How to Handle the We Already Have a Solution Objection (2026 Playbook)

"We already have a solution" is the objection that kills deals quietly. Not because you can't compete, but because most reps turn it into a feature fight the buyer never agreed to.

Nine times out of ten, it isn't about your product. It's about timing, switching risk, and the very human desire to not create extra work this week.

So the goal isn't to "overcome" it. It's to sort it fast: displace now, wedge in, or win the calendar for renewal.

What you need (quick version)

Use this as your pre-call checklist. If you memorize nothing else, memorize the three responses at the bottom.

Mindset (non-negotiable)

- Treat "we already have a solution" as a timing + risk objection, not a product objection.

- Your job isn't to "win the debate." Your job's to classify it fast: displace now, wedge in, or park it for renewal.

- Don't get trapped into naming vendors early. It makes prospects cagey and ends discovery.

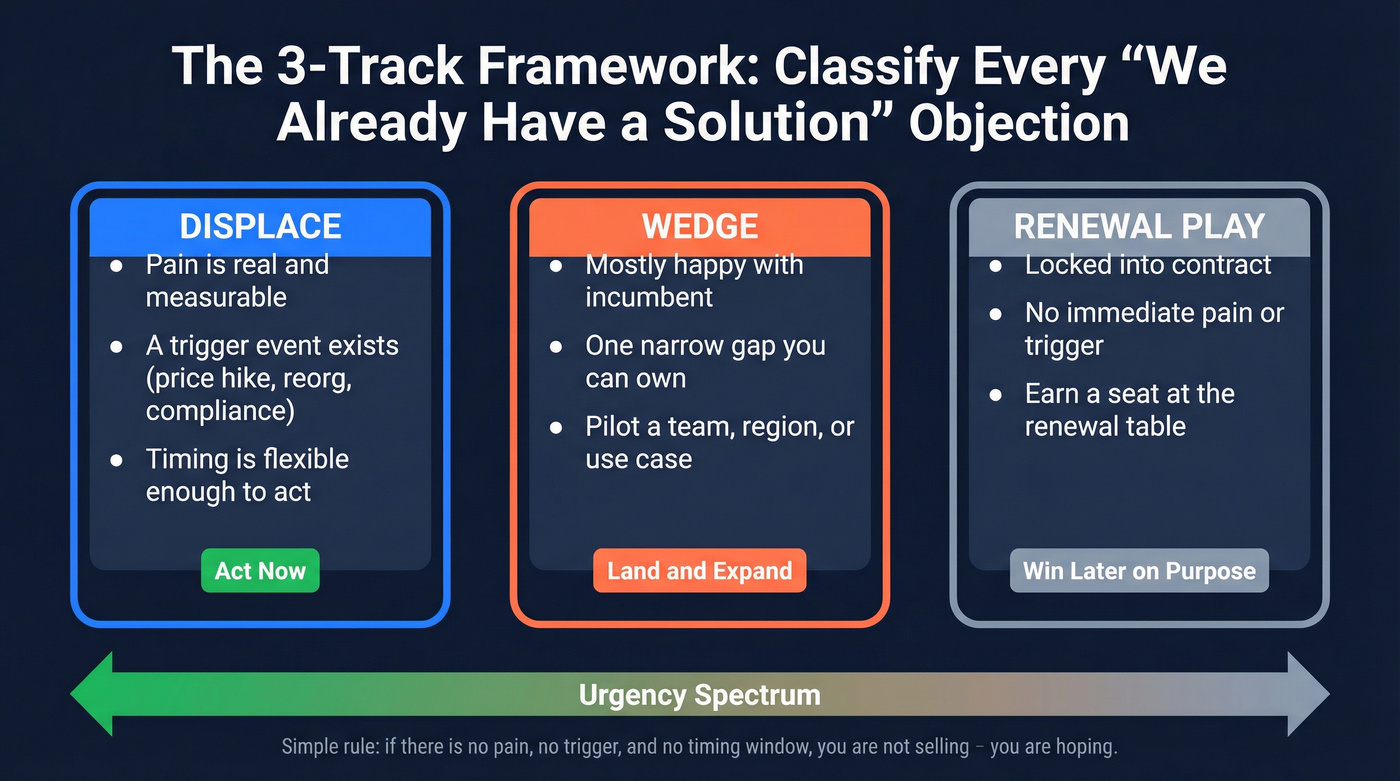

Your 3-track outcome

- Displace: there's pain + a trigger + enough timing flexibility.

