The Best Cold Calling Companies in 2026: Real Pricing, Real Reviews, No BS

You just got off a call with a cold calling agency. They promised 20 qualified meetings a month, wouldn't share pricing until the third call, and their case study was from 2021. Sound familiar?

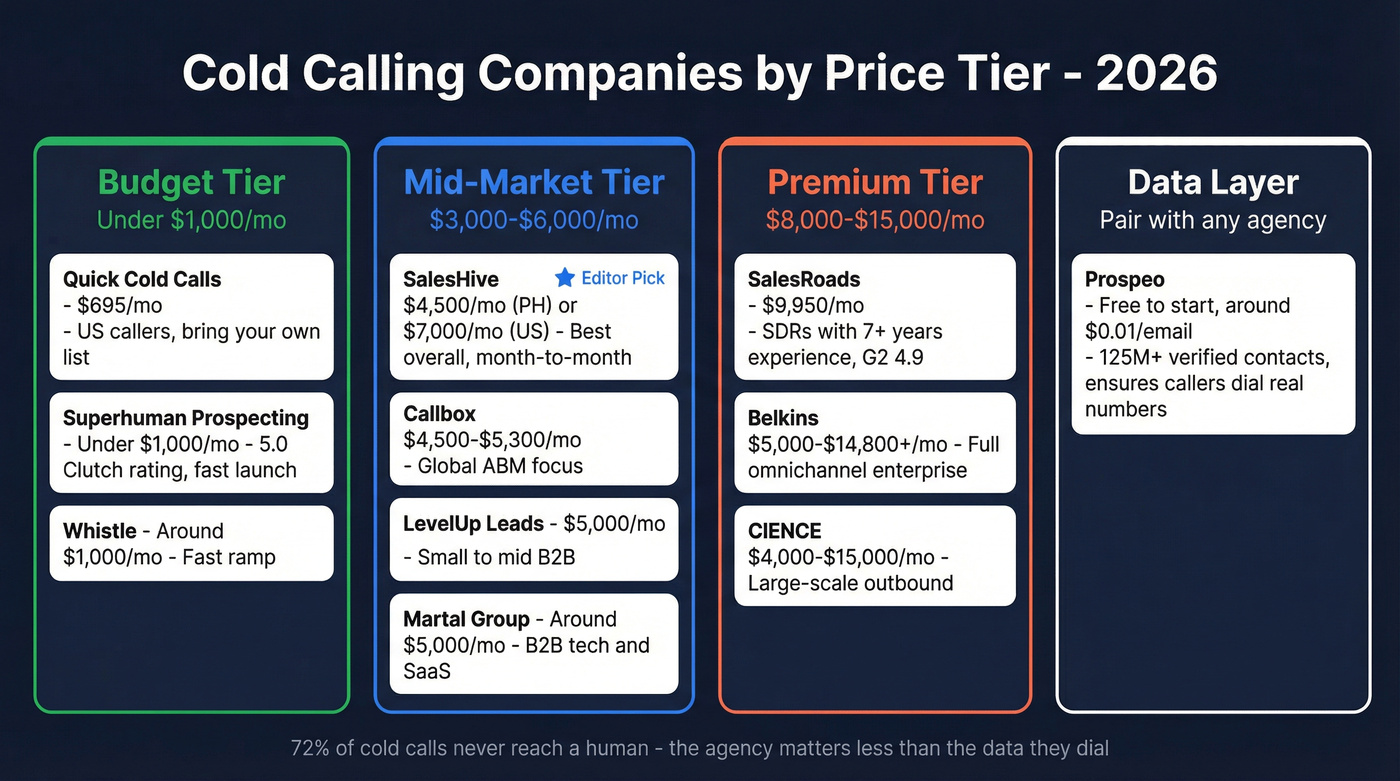

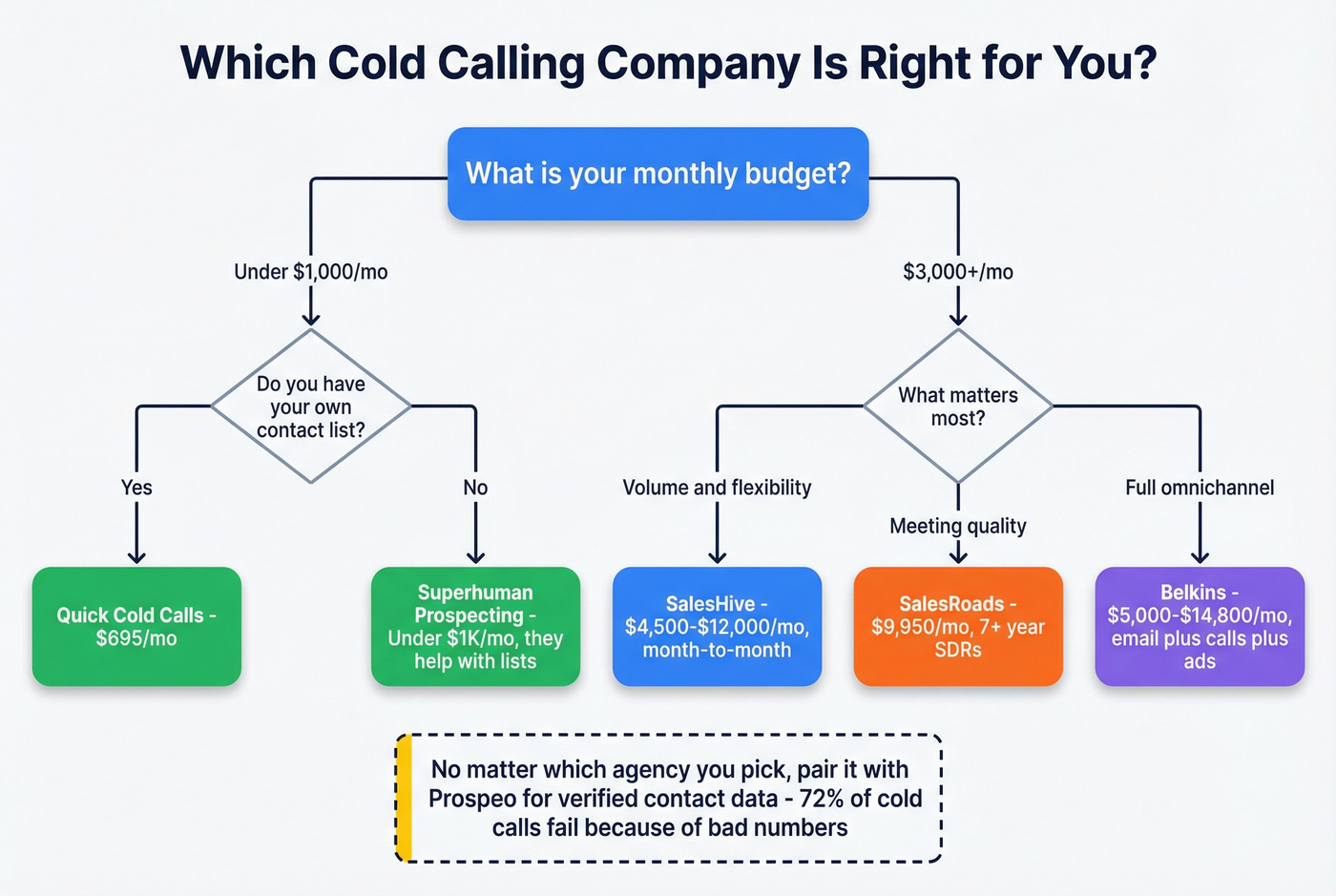

Most "best cold calling companies" lists are written by the agencies ranking themselves #1. This one isn't. I've spent years evaluating outbound vendors and watching teams burn $10K/month on agencies dialing disconnected numbers. Here's what I know: 72% of cold calls never reach a human. That's not a cold calling problem - it's a data problem. The agency you pick matters less than the numbers they're dialing.

