Leadmine vs ninjapear (2026): Which One Fits Your Workflow?

Most "data tool" comparisons dodge the stuff that actually breaks teams: 12-month "monthly" contracts, 30-60s API latency, and credit systems that punish normal experimentation. This leadmine vs ninjapear breakdown sticks to the operational reality: what it costs, how it behaves under load, and what'll annoy you three weeks after you buy.

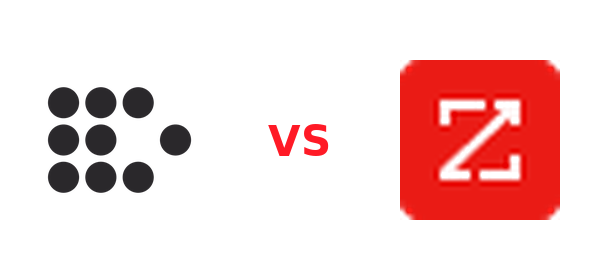

LeadMine and NinjaPear sit on opposite ends of the spectrum: one is rep-first and UI-led, the other is developer-first and API-led.

Here's the thing: the "best" tool is usually the one that matches who owns the workflow (SDRs vs engineering), not the one with the prettiest feature grid.

30-second verdict (who wins + "skip both if...")

- Choose LeadMine if... you want a UI-led prospecting workflow that reps can run themselves: Chrome extension -> grab emails from web sources -> export CSV -> launch sequences. Pricing is simple ($0/10, $29/250, $99/1000), and the credit rule is unusually friendly: you're charged only for 100% verified business emails, and duplicates only count once per billing period. For scrappy outbound, it's the "get moving today" option.

- Choose NinjaPear if... you're building an API-led enrichment pipeline and you're OK treating it like a batch job, not a real-time lookup. NinjaPear's rate limits scale by plan (2/20/50/100/300 req/min), it has official Node/Python clients, and it's positioned as an LLM-enabled data company that's not scraping behind login walls. The tradeoff is operational: endpoints take 30-60 seconds and they recommend a 100-second timeout. Also, it's not truly "monthly" in the way most SaaS is: all monthly and annual plans come with a 12-month commitment, and cancellation fees can equal the remaining months.

LeadMine vs NinjaPear at a glance (comparison table)

| Category | LeadMine | NinjaPear |

|---|---|---|

| Best for | SDRs / founders doing UI-led prospecting + exports | Engineering-led enrichment via API |

| Starting price signal | $0 (10 credits/mo) + 14-day free trial (no card) | 3-day trial (10 credits) + paid tiers starting at $49/mo |

| Core paid pricing signal | $29/mo (250 credits), $99/mo (1000 credits) | Plan anchors: $49 / $299 / $899 / $1899 per month (rate-limit ladder tied to these) |

| Credit trigger | Charged only for 100% verified business emails | Customer Listing: 1 credit/request + 2 credits per company returned (charged even on empty results) |

| Rate limits | UI/extension-first; no API-first throughput positioning | 2/20/50/100/300 req/min by plan; standard 300 req/min with a 5-minute window (burst up to 1500 requests per 5 minutes) |

| Latency | "Human speed" UI workflow | 30-60s responses; 100s timeout guidance |

| Contracting | Cancel anytime; ends next cycle | 12-month commitment even on "monthly"; cancellation fees |

| Credit expiry | Monthly reset; no rollover | Subscription credits expire each cycle; PAYG valid 18 months |

If you're procurement-minded, the table boils down to this: LeadMine behaves like normal month-to-month SaaS, while NinjaPear behaves like an annual contract billed monthly. That single detail changes how risky "just try it" becomes.

Two "never buy" rules from the table:

- If your team needs interactive enrichment (click -> result in a few seconds), don't buy NinjaPear. A 30-60s response time is fine for batch jobs and miserable inside rep workflows.

- If your team needs API-first data infrastructure, don't buy LeadMine. It's built around a browser/rep motion; engineering will hate trying to turn that into a governed pipeline.

Decision rules (hard lines):

- If you need <5s enrichment, don't buy NinjaPear - treat it as async/batch by default.

- If reps must self-serve without RevOps/engineering, don't buy an API-first tool - pick LeadMine.

- If you refuse 12-month commitments, don't buy NinjaPear's "monthly" plan.

