Is B2B Cold Calling Still Effective in 2026?

Is b2b cold calling still effective when you're spending $15,000/year on dialer + data and your reps still hear "send me an email" 40 times a day? Then you look at the call report and realize the real problem isn't the script.

It's that nobody's even picking up.

Cold calling still works in 2026, but only for teams that treat it like a deliverability channel, not a "smile and dial" activity. It works. It's just far more sensitive to data quality and phone reputation than it was a decade ago.

What you need (quick version)

Use this as your "don't waste the week" checklist. Fix these and cold calling gets predictable again.

- Benchmark reality check (connect + meetings)

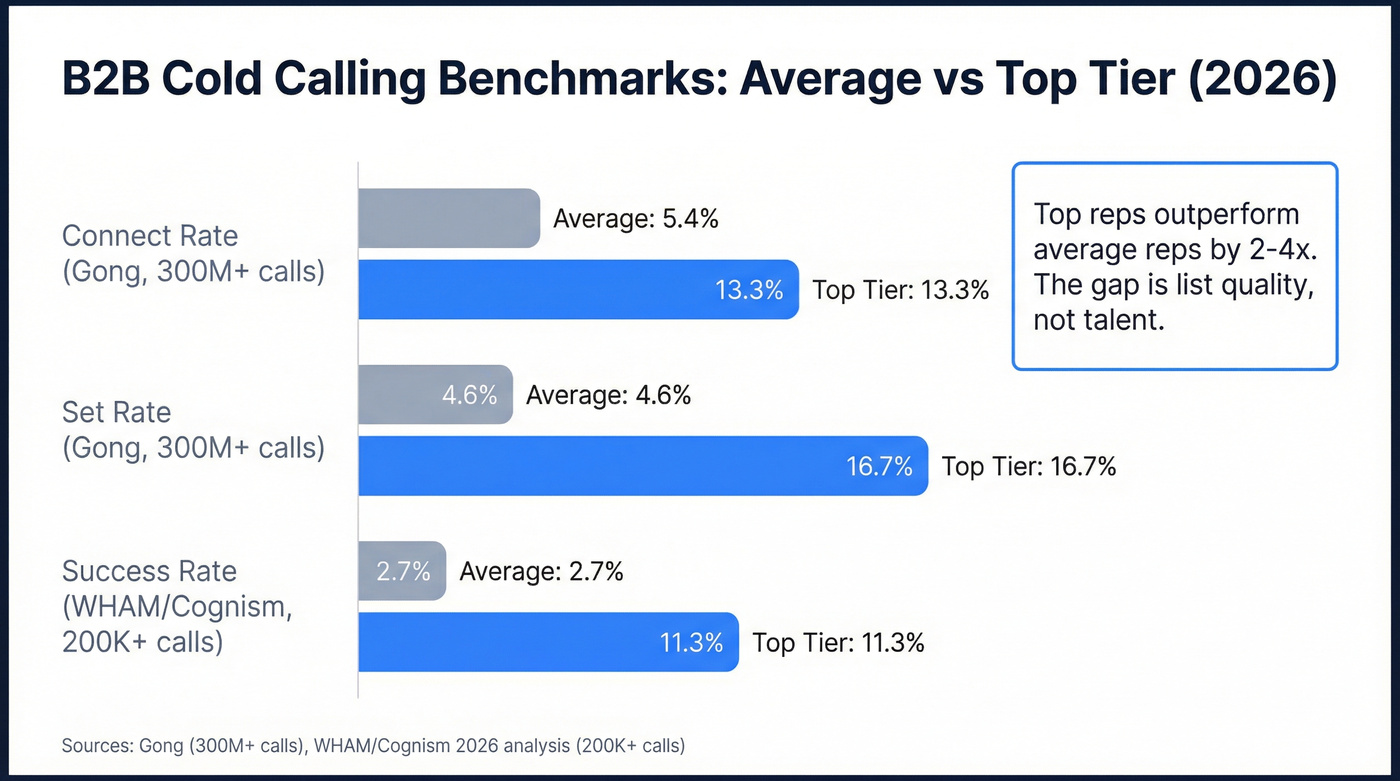

- Gong's dataset (300M+ calls) puts average connect rate at 5.4% and top quartile at 13.3%.

- Gong's average set rate is 4.6% (connects -> meetings) and top quartile is 16.7%.

- Accept that unknown calls are dead on arrival

- Hiya's State of the Call shows 80% of unidentified calls go unanswered.

