The Social Selling Playbook (2026): An Executable 30-Day System

A social selling playbook isn't about being "good at LinkedIn." It's about creating pipeline without turning your reps into full-time content creators - or your brand into a screenshot risk.

Most teams don't fail because they lack hustle. They fail because they chase shiny "magic stacks," copy a few templates, and call it a program. The fix is boring on purpose: a daily rhythm, clear guardrails, a default cadence, and attribution that holds up in a forecast meeting.

Good social selling looks quiet from the outside.

What you need (quick version)

Use this as your minimum viable playbook. If you can't do these, don't buy more tools.

Setup checklist (one-time)

- One ICP you can describe in one sentence (role + company type + pain).

- One offer that's easy to say yes to (15-min teardown, benchmark, template, invite).

- One place to log activity (CRM + a simple "Social touch" activity type).

- One content lane (3-5 topics you can talk about weekly without faking expertise).

- One trigger list (job changes, funding, tool changes, hiring, competitor mentions).

- One escalation path (Comms/Marketing + HR/Legal) for risky situations.

- One attribution method (UTMs + CRM campaign fields) you'll actually maintain.

Daily checklist (30-45 minutes)

- 10 min: listen for triggers + intent

- 10 min: comment thoughtfully on 3-5 posts

- 10 min: send 3-8 targeted connection requests / DMs

- 5 min: log outcomes + tag next step

- Optional 5-10 min: draft one post or save ideas

If you implement only three things first

- A 30-45 min/day routine (consistency beats "viral hacks").

- A 17-21 day cadence + 8-12 touches so follow-up's automatic.

- UTM + CRM attribution monthly so leadership trusts the channel.

What this playbook actually is (vs. tips)

This isn't "post three times a week" or "comment more." Tips are what you do when you're motivated.

A playbook is what you do when you're busy, tired, or onboarding a new rep - and you still want consistent results.

Pipedrive's definition is the right mental model: a playbook's a go-to guide for best practices, processes, and procedures. That's the point: processes and procedures, not vibes. And their bigger point is the one most teams skip: a playbook fails without clear ownership and a clear way to measure performance.

In practice, this system answers four questions:

- Who are we trying to reach (and who are we ignoring)?

- What do we do every day/week so pipeline shows up predictably?

- How do we engage without creating brand risk or creeping people out?

- How do we measure it so it survives budget season?

The "social" part adds two things most sales playbooks skip:

- Governance: rules of engagement, escalation, and what not to touch.

- Attribution: social creates a lot of "influence," which turns hand-wavy unless you operationalize UTMs + CRM fields.

Here's the contrast that matters:

Tips: "Comment on posts." Playbook: "Comment on 3 posts/day from ICP accounts, using these 6 comment starters, log it as 'Social touch,' and if they engage back, start the 17-21 day cadence."

If your team's current "program" depends on one charismatic rep who likes posting, you don't have social selling. You've got a personality-driven exception.

A playbook makes it boring. Boring scales.

Copy/paste playbook table of contents (the deliverable)

This is the artifact you can drop into Notion/Confluence/Google Docs and actually run. It borrows the core components Pipedrive recommends (ICP, stages, Objection handling, tools/tech, KPIs, strategic objectives) and adds the social-specific inserts that make it executable.

| Section | What it contains | Owner |

|---|---|---|

| Strategic objectives | Pipeline target, brand goals | VP Sales |

| ICP + exclusions | ICP, "do not target" list | RevOps |

| Positioning | POV, proof, talk tracks | Marketing |

| Stages + definitions | Social → engaged → meeting | RevOps |

| Trigger library | Signals + what to do next | SDR Mgr |

| Rules of engagement | Do/don't, tone, boundaries | Comms |

| Escalation protocol | Risk categories + owners | HR/Legal |

| Plays & cadences | 17-21 day default sequence | SDR Mgr |

| Objection handling | "Not now," "send info," etc. | Enablement |

| Templates & scripts | DMs, comments, replies | Enablement |

| Tools & tech | Listening, scheduling, data | RevOps |

| KPIs + dashboards | SSI + pipeline metrics | RevOps |

| Attribution | UTM rules + CRM fields | RevOps |

| QA + coaching | Rubrics, callouts, reviews | SDR Mgr |

| Update cadence | Quarterly refresh minimum | Playbook owner |

A few annotations from experience:

- "Exclusions" matters as much as ICP. If you don't define who you're not for, reps'll chase anyone who likes a post.

- Stages need definitions. "Engaged" can't mean "viewed my profile." It should mean "replied, commented back, clicked tracked link, or accepted + responded."

- Update cadence can't be optional. If you don't schedule it, it won't happen, and the playbook becomes a museum.

- Add a one-page "Examples of good" with screenshots of great comments, great DMs, and great "move to meeting" transitions. Reps copy what they can see.

Social selling playbook operating rhythm (30-45 minutes/day)

Nobody truly knows how the algorithm works. That's not cynicism - it's sanity.

So don't build your program around hacks. Build it around consistency and relevance. The best practitioner summary I've seen is blunt: write interesting content, write it often, minimize time wasted.