What each product actually is (UI prospecting vs data API platform)

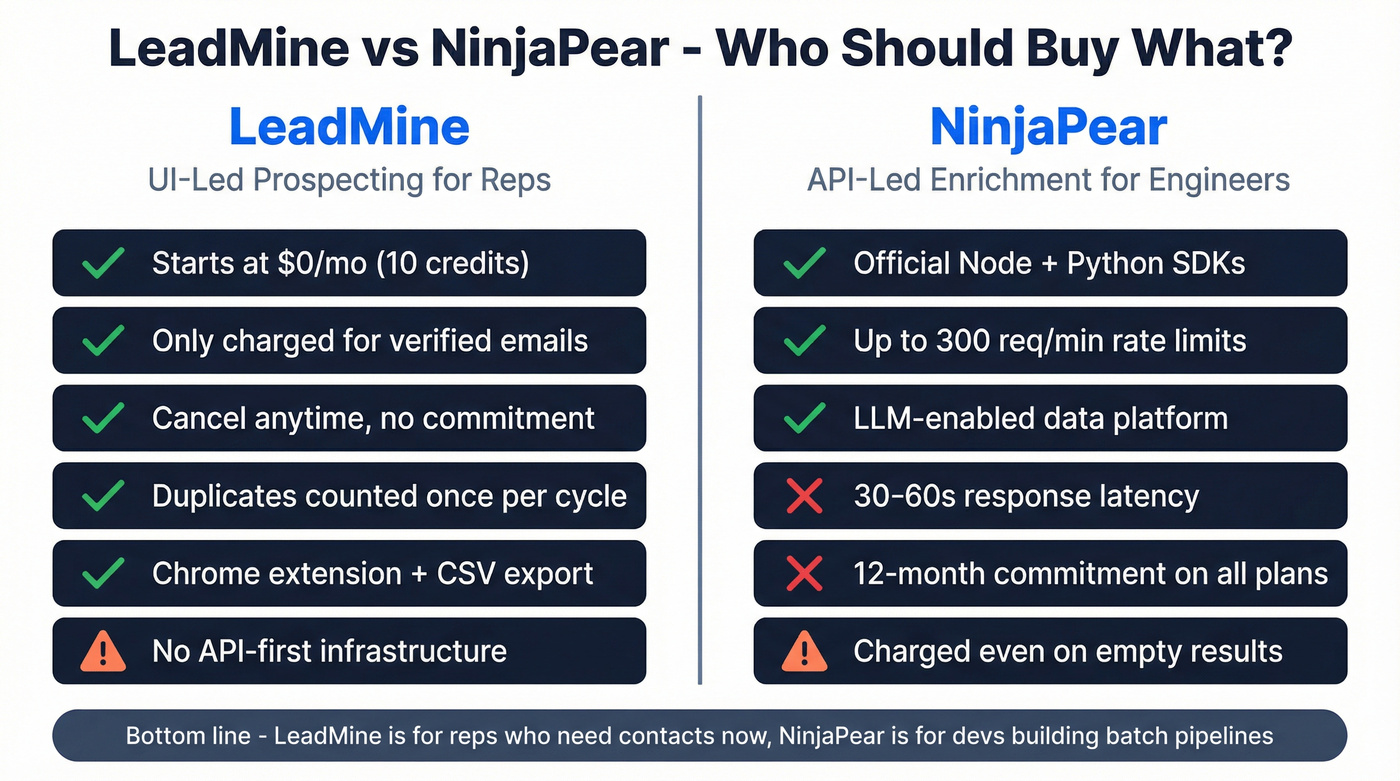

LeadMine is built for the "I need contacts now" motion: Chrome extension + lead finder + CSV export, with lookup and verification baked in. A rep can build a list before standup without waiting on anyone.

It's not trying to be a data infrastructure layer. It's trying to be the thing a human uses at 9:17am when they need a clean export and a verified email.

NinjaPear is the opposite: a developer-centric, LLM-enabled data platform with a flagship Customer Listing endpoint and explicit sourcing boundaries (no scraping behind login walls). It launched in 2026, and it's also a pivot from an earlier v1 AI live chat product - so it feels "new" in a good way if you're an engineer, and in a frustrating way if you're an SDR.

