The Best Startup Prospecting Tools (2026): Lean Stacks That Book Meetings

Your first SDR starts on Monday. By Friday, your domain reputation's already wobbling because they blasted a half-verified list, got a bunch of bounces, and "fixed it" by sending more.

I've watched this exact movie: a startup buys four tools that each do 30% of the job, nobody owns the workflow end-to-end, and the team spends more time reconciling CSVs than booking meetings.

Here's the hard truth: if you're pre-seed, don't buy quote-only tools. Period.

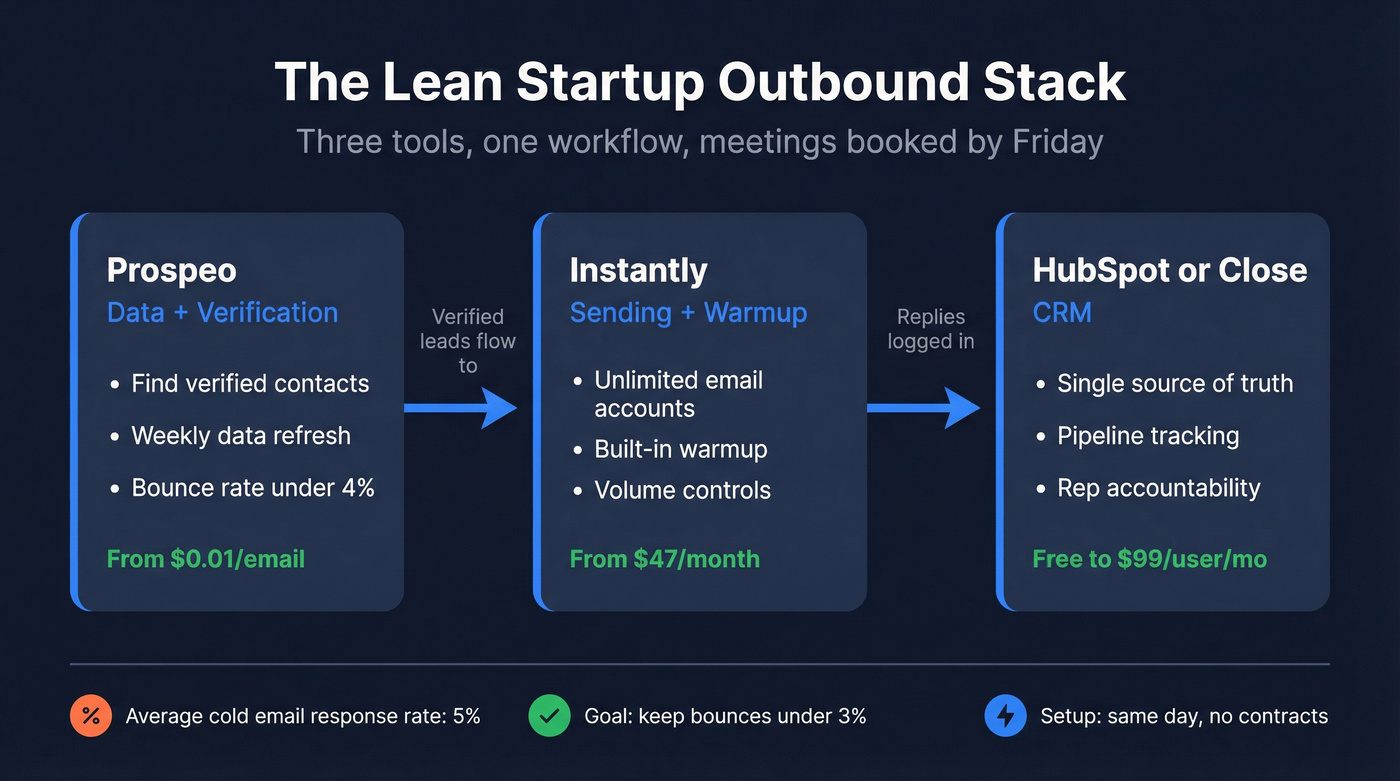

Our picks (TL;DR): the 3 tools most startups should trial first

Most cold email campaigns average about 5% response rate, and plenty land in the 1-5% band. So your stack doesn't need to be feature-complete. It needs to be accurate, deliverable, and simple enough that people actually use it.

If I were setting up outbound for a typical B2B startup this week, I'd start here.

Prospeo (data + verification)

- Use this if you want verified, fresh contacts without annual contracts, and you care about not torching your domain with bad data. (If you're evaluating options, see our roundup of email lookup tools.)

- Skip this if you're trying to buy an all-in-one suite with intent dashboards, chat, and workflow automation in one contract (that's ZoomInfo territory, and it's priced like it).

- Pricing signal: free tier (75 emails + 100 extension credits/month), then roughly ~$0.01 per verified email.

