The Complete Logistics Cold Calling Script Playbook: Templates, Objections, Voicemails, and Follow-Ups

It's Tuesday afternoon. You've made 30 calls. Two people picked up. One hung up mid-sentence. The other said "I'm covered" before you finished your name. Your sales manager just pulled up the CRM and asked why you've booked zero meetings this week. Half the numbers in your list are disconnected anyway.

Logistics cold calling converts at 1.77%. That's roughly 1 sale per 56 calls. The math isn't broken - your approach probably is. Every logistics cold calling script on the first page of Google gives you a 3-sentence skeleton and wishes you luck. That's not a playbook. That's a napkin sketch.

This is the playbook. Copy-paste scripts for eight scenarios, 10 objection rebuttals with exact language, voicemail templates that actually get callbacks, a day-by-day timing schedule, gatekeeper bypass techniques, and the follow-up cadence that turns "call me back" into booked meetings.

If You Don't Read the Full Article

Make these three changes today:

1. Start leaving voicemails with a specific callback reason. 80% of your cold calls go to voicemail. A good voicemail script increases callbacks by up to 22%. Most guides ignore voicemails entirely. Stop treating them as throwaway dials.

2. Use the weekly timing schedule below. Friday afternoons are the best time to cold call shippers. Monday mornings are the worst. Most reps get this backwards.

3. Spend 5 minutes researching each prospect before dialing. An intelligence-based opener that references a company acquisition or seasonal trend outperforms any generic script by a wide margin. Fifty well-researched calls beat 300 spray-and-pray dials every time.

Need scripts? Jump to Script Templates for Every Scenario. Handling objections? Objections You'll Hear. Voicemails? Voicemail Scripts That Actually Get Callbacks. Timing? [The Freight Shipper's Weekly Schedule](#when-to-call - the-freight-shippers-weekly-schedule).

Know Your Numbers Before You Dial

Most freight brokers have no idea what "good" looks like.

The logistics and transportation cold call conversion rate sits at 1.77% - below the cross-industry average of 2.35%. That gap isn't because logistics prospects are harder to reach. It's because most freight brokers get zero formal training and dial without a system.

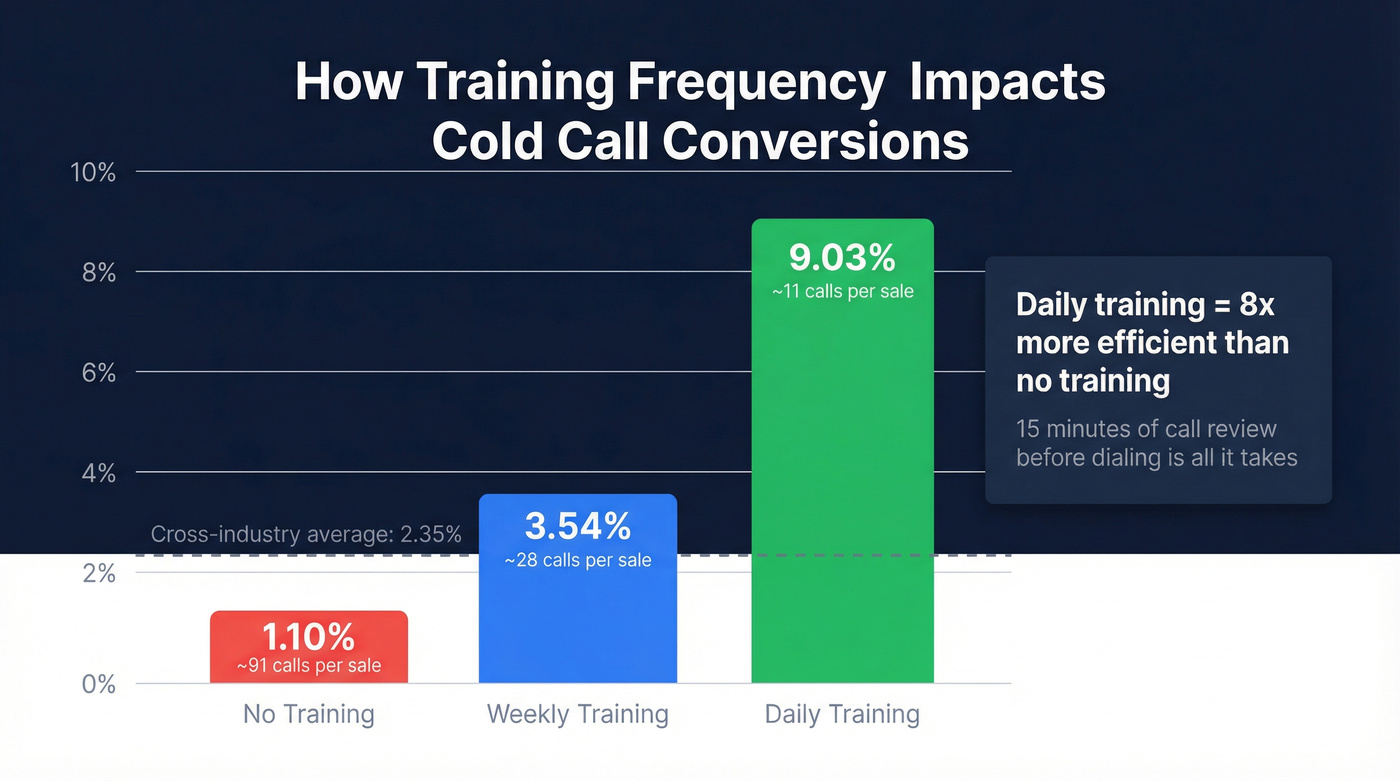

Look at what training does to conversion rates:

| Training Frequency | Conversion Rate | Calls Per Sale |

|---|---|---|

| No training | 1.10% | ~91 calls |

| Weekly training | 3.54% | ~28 calls |

| Daily training | 9.03% | ~11 calls |

Daily training doesn't mean a two-hour workshop. It means 15 minutes of call review, objection drilling, or listening to a recorded call before you start dialing. The difference between 91 calls per sale and 11 calls per sale is staggering - over 8x the no-training baseline - and it's entirely within your control.

Two more numbers worth knowing: 49% of buyers prefer a phone call as their first point of contact, and teams running structured cold calling programs generate 42% more leads than those relying solely on digital marketing. The phone isn't dead. Bad phone technique is.

Understanding the Shipping Manager

Before you pick up the phone, you need to understand who's on the other end.

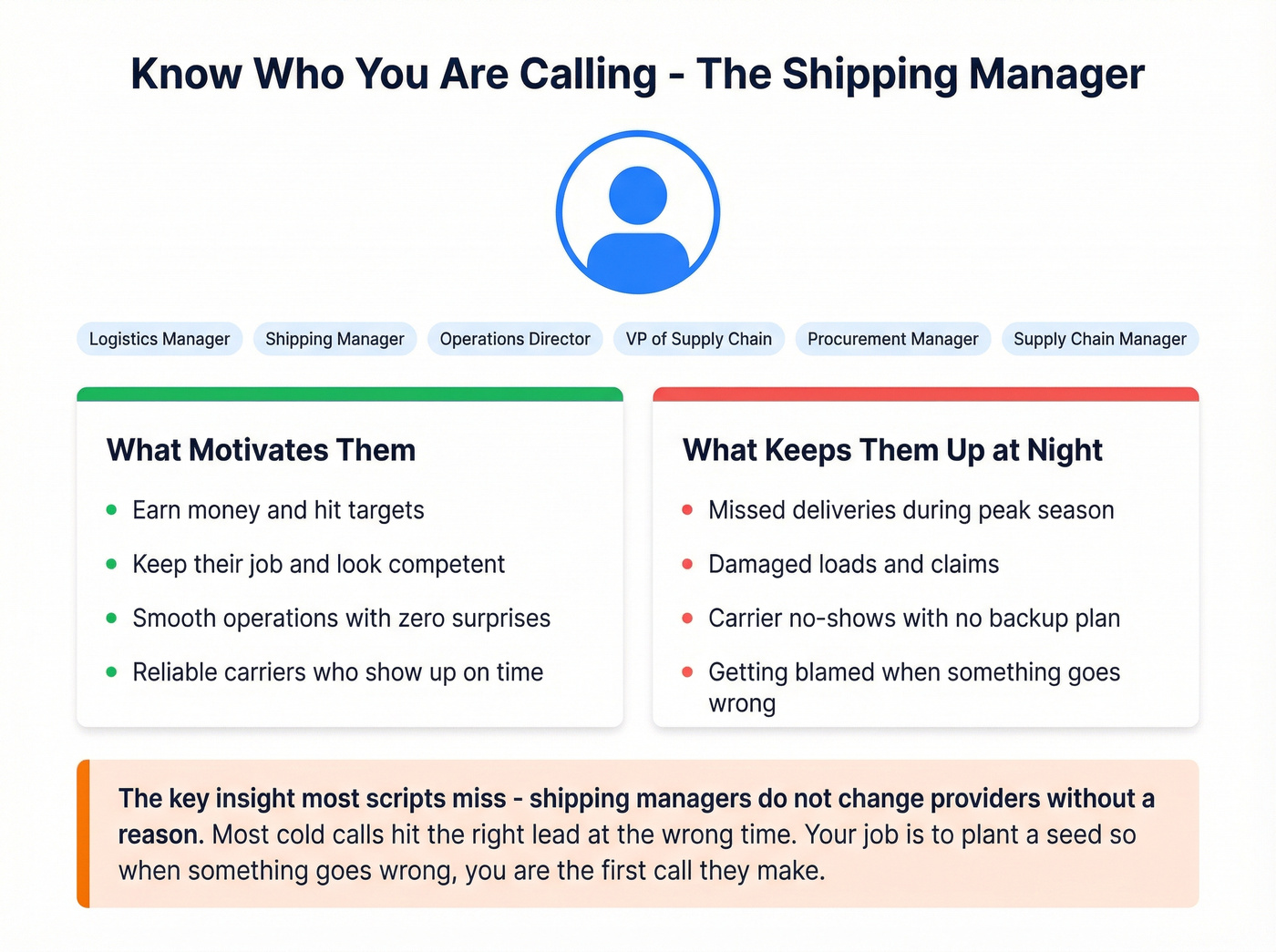

Shipping managers are responsible for everything related to the dock, yard, and warehouse. They get pitched by everyone - pallet suppliers, shrink wrap vendors, freight brokers, software companies, and every new 3PL that launched last quarter. By the time you call, they've already heard three versions of your pitch today.