What follows is an honest breakdown of 13 cold calling companies, with real pricing, real benchmarks, and the red flags nobody else talks about.

Our Picks (TL;DR)

| Pick | Best For | Starting Price | Pricing Model | Location |

|---|---|---|---|---|

| SalesHive | Mid-market teams | $4,500/mo (Philippines SDR) | Monthly retainer | US + PH |

| Quick Cold Calls | Startups & SMBs | $695/mo | Monthly retainer | US-based |

| SalesRoads | Premium US SDRs | $9,950/mo | Monthly retainer | US-based |

| Superhuman | Affordable entry | Under $1,000/mo | Monthly retainer | US-based |

| Prospeo | Contact data accuracy | Free / ~$0.01/email | Per-credit | Self-serve |

SalesHive is the best all-around option for mid-market teams that want transparent pricing and month-to-month flexibility. Quick Cold Calls is the budget play - $695/mo with US-based callers, though you'll need to bring your own list. SalesRoads is the premium pick if you want SDRs with 7+ years of experience. Superhuman Prospecting gets you in the door under $1K/month with a 5.0 Clutch rating.

Before you spend $5,000-$15,000/month on callers, make sure they're dialing real numbers. Data quality is the #1 factor in cold calling ROI - pair Prospeo with any agency on this list so your callers spend time talking, not listening to disconnected recordings.

Should You Outsource Cold Calling? (The $125K Question)

Here's the math most people skip - and a stat that should settle the "is cold calling dead?" debate: 69% of buyers accepted at least one cold call last year, and 82% accept meetings after multiple follow-ups. Cold calling works. The question is who should be doing it.

A fully loaded in-house SDR costs roughly $125,000/year: $55-65K base salary, 25-30% benefits burden, $12K in tech stack, $25K in management overhead, and $10K in recruiting and training. That's before they book a single meeting.

The kicker: average SDR tenure is 14 months. Ramp time to full productivity? Three to four months. You're paying full freight for a rep who's at 50-70% capacity for a quarter, productive for maybe 8 months, then gone.

| Factor | In-House SDR | Outsourced Agency |

|---|---|---|

| Monthly cost | ~$10,400/mo | $3,000-$8,000/mo |

| Annual cost | ~$125,000+ | $36,000-$96,000 |

| Ramp time | 3-4 months | 2-4 weeks |

| Cost per meeting | ~$1,000 | $375-$500 |

| During ramp | $1,500-$2,000 | Same as above |

Pay-per-meeting models bring that down further - roughly $250 per held meeting.

Outsourced teams also deliver 28% faster sales cycles and hit a 22% lead qualification rate versus 17% for in-house reps. That's not a marginal difference.

Choose in-house when: Your deal sizes are $250K+, you've got mature sales enablement and ops, and you need reps who deeply understand a complex product over years.

Choose outsourced when: You need pipeline in 90 days, you don't have the bandwidth to recruit and train, or you want capped, predictable costs while you validate a new market or ICP. The most effective cold calling strategies - the ones that actually move pipeline - almost always start with outsourcing during the validation phase and bring reps in-house once the playbook is proven.

There's no shame in outsourcing. The speed advantage alone - launching in 2-4 weeks versus 4-5 months for an in-house hire - makes it the right call for most growth-stage companies.

You're about to spend $5K-$15K/month on callers. If 72% of their dials hit disconnected numbers, that's $3,600-$10,800 wasted. Prospeo gives your agency 125M+ verified mobiles with a 30% pickup rate - 3x the industry average. At $0.01/email and 10 credits per mobile, accurate data costs less than one hour of wasted dialing.

Stop paying callers to listen to disconnected recordings.

How Much Do Cold Calling Services Actually Cost?

Pricing for outsourced calling is messier than it should be. Here's what you'll actually encounter:

| Pricing Model | Typical Range | Best For |

|---|---|---|

| Per appointment | $75-$300/meeting | Pay-for-performance |

| Hourly (US) | $35-$75/hr | Transparent billing |

| Hourly (offshore) | $15-$25/hr | Budget campaigns |

| Monthly retainer | $3,000-$15,000/mo | Dedicated SDR teams |

| Per lead | $25-$100/lead | Top-of-funnel volume |

| Hybrid | Base + bonus | Aligned incentives |

Those are the sticker prices. Now let's talk about the costs nobody mentions upfront.

