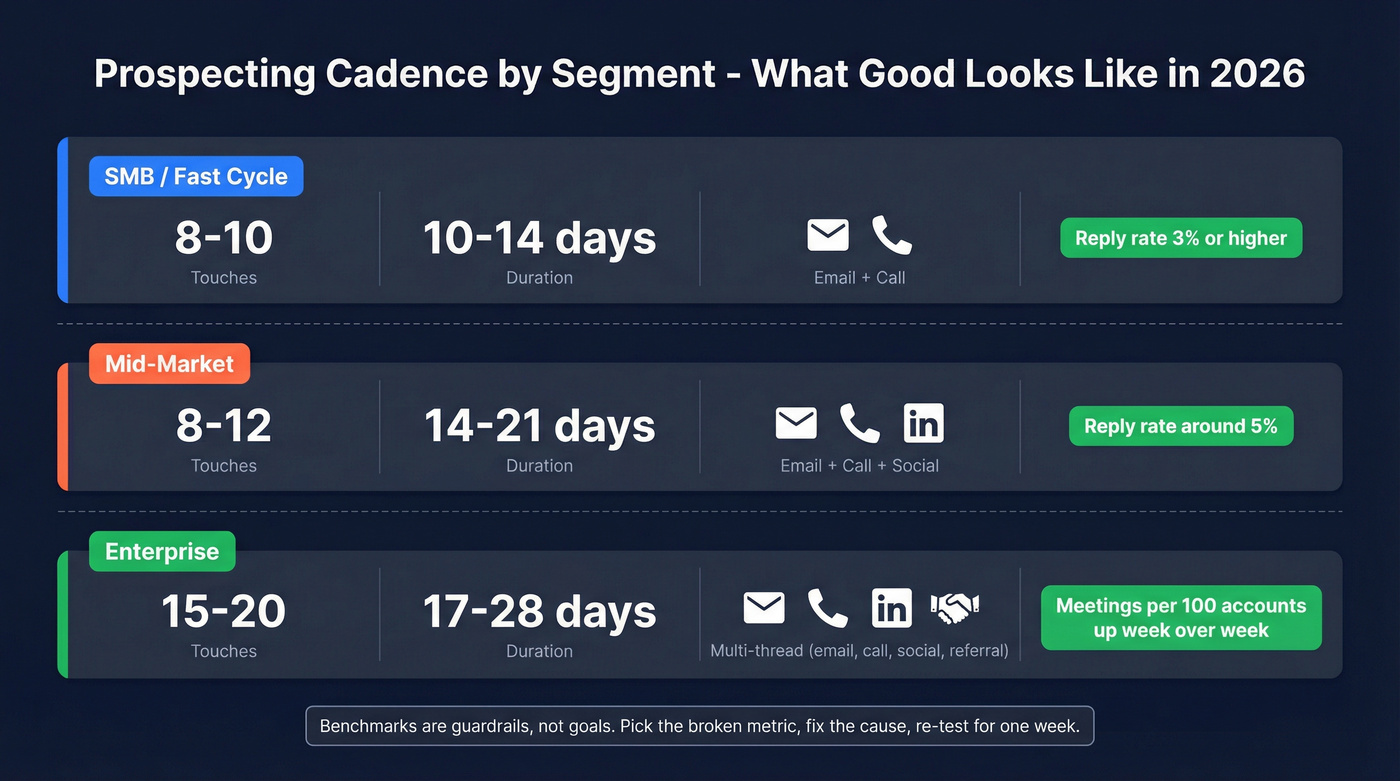

Sales prospecting training cadence and benchmarks in 2026 (what "good" looks like)

Benchmarks aren't goals. They're guardrails.

Without guardrails, every rep invents their own reality: "My market's different," "My buyers don't answer email," "Calling is dead," and on and on. Benchmarks give you a shared language, and they tell you what to fix first.

Baseline benchmarks (use these to set expectations)

- Cold email response rate: 5.1% average baseline; typical range 1-5% (Sopro, updated Feb 6, 2026).

