When to Follow Up With Prospects: The 2026 Data-Backed Playbook

You just ran a killer demo on Tuesday. The prospect said "this looks great, let me loop in my VP." By Friday, silence. You draft a follow-up, delete it, draft another one, and then Google "when to follow up with prospects" - which is probably how you ended up here.

You're not alone. The #1 question on every sales subreddit is some version of "how many follow-ups before I'm being annoying?" The answers are all over the map because most advice ignores context. Following up on a cold email is fundamentally different from following up after a demo or a sent proposal.

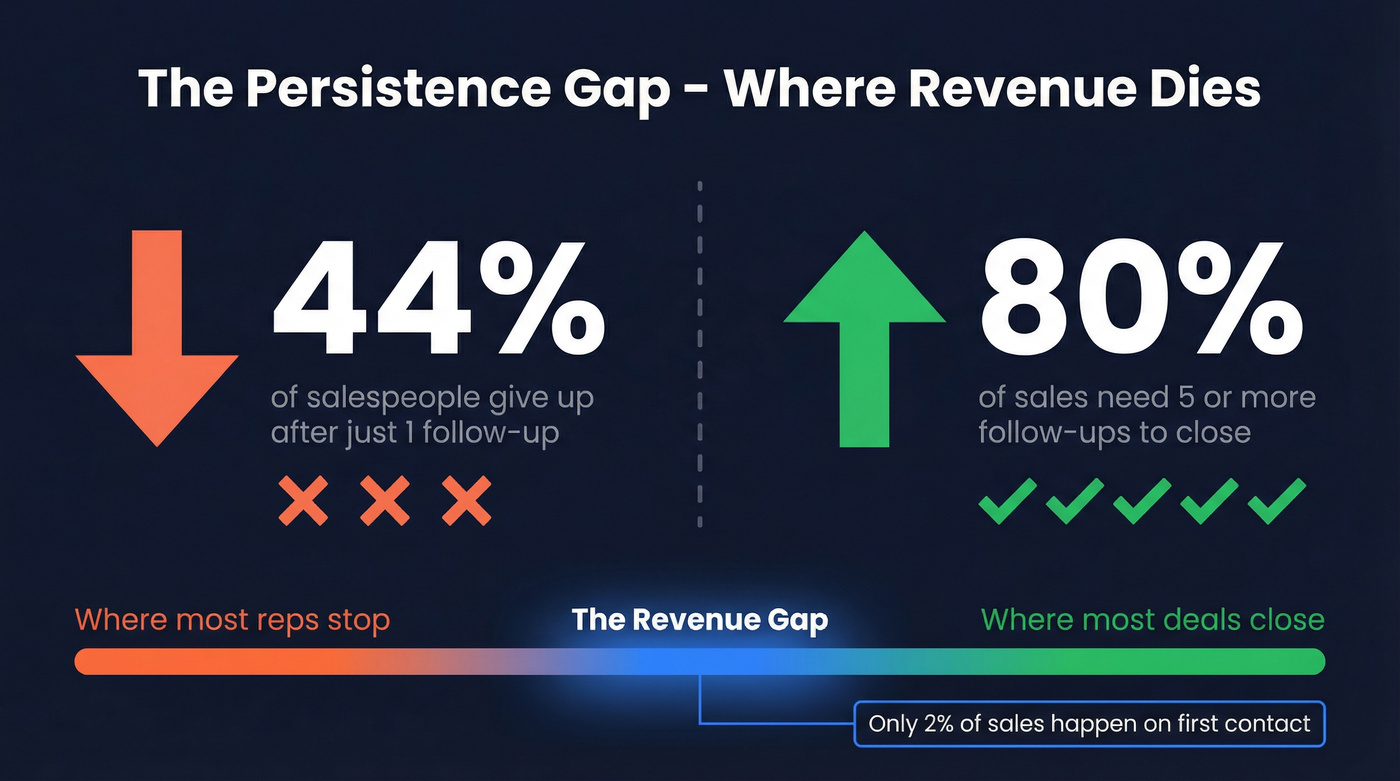

Here's what 16.5 million cold emails, multiple platform studies, and years of watching sales teams get this wrong actually tell us: there's no single "right" number. But there are stage-specific cadences backed by data that dramatically outperform gut-feel timing. 44% of salespeople give up after one follow-up. Meanwhile, 80% of sales require five or more touches after the initial meeting. That gap - between where most reps stop and where most deals close - is where revenue dies.

Only 8.5% of all sales outreach emails get a response. Knowing exactly when to reach back out at each stage is the difference between landing in that 8.5% and shouting into the void.

