GoAgentic Pros and Cons (2026): An Honest Review for Outbound Teams

A $49/month "AI sales agent" sounds like a steal right up until it torches your domain reputation.

GoAgentic is priced like a lightweight tool, but it plays in a high-risk category: autonomous outbound. If your targeting and data are clean, it can be a cheap way to generate meetings. If they're sloppy, it'll scale the sloppiness faster than any human SDR ever could.

Here's the thing: the tool isn't the bottleneck. Your inputs are.

What GoAgentic is (and what it isn't)

GoAgentic positions itself as an AI Sales Agent: it builds targeting, runs outreach and follow-ups, handles replies, and books meetings on your calendar. Think autonomous SDR workflow, not "an email sequencer with AI copy."

GoAgentic publishes four headline metrics: 700+ active users, 3M+ emails sent, 9K+ meetings booked, and a 4.9/5 customer rating.

What it is:

- Built to run outbound end-to-end (prospecting -> personalization -> follow-ups -> booking).

- Designed to remove the "SDR busywork tax" by automating the whole loop.

What it isn't:

- A replacement for ICP clarity, offer quality, or list hygiene.

- A deliverability shield. Bad inputs become bad outputs at scale.

Positioning clarification: GoAgentic is closer to "agentic outbound automation" than a database like ZoomInfo. ZoomInfo is a data + workflow platform; GoAgentic is an execution engine.

Quick verdict: the real pros, cons, and who should use it

GoAgentic's pricing is the headline: $49/mo Starter and $99/mo Pro on monthly billing, or $39/mo and $79/mo on annual billing. It also offers a 7-day money-back guarantee. That's unusually accessible in the AI SDR category, where $500-$3,000/mo is common.

The catch is simple: autonomous outbound amplifies your weakest link - data, ICP, copy, or deliverability.

Best for

- Founders and lean outbound teams who want a low-cost autopilot to test a narrow outbound motion fast.

- Agencies with solid list hygiene + domain infrastructure that want an "always-on" layer.

- Teams that commit to daily oversight (reply handling, exclusions, QA).

Not for

- Anyone with fragile domains, no warmup discipline, or no appetite for deliverability ops.

- Teams without a crisp ICP and a real offer. Automation doesn't fix "we sell to everyone."

- Regulated industries where one off-brand email becomes a compliance incident.

