Pre Call Planning in 2026: A Time-Boxed System That Wins Calls

If your "intro call" starts with, "So... what do you guys do?" you've already handed the steering wheel to the buyer.

Buyers show up informed, skeptical, and busy. Pre call planning is how you stop winging it without disappearing into a research rabbit hole.

Pre-call planning is short, time-boxed work you do before a call to set an outcome, pick a strategy, and show up with the right questions. It's not "research everything." It's "decide what you need to learn and what you need to prove."

What you need (quick version)

Use this when you want a repeatable system you can run every time without becoming the rep who "preps" and never calls.

1) Outcome (one sentence) "By the end of this call, we'll confirm X, quantify Y, and agree on next step Z."

2) Questions (10 bullets, drafted fast) Write the questions you need to qualify the deal (MEDDPICC works). Keep them short; you'll refine live.

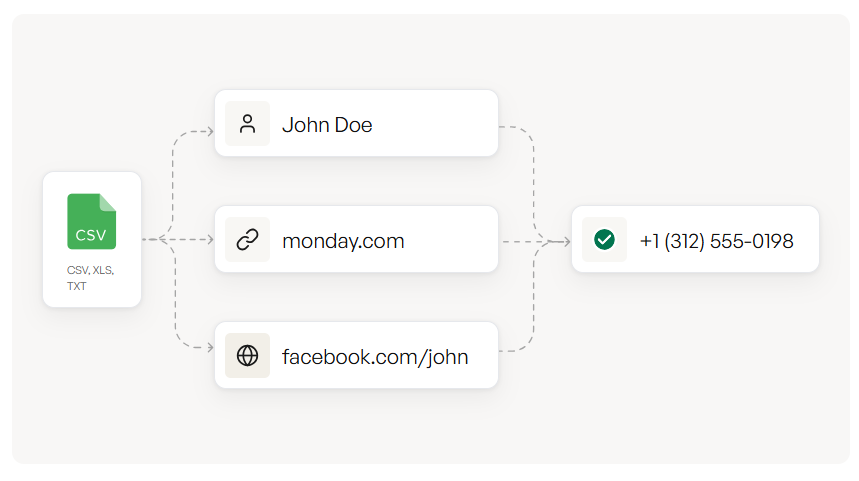

3) Reachability (60 seconds) Confirm you've got a working email and a direct number so follow-up and multi-threading actually happens. In our experience, this is the most skipped step and the one that quietly kills the most deals (no-shows, bounced follow-ups, "I'll loop in my boss" that never turns into an intro).

Tools like Prospeo (tagline: "The B2B data platform built for accuracy") are built for this exact moment: verify the email, grab a direct dial, move on. Prospeo runs on a 7-day data refresh cycle (industry average: 6 weeks) and verifies emails at 98% accuracy, which is exactly what you want before you spend another 10 minutes personalizing.

What this is (and what it isn't)

This is a decision doc you write for yourself: what you want, what you believe, what you need to learn, and what you'll ask for next.

It isn't a company history report. It isn't 25 tabs of "research" that never turns into better discovery. And it isn't a script you cling to when the buyer takes the call somewhere else.

The goal isn't to sound smart. The goal is to steer the conversation with questions and leave with a clean next step.

Research vs decision doc (quick callout)

- Research = raw inputs (news, org changes, tech stack, hiring, intent signals)

- Plan = what you'll do with those inputs (hypothesis, questions, risks, next step)

The 2026 buyer reality: your "intro call" is a shortlist call

Most reps treat the first call like it's the beginning of the buying journey. It's rarely the start. It's the buyer's first time talking to you after they've already formed opinions.