Here's the operating rhythm I'd standardize for most B2B outbound teams.

Daily rhythm (30-45 minutes)

Listen (10 minutes)

- Scan your trigger list (job changes, funding, hiring, tool chatter).

- Save 3-5 posts you can respond to thoughtfully.

- Identify 3-8 people you want to start or advance a conversation with.

Engage (10 minutes)

- Leave 3-5 comments that add something real: a counterpoint, a mini-example, a template, a metric, a question that moves the thread forward.

- Avoid "Great post!" - it's invisible and it trains you to waste time.

Outreach (10-15 minutes)

- Send 3-8 connection requests or DMs.

- Follow your cadence rules (more on that below).

- If someone engaged with you first, prioritize them. Speed-to-lead matters.

Log + next step (5 minutes)

- Log the touch in CRM (or at least in a simple tracker).

- Tag the trigger type and set the next action date.

Weekly rhythm (30-60 minutes)

Monday (15 min): pipeline intent review

- Which engaged accounts are worth moving off-platform this week?

- Which reps have conversations but no next step?

Wednesday (15 min): content planning

- Pick 2-3 posts to write (or 5 comment targets).

- Reuse what worked last week.

Friday (30 min): retro + cleanup

- Review: replies, meetings, influenced pipeline.

- Clean duplicates, fix attribution, update trigger notes.

The goal isn't to be everywhere. It's to be predictable.

I've watched teams burn hours chasing "best posting times" and ignore the only thing that reliably creates pipeline: consistent conversations with the right accounts, followed by disciplined follow-up and clean logging that makes the channel defensible in a forecast.

One practical note for social selling in 2026: the teams that win aren't the ones gaming distribution. They're the ones building repeatable "listen → engage → outreach → log" habits that survive platform changes.

Your 30-day social selling rhythm depends on real triggers - job changes, funding rounds, new hires. Prospeo tracks all of them across 300M+ profiles with a 7-day refresh cycle, so your trigger list is never stale.

Fill your trigger library with signals that actually convert.

Rules of engagement, guardrails, and escalation (non-negotiables)

If you want social selling to survive inside a real company, you need guardrails. Not because reps are reckless - because ambiguity creates risk, and risk kills programs.

Trap.it's guidance is refreshingly practical: include scenario flowcharts, sample responses, and an escalation process. It also includes a "when not to respond" list that saves teams from self-inflicted drama.

What to engage with

Engage when you can do at least one of these:

- Add a specific example ("Here's how we set this up in Salesforce...")

- Share a template (short checklist, message framework, KPI definition)

- Ask a clarifying question that improves the thread

- Offer a measured counterpoint (disagree without being disagreeable)

- Validate with data (even directional ranges beat platitudes)

Green-light topics to engage on:

- Industry changes that affect your ICP

- Hiring, org design, tooling, process, benchmarks

- Customer stories (without leaking confidential details)

- Lessons learned (especially mistakes)

What not to engage with (silence rules)

Trap.it's "when not to respond" list belongs in every playbook:

- Generic mentions without commentary (don't "thanks!" your way into irrelevance)

- Sarcastic/derogatory remarks (you'll lose the tone war)

- Rumors (you'll amplify them and create legal exposure)

Add a few more "silence rules" I've seen save teams from dumb, avoidable messes:

- Political or culture-war bait (unless your brand's explicitly built for that)

- Threads where the buyer's clearly venting (you'll look opportunistic)

- Anything involving confidential customer info, security incidents, or layoffs

Look, one screenshot can erase six months of "good vibes" social selling.

