Types of Sales Strategies (2026): A Practical Taxonomy You Can Choose From

Most "types of sales strategies" lists are a junk drawer: inbound next to SPIN next to "consultative" next to "account-based." Those aren't the same kind of thing, so you can't actually choose.

Here's the clean way to do it: separate the motion you run, the model you sell with, and the methodology you use in calls. Then pick based on constraints like payback speed, stakeholder count, and time-to-value.

This is where teams waste quarters.

What a sales strategy is (and what it includes)

A sales strategy isn't a vibe. It's the set of choices that determines who you sell to, how you reach them, and how you run the revenue engine week to week.

A practical definition: it's a plan to hit revenue targets by identifying target customers, choosing channels, and building a sales process, then updating it as buyer behavior changes.

A real sales strategy includes (at minimum):

- Target customers / ICP: who you're built to win (and who you're not)

- Channels: inbound, outbound, partners, product-led, events, etc.

- Sales process: stages, exit criteria, handoffs, and what "good" looks like

- KPIs: pipeline coverage, win rate, cycle length, CAC payback, expansion, etc.

Where this gets real is when you see how those four elements change by strategy type. Three concrete examples:

- Inbound-led (demand capture)

- ICP: narrower than you think: segments with clear search intent and a problem they already name.

- Channels: SEO/content, webinars, comparison pages, review sites, nurture.

- Process: speed-to-lead + routing matters more than "perfect discovery"; you win by converting intent quickly.

- KPIs: MQL-to-SQL rate, demo-to-close, speed-to-lead, pipeline per content cluster.

- Outbound-led (demand creation)

- ICP: tighter and more operational: industry + trigger + role + environment. If you can't write disqualifiers, outbound will punish you.

- Channels: sequences (email/call), targeted events, account plays, retargeting.

- Process: list hygiene + deliverability + meeting quality become first-class citizens.

- KPIs: meeting rate per 1,000 prospects, connect rate, reply quality, pipeline per rep-month, deliverability/bounce.

- Enterprise ABS (committee selling)

- ICP: fewer accounts, higher stakes; you pick accounts where one win changes the quarter.

- Channels: coordinated touches across roles (sales + marketing + exec), plus partner influence.

- Process: buying-group mapping, multi-threading, mutual action plans, security/procurement paths.

- KPIs: account coverage (roles touched), stage conversion by stakeholder count, multi-thread depth, expansion rate.

Here's the litmus test: "types of sales strategies" only becomes useful when a type changes your ICP, channels, process, or KPIs. If it doesn't, it's a tactic or a methodology wearing a strategy costume.