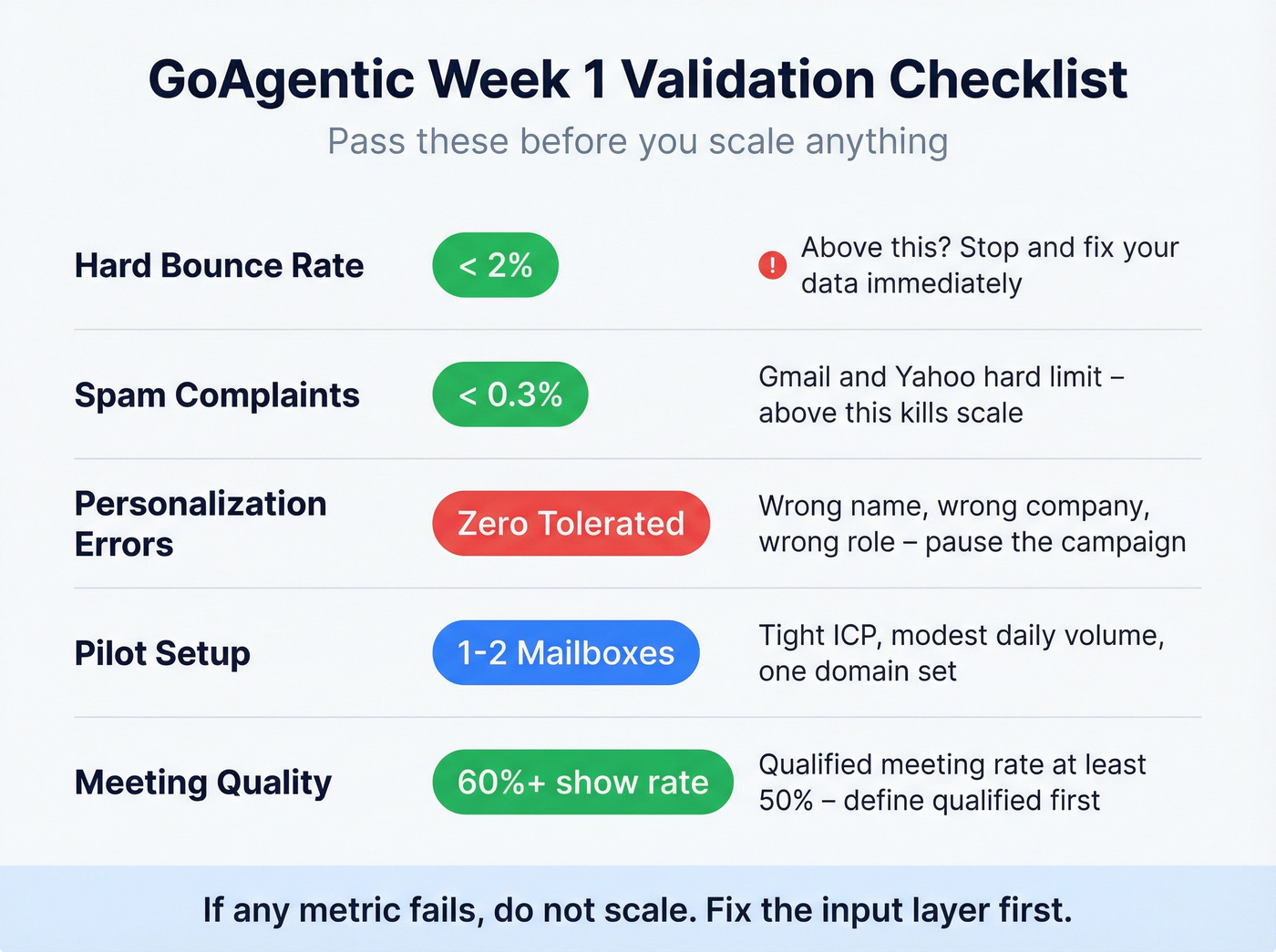

Week-1 validation checklist (pass/fail thresholds)

- Hard bounce rate < 2% (if you're above this, stop and fix data immediately).

- Spam complaints < 0.3% (Gmail/Yahoo reality; above this is a scale-killer).

- Personalization errors = 0 tolerated (wrong company facts, wrong name, wrong role - pause the campaign).

- Run a small pilot: 1-2 mailboxes, tight ICP, modest daily volume.

- Track meeting quality: show rate >= 60% and qualified-meeting rate >= 50% (define "qualified" before you start).

GoAgentic pricing, plan limits, and what you actually get

GoAgentic's pricing page is refreshingly explicit about caps. The only "gotcha" is operational: if you don't watch usage, you'll hit limits and get pushed into an upgrade at the exact moment your campaign starts working.

Here's the clean breakdown:

| Plan | Price (monthly) | Price (annual) | Prospects engaged / mo | Emails / mo | Managed mailboxes provided | Notes |

|---|---|---|---|---|---|---|

| Starter | $49/mo | $39/mo (billed $468/yr) | 500 | 2,000 | 0 | You add your own mailboxes |

| Pro | $99/mo | $79/mo (billed $948/yr) | 3,000 | 12,000 | Up to 15 | Listed as 5 domains x 3 mailboxes |

| Enterprise | Custom | Custom | Custom | Custom | 350 shown | SLA + enterprise security/compliance |

Two plan-limit details matter in the real world:

- Starter includes 0 managed mailboxes. Translation: you're provisioning inboxes/domains yourself. That's fine if you already have infrastructure; it's friction if you don't.

- Auto-upgrade is available when you consistently hit 90% of your cap. That's not sneaky. It's just expensive if you didn't budget for success.

GoAgentic also lists overage pricing for prospects engaged: $0.17 per prospect on monthly billing, or $0.13 per prospect on yearly billing (24% discount).

If you're trying to forecast spend, treat caps as hard limits: when you exceed them, you upgrade or pay overages.