6sense's Buyer Experience Report (nearly 4,000 B2B buyers) put numbers behind what most AEs feel in their bones:

- Buyers first contact sellers around 61% into the journey

- Average buying cycle is 10.1 months

- 95% of the time, the winner is already on the Day One shortlist

- The pre-contact favorite wins around 80% of the time

- AI features are now part of nearly 90% of acquired solutions

- 62% say economic pressure pushed them to engage sellers earlier than planned

Source: https://6sense.com/science-of-b2b/buyer-experience-report-2025/

That means your "intro call" is really a shortlist + risk validation call. Your job is to confirm reality fast, expose decision dynamics, and de-risk the next step, especially around security, integration, and "AI parity."

Hot take: if you're selling a low-price product, you don't need a 30-minute plan. You need more conversations. Timebox hard, qualify faster, and stop treating basic discovery like an enterprise deal.

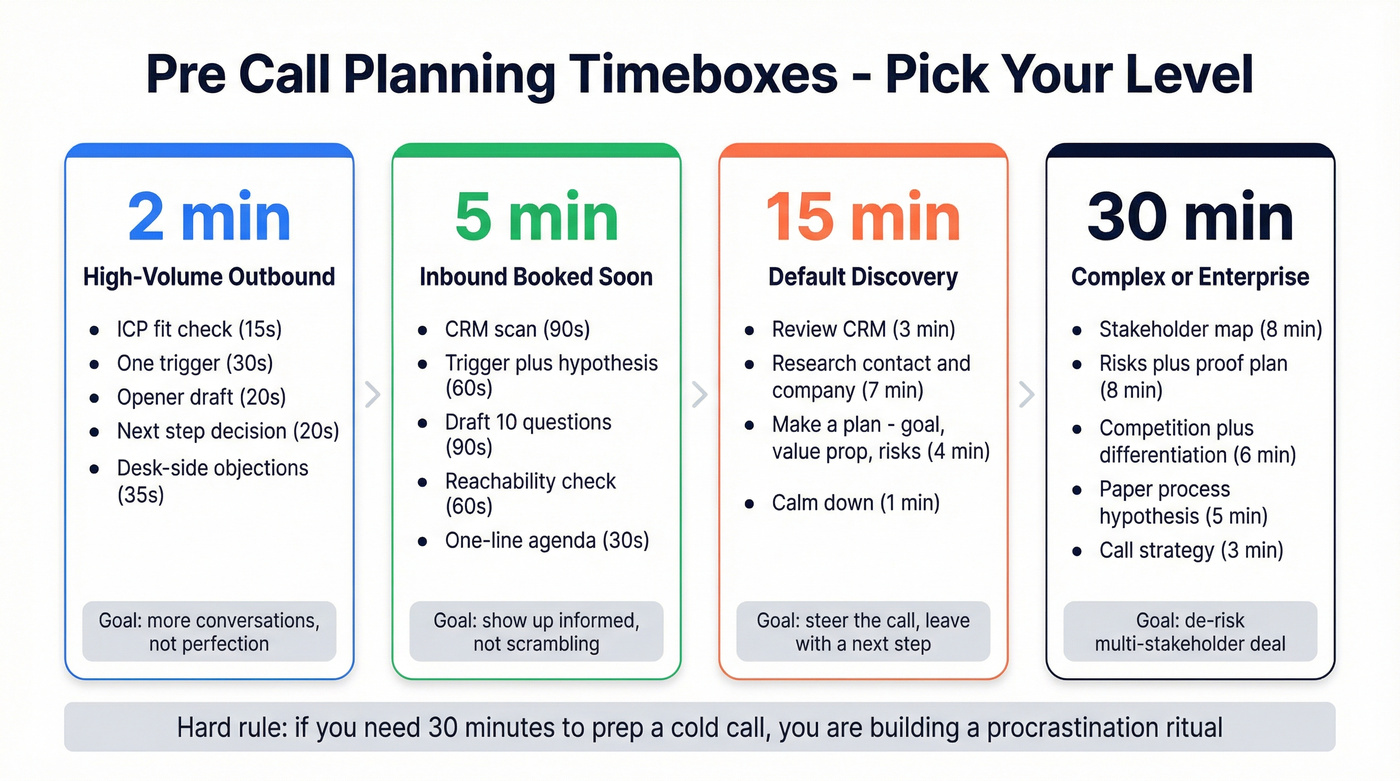

Pre Call Planning Timeboxes (2 / 5 / 15 / 30 minutes)

Timeboxing is the whole game. If you don't constrain prep, it expands until it crowds out calling.