The Hidden Costs That Kill Your Budget

| Hidden Cost | Typical Range | Who Pays |

|---|---|---|

| Data and lists | $500-$5,000/mo | You, unless the agency provides data |

| Dialer technology | $150-$300/seat/mo | Passed through or included |

| Setup and onboarding | $1,000-$5,000 one-time | Often charged separately |

| Minimum commitments | 3-6 months typical | Built into contract terms |

Quick Cold Calls, for example, requires you to supply your own list on Starter plans. That's a real cost. Some agencies include dialer tech (Orum, Nooks, ConnectAndSell); others pass it through at $100-$300/seat/month.

Outbound call center costs range from $10-$50/hour depending on location and service complexity. Philippines-based centers sit at the low end; US-based specialized B2B callers sit at the high end.

Here's the thing: a $4,500/month offshore retainer with a $2,000/month data cost and a $200/seat dialer fee is really $6,700/month. Always ask for the all-in number. A few agencies (SalesHive, Quick Cold Calls) offer month-to-month contracts - that flexibility has real value when you're testing.

The Best Cold Calling Companies Compared for 2026

Here's the master comparison before we get into individual profiles:

| Company | Starting Price | Best For | Location |

|---|---|---|---|

| SalesHive | $4,500/mo | Mid-market | US + PH |

| Quick Cold Calls | $695/mo | SMBs | US |

| SalesRoads | $9,950/mo | Premium SDRs | US |

| Superhuman | Under $1,000/mo | Budget entry | US |

| Belkins | ~$5,000-$14,800+/mo | Enterprise omni | US + UA |

| LevelUp Leads | $5,000/mo | Small-mid B2B | US |

| Martal Group | ~$5,000/mo | B2B tech/SaaS | US + CA |

| CIENCE | ~$4,000-$15,000/mo | Large-scale outbound | US |

| Hit Rate | ~$640-$2,500/mo | Budget offshore | PH |

| Smith.ai | ~$1,200/mo | Modular calling | US |

| Callbox | $4,500-$5,300/mo | Global ABM | Global |

| Whistle | ~$1,000/mo | Fast ramp | US |

| Prospeo | Free / ~$0.01/email | Data accuracy layer | Self-serve |

SalesHive - Best Overall for Mid-Market

I watched a mid-market SaaS team evaluate five agencies last year. SalesHive won because they were the only one that published pricing before the first call. That transparency matters more than people think.

Their pricing page lays it out: US-based SDRs start at $7,000/month (phone only, 150+ touches/day), $8,000/month for phone + email (250+ touches/day), and $12,000/month for the Crush plan with two SDRs and 500+ daily touches. Philippines-based SDRs run $4,500, $5,000, and $7,000 respectively. Annual commitments get you ~10% off.

They've booked 119,000+ meetings across 1,500+ clients, and the risk-free onboarding model - no billing until you approve the playbook - removes the "what if this doesn't work" anxiety. SalesHive also uses DNC.com and supports DNC/TCPA compliance workflows, which saves you a compliance headache.

Use this if: You're a mid-market team that wants predictable costs, month-to-month flexibility, and a proven process.

Skip this if: You need surgical precision over volume. The #1 criticism is mixed results on meeting quality - they optimize for volume, which means some meetings won't be as qualified as you'd like.

Quick Cold Calls - Best for Startups & SMBs

Quick Cold Calls starts at $695/month for 250 call activities with US-based callers, a dedicated account manager, custom H2H (human-to-human) scripts, and real-time reporting. The Starter Double plan bumps to 500 activities for $1,390/month. Premium SDR packages with list building and cold email run ~$2,500-$5,000/month. Everything is month-to-month, cancel anytime.

