Boundo Pros and Cons: What You Need to Know Before Signing Up

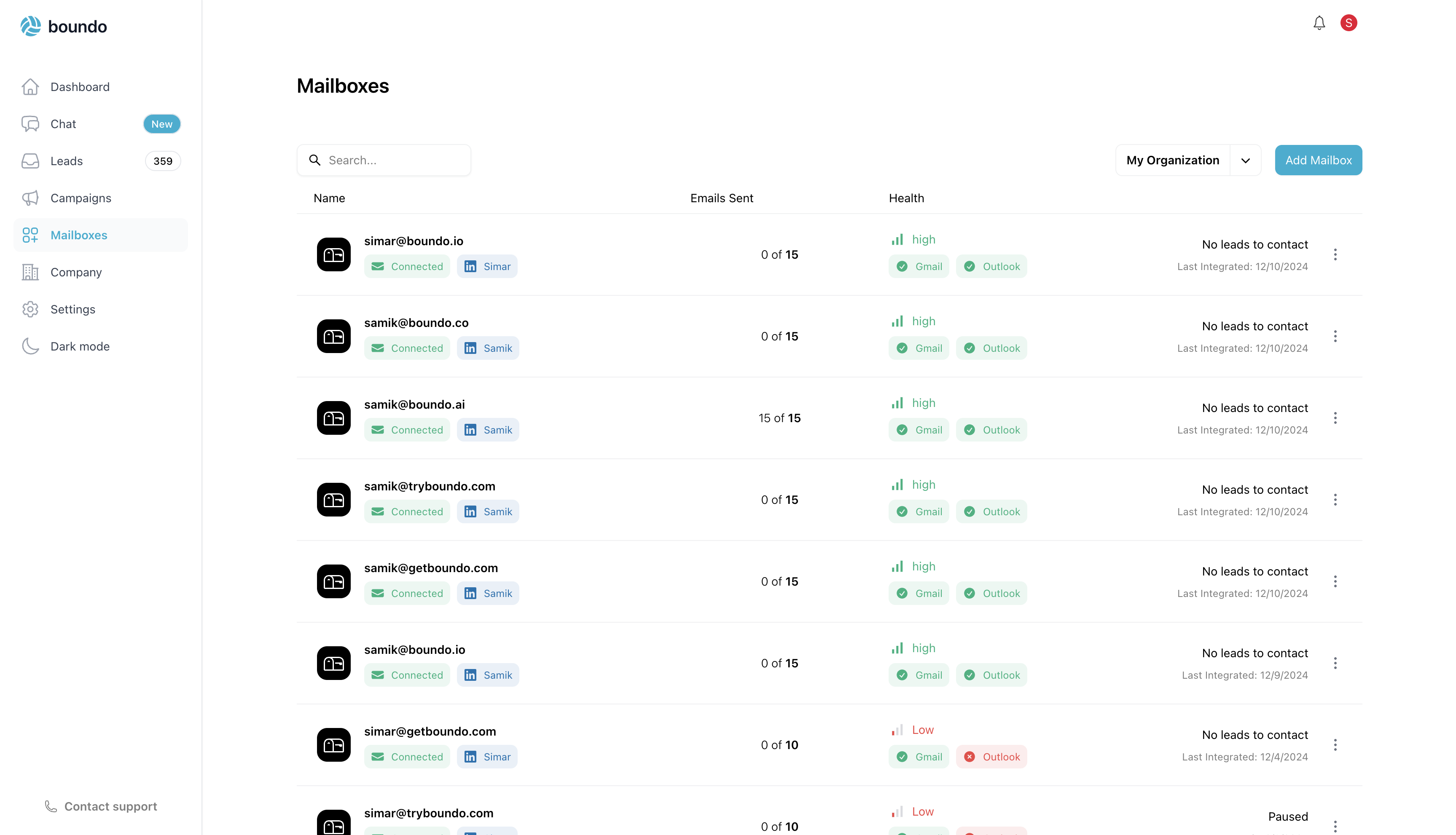

You just got pitched an AI SDR that "replaces your entire outbound team." The demo looked slick. The founders seemed sharp. But when you search for a real boundo pros and cons breakdown, you find... nothing. No G2 page. No Reddit threads. No Capterra listing. Not a single independent opinion anywhere on the internet.

That's Boundo in 2026.

