Channel Sales Incentive Programs: An Operator's Playbook (2026)

$25k in incentives sounds generous... until partners don't register deals, nobody submits claims, and Finance freezes the next payout batch. Channel sales incentive programs don't fail because the reward is too small. They fail because the operating model is sloppy.

This playbook gives you templates, payout SLAs, claims controls, and finance/compliance checklists you can copy.

What you need (quick version)

Use this checklist before you launch anything. If you can't check most boxes, you're about to buy yourself disputes, breakage, and channel conflict.

- A single sentence goal (behavior + who + by when).

- Rules that pass the 60-second test. If partners can't understand the rules in 60 seconds, your program's broken.

- One primary metric (not five).

- A payout SLA you can actually hit

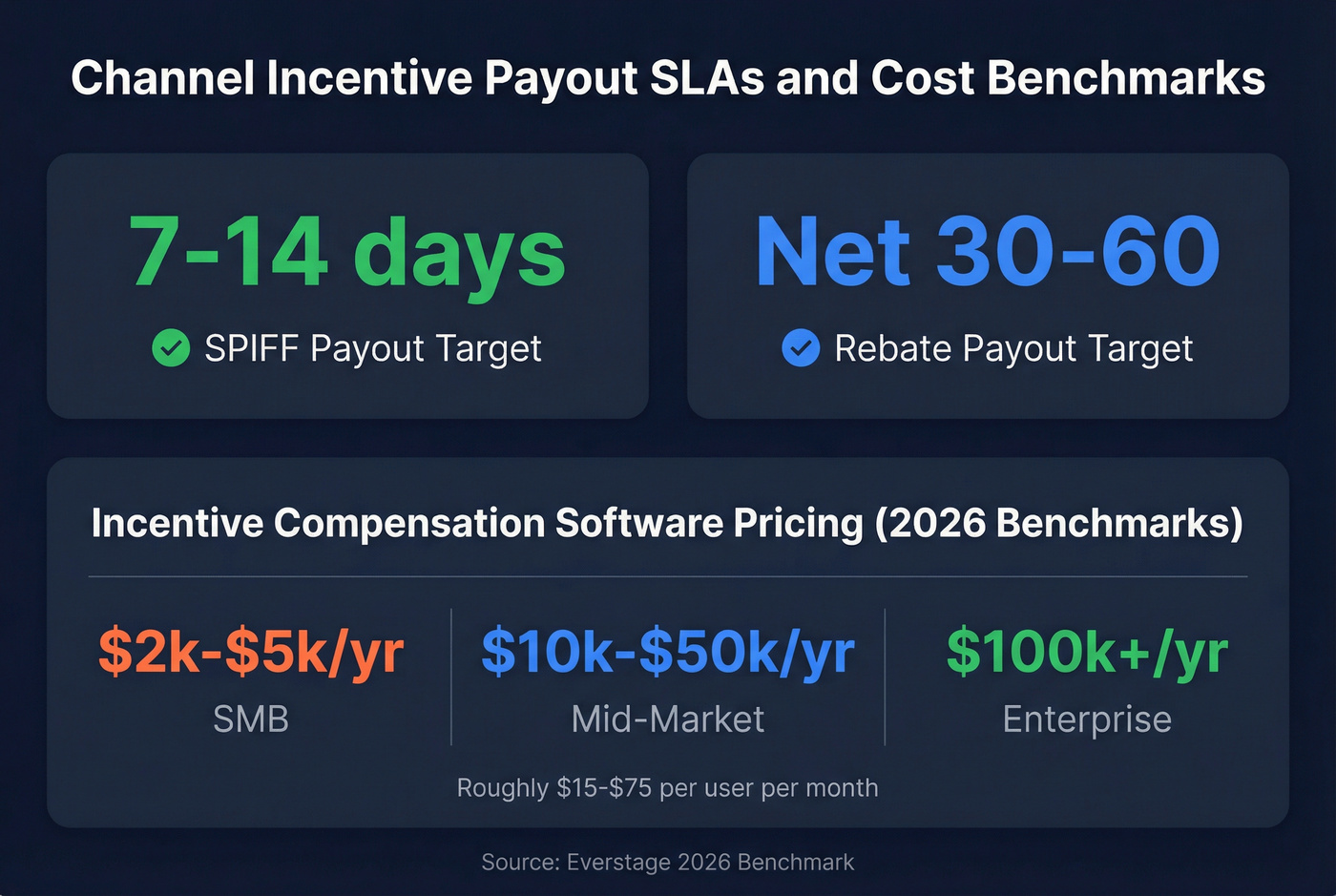

- SPIFF payout target: 7-14 days

- Rebates payout target: net 30-60 after close (reconciling invoices/returns/eligibility)

- A claims path that's obvious (portal link, form, required proof, status tracking).