Use this if: You're a startup or small business that needs cold calling without a $5K/month commitment.

Skip this if: You don't have a contact list ready. Quick Cold Calls doesn't provide data on the Starter plans - you supply your own. That means you need a separate data source with verified numbers, or your $695/month is buying callers who spend half their time hitting voicemail on stale numbers.

SalesRoads - Best for Premium US-Based SDRs

SalesRoads is the agency you hire when you're done experimenting and want callers who sound like they've been in your industry for a decade - because they have. Their SDRs average 7+ years of experience, which is unheard of in an industry where most reps are 6 months out of college.

The quality of conversation is what sets them apart. SalesRoads doesn't just dial - they run a customized demand generation playbook with a dedicated director of client success and talent success manager. The 3-month pilot structure lets you evaluate before committing to month-to-month.

Key tradeoff: Price. At $9,950/month starting, this isn't for bootstrapped startups. A G2 reviewer put it bluntly: "Costly for small businesses or startups." But if your deal sizes justify it - think $50K+ ACV - the cost per qualified meeting often comes in lower than cheaper agencies because the meetings actually convert. Hybrid models run $450-$1,200 per held meeting. G2 rating: 4.9/5 across 13 reviews.

Superhuman Prospecting - Best Affordable Entry Point

Finding a cold calling agency under $1,000/month that doesn't feel like a gamble is hard.

Superhuman Prospecting is the exception. They've earned a 5.0 on Clutch across 44 reviews and a 4.9 on G2 across 18 reviews. Packages start under $1K/month, they have 40+ SDRs, and campaigns can launch within two weeks. Their hourly rate runs $25-49/hour, and most projects come in under $10,000 total.

Use this if: You want to test outsourced cold calling without a massive commitment. The two-week launch time and low entry price make this ideal for validation.

Skip this if: You need airtight reporting and list management. One G2 reviewer flagged inconsistency in list utilization during their first campaign - some contacts got dialed multiple times while portions of the list went untouched. Limited reporting capabilities were also called out. Growing pains, not dealbreakers.

Belkins - Best for Omnichannel Enterprise

Pros:

- Full omnichannel: cold email, intent-based cold calling, voicemails, messenger/WhatsApp, ABM, paid ads

- $2B+ in client revenue generated since 2017; one published case: 57 appointments booked over 11 months for a SaaS client

- G2 4.8/5, Clutch 223+ reviews

Cons:

- Pricing isn't published. Third-party estimates put it at ~$5,000-$14,800+/month with minimum project sizes of $10,000+. The fact that Belkins won't tell you their pricing before a sales call is frustrating - and it's a pattern you'll see with agencies that want to price based on what they think you can pay.

- Typical commitment: 3-6 months minimum

Best for enterprise teams with budget and patience for a complex, multi-channel outbound engine.

LevelUp Leads - Best for Small-to-Mid B2B

Fractional SDR at $5,000/month, full-service at $8,000-$10,000/month, growth tier at $12,000+. G2 4.9/5 with 42+ reviews across 120+ clients in 50+ industries. Cold-calling-only packages run $3,500-$5,000/month for fractional, $6,000-$8,000 for full-service.

The sweet spot is companies with $10K-$100K deal sizes who want the full outbound stack (email + phone + LinkedIn), not just phones. If that's you, LevelUp is worth a conversation.

Martal Group - Best for B2B Tech/SaaS

Starting at ~$5,000/month with retainers ranging up to $12,000. Deep B2B tech and SaaS expertise - they understand the language, objections, and buying cycles. Clutch rating: 4.6/5.

Less pricing transparency than SalesHive, and fewer published benchmarks. Not the best fit outside of technology verticals. But for SaaS-specific outbound, Martal is a strong mid-tier pick.

CIENCE - Best for Large-Scale Outbound

Data-first outbound provider with infrastructure for multi-segment campaigns. Pricing runs ~$4,000-$15,000/month depending on scope and volume. Granular reporting on what's working across segments.