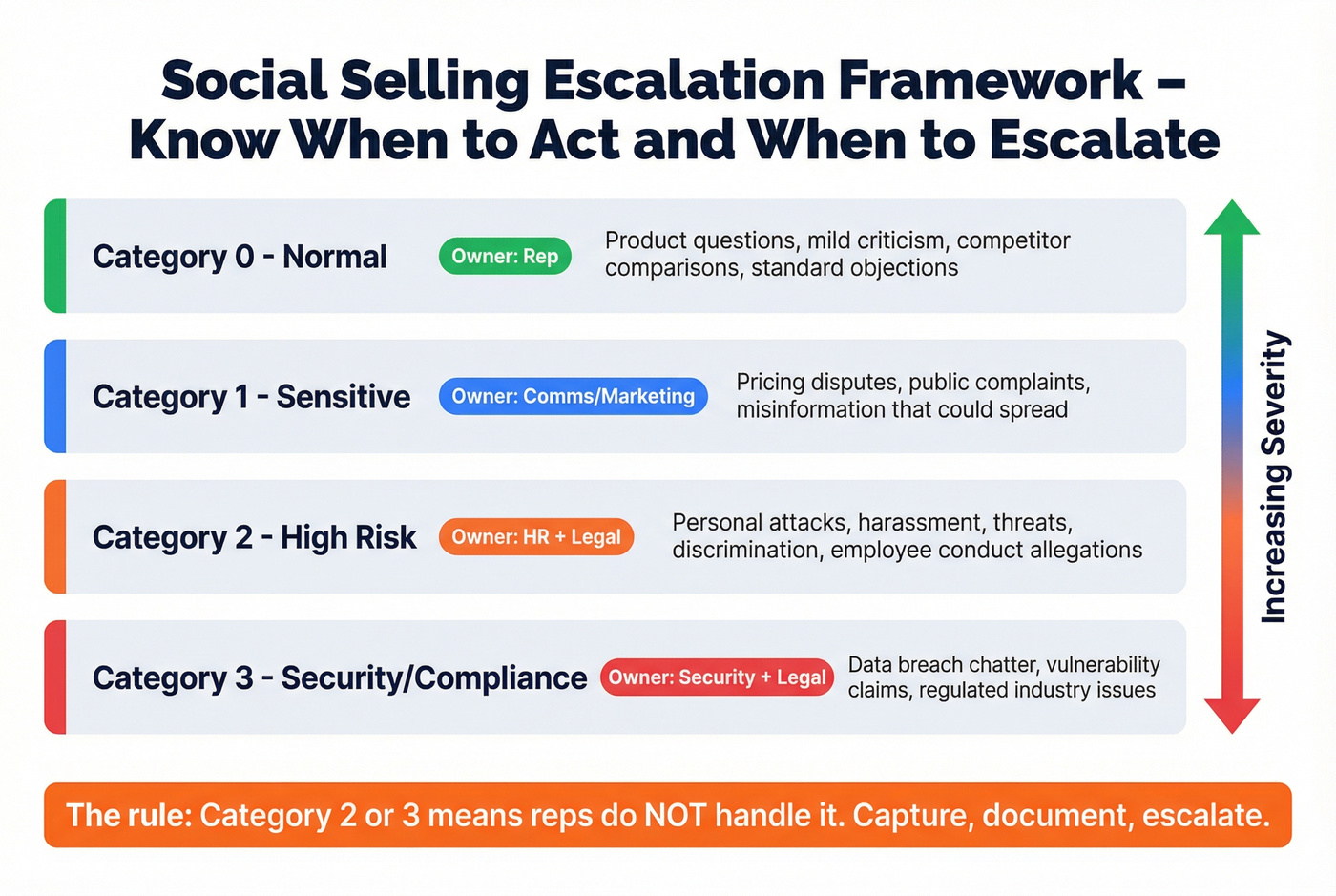

Escalation categories + owners

You need a simple triage model. KH Law's framework is a good backbone: assess impact, then choose a response path (monitor, engage, coach, discipline, ignore). The operational rule that matters most: document what happened, apply policies consistently, and don't freelance discipline decisions.

Use these categories:

Category 0: Normal (owner: rep)

- Product questions, objections, mild criticism, competitor comparisons.

Category 1: Sensitive (owner: Comms/Marketing)

- Pricing disputes, public complaints, misinformation that could spread.

Category 2: High-risk (owner: HR + Legal)

- Personal attacks, harassment, threats, libellous claims, doxxing, discrimination.

- Anything involving employee conduct allegations.

Category 3: Security/compliance (owner: Security + Legal)

- Data breach chatter, vulnerability claims, regulated industry issues.

Escalation rule: if it's Category 2 or 3, reps don't "handle it." They capture, document, escalate.