- A budget guardrail (cap per partner, cap per claim, total program cap).

- A comms plan with segmentation (top partners don't need the same message as long-tail resellers).

- A finance sign-off path (ASC 606 / IFRS 15 treatment decided before launch).

- A compliance path (approvals + documentation + books-and-records discipline).

- Execution hygiene: clean partner contact data before launch so your comms land and your claims team isn't chasing bounced emails.

Pricing reality check: Everstage's 2026 benchmark puts sales compensation / incentive compensation software around $15-$75/user/month, roughly $2k-$5k/yr for SMB, $10k-$50k/yr mid-market, and $100k+/yr enterprise.

What channel incentives are (and are not)

Channel incentives are structured, time-bound rewards you offer to external partners to drive specific actions: register deals, push a SKU, complete certifications, run a co-branded campaign, or retain customers. They're a lever for behavior change, not a permanent pricing policy.

They're also not the same thing as your everyday channel economics. Ansira draws the line cleanly: incentives are behavior-based and measurable, while permanent discounts and margins are just the baseline commercial model. If your "incentive" is always on, it's not an incentive - it's an entitlement.

The partner audience matters because the motion differs:

- VARs (value-added resellers): care about margin, speed, and deal protection.

- Distributors: care about volume mechanics, tiers, and clean product eligibility.

- SIs (systems integrators): care about services attach, certifications, and long-cycle influence.

- Agents/referral partners: care about simple attribution and fast payouts.

Use incentives if:

- You need partners to change behavior quickly (new product, new segment, new motion).

- You can measure and validate the action without heroic manual work.

- You're willing to run it like an ops program (rules, claims, payouts, reporting).

Skip incentives if:

- You're trying to fix a broken product/price fit with gift cards.

- You can't define eligibility without exceptions.

- Your payout process is slow, manual, and under-resourced (partners will learn to ignore you).

Hot take: if your typical partner deal is smaller and your sales cycle is short, you don't need "creative" incentives - you need fast payouts and ruthless simplicity. Most channel programs fail because they try to be clever.

Non-negotiables (operator rules I don't bend on)

These are the rules that keep you out of disputes and keep partners participating:

- Default to rebates for revenue outcomes; use SPIFFs only for time-boxed behavior change.

- Never run evergreen SPIFFs. If it's always on, it becomes an entitlement and you'll never be able to turn it off without a revolt.

- Never pay for meetings unless you can validate quality. If you can't enforce ICP + minimum stage criteria, you're buying calendar spam.

- One incentive per funnel stage. Stack incentives and you'll double-pay, confuse partners, and invite claims fights.

- Publish the payout date up front - and hit it. "We'll pay when we can" trains partners to ignore you.

- If the rules need exceptions, the rules are wrong. Fix the design; don't patch it with manual approvals.

- If you can't explain it in 60 seconds, it won't get used. Partners don't read your PDF; they scan.