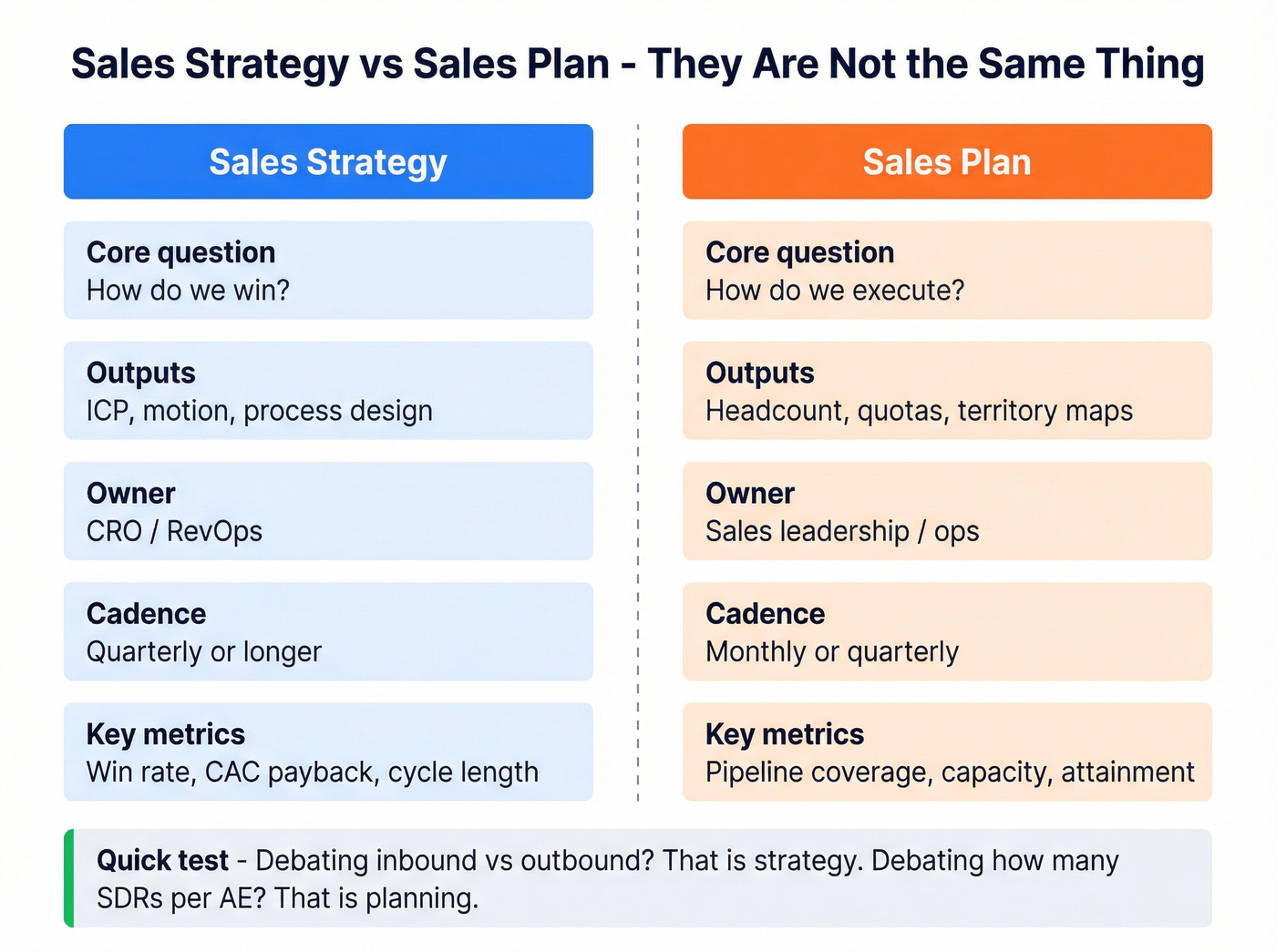

Sales strategy vs sales plan (stop mixing them)

Strategy is the "how we win" logic. Planning is the "how we staff and fund it" math.

A clean line that holds up in real ops: strategy is how you capture market share; planning is resources and targets - revenue by channel, how many accounts you'll work, and what pipeline coverage you need to hit the number.

If you mix them, you get the classic failure mode: a beautiful strategy deck with no capacity model, or a spreadsheet plan that assumes pipeline magically appears.

| Dimension | Sales strategy | Sales plan |

|---|---|---|

| Definition | How you win | How you execute |

| Outputs | ICP, motion, process | Headcount, quotas |

| Owner | CRO/RevOps | Sales leadership |

| Cadence | Quarterly+ | Monthly/quarterly |

| Metrics | Win rate, CAC | Coverage, capacity |

A practical tell: if you're debating "inbound vs outbound," you're in strategy. If you're debating "how many SDRs per AE," you're in planning.

Why strategy types changed in 2026 (buyer reality)

B2B buying got more crowded and more cautious at the same time. That combination punishes generic selling.

Gartner's buyer research makes the shift painfully clear:

- Buying groups run 5-16 people, often across four functions.

- 74% of buyer teams show unhealthy conflict during decisions.

- When groups reach consensus, they're 2.5x more likely to report a high-quality deal.

So "sell to the champion" isn't enough anymore. You need a strategy that assumes internal disagreement and designs for consensus.

Now layer in the rep-free trend:

- 61% of buyers prefer an overall rep-free buying experience.

- 73% actively avoid suppliers who send irrelevant outreach.

- 69% see inconsistency between what the website says and what sellers say.

That's brutal. It means your strategy can't rely on "we'll explain it on the call." Buyers want to self-educate, and they'll punish you if your outreach is off-target or your story changes between marketing and sales.

Here's the thing: the modern seller's job is contextual intelligence, not product education. Buyers can get generic info anywhere. Sellers win when they translate the buyer's situation into what matters, what to ignore, what tradeoffs to accept, and how to get internal alignment.