- Translation: if your numbers look "random," your best reps still miss quota.

- Fix list quality before you "coach"

- Direct dials, correct titles, and fresh employment data matter more than talk tracks.

- Verified direct dials + weekly refresh is the lever most teams ignore.

- Treat phone like email deliverability

- Caller identity, number reputation, and STIR/SHAKEN coverage decide whether you even get a chance.

- Run a tight operating system

- Call in blocks, use 3 attempts by default (5 max), and coordinate calls with email so each channel boosts the other.

- Stay compliant

- The FTC TSR has a B2B solicitation exemption (with exceptions), but TCPA + state mini-TCPAs can still apply depending on how you call/text and what tech you use.

The direct answer: yes, but "effective" changed

Cold calling is still effective in 2026, but the definition of "effective" moved.

Ten years ago, "effective" meant: make enough dials and you'll eventually run into someone bored enough to talk. Now it means: can you consistently reach the right person on a channel that's aggressively filtering you out?

RAIN Group's outbound research shows 82% of buyers accept meetings with sellers who reach out, based on data from 489 sellers and 488 business buyers. They also found top performers generate 2.7x more conversions with target contacts.

Here's the shift: cold calling isn't a pure volume game anymore. It's a systems game.

- Data decides whether you're dialing the right human.

- Deliverability decides whether your call even rings like a legitimate business call.

- Sequencing decides whether the call creates momentum across channels.

Miss any one of those and cold calling feels dead. Nail all three and it's still one of the fastest ways to create pipeline, especially while inboxes are jammed with automated outreach.

Benchmarks that prove it still works (connect vs meeting)

Most teams mash metrics together and end up arguing about nonsense. Separate the two numbers that actually matter:

- Connect rate = answered calls / total dials (Gong definition)

- Set rate = meetings booked / conversations (Gong definition)

And then there's the "all-in" metric leaders care about:

- Dials -> meeting rate = connect rate x set rate

Benchmarks table (what "normal" vs "great" looks like)

| Dataset | What it measures | Average | Top tier |

|---|---|---|---|

| Gong (300M+ calls) | Connect rate | 5.4% | 13.3% |

| Gong (300M+ calls) | Set rate | 4.6% | 16.7% |

| WHAM/Cognism (2026) | Success rate* | 2.7% | 11.3%** |

*WHAM "success rate" = conversations that resulted in a meeting booked. **Cognism's internal team success rate.

Two details from the WHAM/Cognism research matter in the real world, not just in a slide deck:

- The 2026 WHAM analysis covers 200K+ calls, so it's sturdy enough to plan around.

- They also tracked calls needed to reach a prospect: 1.55 calls on average versus 2.9 in the prior season. That's a massive efficiency swing, and it doesn't come from "better vibes" - it comes from tighter targeting, cleaner numbers, and fewer wasted attempts on bad records.

A few blunt takeaways:

- The spread is the story. Average reps and top reps aren't 10-20% apart. They're often 2-4x apart. That's list quality + operating system + coaching.

- Connect rate is the gut check. If your team's connect rate is 2-3%, you don't have a "messaging problem." You've got a list + deliverability problem.

- Stop comparing mismatched definitions. Don't compare your "connect rate" to someone else's "success rate." You'll misdiagnose the bottleneck and waste a quarter.

The benchmarks are clear: connect rate is the revenue lever. Teams using Prospeo's 125M+ verified mobile numbers hit a 30% pickup rate - while the industry average sits around 5.4%. Our numbers refresh every 7 days, so your reps stop burning dials on people who changed jobs last quarter.

Stop coaching scripts when the real problem is stale phone numbers.

A simple funnel math model (so you can forecast meetings and pipeline)

If you want to know whether cold calling is "effective" for your team, stop debating vibes and run the math.

Define the two rates precisely

- Connect rate: answered calls / total dials Example: 54 connects out of 1,000 dials = 5.4%

- Set rate: meetings booked / conversations (answered calls that become real conversations) Example: 3 meetings out of 65 conversations = 4.6%

Calculator-style forecast (dials -> meetings)

- Pick monthly dials per rep (after meetings/admin): 800 dials/month

- Multiply by connect rate

- Average: 800 x 5.4% = 43 connects

- Top quartile: 800 x 13.3% = 106 connects

- Multiply connects by set rate

- Average: 43 x 4.6% ~= 2 meetings/month

- Top quartile: 106 x 16.7% ~= 18 meetings/month

Same effort. Wildly different output.

That's why "just make more calls" is lazy management.

