Cold Call Qualifying Questions That Actually Work (2026)

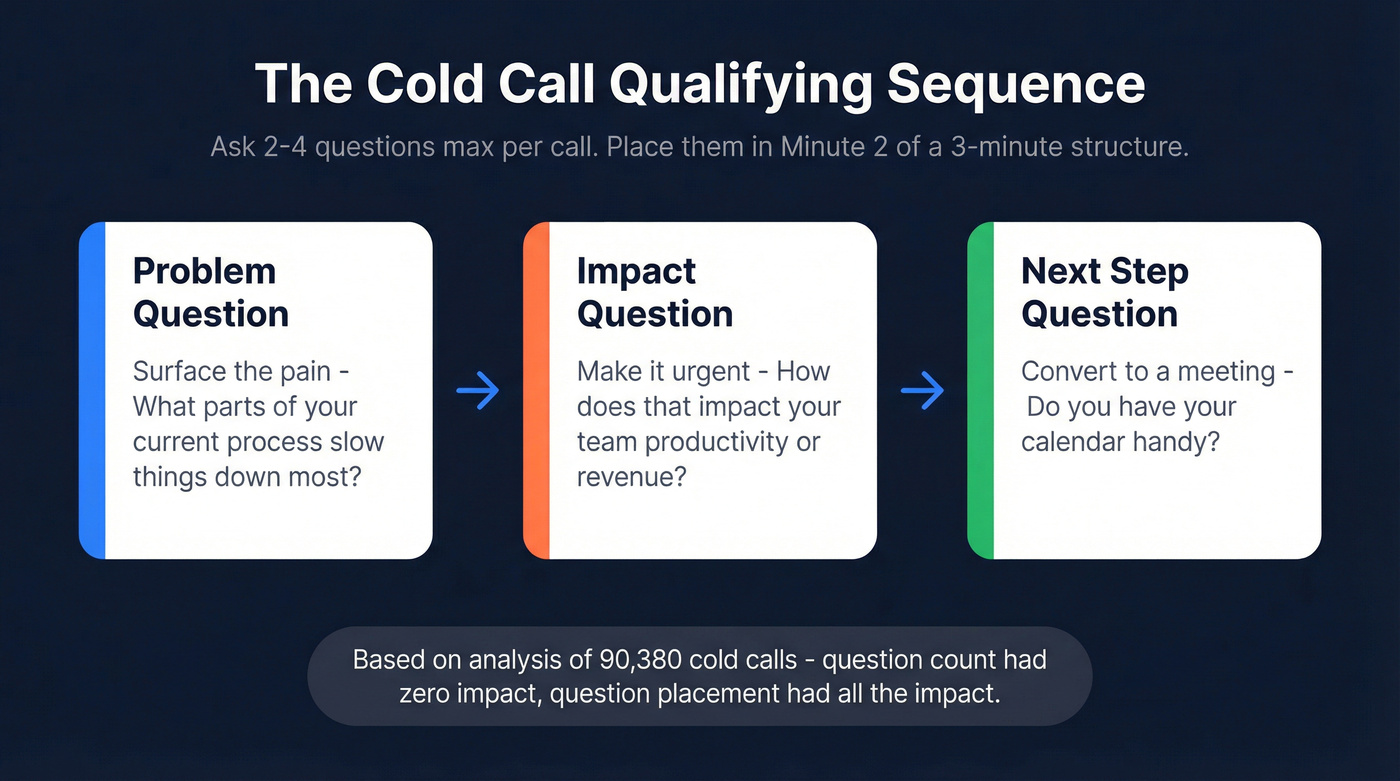

Gong analyzed 90,380 cold calls and found something that should make every sales manager uncomfortable: the number of qualifying questions reps asked had zero statistical difference between successful and unsuccessful calls. Zero. Not "slight" - zero.

That means every "50 Best Cold Call Questions" listicle is solving the wrong problem. The issue isn't finding more cold call qualifying questions to memorize. It's knowing which 2-4 questions actually move a conversation forward - and where to place them.

The numbers paint a clear picture. Industry average cold call success rate sits at 2.3%, but phone-first teams using verified contact data convert at 11.3%, nearly 5x higher. Meanwhile, 82% of buyers say they'll accept meetings from sellers who reach out proactively. The opportunity is massive. Most reps just squander it by asking the wrong questions at the wrong time.

Successful cold calls average 5 minutes and 50 seconds. Failed ones die at 3:14. The difference isn't interrogation skill. It's structure, timing, and understanding that a cold call is not a discovery call - most reps confuse the two, and it costs them meetings every single day. Sellers who focus on problems during calls are 30% more effective, yet only 13% actually do it. That gap is where this guide lives.