What to change Monday morning:

- Message governance: pick one positioning narrative and enforce it across website, decks, and talk tracks.

- Proof library: build assets that help buyers win internal debates (security one-pager, ROI model, implementation plan, "why now" benchmark).

- Multi-threading SOP: define when a deal is "real" (example: 3+ roles engaged, economic buyer identified, decision process mapped).

- Relevance rules for outbound: disqualify hard; "more volume" is the fastest way to train the market to ignore you.

If you're enterprise, multi-threading and enablement content aren't optional. They're how deals survive conflict.

Every strategy in this taxonomy - outbound, ABS, PLG-assisted - lives or dies on data quality. Bad emails kill deliverability, tank reply rates, and train the market to ignore you. Prospeo gives you 300M+ profiles with 98% email accuracy, 125M+ verified mobiles, and a 7-day refresh cycle so your lists never go stale.

Pick your strategy. We'll give you the data that makes it work.

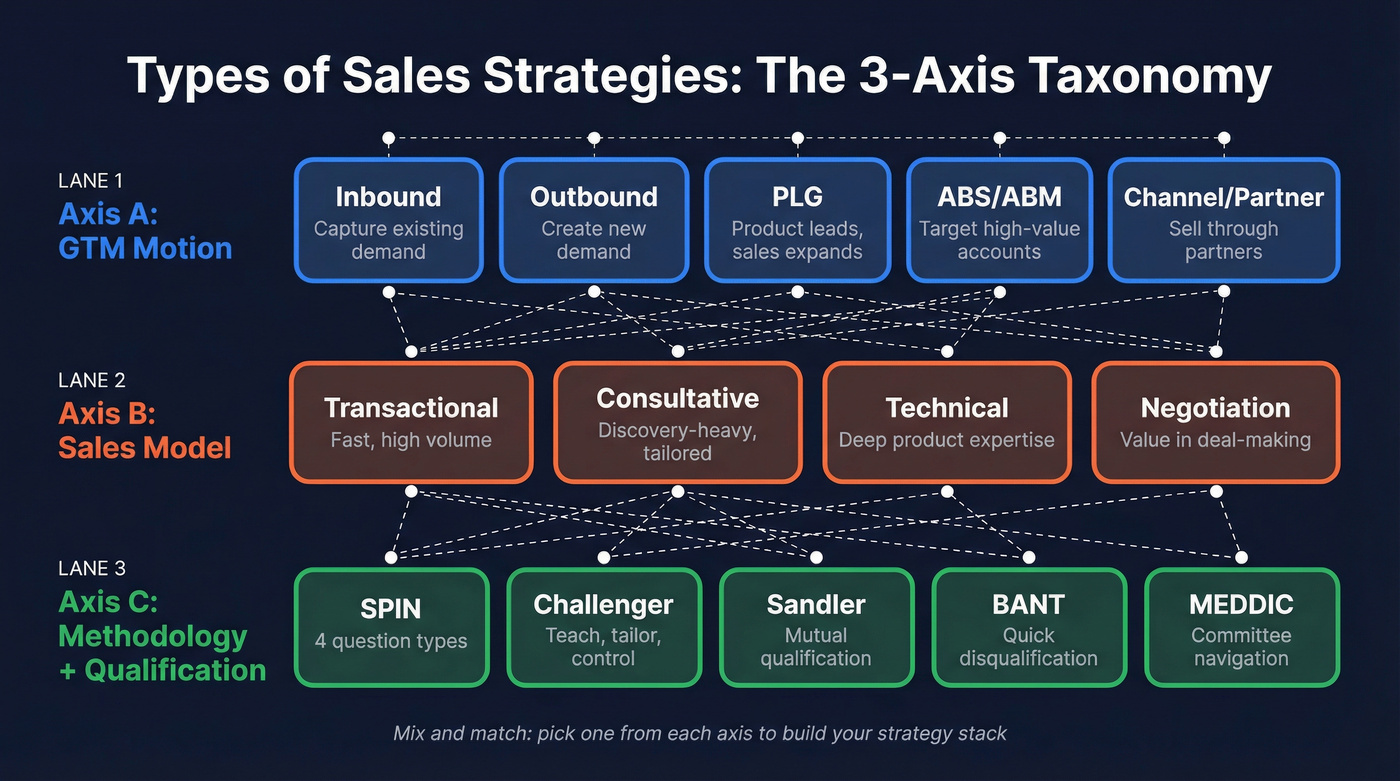

Types of sales strategies: the 3-axis taxonomy (the clean map)

The reason strategy content is confusing is simple: people label different layers with the same word "strategy."