The downside: campaigns take longer to ramp and require more involvement from your team than plug-and-play agencies. Clutch rating (4.2/5) trails top-tier competitors. Skip this if you want simple, fast, and hands-off.

Hit Rate Solutions - Best Budget Offshore

Philippines-based, starting at ~$640-$2,500/month. They monitor 1,900 calls monthly with a 98% QA score and 11-second average speed to answer. One client testimonial: "We doubled our number of appointments in the last month." If you need high-volume appointment setting on a tight budget and your product doesn't require deep US market knowledge, Hit Rate is the offshore option with actual quality controls. Clutch rating: 4.8/5.

Smith.ai - Best for SMBs Needing Modular Calling

Outbound calling from ~$1,200/month with a modular, scalable model. Smith.ai started as a receptionist service and expanded into outbound - which means they handle inbound overflow too. Best for SMBs that need calling as one piece of a broader communication strategy, not a dedicated outbound engine. Clutch rating: 4.9/5.

Callbox - Best for Global Multi-Channel ABM

$4,500-$5,300/month for global multi-channel ABM campaigns. If you're selling into APAC, EMEA, and North America simultaneously, Callbox has the geographic reach most US-focused agencies lack. The tradeoff: their US-specific depth doesn't match domestic specialists. Clutch rating: 4.6/5.

Whistle - Best for Fast Ramp

From ~$1,000/month with a 10-day ramp to booking meetings and performance-based bonuses that align incentives. Flexible contracts make Whistle a low-risk way to test outsourced calling. If you need pipeline yesterday, Whistle belongs on your shortlist.

Cold Calling Benchmarks: What "Good" Actually Looks Like

Before you evaluate any agency, you need to know what realistic performance looks like. Too many teams sign contracts expecting 20 meetings a month and get 5.

Conversion Rates by Industry

| Industry | Conversion Rate | Recommended Agency Type |

|---|---|---|

| Business Services | 2.61% | Mid-tier ($3K-$5K/mo) |

| Consulting | 2.43% | Mid-tier ($3K-$5K/mo) |

| Real Estate | 2.20% | Budget or mid-tier |

| Insurance | 2.12% | Budget or mid-tier |

| Financial Services | 1.54% | Premium SDRs recommended |

| Technology/Software | 0.95% | Premium SDRs recommended |

If you're selling software, your baseline conversion is roughly a third of what business services companies see. That means you need either more volume (cheaper agency, more dials) or higher-quality conversations (premium SDRs like SalesRoads). Insurance and real estate teams can get strong ROI from budget options like Quick Cold Calls or Hit Rate.

The industry-wide success rate sits at approximately 2.7% in 2026 (based on Cognism's analysis of 200K+ calls), continuing a decline from 4.82% in 2024. The gap between average and elite has never been wider - top performers still hit 10-11%.

Conversion by Deal Size

| Deal Size | Conversion Rate |

|---|---|

| $500-$10K | 2.64% |

| $10K-$50K | 2.34% |

| $50K-$100K | 2.03% |

Smaller deals convert at higher rates. If your average contract value is under $10K, you probably don't need a $10K/month agency - a $695/month service with clean data will get you there. If you're closing deals north of $50K, invest in premium callers who can hold a strategic conversation.

Performance Tiers

| Tier | Dials/Day | Connect Rate | Cost/Meeting |

|---|---|---|---|

| Poor | 40-60 | 2-4% | $300+ |

| Average | 80-120 | 6-8% | $150-$300 |

| Best-in-class | 200-300 | 12-18% | $50-$100 |

It takes an average of 209 calls to book one appointment - 7.5 hours of calling per meeting booked. Successful calls last an average of 5:50 minutes versus 3:14 for failed calls, so the reps who take time to have real conversations win.

The Numbers That Should Change How You Evaluate Agencies

Call attempts matter more than you think. Three calls to the same prospect captures 93% of total conversations. Five calls captures 98.6%. Ask your agency how many attempts they make per contact. If the answer is "one or two," they're leaving meetings on the table.