- Wedge: they're mostly happy, but there's a narrow gap you can own (pilot, team, region, use case).

- Renewal play: they're locked in, but you can earn a seat in the renewal evaluation.

The three responses to memorize

Deflection ladder (keep them talking): "Totally fair. How's it going with the current approach? What do you like? What could be better? If you could change one thing, what would it be?"

Cost-of-inaction + escalation-path (make it business, not preference): "If the backlog compounds, that's 300+ hours lost by next fiscal. Is there a process for surfacing that risk to leadership, or should we map the cost together?"

Renewal-window lock (win later on purpose): "Makes sense. So I don't bug you randomly - when's renewal, what's the notice window, and who owns sending notice?"

The meaning behind "we already have something in place" (a quick map)

Here's the thing: the words are the same, but the intent isn't. Your job's to figure out which scenario you're in without turning it into an interrogation.

Also, watch the vendor-name trap. The moment you ask "Who are you using?" a lot of prospects get defensive. They think you're about to trash their choice, or they don't want to give you ammo.

| What they say | What it means in B2B SaaS | What you do next | What not to do |

|---|---|---|---|

| "We love what we have." | Incumbent is safe and broadly working | Ask for "one thing to improve" | Pitch features |

| "We're standardized on it" / "Leadership picked it." | Politically protected incumbent | "What would have to be true to revisit this?" + "Who would sponsor a change if it mattered?" | Trash the tool or imply they chose wrong |

| "We're under contract." | Timing is blocked | Get renewal + notice window + notice channel | Argue switching now |

| "We just implemented." | Change fatigue and sunk cost | Wedge a small use case | Ask for a full rip/replace |

| "It's good enough." | Low urgency and no internal champion | Quantify cost of delay + ask who owns the metric | Keep "checking in" |

| "I'm not the right person." | You hit a user, not the owner | Ask who owns outcomes/renewal | Push for a demo anyway |

| "We're evaluating options." | Active project with a timeline | Confirm criteria + timeline | Dump a generic deck |

Simple rule: if there's no pain, no trigger, and no timing window, you're not selling - you're hoping.

We already have a solution objection scripts: 30-second diagnosis + deflection ladder

Don't ask who they use yet. Ask questions that force clarity without triggering defensiveness.