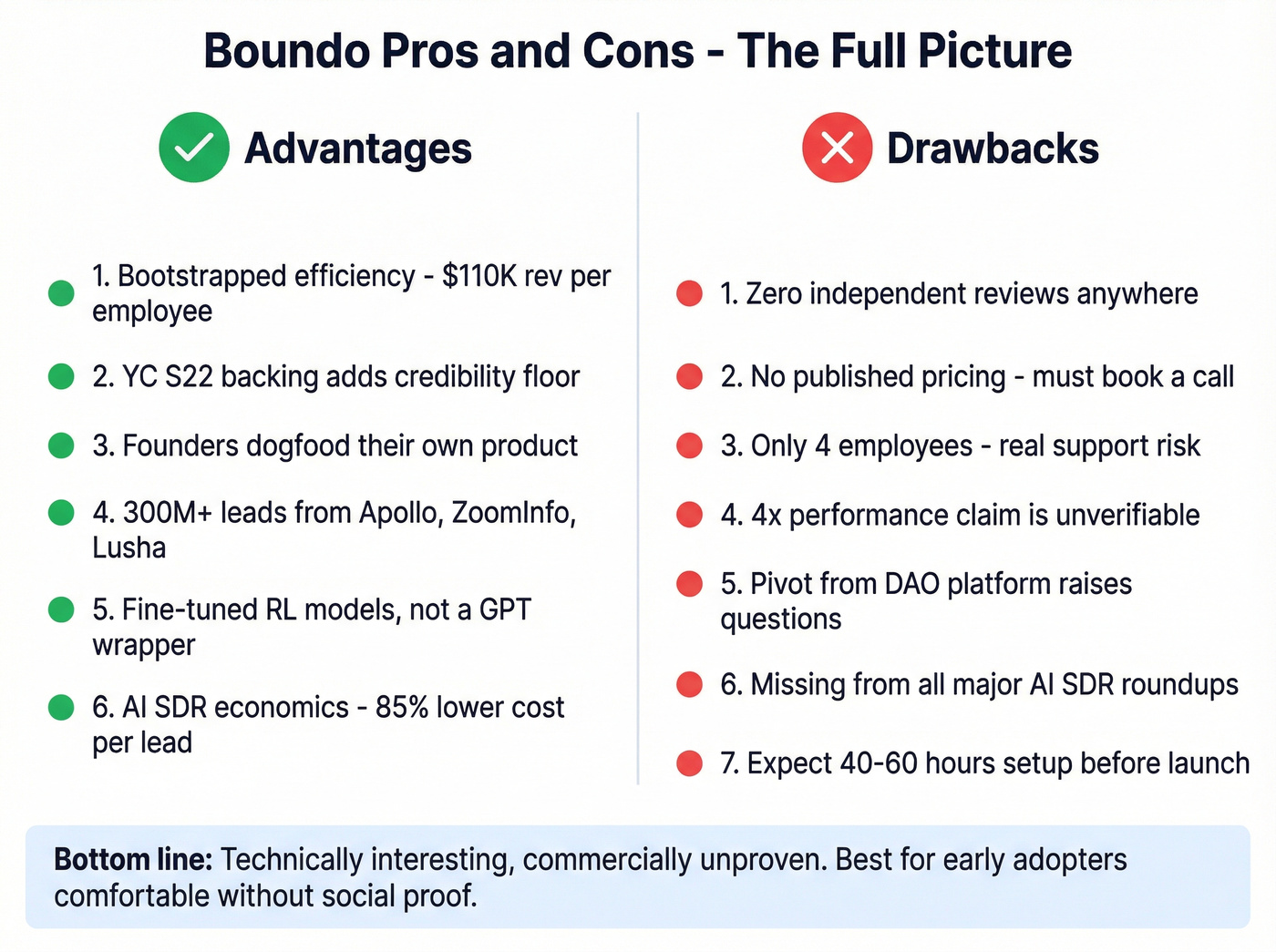

The AI SDR market hit $4.27 billion in 2025 and is racing toward $18 billion by 2032. Dozens of tools are fighting for your budget. Boundo - YC-backed, bootstrapped to $440K in revenue with just four people - has a technically interesting approach built on Reinforcement learning and fine-tuned models. But "technically interesting" and "ready for your pipeline" aren't the same thing.

The 30-second verdict: Boundo is a legitimate company with a differentiated AI approach, but it's commercially unproven. If you're an early adopter comfortable flying without social proof, it's worth a demo. If you need a battle-tested AI SDR today, AiSDR or Salesforge's Agent Frank have more market validation and transparent pricing. And if your real bottleneck is data quality - stale emails, wrong titles, bounced sequences - skip the AI SDR conversation entirely and fix your data first.

What Is Boundo?

Boundo is an AI sales rep platform that automates outbound prospecting, personalization, and multi-channel outreach. It came out of Y Combinator's Summer 2022 batch under partner Harj Taggar. The company positions itself as "the best AI sales rep for enterprise" - a curious claim given that its pricing tiers target teams of 3 to 10 people. That disconnect between enterprise ambition and SMB packaging is worth keeping in mind.