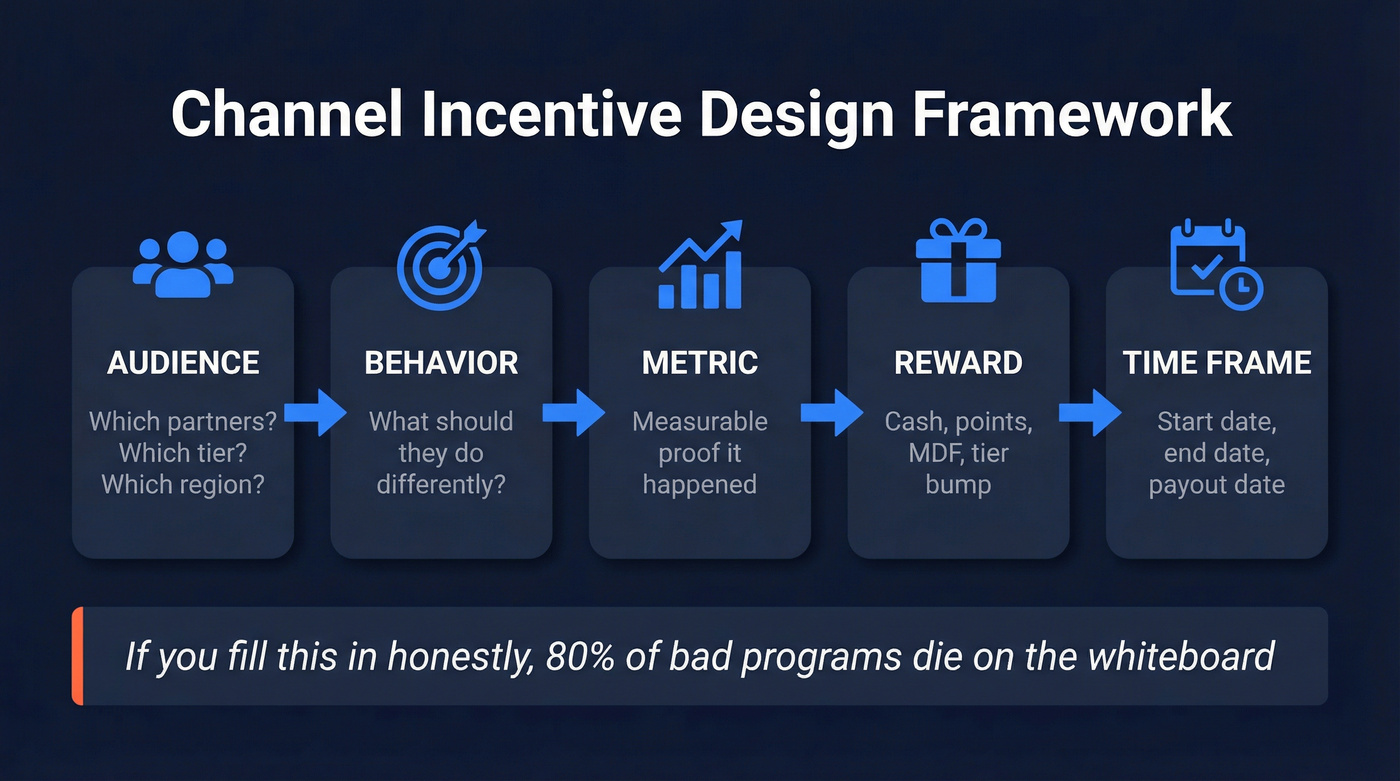

The core design framework (Audience → Behavior → Metric → Reward → Time frame)

Ansira's framework is the one I keep coming back to because it forces clarity:

Audience → Desired behavior → Metric → Reward → Time frame

If you fill this in honestly, 80% of bad programs die on the whiteboard (which is a win).

Mini-template (copy/paste)

- Audience: (Which partner type? which tier? which region? which roles?)

- Desired behavior: (What do you want them to do differently?)

- Metric: (What's the measurable proof it happened?)

- Reward: (Cash, points, MDF approval, tier bump, certification credit)

- Time frame: (Start/end dates + claim window + payout date)

Contrarian rule that saves budgets: run one incentive per funnel stage.

When you stack SPIFF + rebate + contest points on the same behavior, you don't get "more motivation." You get confusion, double-paying, and disputes.

In our experience, the cleanest programs are the ones where a partner can answer three questions instantly: What do I do? How do you measure it? When do I get paid?

Channel sales incentive programs: incentive types you can run (and when each works)

Here's the menu. Most ecosystems need a portfolio (Ansira's word) rather than a single incentive type, but each program should be simple enough to run without heroics.

| Incentive type | Best for | What you're really buying | Common failure mode |

|---|---|---|---|

| SPIFFs | Fast behavior change, launches | Attention + urgency | Paying for low-quality activity |

| Rebates (tiered) | Closed-won revenue, volume | Share shift + predictability | Slow reconciliation, disputes |

| MDF | Partner marketing execution | Pipeline creation capacity | "Free money" with weak proof |

| Co-op | Ongoing partner marketing | Long-term commitment | Accrual confusion + breakage |

| Deal registration incentives | Deal protection + early visibility | Forecast + channel trust | Forms that take 20 minutes |

| Training/certs rewards | Capability building | Better selling + services attach | Training completion with no selling |

| Contests/points | Broad engagement | Habit formation + gamification | Leaderboards that demotivate long tail |

| Referrals | Net-new logos | Top-of-funnel sourcing | Attribution fights |

Universal failure modes (print this and tape it to your monitor)

Most "mystery" failures are the same four problems:

- Complexity: too many rules, too many exceptions, too many fields.

- Slow payout: partners stop trusting you and stop trying.

- Weak validation: you pay for noise, then Finance clamps down.

- Unclear attribution: sales overrides partner credit, partners stop sourcing.

Fix these and your program will feel "easy," which is the highest compliment a partner can give you.

SPIFFs (use sparingly, pay fast)

SPIFFs are short-term incentives (days/weeks, sometimes a quarter) tied to a specific action. Tremendous makes the distinction clean: SPIFF vs bonus is mostly time horizon and specificity - SPIFFs are narrow and immediate; bonuses are broader and tied to longer cycles.