The Quick-Reference Cadences (TL;DR)

If you're mid-sequence and just need the timing, here it is:

| Stage | Day 1 | Follow-Up 1 | Follow-Up 2 | Follow-Up 3 | Breakup |

|---|---|---|---|---|---|

| Cold outreach | Initial send | Day 3-4 | Day 7-8 | Day 12-14 | Day 14 |

| Inbound lead | Within 5 min | 24 hours | Day 3 | Day 7 | Day 14 |

| Post-demo | 24-hr recap | Day 7 | Day 14 | - | Day 14 |

| Post-proposal | 24 hours | Day 3 | Day 7 | Day 14 | Day 14 |

The rule that ties all of these together: every follow-up must add value. If you can't bring new information, a relevant case study, or a specific question about their business, switch channels or stop. "Just checking in" isn't a follow-up strategy - it's a confession that you have nothing to say.

Stop counting follow-ups. Start counting value-adds.

The Persistence Gap - Why Most Reps Lose Deals They Should Win

Only 2% of sales happen on the first contact. That number alone should change how you think about prospect follow-up. The initial email or call is almost never the one that closes the deal - it's the one that starts the conversation.

And yet, 44% of salespeople give up after a single follow-up. They send the initial email, send one bump, hear nothing, and move on. Meanwhile, 80% of sales require five or more follow-ups after the initial meeting. On the phone side, it takes an average of 8 calls to reach a prospect and 6 calls to close a deal.

The math is brutal. 55% of replies to cold email campaigns come from a follow-up - not the initial send. A first follow-up email can produce a 220% surge in reply rates. That means more than half of your potential conversations are locked behind emails you're not sending.

Here's the thing: this isn't about being pushy. 82% of buyers accept meetings from proactive outreach. 49% of customers actually prefer a cold call as first contact. Buyers aren't allergic to salespeople - they're allergic to salespeople who waste their time.

The persistence gap exists because reps confuse silence with rejection. No response doesn't mean "no." It usually means "I'm busy" or "I didn't see it" or "I need more context before I engage." The reps who reach out systematically - with value, across channels, at the right intervals - close deals that their less persistent colleagues leave on the table.

I've seen teams double their pipeline just by adding two more touchpoints to their existing cadence. Not by working harder. By not quitting early.