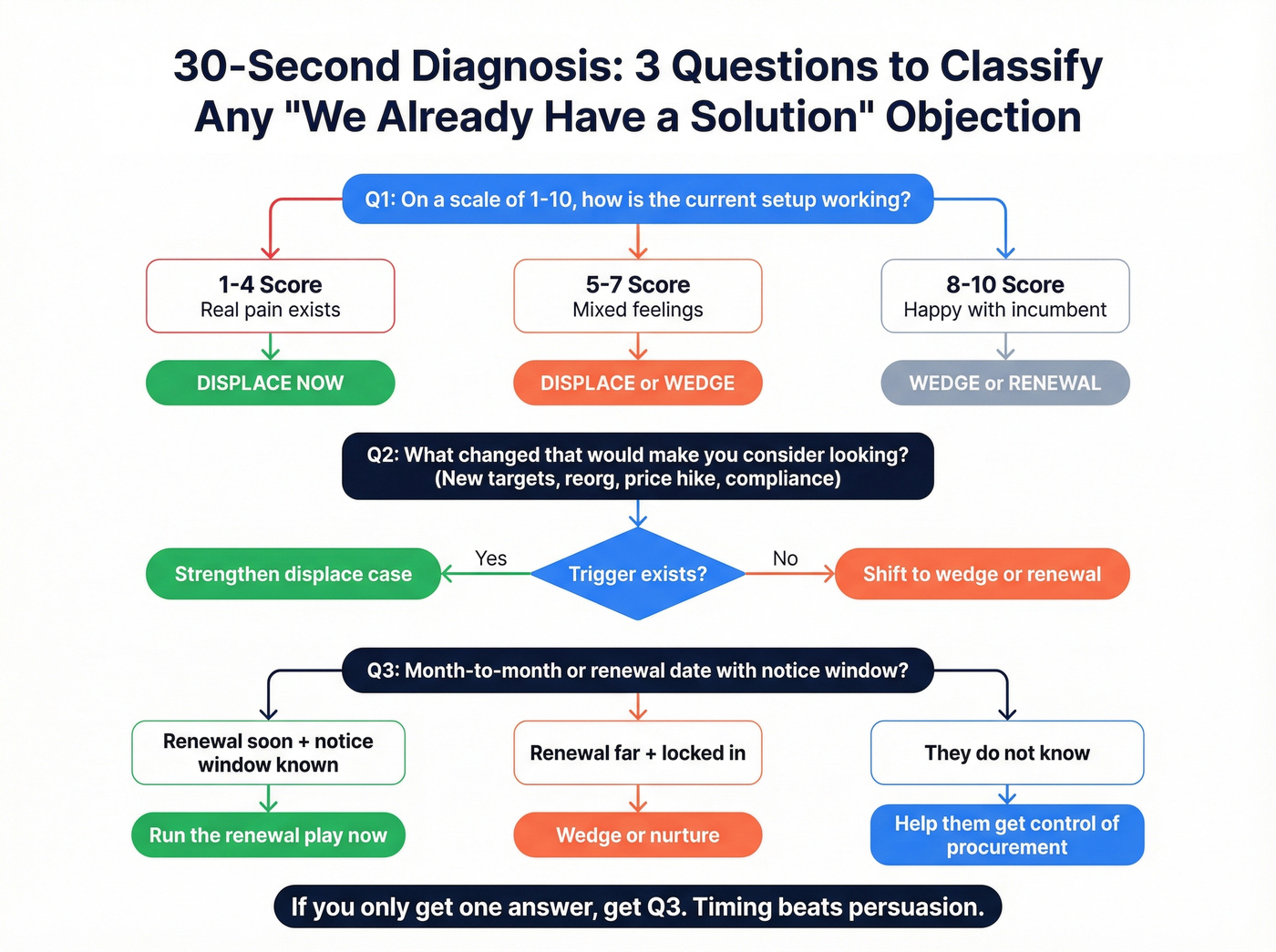

The 30-second diagnosis (3 questions that classify the situation)

Question 1 (satisfaction gaps): "On a scale of 1-10, how's the current setup working for you?"

- 8-10: go wedge or renewal.

- 5-7: displace or wedge.

- 1-4: displace now.

Question 2 (change trigger): "What changed that would make you even consider looking - new targets, new team structure, compliance requirements, consolidation... or an incumbent price hike / packaging change?"

That last one matters right now. Vendors are pushing price increases and packaging shifts, and buyers hate surprises. Use it as your reason to benchmark before notice windows.

Question 3 (timing + renewal mechanics): "Are you month-to-month, or is there a renewal date and notice window you have to hit?"

- Renewal soon + notice window known: run the renewal play.

- Renewal far + locked: wedge or nurture.

- They don't know: procurement/process is messy, and you can help them get control.

If you only get one answer before they bounce, get #3.

Timing beats persuasion.

The deflection method (keep them talking without arguing)

When someone says "we already have a solution," your worst move is: "But we're better." That's an argument they didn't agree to have.

A better move is a deflection ladder. It works because it's about their experience, not your product.

The ladder (say it like this)

- "Totally fair - most teams already have something."

- "How's it going overall?"

- "What do you like about it?"

- "What could be better?"

- "If you could change one thing, what would it be?"

- "When was the last time you considered other options?"

Two "cagey prospect" variants (avoid the vendor-name trap)

- "Got it. Without naming names - are you using a platform your team loves, or one they tolerate because switching is painful?"

- "Makes sense. Is it more of a 'single system' setup, or a few tools stitched together?"

If they keep stonewalling

- "No worries. I'm trying to avoid wasting your time. Teams only talk to us for three reasons: cost creep, workflow gaps, or reporting/visibility. Which one's closest - if any?"

Real talk: if your buyer can't name a single gap, you don't have an opportunity. You've got a polite conversation.

Move on fast and come back at renewal.