So let's separate the layers:

- Axis A: GTM motion = how demand is captured/created and how you reach buyers.

- Axis B: Sales model = how the sale works structurally (speed, complexity, expertise, negotiation dynamics).

- Axis C: Methodology + qualification = how sellers run conversations and how you qualify deals.

This matters because the SERP constantly mixes these up. Example: inbound isn't the same thing as SPIN. Inbound is a motion. SPIN is a conversation methodology. You can run inbound with Challenger, outbound with SPIN, or ABS with Sandler.

Axis A - GTM motions

Inbound Capture existing demand via content, search, community, events, and conversion paths. It fits when you've got a clear problem category, strong intent signals, and you can win on trust plus proof.

Outbound Create demand by targeting accounts/people and initiating conversations. It fits when you can define your ICP tightly, your list quality is high, and you can personalize enough to avoid the irrelevance penalty.

PLG / product-led sales Users start using the product without talking to sales; sales supports expansion and complex use cases. It fits when time-to-value is fast, onboarding is self-serve, and the product can prove value before a call.

Account-based selling (ABS/ABM) Focus on a small set of high-value accounts as "markets," coordinating touches across roles and stakeholders. It fits when deal complexity is high and expansion is real.

Channel / partner Partners source, influence, or close deals (resellers, agencies, marketplaces, affiliates). It fits when you need reach you can't build fast enough directly, or you sell into ecosystems.

Land-and-expand Start small (one team/use case), then expand across departments, regions, or product lines. It fits when your product has natural expansion paths and usage-based proof.

Axis B - Sales models

Think "how the sale works," independent of motion:

Transactional selling Fast, high-volume, low complexity. Fits lower-ticket, standardized offers.

Negotiation selling Value is created in the deal-making: packaging, concessions, terms. Fits competitive markets and procurement-heavy deals.

Technical selling Requires deep product/technical expertise and integration into operations. Fits IT, security, data, and platform sales.

Distributive selling Success depends on intermediaries and channel design. Fits partner-led motions and distribution-heavy industries.

Consultative selling (B2B) Discovery-heavy, tailored proposals, stakeholder alignment. Fits complex problems and higher-stakes decisions.

Hot take: most teams say they're consultative, but they're actually transactional with extra meetings. If your proposal doesn't change based on what you learn, you're not consultative - you're just slow.

Axis C - Methodologies + qualification

Methodologies guide how reps run calls. Qualification frameworks decide what's real pipeline.

SPIN Situation, Problem, Implication, Need-payoff questions. SPIN was developed from research on 35,000+ sales calls (Rackham/Huthwaite).

Challenger Teach, tailor, take control. The useful takeaway isn't "be aggressive." It's "bring insight and help them decide."

Sandler Mutual qualification, upfront contracts, and pain-based discovery. Fits teams that struggle with happy ears and late-stage surprises.

SNAP Simple, iNvaluable, Align, Priority. Fits time-starved buyers and crowded categories.

BANT vs MEDDIC

- BANT: Budget, Authority, Need, Timing. Great when cycles are short and you need quick disqual.

- MEDDIC: Metrics, Economic Buyer, Decision criteria/process, Identify pain, Champion. Great when stakeholder count is high and you need to navigate decision dynamics.