A solid reference point is Salesforce's 15-minute breakdown, 3/7/4/1, from their pre-call checklist: https://www.salesforce.com/ca/blog/sales-call-pre-call-checklist/.

2-minute minimum viable plan (high-volume outbound)

Use this when: you're in a dial block and the goal is conversations, not perfection.

Checklist:

- ICP fit (15 seconds): industry + role + rough size

- One trigger (30 seconds): pick one (job change, hiring, funding, tool change, compliance deadline)

- Opener (20 seconds): "Calling because X is happening in your space and teams are trying to solve Y. Worth a quick question?"

- Next step (20 seconds): decide what you're asking for (15-min discovery, referral, permission to send a 2-line summary)

- Desk-side objections (35 seconds): glance at your top rebuttals

Hard rule: never spend 30 minutes prepping a cold call. If you need that much prep to dial, you're building a procrastination ritual.

5-minute plan (inbound booked soon)

Use this when: an inbound lead booked a call starting in the next hour.

Checklist:

- CRM scan (90 seconds): source, pages viewed, form fields, prior touches, open opps, last activity

- Trigger + hypothesis (60 seconds): "They're evaluating because ___." Write it anyway so you can test it.

- Draft 10 questions (90 seconds): short bullets (use the MEDDPICC bank below)

- Reachability check (60 seconds): verify email + direct number so your follow-up lands and you can multi-thread if they no-show

- One-line agenda (30 seconds): "I'll ask a few questions, share what we typically see, then we'll decide the best next step."

One more thing: open the tabs you'll need before the call starts (calendar, CRM, notes, deck, security doc). Watching a rep fumble for a case study while the buyer sits there is painful, and it screams "I don't do this often."

15-minute plan (default)

Use this when: normal discovery, first meeting with a target account, or any call you actually want to win.

Salesforce's 3/7/4/1 breakdown works because it forces balance:

3 minutes: review CRM (relationship + funnel position)

- Who are they, what's the history, what's already been promised?

- Any open tickets, prior demos, or "we talked last year" landmines?

7 minutes: research contact + company (only what changes the call)

- Contact: scope, tenure, prior companies, likely priorities

- Company: business model, growth signals, strategic initiatives, tech environment

- Mirror their language, but don't cosplay their culture

4 minutes: make a plan (goal, value prop, risks)

Write:

- Goal: what must be true by end of call?

- Value prop: one sentence tied to their trigger

- Risks: what derails this early? (security, integration, budget owner, "already have vendor")

1 minute: calm down This isn't fluff. It prevents the "talk too fast, pitch too early" spiral.

Two practical upgrades that matter on virtual calls:

- Pre-open what you'll share: deck, case study, security doc, pricing one-pager, and the exact tab you'll screenshare. No fumbling in front of the buyer.

- Design the next step now: if you can't name the next step, reschedule. A call without a next step is a calendar-shaped distraction.

We ran an enablement bake-off across 12 reps over 3 weeks. The top performers weren't the smoothest talkers; they were the ones who showed up with a written outcome and a pre-committed next step, then used that structure to stay calm when the buyer tried to drag the call into a product tour.

30-minute plan (complex/enterprise)

Use this when: multi-stakeholder deals, regulated industries, security-heavy products, or anything with procurement/legal gravity.

