How to Run ABM for High-Value Accounts (With Real Numbers, Not Theory)

A practitioner on Reddit put it perfectly: "I understand ABM in theory, but would like to hear how it is implemented on a day-to-day basis." That's the gap - not adoption, but execution. Running ABM for high-value accounts is something 94% of B2B marketers claim to do, yet most teams are stuck between impressive board decks and underwhelming pipeline numbers. They've bought the strategy. They haven't built the machine.

What follows is the practitioner playbook that closes that gap, built on real revenue numbers and the scoring models, intent workflows, and contact data strategies that separate programs that compound from ones that get defunded.

What You Need (Quick Version)

Before you read 3,800 words, here's the short version:

- A scoring model that disqualifies bad-fit accounts - not just selects good ones. Most ABM programs fail because they target too many accounts, not too few.

- Intent data layered on firmographic fit - timing matters as much as profile. An enterprise account surging on your category right now beats a perfect-fit account that's mid-contract with a competitor. (If you want a deeper model, see fit-intent-engagement.)

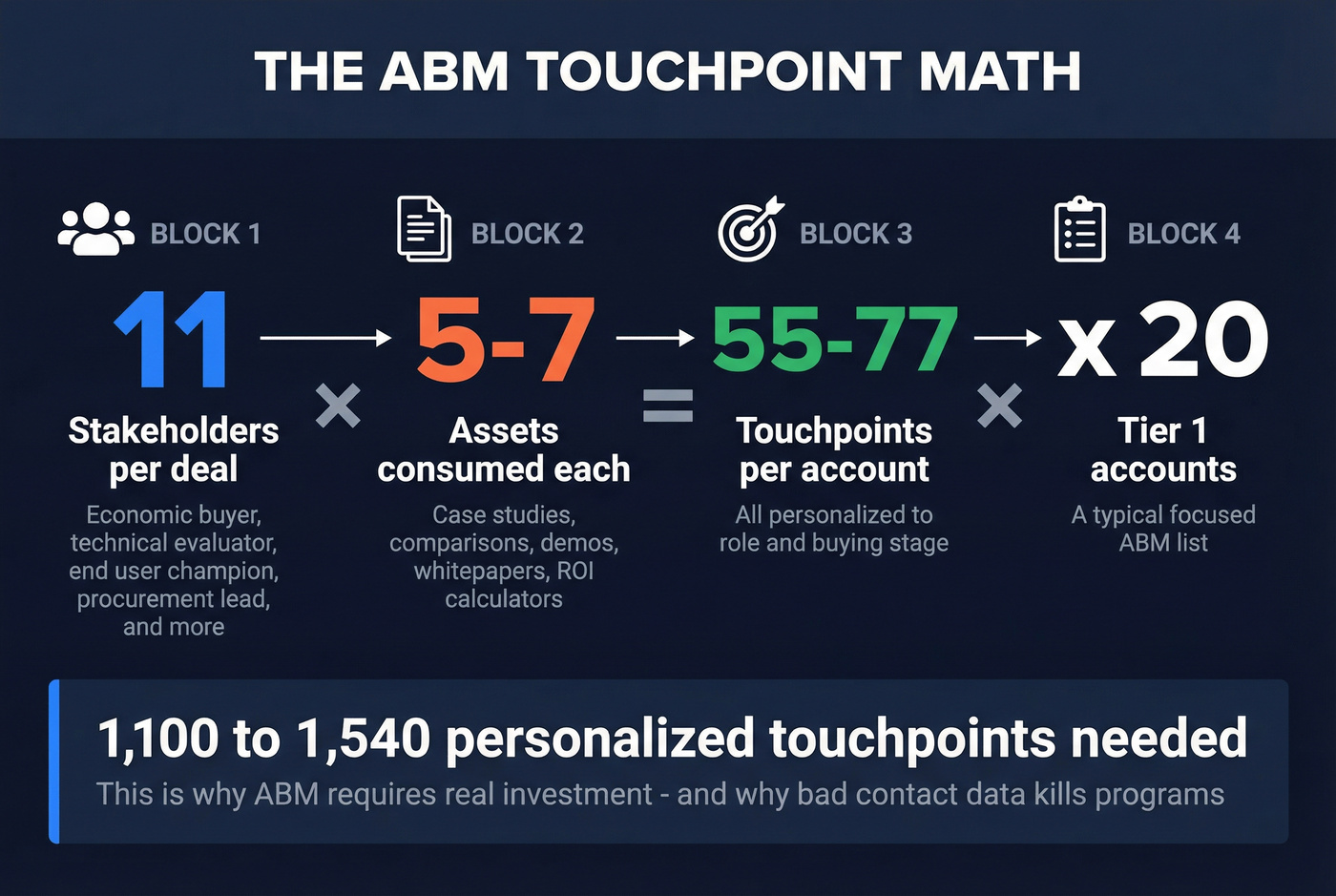

- Verified contact data for 7-11 stakeholders per account - not just one champion. B2B deals involve 11 stakeholders consuming 5-7 assets each before they'll talk to sales.

- Sales-marketing alignment from day one - not a handoff, a partnership. Teams that sync sales and marketing through ABM close deals 67% more effectively.

- Patience - 6-12 months for initial results, 18-24 months for full maturity. Set expectations with leadership early or you'll get defunded before the program compounds.