Speed Kills (Slowly) - Why Every Hour of Delay Costs You

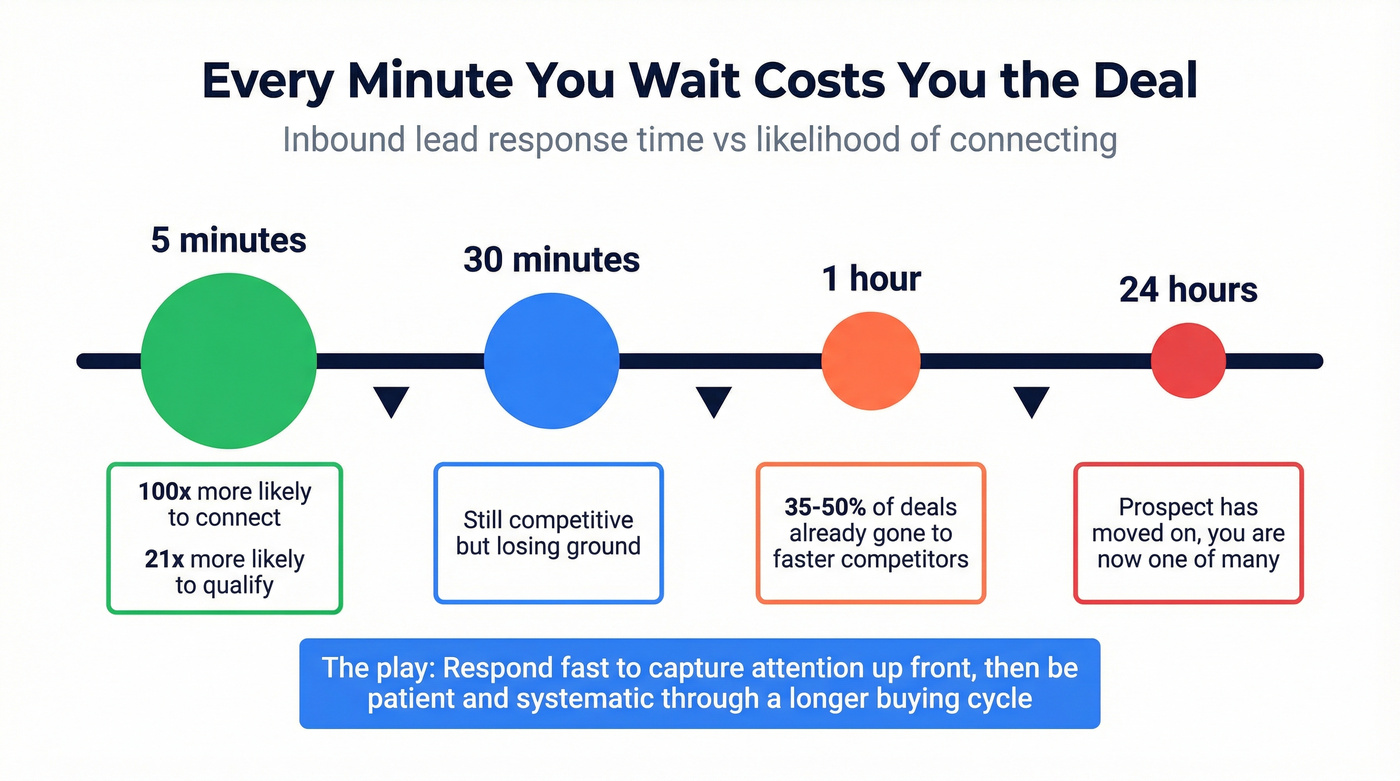

The most famous stat in sales is the 5-minute rule: contacting an inbound lead within 5 minutes makes you 100x more likely to connect and 21x more likely to qualify them. That comes from the original InsideSales.com/MIT study back in 2007 - and the bar has only gotten higher since.

Think about it. In 2007, prospects weren't getting 47 SaaS pitches a week. Today, 77% of customers expect to interact with someone immediately when they contact a company. An estimated 35-50% of deals go to the vendor that responds first. If you're waiting an hour to respond to an inbound demo request, you've already lost to the competitor who responded in three minutes.

Outreach's data makes the long-term case even stronger: opportunities closed within 50 days have a 47% win rate. After 50 days? That drops to 20% or lower.

But here's where it gets nuanced. Speed matters most at the front end of the funnel. 63% of people requesting information don't purchase for at least three months. So the play is: respond fast to capture attention, then be patient and systematic through a longer buying cycle.

Speed on the front end. Patience on the back end. Most teams get this backwards - they're slow to respond initially, then panic and hammer the prospect when the quarter's ending.

80% of sales require 5+ follow-ups, but every touchpoint fails if it bounces. Prospeo's 98% email accuracy and 7-day data refresh mean your carefully timed cadences actually reach real inboxes - not dead addresses that kill your domain reputation.

Stop perfecting your timing on emails that never arrive.

How to Time Your Follow-Ups at Every Sales Stage

This is where most follow-up advice falls apart. A cold prospect who's never heard of you needs a completely different cadence than someone who just sat through a 45-minute demo.