The Short Version

If you're pressed for time, here's the framework:

- Ask 2-4 qualifying questions per cold call. Question count doesn't matter - data across 90,380 calls proves it. Stop memorizing 40 questions. Place yours in Minute 2 of a 3-minute structure.

- Every cold call needs three types of questions: one problem question, one impact question, one next-step question. That's the formula.

- Use the "problem → impact → next step" sequence. Problem surfaces the pain. Impact makes it feel urgent. Next step converts it into a meeting.

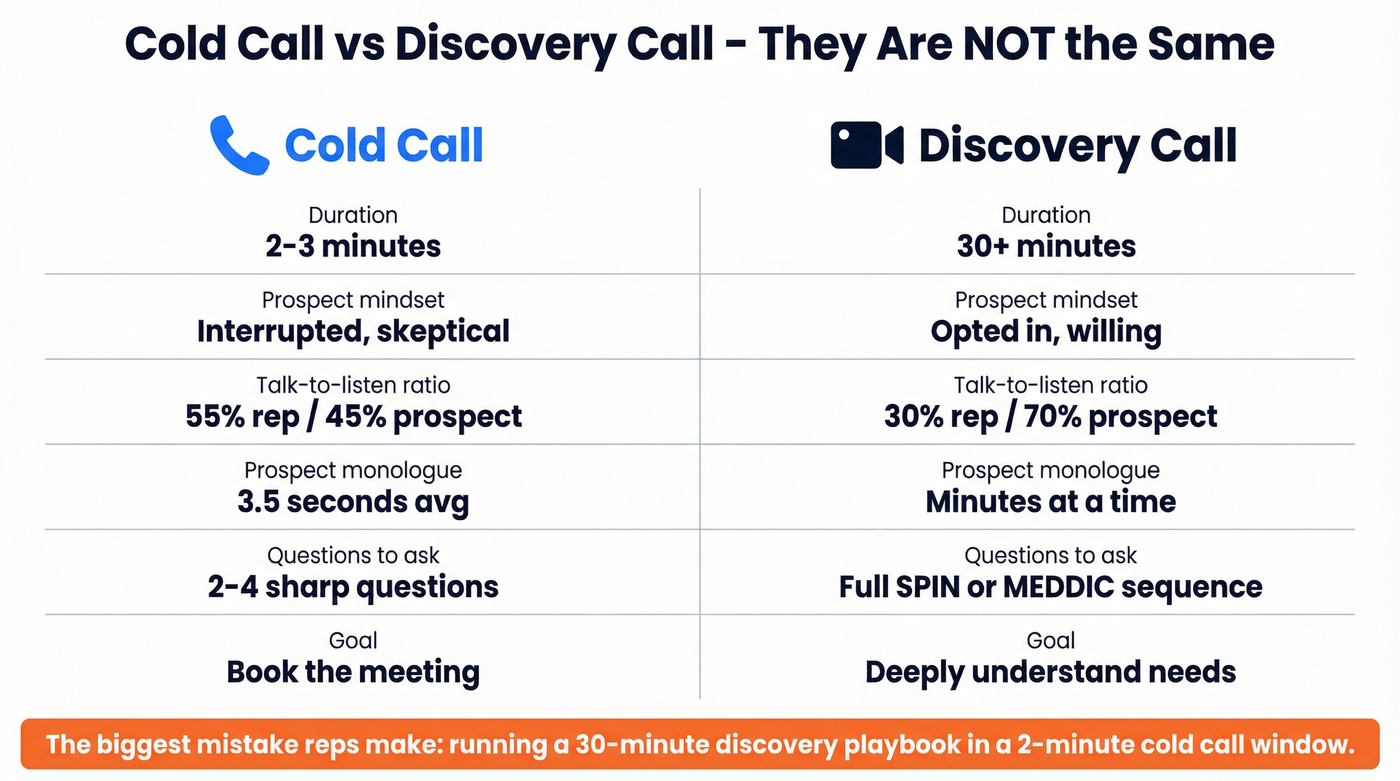

- The biggest mistake: treating a cold call like a discovery call. Discovery calls are 30-minute conversations with willing participants. Cold calls are 2-3 minute interruptions. Different animal, different questions.

Stop Treating Cold Calls Like Discovery Calls

Here's the thing: a discovery call is a 30-minute conversation with someone who voluntarily showed up. A cold call is a 2-minute interruption from someone who accidentally picked up the phone. These are fundamentally different situations, and using the same questioning strategy for both is one of the most common mistakes in sales.