The founding story has a twist. Co-founders Simar Kohli (CEO) and Samik Shrotriya (Cornell grad, ex-Amazon) originally launched through YC with Openpod - a DAO platform. They pivoted to AI-powered sales, rebranding as Boundo and going all-in on generative AI for outbound. Pivots aren't inherently bad (Slack was a gaming company), but it's context worth knowing.

Here's what stands out financially: Boundo hit $440K in revenue with just 4 employees and $0 in external funding. That's impressive capital efficiency. They received an M&A offer in April 2025, which they declined. The founders say they're dogfooding - using Boundo to run their own sales. That's a good sign, though it's hard to verify from the outside.

Key facts at a glance:

- Founded: 2022 (YC S22)

- Revenue: $440K (2025)

- Team: 4 employees

- Funding: $0 raised

- Founders: Simar Kohli (CEO), Samik Shrotriya (Cornell, ex-Amazon)

- HQ: San Francisco

How Boundo Works

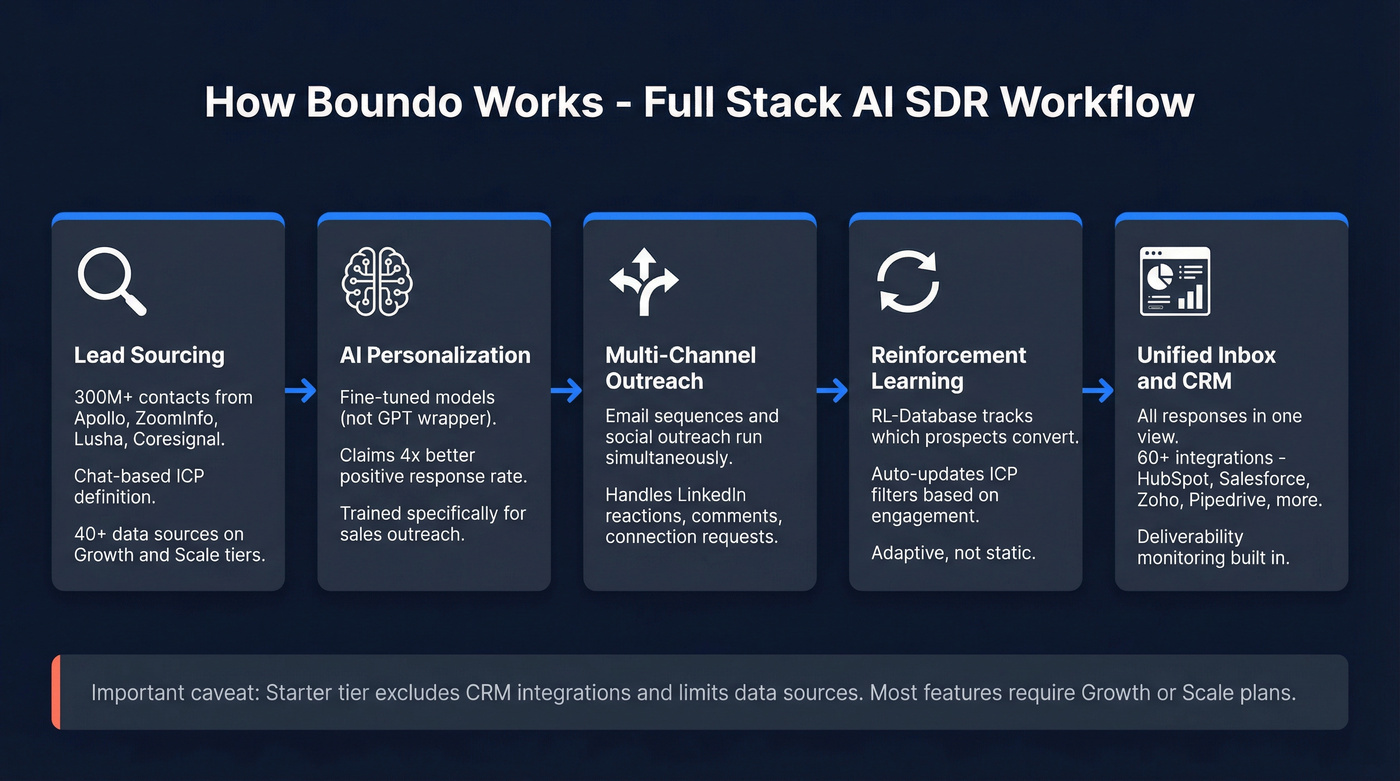

Boundo positions itself as a full-stack AI SDR - not just a sequencer, but the entire outbound workflow from lead sourcing to engagement tracking.