Your deflection ladder only works if you can back it up with real results. When you run that head-to-head test against the incumbent, you need data that doesn't bounce. Prospeo delivers 98% email accuracy and a 30% mobile pickup rate - so your wedge pitch actually lands.

Win the displacement battle with data the incumbent can't match.

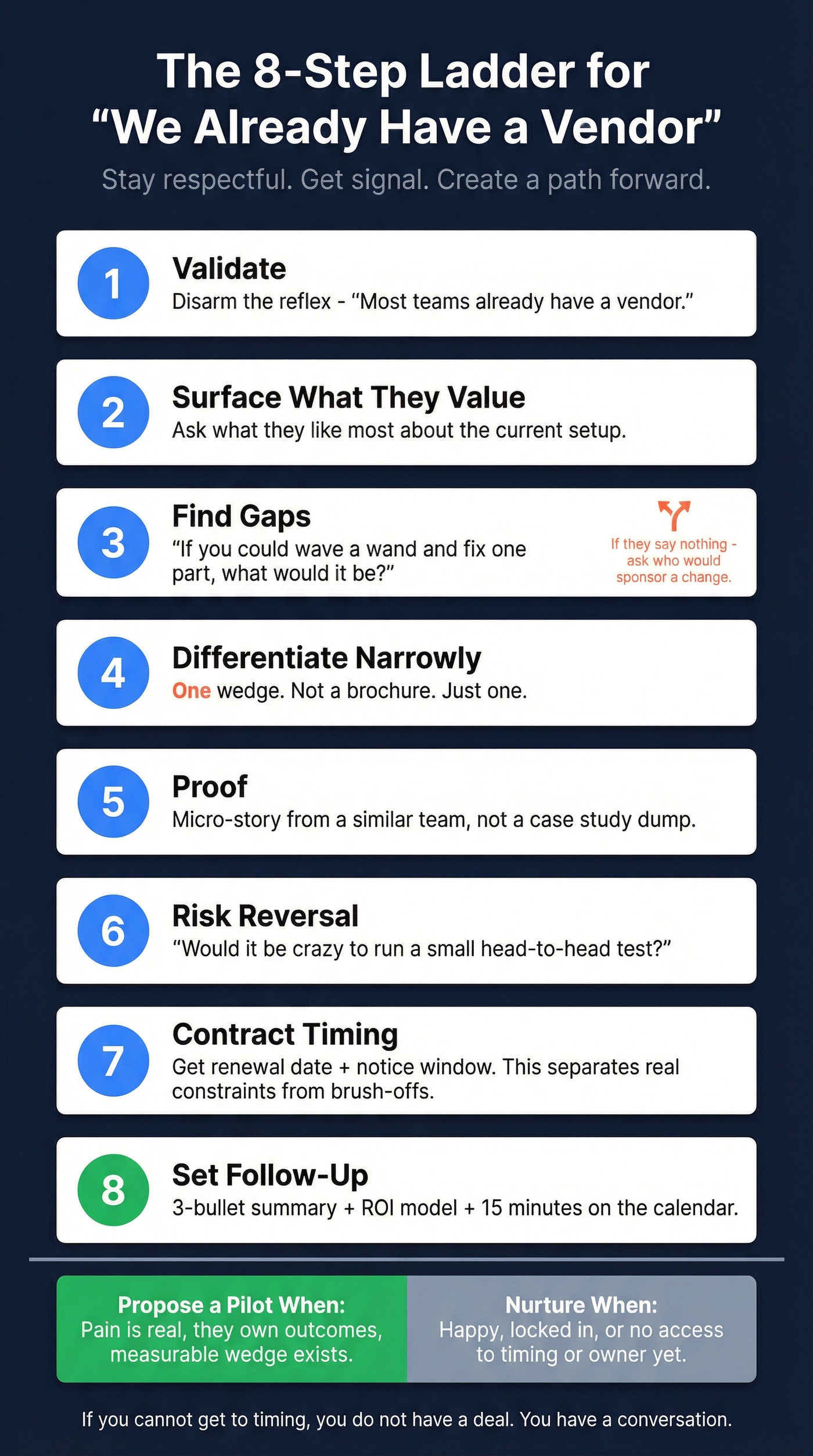

The 8-step ladder for "we already have a vendor" (the canonical flow)

This is the cleanest end-to-end flow I've used when you want to stay respectful, get signal, and still create a path forward. I've watched it reopen "dead" accounts because it doesn't fight the incumbent - it sidesteps them and goes straight to timing and risk.

