DitLead vs Apollo.io (2026): Which One Fits Your Outbound Stack?

Outbound doesn't fail because you picked the "wrong" sequencer. It fails because you bought the wrong category of tool for your bottleneck.

Apollo.io is what you buy when you need leads now. DitLead is what you buy when you already have leads and your sending operation is the thing holding you back.

Here's the hook: most teams should stop forcing a "one tool" decision and instead build a simple stack that protects deliverability first, then scales volume.

30-second verdict (and "skip both if...")

Apollo wins when you need leads. DitLead wins when you need sending control. Most teams don't need an "all-in-one." They need one thing that removes today's bottleneck.

Pick Apollo.io if you want:

- A B2B database + enrichment so reps can prospect immediately

- A mature platform with admin controls and lots of implementation know-how

- Sequencing bundled in (good enough for most SMB outbound)

Pick DitLead if you want:

- Cold email execution at scale: warmup, inbox management, and rotation

- Flat monthly tiers with big credit buckets and rollover mechanics

- A sending-first tool that's priced like an underdog

Skip both if accuracy/freshness is the bottleneck

- When bounce rate creeps past ~3-5%, inboxing drops fast. More features won't save you.

- Fix inputs first with a dedicated accuracy layer. That's the cleanest way to protect domains, inboxes, and budget.