Lead sourcing and database. Boundo aggregates data from Apollo, ZoomInfo, Lusha, Lemlist, Coresignal, and other providers into a combined 300M+ lead database. You describe your ICP through a chat-based interface, and the platform pulls matching prospects. The Growth and Scale tiers tap into 40+ sourcing platforms; Starter is limited to select sources. If you're comparing data vendors, see our Apollo breakdown.

AI personalization. This is Boundo's boldest bet. Their fine-tuned models claim to outperform GPT and Anthropic by 4x for generating personalized sales emails that get positive responses. Both the methodology and the results are unverifiable - no independent benchmarks exist. Boundo says the platform saves 1,000 hours per SDR annually, delivers $70,000 in average annual savings, and has generated $150,000+ in closed deals. These are vendor metrics, not third-party validated - but the specificity is at least a step above vague promises.

Multi-channel outreach. Email and social sequences run simultaneously. The platform handles reactions, comments, and connection requests on social alongside email cadences.

Reinforcement learning. Boundo's "RL-Database" learns which prospects convert and automatically updates your ICP filters based on engagement outcomes. This is the most technically differentiated feature - most AI SDRs use static models, not adaptive ones.

Deliverability infrastructure. Built-in 24/7 monitoring with spam word detection and triple verification. Boundo claims high delivery rates, though no independent testing backs this up.

CRM integrations. HubSpot, Salesforce, Zoho, Copper, Keap, Pipedrive, Affinity, Zendesk, ActiveCampaign - 60+ integrations total via their Growth and Scale tiers. Starter excludes CRM integrations entirely. If your workflow depends on calling, recording, and coaching, consider sales call review software alongside your outbound stack.

Unified inbox. All mailbox responses consolidated in one view. Standard for the category but necessary.

Boundo pulls data from Apollo, ZoomInfo, and Lusha - but freshness and accuracy depend on those sources. Prospeo's proprietary email-finding infrastructure delivers 98% accuracy with a 7-day refresh cycle, not the 6-week industry average. Fix your data before you automate it.

No AI SDR can save a campaign built on stale emails.

The Advantages of Using Boundo

Bootstrapped efficiency that signals discipline

$440K in revenue with 4 people and zero outside capital. That's $110K revenue per employee with no VC burn rate. In a market full of AI SDR startups torching millions in funding, Boundo's lean operation suggests the founders are building something sustainable rather than chasing growth at all costs.

YC backing adds a credibility floor

Y Combinator's acceptance rate hovers around 1-2%. Getting into S22 doesn't guarantee product-market fit, but it means experienced partners vetted the founders and the idea. For a tool with no independent reviews, the YC stamp is the strongest external credibility signal Boundo has.

Dogfooding their own product

The founders use Boundo to run all of Boundo's sales. Every bug, every deliverability issue, every awkward AI-generated email hits their own pipeline first. We've seen teams waste months on tools where the vendor's own sales team uses something else entirely. Dogfooding is a real signal.

300M+ lead database from premium sources

Aggregating from Apollo, ZoomInfo, Lusha, and Coresignal into a single database is genuinely useful. Instead of paying for three separate subscriptions, you get one combined pool. Whether the data is fresh and verified is a separate question (more on that in the cons), but the breadth is there. If you're evaluating data platforms, you may also want our ZoomInfo comparison. If you're weighing other databases for niche coverage, see PrivCo vs Zintlr.

Fine-tuned models with reinforcement learning - not a GPT wrapper

After testing 20 AI SDR demos, Salesforge concluded that "most tools are basic sequencers with GPT slapped on." Boundo's fine-tuned models trained specifically for sales outreach - combined with reinforcement learning that adapts to engagement data - represent a more sophisticated approach. Whether the claimed 4x improvement holds up is unproven, but the architecture is differentiated. Sellers using AI personalization are 3.7x more likely to exceed quota, per Gartner. If Boundo's models deliver, the upside is real.