Checklist:

- Stakeholder map (8 minutes): champion, economic buyer, technical buyer, procurement, security, finance; what each cares about and what they can block

- Risks + proof plan (8 minutes): top 3 risks + the proof that reduces each (pilot, reference call, security docs, ROI model)

- Competition + differentiation (6 minutes): name the likely competitor and "do nothing," then write one differentiation tied to decision criteria

- Paper process hypothesis (5 minutes): procurement steps, security questionnaire, legal redlines, onboarding timeline

- Call strategy (3 minutes): where you'll push, where you'll stay curious, and your "if this happens, I do that" plan

Step 3 of your pre-call checklist - reachability - is where most deals quietly die. Bounced follow-ups, wrong numbers, no-shows you can't recover. Prospeo verifies emails at 98% accuracy on a 7-day refresh cycle, so your prep actually converts into conversations.

Stop prepping calls for contacts you can't actually reach.

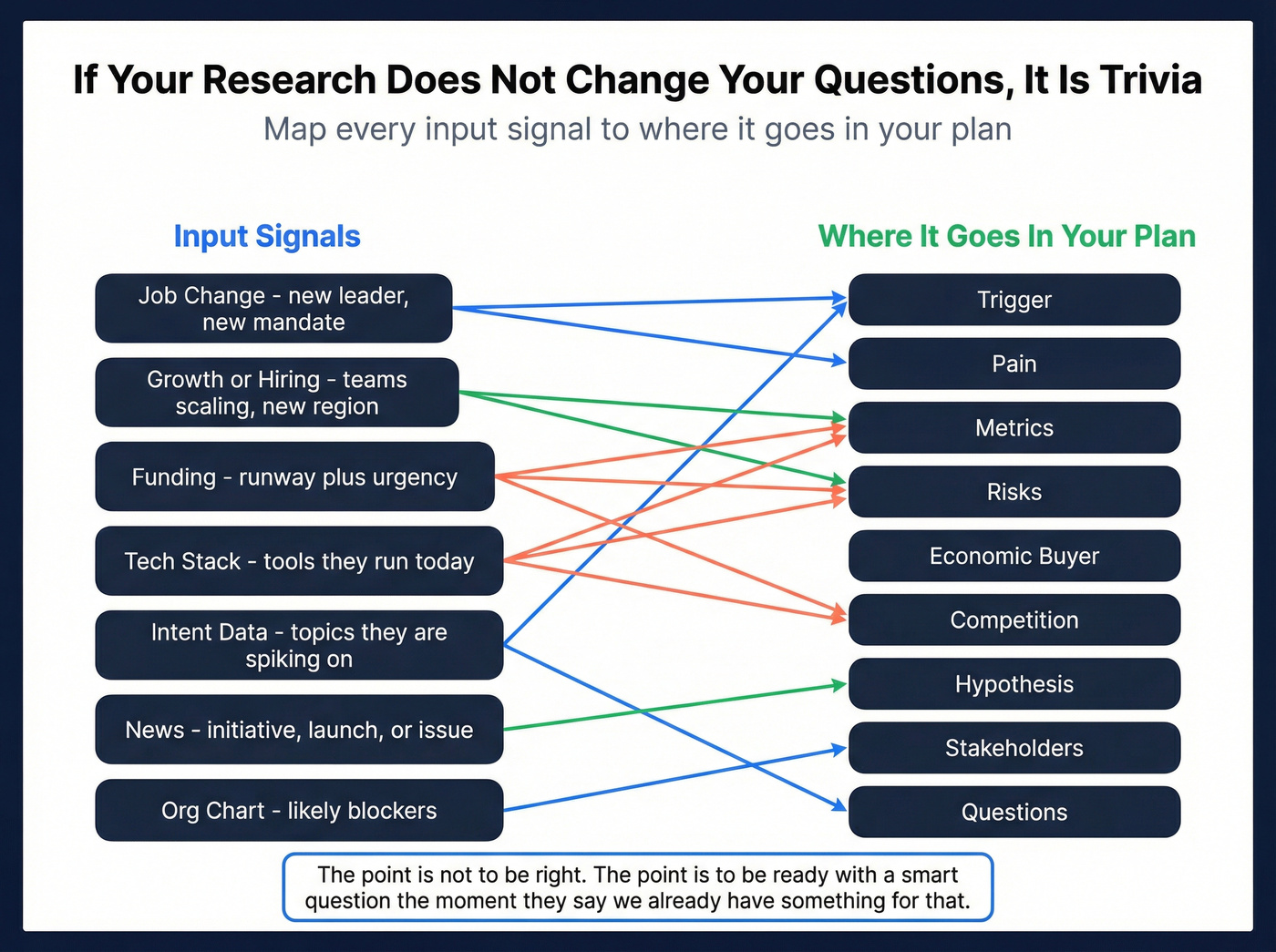

Pre-call research checklist (not a Wikipedia dump)