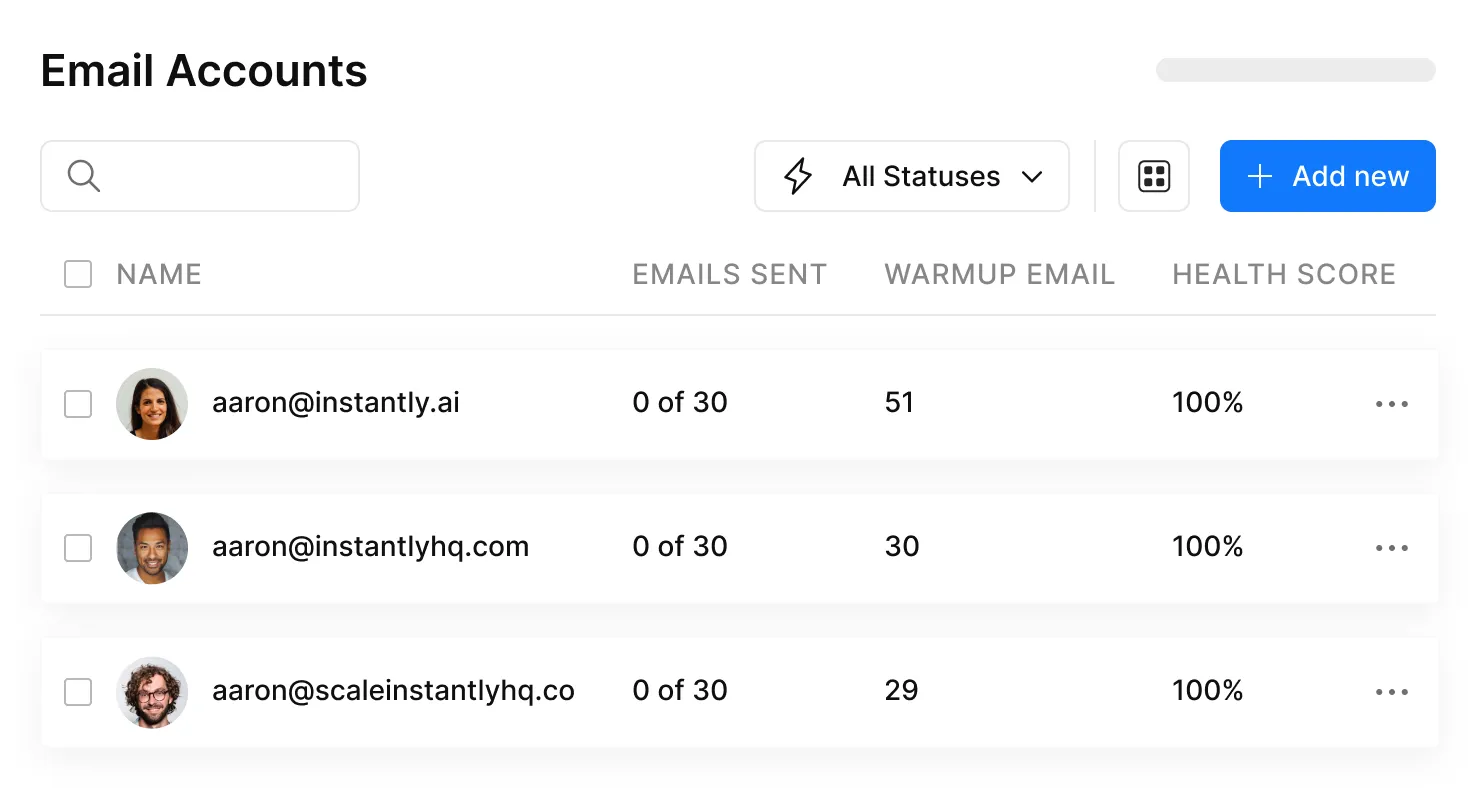

Instantly (sending + warmup)

- Use this if you need a lean sending layer with unlimited email accounts + unlimited warmup, and you don't want to overthink it. (If you're building a lean sending stack, compare more cold email outreach tools.)

- Skip this if you're already running everything inside Outreach/Salesloft and you've got a real RevOps function.

- Pricing signal: $47 / $97 / $358 per month (Growth/Hypergrowth/Light Speed).

HubSpot (CRM) or Close (CRM for outbound)

- Use HubSpot if you're founder-led, you've got inbound, and you want one clean source of truth the whole company can live in.

- Use Close if you're outbound-heavy and want speed (calling + sequences + pipeline) without the HubSpot sprawl.

- Pricing signal: HubSpot starts free; Sales Hub starts at $15/seat/month (Starter). Higher tiers are packaged (for example, $1,450/month for five seats on Professional). Close is typically ~$99-$149/user/month for the plans startups actually use.

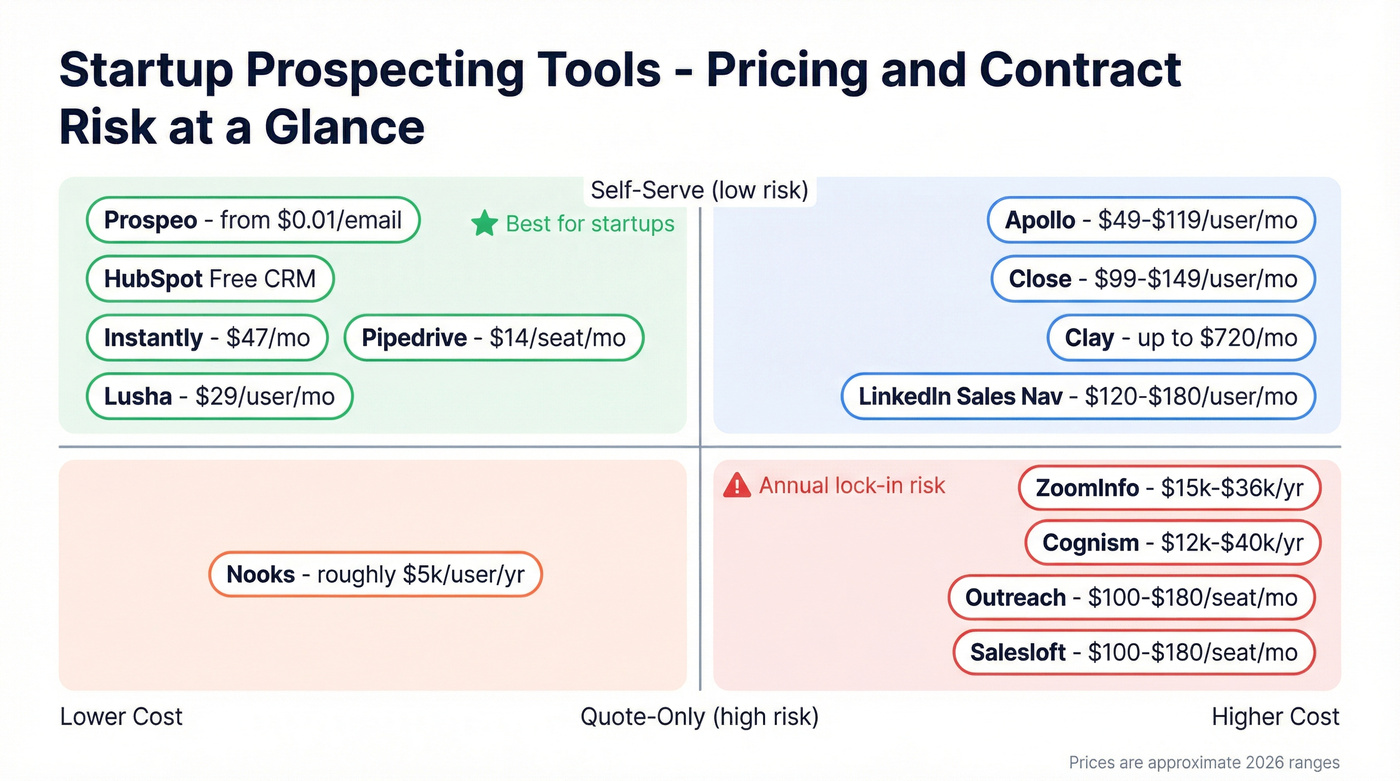

Comparison table: pricing, contracts, and setup time (2026)

