Social Proof in Sales Emails (2026): Where It Goes + Templates That Get Replies

You can personalize perfectly and still lose if the email doesn't feel credible in the first three seconds.

Social proof in sales emails fixes that fast. Done right, it's one clean line that lowers perceived risk and earns you the reply without turning your message into a brochure.

And yes: the benchmarks below are older datasets that people still use in 2026 because they're huge and directionally reliable. Your exact numbers will swing based on list quality and inbox placement, but placement and wording rules don't change.

What you need (quick version)

- Definition: Social proof is a credibility cue that reduces "risk" in the reader's head (peer outcomes, third-party validation, specific results, credible associations).

- One-line proof rule: Proof should be one line--a single metric, peer name, or third-party link. No paragraphs.

- Where it goes: Put proof after your offer and right before the ask, or as a tight P.S. if you want the email to read even cleaner.

- What not to do: Don't paste a case study into the email. Keep proof to one line and move the story to a link or follow-up.

- What to test first: Use Belkins' 5.8% average reply rate across 16.5M emails as your baseline, then A/B test one proof line vs. no proof line.

Why social proof matters more in outbound in 2026

Outbound used to be a volume game. Now it's a trust game.

Gartner puts it plainly: 61% of B2B buyers prefer a rep-free buying experience, and 73% actively avoid suppliers who send irrelevant outreach. Cold email starts with a credibility deficit: you're a stranger, you're an interruption, and you're asking for attention before you've earned it.

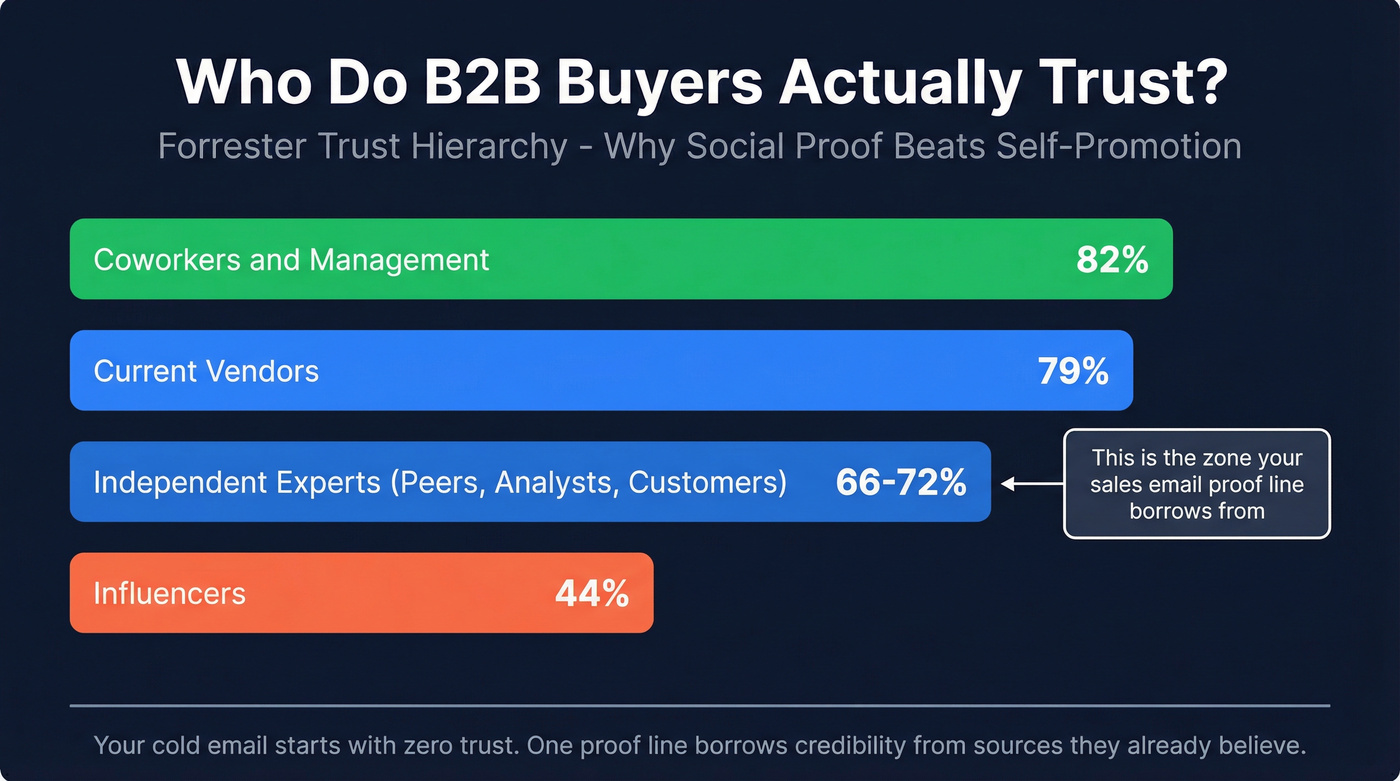

Forrester's trust hierarchy explains why social proof works when "we're the leading platform" doesn't:

- Coworkers/management: 82% trust

- Current vendors: 79% trust

- Independent experts (peers/analysts/customers): 66-72% trust

- Influencers: 44% trust

So your job in a sales email isn't to "convince." It's to borrow trust from sources they already believe.