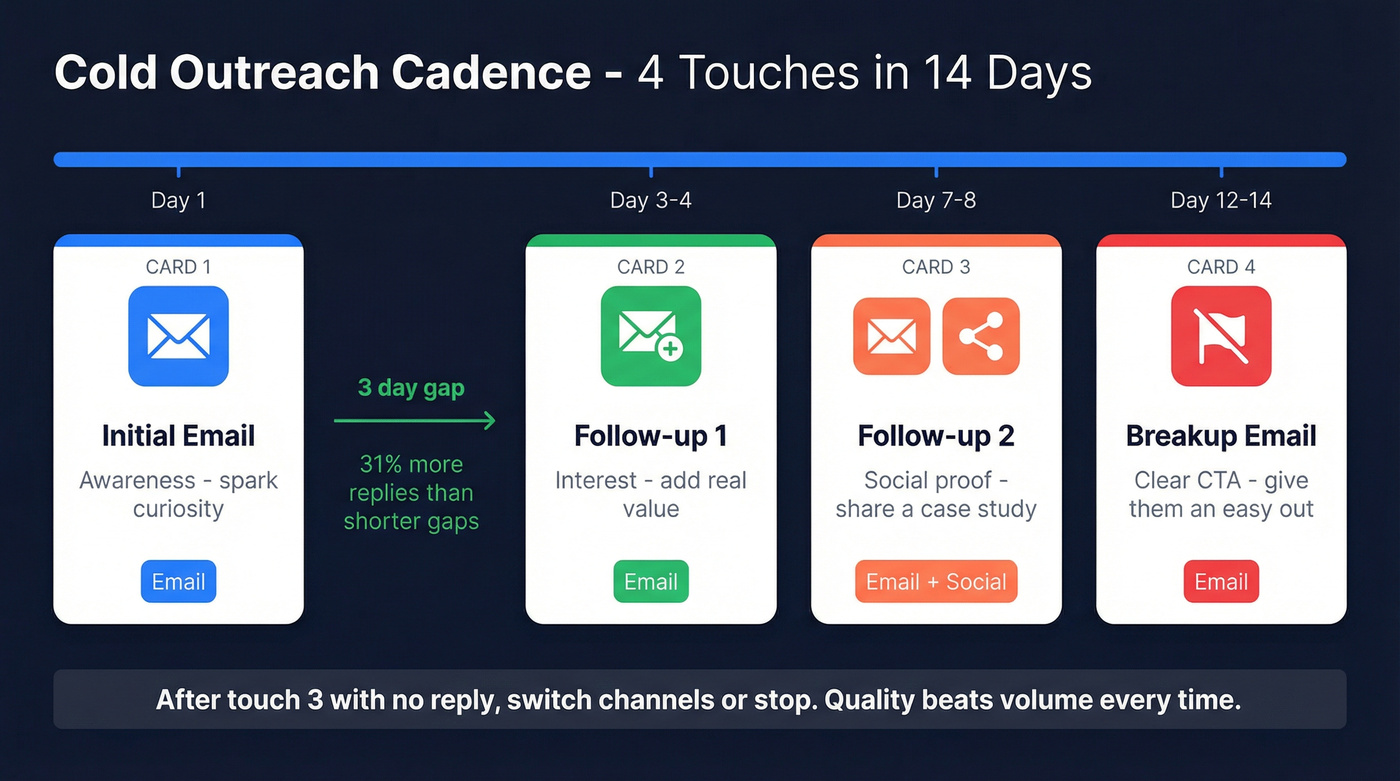

Cold Outreach Cadence

| Touch | Timing | Purpose | Channel |

|---|---|---|---|

| Initial | Day 1 | Awareness - spark curiosity | |

| Follow-up 1 | Day 3-4 | Interest - add value | |

| Follow-up 2 | Day 7-8 | Social proof | Email + social |

| Follow-up 3 | Day 12-14 | Breakup - clear CTA |

The 3-day gap between your initial email and first follow-up isn't arbitrary. Data from Instantly shows a 3-day interval produces 31% more replies than shorter gaps. Too soon feels desperate. Too late and they've forgotten you.

A Reddit practitioner laid out a framework I keep coming back to: three emails, three purposes. Email 1 is awareness - introduce yourself without overwhelming, highlight something relevant to their business. Email 2 is interest - share data, a case study, or an insight that builds credibility. Email 3 is action - you've earned the right to ask for their time because you've been building value from the start.

Analysis of 16.5 million cold emails confirms the diminishing returns. The highest reply rate (8.4%) actually comes from a single well-crafted email - which reinforces the "quality over quantity" principle. Reply rates decline with each subsequent touch after that. As one SDR team lead put it: "After the second touch, unless we bring real value or switch channels, it's like shouting into the void. Timing and relevance beat volume every time."

After the third follow-up with no response, don't send a fourth email. Switch to a different channel - a phone call, a social profile visit - or send a breakup and move on. If you want plug-and-play sequences, start with a proven cold email sequence structure and adjust by stage.

Inbound Lead Cadence

| Touch | Timing | Purpose | Channel |

|---|---|---|---|

| Initial response | Within 5 min | Acknowledge + qualify | Email or phone |

| Follow-up 1 | 24 hours | Value-add if no reply | |

| Follow-up 2 | Day 3 | New angle or resource | Email + social |

| Follow-up 3 | Day 7 | Breakup or nurture |

Inbound leads are fundamentally different from cold prospects. They've already raised their hand. The 5-minute response window isn't a nice-to-have - it's the difference between a conversation and a missed opportunity. If you want to benchmark your team, compare against current speed-to-lead metrics and build an SLA around them.

But don't mistake urgency for desperation. Your first response should acknowledge what they asked for, deliver it, and ask one qualifying question. Not a 500-word pitch about your platform.

The tricky part: 63% of people requesting information don't purchase for at least three months. So your first-week cadence is about capturing attention and qualifying. After that, you're shifting into a longer nurture sequence - monthly touchpoints with relevant content, not weekly "just checking in" emails. The speed-to-lead matters for the first response. The patience matters for everything after.