Extend it to pipeline (meetings -> opps -> deals)

Leaders don't get paid on meetings; they get paid on revenue. Add four inputs:

- Show rate (meetings held / meetings booked)

- Opp creation rate (opps / meetings held)

- Close rate (deals / opps)

- ACV (average contract value)

Example using conservative inputs:

- 2 meetings booked x 60% show = 1.2 held

- 1.2 held x 35% opp rate = 0.42 opps

- 0.42 opps x 25% close = 0.105 deals

- 0.105 deals x $20,000 ACV = $2,100 ACV/month per rep from cold calling

Now do the same math for a rep booking 18 meetings/month and you'll see why fixing connect rate is a revenue lever, not a "sales activity" lever.

Why is b2b cold calling still effective in 2026 (if deliverability's fixed)

Cold calling feels dead because the phone channel's hostile by default.

Truecaller's US spam stats show Americans receive ~2.7B spam/unwanted calls per month, and people wasted 186M hours answering spam calls over the last 12 months (Feb 1, 2025-Jan 31, 2026). That's the environment your reps are calling into.

Hiya puts the behavioral outcome plainly: 80% of unidentified calls go unanswered - based on 262.8B calls analyzed plus surveys of 12K+ consumers.

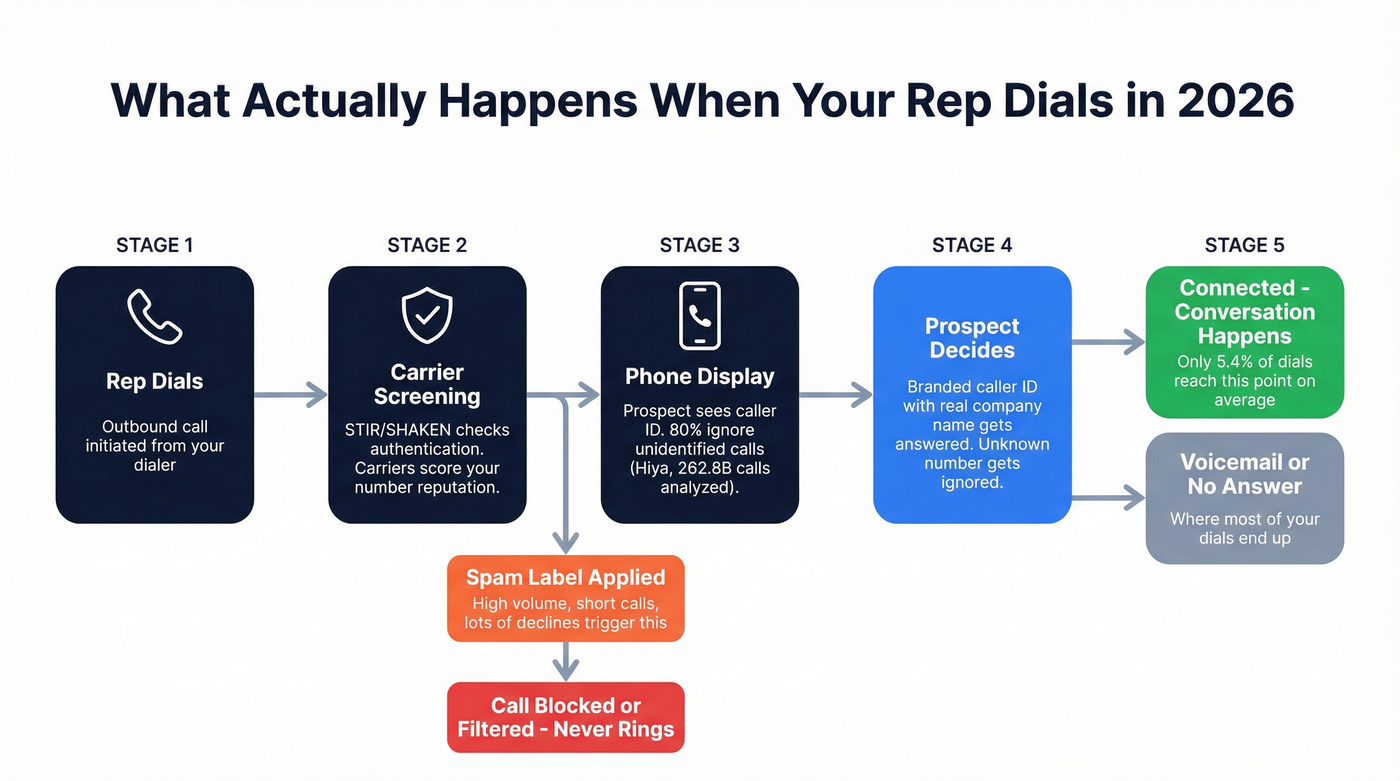

What's actually happening when you dial

- Prospects see "Unknown" or a weird-looking number.