If you're selling into committees, MEDDIC (or a MEDDIC-lite) beats BANT because it forces you to find the economic buyer and decision process early.

| Axis | Options | Best for | Watch-outs |

|---|---|---|---|

| A: Motion | Inbound | Demand capture | Slow ramp |

| A: Motion | Outbound | New markets | Relevance tax |

| A: Motion | PLG | Fast TTV | Needs product |

| A: Motion | ABS | Enterprise | High effort |

| A: Motion | Channel | Reach | Less control |

| B: Model | Transactional | Low complexity | Price pressure |

| B: Model | Technical | Platform sales | Enablement load |

| B: Model | Consultative | Complex deals | Longer cycles |

| C: Method | SPIN | Value discovery | Can drag |

| C: Method | Challenger | Insight selling | Needs POV |

| C: Qual | MEDDIC | Committees | Process heavy |

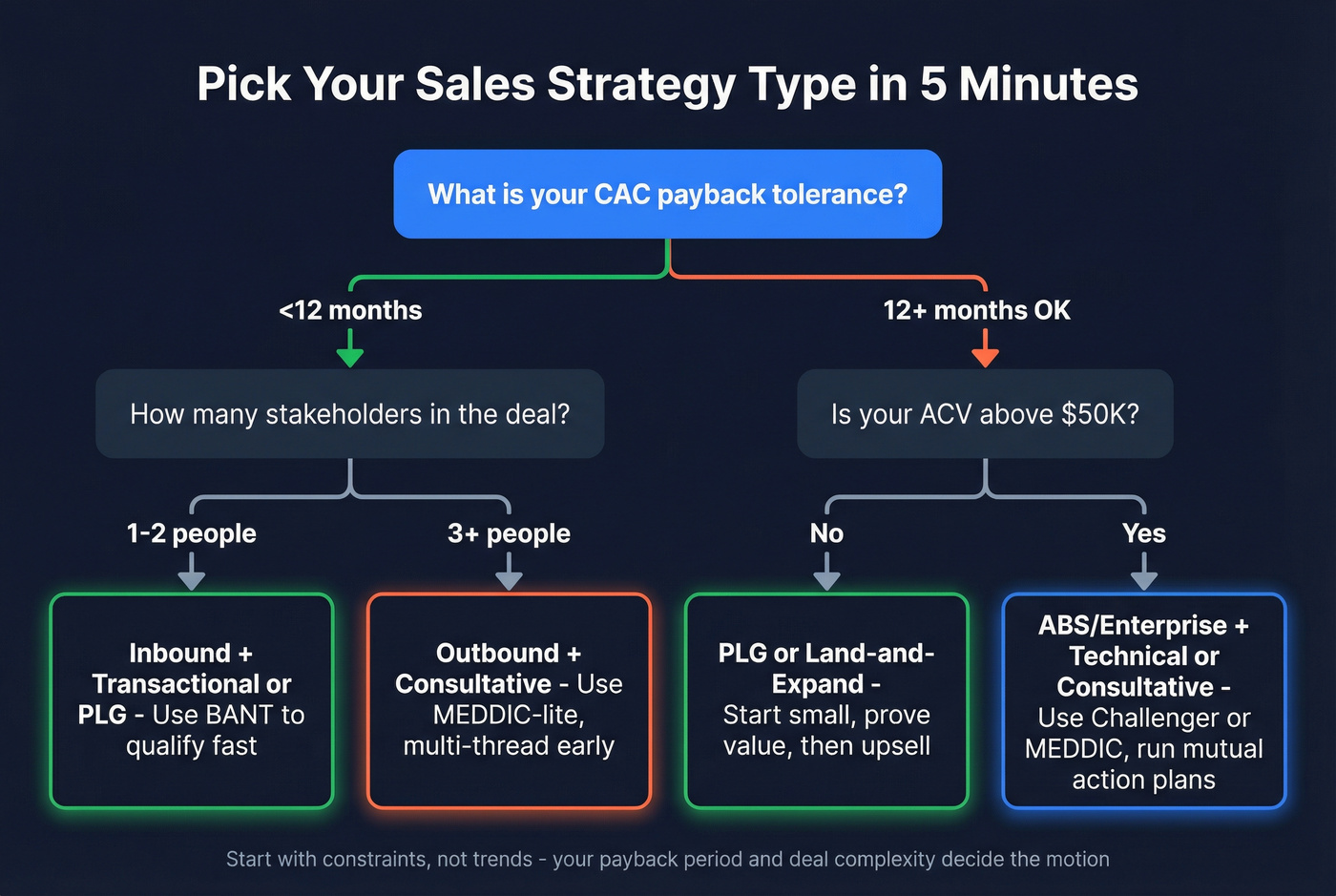

Pick your strategy type in 5 minutes (decision tree)

Use this like a constraint filter. Don't start with "what's trendy." Start with what your business can tolerate.