A counterintuitive but effective framework: book the meeting first, qualify second. The logic is simple - once a prospect agrees to a meeting, they're invested in making it productive. That's when they'll actually answer your questions honestly. Try to run a full BANT checklist before you've earned 30 seconds of trust, and you'll hear a click.

The data backs this up in ways that contradict conventional sales wisdom. The talk-to-listen ratio on successful cold calls is 55% rep / 45% prospect. The rep talks more. On discovery calls, it's the opposite - you want the prospect doing most of the talking. But on a cold call, you need to deliver enough value and context to earn the right to ask anything at all.

Here's the stat that surprises everyone: the average prospect monologue on a successful cold call is only 3.5 seconds.

The prospect barely talks. They give short, direct answers. Successful calls also feature longer rep monologues - 37 seconds on average versus 25 seconds on unsuccessful calls, with 70% more extended monologues (20 versus 12 per call). The rep does the heavy lifting: framing the problem, delivering social proof, and guiding the conversation toward a next step.

So if you're coaching reps to "ask more open-ended questions" on cold calls, you're coaching them toward failure. The goal isn't to get the prospect talking for 5 minutes. It's to ask 2-3 sharp questions that confirm fit and create enough curiosity to book the meeting. Brevity and precision beat volume every time.

Bottom line: bombarding your prospect with the entire SPIN Selling question sequence is overkill. It's a cold call, not a therapy session.

The 3-Minute Cold Call Framework (Where Qualifying Questions Fit)

Most cold calls that convert follow a predictable structure. 49% of successful cold calls last between 2 and 5 minutes.

Minute 1: The Opener and Value Prop

Your first 30-45 seconds determine whether you get a Minute 2. The data on openers is definitive:

- "How have you been?" produces a 6.6x higher success rate than baseline. It's a pattern interrupt - prospects expect a pitch, not a casual greeting.

- "The reason for my call is..." increases success rates by 2.1x. Stating your reason keeps you in control and respects the prospect's time.

- "Did I catch you at a bad time?" drops meeting booking chances by 40%. It hands the prospect an easy exit. Never ask it.

- "I'll be upfront, this is a cold call" is gaining traction as a pattern interrupt - it disarms prospects within the first 27 seconds because it's honest and unexpected.

Lead with a quick intro, state why you're calling, and drop one piece of social proof: "We're helping [similar companies] solve [specific problem]."

Minute 2: The Qualifying Questions

This is your window. You've earned 60-90 seconds of attention. Use it for 1-2 qualifying questions - not 5, not 8. One problem question. Maybe one impact question if the conversation flows.

The key: these questions should feel like conversation, not interrogation. "How are you currently handling [specific process]?" beats "What's your budget for this?" every time.

Minute 3: The Next Step

The close isn't a 10-second afterthought - it's the main event. In the most successful cold calls analyzed, next steps consumed roughly half of the conversation. "Do you have your calendar handy?" is the recommended close. Direct, assumptive, and hard to deflect without a real objection.

Cold call success jumps from 2.3% to 11.3% when reps use verified contact data. Prospeo gives you 125M+ verified mobile numbers with a 30% pickup rate - so your sharp qualifying questions actually reach a human, not a voicemail.

Stop perfecting questions nobody hears. Start dialing numbers that connect.

The 20 Cold Call Qualifying Questions That Actually Work

These aren't generic questions pulled from a textbook. Each one is adapted for the reality of cold calls - short conversations with skeptical strangers who didn't ask to talk to you.