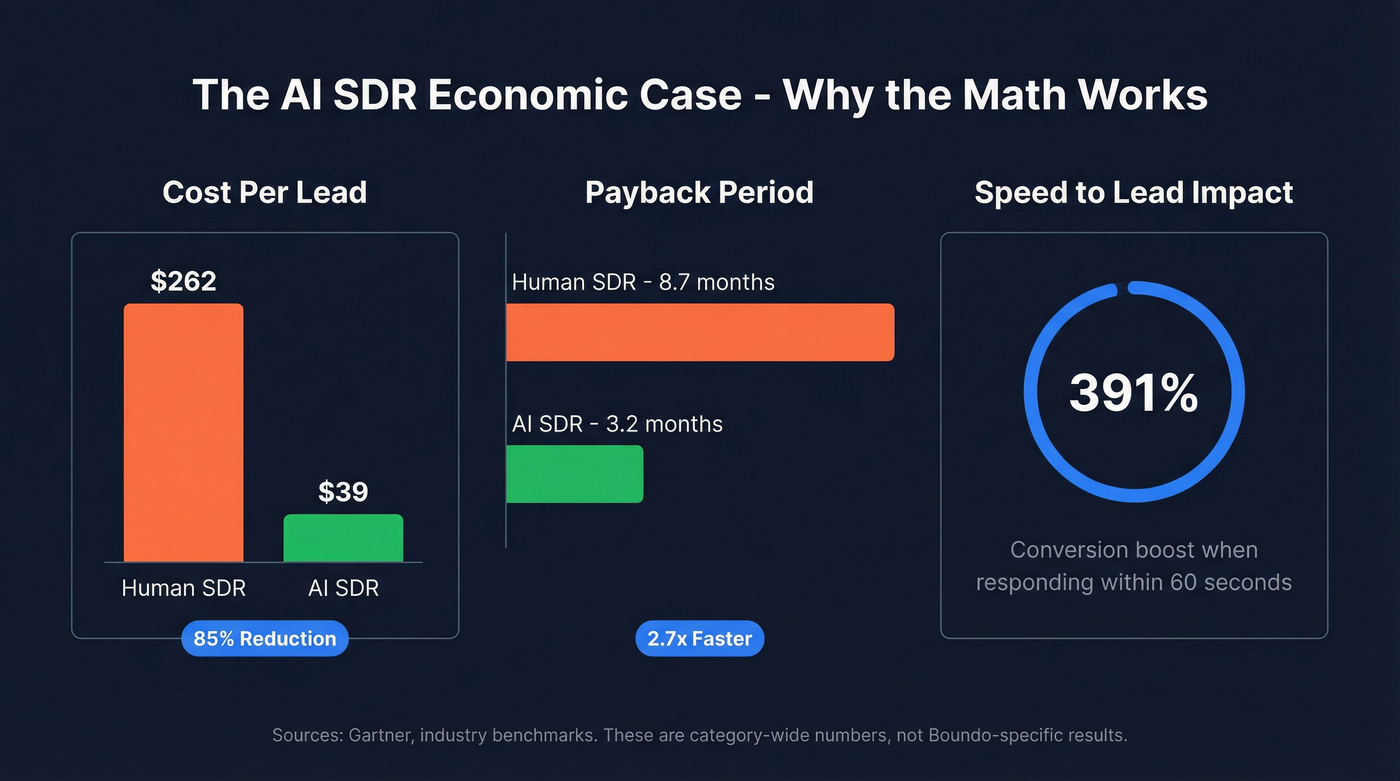

The AI SDR economic case is real

This isn't Boundo-specific, but it matters: human-generated leads cost roughly $262 each versus $39 for AI-generated leads - an 85% reduction. AI SDR payback period runs about 3.2 months versus 8.7 for a human SDR. And responding to leads within 60 seconds boosts conversion by 391%. The math works - the question is whether Boundo specifically delivers on it.