Decision tree (fast version)

1) What's your payback tolerance?

- If you need payback in <12 months, run inbound plus tight outbound and add PLG only if TTV is truly fast.

- If you can tolerate 18-30 months, enterprise ABS and heavier outbound become viable.

2) What's your ACV band? (hard call) Use this as a default mapping - break it only when you've got a strong reason:

- ACV < $5k: transactional plus inbound/PLG. Skip ABS. Don't hire enterprise AEs first.

- $5k-$25k: hybrid inbound plus outbound; inside sales; light technical support.

- $25k-$100k: consultative/technical hybrid; outbound plus inbound; selective ABS for top accounts.

- $100k+: ABS patterns, multi-threading, technical validation, procurement pathing.

3) How many stakeholders are typically involved?

- 1-3 stakeholders: BANT-style qualification can work; keep it fast and ruthless.

- 4-6 stakeholders: MEDDIC-lite (economic buyer + decision process + metrics) becomes worth the overhead.

- 7+ stakeholders: full committee selling - MEDDIC, multi-threading, and proof assets are non-negotiable.

4) Is time-to-value under ~30 minutes? (PLG readiness gate)

- Yes: PLG or hybrid product-led sales is on the table.

- No: pure PLG isn't your strategy. Build sales assist or sales-led and stop pretending onboarding friction is "a growth problem."

5) Pick one primary constraint to optimize for

- Payback speed (cash efficiency)

- Deal size (revenue per win)

- Stakeholder count (enterprise complexity)

You can't optimize all three at once. Teams that try end up with a Frankenstein motion: expensive outbound, weak inbound, and a product that isn't self-serve.

Use/skip rules (practical)

Use ABS if you can name 50-500 accounts that would materially change your year.

Skip ABS if you can't afford deep research and multi-threading.

Use PLG if the product can demonstrate value without a call. Skip pure PLG if onboarding needs humans.

Use channel if distribution is the bottleneck. Skip channel if you can't support partner enablement and deal conflict rules.

Benchmarks that make the choice real (pipeline, CAC, outbound)

Benchmarks are the antidote to strategy-by-opinion. They force you to ask: "Can we afford this motion?"

Pipeline coverage (coverage math that doesn't lie)

A usable rule-of-thumb for pipeline coverage by segment:

- SMB: 2-3x coverage

- Mid-market: 2.5-4x

- Enterprise: 3-5x

The win-rate tie is the key: if your win rate is 25%, you need about 4x coverage to hit plan. That's not trivia - it determines whether outbound headcount will ever pencil out.

Mini-table: what changes if win rate moves?

| Win rate | Coverage needed (rough) | What you should do next |

|---|---|---|

| 15% | ~6.7x | Fix ICP + qualification first, or you'll drown in pipeline you can't close |

| 25% | ~4x | Scale demand gen and keep deal quality tight |

| 35% | ~2.9x | You've earned the right to scale outbound/ABS more aggressively |

My opinion: most teams try to pipeline their way out of a 15% win rate. It's the most expensive way to learn you've got a positioning or qualification problem.

CAC payback (motion reality check)

Typical SaaS CAC payback ranges used as a sanity check:

- SMB: 9-15 months

- Mid-market: 14-20 months

- Enterprise: 18-30 months

Hard call: if leadership demands 9-12 month payback, don't build an enterprise-first ABS engine. You'll miss the year and then blame "market conditions."

Cold calling baseline (capacity reality check)

Operational baseline:

- 2.3-2.5% dial-to-meeting

- Roughly 1 meeting per 40-45 dials

So if your strategy assumes "we'll just add calling," translate it into rep capacity and list volume. Otherwise it's wishcasting.

Optional: CAC by channel (directional, but useful)

A directional CAC snapshot by channel:

- Outbound: $1,980

- Referrals: $150

- Paid search: $802

- "Professional social" ads: $982

- SEO: as low as $290

Outbound isn't "bad." It's just expensive unless your targeting and conversion are tight.

Worked example (so you can feel the math)

Say you're mid-market with a $2M annual new ARR target, and your win rate is 25%. You'll need roughly 4x pipeline coverage, so about $8M in qualified pipeline.