- Carriers and call-screening apps score your number's reputation.

- If your pattern looks spammy (high volume, short calls, lots of declines), you get labeled or filtered.

- Even if you're legit, you're paying the price for scammers.

What reps complain about (and they're right)

This is the modern cold-calling reality in the trenches:

- Reps don't argue about scripts anymore; they argue about connect rate because it dictates their whole day.

- Old "15-20% connect rate" expectations are gone for most teams. When a rep sees 5-7%, they call it a win - because they know unknown numbers get ignored.

- Single-channel outbound (only email or only calls) feels pointless. The teams hitting quota coordinate touches so each channel makes the other one work.

Look, this part frustrates me: I still see teams run weekly "objection handling" sessions while their numbers are getting labeled and their lists are rotting.

That's backwards.

Hot take: most teams don't have a cold-calling problem - they've got a phone reputation problem

If your connect rate's under 5%, stop running script trainings. You're polishing a car that won't start.

Fix the channel first. Then coach.

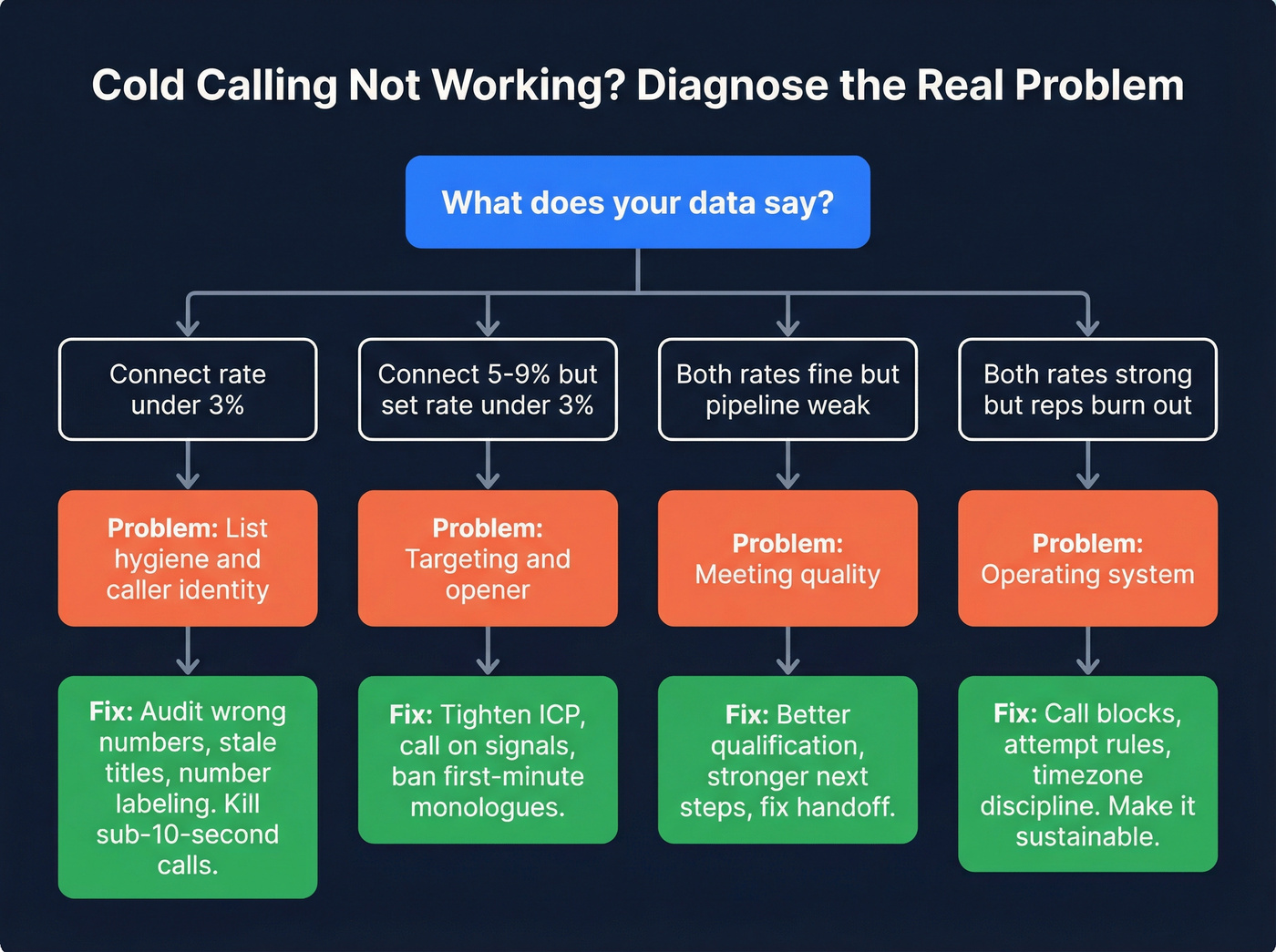

A quick diagnostic decision tree (use this before you change anything)

If connect rate is under 3%:

- Start with list hygiene + caller identity.

- Audit for wrong numbers, stale titles, and number labeling. If you're generating lots of sub-10-second calls, you're poisoning your own reputation.

If connect rate is 5-9% but set rate is under 3%:

- Your list's reaching humans; your targeting and opener are the issue.

- Tighten ICP, call on signals, and ban first-minute monologues.

If connect rate's fine and set rate's fine but pipeline's weak:

- Your issue is meeting quality (wrong persona, weak "why now," no next step).

- Fix qualification and handoff, not the dialer.

If connect and set are strong but reps burn out:

- Your issue is operating system (call blocks, attempt rules, timezone discipline).

- Make the work sustainable or your best callers will quit.

Fix the phone channel: caller identity, reputation, and STIR/SHAKEN

You don't need a perfect phone stack. You need a phone stack that doesn't sabotage you.

In our experience, the fastest wins come from boring work: stabilizing caller ID, cleaning lists, and stopping the "spray and pray" dialing patterns that trigger spam filters.

Use this if / Skip this if (deliverability edition)

Use caller identity + reputation tooling if:

- Your connect rate's under 5% and your lists are already decent.

- Reps keep hearing "I didn't answer because it looked like spam."

- You're doing meaningful outbound volume.

Skip heavy deliverability projects (for now) if:

- Your lists are stale and you're dialing wrong titles/wrong numbers.

- You don't have basic opt-out handling and calling-time rules nailed.

- You're rotating numbers aggressively and creating your own reputation problem.