The Drawbacks You Should Know About

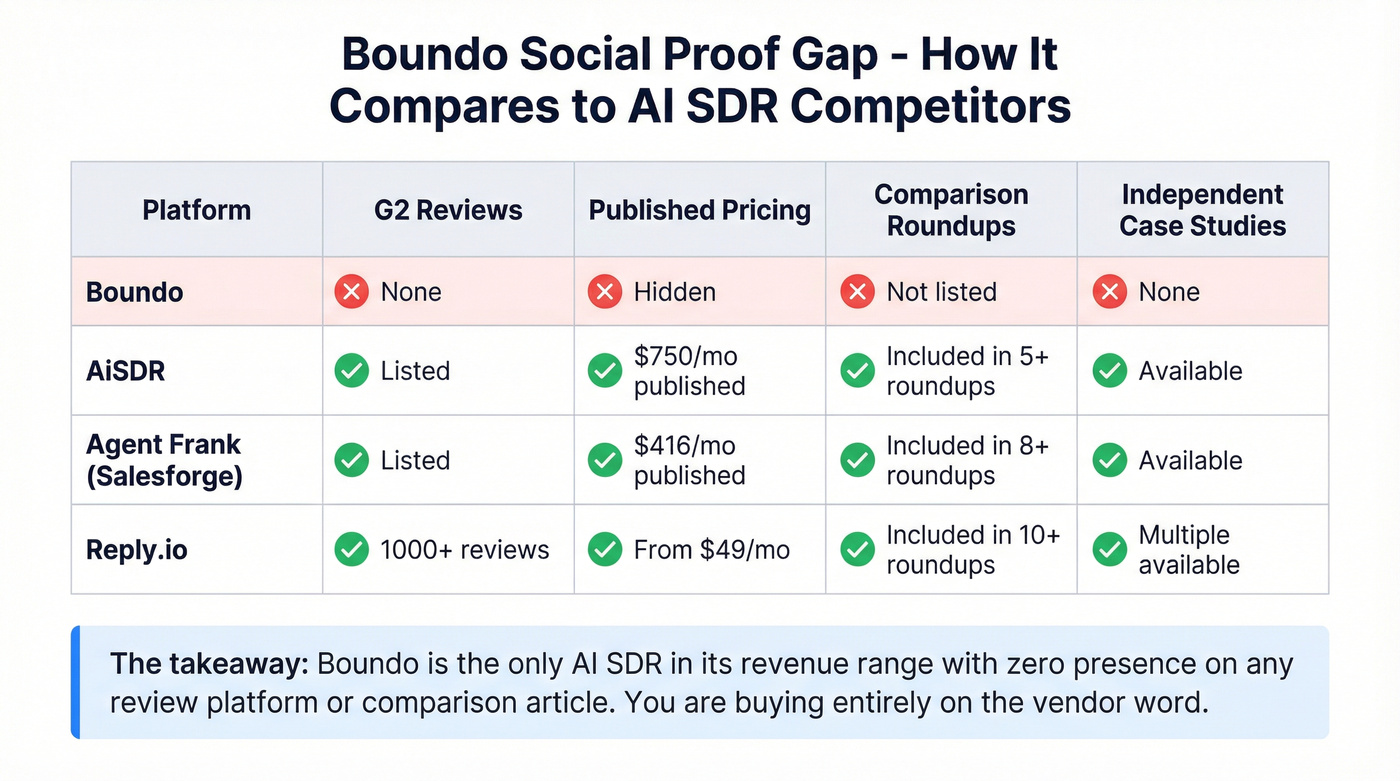

Zero independent reviews anywhere - this is the anchor concern

No G2 profile. No Capterra listing. No Reddit threads. No Product Hunt launch. No TechCrunch coverage. No third-party case studies.

Look, I can find reviews for AI SDR tools with less revenue and smaller teams. Boundo's invisibility isn't just a marketing gap - it means no one outside the company is publicly vouching for the product. For a tool founded in 2022 with $440K in revenue, the complete absence from every review platform and community discussion is the single biggest red flag. You're buying entirely on the vendor's word. If you're evaluating similar early-stage agents, compare it to another newcomer in our GoAgentic pros and cons review.

Opaque pricing with zero dollar amounts

Boundo's pricing page shows three tiers - Starter, Growth, Scale - with feature breakdowns but no prices. Every plan requires booking a call. For a product targeting teams of 3-10 people, this is frustrating. Agent Frank publishes $416/mo. Reply.io starts at $49/mo. Boundo makes you sit through a sales conversation to learn what you'd pay. That's an enterprise sales motion for an SMB product. If you're comparing hidden-cost pricing pages, see our take on Wiza pricing. You may also want to benchmark against FindThatLead pricing.

Four-person team creates real risk

Four employees means limited support bandwidth, limited engineering velocity, and a serious bus factor. If one engineer leaves, that's 25% of the company gone. If you hit a critical bug on a Friday afternoon, who's fixing it? We've seen teams adopt tools from small startups only to get burned when response times stretch to days during crunch periods.

The 4x model performance claim is unverifiable

Boundo claims their fine-tuned models outperform GPT and Anthropic by 4x for personalized sales emails. No independent benchmark, no methodology disclosure, no third-party validation. "4x" is a bold number. Without evidence, it's marketing copy, not a product fact.

Pivot history raises questions

The founders launched through YC with Openpod, a DAO platform, then pivoted to AI sales. Pivots can work brilliantly - but they also mean the team's deep expertise may not be in sales technology. Two years in, the lack of market traction (zero reviews, no presence in comparison roundups) suggests the pivot is still finding its footing.

Absent from every major AI SDR comparison

Boundo doesn't appear in roundups from Cykel, Breakout, Salesforge, Monday.com, Snov.io, or any other major comparison article. These roundups drive discovery in the AI SDR category. Being excluded from all of them means either the product isn't on analysts' radars or it hasn't earned inclusion yet.

Hidden implementation costs are real

Plan for 40-60 hours of data cleaning and enrichment before launch. Real ROI takes 3-6 months with clean data, or 6-9 months if you're building from scratch. Month one is setup and testing - expect 5-10 qualified opportunities at best. This isn't set-it-and-forget-it, and Boundo's marketing doesn't acknowledge that reality.