Hot take: If your average deal size is under $25K, you probably don't need a full ABM program. You need better demand gen with account-level targeting. ABM's ROI only justifies the investment when deals are large enough to absorb the per-account cost of deep personalization.

What Makes a High-Value Account in ABM (And What Doesn't)

Most teams confuse "big logo" with "high-value." They build a target account list full of Fortune 500 names that look impressive in a board deck but have zero buying signals and a 3% chance of closing.

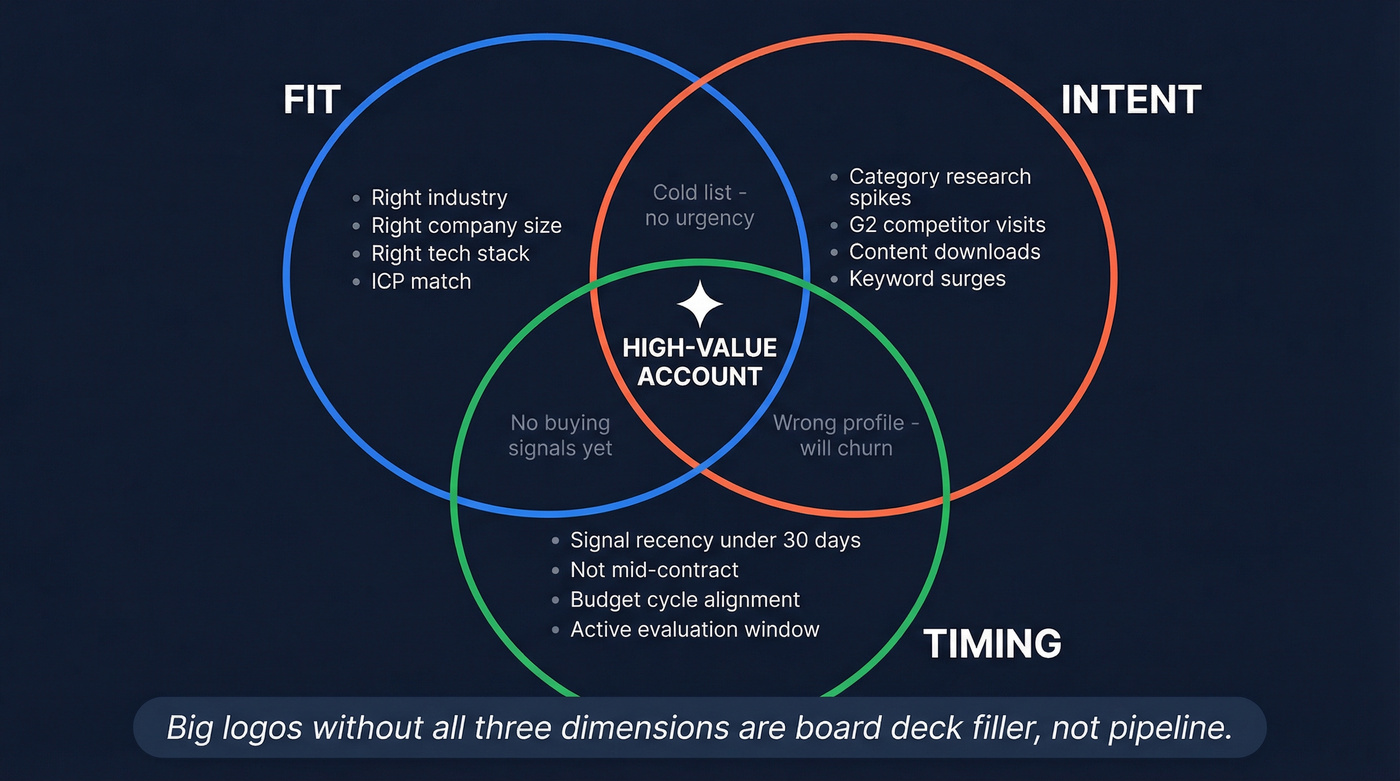

A genuinely high-value account sits at the intersection of three dimensions:

- Fit: Firmographic and technographic match to your ICP. Right industry, right size, right tech stack. If you sell a security product and they're running Okta, that's a fit signal. If they're a 50-person nonprofit, probably not. (Related: firmographic and ideal customer.)

- Intent: Real-time buying signals. Are they researching your category? Visiting competitor pages on G2? Downloading content about the problem you solve? Fit without intent is a cold list. (More on intent signals.)

- Timing: Recency of those signals. An account that surged on "cloud security" 14 days ago is fundamentally different from one that surged 6 months ago. Timing separates pipeline from wishful thinking.

365Talents learned this the hard way. They initially targeted only companies with 10,000+ employees - big logos, impressive names. Results were poor. When they expanded their TAM to include companies with 1,000+ employees, they uncovered far more opportunities with better conversion rates. The "high-value" accounts weren't the biggest ones. They were the ones that actually needed the product.

Your high-value checklist:

- Revenue potential (including upsell/cross-sell over 2-3 years)

- Strategic importance (market influence, case study potential, partnership value)

- Active buying signals in the last 30 days

- Accessible decision-makers (can you actually reach the buying committee?) (See: key decision makers.)

- Evidence of the challenge your product solves

If an account doesn't hit at least three of these, it doesn't belong on your Tier 1 list. Period.