This table prioritizes startup constraints: time-to-value, contract risk, and pricing transparency.

Look, "all-in-one" is overrated for most startups. If your average deal size is small, you don't need a platform that does everything. You need a stack that keeps deliverability clean and reps moving every day.

Table 1 - quick comparison (mobile-friendly)

| Tool | Best for | Typical cost | Contract | Setup |

|---|---|---|---|---|

| Prospeo | Verified data + mobiles | Free; ~$0.01/email | Self-serve | Same day |

| Apollo.io | All-in-one prospecting | ~$49-$119/user/mo | Self-serve | Same day |

| Instantly | Send + warmup | $47/$97/$358 mo | Self-serve | Same day |

| Clay | Enrichment workflows | $0/$134/$314/$720 mo | Self-serve | 1-2 days |

| HubSpot | CRM + hygiene | Free; $15/seat/mo+ | Self-serve | 1-2 days |

| Close | Outbound CRM | ~$99-$149/user/mo | Self-serve | 1-2 days |

| Pipedrive | Simple pipeline | starts ~ $14/seat/mo (annual) | Self-serve | Same day |

| LinkedIn Sales Navigator | Social prospecting | ~$120-$180/user/mo | Monthly/annual | Same day |

| Nooks | Dialing + coaching | ~$5k/user/yr | Quote-only | 1-2 weeks |

| Cognism | EU/UK data + mobiles | ~$12k-$40k/yr | Quote-only | 1-2 weeks |

| Lusha | Quick enrich per lead | Free; ~$29-$49/user/mo | Self-serve | Same day |

| Outreach | Sales engagement | ~$100-$180/seat/mo | Quote-only | 1-2 weeks |

| Salesloft | Sales engagement | ~$100-$180/seat/mo | Quote-only | 1-2 weeks |

| ZoomInfo | Enterprise database | $14,995-$35,995/yr (typical) | Quote-only | 1-2 weeks |

Notes (what matters in practice)

- Prospeo: Weekly refresh + verification-first workflow. Best "don't burn the domain" data layer.

- Apollo: Fastest path to "rep productive today" in one UI. Verify before you scale volume.

- Instantly: Warmup included; great for lean teams.

- Clay: Powerful, but credit burn's real once you operationalize.

- HubSpot: Best early "single source of truth" CRM.

- Close: Best outbound cockpit for small teams.

- Pipedrive: Clean pipeline without admin overhead.

- LinkedIn Sales Navigator: Cheapest early signal you can buy if your buyers live on professional networks.

- Nooks: Buy it when calling's a real channel with coaching, not a side quest.

- Cognism: Strong choice for UK/EU coverage + compliance posture.

- Lusha: Great for enriching known leads; not a list factory.

- Outreach/Salesloft: Governance and analytics for mature SDR teams.

- ZoomInfo: Deep enterprise dataset + modules, but quote-only friction's the hidden cost. In review summaries, "Outdated Data" and "Inaccurate Data" show up repeatedly as top negatives.

A few interpretations that actually matter:

- ZoomInfo vs startup reality: That $14,995-$35,995/year range makes sense when you have a real outbound org and you'll use multiple modules. Early on, it's usually overkill.

- Apollo vs ZoomInfo: Apollo wins on speed and self-serve pricing; ZoomInfo wins on enterprise packaging and breadth.

- Self-serve wins early: If you can't trial it without a demo and an annual commitment, it's not a pre-seed tool.

- Discounts aren't "free money": When a vendor offers 30-65% off, they're usually pushing annual terms, multi-seat bundles, and add-on modules. That creates delays, wrong seat counts, and shelfware.

Your first SDR shouldn't spend week one torching your domain with bad data. Prospeo's 7-day refresh cycle and 5-step verification keep bounce rates under 4% - ask Meritt, who tripled pipeline from $100K to $300K/week after switching. Free tier included, no contracts, no demo calls.

Start sending on day one without the deliverability anxiety.