Their motivations are simple: earn money, keep their job. Their fear is equally simple: a shipment going wrong on their watch. A missed delivery, a damaged load, a carrier no-show during peak season - these are the things that keep them up at night. Not your rate per mile.

Here's the insight most scripts miss: shipping managers don't change transportation providers without a reason. Most cold calls hit the right lead at the wrong time. Your job isn't to convince them their current setup is terrible. It's to plant a seed so that when something does go wrong - and it will - you're the first call they make.

The titles you're targeting: Logistics Managers, Shipping Managers, Operations Directors, VPs of Supply Chain, Procurement Managers, and Supply Chain Managers. The exact title varies by company size. At a 50-person manufacturer, the "shipping manager" might be the owner's nephew who also handles purchasing. At a Fortune 500, you're navigating a procurement committee.

The shipping manager who says "I'm covered" isn't lying. They are covered - until they're not. Your script needs to acknowledge that reality instead of fighting it.

Building Your Call List

Your script is only as good as the list behind it.

A single disconnected number costs you 2-3 minutes of dialing, waiting, and re-checking. Multiply that by 50 bad numbers a day, and you're losing around 2 hours to dead data. That's 2 hours you could've spent actually talking to shippers. The U.S. freight brokerage market is worth $51.7 billion, with over 17,000 brokerages actively operating - and more than 3,000 closing annually. The shippers are out there. The question is whether you can find the right contact at the right company with a working phone number.

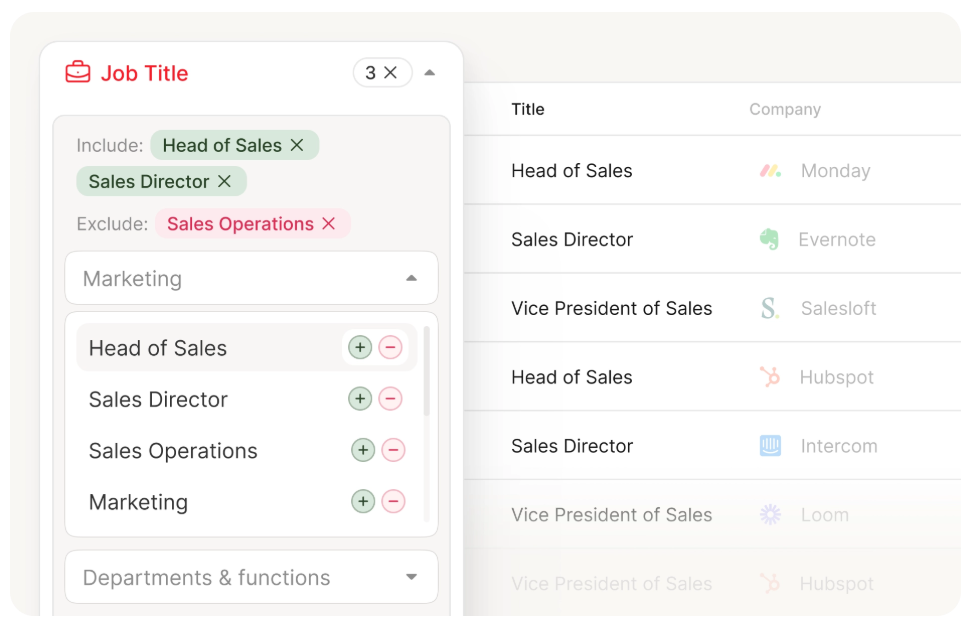

Here's where to build your list, ranked by efficiency:

- B2B data platforms - Search by job title (Shipping Manager, VP of Supply Chain), filter by industry (manufacturing, distribution, retail), and get verified direct dials. Fastest path to a clean list. If you need more direct-dial coverage, use a dedicated B2B phone number workflow.

- Industry directories - Thomasnet and IndustryNet for manufacturers. Good for finding companies, weak on contact data.

- Trade associations - TIA, NITL, CSCMP. Member directories and regional meetups are goldmines for warm introductions.

- Trade shows - MODEX, Breakbulk Americas, TIA Capital Ideas. Badge scans from last year's show are some of the warmest leads you'll ever call. (If you're doing events seriously, follow a tight trade show lead generation process.)

- Carrier and client referrals - Ask your existing network. A warm intro converts at 5-10x the rate of a cold dial. Keep a swipe file of referral template email options for fast intros.

- Local manufacturers - Drive through your nearest industrial park. Every loading dock is a potential customer.

Remember the intro - half the numbers in your list are disconnected? That's the problem tools like Prospeo solve. Filter for "Shipping Manager" at manufacturing companies with 50-500 employees using 30+ search filters, pull verified emails (98% accuracy) and direct mobile numbers, and you've got a targeted list in minutes instead of hours. The free tier lets you test it without a credit card.

The key is verified data. You're not paying for a list of names - you're paying to skip the gatekeepers and disconnected numbers that eat your day alive. If you're battling list rot, get familiar with B2B contact data decay and how to refresh before it hits your dialer.

Every disconnected number costs you 2-3 minutes. Over a full day, that's 2 hours lost to dead data. Prospeo gives you verified direct dials for shipping managers, logistics directors, and VPs of supply chain - 125M+ mobile numbers with a 30% pickup rate. Filter by industry, company size, and job title with 30+ search filters.

Fifty verified dials beat 300 spray-and-pray calls every single time.