Step 1: Validate (disarm the reflex)

- "That makes sense. Most teams we talk to already have a vendor."

Step 2: Surface what they value (so you don't pitch blind)

- "What do you like most about the current setup?"

Step 3: Find gaps (without insulting the incumbent)

- "Where does it fall short, even a little?"

- "If you could wave a wand and fix one part, what would it be?"

If they say "nothing," treat it as a fork:

- Either you're talking to the wrong person, or

- They're protecting a political decision.

Ask it plainly: "If it did become a priority, who'd sponsor a change?" Then: "What would have to be true to revisit it?"

Step 4: Differentiate narrowly (one wedge, not a brochure)

- "The reason I ask is we tend to win when teams care about X - because we do Y differently."

Keep it to one wedge.

One.

Step 5: Proof (micro-story, not a case study dump)

- "A team similar to you kept their incumbent for the core use case, but used us for [wedge]. They saw [specific outcome] within a few weeks."

Quick reality check before you start name-dropping: in some categories, NDAs are common and customer names can backfire. If you're not sure, keep it anonymous and specific.

Step 6: Risk reversal (make the next step feel safe)

- "Would it be crazy to run a small head-to-head test on just that one workflow?"

If they're open, propose a pilot. If they're hesitant, propose a diagnostic.

Step 7: Contract timing (the adult conversation)

- "When does your agreement renew, and what's the notice window?"

In our experience, asking for renewal + notice window early is the fastest way to separate a real timing constraint from a brush-off.

Step 8: Set follow-up (don't leave it vague)

- "If we can't do anything until renewal, let's do this: I'll send a 3-bullet summary of the wedge + a quick ROI model. Can we put 15 minutes on the calendar for [date] to decide if it's worth evaluating before notice?"

Decision points: pilot vs nurture

- Propose a pilot when: pain's real, they own outcomes, and there's a measurable wedge.

- Nurture when: they're happy, locked in, or you don't have access to timing/owner yet.

If you can't get to timing, you don't have a deal. You've got a conversation.

Talk tracks you can use today (call + email + voicemail)

These are meant to be copy/paste. Adjust the bracketed parts and keep them short.

One rule that holds up: avoid yes/no questions that let them end the call. Use open-ended questions that force detail. Freshworks has a solid list of prompts and "5 minutes + specific time" asks - worth skimming once: Freshworks objection handling techniques.

Cold call openers (under 30 seconds)

Opener #1: permission + relevance

"Hey [Name]--I'll be quick, under 30 seconds. We help [peer companies] reduce [specific pain] in [area]. Quick question: how are you handling that today?"

If they say "we already have a solution":

"Totally fair. How's it going - what do you like, and what could be better?"

Opener #2: trigger-based

"Hi [Name]--calling because teams revisit [category] when vendors push price hikes, packaging changes, or consolidation projects. Has anything like that hit you this quarter?"

If they say "we're set":

"Got it. When was the last time you evaluated options - was it recent, or more of a 'we've had this forever' situation?"

Open-ended questions list (keep them talking)

- "What prompted you to pick the current solution originally?"

- "What's the one workflow that still feels manual?"

- "Where do things break - handoffs, reporting, adoption, compliance?"

- "Who feels the pain most: ops, frontline, leadership?"

- "If you could improve one metric in the next 90 days, what would it be?"

The "5 minutes + specific time" ask (simple, effective)

"If I'm off-base, tell me and I'll disappear. If not, could we do 5 minutes Thursday at 2:00 PM or Friday at 11:30 AM to see if there's a wedge worth testing?"

Specific times beat "sometime next week."

Email: "already have something" (short, single CTA)

Subject: Quick question, [Name]

Hi [Name] - makes sense you already have something in place. When teams switch (or add a second tool), it's usually because of one gap: [gap]. Is that on your radar, or is the current setup covering it well?

CTA: "Worth a 10-minute sanity check?"