I've seen teams buy API-first tools expecting reps to "just use it," and it turns into shelfware fast.

Product shape beats feature checklists every time.

LeadMine charges only for verified emails - smart. NinjaPear locks you into 12-month contracts with 30-60s latency - painful. Prospeo gives you both: a rep-friendly UI with 30+ filters AND a 92% match-rate API, all on a 7-day data refresh cycle. 98% email accuracy, $0.01/email, no contracts.

Get the best of both worlds without either tool's biggest tradeoff.

Pricing & credits: where LeadMine and NinjaPear diverge fast

This is where the decision usually gets made: not "database size," but unit economics.

LeadMine: predictable spend (if you live in verified-email land)

LeadMine's pricing page lists:

- Free: $0/mo for 10 credits

- Basic: $29/mo for 250 credits

- Essential: $99/mo for 1000 credits

- Trial: 14-day free trial, no credit card required

Mechanics that matter:

- Credits are deducted only for 100% verified business emails.

- Duplicates count once per billing period.

That combo makes forecasting unusually clean. For list-building, "credits" map closely to "usable contacts," and duplicates don't quietly double-charge you.

If you're sanity-checking spend against other vendors, it's worth comparing to tools with similar credit mechanics and gotchas like in our Wiza pricing breakdown.

NinjaPear: powerful, but credit burn gets weird fast

NinjaPear's pricing is built around API usage and credit consumption. For the Customer Listing endpoint:

- 1 credit per request

- +2 credits per company returned

- Charged even when the request returns an empty result

One extra pricing signal that matters in real budgeting: on the $1899/mo plan, ala-carte credits price at about $0.009/credit. That makes "credit burn" easy to translate into dollars.

Concrete burn example (realistic): You run 200 Customer Listing requests while tuning targeting.

- Base cost: 200 x 1 credit = 200 credits

- Say 120 requests return empty (still charged): 120 credits burned

- The other 80 requests return an average of 4 companies each: 80 x (2 x 4) = 640 credits

Total: 840 credits for 320 companies returned -> 2.6 credits per company. At ~$0.009/credit, that's roughly $0.023 per company just to retrieve the companies, before you do anything else downstream.

This isn't "bad." It's just a model that charges you for exploration. If your team iterates a lot, you'll feel it, and you'll end up building guardrails (caching, dedupe, "don't run this query twice," and a hard budget for experiments) whether you planned to or not.

Callout: Credit burn traps (NinjaPear)

- Iterative querying where you don't know if the segment exists yet (you pay even on empty).

- Broad queries that return lots of companies (2 credits per company compounds fast).

- Using it like a UI tool (lots of tiny "try this" calls) instead of batching + caching.

Callout: Predictable spend patterns (LeadMine)

- SDRs building lists from known sources and verifying before export.

- Teams that want "pay only when it's verified" economics.

- Workflows with lots of overlap (duplicates counted once per billing period saves real money).

Real talk: if your outbound motion is still figuring out ICP week-to-week, request-based pricing is a tax on learning. Pay-for-verified-output models are simply less stressful - especially if you're also tracking account based marketing goals and need stable inputs.