If your research doesn't change your questions, it's trivia.

Use this table to capture only what turns into better discovery, better positioning, or fewer surprises.

Note: EB = Economic Buyer

| Input signal | What to capture | Where it goes |

|---|---|---|

| Job change | New leader, new mandate | Trigger, Pain |

| Growth/hiring | Teams scaling, new region | Metrics, Risks |

| Funding | Runway + urgency | Metrics, Economic Buyer |

| Tech stack | Tools they run today | Competition, Risks |

| Intent | Topics they're spiking on | Trigger, Questions |

| News | Initiative, launch, issue | Hypothesis |

| Org chart | Likely blockers | Stakeholders |

Two ways to keep this operational:

- Competitor research: don't write "they use X." Write: "If they use X, they'll fear Y (switch cost) and care about Z (migration risk)." That becomes two questions and one proof point.

- Stakeholder mapping: don't guess names. Guess roles and incentives, then plan the ask: "Who owns security review?" "Who signs?" "Who will hate this change?"

Here's the thing: the point isn't to be right. The point is to be ready with a smart question the moment they say, "Yeah, we already have something for that."

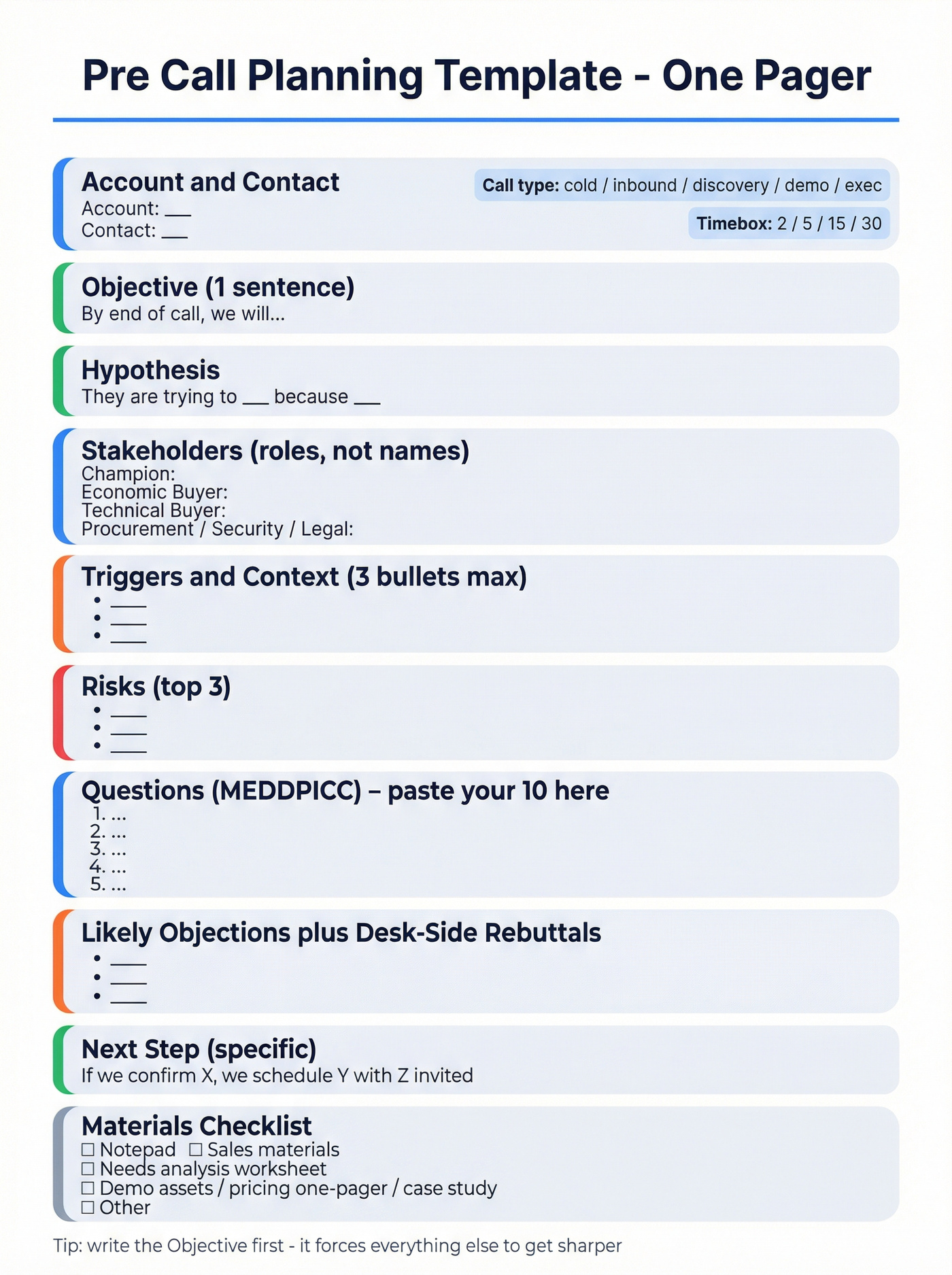

Your pre call planning template (copy/paste) + how to fill it

If you like worksheet-style planning, use a fillable PDF as a reference layout (materials checklist, call notes, next steps). Here are two solid examples: a Hampton Golf pre-call planning worksheet (fillable PDF) and a HubSpot-hosted worksheet template PDF:

- https://hampton.golf/wp-content/uploads/2026/06/HG_-_Pre-Call_Planning_Worksheet_-_Fillable.pdf

- https://53.fs1.hubspotusercontent-na1.net/hubfs/53/Pre-Call%20Planning%20Worksheet%20Template.pdf