C-level prospects require persistence. First call connects with a C-level exec 39% of the time. Second call: 72%. Third call: 93%. If your agency gives up after one attempt on a VP or C-suite target, fire them.

Training is the biggest conversion lever. Here's the breakdown:

| Training Level | Conversion Rate |

|---|---|

| No training | 1.10% |

| Basic training | 2.47% |

| Advanced training | 3.95% |

| Elite / daily training | 9.03% |

Daily training boosts cold call conversion to 9.03% - nearly 4x the industry average. Ask your agency what their ongoing training program looks like. If they don't have one, that tells you everything.

Best day to call: Tuesday. Plan your heaviest dial blocks accordingly.

AI vs Human Cold Calling: The 2026 Reality

The hybrid approach is eating both pure-AI and pure-human models alive. That's my position, and the data backs it up.

| Factor | AI Calling | Human Calling | Hybrid |

|---|---|---|---|

| Conversion rate | 2.3% | 3.8% | ~5.5% (45% above human-only) |

| Cost per call | ~$0.10 | ~$2.00 | ~$1.00 |

| Calls per day | 10,000+ | ~100 | Varies |

| Customer satisfaction | 3.7/5 | 4.2/5 | 4.0+/5 |

The hybrid model delivers 45% higher conversion rates than human-only and 30% lower costs. That isn't a marginal improvement - it's a structural advantage.

AI excels at qualification (95% accuracy versus 87% for humans - AI never forgets a qualifying question), high-volume initial outreach, after-hours calling, and follow-up sequences. Humans win on complex B2B conversations, C-level outreach, deals over $50K, and anything requiring genuine rapport.

Only 13% of sales leaders believe AI will fully match humans on cold calling. The industry isn't betting on full automation - it's betting on AI handling the grunt work so humans can focus on the conversations that matter.

A post on r/marketing captured it well: AI cold calling feels "wrong and off-putting" for complex B2B products. But for simple appointment setting and qualification? AI is already cheaper and more consistent.

My recommendation: use AI for initial qualification and high-volume outreach, then route warm prospects to human callers. Most agencies on this list are already moving toward this model, whether they call it "AI-assisted" or not.

Why Data Quality Makes or Breaks Any Cold Calling Agency

Here's a stat that should make every sales leader uncomfortable: B2B contact data decays at 2.1% per month. That's 22.5% annually. People change jobs, get new numbers, switch companies. A list that was 95% accurate in January is about 76% accurate by December.

And remember - 72% of cold calls never reach a human. Most articles blame voicemail or gatekeepers. The real culprit? Bad numbers. Disconnected lines. Wrong contacts. Data rot.

A veteran AE on r/sales put it bluntly: "Cold calling has gotten way harder. Post-COVID, office lines don't exist and connect rates on cell phones are abysmal." They specifically called out Apollo's data quality as part of the problem.

Top performers achieve 4-5x the success rates of average callers. The difference isn't just skill - it's data. One team hit an 11.3% success rate (4x industry average) using verified data combined with AI workflows and human callers. The verified data was the foundation everything else was built on.

The Snyk case study makes this concrete: 50 AEs prospecting 4-6 hours per week saw their bounce rate drop from 35-40% to under 5%, AE-sourced pipeline jumped 180%, and they generated 200+ new opportunities per month - all by switching to verified contact data with a 7-day refresh cycle instead of the industry average of six weeks.

A $695/month calling service with accurate phone numbers will outperform a $12,000/month service calling numbers that are 22% stale. That's not opinion - it's math.

Every cold calling company on this list is only as good as the numbers they dial. Prospeo's 7-day data refresh cycle means your callers reach real people at current companies - not last quarter's org chart. 98% email accuracy, 125M+ verified mobiles, and zero annual contracts.

Pair Prospeo with any agency above and watch connect rates triple.

How to Evaluate Cold Calling Companies (Red Flags Checklist)

After watching teams sign and regret agency contracts, I've built a checklist. Use it before you sign anything.

Red Flags (Walk Away)

- Vague performance metrics. If they can't tell you their average connect rate, conversion rate, and cost per meeting, they either don't track them or don't want you to see them.