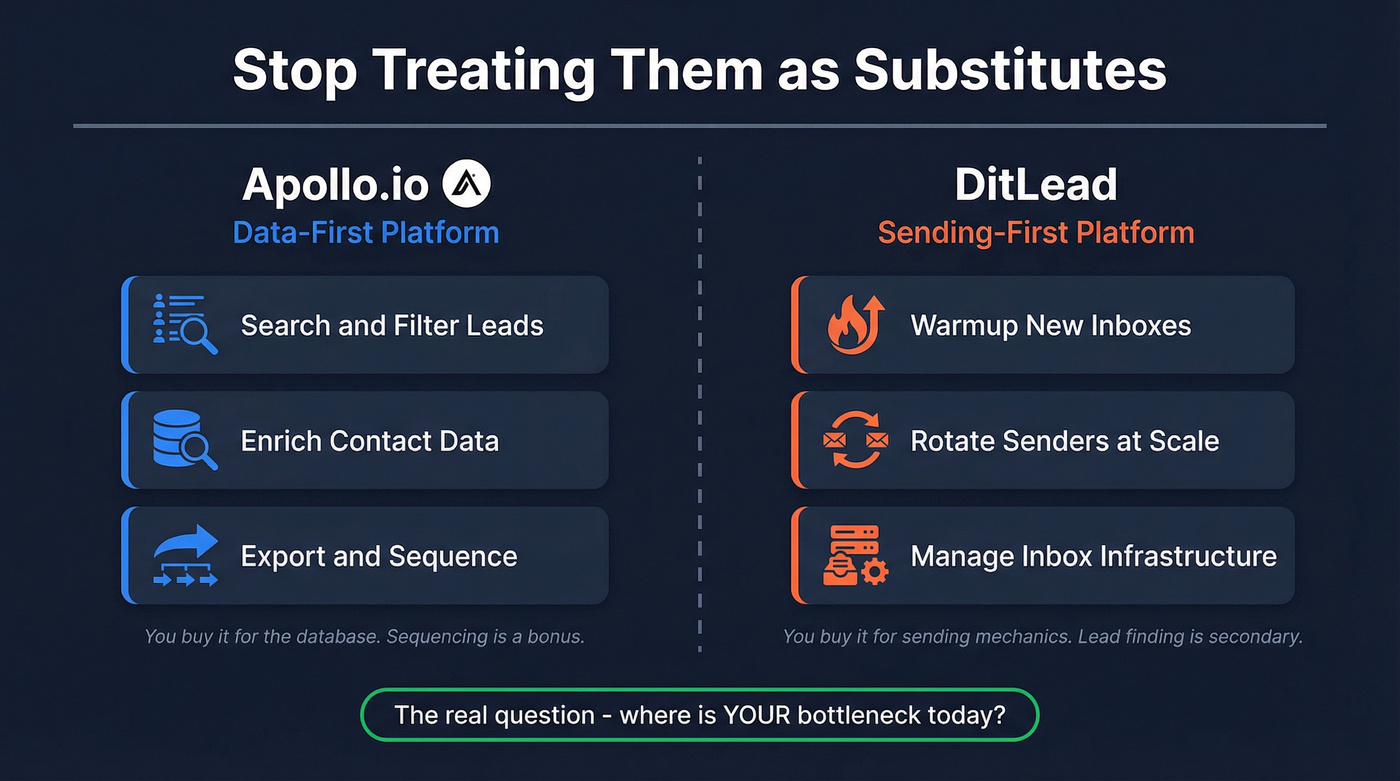

What DitLead and Apollo actually are (stop treating them as substitutes)

Apollo.io is a sales intelligence platform that includes sequencing. Teams buy it for search -> enrich -> export, then run sequences because it's already there.

DitLead is an outreach execution platform built around the mechanics of sending: warmup, rotation, inbox operations, and volume control. It's closer to "inbox infrastructure" than "database."

Here's the thing: DitLead's brand history is messy. It's DitLead (formerly Murlist), and you'll still see Murlist references in directories. That doesn't break the product, but it raises the bar for piloting, documentation, and support expectations.

Category split (the part most "vs" pages ignore):

- Apollo.io: database + enrichment + sequencing (data-first)

- DitLead: warmup/rotation + inbox ops + verification credits (sending-first)