One ZoomInfo price anchor (so you can sanity-check budgets): ZoomInfo starts around $14,995+ annually and often lands $25k-$75k+/year depending on seats and modules. GoAgentic is self-serve monthly pricing; you're trading enterprise data depth for execution automation. If you’re weighing data depth vs workflow, see Extruct AI vs ZoomInfo.

GoAgentic pros and cons: where it's strong (and where it breaks)

GoAgentic is worth testing because it's cheap, fast, and opinionated about "agentic" execution. It also has a few sharp edges that show up as soon as you scale.

Pros (the parts that actually matter)

- Fast time-to-value "Setup in 15 minutes" is the right goal. Outbound fails when teams spend weeks polishing sequences instead of shipping a controlled test.

It's priced like a tool, not a headcount $49-$99/mo makes a pilot painless. You don't need CFO permission to learn.

Managed mailboxes on Pro (up to 15) Scaling outbound safely is mostly infrastructure: more domains, more inboxes, lower volume per inbox. Bundled mailboxes remove a lot of ops drag.

Clear ROI narrative (vendor-reported) GoAgentic publishes outcomes like cost-per-meeting targets and meeting conversion assumptions. Good. You can hold it accountable.

Deliverability focus is part of the pitch (vendor-reported "99.8% deliverability") Important nuance: most vendors mean "accepted by the mailbox provider," not inbox placement. Track inbox placement separately with seed tests if you care about reality, not dashboards.

Privacy-forward angle on their Apollo Lead Exporter Running locally in the browser is a strong design choice. Still, treat "data never touches our servers" as a security claim until you've reviewed extension permissions and your security team's signed off. If Apollo is part of your stack, compare options in DitLead vs Apollo.io.

Where it breaks first (the predictable failure modes)

In our outbound bake-offs, the first cracks usually show up in reply handling and targeting drift, not in copy quality. The AI writes "fine" emails. The system-level mistakes are what hurt.

Concretely, watch for:

- Replies that should be "not interested" getting treated as "follow up later"

- Calendar links getting abused by low-intent leads (calendar spam)

- Exclusions not being strict enough (you end up emailing adjacent personas you never meant to touch)

This is where teams get annoyed fast, because it feels like you're babysitting a robot that keeps finding new ways to be "helpful." If you want another agentic-style review for context, see Boundo pros and cons.

GoAgentic's biggest risk isn't the AI - it's the data you feed it. Prospeo delivers 98% verified emails on a 7-day refresh cycle, so your autonomous outbound starts with contacts that actually land. Hard bounces under 2%? That's our baseline, not your ceiling.

Fix the input layer before you automate the output.