Where SPIFFs shine:

- New product or SKU focus (time-boxed)

- "Register deals this month" pushes

- First demo, first quote, first certified seller (clear proof)

Operator tip: tie SPIFFs to verifiable events (accepted deal reg, closed-won, certification completion) and keep payout fast. If you can't validate it, don't SPIFF it.

Rebates (the default for revenue)

Rebates are the workhorse for closed deals and volume. Tiered rebates are how you shape behavior without renegotiating base pricing.

Rebates win when you want:

- Cleaner alignment to revenue (less gaming)

- Forecastable cost as a % of sales (especially with tiers)

- A program Finance can accrue and audit without drama

They're slower by nature (reconciliation + accruals), so don't pretend they'll feel like a SPIFF. Set expectations and stick to the schedule.

MDF & co-op (marketing money with different control knobs)

MDF and co-op are both "marketing money," but they behave differently in budgeting and controls. MDF is discretionary and often upfront; co-op is earned and accrued. Full breakdown later.

Deal registration incentives (revenue infrastructure, not admin)

Deal registration is a trust mechanism: "If you invest in uncovering the opportunity, we'll recognize and protect your effort." That's why partners care.

Kademi, citing industry research, notes ~70% of customer spending on technology, IT services, and telecom services flows through partners. Deal reg isn't admin; it's revenue infrastructure.

Deal reg incentives work when:

- Registration is fast (few fields, prefill, instant confirmation)

- Approval rules are clear (what qualifies, what doesn't)

- You actually enforce protection (no channel conflict theater)

I've watched teams kill deal reg adoption with a form that reads like a mortgage application. Partners won't do homework to help your forecast.

Enablement rewards (pay for capability, not attendance)

These incentives pay for capability: certifications, product training, demo readiness, implementation credentials.

Make them matter by tying completion to something partners actually want: tier status, MDF access, lead routing priority, or a services attach accelerator.

If training doesn't unlock anything, it becomes busywork.

Contests/points (good for breadth, dangerous for morale)

Points programs and contests are great for broad engagement when you have many partners and you need "always-on" energy.

They fall apart when only the top 3 ever win.

If you run contests, include multiple win paths (regional winners, most improved, first-to-X) so the long tail stays in the game.

Referrals (simple on paper, strict in rules)

Referrals are the simplest incentive on paper: "send us a qualified intro, get paid." In practice, define:

- What "qualified" means (ICP + minimum deal size + stage)

- The trigger (meeting held, opportunity created, closed-won)

- Credit rules (first-touch vs last-touch vs shared)

If you don't lock attribution, your direct sales team will "helpfully" take over the deal and your referral program will die quietly.

Cash vs non-cash: when non-cash wins

Cash is universal, but non-cash rewards are often stickier and cheaper than you think - especially for top partners who already make money with you.

Non-cash incentives that actually move behavior:

- VIP access: roadmap briefings, beta access, executive QBRs

- Priority support: faster escalation paths, dedicated solution architects

- Joint planning: co-sell pods, territory mapping, account-based workshops

- Market advantage: early product access, exclusive bundles, lead-sharing pilots

My opinion: use cash to start motion; use non-cash to keep motion. Cash gets attention. Privilege keeps loyalty.

Choose incentives by funnel stage (pipeline → close → retention)

Everstage's mapping is the clean mental model:

- SPIFFs for pipeline behaviors (top/mid funnel actions you want more of now)

- Rebates for closed deals (bottom-funnel outcomes you can reconcile and accrue)

Here's a simple mapping table you can steal:

| Funnel stage | Partner behavior to reward | Incentive that fits | Metric |

|---|---|---|---|

| Pipeline | Deal registration, demos, training completion | SPIFFs, points, enablement rewards | Accepted registrations, completed certs, qualified demos |

| Close | Closed-won revenue, SKU mix, services attach | Tiered rebates, close SPIFFs | Bookings, margin, SKU eligibility |

| Retention | Renewals, expansions, customer success motions | Renewal rebates, retention SPIFFs, MDF for customer marketing | Renewal rate, expansion $, churn |

Retention is the part most programs ignore, and it's expensive. Everstage cites 10-30% annual partner churn in many ecosystems, which means you're constantly replacing capacity. A small retention incentive (renewal kicker, customer marketing MDF, services attach reward) often beats another acquisition SPIFF.

Real talk: if you're only paying for new logos, you're training partners to treat customers like one-and-done transactions.

You just read that clean partner contact data is a pre-launch non-negotiable. Bounced emails mean missed comms, unsubmitted claims, and wasted incentive budgets. Prospeo's 98% email accuracy and 7-day refresh cycle keep your partner database current - so every SPIFF announcement, payout notification, and program update actually lands.