Outbound vs. marketing email social proof (don't mix these up)

If you're sending newsletters, dynamic counters and visual social proof can work.

If you're sending cold outbound, keep it text-only and minimal. Cold email lives and dies on deliverability and skepticism; a "live counter" might lift clicks in marketing email, but in outbound it often reads like automation and adds friction.

A few rules that hold up in the real world:

- Relevance beats impressiveness. A mid-market peer result beats a famous logo that doesn't match their world.

- Specific beats big. "Cut onboarding time 18% in 45 days" reads like reality. "Game-changing outcomes" reads like spam.

- Proof beats persuasion. One credible line replaces three sentences of selling.

The cold-email benchmarks your proof has to beat (2026 baselines)

If you don't know what "good" looks like, you'll over-credit your proof line (or blame it for problems that are actually deliverability).

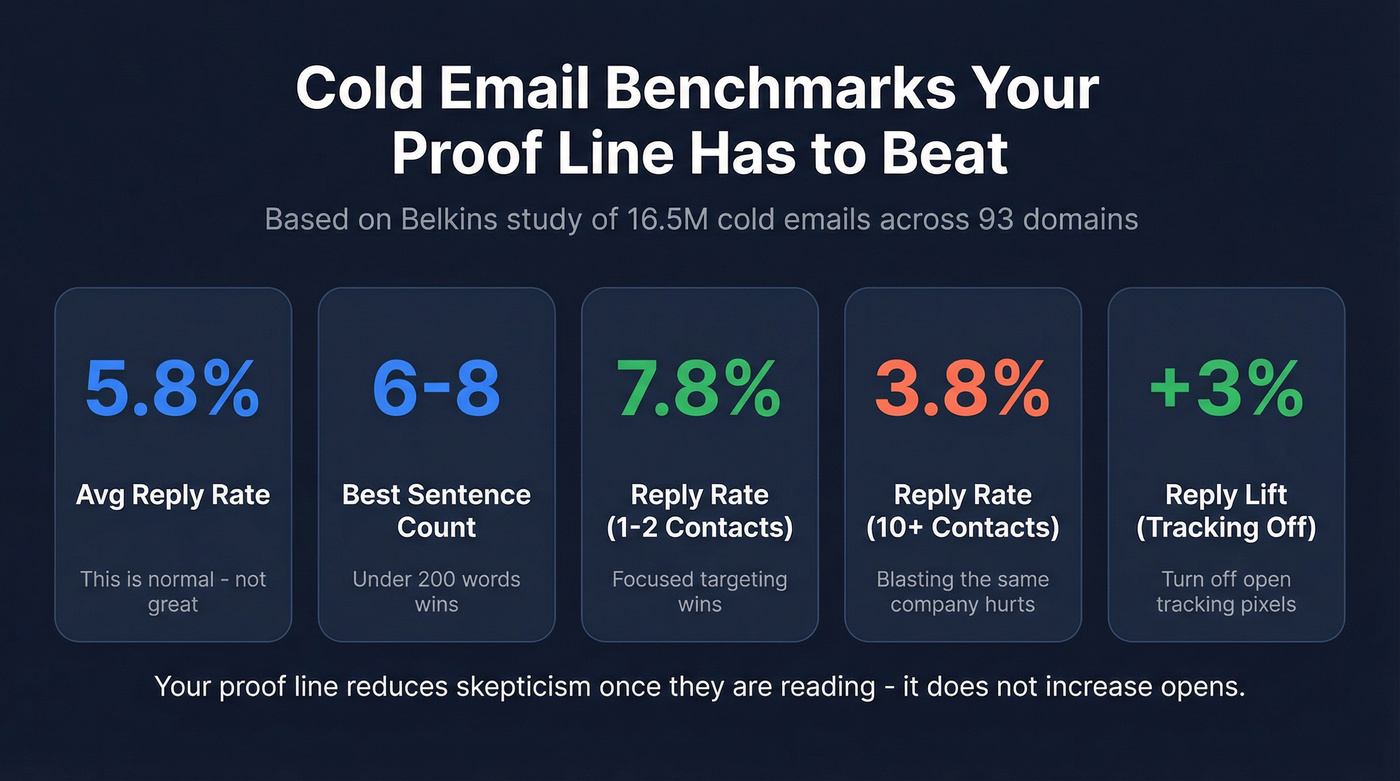

Belkins analyzed 16.5M cold emails across 93 domains over a 12-month period and found a baseline 5.8% average reply rate. Teams still use this benchmark in 2026 because it's one of the largest published outbound datasets.

