FindThatLead Pricing Breakdown: What You Actually Pay Per Usable Contact

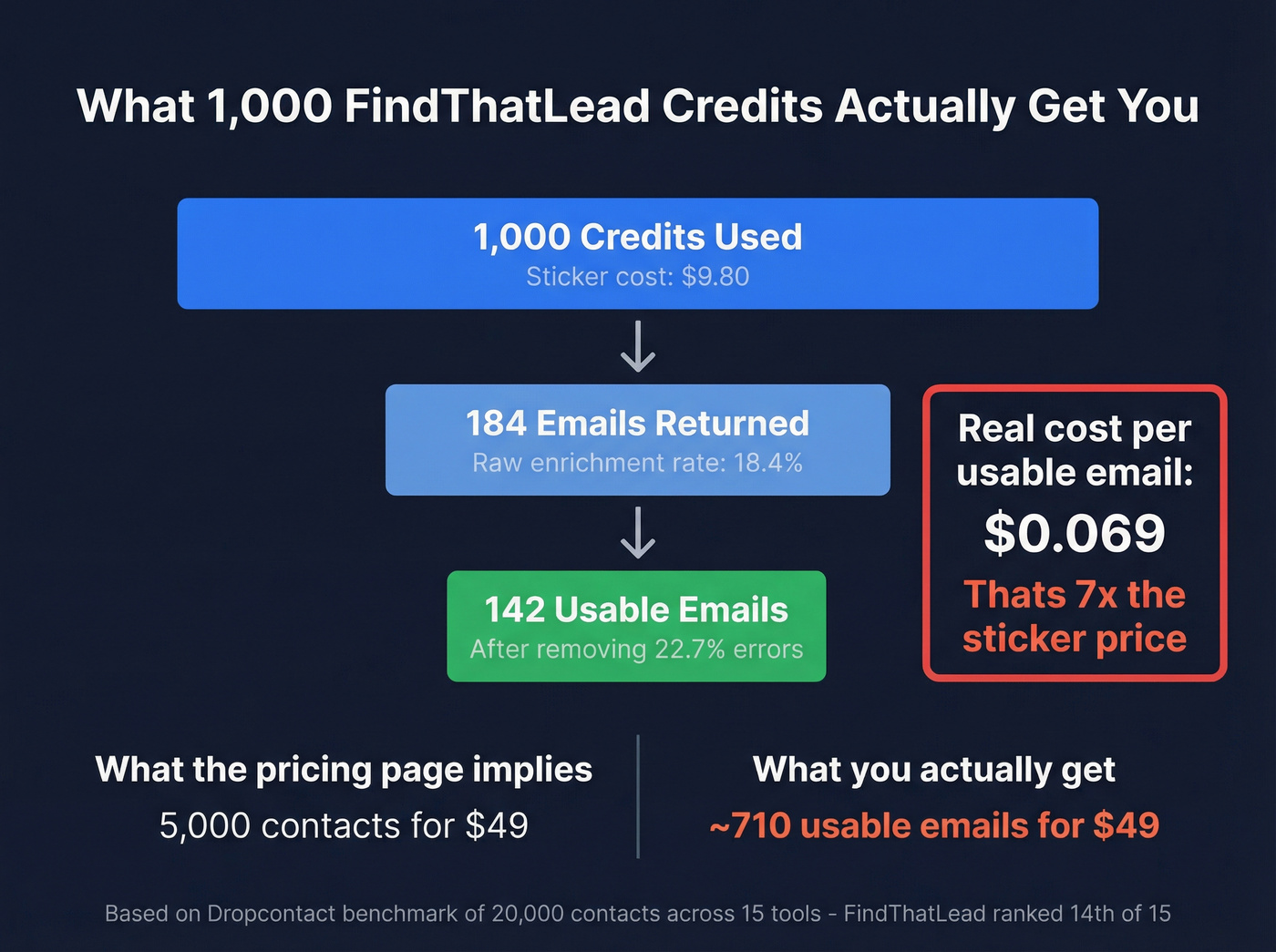

$49 a month for thousands of email credits sounds like a steal - until you run the numbers on how many of those credits actually produce a deliverable email address. Spoiler: it's about 14%. That means your "$49 plan" is really a "$49 for ~710 usable emails" plan, and suddenly the math doesn't look so friendly.

FindThatLead has changed its pricing structure multiple times over the past few years. Search for findthatlead pricing and you'll find at least three different plan structures across the web - old help desk articles quoting prices in euros, a QA subdomain listing steeper annual discounts than the main site, comparison sites referencing $36/mo starting prices, and at least one competitor page listing tiers ($37/$55/$75) that appear to reference older or annual-billing versions of plans. I've reconciled all of them against current third-party sources. Here's what's current, what's outdated, and what you're really paying per contact.