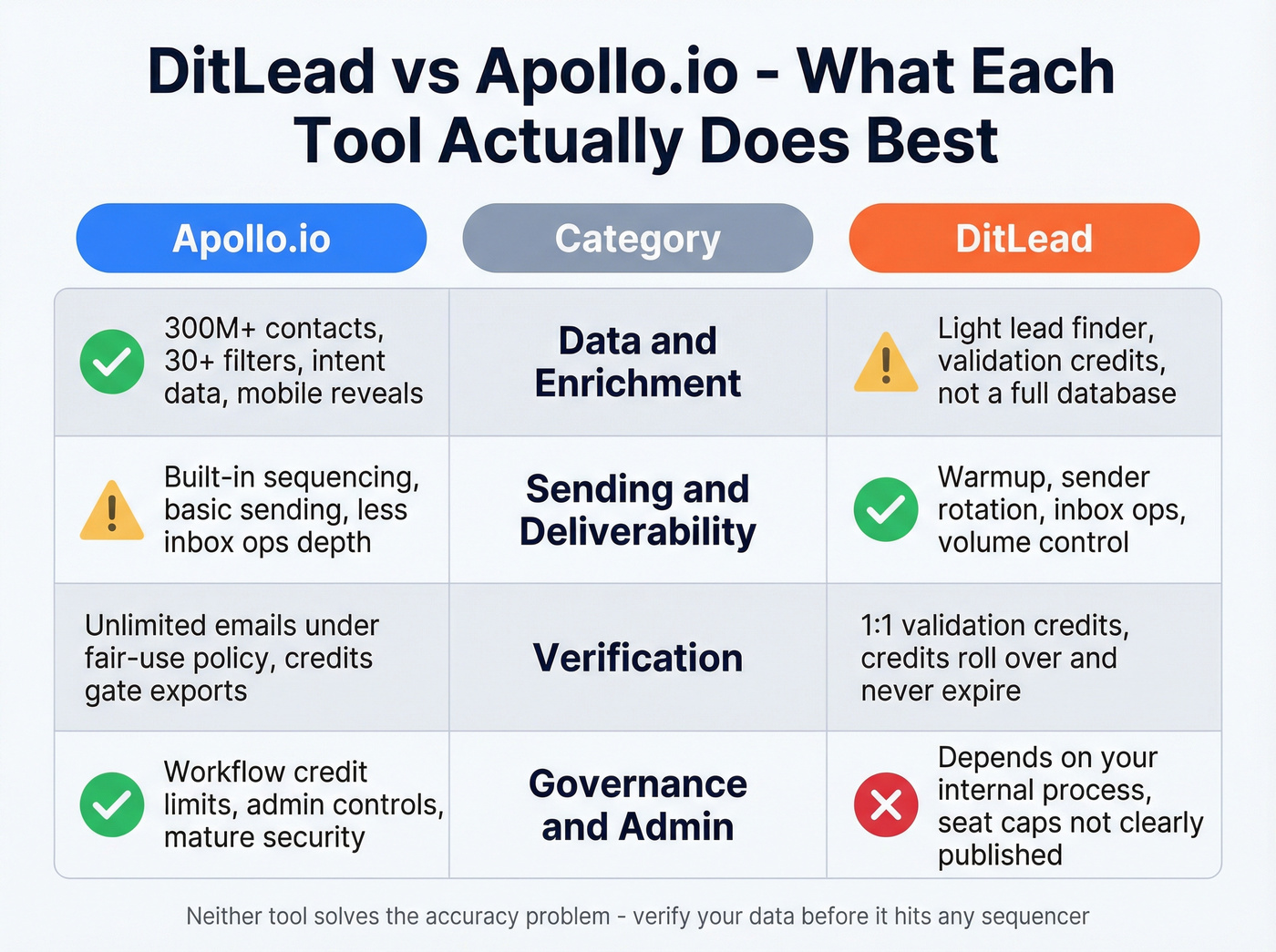

DitLead vs Apollo.io feature comparison (data vs sending vs verification)

The buyer's view: what each tool is "best at"

If you're buying for outcomes (not feature checklists), the split is simple:

- Apollo.io = list building + enrichment. You pay for seats, then manage credits as usage grows.

- DitLead = deliverability mechanics + inbox scaling. You pay flat tiers, then manage inboxes/domains like infrastructure.

Implementation reality: what breaks first

This is where most outbound stacks fail:

- Apollo breaks on credit governance. The product works; budgets and workflows don't.

- DitLead breaks on operational discipline. If you don't have rules for inbox count, per-domain volume, and list hygiene, you'll scale chaos.

Head-to-head capability table (what's actually native)

| Data / Enrichment | Strong native database + enrichment; exports and mobile reveals are often credit-gated | Light lead finder + validation credits; not a full sales intel database experience | 300M+ profiles; 143M+ verified emails; 125M+ verified mobiles; 30+ filters + intent (15,000 topics); 98% email accuracy; 7-day refresh |

| Outreach / Sequencing | Built-in sequencing; best for straightforward outbound | Sending-first: warmup, rotation, inbox ops; built for scale | Accuracy layer that feeds clean, verified contacts into your sequencer (Smartlead/Instantly/Lemlist) |

| Deliverability controls | Better when enrichment is configured for accuracy; less depth in inbox ops | Strong: warmup + sender rotation (Team+) + operational controls | Prevents deliverability damage by keeping invalid/stale data out of campaigns |

| Verification model | "Unlimited" emails under fair-use; credits gate exports, mobile reveals, and enrichment/workflows | Verification credits (1:1 validation/lead finder); credits roll over | ~$0.01 per verified email (charged only when valid); mobiles cost 10 credits per number |

| Governance | Workflow credit limits + admin controls; higher tiers unlock more security | Governance depends on your internal process; seat caps aren't clearly published | Self-serve, no contracts; API + integrations; governance via clean data + weekly refresh |

DitLead operational checklist (what matters when you scale inboxes)

If you're evaluating DitLead, ignore the fluff and confirm these operational basics:

- Warmup: included on paid tiers; decide warmup duration per new inbox before sending volume

- Sender rotation: the feature that makes DitLead worth considering for agencies/high-volume teams (Team+)

- Inbox management: how many inboxes per workspace, how they're grouped, and how sending limits are enforced

- API/webhooks: Team tier includes API/webhooks, which matters if you automate list loading, suppression, or reporting

- Dedicated IPs/proxies + agency controls: positioned on the Popular tier; useful if you run multiple client workspaces

- Optional add-ons: DitLead mentions extras like social/prospecting features; treat them as secondary and buy DitLead for email infrastructure first

DitLead handles sending. Apollo handles leads. Neither solves the accuracy problem that kills deliverability. Prospeo's 98% verified emails and 7-day refresh cycle keep bounce rates under control - so your sequencer and inbox infrastructure actually work.