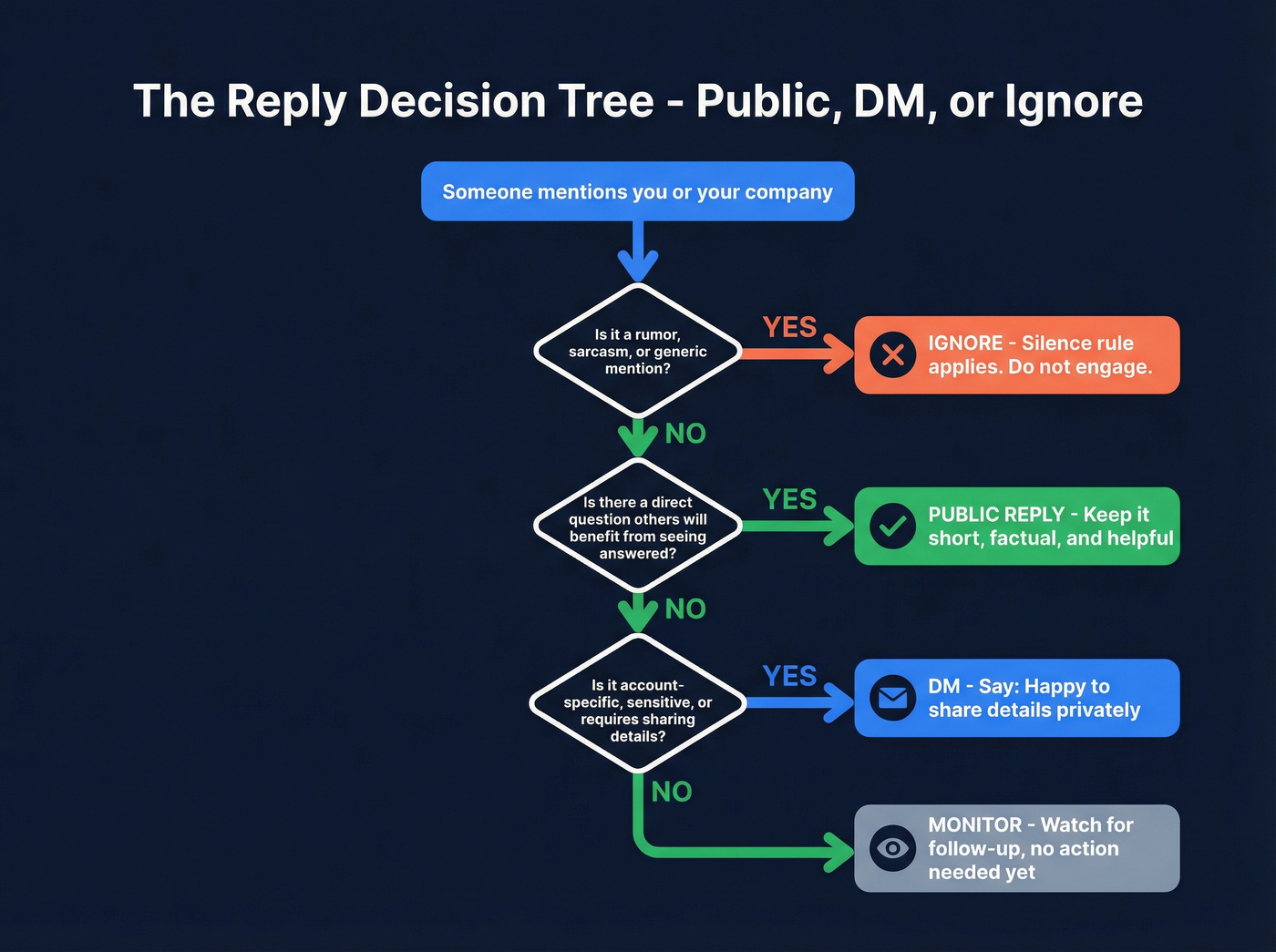

Public reply vs DM vs ignore decision tree

Use this decision tree. It's simple enough to remember.

Step 1: Is it a rumor, sarcasm, or generic mention?

- Yes → Ignore (silence rule)

- No → continue

Step 2: Is there a direct question that others will benefit from?

- Yes → Public reply (short, factual, helpful)

- No → continue

Step 3: Is it account-specific, sensitive, or requires details?

- Yes → DM ("Happy to share details privately.")

- No → continue

Step 4: Is it hostile or personal?

- Yes → Escalate (HR/Legal/Comms)

- No → Reply or DM based on context

Do/don't scripts (keep reps out of trouble)

Do (public reply):

- "Good question. The tradeoff is X vs Y. Here's the checklist we use: ..."

Do (move to DM):

- "I can share specifics, but it'll get detailed. Want me to DM you a quick breakdown?"

Don't (defensive):

- "That's not true, you don't understand..."

- "We're the best, everyone else is wrong..."

Don't (rumor amplification):

- "I've heard that too..."

- "Can't comment, but..."

If you want one governance move that sticks: require reps to complete a 10-minute certification on these rules before they're "approved" to represent the brand publicly.

Social listening that creates pipeline (trigger library + workflow)

Social listening is only useful if it ends in a routed, logged next step. Otherwise it's just doomscrolling with a budget.

Trigger library (table)

Use this trigger library as your default. It's intentionally practical: each trigger has a "why it matters" and a "next action."

| Trigger | Why it matters | Next action |

|---|---|---|

| Job change | New priorities + vendor reset | Congrats + ask focus |

| Funding | Budget + hiring + urgency | Offer benchmark |

| Headcount growth | Scaling pains | Share playbook |

| Competitor mention | Active evaluation | Ask what's missing |

| Tool change | Switching costs + gaps | Offer migration tips |

| Event attendance | Active learning mode | Ask takeaway |

| Content engagement | Warm signal | Start cadence |

Daily workflow: capture → qualify → route → log

Capture (10 min/day)

- Monitor keywords: your category, competitors, "looking for," "recommendations," "stack," "hiring," "RFP."

- Save posts and profiles into a queue.

Qualify (5 min)

- Does it match ICP?

- Is the trigger real (not just a repost)?

- Is there a clear angle to help?

Route (2 min)

- SDR-owned if it's net-new or early stage.

- AE-owned if it's an active account or late-stage signal.

- CS-owned if it's an existing customer signal.

- Comms-owned if it's brand-sensitive.

Log (3 min)

- Create/attach the lead/contact/account in CRM.

- Log "Social trigger" + trigger type + link to the post.

- Set a next step date.

Routing rules (SDR/AE/CS/Comms)

- SDR: new contacts, early intent, content engagement, job changes.

- AE: competitor comparisons, "tool change," buying committee chatter.

- CS: customer complaints, renewal hints, expansion signals.

- Comms/Marketing: public criticism, misinformation, sensitive threads.

Plays & cadences (the default sequence you standardize)

This is where most "social selling" programs fall apart. They get engagement... and then nothing happens.

You need a default cadence that turns signals into meetings. Cognism's benchmark is a solid baseline: 17-21 days and 8-12 touchpoints. That's long enough to be persistent, short enough to stay relevant.

