12 Benefits of Cold Calling That the Data Actually Supports

Every year, some thought leader with a podcast and a LinkedIn following declares cold calling dead. Every year, the numbers tell a different story.

The SDR manager pulling quarterly metrics doesn't care about hot takes - she cares that her team booked 47 meetings last month, and 31 of them came from the phone. 72% of sales pros say cold calling is effective. 55% of high-growth companies use it as a core strategy. Salespeople who make cold calls are 2.5x more likely to hit quota than those who don't. The obituary keeps getting written, but the patient keeps outperforming.

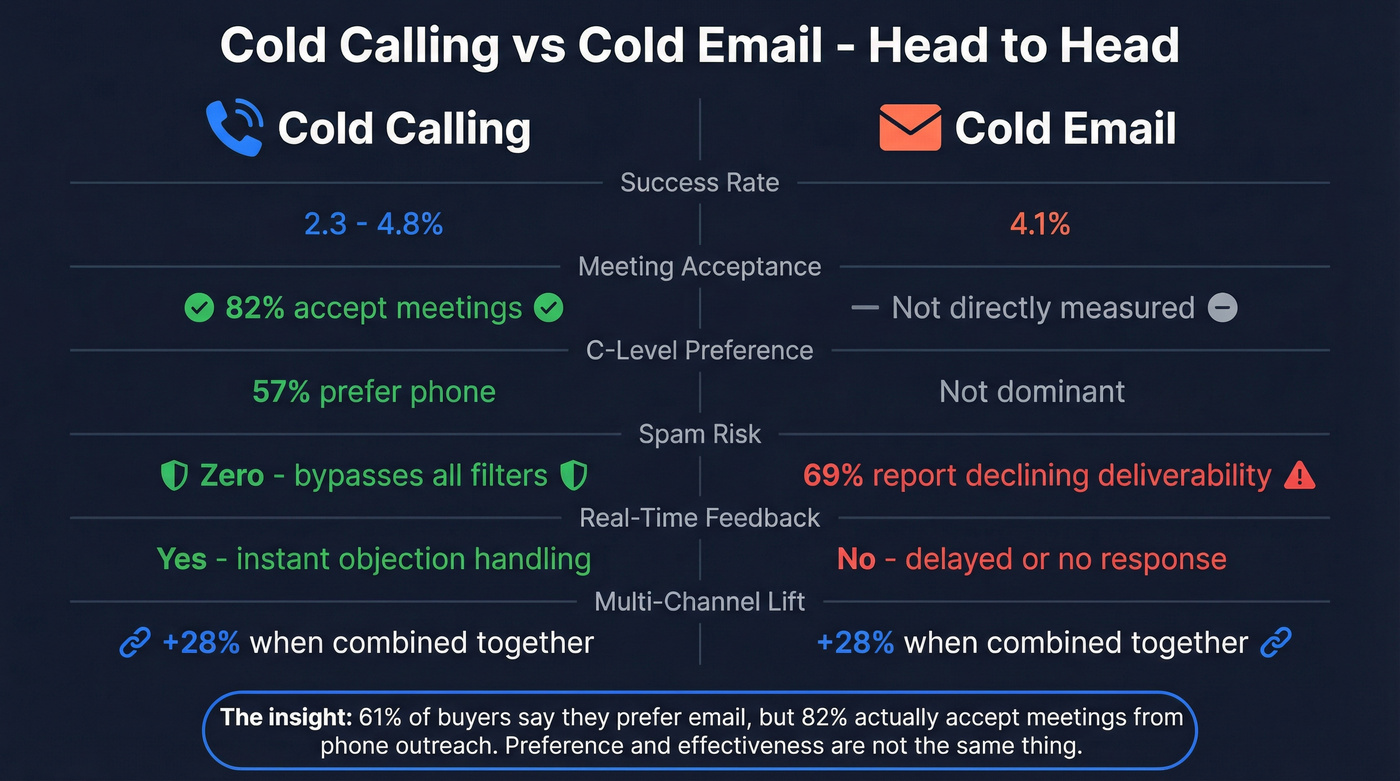

The email-only crowd has a seductive argument: "Scale without the discomfort." But 69% of email senders now report declining performance thanks to spam filters and AI content fatigue. Meanwhile, 82% of buyers accept meetings from proactive phone outreach. The inbox is drowning. The phone line is open.