- Cold calling success rate: 2.7% industry success rate (Cognism, 2026).

- Cadence norm: 8-12 touches over 2-3 weeks for most B2B motions.

- Enterprise cadence: 15-20 touches when deal cycles are longer and stakeholders are more distributed.

Deliverability guardrails (the gating metrics)

If these are off, stop rewriting copy and fix the plumbing:

- Bounce rate

- Target: under 3%

- Warning: 3-5% (expect spam placement to creep up)

- Hard stop: >5% (pause sends, clean lists, verify contacts)

- Spam placement / inboxing

- If replies drop and opens crater across the board, assume deliverability first, not "messaging fatigue."

- Domain reputation

- If you're scaling volume, warm up domains and throttle. Training doesn't override email infrastructure.

This is why data hygiene belongs inside your training system, not as a separate "RevOps thing." (If you need the mechanics, start with email deliverability.)

Practical cadence table (copy/paste)

| Segment | Touches | Duration | Channel mix | Good signal |

|---|---|---|---|---|

| SMB / fast cycle | 8-10 | 10-14 days | email + call | reply rate >=3% |

| Mid-market | 8-12 | 14-21 days | email + call + social | reply rate ~5% |

| Enterprise | 15-20 | 17-28 days | multi-thread | meetings per 100 accounts up WoW |

Diagnostic thresholds (what to change when a metric is off)

Use this like a decision tree. Pick the broken metric, fix the cause, then re-test for one week.

Email metrics

- Bounce rate >5% -> your list's dirty.

- Fix: verify emails, remove catch-all risk, refresh contacts weekly, stop uploading scraped lists into sequencers. (For the SOP, see email verification list.)

- Open rate <25% (with low bounces) -> subject lines + sending reputation are the issue.

- Fix: simplify subjects (no hype), reduce links, throttle volume, and segment by persona.

- Reply rate <1% (with decent opens) -> offer + targeting are wrong.

- Fix: tighten ICP, rewrite the "reason to talk," and remove "maybe" accounts.

- Reply rate's fine but meetings are low -> CTA and qualification are weak.

- Fix: ask for a smaller step, add a disqualifier line, and coach reps to confirm pain before pitching.

Call metrics

- Connect rate <6-8% -> wrong numbers + bad call windows.

- Fix: improve mobile coverage, call in 2-3 tested windows, and stop calling HQ lines. (Use the answer rate benchmarks to sanity-check.)

- "Success" rate below 2.7% -> opener + list quality are the culprits.

- Fix: tighten opener to one sentence, coach objection handling, and multi-thread accounts.

Meeting metrics

- Meetings set but not held -> calendar friction and weak next-step framing.

- Fix: confirm agenda in the invite, add a one-line "what you'll leave with," and send a 24-hour reminder.

A cadence that actually works (step-by-step)

Day 1-3: front-load relevance

- Touch 1: email with a clear offer + proof.

- Touch 2: call within 24 hours (leave voicemail only if it supports the email).

- Touch 3: short follow-up email that tightens the hypothesis.

Day 4-10: add channels, don't add noise

- Alternate call + email.

- Add one social touch that references a trigger or a point of view (not "just connecting").

- If you're multi-threading, add a second persona with a different angle (don't copy/paste the same pitch).

Day 11-21: persistence with a reason

- "Bump" emails are fine once. After that, every touch needs new value: a customer example, a relevant insight, a trigger, or a sharper ask.

Real talk: training that doesn't include a cadence standard is just motivational speaking.

Your reps need a default rhythm they can run when they're tired, behind quota, and getting ignored.

Training formats and pricing (what you'll pay and what drives cost)

Most teams overthink "which provider" and underthink "which format fits our constraints."

If you're a small team with no enablement function, self-paced plus a manager-led coaching loop beats a fancy cohort. If you're a larger org with inconsistent managers, you need heavier facilitation and reinforcement, because otherwise the program turns into a one-time event and the calendar wins.

Also: if your GTM motion depends on pipeline creation, don't treat prospecting as separate from demand gen. The best programs connect ICP, messaging, and list quality directly to meetings and pipeline created.