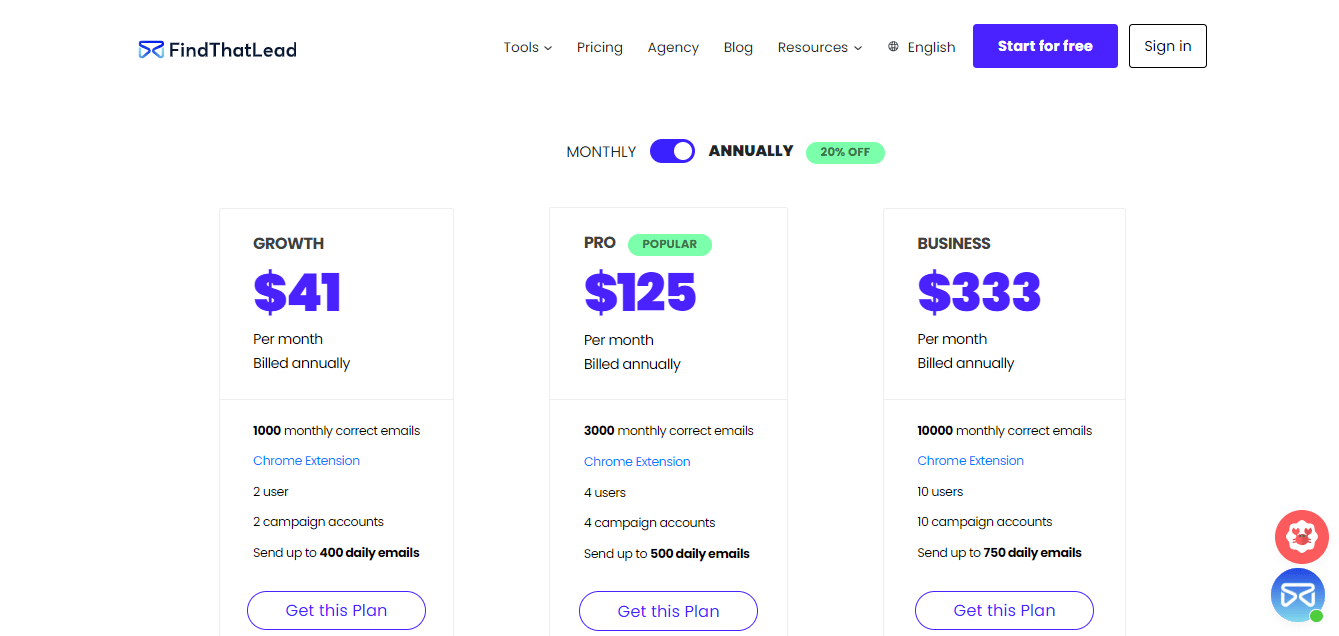

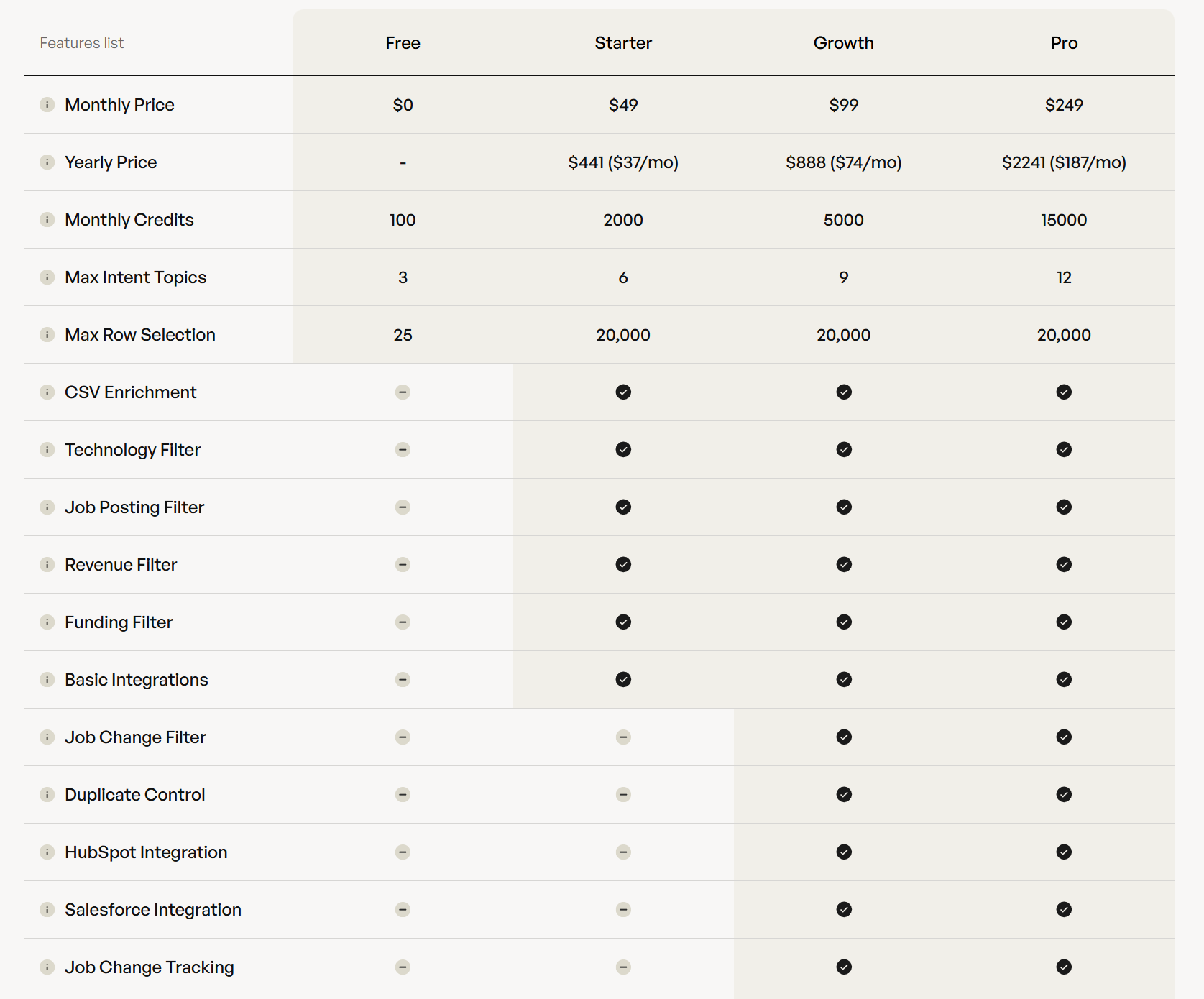

FindThatLead Plans and Pricing at a Glance

Here's the plan structure confirmed across multiple third-party sources. FindThatLead's own pricing page has also shown a simpler two-tier structure (Starter at $49/mo with 2,000 credits, Ultimate at $99/mo with unlimited credits), so check the live page before committing - they change plans frequently.

| Plan | Monthly Price | Annual Price (per mo) | Credits/Month | Users | Campaign Accounts | Daily Emails |

|---|---|---|---|---|---|---|

| Free Trial | $0 (7 days) | - | 50 email + 2 mobile | 1 | 1 | 150 |

| Growth | $49 | ~$39 | 5,000 | 1 | 2 | 400 |

| Startup | $150 | ~$120 | 18,000 | 4 | 4 | 500 |

| Suite | $399 | ~$319 | 30,000 | 6 | 10 | 750 |

Annual billing saves roughly 20% across all tiers. Some FindThatLead subdomains have shown steeper annual discounts - as low as $27/mo for Growth - but ~20% is what current third-party sources agree on. The free trial gives you 7 days and 50 email credits: enough to test the search, not enough to validate accuracy at scale.

Here's the thing: the sticker price is competitive. At $49/mo, it sits alongside Apollo, Hunter, and Snov.io. But an independent benchmark of 20,000 contacts found FindThatLead's effective enrichment rate is just 14.2% - ranking it 14th out of 15 tools tested. That means the effective cost per usable email is 5-7x higher than the sticker price suggests.

FindThatLead Pricing Plans Explained

Free Trial

FindThatLead's free trial runs 7 days with 50 email credits, 2 mobile credits, and a 150 daily email sending cap. You get 1 user, 10 sequences, and restricted export capability. After the trial expires, you drop to a free tier: 20 successful emails per month, 1 user, 50 daily emails.

Use this if: You want to test the interface and see what kind of results FindThatLead returns for your ICP before committing.

Skip this if: You need enough volume to actually validate data quality. Fifty credits won't tell you much.

Growth Plan ($49/month)

The Growth plan is FindThatLead's entry-level paid tier: 5,000 credits per month, 1 user, 2 campaign accounts, and a 400 daily email cap. Annual billing drops this to ~$39/mo.