Post-Demo Cadence

Great demo on Tuesday. Radio silence by Friday. Sound familiar?

| Touch | Timing | Purpose | Channel |

|---|---|---|---|

| Recap | Within 24 hrs | Summarize + next steps | |

| Check-in | Day 7 | Internal discussion? | Email or call |

| Breakup | Day 14 | Final nudge |

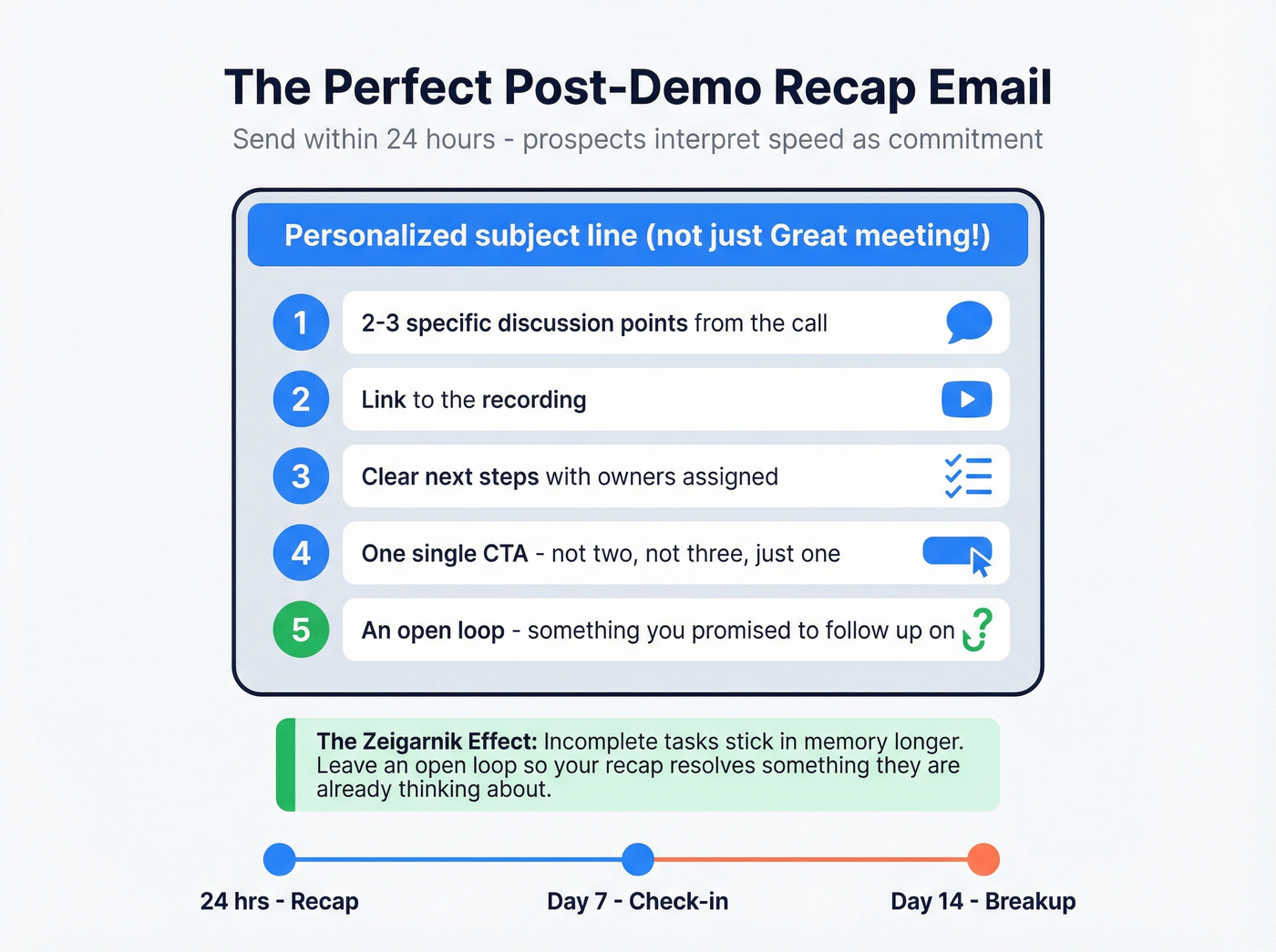

The 24-hour recap is the most important follow-up email you'll ever send. Prospects interpret speed as commitment - if you wait three days to send a recap, they assume you don't care that much about the deal.

Your recap email needs five things: a personalized subject line (not "Great meeting!"), 2-3 specific discussion points from the call, a link to the recording, clear next steps with owners assigned, and a single CTA. Not two CTAs. Not three. One. If you want subject lines that reliably get opened, borrow from these reminder email subject lines.

Here's a psychological trick worth stealing: the Zeigarnik effect says incomplete tasks stick in our memory longer than completed ones. End every demo with an open loop - a question you'll answer in the follow-up, a custom analysis you'll send over, a specific resource you'll pull together. This turns your recap from a "thanks for your time" email into the resolution of something they're already thinking about.

I've watched deals die because the rep sent a generic recap instead of a specific "you mentioned your team's struggling with X - here's how we solve that" recap. The demo isn't what sells. The follow-up is what sells.