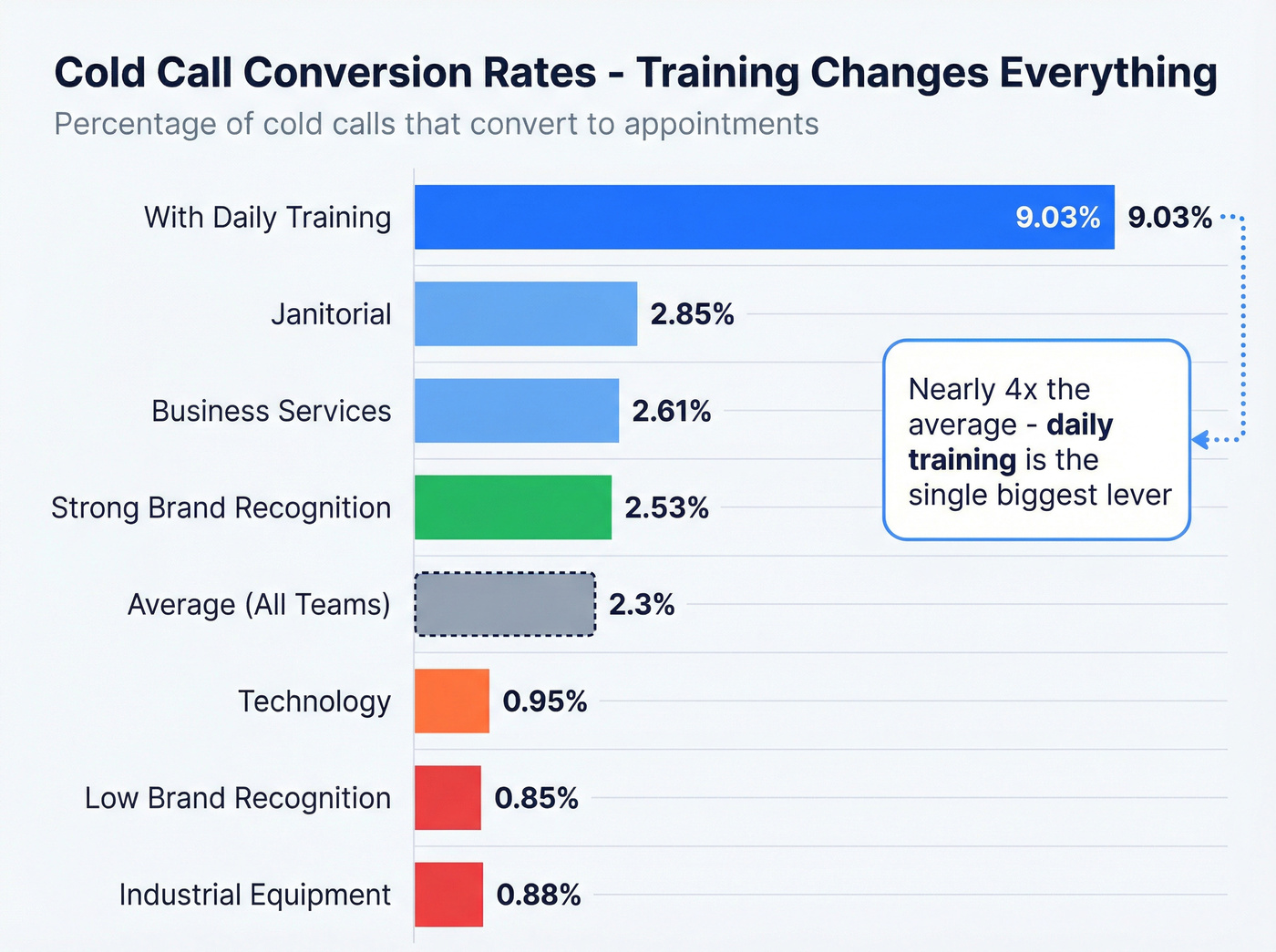

Here's the thing most articles on this topic get wrong: they cite the 2.3% average success rate like it's a verdict. It's not. That number includes every untrained rep dialing from a garbage list at 8 AM on a Monday. The real number, for teams that train daily, is 9.03%. That's a nearly 4x difference hiding in plain sight.