On paper, $49 for 5,000 credits looks generous - that's roughly $0.01 per credit. But credits aren't the same as usable contacts. Based on independent benchmarks, expect ~710 usable emails from those 5,000 credits. We break down the full math in the cost analysis below.

Use this if: You're a solo prospector doing low-volume outreach and you're willing to manually verify results before sending.

Skip this if: You're running sequences at any real scale. A 15% hard bounce rate will torch your domain reputation fast.

Startup Plan ($150/month)

The Startup plan jumps to 18,000 credits, 4 users, 4 campaign accounts, and 500 daily emails. Annual pricing drops to ~$120/mo.

The credit-per-dollar ratio improves here - $0.0083 per credit vs. $0.0098 on Growth. But the same accuracy problem applies. If 14.2% of credits produce usable emails, you're getting ~2,556 deliverable contacts for $150. That's ~$0.059 per usable email.

Use this if: You have a small team that needs shared access and higher volume, and you've already validated FindThatLead's accuracy for your specific market.

Skip this if: You're targeting non-U.S. markets. User reviews consistently flag weak coverage outside North America.

Suite Plan ($399/month)

The top tier: 30,000 credits, 6 users, 10 campaign accounts, 750 daily email cap. Annual billing brings it to ~$319/mo.

At this price point, you're in the same range as Snov.io's Pro M plan (~$149/mo for 20,000 credits with built-in CRM and warm-up) or Apollo's Professional tier. The difference? Those tools deliver significantly better data quality. The "Ultimate Plan" referenced in some FindThatLead FAQ sections appears to have fair-use limits on features described as "unlimited." Email sending accounts are capped at 10 per user, and daily email limits apply to all plans.

Use this if: You've tested FindThatLead extensively, confirmed it works for your market, and need the campaign infrastructure.

Skip this if: You're spending $400/mo on prospecting data. At that budget, Apollo or Snov.io will give you dramatically more usable contacts per dollar.

FindThatLead's 14.2% enrichment rate means 86% of your credits are wasted. Prospeo's 5-step verification delivers 98% email accuracy - so a $49 budget actually gets you thousands of usable contacts, not 710.

Pay $0.01 per email and actually land in inboxes.

How FindThatLead Credits Work (And the Fine Print)

Here's where things get frustrating.