Here's what we use when diagnosing outbound performance:

| Benchmark lever | Baseline / winner | What it means |

|---|---|---|

| Avg reply rate | 5.8% | "Normal" is low |

| Best length | 6-8 sentences | Under 200 words |

| Contacts/company | 1-2 = 7.8% | Focused targeting wins |

| Contacts/company | 10+ = 3.8% | Blasting hurts |

| Open tracking | Off = +3% replies | Pixels can cost replies |

Interpretation (the stuff that actually changes your writing):

- Your proof line isn't there to increase opens. It reduces skepticism once they're reading.

- Keep it short, but not cryptic. Belkins' best-performing length (6-8 sentences) is longer than the 40-60 word "ultra-short" style. Pick one style per campaign and run clean tests.

- Over-targeting a single account is real. Emailing 10+ people at the same company cuts replies hard. Proof won't fix "we're annoying you."

- Turn off open tracking if you want replies. It improves response rate and reduces the "this is marketing automation" smell.

How to run the proof A/B test (so you get a real answer)

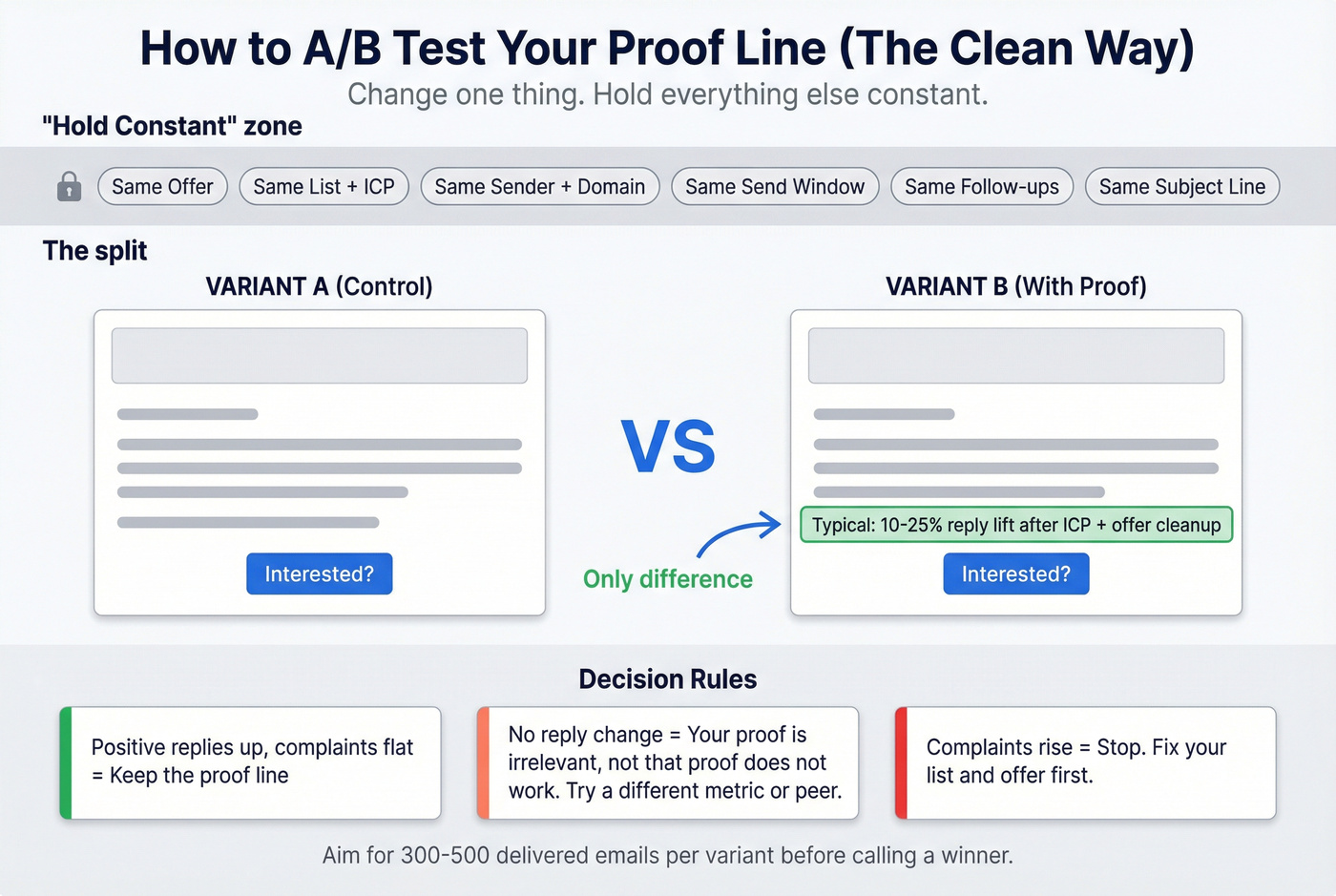

Most "tests" fail because teams change five things at once. Here's the clean way to test social proof in sales emails:

Test: identical email, with and without a single proof line.