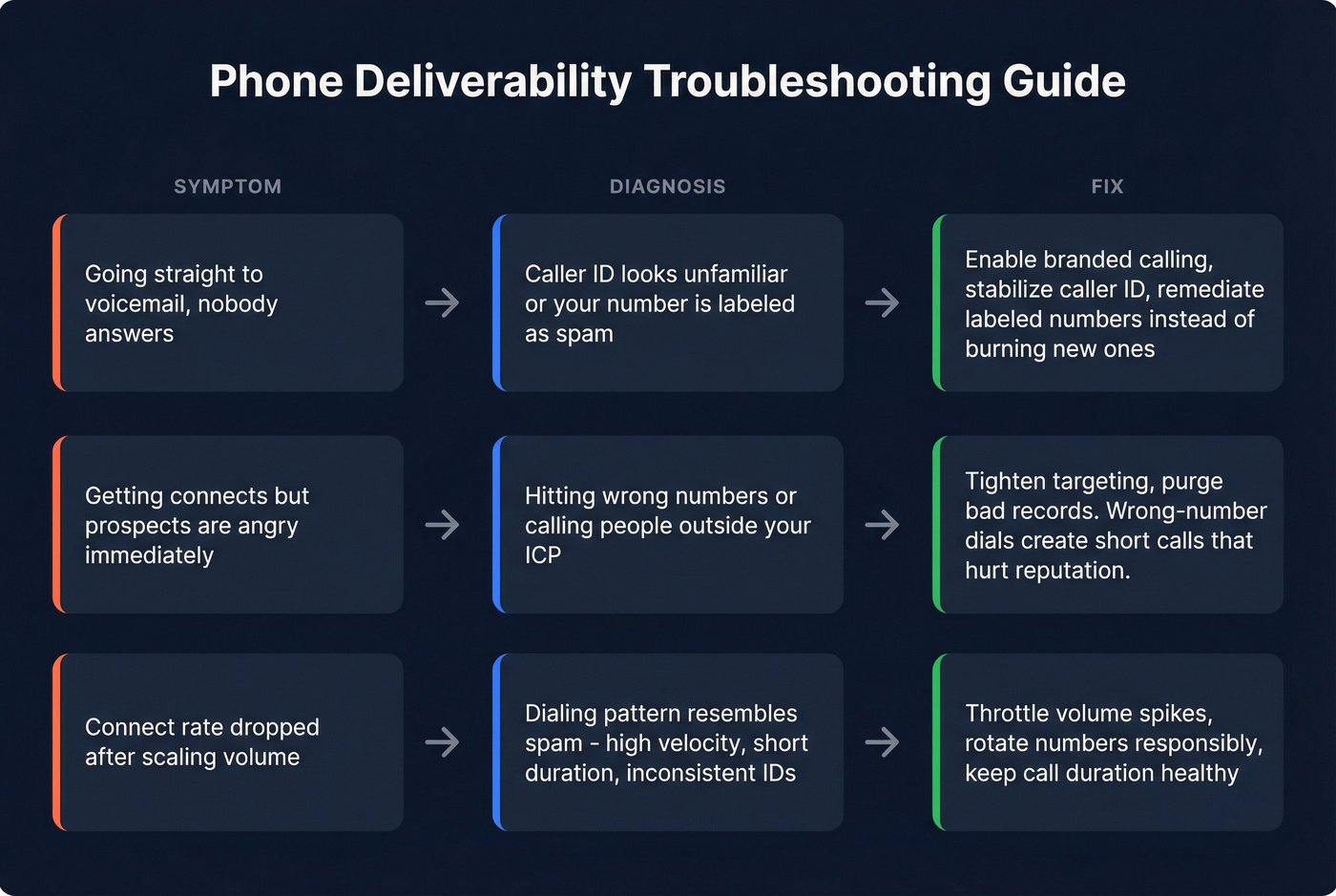

Symptoms -> diagnosis -> fix (the practical version)

Symptom: "We're going straight to voicemail / nobody answers."

- Diagnosis: your caller ID looks unfamiliar or your number's labeled.

- Fix: enable branded calling where available, stabilize caller ID, and remediate labeled numbers instead of burning new ones weekly.

Symptom: "We get connects, but they're angry immediately."

- Diagnosis: you're hitting wrong numbers or calling people who aren't your ICP.

- Fix: tighten targeting and purge bad records; wrong-number dials create short calls and hang-ups that drag reputation down.

Symptom: "Connect rate dropped after we scaled volume."

- Diagnosis: your pattern started to resemble spam (high velocity, short duration, inconsistent IDs).

- Fix: throttle spikes, rotate responsibly, and keep call duration healthy (even voicemails) so your pattern doesn't scream "robocaller."

The checklist that moves the needle

- Get STIR/SHAKEN right (and understand the limits). Only 44.4% of calls were signed at termination (Dec 2025). "Termination" is the receiving end of the call, so even if your carrier signs calls, signing can be lost in routing or non-IP segments before it reaches the recipient. Authentication helps, but it doesn't guarantee your call shows up as trusted, which is why branded calling and reputation management still matter on Monday morning.

- Implement branded calling where it's available. People are 78% more likely to answer when they see a recognizable brand.

- Treat number reputation like domain reputation. Numeracle's scale proves this is real ops work: 161,440+ remediations in 2025 and 66.8M branded calls enabled.