Pricing ranges by format

| Format | Best for | Typical price | What you get |

|---|---|---|---|

| Self-paced | SMB, ramp | $50-$300/mo | lessons + drills |

| Bootcamp | reset + energy | $1k-$2k | 1-2 day event |

| Workshop + sustain | behavior change | $1.5k-$3k | training + follow-up |

| Cohort (team) | alignment | $10k-$50k+ | custom + practice |

| Enterprise program | scale | $50k-$250k+ | multi-cohort |

Concrete anchors you can use in budgeting:

- RAIN Group self-paced prospecting: $199/mo.

- Integrity Selling open enrollment: $1,950/person with sustainment included.

- Sales Gravy Fanatical Prospecting Bootcamp ticket: $1,297.

- Sandler: $1,000-$3,000 ballpark depending on package/franchise.

What drives cost (and what's worth paying for)

Pay for this (it changes behavior)

- Customization to your ICP + messaging

- Live practice time (role plays, call reviews)

- Reinforcement sessions (weekly sustainment)

- Manager coaching enablement (train-the-trainer)

- Measurement support (scorecards, QA, dashboards)

Don't pay extra for this (it's packaging)

- Fancy portals with generic content

- "Certification" that doesn't map to pipeline outcomes

- One-time workshops with no reinforcement

I'm not ranking every boutique firm here because pricing and delivery quality vary wildly. Use the scorecard below and force every vendor into the same evaluation box.

How to evaluate a training provider (scorecard you can copy/paste)

If you're buying prospecting training, you're not buying content. You're buying behavior change.

Give each line a 1-5, then total it. Anything under 35/50 is a no, even if the trainer's charismatic.

Provider scorecard (50 points total)

1) ICP + message tailoring (10 pts)

- Do they customize examples to your segment and buyers?

- Do they help you define disqualification rules?

2) Practice intensity (10 pts)

- How much live practice happens vs lecture?

- Do they review real emails/calls from your team?

3) Reinforcement design (10 pts)

- Is there spaced repetition (weekly sustainment, drills, QA)?

- Do managers get a coaching plan?

4) Measurement + ROI (10 pts)

- Do they define success metrics up front?

- Do they provide scorecards and reporting templates?

5) Implementation support (10 pts)

- Do they help you operationalize cadence, sequencing, and QA?

- Do they support enablement/RevOps integration?

Demand this structure: Craft -> Deliver -> Enable

A good provider can explain their program in three verbs:

- Craft: define success metrics and tailor to your ICP

- Deliver: interactive sessions focused on practice, not lecture

- Enable: spaced repetition, ongoing practice, feedback, coaching

If a provider can't explain their version of this in 2 minutes, they're selling vibes.

Red flags (and the questions to ask)

Ask:

- "Show me the learning path. Where's the practice? Where's the QA?"

- "What changes in the CRM in 30 days - and how will we measure it?"

- "How do you train managers to coach, not just inspect pipeline?"

- "What deliverability and list-quality standards do you require before we scale volume?"

If the provider won't commit to measurement, walk. Pipeline doesn't care how inspiring the workshop was.

ROI model: what prospecting training has to return to be worth it

Ignore vanity ROI claims. Use pipeline math.

Step 1: Estimate incremental meetings per rep per week Start conservative. Even +1 meeting/week/rep is a big win if it's consistent.

Step 2: Convert meetings -> opportunities

Example: if 40% of meetings become qualified opps, then +1 meeting/week = 0.4 opps/week.

Step 3: Convert opportunities -> wins

Example: 25% win rate -> 0.1 wins/week.

Step 4: Multiply by ACV

Example: $20k ACV -> $2k/week per rep in expected revenue.

Step 5: Compare to training cost (and time cost) If training costs $2,000/rep and you net $2,000/week in expected revenue, payback's about 1 week after the behavior sticks. Even if you're off by 50%, it's still fast.

The real ROI killer isn't price. It's drift: no reinforcement, no QA, no manager time.