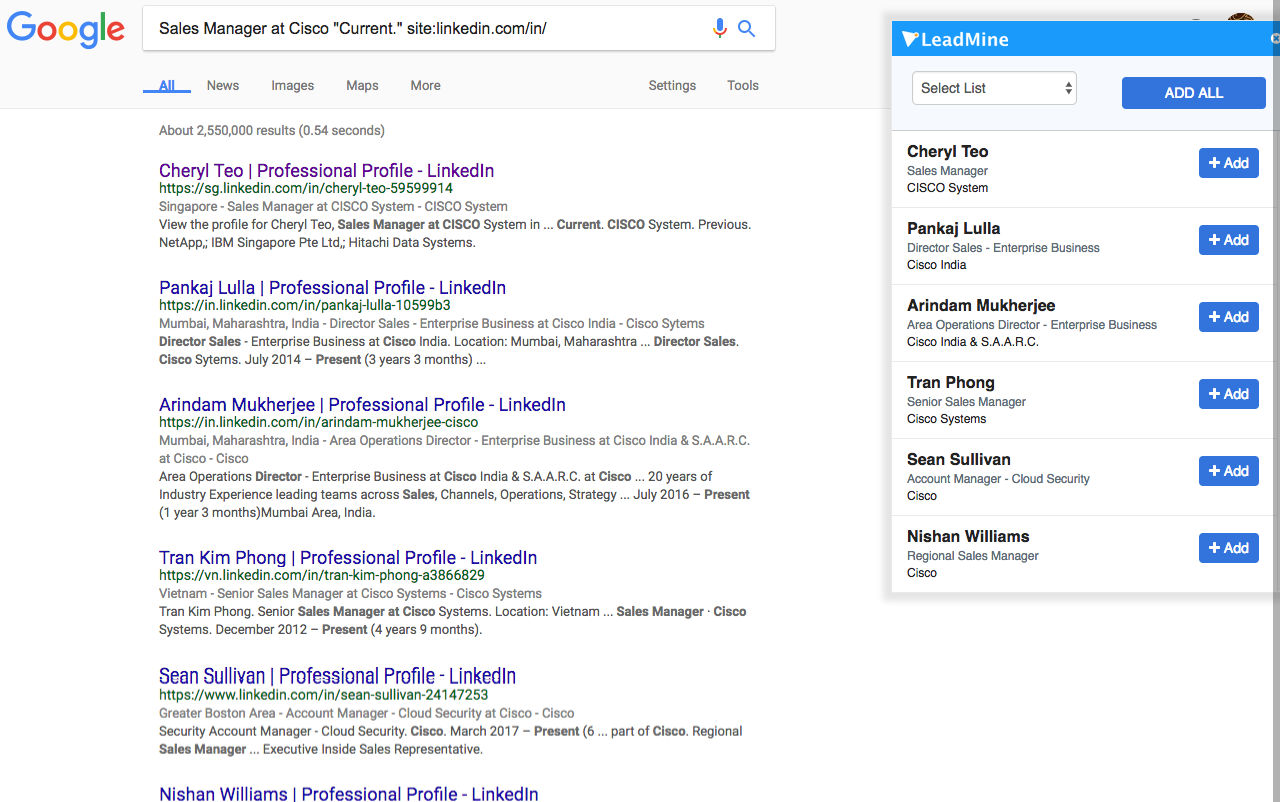

Contract, cancellation, and credit expiry (gotchas checklist)

This is the stuff that creates "we're stuck with it" Slack threads.

Confirm these before you buy

Is it actually cancellable month-to-month? NinjaPear's Monthly & Annual plans come with a 12-month commitment. Canceling a monthly subscription can trigger fees equal to the remaining unpaid months. That's not "monthly SaaS." It's an annual contract billed monthly.

What does cancellation look like in the product? Their cancellation flow explicitly shows a "Pay $xxxx and Cancel plan" fee screen, per Nubela's own cancellation guide. Finance will notice.

Do downgrades count as cancellation? Yes. Downgrading is treated like cancellation and can trigger the same fee logic. If you think you'll "start high then step down," assume you can't.

Do credits expire? When? NinjaPear subscription credits expire at the end of each billing cycle. PAYG credits cost more but are valid for 18 months. Ala-carte credits purchased mid-subscription expire at the end of the subscription billing cycle.

What happens when you hit the limit? LeadMine stops returning data once you hit your cap, then resets monthly. Credits don't roll over.

What's the real annual discount? In this category, annual discounts often land around 15-25%. Treat bigger discounts as a negotiation outcome, not a default.

I hate this kind of contract design. It turns a normal tool trial into a legal decision - especially if you're used to more straightforward SaaS terms like what you see across many pros and cons style evaluations.

Leadmine vs ninjapear API limits, latency, and throughput (timeouts, throttling, batch planning)

NinjaPear is an API product, so the API behavior is the product.

From Nubela's docs, expect:

- 30-60 second response times on endpoints

- Recommended timeout: 100 seconds

- Standard rate limit: 300 requests/minute, with a 5-minute window and burst up to 1500 requests per 5 minutes

- Trial accounts: 2 requests/minute until you do at least one credit top-up

- "Free APIs" rate limits vary by plan: 2/20/50/100/300 req/min mapped to PAYG / $49 / $299 / $899 / $1899

Operational notes from the docs (the production-grade details people miss)

- Charging behavior: requests are charged on HTTP 200, and 404 is also charged; many other error responses aren't charged.