Hold constant (non-negotiable):

- Same offer (exact wording)

- Same list source and ICP slice (see ICP)

- Same sender/domain/mailbox warmup state (see warmup)

- Same send window (days + time)

- Same follow-up schedule

- Same subject line

Only change: add one proof line (one sentence) in the same placement.

Sample size rule of thumb:

- Aim for at least 300-500 delivered emails per variant (A and B) before you call a winner.

- If your reply rate's around the 5-6% baseline, smaller samples swing wildly.

What to measure (in order):

- Positive reply rate (not just "any reply")

- Spam complaints (keep them near zero; if they rise, your list/offer's the problem) (see spam complaints)

- Bounce rate (if it's high, stop testing copy and fix data) (see bounce rate)

Decision rule:

- If proof increases positive replies without increasing bounces/complaints, keep it.

- If proof doesn't move replies, your proof's probably irrelevant (wrong peer, wrong metric), not that "proof doesn't work."

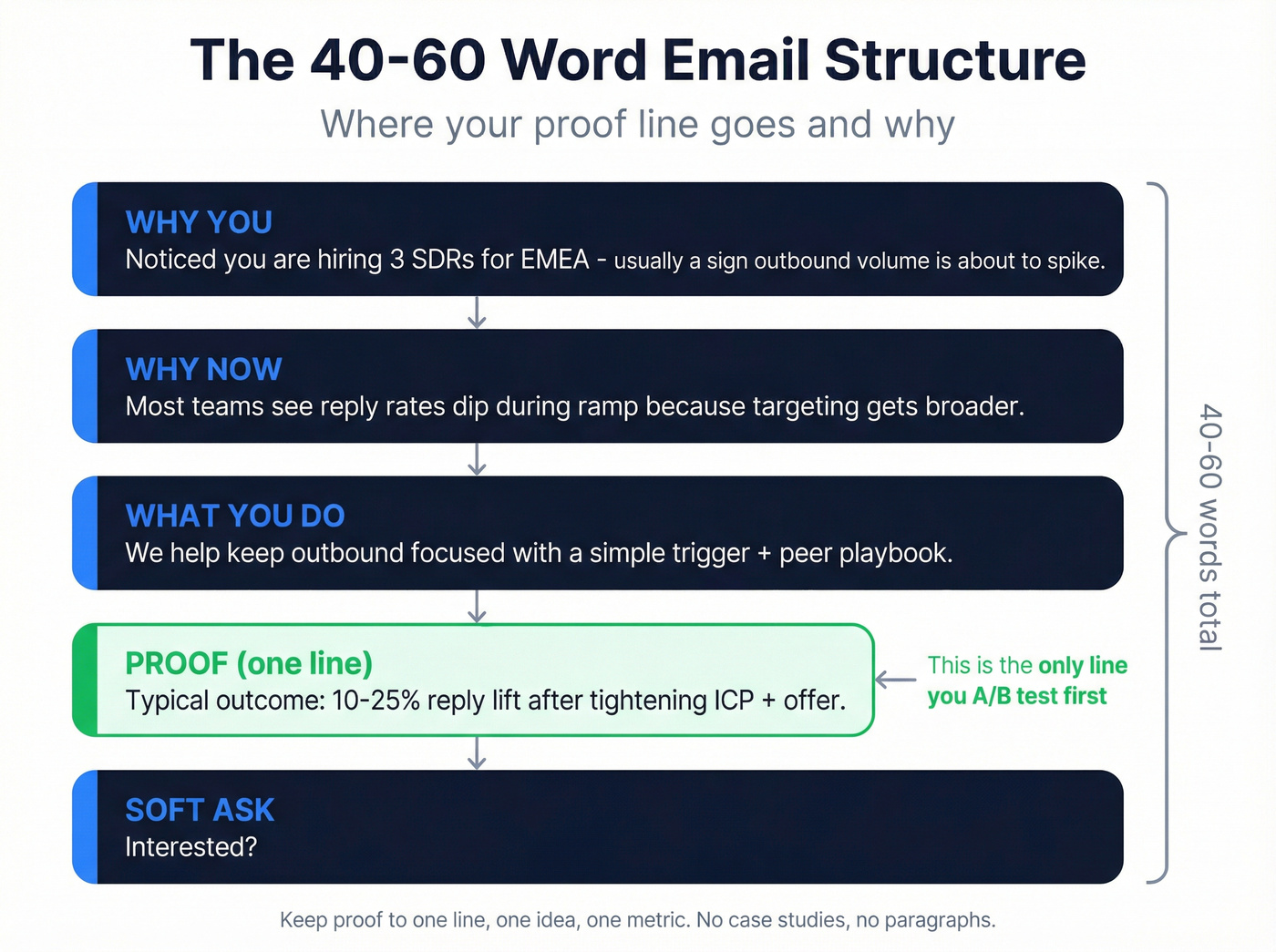

The one-line proof rule (and the 40-60 word email structure)

Most teams mess up social proof the same way: they treat it like a case study. Cold email isn't a landing page.