Your logistics cold calling script is only as good as the list behind it. Prospeo refreshes data every 7 days - not every 6 weeks like competitors - so you're calling current contacts at $0.01 per email. 98% email accuracy means your follow-up sequences actually land, and 15,000 intent topics help you call shippers right when they're evaluating new providers.

Build a clean shipper list in minutes, not hours. Free tier included.

When to Call - The Freight Shipper's Weekly Schedule

Timing matters more in logistics than almost any other industry. Shippers have a weekly rhythm dictated by freight movement, and calling at the wrong time guarantees a hang-up.

This schedule comes from SalesDrip, a freight-specific CRM provider, and it's the only logistics-specific timing data I've found anywhere:

| Day | Morning | Afternoon |

|---|---|---|

| Monday | Never cold call | Follow-up only |

| Tuesday | Follow-up calls | Cold calls |

| Wednesday | Cold calls | Cold calls (prime) |

| Thursday | Follow-up calls | Cold calls |

| Friday | Never cold call | Best time to call |

Monday mornings are a graveyard. Shippers are dealing with freight that moved (or didn't move) over the weekend. Friday mornings are equally dead - they're finalizing outbound shipments and don't want to hear from you.

The counterintuitive winner? Friday afternoons. Shippers have cleared their outbound loads, the week's fires are mostly out, and they're in a more relaxed headspace. That's when they'll actually listen to a 30-second pitch.

Midweek afternoons - Tuesday through Thursday - are your bread and butter for cold calls. Use mornings for follow-ups with people who've already shown interest.

One more stat: you have approximately 8 seconds to capture attention on a cold call. That's not a lot of runway. If you want to track and improve that, start with answer rate benchmarks.

Pre-Call Research - The 5-Minute Prep That Doubles Your Conversion

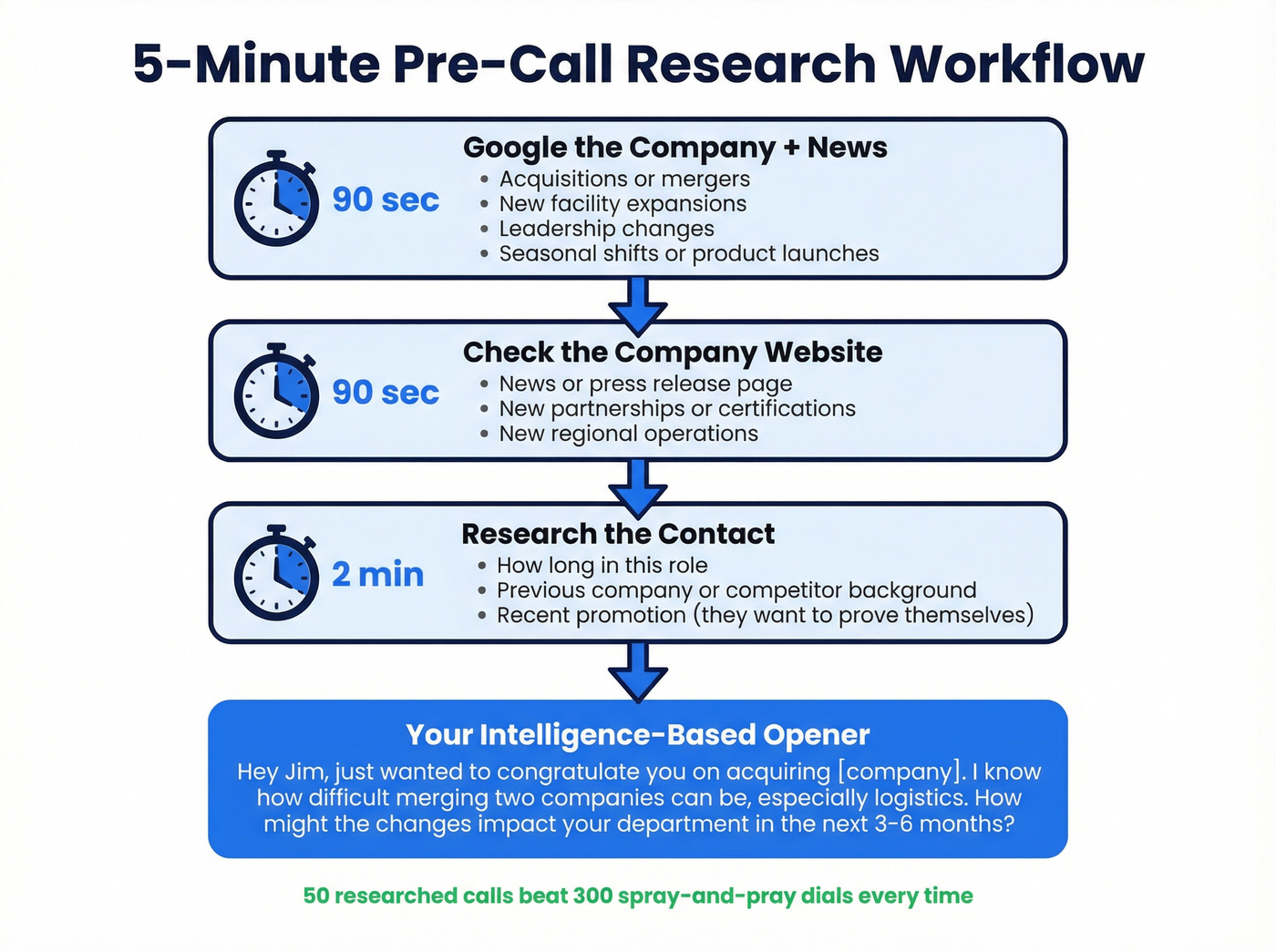

Every cold calling guide says "research your prospect." None of them tell you how. Here's the actual workflow:

Step 1: Google the company + industry news. Spend 90 seconds. You're looking for acquisitions, expansions, new product launches, leadership changes, or seasonal shifts. A company that just acquired another company has logistics headaches. A company expanding into a new region needs new lanes.