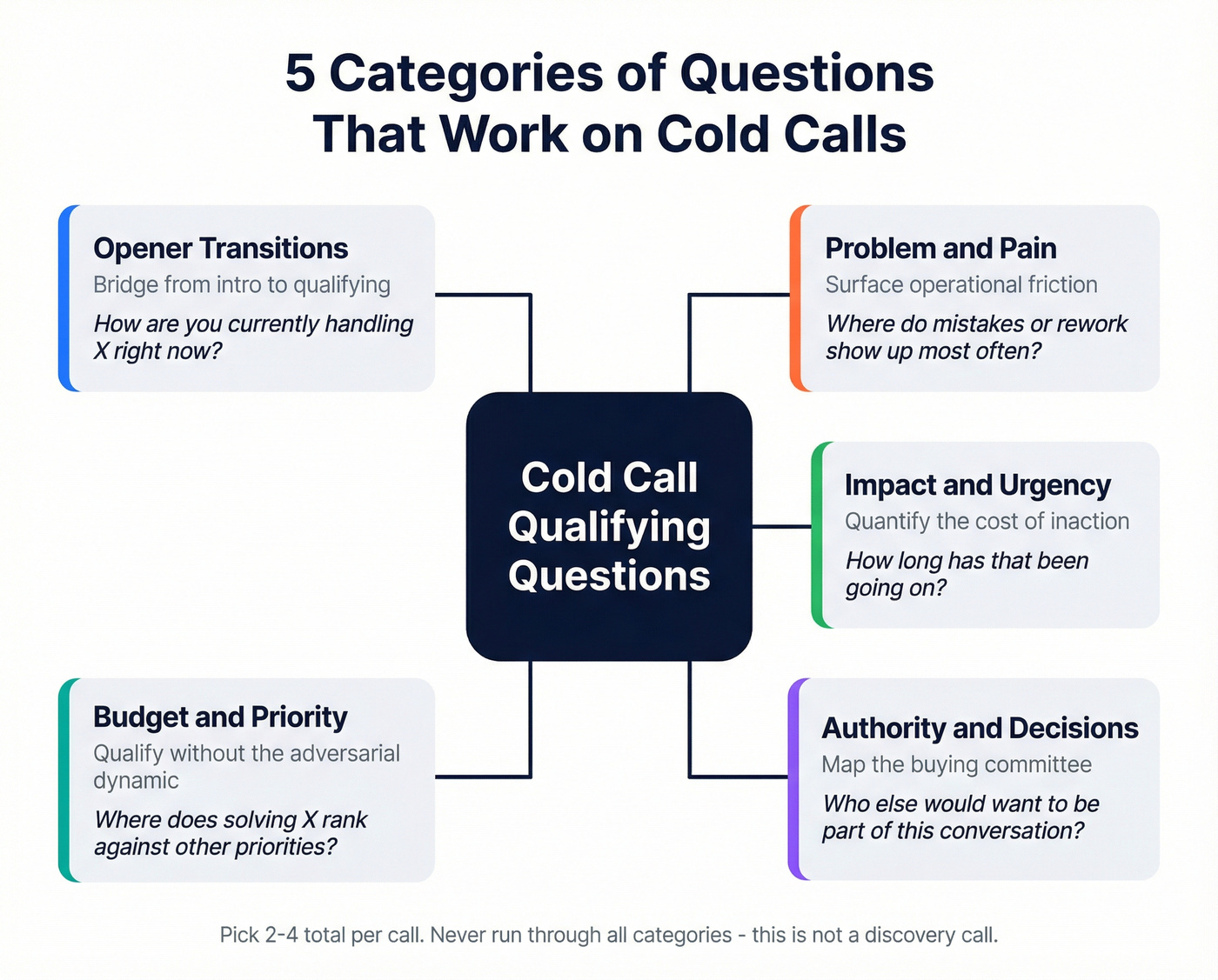

Opener Transition Questions

These bridge the gap from your intro to the qualifying portion.

"How are you currently handling [specific process] right now?" Replaces the terrible "Are you happy with your current provider?" Open-ended without being invasive, and it gives you intel on their current stack and workflow.

"We're hearing a lot of [industry] teams struggling with [specific problem]. Is that on your radar?" Social proof baked into a question. You're not asking if they have a problem - you're telling them others do and checking if it resonates.

"Quick question - is [specific challenge] something your team's actively trying to solve, or is it more of a back-burner thing?"

Does double duty: qualifies for urgency and gives the prospect an easy, non-committal way to engage.

Problem and Pain Questions

These are the money questions - the probing questions that separate top performers from script readers. Adapted from SPIN's Problem Questions for cold call brevity.