A format that works extremely well is the "absurdly short" email--40-60 words max--because it forces clarity. Use it when your offer is immediate-value (audit, teardown, benchmark, quick fix). If your offer is "a platform," skip the ultra-short style; you'll sound vague, and vague is where replies go to die.

Checklist: what "good proof" looks like

- One line, one idea

- Specific metric or specific peer set

- Time-bound when possible ("in 30 days")

- No adjectives ("amazing," "industry-leading")

- No attachments, no images, no logo blocks in the first touch

- Representative outcomes most customers can achieve (save the hero win for later)

The 40-60 word layout (annotated)

why you -> why now -> what you do -> proof (one line) -> ask (soft CTA) (see Sales CTA)

Copy blocks:

- Why you (1 sentence): "Noticed you're hiring 3 SDRs for EMEA - usually a sign outbound volume's about to spike."

- Why now (1 sentence): "Most teams see reply rates dip during ramp because targeting gets broader."

- What you do (1 sentence): "We help keep outbound focused with a simple 'trigger + peer' playbook."

- Proof (1 line): "Typical outcome: 10-25% reply lift after tightening ICP + offer."

- Ask (soft CTA): "Interested?" / "Want the 2-minute version?"

Your proof line is useless if it bounces. Belkins found 5.8% reply rates on clean sends - but bad data kills that before proof ever gets read. Prospeo delivers 98% email accuracy with a 7-day refresh cycle, so your carefully crafted one-liner actually reaches the inbox.

Fix the data first. Then let your proof line do the selling.

Proof types ranked by credibility (what to use first)

Not all proof is equal. The wrong proof makes you look less credible because it signals you're trying too hard.

If I had to pick three proof formats to test first, it'd be these:

- Peer metric proof (same segment, same motion)

- Trigger + proof combo (why now + proof you've done it)

- Third-party proof link (reviews, analyst mention, credible directory)

Why third-party links matter more in 2026: buyers research without you. G2's survey of 1,169 B2B decision-makers found 29% start research with ChatGPT more often than Google, and nearly two out of three prefer engaging sales later in the process. Give them a "go verify this" path.

Mini table: proof types, best use, risk, example line

| Proof type | Best for | Risk | Example proof line |

|---|---|---|---|

| Peer metric | Cold outbound | Low | "Typical: 10-25% reply lift after ICP + offer cleanup." |

| Named customer | ABM / tight ICP | Medium | "Teams like [PeerCo] use this to [outcome]." |

| Review link | Self-serve buyers | Low | "4.6★ on G2 (link)." |

| Expert mention | New category | Medium | "Covered by [credible pub] (link)." |

| Big logo | Enterprise | High | "Worked with [big logo]." |

What to use, where to place it, and what to avoid

| Proof type | Best ICP | Best placement | What to avoid |

|---|---|---|---|

| Peer metric | SMB-mid-market, repeatable motions | Right before CTA | Over-precise fake numbers; long explanations |

| Named customer | Narrow ICP, same category | P.S. or before CTA | Name-dropping irrelevant brands |

| Review link | PLG/self-serve, low security friction | P.S. | Gating behind a form; copying review text without permission |

| Expert mention | New category, thought leadership | P.S. | Influencer quotes; vague "featured in" with no link |

| Big logo | Enterprise, procurement-heavy | Follow-up link | "Logo salad" in first touch; images |

Concrete proof lines you can steal (by type)

We've tested a lot of variants, and the winners usually look boring on paper. That's the point: boring reads as true.

Here's a real scenario I've seen more than once: an SDR team rewrites their whole sequence, celebrates a "better" open rate, then wonders why replies didn't move. The fix wasn't clever copy. It was swapping a fluffy proof line ("trusted by fast-growing teams") for one sentence that matched the prospect's world ("cut bounce from 8% to 2.6% in 14 days during a tool migration") and putting it right before the ask.

1) Peer metric proof (best overall)

Good lines:

- "Typical: 10-25% reply lift after tightening ICP + offer."

- "Cut bounce rate under 3% in two weeks for a similar outbound team."

- "Reduced 'not interested' replies by 18% by fixing relevance + CTA."

- "Moved positive replies from ~5% to ~7% after list cleanup + offer rewrite."

- "Improved connect rate 3x by switching from 'demo ask' to '2-min summary'."

- "Lowered spam complaints to near-zero by removing risky words + tracking pixels."

Bad lines (don't do this):

- "We deliver massive growth fast."

- "Guaranteed results in 7 days."

- "Industry-leading reply rates."

2) Named customer proof (powerful when it's a true peer)

Good lines:

- "Used by teams like [PeerCo] to [specific outcome]."

- "[PeerCo] adopted this playbook to stabilize replies during SDR ramp."

- "We built the same workflow for [PeerCo]'s outbound team."

- "Shared this teardown format with [PeerCo]--they kept it as their SDR template."