Cold calling is the single most underpriced channel in B2B sales right now. Everyone's fighting over the same inbox. The phone is wide open because people think it's dead. That's an arbitrage opportunity, not a liability.

What the Numbers Actually Say (Quick Version)

Before we go deep, here's the TL;DR:

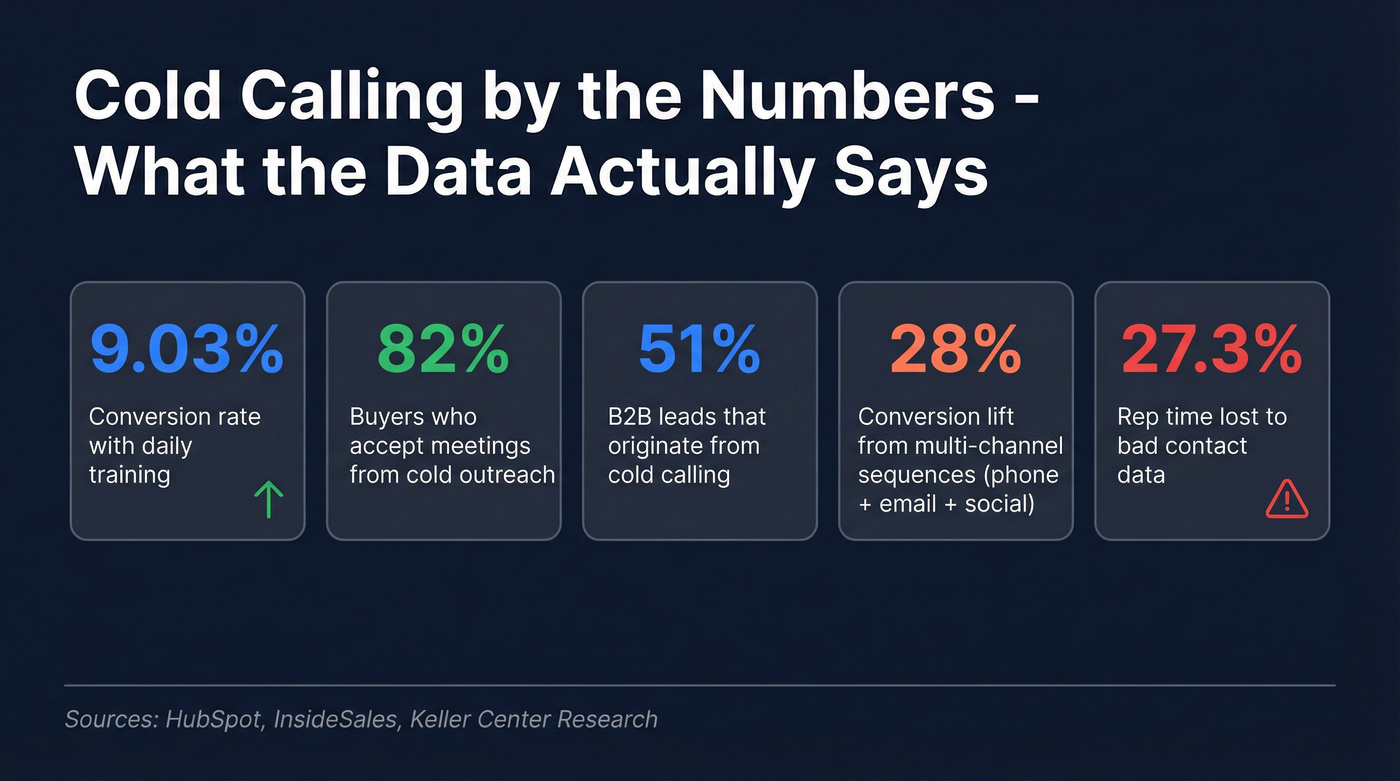

- The average cold call success rate is 2.3% - but teams with daily training hit 9.03%, nearly 4x higher

- 82% of buyers accept meetings from proactive cold outreach when the call delivers value

- Multi-channel sequences (phone + email + social) lift conversion by 28% over single-channel outreach

- 51% of B2B leads originate from cold calling - more than any other outbound channel

- The hidden killer: 27.3% of rep time is lost to bad contact data. If your reps are dialing dead numbers, none of the above matters. Fix the data first.