Email: "switching takes 7-18 months" (set expectations)

Freshworks' benchmark is that switching from an incumbent can take 7-18 months end-to-end, so this email's designed to win timing - not force a decision.

Subject: Timing check

Hi [Name] - totally get it if you're set. Switching with an incumbent often takes 7-18 months end-to-end. What's your renewal month, and is there a 30/60/90-day notice window?

CTA: "Can you point me to the right owner?"

Voicemail (15 seconds, no pitch)

"Hey [Name], it's [You]. Quick one - calling because teams revisit [category] around renewal or when vendors push price hikes/packaging changes. If that's relevant, call me back at [number]. If not, no worries."

Then send the short email immediately after. Voicemail alone's a black hole.

Cost-of-inaction reframes (status quo defense -> business risk)

When they're "fine," you don't win by being louder. You win by making the status quo measurable.

Use cost-of-inaction when

- The pain's operational (backlogs, manual work, errors).

- There's a downstream revenue impact (speed-to-lead, conversion, churn).

- There's risk exposure (compliance, security, auditability).

Skip cost-of-inaction when

- You don't understand their workflow yet.

- You're talking to someone who can't quantify anything.

- The objection's purely timing ("we just renewed")--go renewal play instead.

Verbatim one-liner (keep it intact)

"If this backlog compounds... 300+ hours lost... is there a process for surfacing that risk to leadership now, or map out the cost together...?"

Three variants you can rotate

Ops variant

"If the manual steps keep stacking up, you'll burn a week a month on rework. Who owns surfacing that operational risk - ops leadership, or the business owner?"

Revenue variant

"If response time stays where it is, pipeline takes a hit. Do you have a way to quantify the revenue impact, or should we model it together in 10 minutes?"

Risk/compliance variant

"If this stays undocumented, it becomes an audit problem later. Who signs off on that risk today?"

If they engage, you've earned discovery. If they don't, you've learned they're not movable right now.

The renewal-window play (how to win even when you can't displace today)

Most sellers hear "we already have a solution" and disappear. That's a mistake, because renewals are where incumbents get sloppy - and where buyers get trapped.

A few numbers that matter from BetterCloud's State of SaaS research:

- 69% of software contracts include an auto-renew clause.

- Notice windows are typically 30-90 days.

- 85% of orgs have a renewal process, but only 30% say it's effective.

- If you're not 90-120 days ahead of renewal, you're late.

The one question that changes everything

Ask this exactly:

"What's the renewal date, what's the notice window, and what channel counts as notice - email, portal, or written letter?"

Most sellers only ask "when do you renew?" and still lose because notice has to be sent the right way, on time.

Examples of "notice channel" that trip teams up

- "Notice must be submitted through the vendor portal" (email doesn't count)

- "Notice must be sent to a specific legal/procurement address"

- "Notice must be in writing" (a PDF letter, not a Slack message)

- "Notice must be received, not just sent" (time zones matter)

What to do if they already missed the notice window

I've watched this happen in the wild: procurement realizes they're inside the window, the contract auto-renews, and suddenly the "we're happy" story turns into a scramble.

Here's the clean play:

- Don't dunk on them. Make it normal: "This happens more than people admit."

- Ask for the contract clause (or screenshot) so you can speak precisely: renewal date, notice window, termination for convenience, and any downgrade rights.

- Offer two paths:

- Benchmark anyway: "Even if you're stuck for 12 months, we can run a small wedge test so you're not starting cold next cycle."

- Commercial pressure: "If you're unhappy, you can often negotiate pricing/terms even after auto-renew - especially if you're willing to evaluate alternatives now."

I've seen more deals reopen from a pre-booked T-120 renewal meeting than from a year of "just checking in" emails.

Calendar beats charisma.

Mini-guide: how to run the renewal play

T-120 to T-90 (get on the calendar)

Goal: secure a "pre-renewal evaluation" slot.

Script: "If you're happy, great - then this is just a benchmark. Can we pencil 20 minutes for [month] so you've got options before notice?"

T-90 to notice window (create a wedge)

Goal: define one measurable gap and propose a low-risk test.

Script: "Let's pick one workflow the incumbent doesn't nail and run a head-to-head. If it's not meaningfully better, you keep what you have."