- "Helped [PeerCo] reduce bounce rate below 4%."

- "Supported [PeerCo]'s expansion into [region] with trigger-based targeting."

Bad lines:

- "Trusted by Google, Apple, Amazon..." (if you're not selling to that world)

- "We work with hundreds of companies like yours" (too vague)

- "Our customers include..." followed by a paragraph

3) Trigger + proof combo (best when you have a real reason now)

Good lines:

- "When teams hire SDRs, replies usually dip - this playbook keeps replies stable (typical +10-25%)."

- "Tool change = list chaos; we've cut bounce under 3% during migrations."

- "New region launch: we've improved reply rates by tightening ICP + local triggers."

- "After funding, targeting gets broad; we've helped teams keep replies above baseline."

- "New product line: we've used 'trigger + peer' to avoid generic messaging."

- "Headcount growth: we've kept spam complaints near zero while scaling volume."

Bad lines:

- "Congrats on the funding!!!" (reads fake)

- "I saw your post" (when it's obvious you didn't read it)

- "We specialize in hyper-personalization" (buyers hate this phrase)

4) Third-party proof link (low-friction verification)

Good lines:

- "Reviews: 4.6★ on G2 (link)."

- "Customer stories (link)--happy to point you to 2 closest to your segment."

- "Independent write-up (link) if you want the details."

- "Security overview (link) if that's a blocker."

- "Public case study (link)--short version is the first paragraph."

- "Directory listing (link) so you can sanity-check us quickly."

Bad lines:

- "Here are 12 links"

- "Attached is our PDF"

- "See our 30-slide deck"

5) Expert mention (credible when it's specific and linkable)

Good lines:

- "Covered by [pub] on [topic] (link)."

- "Quoted in [report] on [specific claim] (link)."

- "Presented this framework at [credible event/community] (link)."

- "Analyst note on the category (link)."

- "Guest post on [credible site] (link)."

- "Podcast episode on [topic] (link)."

Bad lines:

- "As seen in the media"

- "Thought leader approved"

- "Influencer says we're the best"

Hot take (because it's true)

If your average deal size is in the low five figures, stop obsessing over giant logos.

A tight peer metric and a clean offer will beat "Trusted by BigCo" almost every time.

Where social proof in sales emails goes (3 layouts + follow-up rule)

Proof works best when it supports the offer - not when it competes with it.

You've got three reliable placements. All assume proof stays a single line. If you're wondering how to use social proof without making your cold outreach feel "marketing-y," start with Layout A and keep the line concrete.

Layout A: Proof right before the ask (default)

- Hook / relevance

- Offer

- Proof line

- Soft CTA

Why it works: the proof answers "why should I believe you?" right before you ask them to respond.

Layout B: Proof as a P.S. (cleanest read)

- Hook / relevance

- Offer

- Soft CTA

- P.S. proof line

This is perfect for 40-60 word emails because it keeps the body frictionless.

Layout C: Proof embedded in the offer sentence (tightest)

- Hook / relevance

- "We do X (proof) - want the 2-min version?"

Example: "We help Series B teams cut bounce rates under 3% (recent example: 38% -> 2.9%)--want the 2-minute version?"

Follow-up rule: logo wall belongs in follow-up, not first touch

If you want a "logo wall," put it in a follow-up as a text link, not an image. Images in first-touch cold email are a deliverability tax. (If you need a full system for scaling sequences, see How to Scale Outbound Sales.)

Subject lines: should you put social proof there?

Almost always: no.

Subject lines have one job: get opened without triggering skepticism. Logos and name-drops in a subject line look like clickbait. If you use proof in a subject line, use a plain metric that's believable and not hypey. (More examples: Cold Email Subject Lines That Get Opened.)

Good subject lines (proof-light):

- "quick idea for outbound at [Company]"

- "question about [trigger]"

- "2-min teardown for [Company]?"

- "cut bounce under 3%?"

- "reply lift: +10-25% (typical)"

- "keeping replies stable during SDR ramp"

- "re: [their tool] + deliverability"

- "worth sharing 2 examples?"

Bad subject lines (proof-heavy):

- "Trusted by [Big Logo]"

- "Case study: how we 10x'd pipeline"

- "Guaranteed meetings"

- "4.9% -> 7.1% in 21 days!!!"

- "You're leaving money on the table"

Copy-paste templates (first touch + follow-ups)

Before you copy anything, pick the template that matches your reality.

Template chooser (use this, don't guess)

- You have a believable metric for a similar segment -> Template 1

- There's a real trigger (hiring, tool change, expansion) -> Template 2

- Your offer is immediate-value (teardown/audit/benchmark) -> Template 3

- They went dark but you have a new angle -> Template 4

- You want to share logos/reviews without wrecking deliverability -> Template 5

- You've followed up and need a clean close-out -> Template 6 (break-up)

Proof-line generator (fill in the blanks)

Use one of these patterns and keep it to one sentence:

- "Typical: [range] improvement in [metric] after [one change]."