The 7-day check-in is simple: "Have you had a chance to discuss this with [stakeholder they mentioned]?" If no response by day 14, send a breakup that gives them an easy out - "not the right time" or "revisit in Q3." Always end meetings with a Scheduled Next Event - a calendar invite for the next conversation, not a vague "I'll follow up." The reps who book the next meeting before the current one ends close at dramatically higher rates.

Post-Proposal Cadence

This is where deals go to die quietly. B2B buying groups average 10 members with cycles lasting up to 10 months. Your champion might love the proposal, but they're fighting for budget against six other priorities you don't know about. If you're selling into longer cycles, it helps to map your SaaS sales cycle stages to a proposal follow-up plan.

Skip this cadence if: you ended the proposal meeting with a signed next step and a calendar hold. If you did, you don't need a follow-up sequence - you need to show up prepared for the next meeting. This cadence is for when the proposal goes out and the prospect goes dark.

| Touch | Timing | Purpose | Channel |

|---|---|---|---|

| Confirmation | 24 hours | Confirm receipt + Q&A | |

| Check-in | Day 3 | Address concerns | Email or call |

| Nudge | Day 7 | New value or urgency | |

| Breakup | Day 14 | Final follow-up |

The key move here is stakeholder enablement. Don't just follow up with your champion - arm them with shareable materials. A one-pager they can forward to their CFO. An ROI calculator. A case study from a company in their industry. Your champion wants to sell this internally. Give them the ammunition. If you need a system for reaching multiple stakeholders, use an ABM multi-threading approach.

Adjust Your Cadence by Audience

Not all prospects respond the same way. Company size, seniority, and industry all change the math on when and how often to reach out.

Company Size - SMB vs. Enterprise

| Metric | SMB (2-50) | Mid-Market | Enterprise (1,000+) |

|---|---|---|---|

| Initial reply rate | 9.2% | ~7% | Lower |

| 1st follow-up | 8.0% | ~6.5% | Drops fast |

| 2nd follow-up | 8.4% | ~6% | Minimal |

| Best approach | 2-3 follow-ups | 2 follow-ups | Multi-channel |

Here's something counterintuitive from the 16.5 million email dataset: small businesses (2-50 employees) actually respond better on the second follow-up (8.4%) than the first (8.0%). SMB founders are busy, they miss things, and a well-timed second touch catches them at a better moment.

Enterprise prospects are allergic to persistence. Reply rates drop fast after the initial email, and a fourth or fifth follow-up is more likely to get you blocked than booked. For enterprise, the play is fewer emails, more channels - a social profile visit, a warm intro through a mutual connection, a phone call to a verified direct dial. If you’re running true enterprise motions, align follow-ups to an enterprise sales process (with multi-threading and tighter stakeholder mapping).

Seniority - C-Suite vs. Individual Contributors

C-suite executives respond at roughly 5% compared to 8% for entry-level professionals across the same dataset. Executives get more email, have more gatekeepers, and have less time.

But here's where the phone changes everything. C-level connection rates by call attempt: 39% on the first call, 72% on the second, 93% by the third. If you're only emailing the C-suite, you're playing on hard mode. Build the call motion with a modern B2B cold calling guide instead of improvising.

Founders are a special case. Their reply rates go 6.64% to 6.66% to 6.94% to 5.75% to 3.01%. They peak on the second follow-up, then drop hard. Two follow-ups is the sweet spot for founders. After that, you're burning goodwill.

Real talk: if your average deal size sits below $10k, you probably don't need to chase C-suite executives at all. Directors and VPs have budget authority for deals that size, respond at higher rates, and don't require six channels and a warm intro just to get a meeting. Target the level that matches your deal size.

Industry Benchmarks

| Industry | Initial Rate | 1st Follow-Up |

|---|---|---|

| Manufacturing | 6.67% | 6.77% (stable) |

| Transportation | 6.46% | 6.66% (rising) |

| Solar | 6.73% | 6.83% (peaks, then drops) |

| E-learning | <5.5% | Declining |

| Crypto | <5.5% | Declining |

| Healthcare | <5.5% | Declining |

These numbers span 93 industries. Manufacturing and transportation prospects are remarkably consistent through follow-ups - they're used to vendor outreach and respond at steady rates. Solar peaks on the first follow-up then drops, so time your best pitch for touch two.

Industries like e-learning, crypto, healthcare, and cloud solutions all sit below 5.5% and decline from there. If you're selling into these verticals, your cadence needs to be tighter - fewer touches, higher quality, and a faster pivot to phone or social.