- Change management: they commit to backward compatibility and provide 30-day notice for breaking changes.

That detail matters when you're building retries, fallbacks, and cost controls.

If you’re comparing this to other API-first stacks, you may also want to look at how teams evaluate similar “workflow vs API” tradeoffs in Extruct AI vs ZoomInfo.

Throughput math (why "300 req/min" doesn't mean what you think)

On paper, 300 req/min looks huge. In practice, latency dominates.

If each request takes 45 seconds on average, you can't "use" 300 req/min unless you're running serious concurrency and you're comfortable with long-running workers. Most teams end up with a smaller worker pool.

Example: a 50-concurrent worker pool

- 50 concurrent x (60/45) ~= 66 requests/min effective throughput

Firm conclusion: given the documented 30-60s latency and 100s timeout guidance, treat NinjaPear as async/batch by default (queues, caching, overnight jobs). Don't wire it into synchronous "rep clicks enrich" UX and expect happiness.

If you want to pressure-test how this affects dialing workflows and rep productivity, pair it with your predictive dialer assumptions (connect rates, pacing, and “time-to-next-action”).

Data quality, verification, and deliverability (reality check)

Email data quality is where tools win or lose quietly, through bounce rates and domain reputation.

A baseline worth knowing: 15%-28% of B2B domains are catch-all (Dropcontact benchmark, 2026). Catch-all domains accept mail for any address during SMTP checks, so "server ping" verification can't fully confirm deliverability.

LeadMine: verification-forward mechanics + bold marketing claims

Let's separate mechanics from claims:

- Documented mechanics: credits are deducted only for 100% verified business emails, and duplicates count once per billing period.

- LeadMine claims: 95%+ deliverability guarantee and 99% accuracy on corporate emails.

- Verification methods include syntax checks, MX records, and mail server ping, plus a credit-back if an email bounces.

In our experience, the mechanics are the real value. Catch-all domains will always blur the edges, but "only pay when verified" plus bounce credit-back is the right incentive alignment for outbound teams that care about deliverability.

NinjaPear: not the right primary tool for cold-email list building

NinjaPear is built around endpoints, latency, and request economics, not around verified-email deliverability as the core promise. If your workflow is "build list -> launch cold email," NinjaPear shouldn't be your primary tool unless you pair it with a dedicated verification layer.

A quick scenario we've watched play out: a team wires NinjaPear into a rep-facing internal tool, reps click "enrich," nothing happens for 40 seconds, they click again, now you've doubled your requests, burned credits, and created a messy "which result is the latest?" problem. The fix is always the same: async jobs, a queue, a status page, and aggressive caching. Great for engineering-led orgs. Terrible for "we need meetings this week."

If you're doing cold email at scale, it also helps to benchmark other list-building tools’ economics (and where they hide costs), like in FindThatLead pricing or Tomba vs UnwrapEmail.

Best-fit scenarios (pick based on your team + workflow)

SDR team (manager cares about activity this week)

- Pick LeadMine if you want UI-led self-serve + exports and you don't want reps filing tickets for data pulls.

- Skip NinjaPear for rep workflows; 30-60s endpoints will feel broken in day-to-day prospecting.

RevOps (cares about dedupe, spend predictability, and CRM hygiene)

- Pick LeadMine if your pain is "we keep paying for the same contacts" (duplicates counted once per billing period is underrated).

- Pick NinjaPear if you're building a governed enrichment pipeline and you can control requests (batching, caching, retries, cost controls).

If RevOps is also responsible for coaching and QA loops, you may want to align this with your sales call review software stack so attribution doesn’t get messy.

Engineering (cares about APIs, limits, and reliability)

- Pick NinjaPear if you're comfortable building around long timeouts and you want official client libraries.

- Skip LeadMine if you need everything via API and you don't want a browser-extension-centric workflow in the middle.

Agency (cares about margin and repeatable unit economics)

- Pick LeadMine for quick-turn list building where "pay only for verified" protects deliverability.

- Pick NinjaPear only if you already run enrichment as a job system and you can keep empty-result exploration under control.