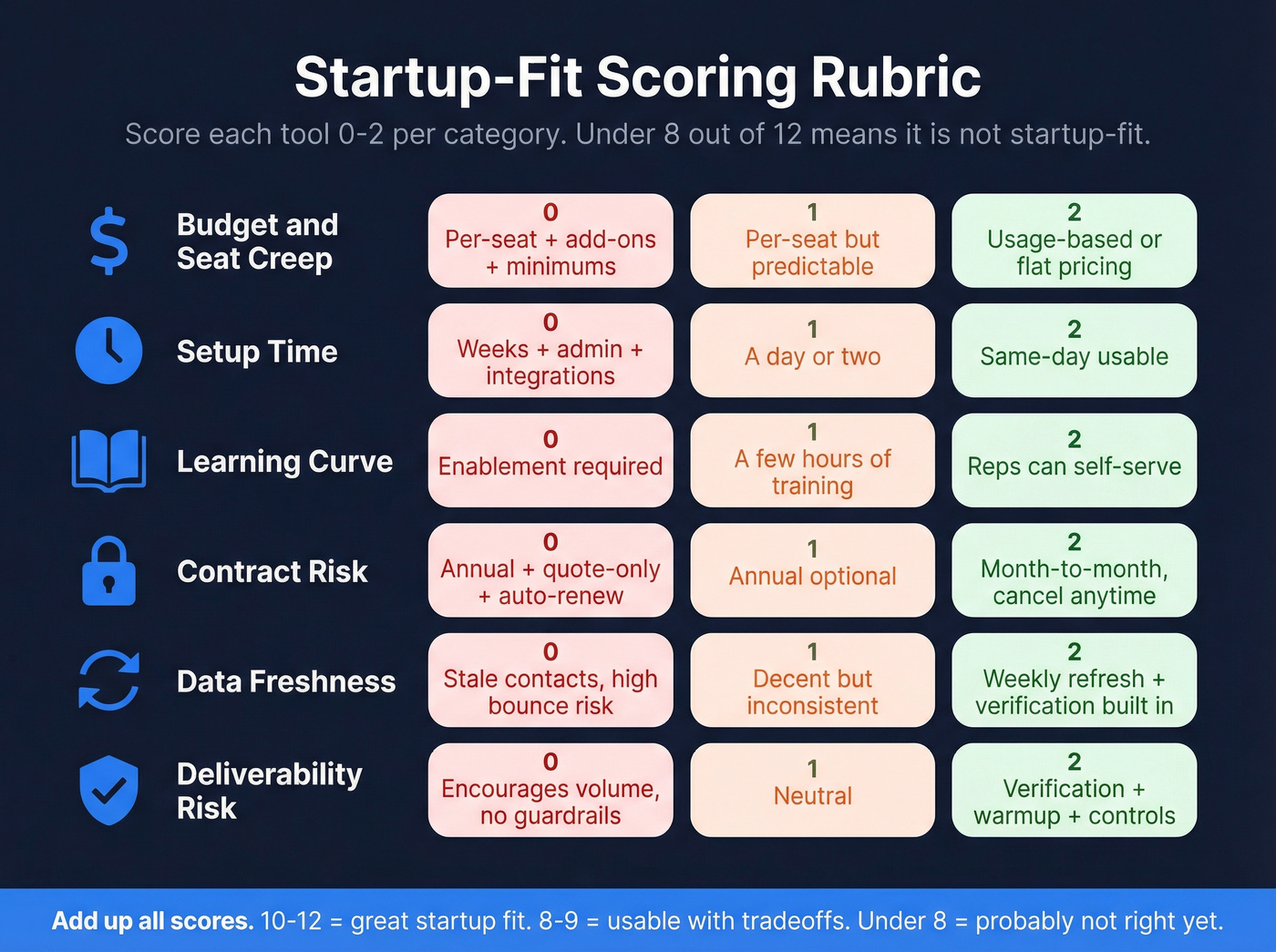

How to choose startup prospecting tools (without buying shelfware): a startup-fit scoring rubric

Startups don't lose outbound because they picked the "wrong" tool. They lose because the stack creates friction, reps cut corners, and deliverability quietly dies.

I use a simple 0-2 scoring rubric. Give each tool a score per category, then add them up. Anything under 8/12 isn't "bad." It's just not startup-fit.

Startup-fit checklist (score 0-2 each)

1) Budget/seat creep (0-2)

- 0: per-seat pricing + add-on modules + minimums

- 1: per-seat but predictable

- 2: usage-based or flat pricing that scales cleanly

2) Setup time (0-2)

- 0: needs admin + integrations + weeks

- 1: a day or two

- 2: same-day usable by a founder/SDR

3) Learning curve (0-2)

- 0: "enablement required"

- 1: a few hours of training

- 2: reps can self-serve

4) Contract risk (0-2)

- 0: annual + quote-only + auto-renew vibes

- 1: annual optional

- 2: month-to-month / cancel anytime

5) Data freshness (0-2)

- 0: stale contacts, high bounce risk (see: B2B contact data decay)

- 1: decent but inconsistent

- 2: weekly refresh + verification built-in

6) Deliverability risk (0-2)