Stop losing incentive ROI to stale partner data.

Copy/paste program recipes (3 motions to launch first)

If you're starting from scratch, don't launch seven programs. Launch three, learn, then expand. These are the top 3 motions I'd rank for most teams:

- Time-boxed SPIFF (fast learning, fast behavior change)

- Deal reg incentive (build trust + visibility)

- Tiered rebate (scale economics)

90-day new-product SPIFF (Everstage-style)

Goal: force attention on a new product/SKU for one quarter.

Audience: top 20% revenue partners + any partner with 2+ certified sellers Behavior: sell SKU X to ICP accounts Metric: closed-won deals with SKU X on the order Reward: $250-$1,000 per deal (scale by deal size) Time frame: 90 days + 30-day claim window Payout SLA: 7-14 days after validation

Guardrails that keep it profitable:

- Cap per partner

- Minimum margin threshold

- SKU eligibility list

Deal reg "trust contract" recipe

Goal: increase early visibility and reduce channel conflict.

Audience: all registered partners (or tier 1-2 only if you're overwhelmed) Behavior: register opportunities before first proposal Metric: accepted deal registrations with required fields complete Reward: either (a) small SPIFF for accepted reg, or (b) enhanced discount/rebate only if registered Time frame: always-on, reviewed quarterly Payout SLA: if you pay for registration, keep it 7-14 days

Rules that drive adoption:

- Keep the form to essentials (account, est. value, close date, products, notes)

- Prefill partner info

- Instant confirmation + clear SLA for approval (24-72 hours)

In our bake-offs, deal reg adoption correlates more with speed and clarity than with the dollar value of the reward.

Tiered rebate recipe (simple tiers)

Goal: drive share shift and predictable growth.

Audience: partners who can report clean sales data Behavior: increase quarterly revenue in category Y Metric: eligible net sales (after returns) Reward: tiered rebate paid quarterly Time frame: quarter + net 30-60 payout after close of quarter

Example tiers:

- Tier 1: $0-$50k eligible sales → 1%

- Tier 2: $50k-$150k → 3%

- Tier 3: $150k+ → 5%

Add one accelerator if you need focus:

- +1% if SKU X is ≥30% of mix

- +1% if 2+ sellers certified

Here's the thing: tiers should be achievable. If Tier 3 is fantasy, partners stop trying and you get "Tier 1 forever."

MDF vs co-op funds (definitions + funding mechanics + example budget)

Use these internal definitions because they prevent budget fights:

- MDF (marketing development funds): discretionary funds you allocate (often upfront) to support partner marketing activities.

- Co-op funds: funds partners earn/accrue based on performance, then use for approved marketing expenses.

Ansira adds the practical design detail: typical co-op accrual is 1-5% of sales. That range is common because it's easy to model and explain.

Funding mechanics (how money actually moves)

- MDF: you set a budget, partners apply, you approve, they execute, then you reimburse (or you pay vendors directly).

- Co-op: partner earns accrual as sales happen, balance accumulates, partner submits claims against that balance for approved activities.

Example budget (simple and realistic)

| Fund type | Budget basis | Example | Release model |

|---|---|---|---|

| MDF | Discretionary | $60,000/quarter | Proposal-based approvals |

| Co-op | Earned | 2% of eligible sales | Accrues monthly, claimed quarterly |

Approval + reimbursement workflow (keep it boring)

- Partner submits plan (activity, audience, expected outcomes, cost)

- You approve with a cap + eligible expense categories

- Partner executes (proof: invoices, screenshots, attendee lists, leads)

- Partner submits claim within claim window

- You validate and reimburse (net 30-60)

The frustration point: MDF/co-op dies when approvals are slow and proof requirements are unclear. If you want partners to market with you, don't make them finance your bureaucracy.

Partner experience requirements (UX that drives adoption)

Partners don't "adopt" incentives because you announced them. They adopt them because the experience feels frictionless and fair - especially if you're trying to coordinate omnichannel sales incentives across portal, email, and the field.

Minimum UX requirements I treat as table stakes:

- SSO (or at least passwordless login): if partners can't get in quickly, they won't.

- Real-time earnings dashboard: show "earned, pending validation, scheduled, paid." If you hide the math, you invite disputes.

- Claim status transparency: "Submitted → In review → Approved → Scheduled → Paid" with timestamps.

- Mobile-first claims: partners submit from the field. If your form breaks on a phone, your participation rate will too.

- Eligibility clarity at the point of action: don't make partners guess whether a SKU, region, or tier qualifies.

- Time-to-approval and time-to-payout as KPIs: track them like revenue metrics. Slow ops is a revenue leak.