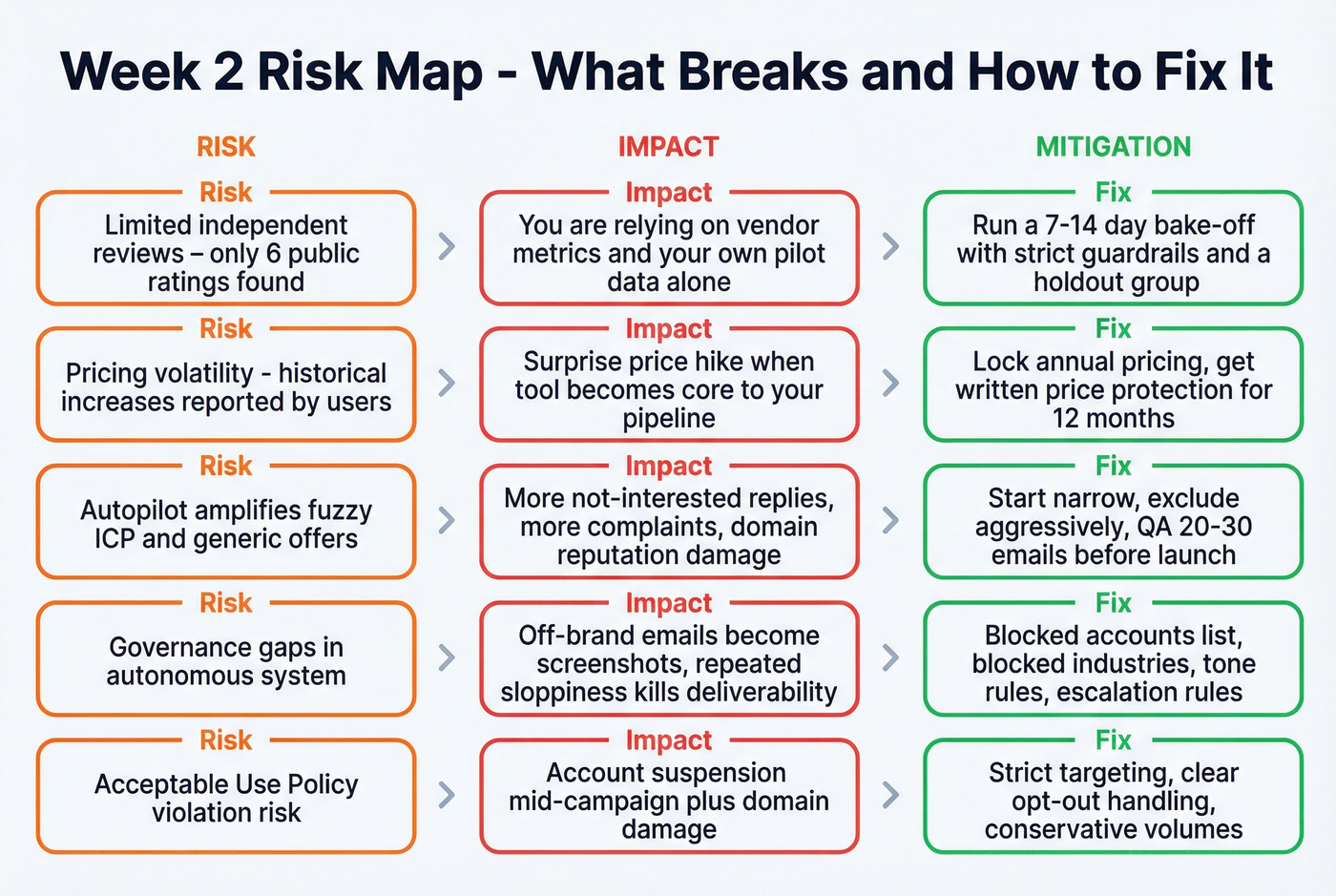

GoAgentic pros and cons after week two: risks, impact, mitigation

Week one feels like a cheat code. Week two is when you notice what the tool's really doing on your behalf.

Limited independent review footprint -> you must self-validate

Risk: GoAgentic doesn't have a deep public review footprint in the research set (no readable G2/Capterra profile, no readable Reddit threads). The only third-party rating captured is 4.2/5 from 6 ratings on TAAFT.

Impact: You're relying on vendor metrics and your own pilot. That's fine, but you need a disciplined evaluation, because "it booked meetings" isn't the same as "it booked meetings you want again next month."

Mitigation: Run a 7-14 day bake-off with strict guardrails: one ICP, one offer, one domain set, and a holdout group using your current stack.

Pricing volatility chatter -> protect your economics upfront

Risk: TAAFT includes pricing-change chatter (a commenter calling $159/mo "too much," and a maker reply referencing a historical increase to $249/mo).

Impact: If GoAgentic becomes core to pipeline, surprise pricing hurts more than a weak month of meetings.

Mitigation (buyer action): If you like it, lock annual pricing and ask for price protection (even a simple "no increase for 12 months" email confirmation). If they won't do it, treat the tool as a tactical layer, not your entire outbound engine.

Autopilot will amplify bad ICP and generic messaging

Risk: Agentic systems do exactly what you instruct, at scale. Fuzzy ICP and generic offers produce more "not interested," more complaints, and more reputation damage.

Impact: Your domain reputation takes the hit, not the tool's. Recovery is slow and annoying.

Mitigation: Start narrow. Exclude aggressively. Add negative keywords and hard filters. Manually QA 20-30 generated emails before you let it run.

Governance and oversight are under-scoped (and the world is less tolerant now)

Risk: Autonomous systems make mistakes. That's not theoretical. It's the default. Agentic adoption is accelerating: 48% of tech executives say agentic AI is already adopted or fully deployed in their organization.

Impact: Prospects and inbox providers are getting less tolerant, not more. One off-brand email can become a screenshot; repeated sloppiness becomes a deliverability problem.