- 0: encourages volume without guardrails

- 1: neutral

- 2: verification + warmup + sending controls

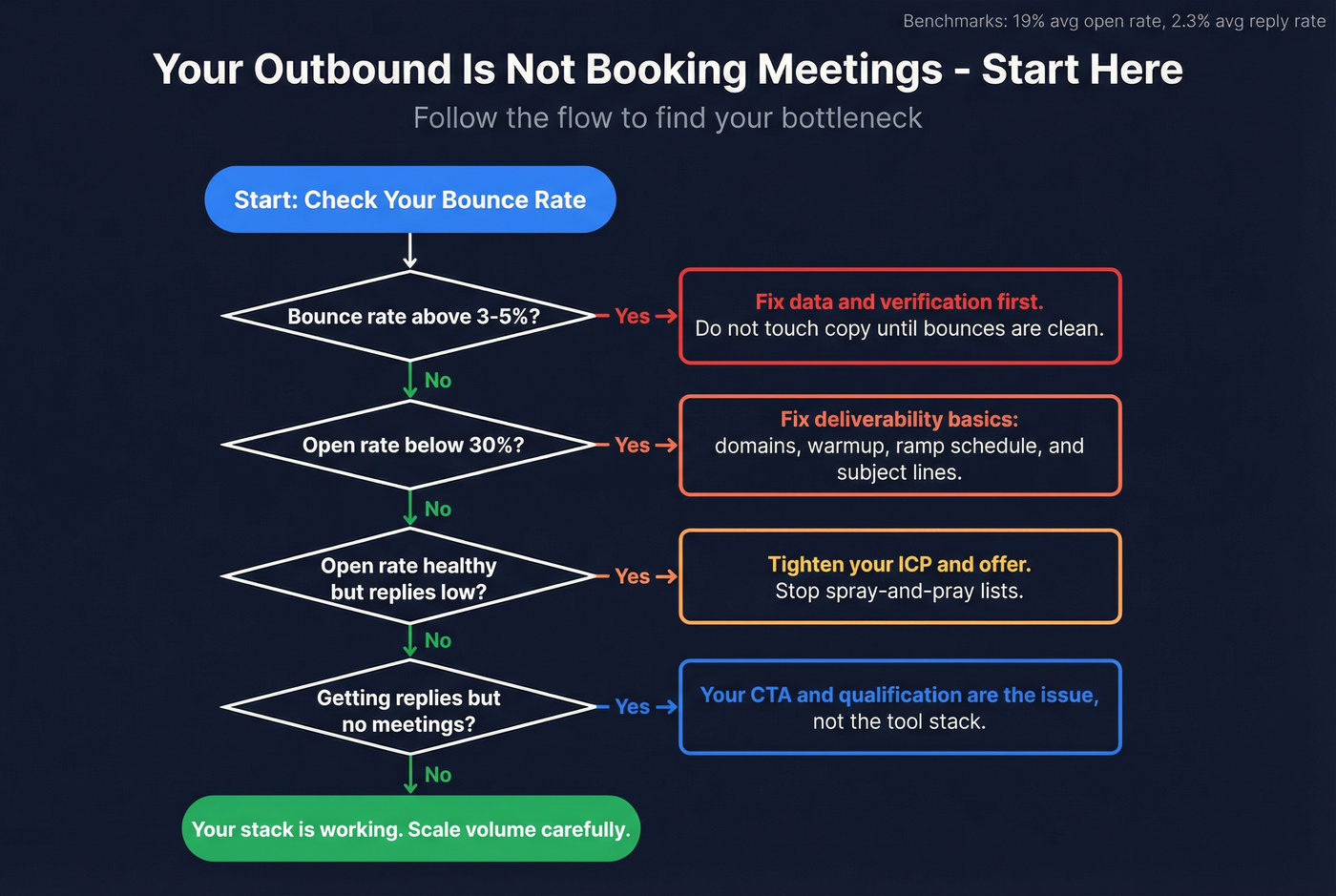

Baseline "stack isn't booking meetings" metrics (and what to do next)

If your outbound's sitting around 19% open and 2.3% reply, you don't need more tools. You need fewer failure points.

Use this quick diagnostic:

- Bounce rate > 3-5%? Fix data + verification before touching copy. (If you want a clean SOP, use this email verification list workflow.)

- Open rate < 30% with low bounces? Fix deliverability basics (domains, warmup, ramp) and subject lines. (More detail: how to warm up an email address.)

- Open rate healthy but replies low? Tighten ICP and offer; stop spray-and-pray lists. (If you need a quick refresher, start with Ideal Customer.)

- Replies exist but no meetings? Your CTA and qualification are the issue, not the tool stack.

Decision tree: pick a stack in 60 seconds

- Pre-seed, founder-led: HubSpot (free) + a verification-first data source + Instantly.

- Need all-in-one today: Apollo + a verification layer + a simple CRM (HubSpot/Pipedrive).

- UK/EU-heavy outbound: Cognism + a sequencer (Instantly/Lemlist) + HubSpot/Close.

- Phone-first motion: a strong mobile dataset + Nooks (or a lighter dialer) + Close.

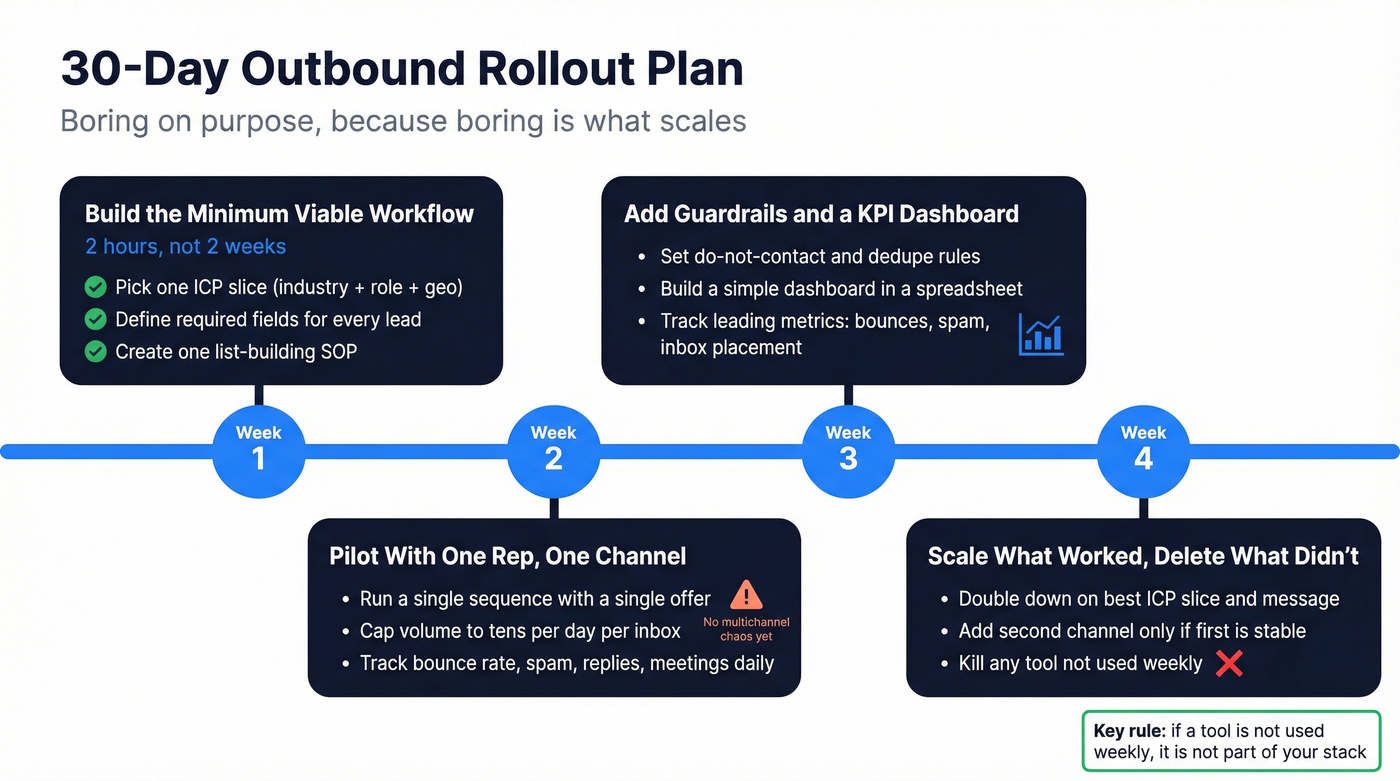

30-day rollout plan (so the stack actually gets used)

Most "tool failures" are rollout failures.