Here's the thing: social touches alone rarely close the loop. Once someone shows intent (reply, comment back, clicks, accepts and engages), you need a reliable way to reach them off-platform. Email and phone still win for scheduling and follow-through.

This is also where Prospeo fits naturally: after engagement, pull verified contact details fast, then run the same logged cadence every time. That "engagement → verified contact → sequence" handoff is what turns social activity into meetings you can actually attribute.

Default 17-21 day cadence (table)

This is a "standardize first, customize later" sequence. Keep it value-led and lightweight.

| Day | Channel | Touch | Goal |

|---|---|---|---|

| 1 | Social | Connect + 1 line | Open door |

| 2 | 75-100 words | Confirm relevance | |

| 3 | Call | Call + VM (opt) | Pattern interrupt |

| 5 | Social | Comment on post | Stay visible |

| 7 | Mini asset/template | Give value | |

| 10 | Call | Call + short email | Ask for interest |

| 14 | Social | DM w/ specific Q | Create reply |

| 17 | "Close the loop" | Yes/no | |

| 21 | Social | Final polite note | Leave door open |

Touchpoints: 8-12 depending on whether you add a short video on Day 10-14 after engagement.

Hot take: teams obsess over "the perfect first message" and ignore the bigger lever - a consistent follow-up system. The rep who follows up cleanly beats the rep with the clever opener.

Add a "video touch" without getting cringe

Video works when it's a clarifier, not a performance.

Use it only after you have a signal (accepted + replied, or they clicked a tracked link). Keep it to 30-45 seconds and make it specific:

- 1 sentence: why you're reaching out (the trigger)

- 1 sentence: what you noticed (their context)

- 1 sentence: the offer (one small next step)

- 1 sentence: the ask (yes/no)

Example script: "Hey {{Name}} - saw you're hiring two SDRs and rolling out a new CRM workflow. Quick thought: most teams lose replies in week two because follow-up isn't standardized. If you want, I'll send our 9-touch cadence and a QA rubric. Want it?"

If you can't say it in 45 seconds, you don't have a tight offer.

Use/skip guidance (so reps don't overcomplicate it)

Use the full 17-21 day cadence when:

- The trigger's real but not urgent (job change, content engagement, light tool chatter).

- You're selling mid-market and need repetition to earn attention.

- You're building a new motion and need consistency for coaching.

Shorten to 10-14 days when:

- The trigger's time-bound (funding, hiring sprint, active migration).

- The prospect's actively engaging (multiple comments, fast replies).

- Your offer's a fast win (benchmark, teardown, template).

Extend to 28-35 days when:

- You're targeting enterprise accounts with slower internal motion.

- You're running a nurture play (education > meeting ask).

- You're multi-threading and don't want to spam one person.

Skip automation entirely when:

- You can't enforce stop-on-reply and stop-on-negative.

- You don't have CRM logging discipline.

- Your reps are still learning tone and boundaries. Automating bad judgment just scales the damage.

Stop rules (stop-on-reply, stop-on-negative)

These are non-negotiable:

- Stop-on-reply: if they reply anywhere, pause the cadence and go human.

- Stop-on-negative: if they say "not interested," stop immediately and set a long-term nurture task (60-120 days).

- Stop-on-meeting: once booked, stop all automated touches and switch to meeting prep.

Governance idea I love (and Cognism calls out): create a cadence committee - SDR manager + one AE + 1-2 top reps + RevOps. They review performance monthly and update quarterly. That's how you avoid zombie sequences that keep running because "we set it up once."

Templates & scripts (copy/paste)

Trap.it recommends arming reps with sample responses. Yes. Not because reps can't write - because consistency matters, and you don't want every rep inventing tone, boundaries, and escalation in real time.

Use these as defaults, then personalize with one specific detail.

Connection request

Template A (trigger-based) "Hey {{FirstName}} - saw you're {{trigger}}. Curious what your top priority is in the first 90 days. Open to connecting?"

Template B (content-based) "Hey {{FirstName}} - your post on {{topic}} was sharp, especially {{specific detail}}. Would love to connect."

Template C (mutual context) "Hey {{FirstName}} - we both follow {{person/community}} and I'm working with teams on {{outcome}}. Open to connecting?"

First message (after connect)

Template A (help-first) "Thanks for connecting, {{FirstName}}. Quick one: are you focused more on {{Option1}} or {{Option2}} this quarter? I've got a 1-page checklist either way."

Template B (micro-asset) "Appreciate the connect. I wrote a short {{asset}} on {{problem}} - want me to send it?"

Keep it short. If it reads like a pitch deck, it'll get ignored.

Follow-up

Template A (context + question) "{{FirstName}}, circling back - when teams {{trigger}}, the usual bottleneck is {{bottleneck}}. Is that true on your side, or is it something else?"

Template B (permission + exit) "Should I stay in your orbit on this, or is it not a priority right now? Either answer's helpful."

Comment starters (that don't sound like a bot)

- "The part people miss is {{nuance}}. Here's how we handle it: ..."

- "Counterpoint: {{respectful disagreement}}. Curious how you'd handle {{edge case}}?"