Here's a consolidated one-pager that works for outbound, inbound, and enterprise. If you're training a team, keep a few examples on hand (one inbound, one outbound, one enterprise) so reps can model the level of detail without over-prepping.

Copy/paste pre-call plan (one-pager)

Account / Contact: Call type: (cold / inbound / discovery / demo / exec) Timebox: (2 / 5 / 15 / 30)

Objective (1 sentence):

- By end of call, we will...

Hypothesis (what I think is true):

- They're trying to... because...

Stakeholders (roles, not names):

- Champion:

- Economic buyer:

- Technical buyer:

- Procurement/security/legal:

Triggers / context (3 bullets max):

Risks (top 3):

Questions (MEDDPICC):

- (paste your 10 here)

Likely objections + desk-side rebuttals:

Next step (specific):

- If we confirm X, we schedule Y with Z invited.

Materials checklist:

- Notepad

- Sales materials

- Needs analysis worksheet

- "Menus" (your demo assets / pricing one-pager / case study)

- Other:

How to fill it fast (without overthinking)

- Write the Objective first. It forces focus.

- Keep Triggers to three bullets. More than three is stalling.

- Put Risks in plain language ("security will slow this down"), not corporate-speak.

- Make your Next step something a buyer can say yes to in 10 seconds.

Question bank: MEDDPICC mapped to your plan (steal these 10)

MEDDIC was created by Dick Dunkel at PTC, and MEDDPICC is the modernized version for complex deals (it adds Paper Process + Competition). Hyperbound reported teams using formal qualification see 28% higher win rates; the exact number matters less than the mechanism, because qualification forces you to stop "hoping" and start testing reality with questions the buyer can't answer with fluff.