- No transparent reporting. You should get daily or weekly dashboards showing dials, connects, conversations, and meetings booked. "We'll send a monthly summary" isn't good enough.

- Inflexible contracts. Six-month minimums with no performance clauses protect the agency, not you. Month-to-month or 3-month pilots with exit clauses are the standard for reputable providers.

- Hidden fees. Ask explicitly about data costs, dialer fees, setup charges, and overage rates. Get it in writing.

- Lofty promises. Any agency promising 25 qualified appointments a day is lying. Period. The math doesn't support it at any scale.

- Pricing opacity. If an agency won't tell you their pricing before a sales call, that's not "custom pricing" - it's a red flag.

- No call recordings available. Reputable agencies will share audio samples or live call recordings. If they won't let you hear their reps in action, ask yourself why.

- No TCPA/DNC compliance process. Ask about TCPA compliance, DNC list scrubbing, and state-level telemarketing regulations. If they look confused, walk away.

Verification Steps Before Signing

Request verifiable client references - not testimonials on their website, but actual people you can call. Ask for case studies with specific numbers (meetings booked, conversion rates, deal sizes). Verify their physical address. Review exit terms line by line.

Ask them to define "qualified" in writing. A "qualified meeting" means wildly different things to different agencies. Some count any conversation over 5 minutes. Others count only meetings where the prospect matches your ICP and has budget authority. Get this nailed down before money changes hands.

Ask about their follow-up cadence. Three calls captures 93% of conversations, and reaching a C-level exec takes an average of 3 attempts for a 93% connection rate. If your agency only dials each prospect once, they're wasting your money.

Ask about their training program. The difference between no training (1.10% conversion) and daily training (9.03%) is nearly 9x. This single question tells you more about an agency's quality than any case study. If you want a deeper rubric, use a cold call coaching scorecard.

Real talk: I've seen agencies that do shallow ICP work over and over. They'll spend 30 minutes on a kickoff call, build a generic persona, and start dialing. The good agencies spend 2-4 weeks on ICP development, script testing, and playbook refinement before a single call goes out. If your agency wants to start dialing on day three, that's not speed - it's laziness.

Also ask what happens to your prospect data when the engagement ends. Data handling practices and compliance certifications matter.

FAQ

How much does it cost to outsource cold calling?

Monthly retainers range from $695 (Quick Cold Calls) to $15,000+ (Belkins, CIENCE). Pay-per-appointment models run $75-300 per qualified meeting. US-based callers cost $35-75/hour; offshore runs $15-25/hour. Budget an additional $500-5,000/month for data, $150-300/seat for dialers, and $1,000-5,000 for setup.

What results should I expect from a cold calling company?

Expect 2-3 months of ramp before consistent results, with the 2026 industry average success rate at approximately 2.7%. A realistic benchmark is 8-15 qualified meetings per month per dedicated SDR. Top-performing agencies with daily training hit 6-9% conversion rates - roughly 3x the average.

Should I use US-based or offshore cold callers?

US-based callers achieve up to 2x the conversion rate of offshore callers but cost 2-3x more ($35-75/hr vs. $15-25/hr). Use US-based for complex B2B, C-level outreach, and deals over $50K. Offshore works well for high-volume appointment setting, simple qualification, and budget-conscious campaigns.

How important is data quality for cold calling success?

It's the single biggest factor in cold calling ROI. B2B contact data decays at 22.5% annually, and 72% of cold calls never reach a human - mostly due to bad numbers. Teams using data refreshed on a 7-day cycle (vs. the 6-week industry average) report 3x improvements in connect rates and dramatically lower bounce rates.

What's the difference between pay-per-appointment and retainer pricing?

Pay-per-appointment ($75-300/meeting) caps your risk but gives the agency incentive to book low-quality meetings that technically count. Monthly retainers ($3,000-15,000) give you a dedicated SDR with consistent effort, but you pay regardless of results. Hybrid models with a base fee plus per-meeting bonuses align incentives best.