Stop scaling bad data. Start with 100 free credits today.

DitLead vs Apollo.io pricing in 2026 (sticker price vs true cost)

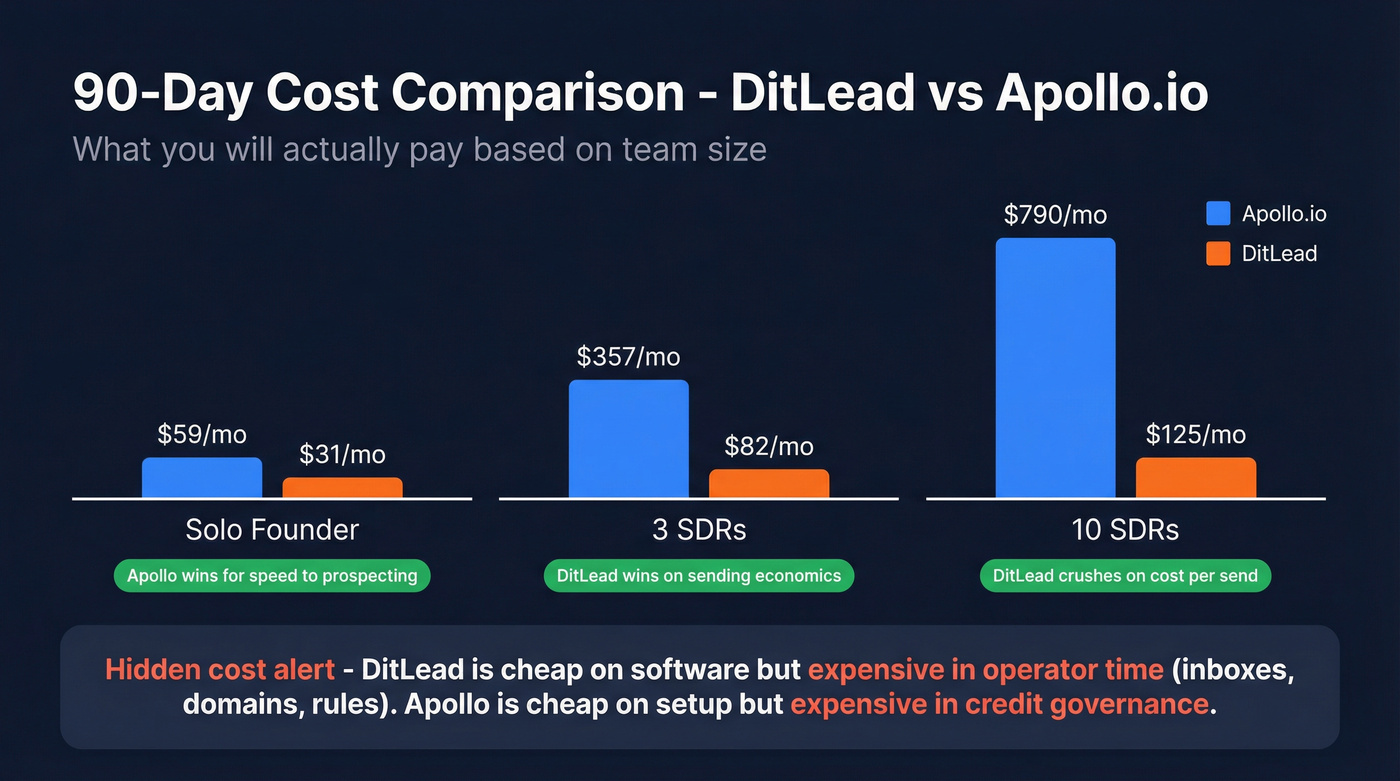

Pricing is where these tools feel like they're from different worlds:

- Apollo.io: per-seat pricing that looks reasonable until credits become the limiter.

- DitLead: flat tiers that look absurdly cheap until you realize you're paying in operational effort (inboxes, domains, rules).