How to Score and Prioritize Accounts Your ABM Team Actually Closes

Scoring isn't complicated, but most teams skip it - or worse, they score accounts once and never update the model. Here's a three-step framework that works in practice.

Step 1: Select Your Parameters

For existing accounts you're trying to expand, score on:

- Buying signals - website visits, content downloads, RFP participation, event attendance

- Decision-maker access - do you have relationships with the economic buyer, or just a mid-level champion?

- Revenue potential - total possible revenue including expansion, not just initial deal size

- Strategic importance - does winning this account open a vertical or create a reference customer?

For new accounts, start with your ICP. Model it off your best existing customers - the ones with highest retention, expansion, and ACV. Then build your target account list and score from there. (Practical guide: account identification.)

Step 2: Develop a Scoring Scheme

Assign min/max points to each parameter. Keep it simple - a 1-5 scale works fine. The goal isn't mathematical precision. It's forcing your team to make explicit decisions about what matters.

Step 3: Assign Weights and Tier

Not all parameters are equal. If you're selling a $200K/year platform, revenue potential might get 3x the weight of strategic importance. If you're entering a new market, strategic importance might outweigh everything else.

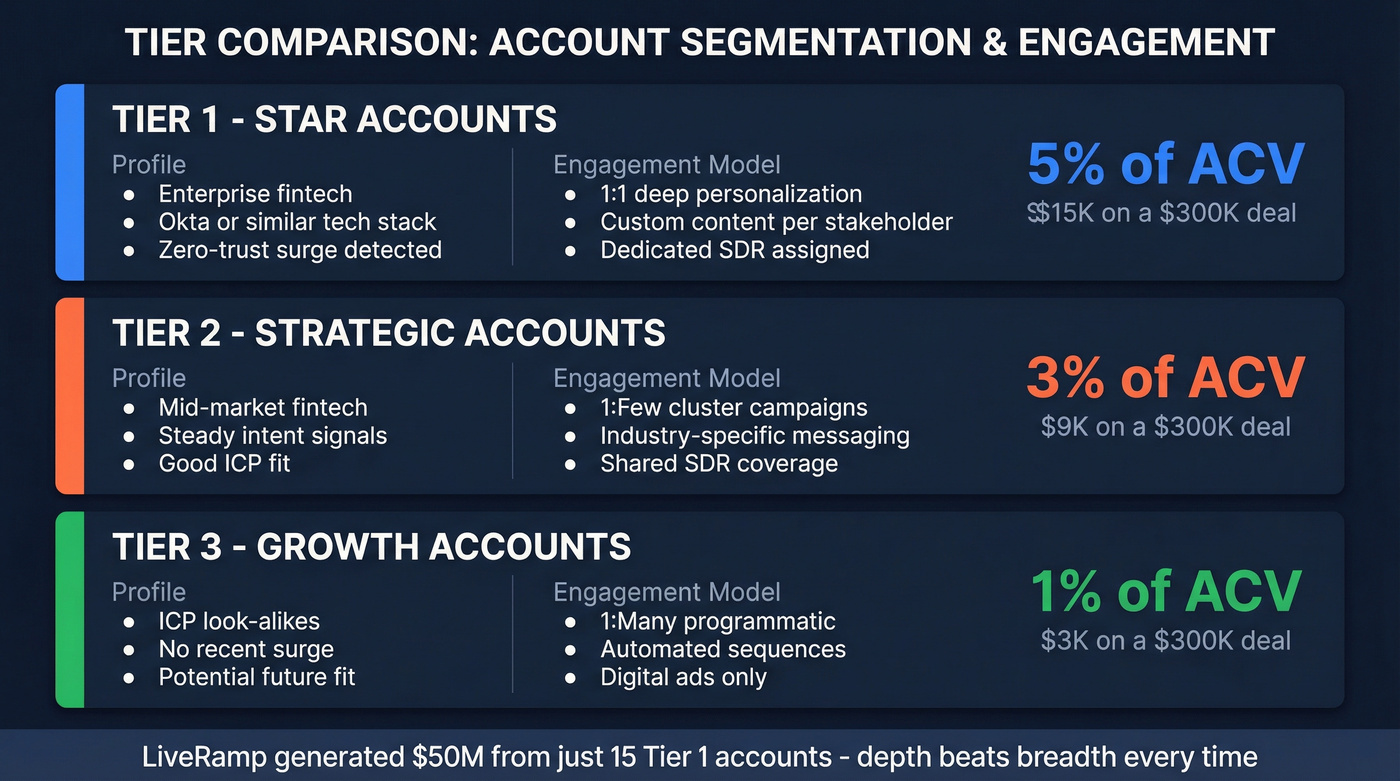

Once scored, accounts fall into tiers:

| Tier | Profile | Engagement | Budget |

|---|---|---|---|

| Tier 1 (Star) | Enterprise fintech, Okta, zero-trust surge | 1:1 deep personalization | ~5% of ACV |

| Tier 2 (Strategic) | Mid-market fintech, steady intent | 1:Few cluster campaigns | ~3% of ACV |

| Tier 3 (Growth) | Look-alikes, no recent surge | 1:Many programmatic | ~1% of ACV |

The budget allocation model: 5% of ACV for star accounts, 3% for strategic, 1% for growth. On a $300K ACV deal, that's $15K invested in a single Tier 1 account. That sounds like a lot until you see LiveRamp generating $50M from 15 accounts.