Here's a 30-day plan that prevents shelfware, and yes, it's boring on purpose because boring is what scales.

Week 1 - Build the minimum viable workflow (2 hours, not 2 weeks)

- Pick one ICP slice (one industry + one role + one geo).

- Define your required fields: first name, company, title, verified email, and one personalization hook.

- Create one list-building SOP: "filters -> verify -> export -> sequence -> log to CRM."

Week 2 - Pilot with one rep (or the founder) and one channel

- Run a single sequence with a single offer. No multichannel chaos yet.

- Cap volume aggressively (think tens/day per inbox, not hundreds).

- Track four numbers daily: bounce rate, spam complaints, reply rate, meetings booked.

Week 3 - Add guardrails and a KPI dashboard

- Add a "do not contact" rule, dedupe rules, and a single naming convention for campaigns.

- Create a simple dashboard (a sheet's fine):

- Leading: bounces, spam complaints, inbox placement checks

- Lagging: replies, meetings, pipeline created

Week 4 - Scale what worked (and delete what didn't)

- Double down on the best-performing ICP slice and message.

- Add a second channel only if the first is stable (calling or social touches).

- Kill any tool that isn't used weekly. If it's not used weekly, it's not part of your stack.

Best tools by job-to-be-done (reviews + best-for)

A quick reality check on "data quality expectations," because most listicles won't say it out loud:

In a 100-lead US SaaS VP Sales bake-off style test, email accuracy ranges looked like ZoomInfo ~85-91% and Apollo ~70-80%. In the real world, accuracy swings hard by segment and geography, so build your workflow like accuracy is variable because it is.

Data & leads (build lists that won't bounce)

Prospeo - best for email accuracy + weekly refresh without contracts (Tier 1)

Prospeo is "The B2B data platform built for accuracy", and it's the cleanest pick when your main goal is simple: get good contacts, keep bounces down, and don't get trapped in an annual contract before outbound even works.

The dataset's big enough for real outbound: 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers. Everything refreshes every 7 days (the industry average is about 6 weeks), and email accuracy sits at 98%. It's used by 15,000+ companies and 40,000+ Chrome extension users.

Here's the thing: deliverability isn't a copy problem half the time. It's a data problem. Prospeo's verification-first approach (including catch-all handling plus spam-trap and honeypot filtering) is exactly what you want before you let a new SDR "learn by doing" on your domain, because the fastest way to kill outbound is to normalize bounces and then try to brute-force your way out with volume.

A 3-step workflow that actually holds up

- Build a tight list with 30+ filters (including intent across 15,000 topics powered by Bombora)

- Verify emails and mobiles in real time

- Push into your CRM/sequencer via native integrations or export

Pricing's self-serve: free tier, then about $0.01 per verified email and 10 credits per mobile. Useful links: B2B leads database, Chrome extension, integrations.

Apollo.io - best "default" all-in-one for fast list building + sequencing (Tier 1)

Apollo's the fastest way to go from "we need leads" to "we sent a sequence" without stitching tools together. New reps get productive the same day because list-building and sequencing live in one UI.

The tradeoff's consistency. Apollo works great for broad outbound, but it's not the tool I'd trust to carry deliverability on its own at scale. If you ramp volume without verification, you'll pay for it in bounces and spam placement, and then everyone blames the copy because that's the easiest thing to change.

Pricing: ~$49-$119/user/month for the plans startups actually buy.

Gotcha: Apollo makes it easy to send more. It doesn't make you earn the right to send more. (If you're comparing accuracy claims, see Apollo.io accuracy.)

Enrichment & workflow (turn messy inputs into usable leads)

Clay - best for "weirdly specific" lists and chained enrichment (Tier 1)

Clay's the tool for teams that want custom lists and don't mind building the machine. If you've ever said, "I want companies hiring for X role, using Y tech, in Z region," Clay's how you do it.

Pricing: $0 / $134 / $314 / $720 per month (annual billing). It's credit-based, so cost scales with how many steps you run per lead.

Gotcha: Clay feels cheap during testing and expensive during production. Model your credit burn before you commit, because once you add multiple enrichments, plus phone lookups, plus retries, your "cost per lead" can jump fast without anyone noticing until the invoice hits.

People Data Labs (PDL) - best API-first enrichment when you have engineering support (Tier 2)

PDL is for teams that want enrichment inside their product, data warehouse, or internal tooling. It's not click-and-go, but it's powerful when you have an engineer who can wire it up once and keep it stable.

Pricing: commonly ~$500-$5,000/month depending on volume and endpoints.

Outreach & deliverability (sending, warmup, and inbox protection)

Instantly - best sending + warmup layer for lean teams (Tier 1)

Instantly's the cleanest "get outbound running" sending layer for startups. Unlimited email accounts and unlimited warmup removes the usual early bottleneck.

Pricing: $47/month (Growth), $97/month (Hypergrowth), $358/month (Light Speed). Growth includes 5,000 emails/month; Hypergrowth goes up to 100,000 emails/month, plus uploaded-contact caps (1,000 / 25,000).

Gotcha: if you treat warmup like a one-time setup, you'll lose inbox placement. Keep it running. (If you want the mechanics, see automated email warmup.)

Smartlead - best Instantly alternative for multi-inbox sending (Tier 2)

Smartlead's a strong alternative when you want multi-inbox sending, rotation, and basic deliverability controls without enterprise overhead.

Pricing: commonly ~$39-$174/month depending on plan and volume.

Lemlist - best when personalization is your strategy (Tier 2)

Lemlist shines when your outbound motion leans on personalization and multichannel touches, not raw volume. If your team writes fewer, better emails, it's a great fit.

Pricing: commonly ~$59-$99/user/month depending on plan.

CRM (keep pipeline clean without slowing down)

HubSpot CRM / Sales Hub - best for founder-led pipeline + inbound/outbound hygiene (Tier 1)

HubSpot's the easiest CRM to keep clean early. That matters more than people admit, because a messy CRM turns follow-up into guesswork and makes performance impossible to diagnose.