- Stop doing "random number behavior." Inconsistent caller ID, chaotic rotation, and floods of sub-10-second calls are how legit teams accidentally look like scammers.

The 2026 cold calling operating system (what to do this week)

This is the playbook I'd implement if I had to improve cold calling performance in the next 7 days without hiring more reps.

ICP + signals-first lists (warm calling)

Cold calling works best when it's not truly cold.

Build call blocks around signals, not static lists:

- job changes (new VP, new IT director)

- headcount growth in a department you sell into

- funding, expansion, new locations

- tech installs that create a clear "why now"

- intent topics (people researching what you solve)

The goal's simple: when they ask "why are you calling me?", you've got a real answer that isn't "because you're in my territory."

Data quality & freshness (the hidden multiplier)

If you only fix one thing, fix this.

Stale records crush connect rates because you're dialing people who changed roles, moved companies, or never had a direct line in the first place. Weekly refresh should be standard in 2026, but plenty of databases still refresh on a 6-week cycle, which guarantees drift and forces reps to waste their best calling hours on dead ends.

I've seen teams spend a full quarter rewriting scripts while quietly accepting that 20-30% of their "direct dials" were wrong; once we cleaned the list and stopped hammering bad numbers, connect rates jumped in a week and the same reps suddenly sounded "better" on calls because they were talking to the right people.