Validate With the 3-2-1 Pilot Method

Before committing your full budget, run a pilot: pick 3 accounts that perfectly match your ICP, 2 accounts that are slightly outside your ideal profile, and 1 wild card - an account that doesn't fit the model but your gut says is worth testing. Run your full Tier 1 playbook on all six for 8 weeks. The results will tell you whether your scoring model is right, too narrow, or missing something entirely.

I've seen teams discover their best-converting segment was the "slightly outside" group, which completely reshaped their TAL.

The hardest part isn't building the model. It's disqualifying accounts that your sales team is emotionally attached to. A scoring model only works if you trust it enough to say no.

Your ABM playbook calls for verified contact data on every stakeholder in the buying committee. Prospeo gives you 300M+ profiles with 98% email accuracy, intent data across 15,000 topics, and 30+ filters to score accounts by fit, intent, and timing - exactly the three dimensions that define high-value accounts.

Stop running ABM on bad data. Start reaching entire buying committees.

Using Intent Data to Find In-Market Accounts

Intent data is the difference between "accounts that fit our ICP" and "accounts that fit our ICP and are actively looking for a solution right now." That distinction is everything. (Deep dive: accounts in market intent data.)

First-Party vs. Third-Party Intent

First-party intent comes from your own channels - webinar signups, content downloads, website visits, product trials, in-product behavior. It's more reliable because these people have already found you. But it only captures accounts that know you exist.

Third-party intent comes from external sources - keyword searches across business websites, G2 and Gartner research activity, content consumption patterns. It captures accounts researching your category who haven't discovered your brand yet. Less reliable per signal, but far broader coverage.

Trust first-party data more, but use both.

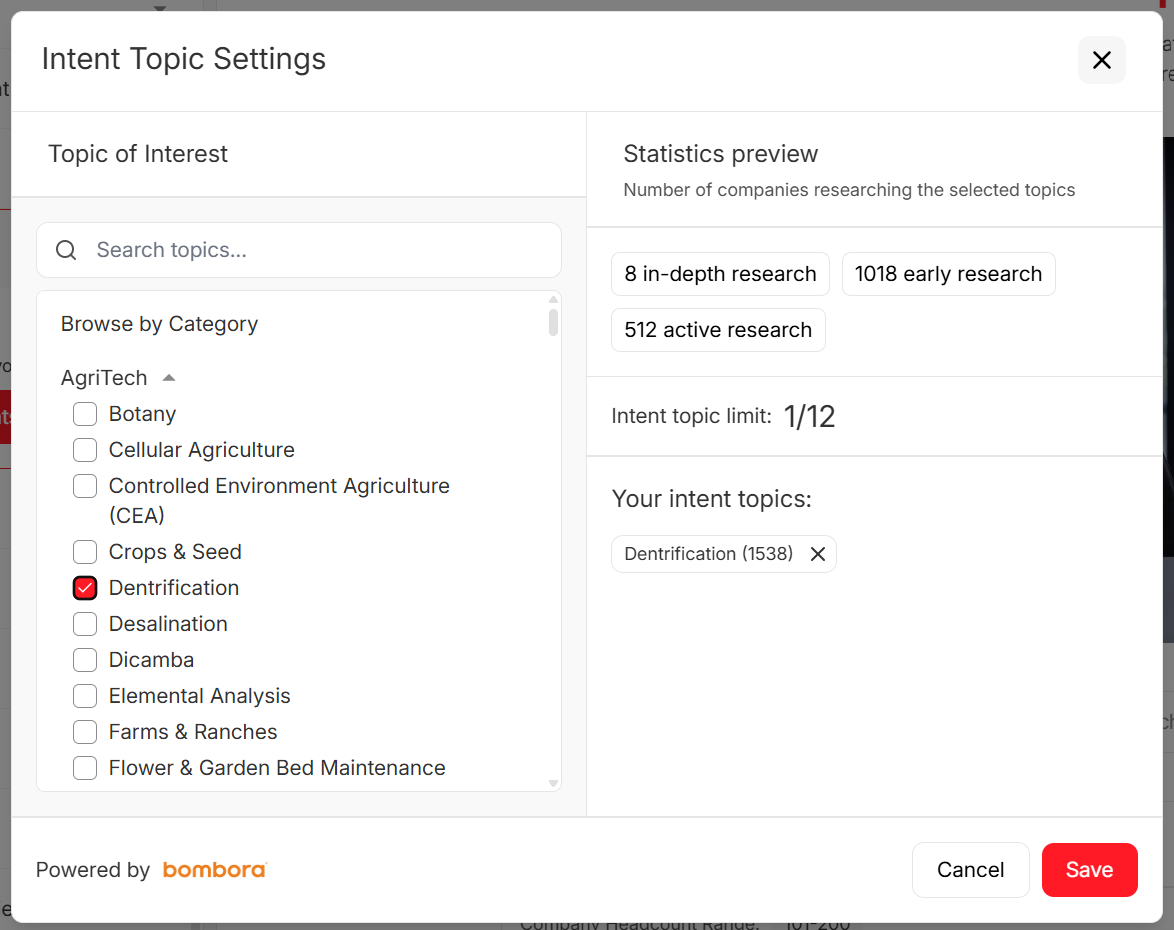

How Bombora Actually Works

Bombora's B2B Intent Data Co-op tracks content consumption across 5,000+ business websites, categorized into 12,000+ topic clusters. Their Company Surge AI flags when an account's activity in specific topics spikes above their historical baseline.