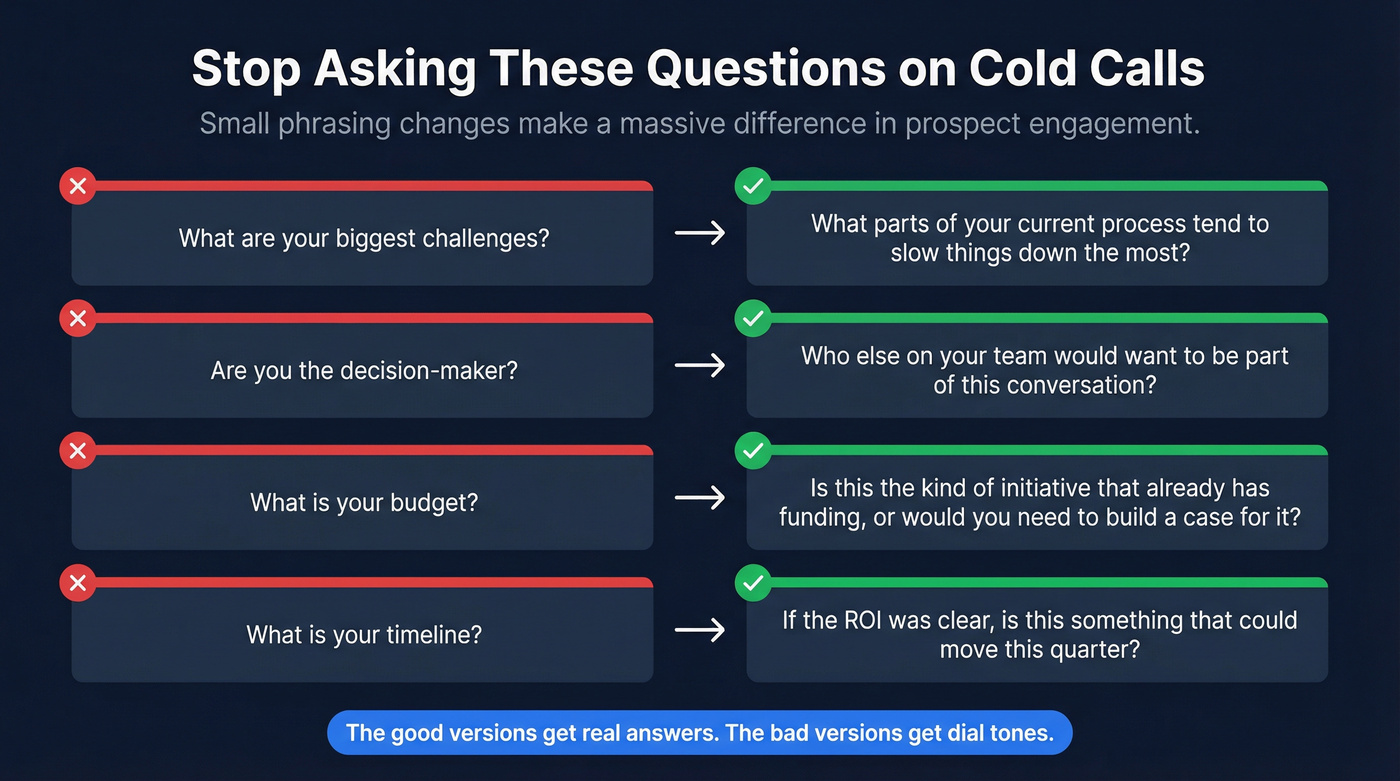

Bad version: "What are your biggest challenges?" Good version: "What parts of your current process tend to slow things down the most?"

The bad version sounds like a scripted sales question because it is one. The good version surfaces operational pain with enough specificity to trigger a real answer.

"Where do mistakes or rework show up most often?" Reps who ask about "challenges" get vague responses. Reps who ask about "mistakes and rework" get stories.

"If you could fix one thing about how your team handles [process], what would it be?"

The magic word is "one." It forces prioritization, which tells you exactly what they care about most.

Scenario: A prospect says "We're pretty happy with our current setup." Don't panic. Try: "That's great to hear. Most teams we talk to say the same thing - until we ask about [specific pain point]. Is that area running smoothly too?" This reframes satisfaction as an opening, not a dead end.

Impact and Urgency Questions

These are Sandler Pain Funnel escalation questions adapted for a 2-minute window. Pick one.

"How does that impact [revenue/team productivity/customer experience]?" Takes whatever problem they just mentioned and makes them quantify the cost. One of these creates enough urgency for a cold call.

"How long has that been going on?" Duration implies severity. "Six months" is a festering problem. "Just started last quarter" is an active buying trigger.

"What happens if nothing changes in the next 6 months?" Forces the prospect to project forward and feel the cost of inaction. Powerful, but save it for conversations that are already flowing - it's too aggressive for a prospect who hasn't opened up yet.

Authority and Decision-Making Questions

B2B buying committees now average 6-10+ stakeholders. Asking "Are you the decision-maker?" point-blank is both rude and useless - nobody says "no, I'm irrelevant."

"Who else on your team would want to be part of this conversation?"

Inclusive, not threatening. Assumes they're important while naturally surfacing other stakeholders.

| Question | What It Actually Reveals |

|---|---|

| "What was the approval process like for your last major tech investment?" | Buying process, authority chain, timeline - 47% higher meeting-to-opportunity conversion |

| "If this looked like a fit, what would next steps typically look like on your end?" | Authority, internal politics, and urgency in one answer |

Budget and Priority Questions

"What's your budget?" is the worst qualifying question you can ask on a cold call. Smart buyers either lowball you to negotiate later or tell you they don't have one yet. Budget isn't a qualification question - it's a value conversation. We've tested both approaches - leading with budget vs. leading with challenges - and the difference in prospect engagement is night and day.