- "Stealing this. One add: {{tactical step}}."

- "If someone's trying this, watch out for {{pitfall}} - it bit us before."

- "What'd you do if {{constraint}} (no budget / no headcount / tight timeline)?"

Move to email/call (off-platform)

This is the "not creepy" bridge. You're not asking for personal info. You're offering a cleaner channel for specifics.

Template A (offer specifics) "Happy to share the exact checklist + examples, but it's easier over email. Where should I send it?"

Template B (schedule) "If it's useful, I can walk you through it in 12 minutes. Want a quick call this week, or should I just send the notes?"

Competitor/rumor scripts

Competitor mention (public, neutral) "Totally fair question. The tradeoffs usually come down to {{tradeoff1}} and {{tradeoff2}}. If you share your context (team size / workflow), I'll point you to the best fit - even if it's not us."

Competitor mention (DM, more direct) "If you're comparing options, what matters more: {{speed}} or {{control}}? I can send a simple comparison grid."

Rumor response (silence rule default)

If it's a rumor: don't respond. If you must (Category 1, Comms-approved): "I can't speak to rumors. If you've got a specific question about {{topic}}, I'm happy to answer what I can."

"Not now" nurture reply

Template A (respect + next step) "Got it - thanks for the straight answer. What's a better time to revisit: next quarter or later this year?"

Template B (value drip) "No worries. I'll send one useful thing and then go quiet - would a {{template/benchmark}} help?"

If they say "not interested," stop. Don't "nurture" someone who opted out.

Measurement that leadership believes (SSI + pipeline attribution)

If you want budget and headcount, you need measurement that a CFO won't laugh at.

SSI's fine - treat it like a diagnostic, not the goal.

SSI as diagnostic

SSI is a 0-100 score that updates daily and breaks into four pillars (each worth up to 25 points):

- Establish your professional brand

- Find the right people

- Engage with insights

- Build relationships

A common rule of thumb is SSI 75+ as a "leader" diagnostic (popularized in multiple guides, including Zendesk). Use it for coaching behaviors - profile basics, targeting, consistent engagement, relationship-building - not as a quota.

Pipeline-first KPI set

Use a two-layer KPI model:

- Activity + quality KPIs (leading indicators you can coach weekly)

- Pipeline KPIs (lagging indicators leadership cares about monthly/quarterly)

| KPI | What "good" looks like | Review |

|---|---|---|

| Daily routine adherence | 4 days/week | Weekly |

| Meaningful comments | 15-25/week | Weekly |

| New convos started | 5-15/week | Weekly |

| Replies (DM/email) | 5-10%+ | Weekly |

| Meetings booked | per role/segment | Weekly |

| Influenced pipeline | tracked monthly | Monthly |

| Sourced pipeline | tracked monthly | Monthly |

| Win rate / cycle | by cohort | Quarterly |

One opinion I'll defend: if you can't define "meaningful comment" and QA it, your activity metrics are noise. Quality's the whole game.

UTM naming convention + CRM fields

Sprout's employee advocacy guidance is right: UTMs are the simplest way to make social impact measurable - and they're also how you connect social selling brand awareness to pipeline without hand-waving.

Use a strict naming convention:

utm_source=platform (or "employee")utm_medium=socialutm_campaign=campaign name (Q1_playbook, webinar, etc.)utm_content=rep name or post theme

Then in CRM, standardize fields:

- Lead Source (Original)

- Campaign (UTM campaign maps here)

- Influenced by Social (checkbox)

- First Social Touch Date

- Last Social Touch Date

- First Social Touch URL (paste the post link)

- Primary Trigger Type (job change, funding, tool change, etc.)

- Social Owner (rep name)

Governance rule: RevOps owns the UTM standard and audits it monthly. If you leave UTMs to individual reps, you'll get utm_campaign=final_final2 and your reporting's fiction.

A simple attribution example (copy this)

Here's a clean way to make "influence" real without inventing fake percentages.

Scenario:

- Day 1: Rep comments on a VP's post (log "Social touch," paste URL).

- Day 2: VP accepts connection; rep sends a DM with a tracked link to a checklist (UTM campaign =

Q1_playbook). - Day 6: VP forwards the checklist internally; a Director fills out a form and becomes the created lead.

How to record it:

- The created lead's Lead Source (Original) = whatever created it (e.g., "Website" or "Inbound").

- The opportunity's Influenced by Social = checked (because social touches occurred during the cycle).

- The opportunity's Campaign =

Q1_playbook(because the tracked link drove the internal share). - The rep's activity report shows: comments → DM → click → meeting.

That's enough for leadership: it shows a chain of events, not a vibe.

Monthly reporting cadence

Monthly:

- Influenced pipeline, sourced pipeline, meetings, reply rates

- Top triggers that converted

- Top templates (what got replies)

- Rep leaderboard: quality touches → replies → meetings

Quarterly:

- Cohort analysis (who's improving, who's stuck)

- Cadence updates (cadence committee)

- Content lane updates (what's resonating)

Team-scale social selling: employee advocacy targets (benchmarks)

If you want social selling to work beyond a few power users, you need employee advocacy targets. Otherwise you get the classic pattern: 2 reps post, everyone else lurks, and leadership decides "social doesn't work."