The operational workflow: intent surge detected, Slack alert fires to your SDR team, display ads auto-activate for that account, personalized email sequence starts within 24 hours. Speed matters. Intent signals decay fast.

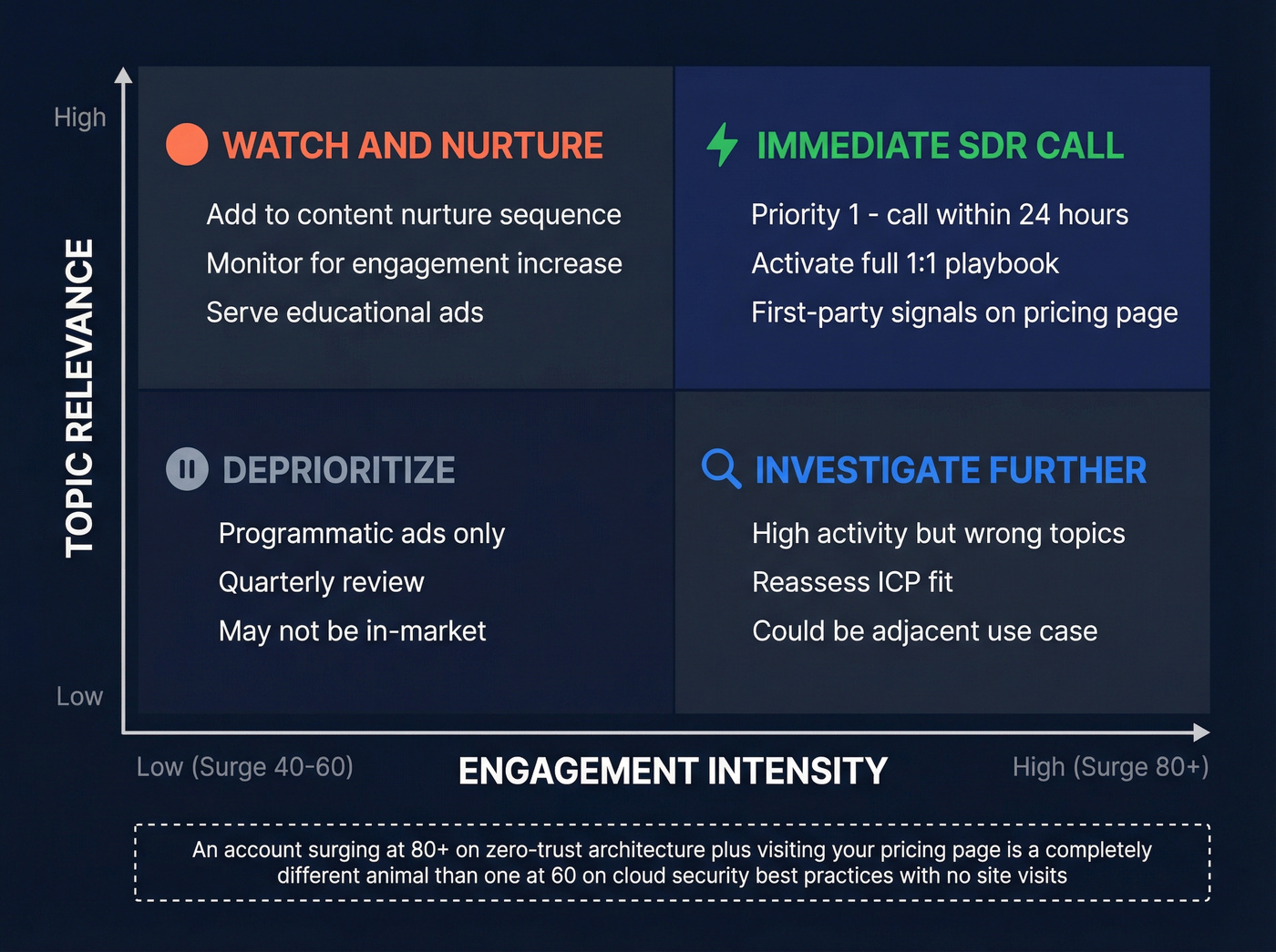

The Intent-Spike Matrix

Don't treat all surges equally. Build a simple matrix that combines topic clusters (what they're researching) with engagement thresholds (how intense the surge is). An account surging at 80+ on "zero-trust architecture" while also showing first-party signals on your pricing page is a fundamentally different animal than one at 60 on "cloud security best practices" with no site visits.

Map each quadrant to a specific response - the high-topic, high-engagement quadrant gets an immediate SDR call; the low-topic, low-engagement quadrant gets added to a nurture sequence.

Where Intent Data Breaks Down

I've seen teams misread intent signals badly enough to waste entire quarters. The most common mistake: treating a Bombora keyword surge as a bottom-of-funnel signal when it's actually top-of-funnel research. An account surging on "cloud security best practices" is in a different universe from one showing up on your G2 competitor comparison page.