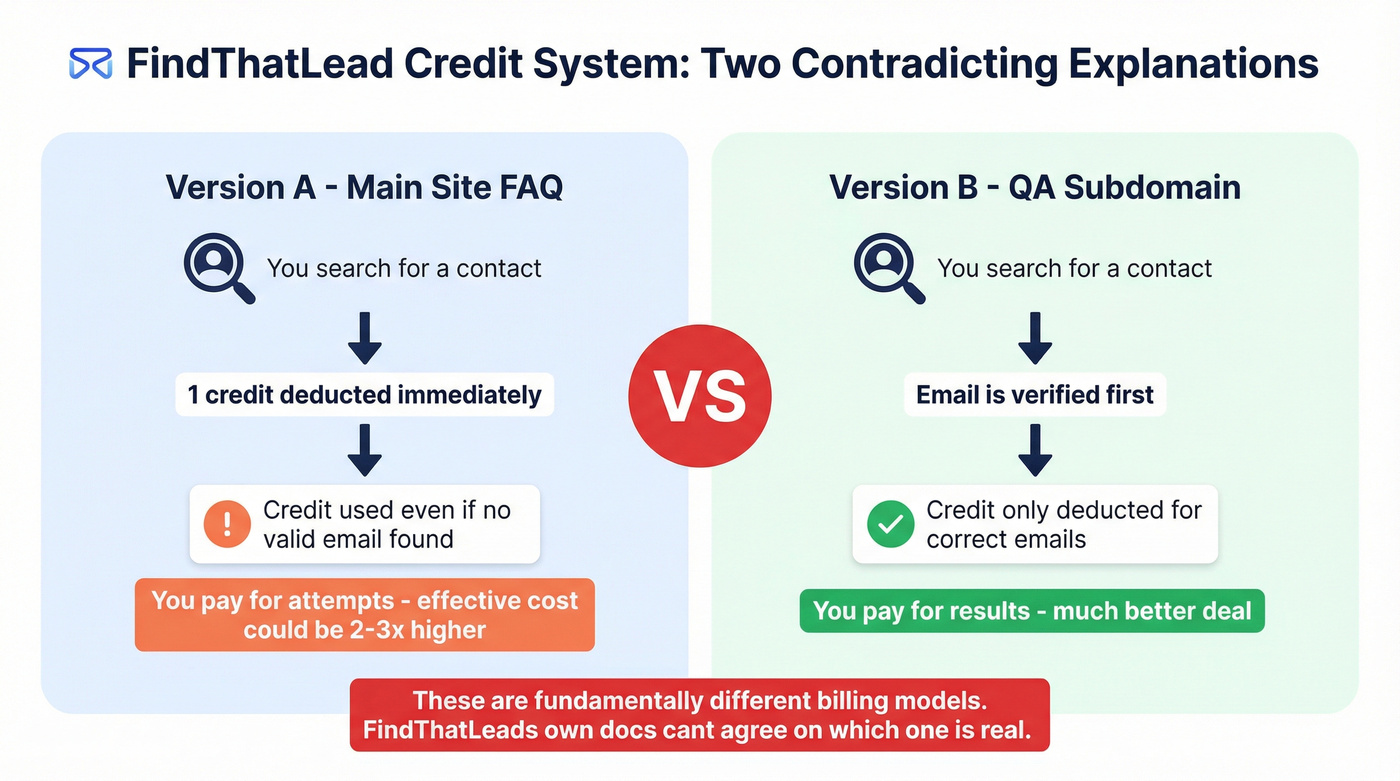

FindThatLead's own documentation contradicts itself on how credits are consumed. The main site FAQ says credits are deducted per search - meaning every lookup costs a credit, whether it finds a valid email or not. But the QA subdomain says the opposite: "A credit used in FindThatLead is equivalent to a verified and correct email. We do not charge any credit per search, only for correct emails."

These are fundamentally different billing models. One means you pay for attempts. The other means you pay for results. If you're paying per search, your effective cost could be 2-3x higher than the per-result model.

This ambiguity is unacceptable for a paid product. If you're charging credits, your customers need to know exactly when a credit is consumed. The fact that FindThatLead's own documentation can't agree on this basic question should give you pause.

What we do know: you won't be charged for the same lead twice within a billing cycle. Search for the same person again in the same month, no additional credit is deducted.

One GDPR-relevant detail: FindThatLead retains prospect data for only 30 days, which functions as a data minimization mechanism. If compliance matters to your team, that's worth knowing - though it also means you'll need to re-search contacts after that window.

If you're evaluating data vendors for outbound, it also helps to align this with your Account Based Marketing Goals so you're optimizing for pipeline outcomes - not just credits.

The Real Cost Per Usable Contact

Let's do the math that the pricing page doesn't show you.

A Dropcontact benchmark tested 20,000 real contacts across 15 email finder tools. FindThatLead ranked 14th out of 15, with an effective enrichment rate of just 14.2%. The hard bounce rate? 15.1%. The overall error rate? 22.7%.

Here's what that looks like in practice: You're on the Growth plan. You run 1,000 credits through FindThatLead's email finder. You get back ~184 email addresses (the raw enrichment rate is 18.4%). But 22.7% of those are errors - wrong format, invalid domains, catch-all traps. After filtering, you're left with ~142 usable emails.

The sticker price says $0.0098 per credit. The effective price is ~$0.069 per usable email - 7x higher.

Now scale that up. On the Startup plan ($150/mo, 18,000 credits), you're getting ~2,556 usable contacts. On Suite ($399/mo, 30,000 credits), about 4,260. Compare that to what the plan page implies - 18,000 and 30,000 - and you see the gap.

But here's the part that really stings: those bounced emails don't just waste credits. They damage your sender domain.

An SDR running sequences with a 15% hard bounce rate will start hitting spam folders within weeks. The cost isn't just the credits - it's the deliverability hit that tanks every campaign you send afterward. We've seen teams come to us after burning through two or three sender domains because their data provider couldn't keep bounce rates under control.

FindThatLead is the most expensive "cheap" tool in B2B data. A $49/mo tool that delivers 710 usable emails costs more per contact than a $99/mo tool that delivers 4,000. Stop comparing sticker prices. Compare cost per deliverable email - that's the only number that matters.