Inside the notice window (be useful, not desperate)

Goal: help them avoid accidental auto-renew and earn trust.

Script: "Even if we don't work together, make sure you know the notice channel. A lot of teams miss it and get stuck another year."

One sentence to remember: if you can't win today, win the calendar.

If they're set: run a parallel nurture (follow-up system that actually gets replies)

If they're "set," your job's to stay relevant without becoming spam. That means a parallel nurture with tight deliverability and a simple CTA.

Benchmarks from Instantly's 2026 benchmark thread (data shared for Jan 1-Dec 18, 2025) are blunt:

- Average reply rate: 3.43%

- Top 25%: 5.5%+

- Top 10%: 10.7%+

- 58% of replies come from email 1

- 42% come from follow-ups (steps 2-7)

Operator sentiment from that same world is even blunter: list quality beats clever personalization at scale. If your data's dirty, your "great copy" just turns into bounces and spam complaints.

The rules (so you don't burn your domain)

- Keep emails under 80 words.

- Use one CTA.

- Operators in Instantly's benchmark thread report reply-style follow-ups outperform formal reminders by ~30%.

- Deliverability baselines: bounce <2%, warmup 4-6 weeks, start at 5-10 sends/day.

Concrete deliverability checklist (the non-negotiables)

Keep this tight and operational:

- SPF: set and passing for your sending domain. (If you need the setup checklist, see SPF, DKIM and DMARC monitoring.)

- DKIM: enabled and aligned (this stops "looks spoofed" flags).

- DMARC: at least

p=noneto start, then tighten once you're stable. - Dedicated tracking domain (optional but helpful) so link tracking doesn't poison your root domain.

- List hygiene cadence: verify before every new sequence launch, and re-verify any list older than 30 days (job changes and catch-alls move fast). Use an email verification list SOP so the team does it the same way.

- Bounce triage: if you spike above 2%, pause, clean, and restart - don't power through. If you’re troubleshooting specific SMTP errors, see 550 Recipient Rejected.

The sequence (6 touches, simple)

Email 1 (day 1): relevance + one question Email 2 (day 3): reply-style nudge + micro-proof Email 3 (day 7): cost-of-inaction angle Email 4 (day 14): renewal/timing question Email 5 (day 30): "new trigger" (price hike / packaging change / consolidation) Email 6 (day 60): breakup / permission to close loop

Templates (<80 words, single CTA)

Email 1: "set already"

Subject: Quick question, [Name]

Hi [Name] - makes sense you already have a solution for [category]. When teams still talk to us, it's usually because [one gap]. Is that something you're seeing, or is the current setup covering it?

CTA: "Worth a 10-minute sanity check?"

Email 2: reply-style follow-up

Subject: Re: Quick question, [Name]

Quick bump - if you're happy with the current approach, I'll back off. If you are seeing [gap], I can share how teams fix it without a rip/replace.

CTA: "Should I send the 3-bullet breakdown?"

Email 3: cost-of-delay

Subject: Re: Quick question, [Name]

If [problem] keeps compounding, it usually turns into [quantified impact]. Do you have a way to measure that today, or should we map it together?

CTA: "Open to 12 minutes next week?"

Email 4: renewal mechanics

Subject: Renewal timing?

Random but important: are you on a 30/60/90-day notice window for [category]? A lot of teams miss the notice channel and auto-renew by accident.

CTA: "Who owns renewal on your side?"

Email 5: trigger

Subject: One thing I'm seeing

Seeing a lot of vendors push price hikes and packaging changes right now. If that hits you, having a benchmark option helps before notice windows.

CTA: "Want me to send a simple evaluation checklist?"

Email 6: breakup

Subject: Close the loop?

I haven't heard back, so I'm assuming timing's not right. If you tell me either "check back at renewal" or "not a fit," I'll update my notes.

CTA: "Which one is it?"

The "accuracy layer" (so follow-ups actually land)

All of this falls apart if your list's dirty. If bounce creeps above 2%, your domain reputation takes the hit, and then even good follow-ups won't reach inboxes.