Hootsuite's benchmarks give you numbers you can actually manage to:

- Activation: aim for 40-50% of eligible employees to be active participants (not 100%).

- Sharing rate: target ~1.2 shares per user per week as a steady baseline.

- Reach multiplier: employee-shared content typically reaches far more people than brand channels alone; the practical takeaway is to measure employee reach separately from brand reach.

- Outcome framing: advocacy works best when it's tied to a concrete business outcome (recruiting, event attendance, pipeline influence), not "more impressions."

Run advocacy like a product rollout:

Participation KPIs (weekly):

- Eligible users

- Activated users (posted or shared at least once)

- Shares per activated user

- Clicks per share (on tracked links)

- Meetings influenced (checkbox + first/last touch)

Operating rule: don't punish non-posters. Coach the middle. Celebrate consistency, not virality.

And yes, this is my hot take: most teams should stop trying to turn every rep into a "creator." Build a system where reps can win with comments + DMs + smart sharing, and let the true writers write.

Tools & stack (categories, selection criteria, pricing)

Tools don't create pipeline. They remove friction.

Prices change, but you still need planning ranges for budgeting, approvals, and "do we even need this?" conversations. The numbers below are typical list-price ranges teams use for 2026 planning, and you should sanity-check them on the vendor's site before procurement locks anything in.

Prospecting & intent

Sales Navigator is the default prospecting layer for most teams because it's the cleanest way to build ICP lists, track leads/accounts, and get alerts that feed your trigger workflow. Typical list pricing: Core $119.99/month, Advanced $179.99/month (Advanced Plus is custom).

Publishing/advocacy (pick based on how "team" you are)

My recommendation (teams): Sprout Social. Sprout's the best grown-up option when you need workflows, approvals, and reporting that doesn't fall apart at 10+ users. Typical pricing: $199-$399/seat/month (Enterprise above that).

Best value (mid-market): Hootsuite. Pick Hootsuite when you want solid scheduling + advocacy at a lower price point and you don't need Sprout's polish. Typical pricing: EUR 149-EUR 399/user/month depending on plan and features.

Solo/lightweight: Buffer. Buffer's great when you just need simple scheduling and you don't want a heavy platform. Typical pricing: free + ~$6-$12/channel/month.

Listening

If you're serious about triggers, you want a listening tool that can route and tag, not just show streams.

- YouScan is the step up when you need deeper monitoring and analysis. Typical pricing: starts at $299/month (annual billing).

- Brandwatch is the heavyweight enterprise option. Pricing's custom, and many teams budget ~$20k+/year for enterprise listening.

CRM + reporting

Whatever CRM you use, the requirement's the same: custom activity types, campaign mapping, and dashboards that separate activity from pipeline.

Automation safety checklist (don't skip this)

CloudCampaign's red flags are real. Outreach automation gets risky fast.

Minimum safety criteria:

- Stop-on-reply (hard requirement)

- Conservative daily limits + random delays

- Inbox detection (don't double-message)

- Clear audit logs

- No "spray and pray" AI personalization

One more rule that saves pain later: be wary of extension-only automation tools. Prefer tools with inbox detection, stop-on-reply, and conservative limits.

Skip automation tools entirely if you can't enforce stop rules and logging. You'll create more cleanup work than pipeline.

Stack comparison table (with pricing)

| Category | Tool | Best for | Typical price | Notes |

|---|---|---|---|---|

| Contact data | Prospeo | Verified outreach | Free + ~$39+/mo | Self-serve |

| Prospecting | Sales Navigator | ICP lists + alerts | $119.99-$179.99/mo | Core layer |

| Publishing | Sprout Social | Workflow + reports | $199-$399/seat/mo | Team-ready |

| Publishing | Hootsuite | Scheduling + advocacy | EUR 149-EUR 399/user/mo | Value pick |

| Publishing | Buffer | Lightweight scheduling | Free + $6-$12/ch/mo | Simple |

| Listening | YouScan | Deeper monitoring | From $299/mo (annual) | Analysis |

| Automation | Salesflow | Outreach sequences | From $99/user/mo | Use limits |

| Listening (ent) | Brandwatch | Enterprise listening | Not public (enterprise) | Ent. only |

| Research (ent) | Pulsar | Audience intel | Not public (enterprise) | Research |

Prospeo (Tier 1): the conversion bridge from engagement → meetings

In our experience, the hardest part of social selling isn't getting a few likes or even starting a thread. It's the handoff: turning "they engaged" into "we can actually reach them, follow up cleanly, and log it in a way RevOps trusts."

Prospeo is that bridge. It's the B2B data platform built for accuracy, with 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, refreshed every 7 days. Email accuracy is 98%, and mobile pickup rate is 30%, which is exactly what you want once a prospect signals interest and you need a reliable off-platform touch that doesn't torch deliverability.

If you're building this workflow for a team, the self-serve model matters more than people think: no contracts, transparent pricing (about $0.01 per verified email), and a free tier with 75 emails + 100 extension credits/month so you can prove the motion before you scale it.