AI SDR limitations still apply

Even the best AI SDRs struggle with surface-level personalization, hallucinated details when enrichment data is weak, and a tone that can feel robotic without constant prompt tuning. One VP-level buyer put it bluntly on Reddit: "I get so many SDR calls and emails. And I ignore all of them... I sure as hell won't talk to a 22-year-old SDR or some AI version of one." No amount of fine-tuning has fully solved that problem yet.

Boundo Pricing (Estimated)

Boundo publishes zero dollar amounts. Every tier says "Get started" and routes you to a sales call. Here are our estimates based on competitor benchmarks, feature parity, and Boundo's $440K revenue across what's likely 20-40 active customers.

| Tier | Team Size | Leads/Mo | Est. Price | Key Inclusions | Key Exclusions |

|---|---|---|---|---|---|

| Starter | Up to 3 | 1,000 | ~$500-800/mo | AI outbound, deliverability monitoring, 300M database, chat support | CRM integrations, fine-tuned models, dedicated support |

| Growth | Up to 5 | 2,500 | ~$1,000-1,500/mo | CRM integrations, fine-tuned models, intent scoring, 40+ sourcing platforms, private Slack | Dedicated support, sales optimization calls |

| Scale | Up to 10 | 5,000 | ~$2,000-3,000/mo | Everything in Growth + dedicated support, sales optimization calls, custom integrations | - |

How we got these numbers: Agent Frank charges $416/mo for 1,000 contacts. AiSDR runs $750-2,000/mo. 11x.ai charges $5,000+/mo for enterprise. Boundo's feature set sits between Agent Frank and AiSDR, and its $440K revenue divided across an estimated customer base suggests mid-market pricing. The Starter tier likely undercuts AiSDR to win early customers; Scale likely approaches $3,000/mo for the full feature set.

Real talk: if your average deal size is under $10K, you probably don't need Boundo-level AI SDR complexity at all. A $49/mo Reply.io plan plus clean data will outperform a $1,500/mo AI SDR running on stale contacts. The bottleneck for most teams isn't sequencing sophistication - it's data quality and targeting.

How Boundo Compares to Alternatives

| Tool | Est. Price | Database Size | Channels | CRM Integrations | Independent Reviews | Best For |

|---|---|---|---|---|---|---|

| Boundo | ~$500-3,000/mo | 300M+ | Email + Social | 9+ | None | Risk-tolerant early adopters |

| AiSDR | $750-2,000/mo | 700M+ | Email + Social | Yes | Yes (G2) | Fully autonomous outbound |

| Agent Frank | $416/mo | Included | Yes | Yes | Budget-conscious teams | |

| Reply.io (Jason AI) | $49-166/mo | Included | Email + Social | Yes | Yes (G2, Capterra) | Teams testing AI outbound |

| 11x.ai | $5,000+/mo | Enterprise | Email + Social | Yes | Limited | Enterprise managed service |

| Valley | $395-895/mo | Included | Email + Social | Yes | Limited | Social-first outbound |

| Instantly.ai | $37-358/mo | Included | Yes | Yes | High-volume cold email | |

| Eve (Cykel) | $300-400/mo | Included | Multi-channel | Yes | Limited | Consolidating tool stack |

AiSDR - the closest apples-to-apples competitor

AiSDR runs $750-2,000/mo and operates as a fully autonomous outbound engine with a 700M+ contact database - more than double Boundo's claimed coverage. Both want to replace the SDR entirely. AiSDR users report needing to monitor closely for the first 2-3 months while the system learns your voice and ICP. But it has G2 reviews, published pricing, and a visible customer base. If you want Boundo's vision with actual market validation, AiSDR is the obvious pick.

Agent Frank by Salesforge - skip this if you need multi-channel

At $416/mo for 1,000 active contacts, Agent Frank is the budget play. It includes email infrastructure, warm-up, prospecting, outreach, replies, and booking - the full loop. The catch: it's email-only. No social sequences, no multi-channel orchestration. If your buyers respond to email and you care about cost, Frank wins. If you need social touches, look elsewhere.

Reply.io with Jason AI - the low-risk on-ramp

| Reply.io | Boundo | |

|---|---|---|

| Starting price | $49/mo (published) | ~$500/mo (estimated, hidden) |

| AI approach | AI bolted onto proven sequencer | AI-first, fine-tuned models |

| Risk level | Low - mature platform, thousands of users | High - zero reviews, 4-person team |

| Best for | Teams dipping a toe into AI outbound | True believers in autonomous AI SDRs |

Reply.io is the most affordable entry point and the one we'd recommend for teams that aren't ready to hand their entire outbound motion to an AI agent. You get a proven sequencer with AI assist, not a black-box system. Start here, graduate to a full AI SDR when you've validated your ICP and messaging.