Now let's break down the benchmarks, the 12 specific advantages, and the mistakes that negate all of them.

Cold Calling Benchmarks for 2026

Before arguing whether cold calling "works," you need to know what "normal" looks like. These benchmarks come from analyses of millions of calls and set the baseline every sales team should measure against.

Activity Benchmarks

| Metric | Benchmark |

|---|---|

| Calls per day (avg) | 33 |

| Conversations per day | 6.6 |

| Calls per appointment | 209 |

| Hours per appointment | 7.5 |

| Calls that don't reach a human | 72% |

| Calls going to voicemail | 80% |

| Calls to connect with a buyer | ~18 |

| Best time to call | 4-5 PM |

| Best day for bookings | Tuesday |

Those numbers look brutal in isolation. 209 calls for one appointment? That's the average. It includes reps with no training, no data hygiene, and no multi-channel strategy. The top teams cut that ratio in half.

Conversion Rates by Industry and Deal Size

| Segment | Conversion Rate |

|---|---|

| Janitorial | 2.85% |

| Business Services | 2.61% |

| Consulting | 2.43% |

| Insurance | 2.12% |

| Financial Services | 1.54% |

| Technology | 0.95% |

| Industrial Equipment | 0.88% |

| Strong brand recognition | 2.53% |

| Low brand recognition | 0.85% |

| Products $500-$10K | 2.64% |

| Products $1M-$5M | 1.16% |

| With daily training | 9.03% |

That last row is the one that matters.

Daily training doesn't just improve results - it transforms the entire economics of cold calling. A team converting at 9% needs a fraction of the calls per appointment compared to the average. That's a different job entirely.

The brand recognition gap is striking too: companies with strong brand awareness convert at 3x the rate of unknowns. If your company isn't a household name, your reps need sharper openers and better targeting to compensate. The deal-size data tells a similar story - if you're selling products under $10K, the conversion math is significantly more favorable than enterprise deals above $1M.

You just read that 27.3% of rep time is lost to bad contact data. That's 11 hours a week per SDR wasted on dead numbers. Prospeo's 125M+ verified mobile numbers deliver a 30% pickup rate - nearly 3x the industry average. At $0.01 per lead, fixing your dial list costs less than one wasted hour.

Stop burning dials on dead numbers. Start every call with a verified direct line.

The 12 Cold Calling Advantages That Data Supports

1. Generates Pipeline Faster Than Any Other Outbound Channel

51% of B2B leads come from cold calling. Not inbound. Not paid ads. Not social DMs. The phone.

Companies that don't cold call experience 42% less growth. Diego Mangabeira - a practitioner who's logged 11,519 cold calls - booked 335 meetings from those dials, contributing to $40M in closed revenue at an enterprise company. His SQL conversion rate from booked meetings hit 69.1%, with under 18% no-shows.

No other outbound channel generates that kind of pipeline velocity. Email scales wider, but the phone converts faster. When you need pipeline this quarter, cold calling is the lever. This is the single biggest advantage that skeptics consistently overlook.

2. Cuts Through Inbox Noise and Spam Filters

69% of email senders report declining performance due to spam filters and AI content fatigue. That number's only going up.

Cold calls bypass every spam filter, every promotions tab, every AI-powered email sorting algorithm ever built.

| Metric | Cold Calling | Cold Email |

|---|---|---|

| Success/reply rate | 2.3-4.8% | 4.1% |

| Meeting acceptance | 82% | Not measured |

| DM pref. (first contact) | 49% | 61% |

| C-level preference | 57% | Not dominant |

| Spam risk | None | 69% declining |

| Real-time feedback | Yes | No |

| Multi-channel lift | +28% combined | +28% combined |

Here's the nuance most people miss: 61% of decision-makers say they prefer email. But 82% accept meetings from phone outreach. Preference and effectiveness aren't the same thing. People prefer email because it's low-effort to ignore. That's exactly why the phone works - it demands a real-time response.