Multi-Channel Follow-Up - Why Email Alone Isn't Enough

A LinkedIn message combined with a profile visit hits an 11.87% reply rate. That's higher than any email-only sequence in the 16.5 million email dataset. If you want more benchmarks like this, keep a running set of social selling statistics to guide channel mix.

LinkedIn nurturing - 3 to 5 actions like connecting, commenting on posts, and sending a message - increases reply rates from 1.07% to over 5%. That's a 5x improvement just by showing up on a second channel.

The rule I give every team: switch channels before you send a 4th email. If three emails haven't gotten a response, a fourth email won't either. A phone call might. A LinkedIn comment on their latest post might. Even SMS or ringless voicemail can work as supplementary channels. If you’re building this into a system, use multi-channel sales automation to keep touchpoints consistent without spamming.

45% of sales teams are already running hybrid AI-SDR models to manage multi-channel cadences, and 100% of respondents in recent surveys saved at least an hour per week with AI-assisted sequencing. If you're still manually tracking "did I call this person on day 5?" across 200 prospects, you're competing against teams that automated that months ago.

High-performing teams run 8-12 touchpoints across 3+ channels as their standard cadence. That's not 12 emails. That's 4 emails, 3 calls, 3 social touches, and 2 value-adds (content shares, mutual connection intros, event invites). The mix matters more than the volume.

What to Say - Follow-Up Templates That Actually Get Replies

Timing matters less than what you actually say. A perfectly timed "just checking in" still gets deleted.

Template 1: The Value-Add Follow-Up (Cold, Touch 2)

Subject: [Their company] + [relevant metric]

Hi [Name],

Saw that [their company] recently [specific trigger - hiring, funding, expansion]. We helped [similar company] hit a 40% increase in lead conversion within six months of a similar growth phase.

Quick case study attached - 2-minute read. Worth a look if [specific challenge] is on your radar.

[Your name]

Template 2: The Post-Demo Recap

Subject: Next steps from Tuesday's call

Hi [Name],

Three things stood out from our conversation:

- [Specific pain point they mentioned]

- [Goal they described]

- [Feature/solution they reacted to]

Recording is here: [link]. I've outlined next steps below with owners - let me know if I'm off base.

[Next step 1 - owner] [Next step 2 - owner]

Can we lock in [specific date] for the follow-up?

Template 3: The Breakup Email

Subject: Should I close your file?

Hi [Name],

I've reached out a few times and haven't heard back - totally understand if the timing's off. I don't want to be the person clogging your inbox.

Two options:

- "Not interested" - I'll stop reaching out, no hard feelings

- "Try again in Q3" - I'll circle back then

Either way, appreciate your time.

Template 4: The Re-Engagement (After 30+ Days of Silence)

Subject: Quick question about [their business challenge]

Hi [Name],

I've been following [their company]'s [specific initiative - new product launch, market expansion, etc.]. Curious how [related challenge] is playing out for your team.

No pitch - genuinely interested in your take. If it'd be useful, I can share what we're seeing across [their industry].

Keep every follow-up between 50 and 125 words. That's the sweet spot for response rates. Anything longer and you're writing a novel nobody asked for. If you want more plug-and-play options, start from a proven follow up format and customize the value-add.

Never say "just checking in." And never open a call with "Is this a bad time?" - Gong.io data shows that phrase decreases your meeting chances by 40%. Instead, explain why you're calling. Stating the reason for your outreach increases success rates by 2.1x. Mentioning a mutual connection increases your meeting chances by 70%.

One more tip I've stolen from the best reps I've worked with: ask the prospect directly how they prefer to be contacted and how often. "Would it be helpful if I checked back in two weeks, or would you rather I send over some materials and let you reach out when you're ready?" This flips the dynamic - you're not chasing, you're collaborating. And the prospect just told you exactly when to reach out next.

When Follow-Up Starts Hurting - The Data on Diminishing Returns

There's a moment where persistence crosses from professional to problematic. The data tells us exactly where that line is.

The 4th follow-up email - your 5th email total - triples spam complaints and more than triples the unsubscribe rate. You're not just wasting your time at that point. You're actively damaging your sender reputation and making it harder for your next campaign to land in inboxes. If you need to diagnose deliverability issues from aggressive cadences, start with email deliverability fundamentals.

Diminishing returns generally set in after the 6th to 8th total touch across all channels. After that, you're in negative-return territory.

Here's the decision framework I use:

- Have you added new value each time? Not "bumped" - actually shared something useful.

- Have you tried at least 2 channels? Email plus phone, or email plus social.

- Has the prospect given any signal - even a negative one? An open, a click, a "not now."

If the answer is no to all three after 3 follow-ups, send a breakup email and move on.