Step 2: Check the company website. Look at their "News" or "About" page. New facilities, new partnerships, new certifications - any of these give you a conversation starter that isn't "I'd love to move your freight."

Step 3: Search professional profiles for the contact's work history. How long have they been in this role? Did they come from a competitor? Did they recently get promoted? A newly promoted VP of Supply Chain is actively looking to make changes and prove themselves.

Now turn that research into an opener:

"Hey Jim, it's [your name] from [company]. Just wanted to congratulate you on acquiring [company name]. I know how difficult merging two companies can be, especially when it comes to logistics. How do you think the changes might impact your department in the next 3-6 months?"

That's an intelligence-based opener. It shows you did homework. It asks a question the prospect actually cares about. And it positions you as someone who understands their world - not just another broker reading from a script. For a tighter workflow, steal a pre call research checklist.

The revenue math makes this worth it. Even a small shipping client can be worth $10,000+ per year in profit. Medium to large shippers generate $100,000 to $1,000,000+ annually. Five minutes of research per call is a tiny investment against those numbers.

Why Your Script Isn't Working (The 5-Phase Fix)

Don't wing it. Every successful cold call to a shipper follows the same five phases, and each one has a job:

Phase 1: Opener (0-20 seconds)

Your only goal is to not get hung up on. Use a permission-based opener:

"Hey [name], I know I'm catching you out of the blue - do you have 30 seconds for me to explain why I called?"

This works because it's honest, it's respectful of their time, and it gives them a sense of control. Most people say yes out of curiosity.

Phase 2: Reason for Call (20-45 seconds)

State who you are, your company, and one specific reason this call is relevant to them. Not a feature dump. One reason.

"I work with [type of company] in [their region] to handle [specific freight type]. I noticed you recently [research-based observation], and I wanted to see if that's creating any new logistics challenges."

Phase 3: Qualify with a Light Question (45-75 seconds)

Ask one question that gets them talking. Not "what's your shipping volume?" - that's an interrogation. Try:

"What's been your biggest headache lately - capacity, pricing, or just keeping things consistent?"

This question works because it assumes they have a headache (they do) and gives them three easy options to pick from. Once they're talking, you're in a conversation, not a pitch. If you want a deeper bank of options, use these cold call qualifying questions.

Phase 4: Deliver Value + Social Proof (75-120 seconds)

Connect their answer to a result you've delivered:

"That's exactly what we helped [similar company] with. They were dealing with [same problem] and we [specific result - saved 18%, reduced transit time, covered a lane they couldn't fill]."

Phase 5: Ask for the Meeting

Don't ask for the sale. Ask for 15 minutes:

"Would it hurt to do a quick benchmarking call and just see how your current setup compares? Worst case, you confirm you've got a great deal. Best case, I save you some money."

Here's the thing about freight sales: there are 30,000 registered brokers selling the same services. Same trucks, same lanes, same capacity. The service itself is a commodity. You are the differentiator. If your average shipper account is under $15K annually, you probably don't need fancy sales tech - you need better conversations. The framework above gives you those conversations by leading with research, asking smart questions, and proving you've done this before.

Logistics Cold Calling Script Templates for Every Scenario

Copy these. Modify them. Make them yours. A script isn't a straitjacket - it's a safety net for when your brain freezes mid-call. Each template below targets a different situation.

First Contact - The Direct Opener

Use this when you have no prior relationship and limited research. It's your baseline.

"Hi [name], this is [your name] with [company] out of [city]. We specialize in [freight type/lane] for [industry type] companies. I know you probably work with a few carriers already, but I wanted to introduce myself in case you ever need backup capacity or a second option on pricing. Do you have 30 seconds?"

Keep it under 20 seconds. The goal is permission to continue, nothing more.

The Intelligence-Based Opener

This is the highest-converting opener in the playbook. Use it when you've done your 5-minute research and found something specific.

"Hey [name], it's [your name] from [company]. I saw that [company] just [expanded into a new market / acquired X / launched a new product line]. Congrats - that's a big move. I work with a lot of [industry] companies going through similar transitions, and logistics is usually the first thing that gets complicated. How are you handling the freight side of that?"

It proves you're not reading from a list. That alone puts you ahead of 90% of the brokers calling that day.

The "Plan B" Pitch - Before and After

Most reps hear "I'm covered" and panic. Here's what the bad version sounds like:

"Oh, okay. Well, if anything changes, give me a call. I'll send you my info."

That gets deleted immediately. Here's the version that works:

"I totally understand you're covered right now, and I'm not asking you to change anything. But what happens if your current broker can't find a truck during peak season? Or they're out of town when something goes sideways? I'd love to be your Plan B - someone you can call when you need a backup. No commitment, just a name in your phone. Can I send you my info?"