3. Reaches the Decision-Makers Who Actually Matter

57% of C-level executives prefer phone calls over other outreach channels. 49% of B2B buyers prefer phone as their first point of contact with a new vendor.

This matters more than ever because buying groups have ballooned to 10+ stakeholders. The average B2B buying cycle now runs 11.5 months. Email gets lost in the committee. A well-timed phone call to the right VP cuts through the layers and gets you to the person who can actually say yes - or tell you exactly why they can't.

You can't navigate a 10-person buying committee through email threads. You need conversations. If you want a full mechanics-first playbook, start with our B2B cold calling guide.

4. Delivers Real-Time Market Intelligence

Every cold call is a micro-focus group. You hear objections email never surfaces. You learn which competitors are in the deal. You discover budget timelines, org restructures, and pain points that no intent data platform captures with the same fidelity.

Sellers who focus on problems during calls are 30% more effective - but only 13% actually do it. That gap is an opportunity. The reps who treat cold calls as intelligence-gathering missions, not pitch delivery vehicles, consistently outperform.

I've seen teams build entire competitive battlecards from patterns their SDRs surfaced on cold calls. That kind of market intelligence doesn't show up in a CRM field. It shows up in the conversation. (If you want to formalize this, see competitive intelligence for B2B sales.)

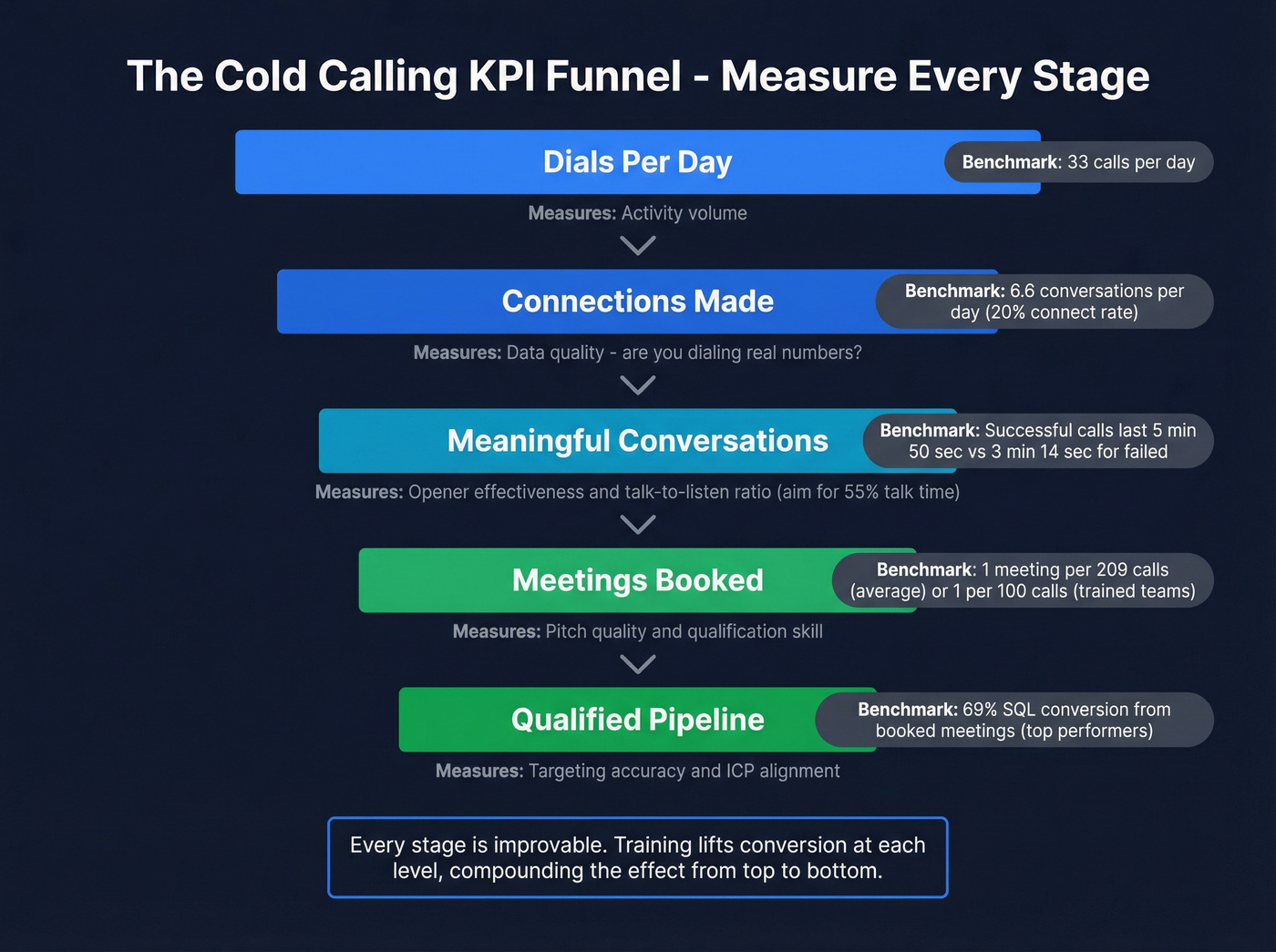

5. Provides Measurable, Improvable KPIs

Cold calling is one of the most measurable activities in sales:

- Dials per day - activity volume

- Connect rate - data quality signal

- Conversation rate - opener effectiveness

- Meeting-booked rate - pitch and qualification skill

- Call duration - successful calls last 5:50 vs. 3:14 for failed calls

- Talk-to-listen ratio - reps who own ~55% of talk time see higher meeting rates

That last one is counterintuitive. You'd think listening more would help. But on cold calls specifically, the rep needs to drive the conversation with enough energy and context to earn the prospect's attention. It's not a discovery call - it's a 90-second audition. (More on dialing KPIs in answer rate.)

6. Costs Less Per Qualified Meeting Than Most Alternatives