Your 30-day rollout plan (skills + coaching + QA + measurement)

Don't "run training." Run a 30-day rollout like a RevOps project: clear scope, clear owners, clear metrics, and a weekly operating rhythm.

Week 0 (prep): set the system up before you train

Decide your "one skill" focus Pick one primary skill for 30 days: offer clarity, objection handling, email writing, call openers, or multi-threading. If you pick five, you'll improve none.

Lock the cadence standard

Baseline: 8-12 touches over 2-3 weeks. Decide your channel mix and your minimum quality bar.

Define your measurement

- Leading: touches sent, calls placed, connects, deliverability, open rate, reply rate

- Lagging: meetings set, meetings held, pipeline created, opportunities created

Build QA scorecards (simple, but real) Email QA and call QA are where "training" turns into behavior change.

Email QA scorecard (1-5 each; target average >=4)

- Relevance: does the first line prove this is for their role/company?

- Offer clarity: can a buyer repeat the "reason to talk" in one sentence?

- Proof: is there a credible anchor (customer, metric, insight) without bragging?

- Brevity: under ~120 words, no fluff, no throat-clearing.

- CTA discipline: one ask, easy to answer, no "15 options."

Call opener rubric (1-5 each; target average >=4)

- Permission-based opener (not apologetic, not pushy)

- Reason for the call tied to a trigger/role

- Clarity (one breath, no jargon)

- First question quality (opens a real conversation)

- Next step control (clear close if there's interest)

Week 1: train + instrument

Day 1-2: training + examples

- Teach the framework.

- Show 3 good examples and 3 bad ones from your market.

Day 3-5: practice + QA

- Every rep writes 10 emails and records 10 call openers.

- Manager reviews using the scorecard and gives one rewrite + one re-record per rep.

Operating rhythm (Week 1)

- 2x 30-minute role play blocks

- 1x 45-minute message QA session

- 1x 30-minute metrics review (bounce/open/reply + connect)

Week 2: execute the cadence + coach to quality (with a real example)

This is where training becomes real, because reps get coached on real touches, not hypothetical role plays.

- Reps run the cadence on a controlled list (same segment, same persona).

- Managers coach on the scorecard, not on "effort."

Week 2 example (what good ops looks like) Let's say you've got 6 reps targeting the same persona, and Monday's baseline looks like this: bounce 6%, open 28%, reply 0.6%, connect 5%, meetings set: 3.

Decision 1 (Day 2): bounce is the fire. Pause scaling volume and clean the list. Decision 2 (Day 3): once bounce drops under 3%, rewrite only the first line + offer sentence (don't rewrite everything). Decision 3 (Day 5): if connect's still under 6-8%, adjust call windows and prioritize mobiles.

By Friday, a realistic "fixed plumbing" improvement looks like: bounce 2-3%, open 30-40%, reply 1-2%, connect 8-12%. That's not magic. That's just removing friction so skill can show up.

Week 3: iterate offers + expand segments

- Keep the cadence stable. Change one variable: offer angle, persona, or list criteria.

- Add multi-threading if you're selling into committees.

Teams double reply rates here all the time by tightening the ICP and removing "maybe" accounts. Less volume, more signal.

Week 4: standardize + scale

- Promote the best-performing sequence to the default.

- Document the rules: who to target, what to say, what "good" looks like.

- Build onboarding: new reps learn the system in week one.

Daily operating rhythm checklist (what managers should actually do)

- Daily: spot-check 5 emails + 2 calls per rep (quality > quantity).

- 2x/week: 30-minute role play (objections + openers).

- Weekly: metrics review by persona (bounce/open/reply + connect + meetings).

- Weekly: list-quality audit (wrong titles, dead numbers, duplicates, "not ICP").

- Biweekly: refresh offers and proof points.

If you do nothing else: protect prospecting blocks and coach to quality.

Everything else is secondary.

Tools and data that make training stick (the execution layer)

The hidden bottleneck in prospecting training is deliverability and list hygiene.

You can teach perfect messaging, but if your list is stale and your emails bounce, your domain reputation tanks and reps stop believing the process. Then they revert to random outreach because the system "doesn't work."