For the workflow described in this playbook, the most relevant pages are the Email Finder (https://prospeo.io/email-finder), Chrome Extension (https://prospeo.io/contact-finder-extension), and Data Enrichment (https://prospeo.io/b2b-data-enrichment).

30-day rollout plan (team adoption + governance)

Most rollouts fail for one reason: they launch as "a thing reps should do," not as plays aligned to roles and objectives. Salesforce's playbook guidance nails this: operationalize with sales plays, not slogans.

Here's a real scenario I've seen: a VP announces "we're doing social selling now," a few reps post for two weeks, nobody logs anything, and then the CFO asks, "Cool - what'd we get?" Silence. Program dies. Everyone blames the platform.

Don't run it like that.

Week 1-4 plan

Week 1: Define + instrument

- Pick ICP + exclusions

- Finalize trigger library

- Create CRM fields + activity type ("Social touch")

- Publish rules of engagement + escalation owners

- Choose tools (or confirm what you already have)

Week 2: Enablement + templates

- Train reps on daily rhythm (30-45 min)

- Ship the swipe file (connection, DM, follow-ups, comments)

- Run a live roleplay session (10 scenarios)

- Certification: reps must pass guardrails quiz

Week 3: Launch plays + QA

- Start the default 17-21 day cadence

- Managers QA 10 interactions per rep (comments + DMs)

- Fix logging issues immediately (attribution debt compounds)

Week 4: Report + iterate

- First monthly dashboard: activity, replies, meetings, influenced pipeline

- Cadence committee meets: what's working, what's not

- Update templates based on real replies

RACI (mini-table)

| Workstream | R | A | C | I |

|---|---|---|---|---|

| Playbook ownership | Enablement | VP Sales | RevOps | All |

| Guardrails/escalation | Comms | Legal/HR | Sales | All |

| CRM + attribution | RevOps | RevOps | Marketing | Sales |

| Cadences + QA | SDR Mgr | VP Sales | Enablement | RevOps |

| Content support | Marketing | CMO | Sales | All |

Quarterly updates + feedback loop

Minimum standard:

- Quarterly playbook update (non-negotiable)

- Monthly cadence committee review

- Feedback loop: reps submit "reply screenshots" + objections weekly

- Enablement updates templates based on what buyers actually say

I've seen teams waste months because nobody owned the playbook. Name a playbook owner, give them 2 hours/week, and make updates part of the operating cadence.

Final checklist (print this, run it weekly)

If you want this to produce pipeline, run this weekly operating checklist:

- ICP discipline: update your exclusions list and remove "nice-to-have" accounts.

- Trigger review: pick the top 3 triggers that produced replies and double down.

- Cadence hygiene: audit stop-on-reply/stop-on-negative compliance (no exceptions).

- Quality QA: managers review 10 touches/rep (comments + DMs) and coach tone.

- Attribution audit: spot-check UTMs + "First/Last Social Touch" fields for accuracy.

- Template refresh: replace the bottom 20% performing messages with new variants.

- One enablement win: ship one micro-asset (checklist, benchmark, teardown offer) reps can use immediately.

Do this for 30 days and you'll know - without guessing - whether social is a channel you can scale.

FAQ

What's the difference between social selling and content marketing?

Social selling is rep-led relationship building that turns conversations into meetings, while content marketing is brand-led distribution that turns attention into inbound demand. Social selling is measured in replies, meetings, and pipeline; content marketing is measured in reach, subscribers, and inbound conversions. Most teams should run both, but manage them with different dashboards.

How long does it take for SSI to improve - and should we even care?

SSI can improve in 3-6 weeks if reps engage 4 days/week and focus on targeting + relationship-building, but it should never be the goal. Treat SSI like a weekly diagnostic: if "Find the right people" is low, fix ICP lists; if "Engage with insights" is low, coach comment quality and consistency.

What's the "not creepy" rule for outreach after someone engages?

Reference the exact engagement, offer one useful asset, and ask permission to continue - then stop after 2 unanswered touches. "Saw your comment on X - want the checklist?" is fine; "I noticed you viewed my profile, here's a pitch" isn't. A clean rule is 8-12 total touches over 17-21 days only after a real signal.

What tool helps you turn engagement into outreach when you don't have contact data?

Prospeo's a strong option because it provides 98% verified email accuracy, 125M+ verified mobile numbers, and a 7-day refresh cycle, so reps can move from engagement to a logged email/phone cadence fast. The free tier includes 75 emails + 100 extension credits/month, which is enough to prove the workflow before scaling.

You just built the cadence. Now you need contacts that won't bounce. Prospeo's 98% email accuracy and 125M+ verified mobiles mean your 3-8 daily DMs and connection requests reach real buyers - not dead inboxes.

Stop logging social touches that land in the void.

Summary

If you want a social selling playbook that survives onboarding, platform changes, and forecast scrutiny, make it boring: a 30-45 minute daily rhythm, clear guardrails, a default 17-21 day follow-up cadence, and attribution that ties activity to pipeline. Run it for 30 days, audit it weekly, and you'll know exactly what to scale.