And yes, that tradeoff is real. I've watched teams "save" money on software and then burn weeks of operator time cleaning up inbox sprawl, domain reputation issues, and inconsistent sending rules across reps.

Apollo.io pricing tiers (monthly vs annual) + seat minimums

Apollo's paid plans (per user/month):

- Monthly: $59 (Basic) / $99 (Professional) / $149 (Organization)

- Annual: $49 (Basic) / $79 (Professional) / $119 (Organization)

Two rules that matter in real life:

- Organization requires a 3-user minimum.

- Seat reductions don't happen mid-term. If headcount drops, the bill doesn't.

Apollo also runs a credit model where mobile reveals, exports, and enrichment/workflows are the first places you feel constraints. Emails are "unlimited" under a fair-use policy, which sounds simple until you try to forecast spend across a growing team.

If you want a clean breakdown of tiers and constraints, Cognism has one here: https://www.cognism.com/blog/apollo-io-pricing

Credit-burn reality (directional, but accurate)

Don't obsess over exact credit numbers. Watch the behaviors that trigger pain:

- 3 SDRs exporting 200 contacts/day each turns into ~600 exports/day. Basic stops feeling "cheap" fast.

- Mobile-heavy motions (call-first, multi-touch) hit limits before email-only motions.

- Automation multiplies spend. If you enrich or run workflows on every new record without limits, credits disappear quietly.

DitLead tiers + verification credits that roll over

DitLead's flat monthly tiers:

- Free: $0 - 200 contacts, 1,000 emails/mo, 100 verification credits

- Starter: $31/mo - 10,000 credits, unlimited contacts/emails, unlimited warmup, unlimited email accounts

- Team: $82/mo - 100,000 credits + sender rotation (inbox rotation) + API/webhooks + more controls

- Popular: $125/mo - 1,000,000 credits + dedicated IPs/proxies + agency access

Credits cover email validation and lead finder at 1:1, and credits roll over / never expire. That's buyer-friendly and rare.

One non-negotiable: DitLead doesn't clearly publish seat caps or multi-user limits. Treat access as capped until proven otherwise, and get user limits and support expectations in writing before rollout. That one email thread saves a lot of "we loved it until we scaled" stories.

Pricing page: https://ditlead.com/pricing

90-day cost scenarios (what you'll actually pay for)

Scenario A: Solo founder (light enrichment + sending)

- Apollo Basic monthly: ~$59/mo

- DitLead Starter: $31/mo

Verdict: Apollo gets you prospecting fastest. DitLead's a cheap sending engine once you have lists.

Scenario B: 3 SDRs (prospecting now, governance later)

- Apollo Organization annual (3-seat minimum): 3 x $119 = $357/mo (annual commitment)

- DitLead Team: $82/mo

Verdict: Apollo wins for speed-to-prospecting. DitLead wins for sending economics, but only if leads are already solved.

Scenario C: 10 SDRs (high volume, lots of inboxes)

- Apollo Professional annual: 10 x $79 = $790/mo (plus credit governance work)

- DitLead Popular: $125/mo

Verdict: DitLead crushes on cost-per-send. Apollo stays valuable for list building, but you must run it like a budgeted data utility.

Pricing mini-table (sticker price view)

| Tool | Entry paid tier | Typical team tier | Cost mechanic that surprises people |

|---|---|---|---|

| Apollo.io | ~$59/user/mo monthly (Basic) | ~$79-$119/user/mo annual | Credits + automation burn + seat lock-in |

| DitLead | $31/mo (Starter) | $82-$125/mo | Seat caps unclear + operational overhead (inboxes/domains/rules) |

| Prospeo | Free tier, then usage-based | Scales with verified data pulled | ~$0.01 per verified email; 10 credits per mobile |

Scorecard: who wins what (no "it depends")

This is the table people actually want. Winners are based on what each product is built to do, not marketing overlap.