If you're building lists, the Email Finder is built around a principle sellers actually care about: pay only for valid addresses. And if you're enriching a CRM or cleaning a CSV, Prospeo's enrichment returns 50+ data points per contact with an 83% enrichment match rate and a 92% API match rate, which is exactly what you want when you're trying to route "renewal owner" and "business owner" to the right sequences. If you’re comparing options, see our roundup of email lookup tools and email verifier websites.

Whatever sequencer you use, the workflow's the same: upload -> verify -> filter -> export.

- Upload your CSV

- Run verification

- Filter out Invalid and Catch-all (or route catch-alls to a separate, lower-volume test)

- Export Valid-only

- Push into your sequencer and launch

Practically: that one step is how you keep a 6-8 touch nurture sequence from getting kneecapped by bad data.

When to disqualify (stop chasing politely)

Chasing "we're set" forever is how pipelines get bloated and reps get demoralized. Disqualifying is a skill. It's also how you earn respect.

And yes, I'm opinionated about this: "just checking in" is one of the laziest habits in sales. It trains buyers to ignore you.

Disqualify if

- There's no pain (they can't name a single gap).

- There's no trigger (nothing changing this quarter or this year).

- You can't access renewal timing (they won't share renewal month/notice window/owner).

- They say "we never evaluate alternatives" and mean it.

- You're with the wrong persona (user with no influence, and no path to owner). If needed, use a clean handoff ask from this guide on how to ask for the right contact person.

Then do the adult thing: close it out, but leave a clean door back in.

One clean sentence in your CRM beats 12 months of false hope.

What to log in your CRM before you walk away (so you can win later)

- Renewal month (even a guess like "Q4" is better than nothing)

- Notice window (30/60/90) and notice channel (email/portal/written)

- Owner (business owner + procurement contact if you have it)

- Wedge hypothesis (one sentence: "If they care about X, we win with Y")

- Next trigger to watch (price hike, packaging change, re-org, new compliance rule, new leader)

That's how you turn a disqual into a future pipeline event instead of a dead lead. If you want a cleaner system, use a prospect follow up cadence that’s tied to renewal and triggers.

Breakup email #1 (polite, single CTA)

Subject: Close the loop?

Hi [Name] - I'm going to close this out on my side so I don't keep bugging you. If it's helpful, I can reconnect around renewal.

CTA: "Should I check back in [month]?"

Breakup email #2 (direct, single CTA)

Subject: Not a fit?

Hi [Name] - quick yes/no: should I stop reaching out about [category]?

CTA: "Yes or no?"

If they reply "yes," you win time back. If they reply "check back," you just created a renewal play.

FAQ

Should I ask "Who are you using?" when they say they already have a solution?

Not first. Lead with satisfaction, gaps, and timing so you don't trigger the vendor-name trap. Ask "How's it going?" and "What could be better?" before vendor details. Once they've shared one concrete gap, asking who they use becomes natural and less defensive.

What if this is the "we do it in house" objection?

Treat it like the we already have a solution objection: diagnose satisfaction, gaps, and timing, then propose a narrow wedge. A good wedge is one workflow that's manually maintained and costs 5-10 hours/week, or a compliance/reporting requirement that's become a recurring fire drill.

What if they're under contract and can't switch this year?

Treat it as a renewal opportunity, not a dead end: get the renewal date, notice window, and required notice channel, then secure a pre-renewal evaluation meeting 90-120 days before renewal. If there's a narrow gap, propose a small pilot that doesn't require ripping anything out.

How many follow-ups should I send after "we're set"?

Send 6-8 touches over 30-60 days, then pause until a trigger or renewal window. Instantly's 2026 benchmark post (Jan-Dec 2025 data) shows 42% of replies come from follow-ups (emails 2-7), so stopping after one message leaves replies on the table.

Step 5 says show proof. Here's yours: teams using Prospeo book 26% more meetings than ZoomInfo users and 35% more than Apollo - at $0.01 per email. When you're pitching against an entrenched vendor, your own data provider can't be the weak link.

Stop hoping your emails land. Know they will.

Summary: win the conversation, or win the calendar

The we already have a solution objection isn't a cue to pitch harder. It's a cue to diagnose timing and risk.

Run the 30-second diagnosis, pick a lane (displace, wedge, or renewal), and lock renewal mechanics early. If they're truly set, disqualify cleanly and come back with a real trigger instead of "checking in."