The difference? The bad version accepts the rejection. The good version reframes the relationship from "replacement" to "insurance."

The Cost-Focused Prospect

Skip this script if you can't back up the number with a real case study. Vague promises of "saving money" mean nothing. Lead with a specific number or don't lead with cost at all.

"Hi [name], this is [your name] with [company]. I recently helped a [similar industry] company save 18% on their [lane/region] freight by adjusting routing and consolidating vendors. I'm not saying I can do the same for you without looking at your lanes first, but would it be worth a 15-minute call to find out?"

The Referral Script

Social proof is the most powerful tool in transportation sales.

"Hey [name], I've been working with [similar company in their industry] on their [freight type] out of [region], and they suggested I reach out to you. They mentioned you might be dealing with some of the same challenges they were - specifically around [capacity/pricing/transit times]. Would you be open to a quick conversation?"

Even if the referral is loose ("I work with companies like yours"), the framing creates instant credibility.

The Seasonal/Capacity Play

When to use this: Time it around Q4 produce season, holiday retail, or any industry-specific peak. Calling about capacity three weeks before peak season hits is devastating.

"Hi [name], this is [your name] with [company]. I know [peak season] is coming up, and I've been hearing from a lot of [industry] shippers that capacity is already tightening on [specific lane/region]. I wanted to reach out now - before things get crazy - to see if you'd want a backup option locked in. Even if you don't need us, it's nice to have a number to call when your primary carrier can't cover a load. Worth a quick chat?"

The 3PL/Warehousing Pitch

The global 3PL market has surpassed $1.19 trillion, and 90% of Fortune 500 companies use at least one 3PL. If you're selling warehousing or fulfillment, lead with operational outcomes - not square footage.

"Hi [name], I'm [your name] with [company]. We help [industry] companies reduce fulfillment costs and improve delivery times through [specific service - regional warehousing, inventory optimization, last-mile solutions]. One of our clients in [similar industry] cut their per-order shipping cost by [X%] after consolidating with us. I know you're probably handling this internally or with another provider, but would it be worth comparing notes? Fifteen minutes, and if it doesn't make sense, no hard feelings."

Truck Dispatcher Cold Call Script

Use this when you're reaching out to dispatchers or fleet managers about capacity partnerships. The dynamic is different - dispatchers care about keeping trucks loaded and minimizing deadhead miles, not about your brokerage's brand story.

"Hey [name], it's [your name] with [company]. I've got consistent loads running [origin lane] to [destination lane] and I'm looking for reliable carriers to partner with on that corridor. Are your trucks running that direction regularly, and would it make sense to talk about keeping them loaded on the backhaul?"

This works because it leads with what the dispatcher actually wants - freight that keeps their trucks moving - rather than asking them to do you a favor.

The Warm Follow-Up Call

You spoke to a shipper last Tuesday. She was interested but busy. You said you'd send info. Now it's Thursday and you're calling back.

"Hey [name], it's [your name] from [company]. We spoke Tuesday about [specific topic you discussed]. I sent over some information on [specific thing] - did you get a chance to look at it? I had a couple of ideas about your [specific lane/challenge] that I wanted to run by you."

The key is specificity. Reference the exact conversation. Reference the exact material you sent. Generic follow-ups get ignored.

Getting Past the Gatekeeper

Overthinking gatekeeper scripts is one of the biggest mistakes freight brokers make. The more elaborate your approach, the more suspicious you sound.

Technique 1: The Direct Ask

"Hey, can I talk to [name]?"

That's it. No company name. No explanation. No "I'm calling from XYZ Logistics regarding your freight needs." Just ask for the person like you know them. This works 8 out of 10 times. Receptionists are trained to transfer calls, not interrogate callers. The moment you start explaining who you are and why you're calling, you've identified yourself as a salesperson.

Technique 2: Research the Gatekeeper

If the direct ask doesn't work, don't fight. Build rapport.

"I totally understand. Hey, maybe you can help me - I'm trying to figure out who handles the freight and logistics side over there. Is that [name], or is there someone else I should be talking to?"

Treat the gatekeeper as a resource, not an obstacle. Ask their name. Remember it for next time. They control access to your prospect, and being rude to them is career suicide.

Technique 3: Call the Sales Department Instead

This is the advanced move.

Logistics people are numb to cold calls. They get pitched all day. But sales reps? They're more empathetic - they make cold calls themselves. Call the sales line, have a brief conversation, and then ask: "Hey, who handles your outbound freight? I'd love to connect with them." You'll get a name, sometimes a direct number, and occasionally even a warm transfer. If you need more language like this, see how to ask for the right contact person.

Objections You'll Hear (and Exactly What to Say)

These are the 10 objections you'll hear most, ranked by frequency. Each one has a psychology behind it and a specific rebuttal. No matter which freight broker call script you're using, these rebuttals apply across the board.

"I already have a broker / I'm covered"

This is the #1 freight objection, and it's the one most reps fumble. The prospect isn't lying - they do have a broker. But "covered" doesn't mean "perfectly served." Hidden pains lurk behind this objection: missed capacity during peak seasons, inconsistent service, overpaying on lanes due to lack of competition, no dedicated support for complex loads.

Five rebuttal techniques, depending on the conversation:

- Isolation: "On a scale of 1-10, how confident are you that your current setup will handle your volume without issues next peak season?"