What Users Actually Say About FindThatLead

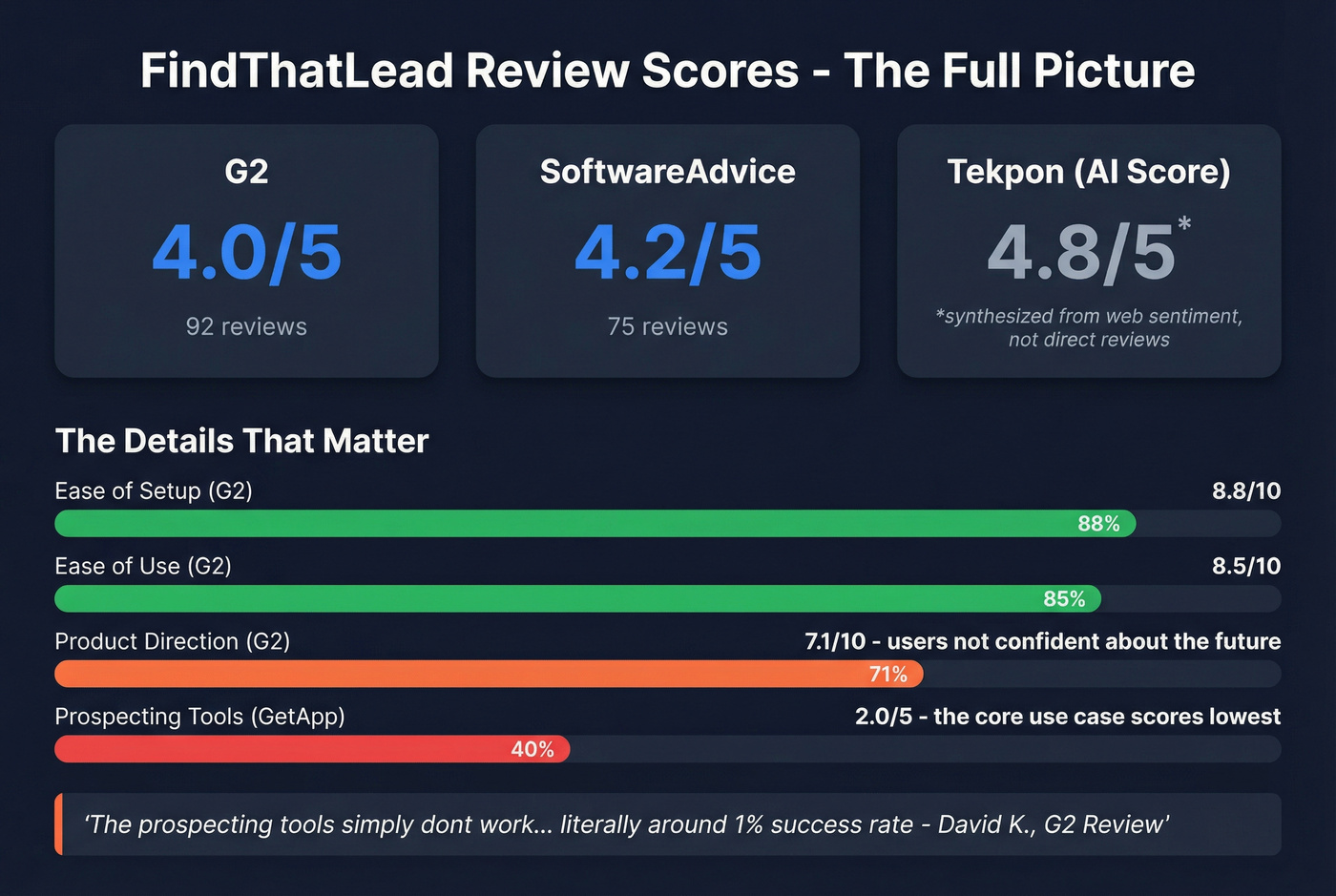

FindThatLead carries a 4.0/5 on G2 from 92 reviews and a 4.2/5 on SoftwareAdvice from 75 reviews. Tekpon's AI-aggregated score is 4.8/5, though that number is synthesized from web sentiment, not direct reviews - take it accordingly.

The G2 breakdown tells a more nuanced story. Ease of setup scores well at 8.8/10, and ease of use hits 8.5/10. But the product direction score is just 7.1/10 - meaning users aren't confident about where FindThatLead is headed. That's a red flag for anyone signing an annual contract.

GetApp's feature-level ratings are even more telling: catch-all server detection scores 5.0/5, but prospecting tools - the core use case - score just 2.0/5. That gap between a niche feature and the primary function says everything.

The positive reviews tend to focus on price. Steve T. on SoftwareAdvice put it bluntly: "Compared to every other email verification tool... the amount of credits you get is laughable when you compare it to FindThatLead." He chose it because competitors were "WAY too expensive." Fair enough - on a per-credit basis, it's cheap. The question is whether cheap credits that don't work are actually cheap.