Mitigation: Put approval gates in place: blocked accounts list, blocked industries list, tone rules, and escalation rules for sensitive replies.

Policy risk: you can lose the account, not just the inbox

Risk: GoAgentic's Acceptable Use Policy prohibits spam/unsolicited email. If your motion's sloppy, you risk account suspension on top of domain damage.

Impact: Your campaigns stop mid-flight and you scramble to rebuild the workflow elsewhere.

Mitigation: Treat compliance like a feature requirement: strict targeting, clear opt-out handling, and conservative volumes until metrics prove you've earned scale.

What we can't verify (so you should test it yourself)

- Whether "meetings booked" are qualified for your ICP

- Whether "deliverability" means inbox placement or just "delivered"

- How accurate reply classification is across edge cases (OOO, referrals, objections, angry replies)

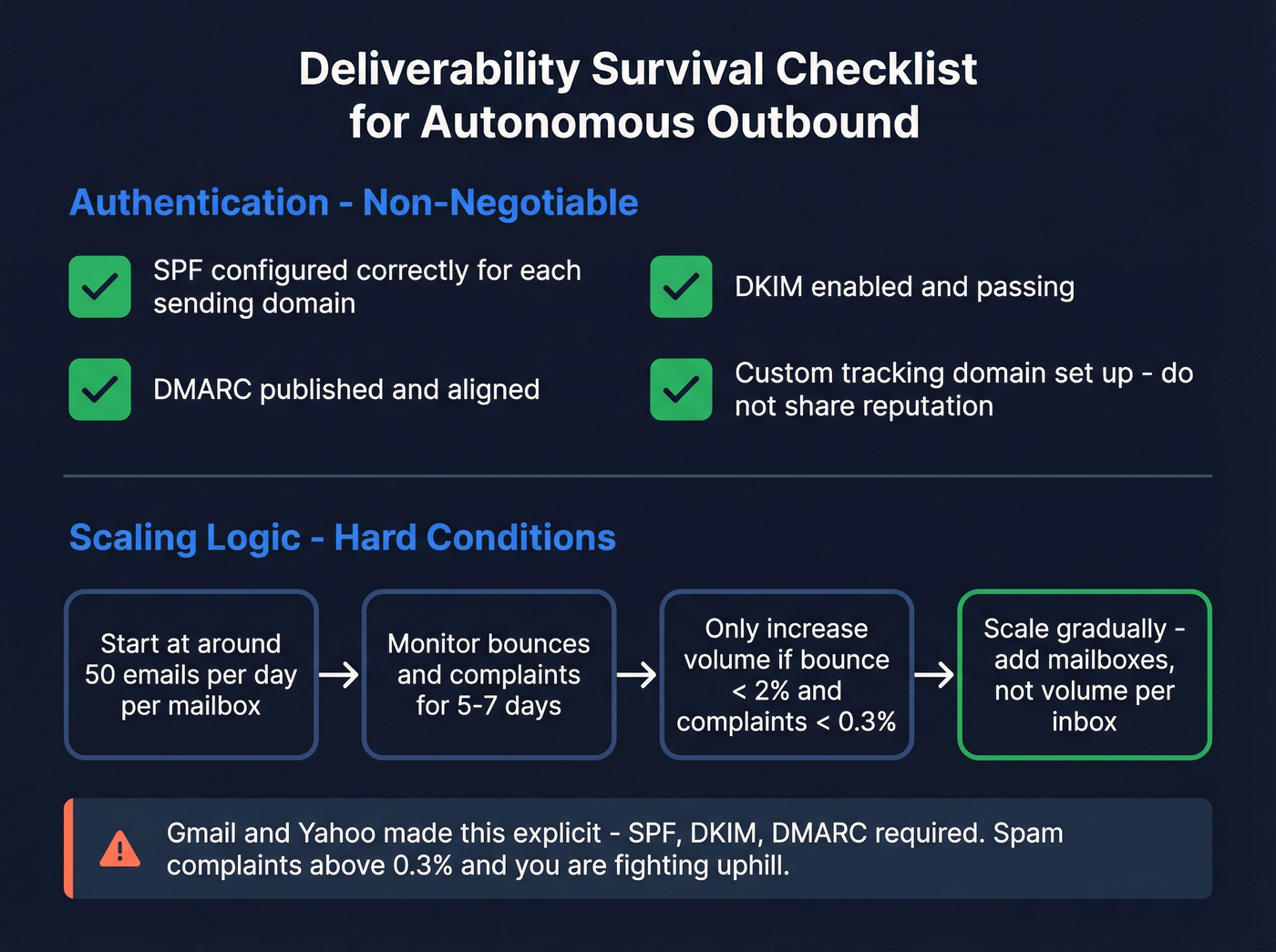

Deliverability & compliance reality check (the part that can hurt you)