Voice of partner (what I hear when UX is bad):

- "I registered it and it disappeared."

- "I don't know what counts until you deny it."

- "Your portal says 'in review' for three weeks."

- "I had to email three people to get paid."

- "Your sales rep took the deal and I got nothing."

If you fix nothing else, fix visibility and speed.

Partners forgive small payouts.

They don't forgive uncertainty.

Governance & ownership model (who runs what, so it doesn't collapse)

Channel incentives need owners, not "contributors." Here's the cleanest governance model I've seen work:

- Program owner (Channel Ops): designs rules, runs calendar, owns partner experience, publishes reporting.

- Approver (Channel leadership): signs off on goals, tiers, and budget caps; resolves escalations.

- Finance owner: sets accrual policy, approves payout rails, owns true-ups and audit readiness.

- Sales/Alliances owner: enforces deal protection and attribution rules in the field.

- Compliance/Legal owner: defines approval thresholds, documentation standards, and high-risk screening.

Operating cadence that prevents chaos:

- Weekly: claims queue health (aging, backlog, denial reasons).

- Monthly: budget burn vs cap, participation, payout SLA performance.

- Quarterly: program reset (kill what's noisy, double down on what lifts revenue).

If you don't assign these owners, the program becomes a shared inbox. Shared inboxes don't ship payouts.

Program guardrails (caps, exclusions, channel conflict rules)

Guardrails are what make incentives scalable. Without them, every edge case becomes a negotiation.

Use these guardrails by default:

- Caps: per partner, per claim, and total program cap (hard stop).

- Exclusions: house accounts, internal deals, renewals (if not a retention program), public sector (if higher risk), and any "strategic" accounts you manage directly.

- Duplicate credit rules: define whether multiple partners can claim the same deal (usually no).

- Returns/cancellations policy: clawback language and timing.

- Channel conflict rules: what happens if direct sales touches the account after registration; who gets credit; how disputes are resolved.

- Claim windows: short and explicit (example: 30 days after close) with a firm "late claims are denied" policy.

Opinion: deny late claims. The first time you make exceptions, you teach partners to submit late forever - and you teach Finance your controls are optional.

Claims, validation, and fraud controls (the operating model)

If your program's claim-based, your operating model is the product. ITA Group's workflow is the right backbone:

Intake → rules → eligibility → payment → status

That's the lifecycle your partners experience, whether you admit it or not.

A practical claims process (what "good" looks like)

Intake

- Short form, mobile-friendly

- Autofill partner details

- Required proof clearly listed (invoice, PO, completion certificate, screenshots)

Rules + eligibility validation

- SKU/date/partner tier checks

- Duplicate claim detection

- Threshold checks (min deal size, max payout)

Payment processing

- Approved amount + payout date visible to partner

- Payment method standardized (ACH, prepaid card, credit memo)

Status updates

- "Submitted → In review → Approved → Scheduled → Paid"

- Partners don't email your channel manager if the portal tells the truth

Audit ladder (pick your rigor)

ITA Group's audit ladder is the tradeoff in plain English:

- Full review of all submitted data vs backup documentation

- Admin approves/denies all claims

- Random sampling at set intervals

- Exception reporting that triggers manual audit

I've seen sampling beat "review everything" because review-everything turns into review-nothing when volume spikes, and then you're paying out based on vibes instead of proof.

Anomaly triggers (what to flag automatically)

Route claims into manual review when you see:

- High-dollar claims (top 5% of payouts)

- Unusual volume (partner submits 10x normal)

- New partner + big claims in first 30 days

- Repeated edits/resubmissions

- Same invoice used across multiple claims

Your goal isn't to treat partners like criminals. It's to protect the budget and keep honest partners from subsidizing the gamers.

Measurement and ROI (prove incrementality, not activity)

Activity metrics are comforting and useless. ROI is the only argument that survives Finance.

Tremendous' formula is simple enough to use in a spreadsheet:

Net ROI = (Expected Revenue Lift × Gross Margin) − Total Incentive Cost

KPI set that actually tells you if it worked

Operator benchmarks (directional, varies by program maturity and enforcement):

- Participation rate: aim 30-60% active participation; strong programs hit 60-80%

- Breakage (unclaimed funds): often 10-25%; mature ops can drive <10%

- Cost of incentive as % of eligible sales

- Payout aging: % paid within SLA (SPIFF 7-14 days; rebates net 30-60)

- Incremental lift: baseline vs test period vs control group (when possible)

- Mix shift: did SKU focus actually change?