Workflow that works:

- Pull your ICP list (company + role filters).

- Verify/enrich contacts so you prioritize verified mobiles and remove junk.

- Refresh weekly so your "best list" doesn't decay into a reputation-killing mess.

Attempts rule: 3 calls default, 5 max

Most teams either quit too early or chase too long.

WHAM/Cognism's data makes the tradeoff clear:

- Optimum number of calls is 3 to get 93% of total conversations.

- 5 calls gets 98.6% of total conversations.

So set a rule:

- 3 attempts is your default.

- 5 attempts is your cap for high-fit accounts or active signals.

- After that, switch the motion (email, referral, event, partner, retargeting).

A simple 5-touch example (over 10 business days):

- Day 1: Call + voicemail (10 seconds max) + short email

- Day 3: Call (no voicemail) + bump email with 1-line value

- Day 5: Call + voicemail + "permission" email ("Worth a 10-min chat?")

- Day 8: Call (early morning) + close-the-loop email

- Day 10: Final call + close the loop ("I'll stop reaching out")

Voicemails don't convert. They create familiarity so your next call doesn't feel random.

Timing: days + hours that win

Timing advice is usually folklore. These two datasets are big enough to trust:

- ZoomInfo analyzed 1.4M calls: Tue-Thu were best overall, and Tue + Wed drove 44% of demos.

- MightyCall analyzed 187,684 weekday calls: best window was 8-11am, with the single best slot Mon 8am (30.4% success) using a "connected >=30 seconds" definition.

Reconcile them like this:

- Core calling blocks: Tue-Thu, 8-11am local time.

- Efficiency slot: Monday 8-10am for quick connects and list cleanup.

- Avoid: Friday for new-meeting hunting. Use it for follow-ups and close-the-loop calls.

Talk track + coaching (interactivity beats monologues)

The best cold calls don't sound "smooth." They sound interactive.

Gong's talk/listen analysis (326K calls, 10+ minutes) shows:

- 57% talk time correlates with won deals

- 62% talk time correlates with lost deals

- Won deals ask 15-16 questions, lost deals ask ~20

That's the nuance most managers miss: it's not "talk less" or "ask more." It's don't ramble and don't interrogate.

Three principles that work:

- Lead with context, not a pitch. One sentence on why you called, tied to a signal.

- Earn the next 20 seconds. Ask a question that's easy to answer.

- Name the exit. "If this isn't relevant, I'll disappear."

Two objection patterns to train (not improvise):

"Email me."

- "Totally. Before I send it - what should I anchor it to: reducing X, speeding up Y, or something else you're focused on?" If they answer, you've got a conversation. If they don't, send a short email and move on.

"Not interested."

- "Fair. Is that because timing's bad, or because this just isn't a priority for your team?" You're not arguing. You're diagnosing.

Multichannel isn't optional: calls make email work better

Cold calling isn't competing with email anymore. It's feeding it.

Gong measured email reply rates and found a big lift when calls are included: 3.44% vs 1.81%. That's true even when you don't get a live connect, because the call creates a "who's this?" moment.

A simple 4-day micro-sequence that works:

- Day 1 morning: Call (no voicemail)

- Day 1 afternoon: Email ("Tried you - quick question on X")

- Day 2: Call + voicemail (short, contextual)

- Day 4: Email bump + calendar link (only if they engaged)

If you're only emailing, you're one of 200. If you call and email, you're a pattern in their week.

Compliance that won't get you burned (US-focused, B2B reality)

Compliance is where "effective" becomes "sustainable." You don't want pipeline this month and a legal fire drill next month.

Here's the clean way to think about it: the FTC TSR and the TCPA are different regimes, and state mini-TCPAs can be stricter than both.

What applies to what (operational matrix)

| Activity | FTC TSR (B2B solicitation exemption exists, with exceptions) | TCPA / FCC rules | State mini-TCPAs |

|---|---|---|---|

| Live manual B2B calls | Often exempt (except certain categories like nondurable office/cleaning supplies) | Can still apply depending on consent/technology and state rules | Often applies (timing, disclosures, opt-out handling, penalties) |

| Autodialed calls | Not your safe harbor | Higher risk; treat as TCPA-sensitive | Higher risk; varies by state |

| Prerecorded/robocalls | Not your safe harbor | High risk; avoid for outbound prospecting | High risk |

| Texts (SMS) | Not your safe harbor | High risk; consent + opt-out handling required | High risk; some states add extra requirements |

If your team can't explain which bucket you're in, you're not compliant - you're guessing.