Pricing: HubSpot CRM is free. Sales Hub starts at $15/seat/month (Starter). Higher tiers are packaged (for example, $1,450/month for five seats on Professional, plus onboarding). If you add enrichment inside HubSpot, Breeze Intelligence is typically priced separately. (If hygiene is a problem, use this guide on how to keep CRM data clean.)

Close - best lightweight CRM for outbound teams (Tier 2)

Close is the outbound cockpit: calling, sequences, and pipeline in one place. Reps move faster because they don't context-switch all day.

Pricing: ~$99-$149/user/month for the tiers startups stick with.

Pipedrive - best simple pipeline for early-stage teams (Tier 2)

Pipedrive's the "don't overbuild it" CRM. Stages, activities, basic reporting. Done.

Pricing: starts around ~$14/seat/month when billed annually.

Calling (when email isn't enough)

Nooks - best for phone-first prospecting + coaching (Tier 2)

Nooks is what you buy when calling becomes a real channel with coaching and QA, not a "we should dial more" slogan. It's built for parallel dialing and rep improvement loops.

Pricing's quote-only; expect ~$5,000/user/year billed annually, plus ~$10-15 per phone number/month via Twilio. Setup takes 1-2 weeks if you implement coaching workflows properly.

Skip Nooks if nobody owns the calling motion. (If you're building the channel, start with this B2B cold calling guide.)

Intent & signals (when to add it, what to measure)

Intent tools are gasoline. If you don't have an engine (clear ICP, clean data, working sequences), gasoline just makes the fire bigger.

When to add intent: once you're already booking meetings weekly and you need better prioritization, not "more leads." (More on this in intent data for SDRs.)

What to measure:

- Lift in reply rate on in-market segments vs baseline

- Meetings per 100 accounts touched

- Time-to-first-meeting after the signal appears

Bombora - best for topic-level B2B intent at scale (Tier 2)

Bombora's a serious intent layer once you have enough accounts and enough outbound capacity to act on signals.

Pricing: commonly ~$15k-$60k/year depending on package and coverage.

Leadfeeder - best for website-visit signals without heavy setup (Tier 2)

Leadfeeder's a practical "who's on our site?" signal layer. It's not magic, but it gives SDRs a reason to prioritize accounts that already showed up.

Pricing: commonly ~$99-$199/month depending on plan and traffic.

Technographics (stack targeting)

Technographics are the most underrated signal for startups because they're concrete. If you sell to teams using a specific tool, stack targeting beats vague intent every day of the week.

Use case I love: "Target companies using Competitor X, then pitch the migration." It's direct, it's relevant, and it writes half the email for you.

BuiltWith - best for deep web tech profiling (Tier 2)

BuiltWith is the classic for identifying what a company runs on its site (analytics, ecommerce, CMS, marketing tags, and so on).

Pricing: commonly ~$295-$995/month depending on plan and export needs.

Wappalyzer - best lower-cost technographics for targeting (Tier 2)

Wappalyzer covers similar ground and is often the cheaper way to get stack-based lists.

Pricing: commonly ~$250-$600/month depending on plan and usage.

Social selling layer (the cheapest signal early)

LinkedIn Sales Navigator - best for founder-led targeting and warm context (Tier 2)

Sales Navigator's the tool founders quietly use even when they swear they "don't do outbound." It's the fastest way to build a target account list, map buying committees, and find warm paths.

- Use this if your ICP lives on professional networks and you sell a product that benefits from context (hiring, funding, job changes, team growth).

- Skip this if you only need bulk lists and never plan to do any manual account research.

Pricing anchors: Core is $119.99/month (or $1,079.88/year), Advanced is $179.99/month (or $1,679.88/year), and Advanced Plus is custom.

Startup-stage stacks + budgets (pre-seed -> seed -> Series A)

The best startup prospecting stack is the one you can run weekly without breaking. Minimum viable outbound stack = 2-3 tools max.

I've seen teams add "just one more tool" every month until nobody knows where truth lives. Don't.

Pre-seed (founder-led): prove ICP + message

Recommended stack

- HubSpot CRM (free) as the system of record

- A verification-first data source (self-serve, cancel anytime)

- Instantly for warmup + sending ($47-$97/month for most founders)

- Optional: Sales Navigator for account research (~$120/month)

Budget range: ~$150-$600/month (depending on email volume and data pulls)

Upgrade triggers

- You're booking meetings weekly and need more volume without risking deliverability

- You want to add calling (then consider Nooks or a lighter dialer)

Seed (1-2 SDRs): repeatable outbound motion

At seed, you're optimizing for rep throughput and list quality. This is where accuracy beats "more features."

Recommended stack

- Close (~$99-$149/user/month) or HubSpot Sales Hub

- Instantly ($97/month is a common sweet spot)

- Optional: Clay if you've got an ops-minded builder ($134-$314/month)

Budget range: ~$500-$2,000/month (2 seats + data + sending)

Upgrade triggers

- You're hitting inbox limits and need more mailboxes/domains

- You want phone as a primary channel (Nooks starts making sense)

Series A (SDR pod + RevOps): scale with governance

Now you're paying for consistency: routing, reporting, coaching, and multichannel.

Recommended stack

- HubSpot Sales Hub or Salesforce Sales Cloud (~$25-$165/user/month, plus admin/implementation)

- Outreach or Salesloft (~$100-$180/seat/month) if you need sequencing governance

- Nooks if calling's core (~$5k/user/year)

- Optional: Bombora intent (~$15k-$60k/year) and technographics (BuiltWith/Wappalyzer) once you can act on signals

Budget range: ~$2,000-$10,000/month depending on seats and quote-only tools.

ZoomInfo can enter the picture here. But if you're buying it before you've nailed list quality, messaging, and deliverability discipline, you're paying for horsepower you can't use yet.

Deliverability & domain reputation: the non-negotiables before you scale

A founder on Reddit described running Apollo + SendGrid + a professional network list, seeing "99% delivered" in SendGrid... and prospects saying the emails never showed up.