Think of tools in two buckets:

- Skill + reinforcement (training providers)

- Execution layer (data, verification, sequencing, CRM hygiene)

Workflow map (how training becomes pipeline)

- Build ICP list (accounts + personas)

- Pull verified contacts (emails + mobiles)

- Verify + enrich (titles, company data, triggers)

- Launch cadence (8-12 touches / 2-3 weeks)

- QA weekly (messages + calls)

- Measure weekly (bounce/open/reply, connect, meetings, pipeline)

- Refresh data weekly (new hires, job changes, bounces)

Now the tools.

Prospeo (The B2B data platform built for accuracy)

Here's the thing: if your reps are prospecting on bad contacts, you're not running training. You're running a morale experiment.

Prospeo is the cleanest way to remove the most common training killer: reps wasting hours on wrong emails, dead dials, and stale titles. It's the best pick for email accuracy, data freshness, and self-serve workflows, which is exactly what you want during a 30-day rollout where you're trying to stabilize inputs before you judge rep skill.

What you get, in plain numbers:

- 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers

- 98% email accuracy

- 7-day data refresh cycle (industry average: 6 weeks)

- 30+ search filters and intent data across 15,000 topics

- 83% enrichment match rate and 92% API match rate

- Transparent, credit-based pricing: ~$0.01/email, 10 credits per mobile, plus a free tier (75 emails + 100 Chrome extension credits/month) and no contracts

A scenario we see constantly: a team runs a "prospecting bootcamp," reps get excited, then Week 2 hits and bounce jumps to 8-12% because someone uploaded an old list. Deliverability drops, replies dry up, and the post-mortem blames messaging. That's backwards. Fix the list first, then coach the craft.

Use Prospeo in the rollout like this: Week 0 list build -> Week 1 verify/enrich -> Week 2 run cadence without bounce spikes -> Week 3-4 refresh weekly so reps don't call ghosts.

For product details: https://prospeo.io/pricing and https://prospeo.io/integrations.

Before the screenshot below, here's what you're looking at: the Chrome Extension (https://prospeo.io/contact-finder-extension) takes a person/company input (URL or page context) and returns email + mobile results with verification badges (including catch-all handling), plus one-click export to CSV/CRM.

RAIN Group (self-paced structure that doesn't waste time)

If you need a clean, self-paced prospecting curriculum that reps will actually finish, RAIN is a strong default. The self-paced prospecting course is $199/month and includes 45+ lessons, assignments/tools, downloadable resources, and certification. It also comes with a 30-day, 100% money-back guarantee.

RAIN also has enterprise credibility: it's rated 4.7/5 on Gartner Peer Insights (119 ratings).

Best for: small teams that need structure fast, plus managers who'll run weekly QA. Avoid if: you want behavior change without manager involvement - self-paced won't save you.

Pricing signal: $199/mo self-serve; team/cohort programs commonly land $10k-$50k+ depending on customization and seats.

Integrity Selling (reinforcement-heavy behavior change)

Integrity Selling is what I'd pick when the real problem is consistency: reps know what to do, but they don't do it the same way every week. The open enrollment workshop is $1,950 per person and includes pre-work, two live virtual sessions, plus eight weekly sustainment sessions (that sustainment's the value).

Common complaints on G2 include scheduling/session friction and that it can feel repetitive. Protect the calendar up front and it stops being a problem.

Pricing signal: $1,950/person open enrollment; team rollouts usually run $15k-$75k+ depending on seats and facilitation.

Sandler (shared language + accountability)

Sandler works when your org needs a common operating language and managers need something concrete to coach to. It's rated 4.8/5 on G2 (100 reviews); the recurring critique is that examples feel generic unless you tailor them to your market.

Skip this if: you won't customize talk tracks and role plays to your ICP. You'll end up with reps parroting scripts buyers can smell from a mile away.

Pricing signal: $1,000-$3,000 per person depending on program/franchise; team programs often land $10k-$50k+.