Worked example (simple)

- Expected revenue lift from a 90-day SPIFF: $400,000

- Gross margin: 70%

- Total incentive cost (payouts + admin + platform fees): $60,000

Net ROI = ($400,000 × 0.70) − $60,000 = $280,000 − $60,000 = $220,000

Two operator notes:

- If you can't estimate lift, run a holdout: pick a region/partner tier that doesn't get the incentive.

- Breakage isn't "free money." It's usually a symptom of confusing rules, weak comms, or a painful claims process.

Finance & accounting checklist (ASC 606 / IFRS 15 reality)

Finance blocks launches for predictable reasons: incentives change revenue recognition, create liabilities, and invite audit questions. If you bring them a half-baked program, they'll slow you down.

Everstage and Vendavo both hit the key point: rebates/discounts reduce revenue at the time of sale, not when you feel like paying them.

Use this checklist:

- Classify the incentive

- Partner rebates and discounts typically reduce transaction price (revenue reduction)

- Sales commissions are usually operating expenses (different treatment)

- Decide variable consideration method

- Estimate using expected value or most likely amount

- Reassess estimates as actuals come in

- Set up accruals

- Record a rebate accrual liability as sales occur

- Keep it until paid/claimed (and true-up regularly)

- Define the data source of truth

- Bookings vs billings vs collections

- Returns/cancellations handling

- Document the policy

- Eligibility, calculation logic, and approval controls

In our experience, the fastest way to get Finance on your side is to show them you've already thought through accruals, true-ups, and auditability.

Compliance checklist for partner incentives (anti-bribery + books & records)

Partner incentives touch the exact risk zone compliance teams worry about: third parties, cross-border payments, and "anything of value." Gibson Dunn's FCPA update is a good reminder that enforcement isn't only about bribery - books-and-records and internal controls failures can be enough to hurt you.

Paul Weiss' 2026 year-in-review highlights why this still matters: cross-border enforcement cooperation got tighter with an international taskforce (UK/France/Switzerland) coordinating complex cases. Operational implication: you need recipient screening + documented approvals for MDF and cash-equivalent rewards, especially when partners sell into public sector or state-owned entities.

Risk tiers (keep it practical)

- Low risk: small-value, standardized rewards to broad partner populations (points, training rewards)

- Medium risk: cash-equivalent rewards, MDF reimbursements, travel/event rewards

- High risk: government customers, state-owned entities, high-risk geographies; large discretionary payments; unusual payment requests

Controls checklist (minimum viable compliance)

- Define "anything of value" broadly (cash, gift cards, travel, discounts, services, donations)

- Approvals with thresholds and segregation of duties

- Documentation: proof of performance, invoices, attendee lists, campaign assets

- Recipient screening: higher scrutiny for higher-risk recipients

- Payment controls: pay to the contracted entity, not random third parties

- Books-and-records hygiene: correct GL coding, clear descriptions, audit trail

- Exception handling: escalation path for weird cases

The goal isn't to make incentives impossible. It's to make them defensible.

How to launch and communicate incentives (segmentation + cadence)

ITA Group's take is blunt and correct: the #1 reason channel incentive programs fail is cuts in communication. Not budget. Not creativity. Communication.

Partners don't participate in what they don't remember, don't understand, or can't find - especially when you're coordinating omnichannel sales incentives across email, portal notifications, and channel manager outreach.

Segmentation matrix (who gets what message)

| Segment | Who they are | What they need | Message angle |

|---|---|---|---|

| Top-tier revenue partners | Your whales | Clear economics + fast enablement | "Here's how to win the quarter" |

| Growth partners | Rising performers | Simple steps + proof it pays | "Do X, get paid in 14 days" |

| Long-tail partners | Many, low volume | Low-friction actions | "Register deals, get protected" |

| SIs/services partners | Influence-heavy | Certs + services attach | "Enablement unlocks margin" |

| Distributor-led sellers | Indirect reporting | Clean eligibility + reconciliation | "Here's what counts and when" |

Copyable comms cadence (steal this)

- Launch (Day 0): 60-second rules + landing page + example payout

- Weekly nudges: progress snapshot + "how to claim" reminder

- Midpoint push: spotlight winners + common mistakes + office hours webinar

- Final-week urgency: "last chance" + countdown + one-click claim link

- Closeout + payout proof: "program closed" + payout date + receipts (trust builder)

Channels that work:

- Email (still the backbone)

- In-portal banners and notifications

- Webinars/office hours for Q&A

- Sales playbooks for your channel managers

- Text/push notifications for in-field audiences (when appropriate)

The unsexy execution detail: your contact list

Incentives die when your partner outreach list is outdated. If the launch email bounces or hits the wrong person, you've already lost.