| Category | Winner | Why |

|---|---|---|

| Best for building lists fast | Apollo.io | Native database + filters + enrichment workflows get reps prospecting today. |

| Best for inbox scaling & rotation | DitLead | Warmup + rotation + inbox ops are the product, not a side feature. |

| Best for predictable spend | DitLead | Flat tiers + rollover credits beat seat lock-in for sending-heavy teams. |

| Best for admin governance | Apollo.io | Workflow credit limits + mature admin controls reduce silent spend. |

| Best for data accuracy & freshness | Prospeo | 98% email accuracy + 7-day refresh is the fastest path to lower bounce and better connect rates. |

| Best "single tool" for a tiny team | Apollo.io | One login gets you data + sequences; fewer moving parts early on. |

| Best for agencies running many inboxes | DitLead | Rotation and operational controls matter more than a giant database. |

Deliverability & data quality in 2026 (what actually moves the needle)

Deliverability in 2026 is mechanical: bounce rate, reputation, and inbox-level volume control. Once bounces cross ~3-5%, you feel inbox placement drop and replies dry up even if your copy's good.

We've tested this pattern across enough outbound programs that it's boring: the team blames subject lines, then the sequencer, then the offer, and only later realizes they were feeding stale contacts into a high-volume machine.

Deliverability checklist that actually matters

- Verify emails before they enter sequences

- Keep bounce rate under ~3-5% consistently

- Ramp volume with warmup and per-domain caps

- Rotate senders when volume increases (don't overload one inbox)

- Dedupe and suppress stale contacts so bad records don't re-enter campaigns

- Track performance by domain/inbox, not just campaign totals

Apollo.io: Waterfall Enrichment + credit governance

Apollo's deliverability-relevant shift is Waterfall Enrichment becoming the default in Dec 2025. Apollo checks its own data first, then selected trusted data sources, and admins can configure modes.

Apollo's Dec 2025 release notes report ~5% more emails, ~7% more phone numbers, and 45% fewer bounces with waterfall enrichment. That's a real improvement, especially if you're currently living in the danger zone and sending at scale.

My recommendation if you're using Apollo sequences: set enrichment for accuracy and budget for it. Paying for "coverage" and then burning a domain is the dumbest trade in outbound, and I've seen teams do it twice because nobody wanted to be the bad guy about credit limits.

DitLead: strong sending controls, zero mercy for bad lists

DitLead helps you send cleanly at scale: warmup, rotation, and inbox operations. That's valuable.

But it doesn't rescue bad inputs. If your list is stale, DitLead just helps you send that stale list faster, and you'll still pay the deliverability price.

Failure modes & fixes (the practical playbook)

| Failure mode | What it looks like | Fix that works |

|---|---|---|

| Bounce rate >5% | Sudden inboxing drop, domains get cold, reply rate collapses | Verify + refresh, suppress invalids, handle catch-alls intentionally, stop recycling old lists |

| Apollo credits exploding | "Why did we burn budget this week?" | Set workflow credit limits, restrict enrichment triggers, dedupe exports, define per-rep export rules |

| Too many inboxes to manage | Inconsistent sending, uneven performance, warmup chaos | Standardize inbox naming, enforce per-domain caps, rotate senders, schedule warmup/ramp rules |

| Data staleness | Wrong titles, wrong companies, "left the company" replies | Refresh weekly for active segments; don't run Q1 lists in Q3 |

Trust, reviews, and adoption risk (DitLead vs Apollo.io)

This is the unsexy part that decides whether your rollout sticks.

DitLead: thin review footprint = higher rollout risk

DitLead's public trust signals are light:

- G2 shows 3.9/5 with 5 reviews, including the headline "Unreliable, Buggy, and Poorly Supported. Big disappointment."

- Capterra shows 0 reviews and lists a $31/mo starting price.

- Directory metadata still contains Murlist references.

Look, I'm not saying "don't use it." I'm saying don't pretend it's the same risk profile as a widely deployed platform.

I wouldn't roll DitLead to a 20+ seat org without a 2-week pilot, written confirmation of seat limits, and a clear support path. For a lean team or agency that can move fast, the economics are tempting enough to justify that pilot.

Apollo.io: mature, widely implemented, and easier to staff

Apollo's a known quantity, with a huge review footprint and a real ecosystem of admins and playbooks.

What users complain about (the recurring themes):

- Credits feel unpredictable once teams scale exports, mobiles, and enrichment.