"Is this the kind of initiative that already has funding, or would you need to build a case for it?" Tells you everything "What's your budget?" would, without the adversarial dynamic.

"Where does solving [problem] rank against the other priorities on your plate right now?" Priority trumps budget. A company with no budget but a burning priority will find money. A company with budget but no urgency will ghost you for months.

"If the ROI was clear, is this something that could move this quarter?" Timeline question disguised as a hypothetical. Qualifies for urgency without the dreaded "What's your timeline?"

Next-Step and Close Questions

This is why the close isn't an afterthought - it's where successful cold calls spend most of their time.

"Based on what you've shared, it sounds like it'd be worth a deeper conversation. Do you have your calendar handy?" Direct and assumptive. The silence after this question is critical - don't fill it.

"I'd love to show you how we helped [similar company] solve exactly this. Can we grab 15 minutes this week?" Social proof plus a specific, low-commitment ask. "15 minutes this week" is easier to say yes to than "a demo."

"I don't want to take more of your time right now - can I send you a calendar link for [day]? I'll bring some data on how we've helped teams like yours." The graceful exit close. Respects their time, offers value for the next conversation, and gives a specific day rather than an open-ended "sometime."

Full Cold Call Scripts with Qualifying Questions in Context

Questions in isolation are useless. Here's how they sound inside actual conversations. Before you dial, verify you're reaching the right person - stale data means wasted qualifying time. Tools like Prospeo refresh contact data every 7 days, so you're not burning your 3 minutes on someone who changed jobs 6 months ago.

If you're building a full calling motion (not just scripts), pair this with a B2B cold calling guide so your questions match your KPIs and call flow.

SaaS Cold Call Script

Target: VP of Operations at a mid-market company using a competitor's tool.

Rep: "Hey Sarah, this is Mike from [Company]. How have you been?"

Prospect: "Oh, hey - good, thanks. What's this about?"

Rep: "Mike from [Company]. The reason for my call - we're working with a few ops teams in [industry] who were spending 15+ hours a week on manual reporting in [Competitor Tool]. I wanted to see if that's something your team deals with too."

Prospect: "I mean, yeah, reporting is a pain point for us."

Rep: "Got it. Quick question - what parts of the reporting process tend to slow your team down the most?"

Prospect: "Honestly, it's the data consolidation. We're pulling from three different systems and nothing talks to each other."

Rep: "That's exactly what [Similar Company] was dealing with before they switched. They cut reporting time by about 60%. I'd love to show you how - do you have your calendar handy for 15 minutes this week?"

Prospect: "Uh, sure. Thursday works."

Rep: "Perfect. Just so I make the most of your time - who else on your team would want to be part of that conversation?"

Two qualifying questions. One problem question, one authority question. The rest is value delivery and closing. Notice how the questions were woven naturally into conversation - no interrogation, no checklist feeling.

Professional Services Cold Call Script

Target: Owner of a regional accounting firm during tax season.

Rep: "Hi David, this is Lisa from [Company]. The reason I'm calling - we're helping accounting firms in [region] handle the post-tax-season client surge without adding headcount. I know timing is everything in your world, so I'll be quick."

Prospect: "Okay, you've got 30 seconds."

Rep: "Fair enough. Most firms we talk to are managing client onboarding manually - spreadsheets, email chains, the works. How are you currently handling that?"

Prospect: "Yeah, it's mostly manual. We've got a system but it's held together with duct tape."

Rep: "How long has that been the situation?"

Prospect: "Honestly? Years. We just deal with it every season."

Rep: "That's what we hear a lot. [Similar Firm] was in the same spot - they automated their onboarding and freed up about 20 hours a week per partner. Would it be crazy to grab 15 minutes next week to see if something similar could work for you?"

One problem question, one duration question from the Sandler Pain Funnel. Clean close with social proof.

Which Qualifying Framework to Use (And When)

Not every framework fits every cold call. Here's when each one earns its place - and how to pick the right approach for your deal size and sales motion.

| Framework | Best For | Cold Call Fit | Key Question | Skip It When |

|---|---|---|---|---|

| BANT | Transactional, <60-day cycles | Low | "Is there budget allocated?" | Deals over $50K - feels like an audit |

| CHAMP | Challenge-led, mid-market | High | "What's your biggest challenge with X?" | You're cold-calling C-suite (too basic) |

| MEDDIC | Enterprise, $100K+ ARR | Low | "What defines success?" | Any cold call - save it for discovery |

| SPIN | Consultative, complex | Medium | "What happens if nothing changes?" | High-velocity transactional sales |

| NEAT | Buyer-psychology-first | High | "What's the economic impact?" | Inbound leads (they already know the impact) |

If you want a deeper scorecard approach beyond frameworks, use a dedicated set of deal qualification questions so reps aren’t improvising what “fit” means.