Other limitations worth knowing: Bombora operates at the account level only - no contact-level insights. A high Surge score doesn't mean they're ready to buy. And coverage varies by industry; niche B2B verticals sometimes have thin data.

The 90-day lookback rule: Don't write off accounts whose surge has cooled. Accounts that showed strong intent within the last 90 days but have gone quiet are often mid-evaluation, not disinterested. Re-engage them with a different angle - a new case study, a competitive comparison, an event invite. We've found that 90-day re-engagement sequences convert at roughly half the rate of active-surge outreach, which is still dramatically better than cold.

Mapping and Reaching the Buying Committee

Here's where the math gets uncomfortable. B2B deals now involve an average of 11 stakeholders consuming 5-7 assets, each consuming 5-7 assets before they'll engage sales. That's 55-77 content touchpoints per account. For a Tier 1 list of 20 accounts, you're looking at 1,100-1,540 personalized touchpoints. (Framework: B2B decision making.)

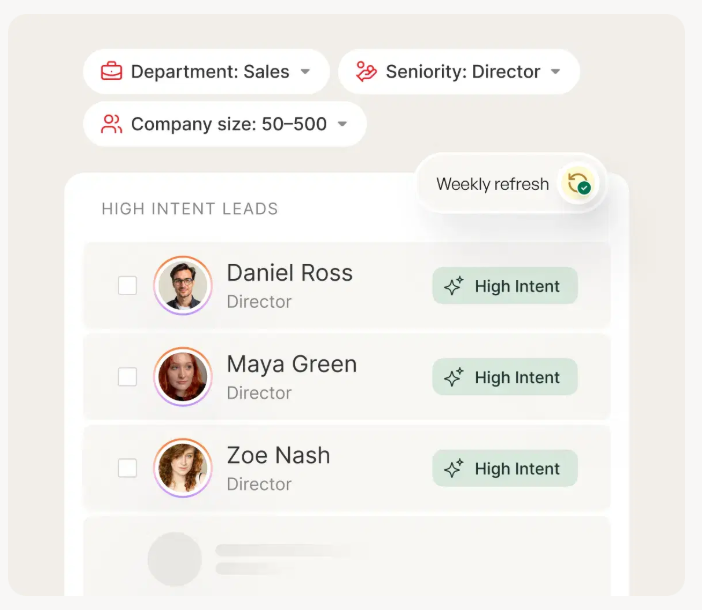

Directive benchmarks five or more roles engaged for a Tier 1 account. That means you need verified contact data for at least the economic buyer, the technical evaluator, the end user champion, the procurement lead, and ideally a few more influencers. (Tactics: ABM multi-threading.)

The role-based engagement strategy:

| Role | Content That Works | Channel Priority |

|---|---|---|

| Economic buyer (VP/C-level) | ROI calculators, business cases, peer case studies | Direct mail, exec events |

| Technical evaluator | Architecture docs, security reviews, integration guides | Email, webinars |

| End user champion | Product demos, trial access, workflow comparisons | In-product, community |

| Procurement | Pricing transparency, compliance docs, vendor templates | Email, portal |

When data isn't unified across these touchpoints, 37% of interactions go unattributed. You literally can't measure what's working.

And here's the practical problem nobody talks about enough: you've identified the accounts, mapped the roles, built the content matrix - now how do you actually get verified contact info for 11 people at each target company?

This is where most ABM programs quietly fail. Stale data means wasted campaigns. Prospeo's database covers 300M+ profiles with 98% email accuracy and 125M+ verified mobile numbers, refreshed every 7 days versus the 6-week industry average. Snyk's sales team saw their bounce rate drop from 35-40% to under 5% after switching, generating 200+ new opportunities per month. That's the difference between an ABM program that looks good on paper and one that actually fills pipeline. (More: B2B contact data decay and verify an email address.)

ABM Engagement Playbook - What Actually Works

The best ABM campaigns don't feel like marketing. They feel like someone did their homework.

Creative That Broke Through

GumGum and T-Mobile: Instead of a standard pitch deck, they researched CEO John Legere's Twitter and discovered he was a Batman fan. They created a custom comic book called "T-Man and Gums" featuring Legere as a superhero. He shared it on Twitter. GumGum won the account. Total cost was a fraction of a traditional enterprise sales cycle.

O2 targeting 2,000+ employees at target accounts: They created individualized cost-saving reports showing each person exactly how much they'd save by switching. The result: 67.5% conversion rate. Not 6.75%. Sixty-seven point five percent.

Cognism's cupcake campaign: Coordinated across SDRs, sales, and customer success, they sent personalized cupcake boxes to target accounts with a follow-up sequence. Their target was a 20% response rate. They hit 80%.

DocuSign targeting 450 enterprise accounts: They implemented dynamic content targeting with industry-specific homepage experiences. Page views jumped 300%. Sales increased 22%. Homepage conversions tripled.

The pattern across all of these: deep research on the account, creative execution that stands out, and multi-channel coordination. Not just email - direct mail, events, personalized content, ads, community engagement.