If you run autonomous outbound, deliverability is the whole game. These are the rules we use because they keep teams alive.

Authentication checklist (non-negotiable)

- SPF configured correctly for each sending domain

- DKIM enabled and passing

- DMARC published (and aligned)

- Custom tracking domain set up (don't share reputation with everyone)

Gmail and Yahoo made this painfully explicit: you need SPF/DKIM/DMARC, and you need to keep spam complaints below 0.3%. Miss that threshold and you're fighting uphill. If calling is part of your mix too, align outreach with compliance basics in our predictive dialer guide.

Scaling logic that works (with hard conditions)

- Start at ~50 emails/day per mailbox.

- Only increase above 50/day when complaints stay < 0.3% for 14 straight days and hard bounces stay < 2%.

- Scale by adding domains/inboxes, not by blasting one inbox.

Monitoring that matters (daily)

- Hard bounce rate (poison)

- Spam complaint rate (keep it under 0.3%)

- Positive reply rate (not just "replies")

- Inbox placement checks (seed tests if you're serious)

Mechanical rule: verify emails and remove risky catch-alls before GoAgentic engages prospects. That's how you keep bounces down and avoid reputation debt.

Biggest hidden risk: data quality (why AI SDR results collapse)

Most teams blame the AI when results fall off. The collapse starts with data.

We've seen this exact movie: a team spins up an agent, points it at a list exported from three different places, and celebrates because "volume is up." Ten days later the bounce rate's ugly, the replies are hostile, and someone asks if they should buy new domains. They should've fixed the list.

B2B outbound reply rates are thin, so even a modest amount of stale or invalid data wipes out the upside and adds deliverability debt at the same time. In our testing, catch-all domains and duplicates were the two biggest silent killers: they don't always bounce immediately, but they inflate risk, confuse reporting, and make it hard to tell whether the message is failing or the list is rotten.

What bad data does in an agentic workflow

- Invalid emails -> hard bounces -> reputation damage

- Wrong titles/companies -> irrelevant personalization -> complaints

- Stale roles -> you hit the wrong person -> negative replies spike

- Duplicates -> multiple touches -> you look spammy

A simple workflow that prevents the collapse

Before you automate:

- Build your target list (ICP filters, exclusions, account list). If you’re running an ABM motion, map metrics to outcomes with Account Based Marketing goals.

- Verify emails in bulk (including catch-all handling).

- Enrich missing fields so personalization doesn't guess.

- Dedupe across lists and campaigns.

After verification/enrichment: 5. Send with modest volume per mailbox. 6. Monitor bounces/complaints daily. 7. Tighten targeting weekly based on negative replies.

Prospeo, "The B2B data platform built for accuracy," is the verification + enrichment layer we use for this because it's built for accuracy and freshness: 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% verified email accuracy on a 7-day data refresh cycle (the industry average is 6 weeks). It also plugs into real workflows (Salesforce, HubSpot, Clay, Zapier, Make, plus native sending-tool integrations), so you can verify -> enrich -> dedupe -> push clean records into your outbound stack without spreadsheet chaos. If you’re comparing verification-first tools, see Wiza pricing and FindThatLead pricing.

You read the week-1 checklist: bounce rate under 2%, zero personalization errors, tight ICP targeting. Prospeo's 300M+ profiles with 30+ filters and 5-step email verification were built for exactly that - at $0.01/email instead of $1.

Stop babysitting bad data. Start with verified contacts.