- Multi-Broker: "Most shippers I work with use multiple brokers to ensure competition and backup capacity. It's not about replacing anyone - it's about having options."

- Pain Probe: "What's been your biggest headache lately with freight - capacity, damages, or pricing volatility?"

- Value Add: "We don't replace existing relationships - we supplement them with dedicated lane expertise."

- Permission Close: "If I could show you a quick comparison on your top 3 lanes that might beat your current rates - would that be worth a look?"

"Your rate is too high"

Don't compete on rate. You'll lose to someone willing to go lower, and they'll lose the load.

"I hear you, and I'm not going to pretend I'm always the cheapest option. But I don't just sell rates - I sell trust, consistency, and peace of mind. When your carrier no-shows at 6 AM and you've got a customer waiting, the cheapest rate doesn't matter anymore. What matters is having someone who picks up the phone and solves it."

"Send me an email"

This is usually a polite dismissal. Call it out - gently.

"I'd be happy to. But honest question - are you going to read it, or is it going to sit in your inbox with 500 others? I'd rather take 30 seconds now and give you the one thing that might actually be useful. If it's not relevant, I'll send the email and get out of your hair."

"I'm not the decision-maker"

Don't argue. Use them as a bridge.

"Totally understand. Could you point me to the right person? And if you don't mind, could you give them a heads-up that I'll be reaching out? I'd really appreciate the introduction - it goes a long way."

"Call back later"

"Later" means never unless you nail down a time.

"Absolutely. When's a good time - would Tuesday at 10 AM work, or is Thursday afternoon better for you?"

Get a specific day and time. Put it in your CRM. Call at exactly that time. The fact that you followed through builds more credibility than any script.

"We don't work with brokers"

This objection is often based on a bad past experience.

"I get that - and honestly, some brokers deserve that reputation. But when it comes to tight lanes, specialty loads, or moments when carriers can't deliver, agents like me are the secret weapon that keeps your freight moving. I'm not asking you to change your whole setup. Just keep my number for the day you need a backup."

"We handle everything internally"

Respect their capability, then probe the edge case.

"That's impressive - not many companies can manage everything in-house. Quick question though: what happens when things get overloaded, or a lane opens up that you can't cover internally? Is there a contingency plan, or do you scramble?"

"I'm just shopping around"

They're comparing you to other brokers. Differentiate on reliability, not rate.

"Smart move - you should be comparing. Here's what I'd say: anyone can give you a rate. Not everyone can guarantee results. I'd love the chance to quote your top 3 lanes and show you what consistency looks like, not just a number on a spreadsheet."

"We're locked into a carrier contract"

Contracts expire. Plant the seed now.

"Makes sense. When does that contract come up for renewal? I'd love to do a benchmarking comparison before that date so you've got real data to negotiate with - whether you stay with them or not. No pressure, just information."

"We're not looking to make changes"

The "Plan B" positioning combined with a story.

"I completely understand. I had a client just like you who thought they were fully covered until their carrier canceled at the last minute during peak season. They called me on a Friday afternoon in a panic, and we had a truck there by Monday morning. I'm not asking you to change anything today. I just want to be the name in your phone when that day comes. Can I send you my info?"

Voicemail Scripts That Actually Get Callbacks

80% of your cold calls go to voicemail. A good voicemail script increases callbacks by up to 22%. Yet most freight brokers either skip the voicemail entirely or leave a rambling message that gets deleted in 5 seconds.

Rules before we get to scripts: keep it under 30 seconds, state your number twice (once at the beginning, once at the end), speak slowly, and always include a specific reason to call back.

The Pain Point Voicemail

"Hi [name], it's [your name] at [company], [phone number]. I work with [industry] shippers who are dealing with [capacity issues / pricing volatility / carrier reliability problems] heading into [season]. I've got some ideas that might help - give me a call back at [phone number]. Talk soon."

The Social Proof Voicemail

"Hey [name], [your name] from [company], [phone number]. I've been working with [similar company] and they just [cut transit times by 2 days / saved 18% on their Southeast lanes / locked in capacity for peak season]. I think I can do the same for you. Call me back at [phone number] when you get a chance."

The Ultra-Short Voicemail

This one is counterintuitive, but it works because curiosity is powerful.

"Hi [name], it's [your name]. Could you call me back? The number's [phone number]. Again, that's [phone number]. Thanks."

No company name. No pitch. Just enough mystery to get a callback.

The Results-Based Voicemail

"Hey [name], [your name] at [company], [phone number]. [Client company] just reduced their per-mile cost by 15% on their [region] lanes, and I know I can help you do the same. Worth a 5-minute conversation. Hit me back at [phone number]."

Voicemail best practices checklist:

- Under 30 seconds

- State your number twice (beginning and end)

- Speak slowly - they're writing your number down

- One specific reason to call back (not "I'd love to chat")

- Leave a voicemail every time - it's a free touchpoint

Post-Call Follow-Up Emails

A shipper once told me: "I get 100 of these a day. It's just a canned speech about your brokerage. I could care less about the brokerage. You're my agent. What are you going to do for me?"

That quote should be taped above every freight broker's monitor. Your follow-up email needs to answer that question in the subject line.

Subject line rules: 40-50 characters (7-9 words), personalize with their name or commodity, use numbers ("saved 18% in 2 months"), ask a question. Examples:

- "[Name], quick follow-up on your SE lanes"

- "15% savings on [commodity] freight - worth a look?"