BANT was created by IBM in the 1960s. It still works for transactional sales with short cycles and 1-3 decision-makers. But leading with "What's your budget?" on a cold call is a conversation killer. If you must use BANT, reorder it - Challenges first, Budget last.

CHAMP (Challenges, Authority, Money, Prioritization) is the best framework for cold calls because it leads with the prospect's pain. You're not asking what they can spend - you're asking what's broken. That's a conversation people will actually have with a stranger on the phone.

MEDDIC is the gold standard for enterprise sales - 73% of SaaS companies selling above $100K ARR use some version. But it requires deep discovery across multiple calls. I've seen teams waste months trying to force MEDDIC into cold call scripts. It doesn't work. Save it for discovery.

SPIN is based on Neil Rackham's analysis of 35,000+ sales calls. Brilliant for consultative selling, but the full Situation → Problem → Implication → Need-Payoff sequence takes time. On a cold call, cherry-pick one Problem question and maybe one Implication question. That's it.

NEAT (Need, Economic Impact, Access to Authority, Timeline) focuses on buyer psychology over checklists. It's the most modern framework and works well on cold calls because it doesn't feel like an interrogation.

Real talk: if your average deal is under $15K, you don't need MEDDIC or SPIN. Use CHAMP, keep your cold calls under 4 minutes, and book the meeting. Overcomplicating the qualification stage is how mid-market teams convince themselves they're doing enterprise sales while their pipeline stalls.

Industry-Specific Qualifying Questions

Generic questions get generic answers. Here's what to ask when you know the industry.

SaaS

Before you dial a SaaS prospect, know their tech stack. Technographic filters let you target companies already running a competitor's product, so your opener becomes "How's [Competitor] working out?" instead of "What tools are you using?"

- "How are you currently handling [specific workflow] - built in-house or off the shelf?"

- "What made you choose [Competitor Tool] originally, and has anything changed since then?"

- "If you could wave a magic wand and fix one thing about your current stack, what would it be?"

The SaaS qualifying angle is always pain + data. Lead with a specific metric: "We helped [Company] reduce churn by 23%." Then qualify around whether they have the same problem.

Insurance

Insurance cold calling has brutal numbers - only 28% of calls get answered, and the meeting booking rate from conversations is 4.82%. Every second counts.

- "If you had to file a claim tomorrow, do you feel confident you'd be fully covered?"

- "When's the last time someone reviewed your coverage against what's actually changed in your business?"

- "Are there any upcoming events - new property, new employees, retirement planning - that might affect your coverage needs?"

The qualifying angle in insurance is coverage gaps and renewal timing. If their renewal is 4+ months away, you're too early. Note it and call back.

Real Estate

- "I noticed your lease at [property] might be coming up. Have you started thinking about what's next?"

- "How's your current space working for the team size you have now versus where you'll be in 18 months?"

- "What would need to be true for you to consider relocating?"

Real estate qualifying is all about timing. Lease expiration dates are public information - use them.

Recruiting

- "Based on your background, there's a role I'm working on that might be worth hearing about. Are you open to exploring, or are you locked in where you are?"

- "What would a move need to look like for it to be worth your time?"

- "Is compensation the main driver, or is it more about the role itself?"

The key distinction: passive versus active candidates. Your qualifying questions need to determine which you're talking to in the first 15 seconds.

Financial Services

Skip this section if you're not in financial services - these questions are compliance-sensitive and won't transfer well to other industries.

- "I specialize in helping professionals like you optimize retirement income and minimize tax exposure. Is that something you're actively working on?"

- "How are you currently handling your tax planning - someone dedicated to that, or part of a broader relationship?"

- "What's your timeline for making any changes to your financial strategy?"

Don't ask about assets directly on a cold call. Qualify around timeline and current advisory relationships instead.

Five Qualifying Mistakes That Kill Cold Calls

67% of lost sales result from poor qualification. Only 39% of firms consistently apply clear qualification criteria. Here's where it goes wrong.

1. Treating the Cold Call Like a Discovery Call

Discovery calls have willing participants, 30-minute windows, and an expectation of deep conversation. Cold calls have reluctant strangers and maybe 120 seconds. When you try to run a full SPIN sequence or MEDDIC framework on a cold call, you're not being thorough - you're being tone-deaf.

Pick 2 questions. Make them count.