The 12-Week ABM Launch Timeline

This is the timeline we recommend for teams launching their first ABM program or resetting one that stalled:

| Week | Phase | Key Activities |

|---|---|---|

| 1-2 | Foundation | Define ICP, build scoring model, align sales + marketing on metrics |

| 3-4 | Account Selection | Score and tier accounts, run 3-2-1 pilot selection, map buying committees |

| 5-6 | Content + Data | Build role-based content matrix, verify contact data, set up intent monitoring |

| 7-8 | Activation | Launch Tier 1 personalized outreach, activate display ads, begin direct mail |

| 9-10 | Optimization | Review engagement data, adjust messaging by role, expand to Tier 2 |

| 11-12 | Measurement | Report on leading indicators, refine scoring model, plan next quarter |

One reality check: manual content creation breaks beyond about 50 accounts. If you're running 1:1 ABM for more than that, you need AI-powered personalization or you'll burn out your content team in a quarter. (See: AI cold email personalization mistakes.)

ABM Case Studies With Real Revenue Numbers

Theory is cheap. Here's what account-based marketing actually produced for companies willing to share their numbers.

| Company | Approach | Key Result | Timeline |

|---|---|---|---|

| LiveRamp | Named accounts, 15 Fortune 500 | $50M rev, 33% conv, 25x CLTV | 4 wks to first conv |

| Auth0 | ABM pilot program | $3M pipeline | 6 weeks |

| TestRail | Ultra-enterprise, regulated | 22 deals created, 2 closed | Multi-quarter |

| Charlesgate | ABM for real estate | $3.5M rev (best quarter) | 2-3 years |

| Payscale | Target account traffic focus | 500% traffic increase, 6x ROI | 7 months |

LiveRamp didn't target 5,000 accounts. They targeted 15 - and generated $50M in annual revenue with a 25x customer lifetime value multiple. That's the thesis in one data point: small lists, disproportionate investment, compounding returns.

Auth0 didn't run a 12-month pilot. Six weeks. $3M in pipeline. If you need internal buy-in, this is your template - scope it tight, move fast, show results before anyone can defund you.

Charlesgate accepted that their 2-3 year real estate sales cycle meant ABM was a long game. They stuck with it and delivered their best quarter ever at $3.5M. Patience isn't optional. It's the strategy.

Payscale focused on driving target account traffic and saw a 500% increase in 7 months with 6x ROI - proof that programmatic ABM at scale works when your targeting is tight.

None of these companies tried to boil the ocean. They picked accounts they could win, invested disproportionately, and let the results compound.

Why ABM Programs Fail (And How to Fix Yours)

I've watched enough ABM programs stall to recognize the failure modes. Here are the six that kill most programs - and the fixes that save them.

Too Narrow a TAM

365Talents targeted only 10,000+ employee companies. Results were terrible. When they expanded to 1,000+ employees, opportunities multiplied. Your Tier 1 list should be ambitious but realistic - if your total addressable market is 200 accounts, you don't have an ABM program, you have a prayer.

Fix: Model your TAM from your best customers, not your dream customers. Expand until conversion rates stabilize.

Treating All Accounts the Same

Running identical playbooks for every account is demand gen with account-level reporting - not ABM. FullFunnel's approach splits accounts into three groups by buying journey stage: unaware, aware and engaged, and aware with evidence of need. Each group gets a fundamentally different playbook.

Fix: Tier your accounts and match investment to potential. A Tier 1 account gets 5x the budget and attention of a Tier 3.

Sales-Marketing Misalignment

"ABM's flaw is that it has 'marketing' in the name when sales is an equal partner." - MarketOne

If sales sends one message while marketing runs a different campaign, you create buyer confusion. Organizations with aligned sales and marketing grew revenue 24% faster over three years.

Fix: Start small with open-minded sales reps. Meet weekly. Find common metrics. Expand from there.

Misreading Intent Signals

A Bombora keyword surge on "data security" isn't the same as a G2 competitor comparison visit. One is top-of-funnel research. The other is active evaluation. Treating them the same wastes your SDRs' time and annoys prospects.

Fix: Map intent signals to funnel stages. Respond with appropriate content, not a demo request.

Bad Contact Data

This is the silent killer. Another practitioner nailed it: "outbound emails and LinkedIn touches producing opens/clicks but rare responses." A 30-40% bounce rate doesn't just waste campaigns - it destroys your sender reputation and makes every future email less likely to land.

Fix: Verify every contact before outreach. Refresh your data monthly at minimum. A 7-day refresh cycle is the gold standard.

Unrealistic Timelines

ABM is 18-24 months of continuous activation, not a 90-day experiment. If your CEO expects pipeline in Q1 from a program launched in Q4, you're set up to fail.

Fix: Set expectations with a phased roadmap. Show leading indicators (engagement, coverage) before pipeline metrics materialize.