If your outbound motion creates $50k pipeline per SDR per month, you'd need about 13 SDR-months of output just to fill the gap, and that's before you account for ramp time, seasonality, no-shows, and the fact that "pipeline created" and "pipeline that closes" are not the same thing in most CRMs.

Strategy playbooks by motion (what to do, not just what it's called)

Below are practical playbooks. They're tactics, yes - but they're the tactics that actually express the strategy.

Inbound strategy (capture demand)

Inbound wins when your buyers can self-educate and you can convert that intent into pipeline without friction.

Checklist that actually moves numbers:

- One ICP page per segment: problem, proof, pricing anchor, and "who it's not for."

- Conversion paths by intent level: newsletter -> webinar -> demo -> trial. Don't force everyone into "book a demo."

- Handoff rules: define what becomes an SQL (and what stays in nurture). If you don't, you'll flood AEs with junk and call it "pipeline."

- Message consistency: if your website promises one thing and reps sell another, trust evaporates. Use the site as the source of truth, then train to it.

Real talk: inbound isn't free. It's prepaid.

Outbound strategy (create demand)

Outbound still works in 2026, but only when it's relevant enough to earn attention.

Operational checklist:

- ICP rules that disqualify hard: industry + trigger + role + environment. If you can't say "no" fast, you'll spam.

- Multichannel sequencing: email + call + light social + retargeting. Buyers are busy; you need more than one lane.

- Plan from the baseline: at 2.3-2.5% dial-to-meeting, you need volume and clean lists. If calling is core, plan for 40-50 dials/day per SDR and enough net-new contacts to sustain it.

- Proof assets that travel inside the account: every sequence needs a "why believe you" artifact (case study, benchmark, teardown, ROI model, security one-pager).

A quick scenario we've seen too many times: a team hires two SDRs, buys a list, and pushes volume. Week two looks "busy." Week six is panic - bounce rates climb, replies turn hostile, and the AEs start rejecting meetings because they're not real buyers. The root cause isn't effort. It's bad targeting plus bad data plus no proof.

Data quality is where outbound quietly lives or dies. Prospeo - "The B2B data platform built for accuracy" - is one of the few tools we've used that treats verification and freshness like the product, not a bullet point: 98% verified email accuracy, a 7-day refresh cycle, 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, with self-serve workflows and no contracts.

Account-based selling (ABS/ABM)

ABS treats a selected set of high-value accounts as individual markets. It's depth over breadth, and it optimizes for long-term revenue and expansion, not quick wins.

ABS playbook:

- Account selection: pick accounts where winning changes your year, not your week.

- Buying-group map: assume 5-16 stakeholders and plan coverage across functions.

- Multi-threading: don't "find the champion," build a coalition.

- Orchestration: coordinate marketing, sales, and often customer success. ABS dies when everyone runs their own play.

Personalization has to be coordinated and role-relevant, or it's just expensive noise.

Tooling by motion (lightweight, but real)

You don't need a giant stack. You need the right categories for the motion you picked, and you need them implemented like an operating system, not a pile of logins.

Tier 1 (core execution)

CRM (system of record) Non-negotiables: clean account hierarchy, contact roles, opportunity stages with exit criteria, and one definition of "qualified." If your CRM can't answer "who's involved, what stage are we truly in, and what happens next," forecasting becomes storytelling.

Sales engagement (sequencing + activity control) This is where outbound either becomes a machine or becomes chaos. You want sequence governance (who can send what), deliverability guardrails, task queues, and reporting that ties activity -> meetings -> pipeline.

Enablement/content (proof that survives committees) Enablement isn't "a content library." It's assets mapped to stakeholder conflict: ROI model for finance, security one-pager for IT, implementation plan for ops, competitive teardown for the champion.

Verified contact data + enrichment (so outreach isn't wasted) This category decides whether your outbound is precise or just loud. "Good" looks like verification (not guessing), frequent refresh, high match rates on enrichment, and compliance workflows (opt-out handling, audit trails). If you're running enrichment at scale, Prospeo's 83% enrichment match rate and 92% API match rate are the kind of numbers that keep ops sane.