2. The Interrogation Trap

Rapid-fire BANT questions - "What's your budget? Who's the decision-maker? What's your timeline?" - sound like a police interrogation. In our experience, this is the #1 reason new SDRs burn through their call lists with nothing to show for it. As one r/sales commenter put it: "How do you transition from random asshole on the phone to someone the prospect would be willing to share information with?" You earn it by leading with value, not questions.

3. Qualifying Too Early

Asking qualifying questions in the first 15 seconds triggers immediate resistance. You haven't established any credibility or relevance yet. Minute 1 is for your opener and value prop. Minute 2 is for questions. Violate this sequence and you'll feel the temperature drop instantly.

If you’re trying to fix early-call drop-offs, start by tracking your answer rate so you know whether it’s a list problem or a script problem.

4. Ignoring the Buying Committee

"Are you the decision-maker?" is a trap question. Nobody says no. But B2B deals now involve 6-10+ stakeholders. If you qualify only the person who picked up the phone, you'll get blindsided in week 6 when "the committee" kills your deal.

Ask "Who else would want to be part of this conversation?" instead.

If you want to understand why committees behave this way (and how to map them fast), read up on B2B decision making.

5. Not Confirming Next Steps

The most painful mistake because it happens after you've done everything else right. You asked great questions, surfaced real pain, built rapport - and then you said "I'll send you some information" instead of "Do you have your calendar handy?" Qualifying without closing is just a nice conversation that goes nowhere.

Advanced Techniques: Socratic Questioning and the Sandler Pain Funnel

Socratic Questioning on Cold Calls

Here's a technique that separates good cold callers from great ones: never answer a question directly without building a question into your response. As long as you're asking the questions, you retain control. The moment you start answering at face value, you've handed over the steering wheel.

The danger in action: A prospect asks, "Do you have a recruitment background?" A rookie answers honestly - "No, I come from tech sales." The prospect immediately disqualifies them. A Socratic rep responds: "I'm guessing that's important to you for a reason?"

Now the prospect is explaining their concern, and you're back in control.

When a prospect asks "What do you do?" or "How does it work?" - don't launch into a pitch. Redirect: "That depends on what you're trying to solve. What's the biggest issue you're dealing with right now?" You've just turned their question into your qualifying question.

The Sandler Pain Funnel

The Sandler method trains 30,000+ people annually, and salespeople using it hit quota 50% more often than those without it. The Pain Funnel is its core technique - escalating questions that move from surface-level to emotional:

- "Can you tell me more about that?"

- "Can you give me an example?"

- "How long has this been going on?"

- "What have you tried to fix it?"

- "What did that cost you?"

On a cold call, pick two. Levels 3 and 4 work best - "How long has this been going on?" establishes severity, and "What have you tried?" reveals whether they're actively solving the problem or just living with it. Even two levels of escalation create more urgency than a flat list of BANT questions ever will.

Want to coach this consistently? Build a rep scorecard around cold call coaching so “good questions” becomes measurable.

You've got 5 minutes and 50 seconds on a successful cold call. Don't waste the first 2 minutes confirming you reached the right person. Prospeo's data refreshes every 7 days - so titles, roles, and numbers are current when you dial.

Reach the right prospect on the first try for $0.01 per lead.

FAQ

How many qualifying questions should I ask on a cold call?

Two to four, maximum. Data across 90,380 cold calls found zero statistical difference in question count between successful and unsuccessful calls. Quality and placement matter more than quantity - place your questions in Minute 2, after you've delivered your value prop.

What's the best qualifying framework for cold calls in 2026?

CHAMP outperforms other frameworks because it leads with the prospect's pain, not your checklist. BANT's budget-first approach feels interrogative on cold calls. NEAT is a strong alternative if you sell deals above $25K and want to lead with economic impact.

Should I qualify before or after booking the meeting?

Book first, qualify second. Once a prospect agrees to a meeting, they'll answer honestly because they're invested. If they turn out unqualified, cancel. That's easier than losing them to a mid-call hang-up during a premature BANT interrogation.

How do I avoid sounding like I'm interrogating the prospect?

Use Socratic questioning - answer their questions with questions to maintain conversational flow. Limit yourself to 2-3 probing questions per conversation. Calling verified contacts also helps: when you don't have to waste time confirming you've reached the right person, you skip straight to value delivery.

What's the biggest qualifying mistake on cold calls?

Treating a cold call like a 30-minute discovery session. Reps who run full SPIN or MEDDIC sequences on a 2-minute interruption lose prospects in the first 60 seconds. Pick one problem question and one impact question - that's enough to confirm fit and book the next conversation.