GoAgentic 7-day evaluation scorecard (use this during the refund window)

If you're going to use the 7-day money-back guarantee, you need a scorecard, not vibes. Here's the one we'd run.

| Category | What to measure | Pass threshold | How to test inside GoAgentic |

|---|---|---|---|

| Deliverability | Hard bounces, complaints, inbox placement | Bounces <2%, complaints <0.3% | Start with 1-2 mailboxes; review daily; pause immediately on threshold breach |

| ICP precision | Relevance of targeted titles/accounts | >=80% "yes, correct persona" in a 50-lead audit | Export/inspect the first 50 engaged prospects; tighten exclusions until it's clean |

| Personalization accuracy | Wrong facts, wrong names, hallucinations | 0 tolerated | Manually QA 20-30 generated emails before scaling |

| Reply handling | Correct classification + safe actions | >=90% correct routing | Spot-check every reply for 7 days; test OOO, objections, referrals, "remove me" |

| Meeting quality | Show rate + qualified rate | Show >=60%, qualified >=50% | Tag outcomes in CRM; don't count "booked" as success until it shows and qualifies |

| Operational overhead | Time spent babysitting | <=30 min/day after day 2 | Track actual time: exclusions, edits, reply triage, calendar cleanup |

Is GoAgentic worth it? A simple cost-per-meeting model (with assumptions)

GoAgentic's pricing is low enough that the real question is: will it book meetings without creating deliverability debt?

GoAgentic's own model assumes 0.5%-0.8% of engaged prospects convert into meetings. Use that as a starting assumption, then force it to earn reality in your pilot.

Assumptions:

- Starter: 500 engaged prospects/month

- Pro: 3,000 engaged prospects/month

- Meeting rate: 0.5% (conservative) to 0.8% (optimistic)

| Scenario | Plan | Engaged prospects | Meeting rate | Meetings/mo | Tool cost/mo | Cost per meeting |

|---|---|---|---|---|---|---|

| Solo founder pilot | Starter | 500 | 0.5% | 2.5 | $49 | ~$20 |

| Solo founder (good ICP) | Starter | 500 | 0.8% | 4 | $49 | ~$12 |

| Agency / small team | Pro | 3,000 | 0.5% | 15 | $99 | ~$7 |

| Agency (dialed-in) | Pro | 3,000 | 0.8% | 24 | $99 | ~$4 |

Those numbers look incredible because they ignore the real costs: domains, inboxes, verification, and the time you spend preventing mistakes. In practice, the tool fee's the smallest line item. The limiting factor is whether you keep bounces low and complaints under 0.3% while staying relevant.

Alternatives (when GoAgentic isn't enough - or is too "autopilot")

Prices change often; the ranges below reflect publicly listed pricing last checked in 2026 where available. Inboxes, add-ons, and credits can change totals fast.

Real talk: if your average deal size is modest, you probably don't need a fully autonomous AI SDR yet. You need clean data, conservative sending, and tight targeting. Autopilot comes last.

Use case x tool table (pick a winner)

| Your situation | Winner | Add-on (only if needed) |

|---|---|---|

| You want safer outbound control (no autonomous decisions) | Instantly | Add a dedicated data/verification layer before scaling volume |

| You want high-volume inbox scaling with warmup workflows | Smartlead | Add stricter reply triage rules and conservative ramping |

| You want leads + basic sequencing in one UI | Apollo | Add verification/enrichment before you increase volume |

| You want a premium AI SDR experience (higher-touch) | AiSDR | Add stricter governance + CRM outcome tracking |

| You're enterprise and inbound-heavy (routing + qualification) | Qualified Piper | Add only if your inbound volume justifies it |

| You want autonomous outbound execution | GoAgentic | Add it only after your deliverability and data hygiene are proven |

Instantly (sending + sequencing ecosystem)

Instantly is the sending layer we'd pick when you want deliverability control and sequencing without an agent making decisions for you. Public Copilot credit packs have been listed at $47 / $97 / $197 for 1,500 / 5,000 / 10,000 credits. Expect total cost to rise with inboxes and add-ons.

Smartlead (high-volume sending + warmup angle)

Smartlead is built for inbox scaling and warmup-heavy outbound. Public pricing commonly lands around $33-$174/month depending on plan. It's a strong fit when your team's disciplined about domains, inbox rotation, and conservative daily volumes.