The negative reviews are more damning. David K. left a 1-star review: "The prospecting tools simply don't work... literally around 1% success rate... Don't buy it, get some of their competitors like snov.io." That 1% figure is one person's experience, not a benchmark - but it directionally aligns with the Dropcontact data showing a 14.2% effective rate. Charles Y. flagged a different problem: "Data furnished is outdated... charged multiple times for the same individual's information... charged for leads that did not even include an email address." Being charged for leads without email addresses is exactly the kind of credit system abuse that erodes trust.

There's also a Reddit thread in r/appsumo titled "FindThatLead kicked LTD users" - which, combined with these billing complaints, points to ongoing friction between the company and its user base around pricing and access.

Common praise: Easy setup, affordable sticker price, built-in campaign sender.

Common complaints: Outdated data, weak non-U.S. coverage, slow support, and accuracy that doesn't match what you'd expect at any price point.

FindThatLead Pricing vs. Competitors

At $49/mo, FindThatLead sits in the most competitive bracket in B2B data. Apollo, Hunter, Snov.io, and Lusha all start at the same price point - but deliver significantly better data quality.

| Tool | Starting Price | Credits at Entry | Effective Cost/Email | Key Differentiator | G2 Rating |

|---|---|---|---|---|---|

| Prospeo | Free (75 emails/mo) | 75 free, paid from ~$39/mo | ~$0.01 | 98% email accuracy, 7-day refresh | New |

| Apollo.io | Free (10K emails/mo) | 10,000 email credits/mo (free) | ~$0.02-0.04 | All-in-one GTM platform | 4.8/5 |

| Snov.io | $39/mo ($29.25 annual) | 1,000 | ~$0.03-0.04 | Built-in CRM + warm-up | 4.6/5 |

| Hunter.io | Free (25 searches) | 500 at $49/mo | ~$0.05-0.08 | Domain search specialist | 4.4/5 |

| Lusha | Free (40 credits) | 40 free, paid from $49/mo | ~$0.10-0.15 | Phone number accuracy | 4.3/5 |

| FindThatLead | $49/mo | 5,000 | ~$0.069 (effective) | Built-in campaign sender | 4.0/5 |

Every competitor in this table delivers more usable contacts per dollar. FindThatLead's 5,000 credits look generous until you account for the 14.2% effective enrichment rate.

Prospeo - Best for Email Accuracy

Prospeo is the accuracy play. With 98% verified email accuracy across 300M+ professional profiles, nearly every credit produces a deliverable contact. Every email goes through 5 verification steps - including catch-all handling and spam-trap removal - before it counts as a credit, all on a 7-day data refresh cycle.

Pricing is straightforward: the free tier gives you 75 emails per month. Paid plans start around $39/mo with no annual contract required. At ~$0.01 per email, the per-contact cost is roughly 7x lower than FindThatLead's effective rate. You also get 30+ search filters, CRM enrichment, intent data powered by Bombora tracking 15,000 topics, and native integrations with Salesforce, HubSpot, Smartlead, Instantly, Lemlist, and Clay.

If your team is comparing vendors by cost structure, you may also want to sanity-check against another data tool’s plan mechanics in our Wiza pricing breakdown.

Snov.io - Best Value for Outreach

Snov.io is the tool that dissatisfied FindThatLead users keep recommending - and for good reason. The Starter plan runs $39/mo ($29.25/mo annual) for 1,000 credits with unlimited team seats, built-in CRM, email warm-up, and multichannel campaigns included. The Pro S tier at $99/mo ($74.25 annual) gives you 5,000 credits with 25,000 recipients.

Real talk: Snov.io gives you a complete outbound stack - prospecting, verification, sequencing, warm-up, and CRM - at a price where FindThatLead only gives you prospecting and basic campaigns. A mid-2025 update nearly doubled recipient limits at the same price, making it even harder to justify FindThatLead at the same budget.

If you’re deciding between list-building tools, you can also compare adjacent options in Tomba vs UnwrapEmail.

Apollo.io - Best All-in-One Platform

Apollo's free tier alone is more generous than FindThatLead's paid Growth plan for most use cases: 275M+ contacts, 10,000 email credits per month, basic sequencing. Paid plans start at $49/mo with access to intent data, advanced filters, and a built-in dialer.

I've seen teams switch from FindThatLead to Apollo's free plan and get better results. Apollo's database depth in North America is hard to beat, and the platform handles everything from prospecting to engagement to analytics. If you're comparing $49/mo tools, Apollo is the obvious choice unless you specifically need FindThatLead's local business search.

If you’re weighing alternatives in the same ecosystem, see our DitLead vs Apollo.io comparison.