ABM Tools and Platforms Worth Evaluating in 2026

Here's the thing about ABM tools: enterprise platforms cost more than most teams' entire marketing budget, and "custom pricing" usually means "we'll charge what we think you can afford." Here's what's actually worth evaluating.

| Tool | Best For | G2 | Pricing | Note |

|---|---|---|---|---|

| Prospeo | Verified contacts + intent | - | Free tier; ~$0.01/email | Pair with orchestration tool |

| Demandbase One | Enterprise ABM orchestration | 4.3/5 | ~$40-75K/yr; $500K+/yr ent. | Steep learning curve |

| 6sense Revenue AI | Predictive buying-stage analytics | 4.3/5 | ~$40-75K/yr; $500K+/yr ent. | Needs dedicated team |

| RollWorks | Mid-market ABM at scale | 4.3/5 | ~$15-30K/yr est. | Less depth than Demandbase |

| Terminus | Ad-first multi-channel ABM | 4.4/5 | ~$20-40K/yr est. | Weaker on data side |

| Bombora | Standalone intent data | 4.4/5 | ~$2-5K/mo | Account-level only |

| HubSpot Marketing Hub | Native ABM for HubSpot users | 4.4/5 | From $800/mo | ABM features less mature |

| LinkedIn Sales Navigator | Account prospecting + mapping | 4.3/5 | From $99/mo/user | No account-level reporting |

How to stack these by team size:

If you're an enterprise team with budget and a dedicated ABM operator, Demandbase or 6sense gives you the full orchestration layer - account identification, intent, advertising, measurement, all in one platform. Expect to spend $500K+ annually and 3-6 months on implementation.

Mid-market teams get better ROI from a modular stack: RollWorks for account-based advertising, Bombora for intent signals, and a verified contact data layer for outreach. Total cost: a fraction of Demandbase, with faster time to value.

Skip HubSpot's ABM features if you're already on a dedicated platform. But if you're already running HubSpot and don't want to add another vendor, their native tools are a reasonable starting point before you invest in point solutions.

Regardless of which orchestration platform you choose, you need a contact data foundation. Intent data tells you which accounts are in-market. Scoring tells you which ones to prioritize. But none of that matters if you can't reach the 7-11 stakeholders at each account with verified emails and direct dials. Tools like Prospeo give mid-market teams intent signals (15,000 topics via Bombora) without a separate Bombora contract - and the contact data to act on those signals immediately, at ~$0.01 per email with self-serve pricing. (Also useful: account-based marketing software.)

Tier 1 ABM accounts deserve Tier 1 data. Prospeo's 7-day refresh cycle means your contact data stays current - not 6 weeks stale like competitors. Layer Bombora intent signals on firmographic fit to find accounts actively surging on your category right now, then pull verified emails and direct dials for every decision-maker.

Real-time intent plus verified contacts at $0.01 per email. That's ABM math that works.

Measuring ABM Success - Metrics That Actually Matter

Stop measuring ABM with demand gen metrics. MQLs, impressions, and click-through rates tell you nothing about whether your program is working.

37% of touchpoints go unattributed when data isn't unified across channels. That single stat should terrify any ABM leader - it means more than a third of your program's impact is invisible. Fix attribution before you invest in more channels.

| Metric | What It Measures | Frequency | Benchmark |

|---|---|---|---|

| ICP Match Rate | % of TAL meeting ICP criteria | Weekly | >80% |

| Intent Hit Rate | % of TAL with above-threshold intent (30 days) | Weekly | >25% |

| Coverage Rate | Engaged contacts / required roles per tier | Weekly | 5+ roles at Tier 1 |

| Pipeline Created | $ from target accounts | Monthly | Track trend, not absolute |

| Pipeline Velocity | Days to close for ABM deals | Monthly | Faster than non-ABM |

| Average Deal Size | ACV of ABM-sourced deals | Monthly | 58% of teams report larger deals |

| Win Rate | Target vs. non-target accounts | Monthly | ABM should outperform |

| Revenue Influenced | $ attributed to ABM campaigns | Quarterly | Tied to program ROI |

| CLTV | Lifetime value of ABM accounts | Quarterly | Higher than non-ABM |

| Expansion Revenue | Upsell/cross-sell from ABM accounts | Quarterly | Growing quarter-over-quarter |

Companies that align sales and marketing through ABM become 67% better at closing deals. Those with full alignment grew revenue 24% faster over three years. The measurement framework isn't just about proving ROI - it's about identifying where alignment breaks down so you can fix it.

FAQ

How many accounts should an ABM program target?

Most programs target 100-500 accounts total, but true 1:1 ABM focuses on 10-50 strategic accounts with deep personalization. Start with a pilot of 10-20 before scaling. LiveRamp generated $50M from just 15 accounts - proof that smaller, well-researched lists outperform bloated ones.

How long does ABM take to show results?

Expect 6-12 months for initial pipeline results and 18-24 months for full program maturity. Auth0 proved the model in 6 weeks with a tight pilot, but sustained compounding takes longer. Set expectations with leadership early using leading indicators like engagement and coverage rate.

What's the difference between ABM and demand generation?

Demand gen casts a wide net to generate leads at scale; ABM flips the funnel by starting with named accounts and building personalized engagement for each. If you're targeting 500+ accounts with identical messaging, that's demand gen with account-level reporting, not a true account-based strategy.

How do you get accurate contact data for ABM target accounts?

ABM requires reaching 7-11 stakeholders per account, making data accuracy non-negotiable. A 7-day data refresh cycle is the gold standard - Snyk cut bounce rates from 35-40% to under 5% and generated 200+ new opportunities per month after switching to weekly-refreshed verified data.

What budget do you need for an ABM program?

Industry benchmarks suggest 28-37% of total marketing budget. Per-account, allocate roughly 1% of ACV for growth-tier accounts, 3% for strategic, and 5% for star accounts. Enterprise orchestration platforms alone run $500K+/year, though modular stacks cost a fraction of that with faster time to value.