The practical checklist

- Know the FTC TSR B2B exemption (and its exception). The FTC's Telemarketing Sales Rule exempts business-to-business solicitation calls, unless you're selling nondurable office or cleaning supplies.

- Still respect the basics (even in B2B).

- Transmit caller ID.

- Don't misrepresent who you are or why you're calling.

- Keep calling hours reasonable and follow state rules.

- Operationalize revocation of consent (FCC/TCPA).

FCC revocation-of-consent rules took effect Apr 11, 2025, with part of the rule delayed to Apr 11, 2026. Operationally, you need:

- A process to honor opt-outs in 10 business days

- A way to treat "stop/quit/cancel/unsubscribe" as valid revocation

- If you send a confirmation text, it must be one-time and within 5 minutes, with no marketing content

- State mini-TCPAs are the trap.

Federal rules aren't enough anymore.

- Texas SB 140 effective Sept 1, 2025

- Virginia SB 1339 effective Jan 1, 2026 (including long-lived opt-out expectations)

- Connecticut penalties up to $20,000 per violation in the tightening trend

Do / Don't callouts

Do:

- Maintain a single suppression list across dialer + CRM + sequencing tools.

- Log opt-outs immediately and propagate them automatically.

- Train reps on what they can't say (misrepresentation is the easiest unforced error).

Don't:

- Treat "B2B exemption" as "no rules apply."

- Keep calling someone who asked you to stop because "it's just a call, not a text."

- Let every rep invent their own compliance behavior.

My opinion: if you can't prove suppression propagation across CRM + dialer + sequencer, you're not compliant in practice. "We have a policy" doesn't count. The system has to enforce it.

Reality-check targets (what "good" looks like in the trenches)

Field targets (practitioner ranges)

- Connect rate: Avg 5%, Great 9%+

- Dials -> meeting: Avg 180, Great <=100

- Hold rate (meeting held): Avg 60%

These line up with Gong's averages: 5.4% connect is average, and anything near 13.3% is top-quartile territory.

And here's the part leaders need to internalize: reps aren't being dramatic when they say the channel changed. They're reacting to real conditions - unknown numbers ignored, spam labeling, and lists that decay faster than most databases refresh. When you fix identity + data, the "cold calling is dead" conversation disappears fast.

Summary: is b2b cold calling still effective in 2026? Yes - when you treat it like a system: verified data first, phone deliverability second, and a tight multichannel operating rhythm on top.

FAQ

What's a "good" B2B cold call connect rate in 2026?

A good connect rate in 2026 is 5-7%, with top performers hitting 9-13%+ when list quality and caller identity are strong. Gong's 300M+ call dataset pegs the average at 5.4% and the top quartile at 13.3%.

How many cold call attempts should I make before I stop?

Make 3 attempts by default and cap at 5 attempts for high-fit accounts or active signals. WHAM/Cognism shows 93% of conversations happen by call 3, and 98.6% by call 5.

What's the best time and day to cold call?

Best overall is Tuesday to Thursday, calling 8-11am local time. ZoomInfo's 1.4M-call analysis shows Tue-Thu outperform, with Tue+Wed driving 44% of demos, while MightyCall's 187,684-call dataset shows 8-11am is the strongest window and Mon 8am is a high-efficiency slot (using a >=30-second connection definition).

Why are my calls getting ignored or labeled spam?

Calls get ignored because screening's aggressive and 80% of unidentified calls go unanswered, per Hiya's State of the Call. In the US, Truecaller tracks ~2.7B spam/unwanted calls per month, so unfamiliar caller IDs and damaged number reputation get filtered out before your opener even matters.

What's a good free tool to improve list quality before cold calling?

If you want a free place to start, Prospeo's free tier gives you 75 email credits + 100 Chrome extension credits per month, and it's built around 98% verified email accuracy with a 7-day refresh cycle. For calling lists specifically, prioritize tools that return verified mobile numbers (Prospeo has 125M+ verified mobiles) so reps spend their call blocks talking to real people, not chasing dead records.

You saw the math: same 800 dials, 2 meetings vs 18. The difference isn't effort - it's data quality. Prospeo gives your team direct dials with 30% pickup rates, 98% email accuracy for multichannel sequences, and weekly-refreshed employment data so every dial hits someone who still works there.

Move your team from average connect rates to top quartile for $0.01 per lead.