- "One example: [peer] moved [metric] from [X] -> [Y] in [time]."

- "We've done this for [peer group]--most see [range] within [time]."

- "Proof: [third-party source] (link)."

Template 1: "Social Proof & Authority" (metric-first, peer outcome)

Subject: quick question, [FirstName]

Saw [Company] is [relevant signal: hiring SDRs / expanding to EMEA / new product line].

We help [peer group] get more replies from cold outbound without increasing volume.

Typical outcome: [range]% lift in [metric] after tightening ICP + offer.

Interested?

Template 2: Trigger event + peer proof + "happy to share two relevant examples"

Subject: [trigger] at [Company]

Noticed [trigger event]. That's usually when teams [pain tied to trigger].

We've helped [peer group] handle this by [simple mechanism / offer].

Proof: typical [range]% improvement in [metric] within [timeframe].

If helpful, I can share two examples closest to [Company]--want them?

Template 3: Ultra-short 40-60 word version (offer-first, proof line, soft CTA)

Subject: quick idea for [Company]

Noticed [specific observation]. I can [offer: audit/teardown] and send 3 fixes in a 2-min video.

Proof: typical [range]% improvement in [metric] after these fixes.

Interested?

Template 4: Reactivation (new capability + proof)

Subject: should I close the loop?

Circling back - since we last spoke, we added [new capability] for [specific use case].

Typical outcome: [range]% improvement in [metric] within [timeframe].

Worth a quick revisit, or should I close this out?

Template 5: Follow-up with "logo wall" as a text link (no image)

Subject: re: [original subject]

Quick nudge - here are a few teams we've helped in [their space]:

[link to customer page / review page / short page]

If you want, I can share two examples closest to [Company] (same size + same motion).

Interested?

Template 6: Break-up / permission to close the loop (with one proof line)

Outbound Squad's analysis of 85 million cold emails found break-up emails can increase replies by 89%. The reason's simple: it gives the prospect an easy "no" without feeling trapped, and it stops you from sounding like you're chasing them around the internet.

Subject: close the loop?

I don't want to keep bugging you - should I close this out?

If outbound replies are a priority this quarter, I can send a 2-min teardown + 3 fixes.

Proof: typical [range]% reply lift after tightening ICP + offer.

Should I send it, or close the loop?

Cadence note (simple, effective)

Use a short sequence. Three touches is enough for most teams:

- Day 0: first touch

- Day 3: follow-up

- Day 10: follow-up

- Day 14: break-up (Template 6)

Longer sequences often create more annoyance than pipeline. (If you want a copy/paste structure, use this cold email cadence.)

What to avoid with social proof in sales emails (deliverability + replies)

Here's the thing: most "social proof" fails because it's not proof. It's fluff dressed up as proof.

Cold email communities complain about the same two things over and over:

- Fake personalization ("Loved your recent post..." with nothing specific)

- Spammy certainty words like "guarantee," which trigger both filters and human skepticism

Use this / skip this

Use this

- One-line proof with a metric or true peer

- "Happy to share two examples" instead of pasting a case study

- Plain text, no images, no fancy formatting

- Soft CTA ("Interested?") or a simple question

Skip this

- Case studies pasted into the email

- Asking for time in the first touch if you haven't earned it

- Buzzwords like "AI," "platform," "ROI" as your value proposition

- Words like "guarantee" that spike spam paranoia and buyer skepticism

- "Personalization trivia" (congrats, flattery, generic compliments) instead of relevance

The dataset callout (so the big deltas make sense)

Outbound Squad's analysis of 85 million cold emails is where the big "reply impact" deltas come from (case-study-heavy emails, early meeting asks, buzzwords, break-up emails). Use those numbers as directional guidance, but treat the writing rules as hard constraints: short, relevant, one proof line.

Deliverability decision rules (practical thresholds)

- First touch: plain text only. Zero images. Zero attachments. (Full playbook: Email Deliverability 2026.)

- Second touch: plain text + one link max (review page, customer page, or short resource).

- Third touch: you can add a lightweight image only if inbox placement's already stable:

- Opens consistently above ~40% on a clean list, and

- Spam complaints below ~0.1%, and

- Bounce rate below ~2% If you can't hit those, stick to text.

Also: if your open rate's under ~30%, stop rewriting copy and fix deliverability (domains, list quality, sending patterns).

Mini rewrites:

Bad: "We're an AI-powered platform that drives ROI for modern revenue teams." Better: "We help SDR teams get more replies by tightening targeting + offer."

Bad: "Can you do 15 minutes Tuesday?" Better: "Want the 2-minute version?" / "Interested?"

Bad: "Here's our case study..." (3 paragraphs) Better: "Proof: typical 10-25% reply lift after tightening ICP + offer. Want two examples closest to you?"

Compliance: how to use testimonials and results without getting burned

You can't wing this anymore.