- "The backup plan we discussed"

Template 1: After a Conversation

Subject: Following up - [specific topic discussed]

Hi [name],

Good talking with you today. As promised, here's a quick summary:

- You mentioned [specific challenge they shared]

- We've helped [similar company] solve that by [specific approach]

- I'd love to run numbers on your [top lane/region] - no commitment, just a comparison

Would [day] at [time] work for a 15-minute call?

[Your name] [Phone number]

Template 2: The Unconventional Intro

This approach, adapted from Kopf Logistics Group, works because it leads with character instead of capabilities:

Subject: Let me tell you why I'm different

Hi [name],

I know you get 100 emails from brokers. Here's why I'm worth reading:

- I answer my phone at 6 AM and 10 PM

- I treat your freight like I own the product on the truck

- I don't disappear after the load books - I track it until it delivers

I know you probably have difficult lanes you could use help with. Let me work one lane for you. Just one. Let me prove what I can do.

[Your name] [Phone number]

Template 3: After a Voicemail (No Prior Conversation)

Subject: Just left you a voicemail - [specific reason]

Hi [name],

I just tried calling - sounds like you're busy (shipping managers always are). Quick reason I reached out: I work with [industry] companies in [region] and I've been seeing [specific trend - tightening capacity, rate increases, carrier consolidation].

If that's hitting your operation too, I've got some ideas. If not, no worries - just wanted to introduce myself.

[Your name] [Phone number]

Send follow-up emails within 1 hour of your call. The conversation (or voicemail) is still fresh, and same-day follow-ups increase engagement over next-day sends.

The Full Cadence - From First Call to Closed Deal

One call doesn't close a logistics deal. It takes an average of 4.8 touches just to get an initial response, and 6-8 touchpoints to close a 3PL deal. Most reps give up after 2-3 touches. That's where the money is - in touches 4 through 8.

Here's a realistic multi-touch cadence:

| Day | Action |

|---|---|

| Day 1 | Cold call + voicemail |

| Day 1 | Follow-up email (within 1 hr) |

| Day 3 | Second call attempt |

| Day 5 | Value-add email (article, rate insight) |

| Day 8 | Third call + voicemail |

| Day 10 | Email with social proof |

| Day 15 | Fourth call |

| Day 30 | Check-in email |

| Day 60 | Circle back call |

Circle back to every lead every 60 days. That's not stalking - that's persistence. The shipper who said "I'm covered" in January might have a carrier no-show in March.

Execution tips:

- Cold call in 20-30 minute blocks, then take a break. Nobody thrives with that much rejection back-to-back.

- Track KPIs: prospects who answered, average call length, email responses, meetings booked. If you're not measuring, you're guessing.

- Block your calendar. Treat calling time like a meeting - non-negotiable.

Staying Motivated Through the Rejection

Look, cold calling in logistics is brutal. The conversion rate is 1.77%. That means 98 out of 100 calls don't convert. Reddit's r/FreightBrokers is full of posts about "Cold Calling Blues," and every freight broker has had weeks where they question their career choice.

The math reframe helps: it takes 56 calls per sale. Rejection isn't personal - it's math. Every "no" gets you closer to the next "yes." If you're making 150-200 calls a day (a realistic range for active brokers, with top performers hitting 250+), you should be generating 2-4 sales opportunities per day.

The 20-30 minute block approach is essential. Dial hard for 25 minutes, then stand up, walk around, grab water. Come back and do another block. This prevents the zombie-dialing that happens at hour three when you're reading the script like a robot and prospects can hear it in your voice.

Daily training - even 15 minutes - pushes your conversion rate from 1.10% to 9.03%. That's the single highest-leverage activity in your day.

Stop memorizing scripts. Start memorizing objections. The script gets you through the first 20 seconds. Objection handling is what gets you the meeting.

FAQ

How many cold calls should a freight broker make per day?

Aim for 150-200 calls per day, with top performers hitting 250+. Quality beats quantity though - 50 well-researched calls with intelligence-based openers outperform 300 spray-and-pray dials. Track conversations and meetings booked, not just raw dials.

What's the best time to cold call shippers?

Friday afternoons are the single best window - shippers have cleared outbound loads and are winding down. Midweek afternoons (Tuesday through Thursday) are also strong. Avoid Monday mornings and Friday mornings entirely; shippers are buried in operational fires during those windows.

How do you get past a gatekeeper at a shipping company?

Ask directly: "Hey, can I talk to [name]?" - no company name, no explanation. Receptionists transfer calls; they don't interrogate. If blocked, call the prospect's sales department instead and ask who handles freight. Sales reps are empathetic to cold callers and will often share a name or direct number.

What's the average cold call conversion rate in logistics?

Logistics cold calls convert at 1.77%, or roughly 1 sale per 56 calls - below the 2.35% cross-industry average. Daily 15-minute training sessions can boost this to 9.03%, over 8x the untrained baseline of 1.10%. The gap between trained and untrained reps is the biggest lever in freight sales.

What's a good free tool for building a logistics cold calling list?

Prospeo's free tier gives you 75 email credits and 100 Chrome extension credits monthly - enough to build a starter list of verified shipping manager contacts without a credit card. Combine that with Thomasnet for company discovery and TIA member directories for warm leads. The key is verified direct dials so you skip gatekeepers and disconnected numbers entirely.