75% of buyers prefer a rep-free experience. 80% of seller conversations are still buyer-initiated. 70% of buyers conduct their own research independently. Some prospects will never respond to outbound - and that's not a failure of your cadence. It's a signal to reallocate your time.

Look, the 4th follow-up email is where you start doing damage. I'd rather see a team send three excellent, value-packed follow-ups and a clean breakup than seven "just circling back" messages that torch their domain reputation.

The Hidden Follow-Up Killer - Bad Contact Data

Your follow-up cadence is worthless if a quarter of your contact data is wrong.

B2B contact databases decay at 2.1% per month - that's 22.5% per year. People change jobs, companies get acquired, email domains rotate. Sales reps lose 27.3% of their productive time to bad contact data. More than a quarter of your week, spent chasing ghosts. If you want the underlying benchmarks and how to model decay, see B2B contact data decay.

Picture this: you send 200 cold emails. 45 bounce. Your bounce rate just hit 22%, which is enough to trigger spam filters and damage your sender reputation for weeks. Now your follow-up emails - the ones going to valid addresses - are landing in spam too. One bad list poisons the entire sequence. If you're seeing hard bounces, troubleshoot errors like 550 Recipient Rejected before you scale volume.

Before you build your follow-up sequence, verify your list. Tools like Prospeo handle this with 98% email accuracy across 143M+ verified emails, refreshed every 7 days versus the 6-week industry average. The free tier gives you 75 verified emails per month to test it. But any verification tool beats no verification. The point is: stop following up with dead addresses.

The connection between data quality and follow-up performance is direct. Clean data means higher deliverability, which means better sender reputation, which means your follow-ups actually reach inboxes. Dirty data means bounces, spam flags, and a cadence that looks great on paper but fails in practice.

You lose 35-50% of deals to the vendor that responds first. Prospeo gives you 143M+ verified emails and 125M+ direct dials so your follow-up sequence hits the right person the moment they're ready to buy - no bounces, no gatekeepers.

Close the persistence gap with contacts that actually connect.

Common Follow-Up Mistakes to Avoid

Cherry-picking leads. Reps gravitate toward the "hot" prospects and neglect the warm and cold segments. Your pipeline needs all three tiers working simultaneously.

Hammering one channel. Five emails in a row isn't a cadence - it's spam. Mix email, phone, and social. Multi-channel outperforms single-channel every time.

No scheduled next steps after meetings. "I'll follow up" without a specific date is a promise to forget. End every meeting with a calendar invite for the next one. If you leave a meeting without a Scheduled Next Event, you've already started losing the deal.

Ignoring buying group dynamics. B2B buying groups average 10 members. If you're only emailing one person, you're hoping that person does all the internal selling for you. Multi-thread into the account.

Treating all prospects the same. An SMB founder and an enterprise VP of Procurement need completely different cadences, messaging, and channel mixes. The data in this article proves it.

Misaligning content with funnel stage. Case studies and product comparisons work near conversion. Thought leadership and industry insights work at awareness. Sending a pricing sheet to someone who just downloaded a whitepaper is a mismatch that kills deals.

Using the word "follow up" with the prospect. This is subtle but powerful. "I'm following up" frames you as the chaser. "I wanted to share something relevant to your [initiative]" frames you as a resource. The language you use shapes how the prospect perceives the interaction.

FAQ

When should I follow up with a prospect after a meeting?

Within 24 hours - always. Send a recap email the same day or the next morning with specific discussion points, a recording link, and clear next steps with owners assigned. Check in at day 7 about internal discussions, and send a breakup at day 14 if you've heard nothing. The 24-hour recap is the single highest-leverage follow-up email in the entire sales cycle.

How many follow-ups should I send before giving up?

Three per channel before switching or stopping. The 16.5 million email dataset shows the 4th email triples spam complaints. If you've tried email, phone, and social with no response after 8-12 total touches, send a breakup and move on. Three value-packed messages outperform seven generic bumps every time.

What's the best day and time to send a follow-up email?

Tuesday through Thursday, 10 AM-2 PM in the prospect's timezone. Avoid Monday mornings when inboxes are overloaded and Friday afternoons when people are mentally checked out. These windows align with the highest open and reply rates across major cold email platforms.

How do I follow up without being annoying?

Add new value every time - a relevant case study, industry insight, or specific question about their business. If you can't contribute something new, don't send the email. Ask the prospect directly how they'd like to be contacted - it shows respect and gives you a clear green light for the next touch.

How do I make sure my follow-up emails actually reach prospects?

Verify your contact data before launching any sequence. B2B data decays 2.1% per month - if your list is six months old, roughly 1 in 8 addresses is dead. Run verification before you build a single sequence, and re-verify any list older than 90 days.