Apollo (lead source + basic sequencing)

Apollo is the default SMB starting point because it combines lead sourcing and sequencing. Expect roughly $49-$119/user/month depending on tier and billing. It's convenient, but you still need verification/enrichment discipline before you scale sends.

Lemlist (personalization-first sequencer) - Tier 3

Lemlist is best when personalization UX is the priority. Pricing commonly sits around $39-$79/month, with email identity add-ons often priced separately (commonly ~EUR9/email/month). Great campaign layer; bring your own data quality.

AiSDR (premium AI SDR band) - Tier 3

AiSDR sits in the premium AI SDR tier at roughly $900-$2,500/month. Buy it when you want a higher-touch agentic experience and you're ready to measure outcomes in CRM (show rate, qualified rate, opp creation).

Qualified Piper (enterprise routing/AI SDR) - Tier 3

Qualified Piper is an enterprise fit focused on routing, qualification, and pipeline context. Pricing isn't public; expect enterprise contracts (often mid five figures annually, sometimes higher) depending on seats, traffic, and modules.

Category-wide complaints buyers have with AI SDR tools (read this before you blame GoAgentic)

This isn't GoAgentic-specific. It's what buyers complain about across the category:

- Hallucinated personalization (wrong facts presented confidently)

- Reply misclassification (objections treated as "follow up," opt-outs mishandled)

- Calendar spam (low-intent bookings clogging calendars)

- Domain burn (volume scaled before data and targeting were clean)

- Attribution fog (meetings booked, but unclear which segment/message actually worked)

My recommendation (buy/skip, with rules)

Buy GoAgentic if you want a cheap agentic pilot and you're willing to run it like a system, not a toy. Keep the first week brutally narrow: one ICP, one offer, 1-2 mailboxes, and daily QA on targeting, personalization, and replies. If you hit bounces <2%, complaints <0.3%, and you see show rate >=60% with qualified >=50%, keep it and scale slowly.

Skip GoAgentic if you don't have the patience for deliverability ops or you can't commit to daily oversight. Build the boring stack first: a controlled sequencer (Instantly or Smartlead), conservative sending volumes, and measurable CRM outcomes. If your outbound motion relies on partners, build structure with channel sales incentive programs. Once your fundamentals are stable, adding an agentic layer becomes a multiplier instead of a liability.

Summary: GoAgentic pros and cons in one line

The goagentic pros and cons trade-off is simple: you're buying cheap, fast autonomous outbound - so you must bring clean data, tight targeting, and daily oversight, or it'll scale mistakes into deliverability debt.

FAQ

What are GoAgentic's pricing tiers and caps in 2026?

GoAgentic offers Starter at $49/mo ($39/mo annual) and Pro at $99/mo ($79/mo annual), plus Enterprise. Starter caps at 500 engaged prospects and 2,000 emails/month; Pro caps at 3,000 engaged prospects and 12,000 emails/month, with auto-upgrade available when you consistently hit 90% of caps.

Does GoAgentic include managed mailboxes?

Starter includes 0 managed mailboxes (you bring your own). Pro includes up to 15 managed mailboxes (listed as 5 domains x 3 mailboxes). Enterprise shows a much larger allocation (350 in the comparison grid) for higher-scale programs.

How does GoAgentic's 7-day money-back guarantee work?

You get a 7-day window to validate fit, and the safest way to use it is a controlled pilot with pass/fail metrics. Run one ICP and one offer on 1-2 mailboxes, and keep hard bounces under 2%, spam complaints under 0.3%, and personalization errors at zero before you scale.

What deliverability setup do I need before running GoAgentic?

You need SPF, DKIM, and DMARC correctly set up on every sending domain, plus a custom tracking domain to avoid shared reputation issues. Start around 50 emails/day per mailbox, and only ramp when spam complaints stay under 0.3% for 14 straight days and hard bounces stay under 2%.

What's a good free data tool to pair with GoAgentic before scaling?

Prospeo's free tier includes 75 emails plus 100 Chrome extension credits per month, and it's built for accuracy with 98% verified email accuracy and a 7-day data refresh cycle. Use it to verify, enrich, and dedupe your list before autonomous outreach so you don't "learn" on your domain reputation the hard way.