- Seat commitments create friction when headcount changes.

- Data gaps still happen, so teams end up paying for multiple sources anyway.

Buyer traps (and how to avoid them)

These are the three mistakes I see most often in the DitLead vs Apollo.io decision.

Trap #1: Buying Apollo and ignoring credit governance

What happens: reps start winning, exports ramp, mobiles become "mandatory," workflows enrich everything, and spend jumps.

Fix: treat credits like a budget line item:

- Set workflow credit limits immediately

- Define per-rep export rules (daily/weekly)

- Enrich only the segments you're actively working

Trap #2: Buying DitLead before you've solved lead sourcing

What happens: you get a great sending engine and nothing to feed it. Campaigns stall, then the tool gets blamed.

Fix: decide your lead source first (database, events, partners, inbound intent, referrals). DitLead's a multiplier, not a generator.

Trap #3: Trying to sequence your way out of bad data

What happens: bounces rise, inboxing drops, and you keep swapping sequencers instead of fixing inputs.

Fix: verify + refresh before you send. Once inputs are clean, both Apollo sequences and sending-first platforms perform dramatically better.

Skip this if you're only sending 20-30 emails a day from one inbox and you're already under 2% bounce. You're not the person paying the deliverability tax yet.

A practical stack that works: Apollo or DitLead + an accuracy layer

If you're building lists in Apollo and sending in Apollo, you still need a gate that keeps junk out of sequences.

If you're sending at scale in DitLead, you definitely need that gate, because volume amplifies every data mistake.

In our experience, the cleanest setup is simple: pick the tool that solves your main bottleneck (data or sending), then add an accuracy layer that verifies and refreshes contacts on a weekly cadence so you aren't quietly torching domains with stale records, role changes, and dead inboxes. If you’re running an ABM motion, align this with your Account Based Marketing Goals so verification stays tied to pipeline outcomes.

The article says it: when bounce rates creep past 3-5%, more features won't save you. Prospeo gives you 143M+ verified emails at $0.01 each, refreshed every 7 days - not 6 weeks. Feed clean data into DitLead, Apollo, or any sequencer and protect every domain you own.

Fix your inputs first. Your entire outbound stack depends on it.

FAQ

Why does Apollo.io get expensive when outbound works?

Apollo gets expensive because the actions that scale with success (exports, mobile reveals, enrichment, and workflows) are credit-gated, while seats stay fixed for the term. Once a team is pulling 100-300 new contacts per rep per day, credit governance becomes the real "pricing plan," not the sticker price.

Does DitLead replace a B2B database like Apollo.io?

DitLead doesn't replace a database-first platform because it's built for sending infrastructure (warmup, rotation, and inbox ops), not deep prospecting and enrichment. For most teams, it works best paired with a lead source, then used to run higher-volume cold email without losing control of deliverability.

Is DitLead pricing per seat or per workspace?

DitLead is sold as flat monthly tiers, but seat caps and multi-user limits aren't clearly published. Assume there's a practical access limit until support confirms it in writing, especially if you need multiple client workspaces, role-based access, or a larger internal team.

What changed with Apollo Waterfall Enrichment in late 2025?

Apollo made Waterfall Enrichment the default in Dec 2025, prioritizing Apollo data first and then selected trusted sources based on admin settings. Apollo's Dec 2025 release notes report ~5% more emails, ~7% more phone numbers, and 45% fewer bounces, which matters if you're trying to keep bounce under ~3-5%.

What's a good free way to reduce bounces before sending?

Verify before sequencing and only send to valid addresses, aiming to keep bounce under ~3-5%. Prospeo's free tier includes 75 verified emails plus 100 Chrome extension credits per month, and it charges only when an email is valid, which makes it practical for cleaning small batches before a bigger push.

Summary: the real answer to DitLead vs Apollo.io

If you're deciding between DitLead and Apollo.io, pick based on your bottleneck: Apollo's the faster path to list building and rep productivity, while DitLead's the better inbox infrastructure play when you're scaling volume and need rotation + warmup controls.

And if bounce rate's creeping up, fix inputs first. Clean, fresh data is what keeps any outbound stack working in 2026.