Use these 10 as your default set:

Metrics

- "What metric is this tied to: pipeline, retention, cycle time, cost?"

- "What's the current baseline, and what would 'good' look like?"

Economic Buyer

- "Who ultimately signs, and what do they care about most?"

Decision Criteria

- "What are the top 3 criteria you'll use to choose a vendor?"

Decision Process

- "What are the steps from today to a decision, and who's involved in each?"

Paper Process

- "What does procurement/security/legal require, and when does that start?"

Identify Pain

- "What's broken today, and what's the impact on the business?"

- "What happens if you don't solve this in the next 90 days?"

Champion

- "Who's most motivated to drive this internally, and why?"

Competition

- "What other options are on the table, including staying with what you've got?"

If you don't know the paper process by the end of discovery, you didn't run discovery. You ran a friendly chat.

Objection prep that works under pressure (desk-side rebuttals)

Use this if: you do cold calls, handle inbound objections live, or freeze when someone says "not interested." Skip this if: you still don't know what you're asking for.

A recurring tip in r/sales threads is simple and effective: keep common objections and rebuttals physically on your desk so you don't have to think mid-call. Repetition makes it automatic.

Mini scripts that hold up:

"Not interested." "Totally fair. Quick question: are you handling X in-house, or is someone owning it?"

"We already use [vendor]." "Makes sense. What do you wish [vendor] did better?"

"Email me something." "I will. Before I do, what's the one thing you'd need to see to decide it's worth a real conversation?"

Operational rule (no moralizing): if they say "email me," ask one qualifying question. If they won't answer, end the call and move on.

Optional low-friction move: if they're on mobile and truly busy, ask, "Can I text you a screenshot of the one slide that matters?" (Only do this if your compliance rules allow it.)

Speed-to-lead changes what you prep (and how long you get)

Inbound is a race. Your prep time's constrained by how fast you're willing to call.

Revenue.io summarizes the lead-response multipliers clearly (popularized by HBR lead-response research):

- Respond within 1 hour: 7x more likely to have a meaningful conversation

- Respond vs waiting 24 hours: 60x more likely to qualify

- Average lead response time: 42 hours

Source: https://www.revenue.io/blog/lead-response-time

The takeaway isn't "prep more." It's "prep faster and call faster."

Make it real:

- Set an SLA: inbound calls within 5-15 minutes during business hours

- Use the 5-minute inbound plan above

- Pre-build a "first call note" template in your CRM

- Decide your escalation path: no answer -> voicemail + email + (if appropriate) text in a tight sequence

Automation: how to generate a pre-call brief (and what to never automate)

AI speeds up planning when it's event-triggered, integrated, and measured, not when it's a prompt library nobody uses.

A workflow that works in real teams:

Inputs -> brief -> CRM notes

- Trigger: meeting booked / lead created / account added to sequence

- Inputs pulled automatically: CRM fields, recent emails, website notes, firmographics, recent news, tech signals

- AI drafts a brief: hypothesis, likely stakeholders, 10 questions, risks, suggested next step

- Human review (2-3 minutes): edit for accuracy and tone

- Write-back: save the brief to the CRM and create tasks

Write-back fields that matter: call agenda, MEDDPICC questions, risks, stakeholders to invite, and the exact next step you'll ask for.

What to never automate:

- Assumptions about budget, urgency, or internal politics

- Pricing promises or discount language

- Sensitive claims (security posture, compliance guarantees, competitor trash talk)

- Anything you wouldn't want quoted back to you on the call

We've seen teams ship "AI call prep" that looked impressive and still made reps worse, because it encouraged confident nonsense ("CFO is the EB" with zero evidence) and reps stopped doing the one job that matters: asking clean questions and listening to the answers.

Sandler's "3 C's" quick check (use this to run the call)

When you're done planning, do this 15-second check before you join:

- Collaboration: did you set a simple agenda and earn permission to ask questions?

- Confirmation: do you have a plan to play back what you heard (not just pitch)?