The FTC's Consumer Reviews & Testimonials Rule took effect Oct 21, 2024, and penalties can hit $53,088 per violation. If you're using testimonials, reviews, star ratings, or outcome claims as social proof, you're in the same sandbox as advertising. The Endorsement Guides (16 CFR Part 255) are the backbone here: 16 CFR Part 255.

Compliance checklist (do / don't)

Do

- Use real testimonials from real customers who actually had that experience (a one-sentence testimonial in sales email form's often enough)

- Get permission to quote (especially if it's from support tickets or calls)

- Disclose material connections when relevant (paid, incentivized, employee, partner)

- Use representative results in cold outbound (ranges beat outliers)

Don't

- Invent testimonials, screenshots, or "review snippets"

- Cherry-pick a wild outlier result with no context

- Imply a reviewer used the product if they didn't

- Condition incentives on positive sentiment ("only if it's 5 stars")

Outbound-safe phrasing that stays strong without getting sloppy:

- "Typical outcome: 10-25% reply lift after tightening ICP + offer."

- "One example: [peer] improved [metric] from X->Y in Z days."

How to create proof when you don't have logos (and how to scale it safely)

No logos? Fine. You can still build credibility fast.

In our experience, the fastest path isn't chasing a brand-name testimonial. It's building a library of "one-line assets" you can rotate by segment, so every rep isn't improvising proof on the fly (and accidentally writing something that sounds made up).

Step-by-step playbook to generate proof (without faking it)

Step 1: Start with micro-proof, not mega-proof Micro-proof is anything specific that reduces perceived risk:

- Process proof: "I'll send a 2-minute teardown within 24 hours."

- Credibility transfer: "I led outbound at [previous role/company]" (only if true)

- Specific outcomes: "Cut bounce from 8% to 2.6%"

- Third-party mentions: podcast, community talk, directory listing, review page

Step 2: Ask for testimonials in the moment Asking "whenever" gets ignored. Asking right after a win gets answers. Build a habit: when a customer says "this helped," ask for a one-sentence quote you can use.

One sentence is enough.

Step 3: Turn proof into one-line assets

Create a simple internal sheet:

- Peer type (industry, size, region)

- Outcome metric (range + one hero example)

- Timeframe

- Permission status

- Link (optional)

Then reps select proof; they don't improvise it.

Step 4: Scale safely: proof only works if your emails land This is where outbound programs quietly fail. Proof doesn't matter if you're bouncing or landing in spam, and that's why data quality ends up being a copywriting problem whether you like it or not. (If you want a QA workflow, see B2B contact data decay.)

If you're building proof-driven outbound at scale, tools like Prospeo (The B2B data platform built for accuracy) help keep the fundamentals tight: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% verified email accuracy on a 7-day data refresh cycle. That combo matters because it lets you keep bounces low and targeting narrow, which makes your proof line believable instead of "spray and pray with a nice sentence." (Related: email verification.)

A simple workflow that scales:

- Build a tight ICP list (role + company filters)

- Verify emails before sending (protects domains)

- Export clean contacts to your sequencer

- Use one proof line matched to that ICP slice (the simplest form of sales pitch social proof)

That's how you keep proof credible and deliverability stable at the same time.

The article says targeting 1-2 contacts per company lifts replies to 7.8%. Prospeo's 30+ filters - buyer intent, job changes, headcount growth - let you find the exact right person instead of blasting 10+ contacts and watching replies drop to 3.8%.

Precise targeting makes every proof line hit harder.

FAQ

How long should a social proof line be in a cold sales email?

One sentence - typically 8-16 words--is the sweet spot because it reads like evidence, not a pitch. A safe default is a range + mechanism (for example: "Typical: 10-25% reply lift after tightening ICP + offer."). If it needs a second sentence, it's too much.

Should you include logos or a case study in the first email?

No. Keep the first touch plain text and avoid logo walls or pasted case studies because they add friction and can hurt deliverability. Put logos in a follow-up as a single text link, or offer "two examples closest to you" and share links only after they engage.

Should you put social proof in the subject line?

Usually no; subject lines should signal relevance, not bragging, and name-drops often look like clickbait. If you do use proof, use a plain metric that's believable (for example, "cut bounce under 3%?") and avoid hype punctuation or extreme claims.

What counts as "typical results" when you mention outcomes?

"Typical" should mean what a normal customer can reasonably expect, so use ranges and keep them conservative (like 10-25% lifts) rather than one-off hero wins. Save the outlier metric for later touches or a link where you can add context, timeframe, and what changed.

How do I scale proof-based outreach without hurting deliverability?

Keep first touches text-only, verify contacts before sending, and aim for <2% bounces and <0.1% spam complaints before adding links or richer assets. Prospeo helps by maintaining 98% verified email accuracy and a 7-day refresh cycle, so proof-driven outreach lands.

Summary: the simplest way to use social proof in sales emails

Keep it to one line.

Place it after the offer and before the ask.

Then test it cleanly (proof line vs. no proof line) against a realistic baseline like ~5.8% replies.