A mid-level SDR costs $50-70K base salary. Add tools - dialer, data platform, sequencer - at $200-500/mo. That's roughly $65-80K fully loaded per year.

A solid SDR books 15-20 qualified meetings per month. That's 180-240 meetings per year. Cost per meeting: $270-445.

Compare that to B2B paid advertising. CPLs run $50-200 per lead, but those leads convert to meetings at maybe 5-10%. Your effective cost per meeting from paid channels is $500-4,000. On a cost-per-qualified-meeting basis, the phone wins - and "qualified" is the key word. A cold call meeting has a human on the other end who agreed to talk. That's fundamentally different from a form fill.

7. Builds Rejection Resilience and Transferable Confidence

This benefit doesn't show up in any dashboard, but it's the one practitioners talk about most.

"I've recently started cold calling and I feel so much more confident in everyday life. It's amazing." - r/sales

"You get numb to rejection." - r/sales

42% of salespeople say prospecting is the hardest part of the job. Cold calling is where that discomfort gets processed and eventually neutralized. The rep who's made 5,000 cold calls doesn't flinch in a boardroom presentation. They don't panic when a deal goes sideways. They've already heard every version of "no" that exists.

This isn't just for extroverts, either. The data on talk-to-listen ratio shows that reps who listen well and hit the 55% talk-time target outperform - a profile that fits introverts perfectly. You don't need to be loud. You need to be present.

No onboarding deck, no role-play exercise, and no AI coaching tool builds this muscle the way live calls do. The discomfort is the feature.

8. Accelerates New Rep Ramp Time

Skip this one if your team has a 2-year average tenure. But if you're hiring SDRs who turn over in 12-18 months - and most teams are - ramp speed is everything.

It takes 6-12 months for a new sales rep to become fully productive. Cold calling compresses that timeline dramatically. A new rep making 30-50 calls per day hears real objections, learns the competitive landscape, and internalizes the ICP faster than any training program can deliver. By week two, they know which titles engage, which industries push back, and which pain points resonate.

We've seen teams cut ramp time nearly in half by front-loading cold calling in the first 60 days. It's uncomfortable, but it works. If you're formalizing ramp, align it with a sales onboarding plan.