- Clarity: do you know the next step you're driving to?

If you can't hit all three, your plan isn't a plan. It's notes.

Filled-in example: a realistic pre-call plan (15-minute version)

This is what "good enough" looks like in practice: short, specific, and built to earn a next step.

Account / Contact: NorthPeak Logistics / Dana R., VP Operations Call type: Discovery (inbound demo request) Timebox: 15 minutes

Objective (1 sentence): By end of call, we'll confirm the operational bottleneck, identify the decision path, and book a technical deep dive with Ops + IT.

Hypothesis (what I think is true): They're scaling volume and their current workflow is causing delays and errors, so they're evaluating automation to reduce cycle time and cost.

Stakeholders (roles, not names):

- Champion: VP Ops (Dana)

- Economic buyer: COO or CFO

- Technical buyer: IT systems lead

- Procurement/security/legal: procurement manager + security reviewer

Triggers / context (3 bullets max):

- Hiring for ops analysts (capacity pressure)

- New region expansion (process strain)

- Demo request mentions "reduce manual work"

Risks (top 3):

- IT blocks due to integration/security concerns

- "We already have a tool" status quo bias

- No quantified metric -> no business case

Questions (MEDDPICC 10):

- Metrics: "What KPI is this tied to?" "What's baseline vs target?"

- EB: "Who signs and what do they care about?"

- DC: "Top 3 criteria: speed, cost, risk, integration?"

- DP: "Steps from here to decision?"

- PP: "Procurement/security/legal steps and timing?"

- Pain: "What breaks today?" "What happens if nothing changes in 90 days?"

- Champion: "Who's most motivated internally and why?"

- Competition: "What else are you evaluating, including doing nothing?"

Competitor note: They'll compare you to "keep current system + add headcount" and one known ops automation vendor. Win on time-to-value and risk reduction.

Likely objections + desk-side rebuttals:

- "Just send info." -> "What would make it worth a real evaluation?"

- "We already have something." -> "What's missing that triggered this demo request?"

Next step (specific): If we confirm a measurable bottleneck and a real timeline, we schedule a 45-minute technical session with IT + Ops and align on success criteria.

What must be true by end of call: We've got a quantified pain, a named economic buyer, and a clear decision path (including paper process).

FAQ

What's the difference between pre-call planning and pre-call research?

Pre-call research collects inputs (news, org changes, tech stack, intent). Pre-call planning decides how you'll run the call (objective, hypothesis, questions, risks, next step). Research fills your brain; planning gives the conversation direction. For cold outreach, the win is finding one credible trigger, not writing a thesis.

How long should pre-call planning take for a 30-minute discovery call?

For a 30-minute discovery call, 10-15 minutes of prep is the sweet spot when the deal matters. Past 15 minutes, you're usually polishing instead of qualifying, and that tends to make reps pitchy and rigid on the call.

What should be in a pre-call plan for cold calls?

A cold-call plan should take 2 minutes: ICP fit, one trigger, one opener, one next step, and 2-3 desk-side objections. If you can't write the next step in one line, you're not ready to dial, because you don't know what "success" is yet.

How do I verify contact details fast before I spend time personalizing?

Verify reachability first by checking the email and direct number in under 60 seconds, then personalize. Prospeo verifies emails at 98% accuracy, includes 125M+ verified mobile numbers with a 30% pickup rate, and refreshes records every 7 days, so you don't waste prep time on bounces or dead dials.

Wrap-up: the system to run every time

Pre call planning is simple: timebox the prep, write the outcome, draft the questions, and pre-commit the next step.

That's it.

One hard rule to end on: if you can't write the next step you're driving to, don't take the call yet. Reschedule and fix the plan.

You just spent 15 minutes building a plan, drafting questions, and mapping stakeholders. Don't let stale data waste that work. Prospeo gives you verified emails and direct dials across 300M+ profiles for ~$0.01 per email - so your 60-second reachability check actually holds up.

Make every minute of pre-call planning count with data that connects.