Hunter.io - Best for Domain Search

| Hunter.io | FindThatLead | |

|---|---|---|

| Primary strength | Domain-level email discovery | Broad email search + campaigns |

| Enrichment rate (Dropcontact) | 32.5% | 14.2% |

| Starting price | Free (25 searches) / $49/mo | $49/mo |

| Best for | "Who works at this company?" | Solo prospecting with built-in sending |

Hunter isn't a full prospecting platform - it's a domain search specialist. Type in a company domain, get back every email pattern and verified address associated with it. Simple, fast, accurate. If domain-level email discovery is your primary use case, Hunter does it better with more than double the effective enrichment rate.

If phone outreach is part of your motion, pairing cleaner data with a compliant dialer matters - our Predictive Dialer guide covers how teams do it.

Lusha - Skip This If You Only Need Email

Lusha's strength is phone data, not email. The free tier gives you 40 credits per month. Paid plans start at $49/mo. With 155M+ profiles and a focus on direct dials, Lusha is the tool you add when you need phone numbers that actually connect.

If you only need email addresses, Lusha is overkill and overpriced. FindThatLead's mobile credits (2 on the free trial, not prominently featured on paid plans) aren't in the same league for phone data - but if phone numbers aren't your priority, neither tool is the right pick. Apollo or Snov.io will serve you better.

For teams with budgets above $1,500+/year, Cognism or ZoomInfo offer enterprise-grade coverage. But for most teams in the $49-$399 range, the tools above are better bets.

A 15% bounce rate doesn't just waste credits - it destroys your sender reputation. Prospeo's proprietary email infrastructure catches spam traps, honeypots, and catch-all domains before you ever hit send.

Stop guessing which credits are real. Verify before you spend.

Who Should (and Shouldn't) Use FindThatLead in 2026

Use FindThatLead if:

- You're a solo prospector on a tight budget who needs basic email finding with a built-in campaign sender

- You're primarily targeting U.S. contacts and don't need deep international coverage

- You want search + verify + send in one tool without juggling multiple subscriptions

- You don't mind manually verifying results before loading them into sequences

- You need local business lead generation by sector and location - this is a genuinely useful feature that most competitors don't offer

Skip FindThatLead if:

- You're running outbound at scale - the 14.2% effective enrichment rate will burn through credits and damage your domain

- You need high accuracy to protect sender reputation - a 15% hard bounce rate is a deliverability killer

- You're targeting non-U.S. markets - users consistently report weak coverage in Europe and Asia

- You need reliable phone numbers - FindThatLead's mobile credit allocation is minimal

- You need CRM integrations beyond basics - Apollo and Snov.io are far ahead here

- You want clear documentation on how credits are consumed - the contradictions in FindThatLead's own docs are a dealbreaker for RevOps teams

Some teams try using FindThatLead as a supplementary data source alongside a primary tool like Apollo or Snov.io. But at that point, you're paying for two tools when one would suffice.

Look, FindThatLead is best suited for budget-conscious solo prospectors who need basic email finding and don't mind manually verifying results. For everyone else, the effective cost per usable contact makes it one of the priciest "affordable" tools on the market. Before committing to any plan, compare the true cost per deliverable email - not the sticker price.

If you’re building a broader go-to-market motion (vs. just buying credits), it can help to map your outbound tooling into channel sales incentive programs and comp plans so behavior matches the numbers.

FAQ

Does FindThatLead offer annual billing discounts?

Yes - annual billing saves roughly 20% across all plans. Growth drops from $49 to ~$39/mo, Startup from $150 to ~$120/mo, and Suite from $399 to ~$319/mo. You'll need to commit to a full year upfront to get the discount.

Is there a free plan for FindThatLead?

FindThatLead offers a 7-day free trial with 50 email credits and 2 mobile credits. After the trial ends, you drop to a free tier limited to 20 successful emails per month - barely enough to test anything meaningful. Compare that to Prospeo's permanent free tier of 75 verified emails per month or Apollo's 10,000 monthly email credits.

Do FindThatLead credits roll over month to month?

No. Unused credits expire at the end of each billing cycle. If you don't use your 5,000 Growth credits in a given month, they're gone.

Why do different websites show different FindThatLead pricing?

FindThatLead has changed its plan structure multiple times. Older articles reference tiers starting at $36-$55/mo with names like Pro and Business. The current structure - confirmed by SoftwareAdvice and Tekpon as of 2026 - is Growth at $49, Startup at $150, and Suite at $399. Always check the live pricing page before purchasing.