9. Separates Top Performers from Everyone Else

Top-performing sellers have a 72% average win rate vs. 47% for everyone else. They're 63% more likely to generate referrals. 58% more likely to lead thorough needs discoveries. 63% more likely to communicate strong ROI cases.

Where does that gap get built? On the phone.

Cold calling is the proving ground. It's where reps develop the conversational agility, objection handling, and real-time thinking that separate quota-crushers from quota-missers. The skills transfer to every stage of the sales cycle - but they're forged in the highest-pressure, lowest-margin-for-error environment: the first 30 seconds of a cold call.

10. Compounds with Multi-Channel Outreach

Cold calling isn't a standalone activity. It's the anchor of a multi-channel strategy.

Reps using calls alongside email and social see 28% higher conversion rates. Multi-touch sequences double conversion vs. one-off dials. The pattern that works: warm up via email or social, then call. Or call first, then follow up with a personalized email referencing the conversation.

The phone call is what makes the other channels work harder. An email after a voicemail gets opened at higher rates. A social touch before a call makes the caller ID less foreign. Cold calling doesn't replace email - it supercharges it. For a systemized approach, see multi-channel sales automation.

11. Scales with Modern Sales Tools

The "cold calling doesn't scale" objection died with parallel dialers.

| Tool Category | Examples | Impact |

|---|---|---|

| Parallel dialers | Orum (~$100-200/user/mo), Nooks (~$100-150/user/mo) | 1,000+ dials/day per rep |

| Conversation intelligence | Gong, Chorus (~$100-150/user/mo) | Every call analyzed for coaching |

| AI pre-call research | Various | 45 min of research down to 15 seconds |

| Data verification | Prospeo, others | Dead numbers eliminated before dialing |

Roughly 75% of B2B companies now use AI in outbound workflows. Cold calling in 2026 looks nothing like cold calling in 2016. The core skill - having a human conversation - is the same. The tooling finally matches the intent. If you're evaluating dialers, start with outbound calling software.

12. Creates Human Connection That Email Can't Replicate

Tone impacts 93% of cold call success. Not the script. Not the offer. Tone.

A successful cold call pitch lasts 37 seconds without interruption - 50% longer than the average failed pitch. That extra breathing room comes from tone and delivery, not from cramming in more words. Explaining why you're calling increases success rates by 2.1x. Mentioning a mutual connection boosts meeting chances by 70%.

These are human dynamics no email template can replicate. The prospect hears your voice, your energy, your curiosity. They decide in seconds whether you're worth talking to. Email can't trigger that judgment.

The Hidden Variable That Makes or Breaks Every Benefit Above

It's 9:02 AM. Your SDR sits down, coffee in hand, headset on, ready to crush a two-hour call block. First dial: disconnected number. Second dial: wrong person, hasn't worked there in eight months. Third dial: voicemail. Fourth dial: "Who? No one by that name here."

By 9:15, she's made twelve dials and had zero conversations. The problem isn't her script. It's her data.

Sales reps lose 27.3% of their time to bad contact data. B2B data decays at 2.1% per month - that's 22.5% annually. Poor data quality costs businesses $12.9M per year on average. And that stat about 72% of cold calls not reaching a human? Bad data makes that number worse.

Phone-verified mobile numbers are 87% accurate. AI-powered verification pushes that to 98%. The difference between dialing a switchboard and dialing a verified direct mobile is the difference between a 7% connect rate and a 30% connect rate. If you want the benchmarks and fixes, read our guide to B2B contact data decay.

This is where tools like Prospeo's Mobile Finder change the math. 125M+ verified mobile numbers with a 30% pickup rate, 98% email accuracy, and a 7-day data refresh cycle compared to the 6-week industry average. Your reps dial, people answer. That alone transforms every benefit listed above. (More on finding direct dials in B2B phone number.)

Mistakes That Kill Cold Calling's Benefits

Every advantage above has a corresponding mistake that neutralizes it.

Not researching the prospect. Spend 30-60 seconds on pre-call research. As Shivan Pillay from Cognism puts it: "If you haven't done your homework, you end up pitching something totally misaligned with who you're speaking to." Even a glance at recent company news gives you an edge.