Sales Gravy Fanatical Prospecting Bootcamp (the momentum reset)

This is the "stop hesitating" option. It's high energy, heavy on activity standards, and it resets a team that's gotten soft on prospecting.

Best for: teams with an effort/consistency problem and a manager who'll enforce prospecting blocks. Avoid if: you need deep messaging work for complex enterprise deals.

Pricing signal: $1,297 per ticket for the live bootcamp; team packages commonly run $5k-$25k depending on seats and travel.

Winning by Design (process alignment across the revenue line)

Winning by Design is the pick when prospecting isn't the only leak. If SDR->AE handoffs are messy, discovery's inconsistent, or pipeline stages mean different things to different people, their process work pays off.

Best for: teams that already get meetings but don't convert cleanly. Avoid if: you're a tiny team that just needs outbound fundamentals this month.

Pricing signal: $5k-$20k for workshops; $25k-$150k+ for broader enablement programs.

JB Sales (tactical outbound skills reps actually use)

JB Sales is practical and conversion-focused: better emails, better calls, better follow-up. It's not trying to be a full methodology - it's trying to make next week's outreach work.

Best for: improving reply rates and call effectiveness quickly. Avoid if: you need a full manager-coaching system built for you.

Pricing signal: $300-$2,000 per person depending on course/coaching; team training often lands $10k-$40k.

Others to know (Janek, Richardson, Udemy, Funnel Clarity)

- Janek: enterprise programs; buy only if they commit to reinforcement + measurement; pricing $10k-$100k+ for cohorts.

- Richardson: strong methodology content; best paired with your internal coaching loop; pricing $1k-$3k/person or $15k-$75k team.

- Udemy: good for cheap onboarding supplements, not transformation; pricing $15-$200/course.

- Funnel Clarity: strong on research discipline; validate fit for your segment; pricing $5k-$30k depending on scope.

You just built a training checklist that demands verified emails, fresh mobiles, and weekly data hygiene. Prospeo covers all three: 143M+ verified emails, 125M+ mobile numbers with 30% pickup rates, and data refreshed every 7 days - not the 6-week industry average. Teams using Prospeo book 35% more meetings than Apollo users.

Give your reps the clean inputs that make training actually stick.

FAQ: sales prospecting training

How long does prospecting training take to show results?

Leading indicators (bounce rate, open rate, reply rate, connect rate) should move in 7-14 days, and pipeline impact typically shows in 3-6 weeks if you enforce the cadence and run weekly QA. The fastest wins usually come from cleaner lists (bounce <3%) and a tighter "reason to talk."

What KPIs should improve after training (and by how much)?

A healthy target is cold email responses trending toward ~5.1% (typical 1-5%) and cold calling success trending toward ~2.7%. If you're below that, fix deliverability first (bounce under 3%) and tighten ICP/offer before you ask reps to do more activity.

Should we buy training or build it internally?

Buy a program when you need speed and an external standard, and build internally when you can commit 60 minutes per rep per week of manager QA/coaching. Most teams win with a hybrid: adopt a framework, then operationalize it with your cadence, scorecards, and dashboards.

What's a good free tool to support prospecting execution during training?

Prospeo's free tier includes 75 emails + 100 Chrome extension credits/month, which is enough to run a real pilot list with verified contacts and avoid bounce spikes. Pair it with your CRM and a sequencer, and you can test one persona + one offer for 2-3 weeks without "training in theory."

What tools do we need so training actually sticks (CRM, sequencing, data)?

You need (1) a CRM with enforced fields/stages, (2) a sequencer that supports multi-channel cadences, and (3) a verification/enrichment layer to prevent bounces and dead dials. If bounce is over 5%, fix data before you fix messaging, or you'll train reps inside a broken system.

Summary: the system that makes sales prospecting training work

Sales prospecting training works when it's treated like an operating system: a defined cadence, clear messaging standards, clean inputs (deliverability + verified contacts), and a manager coaching loop that inspects quality weekly.

Lock the guardrails, instrument the KPIs, and run the 30-day rollout. You'll get predictable meetings, not just a motivational spike.