That story's the whole lesson: "Delivered" isn't "inbox." If you don't measure bounces, complaints, and placement, you're flying blind.

About ~20% of cold emails get flagged as spam. That's not a rounding error. That's a risk you manage.

Deliverability checklist (do this before you add volume)

- Separate domains for cold outreach (don't burn your main domain)

- Ramp volume slowly: start low, increase weekly, and watch bounce/complaint rates

- Warmup discipline: keep warmup running even when you're busy

- Verify before sending: bounces are the fastest way to lose trust (see: how to verify an email address)

- Freshness matters: stale contacts create bounces and spam traps

- Keep targeting tight: broad ICP = low engagement = spam flags

- Measure the right metrics: bounce rate, spam complaints, reply rate, and inbox placement (not just "delivered")

Warning: "More tools" doesn't fix deliverability. If your list quality's bad, adding personalization, intent, and AI copy just helps you spam more convincingly.

Contrarian stance I'll defend: verification + weekly refresh beats more tools. A smaller list of accurate contacts outperforms a giant list of maybes, and it keeps your domain alive long enough to iterate messaging.

Mini proof this isn't academic: one customer result shows bounce rate dropping from 35% to under 4% after switching to a verification-first workflow. That's the difference between "we're scaling" and "we're getting blocked."

Pricing reality + credit math (how startups avoid cost creep)

The fastest way to waste money in prospecting is to ignore pricing mechanics. The second fastest is to sign an annual contract before you've proven your outbound motion.

The "quote-only tax" (and what to ask on the demo)

ZoomInfo's the classic example. Typical contracts run $14,995-$35,995/year, and discounts of 30-65% are common if you negotiate.

Operationally, that usually means annual terms, bundles, and minimum seats. Startups under-seat to reduce cost, then teams build shadow stacks to fill gaps. Everyone loses, and the only winner is the vendor's renewal team.

If you do take the demo, ask these five questions and don't accept hand-wavy answers:

- What's the minimum term and what triggers auto-renewal?

- What's included vs an add-on module?

- What's the seat minimum and can seats be reduced mid-term?

- What's the export limit and what happens if you hit it?

- What's the data replacement policy for bad contacts?

Cognism and Nooks live in the same talk-to-sales universe. They can be great tools, but they're usually post-seed purchases because the commitment forces you to be right.

Credit math examples (model it before you buy)

Clay: You're paying in credits, not seats. If your workflow does 6 enrichments per lead and you process 5,000 leads/month, you can burn through a plan faster than you expect, especially once you add phone enrichments. Clay's worth it when the workflow replaces manual research or unlocks a niche list you can't get elsewhere.

Lusha: Credits roll over up to 2x your plan cap. That's great if you use it steadily; it's wasted money if you buy it "just in case" and never build the habit.

Nooks: Annualized cost is the reality. At ~$5,000/user/year plus $10-15/number/month, a 3-rep pod can easily become a $20k+ annual commitment once you include numbers and overhead.

The decision criterion I push hardest for early-stage teams: self-serve + no contracts until you've got repeatable meetings coming from the channel.

Most startup stacks break because the data layer is stale and the budget is locked in an annual contract. Prospeo gives you 300M+ profiles at ~$0.01/email with 98% accuracy, self-serve signup, and month-to-month pricing. That's a 12/12 on the startup-fit rubric above.

Score a perfect startup fit - accurate data, zero contract risk.

Tier 3 tools (useful, but don't build your identity around them)

These are handy. They're not a strategy.

Email finders/utilities

- Hunter.io: Great for domain pattern discovery. Pricing is commonly ~$49-$299/month.

- RocketReach: Fast lookups across many segments. Expect ~$60-$150/user/month.

- UpLead: Solid mid-market database with verification. Typically ~$99-$249/month.

- Seamless.AI: High-volume prospecting with aggressive upsell. Expect ~$125-$250/user/month.

Sequencing alternatives

- Reply.io: Capable sequencing when you don't want Instantly. Pricing commonly starts around ~$99/user/month.

Email infrastructure (if you're building, not buying)

- SendGrid: Useful for product email and some outbound setups, but deliverability's on you. Common plans run ~$20-$90/month before add-ons and volume.

CRMs adjacent

- monday CRM: Good for lightweight workflows beyond sales. Typically $12-$28/user/month on annual plans.

FAQ

What are the minimum prospecting tools a pre-seed startup needs?

A pre-seed startup needs a CRM, a verified data source, and a sending/warmup tool. That's it. A clean combo is HubSpot CRM (free), a verification-first data layer, and Instantly for warmup + sending. Add anything else only after you've proven you can book meetings weekly.

How much should a startup budget per month for prospecting software in 2026?

Most startups should budget $150-$600/month pre-seed, $500-$2,000/month at seed, and $2,000-$10,000/month at Series A depending on seats and whether you add quote-only tools like Nooks, Cognism, or ZoomInfo. The biggest cost driver isn't features. It's seat creep and annual contracts.

How do credit-based tools get expensive fast (and how do you model it)?

Credit-based tools get expensive when each lead triggers multiple enrichments, so your cost per lead quietly multiplies. Model it by estimating leads/month x enrichments/lead x credits/enrichment, then map that to plan limits. If you can't explain your credit burn in one sentence, you're about to overspend.

How do you avoid burning your domain when you start cold email?

You avoid domain damage by verifying lists, ramping volume slowly, warming inboxes continuously, and keeping targeting tight so engagement stays healthy. Use a separate outreach domain, track bounce/spam rates, and don't trust "99% delivered" as proof you hit inboxes. Bad data is the fastest path to spam flags.

Which tool is best for verified emails without an annual contract?

Prospeo's the cleanest answer if you want verified emails with no annual contract. It delivers 98% email accuracy, refreshes data every 7 days, and runs on self-serve pricing (free tier, then about $0.01 per verified email) so you can scale without procurement overhead.

Summary: build a lean stack, not a Frankenstack

If you take nothing else from this: startup prospecting tools should reduce failure points, not add them.

Start with a verification-first data layer, a simple sending/warmup tool, and a CRM your team'll actually keep clean. Then earn the right to add intent, dialers, and quote-only platforms once you're booking meetings every week.