Pitching too early. Earn the right to pitch. Open with relevance, not rapport. The first 30 seconds should make the prospect curious, not defensive. (If you're rebuilding your opener, start with sales pitch opening.)

Calling with outdated data. Verify your list before every call block. A list that was 90% accurate in January is roughly 70% accurate by December. If you're not refreshing data regularly, you're burning call blocks on ghosts.

Giving up too early. 93% of conversations happen by attempt #3. 80% of sales require 5-12 follow-ups. Most reps quit after one or two attempts. Persistence isn't annoying - it's expected. (See when to follow up with prospects.)

Asking "Is this a bad time?" That phrase decreases meeting chances by 40%. Instead, explain why you're calling - that increases success rates by 2.1x. Lead with the reason, not the apology.

Ignoring training. Daily training boosts conversion to 9.03% - 4x the average. No formal training drops it to 1.10%. Nothing else comes close to that ROI. If you need a concrete program, use our cold calling training framework.

How to Maximize Cold Calling ROI in 2026

Five levers, in order of impact.

1. Invest in daily training. Not weekly. Not monthly. Daily. Even 15-minute pre-call-block sessions move the needle. The data is unambiguous: daily training = 9.03% conversion. That's the single most impactful change you can make.

2. Clean your data before every call block. Before your reps pick up the phone, run the list through a verification tool. Dead numbers don't just waste time; they kill momentum and morale. Discussing pricing on the first call increases win rates by 10% - but you can't discuss pricing if you never reach a human.

3. Build multi-channel sequences. Phone + email + social delivers 28% higher conversion than phone alone. Structure your sequences so the call isn't cold - it's warm. An email the day before, a social touch that morning, then the dial.

4. Track the right KPIs. Dials per day is a vanity metric. Connect rate tells you about data quality. Conversation rate tells you about your opener. Meeting-booked rate tells you about your pitch. Track all four. Optimize in that order.

5. Contact leads fast. Reaching out within 24 hours of an intent signal or inbound action increases conversion by 5x. Speed-to-lead applies to every trigger event your data platform surfaces. (If you want the benchmarks, see average lead response time.)

One compliance note: know your DNC lists, TCPA rules, and GDPR obligations. If you're calling into the EU, you need consent frameworks. Build compliance into your workflow from day one - not after your first fine.

The data is clear: multi-channel sequences lift conversion by 28%. But that only works when your phone numbers and emails are real. Prospeo delivers 98% email accuracy and 125M+ verified mobiles - refreshed every 7 days, not every 6 weeks. Build the call list that turns 2.3% into 9%.

Your cold calling strategy is only as good as the data behind it.

FAQ

Is cold calling still effective in 2026?

Yes. 72% of sales professionals say cold calling is effective, 82% of buyers accept meetings from proactive phone outreach, and salespeople who cold call are 2.5x more likely to hit quota. The question isn't whether the channel works - it's whether your team trains daily and dials verified numbers to capture the full upside.

What's a good cold call conversion rate?

The average is roughly 2.3%, or about 1 meeting per 43 calls. Industry rates range from 0.88% (industrial equipment) to 2.85% (janitorial services). Top teams with daily training hit 9.03%. If you're consistently below 2%, audit training frequency and data quality before blaming the channel.

How many cold calls does it take to book a meeting?

On average, 209 calls per appointment - but that number drops dramatically with training and clean data. 93% of conversations happen by the third attempt, and 80% of sales require 5-12 follow-ups. Most reps quit after one or two tries, which is why persistence alone separates top performers.

Is cold calling better than cold email?

Neither wins alone. Email gets a 4.1% reply rate; phone gets 82% meeting acceptance and delivers real-time feedback. Multi-channel outreach combining both delivers 28% higher conversion than either channel solo. The strongest teams pair verified phone data with email sequences for maximum coverage.

What are the main pros and cons of cold calling for B2B teams?

The pros: faster pipeline generation, direct access to C-level buyers, real-time market intelligence, and measurable KPIs that improve with training. The cons: high rejection rates, rep burnout risk, and heavy dependence on data quality. Teams that train daily and verify contact data before dialing consistently find the advantages far outweigh the drawbacks.