Last quarter, I watched a team run a "simple" deal reg SPIFF and then spend two weeks chasing partner contacts because half the emails were dead and the other half went to someone who left the reseller a year ago. The program didn't fail in the portal. It failed in the spreadsheet.

This is where Prospeo, "The B2B data platform built for accuracy," is genuinely useful in an operator workflow: build segmented partner contact lists (by region, role, tier, product line), then verify before you send. Prospeo delivers 98% email accuracy, runs on a 7-day refresh cycle (vs a 6-week industry average), and includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobiles. It's self-serve (no contracts), so ops teams can clean lists without procurement drag.

A practical flow:

- Export partner companies/contacts from your PRM/CRM

- Enrich missing roles (channel manager, sales lead, technical lead)

- Verify emails in bulk, remove invalids, and tag segments

- Export clean lists to your email/portal comms tools

Tooling stack (keep it boring, keep it connected)

You don't need a "stack" to launch, but you do need systems that agree with each other:

- PRM/portal: where partners see rules, register deals, submit claims, and check status.

- CRM: opportunity source of truth (deal reg linkage, attribution, stage triggers).

- ERP/billing: invoices, returns, and the numbers Finance trusts.

- Payout rails: ACH/virtual cards/credit memos - standardize early.

- Data layer: a simple way to reconcile partner-submitted proof with CRM/ERP reality.

If any one of these is missing, you'll compensate with spreadsheets and heroics. That works for one quarter. Then it breaks.

If your ops team is still chasing down bad contact info, consider tightening your enrichment workflow and vendor selection (for example, comparing pricing and alternatives before you commit).

Document your rules like an enterprise (reduce disputes)

If you want fewer disputes, write rules like you expect to be audited - because you might be. Cisco's seller rewards incentive rules PDF is a good model of what "enterprise-grade" documentation looks like: formal, explicit, and built to reduce interpretation fights.

Use this rules checklist for every program:

- Program name + objective

- Eligibility

- Partner types, tiers, regions, roles

- Exclusions (house accounts, public sector, internal deals, etc.)

- Earning criteria

- What counts, what doesn't

- SKU list, date ranges, minimum thresholds

- Claim window

- How long partners have to submit (and what happens after)

- Required proof

- Invoice/PO, screenshots, certifications, attendee lists, etc.

- Payout SLA

- SPIFF: 7-14 days; rebates: net 30-60 after close (or quarter end)

- Dispute policy

- How to appeal, timelines, and final decision authority

- Budget caps

- Per partner, per claim, total program cap

- Data + audit rights

- Your right to request documentation and reverse invalid payouts

Example callout you should include in plain language: "If you submit incomplete proof, the claim status will be set to 'Needs info' and must be corrected within X days."

Clarity is cheaper than customer service.

Scaling channel programs means reaching the right partner reps - by name, role, and direct line. Prospeo gives you 300M+ profiles with 30+ filters, 125M+ verified mobiles, and a 30% pickup rate. Segment by company size, role, or region so your top-tier VARs get a different message than your long-tail resellers.

Segment your partner outreach with data that's never more than 7 days old.

FAQ

What's the difference between a channel incentive and a channel discount?

A channel incentive is time-bound and tied to a measurable behavior (deal reg, SKU focus, certifications). A channel discount is standing margin/pricing. If it's always on, it's not an incentive - it's an entitlement.

What payout timing should partners expect for SPIFFs vs rebates?

SPIFFs should pay in 7-14 days after validation. Rebates typically pay net 30-60 after close (or quarter end) because they require reconciliation and accrual true-ups.

How do MDF and co-op funds work (and what's a typical co-op accrual rate)?

MDF is discretionary funding you approve for specific marketing activities. Co-op is earned funding that accrues based on performance and is later claimed for approved expenses. A common co-op accrual rate is 1-5% of eligible sales.

What controls prevent fraud and disputes in claim-based incentives?

Use a clear workflow (intake → eligibility → payment → status), publish proof requirements, and enforce claim windows. Add an audit ladder (sampling + exception reporting) and anomaly triggers like high-dollar claims, duplicates, and unusual volume.

How do I build a clean partner contact list for incentive communications?

Deduplicate contacts, map roles (sales, technical, marketing), segment by tier/region, and verify emails before launch so messages land. Prospeo helps by verifying at 98% email accuracy on a 7-day refresh cycle, then exporting segmented lists to your comms tools.

Summary: the operating model is the program

If you want channel sales incentive programs that partners actually use, stop obsessing over "creative rewards" and obsess over the boring stuff: 60-second rules, one metric, clean eligibility, fast claims, and predictable payout dates. Run a tight cadence with Finance and Compliance, and your incentives become a trust engine - not a quarterly argument.