Verdict recap: LeadMine wins when humans are doing the work and you want predictable "verified contact" economics. NinjaPear wins when code is doing the work and you can embrace async pipelines, while accepting contract rigidity and request-based charging.

If neither LeadMine nor NinjaPear fits: Prospeo is the no-contract, accuracy-first option

If you're reading this because you're tired of contract games and stale records, Prospeo is the straightforward third path.

Prospeo is "The B2B data platform built for accuracy": 98% email accuracy with a 7-day data refresh cycle (industry average: 6 weeks), self-serve pricing, and no contracts. It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, and it's used by 15,000+ companies with 40,000+ Chrome extension users.

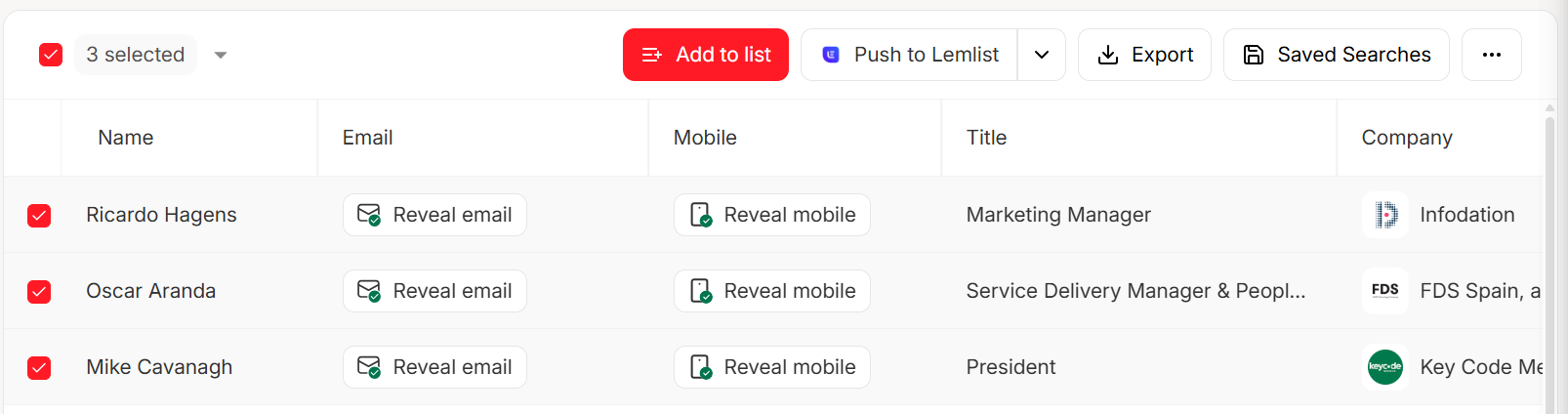

If you want to run enrichment like an engineer (API) or like a sales team (extension + exports), you can do both without signing your life away: 83% enrichment match rate, 92% API match rate, and 50+ data points per enrichment, plus integrations like Salesforce, HubSpot, Smartlead, Instantly, Lemlist, Clay, Zapier, and Make.

Tired of credit systems that punish exploration? NinjaPear charges you even on empty results. Prospeo's 300M+ profile database with 143M+ verified emails lets you search, filter, and export without burning credits on dead ends. Plus: no 12-month commitment, no cancellation fees.

Stop paying for empty results and locked-in contracts.

FAQ

Is NinjaPear really "monthly" if there's a 12-month commitment?

NinjaPear bills monthly, but the subscription behaves like an annual agreement: monthly and annual plans include a 12-month commitment, and canceling can trigger fees equal to the remaining unpaid months. Downgrades are treated like cancellation too, so "start high then step down" can backfire.

Why does NinjaPear feel slow compared to typical enrichment tools?

NinjaPear is optimized for long-running data jobs, not instant lookups: typical response times are 30-60 seconds and the recommended timeout is 100 seconds. Plan for batching, queues, caching, and async processing; if you need sub-5-second enrichment in a rep workflow, it'll feel broken.

How do LeadMine credits work (and what triggers a charge)?

LeadMine deducts credits only for 100% verified business emails, and duplicates count once per billing period, which keeps spend predictable for list-building. In practice, you'll see credits used when you add prospects with valid corporate emails, run lookups, or verify addresses before exporting.