Tier 2 (makes it scalable)

- Forecasting/RevOps: pipeline inspection, forecast hygiene, rollups, deal risk

- Intent data: in-market signals to prioritize accounts

- Conversation intelligence: call recording, coaching, deal risk

Tier 3 (situational, but useful)

- CPQ/quoting: approvals, pricing rules, renewals

- Partner portals: deal reg + enablement

- Scheduling + routing: speed-to-lead and clean handoffs

Common mistakes (and the "3x pipeline" myth)

"3x pipeline coverage" is a myth. The right coverage depends on win rate, cycle length, average deal size, and lead source quality.

Common pitfalls we've seen up close (and yes, we've watched teams lose quarters to these):

- Zombie deals: weighted pipeline looks great because probabilities are fantasy.

- Strategy-by-label: "We're doing ABM" when it's just outbound with company-name tokens.

- Methodology theater: rolling out Challenger/SPIN training without changing ICP, process, or proof assets.

- Ignoring buyer conflict: selling to one stakeholder and acting surprised when legal/procurement/security kills it late.

- Over-hiring outbound before proof exists: then blaming SDRs for "low quality meetings."

The fix is boring and effective: pick a motion, pick a model, pick a methodology, then instrument it with a few KPIs that drive behavior.

One-page strategy spec (template you can steal)

If you want alignment fast, write this on one page and make leadership sign off.

1) ICP (who we win with)

- Segment(s):

- Firmographics:

- Triggers (must-have):

- Disqualifiers (hard no):

2) Axis A - Motion (how we reach buyers)

- Primary motion:

- Secondary motion:

- What we're explicitly not doing this quarter:

3) Axis B - Sales model (how the sale works)

- Transactional / consultative / technical (pick one primary):

- Required roles in the cycle (AE/SE/CS/partner):

4) Axis C - Methodology + qualification

- Call methodology:

- Qualification: BANT / MEDDIC / MEDDIC-lite (define minimum bar):

5) KPIs (the few that matter)

- Coverage target:

- Win rate target:

- Cycle length target:

- CAC payback target:

- Expansion target (if land-and-expand):

6) Weekly operating cadence

- Monday: pipeline inspection (what gets killed, what gets escalated)

- Midweek: enablement + deal reviews (committee risk, proof gaps)

- Friday: experiment review (what we changed, what we keep)

If you can't fill this out without arguing, you don't have a strategy yet. You've got preferences.

FAQ

What are the main sales strategy categories?

The cleanest way to categorize sales strategy is by three layers: GTM motion (inbound, outbound, product-led, account-based, channel), sales model (transactional, consultative, technical), and methodology/qualification (SPIN, Challenger, Sandler plus BANT or MEDDIC). Pick the motion first, then match the model to deal complexity.

What's the difference between a sales strategy and a sales methodology?

A sales strategy sets the ICP, channels, process, and KPIs you'll use to hit revenue targets, while a methodology is how reps run discovery, handle objections, and advance deals. If your ICP is wrong or your motion is mismatched, training won't fix it - your pipeline will just fail more consistently.

Is outbound sales still effective in 2026?

Outbound is effective in 2026 when you enforce tight disqualifiers and can show proof fast, because buyers avoid irrelevant outreach and vendor shortlists are smaller. Use the dial-to-meeting baseline (about 1 meeting per 40-45 dials) to capacity-plan, and invest in assets that travel inside accounts.

What's a good free tool for verified B2B contact data?

Prospeo is a strong free option for verified contact data: it includes 75 verified emails plus 100 Chrome extension credits per month, with 98% verified email accuracy and a 7-day refresh cycle. If you need more volume, pricing stays self-serve at about $0.01 per email, with no contracts.

You read the rules: outbound punishes loose ICPs and dirty lists. Prospeo's 30+ filters - buyer intent, technographics, job changes, headcount growth, funding - let you build the surgical targeting this article demands. Teams using Prospeo book 35% more meetings than Apollo users.

Stop debating strategy types and start executing with verified data.

Summary: choosing between the types of sales strategies

Most teams don't fail because they picked the "wrong" label. They fail because they mixed layers.

Use the 3-axis map to choose among the types of sales strategies based on constraints (payback, ACV, stakeholder count, time-to-value), then operationalize it with a one-page spec and a few benchmarks that keep you honest.