Other Alternatives Worth Knowing

11x.ai (Alice) is the enterprise heavyweight at $5,000+/mo. Fully managed, SOC2 compliant, but expensive and limited on reply logic. Best for large orgs with budget and compliance requirements.

Valley runs $395-895/mo and leans into social-first outbound. If your buyers live on social platforms and email is secondary, Valley's approach is differentiated.

Instantly.ai starts at just $37/mo and scales cold email volume fast. Reply logic is weak, but for pure volume plays, it's the cheapest path to high-volume outbound.

Eve by Cykel costs $300-400/mo and positions itself as a tool consolidator - claiming to replace 4-5 separate tools costing $650+/mo combined. Worth evaluating if your stack is bloated.

Who Should Use Boundo (And Who Shouldn't)

Use Boundo if...

- You've got an early-adopter mindset and don't need G2 reviews to make a buying decision

- You're drawn to the reinforcement learning approach and want an AI SDR that genuinely adapts over time

- Your team is 3-10 people and you want YC-backed technology with a differentiated architecture

- You're comfortable with opaque pricing and willing to sit through a sales process

- You've already solved your data quality problem and need sequencing automation specifically

Skip Boundo if...

- You need social proof before buying - there's literally none available

- Transparent pricing matters to you (it should)

- You're risk-averse or buying for an enterprise with compliance requirements

- You need a tool with community support, active forums, or peer benchmarks

- Your real problem is data quality, not sequencing - if your emails are bouncing and your job titles are stale, no AI SDR will fix that

Fix the data layer first. Then automate on top of it.

The Data Quality Question

Here's something most AI SDR evaluations skip entirely: your AI SDR's output is capped by the quality of its input data.

Boundo aggregates from Apollo, ZoomInfo, Lusha, and others. Aggregation sounds impressive - 300M+ leads from multiple sources. But aggregation isn't verification. Stale emails, wrong job titles, and outdated company data don't become accurate just because they're pulled from three databases instead of one. 52% of B2B SaaS teams now use AI-assisted outreach, but most don't audit the data feeding it. That's how you end up with a beautifully personalized email sent to someone who left the company six months ago.

If you're feeding any AI SDR - Boundo or otherwise - start with verified data. Prospeo runs a 7-day refresh cycle (the industry average is six weeks), delivers 98% email accuracy across 143M+ verified addresses, and covers 125M+ verified mobile numbers. The free tier gives you 75 verified emails per month to test. At roughly $0.01 per email, it's the cheapest insurance policy against tanking your domain reputation with bad data. If you're building a measurable outbound motion, tie this back to clear account-based marketing goals. If your motion includes partners and resellers, align incentives with channel sales incentive programs.

The article says it: if your real bottleneck is data quality, skip the AI SDR conversation and fix your data. Prospeo gives you 300M+ profiles, 143M+ verified emails, and 125M+ direct dials - at $0.01 per email with no annual contracts.

Stop paying AI to personalize emails that bounce.

FAQ

Is Boundo legit?

Boundo is a legitimate company - YC S22 batch, $440K in verified revenue, real founders with Cornell and Amazon backgrounds, and an M&A offer received in April 2025. That said, zero independent reviews exist on G2, Capterra, Reddit, or Product Hunt. It's a real company with an unproven product at scale.

How much does Boundo cost?

Boundo publishes no dollar amounts on its pricing page. Based on competitor benchmarks and revenue analysis, expect ~$500-800/mo for Starter (3 users, 1K leads), ~$1,000-1,500/mo for Growth (5 users, 2.5K leads), and ~$2,000-3,000/mo for Scale (10 users, 5K leads). Every plan requires contacting sales.

What are the best Boundo alternatives?

AiSDR ($750-2,000/mo) is the closest competitor with fully autonomous outbound and a 700M+ database. Agent Frank ($416/mo) is the budget option for email-only teams. Reply.io ($49-166/mo) is best for teams testing AI outbound on a proven platform. For verified contact data specifically, Prospeo offers a free tier with 98% email accuracy and 125M+ verified mobiles - solving the data quality layer that determines whether any AI SDR succeeds or fails.

Can an AI SDR actually replace a human SDR?

For top-of-funnel prospecting and initial outreach, yes - at roughly 85% lower cost per lead and a 3.2-month payback versus 8.7 months for a human hire. AI SDRs handle 500-2,000+ emails daily versus 50-100 for a human. But for complex deals and relationship building, humans still win. Most teams use AI SDRs to augment their first 1-2 reps, not fully replace experienced sellers.